Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CHASE CORP | ccf-20200831ex322427696.htm |

| EX-32.1 - EX-32.1 - CHASE CORP | ccf-20200831ex321ee0f43.htm |

| EX-31.2 - EX-31.2 - CHASE CORP | ccf-20200831ex312f1842c.htm |

| EX-31.1 - EX-31.1 - CHASE CORP | ccf-20200831ex31186a2d3.htm |

| EX-23.2 - EX-23.2 - CHASE CORP | ccf-20200831ex232d17aac.htm |

| EX-23.1 - EX-23.1 - CHASE CORP | ccf-20200831ex231b6eecd.htm |

| EX-21 - EX-21 - CHASE CORP | ccf-20200831ex21451370b.htm |

| EX-10.3.2 - EX-10.3.2 - CHASE CORP | ccf-20200831ex103214b8a.htm |

| EX-10.3.1 - EX-10.3.1 - CHASE CORP | ccf-20200831ex103198e7a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

⌧ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED

AUGUST 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 1-9852

CHASE CORPORATION

(Exact name of registrant as specified in its charter)

Massachusetts | 11-1797126 |

(State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification No.) |

295 University Avenue, Westwood, Massachusetts 02090

(Address of Principal Executive Offices) (Zip Code)

(781) 332-0700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to section 12(b) of the Act:

Title of each class Common stock, $.10 par value | Trading Symbol(s) CCF | Name of each exchange on which registered NYSE American |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ◻ NO ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES ◻ NO ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ⌧ NO ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ⌧ NO ◻

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | ||

Large accelerated filer ◻ | Accelerated filer ⌧ | ||||

Non-accelerated filer ◻ | Smaller reporting company ☐ | ||||

Emerging growth company ☐ | | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ⌧

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the Registrant’s most recently completed second fiscal quarter, February 29, 2020, was approximately $465,871,000.

As of October 31, 2020, the Company had outstanding 9,445,474 shares of common stock, $0.10 par value, which is its only class of common stock.

Documents Incorporated By Reference:

Portions of the registrant’s definitive proxy statement for the Annual Meeting of Shareholders, which is expected to be filed within 120 days after the registrant’s fiscal year ended August 31, 2020, are incorporated by reference into Part III hereof.

CHASE CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

For the Year Ended August 31, 2020

| | | Page No. |

| 2 | ||

| | | |

| | | |

| 3 | ||

| 11 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| | | |

| | | |

| 19 | ||

| 21 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 22 | |

| 40 | ||

| 41 | ||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 103 | |

| 103 | ||

| 106 | ||

| | | |

| | | |

| 106 | ||

| 106 | ||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 106 | |

Certain Relationships and Related Transactions, and Director Independence | | 106 | |

| 107 | ||

| | | |

| | | |

| 108 | ||

| 111 | ||

| | | |

| 112 | ||

1

Cautionary Note Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, including without limitation forward-looking statements made under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” involve risks and uncertainties. Any statements contained in this Annual Report that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements include, without limitation, statements as to our future operating results; seasonality expectations; plans for the development, utilization or disposal of manufacturing facilities; future economic conditions; our expectations as to legal proceedings; the effect of our market and product development efforts; and expectations or plans relating to the implementation or realization of our strategic goals and future growth, including through potential future acquisitions. Forward-looking statements may also include, among other things, statements relating to future sales, earnings, cash flow, results of operations, use of cash and other measures of financial performance, statements relating to future dividend payments, as well as expected impact of the coronavirus disease 2019 (COVID-19) pandemic on the Company's businesses. Forward-looking statements may be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “predicts,” “targets,” “forecasts,” “strategy,” and other words of similar meaning in connection with the discussion of future operating or financial performance. These statements are based on current expectations, estimates and projections about the industries in which we operate, and the beliefs and assumptions made by management. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Accordingly, the Company’s actual results may differ materially from those contemplated by the forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Readers should refer to the discussions under Item 1A “Risk Factors” of this Annual Report on Form 10-K.

2

Primary Operating Divisions and Facilities and Industry Segments

Chase Corporation (the “Company,” “Chase,” “we,” or “us”), a global specialty chemicals company founded in 1946, is a leading manufacturer of protective materials for high-reliability applications across diverse market sectors. Our strategy is to maximize the performance of our core businesses and brands while seeking future opportunities through strategic acquisitions. Through investments in facilities, systems and organizational consolidation we seek to improve performance and gain economies of scale.

In the fourth quarter of our fiscal year 2019 (the prior year), we reorganized from two into three reportable operating segments: an Adhesives, Sealants and Additives segment, an Industrial Tapes segment and a Corrosion Protection and Waterproofing segment. The segments are distinguished by the nature of the products manufactured and how they are delivered to their respective markets. The Adhesives, Sealants and Additives segment (whose operations were formerly included within the Industrial Materials segment) offers innovative and specialized product offerings consisting of both end-use products and intermediates that are used in, or integrated into, another company’s products. Demand for the segment’s product offerings is typically dependent upon general economic conditions. This segment leverages the core specialty chemical competencies of the Company, and serves diverse markets and applications. The segment sells predominantly into the transportation, appliance, medical, general industrial and environmental market verticals. The Industrial Tapes segment (whose operations were formerly included within the Industrial Materials segment) features legacy wire and cable materials, specialty tapes, and other laminated and coated products. The segment derives its competitive advantage through its proven chemistries, diverse specialty offerings and the reliability its supply chain offers to end customers. These products are generally used in the assembly of other manufacturers’ products, with demand typically dependent upon general economic conditions. This segment sells mostly to established markets, with some exposure to growth opportunities through further development of existing products. Markets served include cable manufacturing, utilities and telecommunications, and electronics packaging. The Corrosion Protection and Waterproofing segment (formerly known as the Construction Materials segment) is principally composed of project-oriented product offerings that are primarily sold and used as “Chase” branded products. End markets include new and existing infrastructure projects on oil, gas, water and wastewater pipelines, highways and bridge decks, water and wastewater containment systems, and commercial buildings. The segment’s products include protective coatings for pipeline applications, coating and lining systems for waterproofing and liquid storage applications, adhesives and sealants used in architectural and building envelope waterproofing applications, high-performance polymeric asphalt additives, and expansion joint systems for waterproofing applications in transportation and architectural markets. With sales generally dependent on outdoor project work, the segment experiences highly seasonal sales patterns. Our manufacturing facilities are distinct to their respective segments apart from our O’Hara Township, PA, Blawnox, PA and Hickory, NC facilities, which produce products related to a combination of operating segments.

