Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE - Pangaea Logistics Solutions Ltd. | q32020earningspressrel.htm |

| 8-K - 8-K - Pangaea Logistics Solutions Ltd. | panl-20201111.htm |

THIRD QUARTER 2020 EARNINGS CONFERENCE CALL PRESENTATION 1

SAFE HARBOR This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. 2

BUSINESS HIGHLIGHTS Q3‐2020 Results •Adjusted EBITDA of $15.1 million Consistent •Net income of $7.6 million •$48.1 million cash, restricted cash and cash Performance equivalents Fleet Working Fleet •17 drybulk ships and one barge in owned and controlled fleet at September 30, 2020 Operations Extensive and varied •Operating 52 vessels on average during Q3 2020 •7.4 million tons carried; 123 voyages performed experience for 46 clients 1) Adjusted EBITDA is a non‐GAAP measure and represents income or loss from operations before depreciation and amortization, loss on sale and leaseback of vessel, share‐based compensation, and when applicable, loss on impairment of vessels and certain non‐recurring items. 3

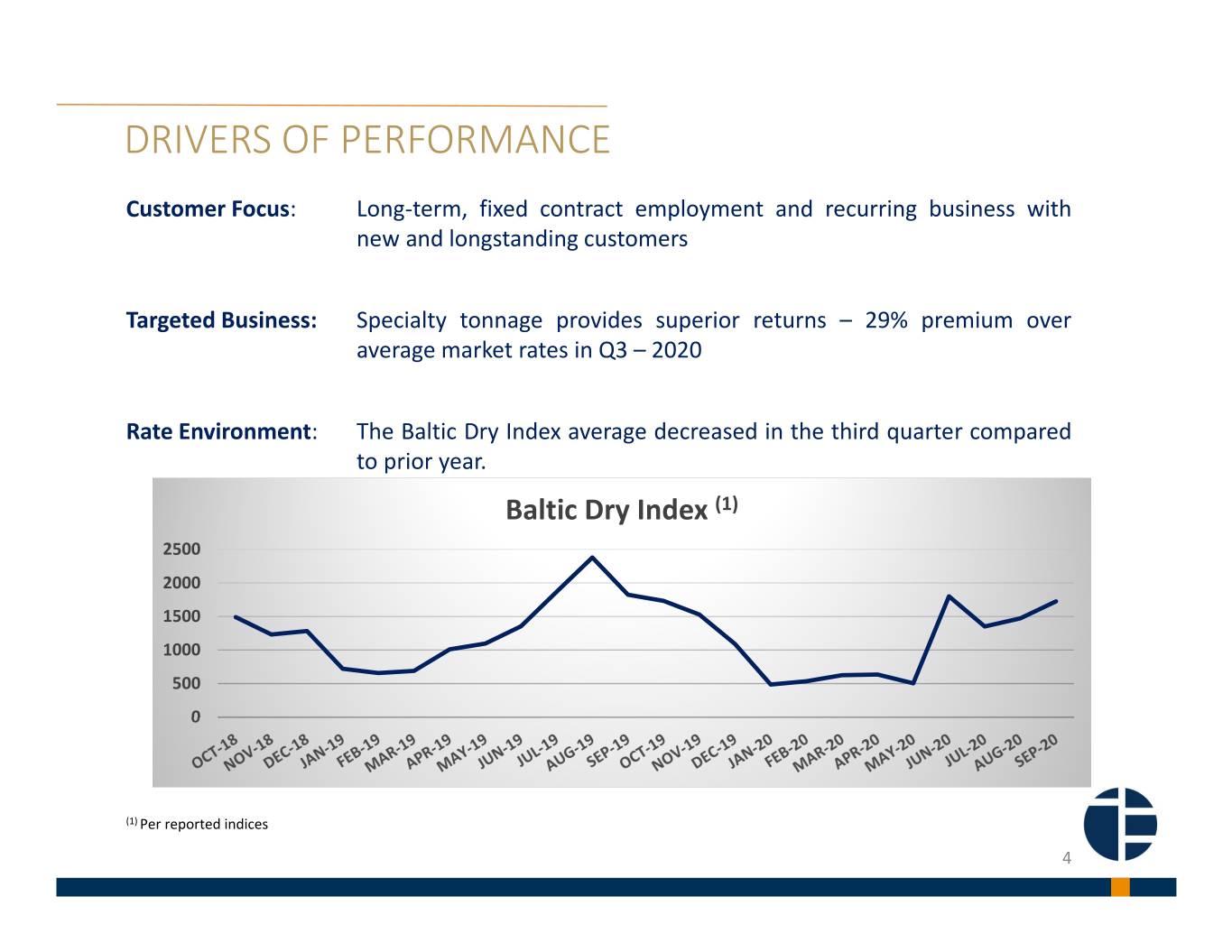

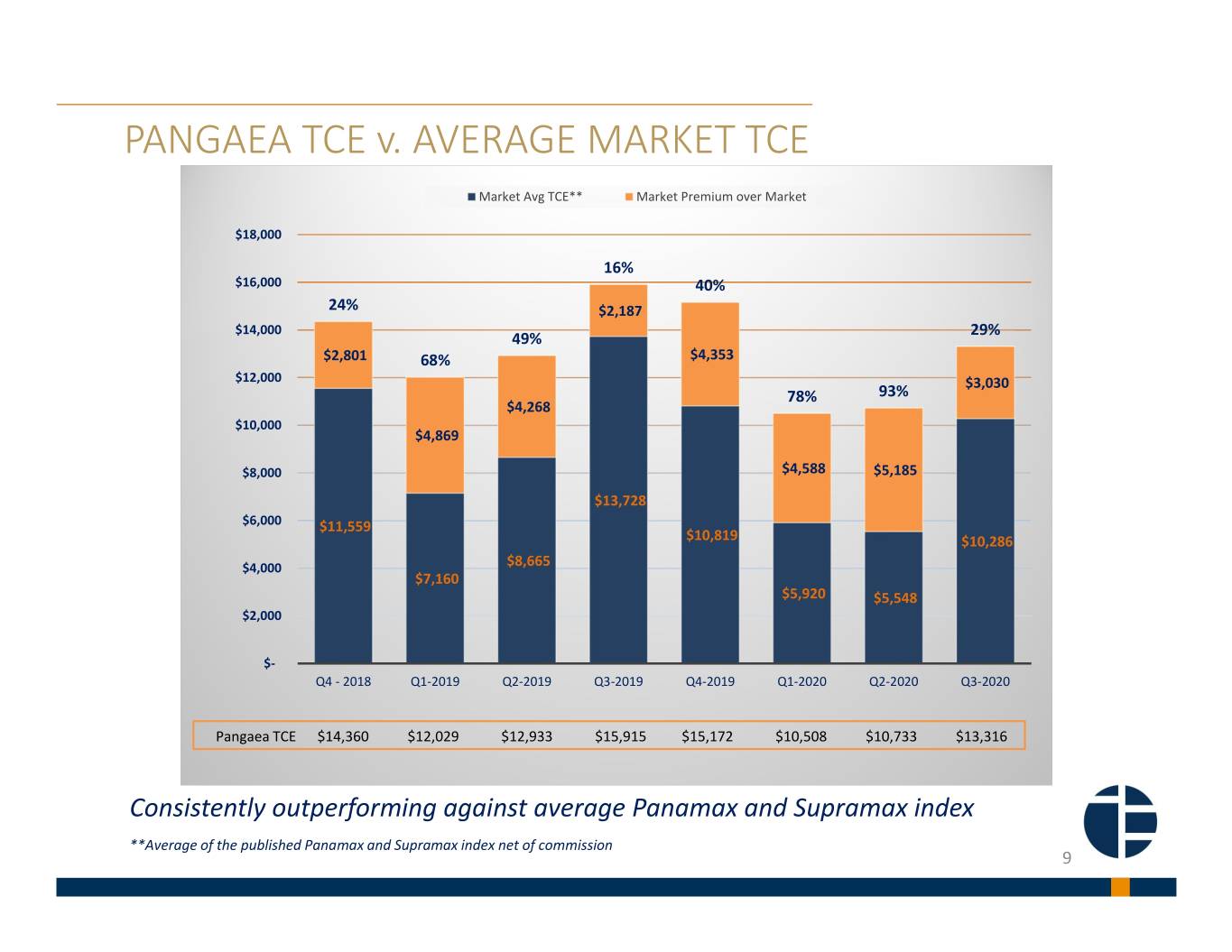

DRIVERS OF PERFORMANCE Customer Focus:Long‐term, fixed contract employment and recurring business with new and longstanding customers Targeted Business: Specialty tonnage provides superior returns – 29% premium over average market rates in Q3 – 2020 Rate Environment: The Baltic Dry Index average decreased in the third quarter compared to prior year. Baltic Dry Index (1) 2500 2000 1500 1000 500 0 (1) Per reported indices 4

