Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Oaktree Strategic Income Corp | d12771dex991.htm |

| 8-K - 8-K - Oaktree Strategic Income Corp | d12771d8k.htm |

Fourth Quarter Fiscal Year 2020 Earnings Presentation November 19, 2020 Nasdaq: OCSI Exhibit 99.2

Forward Looking Statements Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Fund Advisors, LLC (“Oaktree”) to reposition our portfolio and to implement Oaktree’s future plans with respect to our business; the ability of Oaktree and its affiliates to attract and retain highly talented professionals; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2020. Other factors that could cause actual results to differ materially include: changes or potential disruptions in our operations, the economy, financial markets or political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism, natural disasters or the COVID-19 pandemic; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; general considerations associated with the COVID-19 pandemic; the ability of the parties to consummate the two-step merger (the “Mergers”) of OCSI with and into Oaktree Specialty Lending Corporation (“OCSL”) on the expected timeline, or at all; the ability to realize the anticipated benefits of the Mergers; the effects of disruption on our business from the proposed Mergers; the combined company’s plans, expectations, objectives and intentions, as a result of the Mergers; any potential termination of the Merger Agreement; the actions of our stockholders or the stockholders of OCSL with respect to the proposals submitted for their approval in connection with the Mergers; and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Additional Information and Where to Find It In connection with the Mergers, OCSI and OCSL plan to file with the SEC and mail to their respective stockholders a joint proxy statement on Schedule 14A (the “Joint Proxy Statement”), and OCSL plans to file with the SEC a registration statement on Form N-14 (the “Registration Statement”) that will include the Joint Proxy Statement and a prospectus of OCSL. The Joint Proxy Statement and the Registration Statement will each contain important information about OCSI, OCSL, the Mergers and related matters. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. STOCKHOLDERS OF OCSI AND OCSL ARE URGED TO READ THE JOINT PROXY STATEMENT AND REGISTRATION STATEMENT, AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OCSI, OCSL, THE MERGERS AND RELATED MATTERS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s website, http://www.sec.gov or, for documents filed by OCSI, from OCSI’s website at http://www.oaktreestrategicincome.com and, for documents filed by OCSL, from OCSL’s website at http://www.oaktreespecialtylending.com. Participants in the Solicitation OCSI, its directors, certain of its executive officers and certain employees and officers of Oaktree and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Mergers. Information about the directors and executive officers of OCSI is set forth in its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on January 13, 2020. OCSL, its directors, certain of its executive officers and certain employees and officers of Oaktree and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Mergers. Information about the directors and executive officers of OCSL is set forth in its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on January 13, 2020. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the OCSI and OCSL stockholders in connection with the Mergers will be contained in the Joint Proxy Statement when such document becomes available. These documents may be obtained free of charge from the sources indicated above. No Offer or Solicitation This presentation is not, and under no circumstances is it to be construed as, a prospectus or an advertisement and the communication of this presentation is not, and under no circumstances is it to be construed as, an offer to sell or a solicitation of an offer to purchase any securities in OCSI, OCSL or in any fund or other investment vehicle managed by Oaktree or any of its affiliates. Unless otherwise indicated, data provided herein are dated as of September 30, 2020.

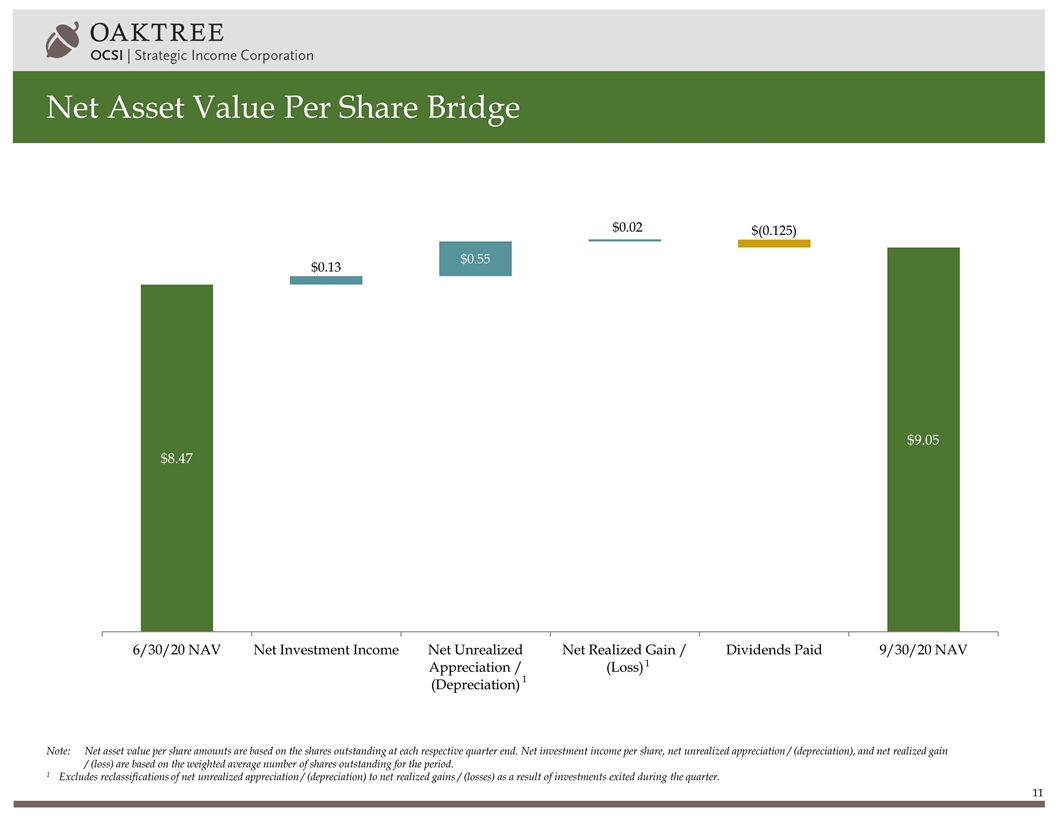

Summary of Results for the Quarter Ended September 30, 2020 Net Investment Income $0.13 per share as of September 30, 2020, up 18% as compared to $0.11 per share as of June 30, 2020 Increase primarily driven by higher yields on new originations, higher make-whole interest and prepayment fees and lower interest expense Dividend Declared a cash distribution of $0.145 per share, an increase of 16% ($0.02 per share) from the prior distribution Distribution will be payable on December 31, 2020 to stockholders of record as of December 15, 2020 Net Asset Value $9.05 per share as of September 30, 2020, up 7% as compared to $8.47 per share as of June 30, 2020 Increase primarily due to unrealized gains resulting from price increases on liquid debt investments Investment Activity $54 million of new investment commitments across 12 companies 9.5% weighted average yield on new investment commitments; 86% first lien, 10% second lien Received $72 million of proceeds from prepayments, exits, other paydowns and sales, primarily driven by active sales of lower yielding investments Capital Structure & Liquidity $268 million of total debt outstanding as of September 30, 2020; 1.00x total debt to equity Liquidity was composed of $25 million of unrestricted cash and $83 million of undrawn capacity on credit facilities1; unfunded commitments were $20 million, approximately $14 million of which can be drawn immediately2 OCSL-OCSI Merger Agreement On October 28, 2020, the Company entered into an agreement to merge with and into OCSL, an affiliated business development company managed by Oaktree, with OCSL as the surviving company. Under the terms of the proposed merger, the Company’s shareholders will receive an amount of shares of OCSL common stock with a NAV equal to the NAV of shares of the Company’s common stock that they hold at the time of closing. The transaction is subject to approval by OCSL and the Company’s stockholders and other customary closing conditions. Assuming these conditions are satisfied, the transaction is expected to close in the first calendar quarter of 2021 1Credit facility availability subject to borrowing base and other limitations. 2Excludes unfunded commitments to OCSI Glick JV LLC (the “Glick JV”), a joint venture that invests primarily in middle market and other corporate debt securities. Approximately $5 million of unfunded commitments were ineligible to be immediately drawn due to certain milestones.

