Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL VALLEY COMMUNITY BANCORP | cvcy-20201119.htm |

Investor Presentation KBW West Coast Virtual Field Trip November 19, 2020 Jim Ford President & CEO Dave Kinross EVP CFO

Forward-Looking Statements Certain matters discussed in this report constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company’s current business strategy and the Company’s plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates; (3) a decline in economic conditions in the Central Valley and the Greater Sacramento Region; (4) the Company’s ability to continue its internal growth at historical rates; (5) the Company’s ability to maintain its net interest margin; (6) the decline in quality of the Company’s earning assets; (7) a decline in credit quality; (8) changes in the regulatory environment; (9) fluctuations in the real estate market; (10) changes in business conditions and inflation; (11) changes in securities markets (12) risks associated with acquisitions, relating to difficulty in integrating combined operations and related negative impact on earnings, and incurrence of substantial expenses; (13) political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, drought, pandemic diseases or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; and (14) the rapidly changing uncertainties related to the Covid-19 pandemic including, but not limited to, the potential adverse effect of the pandemic on the economy, our employees and customers, and our financial performance. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company. When the Company uses in this presentation the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “commit,” “believe,” and similar expressions, the Company intends to identify forward-looking statements. Such statements are not guarantees of performance and are subject to certain risks, uncertainties and assumptions, including those described in this presentation. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected, projected, intended, committed or believed. The future results and shareholder values of the Company may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results and values are beyond the Company’s ability to control or predict. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Central Valley Community Bancorp will undertake no obligation to revise or publically release any revision or update to the forward looking statements to reflect events or circumstances that occur after the date on which statements were made. 2

Experienced Management Team Years at Years of Executive Position CVCY Experience James M. Ford President & CEO 6 40 David A. Kinross EVP, Chief Financial Officer 14 30 James J. Kim EVP, Chief Operating Officer 3 20 Patrick A. Luis EVP, Chief Credit Officer - 35 Ken Ramos EVP, Market Executive – South 1 31 Blaine Lauhon EVP, Market Executive – North 2 33 Teresa Gilio EVP, Chief Administrative Officer 11 38 Dawn Cagle SVP, Human Resources Director 3 35 3

Overview 20 Branches in 9 Contiguous Counties NASDAQ Symbol CVCY Market Capitalization $154 Million Institutional Ownership 47% Insider Ownership 17% Total Assets $1.91 Billion Headquarters Fresno, CA Number of Branches 20 Year Established 1980 Strategic Footprint Bakersfield to Sacramento As of September 30, 2020 4

