Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Homes 4 Rent | amh-20201113.htm |

Investor Highlights November 2020

Legal Disclosures Forward-Looking Statements Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal,” “guidance,” “outlook” or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this presentation include, among others, our expectations with respect to the impacts of the COVID-19 pandemic, and our belief that our acquisition and homebuilding programs will result in continued growth. We have based these forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment philosophy and diversified acquisition strategy, our ability to expand our development program, our ability to grow our portfolio and to create a cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic, regulatory and real estate conditions that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation, November 16, 2020. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations, unless required by applicable law. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the potential adverse effect of the COVID-19 pandemic on the financial markets. The extent to which the COVID-19 pandemic impacts us and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration, including resurgences, status of eviction moratoriums, the speed and effectiveness of vaccine and treatment developments and the direct and indirect economic effects of the pandemic and containment measures, among others. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, the Form 10-Q for the quarter ended September 30, 2020, and in the Company’s subsequent filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP) because we believe they help investors understand our performance. Any non-GAAP financial measures presented are not, and should not be viewed as, substitutes for financial measures required by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies. Definitions of these non-GAAP financial measures and a reconciliation of these measures to GAAP is included in the Defined Terms and Non-GAAP Reconciliations section of this presentation, as well as the 3Q20 Supplemental Information Package available on our website at www.americanhomes4rent.com under “For Investors.” About American Homes 4 Rent American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high-quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, developing, renovating, leasing, and operating attractive, single-family homes as rental properties. As of September 30, 2020 we owned 53,229 single-family properties in selected submarkets in 22 states. Contacts American Homes 4 Rent Investor Relations American Homes 4 Rent Media Relations Phone: (855) 794-2447 / Email: investors@ah4r.com Phone: (805) 413-5088 / Email: media@ah4r.com 2

AMH Today The Market Opportunity AMH’s Strategy to Drive Shareholder Value AMH Strong Governance Practices 3

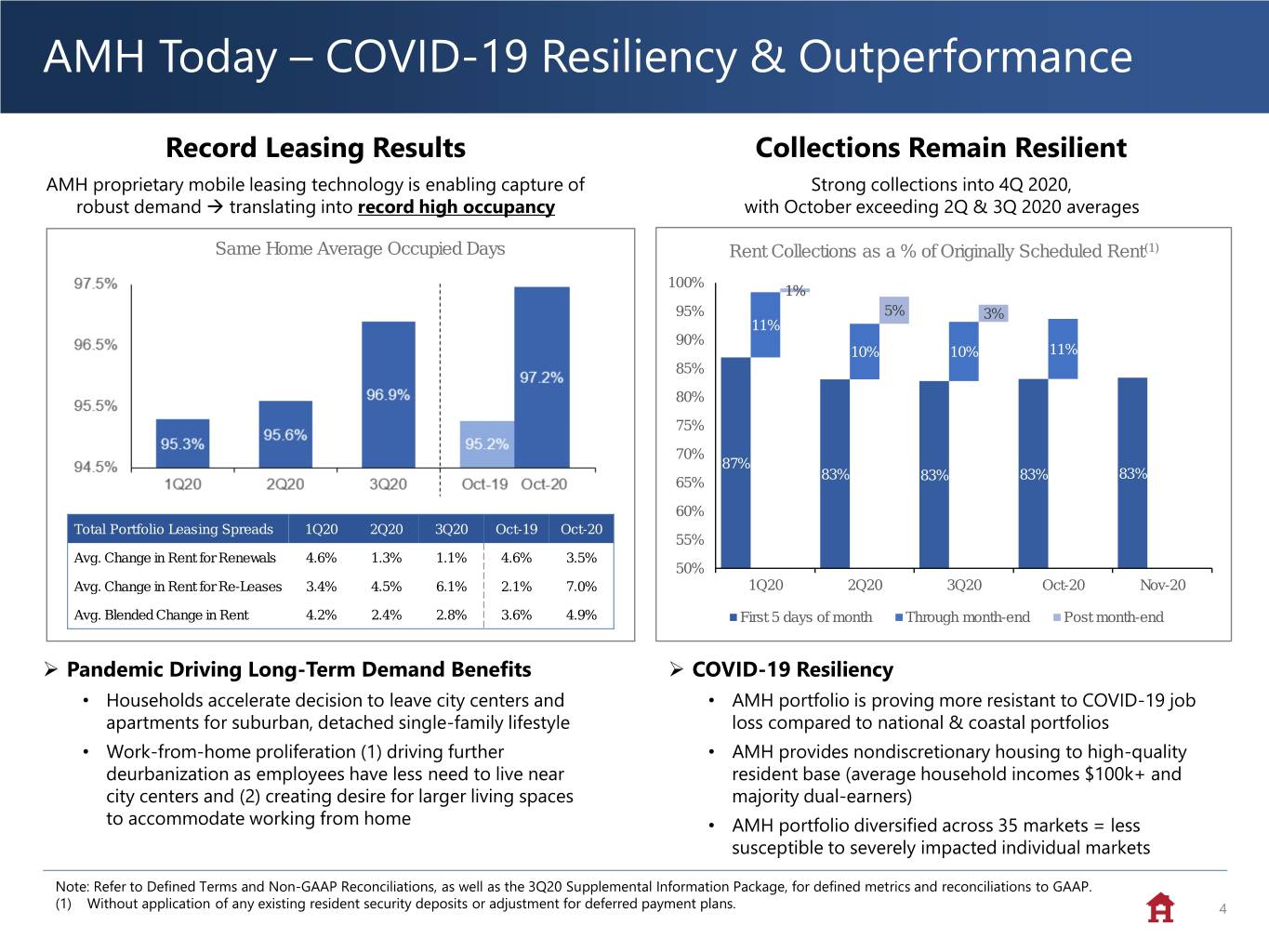

AMH Today – COVID-19 Resiliency & Outperformance Record Leasing Results Collections Remain Resilient AMH proprietary mobile leasing technology is enabling capture of Strong collections into 4Q 2020, robust demand → translating into record high occupancy with October exceeding 2Q & 3Q 2020 averages Same Home Average Occupied Days Rent Collections as a % of Originally Scheduled Rent(1) 100% 1% 95% 5% 3% 11% 90% 10% 10% 11% 85% 80% 75% 70% 87% 83% 83% 83% 83% 65% 60% Total Portfolio Leasing Spreads 1Q20 2Q20 3Q20 Oct-19 Oct-20 55% Avg. Change in Rent for Renewals 4.6% 1.3% 1.1% 4.6% 3.5% 50% Avg. Change in Rent for Re-Leases 3.4% 4.5% 6.1% 2.1% 7.0% 1Q20 2Q20 3Q20 Oct-20 Nov-20 Avg. Blended Change in Rent 4.2% 2.4% 2.8% 3.6% 4.9% First 5 days of month Through month-end Post month-end ➢ Pandemic Driving Long-Term Demand Benefits ➢ COVID-19 Resiliency • Households accelerate decision to leave city centers and • AMH portfolio is proving more resistant to COVID-19 job apartments for suburban, detached single-family lifestyle loss compared to national & coastal portfolios • Work-from-home proliferation (1) driving further • AMH provides nondiscretionary housing to high-quality deurbanization as employees have less need to live near resident base (average household incomes $100k+ and city centers and (2) creating desire for larger living spaces majority dual-earners) to accommodate working from home • AMH portfolio diversified across 35 markets = less susceptible to severely impacted individual markets Note: Refer to Defined Terms and Non-GAAP Reconciliations, as well as the 3Q20 Supplemental Information Package, for defined metrics and reconciliations to GAAP. (1) Without application of any existing resident security deposits or adjustment for deferred payment plans. 4

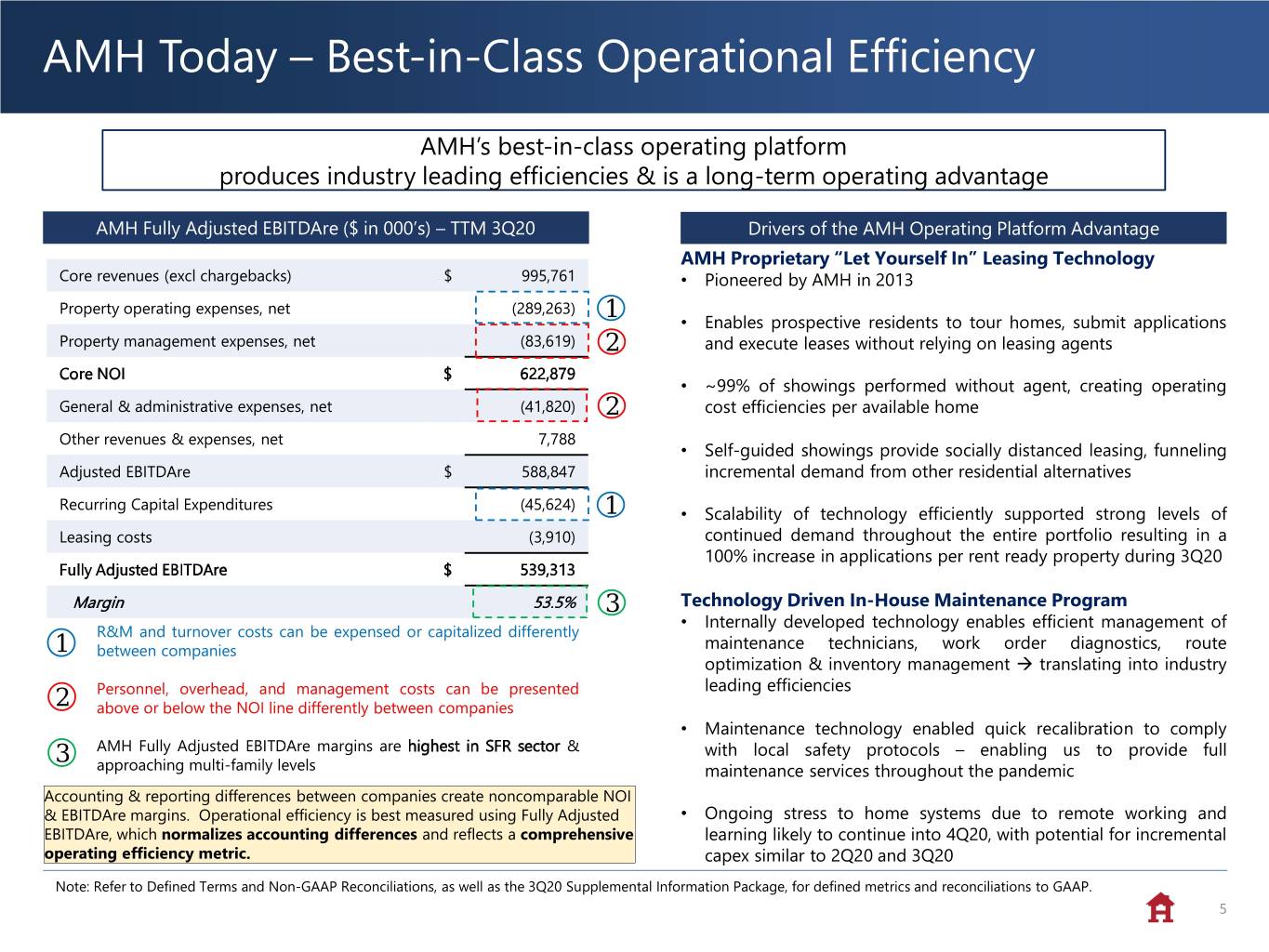

AMH Today – Best-in-Class Operational Efficiency AMH’s best-in-class operating platform produces industry leading efficiencies & is a long-term operating advantage AMH Fully Adjusted EBITDAre ($ in 000’s) – TTM 3Q20 Drivers of the AMH Operating Platform Advantage AMH Proprietary “Let Yourself In” Leasing Technology Core revenues (excl chargebacks) $ 995,761 • Pioneered by AMH in 2013 Property operating expenses, net (289,263) 1 • Enables prospective residents to tour homes, submit applications Property management expenses, net (83,619) 2 and execute leases without relying on leasing agents Core NOI $ 622,879 • ~99% of showings performed without agent, creating operating General & administrative expenses, net (41,820) 2 cost efficiencies per available home Other revenues & expenses, net 7,788 • Self-guided showings provide socially distanced leasing, funneling Adjusted EBITDAre $ 588,847 incremental demand from other residential alternatives Recurring Capital Expenditures (45,624) 1 • Scalability of technology efficiently supported strong levels of Leasing costs (3,910) continued demand throughout the entire portfolio resulting in a 100% increase in applications per rent ready property during 3Q20 Fully Adjusted EBITDAre $ 539,313 Margin 53.5% 3 Technology Driven In-House Maintenance Program • Internally developed technology enables efficient management of R&M and turnover costs can be expensed or capitalized differently 1 between companies maintenance technicians, work order diagnostics, route optimization & inventory management → translating into industry Personnel, overhead, and management costs can be presented leading efficiencies 2 above or below the NOI line differently between companies • Maintenance technology enabled quick recalibration to comply 3 AMH Fully Adjusted EBITDAre margins are highest in SFR sector & with local safety protocols – enabling us to provide full approaching multi-family levels maintenance services throughout the pandemic Accounting & reporting differences between companies create noncomparable NOI & EBITDAre margins. Operational efficiency is best measured using Fully Adjusted • Ongoing stress to home systems due to remote working and EBITDAre, which normalizes accounting differences and reflects a comprehensive learning likely to continue into 4Q20, with potential for incremental operating efficiency metric. capex similar to 2Q20 and 3Q20 Note: Refer to Defined Terms and Non-GAAP Reconciliations, as well as the 3Q20 Supplemental Information Package, for defined metrics and reconciliations to GAAP. 5

