Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE ISSUED ON NOVEMBER 24, 2020 - 1847 Goedeker Inc. | ea130443ex99-2_1847goedeker.htm |

| 8-K - CURRENT REPORT - 1847 Goedeker Inc. | ea130443-8k_1847goedeker.htm |

Exhibit 99.1

to Acquire Creating One of the Fastest Growing and Largest Online Appliance Retailers NOVEMBER 2020 LISTED GOED

Forward Looking Statements This presentation contains forward - looking statements that are based on our management’s beliefs and assumptions and on information currently available to us . All statements other than statements of historical facts are forward - looking . These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements . Forward - looking statements include, but are not limited to, statements about : • Our ability to consummate the proposed acquisition with Appliances Connection ; • the synergies that we expect to experience resulting from the proposed acquisition of Appliances Connection ; • our ability to finance the proposed acquisition of Appliances Connection ; • our ability to successfully integrate the Appliances Connection business with our existing business ; In some cases, you can identify forward - looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology . These statements are only predictions . You should not place undue reliance on forward - looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results . Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “ Risk Factors ” and elsewhere in our SEC filings . If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward - looking statements . No forward - looking statement is a guarantee of future performance . The forward - looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation . We do not intend to update or otherwise revise the forward - looking statements in this prospectus, whether as a result of new information, future events or otherwise . p. 2 GOED This presentation includes certain “non - GAAP” financial measures, including EBITDA and adjusted EBITDA . GAAP refers to generally accepted accounting principles in the United States . EBITDA, or earnings before interest, income taxes, depreciation and amortization, is calculated as net income (loss) before interest expense, income tax benefit (expense), depreciation expense and amortization expense . Amortization expenses consist of amortization of intangibles and debt charges, including debt issuance costs, discounts and the like . Adjusted EBITDA is calculated utilizing the same calculation as described above in arriving at EBITDA, which is further adjusted, in the case of Goedeker, by : ( i ) stock - based compensation ; (ii) a loss on extinguishment of debt ; (iii) a write - off of acquisition receivable ; and (iv) a non - cash charge to change in fair value warrant liability . We have included EBITDA and adjusted EBITDA because we believe it enhances investors’ understanding of the operating results of Goedeker and Appliances Connection, as applicable . EBITDA and adjusted EBITDA is provided because management believes it is an important measure of financial performance commonly used to determine the value of companies, to define standards for borrowing from institutional lenders and because it is the primary measure used by management to evaluate our performance . Because of the limitations inherent in using EBITDA and adjusted EBITDA, you should consider EBITDA and adjusted EBITDA alongside other financial performance measures, including net income (loss) of Goedeker and Appliances Connection, as applicable . Use of Non - GAAP Financial Measures

$37.8 Million in Forecast GOED 2021 EBITDA 10x Increase in GOED Forecast 2021 Revenues p. 3 OVERVIEW AND EXPECTED BENEFITS Goedeker to Acquire Appliances Connection 1. 10x Revenue Growth to $ 550 M with $ 37.8 M in EBITDA forecast for GOED in 2021 2. Strong Online Appliance Sales Trends to continue through 2021 and beyond 3. Double Digit Year - Over - Year Growth for both companies. Appliances Connection is listed #1 on USA Today’s “ Top 7 Places to Buy Appliances Online” November 2020 4. Operating Synergies Will Scale to maximize growth 5. More Brands provide a greater selection to more customers 6. Combined Logistics result in shorter delivery times thus less cancellations and reduced costs 7. Post - Acquisition Valuation Highlights a 10 x Arbitrage Opportunity on GOED’s EV/Sales versus peers GOED