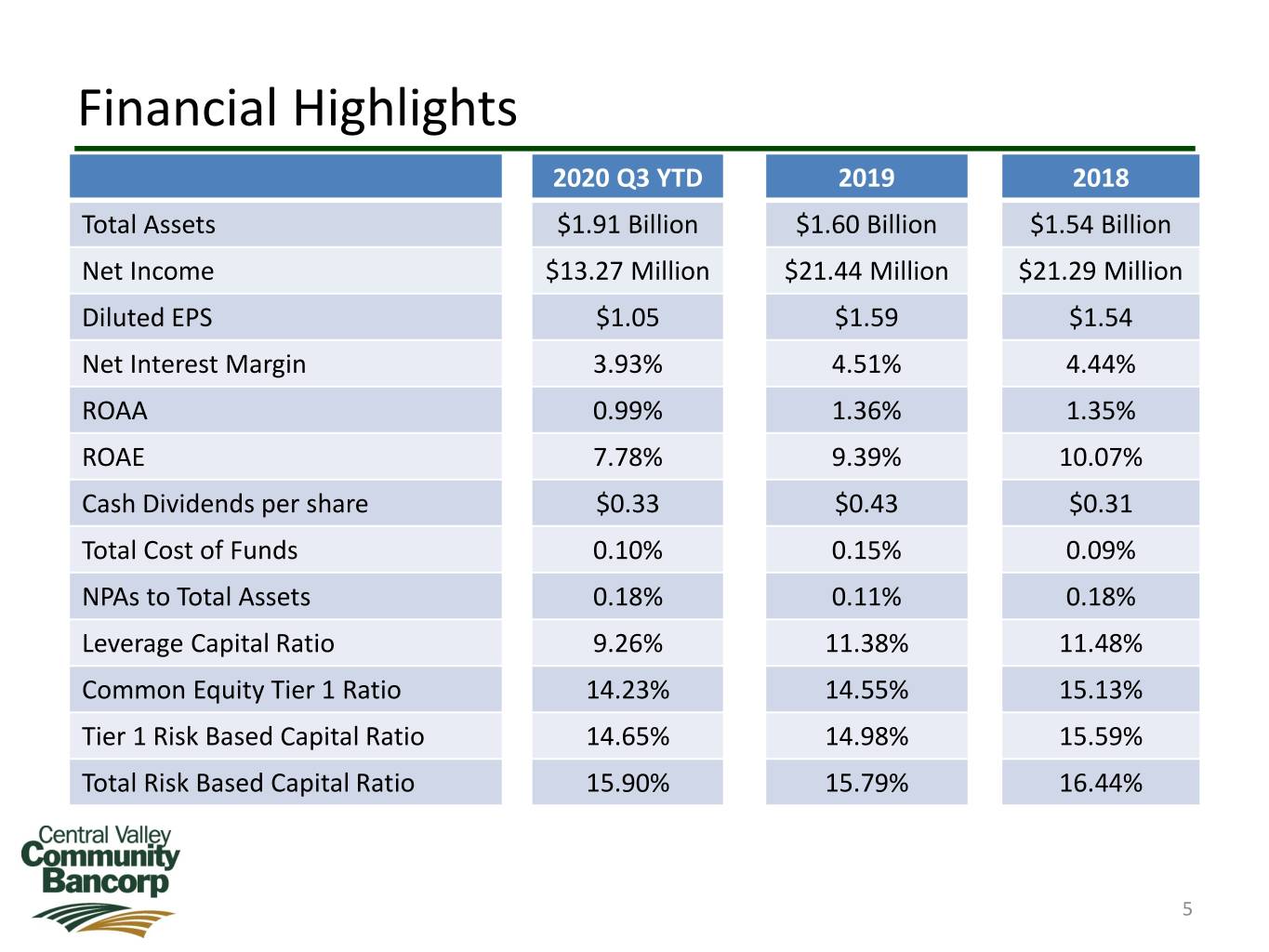

Financial Highlights 2020 Q3 YTD 2019 2018 Total Assets $1.91 Billion $1.60 Billion $1.54 Billion Net Income $13.27 Million $21.44 Million $21.29 Million Diluted EPS $1.05 $1.59 $1.54 Net Interest Margin 3.93% 4.51% 4.44% ROAA 0.99% 1.36% 1.35% ROAE 7.78% 9.39% 10.07% Cash Dividends per share $0.33 $0.43 $0.31 Total Cost of Funds 0.10% 0.15% 0.09% NPAs to Total Assets 0.18% 0.11% 0.18% Leverage Capital Ratio 9.26% 11.38% 11.48% Common Equity Tier 1 Ratio 14.23% 14.55% 15.13% Tier 1 Risk Based Capital Ratio 14.65% 14.98% 15.59% Total Risk Based Capital Ratio 15.90% 15.79% 16.44% 5

COVID-19 Responses • Implemented Pandemic Plan mid February 2020 to address COVID-19 and escalated activities into early March 2020 • Our Credit teams began monitoring clients via direct communication, checklists we deployed to aid in monitoring loans • In Q2 we reviewed 70% of the loan portfolio, and in Q3 we reviewed 41% (excluding PPP loans) • PPP approved SBA loans totaled $211 million with net fees of $6.3 million • Implemented a 90-day loan deferral program with $60 million in outstanding loan balances at September 30, 2020 • Increasing frequency of Problem Loan Report meetings • Focusing on both Probability of Default and Loss Given Default • Monitoring external economic conditions, i.e. unemployment rates, home sales, etc. 6

Attractive Investment Opportunity CVCY Stock Price 25 20 15 Price 10 Dividend Payout Ratio - 31.4% Dividend Yield - 3.59% 5 0 1/1/2015 1/1/2016 1/1/2017 1/1/2018 1/1/2019 1/1/2020 As of Oct. 31, 2020 Source: NASDAQ Monthly Closing Price Data 7

Growing Franchise Average Total Assets 2,000,000 1,800,000 1,600,000 1,400,000 1,200,000 1,000,000 Thousands 1,780,716 800,000 1,577,410 1,574,089 1,491,696 1,321,007 600,000 1,222,526 400,000 200,000 0 2015 2016 2017 2018 2019 2020 Q3 YTD Note: Acquisitions of Sierra Vista Bank occurred on October 1, 2016, and Folsom Lake Bank occurred on October 1, 2017 8

Strong Net Income and NIM 25,000 4.60 4.51 4.44 4.50 4.40 20,000 4.40 4.30 15,000 4.20 4.06 4.10 4.01 Percent Thousands 21,289 21,443 10,000 4.00 3.93 15,182 3.90 14,026 13,118 10,964 5,000 3.80 3.70 0 3.60 2015 2016 2017 2018 2019 2020 Q3 YTD Net Income Net Interest Margin 9

