Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Arrival Vault US, Inc. | d23050d8k.htm |

| EX-99.5 - EX-99.5 - Arrival Vault US, Inc. | d23050dex995.htm |

| EX-99.4 - EX-99.4 - Arrival Vault US, Inc. | d23050dex994.htm |

| EX-99.2 - EX-99.2 - Arrival Vault US, Inc. | d23050dex992.htm |

| EX-99.1 - EX-99.1 - Arrival Vault US, Inc. | d23050dex991.htm |

Exhibit 99.3

|

|

ARRIVAL AT A GLANCE

Arrival is revolutionizing the electric vehicle industry

| 18.11.2020 | ARRIVAL.COM | 01 |

|

|

ARRIVAL AT A GLANCE

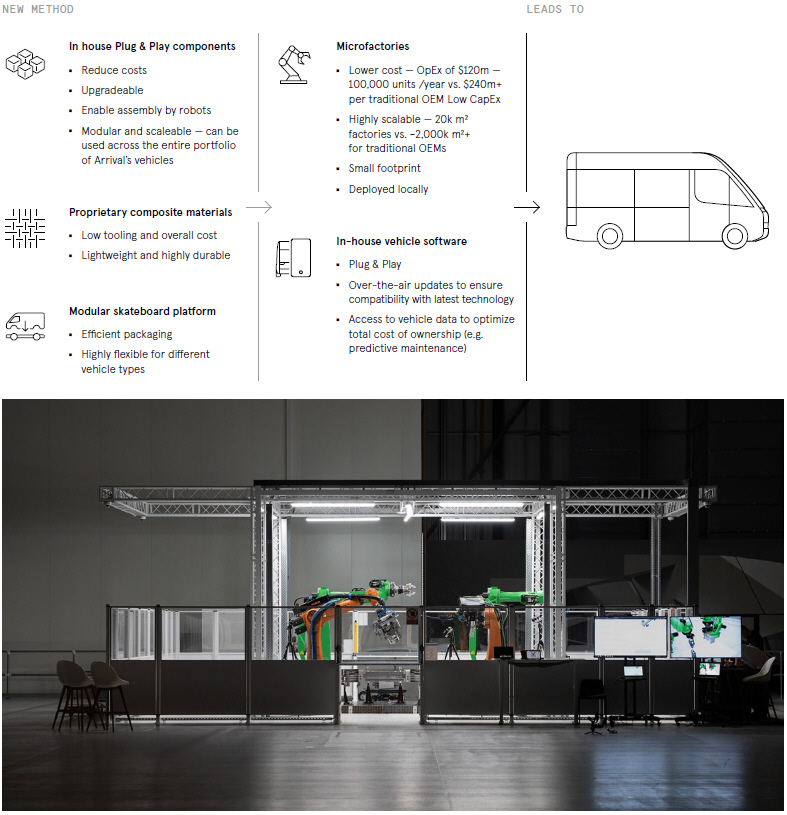

Arrival’s new method of design and production

| 18.11.2020 | ARRIVAL.COM | 02 |

|

|

ARRIVAL AT A GLANCE

Arrival leadership

Leadership team with a proven track record, a mix of IT and engineering backgrounds applied to automotive

|

Denis Sverdlov Founder & CEO, Arrival Group

Denis Sverdlov, is the CEO of Arrival. A serial entrepreneur having built and successfully exited multiple companies, Denis founded Arrival in 2015 to revolutionize the auto-industry through a new method of vertical integration and production. Since its founding, Arrival has grown to a global company, numbering over 1,100 employees, with investments from BlackRock, Hyundai, Kia and UPS. | |

| Denis’ work in tech began with Yota — the telecoms company that pioneered the biggest 4G network in Russia. Having built the company to 1,200 employees and achieved the highest revenue per employee in the world, Denis sold Yota in 2012 for $1.5 billion. Denis is also the founder of Roborace – the world’s first driverless electric racing platform. | ||

