Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | cnfr-8k_20201112.htm |

NASDAQ: CNFR Fulfilling the Unique Needs of Specialty Insurance Markets as a Long-Term Partner November 12, 2020 Exhibit 99.1

Safe Harbor Statement This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to management. These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position, product expansion, future operations, margins, profitability, future efficiencies, and other financial and operating information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation. Our actual future results may be materially different from what we expect due to factors largely outside our control, including the occurrence of severe weather conditions and other catastrophes, the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance coverage at reasonable rates and the effects of competition. These and other risks and uncertainties associated with our business are described under the heading “Risk Factors” in our most recently filed Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, which should be read in conjunction with this presentation. The company and subsidiaries operate in a dynamic business environment, and therefore the risks identified are not meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

Conifer Holdings, Inc. provides niche market insurance programs through Conifer Insurance Company and White Pine Insurance Company on both an admitted and E&S basis. Program Portfolio Hospitality Liquor Liability Security Guards, Alarm Contractors & Private Investigators Quick Service Restaurants Workers’ Compensation Cannabis Specialty Homeowners Conifer’s Infrastructure Conifer Insurance Company Founded in 2009 Licensed in 49 States (Exc. NY) E&S in 45 States, Admitted in 4 (MI, IL, IN, SD) Sycamore Insurance Agency Wholly owned MGA Acts as a conduit for retail agents to access and write E&S policies Facilitates specialty programs and markets on a select basis Venture Agency Specializes in security, alarm and private investigator risks Available in all 50 states White Pine Insurance Company Licensed & Admitted in 43 States Blue Spruce Underwriters Specializes in Quick Service (QSR) and Casual Dining Restaurants Available in all 50 states

Our History 2020 Focus is on enhancing underwriting profit as GWP continues to grow in core specialty lines of business Continued expense management initiatives expected to yield results in consistent expense ratio improvement Conifer completes IPO on Nasdaq Company makes strategic decision to slow growth in homeowners product in Florida; commences new specialty products in security guards and low-value dwelling with historically strong loss ratios 2015-2019 Non-compete agreements expire and Conifer begins writing in predecessor lines of business, bringing together successful executives and experienced underwriters with new, state-of-the-art processing systems 2012 North Pointe (founded by Conifer founder Jim Petcoff) sold to QBE for $146 million, or approximately 1.7X book value 2008

Conifer Response: COVID-19 COVID-19 Conifer is proactively managing the challenges created by the onset of the novel coronavirus (COVID-19). Our primary concern has been the health and welfare of employees, families, associates, agents and insureds. From late March to present, our entire team has worked from home. The transition took place without disrupting our operations or our ability to serve our business partners. This is a strong indicator of our resilience and capacity to manage remote operations as long as necessary. As of November 2020 Robust business continuity plan and significant investments in technology infrastructure have paid off. While Conifer does focus on hospitality and small business commercial accounts, its policy coverages are largely limited to property and general liability. In fact, hospitality and small business commercial policies have yielded lower claim volumes and fewer litigated claims during the COVID period. Minimal exposure to workers’ compensation. No exposure to: First responders Travel insurance Event cancellation Overseas policy exposure

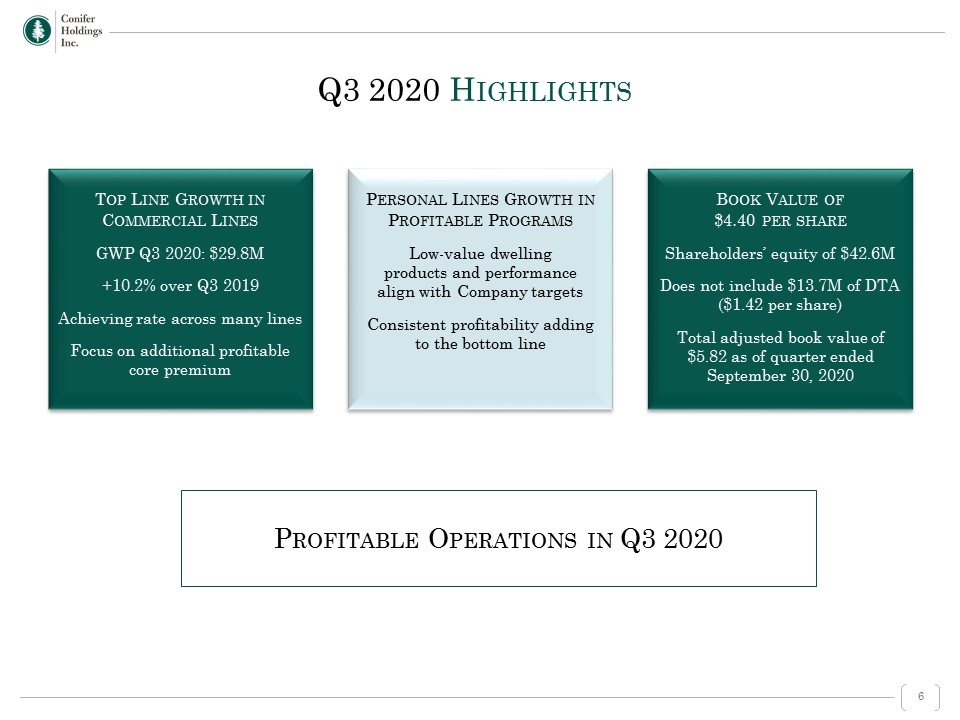

Q3 2020 Highlights Top Line Growth in Commercial Lines GWP Q3 2020: $29.8M +10.2% over Q3 2019 Achieving rate across many lines Focus on additional profitable core premium Personal Lines Growth in Profitable Programs Low-value dwelling products and performance align with Company targets Consistent profitability adding to the bottom line Book Value of $4.40 per share Shareholders’ equity of $42.6M Does not include $13.7M of DTA ($1.42 per share) Total adjusted book value of $5.82 as of quarter ended September 30, 2020 Profitable Operations in Q3 2020

Investment Thesis Focused Expertise in Niche Specialty Insurance Markets Operating Trends Moving in the Right Direction 2 Attractive Entry Point Valuation Based on Operating Trajectory 3 1

