Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE STREET CORP | stt-20201118.htm |

Exhibit 99.1 November 18, 2020 Citi’s 2020 Financial Technology Conference Lou Maiuri Chief Operating Officer 1

Preface and forward-looking statements This presentation contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of the time this presentation is first furnished to the SEC on a Current Report on Form 8-K, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. 2

The State Street AlphaSM front-to-back roadmap CRD and Alpha: An evolving business model driving core growth across State Street 2018-2020 achievements 2021-2022 roadmap Acquired Charles River Development (CRD) in the Accelerate SaaS conversion rate, resulting in more beginning of 4Q18 predictable revenue recognition Integration of CRD with multiple back & middle office and Expect low double-digit average CRD revenue growth, Global Markets products and services with software-enabled revenue growing ~20%B Established standards of interoperability and increased Drive multi-product revenue growth at State Street through trusted partners by nearly 25% (e.g. MSCI, Axioma)A Alpha sales and onboarding Alpha clients Launch of the Alpha platform integration has enabled 7 Expand cloud-based Alpha platform innovations and launch Alpha client wins to-date cloud-native capabilities Live on Microsoft® Azure’s cloud-based computing platform; Continue to grow CRD wealth management sales from paving the way for future cloud-based Alpha solutions pre-acquisition levels A Time period comparison from 3Q18 (pre-acquisition) to 3Q20. B Represents the average annual growth rates for the two-year time period ending December 31, 2022. CRD financial results presented on a standalone basis. Results include revenue associated with affiliates, including SSGA, that is eliminated in consolidation for financial reporting purposes. Please see endnote 1 for further details. 3

CRD performance Quarterly performanceA Yearly performanceA +16% +8% +11-12% -32% $401M $145M $372M $126M 137 63 $100M $99M 178 of 57 65-70% $85M expected total On-premises 28 20 71 B revenue, (on-prem) 20 26 22 reflecting mix 19 56 Professional 17 19 shift towards services 20% software- YoY 52% Software- 193 enabled and 57 57 growth enabled 49 49 53 138 professional B (including SaaS) services 3Q19 4Q19 1Q20 2Q20 3Q20 FY2018 FY2019 FY2020E (Proforma)3 Pre-tax $29 $68 $42 $84 $37 $218 $200 income New 5 23 5 3 17 29 37 Bookings2 A Quarterly and yearly CRD financial results presented on a standalone basis. It includes revenue associated with affiliates, including SSGA, that is eliminated in consolidation for financial reporting purposes. See endnote 1 for further details. B On-prem revenue is license revenue derived from locally installed software. Software-enabled revenue includes software as a service (SaaS), maintenance and support revenue, FIX, brokerage, and value-add services. License revenue recognition pattern for on-prem installations differs from software-enabled revenue. Refer to the Appendix included with this 4 presentation for endnotes 1 to 6.

Measuring CRD’s performance Growth and durability of the CRD franchise demonstrated through key performance metrics Annual recurring revenue (ARR)A Uninstalled revenue backlogB +14% +11% CAGR ARR is the annualized amount of $92M Growth $213M Uninstalled revenue to be $82M most software-enabled revenue $170M recognized from signed client metrics 60 13-24 that is expected to be recognized contracts that are scheduled to months ratably over the term of client be installed on a rolling 24- 73 contracts month period 32 1-12 9 months 4Q18 3Q20 4Q18 3Q20 Average deal sizeC Average initial client termC +100% +40% 5.8 Durability $2.1M Average initial contract deal size 4.1 years Average initial contract term years metrics of new clients inclusive of $1.0M length of new clients license, data, and other fees Pre- 3Q20 Pre- 3Q20 acquisition acquisition A ARR includes the majority of software-enabled revenue generated from SaaS, maintenance and support revenue, FIX, and value-add services, which are all ratably recognized. It excludes software-enabled revenue generated from brokerage. See endnote 4 for further details. B Uninstalled revenue backlog reflects terms currently in effect. It includes SaaS and on-prem license revenue, as well as maintenance and support revenue, and excludes revenue generated from FIX, value-add services, brokerage, and professional services. Line item totals and percentage change may differ due to rounding. C Average initial client 5 term and deal size comparison based on new contracts between FY2017 to 3Q18 (CRD pre-acquisition) and 4Q18 to 3Q20 (CRD post-acquisition). Contracts exclude affiliates. See endnote 5 for further details.