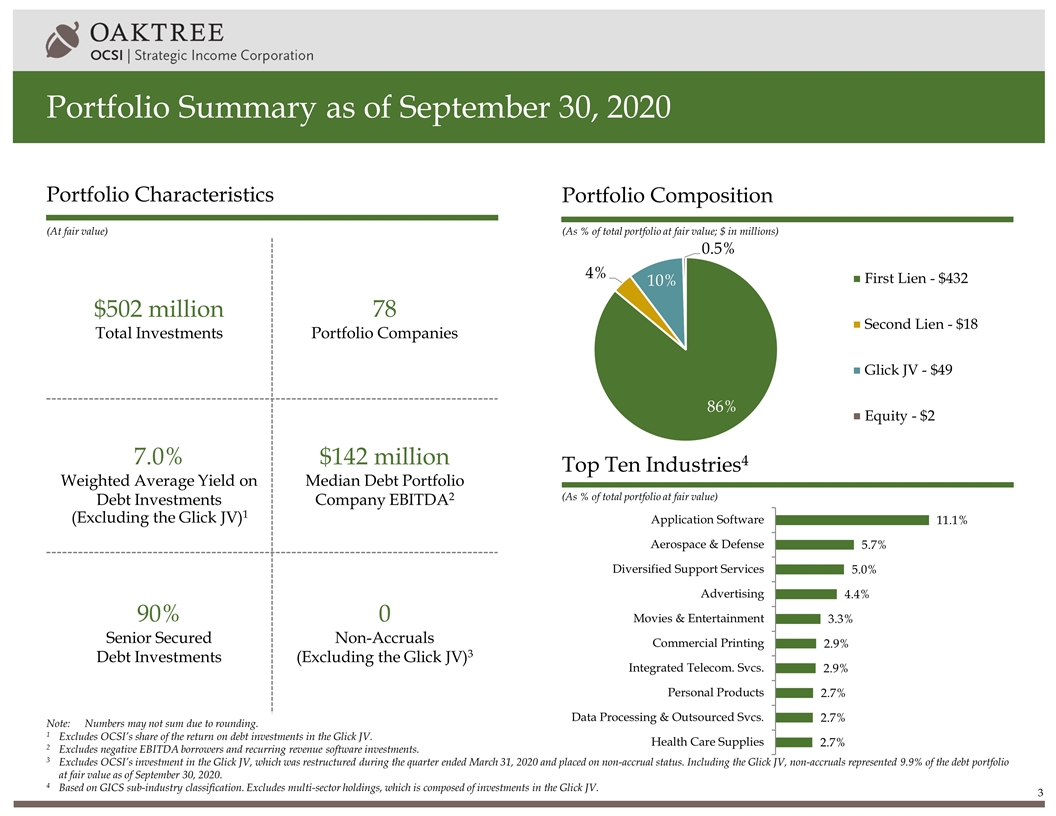

Portfolio Summary as of September 30, 2020 (As % of total portfolio at fair value; $ in millions) (As % of total portfolio at fair value) Portfolio Composition Top Ten Industries4 Portfolio Characteristics Note:Numbers may not sum due to rounding. 1Excludes OCSI’s share of the return on debt investments in the Glick JV. 2 Excludes negative EBITDA borrowers and recurring revenue software investments. 3Excludes OCSI’s investment in the Glick JV, which was restructured during the quarter ended March 31, 2020 and placed on non-accrual status. Including the Glick JV, non-accruals represented 9.9% of the debt portfolio at fair value as of September 30, 2020. 4 Based on GICS sub-industry classification. Excludes multi-sector holdings, which is composed of investments in the Glick JV. $502 million Total Investments 78 Portfolio Companies 7.0% Weighted Average Yield on Debt Investments $142 million Median Debt Portfolio Company EBITDA2 90% Senior Secured Debt Investments 0 Non-Accruals (Excluding the Glick JV)3 (At fair value) (Excluding the Glick JV)1