3

A summary of our operating structure as of August 31, 2020 is as follows:

ADHESIVES, SEALANTS AND ADDITIVES SEGMENT | | | | |

| | Primary | | |

| | Operating | | |

Key Products | | Locations | | Background/History |

Protective conformal coatings under the brand name HumiSeal®, moisture protective electronic coatings sold to the electronics industry including circuitry used in automobiles, industrial controls and home appliances. | | O'Hara Township, PA | | The HumiSeal business and product lines were acquired in the early 1970s. |

Advanced adhesives, sealants, and coatings for automotive and industrial applications that require specialized bonding, encapsulating, environmental protection, or thermal management functionality. | | Woburn, MA Newark, CA | | In September 2016, we acquired certain assets and the operations of Resin Designs, LLC, and entered leases for their existing manufacturing facilities in Massachusetts and California. |

Protective conformal coatings under the brand name HumiSeal®, moisture protective electronic coatings sold to the electronics industry including circuitry used in automobiles, industrial controls and home appliances. | | Winnersh, Wokingham, England Paris, France Pune, India | | In October 2005, we acquired all of the capital stock of Concoat Holdings Ltd. and its subsidiaries. In 2006 Concoat was renamed HumiSeal Europe. |

| | | | |

Superabsorbent polymers, sold through our Zappa Stewart division, which are utilized for water and liquid management, remediation and protection in diverse markets including wire and cable, medical, environmental, infrastructure, energy and consumer products. | | Hickory, NC | | In December 2017, we acquired Stewart Superabsorbents, LLC and its Zappa-Tec business (collectively “Zappa Stewart”). |

4

| | | | |

INDUSTRIAL TAPES SEGMENT | | | | |

| | Primary | | |

| | Operating | | |

Key Products | | Locations | | Background/History |

Specialty tapes and related products for the electronic and telecommunications industries using the brand name Chase & Sons®. | | Oxford, MA | | In August 2011, we relocated our manufacturing processes that had been previously conducted at our Webster, MA facility to this location. In the fourth quarter of 2018, we moved the wire and cable material manufacturing process that had been conducted at our Pawtucket, RI facility to our Lenoir, NC and Oxford, MA locations. |

| | | | |

Laminated film foils for the electronics and cable industries and cover tapes essential to delivering semiconductor components via tape and reel packaging. Pulling and detection tapes used in the installation, measurement and location of fiber optic cable, and water and natural gas lines. | | Lenoir, NC Hickory, NC | | In June 2012, we acquired all of the capital stock of NEPTCO Incorporated, which operated facilities in Rhode Island, North Carolina and China. In the fourth quarter of 2018, we moved the wire and cable material manufacturing process that had been conducted at our Pawtucket, RI facility to our Lenoir, NC and Oxford, MA locations. In the third quarter of 2019, we began relocating the pulling and detection tapes manufacturing process from our Granite Falls, NC location to our Hickory, NC location. This relocation was completed in the second quarter of fiscal 2020. |

| | | | |

5

CORROSION PROTECTION AND WATERPROOFING SEGMENT | | | | |

| | Primary | | |

| | Operating | | |

Key Products | | Locations | | Background/History |

Protective pipe-coating tapes and other protectants for valves, regulators, casings, joints, metals, and concrete, which are sold under the brand name Royston®, to oil companies, gas utilities and pipeline companies. Rosphalt50® is a polymer additive that provides long-term cost-effective solutions in many applications such as waterproofing of bridge decks and approaches, ramps, racetracks, airport runways and taxiways and specialty road applications. Waterproofing membranes for highway bridge deck metal-supported surfaces. | | Blawnox, PA | | The Royston business was acquired in the early 1970s. |

| | | | |

Technologically advanced products, including the brand Tapecoat®, for demanding anti-corrosion applications in the gas, oil and marine pipeline market segments, as well as tapes and membranes for roofing and other construction-related applications. | | | | |

| | | | |

Specialized high-performance coating and lining systems used worldwide in liquid storage and containment applications. | | Houston, TX | | In September 2009, we acquired all the outstanding capital stock of C.I.M. Industries Inc. (“CIM”). |

| | | | |

Waterproofing and corrosion protection systems for oil, gas and water pipelines, and a supplier to Europe, the Middle East and Southeast Asia. The ServiWrap® brand bitumen pipeline protection tapes and products, which offer long-term corrosion protection for buried pipelines in the most challenging natural environments. | | Rye, East Sussex, England | | In September 2007, we purchased certain product lines and a related manufacturing facility in Rye, East Sussex, England through our wholly-owned subsidiary, Chase Protective Coatings Ltd. This facility joins Chase's North American-based Tapecoat® and Royston® brands to broaden the protective pipeline coatings product line and better address global demand. In December 2009, we acquired the full range of ServiWrap® pipeline protection products (“ServiWrap”) from Grace Construction Products Limited, a U.K.-based unit of W.R. Grace & Co. ServiWrap products complement our portfolio of pipeline protection tapes, coatings and accessories and extend our global customer base. |

Other Business Developments

On September 1, 2020 (subsequent to fiscal 2020), the Company acquired all the capital stock of ABchimie for €18,000,000 (approximately $21,420,000 at the time of the transaction) net of cash and marketable securities acquired, subject to final working capital adjustment, excluding acquisition-related costs of $274,000 and with a potential earn out based on performance potentially worth an additional €7,000,000 (approximately $8,330,000 at the time of the transaction). ABchimie is a Corbelin, France headquartered solutions provider for the cleaning and the protection of electronic assemblies, with further formulation, production, and research and development capabilities. The transaction was funded 100% with cash on hand. The financial results of the business will be included in the Company's fiscal 2021 financial statements within the Adhesives, Sealants and Additives operating segment in the electronic and industrial coatings product line. The Company is currently in the process of finalizing purchase accounting, regarding a final allocation of the purchase price to tangible and identifiable intangible assets assumed and anticipates completion within fiscal 2021. The ABchimie acquisition does not represent a significant business combination so pro forma financial information is not provided.

6

The Company’s second quarter of fiscal 2020 saw the beginning of the global spread of the coronavirus pandemic (COVID-19), which subsequently grew to create significant volatility, uncertainty, and global economic disruption. During the third fiscal quarter, the Company implemented changes to its cost structure designed to address market changes brought on by COVID-19 and demonstrate its commitment to fiscal prudence: (a) the Company made a targeted reduction in its global workforce, contemplated pre-pandemic but catalyzed by COVID-19, which resulted in the recognition of $183,000 in severance costs during the period; and (b) the Company also instituted a temporary 20% reduction in the base salaries of its named executive officers and select members of senior management, as well as the cash compensation of the non-employee members of its Board of Directors. The reduction in force, which impacted operations in the Company’s U.S. facilities, and the adjustments in compensation were both effective May 2020.

During the third quarter of fiscal 2019, Chase began moving the pulling and detection operations housed in its Granite Falls, NC location to its Hickory, NC facility. This is in line with the Company’s ongoing initiative to consolidate its manufacturing plants and streamline its existing processes. At the time, the pulling and detection operations were the only Chase-owned production operations in Granite Falls, NC, with the remaining portions of the building being either utilized for research and development or leased to a third party. The process of moving, including moving internal research and development capabilities, was substantially completed during the second quarter of fiscal 2020. The Company recognized $559,000 in expense related to the move in the six-month period ended February 29, 2020, having recognized $526,000 in expense during the second half of fiscal 2019. No costs were recognized in the six months ended August 31, 2020, and future costs related to this move are not anticipated to be significant to the consolidated financial statements.

During the fourth quarter of fiscal 2019 (prior year), Chase commissioned engineering studies of certain legacy operations, machinery and locations related to the Company’s ongoing facility rationalization and consolidation initiative. Chase completed its review of the data and recommendations provided by the study in the fourth quarter of fiscal 2020 (current year). Following the review, the Company wrote down the value of certain non-operating production assets related to the pipeline coatings product line, within the Corrosion Protection and Waterproofing segment. Given the nature and prospects of the equipment, the Company determined its then carrying value exceeded its fair value and recognized an expense of $405,000 to write-down the value. Given the ongoing nature of the facility rationalization and consolidation initiative, an estimate of future costs cannot currently be determined.