AMH Today – Positioned for Outsized Growth AMH balance sheet & investment grade rating Three-pronged growth strategy positions AMH for key differentiator for growth and resiliency consistent external growth throughout all economic cycles Balance Sheet Strength The AMH Three-Pronged Growth Strategy • Only investment grade rated balance sheet in the SFR sector, • All three channels currently open for growth positioning AMH for resiliency and opportunistic flexibility AMH Development • Diverse access to attractive capital sources, including unsecured • Early-mover advantage on built-for-rental strategy, which has debt, joint venture capital, preferred stock, and common stock, potential to revolutionize the industry, requires clarity for long-term enables ability to accretively fund long-term growth programs capital • Oversubscribed and upsized common stock offering in August • AMH Development = best rental-home product and economics 2020, generating $412 million of net proceeds to fund AMH expanded external growth programs and for general corporate • Barriers to entry as AMH is only rental-home builder with purposes complementary and highly efficient property management platform • AMH Development is consistently delivering new home communities with more than 60 communities opened inception to date National Builder Program • Network of relationships with national home builders provides acquisition access to new construction homes, which is a growth supplement to our AMH Development program Traditional Channel • Seasoned, in-market acquisition teams sharp-shoot existing inventory opportunities, adding additional market scale and density • Experienced AMH rehab personnel create additional value through Belmont Glen, Ruskin, FL initial renovation process 6

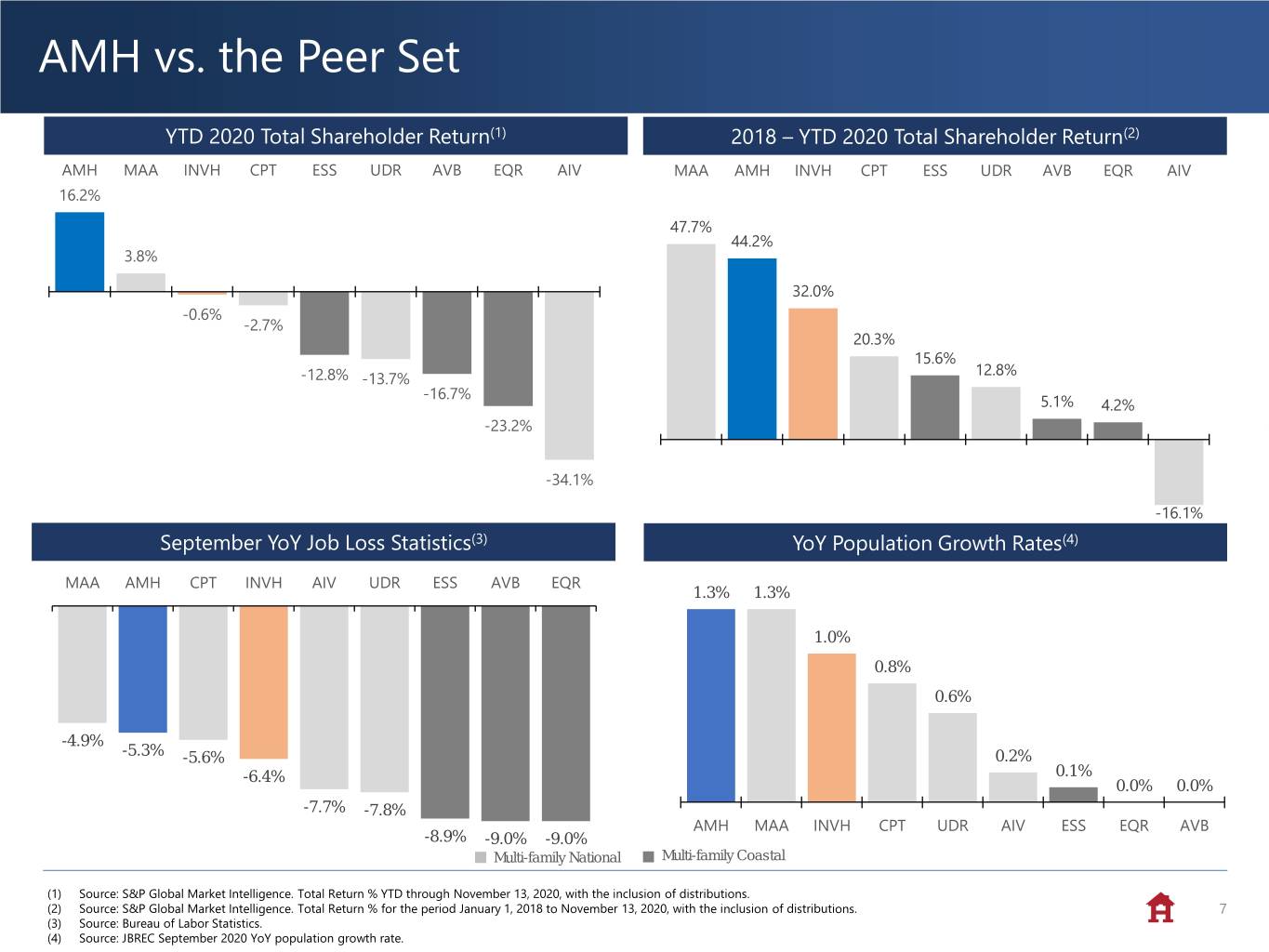

AMH vs. the Peer Set YTD 2020 Total Shareholder Return(1) 2018 – YTD 2020 Total Shareholder Return(2) AMH MAA INVH CPT ESS UDR AVB EQR AIV MAA AMH INVH CPT ESS UDR AVB EQR AIV 16.2% 47.7% 44.2% 3.8% 32.0% -0.6% -2.7% 20.3% 15.6% 12.8% -12.8% -13.7% -16.7% 5.1% 4.2% -23.2% -34.1% -16.1% September YoY Job Loss Statistics(3) YoY Population Growth Rates(4) MAA AMH CPT INVH AIV UDR ESS AVB EQR 1.3% 1.3% 1.0% 0.8% 0.6% -4.9% -5.3% -5.6% 0.2% -6.4% 0.1% 0.0% 0.0% -7.7% -7.8% AMH MAA INVH CPT UDR AIV ESS EQR AVB -8.9% -9.0% -9.0% Multi-family National Multi-family Coastal (1) Source: S&P Global Market Intelligence. Total Return % YTD through November 13, 2020, with the inclusion of distributions. (2) Source: S&P Global Market Intelligence. Total Return % for the period January 1, 2018 to November 13, 2020, with the inclusion of distributions. 7 (3) Source: Bureau of Labor Statistics. (4) Source: JBREC September 2020 YoY population growth rate.

AMH Today The Market Opportunity AMH’s Strategy to Drive Shareholder Value AMH Strong Governance Practices 8

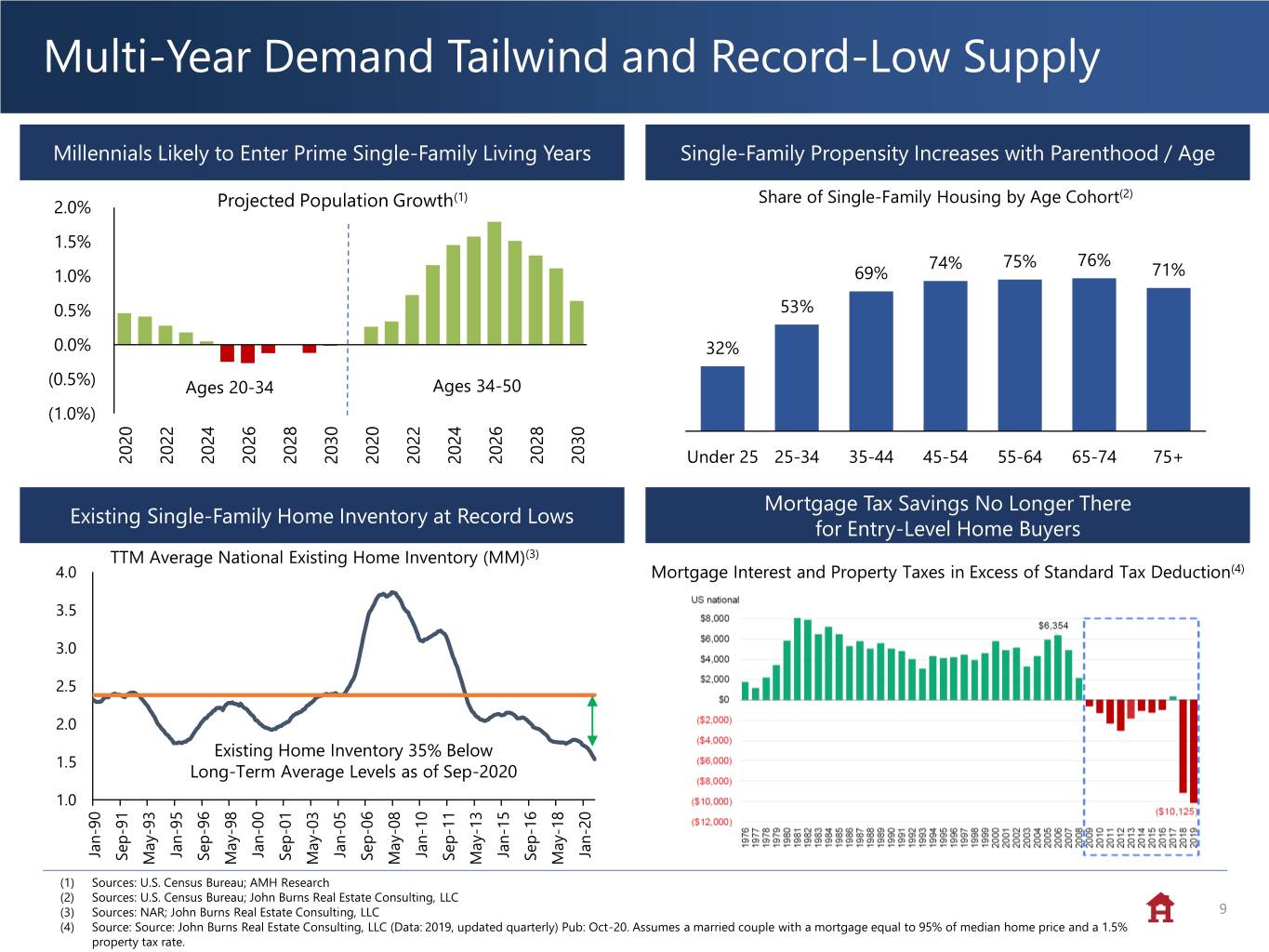

Multi-Year Demand Tailwind and Record-Low Supply Millennials Likely to Enter Prime Single-Family Living Years Single-Family Propensity Increases with Parenthood / Age (1) Share of Single-Family Housing by Age Cohort(2) 2.0% Projected Population Growth 1.5% 74% 75% 76% 1.0% 69% 71% 0.5% 53% 0.0% 32% (0.5%) Ages 20-34 Ages 34-50 (1.0%) 2026 2024 2022 2024 2028 2030 2020 2022 2026 2028 2030 2020 Under 25 25-34 35-44 45-54 55-64 65-74 75+ Mortgage Tax Savings No Longer There Existing Single-Family Home Inventory at Record Lows for Entry-Level Home Buyers TTM Average National Existing Home Inventory (MM)(3) 4.0 Mortgage Interest and Property Taxes in Excess of Standard Tax Deduction(4) 3.5 3.0 2.5 2.0 Existing Home Inventory 35% Below 1.5 Long-Term Average Levels as of Sep-2020 1.0 Jan-00 Jan-90 Jan-95 Jan-05 Jan-10 Jan-15 Jan-20 Sep-91 Sep-96 Sep-01 Sep-06 Sep-11 Sep-16 May-13 May-93 May-98 May-03 May-08 May-18 (1) Sources: U.S. Census Bureau; AMH Research (2) Sources: U.S. Census Bureau; John Burns Real Estate Consulting, LLC (3) Sources: NAR; John Burns Real Estate Consulting, LLC 9 (4) Source: Source: John Burns Real Estate Consulting, LLC (Data: 2019, updated quarterly) Pub: Oct-20. Assumes a married couple with a mortgage equal to 95% of median home price and a 1.5% property tax rate.

