Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - CNL Healthcare Properties, Inc. | chp-ex321_8.htm |

| EX-31.2 - EX-31.2 - CNL Healthcare Properties, Inc. | chp-ex312_7.htm |

| EX-31.1 - EX-31.1 - CNL Healthcare Properties, Inc. | chp-ex311_6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 10-Q |

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the quarterly period ended September 30, 2020 |

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from to |

Commission file number: 000-54685

|

CNL Healthcare Properties, Inc. (Exact name of registrant as specified in its charter) |

|

Maryland |

|

27-2876363 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

CNL Center at City Commons |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code (407) 650-1000 |

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

None |

N/A |

N/A |

The number of shares of common stock of the registrant outstanding as of November 5, 2020 was 173,960,540.

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

INDEX

Item 1. Condensed Consolidated Financial Information

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except per share data)

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

Real estate investment properties, net (including VIEs $44,236 and $45,329, respectively) |

|

$ |

1,399,090 |

|

|

$ |

1,432,655 |

|

|

Cash and cash equivalents (including VIEs $486 and $1,024, respectively) |

|

|

69,941 |

|

|

|

42,350 |

|

|

Other assets (including VIEs $561 and $577, respectively) |

|

|

27,621 |

|

|

|

28,242 |

|

|

Deferred rent and lease incentives |

|

|

15,719 |

|

|

|

17,144 |

|

|

Assets held for sale, net |

|

|

7,527 |

|

|

|

88,804 |

|

|

Restricted cash (including VIEs $110 and $76, respectively) |

|

|

6,831 |

|

|

|

6,021 |

|

|

Intangibles, net |

|

|

924 |

|

|

|

1,220 |

|

|

Total assets |

|

$ |

1,527,653 |

|

|

$ |

1,616,436 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Mortgages and other notes payable, net (including VIEs $29,120 and $29,148, respectively) |

|

$ |

347,415 |

|

|

$ |

375,928 |

|

|

Credit facilities |

|

|

263,305 |

|

|

|

302,950 |

|

|

Accounts payable and accrued liabilities (including VIEs $1,213 and $1,286, respectively) |

|

|

29,129 |

|

|

|

24,560 |

|

|

Other liabilities (including VIEs $252 and $219, respectively) |

|

|

8,200 |

|

|

|

9,001 |

|

|

Due to related parties |

|

|

1,934 |

|

|

|

2,275 |

|

|

Liabilities associated with assets held for sale |

|

|

93 |

|

|

|

691 |

|

|

Total liabilities |

|

|

650,076 |

|

|

|

715,405 |

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

556 |

|

|

|

558 |

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value per share, 200,000 shares authorized; none issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Excess shares, $0.01 par value per share, 300,000 shares authorized; none issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value per share, 1,120,000 shares authorized, 186,626 shares issued and 173,960 shares outstanding |

|

|

1,740 |

|

|

|

1,740 |

|

|

Capital in excess of par value |

|

|

1,516,926 |

|

|

|

1,516,926 |

|

|

Accumulated income |

|

|

124,055 |

|

|

|

120,831 |

|

|

Accumulated distributions |

|

|

(766,959 |

) |

|

|

(740,239 |

) |

|

Accumulated other comprehensive loss |

|

|

(52 |

) |

|

|

(36 |

) |

|

Total stockholders' equity |

|

|

875,710 |

|

|

|

899,222 |

|

|

Noncontrolling interest |

|

|

1,311 |

|

|

|

1,251 |

|

|

Total equity |

|

|

877,577 |

|

|

|

901,031 |

|

|

Total liabilities and equity |

|

$ |

1,527,653 |

|

|

$ |

1,616,436 |

|

|

The abbreviation VIEs above means variable interest entities. |

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements

2

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

|

|

|

Quarter Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income and related revenues |

|

$ |

6,844 |

|

|

$ |

10,462 |

|

|

$ |

21,779 |

|

|

$ |

28,770 |

|

|

Resident fees and services |

|

|

69,356 |

|

|

|

72,289 |

|

|

|

214,555 |

|

|

|

215,452 |

|

|

Total revenues |

|

|

76,200 |

|

|

|

82,751 |

|

|

|

236,334 |

|

|

|

244,222 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

|

48,365 |

|

|

|

47,603 |

|

|

|

145,496 |

|

|

|

140,118 |

|

|

General and administrative expenses |

|

|

2,296 |

|

|

|

2,173 |

|

|

|

7,014 |

|

|

|

10,296 |

|

|

Asset management fees |

|

|

4,488 |

|

|

|

4,664 |

|

|

|

13,563 |

|

|

|

13,993 |

|

|

Property management fees |

|

|

3,759 |

|

|

|

2,594 |

|

|

|

10,623 |

|

|

|

9,472 |

|

|

Financing coordination fees |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,878 |

