Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - ENERGIZER HOLDINGS, INC. | a993enrceosuccession.htm |

| EX-99.1 - EX-99.1 - ENERGIZER HOLDINGS, INC. | enrpr93020.htm |

| 8-K - 8-K - ENERGIZER HOLDINGS, INC. | enr-20201112.htm |

Exhibit 99.2 Fiscal Q4 and FY 2020 Earnings + November 12, 2020

Forward-Looking Statements and Non-GAAP Financial Measures Energizer Holdings, Inc. (the “Company”) and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements represent the Company’s current expectations, plans or forecasts of its future results, revenues, expenses, capital measures, strategy, and future business and economic conditions more generally, and other future matters. These statements are not guarantees of future results or performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and are often beyond the Company’s control. Actual outcomes and results may differ materially from those expressed in these forward looking statements. Factors that could cause actual results or events to differ materially from those anticipated include, without limitation, the matters implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on November 19, 2019, as well as our Form 10-Q filed with the SEC on August 5, 2020: 1) market and economic conditions; (2) market trends in the categories in which we compete; (3) uncertainty relating to the impacts of the COVID-19 outbreak, including but not limited to, its impacts on consumer demand, costs, product mix, the availability of our products, our strategic initiatives, our and our partners' global supply chains, operations and routes to market; (4) our ability to integrate businesses, to realize the projected results of the acquired businesses, and to obtain expected cost savings, synergies and other anticipated benefits of the acquired businesses within the expected timeframe, or at all; (5) the impact of the acquired businesses on our business operations; (6) the success of new products and the ability to continually develop and market new products; (7) our ability to attract, retain and improve distribution with key customers; (8) our ability to continue planned advertising and other promotional spending; (9) our ability to timely execute strategic initiatives, including restructurings, and international go-to-market changes in a manner that will positively impact our financial condition and results of operations and does not disrupt our business operations; (10) the impact of strategic initiatives, including restructurings, on our relationships with employees, customers and vendors; (11) our ability to maintain and improve market share in the categories in which we operate despite heightened competitive pressure; (12) financial strength of distributors and suppliers; (13) our ability to improve operations and realize cost savings; (14) the impact of the United Kingdom’s future trading relationships following its exit from the European Union; (15) the impact of foreign currency exchange rates and currency controls, as well as offsetting hedges; (16) the impact of adverse or unexpected weather conditions; (17) uncertainty from the expected discontinuance of LIBOR and the transition to any other interest rate benchmark; (18) the impact of raw materials and other commodity costs; (19) the impact of legislative changes or regulatory determinations or changes by federal, state and local, and foreign authorities, including customs and tariff determinations, as well as the impact of potential changes to tax laws, policies and regulations; (20) costs and reputational damage associated with cyber-attacks or information security breaches or other events; (21) the impact of advertising and product liability claims and other litigation; and (22) compliance with debt covenants and maintenance of credit ratings as well as the impact of interest and principal repayment of our existing and any future debt. 2

Forward-Looking Statements and Non-GAAP Financial Measures The information contained herein is preliminary and based on Company data available at the time of the earnings presentation. Forward- looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"). However, management believes that certain non-GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period. These non-GAAP financial measures exclude items that are not reflective of the Company's on-going operating performance, such as acquisition and integration costs and related items, settlement loss on pension plan terminations, loss on extinguishment of debt, the one-time impact of the CARES Act and the December 2017 Tax Cuts and Jobs Act (2017 tax reform). In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations, acquisition activity as well as other company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in method and in the items being adjusted. We provide the following non-GAAP measures and calculations, as well as the corresponding reconciliation to the closest GAAP measure in the following supplemental schedules: A reconciliation of all non-GAAP financial metrics used can be found in the Appendix of this presentation: ‒ Adjusted Earnings Per Share (EPS) excludes the impact of the costs related to acquisition and integration, the loss on extinguishment of debt, the prior year settlement loss on pension plan termination, the one-time impact of the CARES Act and the 2017 tax reform. ‒ EBITDA is defined as net earnings before income tax provision, interest, loss on extinguishment of debt and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to acquisition and integration and share based payments. ‒ Adjusted Free Cash Flow excludes the cash payments for acquisition and integration expenses and integration capital expenditures. These expense cash payments are net of the statutory tax benefit associated with the payment. ‒ Adjusted Gross Margin and Adjusted SG&A excludes any charges related to acquisition and integration charges. ‒ Organic revenue is the non-GAAP financial measurement of the change in revenue that excludes or otherwise adjusts for the impactof acquisitions, operations in Argentina, and the impact of currency from the changes in foreign currency exchange rates. References to specific quarters and years pertain to our fiscal years, and references to the legacy and/or base business relate to the Energizer 3 business prior to the completion of the Battery and Auto Care Acquisitions.