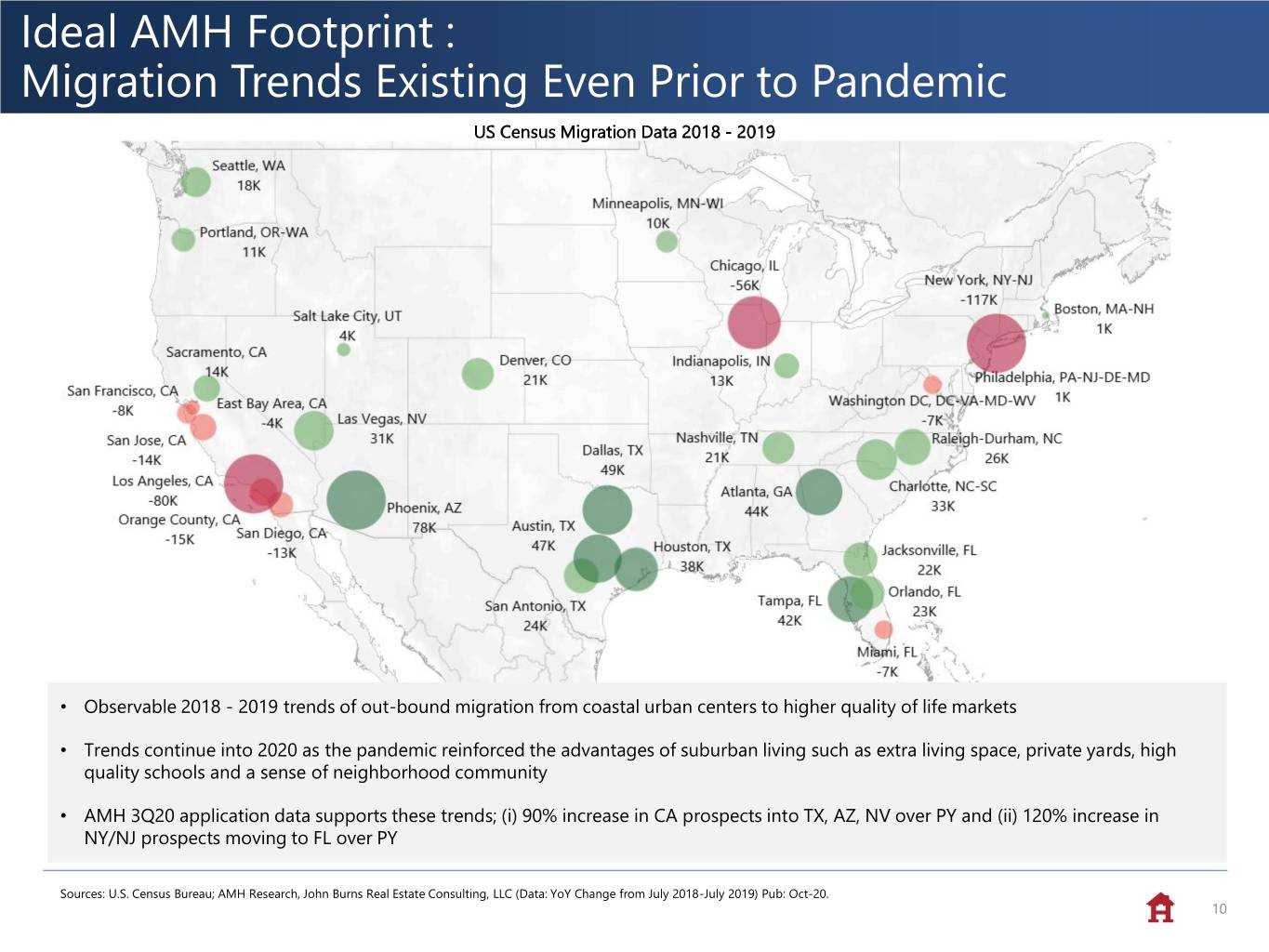

Ideal AMH Footprint : Migration Trends Existing Even Prior to Pandemic US Census Migration Data 2018 - 2019 • Observable 2018 - 2019 trends of out-bound migration from coastal urban centers to higher quality of life markets • Trends continue into 2020 as the pandemic reinforced the advantages of suburban living such as extra living space, private yards, high quality schools and a sense of neighborhood community • AMH 3Q20 application data supports these trends; (i) 90% increase in CA prospects into TX, AZ, NV over PY and (ii) 120% increase in NY/NJ prospects moving to FL over PY Sources: U.S. Census Bureau; AMH Research, John Burns Real Estate Consulting, LLC (Data: YoY Change from July 2018-July 2019) Pub: Oct-20. 10

AMH Today The Market Opportunity AMH’s Strategy to Drive Shareholder Value AMH Strong Governance Practices 11

AMH Has a Well-Defined Plan to Drive Shareholder Value 1 • Continuous operational optimization expected to create long-term margin expansion profile Operational • Balance centralized control and oversight, with local office touch Optimization / Efficiencies • Enhance operating efficiencies with innovative and proprietary technology solutions • Management and execution of all stages of operational lifecycle with AMH internal personnel • Accretively expand portfolio by investing in AMH’s high growth markets and neighborhoods where AMH 2 currently owns homes Development • Superior quality “built-for-rental” homes focused on durability and efficiency translates into premium yields Program Driving and margin enhancement Growth • Focus on high quality properties in desirable neighborhoods and highly rated school districts to attract ideal resident profile: (1) high credit quality, (2) propensity to stay longer and (3) predisposition to care for property as their “home” • Utilize investment grade cost of capital advantage over SFR peers 3 Prudent Capital Allocation & • Maintain flexible and conservative balance sheet, while optimizing capital stack Recycling • Accretively reinvest retained cash flow into internal and external growth initiatives • Focused on delivering a superior customer experience to our residents 4 Superior Customer Service • Training and operational strategies designed to deliver responsive, efficient and convenient service • Customer surveys and external ratings demonstrate our commitment to continued improvement 12

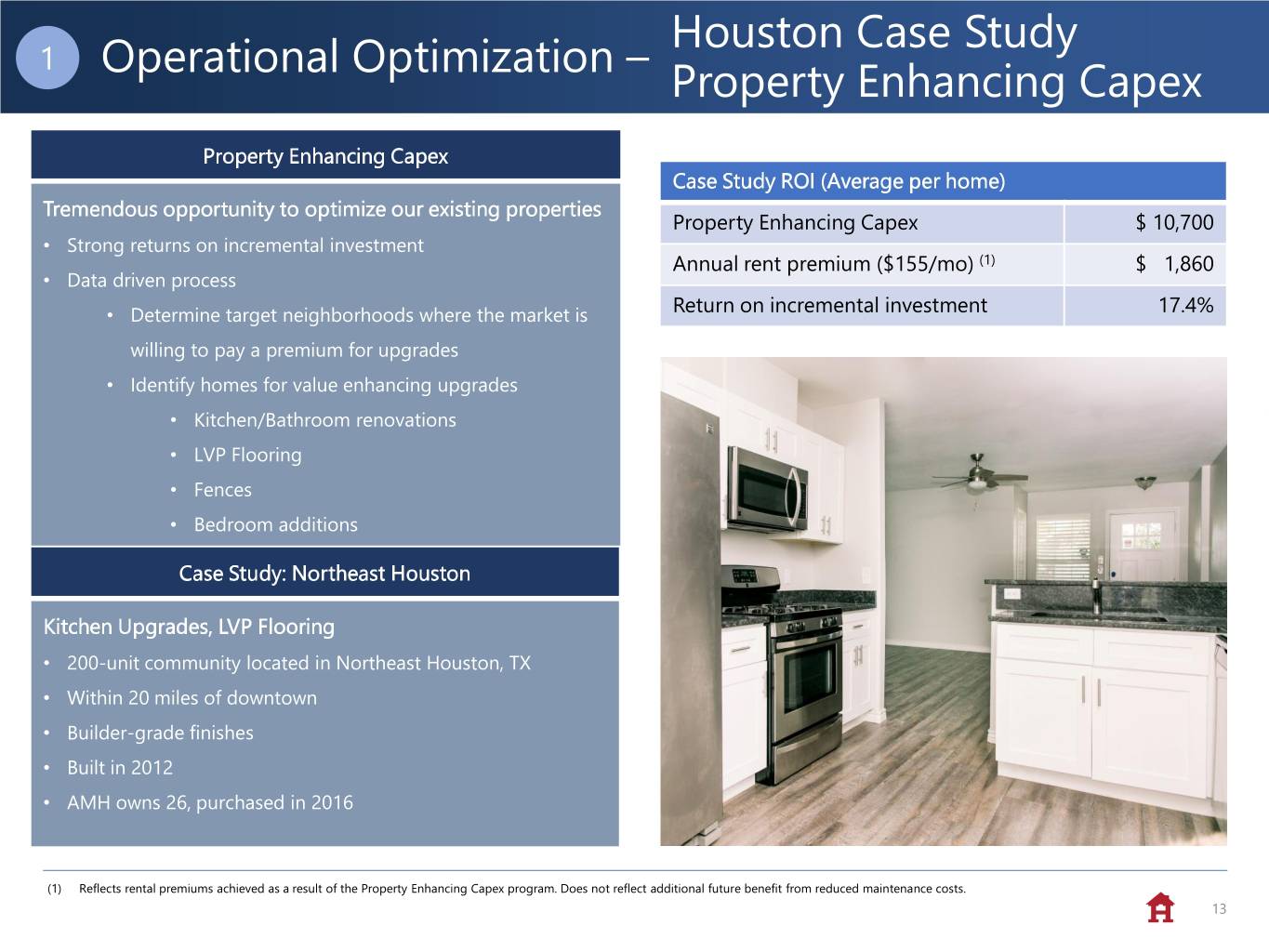

Houston Case Study 1 Operational Optimization – Property Enhancing Capex Property Enhancing Capex Case Study ROI (Average per home) Tremendous opportunity to optimize our existing properties Property Enhancing Capex $ 10,700 • Strong returns on incremental investment Annual rent premium ($155/mo) (1) $ 1,860 • Data driven process • Determine target neighborhoods where the market is Return on incremental investment 17.4% willing to pay a premium for upgrades • Identify homes for value enhancing upgrades • Kitchen/Bathroom renovations • LVP Flooring • Fences • Bedroom additions Case Study: Northeast Houston Kitchen Upgrades, LVP Flooring • 200-unit community located in Northeast Houston, TX • Within 20 miles of downtown • Builder-grade finishes • Built in 2012 • AMH owns 26, purchased in 2016 (1) Reflects rental premiums achieved as a result of the Property Enhancing Capex program. Does not reflect additional future benefit from reduced maintenance costs. 13

