Attached files

| file | filename |

|---|---|

| EX-32.1 - WORLD HEALTH ENERGY HOLDINGS, INC. | ex32-1.htm |

| EX-31.1 - WORLD HEALTH ENERGY HOLDINGS, INC. | ex31-1.htm |

| EX-10.2 - WORLD HEALTH ENERGY HOLDINGS, INC. | ex10-2.htm |

| EX-10.1 - WORLD HEALTH ENERGY HOLDINGS, INC. | ex10-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

MARK ONE

[X] Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the Quarterly Period ended September 30, 2020; or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from ________ to ________

WORLD HEATH ENERGY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-30256 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 1825 NW Corporate Blvd. Suite 110, Boca Raton, FL | 33431 | |

| (Address of principal executive offices) | Zip Code |

(561) 870-0440

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

As of November 20, 2020, 89,789,407,996 shares of the registrant’s common stock, par value $0.0007 per share, were outstanding.

WORLD HEALTH ENERGY HOLDINGS, INC.

Form 10-Q

September 30, 2020

| i |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2020

TABLE OF CONTENTS

| 1 |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars except share and per share data)

| September 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | 94,150 | 359,461 | ||||||

| Accounts receivable, net | 12,432 | 6,448 | ||||||

| Other current assets | 313,218 | 213,012 | ||||||

| Total Current assets | 419,800 | 578,921 | ||||||

| Right Of Use asset arising from operating lease | 6,281 | 24,034 | ||||||

| Property and Equipment, Net | 15,768 | 17,225 | ||||||

| Total assets | 441,849 | 620,180 | ||||||

| Liabilities and Shareholders’ Deficit | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | 36,689 | 31,369 | ||||||

| Other accounts liabilities | 421,920 | 73,477 | ||||||

| Total current liabilities | 458,609 | 104,846 | ||||||

| Liability for employee rights upon retirement | 77,663 | 41,846 | ||||||

| Long term loan from parent company | 1,511,787 | 1,102,799 | ||||||

| Total liabilities | 2,048,059 | 1,249,491 | ||||||

| Stockholders’ Deficit | ||||||||

| Preferred stock, par $0.0007, 10,000,000 shares authorized, 5,000,000 shares issued and outstanding as of September 30, 2020 and December 31, 2019. | 3,500 | - | ||||||

| Series B Convertible Preferred stock, par $0.0007, 3,870,000 shares authorized, 3,870,000 and 0 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively | 2,709 | 2,709 | ||||||

| Common stock, par $0.0007, 110,000,000,000 shares authorized, 89,789,407,996 and 0 shares issued and outstanding at September 30, 2020 and December 31, 2019, respectively. | 62,852,585 | - | ||||||

| Additional paid-in capital | (63,339,224 | ) | (2,681 | ) | ||||

| Foreign currency translation adjustments | (5,713 | ) | (5,495 | ) | ||||

| Accumulated deficit | (1,120,067 | ) | (623,844 | ) | ||||

| Total stockholders’ deficit | (1,606,210 | ) | (629,311 | ) | ||||

| Total liabilities and stockholders’ deficit | 441,849 | 620,180 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 2 |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(U.S. dollars except share and per share data)

| Nine months ended | Three months ended | |||||||||||||||

| September 30 | September 30 | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenues | 52,906 | 66,265 | 24,798 | 12,777 | ||||||||||||

| Research and development expenses | (328,529 | ) | (174,271 | ) | (181,175 | ) | (73,058 | ) | ||||||||

| General and administrative expenses | (227,525 | ) | (196,615 | ) | (109,466 | ) | (132,605 | ) | ||||||||

| Operating loss | (503,148 | ) | (304,621 | ) | (265,843 | ) | (192,886 | ) | ||||||||

| Financing income (expense), net | 6,925 | (83,940 | ) | (2,307 | ) | (73,504 | ) | |||||||||

| Net loss | (496,223 | ) | (388,561 | ) | (268,150 | ) | (266,390 | ) | ||||||||

| Other comprehensive loss - Foreign currency loss | (218 | ) | (19,520 | ) | (3,523 | ) | (8,710 | ) | ||||||||

| Comprehensive loss | (496,441 | ) | (408,081 | ) | (271,673 | ) | (275,100 | ) | ||||||||

| Loss per share (basic and diluted) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | ||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 3 |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

(U.S. dollars except share and per share data)

Preferred Stock, $0.0007, Par Value | Preferred Stock B, $0.0007, Par Value | Common Stock, $0.0007, Par Value | Additional | Foreign currency | Total Company’s | |||||||||||||||||||||||||||||||||||