Financial Results + Fourth Quarter and Fiscal 2020

Key Metrics METRIC Fiscal 2020 Fourth Quarter $0.59 (GAAP loss of $0.67) Fourth Quarter & Fiscal• COVID-19 2020 related costs Financial of $25 million, including Headlines $3 million of incremental interest, or $0.28 per diluted share Adjusted EPS* Fiscal 2020 $2.31 (GAAP earnings of $0.44) • COVID related costs of $36 million, including $7 million of incremental interest, or $0.41 per diluted share Fourth Quarter $140 million, margin 18.3% (GAAP loss of $41.7 million) Adjusted EBITDA* Fiscal 2020 $562 million, margin 20.5% (GAAP earnings of $46.8 million) Adjusted Free Fiscal 2020 $405 million, 14.8% of net sales (GAAP $389.9 million) Cash Flow * • Increased $149 million due to working capital improvement $2.9 billion of net debt** Net Debt and • Net debt to credit defined EBITDA of 4.8 times at the end of Fiscal Leverage 2020 • Over $100 million of debt repaid subsequent to year-end** All comparisons are to Fiscal 2019 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix. ** Excludes the $750.0 million of Senior Notes repaid on October 16,2020 due to the refinancing that occurred at the end of the year.

Fourth Quarter 2020 Results METRIC Fourth Quarter 2020 Net Sales on a reported basis of $763 million was up 6.1%, • Organic net sales up 6.1%, due to distribution gains (3%) and strong replenishments driven by increased demand (3%). Net Sales* • Battery organic sales up 3.2% • Auto Care organic sales up 18.6% • Foreign currency unfavorable 30 bps offset entirely by Argentina revenue growth Adjusted Gross margin, excluding acquisition and integration costs was 38.4%, down 370 bps Adjusted • 130 bps increase from realization of synergies Gross Margin* • 230 bps decline from incremental COVID-19 costs • 170 bps decline due to collective shift in customer and product mix • 100 bps decline from unfavorable currencies and tariffs A&P was 5.3% of net sales, up 150 basis points A&P • Planned incremental investment in branded product portfolio Adjusted SG&A, excluding acquisition and integration costs, was 15.6% Adjusted SG&A* of net sales, and included realization of synergies of $4.7 million primarily due to the exit of transition service agreements All comparisons are to Fiscal 2019 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

Adjusted EPS* Q4 Fiscal 2019 to Q4 Fiscal 2020 * See non-GAAP reconciliations in the Appendix.

