Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELA Bio, Inc. | tm2036181d1_8k.htm |

Exhibit 99.1

Advancing Soft Tissue Reconstruction Investor Presentation November 2020

2 Forward Looking Statements This presentation contains forward - looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 . All statements other than statements of historical facts contained in this document, including but not limited to statements regarding possible or assumed future res ults of operations, business strategies, development plans, regulatory activities, market opportunity competitive position, potential growth opportunities, and the ef fec ts of competition, are forward - looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause TELA B io, Inc.’s (the “Company”) actual results, performance or achievements to be materially different from any future results, performance or achievements expresse d o r implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “expect,” “plan ,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these term s o r other similar expressions. The forward - looking statements in this presentation are only predictions. The Company has based these forward - looking statements largely on its curr ent expectations and projections about future events and financial trends that it believes may affect the Company’s business, financial condition and results of operations. These forward - looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions , s ome of which cannot be predicted or quantified and some of which are beyond the Company’s control, including, among others: the impact to the Company's business of the ongoing COVID - 19 pandemic, including but not limited to any impact on the Company's ability to market its products, demand for the Company's products du e t o deferral of procedures using the Company's products or disruption in the Company's supply chain, the Company's ability to achieve or sustain profitability, th e C ompany's ability to gain market acceptance for the Company's products and to accurately forecast and meet customer demand, the Company's ability to compete s ucc essfully, the Company's ability to enhance the Company's product offerings, development and manufacturing problems, capacity constraints or delays in production of the Company's products, maintenance of coverage and adequate reimbursement for procedures using the Company's products, product defects or failures. The se and other risks and uncertainties are described more fully in the "Risk Factors" section and elsewhere in the Company's filings with the Securiti es and Exchange Commission and available at www.sec.gov. You should not rely on these forward - looking statements as predictions of future events. The events and circumst ances reflected in the Company’s forward - looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward - looking statements. Moreover, the Company operates in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that the Company may face. Except as required by applicable law, we do not plan to pu blicly update or revise any forward - looking statements contained herein, whether as a result of any new information, future events, changed circumstances or othe rwi se.

Redefining soft tissue reconstruction with a differentiated category of tissue reinforcement materials ~$2B U.S Market Opportunity 1 in hernia repair , abdominal wall reconstruction and plastic and reconstructive surgery 3 Innovative Products Compelling Clinical Evidence Products Offer Attractive Value Proposition for Hospitals 1 Management estimate. $2B total equals $1.5B hernia & abdominal wall reconstruction and $0.5B plastic reconstructive surgery.

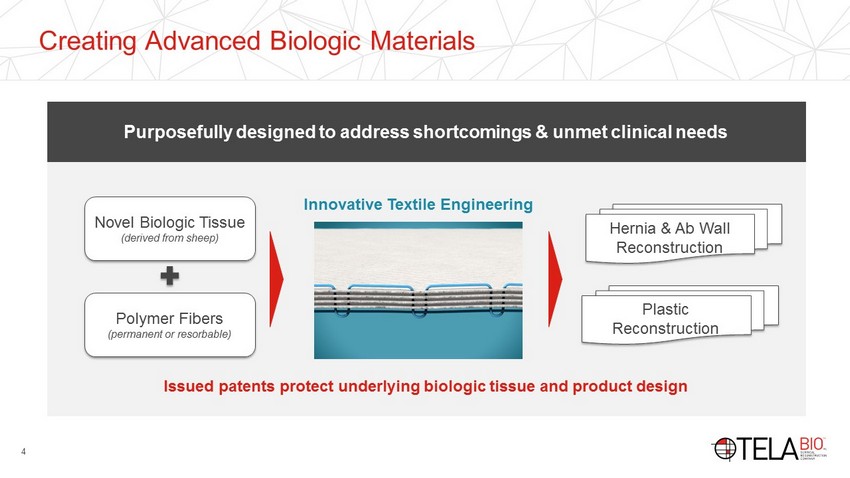

4 Creating Advanced Biologic Materials Novel Biologic Tissue (derived from sheep) Polymer Fibers (permanent or resorbable) Innovative Textile Engineering Purposefully designed to address shortcomings & unmet clinical needs Issued patents protect underlying biologic tissue and product design Hernia & Ab Wall Reconstruction Plastic Reconstruction