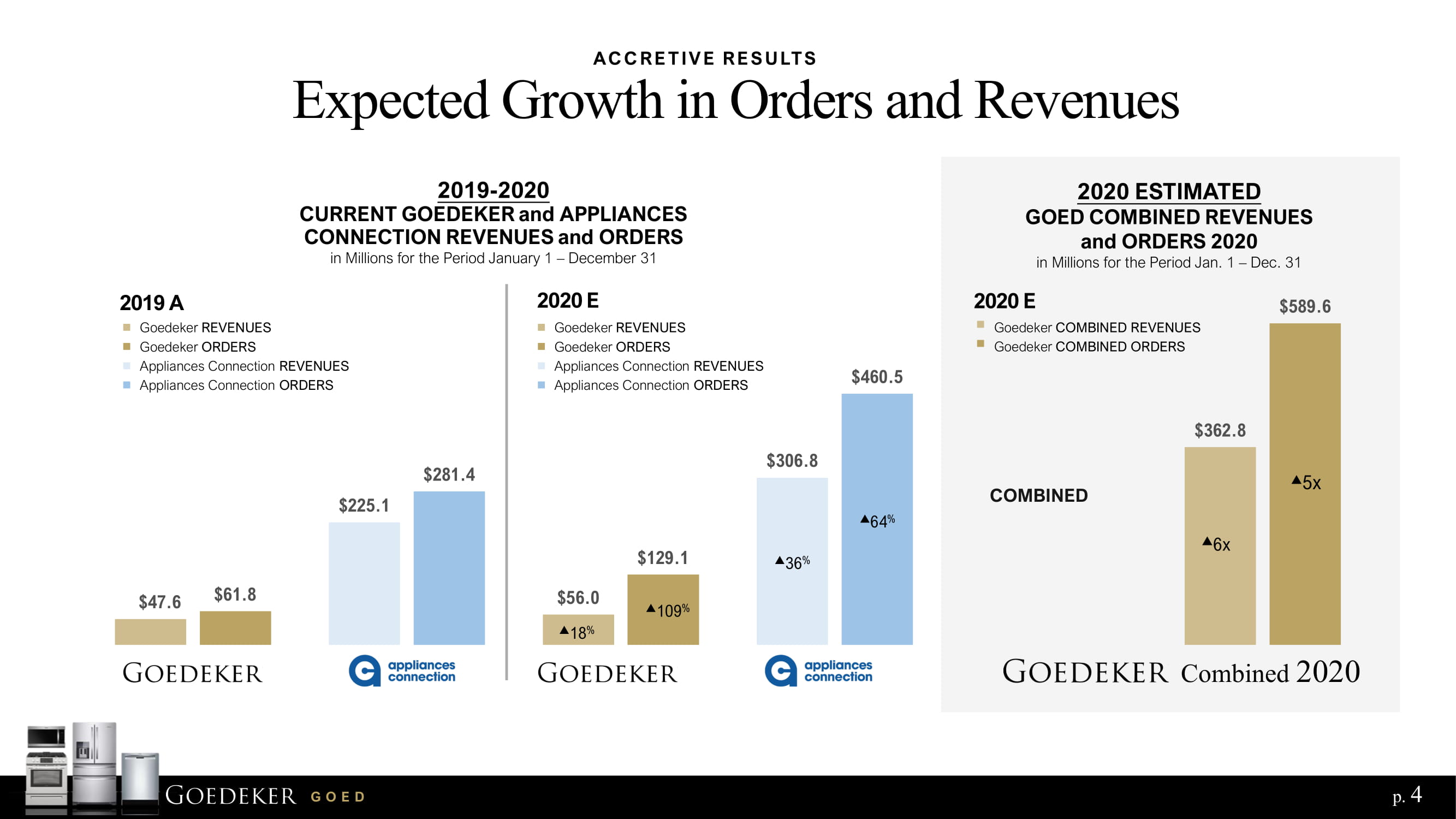

Expected Growth in Orders and Revenues p. 4 $47.6 $225.1 $56.0 $306.8 $362.8 $61.8 $281.4 $129.1 $460.5 $589.6 2019 A 109 % 18 % 2020 E 64 % 36 % 5x 6x 2020 ESTIMATED GOED COMBINED REVENUES and ORDERS 2020 in Millions for the Period Jan. 1 – Dec. 31 2019 - 2020 CURRENT GOEDEKER and APPLIANCES CONNECTION REVENUES and ORDERS in Millions for the Period January 1 – December 31 ACCRETIVE RESULTS 2020 E Goedeker COMBINED REVENUES Goedeker COMBINED ORDERS COMBINED Goedeker REVENUES Goedeker ORDERS Appliances Connection REVENUES Appliances Connection ORDERS Goedeker REVENUES Goedeker ORDERS Appliances Connection REVENUES Appliances Connection ORDERS GOED Combined 2020