|

Avinash Rugoobur President and Chief Strategy Officer, Arrival Group

Avinash is President of Arrival, joining Arrival following a successful career at General Motors, Cruise Automation, and his own venture Curve Tomorrow. As Arrival’s President and Chief Strategy Officer, Avinash has overseen the close of over $200 million in investment from blue-chip investors including Hyundai, Kia, UPS and funds managed by BlackRock, as well as Arrival’s international expansions. | |

| During his time at GM, Avinash was responsible for the $1Bn acquisition of Cruise Autonomous and its subsequent valuation increase to $14Bn. This work was pivotal in accelerating the delivery of AVs as well as creating the OEM - Startup ecosystem. | ||

| Avinash has a unique ability to identify societal shifting technology trends and is steering Arrival’s mission as it revolutionizes the auto industry’s approach to the design, production, and distribution of electric vehicles. | ||

|

Mike Ableson CEO, Arrival Automotive

Mike Ableson is Arrival Automotive’s Chief Executive Officer, joining in October 2019 to support Arrival in its mission to revolutionize the auto industry. As CEO, Mike leads Arrival Automotive in both North America and Europe, and holds a leadership role within Arrival R&D. During his tenure, Arrival has expanded to the US, began building out its first set of microfactories, and launched customer trials with its vehicles. | |

| With more than 30 years in the automotive industry, Mike brings unrivaled OEM and mobility startup expertise to Arrival. Mike began his career as a structural analyst for General Motors, rising to serve as Executive Director of Global Advanced Vehicle Development, and VP of Engineering in Europe. In his role as VP of Global Strategy for General Motors, Mike worked to transition the company from a traditional OEM to a manufacturer of electric and autonomous vehicles. | ||

| Mike specializes in adapting innovative technologies for use in production-ready products and has been a pivotal force in bringing vehicles to market worldwide. | ||

|

Tracey Yi CEO, Arrival Elements, & Chief Procurement Officer, Arrival Group

Tracey Yi is the CEO of Arrival Elements, leading Arrival’s vertical integration efforts. In addition, Tracey serves as Arrival’s Chief Procurement Officer, overseeing the production of Arrival’s materials and vehicle components. | |

|

Prior to joining Arrival, Tracey held various leadership positions in sourcing, strategy and procurement, working at some of the world’s biggest technology companies including Apple, Nokia and Intel. | ||

|

Tim Holbrow Chief Financial Officer, Arrival Group

Tim Holbrow is Arrival’s Chief Financial Officer. Tim joins Arrival after eight years as the finance lead at Symbian. At Symbian, Tim managed an 8 years high growth period, scaling the company from its startup days to a $900M sale to Nokia. | |

| 18.11.2020 | ARRIVAL.COM | 03 |

|

|

ARRIVAL AT A GLANCE

Additional information and where to find It

In connection with the proposed transaction, Arrival Group, a subsidiary of Arrival that will become the holding company of CIIG and be renamed Arrival as of the closing of the proposed transaction, is expected to file a registration statement on Form F-4 (the “Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) that will include a proxy statement of CIIG that will also constitute a prospectus of Arrival Group. CIIG and Arrival Group urge investors, stockholders and other interested persons to read, when available, the Form F-4, including the preliminary proxy statement/prospectus and amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the proposed transaction, as these materials will contain important information about Arrival Group, Arrival, CIIG and the proposed transaction. Such persons can also read CIIG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, for a description of the security holdings of CIIG’s officers and directors and their respective interests as security holders in the consummation of the proposed transaction. When available, the definitive proxy statement/prospectus will be mailed to CIIG’s and Arrival’s stockholders. Stockholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: CIIG Merger Corp., 40 West 57th Street, 29th Floor, New York, NY 10019 or Arrival S.à r.l., 1, rue Peternelchen, L-2370 Howald, Luxembourg.

Participants in solicitation

CIIG, Arrival Group and Arrival and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of CIIG’s stockholders in connection with the proposed transaction. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of CIIG’s directors and executive officers in CIIG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 27, 2020. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of CIIG’s stockholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus for the proposed transaction when available. Information concerning the interests of CIIG’s participants in the solicitation, which may, in some cases, be different than those of CIIG’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed transaction when it becomes available.