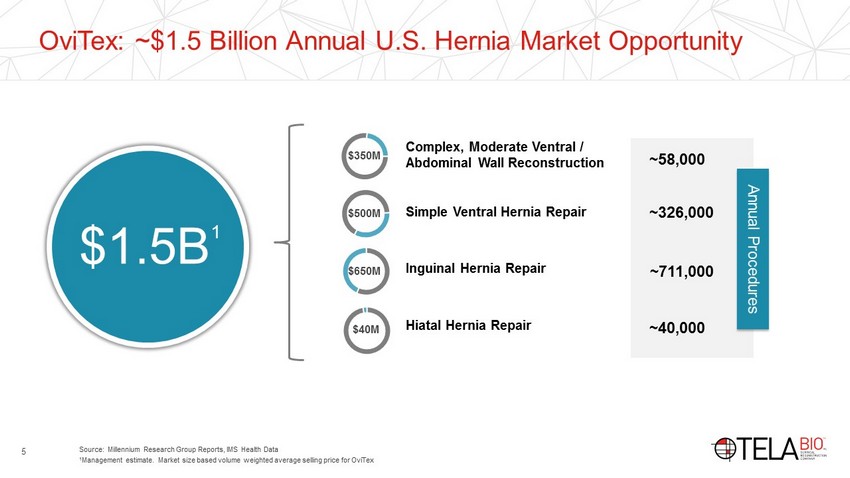

5 OviTex: ~$1.5 Billion Annual U.S. Hernia Market Opportunity Simple Ventral Hernia Repair Complex, Moderate Ventral / Abdominal Wall Reconstruction Simple Ventral Hernia Repair Inguinal Hernia Repair Hiatal Hernia Repair ~58,000 ~326,000 ~711,000 ~40,000 $350M $500M $650M $40M Source: Millennium Research Group Reports, IMS Health Data 1 Management estimate. Market size based volume weighted average selling price for OviTex Annual Procedures $1.5B 1

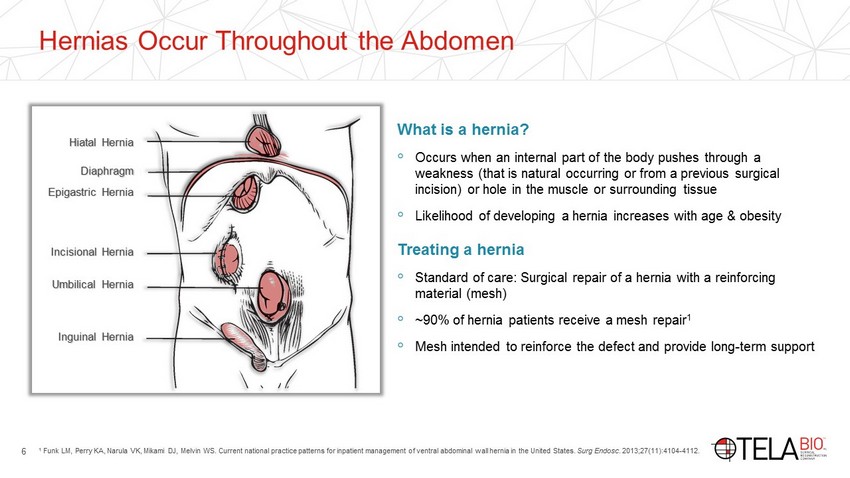

6 Hernias Occur Throughout the Abdomen 1 Funk LM, Perry KA, Narula VK, Mikami DJ, Melvin WS. Current national practice patterns for inpatient management of ventral abdominal wall hernia in the United Sta te s. Surg Endosc . 2013;27(11):4104 - 4112. What is a hernia? ◦ Occurs when an internal part of the body pushes through a weakness (that is natural occurring or from a previous surgical incision) or hole in the muscle or surrounding tissue ◦ Likelihood of developing a hernia increases with age & obesity Treating a hernia ◦ Standard of care: Surgical repair of a hernia with a reinforcing material (mesh) ◦ ~90% of hernia patients receive a mesh repair 1 ◦ Mesh intended to reinforce the defect and provide long - term support Hiatal Hernia Diaphragm Epigastric Hernia Incisional Hernia Umbilical Hernia Inguinal Hernia