Products and Markets

Our principal products are specialty tapes, laminates, adhesives, sealants, coatings and chemical intermediates which are sold by our salespeople, manufacturers' representatives and distributors. In our Adhesives, Sealants and Additives segment, these products consist of:

| (i) | moisture protective coatings, which are sold to the electronics industry for circuitry manufacturing, including circuitry used in automobiles, industrial controls and home appliances; |

| (ii) | advanced adhesives, sealants, and coatings for automotive and industrial applications that require specialized bonding, encapsulating, environmental protection, or thermal management functionality; |

| (iii) | polymeric microspheres utilized by various industries to allow for weight and density reduction and sound dampening; |

| (iv) | polyurethane dispersions utilized for various coating products; and |

| (v) | superabsorbent polymers, which are utilized for water and liquid management, remediation and protection in diverse markets including wire and cable, medical, environmental, infrastructure, energy and consumer products. |

7

In our Industrial Tapes segment, these products consist of:

| (i) | insulating and conducting materials for the manufacture of electrical and telephone wire and cable, electrical splicing, and terminating and repair tapes, which are marketed to wire and cable manufacturers; |

| (ii) | laminated film foils, including EMI/RFI shielding tapes used in communication and local area network (LAN) cable; |

| (iii) | industrial coated or laminate products and custom manufacturing services sold into medical, consumer, automotive, packaging, energy, telecommunications and other specialized markets; |

| (iv) | laminated durable papers, including laminated paper with an inner security barrier used in personal and mail-stream privacy protection, which are sold primarily to the envelope converting and commercial printing industries; |

| (v) | pulling and detection tapes used in the installation, measurement and location of fiber optic cable, water and natural gas lines, and power, data, and video cable for commercial buildings; and |

| (vi) | cover tapes with reliable adhesive and anti-static properties essential to delivering semiconductor components via tape and reel packaging. |

In our Corrosion Protection and Waterproofing segment, these products consist of:

| (i) | protective coatings, tapes and protectants for pipelines, valves, casings and other metals, which are sold to oil companies, gas companies and water/wastewater utilities for use in both the construction and maintenance of oil, gas, water and wastewater pipelines; |

| (ii) | fluid-applied coating and lining systems for use in the water and wastewater industry; |

| (iii) | waterproofing tapes and coatings used in waterproofing of the exterior of both commercial and industrial structures; |

| (iv) | waterproofing membranes for highway bridge deck metal-supported surfaces, and high-performance polymeric asphalt additives, which are sold to municipal transportation authorities; and |

| (v) | expansion and control joint systems designed for roads, bridges, stadiums and airport runways. |

There is some seasonality in selling products into the construction market, which most acutely effects our Corrosion Protection and Waterproofing segment. Higher demand is often experienced when temperatures are warmer in most of North America (April through October), with lower demand occurring when temperatures are colder (typically our second fiscal quarter).

Human Capital Resources

As of October 31, 2020, we employed approximately 619 people (including union employees). 80% are U.S. based and 20% international. 29% of our employees work in administrative, selling and research and development functions, while 71% work in the manufacture of our products at our facilities. We consider our employee relations to be good. In the U.S., we offer our employees a wide array of company-paid benefits, which we believe are competitive relative to others in our industry. In our operations outside the U.S., we offer benefits that may vary from those offered to our U.S. employees due to customary local practices and statutory requirements.

8

Backlog, Customers and Competition

As of October 31, 2020, the backlog of customer orders believed to be firm was approximately $15,949,000. This compared with a backlog of $17,930,000 as of October 31, 2019. The decrease in backlog from the prior year amount is believed to be primarily due to changes in customers’ ordering patterns in the current COVID-19 environment. During fiscal 2020, 2019 and 2018, no customer accounted for more than 10% of sales. No material portion of our business is subject to renegotiation or termination of profits or contracts at the election of the United States Federal Government.

There are other companies that manufacture or sell products and services similar to those made and sold by us. Many of those companies are larger and have greater financial resources than we have. We compete principally on the basis of technical performance, service reliability, quality and price.

Raw Materials

We obtain raw materials from a wide variety of suppliers, with alternative sources of most essential materials available within reasonable lead times.

Patents, Trademarks, Licenses, Franchises and Concessions

As of August 31, 2020, we owned the following trademarks that we believe were of material importance to our business: Chase Corporation®, C-Spray (Logo), a trademark used in conjunction with most of the Company’s business segment and product line marketing material and communications; HumiSeal®, a trademark for moisture protective coatings sold to the electronics industry; Chase & Sons®, a trademark for barrier and insulating tapes sold to the wire and cable industry; Chase BLH2OCK®, a trademark for a water-blocking compound sold to the wire and cable industry; Rosphalt50®, a trademark for an asphalt additive used predominantly on bridge decks for waterproofing protection; PaperTyger®, a trademark for laminated durable papers sold to the envelope converting and commercial printing industries; DuraDocument®, a trademark for durable, laminated papers sold to the digital print industry; Defender® a trademarked RFID protective material sold to the personal accessories and paper industries; Tapecoat®, a trademark for corrosion preventive surface coatings and primers; Maflowrap®, a trademark for anti-corrosive tapes incorporating self-adhesive mastic or rubber-backed strips, made of plastic materials; Royston®, a trademark for a corrosion-inhibiting coating composition for use on pipes; Ceva®, a trademark for epoxy pastes/gels/mortars and elastomeric concrete used in the construction industry; CIM® trademarks for fluid-applied coating and lining systems used in the water and wastewater industry; ServiWrap® trademarks for pipeline protection tapes, coatings and accessories; NEPTCO®, a trademark used in conjunction with most of NEPTCO’s products marketing material and communications; NEPTAPE®, a trademark for coated shielding and insulation materials used in the wire and cable industry; Muletape®, a trademark for pulling and installation tapes sold to the telecommunications industry; Trace-Safe®, a trademark for detection tapes sold to the telecommunications and water and gas utilities industries; Dualite®, a trademark for polymeric microspheres utilized for density and weight reduction and sound dampening by various industries; 4EvaSeal®, a trademark for adhesive-backed tape utilized in various industries; Resin Designs®, a trademark for adhesives and sealants sold into the microelectronics and semiconductor industries; SlickTape®, a trademark for a lubricated shielding tape sold to the wire and cable industry; HighDraw®, a trademark for a highly extensible shielding tape sold to the wire and cable industry; ZapZorb®, a trademark for environmental solidification products that are designed to meet the specific challenges posed by a wide range of liquid-bearing waste streams; ZapLoc®, a trademark for medical waste solidifier products packaged in bottles or larger packages; and ZapPak®, a trademark for medical waste solidifier products packaged in dissolvable film. We do not have any other material trademarks, licenses, franchises, or concessions. While we do hold various patents, as well as other trademarks, we do not believe that they are material to the success of our business.

9

Research and Development

We expensed approximately $4,007,000, $4,021,000 and $3,940,000 for Company-sponsored research and development during fiscal 2020, 2019 and 2018, respectively, which was recorded within Research and Product Development Costs. Research and development stayed consistent from fiscal 2019 to 2020 as the Company continued focused development work on strategic product lines. The increase in expense from fiscal 2018 to 2019 came as the Company recognized its first full fiscal year with the established research and development department of Zappa Stewart (acquired in the second quarter of fiscal 2018).