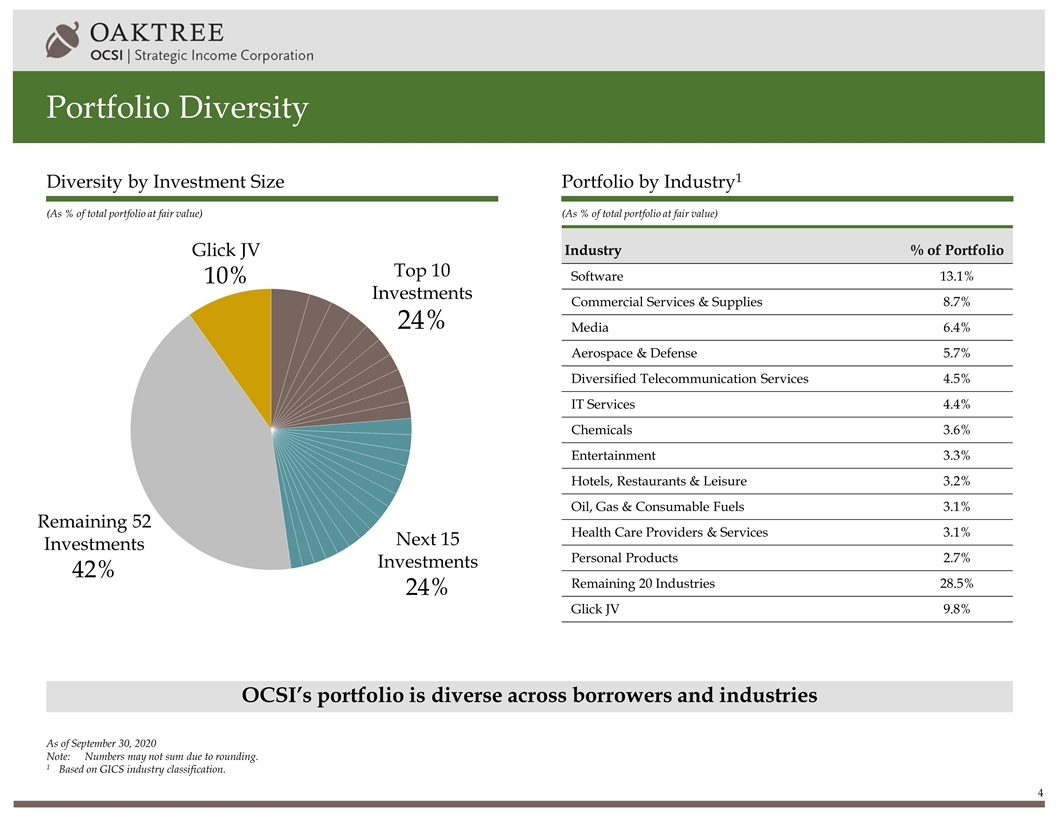

Portfolio Diversity OCSI’s portfolio is diverse across borrowers and industries (As % of total portfolio at fair value) (As % of total portfolio at fair value) Portfolio by Industry1 Diversity by Investment Size Top 10 Investments 24% Next 15 Investments 24% Remaining 52 Investments 42% Glick JV 10% Industry % of Portfolio Software 13.1% Commercial Services & Supplies 8.7% Media 6.4% Aerospace & Defense 5.7% Diversified Telecommunication Services 4.5% IT Services 4.4% Chemicals 3.6% Entertainment 3.3% Hotels, Restaurants & Leisure 3.2% Oil, Gas & Consumable Fuels 3.1% Health Care Providers & Services 3.1% Personal Products 2.7% Remaining 20 Industries 28.5% Glick JV 9.8% As of September 30, 2020 Note:Numbers may not sum due to rounding. 1Based on GICS industry classification.

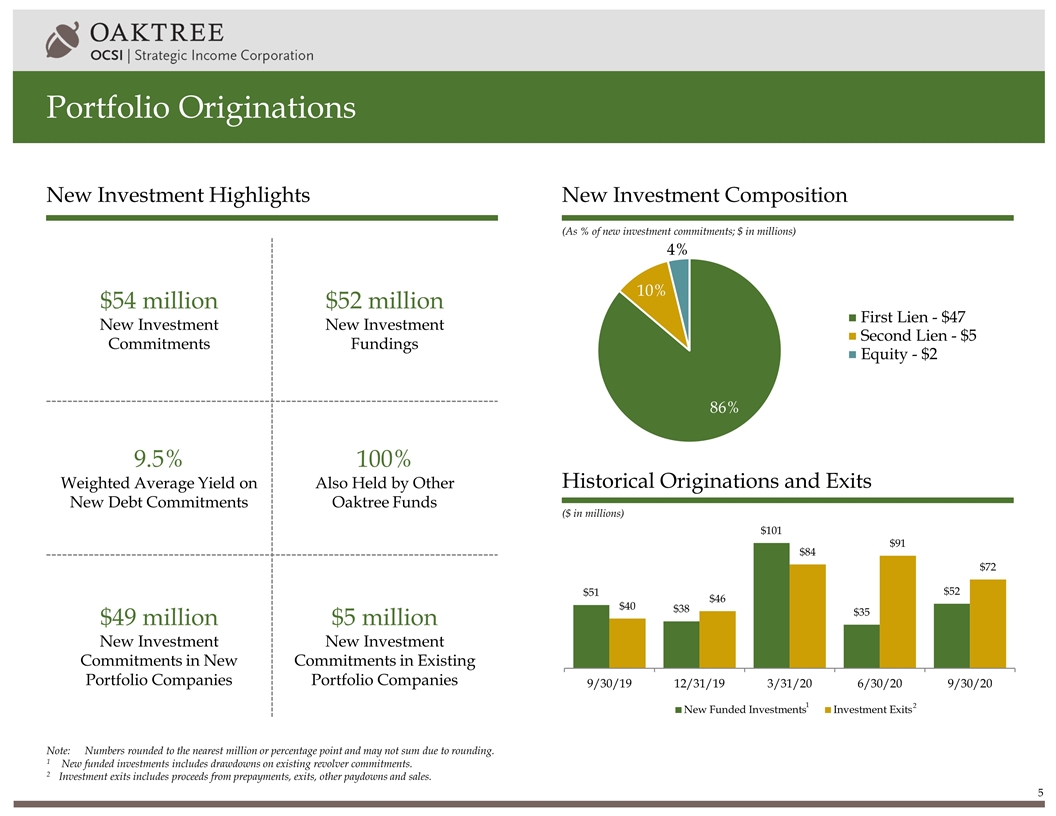

Portfolio Originations New Investment Highlights ($ in millions) Historical Originations and Exits (As % of new investment commitments; $ in millions) New Investment Composition Note:Numbers rounded to the nearest million or percentage point and may not sum due to rounding. 1 New funded investments includes drawdowns on existing revolver commitments. 2Investment exits includes proceeds from prepayments, exits, other paydowns and sales. 2 1 $54 million New Investment Commitments $52 million New Investment Fundings 9.5% Weighted Average Yield on New Debt Commitments 100% Also Held by Other Oaktree Funds $49 million New Investment Commitments in New Portfolio Companies $5 million New Investment Commitments in Existing Portfolio Companies