Organic Growth Accelerates Post - Acquisition p. 5 ACCRETIVE RESULTS GOED $167.7 $389.1 $550.0 $237.0 $500.0 $737.0 Goedeker COMBINED REVENUES Goedeker COMBINED ORDERS 2021 Forecast POST - ACQUISITION COMBINED REVENUES AND ORDERS In Millions for the Period Ended December 31 Post - Acquisition 2021 2021 F POST ACQUISITION 52% 25% Goedeker POST - ACQUISITION REVENUES Goedeker POST - ACQUISITION ORDERS Appliances Connection REVENUES Appliances Connection ORDERS 2021 Forecast GOEDEKER AND APPLIANCES CONNECTION REVENUES AND ORDERS, RESPECTIVELY in Millions for the Period January 1 – December 31 2021 F

Online Appliances Sales Soar MARKET TRENDS p. 6 EXPECTED TO REACH $38B BY 2025 Source: Statista, 2020 44% OF ALL APPLIANCE SALES purchased online by 2024. 80% + of CONSUMERS research and compare appliances RANGES, REFRIGERATORS, DISHWASHERS, WASHING MACHINES are 4 of the top 5 most purchased US household appliance market is growing at $13.7% CAGR and household appliances. online. Source: Consumer Reports, December 2019 STRONG MARKET TRENDS are expected to be Source: Grandview Research, 2018 GOED

Brick and Mortar Challenges BIG BOX RETAILERS Large Online Retailers Not Built for Appliances INDEPENDENT DEALERS ADVANTAGES OF PURE PLAY APPLIANCE - FOCUSED ONLINE SALES p. 7 ▪ Inconsistent brands, lack of access to higher end brands ▪ “Last Mile” omits installation and haul - away ▪ Delivery dates and times vary significantly ▪ Unlike GOED, limited customer service interaction at point of sale, and after the sale ▪ Limited selection and web - ordering presence ▪ Higher prices due to cost structure ▪ Commission - based selling pressure ▪ Limited assortment – lack of premium brands ▪ Inconsistent product knowledge and customer attention ▪ Online presence not focused on appliances GOED

p. 8 GOED Acquisition Value and Investor Benefits

Industry - Experienced Management Team YES YES Brick and Mortar Heritage YES YES Marketing Optimized for Appliance Industry YES YES Access to Premium and Exclusive Brands YES YES Knowledgeable Sales & Customer Service Teams YES YES Multiple Consumer Financing Options YES YES Dedicated Logistics and Fulfillment Centers YES YES Scalable Website Infrastructure YES YES Delivery Trucks YES YES Professional Installation and Haul - Away YES YES Access to Special Manufacturer Rebates YES YES Factory and Extended Warranties YES YES p. 9 Both companies specialize in the household appliance industry and have been built on years of shared experience in the marketing and sales of appliances in - store, and online. COMBINING OPERATIONS AND SERVICES Synergies That Scale GOED

More Brands Available to More Customers p. 10 BRAND AND PRODUCT LINE EXTENSIONS SELECT GOEDEKER BRANDS ACQUISITION ADDS KEY PREMIUM BRANDS GOED

▪ The addition of an East Coast fulfillment center positions suppliers closer to warehouses ▪ Midwest and East Coast fulfillment centers position products closer to customers and speed delivery times ▪ A fleet of 32 dedicated delivery trucks ▪ Combining logistics greatly increases shipping capacity Increased Coverage. Faster Delivery EXTENDING COVERAGE AND SHORTENING DELIVERY TIMES WITH CONNECTED FULFILLMENT CENTERS COMBINING LOGISTICS St. Louis, MO Trenton, NJ p. 11 GOED

p. 12 Post - Acquisition Gains p. 12 Pre - Acquisition 1 Orders Shipped Daily 350 - 450 800 - 1000 Delivery Times in Days 20 Days 10.5 Days Order Fill Rate 80% 85% POST - Acquisition Run Rate Expectations 2 Run Rate Result 3 Change Orders Shipped Daily Increase 1900 4x Delivery Leadtime in Days Decreases 10 Days 6 Days Order Fill Rate Run Rate Increases 87% 700 bps 2 Includes 2021 growth projections and 2020 backlog scheduled to ship in 2021. 3 Run Rate Results expected in 2H of year post - acquisition Order Run Rate Delivery Time Run Rate Order Fill Run Rate COMBINING LOGISTICS Pre - Acquisition Performance GOED 1 Orders, Delivery Times and Fill Rate are averages calculated through December 2019

