Attached files

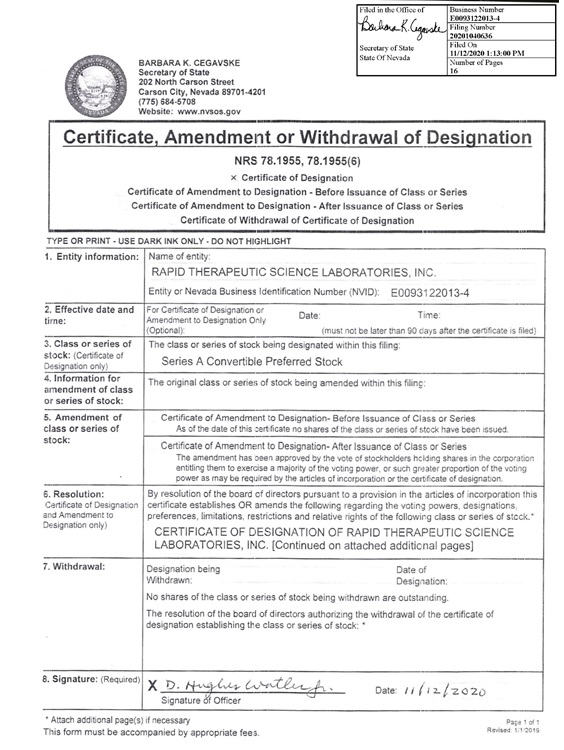

Certificate, Amendment or Withdrawal of Designation

NRS.1955, 78.1955(6)

[X] Certificate of Designation

1. Entity information:

Name of entity: RAPID THERAPEUTIC SCIENCE LABORATORIES, INC.

Entity or Nevada Business Identification Number (NVID): E00093122013-4

2. Effective date and For Certificate of Designation or Date:

Date: _______________ (Optional)

3. Class or series of stock:

The class or series of stock being designated within this filing: Series A Convertible Preferred Stock

4. Information for amendment of class or series of stock: _________________

5. Amendment of class or series of stock:

Before Issuance of Class or Series: As of the date of this certificate no shares of the class or series of stock have been issued.

After Issuance of Class or Series: The amendment has been approved by the vote of stockholders holding shares in the corporation entitling them to exercise a majority of the voting power, or such greater proportion of the voting power as may be required by the articles of incorporation or certificate of designation.

6. Resolution:

CERTIFICATE OF DESIGNATION OF RAPID THERAPEUTIC SCIENCE LABORATORIES, INC. [Continued on attached additional pages]

7. Withdrawal:

8. Signature:

Signature of Officer: /s/ D. Hughes Watler

Date: 11/12/2020

ESTABLISHING THE DESIGNATION, PREFERENCES,

LIMITATIONS AND RELATIVE RIGHTS OF ITS

SERIES A CONVERTIBLE PREFERRED STOCK

Pursuant to Section 78.1955 of the Nevada Revised Statutes (the “NRS”), Rapid Therapeutic Science Laboratories, Inc., a company organized and existing under the State of Nevada (the “Company”),

DOES HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Articles of Incorporation of the Company, as amended, and pursuant to Section 78.1955 of the NRS, the Board of Directors, by unanimous written consent of all members of the Board of Directors on November 10, 2020, duly adopted a resolution providing for the issuance of a series of Sixteen Million and Five Hundred Thousand (16,500,000) shares of Series A Convertible Preferred Stock, which resolution is and reads as follows:

RESOLVED, that pursuant to the authority expressly granted to and invested in the Board of Directors by the provisions of the Articles of Incorporation of the Company, as amended and Section 78.1955 of the NRS, a series of the preferred stock, par value $0.001 per share, of the Company be, and it hereby is, established; and

FURTHER RESOLVED, that the series of preferred stock of the Company be, and it hereby is, given the distinctive designation of “Series A Convertible Preferred Stock”; and

FURTHER RESOLVED, that the Series A Convertible Preferred Stock shall consist of Sixteen Million and Five Hundred Thousand (16,500,000) shares; and

FURTHER RESOLVED, that the Series A Convertible Preferred Stock shall have the powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon set forth in this Certificate of Designation (the “Designation” or the “Certificate of Designation”) below:

1.2 Non-Cash Distributions. Whenever a Distribution provided for in this Section 1 shall be payable in property other than cash, the value of such Distribution shall be deemed to be the fair market value of such property as determined in good faith by the Board of Directors.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 1 |

1.3 Other Distributions. Subject to the terms of this Certificate of Designation, and to the fullest extent permitted by the NRS, the Company shall be expressly permitted to redeem, repurchase or make distributions on the shares of its capital stock.