Available Information

Chase maintains a website at http://www.chasecorp.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as section 16 reports on Form 3, 4, or 5, are available free of charge on this site as soon as is reasonably practicable after they are filed or furnished with the SEC. Our Code of Conduct and Ethics and the charters for the Audit Committee, the Nominating and Governance Committee and the Compensation and Management Development Committee of our Board of Directors are also available on our internet website. The Code of Conduct and Ethics and charters are also available in print to any shareholder upon request. Requests for such documents should be directed to Shareholder and Investor Relations Department, at 295 University Avenue, Westwood, Massachusetts 02090. Our internet website and the information contained on it or connected to it are not part of nor incorporated by reference into this Form 10-K. Our filings with the SEC are also available on the SEC’s website at http://www.sec.gov.

Financial Information regarding Segment and Geographic Areas

Please see Notes 11 and 12 to the Company’s Consolidated Financial Statements for financial information about the Company’s operating segments and domestic and foreign operations for each of the last three fiscal years.

10

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. We feel that any of the following risks could materially adversely affect our business, operations, industry, financial position or our future financial performance. While we believe that we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operations, industry, financial position and financial performance in the future.

Operational and Competitive Risks

We currently operate in mature markets where increases or decreases in market share could be significant.

Our sales and net income are largely dependent on sales from a consistent and well-established customer base. Organic growth opportunities are minimal; however, we have used and will continue to use strategic acquisitions as a means to build and grow the business. In this business environment, increases or decreases in market share could have a material effect on our business condition or results of operation. We face intense competition from a diverse range of competitors, including operating divisions of companies much larger and with far greater resources than we have. If we are unable to maintain our market share, our business could suffer.

Fluctuations in the supply and prices of raw materials may negatively impact our financial results.

We obtain raw materials needed to manufacture our products from a number of suppliers. Many of these raw materials are petroleum-based derivatives. Under normal market conditions, these materials are generally available on the open market and from a variety of producers. From time to time, however, the prices and availability of these raw materials fluctuate, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. If the prices of raw materials increase, and we are unable to pass these increases on to our customers, we could experience reduced profit margins.

If our products fail to perform as expected, or if we experience product recalls, we could incur significant and unexpected costs and lose existing and future business.

Our products are complex and could have defects or errors presently unknown to us, which may give rise to claims against us, diminish our brands or divert our resources from other purposes. Despite testing, new and existing products could contain defects and errors and may in the future contain manufacturing or design defects, errors or performance problems when first introduced, or even after these products have been used by our customers for a period of time. These problems could result in expensive and time-consuming design modifications or warranty charges, changes to our manufacturing processes, product recalls, significant increases in our maintenance costs, or exposure to liability for damages, any of which may result in substantial and unexpected expenditures, require significant management attention, damage our reputation and customer relationships, and adversely affect our business, our operating results and our cash flow.

11

The Company’s results of operations have been adversely affected and could in the future be materially adversely impacted by the coronavirus disease 2019 (COVID-19) pandemic.

The global spread of the coronavirus disease 2019 (COVID-19) pandemic has created significant volatility, uncertainty and economic disruption. The Company experienced lower sales as a result of the economic disruption, and it has initiated cost-saving measures, including a targeted workforce reduction, in response to the uncertainties associated with the scope and duration of the pandemic. The extent to which the COVID-19 pandemic impacts the Company’s business, operations and financial results in future periods will depend on numerous evolving factors that it may not be able to accurately predict, including: the duration and scope of the pandemic; governmental, business and individuals’ actions that have been and continue to be taken in response to the pandemic; the impact of the pandemic on economic activity and actions taken in response; the effect on its customers’ demand for its goods and services and its vendors ability to supply it with raw materials; its ability to sell and provide goods and services, including as a result of travel restrictions and people working from home; the ability of its customers to pay for goods and services; and any closures of its customers’ offices and facilities. Customers may also slow down decision-making, delay planned work or seek to terminate existing agreements.

Further, the effects of the pandemic may also increase the Company’s cost of capital or make additional capital, including the refinancing of its credit facility, more difficult or available only on terms less favorable to it. A sustained downturn may also result in the carrying value of the Company’s goodwill or other intangible assets exceeding their fair value, which may require it to recognize an impairment to those assets. A sustained downturn in the financial markets and asset values may have the effect of increasing the Company’s pension funding obligations in order to ensure that its qualified pension plan continues to be adequately funded, which may divert cash flow from other uses. The effects of the pandemic, including remote working arrangements for employees, may also impact the Company’s financial reporting systems and internal control over financial reporting, including its ability to ensure information required to be disclosed in its reports under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and that such information is accumulated and communicated to its management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow for timely decisions regarding required disclosure.

We may experience difficulties in the redesign and consolidation of our manufacturing facilities which could impact shipments to customers, product quality, and our ability to realize cost savings.

We currently have several ongoing projects to streamline our manufacturing operations, which include the redesign and consolidation of certain manufacturing facilities in order to reduce overhead costs. Despite our planning, we may be unable to effectively leverage assets, personnel, and business processes in the transition of production among manufacturing facilities. Uncertainty is inherent within the facility redesign and consolidation process, and unforeseen circumstances could offset the anticipated benefits of these streamlining projects, disrupt service to customers, and impact product quality.

12

Strategic Risks

Our business strategy includes the pursuit of strategic acquisitions, which may not be successful if they happen at all.

From time to time, we engage in discussions with potential target companies concerning potential acquisitions. In executing our acquisition strategy, we may be unable to identify suitable acquisition candidates. In addition, we may face competition from other companies for acquisition candidates, making it more difficult to acquire suitable companies on favorable terms. We have historically financed larger acquisitions with additional borrowings under our bank credit agreements. Our existing credit agreement places certain restrictions on our ability to acquire other businesses, and imposes certain financial covenants on us that may limit our ability to borrow generally. If we incur additional indebtedness in order to finance an acquisition, that indebtedness may reduce the availability of our cash flow to fund future working capital, capital expenditures, and other general corporate purposes, may increase our vulnerability to adverse economic conditions, and may expose us to the risk of increased interest rates. If we finance an acquisition through the issuance of equity securities, the ownership interest of our existing shareholders would be proportionately diluted.

Even if we do identify a suitable acquisition target and are able to negotiate and close a transaction, the integration of an acquired business into our operations involves numerous risks, including potential difficulties in integrating an acquired company’s product line with ours; the diversion of our resources and management’s attention from other business concerns; the potential loss of key employees; limitations imposed by antitrust or merger control laws in the United States or other jurisdictions; risks associated with entering a new geographical or product market; and the day-to-day management of a larger and more diverse combined company.

We may not realize the synergies, operating efficiencies, market position or revenue growth we anticipate from acquisitions, and our failure to effectively manage the above risks could have a material adverse effect on our business, growth prospects and financial performance.

International Risks

If we cannot successfully manage the unique challenges presented by international markets, we may not be successful in expanding our international operations.

Our strategy includes expansion of our operations in existing and new international markets by selective acquisitions and strategic alliances. Our ability to successfully execute our strategy in international markets is affected by many of the same operational risks we face in expanding our U.S. operations. In addition, our international expansion may be adversely affected by our ability to identify and gain access to local suppliers as well as by local laws and customs, legal and regulatory constraints, political and economic conditions and currency regulations of the countries or regions in which we currently operate or intend to operate in the future. The ongoing negotiations to determine the terms of the U.K.’s exit from the European Union (Brexit), pose risks of volatility in global markets and, given our exposure and presence in the U.K., could specifically affect our operations and future financial results. Risks inherent in our international operations also include, among others, the costs and difficulties of managing international operations, adverse tax consequences, domestic and international tariffs and trade policies and greater difficulty in enforcing intellectual property rights. Additionally, foreign currency exchange rates and fluctuations may have an impact on future costs or on future cash flows from our international operations.