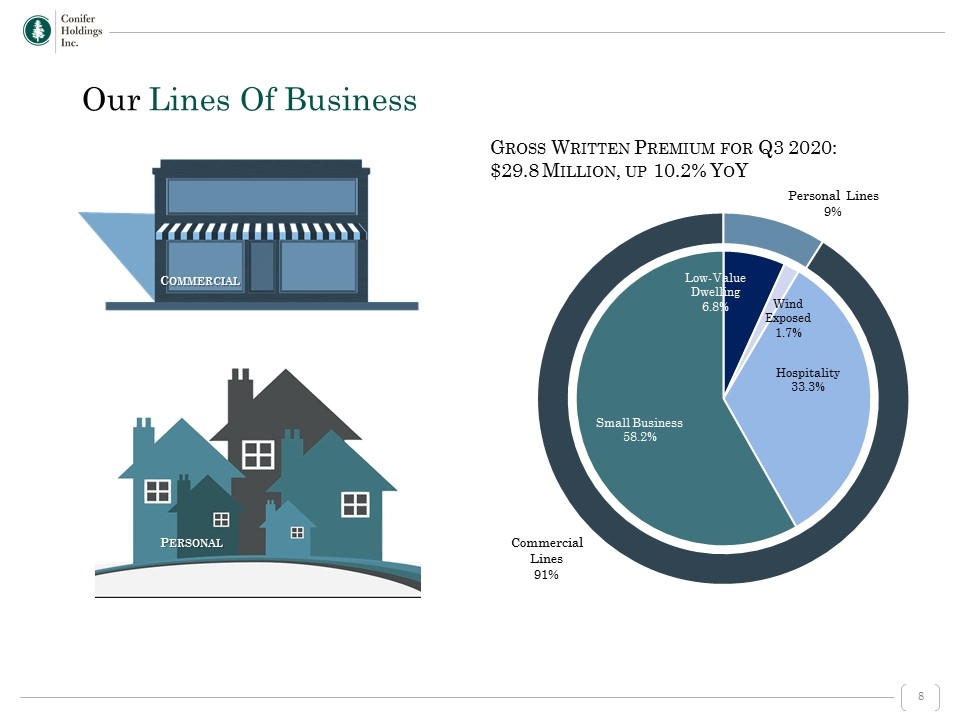

Our Lines Of Business Commercial Personal Gross Written Premium for Q3 2020: $29.8 Million, up 10.2% YoY

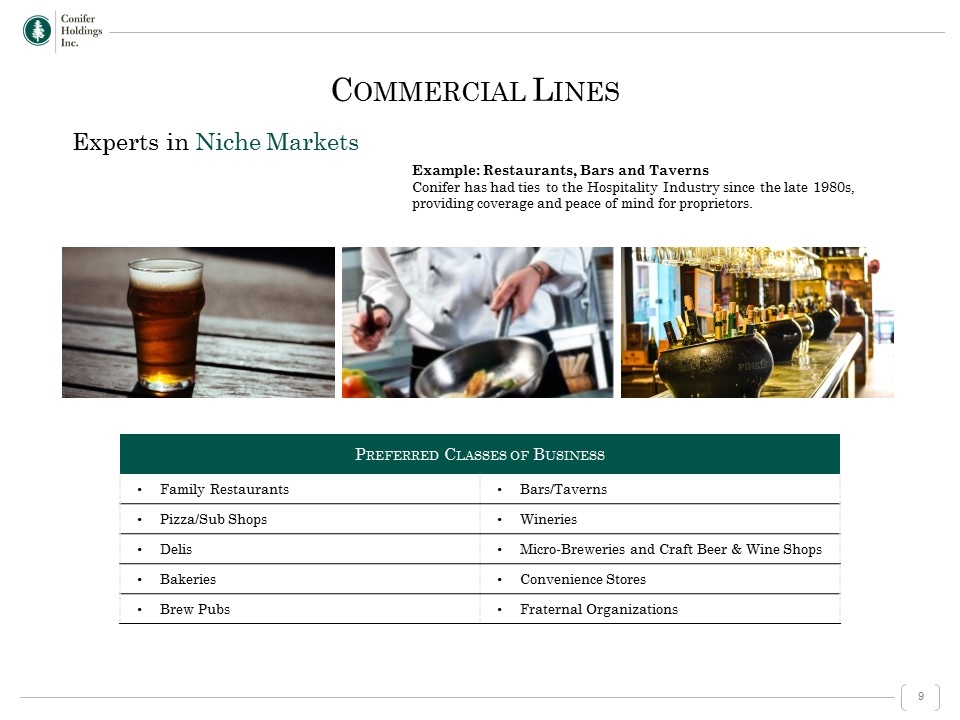

Example: Restaurants, Bars and Taverns Conifer has had ties to the Hospitality Industry since the late 1980s, providing coverage and peace of mind for proprietors. Experts in Niche Markets Preferred Classes of Business Family Restaurants Bars/Taverns Pizza/Sub Shops Wineries Delis Micro-Breweries and Craft Beer & Wine Shops Bakeries Convenience Stores Brew Pubs Fraternal Organizations Commercial Lines

Focus on classes where we have deep underwriting knowledge and experience Partner with retail and select wholesale agencies and retain underwriting authority in-house: Underwriting teams have established strong relationships with retail and wholesale specialists in these lines of business With agents who specialize in our unique classes, we remain closer to our insureds and underwrite a stronger account / risk profile overall A hallmark of our success has always been tight agent relationships that generate high account retention: Commercial retention in the quarter was over 90%. High account retention allows us to selectively grow market share where we see the best pricing and profitability. Leverage ability to write on E&S and admitted paper for rate and form flexibility: Our markets are firming, and we are seeing rate increases in our specialty markets – especially Excess & Surplus lines In general, this has contributed to overall higher account retention, and more rate per risk. High single digits generally, low double digits for most classes, and even higher increases for auto insureds. Maintain low limits as much as possible: vast majority of property TIV is under $1M Also, we are seeing select participants exiting and leading to some market share movement in our space Continuing to emphasize specialty business, our premium mix remains firmly dedicated to Commercial Lines with 91% Specialty Commercial and only 9% Personal Lines as of 9/30/20 Commercial Lines Focus: Disciplined, Quality Underwriting