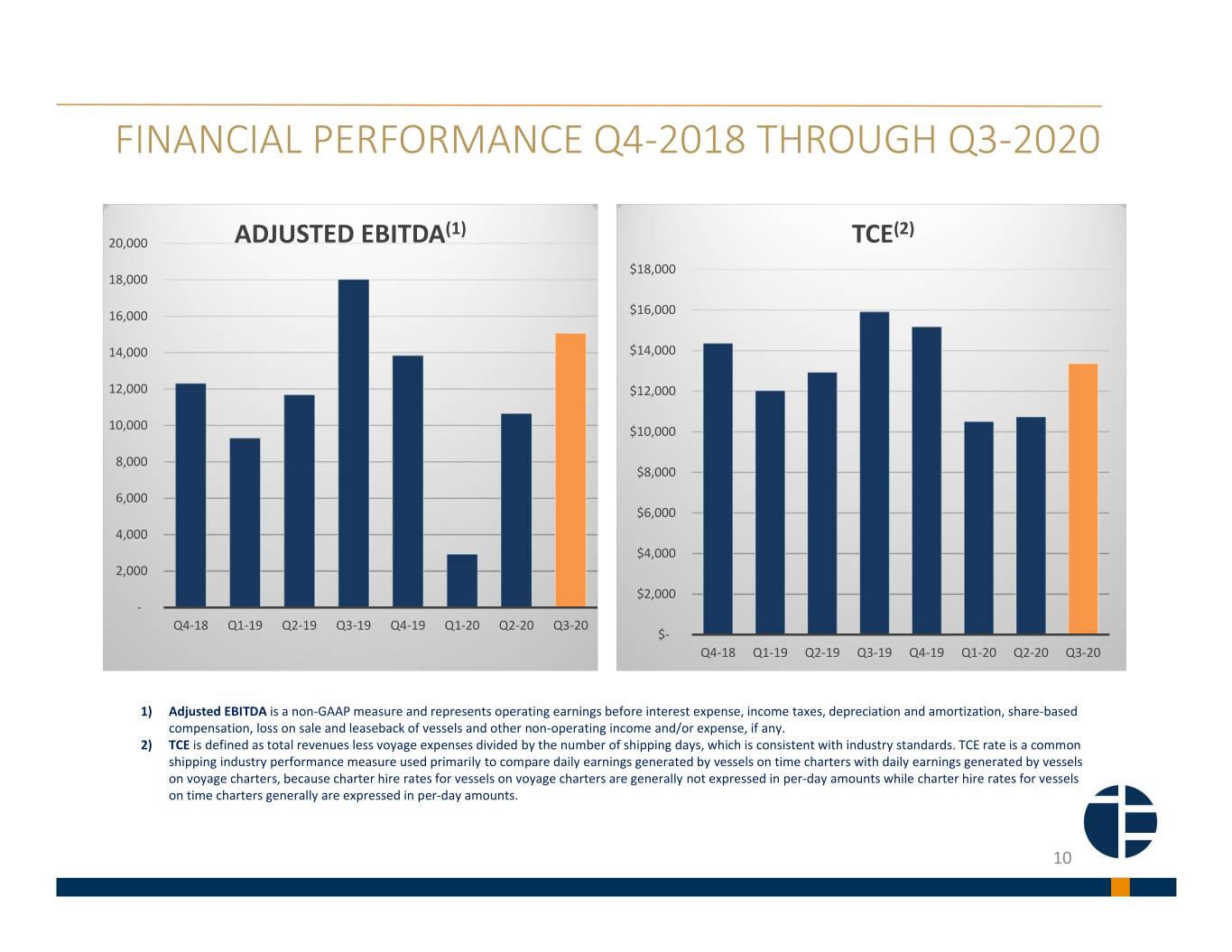

FINANCIAL HIGHLIGHTS 3rd Quarter Highlights • Net income attributable to Pangaea Logistics Solutions Ltd. was $7.6 million for three months ended September 30, 2020 as compared to $8.3 million of net income for the same period of 2019. o Non‐GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd. of $8.1 million as compared to $8.6 million for the three months ended September 30, 2019. • Diluted net income per share was $0.17 for three months ended September 30, 2020 as compared to earnings per share of $0.19 for the same period of 2019. • Pangaea's TCE rates were $13,316 for the three months ended September 30, 2020 and $15,915 for the three months ended September 30, 2019. The market average for the third quarter of 2020 was approximately $10,286, giving the Company an overall average premium over market rates of approximately $3,030 or 29%. • Adjusted EBITDA of $15.1 million for the three months ended September 30, 2020, compared to $18.0 million for the same period of 2019. • At the end of the quarter, Pangaea had $48.1 million in cash, restricted cash and cash equivalents. • The Company acquired an additional one‐third equity interest in its partially‐owned consolidated subsidiary Nordic Bulk Holding Company Ltd. (NBHC), which owns six modern 1‐A ice‐class panamax bulk vessels, increasing its equity interest to 66.7%. 5