13

Current and threatened tariffs on goods from China and other countries could result in lower revenue, profits and cash flows.

The Company imports raw materials from China, makes sales of finished goods into China and has manufacturing operations in China. The Company works to lower the potential negative effects of the tariffs through seeking alternative sources for our raw materials, when available and pragmatic, and, in certain cases, through altering our manufacturing logistics by utilizing non-U.S. manufacturing where tariffs do not apply. While we also attempt to pass on these additional costs to our customers, competitive factors (including competitors who import from other countries not subject to such tariffs) may limit our ability to sustain price increases and, as a result, may adversely impact our revenue, profits and cash flows. In addition, the imposition of tariffs may influence the sourcing habits of certain end users of our products which, in turn, could have a direct impact on the requirements of our direct customers for our products. Such an impact could adversely affect our revenue, profits and cash flows.

Industry Risks

Our results of operations could be adversely affected by uncertain economic and political conditions and the effects of these conditions on our customers’ businesses and levels of business activity.

Global economic and political conditions can affect the businesses of our customers and the markets they serve. A severe or prolonged economic downturn or a negative or uncertain political climate could adversely affect, among others, the automotive, housing, construction, pipeline, energy, transportation infrastructure or electronics industries. This may reduce demand for our products or depress pricing of those products, either of which may have a material adverse effect on our results of operations. Changes in global economic conditions or foreign and domestic trade policy could also shift demand to products for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain. In addition, if we are unable to successfully anticipate changing economic and political conditions, we may be unable to effectively plan for and respond to those changes and our business could be negatively affected.

General economic factors, domestically and internationally, may also adversely affect our financial performance through increased raw material costs or other expenses and by making access to capital more difficult.

The cumulative effect of higher interest rates, energy costs, inflation, levels of unemployment, healthcare costs, unsettled financial markets, and other economic factors (including changes in foreign currency exchange rates and changes to federal, state, local and international tax laws or the application or enforcement practices of such laws) could adversely affect our financial condition by increasing our manufacturing costs and other expenses at the same time that our customers may be scaling back demand for our products. Prices of certain commodity products, including oil and petroleum-based products, are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, weather events and climate change, regional and global public health crises, market speculation, government regulations and periodic delays in delivery. Rapid and significant changes in commodity prices may affect our sales and profit margins. These factors can increase our cost of products and services sold and/or selling, general and administrative expenses, and otherwise adversely affect our operating results. Disruptions in the credit markets may limit our ability to access debt capital for use in acquisitions or other purposes on advantageous terms or at all. If we are unable to manage our expenses in response to general economic conditions and margin pressures, or if we are unable to obtain capital for strategic acquisitions or other needs, then our results of operations would be negatively affected.

14

Other Risks

We are dependent on key personnel.

We depend significantly on our executive officers including our President and Chief Executive Officer, Adam P. Chase, and on other key employees. The loss of the services of any of these key employees could have a material impact on our business and results of operations. In addition, our acquisition strategy will require that we attract, motivate and retain additional skilled and experienced personnel. The inability to satisfy such requirements could have a negative impact on our ability to remain competitive in the future.

Financial market performance may have a material adverse effect on our pension plan assets and require additional funding requirements.

Significant and sustained declines in the financial markets may have a material adverse effect on the fair market value of the assets of our qualified pension plan. While these pension plan assets are considered non-financial assets since they are not carried on our balance sheet (i.e. the balance sheet reflects only the net of plan assets and obligations), the fair market valuation of these assets could impact our funding requirements, funded status or net periodic pension cost. Any significant and sustained declines in the fair market value of these pension assets could require us to increase our funding requirements, which would have an impact on our cash flow, and could also lead to additional pension expense.

If we fail to maintain effective internal control over financial reporting, this may adversely affect investor confidence in our company and, as a result, the value of our common stock.

We are required under Section 404 of the Sarbanes-Oxley Act to furnish a report by management on the effectiveness of our internal control over financial reporting and to include a report by our independent auditors attesting to such effectiveness. Any failure by us to maintain effective internal control over financial reporting could adversely affect our ability to report accurately our financial condition or results of operations.

As discussed in our Annual Report on Form 10-K for the year ended August 31, 2018 (under "Controls and Procedures"), our management concluded that, as of August 31, 2018, we had a material weakness in our internal control over financial reporting related to our business combination processes. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. We have remediated the identified material weakness, but no assurances can be given that management will not identify in the future other internal control deficiencies that constitute a material weakness in our internal control over financial reporting or that any such material weakness will be remediated in a timely fashion.

If we are unable to maintain effective internal control over financial reporting, or if our independent auditors determine that we have a material weakness in our internal control over financial reporting, we could lose investor confidence in the accuracy and completeness of our financial reports, the market price of our common stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities. Failure to remedy any material weakness in our internal control over financial reporting, or to implement or maintain other effective control systems required of public companies, also could restrict our future access to the capital markets.

15

Failure or compromise of security with respect to an operating or information system or portable electronic device could adversely affect our results of operations and financial condition or the effectiveness of our internal controls over operations and financial reporting.

We are highly dependent on automated systems to record and process our daily transactions and certain other components of our financial statements. Notwithstanding efforts to ensure the integrity of our automated systems, we could experience a failure of one or more of these systems, or a compromise of our security due to technical system flaws, data input or recordkeeping errors, or tampering or manipulation of our systems by employees or unauthorized third parties. Information security risks also exist with respect to the use of portable electronic devices, such as laptops and smartphones, which are particularly vulnerable to loss and theft. We may also be subject to disruptions of any of these systems arising from events that are wholly or partially beyond our control (for example, natural disasters, acts of terrorism, epidemics, pandemics, computer viruses, cyber-attacks, malware, ransomware, and electrical/telecommunications outages). All of these risks are also applicable wherever we rely on outside vendors to provide services. Operating system failures, disruptions, or the compromise of security with respect to operating systems or portable electronic devices could subject us to liability claims, harm our reputation, interrupt our operations, or adversely affect our business, results from operations, financial condition, cash flow or internal control over financial reporting.

16

Item 1B – Unresolved Staff Comments

Not applicable.

