Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Walmart Inc. | earningsreleasefy21q3.htm |

| 8-K - 8-K - Walmart Inc. | wmt-20201117.htm |

Financial presentation to accompany management commentary Q3 FY2021

Safe harbor and non-GAAP measures This presentation contains statements that may be "forward-looking statements" as defined in, and are intended to enjoy the protection of the safe harbor for forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Assumptions on which such forward-looking statements are based are also forward-looking statements. Our actual results may differ materially from those expressed in or implied by any of these forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: the impact of the COVID-19 pandemic on our business and the global economy; economic, capital markets and business conditions; trends and events around the world and in the markets in which we operate; currency exchange rate fluctuations, changes in market interest rates and market levels of wages; changes in the size of various markets, including eCommerce markets; unemployment levels; inflation or deflation, generally and in particular product categories; consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; the effectiveness of the implementation and operation of our strategies, plans, programs and initiatives; unexpected changes in our objectives and plans; the impact of acquisitions, investments, divestitures, store or club closures, and other strategic decisions; our ability to successfully integrate acquired businesses, including within the eCommerce space; changes in the trading prices of certain equity investments we hold; initiatives of competitors, competitors' entry into and expansion in our markets, and competitive pressures; customer traffic and average ticket in our stores and clubs and on our eCommerce websites; the mix of merchandise we sell, the cost of goods we sell and the shrinkage we experience; trends in consumer shopping habits around the world and in the markets in which we operate; our gross profit margins; the financial performance of Walmart and each of its segments, including the amounts of our cash flow during various periods; changes in the credit ratings assigned to our commercial paper and debt securities by credit rating agencies; the amount of our net sales and operating expenses denominated in the U.S. dollar and various foreign currencies; transportation, energy and utility costs; commodity prices and the price of gasoline and diesel fuel; supply chain disruptions and disruptions in seasonal buying patterns; the availability of goods from suppliers and the cost of goods acquired from suppliers; consumer acceptance of and response to our stores, clubs, eCommerce platforms, programs, merchandise offerings and delivery methods; cyber security events affecting us and related costs and impact to the business; developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which we are a party or are subject, and the liabilities, obligations and expenses, if any, that we may incur in connection therewith; casualty and accident-related costs and insurance costs; the turnover in our workforce and labor costs, including healthcare and other benefit costs; consumer enrollment in health and drug insurance programs and such programs' reimbursement rates and drug formularies; our effective tax rate and the factors affecting our effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; changes in existing tax, labor and other laws and regulations and changes in tax rates including the enactment of laws and the adoption and interpretation of administrative rules and regulations; the imposition of new taxes on imports, new tariffs and changes in existing tariff rates; the imposition of new trade restrictions and changes in existing trade restrictions; adoption or creation of new, and modification of existing, governmental policies, programs, initiatives and actions in the markets in which Walmart operates and elsewhere and actions with respect to such policies, programs and initiatives; changes in accounting estimates or judgments; the level of public assistance payments; natural disasters, changes in climate, geopolitical events and catastrophic events; and changes in generally accepted accounting principles in the United States. Our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in the presentations. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this release. Walmart cannot assure you that the results reflected in or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on our operations or financial performance. The forward-looking statements made in the presentation are as of the date of this meeting. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances. This presentation includes certain non-GAAP measures as defined under SEC rules, including net sales, revenue, and operating income on a constant currency basis, adjusted operating income, adjusted operating income in constant currency, adjusted EPS, free cash flow and return on investment. Refer to information about the non-GAAP measures contained in this presentation. Additional information as required by Regulation G and Item 10(e) of Regulation S-K regarding non-GAAP measures can be found in our most recent Form 10-K and our Form 8-K furnished as of the date of this presentation with the SEC, which are available at www.stock.walmart.com. 2

Walmart Inc. - 3Q FY21 Dollars in billions, except per share. Change is calculated as the change versus the prior year comparable period Total revenue $134.7 Membership and Other Income Operating income +5.2% $1.0 $5.8 EPS Total revenue, constant 1 -5.3% currency +22.5% $1.80 $135.8 +56.5% Gross profit rate Adj. operating income, constant +6.1% 1 25.0% currency Net sales 1 +50 bps $5.8 Adjusted EPS $133.8 +16.4% $1.34 +5.3% Operating expense as a +15.5% percentage of net sales Effective tax rate2 Net sales, constant currency1 $134.8 21.4% 26.9% -18 bps +284 bps +6.2% 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 2 The increase in effective tax rate for the third quarter of fiscal 2021 is primarily due to the loss related to the sale of Walmart Argentina as it provided minimal 3 realizable tax benefit.

Walmart Inc. - 3Q FY21 Dollars in billions. Change is calculated as the change versus the prior year comparable period Receivables, net Debt to capitalization1 $5.8 38.4% +2.8% -650 bps Inventories Return on assets2 $51.8 8.2% +0.6% +190 bps Accounts payable Return on investment2 $54.2 13.7% +8.8% — bps 1 Debt to total capitalization calculated as of October 31, 2020. Debt includes short-term borrowings, long-term debt due within one year, finance lease obligations due within one year, long-term debt and long-term finance lease obligations. Total capitalization includes debt and total Walmart shareholders' equity. 4 2 Calculated for the trailing 12 months ended October 31, 2020. For ROI, see reconciliations at the end of presentation regarding non-GAAP financial measures.

