Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICOLD REALTY TRUST | art-20201116.htm |

INVESTOR PRESENTATION Winter 2020

Disclaimer This presentation contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; general economic conditions; uncertainties and risks related to natural disasters, global climate change and public health crises, including the recent and ongoing COVID-19 pandemic; risks associated with the ownership of real estate and temperature-controlled warehouses in particular; defaults or non-renewals of contracts with customers; potential bankruptcy or insolvency of our customers; or the inability of our customers to otherwise perform under their contracts, including as a result of the recent and ongoing COVID-19 pandemic; uncertainty of revenues, given the nature of our customer contracts; increased interest rates and operating costs, including as a result of the recent and ongoing COVID-19 pandemic; our failure to obtain necessary outside financing; risks related to, or restrictions contained in, our debt financings; decreased storage rates or increased vacancy rates; risks related to current and potential international operations and properties; our failure to realize the intended benefits from our recent acquisitions, including synergies, or disruptions to our plans and operations or unknown or contingent liabilities related to our recent acquisitions; our failure to successfully integrate and operate acquired or developed properties or businesses, including but not limited to: AM-C Warehouses, Caspers Cold Storage & Distribution, Cloverleaf Cold Storage, Lanier Cold Storage, MHW Group Inc., Nova Cold Logistics, Newport Cold Storage, PortFresh Holdings, LLC, and Hall’s Warehouse; acquisition risks, including the failure of such acquisitions to perform in accordance with projections; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns within expected time frames, or at all, in respect thereof; difficulties in expanding our operations into new markets, including international markets; risks related to the partial ownership of properties, including as a result of our lack of control over such investments and the failure of such entities to perform in accordance with projections; our failure to maintain our status as a REIT; our operating partnership’s failure to qualify as a partnership for federal income tax purposes; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; financial market fluctuations; actions by our competitors and their increasing ability to compete with us; labor and power costs; changes in real estate and zoning laws and increases in real property tax rates; the competitive environment in which we operate; our relationship with our employees, including the occurrence of any work stoppages or any disputes under our collective bargaining agreements and employee related litigation; liabilities as a result of our participation in multi-employer pension plans; losses in excess of our insurance coverage; the cost and time requirements as a result of our operation as a publicly traded REIT; changes in foreign currency exchange rates; the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our shareholders to replace our trustees and affect the price of our common shares of beneficial interest, $0.01 par value per share, or our common shares; the potential dilutive effect of our common share offerings; and risks related to any forward sale agreement, including the various forward sale agreements that we have entered into since September 2018, including substantial dilution to our earnings per share or substantial cash payment obligations. Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near- term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements included in this presentation include, among others, statements about our expected expansion and development pipeline and our targeted return on invested capital on expansion and development opportunities. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, in our Quarterly Report for the quarter ended March 31, 2020, in our Form 8-K filed on April 16, 2020, in our Form 8-K filed on October 13, 2020 and our other reports filed with the Securities and Exchange Commission, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Key Investment Highlights Important First Mover Global Market Leader Infrastructure Supported Strong and Stable Food Advantage as the Only with Integrated Network by Best-in-Class IT and Industry Fundamentals Publicly Traded REIT of Strategically-Located, Operating Platforms Drive Growing Demand Focused on Temperature- High-Quality, “Mission- Provides a Significant for Our Business Controlled Warehouses Critical” Warehouses Competitive Advantage Experienced Substantial Internal and Management Team, External Growth Investment Grade, Alignment of Interest and Opportunities Expected Flexible Balance Sheet Best-In-Class Corporate to Drive Attractive Positioned for Growth Governance Risk-Adjusted Returns 1

Company Snapshot World’s largest publicly traded REIT focused on the ownership, operation, development and acquisition of temperature-controlled warehouses Portfolio Overview Warehouses Ownership Total Average Countries of Estimate of U.S. Number of Number of Type Capacity Facility Size Operation Market Share Customers Pallet Positions 185 150 owned (1), 1.1bn cubic feet 6.1mm cubic U.S., Australia, 18% (2) ~2,600 ~4.0mm 25 capital / / 38mm square feet / 204K New Zealand, operating leased, 10 feet square feet Argentina, managed Canada and Brazil Financial Highlights LTM 9/30/20 Segment Breakdown (5) (3) $9.6bn Total Enterprise Value Revenue Contribution / NOI (6) Equity Market Cap (3) Warehouse $7.7bn Warehouse 94% LTM 9/30/20 $428.2mn LTM PF Core EBITDA 78% LTM 9/30/20 TOTAL TOTAL CONTRIBUTION REVENUE 14% (NOI) Third-Party $1,943mm $536mm 3Q20 Annualized Dividend per Share Managed $0.84 3% 7% 3% Third-Party Managed (4) Transportation 3.6% / 6.5% YTD 3Q20 SS Revenue / NOI Growth Rate Transportation Note: Figures as of September 30, 2020, unless otherwise indicated. Includes acquisitions of AM-C Warehouses and Caspers Cold Storage; excludes acquisitions of Agro Merchants Group and Halls Warehouse Corp. (1) Includes seven ground leased assets (2) 2020 IARW North American Top 25 List (June 2020), per GCCA website. U.S. only. Capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020) 2 (3) Based on COLD share price as of November 13, 2020 (4) Same store revenue and NOI growth rates on a constant currency basis (5) Excludes quarry business (6) Segment contribution refers to segment’s revenues less segment specific operating expenses (excludes any depreciation, depletion and amortization, impairment charges and corporate level SG&A). Contribution for our warehouse segment equates to net operating income (“NOI”)