Douglas T . Moore, CEO Goedeker, Inc . Mr . Moore has served as Chief Executive Officer since August 2019 and as a director since April 2020 . Through his more than 25 years of retail experience, Mr . Moore has developed an understanding of strategic and tactical business issues that include store operations, merchandising, supply chain, sourcing and human resource planning . He also possesses senior management, marketing, risk assessment and retail knowledge . He served as the Chief Merchandising Officer for Circuit City Stores and was senior executive there from August 1990 through February 2007 . From July 2007 through December 2010 , Mr . Moore served as SVP and President of Appliances for Sears Holdings, where he led the $ 5 B appliance business and negotiated all contracts for the manufacturing of Kenmore appliances . Most recently, Mr . Moore was President and Chief Executive Officer of Med - Air Homecare, a home healthcare equipment provider, and Senior Vice President of FirstSTREET for Boomers and Beyond, Inc . , a leading direct marketer from October 2017 until August 2019 . Mr . Moore has served on the board of directors of Lumber Liquidators Holdings, Inc . (NYSE : LL), a leading specialty retailers flooring since April 2006 . Mr . Moore received his undergraduate degree and M . B . A . from the University of Virginia . Robert D . Barry, CFO Goedeker, Inc . Mr . Barry has served as Chief Financial Officer since our inception and as a director from inception until April 2020 . He has served on the board of directors of 1847 Holdings since January 2014 and as Controller of 1847 Holdings’ subsidiary Neese, Inc . , since July 2017 . From April 2013 until August 2016 , Mr . Barry was Chief Executive Officer and Chief Financial Officer of Pawn Plus Inc . , a chain of six retail pawn stores . Mr . Barry served as Executive Vice President and Chief Financial Officer of Regional Management Corp . (NYSE : RM), a consumer loan company based in Greenville, South Carolina, from March 2007 to January 2013 . Mr . Barry was also the Managing Member of AccessOne Mortgage Company, LLC in Raleigh, North Carolina, from 1997 to 2007 . During this time, he also served as part - time Chief Financial Officer for Patriot State Bank, in Fuquay - Varina, North Carolina, and Nuestro Banco, Raleigh, North Carolina, from July 2006 to March 2007 . Prior to his time at AccessOne, Mr . Barry was Executive Vice President and Chief Financial Officer for Regional Acceptance Corporation (NASDAQ : REGA), a consumer finance company based in Greenville, North Carolina and prior to that he was a financial institutions partner in the Raleigh, North Carolina office of KPMG LLP . Mr . Barry is a Certified Public Accountant licensed in North Carolina and Georgia . p. 13 Albert Fouerti, Appliances Connection President Mr . Fouerti will continue to serve as Appliances Connection President and serve on Goedeker’s Board of Directors . Mr . Fouerti has served as CEO of Appliances Connection/ 1 Stop Electronics Center, Inc . since 1999 . With over 20 years of experience in retail, he has made Appliances Connection into a leader for kitchen appliances . Starting out as a small camera and computer shop in Great Neck, NY, Mr . Fouerti was an early adopter of ecommerce . Driven by technology, Mr . Fouerti entered the appliance business in 2008 and has taken the appliance industry to the digital age . Along with his brother, Mr . Elie Fouerti, they developed a process of delivering large kitchen appliances across the U . S . Elie Fouerti, Appliances Connection VP Mr . Fouerti will continue to serve as Appliances Connection Vice President and CFO for Appliances Connection . Mr . Fouerti was both the CFO and VP of Appliances Connection/ 1 Stop Electronics Center, where he served for over 20 years . Along with Mr . Albert Fouerti, they have created one of the most successful independent online retailers of appliances . Their work included developing a logistic system to ship large, household appliances across the US quickly and cost - effectively . Executive Team GOED