2 AMH Development – Revolutionizing the Industry Data driven insights from AMH’s years of experience formulate blueprint for the optimal rental home – made possible by AMH’s unique full lifecycle development capabilities and management platform. The AMH Developed Home Desirable Durable Efficient • Existing AMH submarkets with • Designed for durability and long- • Value engineering = superior proven strong demand term efficient maintenance: quality at significant discount to • “Neighborhood feel” and / or • Hard surface flooring market retail value: community amenities designed to • Solid surface countertops • Standardized floorplans based create emotional attachment • HVAC equipment & design on resident feedback and construction efficiency • Designed for today’s home • Cementitious siding shopper: • Square footage optimized to • Durability proven appliances • Designer finishes & colors bed / bath count • LED lighting • Open floor plans • Standardized finishes & SKUs • Pet friendly features for efficient construction & long-term maintenance Translates Into Premium Yield and Margin Enhancement 14

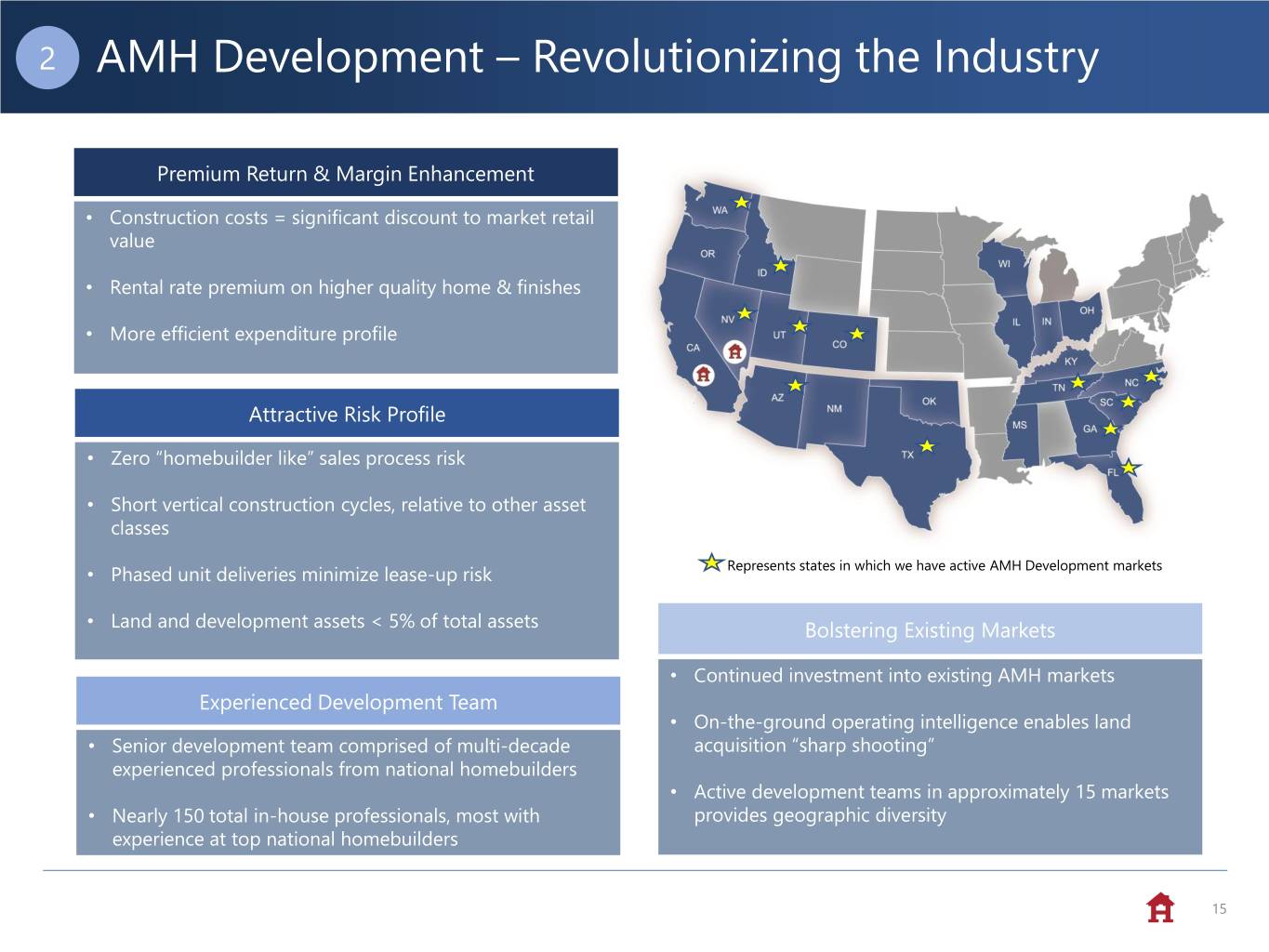

2 AMH Development – Revolutionizing the Industry Premium Return & Margin Enhancement • Construction costs = significant discount to market retail value • Rental rate premium on higher quality home & finishes • More efficient expenditure profile Attractive Risk Profile • Zero “homebuilder like” sales process risk • Short vertical construction cycles, relative to other asset classes • Phased unit deliveries minimize lease-up risk Represents states in which we have active AMH Development markets • Land and development assets < 5% of total assets Bolstering Existing Markets • Continued investment into existing AMH markets Experienced Development Team • On-the-ground operating intelligence enables land • Senior development team comprised of multi-decade acquisition “sharp shooting” experienced professionals from national homebuilders • Active development teams in approximately 15 markets • Nearly 150 total in-house professionals, most with provides geographic diversity experience at top national homebuilders 15

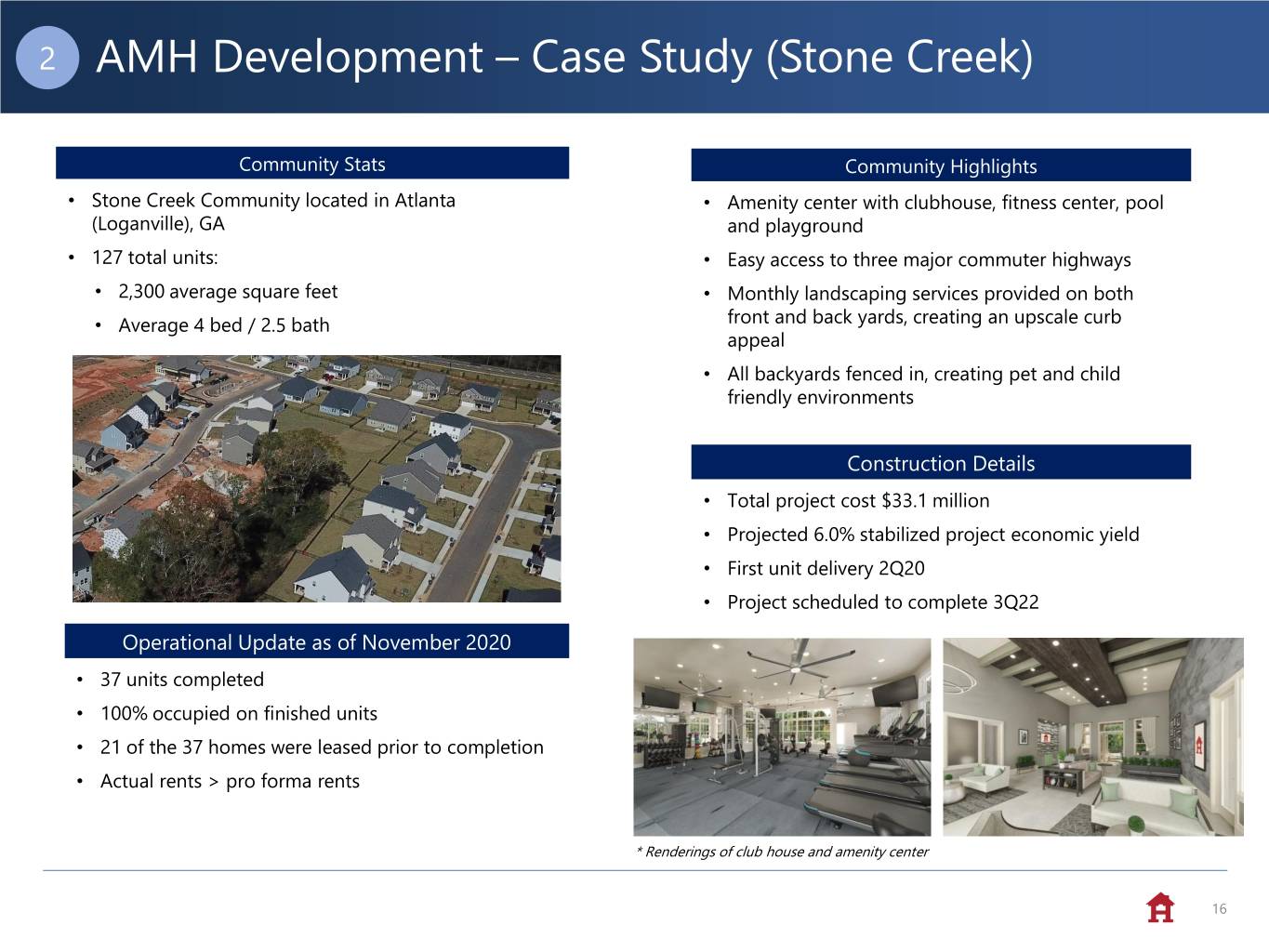

2 AMH Development – Case Study (Stone Creek) Community Stats Community Highlights • Stone Creek Community located in Atlanta • Amenity center with clubhouse, fitness center, pool (Loganville), GA and playground • 127 total units: • Easy access to three major commuter highways • 2,300 average square feet • Monthly landscaping services provided on both • Average 4 bed / 2.5 bath front and back yards, creating an upscale curb appeal • All backyards fenced in, creating pet and child friendly environments Construction Details • Total project cost $33.1 million • Projected 6.0% stabilized project economic yield • First unit delivery 2Q20 • Project scheduled to complete 3Q22 Operational Update as of November 2020 • 37 units completed • 100% occupied on finished units • 21 of the 37 homes were leased prior to completion • Actual rents > pro forma rents * Renderings of club house and amenity center 16

2 AMH Development – Construction Sustainability AMH Develops Homes That Are Environmentally Friendly Development & Construction Sustainability Aim to minimize our carbon footprint in our development: • We conserve natural resources and reduce waste while focusing on building new single-family homes that are desirable to families To reduce our energy consumption: We include tree planting plans as part of community design. • We adhere to the most recent upgraded standards in energy efficiency and construction methodology • We select finishes that are both desirable and durable to reduce the waste generated by home turnover from one resident to another To help improve the community: • We build neighborhoods, not just homes, and we include green space or natural areas and tree planting plans as part of the design Granite countertops, hard surface luxury vinyl plank (LVP) flooring and LED lighting are all designed to last for many years without repairs or replacement. 17