The principal properties of the Company as of August 31, 2020 are situated at the following locations and have the following characteristics:

|

| Square |

| Owned / |

| |

Location | | Feet | | Leased | | Principal Use |

Westwood, MA | | 20,200 | | Leased | | Corporate headquarters, executive office and global operations center, including research and development, sales and administrative services |

Blawnox, PA | | 44,000 | | Owned | | Manufacture and sale of protective coatings and tape products |

Evanston, IL | | 100,000 | | Owned | | Manufacture and sale of protective coatings and tape products |

Granite Falls, NC | | 108,000 | | Owned | | Manufacture and sale of pulling and detection tapes, as well as research and development services, (through the second quarter of fiscal 2020, when operations were relocated to our Hickory, NC facility). The building is currently being leased to a third party |

Greenville, SC | | 34,600 | | Leased | | Manufacture and sale of polymeric microspheres, as well as research and development |

Hickory, NC | | 180,000 | | Leased | | Manufacture and sale of superabsorbent polymer products and pulling and detection tapes, as well as research and development |

Houston, TX | | 45,000 | | Owned | | Manufacture of coating and lining systems for use in liquid storage and containment applications |

Lenoir, NC | | 110,000 | | Owned | | Manufacture and sale of laminated film foils and cover tapes |

McLeansville, NC | | 41,000 | | Leased | | Sales/technical service office and warehouse for superabsorbent polymer products |

Mississauga, Canada | | 2,500 | | Leased | | Distribution center |

Newark, CA | | 32,500 | | Leased | | Manufacture and sale of sealant systems |

O’Hara Township, PA | | 109,000 | | Owned | | Manufacture and sale of protective electronic coatings, expansion joints and accessories |

Oxford, MA | | 73,600 | | Owned | | Manufacture of tape and related products for the electronic and telecommunications industries, as well as laminated durable papers |

Paris, France | | 1,900 | | Leased | | Sales/technical service office and warehouse allowing direct sales and service to the French market |

Pune, India | | 4,650 | | Leased | | Manufacture, packaging and sale of protective electronic coatings |

Rotterdam, Netherlands | | 2,500 | | Leased | | Distribution center |

Rye, East Sussex, England | | 36,600 | | Owned | | Manufacture and sale of protective coatings and tape products |

Suzhou, China | | 48,000 | | Leased | | Manufacture of packaging tape products for the electronics industries |

Winnersh, Wokingham, England | | 18,800 | | Leased | | Manufacture and sale of protective electronic coatings, as well as research and development |

Woburn, MA | | 34,000 | | Leased | | Manufacture and sale of adhesive systems, as well as research and development |

The above facilities vary in age, are in good condition and, in the opinion of management, adequate and suitable for present operations. We also own equipment and machinery that is in good repair and, in the opinion of management, adequate and suitable for present operations. We believe that we could significantly add to our capacity by increasing shift operations. Availability of machine hours through additional shifts would provide expansion of current production volume without significant additional capital investment.

17

The Company is involved from time to time in litigation incidental to the conduct of its business. Although the Company does not expect that the outcome in any of these matters, individually or collectively, will have a material adverse effect on its financial condition, results of operations or cash flows, litigation is inherently unpredictable. Therefore, judgments could be rendered, or settlements agreed to, that could adversely affect the Company’s operating results or cash flows in a particular period. The Company routinely assesses all its litigation and threatened litigation as to the probability of ultimately incurring a liability and records its best estimate of the ultimate loss in situations where it assesses the likelihood of loss as probable.

item 4 – mine safety disclosures

Not applicable.

Item 4a – INFORMATION ABOUT OUR Executive OfficerS

The following table sets forth information concerning our Executive Officers as of October 31, 2020. Each of our Executive Officers is selected by our Board of Directors and holds office until his successor is elected and qualified.

Name |

| Age |

| Offices Held and Business Experience during the Past Five Years |

Adam P. Chase | | 48 | | President of the Company since January 2008, Chief Executive Officer of the Company since February 2015. Adam Chase was the Chief Operating Officer of the Company from February 2007 to February 2015. |

Peter R. Chase | | 72 | | Chairman of the Board of the Company since February 2007, and Executive Chairman of the Company since February 2015. Peter Chase was the Chief Executive Officer of the Company from September 1993 to February 2015. Peter Chase is the father of Adam Chase. |

Christian J. Talma | | 47 | | Chief Financial Officer of the Company since February 2019 and Chief Accounting Officer from August 2018 to February 2019. Previously, Vice President Operations Finance and Strategy for Haemonetics Corp. from 2016 to 2018. Prior to that, Christian Talma was employed at Siemens A.G., since 2002, most recently as Head of North America Service Sales Finance. |

18

Item 5 – Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NYSE American under the symbol CCF. As of October 31, 2020, there were 320 shareholders of record of our Common Stock and we believe there were approximately 6,435 beneficial shareholders who held shares in nominee name. On that date, the closing price of our common stock was $95.16 per share as reported by the NYSE American.

Single annual cash dividend payments were declared and scheduled to be paid subsequent to each year ended August 31, 2020, 2019 and 2018 in the amount of $0.80 per common share. Our revolving credit facility contains financial covenants which may have the effect of limiting the amount of dividends that we can pay.

19

Comparative Stock Performance

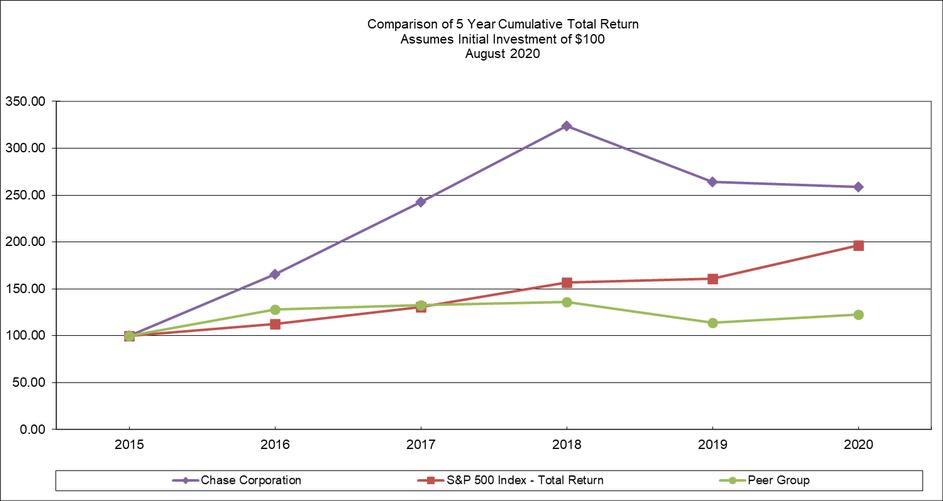

The following line graph compares the yearly percentage change in our cumulative total shareholder return on the Common Stock for the last five fiscal years with the cumulative total return on the Standard & Poor's 500 Stock Index (the “S&P 500 Index”), and a composite peer index that is weighted by market equity capitalization (the “Peer Group Index”). The companies included in the Peer Group Index are Henkel AG & Co KGaA, H.B. Fuller Company, Intertape Polymer Group, Rogers Corporation and RPM International, Inc. Cumulative total returns are calculated assuming that $100 was invested on August 31, 2015 in each of the Common Stock, the S&P 500 Index and the Peer Group Index, and that all dividends were reinvested.

|

| 2015 |

| 2016 |

| 2017 |

| 2018 |

| 2019 |

| 2020 |

| ||||||

Chase Corp | | $ | 100 | | $ | 165 | | $ | 243 | | $ | 324 | | $ | 264 | | $ | 259 | |

S&P 500 Index | | $ | 100 | | $ | 113 | | $ | 131 | | $ | 157 | | $ | 161 | | $ | 196 | |

Peer Group Index | | $ | 100 | | $ | 128 | | $ | 133 | | $ | 136 | | $ | 114 | | $ | 123 | |

The information under the caption “Comparative Stock Performance” above is not deemed to be “filed” as part of this Annual Report, and is not subject to the liability provisions of Section 18 of the Securities Exchange Act of 1934. Such information will not be deemed to be incorporated by reference into any filing we make under the Securities Act of 1933 unless we explicitly incorporate it into such a filing at the time.