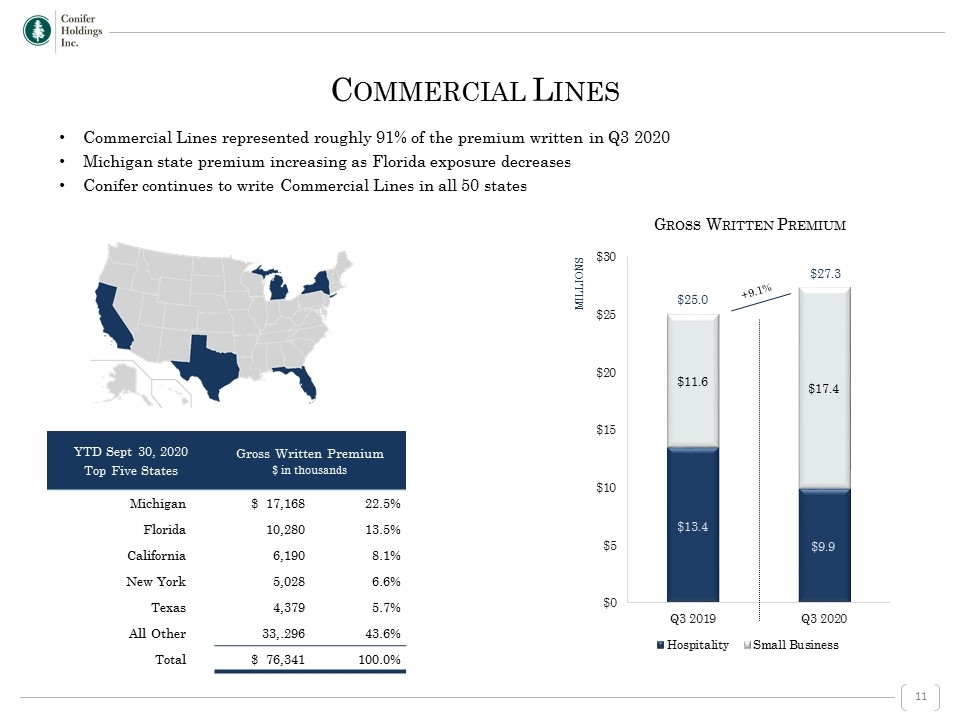

$25.0 $27.3 MILLIONS +9.1% Gross Written Premium Commercial Lines represented roughly 91% of the premium written in Q3 2020 Michigan state premium increasing as Florida exposure decreases Conifer continues to write Commercial Lines in all 50 states Commercial Lines YTD Sept 30, 2020 Top Five States Gross Written Premium $ in thousands Michigan $ 17,168 22.5% Florida 10,280 13.5% California 6,190 8.1% New York 5,028 6.6% Texas 4,379 5.7% All Other 33,.296 43.6% Total $ 76,341 100.0%

Low value dwelling focus Underwriting teams have established strong relationships with retail and wholesale specialists in low value dwelling markets Leverage ability to write on E&S and admitted paper, where possible, for rate and form flexibility Utilize technology to appropriately price our property risks – for example, employing satellite imagery software for positive roof selection Improved technology to streamline claims process – for example, text messaging with claimants (including in-app translation capability) Maintain competitive advantage in ease of use for agency portal and submission/bind process Cloud-based agency portal system with strong data mining and predictive outcome capabilities Redesigned insurance company websites with the agent experience in mind Maintain rate and underwriting discipline regardless of market cycles Wind driven premium has been largely non-renewed, which lowered overall PML by up to 90% Personal Lines Focus: Niche Specialty Homeowners Products

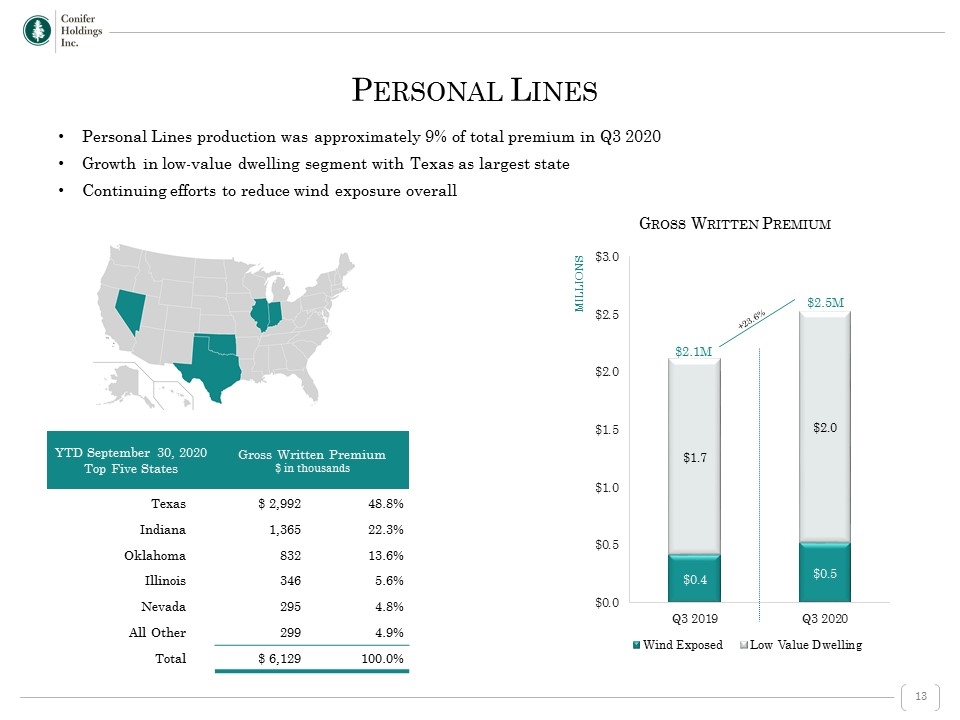

$2.1M $2.5M MILLIONS Gross Written Premium Personal Lines production was approximately 9% of total premium in Q3 2020 Growth in low-value dwelling segment with Texas as largest state Continuing efforts to reduce wind exposure overall +23.6% Personal Lines YTD September 30, 2020 Top Five States Gross Written Premium $ in thousands Texas $ 2,992 48.8% Indiana 1,365 22.3% Oklahoma 832 13.6% Illinois 346 5.6% Nevada 295 4.8% All Other 299 4.9% Total $ 6,129 100.0%

Sycamore Insurance Agency, Inc. Acts as a wholesaler / surplus lines broker / retail agent recording non-risk revenue on business we place with other companies. Can pay E&S taxes and fees on behalf of retail agents, giving greater access to see more tailored risks from a wider distribution pool. We expect that Sycamore’s revenue opportunities will continue to grow: Total Commission Revenue from third party or affiliated sources is expected to be over $7M in 2020 ($6M in first nine months of 2020) SMALL BUSINESS PERSONAL LINES HOSPITALITY CANNABIS & HEMP Agency: Upside Benefits Fee-based Business / Risk-free Revenue

Operating Trends Moving in the Right Direction Attractive Entry Point Valuation Based on Operating Trajectory Focused Expertise in Niche Specialty Insurance Markets 2 3 1 Investment Thesis

Strategic Initiatives: Progress to Date Writing Specialty Commercial Lines Significant rate increases Infrastructure in place to handle anticipated growth Reducing exposure to underperforming markets (example: exiting select FL commercial lines) Expense management ongoing Focus on Small Commercial Business Experiencing premium growth Achieving appropriate scale Substantial decrease in number of open claims leads to more predictable loss-cost predictions in future periods Consistent quarter-over-quarter expense ratio improvements anticipated