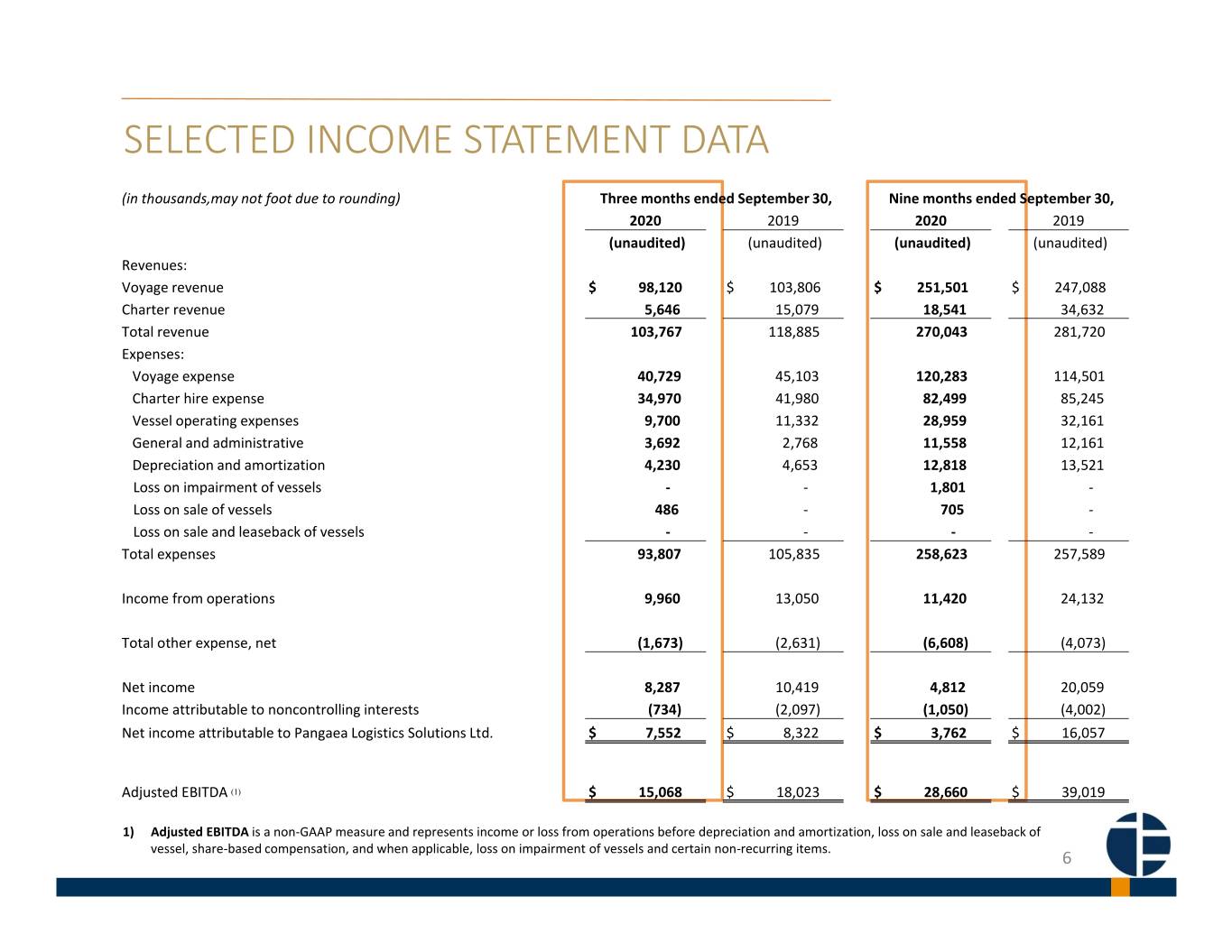

SELECTED INCOME STATEMENT DATA (in thousands,may not foot due to rounding) Three months ended September 30, Nine months ended September 30, 2020 2019 2020 2019 (unaudited) (unaudited) (unaudited) (unaudited) Revenues: Voyage revenue $ 98,120 $ 103,806 $ 251,501 $ 247,088 Charter revenue 5,646 15,079 18,541 34,632 Total revenue 103,767 118,885 270,043 281,720 Expenses: Voyage expense 40,729 45,103 120,283 114,501 Charter hire expense 34,970 41,980 82,499 85,245 Vessel operating expenses 9,700 11,332 28,959 32,161 General and administrative 3,692 2,768 11,558 12,161 Depreciation and amortization 4,230 4,653 12,818 13,521 Loss on impairment of vessels ‐ ‐ 1,801 ‐ Loss on sale of vessels 486 ‐ 705 ‐ Loss on sale and leaseback of vessels ‐ ‐ ‐ ‐ Total expenses 93,807 105,835 258,623 257,589 Income from operations 9,960 13,050 11,420 24,132 Total other expense, net (1,673) (2,631) (6,608) (4,073) Net income 8,287 10,419 4,812 20,059 Income attributable to noncontrolling interests (734) (2,097) (1,050) (4,002) Net income attributable to Pangaea Logistics Solutions Ltd. $ 7,552 $ 8,322 $ 3,762 $ 16,057 Adjusted EBITDA (1) $ 15,068 $ 18,023 $ 28,660 $ 39,019 1) Adjusted EBITDA is a non‐GAAP measure and represents income or loss from operations before depreciation and amortization, loss on sale and leaseback of vessel, share‐based compensation, and when applicable, loss on impairment of vessels and certain non‐recurring items. 6