Solid Earnings ROAA / ROAE 1.60 12.00 10.07 1.40 9.84 9.39 10.00 1.20 8.12 7.69 7.78 8.00 1.00 0.80 6.00 1.36 1.35 Percent ROAE ROAA Percent ROAA 0.60 1.15 4.00 0.99 0.90 0.94 0.40 2.00 0.20 - - 2015 2016 2017 2018 2019 2020 Q3 YTD ROAA ROAE 10

Steady Deposit Growth and Lowest Cost of Funds Average Total Deposits 1,600,000 0.15 0.16 1,400,000 0.14 1,200,000 0.12 0.10 1,000,000 0.10 0.09 0.09 0.09 0.08 800,000 0.08 1,518,250 Percent Thousands 1,284,305 1,333,754 1,295,780 600,000 0.06 1,144,231 1,065,798 400,000 0.04 200,000 0.02 0 0.00 2015 2016 2017 2018 2019 2020 Q3 YTD Avg Deposits Cost of Funds 11

Attractive Deposit Mix Total Deposits = $1.68 Billion TCDs 5% Money Market 19% Non-Interest Bearing 48% Now/Savings 28% As of September 30, 2020 12

Loan Totals and Yield Average Total Loans 1,200,000 5.54 5.60 5.51 5.50 5.50 1,000,000 5.40 5.29 5.27 5.30 800,000 5.20 600,000 5.10 Percent Thousands 1,042,010 5.00 908,419 928,560 400,000 4.97 4.90 790,504 578,899 644,282 4.80 200,000 4.70 0 4.60 2015 2016 2017 2018 2019 2020 Q3 YTD Total Loans Loan Yield * Loan Yield 9/30/2020 w/o PPP Loans 5.34% 13

Well Diversified Loan Portfolio Total Loans = $1.14 Billion Consumer & Equity Loans and Installment, 3% Other Real Estate, Lines, 5% 3% Commercial & Industrial, 27% Commercial Real Estate, 29% Agriculture Production & Land, 9% R/E Construction & Owner Occupied Land, 7% Real Estate, 18% As of September 30, 2020 Excludes Deferred Loan Fees 14

Agricultural Loan Commitments Cotton Pistachios Citrus 2% 1% 1% Almonds Tree Fruit 17% 10% Cherries 7% Table Grapes 4% Raisins 6% Open Land 16% Tomatoes 11% Row Crops Walnuts 4% Other Wine Grapes 8% 7% 6% Total Ag Line Commitments $121.5 Million As of September 30, 2020 15

Non Performing Loans 4,000 1.80 1.61 3,500 1.60 1.32 1.40 3,000 1.23 1.20 2,500 0.97 0.99 0.97 1.00 2,000 Percent Thousands 3,458 0.80 1,500 2,945 2,740 0.60 2,542 2,413 1,000 1,693 0.40 500 0.20 0 - 2015 2016 2017 2018 2019 2020 Q3 YTD Non Performing Assets ALLL/Loans * ALLL/Loans 9/30/2020 w/o PPP and acquired loans 1.92% 16

Special Mention Loans 50,000 6.00 45,000 4.80 5.00 40,000 35,000 3.95 3.95 4.00 30,000 2.99 2.86 25,000 3.00 2.43 Percent Thousands 43,893 20,000 2.00 15,000 29,911 28,719 28,183 26,254 21,908 10,000 1.00 5,000 - - 2015 2016 2017 2018 2019 2020 Q3 YTD Special Mention Loans SM Loans/Gross Loans 17

Substandard Loans 60,000 6.54 7.00 6.00 50,000 5.55 5.31 5.00 40,000 3.59 4.00 3.39 30,000 3.09 Percent Thousands 3.00 49,464 49,998 20,000 37,643 33,838 2.00 31,764 28,394 10,000 1.00 - - 2015 2016 2017 2018 2019 2020 Q3 YTD Substandard Loans Sub Loans/Gross Loans 18

Conservative Investment Portfolio Total = $639 Million Total = $503 Million Yield = 2.38% Yield = 2.91% Effective Duration 5.07 US Effective Duration 4.00 Government Equity Corporate Agencies Private Fed Funds Mutual Debt 6% Private Label Sold Funds 1% Label Equity US Mortgage 8% 2% Mortgage Mutual Government and Asset & Asset Fed Funds Funds Agencies Backed Backed Sold 1% 3% 31% 8% 6% Agency CMO, MBS & Other Agency Municipal Securities CMO, MBS Securities & Other 31% Municipal 37% Securities Securities 39% 27% As of September 30, 2020 As of December 31, 2019 19

On the Horizon Improve Efficiencies Monitor COVID-19 Impacts on Customers and Local Economy Proactively Respond to COVID-19 Related Borrower Issues Organic Loan & Deposit Growth Invest in Team & Technology 20

Investing in Relationships 21