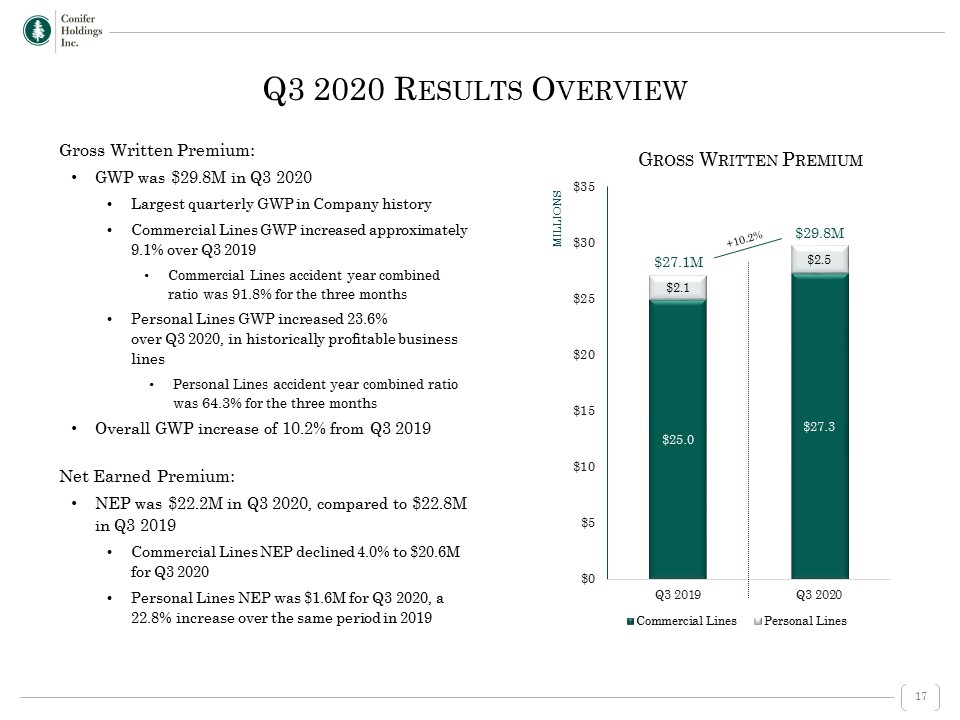

Q3 2020 Results Overview Gross Written Premium: GWP was $29.8M in Q3 2020 Largest quarterly GWP in Company history Commercial Lines GWP increased approximately 9.1% over Q3 2019 Commercial Lines accident year combined ratio was 91.8% for the three months Personal Lines GWP increased 23.6% over Q3 2020, in historically profitable business lines Personal Lines accident year combined ratio was 64.3% for the three months Overall GWP increase of 10.2% from Q3 2019 Net Earned Premium: NEP was $22.2M in Q3 2020, compared to $22.8M in Q3 2019 Commercial Lines NEP declined 4.0% to $20.6M for Q3 2020 Personal Lines NEP was $1.6M for Q3 2020, a 22.8% increase over the same period in 2019 Gross Written Premium $27.1M $29.8M MILLIONS +10.2%

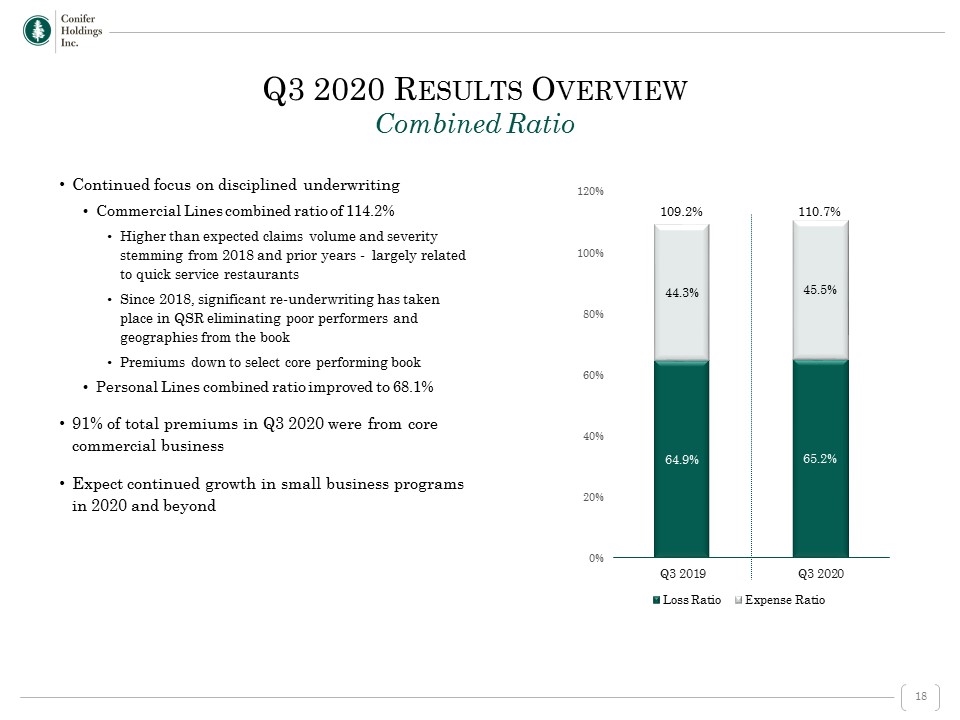

Continued focus on disciplined underwriting Commercial Lines combined ratio of 114.2% Higher than expected claims volume and severity stemming from 2018 and prior years - largely related to quick service restaurants Since 2018, significant re-underwriting has taken place in QSR eliminating poor performers and geographies from the book Premiums down to select core performing book Personal Lines combined ratio improved to 68.1% 91% of total premiums in Q3 2020 were from core commercial business Expect continued growth in small business programs in 2020 and beyond Q3 2020 Results Overview Combined Ratio 109.2% 110.7%

For Q3 2020, the consolidated loss ratio was 65.2%, compared to 64.9% in Q3 2019 Commercial Lines loss ratio was 68.8% Personal Lines loss ratio was 21.3% Ongoing trend of shifting away from wind-exposed Personal Lines premium leading to out performance Commercial lines continued focus on disciplined growth in solidly performing core lines of business Q3 2020 Results Overview Loss Ratio