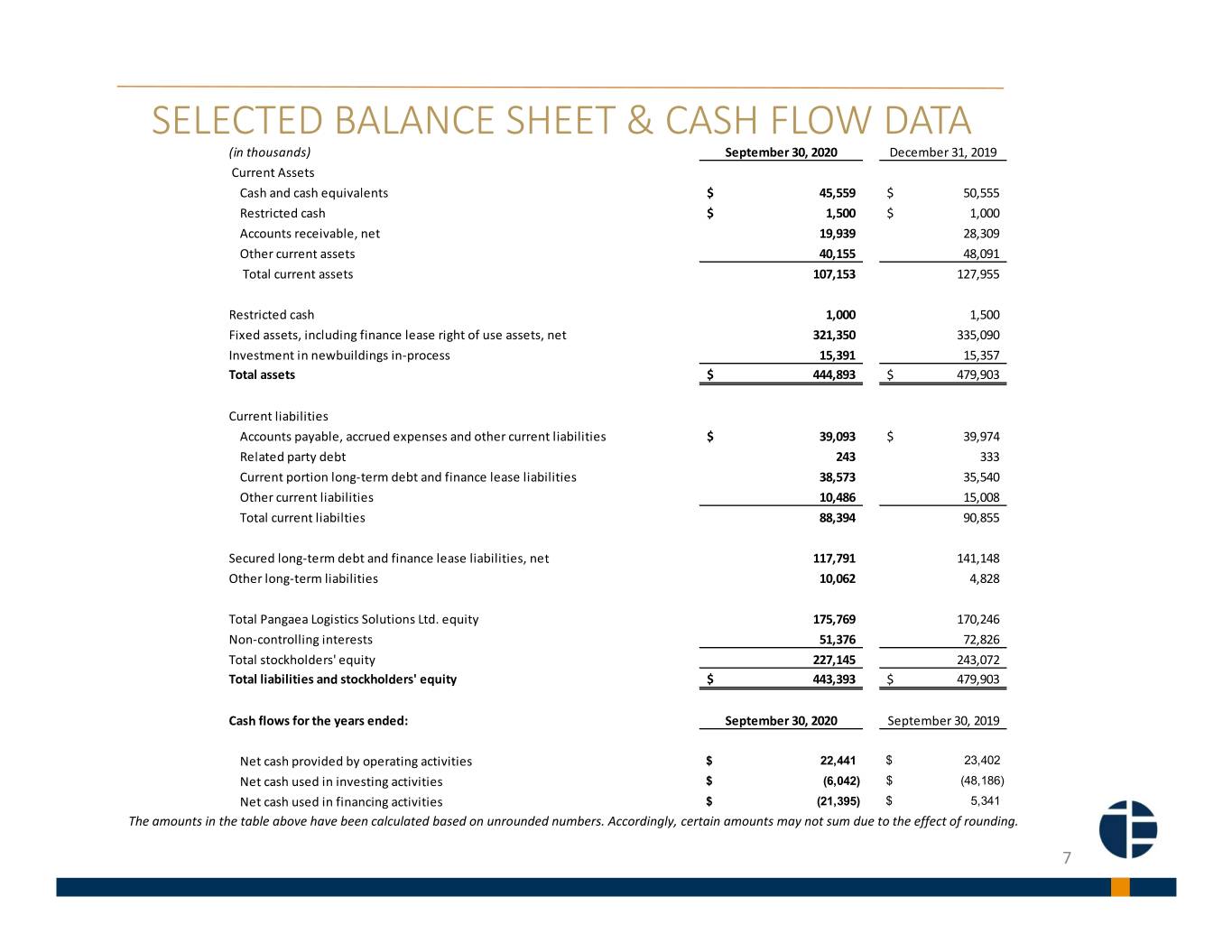

SELECTED BALANCE SHEET & CASH FLOW DATA (in thousands) September 30, 2020 December 31, 2019 Current Assets Cash and cash equivalents $ 45,559 $ 50,555 Restricted cash $ 1,500 $ 1,000 Accounts receivable, net 19,939 28,309 Other current assets 40,155 48,091 Total current assets 107,153 127,955 Restricted cash 1,000 1,500 Fixed assets, including finance lease right of use assets, net 321,350 335,090 Investment in newbuildings in‐process 15,391 15,357 Total assets $ 444,893 $ 479,903 Current liabilities Accounts payable, accrued expenses and other current liabilities $ 39,093 $ 39,974 Related party debt 243 333 Current portion long‐term debt and finance lease liabilities 38,573 35,540 Other current liabilities 10,486 15,008 Total current liabilties 88,394 90,855 Secured long‐term debt and finance lease liabilities, net 117,791 141,148 Other long‐term liabilities 10,062 4,828 Total Pangaea Logistics Solutions Ltd. equity 175,769 170,246 Non‐controlling interests 51,376 72,826 Total stockholders' equity 227,145 243,072 Total liabilities and stockholders' equity$ 443,393 $ 479,903 Cash flows for the years ended: September 30, 2020 September 30, 2019 Net cash provided by operating activities $ 22,441 $ 23,402 Net cash used in investing activities $ (6,042) $ (48,186) Net cash used in financing activities $ (21,395) $ 5,341 The amounts in the table above have been calculated based on unrounded numbers. Accordingly, certain amounts may not sum due to the effect of rounding. 7