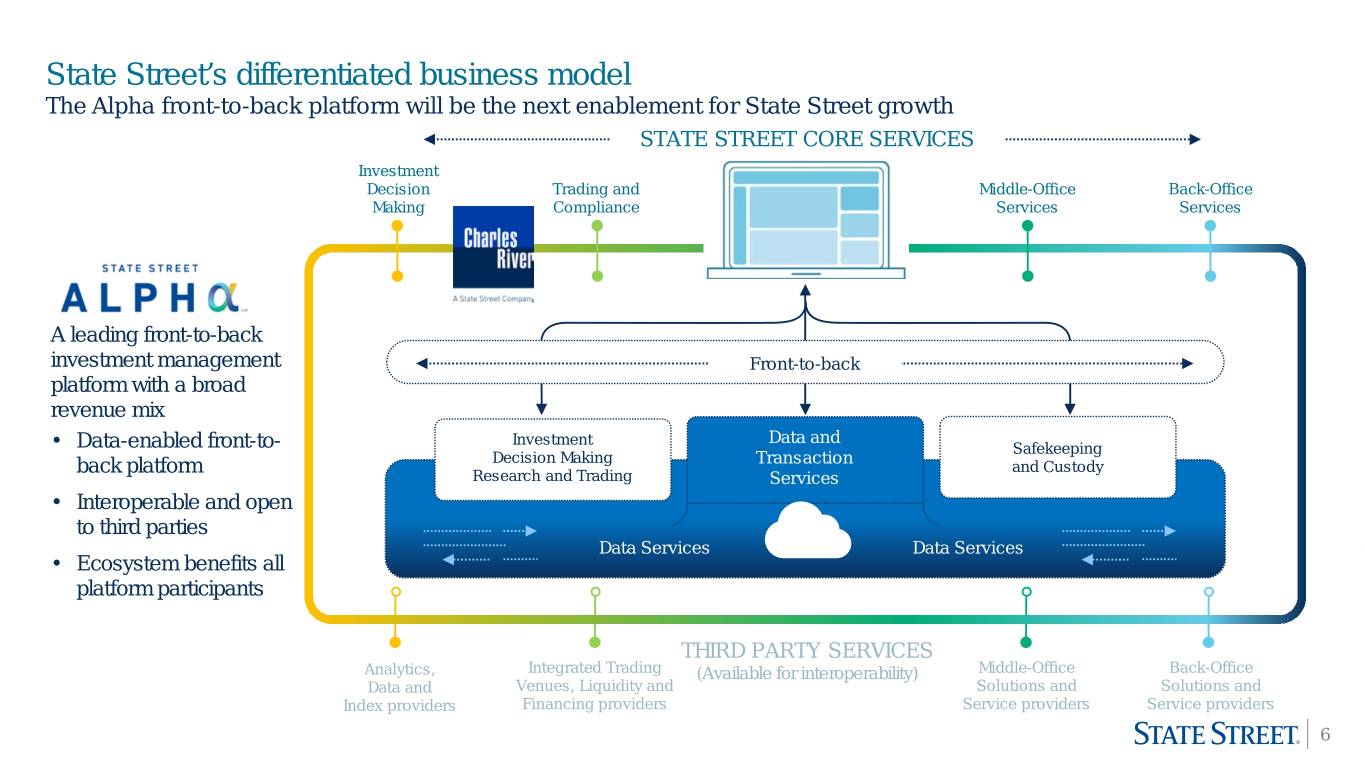

State Street’s differentiated business model The Alpha front-to-back platform will be the next enablement for State Street growth STATE STREET CORE SERVICES Investment Decision Trading and Middle-Office Back-Office Making Compliance Services Services A leading front-to-back investment management Front-to-back platform with a broad revenue mix Investment Data and • Data-enabled front-to- Safekeeping Decision Making Transaction back platform and Custody Research and Trading Services • Interoperable and open to third parties Data Services Data Services • Ecosystem benefits all platform participants THIRD PARTY SERVICES Analytics, Integrated Trading (Available for interoperability) Middle-Office Back-Office Data and Venues, Liquidity and Solutions and Solutions and Index providers Financing providers Service providers Service providers 6