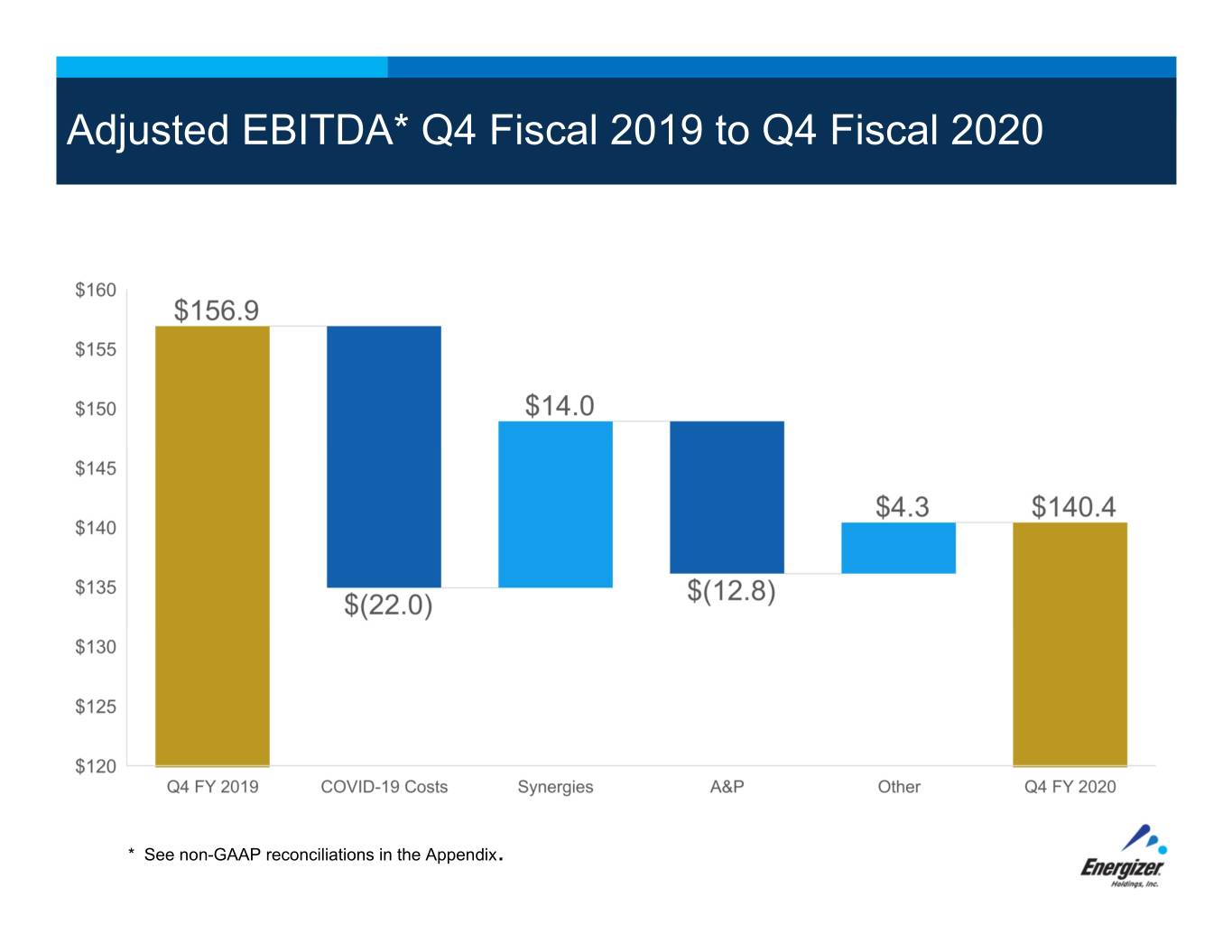

Adjusted EBITDA* Q4 Fiscal 2019 to Q4 Fiscal 2020 * See non-GAAP reconciliations in the Appendix.

Comparison to Previous Guidance Although we achieved strong topline growth, we did not achieve previously provided guidance due to three factors: Increased incremental COVID-19 costs of $6 million caused by elevated demand, primarily customer fines and penalties Increased costs associated with sourced product from third parties of $4 million, including tariffs Increased SG&A costs of $6 million due to factoring costs, legal fees and compensation expense. This resulted in a decline of $16 million in Adjusted EBITDA, and coupled with the increase in tax rate, approximately $0.20 of earnings per share for the fiscal year. 9

Fiscal 2020 Results METRIC Fiscal 2020 Net sales on a reported basis of $2,744.8 million was up 10%, inclusive of acquisitions from prior year • Organic net sales up 2.5%, driven by distribution gains (2.7%) and increased Net Sales* demand due to the impact of COVID, offset by declines due to year-over-year storm activity and lower replenishment. • Acquired businesses contributed $211 million, or 8.4% • Foreign currency unfavorable 1% Adjusted Gross margin, excluding acquisition and integration costs and inventory step up, was 40.6%, down 200 bps Adjusted Gross • 130 bps increase due to Incremental synergies of $33.1 million. • 110 bps decline due to $29 million of costs related to COVID Margin* • 80 bps decline due to collective shift in customer and product mix • 80 bps decline due to lower margin profile of acquired businesses • 60 bps decline due to unfavorable foreign currencies and tariffs A&P was 5.4% of net sales, an increase of 30 bps, or $19.8 million, including A&P additional acquisition impact of $3.5 million • Increase represents planned investments in our branded product portfolio Adjusted SG&A, excluding acquisition and integration costs, was 16.2% of net sales Adjusted SG&A* • Synergy realization of $14.6 million primarily due to TSA exists • Reduced spending due to net COVID impacts, including travel restrictions All comparisons are to Fiscal 2019 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