TOTAL SHIPPING DAYS 6,000 5,000 4,000 3,365 2,750 3,168 3,000 2,556 3,003 Days 2,220 1,742 1,977 2,000 1,000 1,820 1,886 1,875 1,731 1,718 1,573 1,623 1,566 ‐ Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Owned Days Charter‐in Days Capital Efficiency: Leveraged owned fleet by chartering‐in market vessels Flexibility: Short‐term charters allow us to react quickly and take advantage of arbitrage opportunities 8

PANGAEA TCE v. AVERAGE MARKET TCE Market Avg TCE** Market Premium over Market $18,000 16% $16,000 40% 24% $2,187 $14,000 29% 49% $2,801 68% $4,353 $12,000 $3,030 78% 93% $4,268 $10,000 $4,869 $8,000 $4,588 $5,185 $13,728 $6,000 $11,559 $10,819 $10,286 $4,000 $8,665 $7,160 $5,920 $5,548 $2,000 $‐ Q4 ‐ 2018 Q1‐2019 Q2‐2019 Q3‐2019 Q4‐2019 Q1‐2020 Q2‐2020 Q3‐2020 Pangaea TCE $14,360 $12,029 $12,933 $15,915 $15,172 $10,508 $10,733 $13,316 Consistently outperforming against average Panamax and Supramax index **Average of the published Panamax and Supramax index net of commission 9

FINANCIAL PERFORMANCE Q4‐2018 THROUGH Q3‐2020 (1) (2) 20,000 ADJUSTED EBITDA TCE $18,000 18,000 16,000 $16,000 14,000 $14,000 12,000 $12,000 10,000 $10,000 8,000 $8,000 6,000 $6,000 4,000 $4,000 2,000 $2,000 ‐ Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 $‐ Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 1) Adjusted EBITDA is a non‐GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, share‐based compensation, loss on sale and leaseback of vessels and other non‐operating income and/or expense, if any. 2) TCE is defined as total revenues less voyage expenses divided by the number of shipping days, which is consistent with industry standards. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per‐day amounts while charter hire rates for vessels on time charters generally are expressed in per‐day amounts. 10