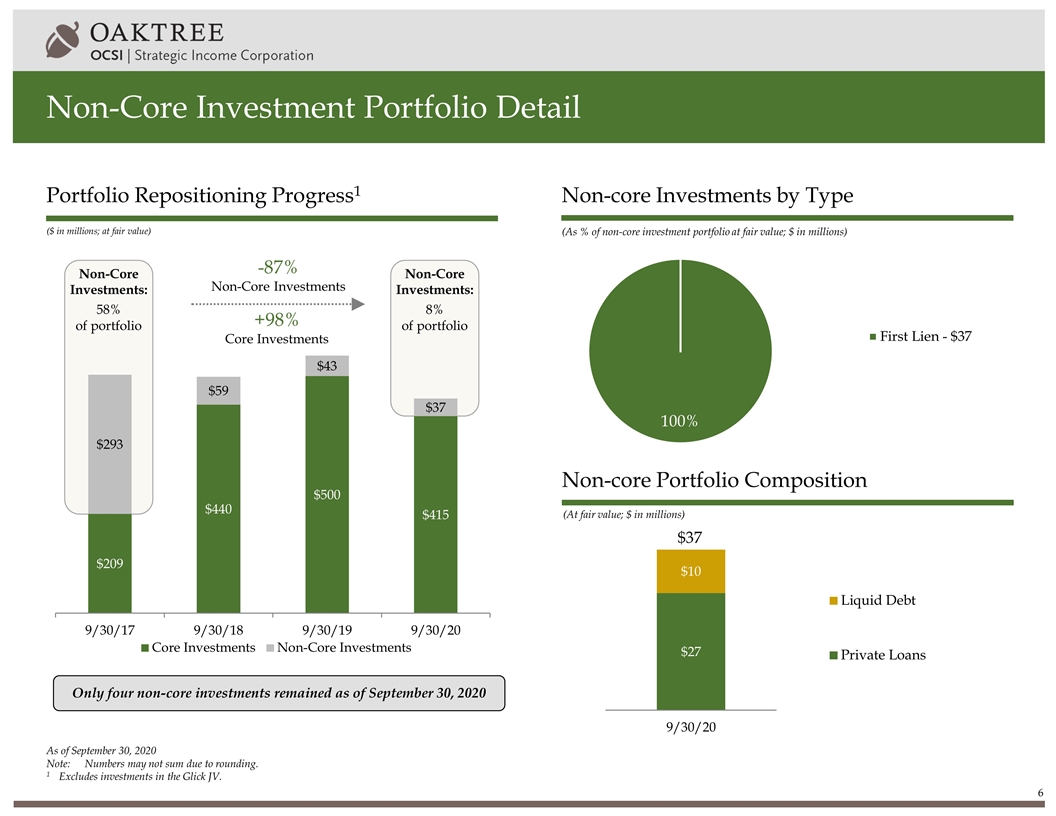

As of September 30, 2020 Note:Numbers may not sum due to rounding. 1Excludes investments in the Glick JV. Non-Core Investment Portfolio Detail Portfolio Repositioning Progress1 (As % of non-core investment portfolio at fair value; $ in millions) Non-core Investments by Type (At fair value; $ in millions) Non-core Portfolio Composition $37 Non-Core Investments: 8% of portfolio Non-Core Investments: 58% of portfolio -87% Non-Core Investments +98% Core Investments ($ in millions; at fair value) Only four non-core investments remained as of September 30, 2020

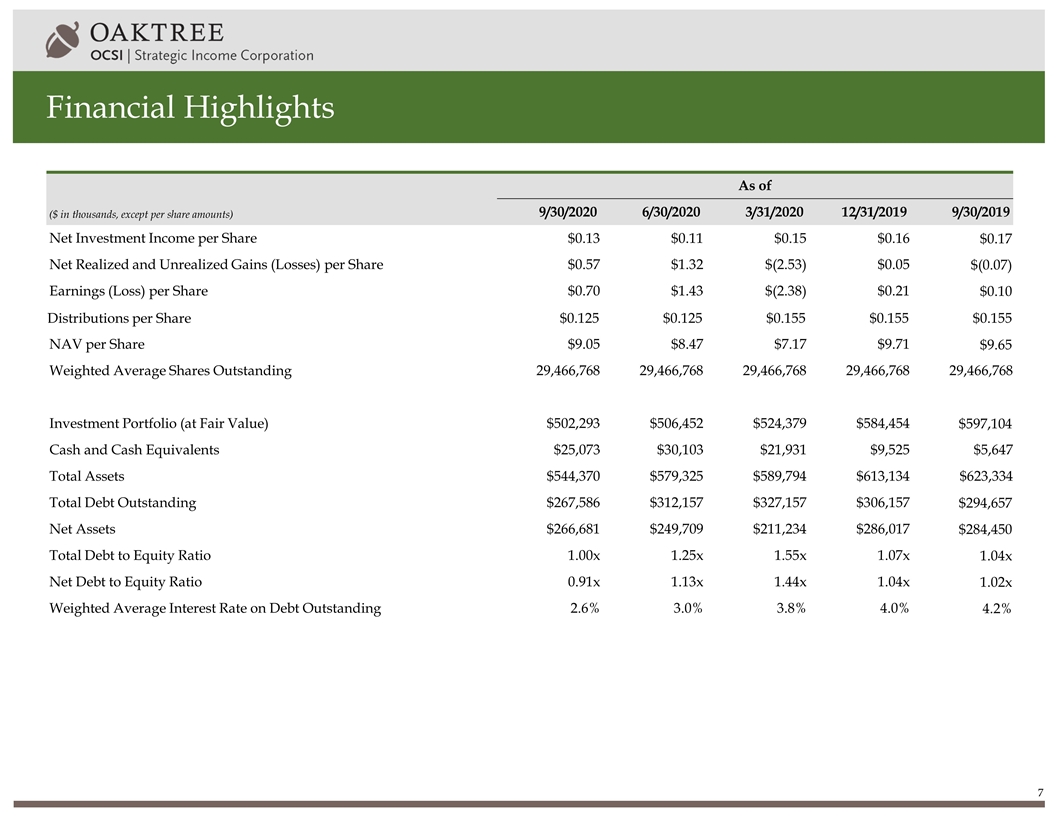

Financial Highlights ($ in thousands, except per share amounts) As of 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Net Investment Income per Share $0.13 $0.11 $0.15 $0.16 $0.17 Net Realized and Unrealized Gains (Losses) per Share $0.57 $1.32 $(2.53) $0.05 $(0.07) Earnings (Loss) per Share $0.70 $1.43 $(2.38) $0.21 $0.10 Distributions per Share $0.125 $0.125 $0.155 $0.155 $0.155 NAV per Share $9.05 $8.47 $7.17 $9.71 $9.65 Weighted Average Shares Outstanding 29,466,768 29,466,768 29,466,768 29,466,768 29,466,768 Investment Portfolio (at Fair Value) $502,293 $506,452 $524,379 $584,454 $597,104 Cash and Cash Equivalents $25,073 $30,103 $21,931 $9,525 $5,647 Total Assets $544,370 $579,325 $589,794 $613,134 $623,334 Total Debt Outstanding $267,586 $312,157 $327,157 $306,157 $294,657 Net Assets $266,681 $249,709 $211,234 $286,017 $284,450 Total Debt to Equity Ratio 1.00x 1.25x 1.55x 1.07x 1.04x Net Debt to Equity Ratio 0.91x 1.13x 1.44x 1.04x 1.02x Weighted Average Interest Rate on Debt Outstanding 2.6% 3.0% 3.8% 4.0% 4.2%