Fiscal 2020 Results METRIC Fiscal 2020 Interest expense was $195 million up $34.6, excluding prior year acquisition costs of $66 million. The increase was due to a full year of Interest Expense interest on the acquisitions that closed in the second quarter FY2019 and interest incurred to improve liquidity in the pandemic Non-GAAP Non-GAAP Tax rate of 23.3% compared to 18.5% in the prior year Tax Rate* GAAP tax rate of 30.9% compared to 11.5% in the prior year Common Dividend payment of $85.4 million Dividend Preferred dividends payment of $16.2 million Share Repurchased approximately 980,000 shares for $45.0 million in the first Repurchase quarter of FY2020 Discontinued Discontinued operations reported loss, including loss on the Varta sale, Operations of $2.02 per diluted share All comparisons are to Fiscal 2019 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

Adjusted EPS* Fiscal 2019 to Fiscal 2020 *See non-GAAP reconciliations in the Appendix. ** Acquisitions includes the operating profit for the months the Company operated the business that were not included in fiscal 2019. *** Interest includes $0.35 from additional interest in fiscal 2020 from the debt issued to fund our acquisitions.

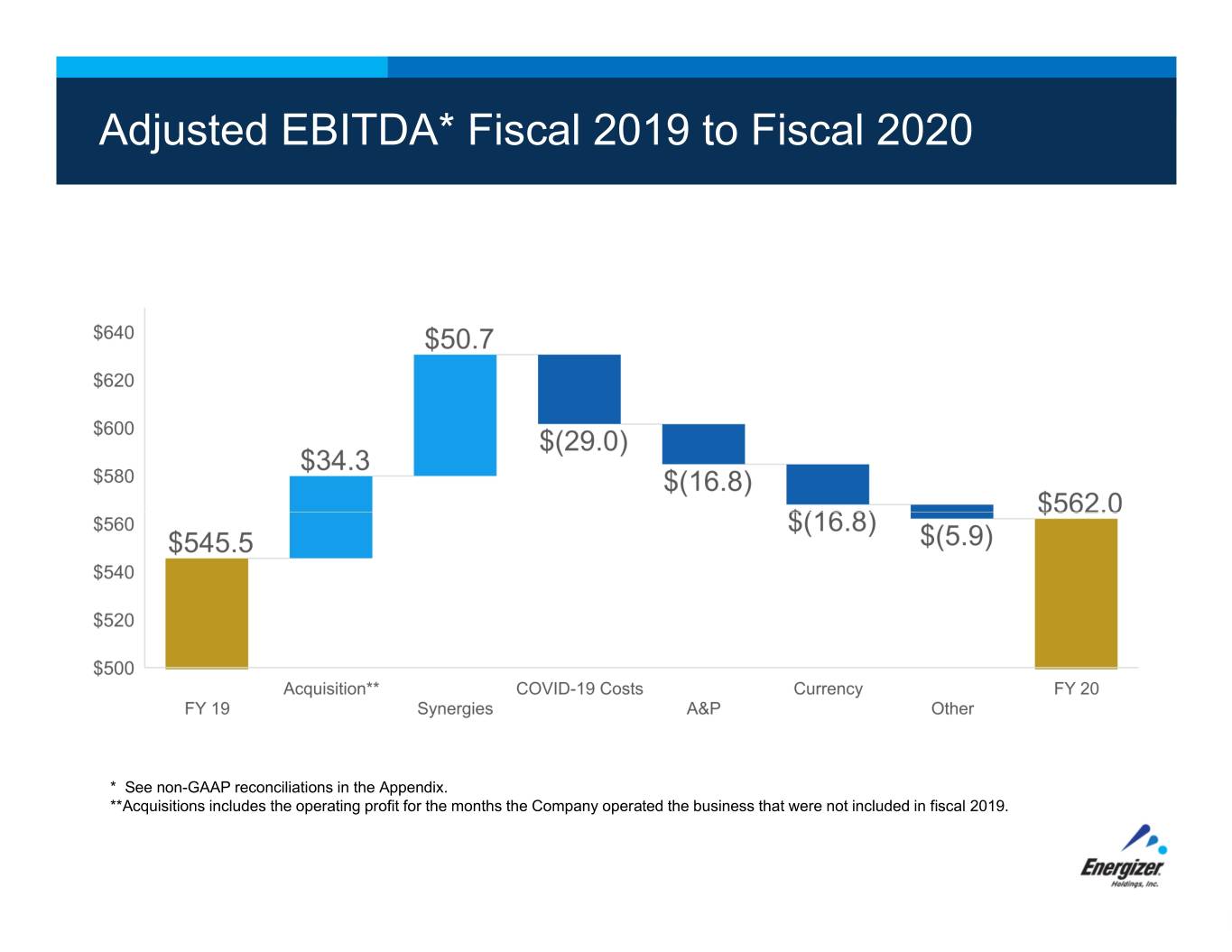

Adjusted EBITDA* Fiscal 2019 to Fiscal 2020 * See non-GAAP reconciliations in the Appendix. **Acquisitions includes the operating profit for the months the Company operated the business that were not included in fiscal 2019.