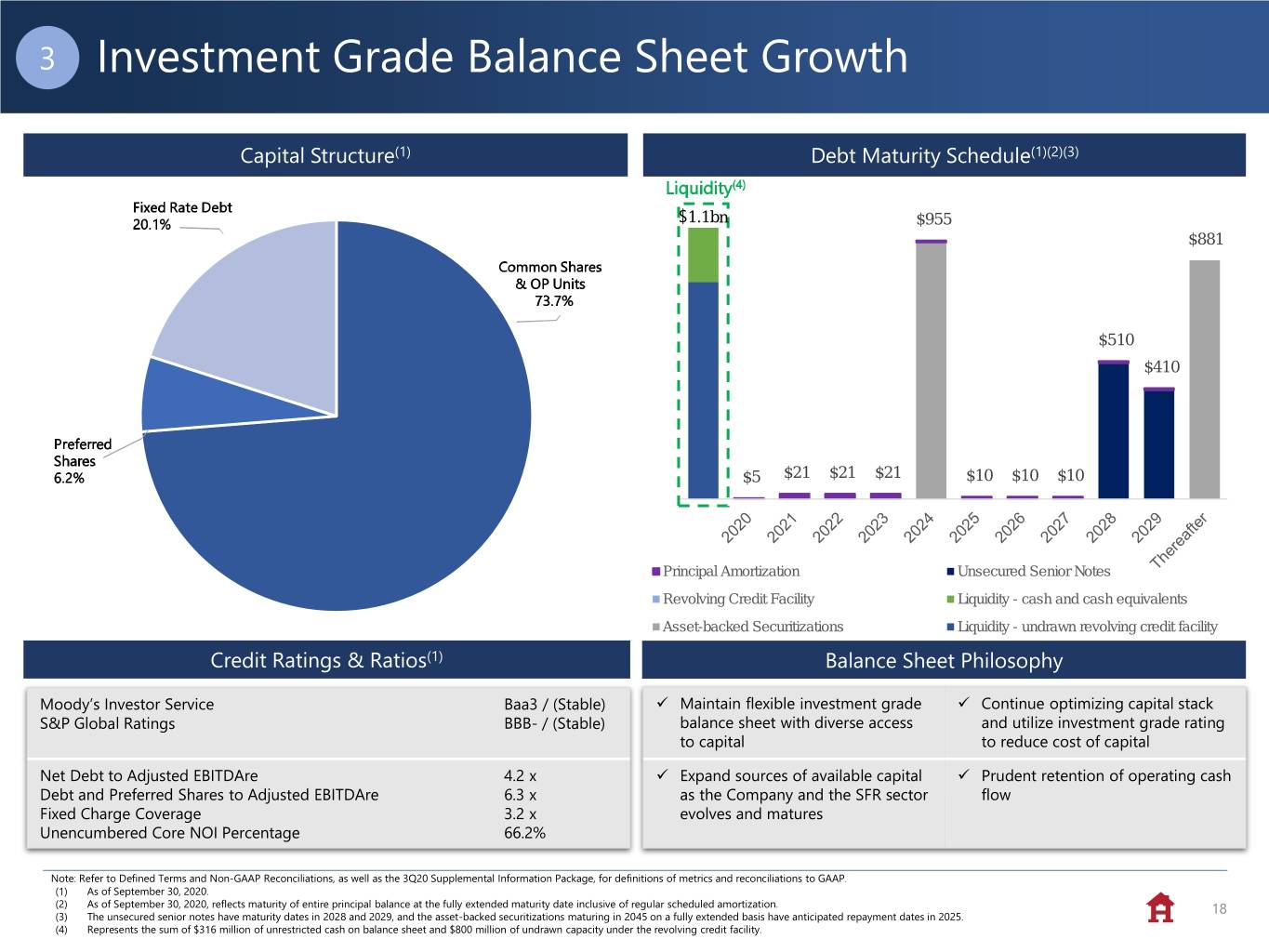

3 Investment Grade Balance Sheet Growth Capital Structure(1) Debt Maturity Schedule(1)(2)(3) Liquidity(4) Fixed Rate Debt 20.1% $1.1bn $955 $881 Common Shares & OP Units 73.7% $510 $410 Preferred Shares 6.2% $5 $21 $21 $21 $10 $10 $10 Principal Amortization Unsecured Senior Notes Revolving Credit Facility Liquidity - cash and cash equivalents Asset-backed Securitizations Liquidity - undrawn revolving credit facility Credit Ratings & Ratios(1) Balance Sheet Philosophy Moody’s Investor Service Baa3 / (Stable) ✓ Maintain flexible investment grade ✓ Continue optimizing capital stack S&P Global Ratings BBB- / (Stable) balance sheet with diverse access and utilize investment grade rating to capital to reduce cost of capital Net Debt to Adjusted EBITDAre 4.2 x ✓ Expand sources of available capital ✓ Prudent retention of operating cash Debt and Preferred Shares to Adjusted EBITDAre 6.3 x as the Company and the SFR sector flow Fixed Charge Coverage 3.2 x evolves and matures Unencumbered Core NOI Percentage 66.2% Note: Refer to Defined Terms and Non-GAAP Reconciliations, as well as the 3Q20 Supplemental Information Package, for definitions of metrics and reconciliations to GAAP. (1) As of September 30, 2020. (2) As of September 30, 2020, reflects maturity of entire principal balance at the fully extended maturity date inclusive of regular scheduled amortization. 18 (3) The unsecured senior notes have maturity dates in 2028 and 2029, and the asset-backed securitizations maturing in 2045 on a fully extended basis have anticipated repayment dates in 2025. (4) Represents the sum of $316 million of unrestricted cash on balance sheet and $800 million of undrawn capacity under the revolving credit facility.

Leveraging Technology to 4 Superior Customer Service – Enhance our Platform Resident Experience Technology Warm and Welcoming Renting a Home Just Got Easier Resident satisfaction is the key to consistent results and is Our best-in-class contact center and proprietary technology paramount to our long-term success. are designed to make our residents’ experience as simple as possible. ➢ District offices and field management teams provide ➢ Let Yourself In SM exceptional customer service and care with a local touch • Tour available homes in a resident’s desired neighborhood on their schedule ➢ Ongoing resident engagement campaigns and • Enables prospective residents to complete entire leasing correspondence provide quick reference tools and monthly cycle, including submitting applications and executing news updates leases from mobile devices ➢ With over 700 field-based team members, our goal is to ➢ Personal Online Search Account make residents feel right at home • Request notices about newly available homes for rent ➢ Achieved all time highs in Google ratings in 2019 with ➢ Online Resident Account continued improvement in 2020 • Manage entire rental experience online; pay rent, set-up automatic payments, review and manage online documents that relate to a resident’s lease and neighborhood rules and regulations 19

AMH Today The Market Opportunity AMH’s Strategy to Drive Shareholder Value AMH Strong Governance Practices 20

Corporate Governance Highlights • AMH is governed by a 13‐member board of trustees, 9 of whom are independent directors Independent & Accountable • Independent Chairman of the Board Stewardship • Annual election of directors • Majority voting standard (plurality carve‐out voting standard only in contested elections) • Continual process to refresh and strengthen board composition • The average tenure of the Board is ~5 years • 6 new independent trustees added in the past 4 years Continued Focus on • Michelle Kerrick joined the Board in September 2020, adding deep experience in corporate governance, Board Refreshment financial and strategic planning, operational effectiveness and digital transformation • Lynn Swann joined the Board in August 2020, adding extensive public company board experience as well as considerable expertise in business, marketing and civic engagement • Matthew Zaist joined the Board in February 2020, adding homebuilding experience, a critical element given importance of the Company’s development program to drive value • Commitment to sound environmental, social responsibility and corporate governance practices is the foundation to help us provide a superior experience for our residents ESG Focus • These efforts can enhance shareholder value both by reducing our costs and by creating more desirable homes and communities that appeal to our current and future residents • When developing or renovating properties, we look for ways to reduce water and energy usage costs as well as using materials that are both durable and sustainable Performance-Based • Incentive compensation includes performance based Corporate, business and personal goals Compensation Practices • Align shareholders and management through standard vesting period 21

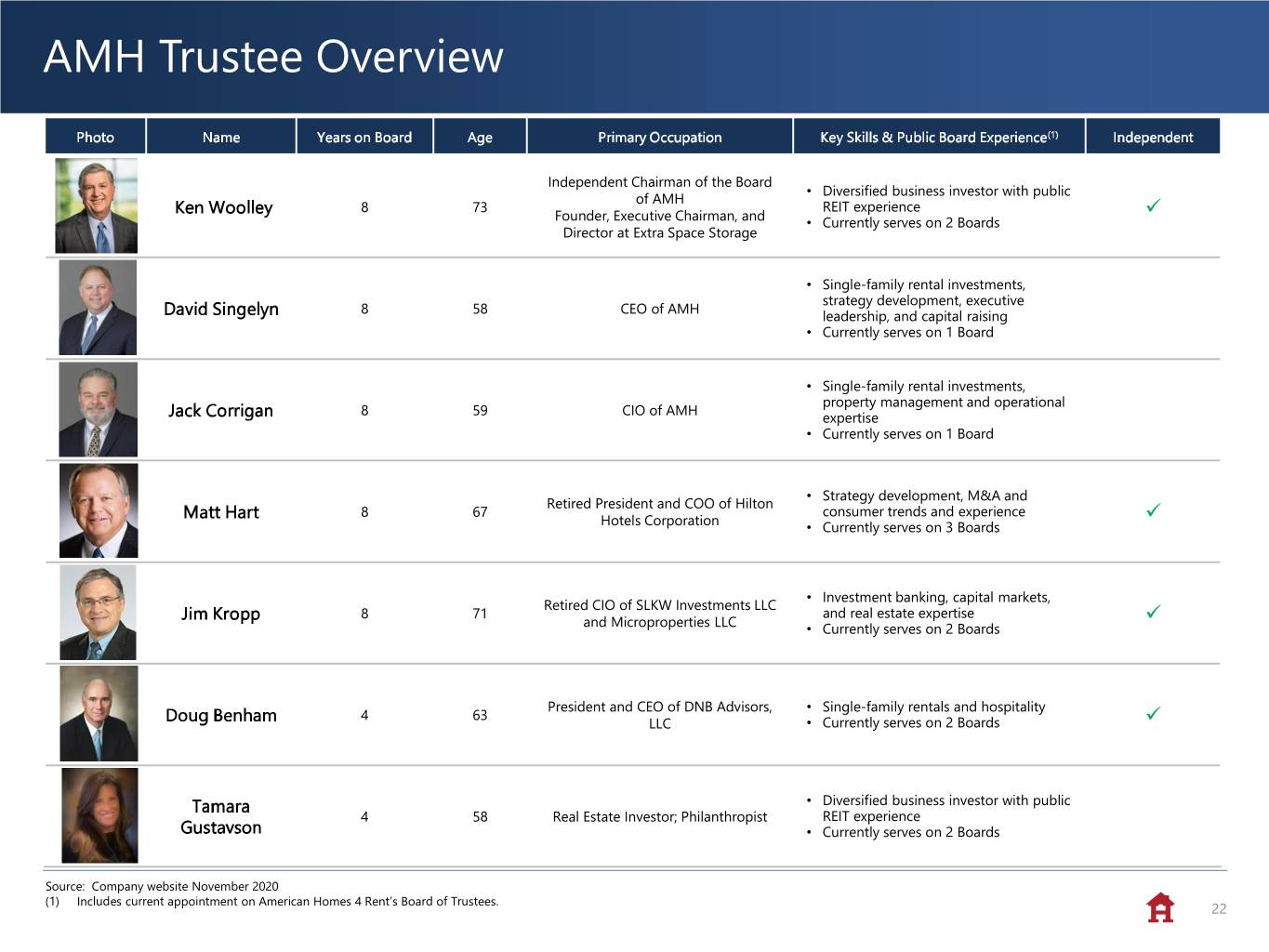

AMH Trustee Overview Photo Name Years on Board Age Primary Occupation Key Skills & Public Board Experience(1) Independent Independent Chairman of the Board • Diversified business investor with public of AMH Ken Woolley 8 73 REIT experience ✓ Founder, Executive Chairman, and • Currently serves on 2 Boards Director at Extra Space Storage • Single-family rental investments, strategy development, executive 8 58 CEO of AMH David Singelyn leadership, and capital raising • Currently serves on 1 Board • Single-family rental investments, property management and operational 8 59 CIO of AMH Jack Corrigan expertise • Currently serves on 1 Board • Strategy development, M&A and Retired President and COO of Hilton Matt Hart 8 67 consumer trends and experience ✓ Hotels Corporation • Currently serves on 3 Boards • Investment banking, capital markets, Retired CIO of SLKW Investments LLC Jim Kropp 8 71 and real estate expertise ✓ and Microproperties LLC • Currently serves on 2 Boards President and CEO of DNB Advisors, • Single-family rentals and hospitality 4 63 Doug Benham LLC • Currently serves on 2 Boards ✓ Tamara • Diversified business investor with public 4 58 Real Estate Investor; Philanthropist REIT experience Gustavson • Currently serves on 2 Boards Source: Company website November 2020 (1) Includes current appointment on American Homes 4 Rent’s Board of Trustees. 22