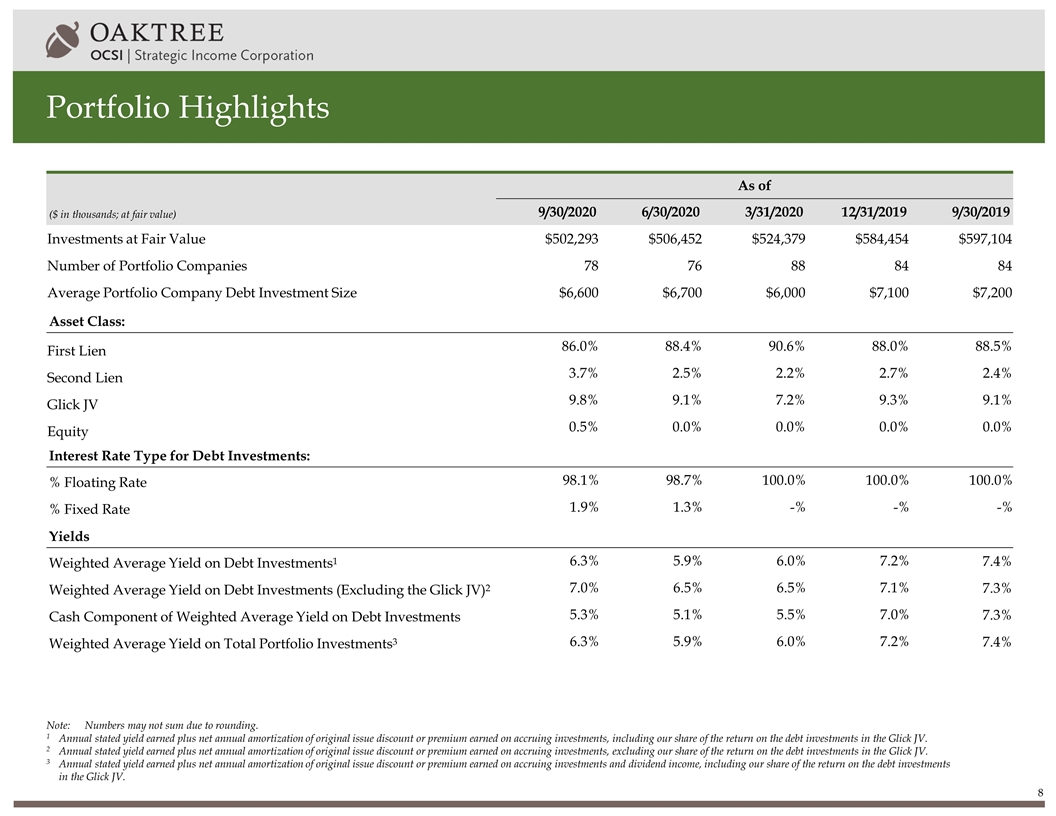

Portfolio Highlights ($ in thousands; at fair value) As of 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Investments at Fair Value $502,293 $506,452 $524,379 $584,454 $597,104 Number of Portfolio Companies 78 76 88 84 84 Average Portfolio Company Debt Investment Size $6,600 $6,700 $6,000 $7,100 $7,200 Asset Class: First Lien 86.0% 88.4% 90.6% 88.0% 88.5% Second Lien 3.7% 2.5% 2.2% 2.7% 2.4% Glick JV 9.8% 9.1% 7.2% 9.3% 9.1% Equity 0.5% 0.0% 0.0% 0.0% 0.0% Interest Rate Type for Debt Investments: % Floating Rate 98.1% 98.7% 100.0% 100.0% 100.0% % Fixed Rate 1.9% 1.3% -% -% -% Yields Weighted Average Yield on Debt Investments1 6.3% 5.9% 6.0% 7.2% 7.4% Weighted Average Yield on Debt Investments (Excluding the Glick JV)2 7.0% 6.5% 6.5% 7.1% 7.3% Cash Component of Weighted Average Yield on Debt Investments 5.3% 5.1% 5.5% 7.0% 7.3% Weighted Average Yield on Total Portfolio Investments3 6.3% 5.9% 6.0% 7.2% 7.4% Note:Numbers may not sum due to rounding. 1Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, including our share of the return on the debt investments in the Glick JV. 2Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, excluding our share of the return on the debt investments in the Glick JV. 3Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments and dividend income, including our share of the return on the debt investments in the Glick JV.

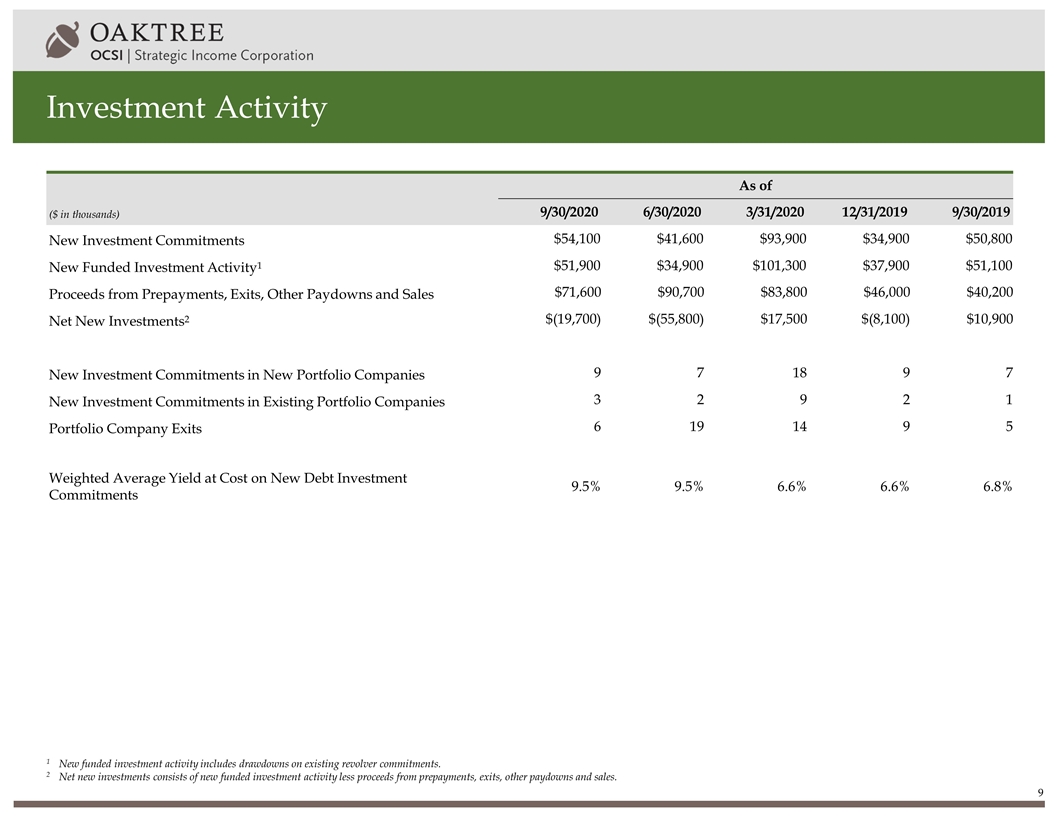

Investment Activity ($ in thousands) As of 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 New Investment Commitments $54,100 $41,600 $93,900 $34,900 $50,800 New Funded Investment Activity1 $51,900 $34,900 $101,300 $37,900 $51,100 Proceeds from Prepayments, Exits, Other Paydowns and Sales $71,600 $90,700 $83,800 $46,000 $40,200 Net New Investments2 $(19,700) $(55,800) $17,500 $(8,100) $10,900 New Investment Commitments in New Portfolio Companies 9 7 18 9 7 New Investment Commitments in Existing Portfolio Companies 3 2 9 2 1 Portfolio Company Exits 6 19 14 9 5 Weighted Average Yield at Cost on New Debt Investment Commitments 9.5% 9.5% 6.6% 6.6% 6.8% 1New funded investment activity includes drawdowns on existing revolver commitments. 2Net new investments consists of new funded investment activity less proceeds from prepayments, exits, other paydowns and sales.