Outlook + Fiscal 2021

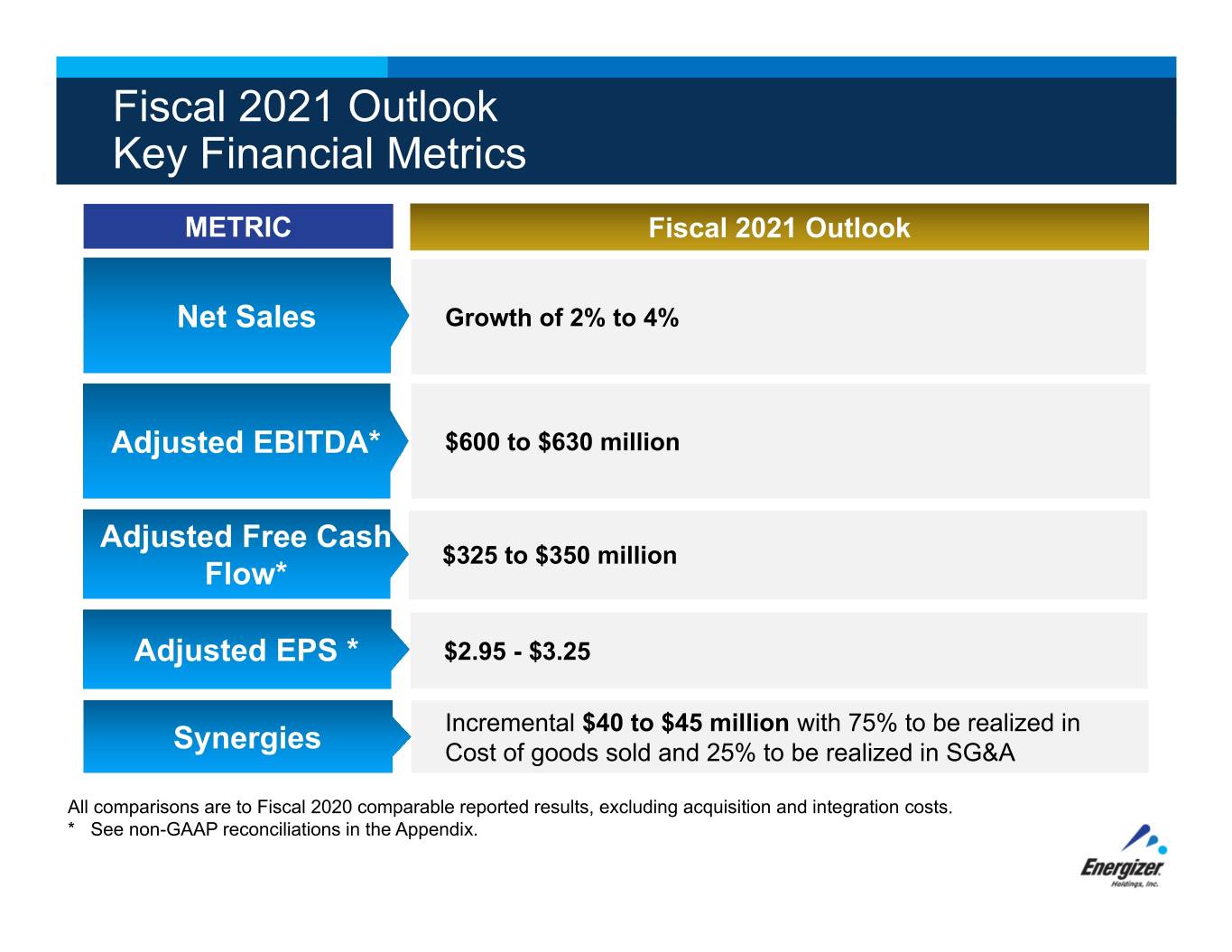

Fiscal 2021 Outlook Key Financial Metrics METRIC Fiscal 2021 Outlook Net Sales Growth of 2% to 4% Adjusted EBITDA* $600 to $630 million Adjusted Free Cash $325 to $350 million Flow* Adjusted EPS * $2.95 - $3.25 Incremental $40 to $45 million with 75% to be realized in Synergies Cost of goods sold and 25% to be realized in SG&A All comparisons are to Fiscal 2020 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

