Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - ANTARES PHARMA, INC. | atrs-8k_20201112.htm |

NASDAQ: ATRS | November 2020 Investor Presentation EX 99.1

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the uncertainty regarding the duration, scope and severity of the COVID-19 pandemic and the mitigation measures and other restrictions implemented in response to the same and the impact on demand for our products, new patients and prescriptions, future revenue, product supply, and our overall business, operating results and financial condition; our ability to achieve the 2020 full year revenue guidance; successful commercialization of NOCDURNA® in the United States and market acceptance and future revenue from the same; market acceptance, adequate reimbursement coverage and commercial success of XYOSTED® and future revenue from the same; market acceptance of Teva’s generic epinephrine auto-injector product and future revenue from the same; whether the FDA will withdraw marketing approval for AMAG’s Makena® subcutaneous auto injector following the recent FDA letter seeking withdrawal, whether AMAG will be granted an appeal hearing and if granted, whether AMAG will be successful and future prescriptions, market acceptance and revenue from the same; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; future prescriptions and sales of OTREXUP®; Teva’s ability to successfully commercialize generic Forsteo® in certain countries outside the USA and future revenue from the same; FDA approval of Teva’s pending ANDA for generic Forteo® in the USA and future revenue form the same; the ability of Lunatus to obtain regulatory approvals for XYOSTED® in Saudi Arabia and UAE and successfully commercialize the product and future revenue from the same; successful development including the timing and results of the clinical bridging and Phase 3 clinical trial of the drug device combination product for Selatogrel with Idorsia Pharmaceuticals and FDA and global regulatory approvals and future revenue from the same; the timing and results of the Company’s or its partners’, Teva and Pfizer, research projects or clinical trials of product candidates in development and future regulatory approval and revenue from the same; actions by the FDA or other regulatory agencies with respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to meet loan extension and interest only payment milestones and the ability to repay the debt obligation to Hercules Capital; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's Annual Report on Form 10-K, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2020 Copyright Antares Pharma, Inc. All Rights Reserved.

Executive Team Robert F. Apple President and CEO Fred Powell EVP and CFO Patrick Shea SVP, Commercial Peter J. Graham EVP, General Counsel, Human Resources and Corporate Secretary Dr. Steven Knapp SVP, Regulatory Affairs and Quality Assurance Ed Tykot SVP, Corporate Business Development Greg DeFilippis SVP, Device Business and Alliances Pharmaceutical and Device Expertise with a Proven Track Record Patrick Madsen SVP, Operations

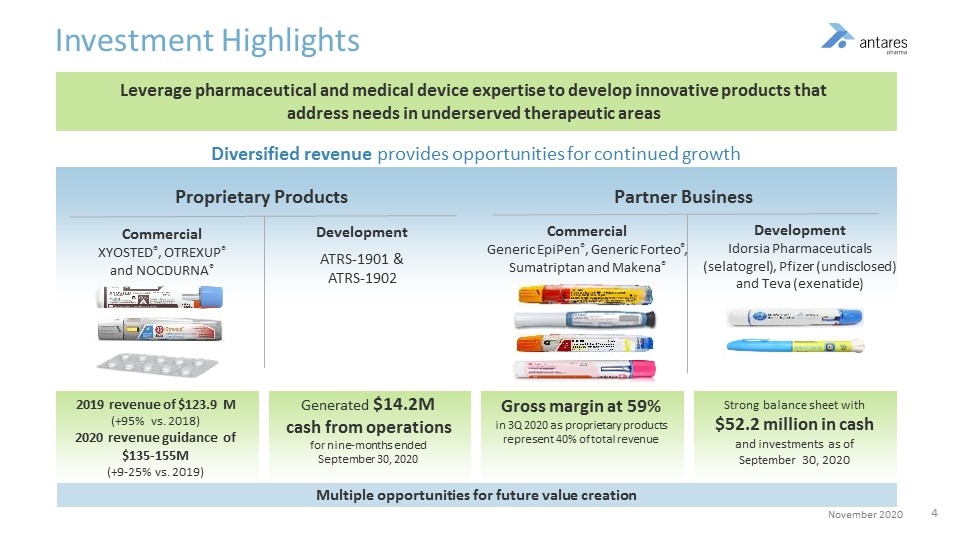

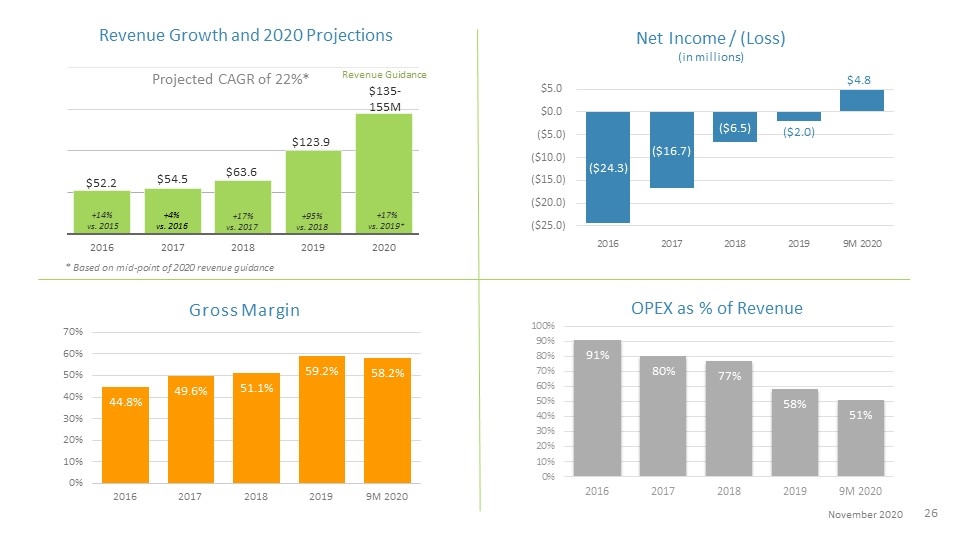

Investment Highlights Leverage pharmaceutical and medical device expertise to develop innovative products that address needs in underserved therapeutic areas Diversified revenue provides opportunities for continued growth Commercial XYOSTED®, OTREXUP® and NOCDURNA® Commercial Generic EpiPen®, Generic Forteo®, Sumatriptan and Makena® Development Idorsia Pharmaceuticals (selatogrel), Pfizer (undisclosed) and Teva (exenatide) 2019 revenue of $123.9 M (+95% vs. 2018) 2020 revenue guidance of $135-155M (+9-25% vs. 2019) Gross margin at 59% in 3Q 2020 as proprietary products represent 40% of total revenue Strong balance sheet with $52.2 million in cash and investments as of September 30, 2020 Generated $14.2M cash from operations for nine-months ended September 30, 2020 Multiple opportunities for future value creation Partner Business Development ATRS-1901 & ATRS-1902 Proprietary Products

Long-Term Growth Strategy Expand Partnership Opportunities A leader in self-administered injection technology Support life-cycle management solutions Disciplined Capital Allocation Corporate development In-licensing opportunities Enhance Proprietary Portfolio Support research and development Leverage salesforce Strong Financials Drive operational efficiency Increase margin profile and EPS

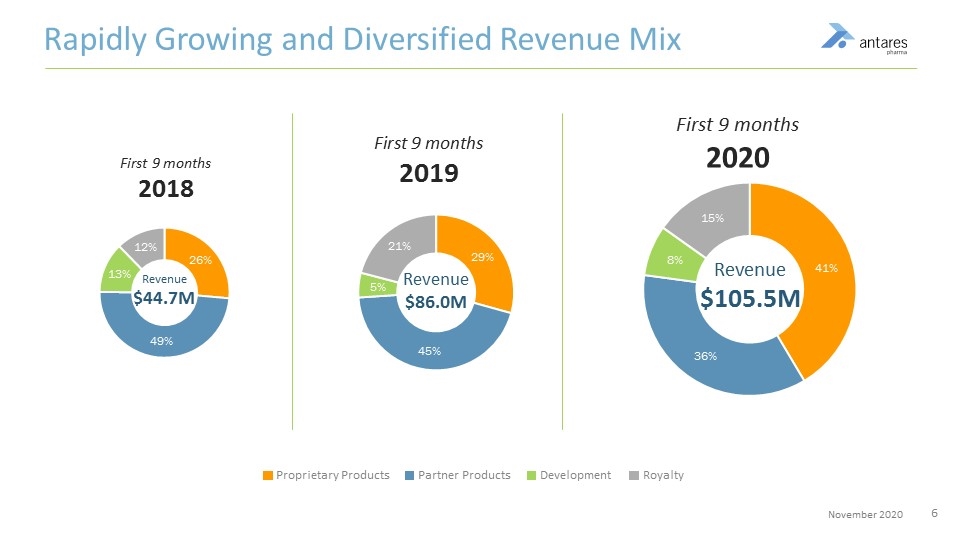

Rapidly Growing and Diversified Revenue Mix Proprietary Products Partner Products Development Royalty First 9 months 2018 Revenue $44.7M Revenue $86.0M Revenue $105.5M First 9 months 2019 First 9 months 2020

Proprietary Products (desmopressin acetate) sublingual tablet

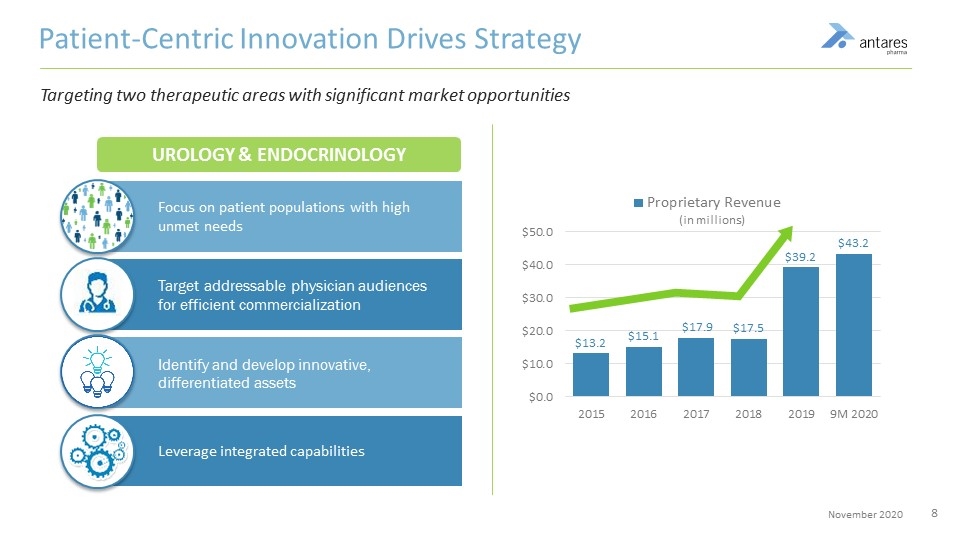

Patient-Centric Innovation Drives Strategy Targeting two therapeutic areas with significant market opportunities UROLOGY & ENDOCRINOLOGY Focus on patient populations with high unmet needs Target addressable physician audiences for efficient commercialization Identify and develop innovative, differentiated assets Leverage integrated capabilities

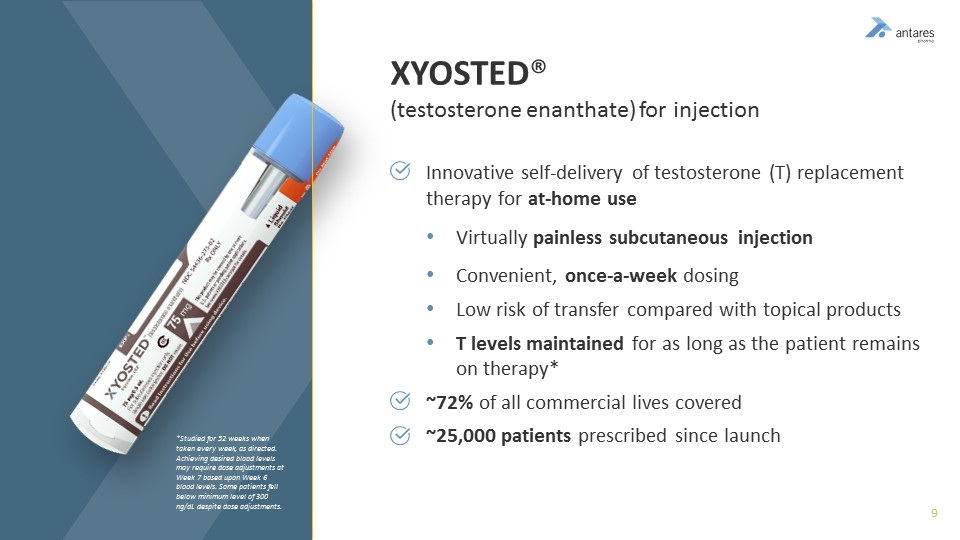

*Studied for 52 weeks when taken every week, as directed. Achieving desired blood levels may require dose adjustments at Week 7 based upon Week 6 blood levels. Some patients fell below minimum level of 300 ng/dL despite dose adjustments. Innovative self-delivery of testosterone (T) replacement therapy for at-home use Virtually painless subcutaneous injection Convenient, once-a-week dosing Low risk of transfer compared with topical products T levels maintained for as long as the patient remains on therapy* ~72% of all commercial lives covered ~25,000 patients prescribed since launch XYOSTED® (testosterone enanthate) for injection

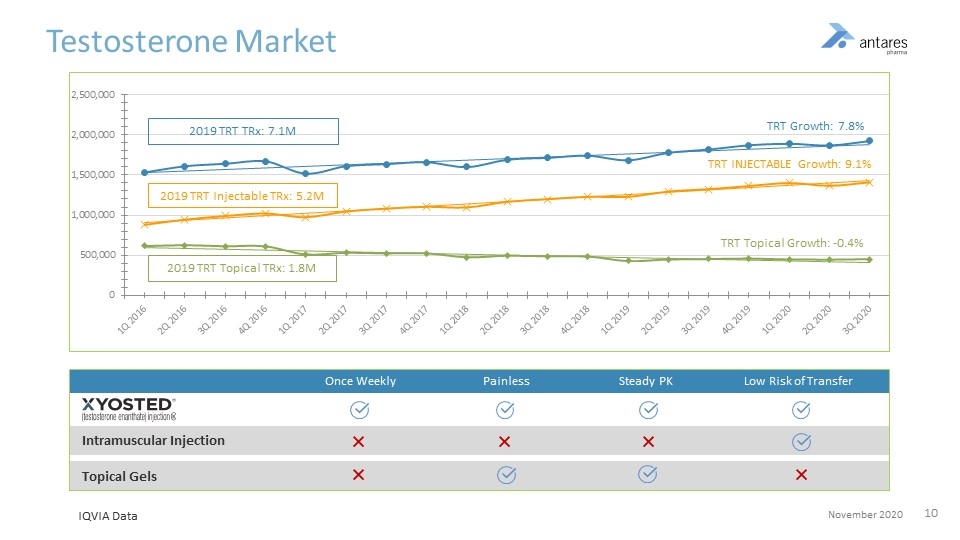

Testosterone Market Once Weekly Painless Efficacious Steady PK No Risk of Transfer Once Weekly Painless Steady PK Low Risk of Transfer Intramuscular Injection Topical Gels IQVIA Data

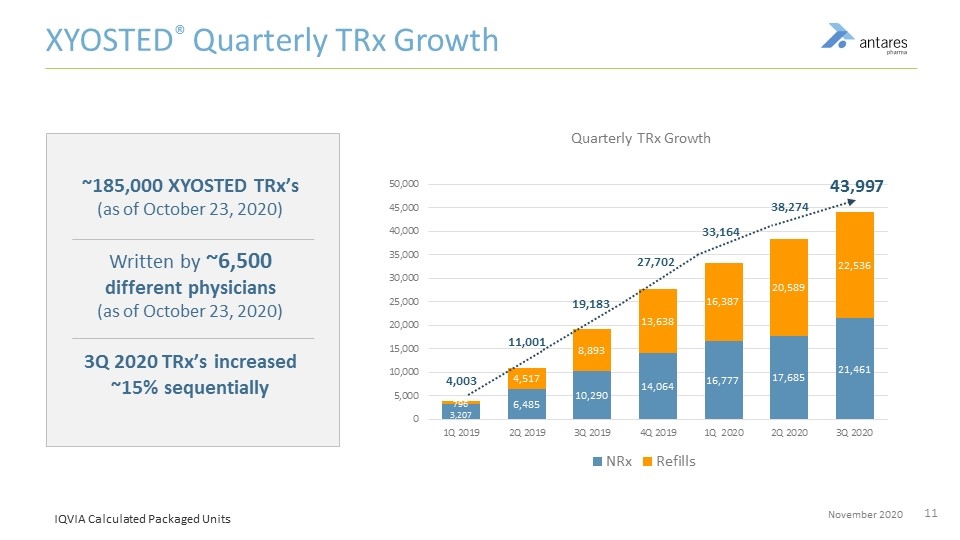

XYOSTED® Quarterly TRx Growth ~185,000 XYOSTED TRx’s (as of October 23, 2020) Written by ~6,500 different physicians (as of October 23, 2020) 3Q 2020 TRx’s increased ~15% sequentially IQVIA Calculated Packaged Units 43,997 38,274 27,702 19,183 11,001 4,003 33,164

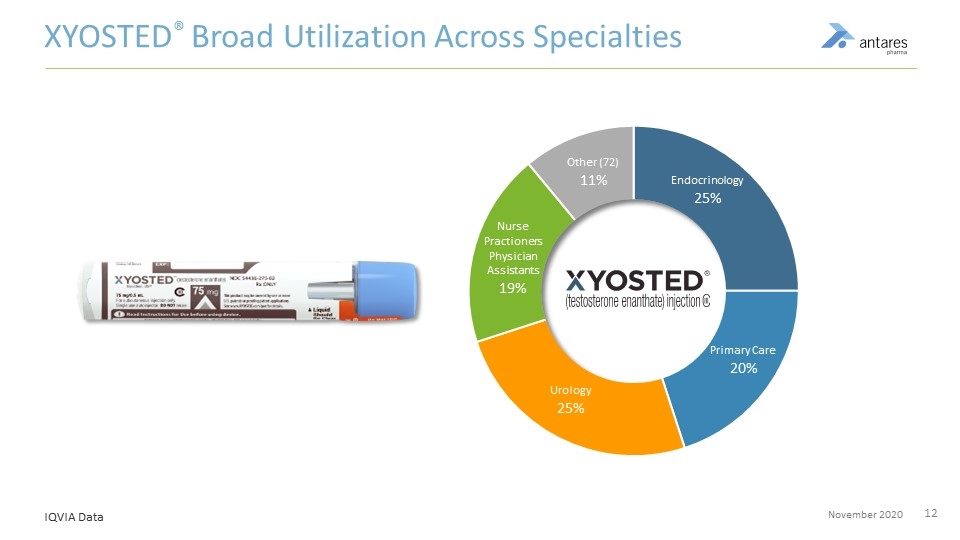

XYOSTED® Broad Utilization Across Specialties IQVIA Data

Multiple Channels Directed at Key XYOSTED® Targets STEADYCare: Competitive co-pay assistance (up to $125/month) CoverMyMeds.com: Office support to drive rapid claim adjudication First-Fill-Free and product sample programs Social Media and Digital Engagement Enduring Materials and Sales Assets Congresses and Exhibit Presence Live Promotional Events PRESCRIBERS and PATIENTS

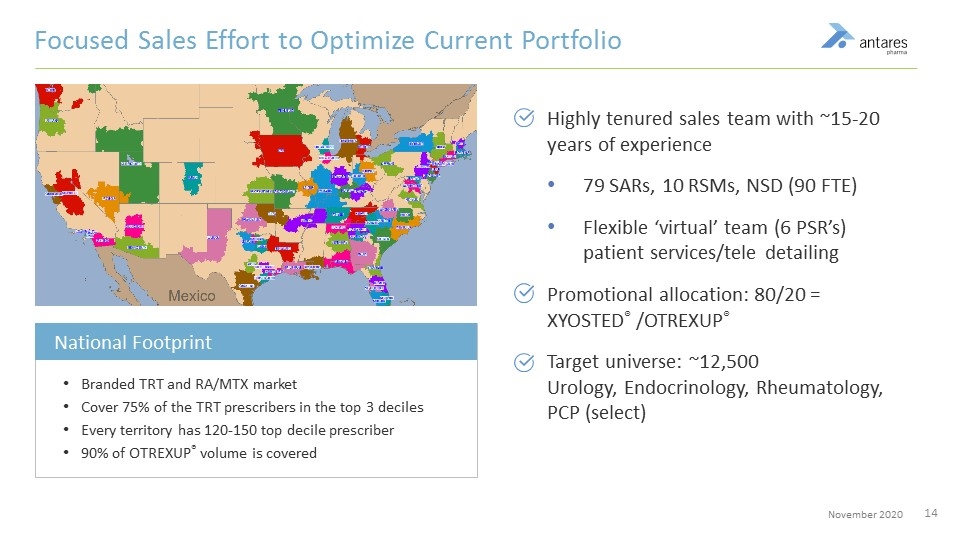

Branded TRT and RA/MTX market Cover 75% of the TRT prescribers in the top 3 deciles Every territory has 120-150 top decile prescriber 90% of OTREXUP® volume is covered Highly tenured sales team with ~15-20 years of experience 79 SARs, 10 RSMs, NSD (90 FTE) Flexible ‘virtual’ team (6 PSR’s) patient services/tele detailing Promotional allocation: 80/20 = XYOSTED® /OTREXUP® Target universe: ~12,500 Urology, Endocrinology, Rheumatology, PCP (select) Focused Sales Effort to Optimize Current Portfolio National Footprint

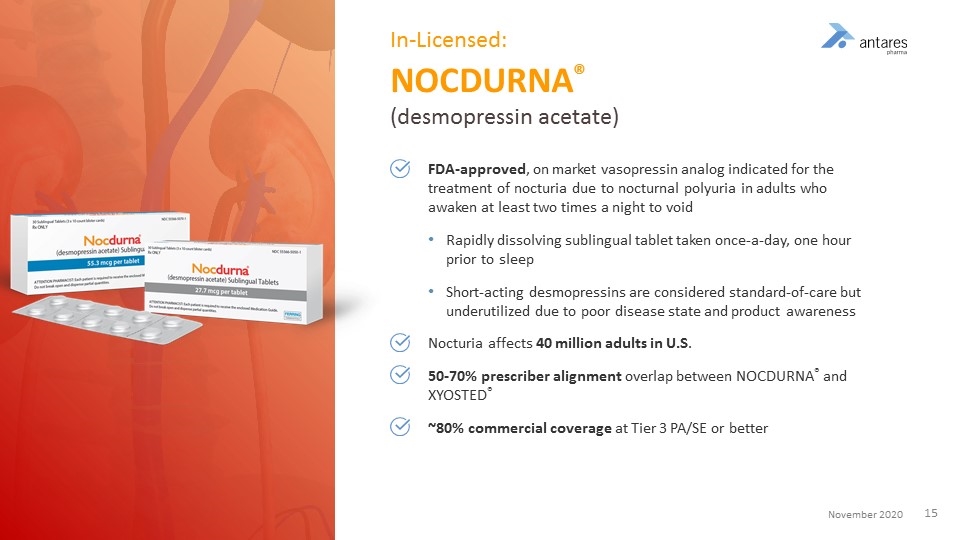

FDA-approved, on market vasopressin analog indicated for the treatment of nocturia due to nocturnal polyuria in adults who awaken at least two times a night to void Rapidly dissolving sublingual tablet taken once-a-day, one hour prior to sleep Short-acting desmopressins are considered standard-of-care but underutilized due to poor disease state and product awareness Nocturia affects 40 million adults in U.S. 50-70% prescriber alignment overlap between NOCDURNA® and XYOSTED® ~80% commercial coverage at Tier 3 PA/SE or better In-Licensed: NOCDURNA® (desmopressin acetate)

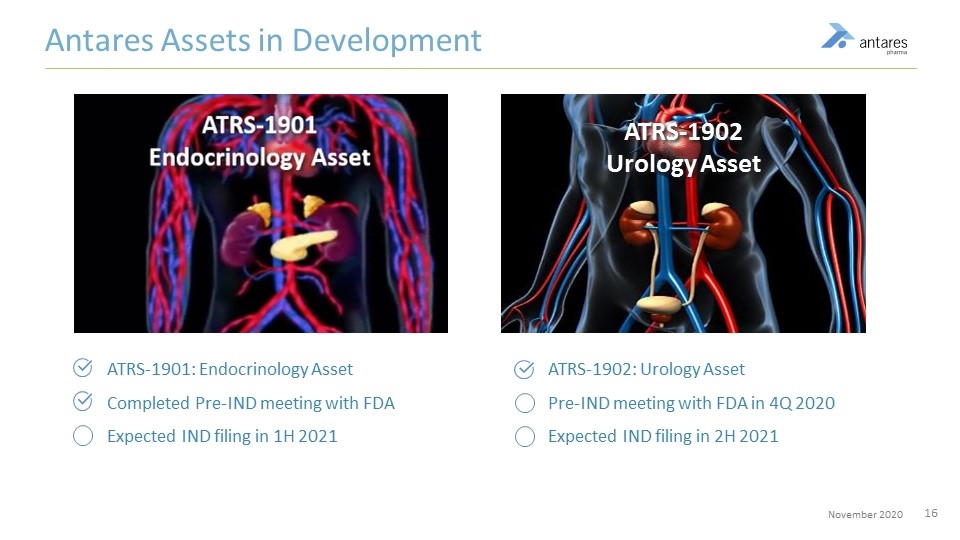

ATRS-1902 Urology Asset Antares Assets in Development ATRS-1901: Endocrinology Asset Completed Pre-IND meeting with FDA Expected IND filing in 1H 2021 ATRS-1902: Urology Asset Pre-IND meeting with FDA in 4Q 2020 Expected IND filing in 2H 2021

Partner Business

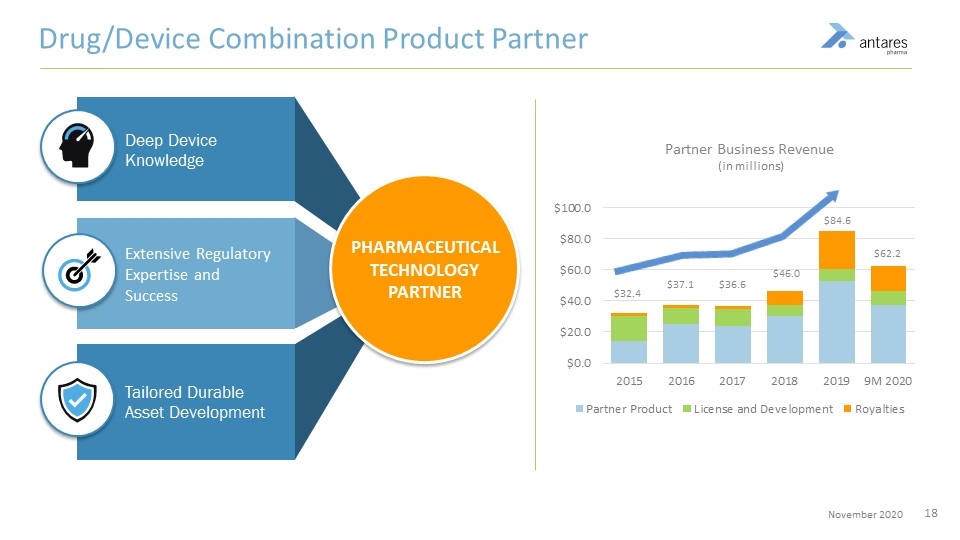

Drug/Device Combination Product Partner Deep Device Knowledge Extensive Regulatory Expertise and Success Tailored Durable Asset Development PHARMACEUTICAL TECHNOLOGY PARTNER Partner Business Revenue (in millions)

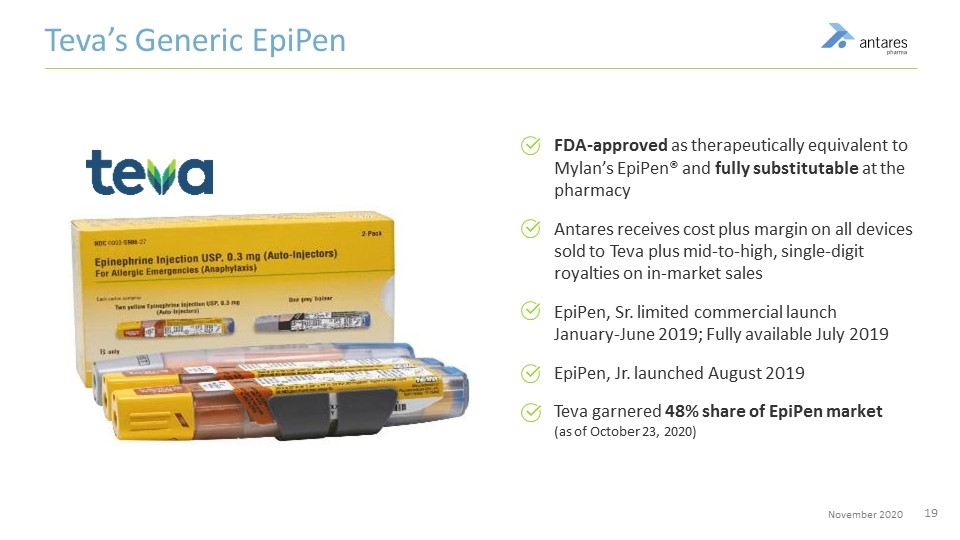

Commercial Experience Teva’s Generic EpiPen FDA-approved as therapeutically equivalent to Mylan’s EpiPen® and fully substitutable at the pharmacy Antares receives cost plus margin on all devices sold to Teva plus mid-to-high, single-digit royalties on in-market sales EpiPen, Sr. limited commercial launch January-June 2019; Fully available July 2019 EpiPen, Jr. launched August 2019 Teva garnered 48% share of EpiPen market (as of October 23, 2020)

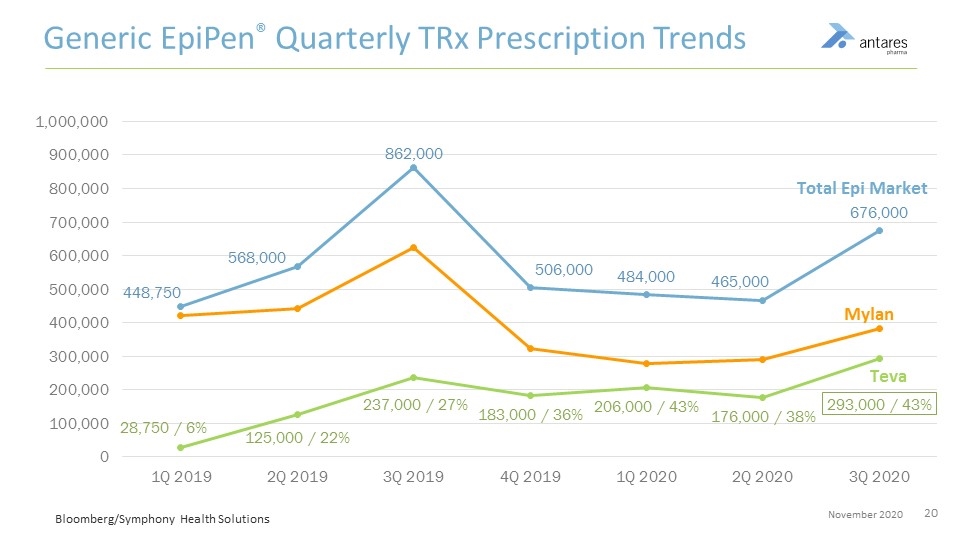

Generic EpiPen® Quarterly TRx Prescription Trends Bloomberg/Symphony Health Solutions

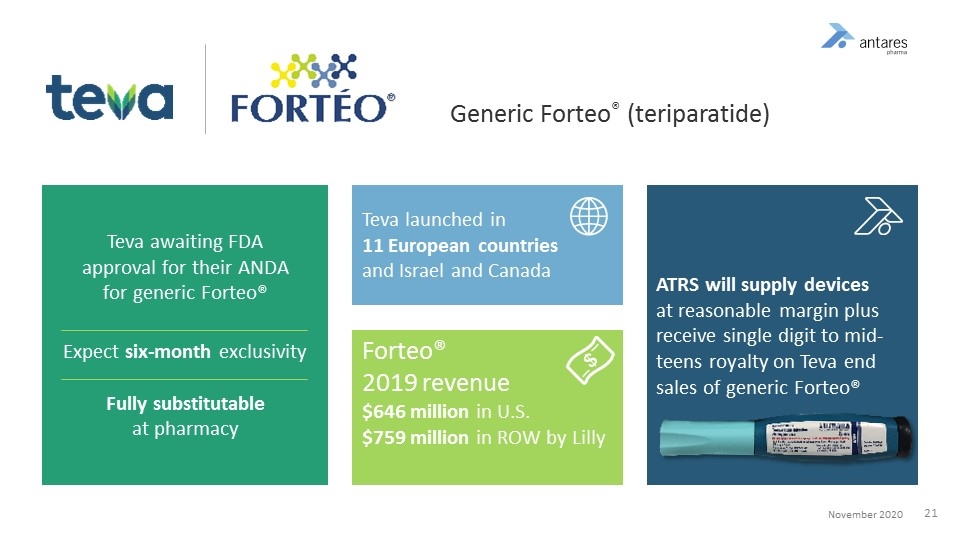

Generic Forteo® (teriparatide) Teva awaiting FDA approval for their ANDA for generic Forteo® Expect six-month exclusivity Fully substitutable at pharmacy Teva launched in 11 European countries and Israel and Canada Forteo® 2019 revenue $646 million in U.S. $759 million in ROW by Lilly ATRS will supply devices at reasonable margin plus receive single digit to mid-teens royalty on Teva end sales of generic Forteo®

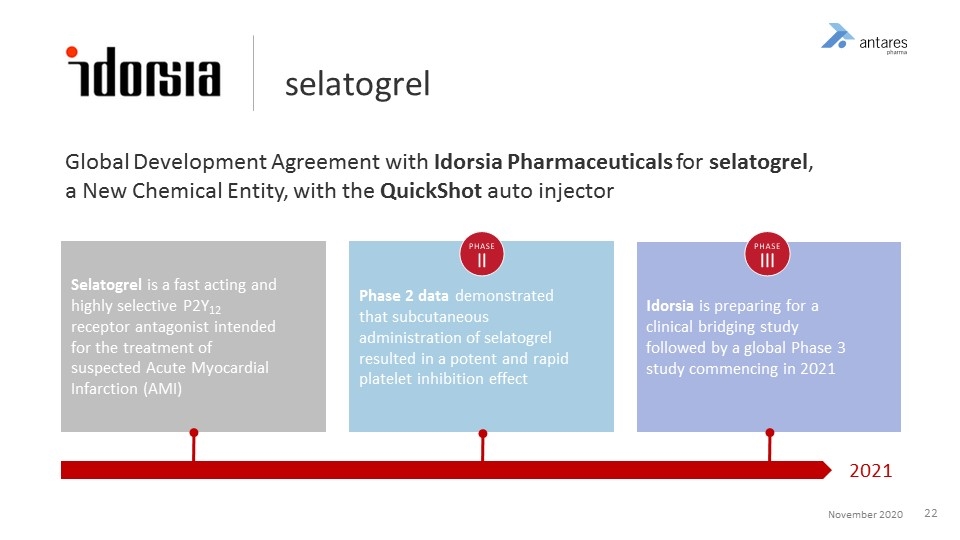

selatogrel Global Development Agreement with Idorsia Pharmaceuticals for selatogrel, a New Chemical Entity, with the QuickShot auto injector Selatogrel is a fast acting and highly selective P2Y12 receptor antagonist intended for the treatment of suspected Acute Myocardial Infarction (AMI) Phase 2 data demonstrated that subcutaneous administration of selatogrel resulted in a potent and rapid platelet inhibition effect Idorsia is preparing for a clinical bridging study followed by a global Phase 3 study commencing in 2021 2021

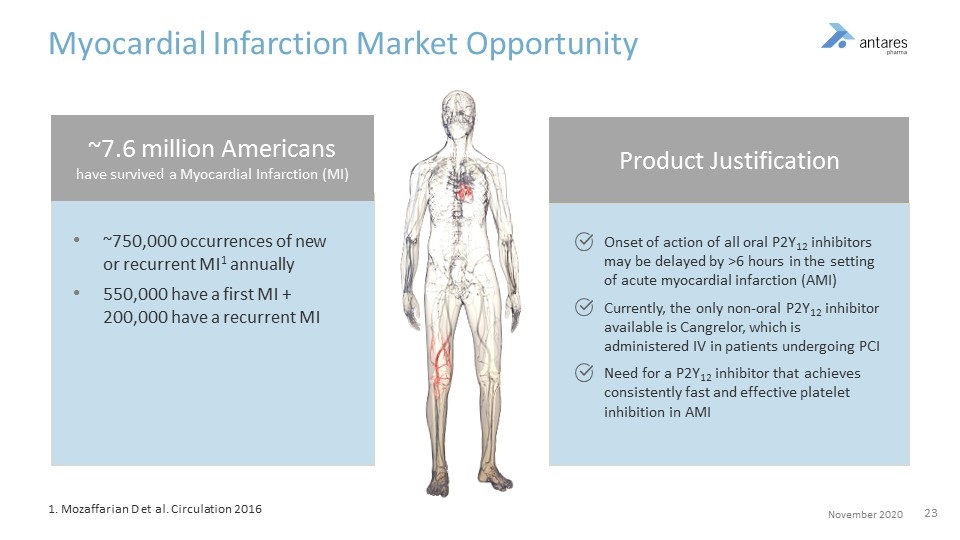

Myocardial Infarction Market Opportunity 1. Mozaffarian D et al. Circulation 2016 ~750,000 occurrences of new or recurrent MI1 annually 550,000 have a first MI + 200,000 have a recurrent MI Onset of action of all oral P2Y12 inhibitors may be delayed by >6 hours in the setting of acute myocardial infarction (AMI) Currently, the only non-oral P2Y12 inhibitor available is Cangrelor, which is administered IV in patients undergoing PCI Need for a P2Y12 inhibitor that achieves consistently fast and effective platelet inhibition in AMI ~7.6 million Americans have survived a Myocardial Infarction (MI) Product Justification

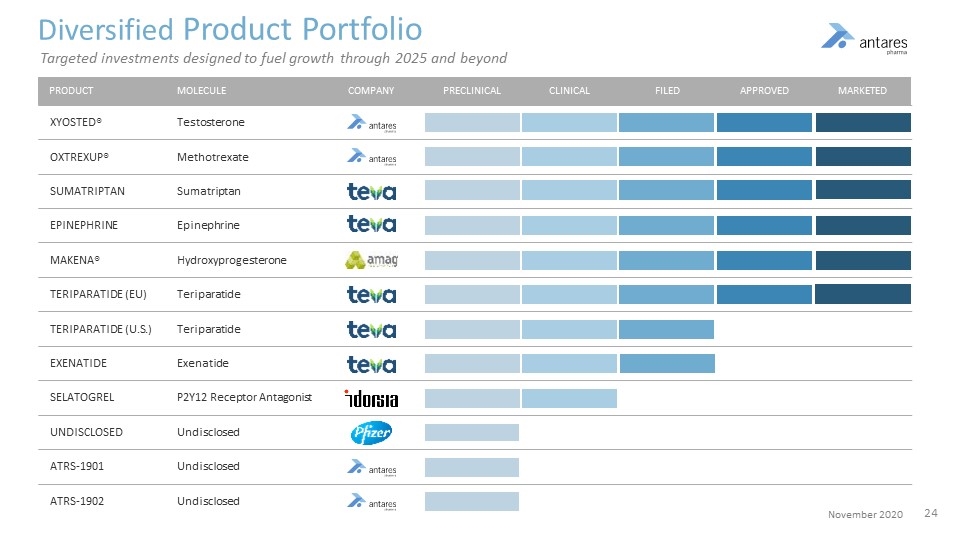

Diversified Product Portfolio Testosterone Methotrexate Sumatriptan Epinephrine Hydroxyprogesterone Teriparatide Teriparatide Exenatide P2Y12 Receptor Antagonist Undisclosed Undisclosed Undisclosed XYOSTED® OXTREXUP® SUMATRIPTAN EPINEPHRINE MAKENA® TERIPARATIDE (EU) TERIPARATIDE (U.S.) EXENATIDE SELATOGREL UNDISCLOSED ATRS-1901 ATRS-1902 Targeted investments designed to fuel growth through 2025 and beyond PRODUCT MOLECULE PRECLINICAL CLINICAL FILED APPROVED MARKETED COMPANY

Financial Overview

+17% vs. 2017 +95% vs. 2018 Revenue Growth and 2020 Projections Projected CAGR of 22%* * Based on mid-point of 2020 revenue guidance +14% vs. 2015 Revenue Guidance

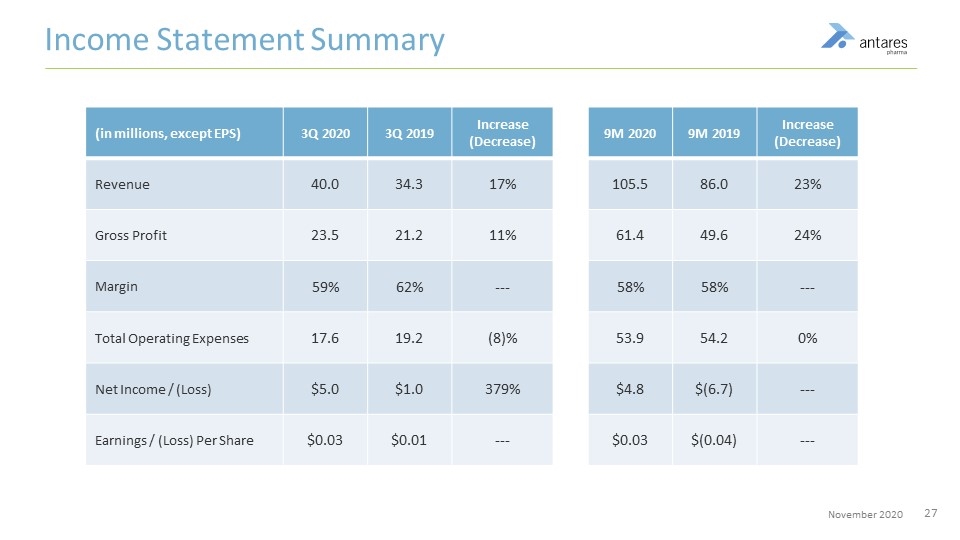

Income Statement Summary (in millions, except EPS) 3Q 2020 3Q 2019 Increase (Decrease) 9M 2020 9M 2019 Increase (Decrease) Revenue 40.0 34.3 17% 105.5 86.0 23% Gross Profit 23.5 21.2 11% 61.4 49.6 24% Margin 59% 62% --- 58% 58% --- Total Operating Expenses 17.6 19.2 (8)% 53.9 54.2 0% Net Income / (Loss) $5.0 $1.0 379% $4.8 $(6.7) --- Earnings / (Loss) Per Share $0.03 $0.01 --- $0.03 $(0.04) ---

Value Creation

Antares Pharma: Value Proposition Diverse portfolio of commercialized products Multiple growth drivers Continued XYOSTED® prescription growth Continued generic EpiPen® prescription growth Relaunch of NOCDURNA® Potential FDA approval and U.S. launch of Teva’s generic teriparatide Pfizer development program Idorsia’s selatogrel rescue pen development program R&D portfolio Endocrinology asset Urology asset Disciplined capital allocation Invest to diversify portfolio Expanding operational capabilities

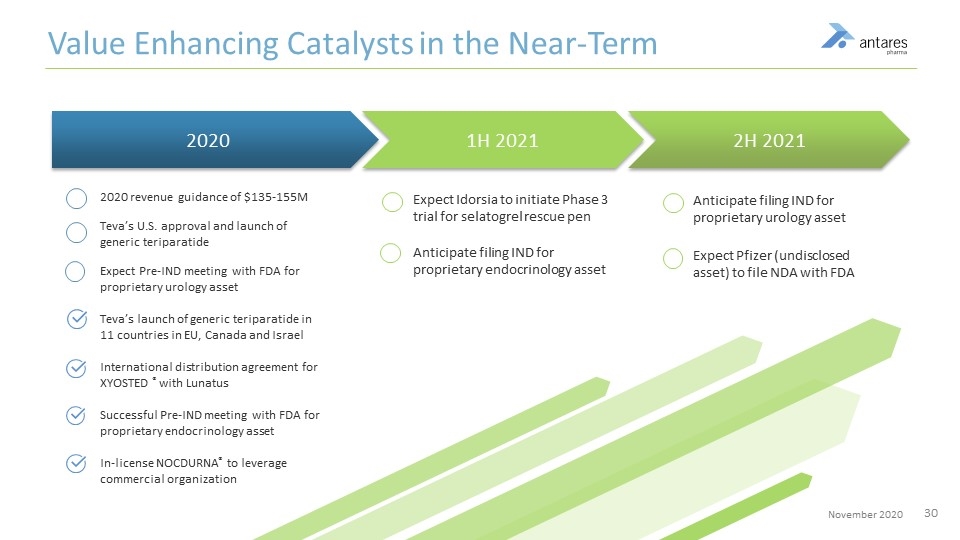

Value Enhancing Catalysts in the Near-Term 2H 2021 2020 revenue guidance of $135-155M Teva’s U.S. approval and launch of generic teriparatide Expect Pre-IND meeting with FDA for proprietary urology asset Teva’s launch of generic teriparatide in 11 countries in EU, Canada and Israel International distribution agreement for XYOSTED ® with Lunatus Successful Pre-IND meeting with FDA for proprietary endocrinology asset In-license NOCDURNA® to leverage commercial organization 2020 1H 2021 Expect Idorsia to initiate Phase 3 trial for selatogrel rescue pen Anticipate filing IND for proprietary endocrinology asset Anticipate filing IND for proprietary urology asset Expect Pfizer (undisclosed asset) to file NDA with FDA

Thank You!