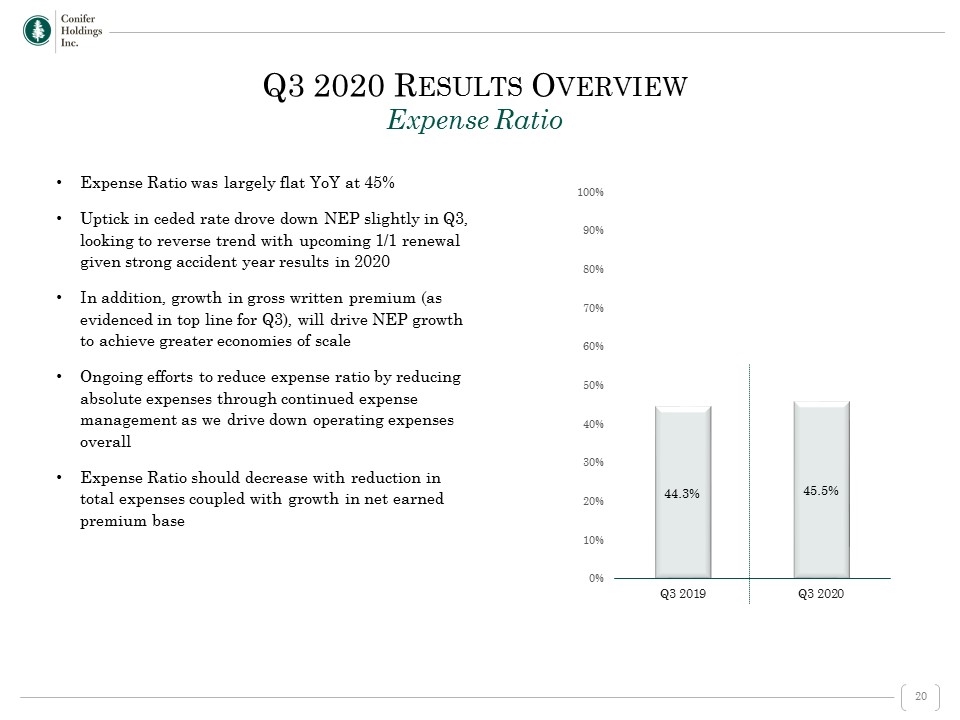

Expense Ratio was largely flat YoY at 45% Uptick in ceded rate drove down NEP slightly in Q3, looking to reverse trend with upcoming 1/1 renewal given strong accident year results in 2020 In addition, growth in gross written premium (as evidenced in top line for Q3), will drive NEP growth to achieve greater economies of scale Ongoing efforts to reduce expense ratio by reducing absolute expenses through continued expense management as we drive down operating expenses overall Expense Ratio should decrease with reduction in total expenses coupled with growth in net earned premium base Q3 2020 Results Overview Expense Ratio

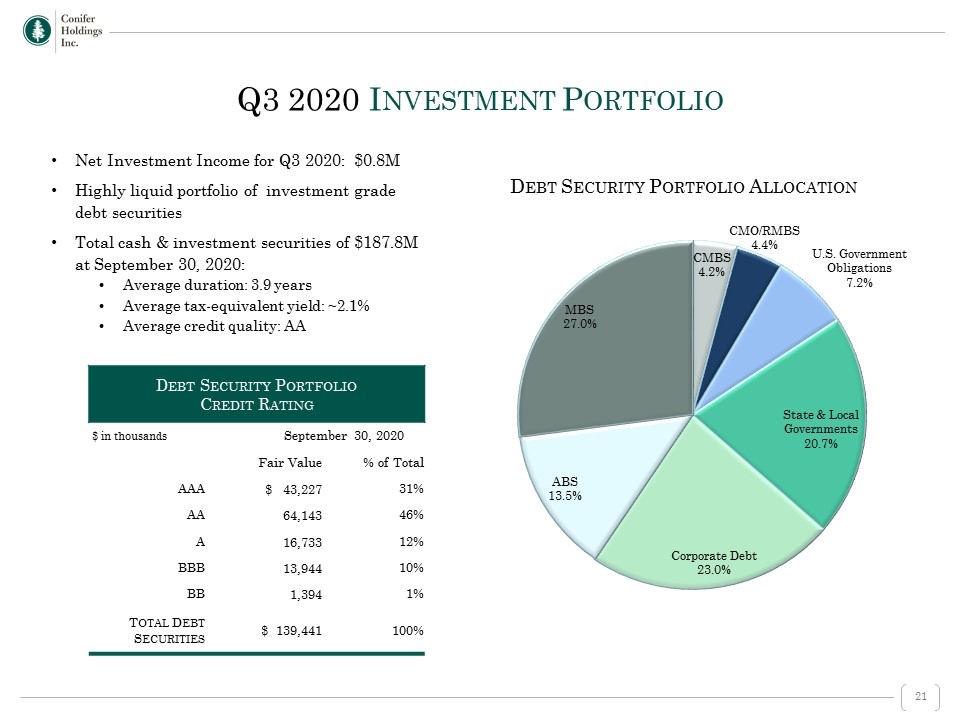

Debt Security Portfolio Allocation Net Investment Income for Q3 2020: $0.8M Highly liquid portfolio of investment grade debt securities Total cash & investment securities of $187.8M at September 30, 2020: Average duration: 3.9 years Average tax-equivalent yield: ~2.1% Average credit quality: AA Debt Security Portfolio Credit Rating $ in thousands September 30, 2020 Fair Value % of Total AAA $ 43,227 31% AA 64,143 46% A 16,733 12% BBB 13,944 10% BB 1,394 1% Total Debt Securities $ 139,441 100% Q3 2020 Investment Portfolio

Operating Trends Moving in the Right Direction 2 Attractive Entry Point Valuation Based on Operating Trajectory 3 Focused Expertise in Niche Specialty Insurance Markets 1 Investment Thesis