Number of Shares | Amount | Number of Shares | Amount | Number of Shares | Amount | paid-in capital | translation adjustments | Accumulated deficit | stockholders’ equity | |||||||||||||||||||||||||||||||

| BALANCE AT JANUARY 1, 2019 | - | - | 3,870,000 | 2,709 | - | - | (2,681 | ) | 6,091 | (209,918 | ) | (203,799 | ) | |||||||||||||||||||||||||||

| CHANGES DURING THE PERIOD OF NINE MONTHS ENDED SEPTEMBER 30, 2019: | ||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | - | - | - | - | - | - | - | (19,520 | ) | - | (19,520 | ) | ||||||||||||||||||||||||||||

| Comprehensive loss for nine month ended September 30, 2019 | - | - | - | - | - | - | - | - | (388,561 | ) | (388,561 | ) | ||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2019 (Unaudited) | - | - | 3,870,000 | 2,709 | - | - | (2,681 | ) | (13,429 | ) | (598,479 | ) | (611,880 | ) | ||||||||||||||||||||||||||

Preferred Stock, $0.0007, Par Value | Preferred Stock B, $0.0007, Par Value | Common Stock, $0.0007, Par Value | Additional | Foreign currency | Total Company’s | |||||||||||||||||||||||||||||||||||

Number of Shares | Amount | Number of Shares | Amount | Number of Shares | Amount | paid-in capital | translation adjustments | Accumulated deficit | stockholders’ equity | |||||||||||||||||||||||||||||||

| BALANCE AT JANUARY 1, 2020 | - | - | 3,870,000 | 2,709 | - | - | (2,681 | ) | (5,495 | ) | (623,844 | ) | (629,311 | ) | ||||||||||||||||||||||||||

| CHANGES DURING THE PERIOD OF NINE MONTHS ENDED SEPTEMBER 30, 2020: | ||||||||||||||||||||||||||||||||||||||||

| Effect of Reverse Capitalization | 5,000,000 | 3,500 | - | - | 89,789,407,996 | 62,852,585 | (63,336,543 | ) | - | - | (480,458 | ) | ||||||||||||||||||||||||||||

| Foreign currency translation adjustments | - | - | - | - | - | - | - | (218 | ) | - | (218 | ) | ||||||||||||||||||||||||||||

| Comprehensive loss for nine month ended September 30, 2020 | - | - | - | - | - | - | - | - | (496,223 | ) | (496,223 | ) | ||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2020 (Unaudited) | 5,000,000 | 3,500 | 3,870,000 | 2,709 | 89,789,407,996 | 62,852,585 | (63,339,224 | ) | (5,713 | ) | (1,120,067 | ) | (1,606,210 | ) | ||||||||||||||||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

| 4 |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars)

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2020 | 2019 | |||||||

| (Unaudited) | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss for the period | (496,223 | ) | (388,561 | ) | ||||

| Adjustments required to reconcile net loss for the period to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 29,775 | 29,563 | ||||||

| Increase in liability for employee rights upon retirement | 34,950 | 18,447 | ||||||

| Decrease (increase) in accounts receivable | (5,956 | ) | 5,071 | |||||

| Decrease (increase) in other current assets | (15,029 | ) | (14,594 | ) | ||||

| Increase in accounts payable | 5,183 | 17,824 | ||||||

| Increase in other accounts liabilities | 47,351 | 25,345 | ||||||

| Net cash used in operating activities | (399,949 | ) | (306,905 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Loans granted to related parties | (242,091 | ) | (149,178 | ) | ||||

| Purchase of Property and Equipment | (9,218 | ) | (676 | ) | ||||

| Net cash used in investing activities | (251,309 | ) | (149,854 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Payments of lease liability | (21,474 | ) | (13,881 | ) | ||||

| Loan received from parent company | 408,988 | 673,133 | ||||||

| Net cash provided by financing activities | 387,514 | 659,252 | ||||||

| EFFECT OF EXCHANGE RATES ON CASH AND CASH EQUIVALENTS | (1,567 | ) | (1,768 | ) | ||||

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | (265,311 | ) | 200,725 | |||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 359,461 | 23,149 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | 94,150 | 223,874 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statement

| 5 |

WORLD HEALTH ENERGY HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(U.S. dollars except share and per share data)

NOTE 1 - GENERAL

| A. | Operations |

World Health Energy Holdings, Inc., (the “Company” or “WHEN”), was formed on May 21, 1986, under the laws of the State of Delaware. The Company has invested in and abandoned a variety of software programs that it strove to commercialize.

UCG, INC. (the “UCG”) was incorporated on September 13, 2017, under the laws of the State of Florida. The Company wholly-owns the issued and outstanding shares of RNA Ltd (Hereinafter: “RNA”).

RNA is primarily a research and development company that has been performing software design work for UCG in the field of cybersecurity under the terms of development agreement between UCG and RNA. UCG is primarily engaged in the marketing and distribution of cybersecurity related products.

In anticipation of the transaction contemplated under the Merger Agreement, SG 77 Inc. a Delaware Corporation and a wholly-owned subsidiary of UCG (“SG”), was incorporated on April 16, 2020 and all of the cybersecurity rights and interests held by UCG, including the share ownership of RNA, were assigned to SG.