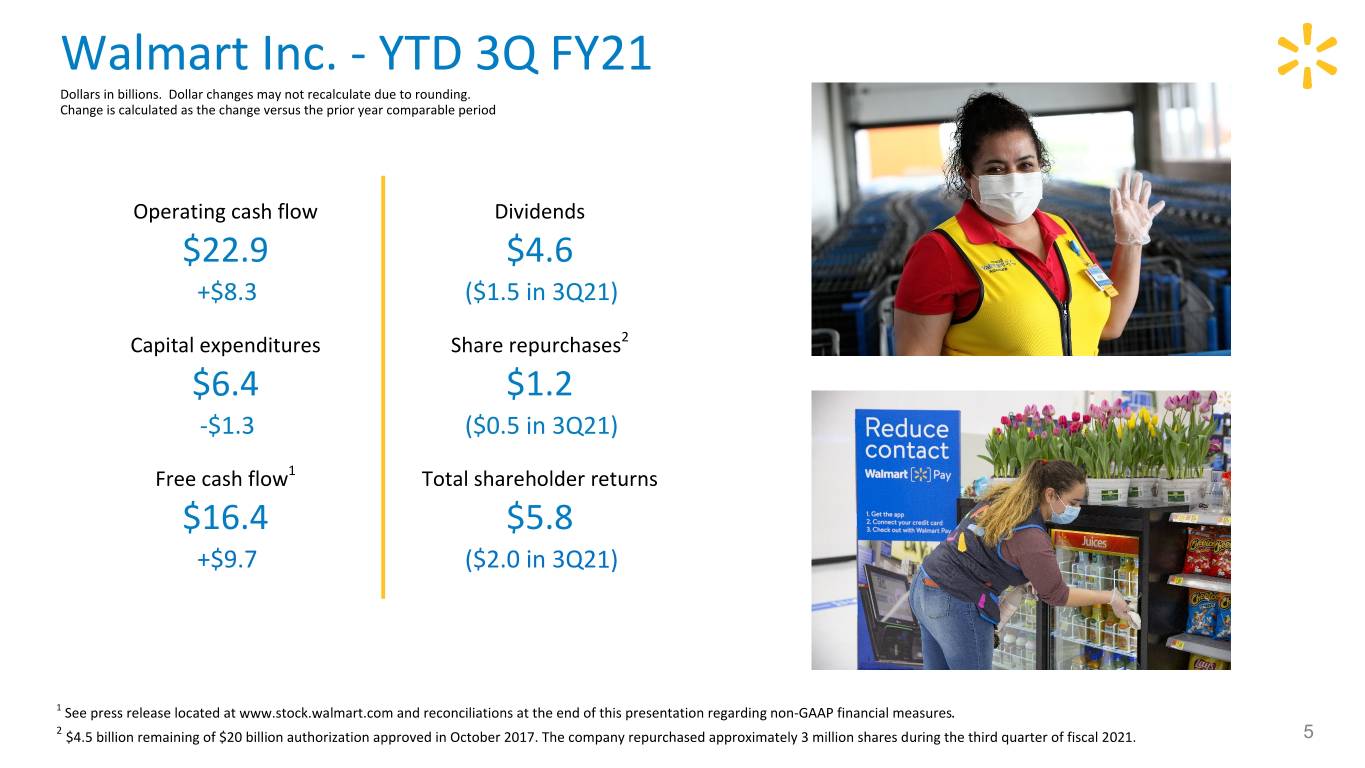

Walmart Inc. - YTD 3Q FY21 Dollars in billions. Dollar changes may not recalculate due to rounding. Change is calculated as the change versus the prior year comparable period Operating cash flow Dividends $22.9 $4.6 +$8.3 ($1.5 in 3Q21) Capital expenditures Share repurchases2 $6.4 $1.2 -$1.3 ($0.5 in 3Q21) Free cash flow1 Total shareholder returns $16.4 $5.8 +$9.7 ($2.0 in 3Q21) 1 See press release located at www.stock.walmart.com and reconciliations at the end of this presentation regarding non-GAAP financial measures. 2 $4.5 billion remaining of $20 billion authorization approved in October 2017. The company repurchased approximately 3 million shares during the third quarter of fiscal 2021. 5

Walmart U.S. - 3Q FY21 Dollars in billions. Change is calculated as the change versus the prior year comparable period 1, 2 Net Sales Comparable sales Inventory $88.4 6.4% Comp store: +3.6% Total: +5.5% +6.2% Comparable transactions • Increase primarily reflects inventory build for eCommerce net sales growth -14.2% holiday events that are earlier than last year • Overall in-stock continues to improve from +79% Comparable average ticket Q2 levels 24.0% eCommerce contribution to comp1, 2 • Customers continued to consolidate store Format Growth ~570 bps shopping trips with significantly larger average baskets and shifted more purchases Net Store Openings: 1 • Robust eCommerce sales growth across to eCommerce; transaction volume improved Remodels: ~205 stores channels throughout Q3 with strong traffic to as store hours were extended Walmart.com • Q3 sales accelerated in September due in Pickup: ~3,600 locations • Marketplace and pickup & delivery sales up part to delayed back-to-school spending and Same-day delivery: ~2,900 stores triple-digits percentage this momentum continued throughout October; grocery sales strengthened as the quarter progressed led by strong food comps 1 Comp sales for the 13-week period ended October 30, 2020 compared to the 13-week period ended October 25, 2019, and excludes fuel. 6 2 The results of new acquisitions are included in our comp sales metrics in the 13th month after acquisition.

Walmart U.S. - 3Q FY21 Dollars in billions. Change is calculated as the change versus the prior year comparable period Gross profit rate Operating expense rate Operating income +33 bps +9 bps $4.6 +9.9% • Strategic sourcing initiatives and • Expense leverage negatively affected fewer markdowns benefited gross by ~$400 million of incremental profit COVID-related associate and sanitation costs (~50 bps of • The phased reopening of Auto Care deleverage). This was partially offset Centers and Vision Centers alleviated by a reduction in travel and some of the gross margin pressure professional services. experienced during the first half of the year • Making progress on eCommerce margin rates with faster growth of marketplace sales and improved product mix • The carryover of last year's price investments continued to negatively affect the margin rate 7 Adj. operating income1 $5.0 +16.7%