|

|

Depreciation and amortization |

|

|

14,378 |

|

|

|

12,337 |

|

|

|

39,376 |

|

|

|

37,018 |

|

|

Total operating expenses |

|

|

73,286 |

|

|

|

69,371 |

|

|

|

216,072 |

|

|

|

212,775 |

|

|

Gain on sale of real estate |

|

― |

|

|

― |

|

|

|

1,074 |

|

|

|

228 |

|

||

|

Operating income |

|

|

2,914 |

|

|

|

13,380 |

|

|

|

21,336 |

|

|

|

31,675 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

|

181 |

|

|

|

193 |

|

|

|

306 |

|

|

|

1,239 |

|

|

Interest expense and loan cost amortization |

|

|

(5,655 |

) |

|

|

(9,174 |

) |

|

|

(18,839 |

) |

|

|

(32,035 |

) |

|

Equity in earnings of unconsolidated entity |

|

|

200 |

|

|

|

220 |

|

|

|

606 |

|

|

|

414 |

|

|

Total other expense |

|

|

(5,274 |

) |

|

|

(8,761 |

) |

|

|

(17,927 |

) |

|

|

(30,382 |

) |

|

(Loss) income before income taxes |

|

|

(2,360 |

) |

|

|

4,619 |

|

|

|

3,409 |

|

|

|

1,293 |

|

|

Income tax benefit (expense) |

|

|

420 |

|

|

|

(708 |

) |

|

|

(905 |

) |

|

|

(1,910 |

) |

|

(Loss) income from continuing operations |

|

|

(1,940 |

) |

|

|

3,911 |

|

|

|

2,504 |

|

|

|

(617 |

) |

|

Income from discontinued operations |

|

|

218 |

|

|

|

1,557 |

|

|

|

798 |

|

|

|

344,520 |

|

|

Net (loss) income |

|

|

(1,722 |

) |

|

|

5,468 |

|

|

|

3,302 |

|

|

|

343,903 |

|

|

Less: Amounts attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income from continuing operations |

|

|

16 |

|

|

|

14 |

|

|

|

78 |

|

|

|

12 |

|

|

Net income from discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

265 |

|

|

Net (loss) income attributable to common stockholders |

|

$ |

(1,738 |

) |

|

$ |

5,454 |

|

|

$ |

3,224 |

|

|

$ |

343,626 |

|

|

Net (loss) income per share of common stock (basic and diluted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.01 |

) |

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

Discontinued operations |

|

$ |

0.00 |

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

1.98 |

|

|

Weighted average number of shares of common stock outstanding (basic and diluted) |

|

|

173,960 |

|

|

|

173,963 |

|

|

|

173,960 |

|

|

|

173,963 |

|

See accompanying notes to condensed consolidated financial statements.

3

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(in thousands)

|

|

|

Quarter Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Net (loss) income |

|

$ |

(1,722) |

|

|

$ |

5,468 |

|

|

$ |

3,302 |

|

|

$ |

343,903 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized (loss) gain on derivative financial instruments, net |

|

|

(13) |

|

|

|

32 |

|

|

|

(4) |

|

|

|

(1,004) |

|

|

Reclassification of interest rate swaps upon derecognition |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(509) |

|

|

Reclassification of interest rate caps upon derecognition |

|

|

2 |

|

|

|

— |

|

|

|

2 |

|

|

|

265 |

|

|

Unrealized (loss) gain on derivative financial instruments of equity method investments |

|

|

— |

|

|

|

(1) |

|

|

|

(14) |

|

|

|

11 |

|

|

Total other comprehensive (loss) income |

|

|

(11) |

|

|

|

31 |

|

|

|

(16) |

|

|

|

(1,237) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (loss) income |

|

|

(1,733) |

|

|

|

5,499 |

|

|

|

3,286 |

|

|

|

342,666 |

|

|

Less: Comprehensive income attributable to noncontrolling interest |

|

|

16 |

|

|

|

14 |

|

|

|

78 |

|

|

|

277 |

|

|

Comprehensive (loss) income attributable to common stockholders |

|

$ |

(1,749) |

|

|

$ |

5,485 |

|

|

$ |

3,208 |

|

|

$ |

342,389 |

|

See accompanying notes to condensed consolidated financial statements.

4

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND REDEEMABLE NONCONTROLLING INTEREST

QUARTER AND NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable |

|

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Total |

|

|

Non- |

|

|

|

|

|

||||||||||

|

|

|

Noncontrolling |

|

|

|

Number |

|

|

Par |

|

|

Excess of |

|

|

Accumulated |

|

|

Accumulated |

|

|

Comprehensive |

|

|

Stockholders' |

|

|

controlling |

|

|

Total |

|

||||||||||

|

|

|

Interest |

|

|

|

of Shares |

|

|

Value |

|

|

Par Value |

|

|

Income |

|

|

Distributions |

|

|

Loss |

|

|

Equity |

|

|

Interest |

|

|

Equity |

|

||||||||||

|

Balance at June 30, 2020 |

|

$ |

544 |

|

|

|

|

173,960 |

|

|

$ |

1,740 |

|

|

$ |

1,516,926 |

|

|

$ |

125,793 |

|

|

$ |

(758,052 |

) |

|

$ |

(41 |

) |

|

$ |

886,366 |

|

|

$ |

1,317 |

|

|

$ |

888,227 |

|

|

Net (loss) income |

|

|

12 |

|

|

|

― |

|

|

― |

|

|

― |

|

|

|

(1,738 |

) |

|

― |

|

|

― |

|

|

|

(1,738 |

) |

|

|

4 |

|

|

|

(1,722 |

) |

|||||

|

Other comprehensive loss |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(11 |

) |

|

|

(11 |

) |

|

― |

|

|

|

(11 |

) |

|||||||

|

Distributions to noncontrolling interests |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(10 |

) |

|

|

(10 |

) |

||||||||

|

Cash distributions declared ($0.0512 per share) |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(8,907 |

) |

|

― |

|

|

|

(8,907 |

) |

|

― |

|

|

|

(8,907 |

) |

|||||||

|

Balance at September 30, 2020 |

|

$ |

556 |

|

|

|

|

173,960 |

|

|

$ |

1,740 |

|

|

$ |

1,516,926 |

|

|

$ |

124,055 |

|

|

$ |

(766,959 |

) |

|

$ |

(52 |

) |

|

$ |

875,710 |

|

|

$ |

1,311 |

|

|

$ |

877,577 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2019 |

|

$ |

558 |

|

|

|

|

173,960 |

|

|

$ |

1,740 |

|

|

$ |

1,516,926 |

|

|

$ |

120,831 |

|

|

$ |

(740,239 |

) |

|

$ |

(36 |

) |

|

$ |

899,222 |

|

|

$ |

1,251 |

|

|

$ |

901,031 |

|

|

Net income |

|

|

28 |

|

|

|

― |

|

|

― |

|

|

― |

|

|

|

3,224 |

|

|

― |

|

|

― |

|

|

|

3,224 |

|

|

|

50 |

|

|

|

3,302 |

|

|||||

|

Other comprehensive loss |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(16 |