On September 10, 2020, the holders of a majority of the Company’s voting stock approved an increase in the number of the authorized shares of the Company’s common stock to 750,000,000,000 shares. As of September 30, 2020, the increase in authorized common stock was not yet effective.

| B. | Merger Transaction |

On April 27, 2020, the Company completed a reverse triangular merger pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) among WHEN, R2GA, Inc., a Delaware corporation and a wholly owned subsidiary of WHEN (“Sub”), UCG, SG, and RNA. Under the terms of the Merger Agreement, R2GA merged with SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the WHEN (the “Merger”). The Merger was effective as of April 27, 2020 whereby SG became a direct and wholly owned subsidiary of WHEN and RNA indirect wholly owned subsidiary of the Company. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of the Company.

As consideration for the Merger, WHEN issued to UCG 3,870,000 Series B Convertible Preferred Stock, par value $0.0007 per share, of WHEN (the “Series B Preferred Shares”). Each share of the Series B Preferred Shares will automatically convert into 100,000 shares of WHEN’s common stock, par value $0.0007 (the “Common Stock”), for an aggregate amount of 387,000,000,000 shares of WHEN’s Common Stock, upon the filing with the Secretary of State of Delaware of an amendment to WHEN’s certificate of incorporation increasing the number of authorized shares of Common Stock that the Company is authorized to issue from time to time.

The Company, collectively with SG, Sub and RNA are hereunder referred to as the “Group”.

| 6 |

WORLD HEALTH ENERGY HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(U.S. dollars except share and per share data)

NOTE 1 – GENERAL (continue)

The transaction was accounted for as a reverse asset acquisition in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Under this method of accounting, SG was deemed to be the accounting acquirer for financial reporting purposes. This determination was primarily based on the facts that, immediately following the Merger: (i) SG’s stockholders owned a substantial majority of the voting rights in the combined company, (ii) SG designated a majority of the members of the initial board of directors of the combined company, and (iii) SG’s senior management holds all key positions in the senior management of the combined company. As a result of the Recapitalization Transaction, the shareholders of SG received the largest ownership interest in the Company, and SG was determined to be the “accounting acquirer” in the Recapitalization Transaction. As a result, the historical financial statements of the Company were replaced with the historical financial statements of SG. The number of shares prior to the reverse capitalization have been retroactively adjusted based on the equivalent number of shares received by the accounting acquirer in the Recapitalization Transaction.

| C. | Going concern uncertainty |

Since inception, the Group has devoted substantially all its efforts to research and development. The Group is still in its development stage and the extent of the Group’s future operating losses and the timing of becoming profitable, if ever, are uncertain. As of September 30, 2020, the Group had $94,150 of cash and cash equivalents, net losses of $496,223, accumulated deficit of $1,120,067, and a negative working capital of $38,809.

The Group will need to secure additional capital in the future in order to meet its anticipated liquidity needs primarily through the sale of additional Common Stock or other equity securities and/or debt financing. Funds from these sources may not be available to the Group on acceptable terms, if at all, and the Group cannot give assurance that it will be successful in securing such additional capital.

These conditions raise substantial doubt about the Company’s ability to continue to operate as a “going concern.” The Company’s ability to continue operating as a going concern is dependent on several factors, among them is the ability to raise sufficient additional funding.

The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| D. | On March 11, 2020, the World Health Organization declared the outbreak of a novel coronavirus (SARS-CoV-2) to be a global pandemic (COVID-19), which continues to spread throughout the United States and around the world. The COVID-19 pandemic is having significant effects on global markets, supply chains, businesses, and communities. Specific to the Company, COVID-19 may impact various parts of its 2020 operations and financial results including but not limited to reduction is sales, difficulties in obtaining additional financing, or potential shortages of personnel. The Company believes it is taking appropriate actions to mitigate the negative impact. However, the full impact of COVID-19 is unknown and cannot be reasonably estimated as these events occurred subsequent to year end and are still developing. |

| 7 |

WORLD HEALTH ENERGY HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(U.S. dollars except share and per share data)

| E. | Risk factors |

The Group face a number of risks, including uncertainties regarding finalization of the development process, demand and market acceptance of the Group’s products, the effects of technological changes, competition and the development of products by competitors. Additionally, other risk factors also exist, such as the ability to manage growth and the effect of planned expansion of operations on the Group’s future results. In addition, the Group expects to continue incurring significant operating costs and losses in connection with the development of its products and increased marketing efforts. As mentioned above, the Group has not yet generated significant revenues from its operations to fund its activities, and therefore the continuance of its activities as a going concern depends on the receipt of additional funding from its current stockholders and investors or from third parties.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Unaudited Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiary, prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with the instructions to Form 10-Q. In the opinion of management, the financial statements presented herein have not been audited by an independent registered public accounting firm but include all material adjustments (consisting of normal recurring adjustments) which are, in the opinion of management, necessary for a fair statement of the financial condition, results of operations and cash flows for the nine-months ended September 30, 2020. However, these results are not necessarily indicative of results for any other interim period or for the year ended December 31, 2020. The preparation of financial statements in conformity with GAAP requires the Company to make certain estimates and assumptions for the reporting periods covered by the financial statements. These estimates and assumptions affect the reported amounts of assets, liabilities, revenues and expenses. Actual amounts could differ from these estimates.