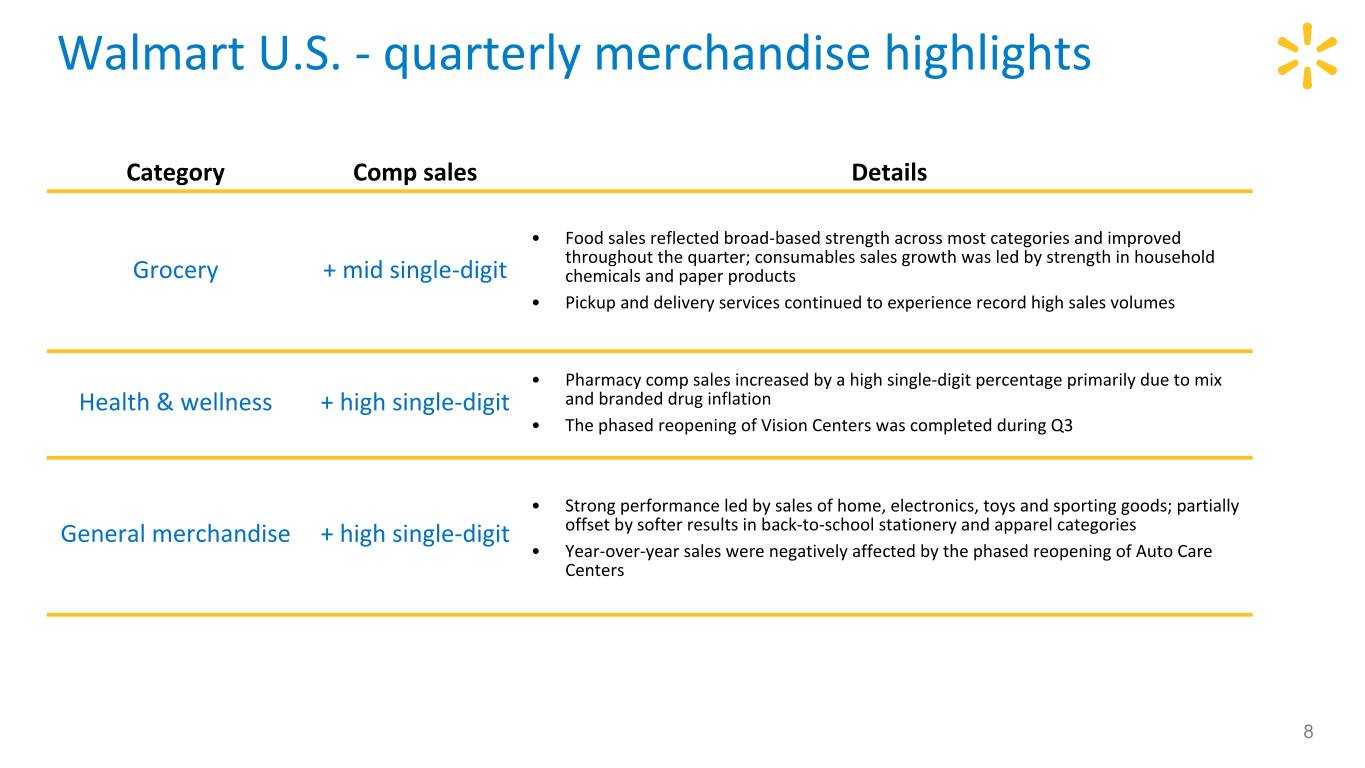

Walmart U.S. - quarterly merchandise highlights Category Comp sales Details • Food sales reflected broad-based strength across most categories and improved throughout the quarter; consumables sales growth was led by strength in household Grocery + mid single-digit chemicals and paper products • Pickup and delivery services continued to experience record high sales volumes • Pharmacy comp sales increased by a high single-digit percentage primarily due to mix Health & wellness + high single-digit and branded drug inflation • The phased reopening of Vision Centers was completed during Q3 • Strong performance led by sales of home, electronics, toys and sporting goods; partially General merchandise + high single-digit offset by softer results in back-to-school stationery and apparel categories • Year-over-year sales were negatively affected by the phased reopening of Auto Care Centers 8