2.2 Valuation of Non-Cash Consideration. If any assets of the Company distributed to stockholders in connection with any liquidation, dissolution, or winding up of the Company are other than cash, then the value of such assets shall be their fair market value as determined in good faith by the Board of Directors.

2.3 Effecting a Merger or Consolidation. The Company shall not have the power to effect a Liquidation Event or other transaction which is a merger, consolidation or exchange pursuant to which the shareholders of the Company will, subsequent to such transaction, hold less than 50% of the voting securities of the resulting entity, unless the agreement or plan of merger or consolidation for such transaction (the “Merger Agreement”) provides that the consideration payable to the stockholders of the Company shall be allocated among the holders of Series A Convertible Preferred Stock and Common Stock of the Company in accordance with Sections 2.1 and 2.2.

3. Conversion. The holders of the Series A Convertible Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

3.1 Holder Conversion.

(a) Each share of Series A Convertible Preferred Stock shall be convertible, at the option of the holder thereof (a “Conversion”), at any time following the second anniversary of the Closing Date, at the office of the Company or any Transfer Agent for the Series A Convertible Preferred Stock, into that number of fully-paid, nonassessable shares of Common Stock determined by dividing (i) the Original Issue Price for the Series A Convertible Preferred Stock by (ii) the Conversion Price (such shares of Common Stock issuable upon a Conversion, the “Shares”). In order to effectuate the Conversion under this Section 3.1, the Holder must provide the Company a written notice of conversion in the form of Exhibit A hereto (the “Notice of Conversion”). The Notice of Conversion must be dated no earlier than three Business Days from the date the Notice of Conversion is actually received by the Company.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 2 |

(c) Restricted Shares. Unless the Shares are covered by a valid and effective registration under the Securities Act or the Notice of Conversion provided by the Holder includes a valid opinion from an attorney stating that such shares of Common Stock issuable in connection with the Notice of Conversion can be issued free of restrictive legend, which shall be determined by the Company in its sole discretion, such shares shall be issued as Restricted Shares. In the event such Shares are separately covered by a contractual lock-up and/or restriction, such Shares shall be issued, in the discretion of the Company, with a legend disclosing such contract lock-up and/or restriction.

(d) Delivery of Common Stock upon Conversion. Upon the receipt of a Notice of Conversion, the Company (itself, or through its Transfer Agent) shall, no later than the fifth Business Day following the date of such receipt (subject to the surrender of the Preferred Stock Certificates by the Holder within the period described in Section 3.1(b) or, in the case of lost, stolen or destroyed certificates, after provision of the Lost Certificate Materials), issue and deliver (i.e., deposit with a nationally recognized overnight courier service postage prepaid) to the Holder or its nominee (x) a certificate representing the Shares and (y) a certificate representing the number of shares of Series A Convertible Preferred Stock not being converted, if any. Notwithstanding the foregoing, if the Company’s Transfer Agent is participating in the Depository Trust Corporation (“DTC”) Fast Automated Securities Transfer program, and so long as the certificates therefor do not bear a legend and the Holder thereof is not then required to return such certificate for the placement of a legend thereon, the Company shall cause its Transfer Agent to promptly electronically transmit the Common Stock issuable upon conversion to the Holder by crediting the account of the Holder or its nominee with DTC through its Deposit Withdrawal Agent Commission system (“DTC Transfer”). If the aforementioned conditions to a DTC Transfer are not satisfied, the Company shall deliver as provided above to the Holder physical certificates representing the Common Stock issuable upon Conversion. Further, a Holder may instruct the Company to deliver to the Holder physical certificates representing the Common Stock issuable upon conversion in lieu of delivering such shares by way of DTC Transfer.

(e) Failure to Provide Preferred Stock Certificates. In the event the Holder provides the Company with a Notice of Conversion, but fails to provide the Company with the Preferred Stock Certificates or the Lost Certificate Materials (as defined in Section 10 below), by the end of the

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 3 |

Delivery Period, the Notice of Conversion shall be considered void and the Company shall not be required to comply with such Notice of Conversion, unless such shares of Series A Convertible Preferred Stock are held in book entry/non-certificate form.