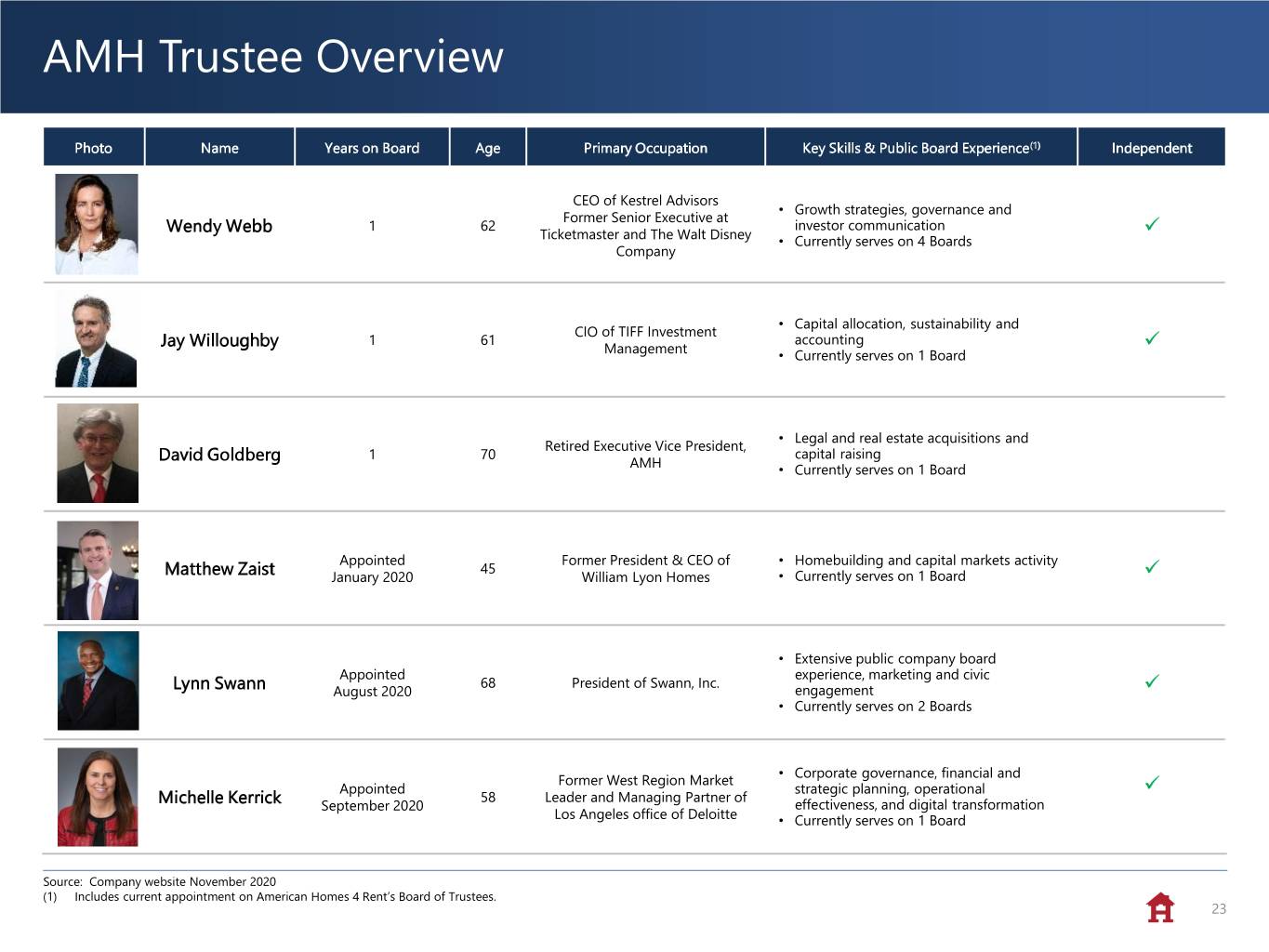

AMH Trustee Overview Photo Name Years on Board Age Primary Occupation Key Skills & Public Board Experience(1) Independent CEO of Kestrel Advisors • Growth strategies, governance and Former Senior Executive at Wendy Webb 1 62 investor communication ✓ Ticketmaster and The Walt Disney • Currently serves on 4 Boards Company • Capital allocation, sustainability and CIO of TIFF Investment Jay Willoughby 1 61 accounting ✓ Management • Currently serves on 1 Board • Legal and real estate acquisitions and Retired Executive Vice President, David Goldberg 1 70 capital raising AMH • Currently serves on 1 Board Appointed Former President & CEO of • Homebuilding and capital markets activity 45 Matthew Zaist January 2020 William Lyon Homes • Currently serves on 1 Board ✓ • Extensive public company board Appointed experience, marketing and civic 68 President of Swann, Inc. Lynn Swann August 2020 engagement ✓ • Currently serves on 2 Boards • Corporate governance, financial and Former West Region Market Appointed strategic planning, operational ✓ 58 Leader and Managing Partner of Michelle Kerrick September 2020 effectiveness, and digital transformation Los Angeles office of Deloitte • Currently serves on 1 Board Source: Company website November 2020 (1) Includes current appointment on American Homes 4 Rent’s Board of Trustees. 23

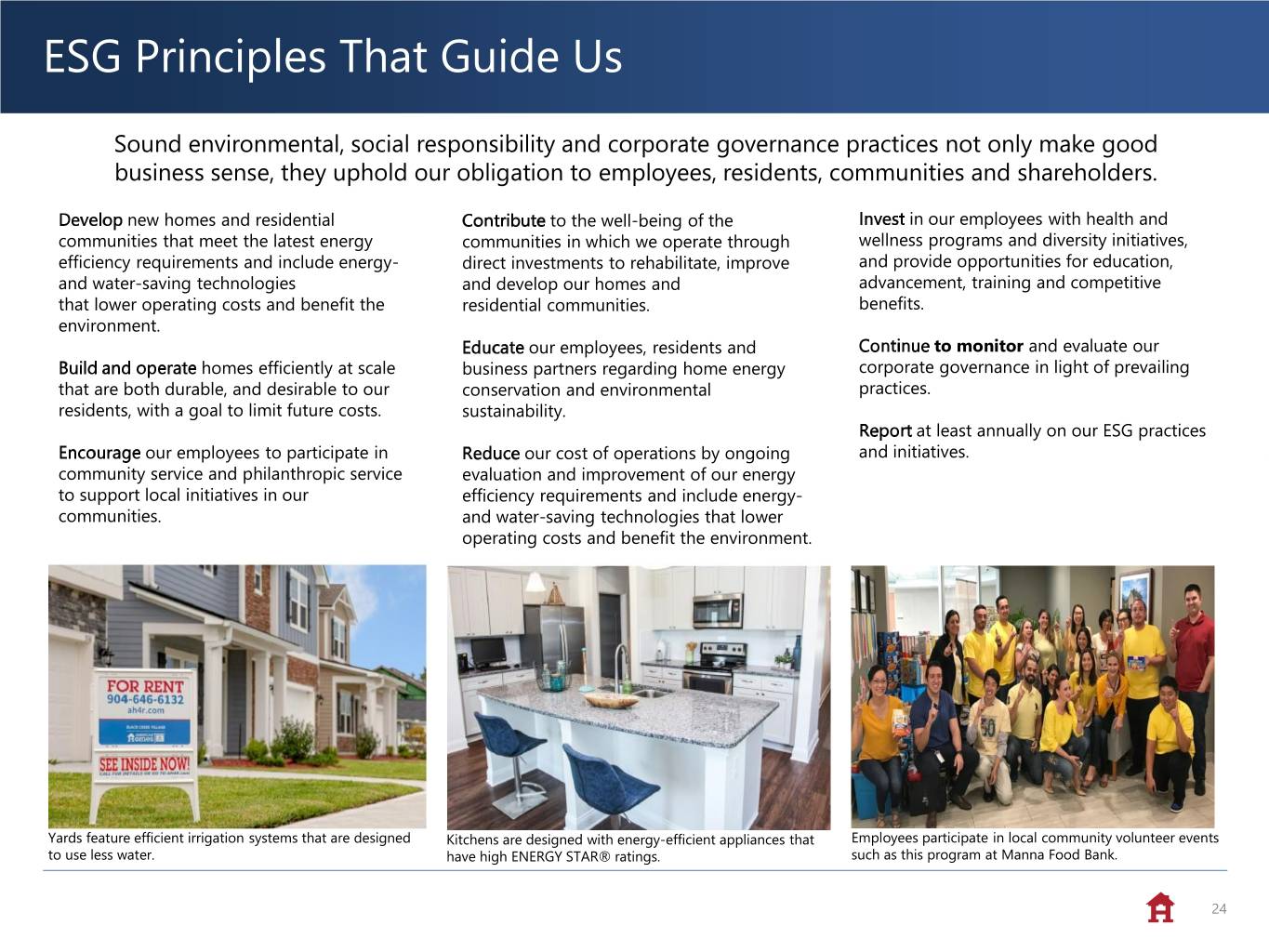

ESG Principles That Guide Us Sound environmental, social responsibility and corporate governance practices not only make good business sense, they uphold our obligation to employees, residents, communities and shareholders. Develop new homes and residential Contribute to the well-being of the Invest in our employees with health and communities that meet the latest energy communities in which we operate through wellness programs and diversity initiatives, efficiency requirements and include energy- direct investments to rehabilitate, improve and provide opportunities for education, and water-saving technologies and develop our homes and advancement, training and competitive that lower operating costs and benefit the residential communities. benefits. environment. Educate our employees, residents and Continue to monitor and evaluate our Build and operate homes efficiently at scale business partners regarding home energy corporate governance in light of prevailing that are both durable, and desirable to our conservation and environmental practices. residents, with a goal to limit future costs. sustainability. Report at least annually on our ESG practices Encourage our employees to participate in Reduce our cost of operations by ongoing and initiatives. community service and philanthropic service evaluation and improvement of our energy to support local initiatives in our efficiency requirements and include energy- communities. and water-saving technologies that lower operating costs and benefit the environment. Yards feature efficient irrigation systems that are designed Kitchens are designed with energy-efficient appliances that Employees participate in local community volunteer events to use less water. have high ENERGY STAR® ratings. such as this program at Manna Food Bank. 24