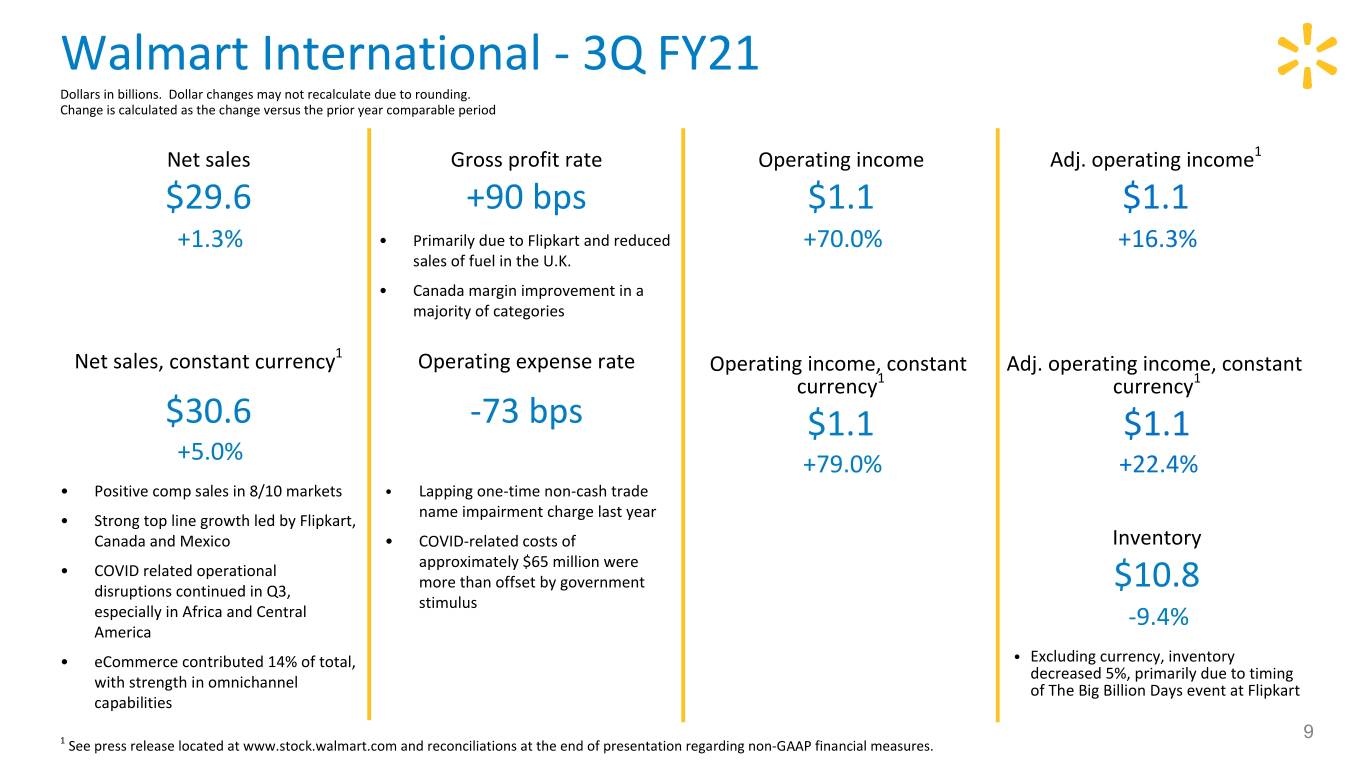

Walmart International - 3Q FY21 Dollars in billions. Dollar changes may not recalculate due to rounding. Change is calculated as the change versus the prior year comparable period Net sales Gross profit rate Operating income Adj. operating income1 $29.6 +90 bps $1.1 $1.1 +1.3% • Primarily due to Flipkart and reduced +70.0% +16.3% sales of fuel in the U.K. • Canada margin improvement in a majority of categories Net sales, constant currency1 Operating expense rate Operating income, constant Adj. operating income, constant currency1 currency1 $30.6 -73 bps $1.1 $1.1 +5.0% +79.0% +22.4% • Positive comp sales in 8/10 markets • Lapping one-time non-cash trade name impairment charge last year • Strong top line growth led by Flipkart, Canada and Mexico • COVID-related costs of Inventory approximately $65 million were • COVID related operational more than offset by government disruptions continued in Q3, $10.8 stimulus especially in Africa and Central -9.4% America • eCommerce contributed 14% of total, • Excluding currency, inventory decreased 5%, primarily due to timing with strength in omnichannel of The Big Billion Days event at Flipkart capabilities 9 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures.

Walmart International - 3Q FY21 Results are presented on a constant currency basis. Net sales and comp sales are presented on a nominal, calendar basis and include eCommerce results. Change is calculated as the change versus the prior year comparable period. Walmex1 China Canada United Kingdom2 Net sales growth +4.7% +0.9% +7.7% -0.6% Comparable sales +3.4% +0.4% +7.7% +2.7% Comparable transactions -20.1% -12.4% -13.1% -22.5% Comparable ticket +29.3% +14.6% +24.0% +32.4% • Higher growth in grocery, • Strong sales in Sam's Club • Strong growth in grocery and • Strong growth in grocery, partially offset by softer across all categories, offset by general merchandise driven by omnichannel demand for apparel softer traffic in Hypermarkets • Monthly comp sales • Outpaced the online market, • In Mexico, comp sales • Sam's Club delivered double accelerated into the holiday according to Kantar increased 5.4% digit comp sales growth season 3 • Net sales negatively affected • Comp sales outpaced ANTAD • eCommerce net sales +63% • eCommerce sales grew across by lower demand for fuel self-service and club all categories, led by online • eCommerce net sales +72% • eCommerce net sales +201% grocery • eCommerce net sales +177% 1 Walmex includes the consolidated results of Mexico and Central America 2 Comp sales for the United Kingdom are presented excluding fuel 3 ANTAD - Asociacion Nacional de Tiendas de Autoservicio y Departamentales; The National Association of Supermarkets and Department Stores 10

Walmart International - 3Q FY21 Results are presented on a constant currency basis. Change is calculated as the change versus the prior year comparable period Walmex1 China Canada United Kingdom Gross profit rate Increase Decrease Increase Increase • Cost of goods savings • Change in mix to lower • Cost of goods savings • Sharp reduction in sales of initiatives, partially offset by margin formats and price initiatives fuel and change in mix to mix shift to lower margin investment/markdowns in higher margin categories categories and price certain categories • Margin improvement in a investment majority of categories Operating expense rate Increase Increase Increase Decrease • Higher costs to operate • Lapping of one-time gains on • Higher costs to operate • Temporary property tax relief during the COVID-19 lease terminations from last during the COVID-19 from government stimulus pandemic year pandemic and additional investments in customer experience Operating income Increase Decrease Decrease Increase 1 Walmex includes the consolidated results of Mexico and Central America. 11

Comparable sales +7.9% Sam's Club - 3Q FY21 Dollars in billions. Change is calculated as the change versus the prior year comparable period With Fuel Without Fuel Net sales eCommerce net sales growth Gross profit rate Operating income $15.8 +41% +79 bps $0.4 $14,596 +8.3% • Strong direct-to-home performance • Higher fuel margins, reduced tobacco +31.8% +12% +11.1% and growing curbside contribution sales and better fresh sell through were Comparable sales partially offset by higher eCommerce Net sales fulfillment costs +10.4% +6.8% Comparable transactions Comparable sales1 Membership income Operating expense rate Inventory Membership income 40.9999999999999 +7.9% +10.4% +30 bps $5.0 +4.0% -8.5% bps • Comparable sales strengthened • Improvement in total number of • Incremental COVID-19 costs and lower Average comparable ticket throughout the quarter with members, overall renewal rates, Plus tobacco and fuel sales weighed on Gross profit rate contribution from both increased renewal rates and Plus penetration operating expense leverage • Decline primarily driven by higher sales rate volume transactions and average ticket • Incremental COVID-19 costs of ~$80 ~230 bps • Broad strength across categories, led • Highest quarterly increase in more mil. negatively affected expense • Overall in-stock continues to improve -5 bps by food and consumables than 5 years leverage by about 50 bps from Q2 levels eCommerce contribution Operating expense rate • Tobacco negatively affected comp sales • New member count increased approximately 28% $358 30.7% 1 Comp sales for the 13-week period ended October 30, 2020 compared to the 13-week period ended October 25, 2019. 12 Operating income

Sam's Club - 3Q FY21 Dollars in billions. Change is calculated as the change versus the prior year comparable period Without Fuel +78.9999999999999 Net sales Gross profit rate Comparable sales1, 2 eCommerce contribution $15,845 bps +8.3% Gross profit rate $14.6 +41 bps +11.1% ~230 bps Net Sales +11.6% +29.9999999999999 +33% bps eCommerce net sales growth Operating expense rate Operating expense rate Operating income Comparable transactions Average comparable ticket -5 bps $0.4 +6.8% +4.0% +7.9% $431 +30.7% Comparable sales 31.8% Operating income 1 Comp sales for the 13-week period ended October 30, 2020 compared to the 13-week period ended October 25, 2019, and excludes fuel. 13 2 Tobacco negatively affected comp sales by 420 basis points.