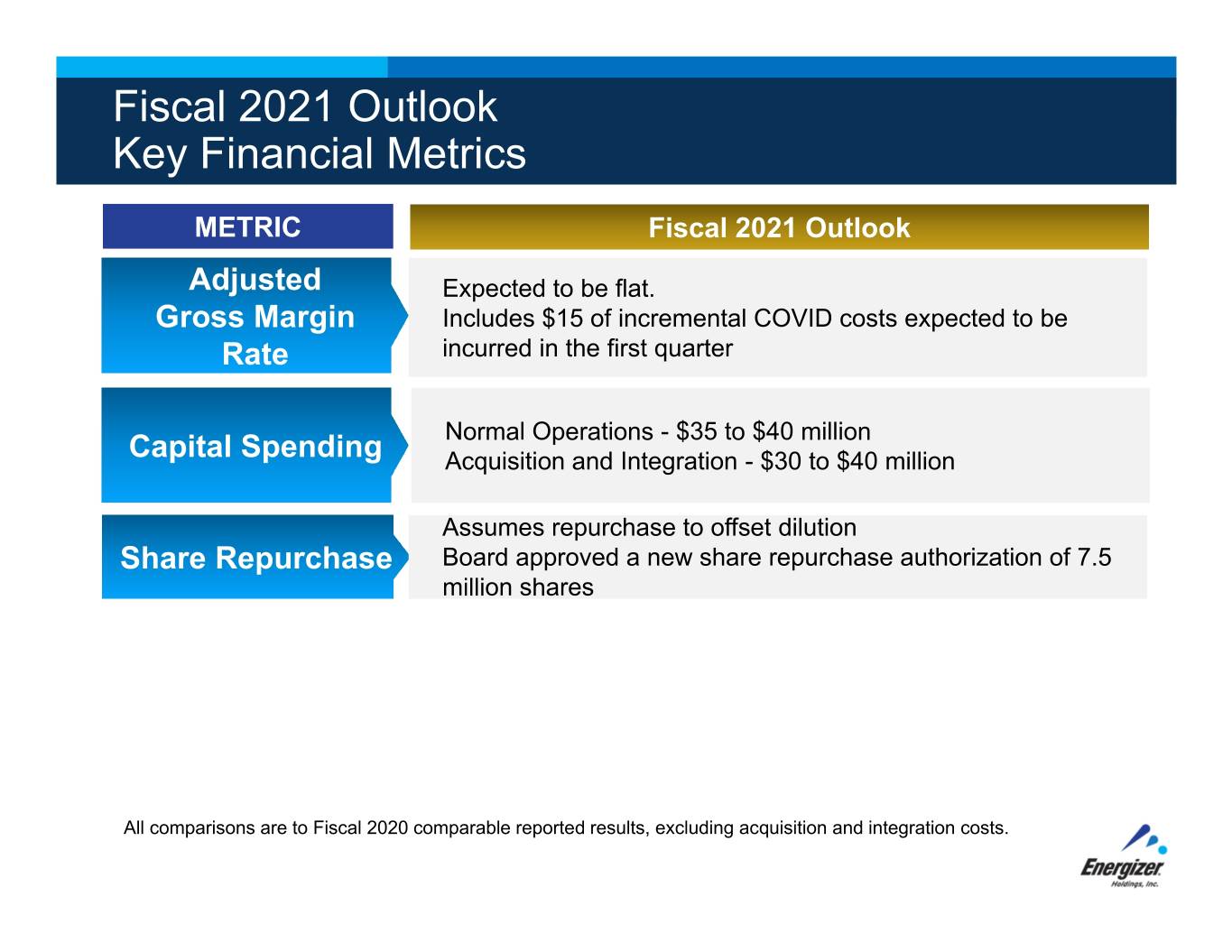

Fiscal 2021 Outlook Key Financial Metrics METRIC Fiscal 2021 Outlook Adjusted Expected to be flat. Gross Margin Includes $15 of incremental COVID costs expected to be Rate incurred in the first quarter Normal Operations - $35 to $40 million Capital Spending Acquisition and Integration - $30 to $40 million Assumes repurchase to offset dilution Share Repurchase Board approved a new share repurchase authorization of 7.5 million shares All comparisons are to Fiscal 2020 comparable reported results, excluding acquisition and integration costs.

Long-Term Financial Algorithm + Fiscal 2021

Long-term Financial Algorithm METRIC Long-term Target Revenue growth at or above the categories Net Sales (Normalized environment – flat to low-single digit Adjusted Low to mid- single digit growth EPS and EBITDA (Improving gross margin and SG&A % of net sales) Adjusted Free Cash Generate free cash flow between 11% to 13% of sales Flow Return of capital via dividend, subject to Board approval, and Dividend opportunistic share repurchase

Appendix Materials 19

Non-GAAP Reconciliation: Consolidated Net Sales (in millions) Organic revenue is the non-GAAP financial measurement of the change in revenue that excludes or otherwise adjusts for the impactof acquisitions, change in Argentina and impact of currency from the changes in foreign currency exchange rates as defined below: • Impact of Acquisitions. Energizer completed the Auto Care Acquisition on January 28, 2019 and the Battery Acquisition on January 2, 2019. These adjustments include the impact of the Acquisitions' ongoing operations contributed to each respective income statement caption for the first year's operations directly after the Acquisition date. This does not include the impact of acquisition and integration costs associated with any acquisition. • Change in Argentina Operations. The Company is presenting separately all changes in sales and segment profit from our Argentina affiliate due to the designation of the economy as highly inflationary as of July 1, 2018. For presentation purposes, the Company has recast Argentina's prior period operations as well. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The impact of currency is the difference between the value of current year foreign operations at the current period ending USD exchange rate, compared to the value of the current year foreign operations at the prior period ending USD exchange rate. 20