Certain information and footnote disclosures normally included in financial statements in accordance with generally accepted accounting principles have been omitted pursuant to the rules of the U.S. Securities and Exchange Commission (“SEC”). These financial statements should be read in conjunction with the financial statements and notes thereto contained in the Company’s Annual Report published on the OTCIQ, for the year ended December 31, 2019.

Principles of Consolidation

The consolidated financial statements are prepared in accordance with US GAAP. The consolidated financial statements of the Company include the Company and its wholly-owned and majority-owned subsidiaries. All inter-company balances and transactions have been eliminated.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, certain revenues and expenses, and disclosure of contingent assets and liabilities as of the date of the financial statements. Actual results could differ from those estimates. As applicable to these financial statements, the most significant estimates and assumptions relate to going concern assumptions.

| 8 |

WORLD HEALTH ENERGY HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(U.S. dollars except share and per share data)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Recent Accounting Pronouncements

In June 2016, FASB issued ASU No. 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. In November 2018, FASB issued ASU No. 2018-19, “Codification Improvements to Topic 326, Financial Instruments-Credit Losses”, which amends the scope and transition requirements of ASU 2016-13. Topic 326 requires a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected. The measurement of expected credit losses is based on relevant information about past events, including historical experience, current conditions and reasonable and supportable forecasts that affect the collectability of the reported amount. Topic 326 will originally become effective for the Company beginning January 1, 2020, with early adoption permitted, on a modified retrospective approach. As a smaller reporting company, the effective date for the Company has been delayed until fiscal years beginning after December 15, 2022, in accordance with ASU 2019-10, although early adoption is still permitted. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies certain aspects of the current guidance to improve consistent application among reporting entities. ASU 2019-12 is effective for fiscal years beginning after December 15, 2021 and interim periods within annual periods beginning after December 15, 2022, though early adoption is permitted, including adoption in any interim period for which financial statements have not yet been issued. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

The Company has implemented all new accounting pronouncements that are in effect and that could impact its consolidated financial statements and does not believe that there are any other new accounting pronouncements that have been issued, but are not yet effective, that might have a material impact on the consolidated financial statements of the Company.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies certain aspects of the current guidance to improve consistent application among reporting entities. ASU 2019-12 is effective for fiscal years beginning after December 15, 2021 and interim periods within annual periods beginning after December 15, 2022, though early adoption is permitted, including adoption in any interim period for which financial statements have not yet been issued. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement. This standard will require entities to disclose the amount of total gains or losses for the period recognized in other comprehensive income that is attributable to fair value changes in assets and liabilities held as of the balance sheet date and categorized within Level 3 of the fair value hierarchy. This ASU will be effective for the Company for annual and interim periods beginning after December 31, 2020. Early adoption of this standard is permitted. We have not yet determined the impact of the adoption of this ASU on our results of operations, financial position and cash flows.

| 9 |

WORLD HEALTH ENERGY HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(U.S. dollars except share and per share data)

NOTE 3 – RELATED PARTIES

A. Transactions and balances with related parties

| Nine

months ended September 30 | Three

months ended September 30 | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| General and administrative expenses: | ||||||||||||||||

| Salaries and fees to officers | 81,377 | 55,768 | 51,791 | 29,720 | ||||||||||||

| Research and development expenses: | ||||||||||||||||

| Salaries and fees to officers | 46,779 | 29,869 | 31,357 | 15,889 | ||||||||||||

B. Balances with related parties and officers:

As of September 30, | As of December 31, | |||||||

| 2020 | 2019 | |||||||

| Other current assets | 261,823 | 176,804 | ||||||

| Other accounts liabilities | 167,232 | - | ||||||

| Long term loan from related party | 1,511,787 | 1,102,799 | ||||||

NOTE 4 – SUBSEQUENT EVENTS

On October 21, 2020, RNA Ltd., the Company’s subsidiary, and Giora Rozensweig, the Company’s interim Chief Executive Officer, entered into an employment agreement providing for the employment (the “Giora Employment Agreement”) of Mr. Giora Rozensweig as RNA’s Chief Executive Officer, with retroactive application to July 1, 2020. Under the Giora Employment Agreement, Mr. Rozensweig is paid an annual salary of the current New Israeli Shekel equivalent of $124,080, payable monthly. Under the Giora Rozensweig Employment Agreement he also receives the following: (i) Manager’s Insurance under Israeli law for the benefit of Mr. Rosenzweig pursuant to which RNA contributes amounts equal to (a) 8-1/3 percent (and Mr. Rosenzweig contributes an additional 5%) of each monthly salary payment, and (b) 6.5 % of Mr. Rosenzweig’s salary (with Mr. Rosenzweig contributing an additional 6%) to a pension fund, a form of deferred compensation program established under Israeli law. The Giora Employment Agreement also contains certain provisions for termination by RNA, which may result in a severance payment equal to twenty four months of base salary then in effect.