Sam's Club - quarterly financial highlights Category Comp sales Details Fresh / Freezer / Cooler + high teens • Fresh meat, frozen and produce performed well Grocery and beverage + mid teens • Dry grocery, juice, snacks and soda performed well Consumables + low 20% • Broad-based strength, including laundry, paper goods and beauty aids Home and apparel + low double-digit • Kitchen, apparel and toys performed well Technology, office and • TVs and office electronics performed well entertainment + mid single-digit Health and wellness + high teens • OTC performed well 14

Non-GAAP measures - ROI We include Return on Assets ("ROA"), which is calculated in accordance with U.S. generally accepted accounting principles ("GAAP") as well as Return on Investment ("ROI") as measures to assess returns on assets. Management believes ROI is a meaningful measure to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term strategic initiatives with possible short-term impacts. We consider ROA to be the financial measure computed in accordance with GAAP that is the most directly comparable financial measure to our calculation of ROI. ROA was 8.2 percent and 6.3 percent for the trailing twelve months ended October 31, 2020 and 2019, respectively. The increase in ROA was primarily due to the increase in consolidated net income primarily driven by the change in fair value of the investment in JD.com, partially offset by the loss on sale of Walmart Argentina. ROI was flat at 13.7 percent for each of the trailing twelve month periods ended October 31, 2020 and 2019. We define ROI as operating income plus interest income, depreciation and amortization, and rent expense for the trailing twelve months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period. For the trailing twelve months ended October 31, 2019, lease related assets and associated accumulated amortization are included in the denominator at their carrying amount as of that balance sheet date, rather than averaged, because they are not directly comparable to the prior year calculation which included rent for the trailing 12 months multiplied by a factor of 8. A two-point average was used for leased assets beginning in fiscal 2021, after one full year from the date of adoption of the new lease standard. Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in the most directly comparable GAAP financial measure. For example, we exclude the impact of depreciation and amortization from our reported operating income in calculating the numerator of our calculation of ROI. As mentioned above, we consider ROA to be the financial measure computed in accordance with generally accepted accounting principles most directly comparable to our calculation of ROI. ROI differs from ROA (which is consolidated net income for the period divided by average total assets for the period) because ROI: adjusts operating income to exclude certain expense items and adds interest income; adjusts total assets for the impact of accumulated depreciation and amortization, accounts payable and accrued liabilities to arrive at total invested capital. Because of the adjustments mentioned above, we believe ROI more accurately measures how we are deploying our key assets and is more meaningful to investors than ROA. Although ROI is a standard financial measure, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI. 15

Non-GAAP measures - ROI (cont.) The calculation of ROA and ROI, along with a reconciliation of ROI to the calculation of ROA, is as follows: CALCULATION OF RETURN ON ASSETS CALCULATION OF RETURN ON INVESTMENT Trailing Twelve Months Trailing Twelve Months Ended October 31, Ended October 31, (Dollars in millions) 2020 2019 (Dollars in millions) 2020 2019 Numerator Numerator Consolidated net income $ 20,008 $ 14,720 Operating income $ 22,383 $ 21,313 Denominator + Interest income 132 212 Average total assets1 $ 245,347 $ 233,207 + Depreciation and amortization 11,161 10,889 Return on assets (ROA) 8.2 % 6.3 % + Rent 2,646 2,733 ROI operating income $ 36,322 $ 35,147 October 31, Denominator Certain Balance Sheet Data 2020 2019 2018 Average total assets1,2 $ 245,347 $ 240,261 + Average accumulated depreciation and Total assets $ 250,863 $ 239,830 $ 226,583 amortization1,2 95,637 87,982 Leased assets, net NP 21,099 6,991 - Average accounts payable1 51,951 49,740 Total assets without leased assets, net NP 218,731 219,592 - Average accrued liabilities1 22,984 21,884 Accumulated depreciation and amortization 99,576 91,697 85,827 Average invested capital $ 266,049 $ 256,619 Accumulated amortization on leased assets NP 4,140 5,701 Return on investment (ROI) 13.7 % 13.7 % Accumulated depreciation and amortization, without leased assets NP 87,557 80,126 Accounts payable 54,152 49,750 49,729 Accrued liabilities 24,995 20,973 22,795 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the corresponding prior period and dividing by 2. Average total assets as used in ROA includes the average impact of the adoption of ASU 2016-02, Leases (Topic 842). 2 For the twelve months ended October 31, 2019, as a result of adopting ASU 2016-02, average total assets is based on the average of total assets without leased assets, net plus leased assets, net as of October 31, 2019. Average accumulated depreciation and amortization is based on the average of accumulated depreciation and amortization, without leased assets plus accumulated amortization on leased assets as of October 31, 2019. 16 NP - not provided 3 Upon adoption of ASU 2016-02, Leases, a factor of eight times rent is no longer included in the calculation of ROI on a prospective basis as operating lease assets are now recorded on the Consolidated Balance Sheet. 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. 2 The average is based on the addition of 'total assets without leased assets, net' at the end of the current period to 'total assets without leased assets, net' at the end of the prior period and dividing by 2, plus 'leased assets, net' at the end of the current period. 3 The average is based on the addition of 'accumulated depreciation and amortization, without leased assets' at the end of the current period to 'accumulated depreciation and amortization, without leased assets' at the end of the prior period and dividing by 2, plus 'accumulated amortization on leased assets' at the end of the current period. NP = not provided

Non-GAAP measures - free cash flow We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. We had net cash provided by operating activities of $22.9 billion for the nine months ended October 31, 2020, which increased when compared to $14.5 billion for the nine months ended October 31, 2019 primarily due to the impact of the global health crisis which accelerated inventory sell-through, as well as the timing and payment of inventory purchases, incremental COVID-19 related expenses and certain benefit payments. We generated free cash flow of $16.4 billion for the nine months ended October 31, 2020, which increased when compared to $6.8 billion for the nine months ended October 31, 2019 due to the same reasons as the increase in net cash provided by operating activities, as well as $1.3 billion in decreased capital expenditures due to impacts from the COVID-19 pandemic which impacted the timing of store remodeling and front-end technology transformation activities in Walmart U.S.. Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the company’s financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. Additionally, Walmart’s definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows. Although other companies report their free cash flow, numerous methods may exist for calculating a company’s free cash flow. As a result, the method used by Walmart’s management to calculate our free cash flow may differ from the methods used by other companies to calculate their free cash flow. The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities. Nine Months Ended October 31, 2020 (Dollars in millions) 2020 2019 Net cash provided by operating activities $ 22,880 $ 14,539 Payments for property and equipment (capital expenditures) (6,438) (7,765) Free cash flow $ 16,442 $ 6,774 Net cash used in investing activities1 $ (6,507) $ (6,285) Net cash used in financing activities (11,340) (7,213) 1 "Net cash used in investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow. 17