Thomas S . Harcum, CMO/CTO Goedeker, Inc . Mr . Harcum joined Goedeker as Chief Marketing Officer and Chief Technology Officer in January 2020 . He has more than 20 years' experience in marketing and technology in several fields including ; Pharma and Publishing and Ecommerce . Particularly, Mr . Harcum’s expertise includes Direct - to - Consumer E - commerce and Lead Generation . Mr . Harcum has also managed departments as cost centers and held P&L responsibilities for Marketing Funnel Management, Customer Acquisition, Telephony, Product Development, Technology Management, Project Management, Development Lifecycle and Brand Management . Previously he was the Sr . Director of Marketing for firstSTREET . Mr . Harcum received a B . A . in Marketing from Virginia Commonwealth University Michael K . Hargrave, Senior Merchant Goedeker, Inc . Mr . Hargrave has served as Senior Merchant since May 2020 . Over the course of his more than 33 years of retail experience, Mr . Hargrave has developed an understanding of strategic and tactical business issues that include sales management, merchandising, marketing, product development, strategic sourcing and online content management . He also possesses, store operation, supply chain management, website development and affiliate marketing knowledge . Prior to joining us, Mr . Hargrave held roles for Sears Holdings Corporation as Senior Director, Online Hardlines Merchandising, from June 2017 until April 2020 , Divisional Merchandise Manager, Online Tools, from July 2014 until June 2017 , and Director, Online Merchandising, Lawn & Garden, from March 2009 until July 2014 . Mr . Hargrave has been named to the Home Improvement Executive Magazine’s “Top 100 Retail Executives" . Mr . Hargrave received his undergraduate degree from the University of Michigan . Jacob Guilhas, VP Logistics Goedeker, Inc . Mr . Guilhas joined Goedeker as the Vice President of Logistics in October 2020 . With 20 years of retail logistics experience he is qualifie d to run a full spectrum of multi - site business operations in highly competitive, fast - paced, and complex environments . Prior to joining Goedeker, Mr . Guilhas served as Managing Director at FedEx Supply Chain, Head of Logistics and Fulfillment for Groupon, facility General Manager with Exel (now DP - DHL), and Regional Operations Director for Walmart eCommerce . Mr . Guilhas has established a track record of providing nationwide leadership for multiple large - scale distribution and fulfillment centers . He is an expert in leading a variety of projects including multiple distribution center “greenfield” start - ups, international operations start - ups, and long - term strategic planning . Mr . Guilhas brings specialized experience in coordinating multi - channel operations, complex systems integrations, safety controls, and continuous improvement . Mr . Guilhas holds multiple advanced degrees including a Doctorate of Management received in 2016 from Colorado Tech in Colorado Springs, CO . Executives and Senior Staff’s Brand and Operations Experience Senior Staff p. 14 GOED

9 - Months Ended September 30 9M 2020 A 3 - Months Ended December 31 Q4 2020 E 12 - Months Ended December 31 FY 2020 E GOEDEKER (GOED) Appliances Connection GOEDEKER (GOED) Appliances Connection GOEDEKER (GOED) Product Sales, Net $ 38,397,304 $ 226,785,594 $ 17,600,000 $ 80,000,000 $ 362,782,898 Cost of Sales 32,060,897 171,700,216 14,695,000 60,560,000 279,016,113 Gross Profit 6,336,407 55,085,378 2,905,000 19,440,000 83,766,785 Personnel 4,513,602 9,030,925 1,867,000 3,010,000 18,421,527 Advertising 2,991,177 5,508,329 1,300,000 1,836,000 11,635,506 Bank and Credit Card Fees 1,274,117 11,823,278 684,000 3,941,000 17,722,395 Depreciation and Amortization 276,914 481,904 93,000 161,000 1,012,818 General and Administrative 2,160,560 5,522,553 949,000 1,841,000 10,473,113 Total Operating Expenses 11,216,370 32,366,989 4,893,000 10,789,000 59,265,359 NET INCOME (LOSS) Operations (4,879,963) 22,718,389 (1,988,000) 8,651,000 24,501,426 Interest income 2,480 749,177 - 250,000 1,001,657 Financing costs (757,646) - (5,000) - (762,646) Interest expense (604,908) (39,466) (28,000) (13,000) (685,374) Loss on extinguishment of debt (1,756,095) - - - (1,756,095) Write - off of acquisition receivable (809,000) - - - (809,000) Change in fair value of warrant liability (2,127,656) - - - (2,127,656) Other income (expense) 6,920 251,046 - 84,000 264,886 Total Other Income (Expense) (6,045,905) 960,757 (33,000) 321,000 (4,874,228) NET INCOME (LOSS) Pre - Tax $ (10,925,868) $ 23,679,146 $ (2,021,000) $ 8,972,000 $ 19,627,198 EBITDA $ (9,286,400) $ 24,200,516 $ (1,896,000) $ 9,146,000 $ 22,164,914 ADJUSTED EBITDA $ (4,312,455) $ 24,200,516 $ (1,778,000) $ 9,146,000 $ 27,256,573 p. 15 :GOED 2020 Income Statement 9M 2020 A ctual GOED and Appliances Connection 9 - Month Actuals Q4 2020 E stimates GOED and Appliances Connection Q42020 Projections FY 2020 E stimates GOED and Appliances Connection Full Year Combined Projections