On October 21, 2020, RNA Ltd., the Company’s subsidiary, and Gaya Rozensweig entered into an employment agreement providing for the employment (the “Gaya Employment Agreement”) of Ms. Gaya Rozensweig as RNA’s controller, with retroactive application to July 1, 2020. Under the Gaya Employment Agreement, Ms. Rozensweig is paid an annual salary of the current New Israeli Shekel equivalent of $86,880, payable monthly. Under the Rosenzweig Employment Agreement, she also receives the following: (i) Manager’s Insurance under Israeli law for the benefit of Ms. Rosenzweig pursuant to which RNA contributes amounts equal to (a) 8-1/3 percent (and Ms. Rosenzweig contributes an additional 5%) of each monthly salary payment, and (b) 6.5% of Ms. Rosenzweig’s salary (with Ms. Rosenzweig contributing an additional 6%) to a pension fund, a form of deferred compensation program established under Israeli law. The Gaya Employment Agreement also contains certain provisions for termination by RNA, which may result in a severance payment equal to twenty four months of base salary then in effect.

| 10 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the audited financial statements and notes thereto of our wholly-owned subsidiary UCG Inc. for the years ended December 31, 2019 and 2018 included in our Current Report on Form 8-K field on April 30, 2020, as amended by the Current Report on Form 8-K/A filed with the Securities and Exchange Commission (the “SEC”) on July 30, 2020, as further amended by the Current Report on Form 8-K/A filed in August 25, 2020 (collectively, the “Current Report 8-K”). This section of the Quarterly Report includes a number of forward-looking statements within the meaning of the private securities litigation reform act of 1995, as amended that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements which speak only as of the date made, and except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. Factors that could cause differences include, but are not limited to, customer acceptance risks for current and new products and services, reliance on external sources of financing, development risks for new products and brands, dependence on third party service providers, fluctuations in market demand and customer preferences, changes in government regulations, as well as general conditions of the industry, and other “Risk Factors” discussed in our Current Report in the Current Report Form 8-K and similar discussions in subsequently filed Quarterly Reports on Form 10-Q, including this Form 10-Q, as applicable, and those contained from time to time in our other filings with the SEC.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements regarding our business, financial condition, results of operations and prospects. The Securities and Exchange Commission (the “SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This Quarterly Report on Form 10-Q and other written and oral statements that we make from time to time contain such forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal proceedings, and financial results and the effects of the COVID-19 pandemic or any similar pandemic.

We caution that these factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The following discussion should be read in conjunction with our unaudited financial statements and the related notes that appear elsewhere in this Quarterly Report on Form 10-Q as well as our other SEC filings.

| 11 |

Overview

World Health Energy Holdings, Inc.(“we” “us” “our” the “Company” or “WHEN”) was incorporated on May 21, 1986 in the state of Delaware. WHEN is a diversified energy, health, and security technology company with corporate offices that are located in Boca Raton, Florida and Ramat Gan, Israel.

On April 27, 2020, WHEN completed a reverse triangular merger pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) among the Company, R2GA, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Sub”), UCG, Inc., a Florida corporation (“Seller”), SG 77 Inc., a Delaware corporation and wholly-owned subsidiary of Seller (“SG”), and RNA Ltd., an Israeli company and a wholly owned subsidiary of SG (“RNA”). Under the terms of the Merger Agreement, R2GA merged with and into SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the Company (the “Merger”). The Merger became effective as of April 29, 2020, upon the filing of a copy of the Merger Agreement and certificate of merger with the Secretary of State of the State of Delaware, whereby SG became a direct and wholly owned subsidiary of the Company and RNA indirect wholly owned subsidiary of the Company. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of UCG.

RNA is primarily a research and development company that has been performing software design work for the Seller in the field of cybersecurity. SG is primarily engaged in the marketing and distribution of cybersecurity related products. In anticipation of the transaction contemplated under the Merger Agreement, SG was formed and all of the cybersecurity rights and interests held by UCG, including the share ownership of RNA, were assigned to SG.

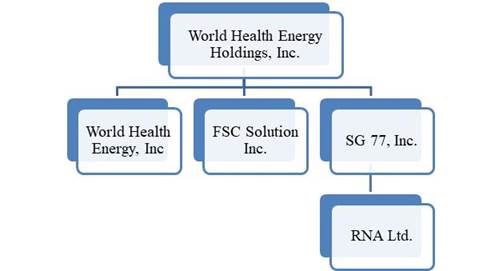

Following the closing, each of SG 77 and RNA became wholly-owned subsidiaries of the Company. Below is a diagram of the current corporate structure of the Company. We intend to continue the business of SG/RNA as our principal business enterprise.

Overview of the Post Merger Entity

World Health Energy Holdings (d/b/a WHEN Group) is a cyber, intelligence and behavioral security company, comprised of SG 77, Inc. (“SG”) , and RNA Ltd (“RNA”). See the corporate structure diagram below. SG is a software security company that designs, develops and markets data security software-based solutions. SG’s solutions are intended for use by commercial enterprises to prevent unauthorized transfer of proprietary and confidential enterprise data (Business System) and parental or other legal guardian use to protect their minor children when online (Parental System). The main focus of the Company post-merger is on developing next generation intelligence and cyber systems based on a proprietary pattern recognition technology. This system analyzes mobiles, servers and computer activity, using a proprietary algorithm to determine and analyze human behavioral patterns. Any deviation from the regular behavior pattern is identified and flagged, thus, preventing potential danger both in the business and the parental sector.