The State Street Alpha front-to-back proposition Illustrative case study: Targeted annual technology and operations savings of ~10-15% for clients over timeA Alpha platform expected to lower clients’ operational expenses… Adopting the Alpha platform positions clients to deliver operational solutions and increase productivity while reducing expenses • Adoption of Alpha platform reduces client operational and technology expenses with targeted savings of ~10-15% Projected • Productivity and scale efficiencies, as well as lower costs for resiliency, cost curve prior to Alpha business continuity, and operational risk exposure 1 integration • Alpha savings allow clients to shift funding for cap-ex investments to core ~10-15% competency initiatives targeted savingsA Projected cost curve with Alpha …while also enabling clients to differentiate their capabilities integration 2 • Global scale of the Alpha platform enables clients to enter and grow in new regions and markets, as well as launch new products • End-to-end analytics delivered via proprietary offerings, partnerships, and cost ops tech Client & client co-developed solutions support portfolio expansion and diversification • Fully automated real-time cash management provides a centralized view of actionable cash across the enterprise Client AUM A Case study is indicative only, representing 3 current or prospective clients that provided sufficient data to allow for cost analysis. Individual client results may vary. Data reflects internal analyses, including data sourced from clients and prospects, which data was not provided in standardized scope or form and is therefore subject to definitional, content and other differences (e.g., variances in cost structures), as well as other methodology differences in the collection, assessment and presentation of data. Targeted cost savings are based on client’s or prospect’s technology and operations spend, all else equal, and not 7 their entire expense base. Targeted cost savings to be realized over the short-to-mid term post implementation.

Driving State Street revenue through Alpha Illustrative case studies: Deepening client relationships to drive core revenue growthA Global Asset Manager #1 Global Asset Manager #2 Global Asset Owner Official Institution Alpha Global transformation Unified global model Consolidated platform Front-to-back solution solution: Existing Back Office Back Office Back Office None relationship: Charles River IMS (single asset class) Charles River IMS (U.S. only) Global Markets Expanded Back Office and Expanded Back Office and Back Office Expanded Back Office Charles River IMS (fixed income) Charles River IMS (Global) Charles River IMS Scope of new Added Charles River IMS, Added Middle Office, Data and Added Middle Office, Data and Middle Office and Data business: Middle Office and Data Global Markets Global Markets Global Markets Front-to-back outsourced solution, Realization of target operating model Realization of target operating model Risk mitigation and improved insights Value to partner for trading, middle office, including front office rationalization through consolidation to one provider from outsourced solution client: custody and accounting Projected value ~5-15% projected revenue growth Net new revenue across multiple B products including back office to State Street: Incremental business and organic growth of existing book of business and outsourced trading A Case study for illustrative purposes only. Projected revenue growth from both fee revenue and NII is specific to revenue generated from the individual client. Revenue growth will differ by client dependent on multiple variables including, but not limited to, the size of the client, types of assets, number of products State Street is providing, and different product offerings the clients are receiving. B Projected revenue 8 compounded annual growth rate from the respective client over the next four years. See endnote 6 for further details.

Summary CRD and Alpha are critical enablers of State Street’s strategy and core revenue growth plan • Expect low double-digit average CRD revenue growth over the 2021-2022 roadmap time periodB CRD – Software-enabled revenue to grow ~20% revenueA – Continue to grow CRD wealth management sales from pre-acquisition levels • Clients’ shift towards a SaaS operating model results in more predictable revenue recognition • Annual recurring revenue (ARR) expected to grow at healthy rates as more clients onboard CRD performance • Strong uninstalled revenue backlog reflecting future revenue potential metrics • Post acquisition, average deal size and initial client term increasedC • Alpha is evolving the State Street business model and enabling enhanced technology services for clients State Street Alpha • Adopting the Alpha platform positions clients to deliver differentiated capabilities and increase productivity while reducing expenses value proposition • State Street Alpha deepens client relationships and demonstrates the ability to drive core State Street revenue growth A CRD financial results presented on a standalone basis. It includes revenue associated with affiliates, including SSGA, that is eliminated in consolidation for financial reporting purposes. Please see endnote 1 for further details. B Represents the average annual growth rates for the two-year time period ending December 31, 2022. C Average initial client term and deal size comparison based on new 9 contracts between FY2017 to 3Q18 (CRD pre-acquisition) and 4Q18 to 3Q20 (CRD post-acquisition). Contracts exclude affiliates. See endnote 5 for further details.