Largest Fully Integrated Network of Temperature-Controlled Warehouses An indispensable component of food infrastructure from “farm to fork" e-Commerce Fulfillment Delhi, LA LaPorte, TX Atlanta, GA Farm Phoenix, AZ Fork Production Public Distribution Retail Distribution Advantaged Warehouse Center Center Supermarket Warehouse Food Producers Americold Realty Trust Food Distribution + Retailers Gouldsboro Distribution Center Gouldsboro, PA 3

Integrated Operations Overview Real estate value is driven by the critical nature of our infrastructure, strategic locations and integrated, full-service strategy Segment Overview Select Customers % of Contribution (1) . Mission-critical, temperature-controlled real estate infrastructure generates rent and storage income . Comprehensive value-add services Warehouse NOI . Strategic locations, network breadth, scale, reliable temperature integrity and best-in-class customer IT interface distinguish our warehouses from our competitors 94% Warehouse Third-Party (Storage and Handling) (Storage Managed Transportation Tradewater Distribution Facility – Atlanta, GA Warehouse . Management of customer-owned warehouses Party . Warehouse management services provided at customer- - owned facilities 3% Managed Third-Party Third . Operating costs passed through to customers Managed . Asset-light consolidation, management and brokerage services . Complements warehouse segment . Enhances customer retention and drives warehouse storage 3% and occupancy . Supplementary offering that improves supply chain efficiency Transportation Transportation and reduces cost by leveraging Americold’s scale 4 (1) LTM figures as of September 30, 2020 and excludes the quarry business segment

Strategically Located, “Mission-Critical” Temperature-Controlled Warehouses Strategic locations and extensive geographic presence provide an integrated warehouse network that is fundamental to customers’ ability to optimize their distribution networks Australia Argentina Distribution Public Production Advantaged New Zealand Facility Leased Third-Party Managed United States Canada AustraliaAustralia (1)(1) NewNew Zealand Zealand Argentina # of Facilities 164 6 6 7 2 Square Feet (000s) 34,614 1,282 1,201 516 216 Cubic Feet (mm) 1,006.3 39.8 47.6 20.4 9.7 5 Note: Americold portfolio figures as of September 30, 2020. Excludes 15% interest in Brazilian joint-venture (1) Figures include ambient facility, except for cubic feet metric

A Global Market Leader in Temperature-Controlled Warehousing Our position as a global market leader allows us to realize economies of scale, reduce operating costs and lower our overall cost of capital. Ideally positioned to compete for customers and external growth opportunities U.S. Market (1) Global Market (2) Rank Company Market Share Cubic Ft (mm) Rank Company Market Share Cubic Ft (mm) 1 Lineage Logistics 25.2% 1,392 1 Lineage Logistics 7.0% 1,789 2 18.2% 1,006 2 4.4% (3) 1,120 (3) 3 US Cold Storage, Inc. 6.8% 374 3 US Cold Storage, Inc. 1.5% 374 4 AGRO Merchants Group (4) 2.2% 119 4 AGRO Merchants Group (4) 1.0% 242 NewCold Advanced Cold Interstate Warehousing, Inc. 5 2.1% 116 5 Logistics 0.8% 195 6 Burris Logistics 1.4% 75 6 Nichirei Logistics Group, Inc. 0.7% 183 NewCold Advanced Cold Kloosterboer B.V. 7 Logistics 0.9% 48 7 0.7% 171 8 Hanson Logistics 0.8% 44 8 VersaCold Logistics Services 0.5% 123 9 Holt Logistics Corp. 0.6% 35 9 Interstate Warehousing, Inc. 0.5% 116 10 MTC Logistics 0.5% 25 10 Frialsa Frigorificos 0.4% 106 TOTAL (5) 58.6% 3,234 TOTAL (5) 17.4% 4,409 Note: Americold portfolio figures provided by the Company as of September 30, 2020. Figures may not sum due to rounding (1) 2020 IARW North American Top 25 List (June 2020), per GCCA website. U.S. only. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020) (2) 2020 IARW Global Top 25 List (July 2020), per GCCA website. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020) 6 (3) Figures do not include Americold’s SuperFrio JV investment in Brazil (4) Americold’s acquisition of Agro Merchants Group expected to close year-end 2020 (5) The remaining 41.4% and 82.6% of the U.S. and global markets consist of ~2.3bn cubic feet and ~20.1bn cubic feet, respectively