The Business Sector (Business System)

Though Mobile Device Management’s (MDM) are widely used in the workforce, they are focused on providing protection from threats originating outside the organization. Our commercially available Business System provides such protection but also is designed to prevent threats to data loss or unauthorized use or transfer originating from persons within the organization. Contrary to the common misconception that outside threats are more significant, in numerous cases the cyber threat arises from inside the company. SG’s Business System provides innovative solutions for the constantly evolving cyber challenges that arise, whether this is a private business, NGO or governmental entities. Enterprises may be vulnerable to cyberattacks from many sources, including but not limited to, network, endpoint, data, and cloud services.

The Business System has similar filters as would any other firewall and antivirus yet stands out in the manner of information analysis. The Business System collects and analyzes the employee’s organizational behavior, active on a mobile, tablet desktop and server device creating an employee profile. This enables an employer or manager to instantly identify and prevent the unauthorized behavior such as but not limited to: access, download or transfer of company documents or information. The employee profile is unique to each individual, and the Business System can detect changes and disconnect the device if the profile is compromised while simultaneously sending an alert. Additionally, the Business System knows to identify non-routine employee activities such as correspondence that suggests the employee is planning to resign or a change in a behavioral pattern.

| 12 |

The Business System is designed to protect sensitive company data by identifying and preventing any authorized downloads or transfer. Access to any unusual or unauthorized files will be identified as a change in behavioral pattern and send an immediate alert. Any irregularities will send real time alerts, thus enabling a real-time response and protecting the company from both internal and external threats. Additionally, the software generates real time reports which help analyze and assess employee activity and improve employee efficiency.

The Parental Sector (Parental System)

SG’s Parental System offers a comprehensive solution which is designed to enable parents wishing to observe their children’s online and offline behavior to learn if they are accessing inappropriate websites and content and/or to protect them from a range of threats including cyberbullying, pedophiles and other predators and identity theft.

The Parental System line is positioned as the “ultimate parental cyber solution”. This system incorporates a range of features enabling parents to view and manage their children’s phones. The key elements of our proprietary solutions include the following: analysis of all incoming and outgoing written data; analysis of all incoming and outgoing audio communication; real time location tracking; environmental surroundings analysis; and cyber activity analysis.

The Parental System has similar features to those of the Business System yet tailored to fit the needs of parents and guardians to protect their children. Such variations focus on online behavioral patterns whether vocally, via SMS or any other way. If there is a change in behavior patterns, the product is designed to immediately send the parent or adult guardian an alert. For example, one of the identifiable indicators before suicide is social withdrawal, something which today appears as a significant decrease in text message exchanges. The system categorizes this decrease as a red flag. Moreover, prior to suicide, there are certain words and phrases which usage are increase, should the system detect these it will put them in the red flag category.

While analyzing voice calls based on; tone of speech, lengths of the conversation and the frequency of calls, Parental System Analytics is capable of identifying changes in behavioral patterns and flagging these. I.e. studies showed that with mental health decrease, the frequency of calls decreases and the sentences along with the length of the conversations get shorter. Any such discrepancy in behavior patterns will send a real time alert to the parent or legal guardian, potentially avoiding a tragedy.

Other Corporate Holdings

FSC Solutions, Inc. On June 26, 2015, we entered into a Stock Purchase Agreement (the “Agreement”) with FSC and its shareholders which included Uri Tadelis, our former Chief Executive Officer and Director and our former Directors Chaim J. Lieberman and Gal Levy. The Agreement was effective as of July 1, 2015 which served as the closing date for the acquisition. Pursuant to the terms of the Agreement, we acquired all of the capital stock of FSC in exchange for the issuance of 70 billion shares of our unregistered common stock with the possibility of the issuance of an additional 130 Billion common shares upon FSC meeting certain milestones as outlined in the Agreement. Upon completion of the acquisition of FSC, we intended to employ FSC’s software and trading platform to enter the on-line trading industry. Subsequent to the completion of the acquisition, we determined that FSC did not have control over the trading platform and software we expected to acquire and operate. Consequently, we never commenced operations of this business and we are in discussions with the non-management sellers of FSC to resolve this issue that arose after closing and are evaluating our alternatives.

World Health Energy, Inc. World Health Energy, Inc. owns an algae-tech business who’s primary focus was the production of algae using their proprietary GB3000 growth system. The system quickly and efficiently grows algae for the production of biofuels and food protein. We also sought to produce and market high-quality, low-cost B100 biodiesel. Though, we believe that the Company has been successful in demonstrating the effectiveness of the GB3000 system on a small-scale the Company has not yet been able to raise the necessary capital to implement their technologies on a commercial scale. The Company continues to pursue all available options for raising the necessary capital in addition to exploring alternative revenue sources including joint ventures and mergers with existing Green Energy organizations. However, there can be no assurance that the foregoing can occur as planned, or at all.

| 13 |

Corporate Structure (Diagram)

The corporate structure of the WHEN Group is reflected below in this diagram

Comparison of the Three and Nine Months Ended September 30, 2020 to the Three and Nine Months Ended September 30, 2019

Results of Operations

Comparison of the three months ended September 30, 2020 and 2019

Revenues.