Fireside Chat Q&A Lou Maiuri Eric Aboaf Keith Horowitz 10

Appendix 11

Endnotes and Definitions Endnotes 1. Quarterly and yearly CRD financial results presented on a standalone basis. Revenue line items may not sum to total due to rounding. CRD revenue in 3Q19, 4Q19, 1Q20, 2Q20, and 3Q20 included revenue associated with affiliates, including SSGA, of $4M, $5M, $5M, $7M, and $10M, respectively, which are eliminated in consolidation for financial reporting purposes. CRD revenue in FY2018 and FY2019 included revenue associated with affiliates, including SSGA, of $2M and $16M, respectively, which are eliminated in consolidation for financial reporting purposes. State Street acquired CRD on October 1, 2018. 2. CRD bookings, as presented in this presentation, represent the net new signed annual contract values excluding bookings with affiliates, including SSGA. CRD revenue derived from affiliate agreements is eliminated in consolidation for financial reporting purposes. 3. FY2018 information based on estimated proforma financial results for CRD under the ASC606 accounting standard. Proforma results include certain assumptions and estimates and are unaudited. State Street acquired CRD on October 1, 2018. In 4Q18, CRD generated $121M in standalone revenue. 4. ARR is presented by annualizing the current quarter revenue. ARR CAGR of 14% calculated based on 1.75 years from 4Q18 ARR of $170M to 3Q20 ARR of $213M. 5. Average deal size based on the annual contract value of the initial contract. Annual contract value is the annual revenue generated from each client contract, but excludes any revenue generated from brokerage and professional services. Line item totals and percentage change may differ due to rounding. 6. Projected growth rates are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties, including timing of implementation of Alpha services, client business performance, interest rate environment and market performance. Therefore, actual outcomes and results may differ materially from what is expressed in those projections. Definitions 1. AUC/A: Assets under custody and/or administration 2. AUM: Assets under management 3. CAGR: Compounded annual growth rate 4. Charles River IMS: Charles River Investment Management Solution 5. CRD: Charles River Development 6. FIX: The Charles River Network’s FIX Network Service (CRN) is an end-to-end trade execution and support service facilitating electronic trading between Charles River’s asset management and broker clients. 7. On-prem: On-premises revenue as recognized in the CRD business 8. SaaS: Software-as-a-service 9. SSGA: State Street Global Advisors 12

