Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PCB BANCORP | pcb-20201117.htm |

Keefe, Bruyette & Wood, Inc. West Coast Field Trip November 19, 2020

Safe Harbor Statement This presentation (and oral statements made regarding the subject of this presentation) contains certain “forward- looking statements” that are based on various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include information about our future financial performance, business and growth strategy, projected plans and objectives, as well as projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. Forward-looking statements are based on management’s current expectations and involve risks and uncertainties that could cause actual results to differ materially from the Company’s historical results or those described in our forward-looking statements. PCB Bancorp disclaims any obligation to update any forward-looking statement. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. your Partner • Choice • Bank | 2

Introduction your Partner • Choice • Bank | 3

Franchise Footprint • Servicing 6 of top 10 Korean-American MSAs in the U.S. through our branches and LPOs (1) (1) Based on total population projected for 2018 by S&P Global Market Intelligence. your Partner • Choice • Bank | 4

Equity Information As of November 13, 2020 Ticker PCB Market Cap $173.3 million Price Per Share $11.27 52 Week Range $7.97 - $17.55 Dividend Yield (Dividend Payout Ratio) 3.55% (40.4% 4Q19-3Q20) Number of Shares 15,381,038 Historical Quarterly Cash Dividend Per Share 0.120 0.100 25% 0.080 33% 20% 0.060 $0.100 $0.100 $0.100 67% $0.080 0.040 $0.060 $0.060 $0.050 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.030 $0.025 $0.025 $0.025 $0.027 $0.027 $0.027 $0.027 0.020 0.000 (1) (1) 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 (1) Retrospectively adjusted for 10% stock dividend payouts on February 22, 2016 and January 15, 2017 your Partner • Choice • Bank | 5

Historical Performance Held-For-Investment Loans ($bn) Deposits ($bn) 1.800 CAGR +14.5% 1.800 CAGR +12.0% 1.600 1.600 1.400 1.400 1.200 1.200 1.000 1.000 0.800 0.800 $1.65 $1.58 $1.48 $1.34 $1.45 $1.44 0.600 0.600 $1.25 $1.19 $1.09 $1.03 $0.94 0.400 $0.84 0.400 0.200 0.200 0.000 0.000 2015 2016 2017 2018 2019 Sep-20 2015 2016 2017 2018 2019 Sep-20 Net Income ($mm) Diluted Earnings Per Share 30.000 1.800 25.000 1.600 1.400 20.000 1.200 1.000 15.000 0.800 $1.65 $24.3 $24.1 $1.49 10.000 0.600 $1.21 $16.4 $1.02 $1.11 $12.2 $14.0 0.400 5.000 $10.4 $0.67 0.200 0.000 0.000 2015 2016 2017 2018 2019 09/20 YTD 2015 2016 2017 2018 2019 09/20 YTD your Partner • Choice • Bank | 6

Historical Performance Return on Average Assets Return on Average Equity 0.018 0.160 0.016 0.140 0.014 0.120 0.012 0.100 0.010 0.080 0.008 1.53% 14.26% 1.40% 0.060 13.10% 12.47% 12.00% 0.006 1.25% 1.25% 1.22% 10.88% 0.040 0.004 0.73% 6.10% 0.020 0.002 0.000 0.000 2015 2016 2017 2018 2019 09/20 YTD 2015 2016 2017 2018 2019 09/20 YTD Efficiency Ratio Net Interest Margin 0.580 0.045 0.570 0.040 0.560 0.035 0.550 0.030 0.540 0.025 0.530 0.020 4.22% 4.23% 56.9% 3.89% 4.18% 4.11% 3.49% 0.520 54.9% 0.015 53.8% 0.510 52.8% 0.010 52.0% 52.3% 0.500 0.005 0.490 0.000 2015 2016 2017 2018 2019 09/20 YTD 2015 2016 2017 2018 2019 09/20 YTD your Partner • Choice • Bank | 7

COVID-19 Update As of September 30, 2020 (unless otherwise indicated) o SBA PPP Loans • 1,614 loans with aggregated contractual loan balance of $139.4 million • Origination fee income of $5.7 million and cost of $1.1 million o Loan Modification Related to COVID-19 • 154 customers for aggregated loan balance of $171.6 million • 16 customers for aggregated loan balance of $19.4 million as of November 13, 2020 o Allowance for Loan Losses • Established 1.55% of total loans held-for-investment (1.70% excluding SBA PPP loans) o Liquidity • Maintained cash and cash equivalents of $257.4 million, or 12.7% of total assets • Maintained available borrowing capacity of $419.9 million, or 20.8% of total assets o Capital • Bank’s Tier 1 leverage capital ratio of 11.21% and CET 1 capital ratio of 15.34% your Partner • Choice • Bank | 8

Recent Financial Performance your Partner • Choice • Bank | 9

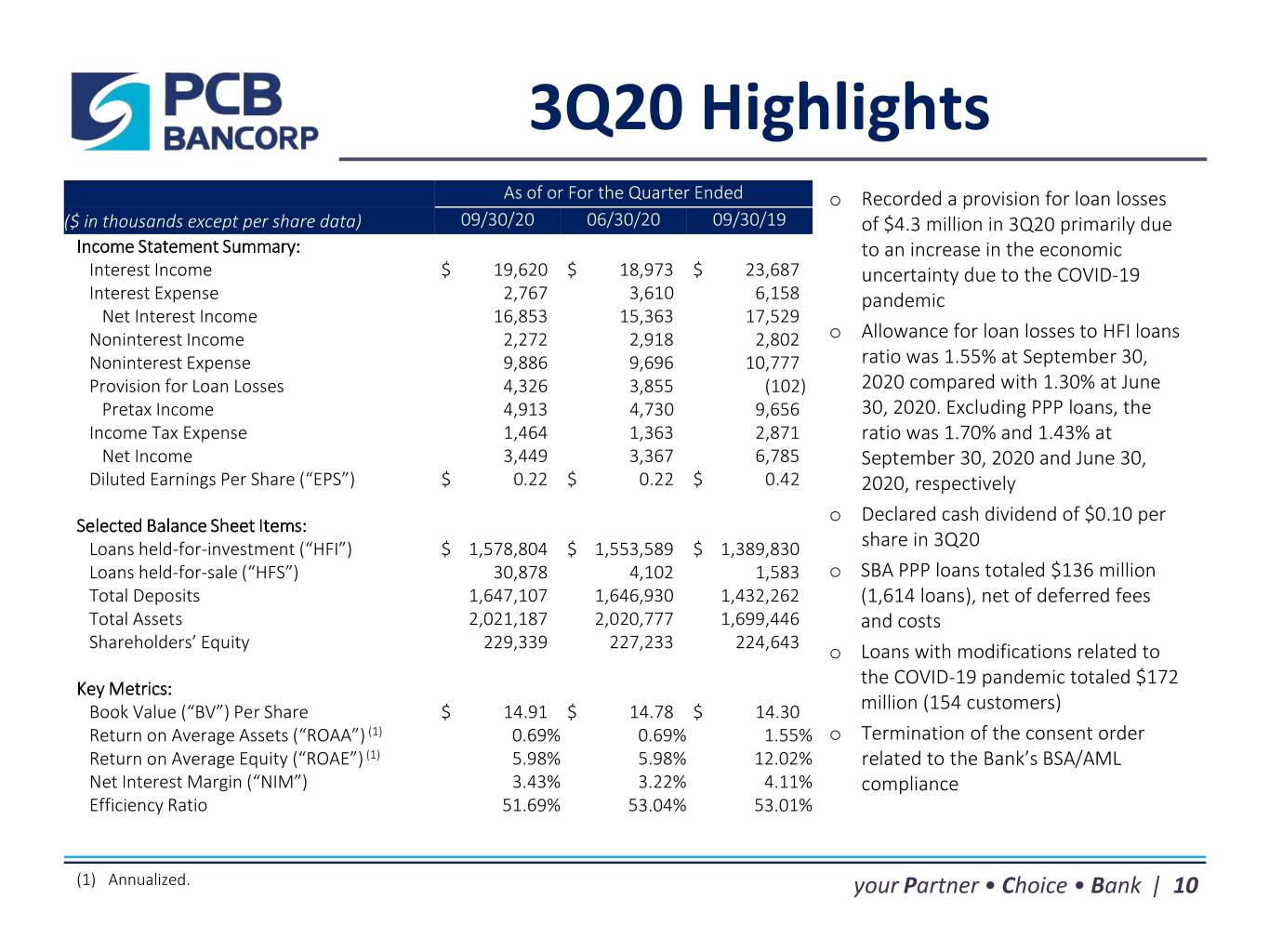

3Q20 Highlights As of or For the Quarter Ended o Recorded a provision for loan losses ($ in thousands except per share data) 09/30/20 06/30/20 09/30/19 of $4.3 million in 3Q20 primarily due Income Statement Summary: to an increase in the economic Interest Income $ 19,620 $ 18,973 $ 23,687 uncertainty due to the COVID-19 Interest Expense 2,767 3,610 6,158 pandemic Net Interest Income 16,853 15,363 17,529 Noninterest Income 2,272 2,918 2,802 o Allowance for loan losses to HFI loans Noninterest Expense 9,886 9,696 10,777 ratio was 1.55% at September 30, Provision for Loan Losses 4,326 3,855 (102) 2020 compared with 1.30% at June Pretax Income 4,913 4,730 9,656 30, 2020. Excluding PPP loans, the Income Tax Expense 1,464 1,363 2,871 ratio was 1.70% and 1.43% at Net Income 3,449 3,367 6,785 September 30, 2020 and June 30, Diluted Earnings Per Share (“EPS”) $ 0.22 $ 0.22 $ 0.42 2020, respectively o Declared cash dividend of $0.10 per Selected Balance Sheet Items: Loans held-for-investment (“HFI”) $ 1,578,804 $ 1,553,589 $ 1,389,830 share in 3Q20 Loans held-for-sale (“HFS”) 30,878 4,102 1,583 o SBA PPP loans totaled $136 million Total Deposits 1,647,107 1,646,930 1,432,262 (1,614 loans), net of deferred fees Total Assets 2,021,187 2,020,777 1,699,446 and costs Shareholders’ Equity 229,339 227,233 224,643 o Loans with modifications related to the COVID-19 pandemic totaled $172 Key Metrics: Book Value (“BV”) Per Share $ 14.91 $ 14.78 $ 14.30 million (154 customers) Return on Average Assets (“ROAA”) (1) 0.69% 0.69% 1.55% o Termination of the consent order Return on Average Equity (“ROAE”) (1) 5.98% 5.98% 12.02% related to the Bank’s BSA/AML Net Interest Margin (“NIM”) 3.43% 3.22% 4.11% compliance Efficiency Ratio 51.69% 53.04% 53.01% (1) Annualized. your Partner • Choice • Bank | 10

Loan Overview HFI Loan Trend HFI Loan Composition ($ in millions) September 30, 2020 Other Consumer Commercial and Industrial SBA PPP Residential Property 1% YoY +13.6% 13% 13% 1,800 9% $1,554 $1,579 1,600 Commercial Property - Commercial Property - $1,451 $1,451 Owner Occupied $1,396 $1,390 $134 $136 Non-Owner Occupied 25% 1,400 $1,339 $1,343 $23 $23 $22 $24 $23 $22 39% $26 $25 $235 $227 $213 $241 $236 $224 1,200 $234 $237 $206 $240 $244 $218 1,000 $232 $227 $221 $221 800 Commercial Real Estate(1) Loan Trend ($ in millions) 600 700.0 $1,002 420.0% $953 $957 $956 650.0 254% 245% 250% 242% 244% 249% 247% 257% $899 $904 320.0% 400 $858 $860 600.0 220.0% 550.0 120.0% 500.0 200 20.0% 450.0 $619 -80.0% $565 $559 $584 $565 $580 $587 $590 400.0 -180.0% 0 350.0 -280.0% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 300.0 -380.0% Commercial Property Commercial and Industrial Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Residential Property Other Consumer SBA PPP CRE Loans % to the Bank's Total Risk-Based Capital (1) Per regulatory definitions in the Commercial Real Estate (“CRE”) Concentration Guidance your Partner • Choice • Bank | 11

Loan Interest Rate Mix New Production(1),(2) by Rate Type Interest Rate Mix(2) ($ in millions) September 30, 2020 6.31% 200.0 5.91% 6.02% 5.92% Variable (WA Rate: 4.10%) 6.00% 52% 180.0 5.20% 5.20% Fixed (WA Rate:4.96%) 5.00% 35% 160.0 4.15% 4.14% Hybrid (WA Rate: 4.98%) 4.00% 13% 140.0 $87 3.00% 120.0 $83 2.00% 100.0 $53 $64 1.00% (2) 80.0 $65 $57 Interest Rate Mix Trend 100% $33 0.00% $78 90% 60.0 $31 $22 $25 80% 70% 57% 55% 53% 52% -1.00% 62% 60% 40.0 66% 65% $32 $20 $19 60% $19 50% $52 $50 -2.00% 20.0 $45 40% 13% $13 15% 15% 15% $25 $29 30% 16% $23 $21 17% 17% 17% $13 20% 0.0 -3.00% 33% 35% 10% 28% 30% 17% 18% 21% 24% 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 0% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Fixed Hybrid Variable WA Rate Fixed Hybrid Variable (1) Total commitment basis your Partner • Choice • Bank | 12 (2) Excluding SBA PPP loans.

SBA PPP Loans Summary of SBA PPP loans as of September 30, 2020: Unpaid Principal Balance (“UPB”) Remaining Balance of ($ in thousands) # of Loans Carrying Value 2-Year Maturity 5-Year Maturity Origination Fee Origination Cost $50K or Under 1,043 $ 21,551 $ 20,080 $ 1,671 $ 759 $ 559 Between $50K and $150K 357 29,375 29,571 630 989 165 Between $150K and $350K 142 31,304 32,046 259 1,066 65 Between $350K and $2MM 69 45,813 46,232 486 937 32 $2MM or More 3 8,375 8,427 0 54 1 Total 1,614 $ 136,418 $ 136,356 $ 3,046 $ 3,805 $ 822 Summary of relationships of SBA PPP loan customers as of September 30, 2020: SBA PPP Loans Demand Deposit Accounts (“DDAs”) ($ in thousands) # of Loans UPB Sep-20 Mar-20 Change Existing relationships 1,148 $ 103,760 $ 240,483 $ 152,769 $ 87,714 New customers with new DDA relationships 205 22,806 10,566 0 10,566 No other relationships 261 12,836 0 0 0 Total 1,614 $ 139,402 $ 251,049 $ 152,769 $ 98,280 your Partner • Choice • Bank | 13

Loan Modification As of September 30, 2020 Summary of loans with modifications related to the COVID-19 pandemic: Currently Modified Previously Carrying Value Weighted-Average Modified Accrued Accrued Payment Interest Interest Loan-to- Interest Carrying Interest ($ in thousands) Deferment Only Total Rate Value (1) Receivable Value Receivable Commercial property $ 135,165 $ 2,397 $ 137,562 4.49% 48.5% $ 3,048 $ 240,472 $ 3,485 Commercial term 11,797 2,960 14,757 4.29% 309 40,259 387 SBA commercial term 0 72 72 5.25% 1 0 0 Residential property 19,233 0 19,233 4.91% 54.6% 519 25,231 361 Other consumer 0 0 0 0.00% 0 1,442 6 Total $ 166,195 $ 5,429 $ 171,624 4.52% $ 3,877 $ 307,404 $ 4,239 Summary of modification expiration: During the Month of ($ in thousands) Oct-20 Nov-20 Dec-20 Jan-21 Total Commercial property Principal deferment $ 122,564 $ 12,601 $ 0 $ 0 $ 135,165 Interest only 0 1,285 1,112 0 2,397 Commercial term Principal deferment 9,937 1,860 0 0 11,797 Interest only 1,795 0 0 1,165 2,960 SBA commercial term 0 0 0 72 72 Residential property 13,045 5,317 871 0 19,233 Total $ 147,341 $ 21,063 $ 1,983 $ 1,237 $ 171,624 (1) Collateral value at origination your Partner • Choice • Bank | 14

Loan Modification From June 30, 2020 to September 30, 2020 Migration of loans with modifications related to the COVID-19 pandemic: Early Re- New Modification ($ in thousands) Jun-20 Termination Expired Modification Modification Type Change Amortization Sep-20 Commercial property Principal deferment $ 369,716 $ (68,277) $ (162,737) $ 343 $ 0 $ (1,282) $ (2,598) $ 135,165 Interest only 9,850 (9,800) 0 0 1,112 1,282 (47) 2,397 Commercial term Principal deferment 53,277 (25,620) (13,743) 0 0 (1,165) (952) 11,797 Interest only 4,882 0 (2,060) 1,165 0 1,165 (2,192) 2,960 SBA commercial term 0 0 0 0 72 0 0 72 Residential property 44,804 (2,958) (40,534) 18,262 668 0 (1,009) 19,233 Other consumer 1,507 (5) (1,436) 0 7 0 (73) 0 Total $ 484,036 $ (106,660) $ (220,510) $ 19,770 $ 1,859 $ 0 $ (6,871) $ 171,624 HFI loans $ 1,553,589 $ 1,578,804 SBA PPP loans 133,675 136,418 HFI loans, excluding SBA PPP loans $ 1,419,914 $ 1,442,386 Total modified loans to HFI loans, excluding SBA PPP loans 34.1% 11.9% your Partner • Choice • Bank | 15

Loan Modification As of November 13, 2020 Summary of loans with modifications related to the COVID-19 pandemic: Currently Modified Previously Carrying Value Weighted- Modified Average Accrued Accrued Payment Interest Interest Interest Carrying Interest ($ in thousands) Deferment Only Total Rate Receivable Value Receivable Commercial property $ 10,030 $ 2,397 $ 12,427 3.67% $ 70 $ 360,954 $ 5,664 SBA commercial property 0 878 878 5.11% 4 0 0 Commercial term 2,461 2,250 4,711 3.73% 83 49,173 227 SBA commercial term 0 97 97 5.33% 0 0 0 Residential property 1,296 0 1,296 4.75% 32 41,196 789 Other consumer 0 0 0 0.00% 0 1,338 5 Total $ 13,787 $ 5,622 $ 19,409 3.83% $ 189 $ 452,661 $ 6,685 954 Summary of modification expiration: During the Month of ($ in thousands) Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Total Commercial property Principal Deferment $ 343 $ 706 $ 0 $ 0 $ 0 $ 8,981 $ 0 $ 10,030 Interest Only 0 1,112 0 1,285 0 0 0 2,397 SBA commercial property 0 0 0 0 0 878 0 878 Commercial term Principal Deferment 0 0 2,461 0 0 0 0 2,461 Interest Only 0 0 1,165 0 0 0 1,085 2,250 SBA commercial term 0 0 72 0 0 25 0 97 Residential property 0 871 425 0 0 0 0 1,296 Total $ 334 $ 2,689 $ 4,123 $ 1,285 $ 0 $ 9,884 $ 1,085 $ 19,409 your Partner • Choice • Bank | 16

Loan Modification From September 30, 2020 to November 13, 2020 Migration of loans with modifications related to the COVID-19 pandemic: Early Re- New Modification ($ in thousands) 9/30/20 Termination Expired Modification Modification Type Change Amortization 11/13/20 Commercial property Principal deferment $ 135,165 $ 0 $ (134,795) $ 9,688 $ 0 $ 0 $ (28) $ 10,030 Interest only 2,397 0 (1,285) 1,285 0 0 0 2,397 SBA commercial property 0 0 0 0 878 0 0 878 Commercial term Principal deferment 11,797 0 (10,933) 2,461 0 (417) (447) 2,461 Interest only 2,960 0 (2,185) 1,085 0 417 (27) 2,250 SBA commercial term 72 0 0 0 25 0 0 97 Residential property 19,233 0 (18,222) 425 0 0 (140) 1,296 Total $ 171,624 $ 0 $ (167,420) $ 14,944 $ 903 $ 0 $ (642) $ 19,409 HFI loans $ 1,578,804 $ 1,581,358 SBA PPP loans 136,418 136,497 HFI loans, excluding SBA PPP loans $ 1,442,386 $ 1,444,861 Total modified loans to HFI loans, excluding SBA PPP loans 11.9% 1.34% your Partner • Choice • Bank | 17

Credit Quality Non-Performing Assets (“NPAs”) NPAs to Total Assets 6.0 ($ in millions) 0.30% 5.0 0.25% 4.0 0.20% 3.0 0.15% $4.8 0.25% 0.24% 2.0 $4.5 0.10% $4.0 0.20% $2.8 0.16% 1.0 $1.7 $1.8 $1.8 0.05% 0.10% 0.11% 0.11% $1.1 0.06% 0.0 0.00% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Allowance(1) to HFI Loans Allowance(1) to Non-Performing Loans 1.80% 1.70% (2) 1400% 1.60% 1.43% (2) 1200% 1.40% 1000% 1.20% 800% 1.00% 0.80% 1.55% 600% 1241% 0.60% 1.30% 1034% 933% 1.15% 400% 0.98% 0.98% 0.99% 0.40% 0.96% 0.94% 710% 683% 200% 509% 453% 0.20% 408% 0.00% 0% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 (1) Allowance for Loan Losses your Partner • Choice • Bank | 18 (2) Excluding SBA PPP loans

Loan Concentration Real Estate Loans – Commercial By Property Type Total Loans With Modification Related to COVID-19 % to Carrying Carrying Property ($ in thousands) Value % to Total LTV(1) Value % to Total Type Total LTV(1) Retail (More Than 50%) $ 185,050 18.5% 51.0% $ 22,656 16.4% 12.2% 46.5% Industrial 174,492 17.4% 49.8% 33,358 24.1% 19.1% 47.5% Mixed Use 136,061 13.6% 47.1% 17,846 13.0% 13.1% 46.6% Motel / Hotel 74,117 7.4% 51.9% 19,787 14.4% 26.7% 50.2% Gas Station 71,878 7.2% 54.0% 3,269 2.4% 4.5% 48.7% Office 69,900 7.0% 54.4% 2,588 1.9% 3.7% 49.2% Apartments 59,714 6.0% 47.4% 5,760 4.2% 9.6% 46.7% Medical 57,033 5.7% 54.2% 351 0.3% 0.6% 62.8% Car Wash 23,059 2.3% 51.6% 2,555 1.9% 11.1% 47.8% Auto - Sales, Repair, etc. 22,246 2.2% 50.6% 254 0.2% 1.1% 24.1% Construction 19,803 2.0% 60.9% 0 0% 0.0% 0.0% Church 16,689 1.7% 50.3% 2,493 1.8% 14.9% 40.3% Spa 16,217 1.6% 57.4% 14,853 10.8% 91.6% 56.2% Condominium - Commercial 13,849 1.4% 52.1% 1,404 1.0% 10.1% 44.6% Supermarket 9,577 1.0% 60.1% 0 0.0% 0.0% 0.0% Golf Course 9,244 0.9% 55.9% 3,379 2.5% 36.6% 49.7% Other 42,620 4.3% 48.6% 7,009 5.1% 16.4% 47.5% Total $ 1,001,549 100.0% 51.1% $ 137,562 100.0% 13.7% 48.5% Real Estate Loans - Residential Total Loans With Modification Related to COVID-19 Carrying Carrying ($ in thousands) Value LTV(1) FICO Value % to Total LTV(1) FICO Residential Property $ 212,804 56.8% 754 $ 19,233 9.0% 54.6% 730 (1) Collateral value at origination your Partner • Choice • Bank | 19

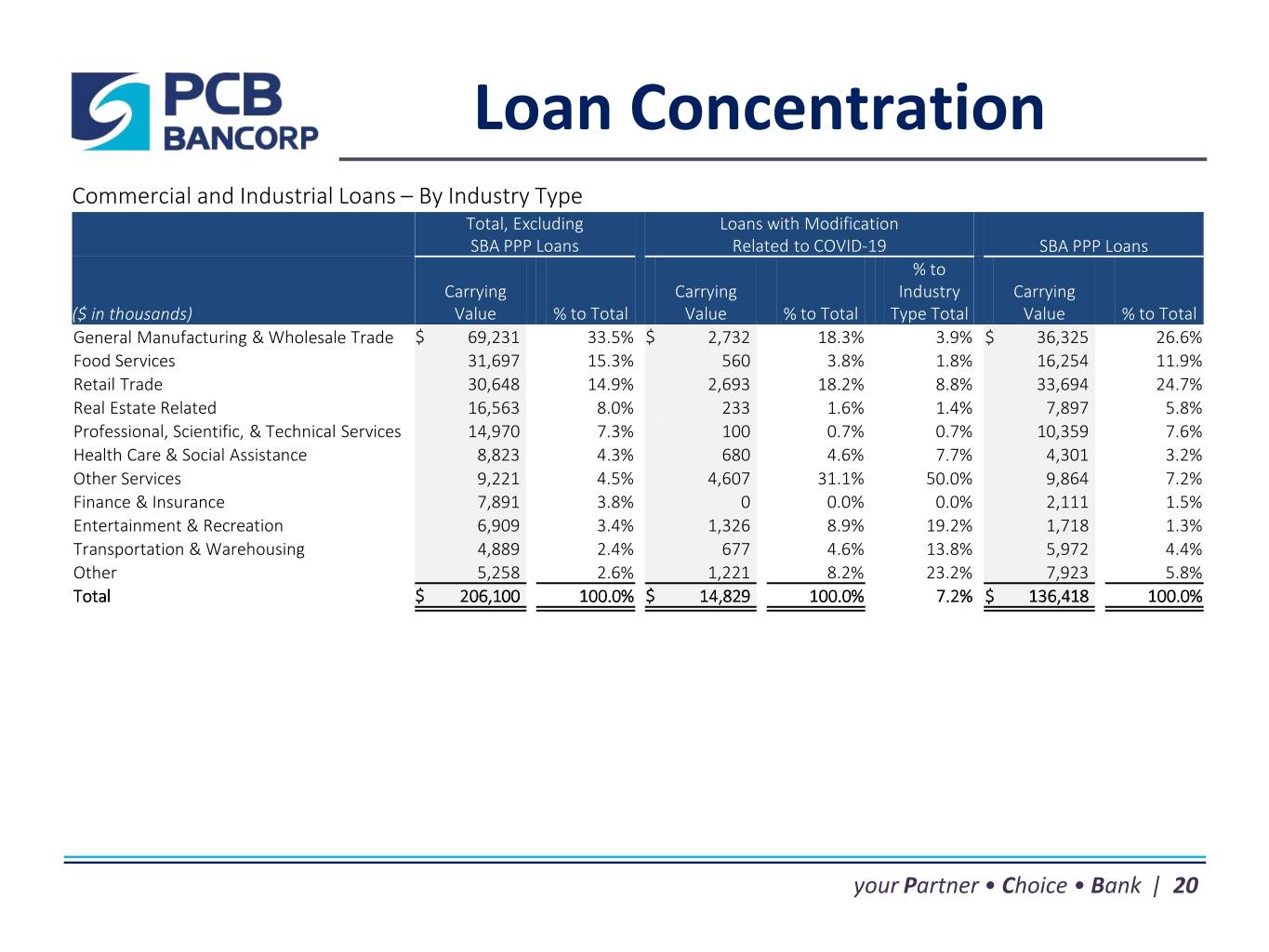

Loan Concentration Commercial and Industrial Loans – By Industry Type Total, Excluding Loans with Modification SBA PPP Loans Related to COVID-19 SBA PPP Loans % to Carrying Carrying Industry Carrying ($ in thousands) Value % to Total Value % to Total Type Total Value % to Total General Manufacturing & Wholesale Trade $ 69,231 33.5% $ 2,732 18.3% 3.9% $ 36,325 26.6% Food Services 31,697 15.3% 560 3.8% 1.8% 16,254 11.9% Retail Trade 30,648 14.9% 2,693 18.2% 8.8% 33,694 24.7% Real Estate Related 16,563 8.0% 233 1.6% 1.4% 7,897 5.8% Professional, Scientific, & Technical Services 14,970 7.3% 100 0.7% 0.7% 10,359 7.6% Health Care & Social Assistance 8,823 4.3% 680 4.6% 7.7% 4,301 3.2% Other Services 9,221 4.5% 4,607 31.1% 50.0% 9,864 7.2% Finance & Insurance 7,891 3.8% 0 0.0% 0.0% 2,111 1.5% Entertainment & Recreation 6,909 3.4% 1,326 8.9% 19.2% 1,718 1.3% Transportation & Warehousing 4,889 2.4% 677 4.6% 13.8% 5,972 4.4% Other 5,258 2.6% 1,221 8.2% 23.2% 7,923 5.8% Total $ 206,100 100.0% $ 14,829 100.0% 7.2% $ 136,418 100.0% your Partner • Choice • Bank | 20

Loan Concentration Geographic Concentration Commercial & Industrial, Real Estate - Commercial Real Estate – Residential Excluding SBA PPP SBA PPP Carrying Carrying Carrying Carrying ($ in thousands) Value % to Total Value % to Total Value % to Total Value % to Total California $ 833,879 83.4% $ 207,325 97.4% $ 170,824 82.7% $ 105,284 77.1% New Jersey 34,420 3.4% 5,479 2.6% 10,972 5.3% 8,221 6.0% New York 37,570 3.8% 0 0% 9,797 4.8% 6,001 4.4% Washington 33,173 3.3% 0 0% 575 0.3% 1,480 1.1% Texas 17,522 1.7% 0 0% 4,244 2.1% 2,610 1.9% Nevada 13,083 1.3% 0 0% 1,309 0.6% 2,803 2.1% Georgia 4,264 0.4% 0 0% 1,321 0.6% 2,834 2.1% Illinois 3,083 0.3% 0 0% 1,554 0.8% 1,225 0.9% Colorado 4,335 0.4% 0 0% 724 0.4% 175 0.1% Virginia 3,455 0.3% 0 0% 249 0.1% 799 0.6% Maryland 1,862 0.2% 0 0% 1,495 0.7% 854 0.6% Oregon 2,491 0.2% 0 0% 174 0.1% 376 0.3% Pennsylvania 2,820 0.3% 0 0% 18 0.1% 35 0.1% Other 9,592 1.0% 0 0% 2,844 1.4% 3,721 2.7% Total $ 1,001,549 100.0% $ 212,804 100.0% $ 206,100 100.0% $ 136,418 100.0% your Partner • Choice • Bank | 21

Credit Quality vs. Peers(1) NPAs / (Total Loans + OREO)(2) Classified Assets to Total Assets(3) September 30, 2020 September 30, 2020 1.40% Peer Data as of June 30, 2020 Peer Data as of June 30, 2020 2.00% 1.21% 1.87% 1.20% 1.80% 1.04% 1.60% 1.51% 1.00% 1.40% 0.80% 0.74% 1.20% 0.63% 1.00% 0.60% 0.48% 0.80% 0.74% 0.40% 0.60% 0.25% 0.40% 0.26% 0.20% 0.17% 0.15% 0.22% 0.07% 0.20% 0.00% 0.00% Hanmi Hope Peer Woori CBB PCB Shinhan US Open Hope Hanmi CBB PCB Open Group America America Metro $1 to $3BN (1) Korean-American banks operating in Southern California your Partner • Choice • Bank | 22 (2) Source: UBPR (3) Source: 10Q or press release concerning financial performance

Deposit Overview Deposit Trend Deposit Composition ($ in millions) September 30, 2020 Internet Time Deposits YoY +15.0% Retail Time Deposits 1,800 2% Retail Other Interest- 29% $1,647 $1,647 Bearing State and Brokered 1,600 23% Deposits $1,479 $1,477 Noninterest $1,444 $1,448 $1,447 $1,432 $172 $182 11% DDA $37 $32 1,400 $143 $158 $118 $123 $182 $175 35% $5 1,200 $518 $479 1,000 $658 $624 $539 $658 $664 $605 800 (1) $369 $378 Core Deposits ($ in millions) 600 $364 79% $331 $332 $332 78% 78% 75% 78% 77% 74% 76% 79% $314 $295 1,400 80% 400 1,300 70% 1,200 $576 60% $551 1,100 50% 200 $394 1,000 $329 $331 $340 $353 $360 40% 900 $1,305 $1,298 30% 800 $1,110 $1,120 $1,124 $1,103 $1,097 $1,126 - $1,081 20% 700 10% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 600 500 0% Noninterest DDA Retail Other Interest-Bearing Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Retail Time Deposits Internet Time Deposits State and Brokered Deposits Core Deposits % to Total Deposits (1) Core Deposits are not presented in accordance with U.S. generally accepted accounting principles your Partner • Choice • Bank | 23 (“GAAP”). See “Non-GAAP measure” for a reconciliation of this measure to its most comparable GAAP measure.

Maturity Schedule Time Deposits State and Brokered Retail Time Deposits Internet Time Deposits Time Deposits Total ($ in thousands) Amount WA Rate Amount WA Rate Amount WA Rate Amount WA Rate Less Than 3 Month $ 107,427 1.69% $ 6,950 0.71% $ 137,000 0.67% $ 251,377 1.11% 3 to 6 Month 170,194 1.58% 7,286 0.69% 15,000 0.55% 192,480 1.46% 6 to 9 Month 84,618 0.86% 17,616 0.73% 0 0.00% 102,234 0.84% 9 to 12 Month 101,333 0.65% 0 0.00% 0 0.00% 101,333 0.65% More than 12 Month 15,807 2.01% 0 0.00% 0 0.00% 15,807 2.01% Total $ 479,379 1.29% $ 31,852 0.72% $ 152,000 0.65% $ 663,231 1.12% FHLB Advances FHLB Advances ($ in thousands) Amount WA Rate Less Than 3 Month $ 50,000 0.26% 3 to 6 Month 40,000 0.59% 6 to 9 Month 30,000 0.32% 9 to 12 Month 0 0.00% More than 12 Month 10,000 2.07% Total $ 130,000 0.51% your Partner • Choice • Bank | 24

Profitability (1) 15.0 Net Income & PTPP Income Diluted EPS & Adjusted Diluted EPS(1) ($ in millions) 13.0 $0.61 $0.63 11.0 $10.0 $10.0 $0.60 $0.59 $0.60 $9.3 $9.8 $9.6 $0.57 $0.56 $8.6 $9.2 $0.51 9.0 $8.0 7.0 5.0 3.0 $6.7 $6.6 $6.6 $6.8 $0.41 $0.40 $0.40 $0.42 $4.2 $3.6 $3.4 $3.4 $0.26 $0.23 $0.22 $0.22 1.0 (1.0) 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Net Income PTPP Diluted EPS Adjusted Diluted EPS ROAA & Adjusted ROAA(1) ROAE & Adjusted ROAE(1) 25.00% 2.50% 2.37% 2.25% 2.32% 2.22% 2.18% 19.11% 20.00% 17.55% 17.76% 17.44% 2.00% 1.82% 1.76% 1.85% 16.93% 16.02% 14.28% 15.25% 15.00% 1.50% 10.00% 1.00% 1.60% 1.57% 1.52% 1.55% 12.92% 5.00% 12.43% 12.01% 12.02% 0.50% 0.96% 0.81% 0.69% 0.69% 7.25% 6.35% 5.98% 5.98% 0.00% 0.00% 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 ROAA Adjusted ROAA ROAE Adjusted ROAE (1) PTPP (Pre-Tax Pre-Provision) income, and adjusted EPS, ROAA and ROAE for PTPP are not presented in your Partner • Choice • Bank | 25 accordance with GAAP. See “Non-GAAP measure” for reconciliations of these measures to their most comparable GAAP measure.

Noninterest Income Noninterest Income Trend SBA Loan Sale Trend ($ in millions) ($ in millions) 10.7% 5.0 70% 9.1% 9.3% 65.00 7.4% 7.6% 9.0% 7.5% 6.2% 10.0% 62% 62% 55.00 5.0% 4.5 45.00 6.8% 8.0% 6.5% 0.0% 60% 5.2% 5.3% 6.0% 5.3% 55% 35.00 4.0% -5.0% 4.0 51% 25.00 -10.0% 48% 15.00 $29.2 50% $26.2 $27.1 $27.1 3.5 46% $21.2 $22.2 -15.0% 5.00 $11.7 $8.6 $0.8 -5.00 -20.0% 3.0 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 40% SBA Loan Sold $ Premium % Gain % 2.5 36% 36% $1.9 $1.5 30% (1) 2.0 $1.5 $1.4 SBA 7(a) Loan Production $1.1 $0.8 $1.0 $0.7 45.00 ($ in millions) 1.5 20% 40.00 35.00 1.0 30.00 10% $1.5 25.00 $1.3 $1.3 $1.4 $1.3 $1.4 0.5 $1.2 $1.2 20.00 $40.1 $35.1 $37.9 15.00 $26.9 $30.6 0.0 0% 10.00 $22.2 5.00 $14.5 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 $10.7 0.00 Gain on Sale of AFS Securities Gain on Sale of Loans 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 All Other Income Gain % to Total (1) Total commitment basis your Partner • Choice • Bank | 26

Noninterest Expense Noninterest Expense Trend Efficiency Ratio(2) ($ in millions) 64.1% 70.00% 61.8% 62.4% 62.5% 61.9% 62.1% 61.1% 16.0 60.00% 3.00% 50.00% 40.00% 14.0 2.52% 2.48% 2.43% 2.43% 2.40% 30.00% 2.39% 2.50% 50.4% 52.6% 53.0% 53.0% 50.7% 56.8% 53.0% 51.7% 20.00% 12.0 10.00% 1.98% 1.99% 0.00% 2.00% 10.0 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 $4.4 $3.9 PCB Peer Average $3.7 $4.0 8.0 $3.9 $4.3 $3.5 $3.9 1.50% 6.0 Number of FTE Employees 1.00% 260 258 4.0 256 $6.9 254 $6.2 $6.6 $6.6 $6.0 $6.6 $6.4 $5.8 0.50% 252 2.0 250 259 248 255 246 252 252 - 0.00% 251 244 249 247 248 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 242 240 Compensation All Other Expenses Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 (1) % to Average Total Assets (1) Annualized your Partner • Choice • Bank | 27 (2) Source: Peer $1 to $3 billion per UBPR

Net Interest Margin Yield & Cost(1) 7.00% 6.39% 6.34% 6.33% 6.22% 5.85% 6.00% 5.64% 4.81% 5.00% 4.73% 4.33% 4.22% 4.17% 4.11% 3.96% 3.85% 4.00% 3.43% 3.22% 3.00% 2.06% 2.17% 2.13% 1.89% 1.99% 2.00% 1.77% 1.17% 1.69% 1.62% 1.64% 1.53% 0.92% 1.00% 1.47% 1.34% 0.85% 0.63% 0.00% 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Loan Yield NIM Cost of Int-Bearing Liab Cost of Funds (1) Annualized your Partner • Choice • Bank | 28