Revenues for the three months ended September 30, 2020 were $24,798 an increase of $12,021, or 94%, compared to total revenues of $12,777 for the three months ended September 30, 2019. Revenues were comprised primarily of software license fees

Research and Development

Research and development expenses consist of salaries and related expenses, consulting fees, service providers’ costs, related materials and overhead expenses. Research and development expenses for the three months ended September 30, 2020 were $181,175, an increase of $108,117, or 148%, compared to research and development expenses of $73,058 for the three months ended September 30, 2019. The increase is mainly attributable to the increase in payroll and related expenses as well as professional fees paid to outside consultant, rent and office expenses attributable to our research and development activities.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related expenses, rent and office expenses. General and administrative expenses for the three months ended September 30, 2020 were $109,466, an increase of $23,139, or 17%, compared to general and administrative expenses of $132,605 for the three months ended September 30, 2019. The increase is primarily attributable to the increase in administrative manpower and the related salaries and related expenses, rent and office expenses.

| 14 |

Financing Expenses, Net

Financing expenses, net for the three months ended September 30, 2020 was $2,307, an decrease of $71,197, or 97%, compared to financing expenses, net, of $73,504 for the three months ended September 30, 2019. The decrease is mainly a result of the effect of currency exchange differentials between the US Dollar and the New Israeli Shekel in the three months ended September 30, 2019 resulting in exchange losses in RNA.

Comparison of the Nine Months ended September 30, 2020 and 2019

Revenues

Revenues for the nine months ended September 30, 2020 were $52,906, a decrease of $13,359, or 20%, compared to total revenues of $66,265 for the nine months ended September 30, 2019.

Research and Development

Research and development expenses consist of salaries and related expenses, consulting fees, service providers’ costs, related materials and overhead expenses. Research and development expenses for the nine months ended September 30, 2020 were $328,529, an increase of $154,258, or 89%, compared to total research and development expenses of $174,271 for the nine months ended September 30, 2019. The increase is mainly attributable to the increase in payroll and related expenses as well as professional fees paid to outside consultant, rent and office expenses attributable to our research and development activities.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related expenses, rent and office expenses. General and administrative expenses for the nine months ended September 30, 2020 were $227,525, an increase of $30,910, or 16%, compared to total general and administrative expenses of $196,615 for the nine months ended September 30, 2019. The increase is mainly a result of the increase in administrative manpower and the related salaries and related expenses, rent and office expenses.

Financing Expenses, Net

Financing income, net for the nine months ended September 30, 2020 were $6,925, an increase of $90,865, compared to total financing expenses of $83,940 for the nine months ended September 30, 2019. The increase in finance income is mainly a result of the effect of currency exchange differences between the US Dollar and the New Israeli Shekel in the nine months ended September 30, 2019 resulting in exchange losses in RNA.

Financial Condition, Liquidity and Capital Resources

On September 30, 2020, we had current and total assets of $441,849. We had current and total liabilities of $458,609 and $2,048,059, respectively, at September 30, 2020.

On September 30, 2020, we had a working capital deficiency of $38,809.

We had $94,150 in cash on September 30, 2020 compared to $223,874 in cash on September 30, 2019. Cash used by operations for the nine months ended September 30, 2020 was $399,949 as compared to $306,905 for nine months ended September 30, 2019. The increase in cash used by operations is related to the increase in salaries and related expenses as well as service providers.

Net cash used in investing activities was $251,309 for the nine months ended September 30, 2020, as compared to net cash used in investing activities of $149,854 for the nine months ended September 30, 2019. The increase is mainly due to the increase in loans granted to related parties.

| 15 |

Net cash provided by financing activities was $387,514 for the nine months ended September 30, 2020, as compared to net cash provided by financing activities of $659,252 for the nine months ended September 30, 2019. The decrease is mainly due to the decrease in loans received from related parties.

Management believes that funds on hand, as well as anticipated revenues, will allow us to conduct operations as presently conducted through the end of 2020. We need to raise capital on an immediate basis in order to maintain operations. Without additional sources of cash and/or the deferral, reduction, or elimination of significant planned expenditures and debt repayment, we may not have the cash resources to continue as a going concern thereafter. To meet our short and long-term liquidity needs, we expect to use existing cash balances, cash from our revenue generating activities, as well as a variety of other means, including raising capital through potential issuances of debt or equity securities in public or private financings, partnerships and/or collaborations. There can be no assurance that additional financing will be available when needed or, if available, that can be obtained on commercially reasonable terms. If we will not be able to obtain the additional financing on a timely basis as required, or generate significant material revenues from operations, we will not be able to meet our other obligations as they become due and will be forced to limit or curtail certain of our business plans.