Highly Diversified Business Model Produces Stable Cash Flows Diversification helps reduce revenue volatility associated with seasonality and changing commodity trends Pro Forma Commodity (1) Pro Forma Global Geographic Diversity (1) Global Warehouse U.S. Warehouse Potatoes Argentina United Southeast Pork Canada States Central <1% 27% Dairy New 2% 28% 8% Other Zealand 2% 7% LTM 9/30/20 LTM 9/30/20 8% Australia 11% WAREHOUSE TOTAL U.S. REVENUE 85% WAREHOUSE 7% REVENUE Fruits & 21% 6% Vegetables 24% West Poultry 15% LTM 9/30/20 East Bakery WAREHOUSE 3% REVENUE 3% Beef 2% (1) 2% Distributors ⁽⁴⁾ Pro Forma Warehouse Type Seafood 17% Distribution Distribution Production 22% Production Advantaged Advantaged Packaged Foods ⁽³⁾ 24% Retail ⁽²⁾ 29% LTM 9/30/20 LTM 9/30/20 WAREHOUSE 50% WAREHOUSE REVENUE CONTRIBUTION 54% (NOI) ~78% of Revenue from Food Manufacturers 21% Public and ~22% from Retailers Warehouse 20% 1% 1% Public Warehouse Facility Leased Facility Leased Note: Figures may not sum due to rounding. (1) Diversification based on warehouse segment revenues for the twelve months ended September 30, 2020 7 (2) Retail reflects a broad variety of product types from retail customers (3) Packaged food reflects a broad variety of temperature-controlled meals and foodstuffs (4) Distributors reflects a broad variety of product types from distribution customers

Long Standing Relationships with Top 25 Customers Scope and scale of network coupled with long-standing relationships position us to grow market share organically and through acquisitions Representative Food Producers / CPG Companies (1) Top 25 Customers Have been with Americold for an average of 30+ years 12 customers are investment grade (2) 100% utilize multiple facilities 100% utilize technology integration 92% utilize value-add services Representative Retailers / Distributors (1) 88% utilize committed contracts or leases 60% are in fully dedicated sites 48% utilize transportation and consolidation services 25 largest customers account for approximately 57% (3) of warehouse revenues, with no customer generating more than 8% (3) of revenues 8 (1) Not all customers shown are in COLD’s top 25 largest customers in the warehouse segment (2) Represents long-term issuer ratings as of 3Q20 (3) Based on LTM warehouse revenues as of September 30, 2020. Figures pro forma for the acquisition of MHW Group, including 10.5 months of COLD ownership and 1.5 months of prior ownership, the acquisition of Nova Cold Logistics and Newport Cold Storage, including 9 months of COLD ownership and 3 months of prior ownership and the acquisition of Caspers and AM-C Warehouse, including 1 month of COLD ownership and the 11 months of prior ownership

Economic Occupancy Driving Improved Returns Implementation of our standard underwriting procedures has contributed to consistent occupancy growth over the last three years Economic Occupancy Network Average Economic & Physical Occupancy Trend . Significantly increased fixed commitment contracts in our portfolio 1Q 2Q 3Q 4Q Annual . Economic occupancy reflects the aggregate number of physically 84%83% 80% 81% 81% 80%80% occupied pallets and any additional pallets otherwise contractually 79% 77%77% 78% 79%77% 81%82% 81% 80% committed for a given period, without duplication 78%76% 76% 76% 77%77% 77% 76%78% 77% 76% 75% 75% 74% 74%73% 75% 71% 70% Physical Occupancy . Typical optimal physical occupancy is ~85% to maximize four-wall cash flow / NOI o Varies based on several factors, including intended customer base, throughput maximization, seasonality and leased but unoccupied pallets '16'17'18'19'20 16 '17'18'19'20 '16 17 '18'19'20 '16'17 18 '19 '16'17'18 19 Note: Dotted lines represent incremental average economic occupancy percentage Illustrative Economic Occupancy (1) 10,000 Warehouse Pallets 9,000 8,800 X Currently 9,000 X X X X Economic Occupancy: 8,500 8,500 Occupied 8,300 8,300 7,850 Contractually 8,000 Reserved Pallets 7,600 X X 7,350 7,100 7,000 7,000 7,000 6,800 X X Physical Occupancy 6,000 X X X X 5,000 January February March April May June July August September October November December 9 (1) Example assumes 10,000 pallet positions and is for illustrative purposes only