) |

|

|

(16 |

) |

|

― |

|

|

|

(16 |

) |

|||||||

|

Distributions to noncontrolling interest |

|

|

(30 |

) |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(65 |

) |

|

|

(95 |

) |

|||||||

|

Cash distributions declared ($0.1536 per share) |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(26,720 |

) |

|

― |

|

|

|

(26,720 |

) |

|

― |

|

|

|

(26,720 |

) |

|||||||

|

Contributions from noncontrolling interests |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

75 |

|

|

|

75 |

|

||||||||

|

Balance at September 30, 2020 |

|

$ |

556 |

|

|

|

|

173,960 |

|

|

$ |

1,740 |

|

|

$ |

1,516,926 |

|

|

$ |

124,055 |

|

|

$ |

(766,959 |

) |

|

$ |

(52 |

) |

|

$ |

875,710 |

|

|

$ |

1,311 |

|

|

$ |

877,577 |

|

See accompanying notes to condensed consolidated financial statements.

5

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND REDEEMABLE NONCONTROLLING INTEREST

QUARTER AND NINE MONTHS ENDED SEPTEMBER 30, 2019 (UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable |

|

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Total |

|

|

Non- |

|

|

|

|

|

||||||||||

|

|

|

Noncontrolling |

|

|

|

Number |

|

|

Par |

|

|

Excess of |

|

|

Accumulated |

|

|

Accumulated |

|

|

Comprehensive |

|

|

Stockholders' |

|

|

controlling |

|

|

Total |

|

||||||||||

|

|

|

Interest |

|

|

|

of Shares |

|

|

Value |

|

|

Par Value |

|

|

Income (Loss) |

|

|

Distributions |

|

|

Income (Loss) |

|

|

Equity |

|

|

Interest |

|

|

Equity |

|

||||||||||

|

Balance at June 30, 2019 |

|

$ |

587 |

|

|

|

|

173,963 |

|

|

$ |

1,740 |

|

|

$ |

1,516,949 |

|

|

$ |

107,507 |

|

|

$ |

(722,425 |

) |

|

$ |

(91 |

) |

|

$ |

903,680 |

|

|

$ |

1,397 |

|

|

$ |

905,664 |

|

|

Net income |

|

|

8 |

|

|

|

― |

|

|

― |

|

|

― |

|

|

|

5,454 |

|

|

― |

|

|

― |

|

|

|

5,454 |

|

|

|

6 |

|

|

|

5,468 |

|

|||||

|

Other comprehensive income |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

31 |

|

|

|

31 |

|

|

― |

|

|

|

31 |

|

|||||||

|

Distributions to holder of noncontrolling interests |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(80 |

) |

|

|

(80 |

) |

||||||||

|

Cash distributions declared ($0.0512 per share) |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(8,907 |

) |

|

― |

|

|

|

(8,907 |

) |

|

― |

|

|

|

(8,907 |

) |

|||||||

|

Balance at September 30, 2019 |

|

$ |

595 |

|

|

|

|

173,963 |

|

|

$ |

1,740 |

|

|

$ |

1,516,949 |

|

|

$ |

112,961 |

|

|

$ |

(731,332 |

) |

|

$ |

(60 |

) |

|

$ |

900,258 |

|

|

$ |

1,323 |

|

|

$ |

902,176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2018 |

|

$ |

579 |

|

|

|

|

173,963 |

|

|

$ |

1,740 |

|

|

$ |

1,516,543 |

|

|

$ |

(233,847 |

) |

|

$ |

(345,347 |

) |

|

$ |

1,177 |

|

|

$ |

940,266 |

|

|

$ |

1,081 |

|

|

$ |

941,926 |

|

|

Adoption of lease accounting standard |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

|

3,182 |

|

|

― |

|

|

― |

|

|

|

3,182 |

|

|

― |

|

|

|

3,182 |

|

|||||||

|

Net income |

|

|

16 |

|

|

|

― |

|

|

― |

|

|

― |

|

|

|

343,626 |

|

|

― |

|

|

― |

|

|

|

343,626 |

|

|

|

261 |

|

|

|

343,903 |

|

|||||

|

Other comprehensive loss |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(1,237 |

) |

|

|

(1,237 |

) |

|

― |

|

|

|

(1,237 |

) |

|||||||

|

Distributions to holders of promoted interest |

|

― |

|

|

|

― |

|

|

― |

|

|

|

406 |

|

|

― |

|

|

― |

|

|

― |

|

|

|

406 |

|

|

― |

|

|

|

406 |

|

|||||||

|

Distributions to holder noncontrolling interest |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(610 |

) |

|

|

(610 |

) |

||||||||

|

Cash distributions declared ($2.21879 per share) |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(385,985 |

) |

|

― |

|

|

|

(385,985 |

) |

|

― |

|

|

|

(385,985 |

) |

|||||||

|

Contributions from noncontrolling interests |

|

― |

|

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

591 |

|

|

|

591 |

|

||||||||

|

Balance at September 30, 2019 |

|

$ |

595 |

|

|

|

|

173,963 |

|

|

$ |

1,740 |

|

|

$ |

1,516,949 |

|

|

$ |

112,961 |

|

|

$ |

(731,332 |

) |

|

$ |

(60 |

) |

|

$ |

900,258 |

|

|

$ |

1,323 |

|

|

$ |

902,176 |

|

See accompanying notes to condensed consolidated financial statements.