For the 12 Months Ended 12/31 For the 12 Months Ended 12/31 For the 12 Months Ended 12/3 FY 202 0 E GOEDEKER (GOED) PRO - FORMA Combined FY 202 1 F GOEDEKER (GOED) - ONLY - FY 202 1 F Appliances Connection - ONLY - FY 202 1 F POST - ACQUISITION Combined Product Sales, Net $ 362,783,000 $ 165,675,000 $ 389,100,000 $554,775,000 Cost of Sales 279,017,000 138,339,000 310,891,000 449,230,000 Gross Profit 83,766,000 27,336,000 78,209,000 105,545,000 Personnel 18,304,000 7,938,000 13,075,000 21,012,000 Advertising 11,636,000 7,087,000 7,975,000 15,062,000 Bank and Credit Card Fees 17,723,000 3,792,000 17,117,000 20,909,000 Depreciation and Amortization 1,013,000 397,000 680,000 1,077,000 General and Administrative 10,472,000 4,842,000 7,760,000 12,603,000 Total Operating Expenses 59,148,000 24,056,000 46,607,000 70,663,000 NET INCOME (LOSS) From Operations 24,618,000 3,280,000 31,602,000 34,882,000 Interest income 1,002,000 - 1,000,000 1,000.000 Financing costs (763,000) (21,000) - (21,000) Interest expense (686,000) (104,000) (53,000) (157,000) Loss on extinguishment of debt (1,756,000) - - Write - off of acquisition receivable (809,000) - - Change in fair value of warrant liability (2,128,000) - - Other income (expense) 343,000 - 359,000 359,000 Total Other Income (Expense) 15,024,000 (125,000) 1,306,000 1,181,000 NET INCOME (LOSS) Pre - Tax $ 19,821,000 $ 3,155,000 $ 32,908,000 $ 36,063,000 EBITDA $ 22,164,914 $ 3,676,000 $ 33,642,000 $ 37,318,000 ADJUSTED EBITDA $27,256,573 $ 4,160,000 $ 33,642,000 $ 37,802,000 p. 16 :GOED 2021 Income Statement FY 2020 E stimates GOED and Appliances Connection Full Year Combined Estimates FY 2021 F orecast GOED and Appliances Connection Full Year Forecasts, Respectively FY 2021 F orecast GOED 2021 Forecast Post - Acquisition 2021 FORECAST