3.2 Fractional Shares. If any Conversion of Series A Convertible Preferred Stock would result in the issuance of a fractional share of Common Stock (aggregating all shares of Series A Convertible Preferred Stock being converted pursuant to a given Notice of Conversion), such fractional share shall be payable in cash based upon the market value of the Common Stock on the trading day immediately prior to the date of conversion (as determined in good faith by the Board of Directors) and the number of shares of Common Stock issuable upon conversion of the Series A Convertible Preferred Stock shall be the next lower whole number of shares. If the Company elects not to, or is unable to, make such a cash payment, the Holder shall be entitled to receive, in lieu of the final fraction of a share, one whole share of Common Stock.

3.3 Taxes. The Company shall not be required to pay any tax which may be payable in respect to any transfer involved in the issue and delivery of shares of Common Stock upon Conversion in a name other than that in which the shares of the Series A Convertible Preferred Stock so converted were registered, and no such issue or delivery shall be made unless and until the person requesting such issue or delivery has paid to the Company the amount of any such tax, or has established, to the satisfaction of the Company, that such tax has been paid. The Company shall withhold from any payment due whatsoever in connection with the Series A Convertible Preferred Stock any and all required withholdings and/or taxes the Company, in its sole discretion deems reasonable or necessary, absent an opinion from Holder’s accountant or legal counsel, acceptable to the Company in its sole determination, that such withholdings and/or taxes are not required to be withheld by the Company.

3.4 No Impairment. The Corporation will not through any reorganization, transfer of assets, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company but will at all times in good faith assist in the carrying out of all the provisions of this Section 3 and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the Holders of Series A Convertible Preferred Stock against impairment. Notwithstanding the foregoing, nothing in this Section shall prohibit the Company from amending its Articles of Incorporation with the requisite consent of its stockholders and the Board of Directors, provided that such amendment will not prohibit the Company from having sufficient authorized shares of Common Stock to permit conversion hereunder.

3.5 Reservation of Stock Issuable Upon Conversion. The Company shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock solely for the purpose of effecting the conversion of the shares of the Series A Convertible Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding shares of the Series A Convertible Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series A Convertible Preferred Stock, the Company will use its commercially reasonable efforts to take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

4. Adjustments for Recapitalizations.

4.1 Equitable Adjustments for Recapitalizations. (a) The Liquidation Preference and the Original Issue Price (each, as and if applicable) (the “Preferred Stock Adjustable Provisions”); (b) the Conversion Price (as and if applicable) (the “Common Stock Adjustable Provisions”), and (c) any and

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 4 |

all other terms, conditions, amounts and provisions of this Designation which (i) pursuant to the terms of this Designation provide for equitable adjustment in the event of a Recapitalization (the “Other Equitable Adjustable Provisions”); or (ii) the Board of Directors of the Company determines in their reasonable good faith judgment is required to be equitably adjusted in connection with any Recapitalizations, shall each be subject to equitable adjustment as provided in Sections 4.2 through 4.3, below, as determined by the Board of Directors in their sole and reasonable discretion.

4.2 Adjustments for Subdivisions or Combinations of Common Stock. In the event the outstanding shares of Common Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Common Stock, without a corresponding subdivision of the Series A Convertible Preferred Stock, the applicable Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately and equitably adjusted. In the event the outstanding shares of Common Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Common Stock, without a corresponding combination of the Series A Convertible Preferred Stock, the Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately and equitably adjusted.

4.3 Adjustments for Subdivisions or Combinations of Series A Convertible Preferred Stock. In the event the outstanding shares of Series A Convertible Preferred Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Series A Convertible Preferred Stock, the applicable Preferred Stock Adjustable Provisions, Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately and equitably adjusted. In the event the outstanding shares of Series A Convertible Preferred Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Series A Convertible Preferred Stock, the applicable Preferred Stock Adjustable Provisions, Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately and equitably adjusted. Provided however that the result of any concurrent adjustment in the Common Stock (as provided under Section 4.2) and Series A Convertible Preferred Stock (as provided under Section 4.3) shall only be to affect the equitable adjustable provisions hereof once.