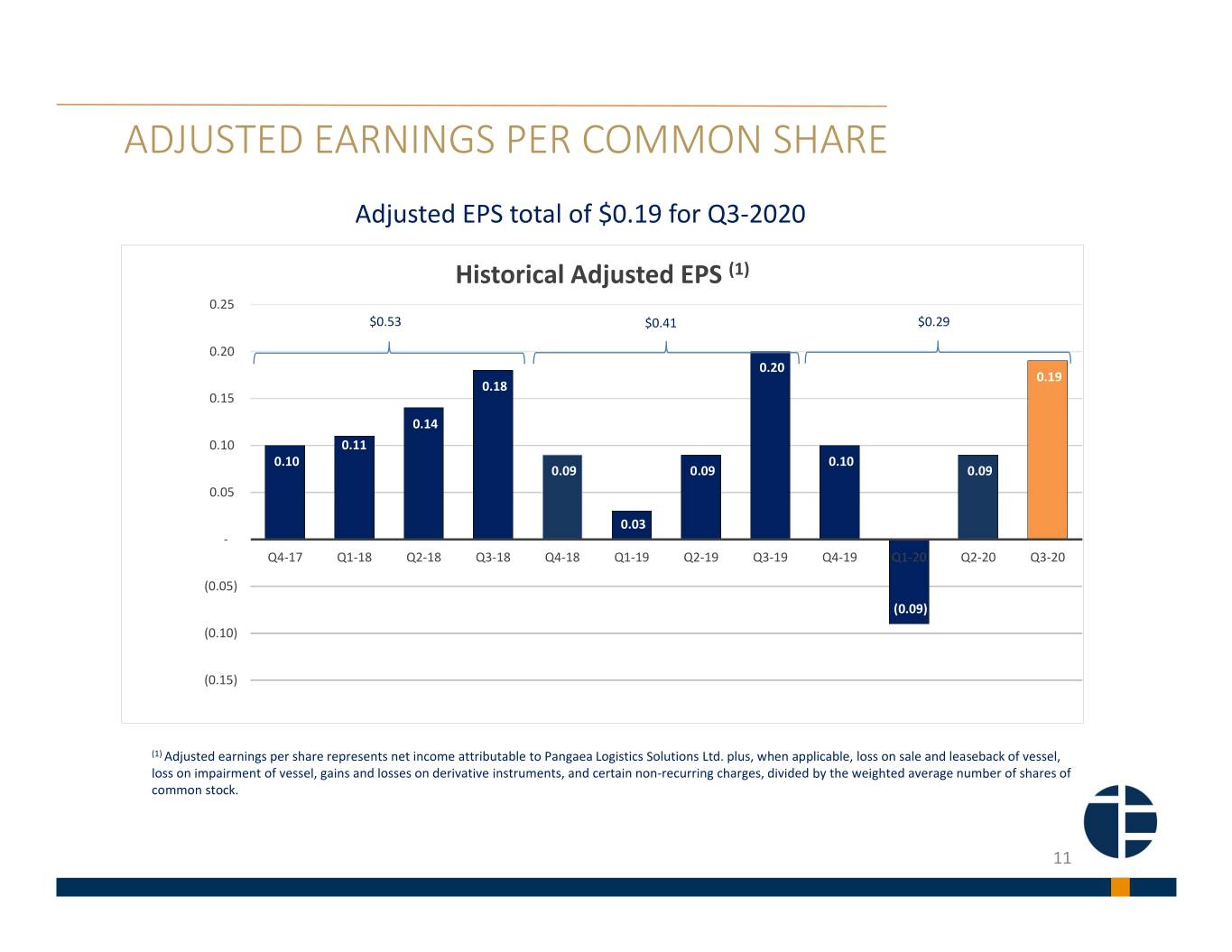

ADJUSTED EARNINGS PER COMMON SHARE Adjusted EPS total of $0.19 for Q3‐2020 Historical Adjusted EPS (1) 0.25 $0.53 $0.41 $0.29 0.20 0.20 0.19 0.18 0.15 0.14 0.10 0.11 0.10 0.10 0.09 0.09 0.09 0.05 0.03 ‐ Q4‐17 Q1‐18 Q2‐18 Q3‐18 Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 (0.05) (0.09) (0.10) (0.15) (1) Adjusted earnings per share represents net income attributable to Pangaea Logistics Solutions Ltd. plus, when applicable, loss on sale and leaseback of vessel, loss on impairment of vessel, gains and losses on derivative instruments, and certain non‐recurring charges, divided by the weighted average number of shares of common stock. 11