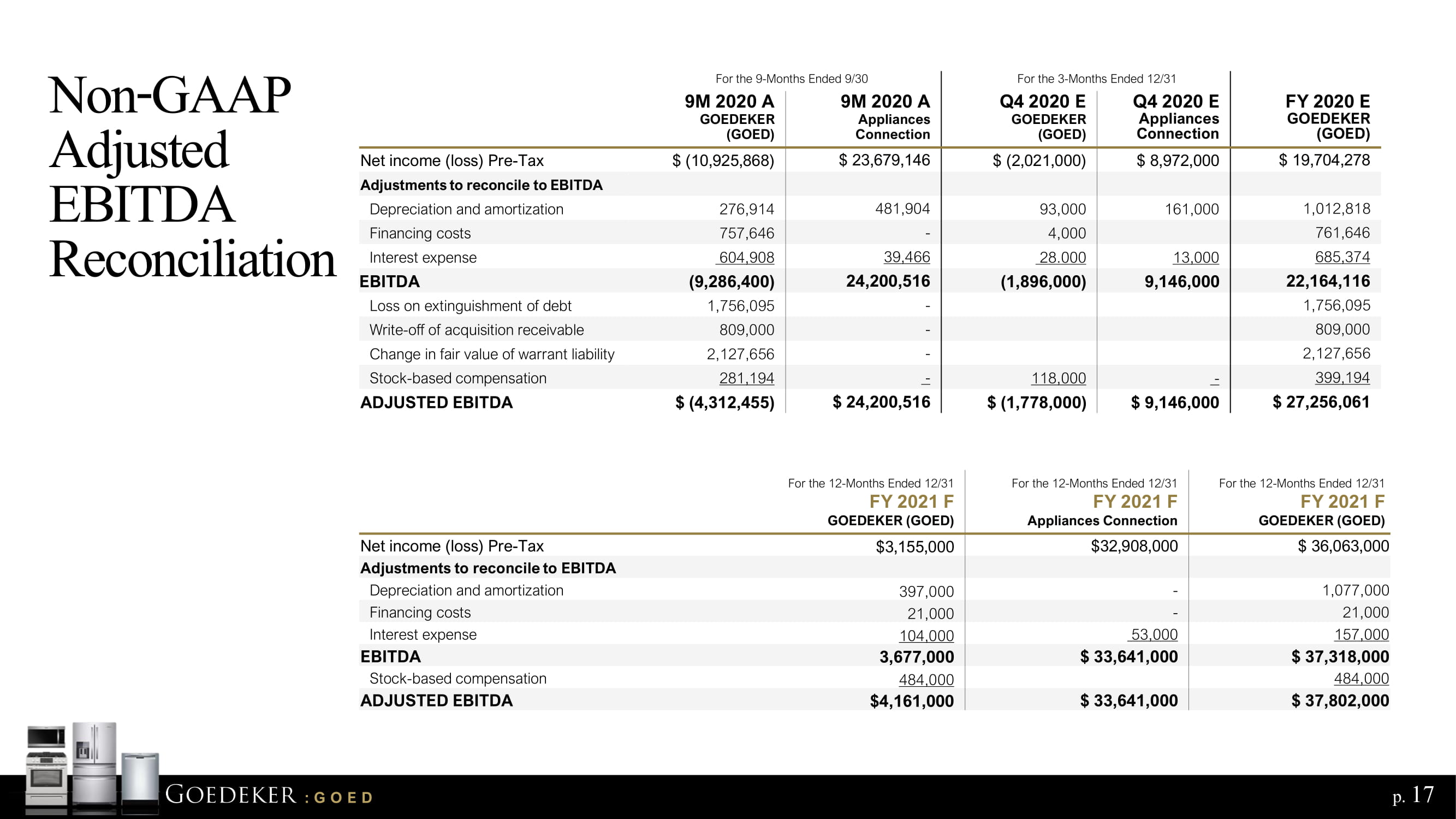

For the 9 - Months Ended 9/30 For the 3 - Months Ended 12/31 9M 2020 A GOEDEKER (GOED) 9M 2020 A Appliances Connection Q4 2020 E GOEDEKER (GOED) Q4 2020 E Appliances Connection FY 2020 E GOEDEKER (GOED) Net income (loss) Pre - Tax $ (10,925,868) $ 23,679,146 $ (2,021,000) $ 8,972,000 $ 19,704,278 Adjustments to reconcile to EBITDA Depreciation and amortization 276,914 481,904 93,000 161,000 1,012,818 Financing costs 757,646 - 4,000 761,646 Interest expense 604,908 39,466 28.000 13,000 685,374 EBITDA (9,286,400) 24,200,516 (1,896,000) 9,146,000 22,164,116 Loss on extinguishment of debt 1,756,095 - 1,756,095 Write - off of acquisition receivable 809,000 - 809,000 Change in fair value of warrant liability 2,127,656 - 2,127,656 Stock - based compensation 281,194 - 118,000 - 399,194 ADJUSTED EBITDA $ (4,312,455) $ 24,200,516 $ (1,778,000) $ 9,146,000 $ 27,256,061 p. 17 :GOED Non - GAAP Adjusted EBITDA Reconciliation For the 12 - Months Ended 12/31 FY 2021 F GOEDEKER (GOED) For the 12 - Months Ended 12/31 FY 2021 F Appliances Connection For the 12 - Months Ended 12/31 FY 2021 F GOEDEKER (GOED) Net income (loss) Pre - Tax $3,155,000 $32,908,000 $ 36,063,000 Adjustments to reconcile to EBITDA Depreciation and amortization 397,000 - 1,077,000 Financing costs 21,000 - 21,000 Interest expense 104,000 53,000 157,000 EBITDA 3,677,000 $ 33,641,000 $ 37,318,000 Stock - based compensation 484,000 484,000 ADJUSTED EBITDA $4,161,000 $ 33,641,000 $ 37,802,000