4.4 Other Adjustments. The Board of Directors of the Company shall also adjust equitably, and shall have the right to adjust equitably, any or all of the Preferred Stock Adjustable Provisions, Common Stock Adjustable Provisions or Other Equitable Adjustable Provisions from time to time, if the Board of Directors of the Company determine in their reasonable good faith judgment that such values and/or provisions are required to be equitably adjusted in connection with any Company action.

4.5 Adjustments for Reclassification, Exchange and Substitution.

(a) Except to the extent such Recapitalization Event is subject to Sections 4.1 through4.3, above (the “Recapitalization and Adjustment Rights”), and/or Section 2 (“Liquidation Rights”), if at any time or from time to time after the Closing Date there shall occur any capital reorganization, recapitalization, reclassification, share exchange, restructuring, consolidation, combination or merger involving the Company in which the Common Stock (but not the Series A Convertible Preferred Stock) is converted into or exchanged for shares of stock or other securities or property (including cash) of the Company or otherwise (other than a transaction covered by the Recapitalization and Adjustment Rights or Liquidation Rights) (each a “Recapitalization Event”), provision shall be made so that each Series A Convertible Preferred Holder shall thereafter be entitled to

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 5 |

receive upon conversion of the shares of Series A Convertible Preferred Stock held by such Series A Convertible Preferred Holder the kind and number of shares of stock or other securities or property (including cash or any combination thereof) of the Company or otherwise, to which a Common Stock shareholder holding the number of shares of Common Stock into which the shares of Series A Convertible Preferred Stock held by such Series A Convertible Preferred Holder are convertible immediately prior to such reorganization, recapitalization, reclassification, consolidation or merger (without regard for the Maximum Percentage) would have been entitled upon such event.

(b) In the event that the holders of Common Stock have the opportunity to elect the form of consideration to be received in the business combination, then the Company shall make adequate provision whereby the Holders of Series A Convertible Preferred Stock shall have the opportunity to determine the form of consideration into which all of the Series A Convertible Preferred Stock, treated as a single class, shall be convertible from and after the effective date of such business combination. If such opportunity is granted, such determination shall be based on the determination at a meeting duly called or via a written consent to action of a Majority In Interest, shall be subject to any limitations to which all holders of Common Stock are subject, such as pro rata reductions applicable to any portion of the consideration payable in such business combination, and shall be conducted in such a manner as to be completed by the date which is the earliest of (1) the deadline for elections to be made by holders of Common Stock and (2) two Business Days prior to the anticipated effective date of the business combination. Further, the Company shall not affect any such consolidation, merger or sale, unless prior to the consummation thereof, the successor entity (if other than the Company) resulting from consolidation or merger or the entity purchasing such assets assumes by written instrument, the obligation to deliver to each such holder such shares of stock, securities or assets as, in accordance with the foregoing provisions, such holder may be entitled to acquire.

(c) If a conversion of Series A Convertible Preferred Stock is to be made in connection with a transaction contemplated by this Section 4.5 or a similar transaction affecting the Company (other than a tender or exchange offer), the conversion of any shares of Series A Convertible Preferred Stock may, at the election of the Holder thereof, be conditioned upon the consummation of such transaction, in which case such conversion shall not be deemed to be effective until such transaction has been consummated. In connection with any tender or exchange offer for shares of Common Stock, Holders of Series A Convertible Preferred Stock shall have the right to tender (or submit for exchange) shares of Series A Convertible Preferred Stock in such a manner so as to preserve the status of such shares as Series A Convertible Preferred Stock until immediately prior to such time as shares of Common Stock are to be purchased (or exchanged) pursuant to such offer, at which time that portion of the shares of Series A Convertible Preferred Stock so tendered which is convertible into the number of shares of Common Stock to be purchased (or exchanged) pursuant to such offer shall be deemed converted into the appropriate number of shares of Common Stock. Any shares of Series A Convertible Preferred Stock not so converted shall be returned to the Holder as Series A Convertible Preferred Stock.

(d) None of the foregoing provisions shall affect the right of a Holder of shares of Series A Convertible Preferred Stock to convert such Holder’s shares of Series A Convertible Preferred Stock into shares of Common Stock prior to the effective date of such business combination, subject to the terms of this Designation.

(e) In the event of any Recapitalization Event falling under this Section 4.5, in such case, appropriate adjustment shall be made in the application of the provisions of this Section 4.5 with respect to the rights and interests of the Series A Convertible Preferred Holders after such events to the end that the provisions of this Section 4.5 (including, but not limited to, adjustment of the Conversion Price in respect of any shares of Series A Convertible Preferred Stock then in effect and the number of shares issuable upon conversion of all such shares of Series A Convertible Preferred Stock) shall be applicable after that event as nearly reasonably as may be. The Company may not become a party to any such

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 6 |

transaction unless its terms are consistent with the preceding requirements and such transaction is otherwise affected in accordance with this Designation.

4.6 Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment pursuant to this Section 4, the Company at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Series A Convertible Preferred Stock a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Company shall, upon the reasonable written request at any time of any holder of Series A Convertible Preferred Stock, furnish or cause to be furnished to such holder a like certificate setting forth (i) such adjustments and readjustments, (ii) the Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of the Series A Convertible Preferred Stock.

5. Voting. The Series A Convertible Preferred Stock shall not have any voting rights, except as expressly set forth below under Section 6, “Protective Provisions”. Other than as provided herein or required by law, there shall be no series voting.

6.1 Subject to the rights of series of preferred stock which may from time to time come into existence, so long as any shares of Series A Convertible Preferred Stock are outstanding, the Company shall not, without first obtaining the approval (at a meeting duly called or by written consent, as provided by law) of the holders of a Majority In Interest:

(a) Increase or decrease (other than by redemption or conversion) the total number of authorized shares of Series A Convertible Preferred Stock;

(b) Re-issue any shares of Series A Convertible Preferred Stock converted pursuant to the terms of this Designation;

(c) Issue any shares of Series A Convertible Preferred Stock other than pursuant to the Asset Purchase Agreement;

(d) Alter or change the rights, preferences or privileges of the shares of Series A Convertible Preferred Stock so as to affect adversely the shares of such series; or

(e) Amend or waive any provision of the Company’s Articles of Incorporation or Bylaws relative to the Series A Convertible Preferred Stock so as to affect adversely the shares of Series A Convertible Preferred Stock in any material respect as compared to holders of other series of shares.

7. Redemption Rights. The Series A Convertible Preferred Stock shall not have any redemption rights.

8. Notices.

8.1 In General. Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile or email transmission, and shall be effective, unless otherwise provided herein, three days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 7 |

9. No Preemptive Rights. No Holder shall have the right to repurchase shares of capital stock of the Company sold or issued by the Company except to the extent that such right may from time to time be set forth in a written agreement between the Company and such stockholder.

11. No Other Rights or Privileges. Except as specifically set forth herein, the Holders of the Series A Convertible Preferred Stock shall have no other rights, privileges or preferences with respect to the Series A Convertible Preferred Stock.

12. Miscellaneous.

12.1 Cancellation of Series A Convertible Preferred Stock. If any shares of Series A Convertible Preferred Stock are converted pursuant to Section 3, the shares so converted or redeemed shall be canceled and shall return to the status of designated, but unissued Series A Convertible Preferred Stock.

12.2 Further Assurances. Each Holder hereby covenants that, in consideration for receiving shares of Series A Convertible Preferred Stock, that he, she or it will, whenever and as reasonably requested by the Company, do, execute, acknowledge and deliver any and all such other and further acts, deeds, confirmations, agreements and documents as the Company or its Transfer Agent may reasonably require in order to complete, insure and perfect any of the terms, conditions or provisions of this Designation.

12.3 Technical, Corrective, Administrative or Similar Changes. The Company may, by any means authorized by law and without any vote of the Holders of shares of the Series A Convertible Preferred Stock, make technical, corrective, administrative or similar changes in this Designation that do not, individually or in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Series A Convertible Preferred Stock.

12.4 Waiver/Amendment. Notwithstanding any provision in this Designation to the contrary, any provision contained herein and any right of the holders of Series A Convertible Preferred Stock granted hereunder may be waived and/or amended as to all shares of Series A Convertible Preferred Stock (and the Holders thereof) upon the written consent of a Majority In Interest, unless a higher percentage is required by applicable law, in which case the written consent of the Holders of not less than such higher percentage of shares of Series A Convertible Preferred Stock shall be required, and no separate approval of the holders of the Common Stock of the Company shall be required.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 8 |

12.5 Interpretation. Whenever possible, each provision of this Designation shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Designation. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

13.1 “Asset Purchase Agreement” means that certain Asset Purchase and Sale Agreement dated October 23, 2020, by and between the Company, Razor Jacket, LLC, Frank Gill and Ryan Johnson, as such may be amended or modified from time to time.