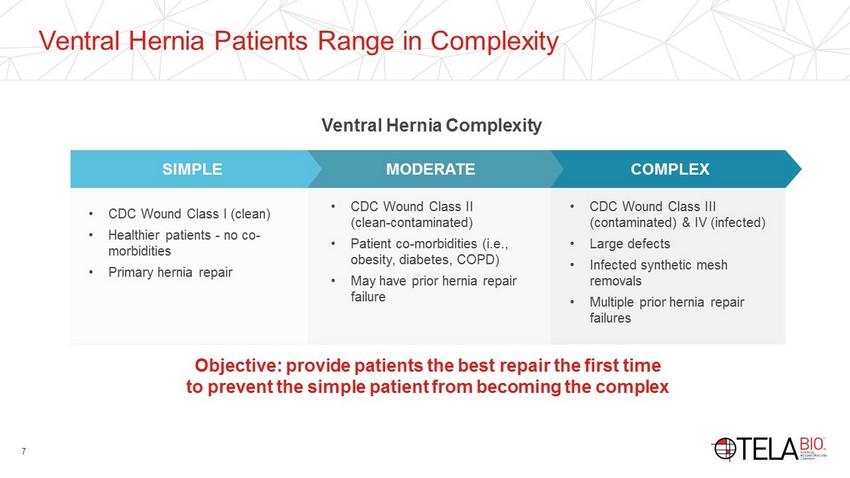

7 Ventral Hernia Patients Range in Complexity • CDC Wound Class I (clean) • Healthier patients - no co - morbidities • Primary hernia repair • CDC Wound Class II (clean - contaminated) • Patient co - morbidities (i.e., obesity, diabetes, COPD) • May have prior hernia repair failure • CDC Wound Class III (contaminated) & IV (infected) • Large defects • Infected synthetic mesh removals • Multiple prior hernia repair failures COMPLEX MODERATE SIMPLE Ventral Hernia Complexity Objective: provide patients the best repair the first time to prevent the simple patient from becoming the complex

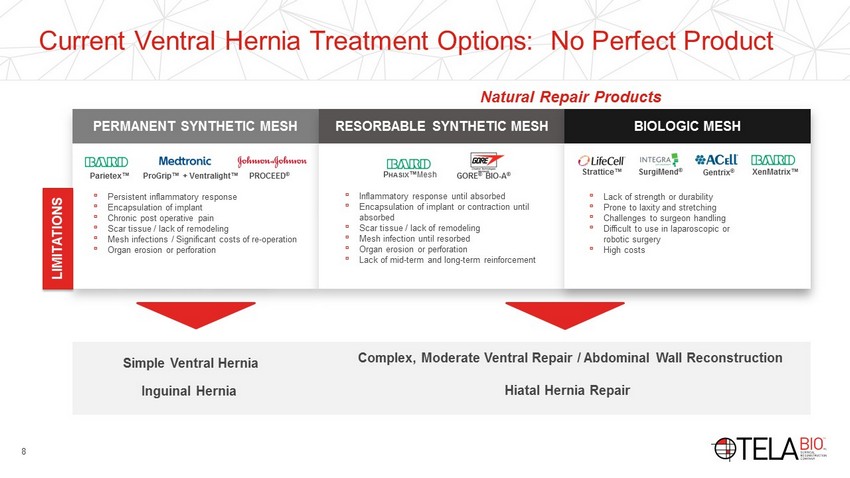

8 Current Ventral Hernia Treatment Options: No Perfect Product Persistent inflammatory response Encapsulation of implant Chronic post operative pain Scar tissue / lack of remodeling Mesh infections Significant costs of re - operation Organ erosion or perforation 6,000 related U.S. lawsuits PERMANENT SYNTHETIC MESH Strattice™ RESORBABLE SYNTHETIC MESH Strattice™ BIOLOGIC MESH Parietex ™ PROCEED ® GORE ® BIO - A ® SurgiMend ® XenMatrix ™ Natural Repair Products Simple Ventral Hernia Inguinal Hernia Complex, Moderate Ventral Repair / Abdominal Wall Reconstruction Hiatal Hernia Repair ProGrip ™ + Ventralight ™ P HASIX ™ Mesh Strattice ™ Gentrix ® ▫ Persistent inflammatory response ▫ Encapsulation of implant ▫ Chronic post operative pain ▫ Scar tissue / lack of remodeling ▫ Mesh infections / Significant costs of re - operation ▫ Organ erosion or perforation LIMITATIONS ▫ Inflammatory response until absorbed ▫ Encapsulation of implant or contraction until absorbed ▫ Scar tissue / lack of remodeling ▫ Mesh infection until resorbed ▫ Organ erosion or perforation ▫ Lack of mid - term and long - term reinforcement ▫ Lack of strength or durability ▫ Prone to laxity and stretching ▫ Challenges to surgeon handling ▫ Difficult to use in laparoscopic or robotic surgery ▫ High costs