Cap Table September 30 2020 A GOEDEKER (GOED) September 30 2020 E Combined GOEDEKER (GOED) GOED Shares Currently Outstanding 6,111,200 6,111,200 Issuance of Common Stock Equivalents in Acquisition 1 - 5,472,346 Options ( WAEP $9.00) 555,000 555,000 Warrants 55,560 55,560 September 30 2020 A GOEDEKER (GOED) September 30 2020 A Appliances Connection September 30 2020 E Combined GOEDEKER (GOED) Cash and Cash Equivalents $ 3,466,981 $17,179,592 $ 20,646,573 Restricted Cash 8,912,367 - 8,912,367 Receivables 1,219,455 16,430,499 17,649,954 Deposits with Vendors 547,648 27,421,292 27,968,940 Merchandise Inventory 3,086,873 13,313,145 16,400,018 Accounts Payable 4,371,204 10,810,183 15,181,387 Notes Payable, Current 1,300,579 1,683,163 2,983,742 Long - term notes payable, net of current portion 2,684,623 2,140,430 4,825,053 p. 18 :GOED Balance Sheet 1 Represents $ 42 million of stock with $ 21 million of such amount being issued at a price of $ 9 . 00 per share or 2 , 333 , 333 shares (the Fixed Share Consideration) and the remaining $ 21 million being issued at a price per share equal to the average 20 - day volume weighted average price of our common stock for the 20 trading days immediately preceding the 3 rd trading day prior to the closing date (the Variable Share Consideration) of the Appliances Connection acquisition . Since the Variable Share Consideration cannot yet be determined, we used $ 6 . 69 , which is the average VWAP for the 20 - day period prior to November 20 , 2020 .

COMPANY (SYMBOL) Stock Price Enterprise Value (EV) Revenues CY 2O21E EBITDA CY 2O21E EV / EBITDA CY 2021E EV / Sales CY 2021E AMAZON.COM, INC. (AMZN) $3,099.40 $1,583,540 $448,965 $69,169 22.9 x 3.5 x WAYFAIR, INC (W) $252.54 $26,390 $15,982 $686 38.5 x 1.7 x ETSY, Inc. (ETSY) $140.06 $17,246 $1,808 $506 34.1 x 9.5 x PURPLE, INC. (PRPL) $30.59 $1,812 $829 $101 17.9 x 2.2 x MEAN 28.3 x 4.2 x Stock Price Enterprise Value (EV) Revenues EBITDA EV / EBITDA EV / Sales 2020 ESTIMATED PRE - Acquisition $5.89 $48 M $56 M - - 0.8x 2021 FORECAST POST - Acquisition $5.89 $246 M $550 M $37.8 M 9.0x 0.4x FAVORABLE MARKET TRENDS p. 19 Near Term Arbitrage INVESTMENT OPPORTUNITY (GOED) DISCLOSURE: The information contained herein is for informational purposes only. The source is S&P Capital IQ and Wall Street re search estimates compiled by S&P Capital IQ on 11/17/2020 at 4:30pm and believed by the Company to be reliable but has not been independently ver ified. GOED GOED shares currently trade at a 3x discount EV/EBITDA and a 10 x discount EV/SALES JM [2]24

▪ Two companies undervalued based on megatrends can combine to form a $550 M industry powerhouse ▪ EV expected well below comparable EVs at time of acquisition ▪ Synergies will bring strong revenue growth and significant operating savings ▪ Growth in consumer demand will continue at strong pace with low customer acquisition cost and low need for adding material fixed cost for the foreseeable future INVESTORS Dave Gentry RedChip Companies 1.800.733.2447 FOR THE COMPANY Doug Moore, CEO GOEDEKER 1.888.768.1710 www.goedekers.com Acquisition Summary LISTED GOED Best brands. Best value. Expert help. $1B in revenues and the industry’s most profitable online appliance retailer in three years Our Goal GOED