Non-GAAP measures - constant currency In discussing our operating results, the term currency exchange rates refers to the currency exchange rates we use to convert the operating results for countries where the functional currency is not the U.S. dollar into U.S. dollars or for countries experiencing hyperinflation. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior year period’s currency exchange rates. Additionally, no currency exchange rate fluctuations are calculated for non-USD acquisitions until owned for 12 months. Throughout our discussion, we refer to the results of this calculation as the impact of currency exchange rate fluctuations. When we refer to constant currency operating results, this means operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations. The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three and nine months ended October 31, 2020. Three Months Ended October 31, 2020 Nine Months Ended October 31, 2020 Percent Percent Percent Percent 2020 Change1 2020 Change1 2020 Change1 2020 Change1 (Dollars in millions) Walmart International Consolidated Walmart International Consolidated Total revenues: As reported $ 29,835 1.2 % $ 134,708 5.2 % $ 87,293 -0.8 % $ 407,072 6.5 % Currency exchange rate fluctuations 1,075 N/A 1,075 N/A 4,801 N/A 4,801 N/A Constant currency total revenues $ 30,910 4.8 % $ 135,783 6.1 % $ 92,094 4.6 % $ 411,873 7.7 % Net sales: As reported $ 29,554 1.3 % $ 133,752 5.3 % $ 86,487 -0.7 % $ 404,248 6.6 % Currency exchange rate fluctuations 1,067 N/A 1,067 N/A 4,766 N/A 4,766 N/A Constant currency net sales $ 30,621 5.0 % $ 134,819 6.2 % $ 91,253 4.8 % $ 409,014 7.8 % Operating income: As reported $ 1,078 70.0 % $ 5,778 22.5 % $ 2,696 19.0 % $ 17,061 11.9 % Currency exchange rate fluctuations 57 N/A 57 N/A 193 N/A 193 N/A Constant currency operating income $ 1,135 79.0 % $ 5,835 23.7 % $ 2,889 27.5 % $ 17,254 13.2 % 1 Change versus prior year comparable period. 18