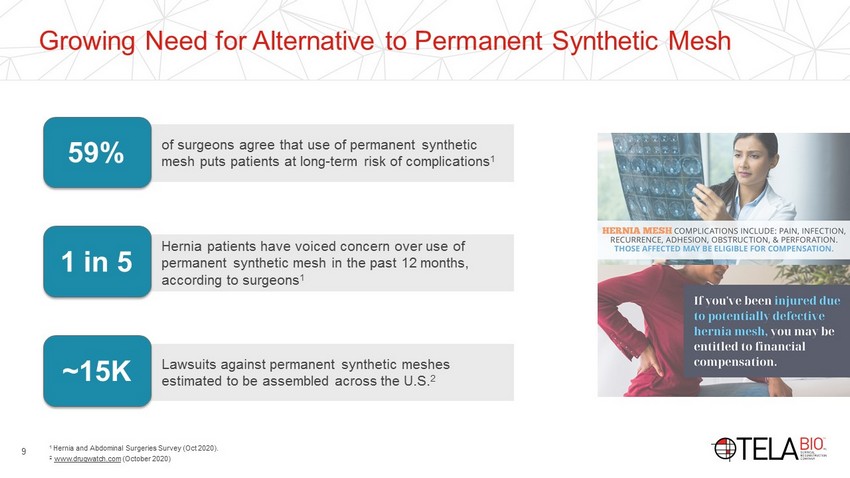

9 Lawsuits against permanent synthetic meshes estimated to be assembled across the U.S. 2 of surgeons agree that use of permanent synthetic mesh puts patients at long - term risk of complications 1 Growing Need for Alternative to Permanent Synthetic Mesh 1 Hernia and Abdominal Surgeries Survey (Oct 2020). 2 www.drugwatch.com (October 2020) 59% Hernia patients have voiced concern over use of permanent synthetic mesh in the past 12 months, according to surgeons 1 1 in 5 ~15K

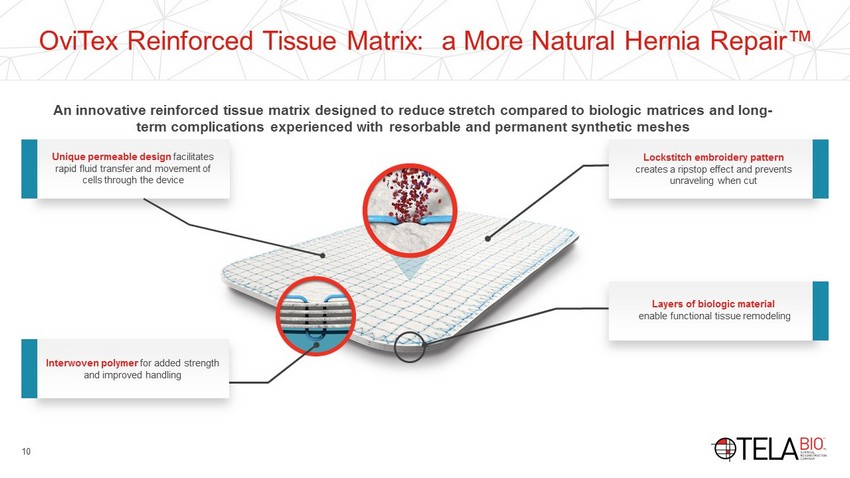

10 OviTex Reinforced Tissue Matrix: a More Natural Hernia Repair™ An innovative reinforced tissue matrix designed to reduce stretch compared to biologic matrices and long - term complications experienced with resorbable and permanent synthetic meshes Unique permeable design facilitates rapid fluid transfer and movement of cells through the device Layers of biologic material enable functional tissue remodeling Interwoven polymer for added strength and improved handling Lockstitch embroidery pattern creates a ripstop effect and prevents unraveling when cut

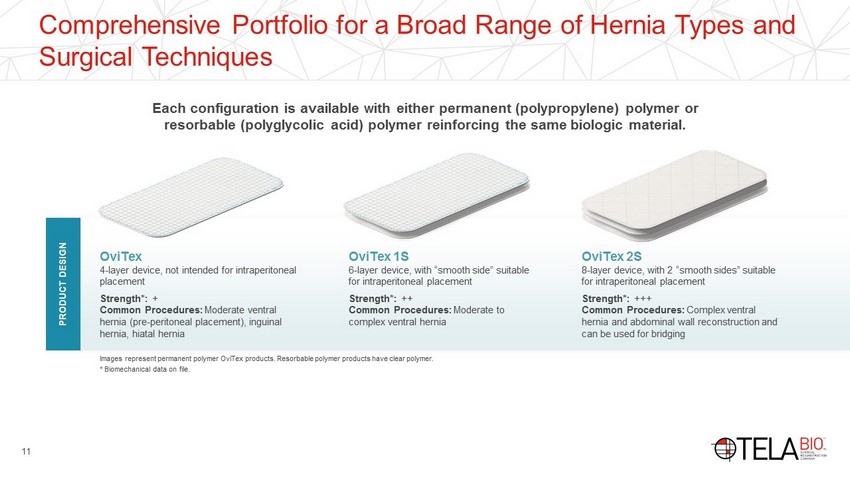

11 Comprehensive Portfolio for a Broad Range of Hernia Types and Surgical Techniques Images represent permanent polymer OviTex products. Resorbable polymer products have clear polymer. * Biomechanical data on file. PRODUCT DESIGN OviTex 4 - layer device, not intended for intraperitoneal placement Strength*: + Common Procedures: Moderate ventral hernia (pre - peritoneal placement), inguinal hernia, hiatal hernia OviTex 2S 8 - layer device, with 2 “smooth sides” suitable for intraperitoneal placement Strength*: +++ Common Procedures: Complex ventral hernia and abdominal wall reconstruction and can be used for bridging OviTex 1S 6 - layer device, with “smooth side” suitable for intraperitoneal placement Strength*: ++ Common Procedures: Moderate to complex ventral hernia Each configuration is available with either permanent (polypropylene) polymer or resorbable (polyglycolic acid) polymer reinforcing the same biologic material.

12 OviTex LPR for Laparoscopic & Robotic Hernia Repair Tailored OviTex product designed for improved handling in MIS techniques and trocar accessibility Our Solution: OviTex LPR Increase in Robotic - Assisted Hernia Repair ▫ Surgeons have adopted robotic - assisted techniques, primarily for inguinal & simple ventral Hernia repair, due to perceived patient and technique benefits ▫ Legacy biologic products are difficult to use minimally invasively (MIS) due to their thickness and handling properties

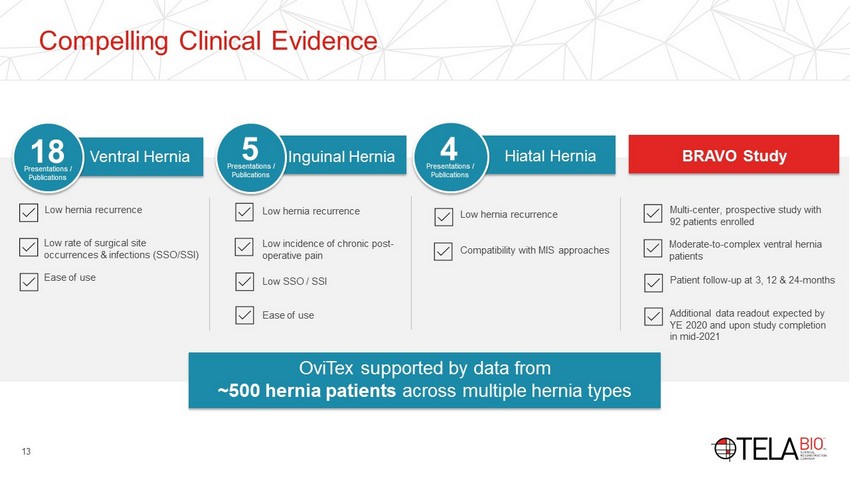

13 Compelling Clinical Evidence Ventral Hernia Inguinal Hernia Hiatal Hernia Presentations / Publications 18 Presentations / Publications 5 Presentations / Publications 4 Low incidence of chronic post - operative pain Low hernia recurrence Low SSO / SSI Ease of use Low rate of surgical site occurrences & infections (SSO/SSI) Low hernia recurrence Ease of use Compatibility with MIS approaches Low hernia recurrence OviTex supported by data from ~500 hernia patients across multiple hernia types Moderate - to - complex ventral hernia patients Multi - center, prospective study with 92 patients enrolled Patient follow - up at 3, 12 & 24 - months Additional data readout expected by YE 2020 and upon study completion in mid - 2021 BRAVO Study

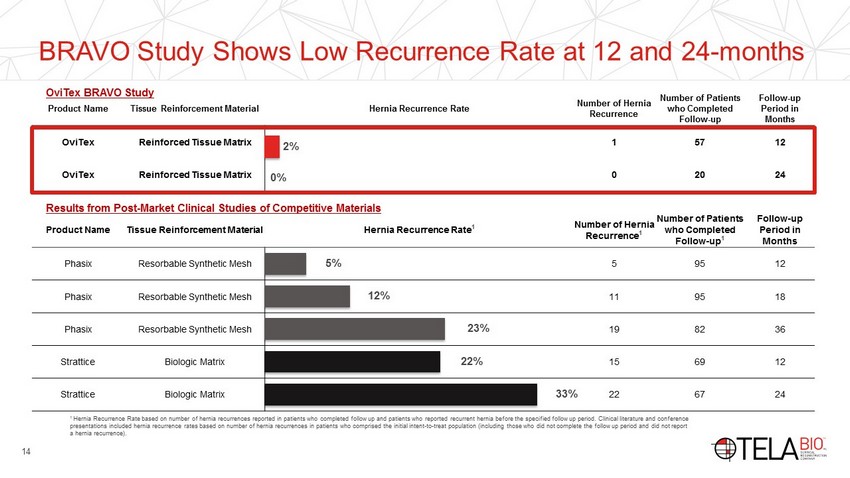

14 BRAVO Study Shows Low Recurrence Rate at 12 and 24 - months Product Name Tissue Reinforcement Material Hernia Recurrence Rate Number of Hernia Recurrence Number of Patients who Completed Follow - up Follow - up Period in Months OviTex Reinforced Tissue Matrix 1 57 12 OviTex Reinforced Tissue Matrix 0 20 24 Product Name Tissue Reinforcement Material Hernia Recurrence Rate 1 Number of Hernia Recurrence 1 Number of Patients who Completed Follow - up 1 Follow - up Period in Months Phasix Resorbable Synthetic Mesh 5 95 12 Phasix Resorbable Synthetic Mesh 11 95 18 Phasix Resorbable Synthetic Mesh 19 82 36 Strattice Biologic Matrix 15 69 12 Strattice Biologic Matrix 22 67 24 12% 23% 22% 33% 5% 2% 1 Hernia Recurrence Rate based on number of hernia recurrences reported in patients who completed follow up and patients who re por ted recurrent hernia before the specified follow up period. Clinical literature and conference presentations included hernia recurrence rates based on number of hernia recurrences in patients who comprised the initial in ten t - to - treat population (including those who did not complete the follow up period and did not report a hernia recurrence). OviTex BRAVO Study Results from Post - Market Clinical Studies of Competitive Materials 0%

15 OviTex PRS: ~$500 Million Annual U.S. Plastic & Reconstructive Surgery Market Opportunity $500M 1 Market dominated by human acellular dermal matrices (HADMs) ▫ Prone to high degree of stretch ▫ Expensive, putting pressure on hospital systems ▫ Often experience supply shortages, particularly when large pieces of material are required Surgeons use products to reinforce soft tissue during various reconstructive surgeries, including: ▫ Breast reconstruction ▫ Head and neck surgery ▫ Chest wall reconstruction ▫ Pelvic reconstruction ▫ Extremities reconstruction 1 Management estimate. Market size based on sales of current biologics

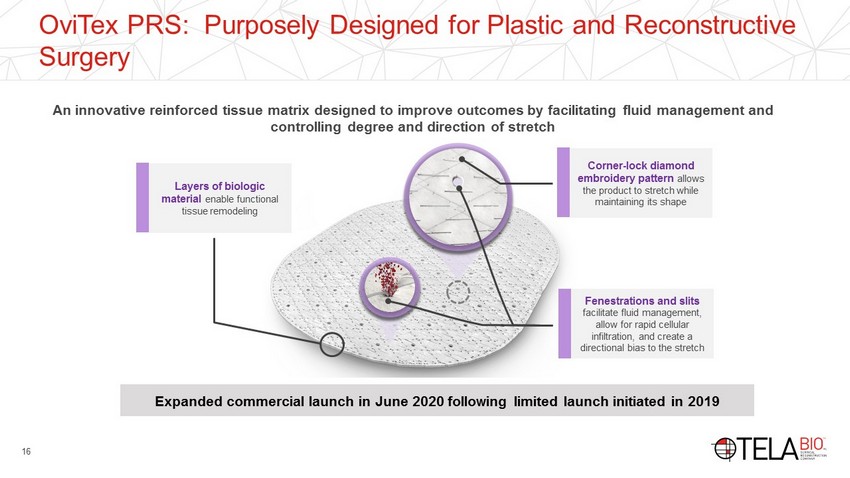

16 OviTex PRS: Purposely Designed for Plastic and Reconstructive Surgery Layers of biologic material enable functional tissue remodeling Corner - lock diamond embroidery pattern allows the product to stretch while maintaining its shape Fenestrations and slits facilitate fluid management, allow for rapid cellular infiltration, and create a directional bias to the stretch Expanded commercial launch in June 2020 following limited launch initiated in 2019 An innovative reinforced tissue matrix designed to improve outcomes by facilitating fluid management and controlling degree and direction of stretch

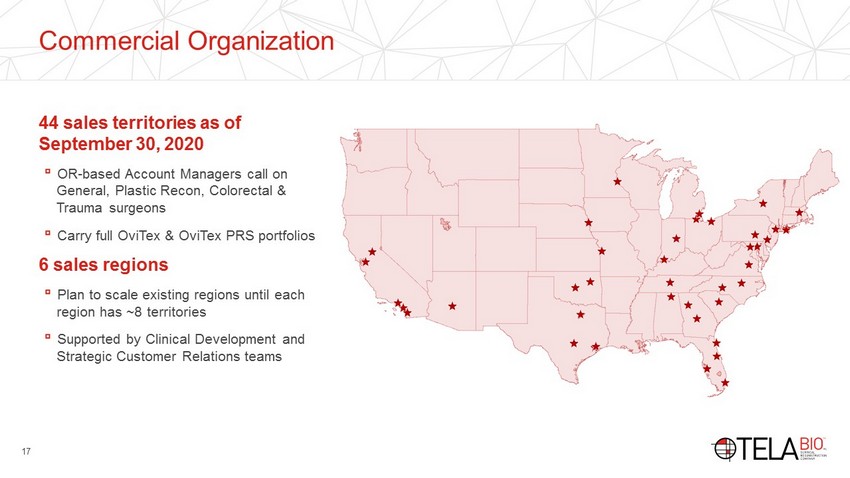

17 Commercial Organization 44 sales territories as of September 30, 2020 ▫ OR - based Account Managers call on General, Plastic Recon, Colorectal & Trauma surgeons ▫ Carry full OviTex & OviTex PRS portfolios 6 sales regions ▫ Plan to scale existing regions until each region has ~8 territories ▫ Supported by Clinical Development and Strategic Customer Relations teams

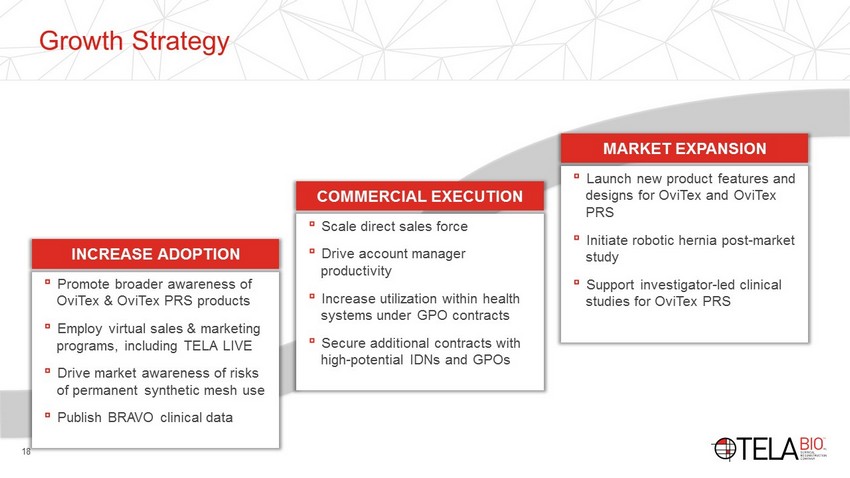

18 Growth Strategy ▫ Promote broader awareness of OviTex & OviTex PRS products ▫ Employ virtual sales & marketing programs, including TELA LIVE ▫ Drive market awareness of risks of permanent synthetic mesh use ▫ Publish BRAVO clinical data INCREASE ADOPTION ▫ Scale direct sales force ▫ Drive account manager productivity ▫ Increase utilization within health systems under GPO contracts ▫ Secure additional contracts with high - potential IDNs and GPOs COMMERCIAL EXECUTION ▫ Launch new product features and designs for OviTex and OviTex PRS ▫ Initiate robotic hernia post - market study ▫ Support investigator - led clinical studies for OviTex PRS MARKET EXPANSION