13.2 “Business Day” means any day except Saturday, Sunday or any day on which banks are authorized by law to be closed in the City of Dallas, Texas.

13.3 “Closing Date” means the ‘Closing Date’ as defined in the Asset Purchase Agreement.

13.4 “Common Stock” shall mean the common stock, $0.001 par value per share of the Company.

13.5 “Conversion Price” shall equal $0.80 per share, subject to adjustment in connection with any Recapitalization.

13.6 “Distribution” shall mean the transfer of cash or other property without consideration whether by way of dividend or otherwise (other than dividends on Common Stock payable in Common Stock), other than: (i) repurchases of Common Stock (or securities convertible into Common Stock) in individually negotiated transactions, (ii) other repurchases allowed pursuant to the terms of this Designation, or (iii) any other repurchases or redemptions of capital stock of the Corporation approved by the Board of Directors of the Company.

13.7 “Exchange Act” means the Securities Exchange Act of 1934, as amended (and any successor thereto) and the rules and regulations promulgated thereunder.

13.8 “Holder” shall mean the person or entity in which the Series A Convertible Preferred Stock is registered on the books of the Company, which shall initially be the person or entity which such Series A Convertible Preferred Stock is issued to, and shall thereafter be permitted and legal assigns which the Company is notified of by the Holder and which the Holder has provided a valid legal opinion in connection therewith to the Company and to whom such Preferred Stock Shares are legally transferred.

13.9 “Junior Securities” shall mean each other class of capital stock or series of preferred stock of the Company other than the Common Stock established after the Closing Date, the terms of which do not expressly provide that such class or series ranks senior to or on parity with the Series A Convertible Preferred upon the liquidation, winding-up or dissolution of the Company.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 9 |

13.10 “Liquidation Preference” shall equal the Original Issue Price per share.

13.11 “Majority In Interest” means Holders holding a majority of the then aggregate shares of Series A Convertible Preferred Stock.

13.12 “Original Issue Date” means the date that such applicable shares of Series A Convertible Preferred Stock are actually earned and issued.

13.13 “Original Issue Price” shall mean $0.80 per share (as appropriately adjusted for any Recapitalizations).

13.14 “Preferred Stock Certificates” means the stock certificate(s) issued by the Company representing the applicable Series A Convertible Preferred Stock shares.

13.15 “Recapitalization” shall mean any stock dividend, stock split, combination of shares, reorganization, recapitalization, reclassification or other similar event described in Sections 4.2 through 4.3.

13.16 “Restricted Shares” means shares of the Company’s Common Stock which are restricted from being transferred by the Holder thereof unless the transfer is affected in compliance with the Securities Act and applicable state securities laws (including investment suitability standards, which shares shall bear the following restrictive legend (or one substantially similar):

The securities represented by this certificate have not been registered under the Securities Act of 1933 or any state securities act. The securities have been acquired for investment and may not be sold, transferred, pledged or hypothecated unless (i) they shall have been registered under the Securities Act of 1933 and any applicable state securities act, or (ii) the corporation shall have been furnished with an opinion of counsel, satisfactory to counsel for the corporation, that registration is not required under any such acts.

13.17 “SEC” means the Securities and Exchange Commission.

13.18 “Securities Act” means the Securities Act of 1933, as amended (and any successor thereto) and the rules and regulations promulgated thereunder.

13.19 “Senior Securities” means the Company’s capital leases as may be in place from time to time; and any other senior debt, equity or other security holders of the Company, including certain banks and/or institutions, which hold security interests over the Company’s assets as of the Issuance Date, or which the Company may agree in the future to provide priority security interests to, priority right in liquidation, or priority voting rights to, which shall not require notice to, or the approval and/or consent of the Holders.

13.20 “Transfer Agent” means initially, the Company, which will be serving as its own transfer agent for the Series A Convertible Preferred Stock, but at the option of the Company from time to time, may also mean Vail Stock Transfer, or any successor transfer agent which the Company may use for its Series A Convertible Preferred Stock.