6

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

|

|

|

Nine Months Ended |

|

|||||

|

|

|

September 30, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Operating activities: |

|

|

|

|

|

|

|

|

|

Net cash flows provided by operating activities – continuing operations |

|

$ |

46,627 |

|

|

$ |

36,223 |

|

|

Net cash flows provided by operating activities – discontinued operations |

|

|

870 |

|

|

|

17,672 |

|

|

Net cash flows provided by operating activities |

|

|

47,497 |

|

|

|

53,895 |

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from sale of real estate |

|

|

53,712 |

|

|

|

246 |

|

|

Capital expenditures |

|

|

(5,747 |

) |

|

|

(4,290 |

) |

|

Other investing activities |

|

|

26 |

|

|

|

993 |

|

|

Net cash provided by (used in) investing activities – continuing operations |

|

|

47,991 |

|

|

|

(3,051 |

) |

|

Development of properties |

|

― |

|

|

|

(80 |

) |

|

|

Capital expenditures |

|

― |

|

|

|

(1,632 |

) |

|

|

Proceeds from sale of real estate |

|

|

28,398 |

|

|

|

1,312,479 |

|

|

Other investing activities |

|

― |

|

|

|

(721 |

) |

|

|

Net cash provided by investing activities – discontinued operations |

|

|

28,398 |

|

|

|

1,310,046 |

|

|

Net cash provided by investing activities |

|

|

76,389 |

|

|

|

1,306,995 |

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Distributions to stockholders, net of distribution reinvestments |

|

|

(26,720 |

) |

|

|

(385,985 |

) |

|

Draws under credit facilities |

|

|

40,000 |

|

|

|

55,000 |

|

|

Payment of loan costs |

|

|

(46 |

) |

|

|

(6,028 |

) |

|

Proceeds from mortgages and other notes payable |

|

― |

|

|

|

178 |

|

|

|

Principal payments on mortgages and other notes payable |

|

|

(28,961 |

) |

|

|

(600,747 |

) |

|

Repayments on credit facilities |

|

|

(80,000 |

) |

|

|

(444,125 |

) |

|

Other financing activities |

|

|

76 |

|

|

|

(1,170 |

) |

|

Net cash flows used in financing activities |

|

|

(95,651 |

) |

|

|

(1,382,877 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and restricted cash |

|

|

28,235 |

|

|

|

(21,987 |

) |

|

Cash and restricted cash at beginning of period, including assets held for sale |

|

|

48,537 |

|

|

|

65,501 |

|

|

Cash and restricted cash at end of period, including assets held for sale |

|

$ |

76,772 |

|

|

$ |

43,514 |

|

See accompanying notes to condensed consolidated financial statements.

7

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

CNL Healthcare Properties, Inc. (“Company”) is a Maryland corporation that incorporated on June 8, 2010 and elected to be taxed as a real estate investment trust (“REIT”) for United States (“U.S.”) federal income tax purposes beginning with the year ended December 31, 2012. The Company’s intention is to be organized and operate in a manner that allows it to remain qualified as a REIT for U.S. federal income tax purposes. The Company conducts substantially all of its operations either directly or indirectly through: (1) an operating partnership, CHP Partners, LP (“Operating Partnership”), in which the Company is the sole limited partner and its wholly-owned subsidiary, CHP GP, LLC, is the sole general partner; (2) a wholly-owned taxable REIT subsidiary (“TRS”), CHP TRS Holding, Inc.; (3) property owner and lender subsidiaries, which are single purpose entities; and (4) investments in joint ventures.

The Company is externally managed and advised by CNL Healthcare Corp. (“Advisor”), which is an affiliate of CNL Financial Group, LLC (“Sponsor”). The Sponsor is an affiliate of CNL Financial Group, Inc. (“CNL”). The Advisor is responsible for managing the Company’s day-to-day operations, serving as a consultant in connection with policy decisions to be made by the board of directors, and for identifying, recommending and executing on possible strategic alternatives and dispositions on the Company’s behalf pursuant to an advisory agreement among the Company, the Operating Partnership and the Advisor. Substantially all of the Company’s operating, administrative and certain property management services are, provided by affiliates of the Advisor. In addition, certain property management services are provided by third-party property managers.

On September 30, 2015, the Company completed its public offerings (“Offerings”) having received aggregate subscription proceeds of approximately $1.7 billion. In October 2015, the Company deregistered the unsold shares of its common stock under its previous registration statement on Form S-11, except for 20 million shares that it registered on Form S-3 under the Securities Exchange Act of 1933 with the Securities and Exchange Commission (“SEC”) for the sale of additional shares of common stock through its distribution reinvestment plan (“Reinvestment Plan”). Effective July 11, 2018, the Company suspended both its Reinvestment Plan and its stock redemption plan (“Redemption Plan”).

In 2017, the Company began evaluating possible strategic alternatives to provide liquidity to the Company’s stockholders. In April 2018, the Company’s board of directors formed a special committee consisting solely of its independent directors (“Special Committee”) to consider possible strategic alternatives, including, but not limited to (i) the listing of the Company’s or one of its subsidiaries’ common stock on a national securities exchange, (ii) an orderly disposition of the Company’s assets or one or more of the Company’s asset classes and the distribution of the net sale proceeds thereof to the stockholders of the Company and (iii) a potential business combination or other transaction with a third party or parties that provides the stockholders of the Company with cash and/or securities of a publicly traded company (collectively, among other options, “Possible Strategic Alternatives”). During 2018, the Special Committee engaged HFF Securities L.P. (through June 2019) and KeyBanc Capital Markets Inc. to act as financial advisors to the aforementioned Special Committee. As of December 2018, as part of executing on Possible Strategic Alternatives, the Company had committed to a plan to sell a total of 70 properties including the sale of 63 properties consisting of 53 medical office buildings (“MOBs”), five post-acute care facilities and five acute care hospitals across the US (collectively, the “MOB/Healthcare Portfolio”), a skilled nursing facility in Colorado (“Welbrook Senior Living Grand Junction”) and six skilled nursing facilities in Arkansas (the “Perennial Communities”). During the year ended December 31, 2019, the Company sold 61 of the properties and during the nine months ended September 30, 2020, the Company sold seven additional properties. In September 2020, the Company decided to discontinue marketing for sale one of its two remaining acute care properties and therefore only had one acute care property classified as assets held for sale as of September 30, 2020.