20

Item 6 – Selected Financial Data

the following selected financial data should be read in conjunction with “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8 – Financial Statements and Supplementary Data.”

| | Fiscal Years Ended August 31, | | |||||||||||||

|

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| |||||

| | (In thousands, except per share amounts) | | |||||||||||||

Statement of Operations Data | | | | | | | | | | | | | | | | |

Revenue | | $ | 261,162 | | $ | 281,351 | | $ | 284,188 | | $ | 252,560 | | $ | 238,094 | |

Net income | | $ | 34,157 | | $ | 32,711 | | $ | 43,143 | | $ | 42,014 | | $ | 32,807 | |

Net income available to common shareholders, per common and common equivalent share: | | | | | | | | | | | | | | | | |

Basic: | | | | | | | | | | | | | | | | |

Net income per common and common equivalent share | | $ | 3.62 | | $ | 3.48 | | $ | 4.60 | | $ | 4.49 | | $ | 3.55 | |

Diluted: | | | | | | | | | | | | | | | | |

Net income per common and common equivalent share | | $ | 3.59 | | $ | 3.46 | | $ | 4.56 | | $ | 4.44 | | $ | 3.50 | |

Balance Sheet Data | | | | | | | | | | | | | | | | |

Total assets | | $ | 346,830 | | $ | 307,968 | | $ | 316,469 | | $ | 254,738 | | $ | 262,819 | |

Long-term debt, including current portion | | $ | — | | $ | — | | $ | 25,000 | | $ | — | | $ | 43,400 | |

Total stockholders' equity | | $ | 302,792 | | $ | 271,227 | | $ | 246,756 | | $ | 210,929 | | $ | 174,089 | |

Cash dividends paid per common and common equivalent share | | $ | 0.80 | | $ | 0.80 | | $ | 0.80 | | $ | 0.70 | | $ | 0.65 | |

21

Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion provides an analysis of our financial condition and results of operations and should be read in conjunction with the Consolidated Financial Statements and notes thereto included in Item 8 of this Annual Report on Form 10-K.

Selected Relationships within the Consolidated Statements of Operations

| | Years Ended August 31, | | |||||||

|

| 2020 |

| 2019 |

| 2018 |

| |||

| | (Dollars in thousands) | | |||||||

Revenue | | $ | 261,162 | | $ | 281,351 | | $ | 284,188 | |

Net income | | $ | 34,157 | | $ | 32,711 | | $ | 43,143 | |

Increase (decrease) in revenue from prior year | | | | | | | | | | |

Amount | | $ | (20,189) | | $ | (2,837) | | $ | 31,628 | |

Percentage | | | (7) | % | | (1) | % | | 13 | % |

Increase (decrease) in net income from prior year | | | | | | | | | | |

Amount | | $ | 1,446 | | $ | (10,432) | | $ | 1,129 | |

Percentage | | | 4 | % | | (24) | % | | 3 | % |

| | | | | | | | | | |

Percentage of revenue: | | | | | | | | | | |

Revenue | | | 100 | % | | 100 | % | | 100 | % |

Cost of products and services sold | | | 62 | | | 64 | | | 62 | |

Selling, general and administrative expenses | | | 19 | | | 17 | | | 17 | |

Research and Product Development Costs | | | 2 | | | 1 | | | 1 | |

Other (income) expense, net | | | * | | | 2 | | | * | |

Income before income taxes | | | 17 | % | | 15 | % | | 20 | % |

Income taxes | | | 4 | | | 4 | | | 5 | |

Net income | | | 13 | % | | 12 | % | | 15 | % |

| | | | | | | | | | |

* denotes less than one percent

Note: Some percentage of revenue amounts may not sum due to rounding

Overview

Chase Corporation emphasized operational and financial discipline in fiscal 2020, a year which continued the macrotrend revenue drag observed in the prior year, and ultimately saw the spread of the coronavirus pandemic (COVID-19) across all geographies served by the Company. Domestic and international top-line headwinds attributable to the pandemic affected all three of the Company’s operating segments, while the prior year tightness in Asian markets persisted. Through this, the Company was able to increase its relative gross margin, complete the consolidation of its pulling and detection operations into its existing Hickory, NC location, liquidate two real estate assets for gains and achieve a year-over-year increase in cashflows from operations.

Chase Corporation’s balance sheet remained strong at August 31, 2020, with cash on hand of $99,068,000, a current ratio of 7.7 and no outstanding principal balance owed on the Company’s $150,000,000 revolving credit facility. The Company took advantage of its solid financial position with its September 2020 (fiscal 2021) cash on hand funded purchase of ABchimie, a Corbelin, France headquartered solutions provider for the cleaning and the protection of electronic assemblies, with further formulation, production, and research and development capabilities.

As an extension of the Company’s pre-existing facility consolidation and rationalization initiative, the Company implemented certain changes in its cost structure in fiscal 2020 designed to address market dynamics brought on by COVID-19. In the third fiscal quarter, these included: (a) a targeted 4.5% reduction in the Company’s global workforce, contemplated pre-pandemic but catalyzed by COVID-19; and (b) the institution of a temporary 20% reduction in the

22

base salaries of named executive officers and select members of senior management, as well as the cash compensation of the non-employee members of the Board. The Company remains profitable with sufficient cash on hand to continue to meet its short- and long-term strategic objectives and implemented the aforementioned expense reductions as a demonstration of fiscal prudence during these uncertain times.

Chase Corporation is a supplier of several essential industries, providing products to critical industries such as healthcare, utilities, infrastructure and telecommunications, and throughout the COVID-19 effected period of fiscal 2020, successfully maintained business continuity for the Company’s global customers. As of August 31, 2020, all the Company’s facilities were operational, with only two facilities, Pune, India and Newark, CA, having experienced prior temporary closures due to separate general government orders. However, given the magnitude of the uncertainty that COVID-19 has broadly placed on global markets, the pandemic’s long-term effects on the Company’s results and the Company’s ability to maintain current service levels cannot currently be estimated. The Company will continue to assess the situation and take the appropriate actions to ensure it is in the strongest position possible.

During the second fiscal quarter of 2020, the relocation of the Company’s pulling and detection product line production operations from the Granite Falls, NC facility to the existing Hickory, NC facility was completed. In the third fiscal quarter of 2020, the Company completed the sale of its Pawtucket, RI location for a net gain. Also during the third quarter, the administrative functions based in the Pawtucket, RI location were moved into the Company’s existing Westwood, MA location. In the fourth fiscal quarter of 2020, the Company sold its Randolph, MA property for a net gain.

Net cash provided by operating activities exceeded that of the prior year, with the Company’s cash position continuing the positive trend seen in the latter half of fiscal 2019 (prior year) following the full payoff of its outstanding debt. The Company held no outstanding balance on its $150,000,000 revolving credit facility as of August 31, 2020. The revolving credit facility allows for the Company to pay down debt with excess cash, while retaining access to immediate liquidity to fund future accretive activities, including mergers and acquisitions, as identified.

Revenue from the Adhesives, Sealants and Additives segment decreased versus the prior year. Sales volume within the electronic and industrial coatings product line decreased in North American, European, and Asian markets. This decrease was attributable to the effects of the COVID-19 pandemic on the already strained automotive and industrial markets, and Asian headwinds. The Company’s specialty chemical intermediates product line sales, which have a North American concentration, also experienced a volume drop as compared to the prior year.