Forward-looking statements

This communication contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the benefits of the proposed transaction, the anticipated timing of the proposed transaction, the products offered by Arrival and the markets in which it operates, and Arrival Group’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management’s belief or interpretation of information currently available. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including, but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of CIIG’s securities, (ii) the risk that the transaction may not be completed by CIIG’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by CIIG, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the stockholders of CIIG and Arrival, the satisfaction of the minimum trust account amount following redemptions by CIIG’s public stockholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (vi) the impact of COVID-19 on Arrival’s business and/or the ability of the parties to complete the proposed transaction; (vii) the effect of the announcement or pendency of the transaction on Arrival’s business relationships, performance, and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of Arrival and potential difficulties in Arrival employee retention as a result of the proposed transaction, (ix) the outcome of any legal proceedings that may be instituted against Arrival Group, Arrival or CIIG related to the business combination agreement or the proposed transaction, (x) the ability to maintain the listing of CIIG’s securities on the NASDAQ Stock Market, (xi) the price of CIIG’s and the post-combination company’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Arrival operates, variations in performance across competitors, changes in laws and

| 18.11.2020 | ARRIVAL.COM | 04 |

|

|

regulations affecting Arrival business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xiii) the risk of downturns and the possibility of rapid change in the highly competitive industry in which Arrival operates, (xiv) the risk that Arrival and its current and future collaborators are unable to successfully develop and commercialize Arrival’s products or services, or experience significant delays in doing so, (xv) the risk that the post-combination company may never achieve or sustain profitability; (xvi) the risk that the post-combination company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; (xvii) the risk that the post-combination company experiences difficulties in managing its growth and expanding operations, (xviii) the risk that third-parties suppliers and manufacturers are not able to fully and timely meet their obligations; (xix) the risk that the utilization of Microfactories will not provide the expected benefits due to, among other things, the inability to locate appropriate buildings to use as Microfactories, Microfactories needing a larger than anticipated factory footprint, and the inability of Arrival to deploy Microfactories in the anticipated time frame; (xx) the risk that the orders that have been placed for vehicles, including the order from UPS, are cancelled or modified; (xxi) the risk of product liability or regulatory lawsuits or proceedings relating to Arrival’s products and services; (xxii) the risk that Arrival is unable to secure or protect its intellectual property; and (xxiii) the risk that the post-combination company’s securities will not be approved for listing on the NASDAQ Stock Market or if approved, maintain the listing. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of CIIG’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the registration statement on Form F-4 and proxy statement/prospectus discussed above and other documents filed by CIIG from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arrival Group, Arrival and CIIG assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Arrival Group, Arrival nor CIIG gives any assurance that either Arrival Group, Arrival or CIIG will achieve its expectations.

No offer or solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of CIIG, Arrival or Arrival Group, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or exemptions therefrom.

PRIIPs / Prospectus regulation /IMPORTANT – EEA AND UK RETAIL INVESTORS

The ordinary shares to be issued by Arrival Group in the proposed transaction (the “Ordinary Shares”) are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA or in the UK. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017

(this Regulation together with any implementing measures in any member state, the “Prospectus Regulation”). Consequently, no offer of securities to which this announcement relates, is made to any person in any Member State of the EEA which applies the Prospectus Regulation who are not qualified investors for the purposes of the Prospectus Regulation, is made in the EEA and no key information document required by Regulation (EU) No. 1286/2014 (as amended the “PRIIPs Regulation”) for offering or selling the Ordinary Shares or otherwise making them available to retail investors in the EEA or in the United Kingdom will be prepared and therefore offering or selling the Ordinary Shares or otherwise making them available to any retail investor in the EEA or in the United Kingdom may be unlawful under the PRIIPs Regulation.

| 18.11.2020 | ARRIVAL.COM | 05 |