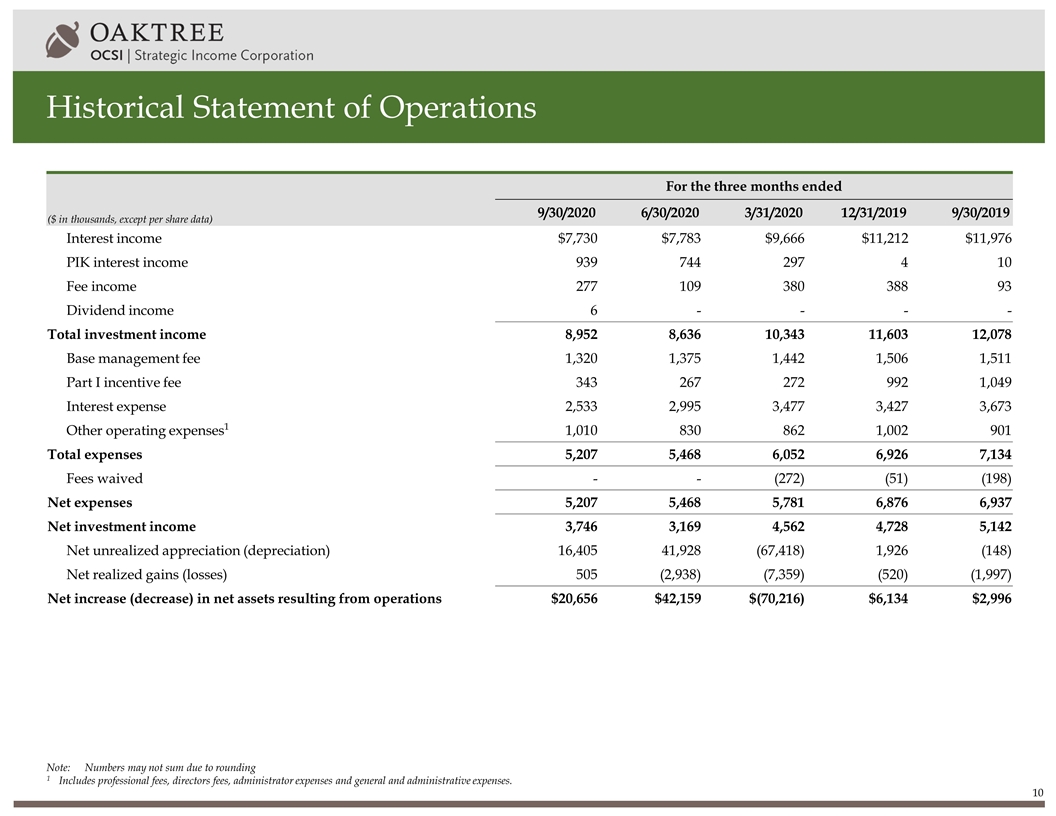

Historical Statement of Operations ($ in thousands, except per share data) For the three months ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Interest income $7,730 $7,783 $9,666 $11,212 $11,976 PIK interest income 939 744 297 4 10 Fee income 277 109 380 388 93 Dividend income 6 - - - - Total investment income 8,952 8,636 10,343 11,603 12,078 Base management fee 1,320 1,375 1,442 1,506 1,511 Part I incentive fee 343 267 272 992 1,049 Interest expense 2,533 2,995 3,477 3,427 3,673 Other operating expenses1 1,010 830 862 1,002 901 Total expenses 5,207 5,468 6,052 6,926 7,134 Fees waived - - (272) (51) (198) Net expenses 5,207 5,468 5,781 6,876 6,937 Net investment income 3,746 3,169 4,562 4,728 5,142 Net unrealized appreciation (depreciation) 16,405 41,928 (67,418) 1,926 (148) Net realized gains (losses) 505 (2,938) (7,359) (520) (1,997) Net increase (decrease) in net assets resulting from operations $20,656 $42,159 $(70,216) $6,134 $2,996 Note:Numbers may not sum due to rounding 1Includes professional fees, directors fees, administrator expenses and general and administrative expenses.

Net Asset Value Per Share Bridge Note:Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. 1Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. 1 1

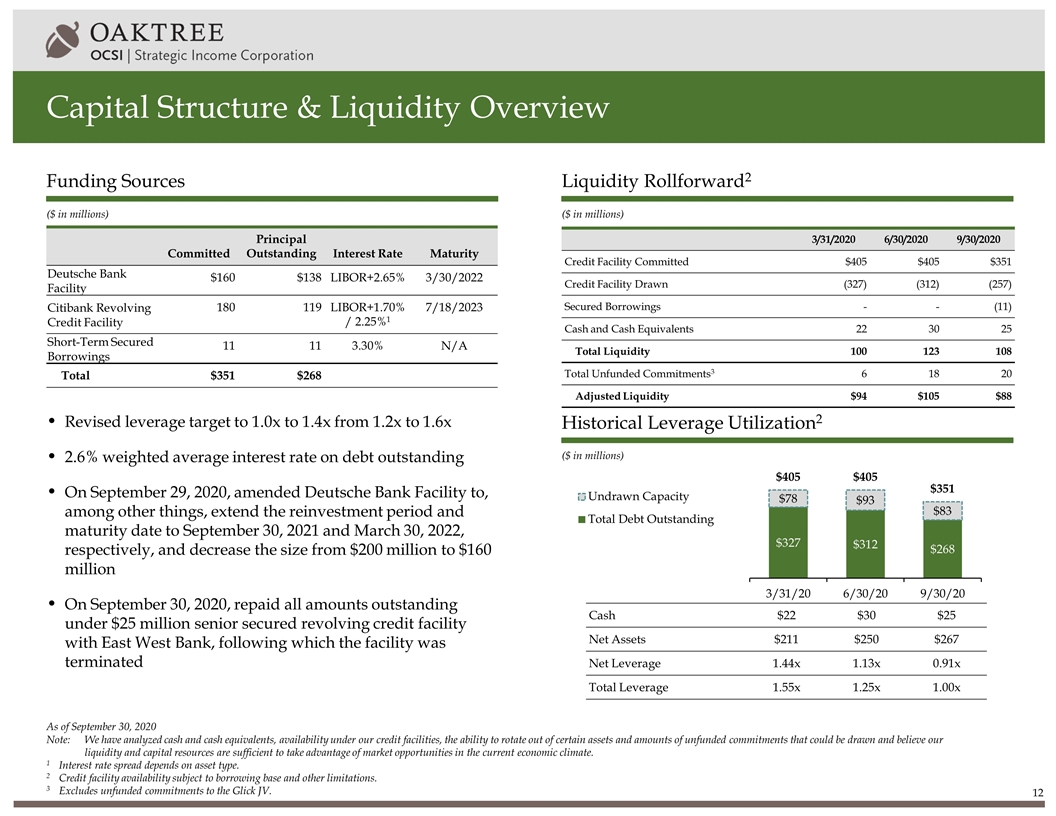

Capital Structure & Liquidity Overview ($ in millions) ($ in millions) ($ in millions) Funding Sources Liquidity Rollforward2 Historical Leverage Utilization2 Committed Principal Outstanding Interest Rate Maturity Deutsche Bank Facility $160 $138 LIBOR+2.65% 3/30/2022 Citibank Revolving Credit Facility 180 119 LIBOR+1.70% / 2.25%1 7/18/2023 Short-Term Secured Borrowings 11 11 3.30% N/A Total $351 $268 As of September 30, 2020 Note:We have analyzed cash and cash equivalents, availability under our credit facilities, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and believe our liquidity and capital resources are sufficient to take advantage of market opportunities in the current economic climate. 1Interest rate spread depends on asset type. 2Credit facility availability subject to borrowing base and other limitations. 3 Excludes unfunded commitments to the Glick JV. Revised leverage target to 1.0x to 1.4x from 1.2x to 1.6x 2.6% weighted average interest rate on debt outstanding On September 29, 2020, amended Deutsche Bank Facility to, among other things, extend the reinvestment period and maturity date to September 30, 2021 and March 30, 2022, respectively, and decrease the size from $200 million to $160 million On September 30, 2020, repaid all amounts outstanding under $25 million senior secured revolving credit facility with East West Bank, following which the facility was terminated 3/31/2020 6/30/2020 9/30/2020 Credit Facility Committed $405 $405 $351 Credit Facility Drawn (327) (312) (257) Secured Borrowings - - (11) Cash and Cash Equivalents 22 30 25 Total Liquidity 100 123 108 Total Unfunded Commitments3 6 18 20 Adjusted Liquidity $94 $105 $88 Cash $22 $30 $25 Net Assets $211 $250 $267 Net Leverage 1.44x 1.13x 0.91x Total Leverage 1.55x 1.25x 1.00x

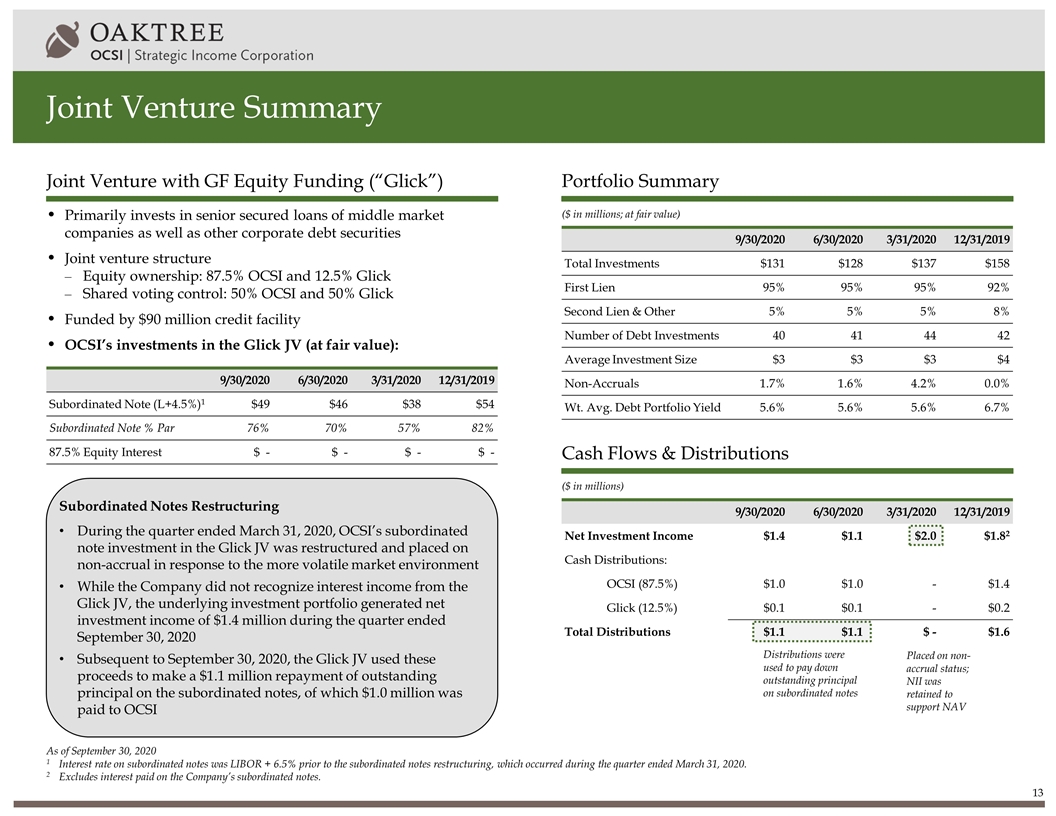

Joint Venture Summary ($ in millions; at fair value) ($ in millions) Joint Venture with GF Equity Funding (“Glick”) Portfolio Summary Cash Flows & Distributions As of September 30, 2020 1Interest rate on subordinated notes was LIBOR + 6.5% prior to the subordinated notes restructuring, which occurred during the quarter ended March 31, 2020. 2Excludes interest paid on the Company’s subordinated notes. Primarily invests in senior secured loans of middle market companies as well as other corporate debt securities Joint venture structure Equity ownership: 87.5% OCSI and 12.5% Glick Shared voting control: 50% OCSI and 50% Glick Funded by $90 million credit facility OCSI’s investments in the Glick JV (at fair value): 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Total Investments $131 $128 $137 $158 First Lien 95% 95% 95% 92% Second Lien & Other 5% 5% 5% 8% Number of Debt Investments 40 41 44 42 Average Investment Size $3 $3 $3 $4 Non-Accruals 1.7% 1.6% 4.2% 0.0% Wt. Avg. Debt Portfolio Yield 5.6% 5.6% 5.6% 6.7% Subordinated Notes Restructuring During the quarter ended March 31, 2020, OCSI’s subordinated note investment in the Glick JV was restructured and placed on non-accrual in response to the more volatile market environment While the Company did not recognize interest income from the Glick JV, the underlying investment portfolio generated net investment income of $1.4 million during the quarter ended September 30, 2020 Subsequent to September 30, 2020, the Glick JV used these proceeds to make a $1.1 million repayment of outstanding principal on the subordinated notes, of which $1.0 million was paid to OCSI 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Subordinated Note (L+4.5%)1 $49 $46 $38 $54 Subordinated Note % Par 76% 70% 57% 82% 87.5% Equity Interest $ - $ - $ - $ - 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Net Investment Income $1.4 $1.1 $2.0 $1.82 Cash Distributions: OCSI (87.5%) $1.0 $1.0 - $1.4 Glick (12.5%) $0.1 $0.1 - $0.2 Total Distributions $1.1 $1.1 $ - $1.6 Distributions were used to pay down outstanding principal on subordinated notes Placed on non-accrual status; NII was retained to support NAV