APPENDIX 25

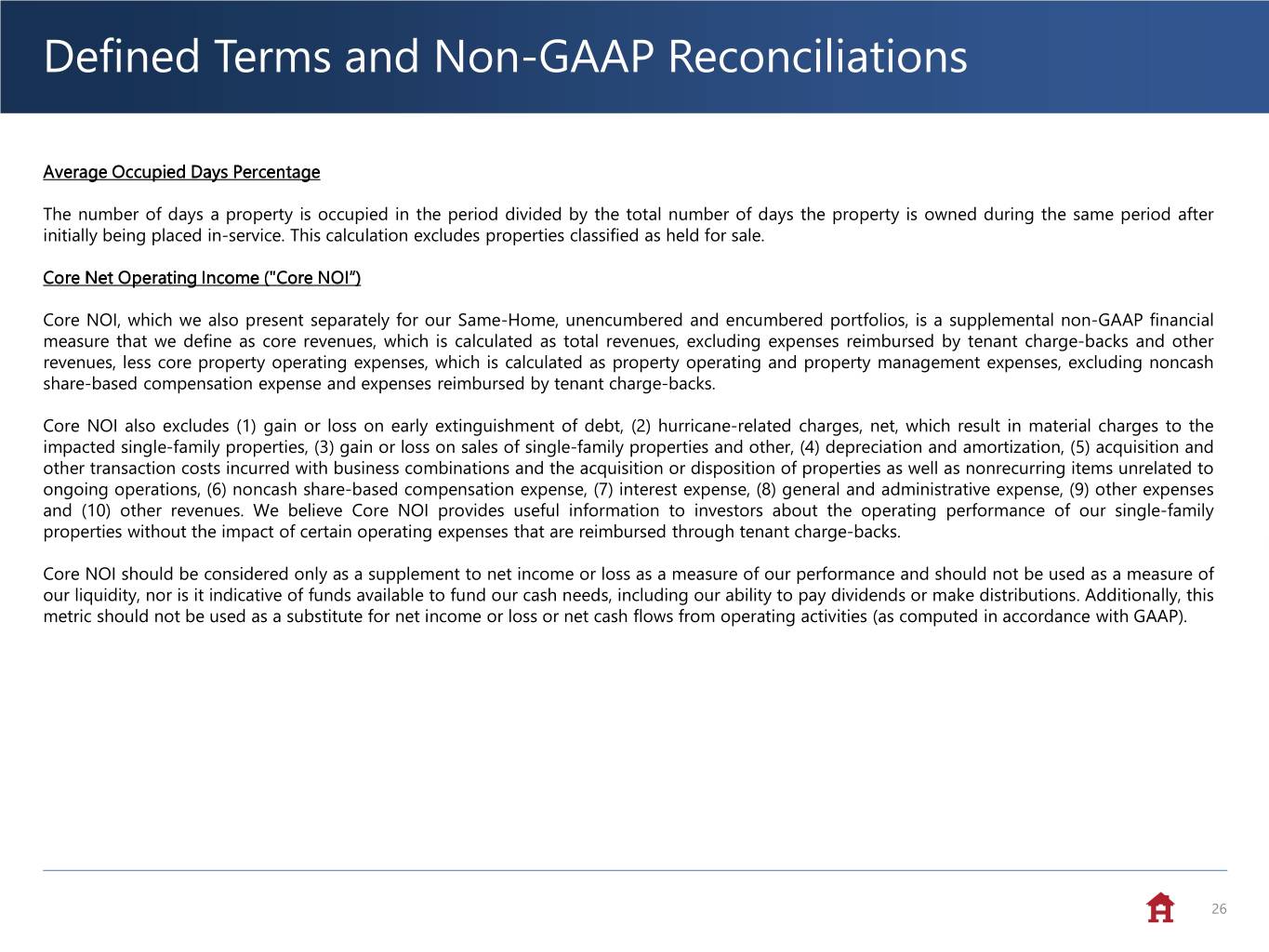

Defined Terms and Non-GAAP Reconciliations Average Occupied Days Percentage The number of days a property is occupied in the period divided by the total number of days the property is owned during the same period after initially being placed in-service. This calculation excludes properties classified as held for sale. Core Net Operating Income ("Core NOI“) Core NOI, which we also present separately for our Same-Home, unencumbered and encumbered portfolios, is a supplemental non-GAAP financial measure that we define as core revenues, which is calculated as total revenues, excluding expenses reimbursed by tenant charge-backs and other revenues, less core property operating expenses, which is calculated as property operating and property management expenses, excluding noncash share-based compensation expense and expenses reimbursed by tenant charge-backs. Core NOI also excludes (1) gain or loss on early extinguishment of debt, (2) hurricane-related charges, net, which result in material charges to the impacted single-family properties, (3) gain or loss on sales of single-family properties and other, (4) depreciation and amortization, (5) acquisition and other transaction costs incurred with business combinations and the acquisition or disposition of properties as well as nonrecurring items unrelated to ongoing operations, (6) noncash share-based compensation expense, (7) interest expense, (8) general and administrative expense, (9) other expenses and (10) other revenues. We believe Core NOI provides useful information to investors about the operating performance of our single-family properties without the impact of certain operating expenses that are reimbursed through tenant charge-backs. Core NOI should be considered only as a supplement to net income or loss as a measure of our performance and should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Additionally, this metric should not be used as a substitute for net income or loss or net cash flows from operating activities (as computed in accordance with GAAP). 26

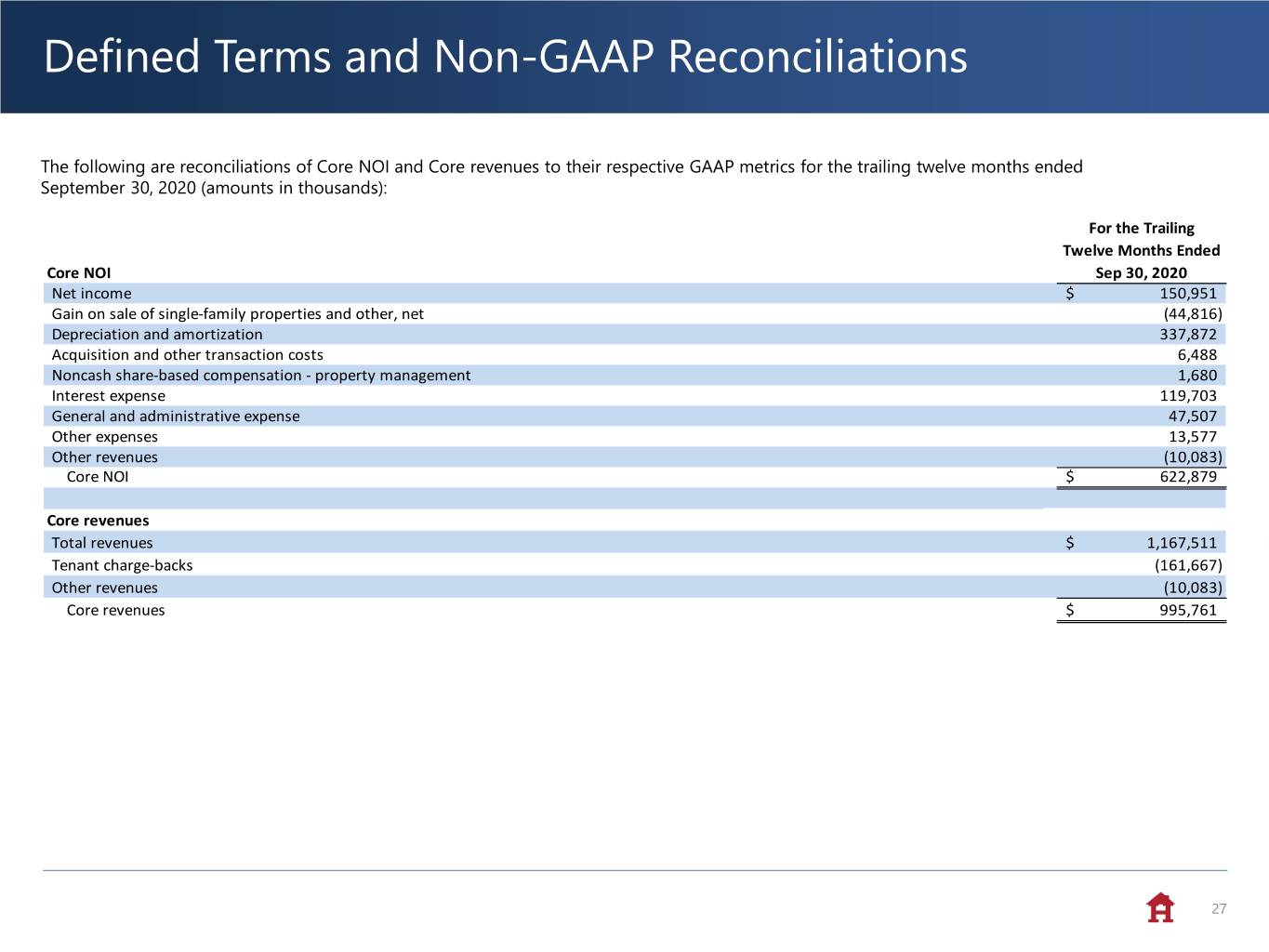

Defined Terms and Non-GAAP Reconciliations The following are reconciliations of Core NOI and Core revenues to their respective GAAP metrics for the trailing twelve months ended September 30, 2020 (amounts in thousands): For the Trailing Twelve Months Ended Core NOI Sep 30, 2020 Net income $ 150,951 Gain on sale of single-family properties and other, net (44,816) Depreciation and amortization 337,872 Acquisition and other transaction costs 6,488 Noncash share-based compensation - property management 1,680 Interest expense 119,703 General and administrative expense 47,507 Other expenses 13,577 Other revenues (10,083) Core NOI $ 622,879 Core revenues Total revenues $ 1,167,511 Tenant charge-backs (161,667) Other revenues (10,083) Core revenues $ 995,761 27

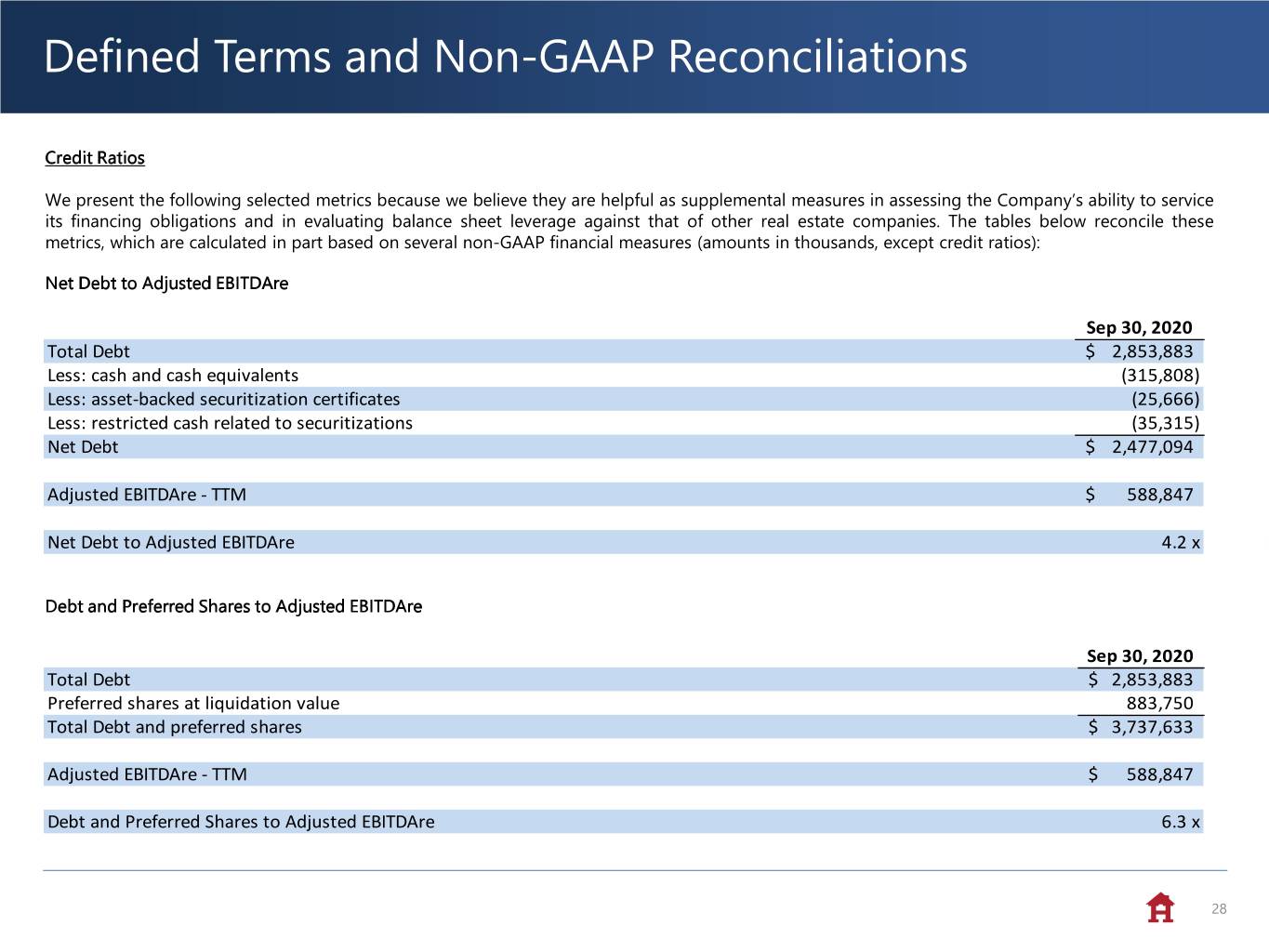

Defined Terms and Non-GAAP Reconciliations Credit Ratios We present the following selected metrics because we believe they are helpful as supplemental measures in assessing the Company’s ability to service its financing obligations and in evaluating balance sheet leverage against that of other real estate companies. The tables below reconcile these metrics, which are calculated in part based on several non-GAAP financial measures (amounts in thousands, except credit ratios): Net Debt to Adjusted EBITDAre Sep 30, 2020 Total Debt $ 2,853,883 Less: cash and cash equivalents (315,808) Less: asset-backed securitization certificates (25,666) Less: restricted cash related to securitizations (35,315) Net Debt $ 2,477,094 Adjusted EBITDAre - TTM $ 588,847 Net Debt to Adjusted EBITDAre 4.2 x Debt and Preferred Shares to Adjusted EBITDAre Sep 30, 2020 Total Debt $ 2,853,883 Preferred shares at liquidation value 883,750 Total Debt and preferred shares $ 3,737,633 Adjusted EBITDAre - TTM $ 588,847 Debt and Preferred Shares to Adjusted EBITDAre 6.3 x 28