——————————————————————————

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 10 |

NOW THEREFORE BE IT RESOLVED, that the Designation is hereby approved, affirmed, confirmed, and ratified; and it is further

RESOLVED, that each officer of the Company be and hereby is authorized, empowered and directed to execute and deliver, in the name of and on behalf of the Company, any and all documents, and to perform any and all acts necessary to reflect the Board of Directors approval and ratification of the resolutions set forth above; and it is further

RESOLVED, that in addition to and without limiting the foregoing, each officer of the Company and the Company’s attorney be and hereby is authorized to take, or cause to be taken, such further action, and to execute and deliver, or cause to be delivered, for and in the name and on behalf of the Company, all such instruments and documents as he may deem appropriate in order to effect the purpose or intent of the foregoing resolutions (as conclusively evidenced by the taking of such action or the execution and delivery of such instruments, as the case may be) and all action heretofore taken by such officer in connection with the subject of the foregoing recitals and resolutions be, and it hereby is approved, ratified and confirmed in all respects as the act and deed of the Company; and it is further

RESOLVED, that this Designation may be executed in several counterparts, each of which is an original; that it shall not be necessary in making proof of this Designation or any counterpart hereof to produce or account for any of the other.

[Remainder of page left intentionally blank. Signature page follows.]

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 11 |

IN WITNESS WHEREOF, the Board of Directors of the Company has unanimously approved and caused this “Certificate of Designation of Rapid Therapeutic Science Laboratories, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series A Convertible Preferred Stock” to be duly executed and approved this 10th day of November 2020.

DIRECTORS:

/s/ Donal R. Schmidt, Jr.

DONAL R. SCHMIDT, JR.

DIRECTOR

/S/ D. Hughes Watler, Jr.

D. HUGHES WATLER, JR.

DIRECTOR

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 12 |

Exhibit A

NOTICE OF CONVERSION

This Notice of Conversion is executed by the undersigned holder (the “Holder”) in connection with the conversion of shares of the Series A Convertible Preferred Stock of Rapid Therapeutic Science Laboratories, Inc., a Nevada corporation (the “Company”), pursuant to the terms and conditions of that certain Certificate of Designation of Rapid Therapeutic Science Laboratories, Inc., Establishing the Designation, Preferences, Limitations and Relative Rights of its Series A Convertible Preferred Stock (the “Designation”), approved by the Board of Directors of the Company on November 10, 2020. Capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Designation.

Conversion: In accordance with and pursuant to such Designation, the Holder hereby elects to convert the number of shares of Series A Convertible Preferred Stock indicated below into shares of Common Stock of the Company as of the date specified below.

|

Date of Conversion: _____________________

Number of Preferred Shares Held by Holder Prior to Conversion: _______________

Amount Being Converted Hereby: ______________________

Common Stock Shares Due:___________________

Preferred Shares Held After Conversion: ________________________ |

Delivery of Shares: Pursuant to this Notice of Conversion, the Company shall deliver the applicable number of shares of Common Stock (the “Shares”) issuable in accordance with the terms of the Designation as set forth below. If Shares are to be issued in the name of a person other than the Holder, the Holder will pay all transfer taxes payable with respect thereto and is delivering herewith such certificates and opinions as reasonably requested by the Company in accordance therewith. No fee will be charged to the Holder for any conversion, except for such transfer taxes, if any. The Holder acknowledges and confirms that the Shares issued pursuant to this Notice of Conversion will, to the extent not previously registered by the Company under the Securities Act, be Restricted Shares, unless the Shares are covered by a valid and effective registration under the Securities Act or this Notice of Conversion includes a valid opinion from an attorney stating that such Shares can be issued free of restrictive legend, which shall be determined by the Company in its sole discretion.

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 13 |

| If stock certificates are to be issued, in the following name and to the following address: | If DWAC is permissible, to the following brokerage account: |

|

__________________________________

__________________________________

__________________________________

__________________________________

__________________________________

| Broker: ___________________________________

DTC No.: ___________________________________

Acct. Name: ___________________________________

For Further Credit (if applicable): ___________________________________ |

Authority: Any individual executing this Notice of Conversion on behalf of an entity has authority to act on behalf of such entity and has been duly and properly authorized to sign this Notice of Conversion on behalf of such entity.

|

|

_______________________________________ (Print Name of Holder)

By/Sign: _______________________________

Print Name: ____________________________

Print Title: _____________________________ |

| Rapid Therapeutic: Certificate of Designation of Series A Convertible Preferred Stock | Page 14 |