Going Concern

The accompanying Condensed Consolidated Financial Statements have been prepared assuming that we will continue as a going concern. We have an accumulated deficit of $1,120,067, and a working capital deficiency of $38,809 at September 30, 2020, and net loss from operations of $503,148 for the nine months period ended September 30, 2020. These conditions raise substantial doubt about our ability to continue as a going concern. The Condensed Consolidated Financial Statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Critical Accounting Policies

Use of Estimates The Condensed Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). In preparing the Condensed Consolidated Financial Statements, management is required to make estimates and assumptions that affect the reported amounts on the condensed consolidated balance sheets and condensed consolidated statements of operations for the year then ended. Actual results may differ significantly from those estimates. As applicable to these financial statements, the most significant estimates and assumptions relate to the going concern assumptions.

Going Concern Uncertainty

The development and commercialization of our product will require substantial expenditures. We have not yet generated any material revenues and have incurred substantial accumulated deficit and negative operating cash flows. We currently have no sources of recurring revenue and are therefore dependent upon external sources for financing our operations. There can be no assurance that we will succeed in obtaining the necessary financing to continue our operations. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Off-Balance Sheet Arrangements We have not entered into any off-balance sheet arrangements during 2020 and do not anticipate entering into any off-balance sheet arrangements during the next 12 months.

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable.

| ITEM 4. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures.

| 16 |

We maintain disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) that are designed to ensure that information required to be disclosed by us in reports that we file under the Exchange Act is recorded, processed, summarized and reported as specified in the SEC’s rules and forms and that such information required to be disclosed by us in reports that we file under the Exchange Act is accumulated and communicated to our management, including our Interim Chief Executive Officer, to allow timely decisions regarding required disclosure. Management, with the participation of our Interim Chief Executive Officer, performed an evaluation of the effectiveness of our disclosure controls and procedures as of September 30, 2020. Based on that evaluation, our management, including our Interim Chief Executive Officer, concluded that our disclosure controls and procedures were not effective as of September 30, 2020.

Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. As disclosed in Item 9A of our Annual Report on Form 10-K for the year ended December 31, 2019, our management concluded that our internal control over financial reporting was not effective at December 31, 2019. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. The limitation of the Company’s internal control over financial reporting was due to the applied risk-based approach which is indicative of many small companies with limited number of staff in corporate functions. The identified weakness were:

| ● | Material Weakness – We did not maintain effective controls over certain aspects of the financial reporting process because we (i) lacked a sufficient complement of personnel with a level of accounting expertise and an adequate supervisory review structure that is commensurate with our financial reporting requirements and (ii) we lacked controls over the disclosure of our business operations. |

| ● | lack of segregation of duties Significant Deficiencies – Inadequate segregation of duties. |

Our management believes the weaknesses identified above have not had any material effect on our financial results.

We expect to be materially dependent upon third parties to provide us with accounting consulting services for the foreseeable future which we believe will mitigate the impact of the material weaknesses discussed above. Until such time as we have a chief financial officer with the requisite expertise in U.S. GAAP and establish an audit committee and implement internal controls and procedures, there are no assurances that the material weaknesses and significant deficiencies in our disclosure controls and procedures will not result in errors in our financial statements which could lead to a restatement of those financial statements.

Changes in Internal Controls over Financial Reporting.

Except for the material weakness and associated remediation plan, there have been no changes in our internal control over financial reporting during the fiscal quarter ended September 30, 2020 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| ITEM 1. | LEGAL PROCEEDINGS |

We are not currently a party to any lawsuit or proceeding which, in the opinion of management, is likely to have a material adverse effect on us or our business.

| ITEM 1A. | RISK FACTORS |

During the quarter ended September 30, 2020, there were no material changes to the risk factors previously reported in our Current Report on Form 8-K filed on April 30, 2020.

| 17 |

| ITEM 2. | UNREGISTERED SALES OF SECURITIES AND USE OF PROCEEDS |

None.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

None.

| ITEM 5. | OTHER INFORMATION: |

None.

| ITEM 6. | EXHIBITS |

| 10.1 | Employment Agreement dated as of October 21, 2020 between RNA Ltd. and Giora Rozensweig

| |

| 10.2 | Employment Agreement dated as of October 21, 2020 between RNA Ltd. and Gaya Rozensweig

| |

| 31.1* | Certification of Interim Chief Executive Officer (Principal Executive Officer and Principal Financial and Accounting Officer) pursuant to Rule 13a-14(a) of the Securities Exchange Act of 1934 | |

| 32.1* | Certification of Interim Chief Executive Officer (Principal Executive Officer and Principal Financial and Accounting Officer), as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

* Filed herewith

| 18 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| WORLD HEALTH ENERGY HOLDINGS, INC. | ||

| (Registrant) | ||

| By: | /s/ Giora Rozensweig | |

| Giora Rozensweig | ||

| Interim Chief Executive Officer | ||

| (Principal Executive Officer and Principal Financial and Accounting Officer) | ||

| Date: | November 23, 2020 | |

| 19 |