Appendix

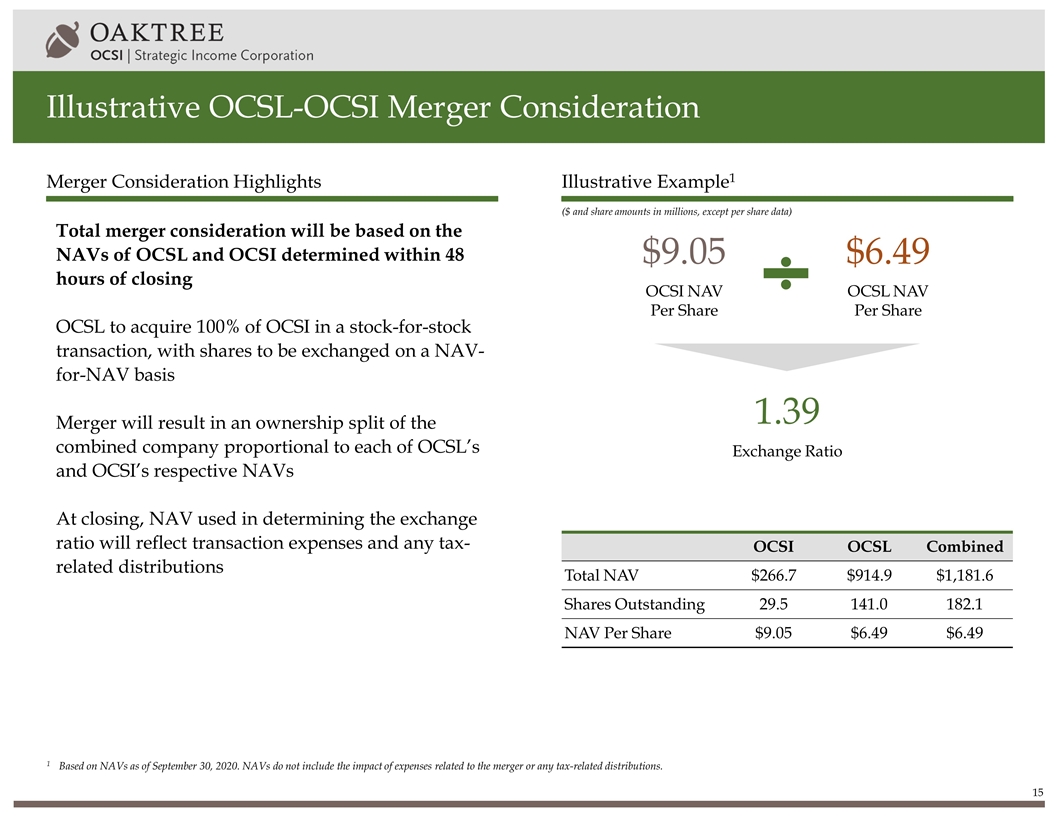

Illustrative OCSL-OCSI Merger Consideration Merger Consideration Highlights Illustrative Example1 OCSI OCSL Combined Total NAV $266.7 $914.9 $1,181.6 Shares Outstanding 29.5 141.0 182.1 NAV Per Share $9.05 $6.49 $6.49 Total merger consideration will be based on the NAVs of OCSL and OCSI determined within 48 hours of closing OCSL to acquire 100% of OCSI in a stock-for-stock transaction, with shares to be exchanged on a NAV-for-NAV basis Merger will result in an ownership split of the combined company proportional to each of OCSL’s and OCSI’s respective NAVs At closing, NAV used in determining the exchange ratio will reflect transaction expenses and any tax-related distributions 1Based on NAVs as of September 30, 2020. NAVs do not include the impact of expenses related to the merger or any tax-related distributions. OCSI NAV Per Share $9.05 OCSL NAV Per Share $6.49 Exchange Ratio 1.39 ($ and share amounts in millions, except per share data)

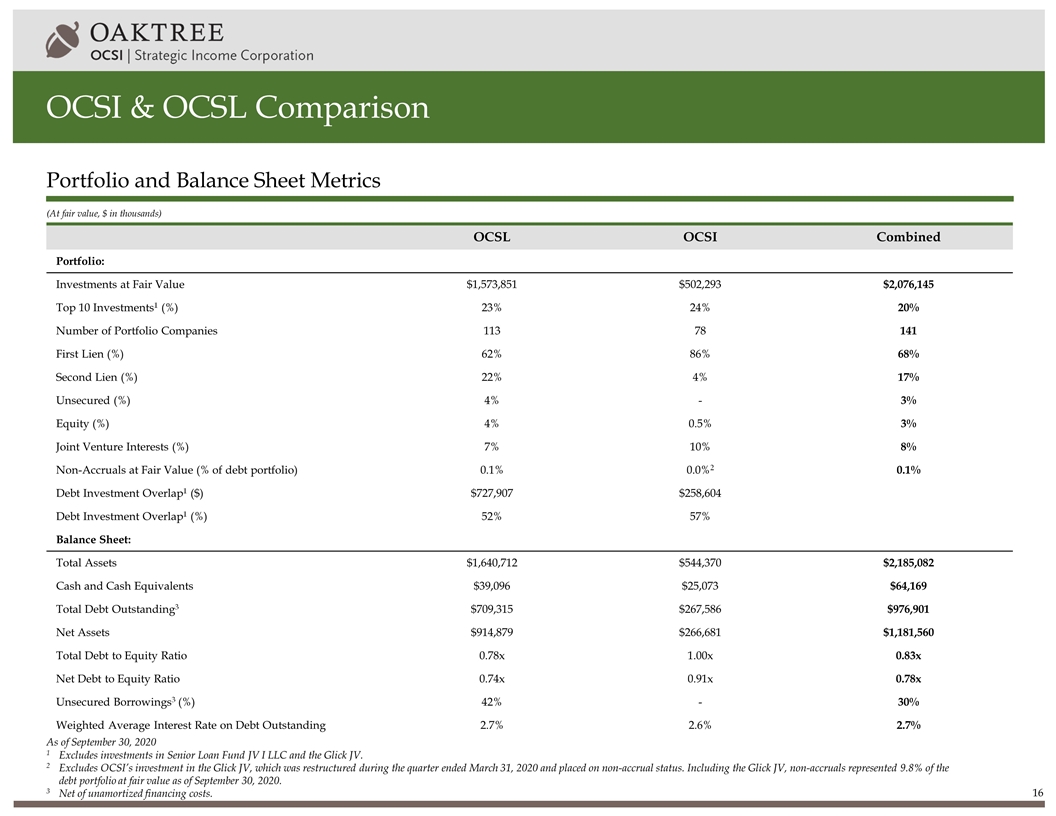

OCSI & OCSL Comparison (At fair value, $ in thousands) Portfolio and Balance Sheet Metrics OCSL OCSI Combined Portfolio: Investments at Fair Value $1,573,851 $502,293 $2,076,145 Top 10 Investments1 (%) 23% 24% 20% Number of Portfolio Companies 113 78 141 First Lien (%) 62% 86% 68% Second Lien (%) 22% 4% 17% Unsecured (%) 4% - 3% Equity (%) 4% 0.5% 3% Joint Venture Interests (%) 7% 10% 8% Non-Accruals at Fair Value (% of debt portfolio) 0.1% 0.0%2 0.1% Debt Investment Overlap1 ($) $727,907 $258,604 Debt Investment Overlap1 (%) 52% 57% Balance Sheet: Total Assets $1,640,712 $544,370 $2,185,082 Cash and Cash Equivalents $39,096 $25,073 $64,169 Total Debt Outstanding3 $709,315 $267,586 $976,901 Net Assets $914,879 $266,681 $1,181,560 Total Debt to Equity Ratio 0.78x 1.00x 0.83x Net Debt to Equity Ratio 0.74x 0.91x 0.78x Unsecured Borrowings3 (%) 42% - 30% Weighted Average Interest Rate on Debt Outstanding 2.7% 2.6% 2.7% As of September 30, 2020 1Excludes investments in Senior Loan Fund JV I LLC and the Glick JV. 2Excludes OCSI’s investment in the Glick JV, which was restructured during the quarter ended March 31, 2020 and placed on non-accrual status. Including the Glick JV, non-accruals represented 9.8% of the debt portfolio at fair value as of September 30, 2020. 3Net of unamortized financing costs.

Contact: Michael Mosticchio, Investor Relations ocsi-ir@oaktreecapital.com