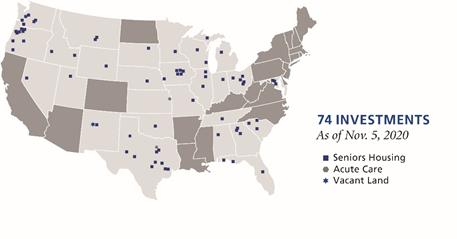

As of September 30, 2020, the Company’s healthcare investment portfolio was geographically diversified with properties in 27 states and consisted of interests in 74 properties, including 71 senior housing communities, one acute care hospital, one vacant land parcel and one acute care facility classified as held for sale. The Company

8

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

1. |

Organization (continued) |

has primarily leased its seniors housing properties to wholly-owned TRS entities and engaged independent third-party managers under management agreements to operate the properties under the REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”) structures; however, the Company has also leased its properties to third-party tenants under triple-net or similar lease structures, where the tenant bears all or substantially all of the costs (including cost increases, for real estate taxes, utilities, insurance and ordinary repairs). In addition, although most of the Company’s investments are wholly owned, it has invested in properties through partnerships with other entities where it is believed to be appropriate and beneficial.

Basis of Presentation and Consolidation — The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and note disclosures required by generally accepted accounting principles in the U.S. (“GAAP”). The unaudited condensed consolidated financial statements reflect all normal recurring adjustments, which, in the opinion of management, are necessary for the fair statement of the Company’s results for the interim period presented. Operating results for the nine months ended September 30, 2020 may not be indicative of the results that may be expected for the year ending December 31, 2020. Amounts as of December 31, 2019 included in the unaudited condensed consolidated financial statements have been derived from audited consolidated financial statements as of that date but do not include all disclosures required by GAAP. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

The accompanying unaudited condensed consolidated financial statements include the Company’s accounts, the accounts of wholly owned subsidiaries or subsidiaries for which the Company has a controlling interest, the accounts of two variable interest entities (“VIEs”) in which the Company is the primary beneficiary, and the accounts of other subsidiaries over which the Company has a controlling financial interest. All material intercompany accounts and transactions have been eliminated in consolidation.

Assets Reclassified from Held for Sale to Held and Used — Upon management’s determination to discontinue marketing properties for sale, the properties will no longer meet the held for sale criteria and are required to be reclassified as held and used at the lower of adjusted carrying value (carrying value of the properties prior to being classified as held for sale adjusted for any depreciation and/or amortization expense that would have been recognized had the properties been continuously classified as held and used) or its fair value at the date of the subsequent decision not to sell. If adjusted carrying value is determined to be lower, a catch-up depreciation and/or amortization adjustment will be recorded. The depreciation and/or amortization expenses that would have been recognized had the properties been continuously classified as held and used and will be included as a component of depreciation and amortization expense in the accompanying unaudited condensed consolidated statements of operations. If fair value is determined to be lower, the Company will record a loss on reclassification which will be included in income or loss from continuing operations in the accompanying unaudited condensed consolidated statements of operations.

Government Grant Income — On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law which provided, among other things, for the establishment of a Provider Relief Fund under the direction of the Department of Health and Human Services (“HHS”). During the nine months ended September 30, 2020, the Company received $0.6 million in government grants under Phase 1 of the Provider Relief Fund primarily to cover increased expenses and lost revenue during the coronavirus pandemic. In September 2020, HHS announced that it expanded the eligibility to the Provider Relief Fund to include assisted living facilities as part of Phase 2 of the Provider Relief Fund. The Company submitted an application for Phase 2 in September 2020 for approximately $5.5 million in government grants. In October 2020, HHS announced that additional funds were made available for healthcare providers under Phase 3 of the Provider Relief Fund. The Company submitted an application under Phase 3 in November 2020 and is awaiting specific guidance from HHS on how Phase 3 relief will be calculated. Grant income is recognized upon receipt of grant income and when all the conditions of the grant have been met. As of September 30, 2020, the

9

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

2. |

Summary of Significant Accounting Policies (continued) |

Company recorded $0.6 million of grant income related to the funding from Phase 1 of the Provider Relief Fund as all conditions had been met.

Risks and Uncertainties — The outbreak of the novel coronavirus (“COVID-19”) pandemic around the globe and the impact of the outbreak has been rapidly evolving. Various of the states in which the Company owns properties have reacted by, among other things, instituting quarantines in many business sectors and instituting move-in restrictions to seniors housing communities. The pandemic has also resulted in the incurrence of costs related to disease control and containment. Such actions are creating significant business disruption and adversely impacting a number of industries, including the senior housing sector.

The full impact of COVID-19 on the Company’s financial condition and results of operations is uncertain and cannot be predicted at the current time as it depends on several factors beyond the control of the Company including, but not limited to (i) the uncertainty around the severity and duration of the outbreak, (ii) the effectiveness of the United States public health response, (iii) the pandemic’s impact on the U.S. and global economies, (iv) the timing, scope and effectiveness of additional governmental responses to the pandemic and (v) the timing and speed of economic recovery, including the availability of a treatment or vaccination for COVID-19.