Growing Committed Revenue in Warehouse Portfolio Significant improvement transitioning from as-utilized, on demand contracts to fixed storage committed contracts and leases . Fixed storage committed contracts and leases currently Rent & Storage Warehouse Revenue $0.64bn $0.66bn $0.67bn represent: $0.61bn $0.61bn $0.62bn $0.51bn $0.51bn $0.52bn o 42% of warehouse rent and storage revenues (1) and 59% 60% 59% 57% 62% 60% 60% 58% 57% o 47% of total warehouse segment revenues (2) 38% 40% 41% 40% 41% . 6-year weighted average stated term (3) 40% 42% 43% 43% 3Q18 4Q18 1Q19 2Q19 ⁽⁴⁾ 3Q19 ⁽⁴⁾ 4Q19 ⁽⁴⁾ 1Q20 ⁽⁴⁾ 2Q20 ⁽⁴⁾ 3Q20 ⁽⁴⁾ . 3-year weighted average remaining term (3) Other Rent & Storage Revenue Annualized Committed Rent & Storage Revenue (1) . As of September 30, 2020, we had entered into at least Total Warehouse Segment Revenue one fixed commitment contract or lease with 22 of our top $1.51bn $1.52bn $1.54bn 25 warehouse customers $1.43bn $1.44bn $1.47bn $1.17bn $1.17bn $1.18bn 54% 55% 55% . The scope and breadth of our network positions us to 51% 55% 55% continue to increase our fixed storage commitments 56% 56% 55% . Our recent acquisitions have a lower percentage of fixed 49% 45% 45% 46% 45% 45% 44% 44% 45% commitment contracts as a percent of rent and storage revenue. We view this as an opportunity as we bring these 3Q18 4Q18 1Q19 2Q19 ⁽⁴⁾ 3Q19 ⁽⁴⁾ 4Q19 ⁽⁴⁾ 1Q20 ⁽⁴⁾ 2Q20 ⁽⁴⁾ 3Q20 ⁽⁴⁾ acquisitions onto Americold’s commercialization standards Other Warehouse Segment Revenue Warehouse Segment Revenue Generated by Fixed Commitment Contracts or Leases (2) (1) Based on the annual committed rent and storage revenues attributable to fixed storage commitment contracts and leases as of September 30, 2020 (2) Based on total warehouse segment revenue generated by contracts with fixed storage commitments and leases for the quarter ended September 30, 2020 10 (3) Represents weighted average term for contracts featuring fixed storage commitments and leases as of September 30, 2020 (4) Figures pro forma for the acquisition of MHW Group, including 10.5 months of COLD ownership and 1.5 months of prior ownership, the acquisition of Nova Cold Logistics and Newport Cold Storage, including 9 months of COLD ownership and 3 months of prior ownership and the acquisition of Caspers and AM-C Warehouse, including 1 month of COLD ownership and the 11 months of prior ownership

Warehouse Financial Summary Warehouse Revenue ($mm) 2015A – LTM 9/30/20 CAGR $1,525 Constant $1,377 Actual $ Currency (1) $1,146 $1,177 $1,057 $1,081 $875 Warehouse $795 8.7% 9.3% $662 Services $588 $604 $644 Rent & $650 7.1% 8.0% $469 $477 $502 $515 $583 Storage 2015A 2016A 2017A 2018A 2019A LTM 9/30/20 Total 8.0% 8.7% Rent & Storage Warehouse Services Warehouse NOI ($mm) Contribution (NOI) 29.1% 29.1% 30.4% 31.8% 32.5% 33.1% 2015A – LTM 9/30/20 CAGR Margin Constant $504 Actual $ Currency (1) $448 $76 $375 $61 Warehouse $348 42.8% 40.2% $308 $314 $24 $37 Services $14 $11 $428 Rent & $387 8.3% 9.0% $338 $294 $303 $324 Storage Total 11.0% 11.3% 2015A 2016A 2017A 2018A 2019A LTM 9/30/20 Rent & Storage Warehouse Services Margin expansion has been driven by improved commercialization and customer mix, contractual rate increases, occupancy growth and operational improvements 11 (1) On a constant currency basis relative to fiscal year 2015 foreign currency exchange rates