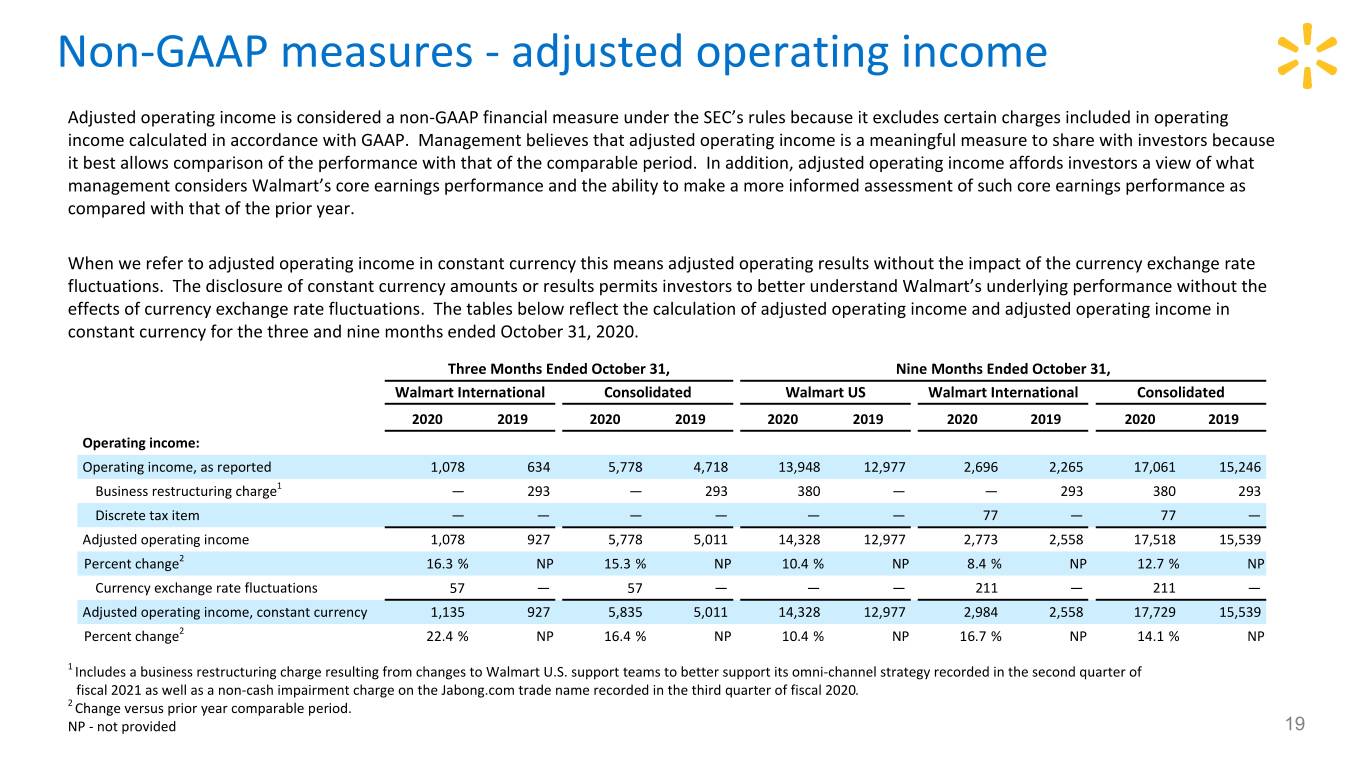

Non-GAAP measures - adjusted operating income Adjusted operating income is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain charges included in operating income calculated in accordance with GAAP. Management believes that adjusted operating income is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, adjusted operating income affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance as compared with that of the prior year. When we refer to adjusted operating income in constant currency this means adjusted operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations. The tables below reflect the calculation of adjusted operating income and adjusted operating income in constant currency for the three and nine months ended October 31, 2020. Three Months Ended October 31, Nine Months Ended October 31, Walmart International Consolidated Walmart US Walmart International Consolidated 2020 2019 2020 2019 2020 2019 2020 2019 2020 2019 Operating income: Operating income, as reported 1,078 634 5,778 4,718 13,948 12,977 2,696 2,265 17,061 15,246 Business restructuring charge1 — 293 — 293 380 — — 293 380 293 Discrete tax item — — — — — — 77 — 77 — Adjusted operating income 1,078 927 5,778 5,011 14,328 12,977 2,773 2,558 17,518 15,539 Percent change2 16.3 % NP 15.3 % NP 10.4 % NP 8.4 % NP 12.7 % NP Currency exchange rate fluctuations 57 — 57 — — — 211 — 211 — Adjusted operating income, constant currency 1,135 927 5,835 5,011 14,328 12,977 2,984 2,558 17,729 15,539 Percent change2 22.4 % NP 16.4 % NP 10.4 % NP 16.7 % NP 14.1 % NP 1 Includes a business restructuring charge resulting from changes to Walmart U.S. support teams to better support its omni-channel strategy recorded in the second quarter of fiscal 2021 as well as a non-cash impairment charge on the Jabong.com trade name recorded in the third quarter of fiscal 2020. 2 Change versus prior year comparable period. NP - not provided 19

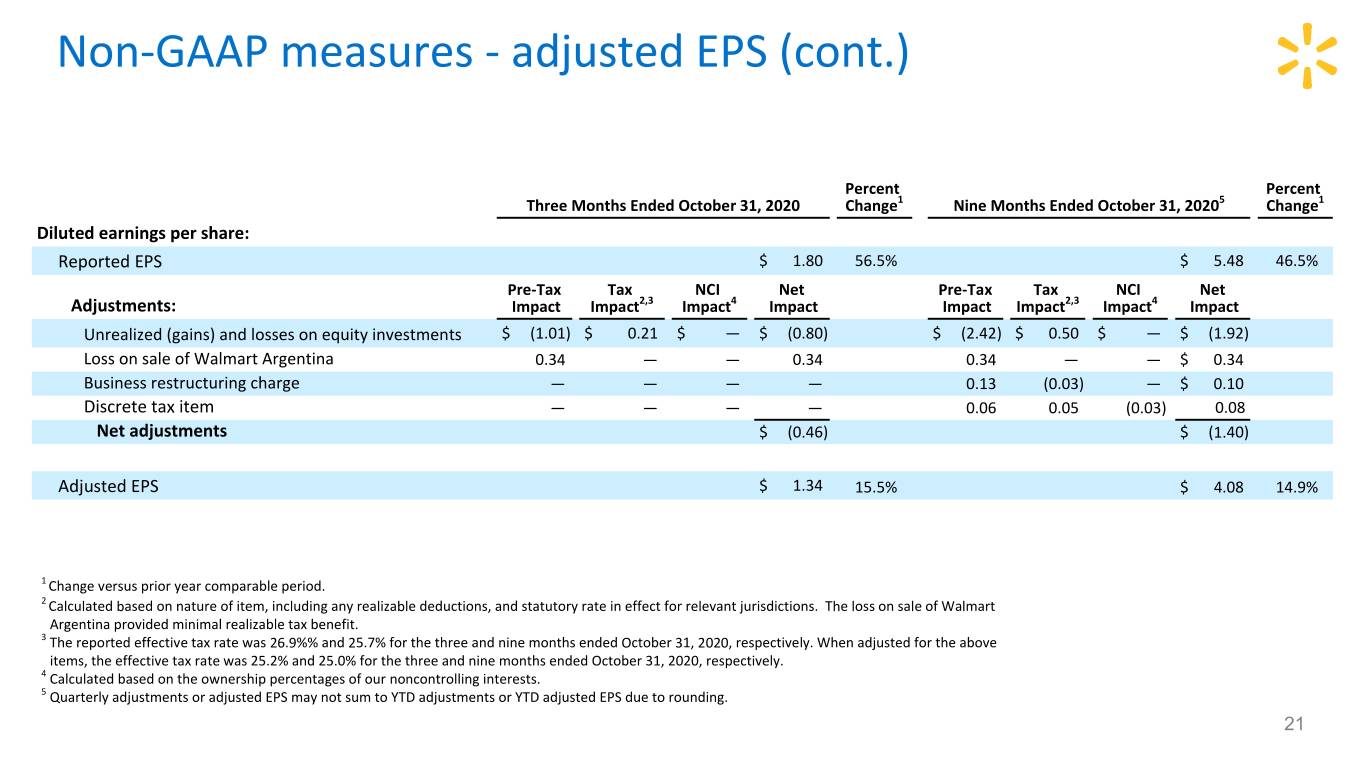

Non-GAAP measures - adjusted EPS Adjusted diluted earnings per share attributable to Walmart (Adjusted EPS) is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain amounts included in the diluted earnings per share attributable to Walmart calculated in accordance with GAAP (EPS), the most directly comparable financial measure calculated in accordance with GAAP. Management believes that Adjusted EPS is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, Adjusted EPS affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance with that of the prior year. We adjust for the unrealized gains and losses on our equity investments (primarily JD.com) each quarter because although the investments are strategic decisions for the Company’s retail operations, management’s measurement of each strategy is primarily focused on the respective market’s operational results rather than the fair value of such investments. Additionally, management does not forecast changes in the fair value of its equity investments. Accordingly, management adjusts EPS each quarter for the unrealized gains and losses related to those equity investments. We have calculated Adjusted EPS for the three and nine months ended October 31, 2020 by adjusting EPS for the following: (1) unrealized gains and losses on the company’s equity investments and (2) the loss on sale of Walmart Argentina classified as held for sale as of October 31, 2020. For the nine months ended October 31, 2020 we also adjusted EPS for (3) a business restructuring charge resulting from changes to corporate support teams to better support the Walmart U.S. omni-channel support strategy and (4) a discrete tax item. 20