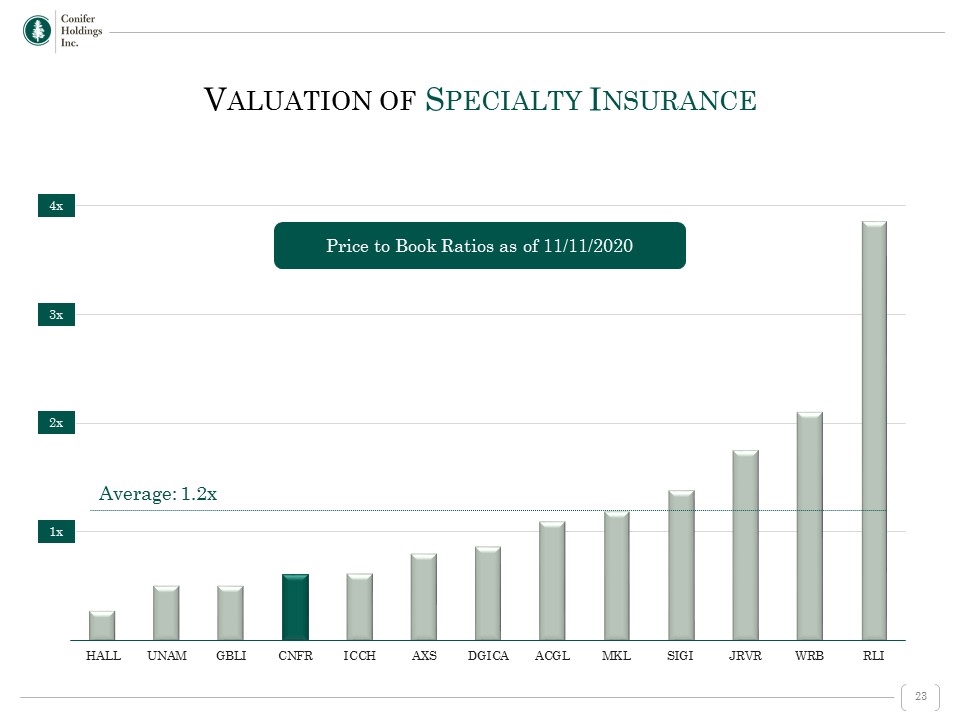

Price to Book Ratios as of 11/11/2020 2x 4x 3x 1x Average: 1.2x Valuation of Specialty Insurance

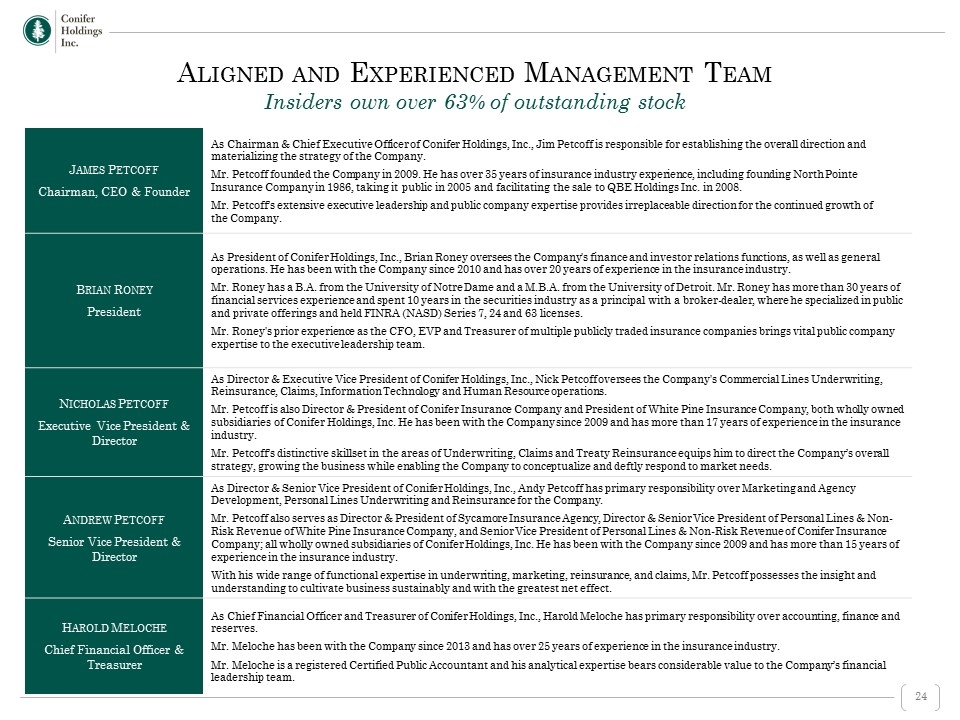

Aligned and Experienced Management Team Insiders own over 63% of outstanding stock James Petcoff Chairman, CEO & Founder As Chairman & Chief Executive Officer of Conifer Holdings, Inc., Jim Petcoff is responsible for establishing the overall direction and materializing the strategy of the Company. Mr. Petcoff founded the Company in 2009. He has over 35 years of insurance industry experience, including founding North Pointe Insurance Company in 1986, taking it public in 2005 and facilitating the sale to QBE Holdings Inc. in 2008. Mr. Petcoff’s extensive executive leadership and public company expertise provides irreplaceable direction for the continued growth of the Company. Brian Roney President As President of Conifer Holdings, Inc., Brian Roney oversees the Company's finance and investor relations functions, as well as general operations. He has been with the Company since 2010 and has over 20 years of experience in the insurance industry. Mr. Roney has a B.A. from the University of Notre Dame and a M.B.A. from the University of Detroit. Mr. Roney has more than 30 years of financial services experience and spent 10 years in the securities industry as a principal with a broker-dealer, where he specialized in public and private offerings and held FINRA (NASD) Series 7, 24 and 63 licenses. Mr. Roney's prior experience as the CFO, EVP and Treasurer of multiple publicly traded insurance companies brings vital public company expertise to the executive leadership team. Nicholas Petcoff Executive Vice President & Director As Director & Executive Vice President of Conifer Holdings, Inc., Nick Petcoff oversees the Company's Commercial Lines Underwriting, Reinsurance, Claims, Information Technology and Human Resource operations. Mr. Petcoff is also Director & President of Conifer Insurance Company and President of White Pine Insurance Company, both wholly owned subsidiaries of Conifer Holdings, Inc. He has been with the Company since 2009 and has more than 17 years of experience in the insurance industry. Mr. Petcoff’s distinctive skillset in the areas of Underwriting, Claims and Treaty Reinsurance equips him to direct the Company’s overall strategy, growing the business while enabling the Company to conceptualize and deftly respond to market needs. Andrew Petcoff Senior Vice President & Director As Director & Senior Vice President of Conifer Holdings, Inc., Andy Petcoff has primary responsibility over Marketing and Agency Development, Personal Lines Underwriting and Reinsurance for the Company. Mr. Petcoff also serves as Director & President of Sycamore Insurance Agency, Director & Senior Vice President of Personal Lines & Non-Risk Revenue of White Pine Insurance Company, and Senior Vice President of Personal Lines & Non-Risk Revenue of Conifer Insurance Company; all wholly owned subsidiaries of Conifer Holdings, Inc. He has been with the Company since 2009 and has more than 15 years of experience in the insurance industry. With his wide range of functional expertise in underwriting, marketing, reinsurance, and claims, Mr. Petcoff possesses the insight and understanding to cultivate business sustainably and with the greatest net effect. Harold Meloche Chief Financial Officer & Treasurer As Chief Financial Officer and Treasurer of Conifer Holdings, Inc., Harold Meloche has primary responsibility over accounting, finance and reserves. Mr. Meloche has been with the Company since 2013 and has over 25 years of experience in the insurance industry. Mr. Meloche is a registered Certified Public Accountant and his analytical expertise bears considerable value to the Company’s financial leadership team.