Substantially All Warehouse NOI Driven by Rental & Storage Revenue + = Rent & Storage Warehouse Services Total Warehouse Commentary REIT: Rent & Storage $0.43 $0.57 $1.00 TRS: Warehouse Services Revenues Power ($0.06) – ($0.06) Power and utilities Other Real Estate Related Costs: facility Facility ($0.09) – ($0.09) maintenance, property taxes, insurance, Costs rent, security, sanitation, etc. Direct labor, overtime, contract labor, Expenses Labor – ($0.44) ($0.44) indirect labor, workers’ compensation and benefits Other MHE (1), warehouse operations Services – ($0.08) ($0.08) (pallets, shrink wrap, OS&D and D&D (2)) Costs PPE and warehouse administration $0.28 $0.05 $0.33 Margin: 66% 9% 33% NOI + = % WH Total: 85% 15% 100% 12 Note: Based on LTM warehouse segment as of September 30, 2020. Future results may vary. Figures may not sum due to rounding (1) Material Handling Equipment (2) OS&D and D&D refer to Over Short & Damaged and Detentioned & Demurrage, respectively

Positioned for Multiple Avenues of Growth Global warehouse network, operating systems, scalable information technology platform and economies of scale provide a significant advantage over competitors with respect to organic and external growth opportunities Organic Growth Opportunities Development and External Growth and Expansion Redevelopment Opportunities 9 Expand Presence 8 in Other Global Food Temperature Sensitive Products 7 Producers Outsourcing & in the Cold Chain Geographic 6 Sale-Leaseback Expansion Opportunities into New 5 Industry Markets Consolidation 4 Redevelopment & Existing Site Customer-Specific 3 Expansion Build-to-Suit Operational & Market-Driven 2 Efficiencies Development & Cost 1 Underwriting Containment & Contract Rate Standardization Escalations / Occupancy Signifies COLD has and continues to capitalize on growth opportunities Increases 13

Organic Growth Initiatives Have Driven Same Store Growth Same store performance is the culmination of replacing legacy customer agreements with new contracts implementing our Commercial Business Rules, active asset management and leveraging integrated network, scale and market position Same Store Warehouse Revenue Growth Total Same Store Warehouse NOI Growth Expected to range between 2% – 4% on a constant currency basis Expected to range 100 – 200 bps higher than associated SS revenue Actual $ Actual $ 1.6% 3.2% 6.1% 2.9% 1.9% 3.1% 3.2% 2.1% 9.8% 6.9% 3.9% 5.8% Growth % Growth % 9.5% 5.8% 7.4% 4.9% 6.5% 4.1% 6.1% 3.9% 3.5% 3.6% 5.1% Constant Constant Currency $ Currency $ 2.9% Growth % Growth % 2015 2016 2017 2018 2019 YTD'20 2015 2016 2017 2018 2019 YTD'20 YTD Same Store Portfolio Same Store NOI Margin Non-Same 3% Legacy COLD Same Store 65.5% 66.2% 67.0% 66.1% Store Acquired Non-Same Store 63.0% 64.5% SS Rent & Legacy COLD Non-Same Store 6 Storage 19% 33.2% 34 TOTAL COLD 29.5% 29.8% 30.9% 32.1% 32.6% Total SS WAREHOUSE Warehouse FACILITIES 8.1% 175 4.0% 5.8% 6.9% 135 Same Store 2.5% 2.0% SS Warehouse 77% Services 2015 2016 2017 2018 2019 YTD'20 14 Note: Figures as of September 30, 2020, unless otherwise indicated Note: Constant currency growth represents year-over-year growth based on the same foreign exchange rates relative to the comparable prior year period Note: NOI growth represents year-over-year growth to the comparable prior period

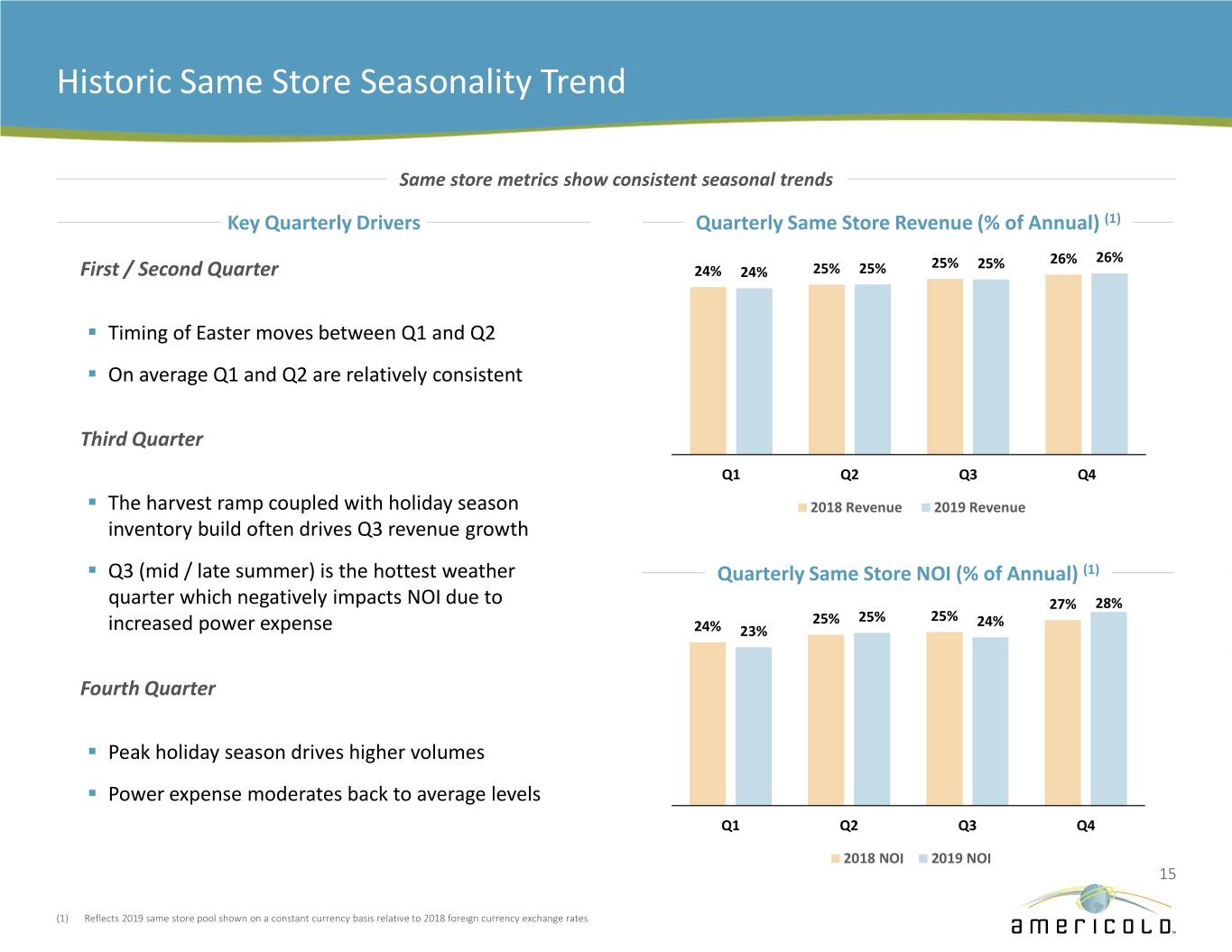

Historic Same Store Seasonality Trend Same store metrics show consistent seasonal trends Key Quarterly Drivers Quarterly Same Store Revenue (% of Annual) (1) 25% 25% 26% 26% First / Second Quarter 24% 24% 25% 25% . Timing of Easter moves between Q1 and Q2 . On average Q1 and Q2 are relatively consistent Third Quarter Q1 Q2 Q3 Q4 . The harvest ramp coupled with holiday season 2018 Revenue 2019 Revenue inventory build often drives Q3 revenue growth . Q3 (mid / late summer) is the hottest weather Quarterly Same Store NOI (% of Annual) (1) quarter which negatively impacts NOI due to 27% 28% 25% 25% 25% 24% increased power expense 24% 23% Fourth Quarter . Peak holiday season drives higher volumes . Power expense moderates back to average levels Q1 Q2 Q3 Q4 2018 NOI 2019 NOI 15 (1) Reflects 2019 same store pool shown on a constant currency basis relative to 2018 foreign currency exchange rates

Growth Strategy – Expansion and Development Middleboro, MA Chesapeake, VA Completed 44.1mm Cu Ft Incurred Cost Rochelle, IL North Little Rock, AR Since 2018 ~$237mm Columbus, OH Savannah, GA ~147,000 Pallets Expansion and Development Opportunities (1) Total Estimated Costs ⁽²⁾ Under Atlanta, GA Plainville, CT 61.4mm Cu Ft Construction Auckland, New Zealand Lancaster, PA ~$620mm ~195,000 Pallets 6 Expansions Russellville, AR Calgary, Canada Current Expansion and Estimated Investment $1bn+ Development Includes both customer-specific Pipeline (3) and market-demand Existing Sites Expansion Customer- Market- 760+ acres of excess for Future Opportunities developable land Specific Demand + Expansion In current portfolio Expect to initiate on average 2 to 3 expansion / development opportunities annually, with aggregate invested capital of $75 million to $200 million 16 (1) As of September 30, 2020; no assurance can be given that the actual cost or completion dates of any expansions or developments will not exceed our estimate (2) Reflects management’s estimate of cost of completion as of September 30, 2020 (3) These future pipeline opportunities are at various stages of discussion and consideration and, based on historical experiences, many of them may not be pursued or completed as contemplated or at all