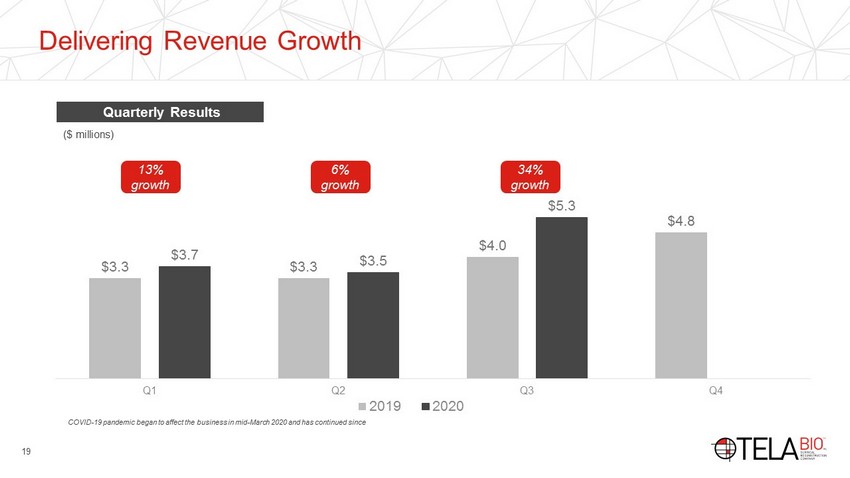

19 Delivering Revenue Growth Quarterly Results ($ millions) $3.3 $3.3 $4.0 $4.8 $3.7 $3.5 $5.3 Q1 Q2 Q3 Q4 2019 2020 6% growth 13% growth 34% growth COVID - 19 pandemic began to affect the business in mid - March 2020 and has continued since

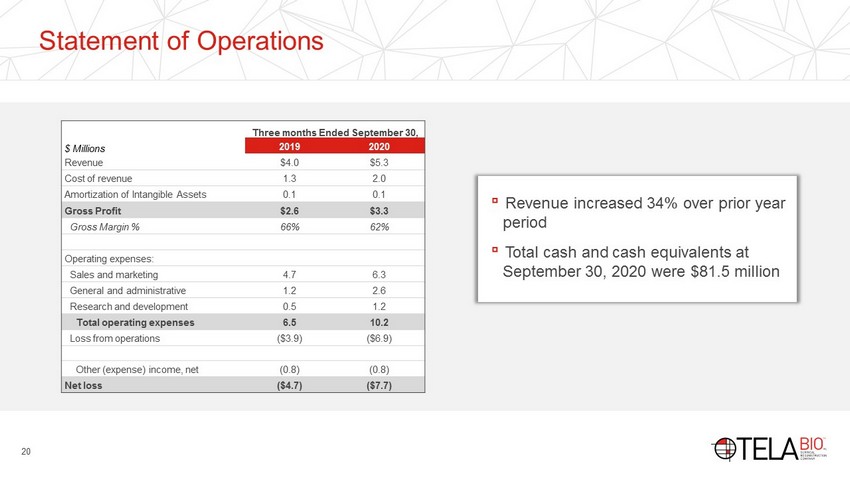

20 Statement of Operations Three months Ended September 30, $ Millions 2019 2020 Revenue $4.0 $5.3 Cost of revenue 1.3 2.0 Amortization of Intangible Assets 0.1 0.1 Gross Profit $2.6 $3.3 Gross Margin % 66% 62% Operating expenses: Sales and marketing 4.7 6.3 General and administrative 1.2 2.6 Research and development 0.5 1.2 Total operating expenses 6.5 10.2 Loss from operations ($3.9) ($6.9) Other (expense) income, net (0.8) (0.8) Net loss ($4.7) ($7.7) ▫ Revenue increased 34% over prior year period ▫ Total cash and cash equivalents at September 30, 2020 were $81.5 million

21 Investment Highlights Advanced reinforced tissue matrix portfolio supported by compelling clinical evidence Focused on ~$2.0 billion annual U.S. total addressable markets Driving commercial adoption with targeted direct - sales approach Recent product launches in growing markets: robotic hernia surgery + plastic and reconstructive surgery Broad intellectual property portfolio Established DRG - based reimbursement pathway for hernia repair Industry leading executive team with proven track record