Net sales decreased in the Industrial Tapes segment as compared to the prior year, with the cable materials and specialty products product lines driving the top-line remission. A primary driver in the sales reduction in the specialty products product line was the Company’s planned exit from providing transitional toll manufacturing services to the common purchaser of its former structural composites rod and fiber optical cable components businesses, with sales tapering in the first quarter of fiscal 2020 and fully ending in the second quarter. The Company’s electronic materials product line, which sells nearly exclusively to Asian markets, achieved sales growth over the prior year. The pulling and detection product line, carried by sales momentum in the North American utility and telecommunication markets, also achieved a year-over-year increase in sales.

The Company’s Corrosion Protection and Waterproofing segment’s sales decreased compared to the prior year. The building envelope product line’s sales were unfavorable to the prior year, driving the segment’s overall unfavorable results. The coating and lining systems, bridge and highway and pipeline coatings product lines all saw sales increases over the prior year. The pipeline coatings product line results were driven by increased sales by our Rye, U.K. facility, especially in the fourth fiscal quarter of 2020 with sales into the Middle East.

Through mergers, acquisitions and divestitures, its marketing and product development efforts and its ability to rationalize and consolidate its operations, the Company remains focused on its core strategies for sustainable long-term growth.

23

The Company has three reportable operating segments summarized below:

Segment |

| Product Lines |

| Manufacturing Focus and Products |

Adhesives, Sealants and Additives | | Electronic and Industrial Coatings | | Protective coatings, including moisture protective coatings and customized sealant and adhesive systems for electronics; polyurethane dispersions, polymeric microspheres and superabsorbent polymers. |

Industrial Tapes | | Cable Materials Specialty Products Pulling and Detection Electronic Materials Structural Composites (1) | | Protective tape and coating products and services, including insulating and conducting materials for wire and cable manufacturers; laminated durable papers, packaging and industrial laminate products and custom manufacturing services; pulling and detection tapes used in the installation, measurement and location of fiber optic cable and water and natural gas lines; cover tapes essential to delivering semiconductor components via tape and reel packaging; and composite materials elements (now divested). |

Corrosion Protection and Waterproofing | | Coating and Lining Systems Pipeline Coatings Building Envelope Bridge and Highway | | Protective coatings and tape products, including coating and lining systems for use in liquid storage and containment applications; protective coatings for pipeline and general construction applications; adhesives and sealants used in architectural and building envelope waterproofing applications; high-performance polymeric asphalt additives and expansion and control joint systems for use in the transportation and architectural markets. |

| (1) | Product line was substantially divested with the sale of the structural composites rod business on April 20, 2018. Custom manufacturing performed for the purchaser of the structural composites rod business subsequent to the sale is included within the specialty products product line. |

24

Results of Operations

Revenue and Income Before Income Taxes by Segment are as follows:

| | | | | Income Before | | % of | | |

|

| Revenue |

| Income Taxes | | Revenue |

| ||

| | (Dollars in thousands) | | | | ||||

Fiscal 2020 | | | | | | | | | |

Adhesives, Sealants and Additives | | $ | 96,208 | | $ | 25,953 | | 27 | % |

Industrial Tapes | | | 118,960 | | | 31,237 | (a) | 26 | % |

Corrosion Protection and Waterproofing | | | 45,994 | | | 16,638 | (b) | 36 | % |

| | $ | 261,162 | | | 73,828 | | 28 | % |

Less corporate and common costs | | | | | | (28,508) | (c) | | |

Income before income taxes | | | | | $ | 45,320 | | | |

| | | | | | | | | |

Fiscal 2019 | | | | | | | | | |

Adhesives, Sealants and Additives | | $ | 104,796 | | $ | 27,142 | (d) | 26 | % |

Industrial Tapes | | | 129,845 | | | 28,216 | (e) | 22 | % |

Corrosion Protection and Waterproofing | | | 46,710 | | | 15,909 | (f) | 34 | % |

| | $ | 281,351 | | | 71,267 | | 25 | % |

Less corporate and common costs | | | | | | (27,714) | (g) | | |

Income before income taxes | | | | | $ | 43,553 | | | |

| | | | | | | | | |

Fiscal 2018 | | | | | | | | | |

Adhesives, Sealants and Additives | | $ | 101,690 | | $ | 35,190 | (h) | 35 | % |

Industrial Tapes | | | 130,598 | | | 30,886 | (i) | 24 | % |

Corrosion Protection and Waterproofing | | | 51,900 | | | 18,178 | | 35 | % |

| | $ | 284,188 | | | 84,254 | | 30 | % |

Less corporate and common costs | | | | | | (27,289) | (j) | | |

Income before income taxes | | | | | $ | 56,965 | | | |

| (a) | Includes $559 in exit costs related to the movement of the pulling and detection business out of the Granite Falls, NC location and into the Hickory, NC location during the first six months of fiscal 2020 |

| (b) | Includes $170 gain on the refund of a payment made in fiscal 2019 related to engineering studies performed to assess potential operational changes and further plant rationalization and consolidation and an expense of $405 for the write-down of certain assets under construction. |

| (c) | Includes $150 of expense related to exploratory IT work performed to assess potential future upgrades to the Company’s companywide ERP system, a $760 gain related to the April 2020 sale of the Company’s Pawtucket, RI location, a $1,791 gain related to the August 2020 sale of the Company’s Randolph, MA property, $183 in severance expense related to the May 2020 reduction in force, $85 in expenses related to the final transition out of the Pawtucket, RI facility, $155 of pension-related settlement costs due to the timing of lump-sum distribution and $274 in acquisition-related costs attributable to the September 2020 (fiscal 2021) acquisition of ABchimie |

| (d) | Includes $2,410 of loss on impairment of goodwill related to the Company’s polyurethane dispersions business |

| (e) | Includes $260 of expense related to the closure and exit of our Pawtucket, RI location recognized in the first quarter of fiscal 2019, and $526 in exit costs related to the movement of the pulling and detection business out of the Granite Falls, NC location and into the Hickory, NC location during the second half of fiscal 2019 |

| (f) | Includes $200 of expense related to engineering studies performed to assess potential future operational changes and further plant rationalization and consolidation, see note (b) |

| (g) | Includes $511 of pension-related settlement costs due to the timing of lump-sum distributions |

| (h) | Includes $1,070 of expense related to inventory step-up in fair value attributable to the acquisition of Zappa Stewart |

| (i) | Includes $1,085 gain on sale of license related to the structural composites product line recorded in the second quarter of fiscal 2018, $1,480 gain on sale of business related to the April 2018 sale of the structural composites rod business and $1,272 of expense related to the exit of our Pawtucket, RI location in the fourth quarter of fiscal 2018 |

| (j) | Includes $393 in acquisition-related expense attributable to the December 2017 acquisition of Zappa Stewart |

25

Total Revenue

Total revenue in fiscal 2020 decreased $20,189,000 or 7% to $261,162,000 from $281,351,000 in the prior year.

Revenue in our Adhesives, Sealants and Additives segment decreased $8,588,000 or 8% to $96,208,000 for the year ended August 31, 2020 compared to $104,796,000 in fiscal 2019. The decreases in revenue from the Adhesives, Sealants and Additives segment in fiscal 2020 was primarily due to the electronic and industrial coatings product line’s $6,276,000 sales volume-driven decrease. North American, European, and Asian automotive and industrial weakness, exacerbated by COVID-19, affected revenue, including the royalty received from the Company’s licensed manufacturer in Asia. Also contributing to the segment’s sales decline was a decrease in revenue from the North American focused specialty chemical intermediates product line, totaling $2,312,000 in fiscal 2020.