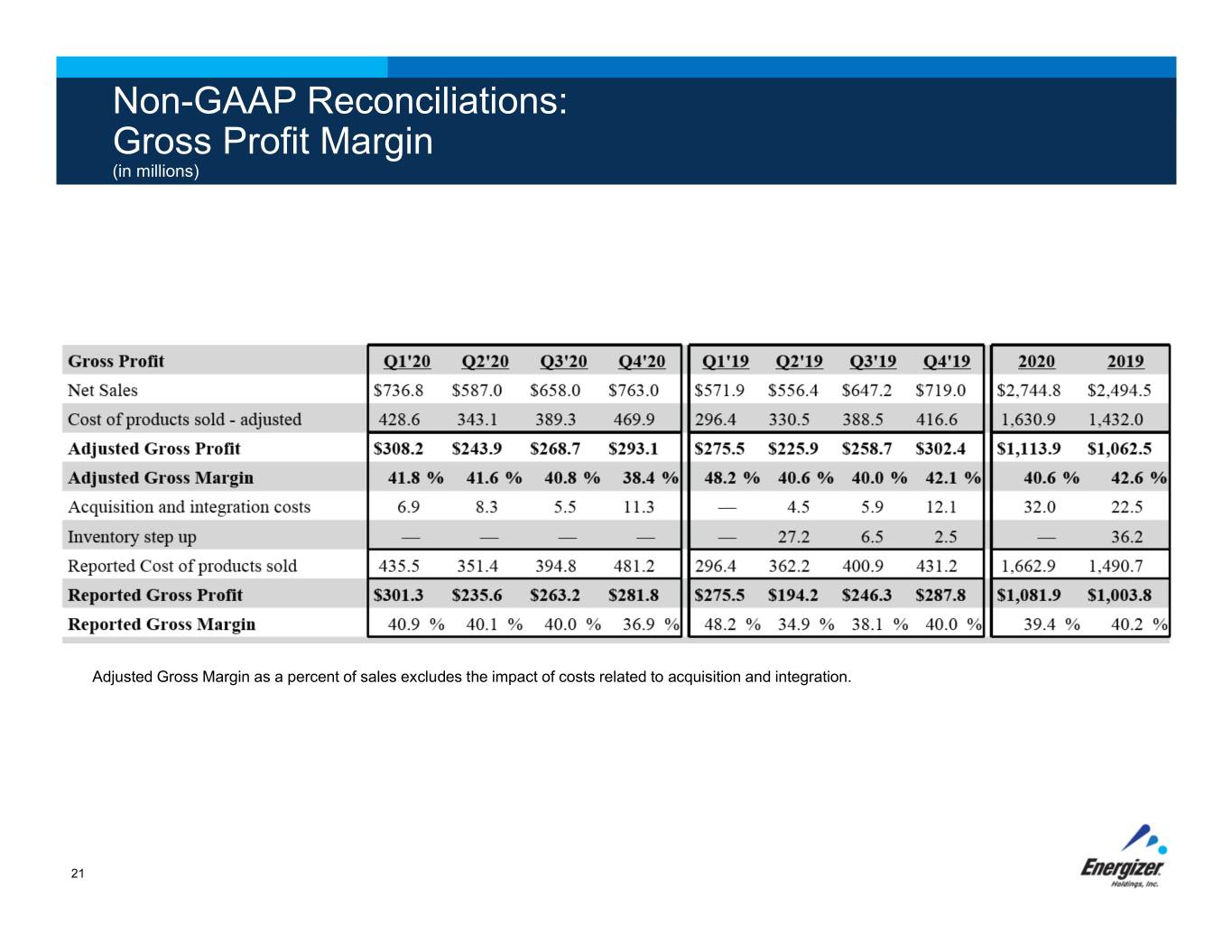

Non-GAAP Reconciliations: Gross Profit Margin (in millions) Adjusted Gross Margin as a percent of sales excludes the impact of costs related to acquisition and integration. 21

Non-GAAP Reconciliation: Adjusted SG&A (in millions) Adjusted SG&A as a percent of sales excludes the impact of costs related to acquisition and integration. 22

Non-GAAP Reconciliation: Adjusted EPS (in millions, except per share data) (1) The Effective tax rate for the quarters ended September 30, 2020 and 2019 for the Adjusted - Non-GAAP Net Earnings and Diluted EPS was 24.6% and 14.1%, respectively, as calculated utilizing the statutory rate for where the costs were incurred. The effective rate for the twelve months ended September 30, 2020 and 2019 for the Adjusted - Non-GAAP Net Earnings and Diluted EPS was 23.3% and 18.5%, respectively, as calculated utilizing the statutory rate for where the costs were incurred. (2) For the quarter ended September 30, 2020, the Adjusted Weighted average shares of common stock - Diluted includes the dilutive impact of our outstanding performance shares and restricted stock as they are dilutive to the calculation. For the quarter and twelve months ended September 30, 2019, the Adjusted Weighted average shares of common stock - Diluted is assuming conversion of the preferred shares as those results are more dilutive. The shares have been adjusted for the 4.7 million share conversion and the preferred dividend has been excluded from the Adjusted net earnings. 23

Non-GAAP Reconciliations: Adjusted EBITDA and Adjusted Free Cash Flow (in millions) 24

Non-GAAP Reconciliations: Fiscal 2021 Outlook 25