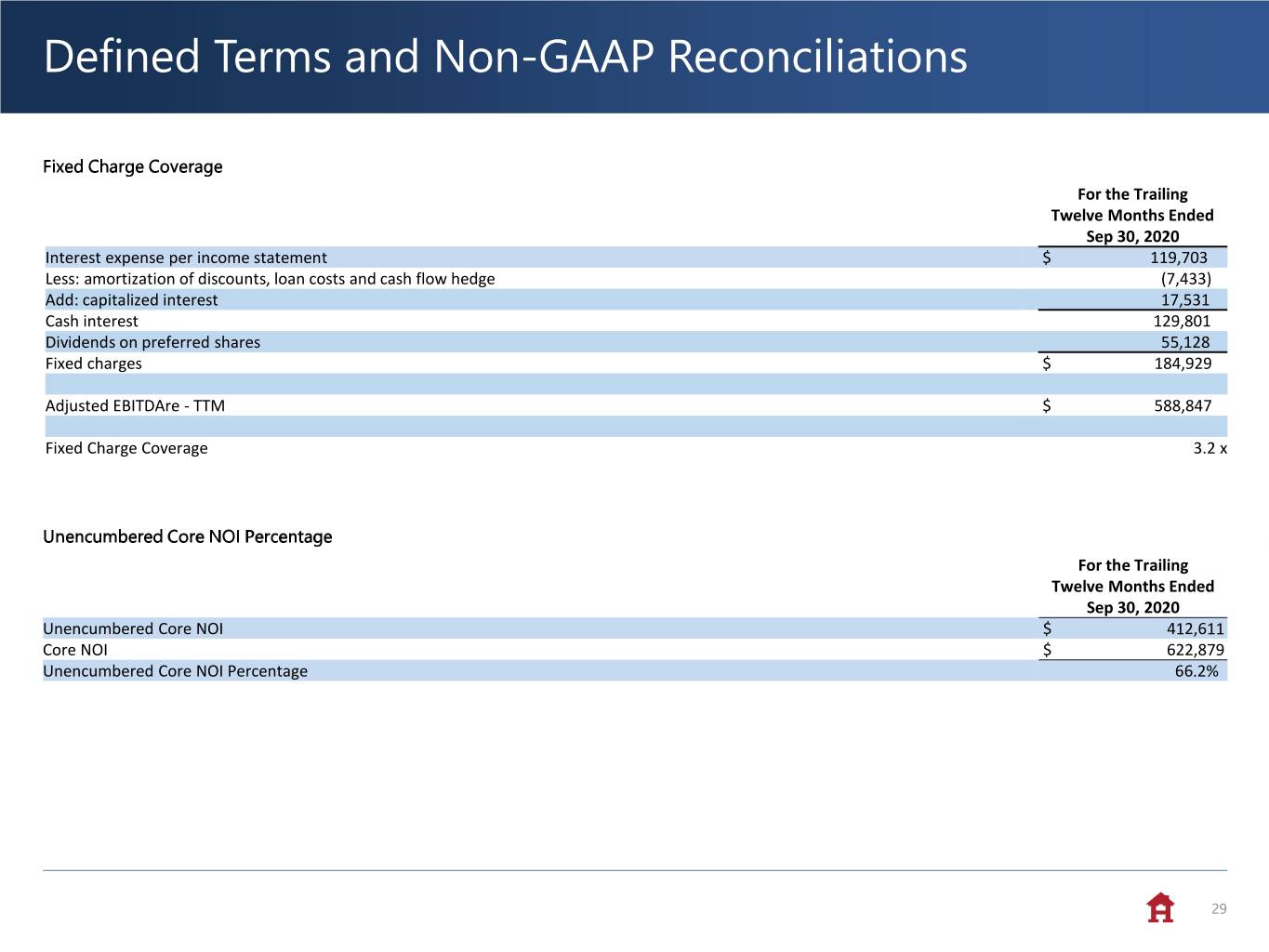

Defined Terms and Non-GAAP Reconciliations Fixed Charge Coverage For the Trailing Twelve Months Ended Sep 30, 2020 Interest expense per income statement $ 119,703 Less: amortization of discounts, loan costs and cash flow hedge (7,433) Add: capitalized interest 17,531 Cash interest 129,801 Dividends on preferred shares 55,128 Fixed charges $ 184,929 Adjusted EBITDAre - TTM $ 588,847 Fixed Charge Coverage 3.2 x Unencumbered Core NOI Percentage For the Trailing Twelve Months Ended Sep 30, 2020 Unencumbered Core NOI $ 412,611 Core NOI $ 622,879 Unencumbered Core NOI Percentage 66.2% 29

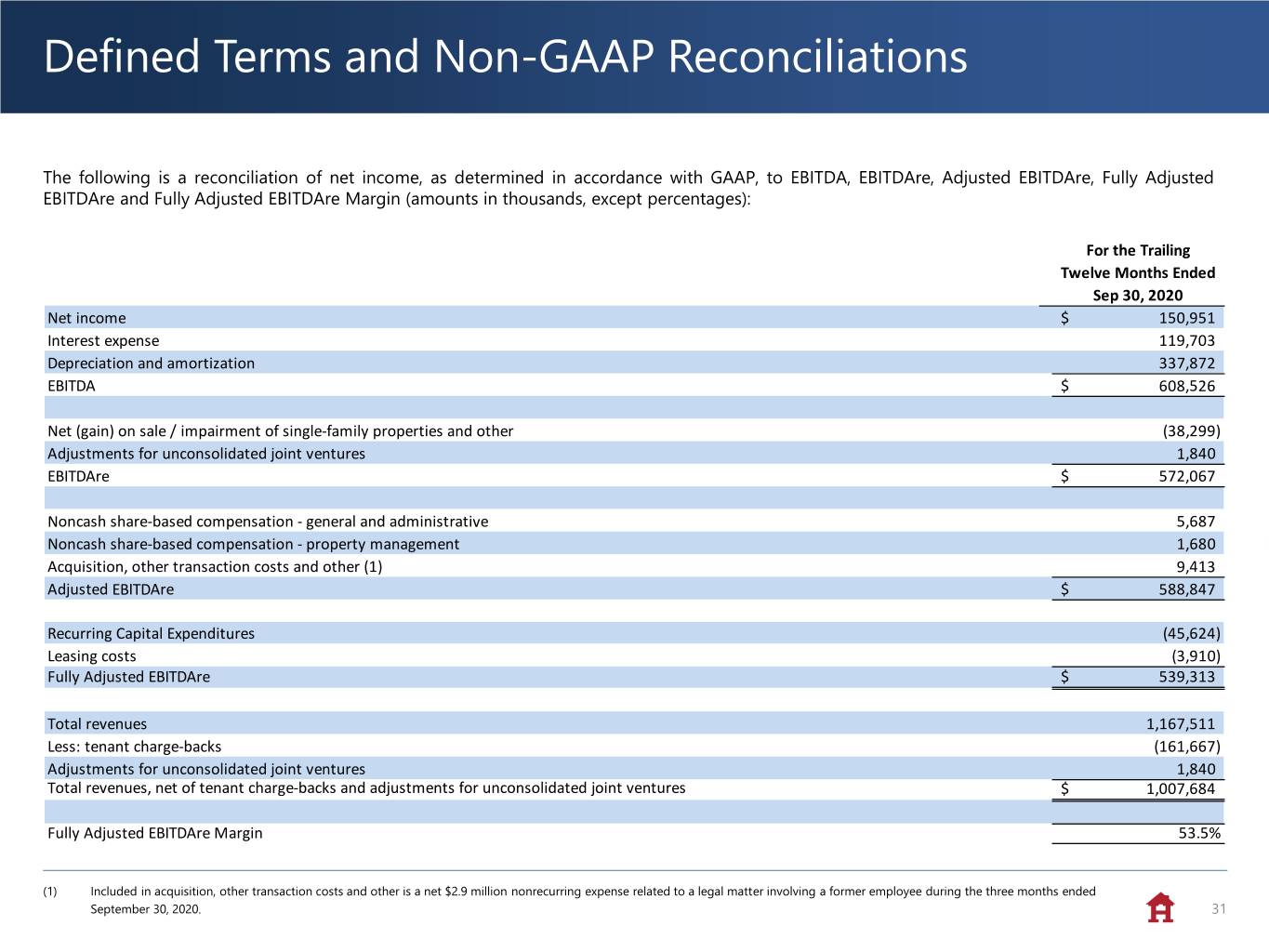

Defined Terms and Non-GAAP Reconciliations EBITDA / EBITDAre / Adjusted EBITDAre / Fully Adjusted EBITDAre / Fully Adjusted EBITDAre Margin EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and others as a supplemental measure of performance. EBITDAre is a supplemental non-GAAP financial measure, which we calculate in accordance with the definition approved by the National Association of Real Estate Investment Trusts (“NAREIT”) by adjusting EBITDA for the net gain or loss on sales / impairment of single-family properties and other and adjusting for unconsolidated partnerships and joint ventures on the same basis. Adjusted EBITDAre is a supplemental non-GAAP financial measure calculated by adjusting EBITDAre for (1) acquisition and other transaction costs incurred with business combinations and the acquisition or disposition of properties as well as nonrecurring items unrelated to ongoing operations, (2) noncash share-based compensation expense, (3) hurricane-related charges, net, which result in material charges to the impacted single-family properties, and (4) gain or loss on early extinguishment of debt. Fully Adjusted EBITDAre is a supplemental non-GAAP financial measure calculated by adjusting Adjusted EBITDAre for (1) Recurring Capital Expenditures and (2) leasing costs. Fully Adjusted EBITDAre Margin is a supplemental non-GAAP financial measure calculated as Fully Adjusted EBITDAre divided by total revenues, net of tenant charge-backs and adjusted for unconsolidated joint ventures. We believe these metrics provide useful information to investors because they exclude the impact of various income and expense items that are not indicative of operating performance. 30

Defined Terms and Non-GAAP Reconciliations The following is a reconciliation of net income, as determined in accordance with GAAP, to EBITDA, EBITDAre, Adjusted EBITDAre, Fully Adjusted EBITDAre and Fully Adjusted EBITDAre Margin (amounts in thousands, except percentages): For the Trailing Twelve Months Ended Sep 30, 2020 Net income $ 150,951 Interest expense 119,703 Depreciation and amortization 337,872 EBITDA $ 608,526 Net (gain) on sale / impairment of single-family properties and other (38,299) Adjustments for unconsolidated joint ventures 1,840 EBITDAre $ 572,067 Noncash share-based compensation - general and administrative 5,687 Noncash share-based compensation - property management 1,680 Acquisition, other transaction costs and other (1) 9,413 Adjusted EBITDAre $ 588,847 Recurring Capital Expenditures (45,624) Leasing costs (3,910) Fully Adjusted EBITDAre $ 539,313 Total revenues 1,167,511 Less: tenant charge-backs (161,667) Adjustments for unconsolidated joint ventures 1,840 Total revenues, net of tenant charge-backs and adjustments for unconsolidated joint ventures $ 1,007,684 Fully Adjusted EBITDAre Margin 53.5% (1) Included in acquisition, other transaction costs and other is a net $2.9 million nonrecurring expense related to a legal matter involving a former employee during the three months ended September 30, 2020. 31

Defined Terms and Non-GAAP Reconciliations Property Enhancing Capex Includes elective capital expenditures to enhance the operating profile of a property, such as investments to increase future revenues or reduce maintenance expenditures. Recurring Capital Expenditures For our Same-Home portfolio, Recurring Capital Expenditures includes replacement costs and other capital expenditures recorded during the period that are necessary to help preserve the value and maintain functionality of our properties. For our total portfolio, we calculate Recurring Capital Expenditures by multiplying (a) current period actual Recurring Capital Expenditures per Same-Home property by (b) our total number of properties, excluding newly acquired non-stabilized properties and properties classified as held for sale. Same-Home Property A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period presented under comparison. A property is removed from Same-Home if it has been classified as held for sale or has been taken out of service as a result of a casualty loss. Stabilized Property A property acquired individually (i.e., not through a bulk purchase) is classified as stabilized once it has been renovated by the Company or newly constructed and then initially leased or available for rent for a period greater than 90 days. Properties acquired through a bulk purchase are first considered non-stabilized, as an entire group, until (1) we have owned them for an adequate period of time to allow for complete on-boarding to our operating platform, and (2) a substantial portion of the properties have experienced tenant turnover at least once under our ownership, providing the opportunity for renovations and improvements to meet our property standards. After such time has passed, properties acquired through a bulk purchase are then evaluated on an individual property basis under our standard stabilization criteria. Total Debt Includes principal balances on asset-backed securitizations, unsecured senior notes and borrowings outstanding under our revolving credit facility as of period end, and excludes unamortized discounts and unamortized deferred financing costs. 32