Forward-looking statements This presentation (and the conference to which it relates) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, expense reduction programs, new client business, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “roadmap,” “outlook,” “guidance,” “expect,” “priority,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposures or to which our clients have such exposures as a result of our acting as agent, including as an asset manager or securities lending agent; the significant risks and uncertainties for our business, results of operations and financial condition, as well as our regulatory capital and liquidity ratios and other regulatory requirements, caused by the COVID-19 pandemic, which will depend on several factors, including the scope and duration of the pandemic, its influence on the economy and financial markets, the effectiveness of our work from home arrangements and staffing levels in operational facilities, challenges associated with our return to office plans such as maintaining a safe office environment and integrating at- home and in-office staff, the impact of market participants on which we rely and actions taken by governmental authorities and other third parties in response to the pandemic and the impact of lower equity market valuations on our service and management fee revenue; increases in the volatility of, or declines in the level of, our NII; changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities); and changes in the manner in which we fund those assets; the volatility of servicing fee, management fee, trading fee and securities finance revenues due to, among other factors, the value of equity and fixed-income markets, market interest and FX rates, the volume of client transaction activity, competitive pressures in the investment servicing and asset management industries, and the timing of revenue recognition with respect to software and processing fees revenues; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits; the liquidity of the assets on our balance sheet and changes or volatility in the sources of such funding, particularly the deposits of our clients; and demands upon our liquidity, including the liquidity demands and requirements of our clients; the level, volatility and uncertainty of interest rates; the expected discontinuation of Interbank Offered Rates including London Interbank Offered Rate (LIBOR); the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses; the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; and the impact of monetary and fiscal policy in the U.S. and internationally on prevailing rates of interest and currency exchange rates in the markets in which we provide services to our clients; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to impairment of such securities and the recognition of a provision for credit losses in our consolidated statement of income; our ability to attract and retain deposits and other low-cost, short-term funding; our ability to manage the level and pricing of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines; our ability to deploy deposits in a profitable manner consistent with our liquidity needs, regulatory requirements and risk profile; and the risks associated with the potential liquidity mismatch between short-term deposit funding and longer term investments; the manner and timing with which the Federal Reserve and other U.S. and non-U.S. regulators implement or reevaluate the regulatory framework applicable to our operations (as well as changes to that framework), including implementation or modification of the Dodd-Frank Act and related stress testing and resolution planning requirements and implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee and European legislation (such as Undertakings for Collective Investments in Transferable Securities (UCITS) V, the Money Market Fund Regulation and the Markets in Financial Instruments Directive II/Markets in Financial Instruments Regulation); among other consequences, these regulatory changes impact the levels of regulatory capital, long-term debt and liquidity we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, restrictions on banking and financial activities and the manner in which we structure and implement our global operations and servicing relationships. In addition, our regulatory posture and related expenses have been and will continue to be affected by heightened standards and changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning, cyber-security, resiliency, resolution planning and compliance programs, as well as changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory ratios that we are, or will be, required to meet, whether arising under the Dodd-Frank Act or implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital or liquidity ratios that cause changes in those ratios as they are measured from period to period; requirements to obtain the prior approval or non-objection of the Federal Reserve or other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or corporate activities, including, without limitation, acquisitions, investments in subsidiaries, dividends and stock repurchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital or corporate initiatives may be restricted; geopolitical risks applicable to our operations and activities in jurisdictions globally, including emerging markets and economies, that have the potential to disrupt or impose costs, delays or damages upon our, our clients', our counterparties' and suppliers' and our infrastructure providers' respective operations, activities and strategic planning and to compromise financial markets and stability; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including, without limitation, additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to our operating model and the adequacy and resiliency of our controls or compliance programs; cyber-security incidents, or failures to protect our systems and our, our clients' and others' information against cyber-attacks, that could result in the theft, loss, unauthorized access to, disclosure, use or alteration of information, system failures, or loss of access to information; any such incident or failure could adversely impact our ability to conduct our businesses, damage our reputation and cause losses, potentially materially; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology; to replace and consolidate systems, particularly those relying upon older technology, and to adequately incorporate cyber- security, resiliency and business continuity into our operations, information technology infrastructure and systems management; to implement robust management processes into our technology development and maintenance programs; and to control risks related to use of technology, including cyber-crime and inadvertent data disclosures; our ability to identify and address threats to our information technology infrastructure and systems (including those of our third-party service providers); the effectiveness of our and our third party service providers' efforts to manage the resiliency of the systems on which we rely; controls regarding the access to, and integrity of, our and our clients' data; and complexities and costs of protecting the security of such systems and data; our ability to control operational and resiliency risks, data security breach risks and outsourcing risks; our ability to protect our intellectual property rights; the possibility of errors in the quantitative models we use to manage our business; and the possibility that our controls will prove insufficient, fail or be circumvented; economic or financial market disruptions in the U.S. or internationally, including those which may result from recessions or political instability; for example, the United Kingdom's (U.K.) exit from the European Union or actual or potential changes in trade policy, such as tariffs or bilateral and multilateral trade agreements; our ability to create cost efficiencies through changes in our operational processes and to further digitize our processes and interfaces with our clients, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight, ethical behavior and governance that meets our expectations and those of our clients and our regulators, and the financial, regulatory, reputational and other consequences of our failure to meet such expectations; the impact on our compliance and controls enhancement programs associated with the appointment of a monitor under the deferred prosecution agreement with the DOJ and compliance consultant appointed under a settlement with the SEC, including the potential for such monitor and compliance consultant to require changes to our programs or to identify other issues that require substantial expenditures, changes in our operations, payments to clients or reporting to U.S. authorities; the results of our review of our billing practices, including additional findings or amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships or our reputation, adverse actions or penalties imposed by governmental authorities and costs associated with remediation of identified deficiencies; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; the large institutional clients on which we focus are often able to exert considerable market influence and have diverse investment activities, and this, combined with strong competitive market forces, subjects us to significant pressure to reduce the fees we charge, to potentially significant changes in our AUC/A or our AUM in the event of the acquisition or loss of a client, in whole or in part, and to potentially significant changes in our revenue in the event a client re-balances or changes its investment approach, re-directs assets to lower- or higher-fee asset classes or changes the mix of products or services that it receives from us; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent; the possibility of significant reductions in the liquidity or valuation of assets underlying those pools and the potential that clients will seek to hold us liable for such losses; and the possibility that our clients or regulators will assert claims that our fees, with respect to such investment products, are not appropriate; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to us or regarding other industry participants or industry- wide factors, or other reputational harm; changes or potential changes to the competitive environment, due to, among other things, regulatory and technological changes, the effects of industry consolidation and perceptions of us, as a suitable service provider or counterparty; our ability to complete acquisitions, joint ventures and divestitures, including, without limitation, our ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses, including, without limitation, CRD, and joint ventures will not achieve their anticipated financial, operational and product innovation benefits or will not be integrated successfully, or that the integration will take longer than anticipated; that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced; that client and deposit retention goals will not be met; that other regulatory or operational challenges will be experienced; and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to integrate CRD's front office software solutions with our middle and back office capabilities to develop our front-to-middle-to-back office State Street Alpha that is competitive, generates revenues in line with our expectations and meets our clients' requirements; the dependency of State Street Alpha on enhancements to our data management and the risks to our servicing model associated with increased exposure to client data; our ability to recognize evolving needs of our clients and to develop products that are responsive to such trends and profitable to us; the performance of and demand for the products and services we offer; and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes in accounting standards and practices; and the impact of the U.S. tax legislation enacted in 2017, and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2019 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time. 13