Capital Ratios & BV Per Share Bank Regulatory Capital Ratios 15.50 BV Per Share 18.00% September 30, 2020 15.00 14.50 16.00% 14.00 13.50 14.00% $14.91 $14.58 $14.78 $14.30 $14.44 13.00 $13.98 $13.57 12.00% 12.50 $13.16 12.00 10.00% Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 8.00% 16.60% 15.34% 15.34% Total Equity to Total Assets (1) 13.50% 6.00% 11.21% 13.00% 10.00% 12.50% 4.00% 8.00% 6.50% 12.00% 5.00% 2.00% 11.50% 13.22% 12.94% 12.99% 12.39% 12.64% 12.45% 11.00% 0.00% 11.35% 10.50% 11.24% Tier 1 Leverage CET 1 Capital Tier 1 Capital Total Capital 10.00% Actual Minimum Requirement For Well-Capitalized Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 (1) The Company did not have any intangible equity components for the presented periods. your Partner • Choice • Bank | 29

Non-GAAP Measures Core Deposits Core Deposits are a non-GAAP measure that we use to measure the portion of our total deposits that are thought to be more stable, lower cost and reprice less frequently on average in a rising rate environment. We calculate core deposits as total deposits less time deposits greater than $250,000 and brokered deposits. Management tracks its core deposits because management believes it is a useful measure to help assess the Company’s deposit base and, among other things, potential volatility therein. Pre-Tax Pre-Provision Income, and Adjusted ROAA, ROAE and Diluted EPS for PTPP PTPP income, and adjusted ROAA, ROAE and Diluted EPS are non-GAAP measures that we use to measure the Company’s performance and believe these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. We calculated PTPP income as net income excluding income tax provision and provision for loan losses. Management believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently your Partner • Choice • Bank | 30

Non-GAAP Measures The following table reconciles core deposits to total deposits to its most comparable GAAP measure: ($ in thousands) 12/31/18 03/31/19 06/30/19 09/30/19 12/31/19 03/31/20 06/30/20 09/30/20 Total Deposits $ 1,443,753 $ 1,447,758 $ 1,446,526 $ 1,432,262 $ 1,479,307 $ 1,477,442 $ 1,646,930 $ 1,647,107 Less: Time Deposits Greater Than $250K (281,239) (329,693) (284,780) (296,785) (289,726) (266,970) (260,180) (257,208) Less: Brokered Deposits (42,500) (37,510) (27,510) (32,503) (92,393) (84,506) (82,010) (92,001) Core Deposits $ 1,120,014 $ 1,080,555 $ 1,124,236 $ 1,102,974 $ 1,097,188 $ 1,125,966 $ 1,304,740 $ 1,297,898 Core Deposits to Total Deposits 77.6% 74.6% 77.7% 77.0% 74.2% 76.2% 79.2% 78.8% your Partner • Choice • Bank | 31

Non-GAAP Measures The following table reconciles PTPP income, and adjusted ROAA, ROAE and diluted EPS for PTPP to their most comparable GAAP measures: ($ in thousands) 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Net Income (a)$ 6,732 $ 6,564 $ 6,601 $ 6,785 $ 4,158 $ 3,572 $ 3,367 $ 3,449 Add: Provision for Loan Losses 294 (85) 394 (102) 4,030 2,896 3,855 4,326 Add: Income Tax Provision 2,934 2,794 2,767 2,871 1,811 1,557 1,363 1,464 PTPP Income (Non-GAAP) (b)$ 9,960 $ 9,273 $ 9,762 $ 9,554 $ 9,999 $ 8,025 $ 8,585 $ 9,239 Average Total Assets (c)$ 1,669,770 $ 1,690,349 $ 1,742,584 $ 1,734,957 $ 1,710,370 $ 1,770,785 $ 1,956,464 $ 1,991,614 ROAA (1) (a)/(c) 1.60% 1.57% 1.52% 1.55% 0.96% 0.81% 0.69% 0.69% Adjusted ROAA (Non-GAAP)(1) (b)/(c) 2.37% 2.22% 2.25% 2.18% 2.32% 1.82% 1.76% 1.85% Average Total Shareholders' Equity (d)$ 206,740 $ 214,234 $ 220,486 $ 223,932 $ 227,472 $ 226,086 $ 226,454 $ 229,463 ROAE (1) (a)/(d) 12.92% 12.43% 12.01% 12.02% 7.25% 6.35% 5.98% 5.98% Adjusted ROAE (Non-GAAP)(1) (b)/(d) 19.11% 17.55% 17.76% 16.93% 17.44% 14.28% 15.25% 16.02% Net Income $ 6,732 $ 6,564 $ 6,601 $ 6,785 $ 4,158 $ 3,572 $ 3,367 $ 3,449 Less: Income Allocated to Participating Securities 0 0 0 0 (10) (9) (8) (8) Net Income Allocated to Common Stock (e) 6,732 6,564 6,601 6,785 4,148 3,563 3,359 3,441 Add: Provision for Loan Losses 294 (85) 394 (102) 4,030 2,896 3,855 4,326 Add: Income Tax Provision 2,934 2,794 2,767 2,871 1,811 1,557 1,363 1,464 PTPP Income Allocated to Common Stock (f)$ 9,960 $ 9,273 $ 9,762 $ 9,554 $ 9,989 $ 8,016 $ 8,577 $ 9,231 WA common shares outstanding, diluted (g) 16,244,837 16,271,269 16,330,039 16,099,598 15,948,793 15,700,144 15,373,655 15,377,531 Diluted EPS (e)/(g)$ 0.41 $ 0.40 $ 0.40 $ 0.42 $ 0.26 $ 0.23 $ 0.22 $ 0.22 Adjusted Diluted EPS (Non-GAAP) (f)/(g)$ 0.61 $ 0.57 $ 0.60 $ 0.59 $ 0.63 $ 0.51 $ 0.56 $ 0.60 (1) Annualized. your Partner • Choice • Bank | 32