Acquisition of Agro Merchants Group The acquisition of Agro provides Americold with a strategic presence throughout Europe and complementary operations in other global geographies Transaction Overview . In October 2020, COLD announced the acquisition of Agro Merchants Group for ~$1.74bn at an in-place net entry NOI yield of ~6.3% – Agro represents a unique opportunity to acquire an institutional- quality global portfolio that facilitates COLD’s strategic entry into Europe and adds complementary locations in the US, South America and Australia Agro Merchants Valencia Valencia, Spain – Agro is the fourth largest temperature-controlled warehouse company globally, the third largest in Europe, and the fourth largest in the United States Agro at a Glance Total Facilities 46 (1) Countries 10 Refrigerated Cubic Feet ~236mm cubic feet (1) Customers 2,900+ 17 Note: Figures as of June 30, 2020 and do not include expansions and any potential new builds (1) Excludes Oakland, CA facility (discontinued) and 22.1% minority stake in Comfrio Soluções Logística, Brazil joint-venture

Acquisition of Hall’s Warehouse The acquisition of Hall’s strengthens Americold’s presence in the Northeastern U.S. Transaction Overview . In November 2020, COLD closed on the acquisition Hall’s Warehouse for ~$480mm at an in-place net entry NOI yield of ~6.3% . Leading integrated platform provides temperature controlled storage and logistics solutions for food manufacturers and retail customers – 8 distribution centers – Strategically located in the heart of the Northeast Corridor – All sites under 30 miles from the Port of Newark in Hall’s Warehouse New Jersey – All sites within 15 miles of each other – 30% of U.S. population within a day’s drive Hall’s at a Glance Location New Jersey Cubic Feet ~58mm cubic feet Pallet Positions ~200K pallet positions 18

Russellville, AR Expansion for Conagra Brands The Russellville highly automated expansion is an opportunity to provide mission critical, long-term infrastructure for a top tier strategic customer Transaction Overview . COLD is expanding its Russellville, Arkansas facility for a total of ~$84mm in a dedicated build for Conagra Brands – Construction expected to start in Q4 2020 and is expected to fully stabilize in Q1 2024 – Expected to generate stabilized NOI ROIC of ~10%-12% . Conagra Brands (NYSE: CAG) is one of North America’s leading branded food companies – CAG is a top tier strategic customer – COLD has served CAG for decades in multiple locations – CAG is rated BBB-/Baa3/BBB by S&P, Moody’s, Fitch (1) Expansion at a Glance Clear Height ~130 feet Cubic Feet ~13mm cubic feet Pallet Positions ~42K pallet positions 19 (1) Ratings as of November 13, 2020

Flexible Balance Sheet Positioned for Growth As of 09/30/2020, Pro Forma for Acquisition of Agro Merchants and Hall’s Real Estate Debt Maturity (1) Total Debt Profile % of Investment grade ratings: Baa3 (Moody’s), BBB (Fitch / DBRS Morningstar) Debt – – – 12% – 12% 8% – – 17% 15% 20% – 17% Maturing Debt Type Rate Type 2013 Mortgage Loans $288 $581 Floating Undrawn Revolver (2) Secured 11% Unsecured Term Loan A-2 22% (CAD Denominated) Unsecured Term Loan A-1 78% 89% Series A 4.68% Unsecured Notes $2,115 Unsecured Series B 4.86% Unsecured Notes $2,409 Fixed Series C 4.10% Unsecured Notes New 10Y 1.62% Unsecured Notes $800 (EUR Denominated) New 12Y 1.65% Unsecured Notes (EUR Denominated) Liquidity Significant Liquidity: ~$1.6bn (3) 2018 Forward Revolver Proceeds (4) Availability – $800mm Undrawn Senior $132 $779 Unsecured Revolving Credit 2020 8% 50% Facility Forward TOTAL (5) 6% LIQUIDITY Proceeds $468 . Interest Rate: L + 85 bps $88 $188 $400 $409 $1.6bn $350 Minimal near-term debt 17% $278 maturities 2020 New $200 Forward 19% $100 Proceeds (6) $267 Cash 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 $296 Note: Dollars in millions except per share figures. Figures based on company filings as of 9/30/2020. Figures include proceeds from October 2020 forward sale, closed 11/12/2020, and private placement, expected to close Q4 2020. The Company may settle the forwards by issuing new shares or may instead elect to cash settle or net share settle all or a portion of the forward shares. Figures may not sum due to rounding (1) Reflects the principal due each period and does not adjust for amortization of principal balances. Balances denominated in foreign currencies have been translated to USD (2) Revolver maturity date assumes the exercise of two six month extension options (3) Figure reflects cash, forward proceeds and the capacity available under the Senior Unsecured Revolving Credit Facility less ~$21mm in letters of credit 20 (4) Assumes the issuance of ~6mm common shares upon the full physical settlement of the 2018 forward sale agreement (5) Assumes the issuance of ~2.4mm common shares upon the full physical settlement of the 2020 forward sale agreement (6) Assumes the issuance of ~7.3mm common shares upon the full physical settlement of the 2020 forward sale agreement. Proceeds include exercise of over-allotment option, net of Agro Merchants Group acquisition and transaction fees

