Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOWES COMPANIES INC | low-20201118.htm |

| EX-99.1 - PRESS RELEASE - LOWES COMPANIES INC | exhibit991-10302020.htm |

Exhibit 99.2 “Strong execution enabled us to meet continued broad-based demand, as we delivered over 15% growth in all merchandising departments, over 20% growth across all geographic regions, and triple-digit growth online. We continued to invest in the future growth of the company, including a $100 million investment in the quarter as part of an ongoing effort to reset the layout of our U.S. stores, making them easier to shop with improved product adjacencies, especially for Pro customers. Our omni-channel transformation continued in the third quarter with further investments in Lowes.com and our supply chain. I remain Q3 2020 RESULTS confident that we are making the right strategic investments to deliver sustainable, long-term growth. I would also like to thank our outstanding frontline associates for their unwavering commitment to customer service and safety.” - Marvin R. Ellison, Lowe’s President and CEO FINANCIAL HIGHLIGHTS U.S. COMPARABLE SALES SUMMARY MERCHANDISING DEPARTMENT PERFORMANCE TRANSACTIONS/TICKET LOWES.COM Positive Comps Exceeded 15% in all 15 COMP COMP AVERAGE SALES IN SALES TRANSACTIONS TICKET GROWTH +106% Merchandising Departments $22.3B +28.3% 16.4% 13.7% U.S. COMP COMP SALES BY TICKET SIZE All 15 Regions U.S. +30.4% SALES Delivered Comp Sales >$500 +32.5% Growth Exceeding +20% $50-500 +30.9% GROSS MARGIN 32.72% +28 basis points <$50 +16.9% +31.8% +28.9% +30.0% OPERATING U.S. MONTHLY COMP MARGIN PERFORMANCE 9.75% +79 basis points 2020 2019 2 +3.6% +2.7% +2.7% AUGUST SEPTEMBER OCTOBER DILUTED EPS Invested an Incremental $245 Million in Financial Assistance $0.91 -33% for Associates in Response to COVID-19 Our highest priority will always be protecting the health and safety of our associates and ADJ. DILUTED EPS1 customers through a safe store environment and shopping experience $1.98 +40% Maintaining Enhanced Store Safety Measures Financial Support for Associates All frontline associates required to wear masks Provided bonuses in October and November totaling ~$230 1 Adjusted Diluted EPS is a non-GAAP financial measure. Refer to Nationwide standard for all customers to wear masks million for frontline associates Lowes.com/investor for a reconciliation of non-GAAP measures. Total COVID-Related Support 2 Beginning on 2/1/2020, the Company changed the basis in which it presents Providing free masks for customers who need them the comparable sales metric. Q3 2019 comp sales have not been adjusted. More than $1.1 billion for associates, store safety and community “All comparisons are to Q3 2019” For more information visit: corporate.lowes.com/covid-19-response pandemic relief through first nine months of fiscal 2020

STRATEGIC INITIATIVES SUPPLY CHAIN MERCHANDISING OPERATIONAL CUSTOMER TRANSFORMATION EXCELLENCE EFFICIENCY ENGAGEMENT Fulfillment Improve Productivity Store Own the Pro and Delivery Drive Localization Simplification Associate Optimization Improve In-Stock Engagement Order Management Reset Execution Execution Optimization Best-in-Class Online Experience OMNI-CHANNEL

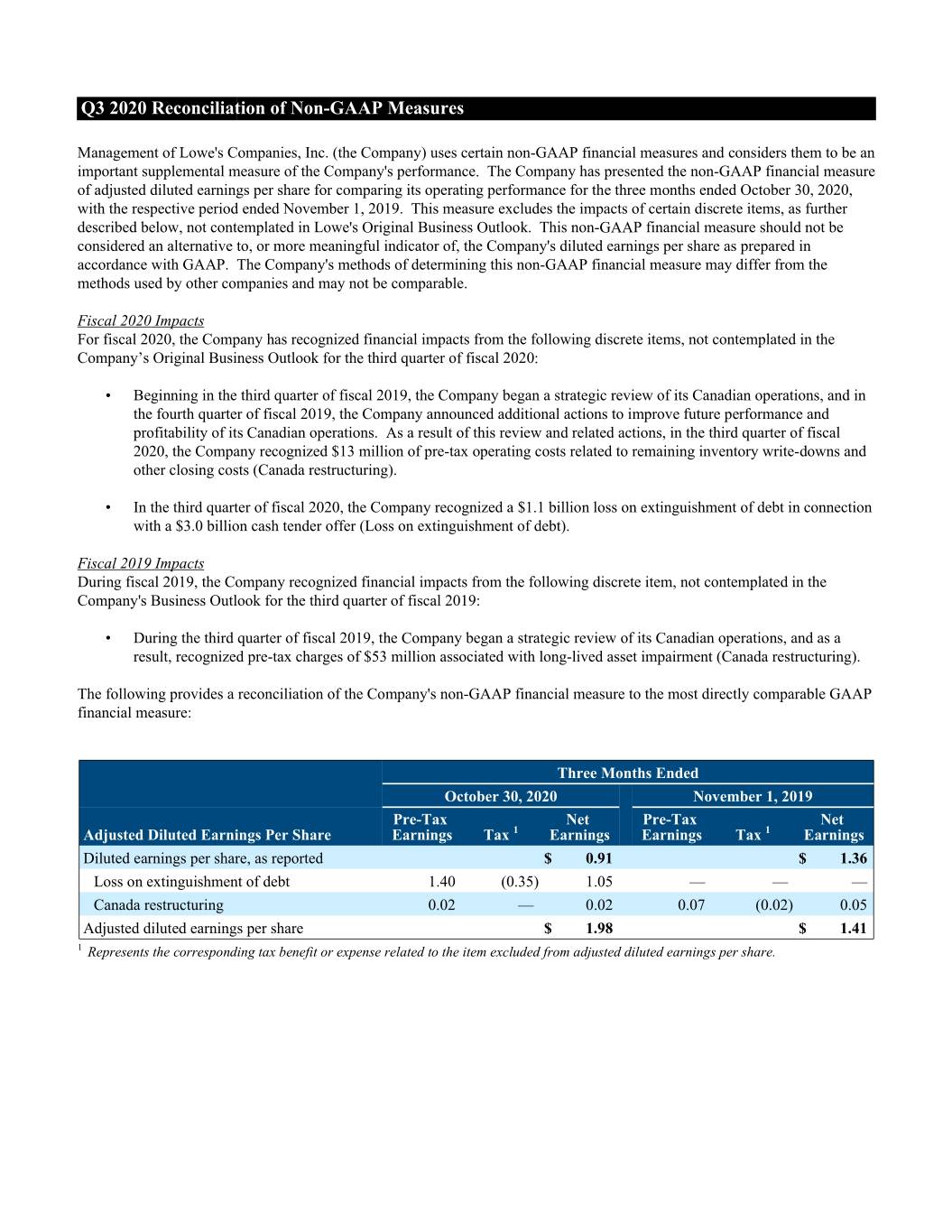

Q3 2020 Reconciliation of Non-GAAP Measures Management of Lowe's Companies, Inc. (the Company) uses certain non-GAAP financial measures and considers them to be an important supplemental measure of the Company's performance. The Company has presented the non-GAAP financial measure of adjusted diluted earnings per share for comparing its operating performance for the three months ended October 30, 2020, with the respective period ended November 1, 2019. This measure excludes the impacts of certain discrete items, as further described below, not contemplated in Lowe's Original Business Outlook. This non-GAAP financial measure should not be considered an alternative to, or more meaningful indicator of, the Company's diluted earnings per share as prepared in accordance with GAAP. The Company's methods of determining this non-GAAP financial measure may differ from the methods used by other companies and may not be comparable. Fiscal 2020 Impacts For fiscal 2020, the Company has recognized financial impacts from the following discrete items, not contemplated in the Company’s Original Business Outlook for the third quarter of fiscal 2020: • Beginning in the third quarter of fiscal 2019, the Company began a strategic review of its Canadian operations, and in the fourth quarter of fiscal 2019, the Company announced additional actions to improve future performance and profitability of its Canadian operations. As a result of this review and related actions, in the third quarter of fiscal 2020, the Company recognized $13 million of pre-tax operating costs related to remaining inventory write-downs and other closing costs (Canada restructuring). • In the third quarter of fiscal 2020, the Company recognized a $1.1 billion loss on extinguishment of debt in connection with a $3.0 billion cash tender offer (Loss on extinguishment of debt). Fiscal 2019 Impacts During fiscal 2019, the Company recognized financial impacts from the following discrete item, not contemplated in the Company's Business Outlook for the third quarter of fiscal 2019: • During the third quarter of fiscal 2019, the Company began a strategic review of its Canadian operations, and as a result, recognized pre-tax charges of $53 million associated with long-lived asset impairment (Canada restructuring). The following provides a reconciliation of the Company's non-GAAP financial measure to the most directly comparable GAAP financial measure: Three Months Ended October 30, 2020 November 1, 2019 Pre-Tax Net Pre-Tax Net Adjusted Diluted Earnings Per Share Earnings Tax 1 Earnings Earnings Tax 1 Earnings Diluted earnings per share, as reported $ 0.91 $ 1.36 Loss on extinguishment of debt 1.40 (0.35) 1.05 — — — Canada restructuring 0.02 — 0.02 0.07 (0.02) 0.05 Adjusted diluted earnings per share $ 1.98 $ 1.41 1 Represents the corresponding tax benefit or expense related to the item excluded from adjusted diluted earnings per share.

Forward Looking Statements This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believe”, “expect”, “anticipate”, “plan”, “desire”, “project”, “estimate”, “intend”, “will”, “should”, “could”, “would”, “may”, “strategy”, “potential”, “opportunity”, “outlook”, “guidance”, and similar expressions are forward-looking statements. Forward-looking statements involve, among other things, expectations, projections, and assumptions about future financial and operating results, objectives, business outlook, priorities, sales growth, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for products and services, share repurchases, Lowe’s strategic initiatives, including those relating to acquisitions and dispositions and the impact of such transactions on our strategic and operational plans and financial results. Such statements involve risks and uncertainties and we can give no assurance that they will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, changes in general economic conditions, such as the rate of unemployment, interest rate and currency fluctuations, fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability of consumer credit and of mortgage financing, changes in commodity prices, changes or threatened changes in tariffs, outbreak of public health crises, such as the COVID-19 pandemic, availability and cost of goods from suppliers, changes in our management and key personnel, and other factors that can negatively affect our customers. Investors and others should carefully consider the foregoing factors and other uncertainties, risks and potential events including, but not limited to, those described in “Item 1A - Risk Factors” in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A in our quarterly reports on Form 10-Q or other subsequent filings with the SEC. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law.