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the consolidated financial statements, the reported amounts of revenues and expenses during the reporting periods and the disclosure of contingent liabilities. For example, significant assumptions are made in the analysis of real estate impairments, the valuation of contingent assets and liabilities, and the valuation of restricted common stock (“Restricted Stock”) shares issued to the Advisor. The uncertainty surrounding the COVID-19 pandemic may materially impact the accuracy of the estimates and assumptions used in the financial statements and related footnotes and accordingly, actual results could differ from those estimates.

Adopted Accounting Pronouncements — In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-13, “Measurement of Credit Losses on Financial Instruments (Topic 326),” which requires a new forward-looking expected loss model to be used for receivables, held-to-maturity debt, loans and other financial instruments. Previously, when credit losses were measured under current GAAP, an entity generally only considered past events and current conditions in measuring the incurred loss. The amendments eliminate the probable initial threshold for recognition of credit losses in current GAAP and, instead, reflect an entity’s current estimate of all expected credit losses over the life of the financial instrument. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2019. The Company adopted this ASU prospectively on January 1, 2020, the adoption of which did not have a material impact on the Company’s consolidated results of operations.

Impact of Recent Accounting Pronouncements - In Q1 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848). ASU 2020-04 contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance in ASU 2020-04 is optional and may be elected over time as reference rate reform activities occur. During the nine months ended September 30, 2020, the Company has elected to apply the hedge accounting expedients related to probability and the assessments of effectiveness for future LIBOR-indexed cash flows to assume that the index upon which future hedged transactions will be based matches the index on the corresponding derivatives. Application of these expedients preserves the presentation of derivatives consistent with past presentation. The Company continues to evaluate the impact of the guidance and may apply other elections as applicable as additional changes in the market occur.

In April 2020, the FASB issued a Staff Question-and-Answer (“Q&A”) to clarify whether lease concessions related to the effects of COVID-19 require the application of the lease modification guidance under the new lease standard, which the Company adopted on January 1, 2019. Under the new leasing standard, an entity would have to determine, on a lease by lease basis, if a lease concession was the result of a new arrangement

10

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

2. |

Summary of Significant Accounting Policies (continued) |

reached with the tenant, which would be accounted for under the lease modification framework, or if the lease concession was under the enforceable rights and obligations that existed in the original lease, which would be accounted for outside the lease modification framework. The Q&A provides entities with the option to elect to account for lease concessions as though the enforceable rights and obligations existed in the original lease as long as the total cash flows from the modified lease are substantially similar to the cash flows in the original lease. We have elected this option and therefore, to the extent that a rent concession is granted as a deferral of payments, but total payments are substantially the same, we will account for the concession as if no change has been made to the original lease.

The following table presents disaggregated revenue related to the Company’s resident fees and services during the nine months ended September 30, 2020 and 2019:

|

|

|

Number of Units |

|

Revenues (in millions) |

|

Percentage of Revenues |

||||||||||

|

Resident fees and services: |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||

|

Independent living |

|

2,261 |

|

2,261 |

|

$ |

55.3 |

|

$ |

55.6 |

|

25.8 |

% |

|

25.8 |

% |

|

Assisted living |

|

2,966 |

|

2,966 |

|

|

105.7 |

|

|

105.0 |

|

49.3 |

% |

|

48.7 |

% |

|

Memory care |

|

853 |

|

853 |

|

|

43.2 |

|

|

44.6 |

|

20.1 |

% |

|

20.7 |

% |

|

Other revenues |

|

― |

|

― |

|

|

10.4 |

|

|

10.3 |

|

4.8 |

% |

|

4.8 |

% |

|

|

|

6,080 |

|

6,080 |

|

$ |

214.6 |

|

$ |

215.5 |

|

100.0 |

% |

|

100.0 |

% |

The gross carrying amount and accumulated depreciation of the Company’s real estate assets as of September 30, 2020 and December 31, 2019 are as follows, excluding assets held for sale (in thousands):

|

|

September 30, |

|

December 31, |

|

||

|

|

2020 |

|

2019 |

|

||

|

Land and land improvements |

$ |

132,605 |

|

$ |

132,453 |

|

|

Building and building improvements |

|

1,500,230 |

|

|

1,498,297 |

|

|

Furniture, fixtures and equipment |

|

88,963 |

|

|

86,543 |

|

|

Less: accumulated depreciation |

|

(322,708) |

|

|

(284,638) |

|

|

Real estate investment properties, net |

$ |

1,399,090 |

|

$ |

1,432,655 |

|

In September 2020, the Company decided to discontinue marketing for sale one of its two remaining acute care properties that it had previously classified as assets held for sale. As a result of discontinuing marketing efforts, this acute care property no longer met the assets held for sale criteria and the Company recorded an adjustment of $1.6 million during the quarter and nine months ended September 30, 2020, representing the catch up in depreciation expense that would have been recognized had this property been continuously classified as held and used. The property was reclassified as held and used at the adjusted carrying value, which was lower than its fair value, resulting in no loss on reclassification on this property. The Company recorded all operating results from this acute care property as income or loss from continuing operations for all periods presented.

11

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

4. |

Real Estate Assets, net (continued) |

Depreciation expense on the Company’s real estate investment properties, net was approximately $14.3 million and $39.1 million for the quarter and nine months ended September 30, 2020, respectively, and approximately $12.2 million and $36.7 million for the quarter and nine months ended September 30, 2019, respectively. These amounts include the $1.6 million depreciation catch up adjustment described above and depreciation through the determination date on assets held for sale; refer to Note 6. “Assets and Associated Liabilities Held For Sale and Discontinued Operations” for additional information.

The gross carrying amount and accumulated amortization of the Company’s intangible assets as of September 30, 2020 and December 31, 2019 are as follows (in thousands):

|

|

As of |

|

||||

|

|

September 30, 2020 |

|

December 31, 2019 |

|

||

|

In-place lease intangibles |

$ |

3,943 |

|

$ |

83,275 |

|

|

Less: accumulated amortization |

|

(3,019) |

|

|

(82,055) |

|

|

Intangible assets, net |

$ |

924 |

|

$ |

1,220 |

|

For each of the quarter and nine months ended September 30, 2020 and 2019, amortization on the Company’s intangible assets was approximately $0.1 million and $0.3 million, respectively, all of which were included in depreciation and amortization.

