Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 PRESS RELEASE OF THE COMPANY, DATED NOVEMBER 23, 2020 - KEMPER Corp | a11232020ex991pressrel.htm |

| 8-K - 8-K - KEMPER Corp | kmpr-20201122.htm |

Exhibit 99.2 Kemper Corporation: Acquisition of American Access November 23, 2020

Preliminary Matters Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events and can be identified by the fact that they relate to future actions, performance or results rather than strictly to historical or current facts. Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this presentation. Forward-looking statements involve a number of risks and uncertainties that are difficult to predict and are not guarantees of future performance. Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are those factors listed in periodic reports filed by Kemper Corporation with the Securities and Exchange Commission (“SEC”). The COVID-19 outbreak and subsequent global pandemic (“Pandemic”) is an extraordinary event that creates unique uncertainties and risks. Kemper cannot provide any assurances as to the impacts of the Pandemic and related economic conditions on the Company’s operating and financial results. No assurances can be given that the results and financial condition contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation, including any such statements related to the Pandemic. The reader is advised, however, to consult any further disclosures Kemper makes on related subjects in its filings with the SEC. 2

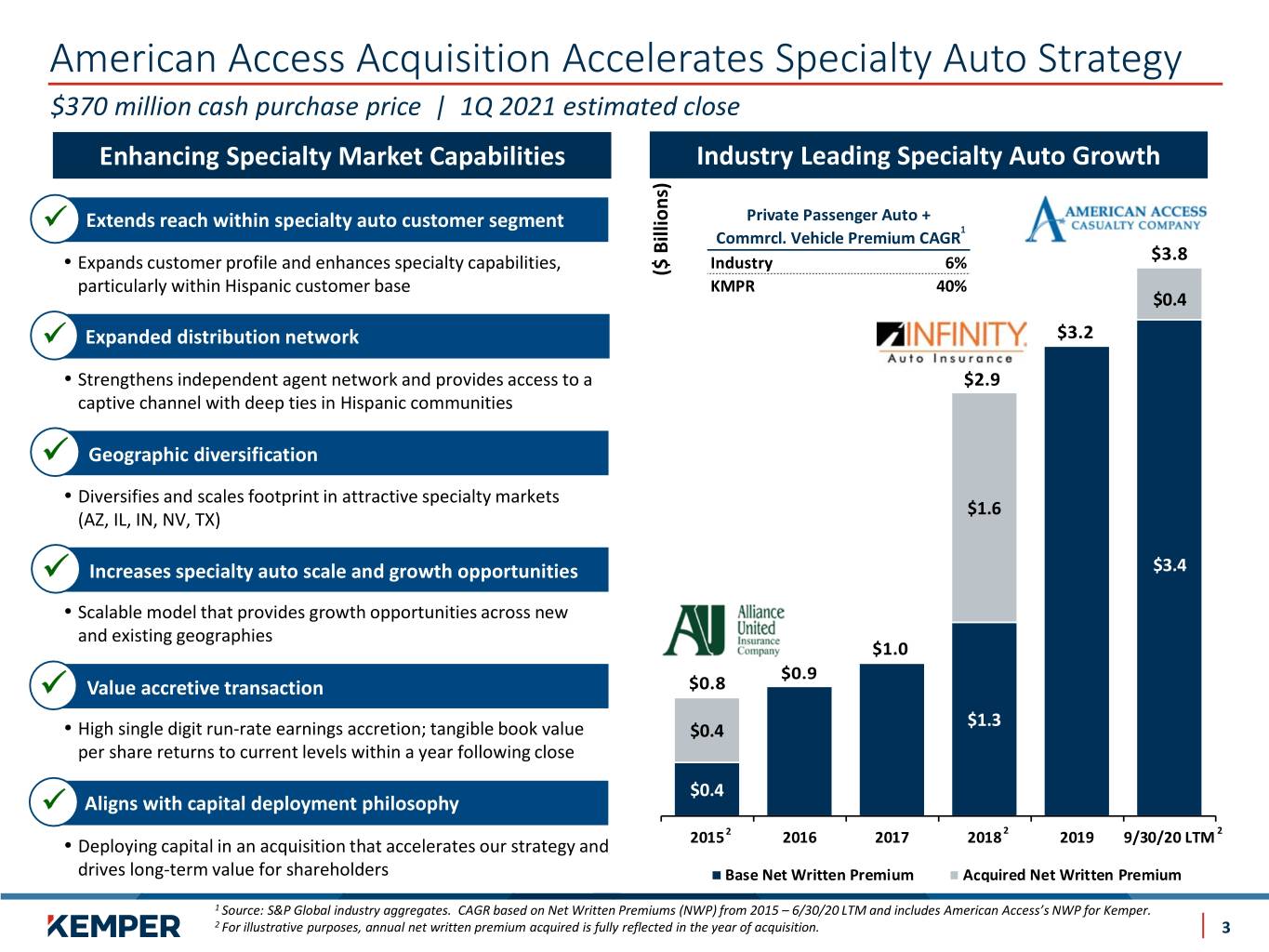

American Access Acquisition Accelerates Specialty Auto Strategy $370 million cash purchase price | 1Q 2021 estimated close Enhancing Specialty Market Capabilities Industry Leading Specialty Auto Growth Private Passenger Auto + Extends reach within specialty auto customer segment 1 (MM Commrcl. Vehicle Premium CAGR • Expands customer profile and enhances specialty capabilities, Industry 6% $3.8 ($ Billions) ($ particularly within Hispanic customer base KMPR 40% $0.4 Expanded distribution network $3.2 • Strengthens independent agent network and provides access to a $2.9 captive channel with deep ties in Hispanic communities Geographic diversification • Diversifies and scales footprint in attractive specialty markets $1.6 (AZ, IL, IN, NV, TX) Increases specialty auto scale and growth opportunities $3.4 • Scalable model that provides growth opportunities across new and existing geographies $1.0 $0.9 Value accretive transaction $0.8 $1.3 • High single digit run-rate earnings accretion; tangible book value $0.4 per share returns to current levels within a year following close $0.4 Aligns with capital deployment philosophy 2 2 2 • Deploying capital in an acquisition that accelerates our strategy and 2015 2016 2017 2018 2019 9/30/20 LTM drives long-term value for shareholders Base Net Written Premium Acquired Net Written Premium 1 Source: S&P Global industry aggregates. CAGR based on Net Written Premiums (NWP) from 2015 – 6/30/20 LTM and includes American Access’s NWP for Kemper. 2 For illustrative purposes, annual net written premium acquired is fully reflected in the year of acquisition. 3

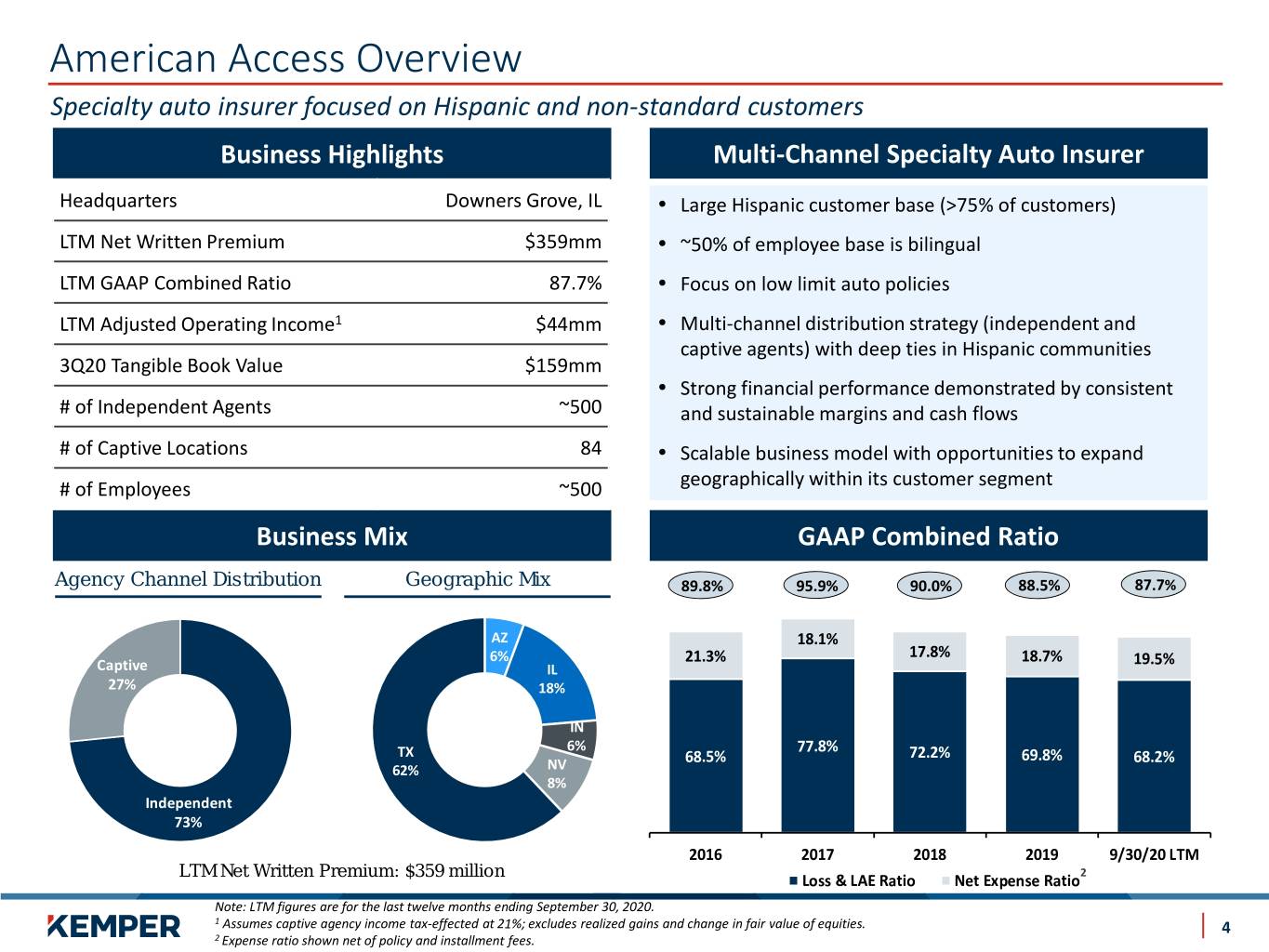

American Access Overview Specialty auto insurer focused on Hispanic and non-standard customers Business Highlights Multi-Channel Specialty Auto Insurer Headquarters Downers Grove, IL • Large Hispanic customer base (>75% of customers) LTM Net Written Premium $359mm • ~50% of employee base is bilingual LTM GAAP Combined Ratio 87.7% • Focus on low limit auto policies LTM Adjusted Operating Income1 $44mm • Multi-channel distribution strategy (independent and captive agents) with deep ties in Hispanic communities 3Q20 Tangible Book Value $159mm • Strong financial performance demonstrated by consistent # of Independent Agents ~500 and sustainable margins and cash flows # of Captive Locations 84 • Scalable business model with opportunities to expand geographically within its customer segment # of Employees ~500 Business Mix GAAP Combined Ratio Agency Channel Distribution Geographic Mix 89.8% 95.9% 90.0% 88.5% 87.7% AZ 18.1% 6% 21.3% 17.8% 18.7% 19.5% Captive IL 27% 18% IN 6% 77.8% TX 68.5% 72.2% 69.8% 68.2% 62% NV 8% Independent 73% 2016 2017 2018 2019 9/30/20 LTM LTM Net Written Premium: $359 million 2 Loss & LAE Ratio Net Expense Ratio Note: LTM figures are for the last twelve months ending September 30, 2020. 1 Assumes captive agency income tax-effected at 21%; excludes realized gains and change in fair value of equities. 4 2 Expense ratio shown net of policy and installment fees.