Strategic Investment Approach to Maintain a High-Quality Portfolio Capital expenditures ensure that our temperature-controlled warehouses meet the “mission-critical” role they serve in the cold chain As a % of Total Warehouse NOI before R&M Expense 2017A 2018A 2019A Total Spend $103mm Total Spend $96mm Total Spend $115mm 13.1% 12.4% 12.3% 11.8% 1.0% 11.0% 0.5% 10.3% 0.8% 0.9% 0.7% 7.8% 0.7% 7.6% 6.6% 11.0% 10.1% 8.8% 5.4% 4.6% 4.4% Recurring R&M Recurring R&M Recurring R&M Capex ⁽¹⁾ Expense ⁽²⁾ Capex ⁽¹⁾ Expense ⁽²⁾ Capex ⁽¹⁾ Expense ⁽²⁾ (Capitalized) (Expensed – P/L) (Capitalized) (Expensed – P/L) (Capitalized) (Expensed – P/L) Real Estate Personal Property Information Technology Note: Dollars in millions. Figures may not sum due to rounding (1) Recurring capital expenditures are incurred to extend the life of, and provide future economic benefit from, our existing temperature-controlled warehouse network and its existing supporting personal property and information technology systems. Examples include replacing roof and refrigeration equipment, re-racking warehouses and implementing energy efficient projects. Personal property capital expenditures include material handling equipment (e.g. fork lifts and pallet jacks) and related batteries. Information technology expenditures include expenditures on existing servers, networking equipment and current software. Maintenance capital expenditures do not include acquisition costs contemplated when underwriting the purchase of a building or costs which are incurred to bring a building up to Americold’s operating standards 21 (2) Repairs and maintenance expense includes costs of normal maintenance and repairs and minor replacements that do not materially extend the life of the property or provide future economic benefits. Examples include ordinary repair and maintenance on roofs, racking, walls, doors, parking lots and refrigeration equipment. Personal property expense includes ordinary repair and maintenance expenses on material handling equipment (e.g. fork lifts and pallet jacks) and related batteries

Commitment to Environmental, Social and Governance Initiatives Commitment to energy excellence and efficiency Recognized under the Global Cold Chain Alliance’s (GCCA) new Energy Excellence Recognition Program with Gold and Silver certifications at 131 facilities Completed LED lighting conversions at 107 facilities since 2011 Noteworthy fast door implementation savings Environmental Food Logistics magazine’s Top Green Service provider for last three years Awards & Recognition Social initiatives Serve the public good by maintaining the integrity of the food supply and reducing waste Corporate contributions / support to charities aligned with our core beliefs and focus, such as Feed the Children and HeroBox Social Shareholder-friendly corporate governance Charitable Organizations Eight of nine board members independent All committees comprised of independents Gender diversity at board level Cannot opt into MUTA without shareholder vote Governance No poison pill Non-classified board 22 Shareholder “Say on Pay”

Conclusion Important First Mover Global Market Leader Infrastructure Supported Strong and Stable Food Advantage as the Only with Integrated Network by Best-in-Class IT and Industry Fundamentals Publicly Traded REIT of Strategically-Located, Operating Platforms Drive Growing Demand Focused on Temperature- High-Quality, “Mission- Provides a Significant for Our Business Controlled Warehouses Critical” Warehouses Competitive Advantage Experienced Substantial Internal and Management Team, External Growth Investment Grade, Alignment of Interest and Opportunities Expected Flexible Balance Sheet Best-In-Class Corporate to Drive Attractive Positioned for Growth Governance Risk-Adjusted Returns 23