As part of executing on Possible Strategic Alternatives, during 2018, the Company committed to a plan to sell a total of 70 properties, including: (1) the 63 property MOB/Healthcare Portfolio, (2) the six properties comprising the Perennial Communities and (3) Welbrook Senior Living Grand Junction. As such, the Company classified the 70 properties as held for sale. The Company believed the sale of the MOB/Healthcare Portfolio would cause a strategic shift in the Company’s operations and therefore classified the operations of those properties as discontinued operations. The sale of the other seven properties would not cause a strategic shift in the Company’s operations and were not considered individually significant; therefore, those properties did not qualify as discontinued operations.

During the year ended December 31, 2019, the Company sold 61 of the 70 properties and as of December 31, 2019, had entered into purchase and sale agreements for its acute care property in New Orleans (the “New Orleans Sale Agreement”) and for the Perennial Communities (the “Perennial Sale Agreement”) with unrelated third party buyers. During the nine months ended September 30, 2020, the Company sold the seven properties in accordance with the New Orleans Sale Agreement and the Perennial Sale Agreement and recorded gain on sale of $1.1 million for financial reporting purposes.

As described in Note 4, “Real Estate Assets, Net”, in September 2020, the Company decided to discontinue marketing for sale one of its two remaining acute care properties that it had previously classified as assets held for sale. As a result of discontinued marketing efforts, this acute care property no longer met the assets held for sale criteria. The Company recorded all operating results from this acute care property as income or loss from continuing operations for all periods presented.

12

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

6. |

Assets and Associated Liabilities Held For Sale and Discontinued Operations (continued) |

As of September 30, 2020 and December 31, 2019, the Company had one acute care property and eight properties, respectively, classified as assets held for sale. The one asset held for sale, and the liabilities associated with those assets held for sale, consisted of the following (in thousands):

|

|

|

As of September 30, 2020 |

|

|||||||||

|

|

|

MOB/Healthcare Portfolio |

|

|

Other |

|

|

Total |

|

|||

|

Real estate investment properties, net |

|

$ |

5,922 |

|

|

$ |

— |

|

|

$ |

5,922 |

|

|

Intangibles, net |

|

|

1,583 |

|

|

― |

|

|

|

1,583 |

|

|

|

Other assets |

|

|

22 |

|

|

― |

|

|

|

22 |

|

|

|

Assets held for sale, net |

|

$ |

7,527 |

|

|

$ |

— |

|

|

$ |

7,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

6 |

|

|

$ |

— |

|

|

$ |

6 |

|

|

Other liabilities |

|

|

87 |

|

|

― |

|

|

|

87 |

|

|

|

Liabilities associated with assets held for sale |

|

$ |

93 |

|

|

$ |

— |

|

|

$ |

93 |

|

As of December 31, 2019, the eight properties classified as assets held for sale, and the liabilities associated with those assets held for sale, consisted of the following (in thousands):

|

|

|

As of December 31, 2019 |

|

|||||||||

|

|

|

MOB/Healthcare Portfolio |

|

|

Other |

|

|

Total |

|

|||

|

Real estate held for sale, net |

|

$ |

28,307 |

|

|

$ |

46,908 |

|

|

$ |

75,215 |

|

|

Intangibles, net |

|

|

6,252 |

|

|

|

800 |

|

|

|

7,052 |

|

|

Deferred rent and lease incentives |

|

|

1,345 |

|

|

|

4,952 |

|

|

|

6,297 |

|

|

Other assets |

|

|

6 |

|

|

|

68 |

|

|

|

74 |

|

|

Restricted cash |

|

|

94 |

|

|

|

72 |

|

|

|

166 |

|

|

Assets held for sale, net |

|

$ |

36,004 |

|

|

$ |

52,800 |

|

|

$ |

88,804 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

4 |

|

|

$ |

3 |

|

|

$ |

7 |

|

|

Other liabilities |

|

― |

|

|

|

684 |

|

|

|

684 |

|

|

|

Liabilities associated with assets held for sale |

|

$ |

4 |

|

|

$ |

687 |

|

|

$ |

691 |

|

13

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

6. |

Assets and Associated Liabilities Held For Sale and Discontinued Operations (continued) |

The Company classified the revenues and expenses related to the Company’s MOB/Healthcare Portfolio, which consisted of 62 properties, as discontinued operations in the accompanying condensed consolidated statements of operations, as it believed the sale of these properties represented a strategic shift in the Company’s operations. The following table is a summary of the Company’s income from discontinued operations for the quarter and nine months ended September 30, 2020 and 2019 (in thousands):

|

|

|

Quarter Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income and related revenues |