Balance Sheet Remains Well-Positioned to Support Companies Significant Runway for Additional Growth Opportunities Financial Trends Moving Toward Sustainably Profitable Operations Tech Investments Create a Scalable Platform Why Conifer

Contact: Jessica Gulis (248) 559-0840 ir@cnfrh.com Appendix Income Statement Balance Sheet Summary Financial Information Adjusted Operating EPS

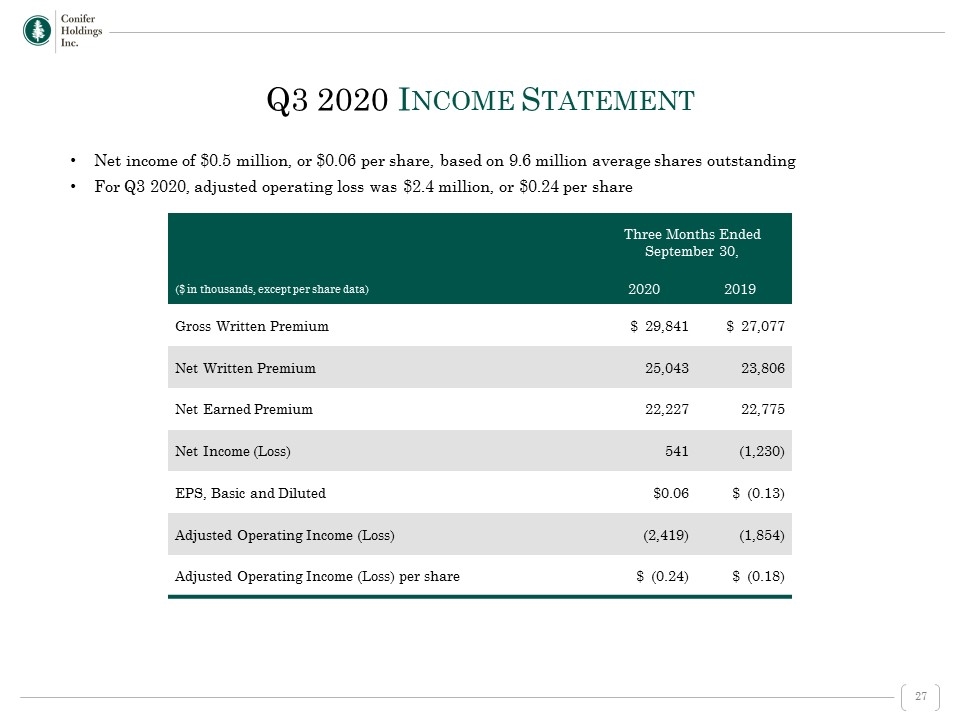

Net income of $0.5 million, or $0.06 per share, based on 9.6 million average shares outstanding For Q3 2020, adjusted operating loss was $2.4 million, or $0.24 per share Three Months Ended September 30, ($ in thousands, except per share data) 2020 2019 Gross Written Premium $ 29,841 $ 27,077 Net Written Premium 25,043 23,806 Net Earned Premium 22,227 22,775 Net Income (Loss) 541 (1,230) EPS, Basic and Diluted $0.06 $ (0.13) Adjusted Operating Income (Loss) (2,419) (1,854) Adjusted Operating Income (Loss) per share $ (0.24) $ (0.18) Q3 2020 Income Statement

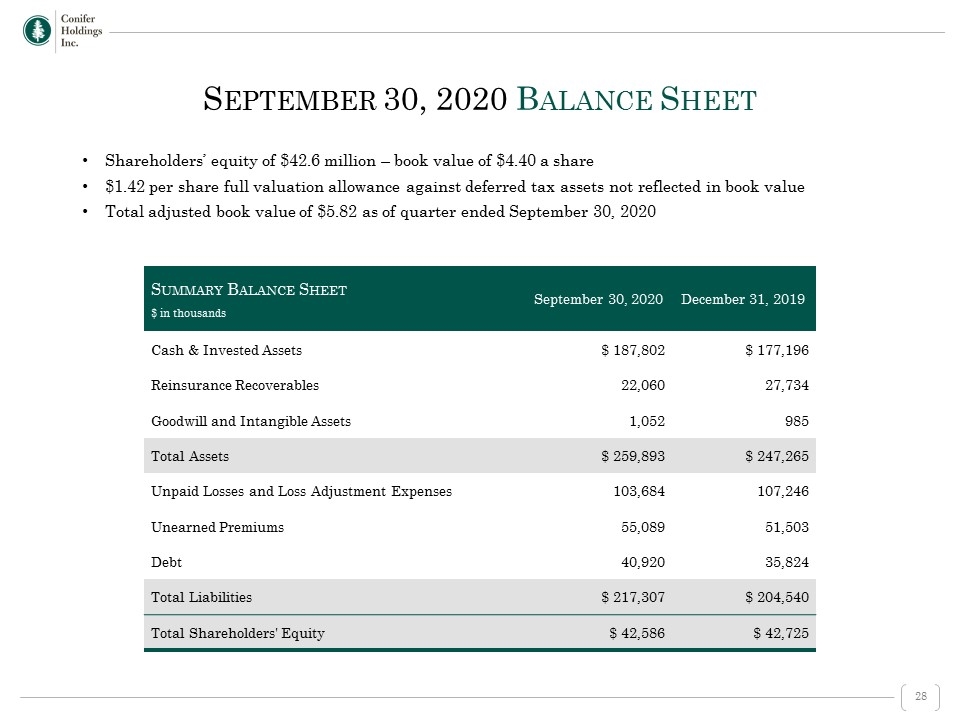

Shareholders’ equity of $42.6 million – book value of $4.40 a share $1.42 per share full valuation allowance against deferred tax assets not reflected in book value Total adjusted book value of $5.82 as of quarter ended September 30, 2020 Summary Balance Sheet $ in thousands September 30, 2020 December 31, 2019 Cash & Invested Assets $ 187,802 $ 177,196 Reinsurance Recoverables 22,060 27,734 Goodwill and Intangible Assets 1,052 985 Total Assets $ 259,893 $ 247,265 Unpaid Losses and Loss Adjustment Expenses 103,684 107,246 Unearned Premiums 55,089 51,503 Debt 40,920 35,824 Total Liabilities $ 217,307 $ 204,540 Total Shareholders' Equity $ 42,586 $ 42,725 September 30, 2020 Balance Sheet

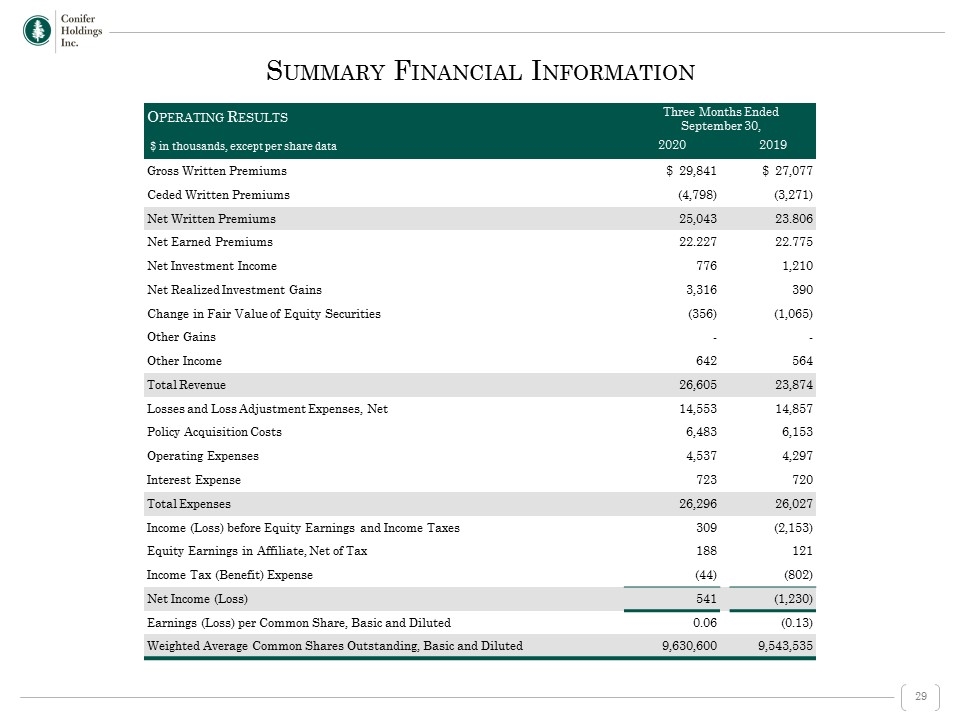

Operating Results Three Months Ended September 30, $ in thousands, except per share data 2020 2019 Gross Written Premiums $ 29,841 $ 27,077 Ceded Written Premiums (4,798) (3,271) Net Written Premiums 25,043 23.806 Net Earned Premiums 22.227 22.775 Net Investment Income 776 1,210 Net Realized Investment Gains 3,316 390 Change in Fair Value of Equity Securities (356) (1,065) Other Gains - - Other Income 642 564 Total Revenue 26,605 23,874 Losses and Loss Adjustment Expenses, Net 14,553 14,857 Policy Acquisition Costs 6,483 6,153 Operating Expenses 4,537 4,297 Interest Expense 723 720 Total Expenses 26,296 26,027 Income (Loss) before Equity Earnings and Income Taxes 309 (2,153) Equity Earnings in Affiliate, Net of Tax 188 121 Income Tax (Benefit) Expense (44) (802) Net Income (Loss) 541 (1,230) Earnings (Loss) per Common Share, Basic and Diluted 0.06 (0.13) Weighted Average Common Shares Outstanding, Basic and Diluted 9,630,600 9,543,535 Summary Financial Information

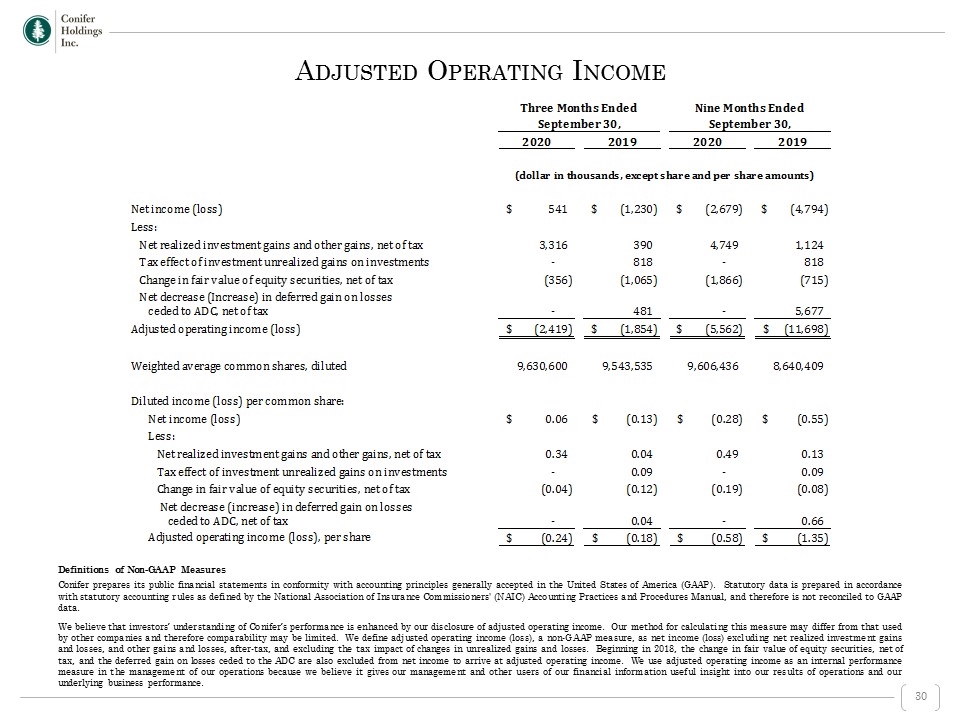

Definitions of Non-GAAP Measures Conifer prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as defined by the National Association of Insurance Commissioners' (NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data. We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of adjusted operating income. Our method for calculating this measure may differ from that used by other companies and therefore comparability may be limited. We define adjusted operating income (loss), a non-GAAP measure, as net income (loss) excluding net realized investment gains and losses, and other gains and losses, after-tax, and excluding the tax impact of changes in unrealized gains and losses. Beginning in 2018, the change in fair value of equity securities, net of tax, and the deferred gain on losses ceded to the ADC are also excluded from net income to arrive at adjusted operating income. We use adjusted operating income as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted Operating Income