Non-GAAP measures - adjusted EPS (cont.) Percent Percent Three Months Ended October 31, 2020 Change1 Nine Months Ended October 31, 20205 Change1 Diluted earnings per share: Reported EPS $ 1.80 56.5% $ 5.48 46.5% Pre-Tax Tax NCI Net Pre-Tax Tax NCI Net Adjustments: Impact Impact2,3 Impact4 Impact Impact Impact2,3 Impact4 Impact Unrealized (gains) and losses on equity investments $ (1.01) $ 0.21 $ — $ (0.80) $ (2.42) $ 0.50 $ — $ (1.92) Loss on sale of Walmart Argentina 0.34 — — 0.34 0.34 — — $ 0.34 Business restructuring charge — — — — 0.13 (0.03) — $ 0.10 Discrete tax item — — — — 0.06 0.05 (0.03) 0.08 Net adjustments $ (0.46) $ (1.40) Adjusted EPS $ 1.34 15.5% $ 4.08 14.9% 1 Change versus prior year comparable period. 2 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. The loss on sale of Walmart Argentina provided minimal realizable tax benefit. 3 The reported effective tax rate was 26.9%% and 25.7% for the three and nine months ended October 31, 2020, respectively. When adjusted for the above items, the effective tax rate was 25.2% and 25.0% for the three and nine months ended October 31, 2020, respectively. 4 Calculated based on the ownership percentages of our noncontrolling interests. 5 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. 21

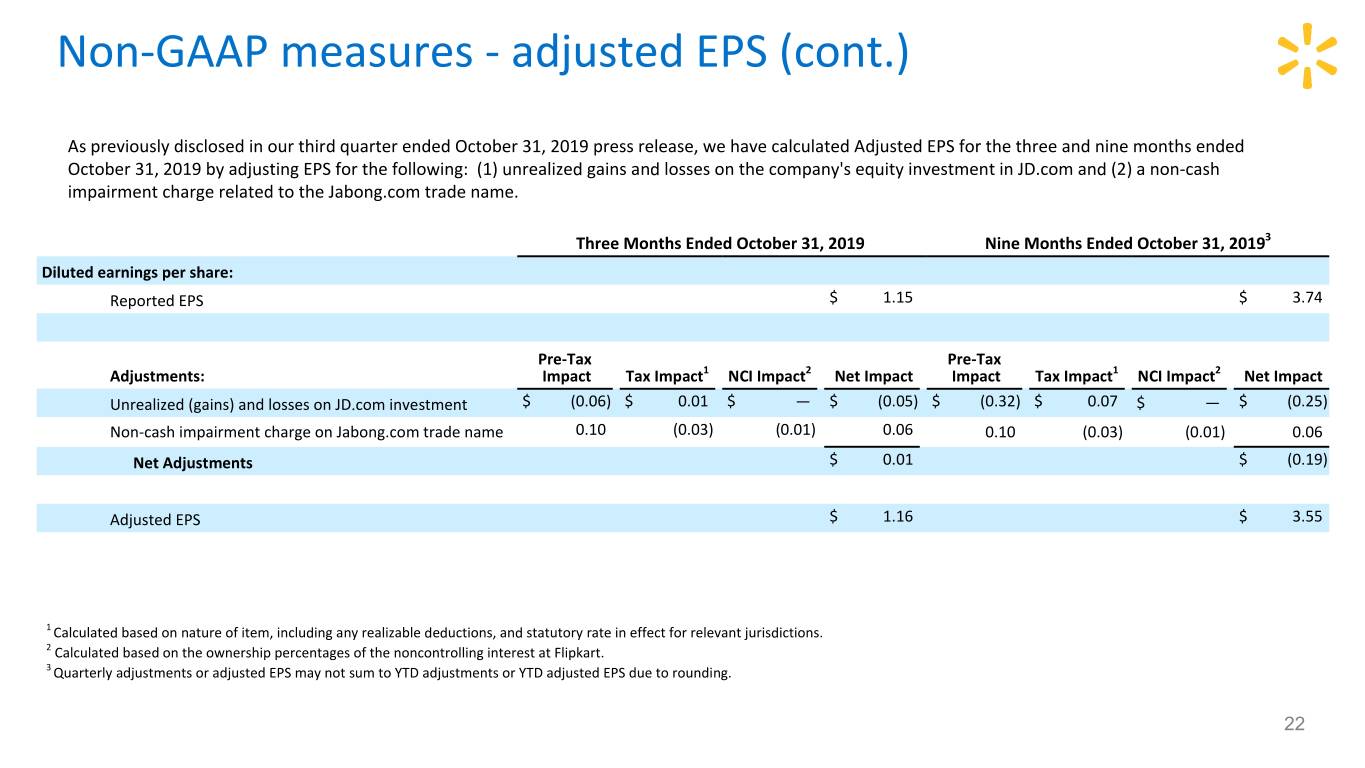

Non-GAAP measures - adjusted EPS (cont.) As previously disclosed in our third quarter ended October 31, 2019 press release, we have calculated Adjusted EPS for the three and nine months ended October 31, 2019 by adjusting EPS for the following: (1) unrealized gains and losses on the company's equity investment in JD.com and (2) a non-cash impairment charge related to the Jabong.com trade name. Three Months Ended October 31, 2019 Nine Months Ended October 31, 20193 Diluted earnings per share: Reported EPS $ 1.15 $ 3.74 Pre-Tax Pre-Tax Adjustments: Impact Tax Impact1 NCI Impact2 Net Impact Impact Tax Impact1 NCI Impact2 Net Impact Unrealized (gains) and losses on JD.com investment $ (0.06) $ 0.01 $ — $ (0.05) $ (0.32) $ 0.07 $ — $ (0.25) Non-cash impairment charge on Jabong.com trade name 0.10 (0.03) (0.01) 0.06 0.10 (0.03) (0.01) 0.06 Net Adjustments $ 0.01 $ (0.19) Adjusted EPS $ 1.16 $ 3.55 1 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. 2 Calculated based on the ownership percentages of the noncontrolling interest at Flipkart. 3 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. 22

Additional resources at stock.walmart.com • Unit counts & square footage • Comparable store sales, including and excluding fuel • Terminology 23