|

$ |

256 |

|

|

$ |

1,707 |

|

|

$ |

1,112 |

|

|

$ |

45,174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

― |

|

|

― |

|

|

|

6 |

|

|

|

11,116 |

|

||

|

General and administrative expenses |

|

|

6 |

|

|

|

42 |

|

|

|

178 |

|

|

|

658 |

|

|

Asset management fees |

|

|

25 |

|

|

|

180 |

|

|

|

114 |

|

|

|

4,537 |

|

|

Property management fees |

|

|

7 |

|

|

|

9 |

|

|

|

23 |

|

|

|

1,249 |

|

|

Total operating expenses |

|

|

38 |

|

|

|

231 |

|

|

|

321 |

|

|

|

17,560 |

|

|

Gain on sale of real estate |

|

― |

|

|

― |

|

|

― |

|

|

|

331,663 |

|

|||

|

Operating income |

|

|

218 |

|

|

|

1,476 |

|

|

|

791 |

|

|

|

359,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

― |

|

|

|

22 |

|

|

|

7 |

|

|

|

33 |

|

|

|

Interest expense and loan cost amortization(1)(2) |

|

― |

|

|

― |

|

|

― |

|

|

|

(14,618) |

|

|||

|

Total other income (expense) |

|

― |

|

|

|

22 |

|

|

|

7 |

|

|

|

(14,585) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

218 |

|

|

|

1,498 |

|

|

|

798 |

|

|

|

344,692 |

|

|

Income tax benefit (expense) |

|

― |

|

|

|

59 |

|

|

― |

|

|

|

(172) |

|

||

|

Income from discontinued operations |

|

$ |

218 |

|

|

$ |

1,557 |

|

|

$ |

798 |

|

|

$ |

344,520 |

|

FOOTNOTES:

As of September 30, 2020 and December 31, 2019, the Company had two subsidiaries classified as VIEs. These subsidiaries are joint ventures with completed real estate under development in which their equity interest consists of non-substantive protective voting rights. Additionally, one of the subsidiaries has insufficient equity at risk due to the development nature of the joint venture. The Company determined it is the primary beneficiary and holds a controlling financial interest in each of these subsidiaries due to its power to direct the activities that most significantly impact the economic performance of the entities, as well as its obligation to absorb the losses and its right to receive benefits from these entities that could potentially be significant to these entities. As such, the transactions and accounts of these VIEs are included in the accompanying consolidated financial statements. The Company’s maximum exposure to loss as a result of its involvement with these VIEs

14

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

7. |

Variable Interest Entities (continued) |

is limited to its net investment in these entities which totaled approximately $13.0 million as of September 30, 2020. The Company’s exposure is limited because of the non-recourse nature of the borrowings of the VIEs.

During the nine months ended September 30, 2020, the Company repaid the Primrose II Communities outstanding mortgage loan balance of approximately $20.5 million, which matured in June 2020. In April 2020, the Company borrowed $40 million under its Revolving Credit Facility as a precautionary measure to increase liquidity and preserve financial flexibility in light of COVID-19 and in September 2020 repaid $80 million under its Revolving Credit Facility.

The following table provides the details of the fair market value and carrying value of the Company’s indebtedness as of September 30, 2020 and December 31, 2019 (in millions):

|

|

|

|

September 30, |

|

|

December 31, |

||||||

|

|

|

2020 |

|

2019 |

||||||||

|

|

|

Fair Value |

|

Carrying Value |

|

Fair Value |

|

Carrying Value |

||||

|

Mortgages and other notes payable, net |

|

$ |

351.7 |

|

$ |

347.4 |

|

$ |

381.2 |

|

$ |

375.9 |

|

Credit facilities |

|

$ |

265.0 |

|

$ |

263.3 |

|

$ |

305.0 |

|

$ |

303.0 |

These fair market values are based on current rates and spreads the Company would expect to obtain for similar borrowings. Since this methodology includes inputs that are less observable by the public and are not necessarily reflected in active markets, the measurement of the estimated fair values related to the Company’s mortgage notes payable is categorized as Level 3 on the three-level valuation hierarchy. The estimated fair value of accounts payable and accrued liabilities approximates the carrying value as of September 30, 2020 and December 31, 2019 because of the relatively short maturities of the obligations.

All of the Company’s mortgage loans contain customary financial covenants and ratios, including (but not limited to) debt service coverage ratio, minimum occupancy levels, limitations on incurrence of additional indebtedness, etc.

The credit facilities contain affirmative, negative, and financial covenants which are customary for loans of this type, including (but not limited to): (i) maximum leverage, (ii) minimum fixed charge coverage ratio, (iii) minimum consolidated net worth, (iv) restrictions on payments of cash distributions except if required by REIT requirements, (v) maximum secured indebtedness, (vi) maximum secured recourse debt, (vii) minimum unsecured interest coverage, (viii) maximum unsecured indebtedness ratio, and (ix) limitations on certain types of investments and with respect to the pool of properties supporting borrowings under the credit facilities, minimum weighted average occupancy, and remaining lease terms, as well as property type, MSA, operator, and asset value concentration limits. The limitations on distributions generally include a limitation on the extent of allowable distributions, which are not to exceed the greater of 95% of adjusted FFO (as defined per the credit facilities) and the minimum amount of distributions required to maintain the Company’s REIT status. As of September 30, 2020, the Company was in compliance with all financial covenants.

During the quarter and nine months ended September 30, 2020, the Company paid approximately $0.07 million and $0.20 million, respectively, of cash distributions on restricted stock issued through March 2017 pursuant to the Advisor expense support agreement. During the quarter and nine months ended September 30, 2019, the Company paid approximately $0.07 million and $3.0 million, respectively, of cash distributions on restricted stock issued pursuant to the Advisor expense support agreement, which included a special cash distribution in May 2019 funded with sales proceeds from the sale of real estate. These amounts have been recognized as

15

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2020 (UNAUDITED)

|

9. |

Related Party Arrangements (continued) |

compensation expense and included in general and administrative expenses in the accompanying condensed consolidated statements of operations.

In May 2020, the Company’s board of directors approved the renewal of its advisory agreement with the Advisor through June 2021. The expenses and fees incurred by and reimbursable to the Company’s related parties, including amounts included in income from discontinued operations, for the quarter and nine months ended September 30, 2020 and 2019, and related amounts unpaid as of September 30, 2020 and December 31, 2019 are as follows (in thousands):

|

|

|

|

|

Quarter Ended |

|

Nine Months Ended |

|

Unpaid amounts as of (1) |

|

|||||||||||||

|

|

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

December 31, |

|

|||||||||||

|

|

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |