Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE OF THE COMPANY DATED NOVEMBER 10, 2020 - Neonode Inc. | ea129565ex99-1_neonodeinc.htm |

| 8-K - CURRENT REPORT - Neonode Inc. | ea129565-8k_neonodeinc.htm |

Exhibit 99.2

Neonode Inc. Third Quarter 2020 Presentation Dr. Urban Forssell, CEO Ms. Maria Ek, CFO Mr. David Brunton, Head of Investor Relations November 10, 2020

2 Disclaimer This presentation contains, and related oral and written statements of Neonode Inc. (“Neonode” or the “Company”) and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include information about current expectations, potential financial performance or future events. The se also may include statements about market and sales growth, financial results, use of free cash flow, product development and introduction, regulatory matters and sales efforts. They are based on assumptions, expectations and information available to the Company and its management and involve a number of known and unknown risks, uncertainties and other factors that may cause th e Company’s actual results, levels of activity, performance or achievements to be materially different from any expressed or im pli ed by these forward-looking statements. These uncertainties and risks include, but are not limited to, those outlined in filings of th e Company with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, including sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are advised to carefully consider these various risks, uncertainties and other factors. Forward-looking stat eme nts are made as of today’s date. The Company and its management undertake no duty to update or revise forward - looking statements. This presentation has been prepared by the Company based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believe s such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information.

3 Strategy and Business Update

4 Remote Sensing Solutions • Sales of software solutions for driver and in - cabin monitoring • Focuses on OEM and Tier 1 customers in Automotive HMI Solutions • Sales of customized engineering solutions for touch and gesture sensing • Focuses on customers in Military & Avionics and Industrial segments Business Areas HMI Products • Sales of standardized sensor modules for contactless touch, touch, and gesture sensing • Focuses on customers in Elevator and Interactive Kiosk segments

5 Technologies and Application Areas Our IR - based zForce ® technology supports: • Touch Sensing Applications • Touch on displays • Touch on other surfaces • Gesture Sensing Applications • Contactless touch • Gesture control • Proximity sensing Our software platform MultiSensing ® supports: • Driver and In - Cabin Monitoring Applications • Drowsiness and distraction monitoring • Occupancy and situational context monitoring

6 Business Area – HMI Solutions Focuses on customized optical touch and gesture control solutions for demanding customers in the Military & Avionics and Industrial segments using our patented IR - based zForce technology.

7 Business Concept • IR - based touch and gesture sensing solutions • 100% bespoke solutions adapted for each customer’s specific needs • Scalable custom solutions to fit any touch area and size • Develop jointly with the customer focusing on a consultative, long - term relationship approach • Works on any surface, in - air, and with any touch object, nightvision compatible • Focus areas: military & avionics and industrial Neonode’s Technology at a Glance: x Cost - effective touch and gesture control solutions x EMI/EMC - ruggedness x Robust operation (with gloves, in sunlight etc.) x 100% image quality x Low latency x Freedom of design x Flexible integration x High quality x Low power consumption x Low electromagnetic interference

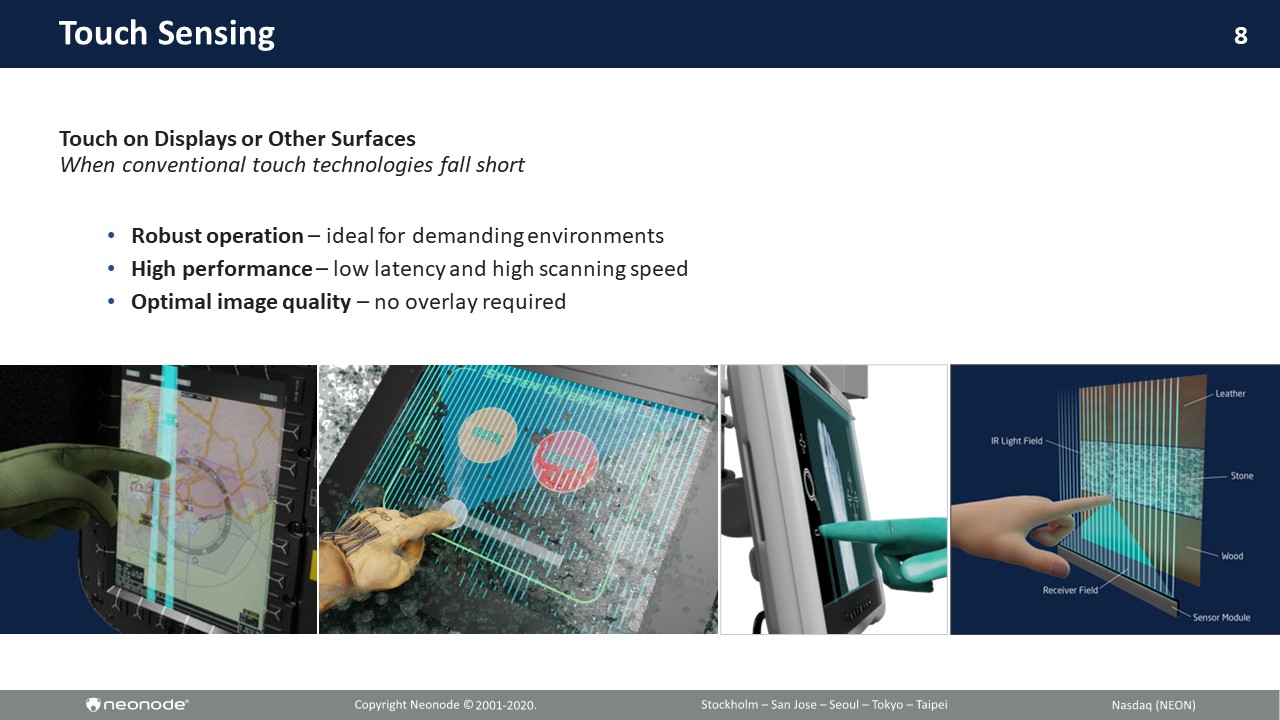

8 Touch Sensing Touch on Displays or Other Surfaces When conventional touch technologies fall short • Robust operation – ideal for demanding environments • High performance – low latency and high scanning speed • Optimal image quality – no overlay required

9 zForce Blocking Technology • Display solution • Four - sided sensor arrangement • Objects positioned by detecting blocked IR light beams zForce Technology Platforms Neonode’s IR - based zForce technology comes in two main variants: zForce Reflective Technology • Display, surface or in - air solution. • One - sided sensor arrangement • Objects positioned by detecting reflections from the object (s) in a 2D IR light field

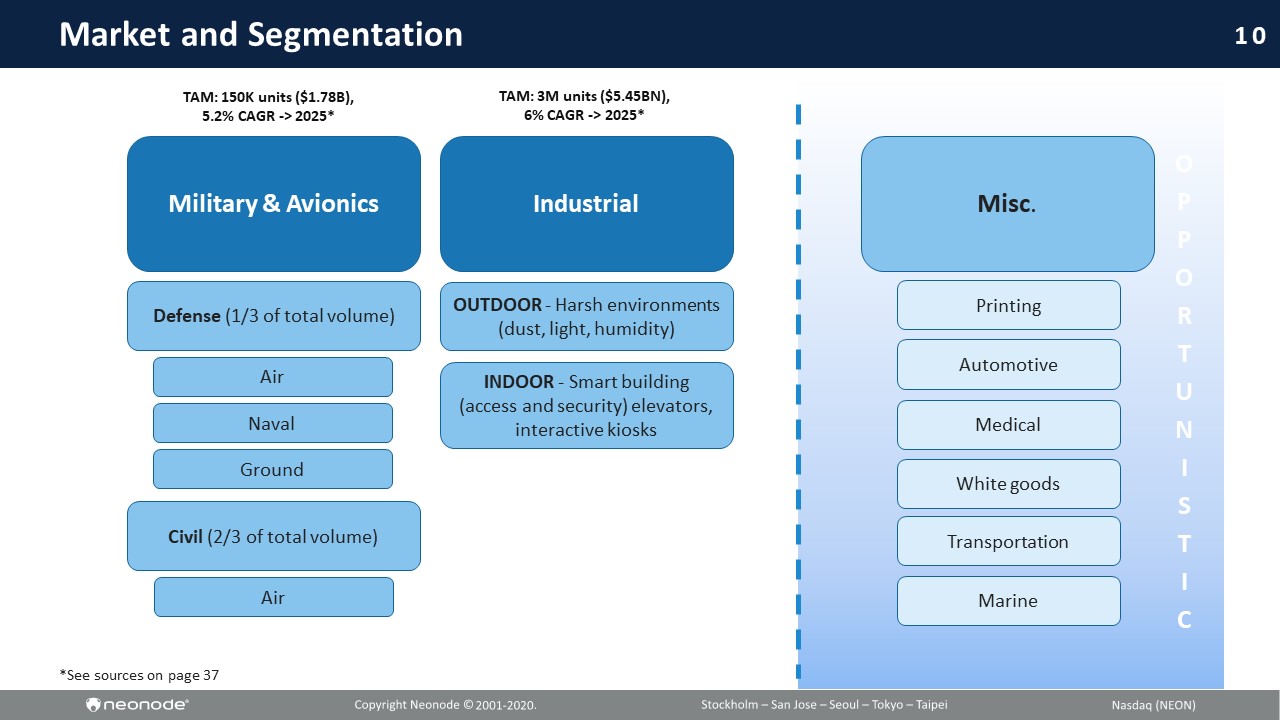

10 Printing Automotive Market and Segmentation Military & Avionics Industrial Misc . Defense (1/3 of total volume ) Civil (2/3 of total volume ) Medical Transportation White goods Marine OUTDOOR - Harsh environments (dust, light , humidity ) INDOOR - Smart building (access and security ) elevators, interactive kiosks TAM: 3M units ($5.45BN), 6% CAGR - > 2025* Air Naval Ground Air O P P O R T U N I S T I C TAM: 150K units ( $ 1.78B) , 5.2 % CAGR - > 2025* *See sources on page 37

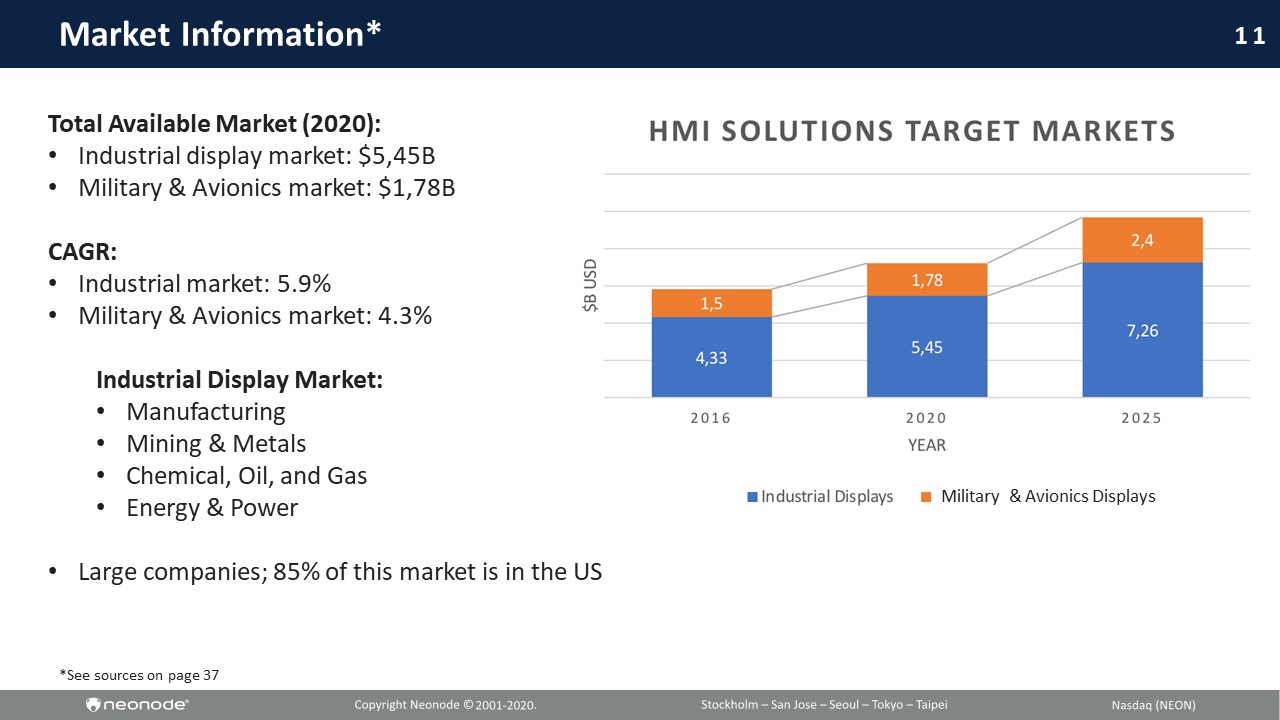

11 Market Information* Total A vail able M arket (2020): • Industrial display market: $5,4 5 B • Military & Avionics market: $1,78B CAGR: • Industrial market : 5.9% • Military & Avionics market : 4 . 3% Industrial Display Market: • Manufacturing • Mining & Metals • Chemical, Oil, and Gas • Energy & Power • Large companies ; 85% of this market is in the US Military & Avionics Displays *See sources on page 37

12 Business Area – HMI Products Focuses on sales of Neonode’s innovative, plug - and - play sensor modules, using our reflective IR - based zForce technology that enable contactless touch, touch, and gesture sensing applications.

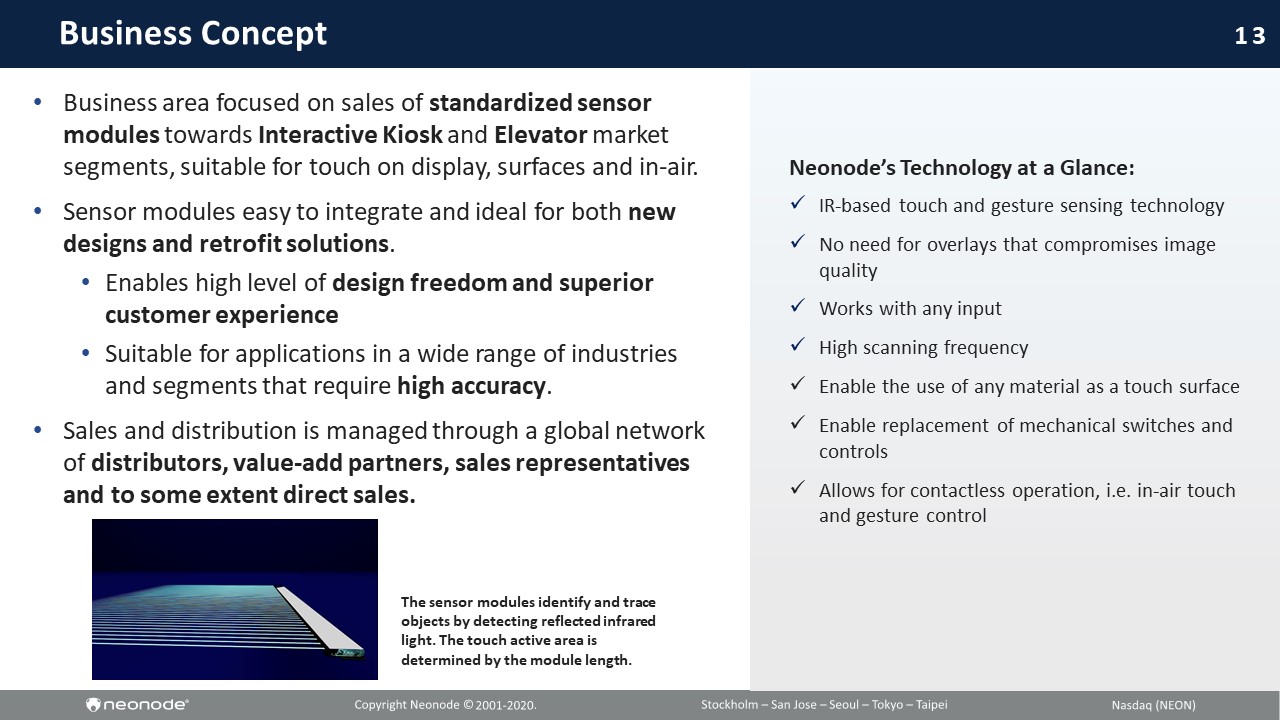

13 x IR - based touch and gesture sensing technology x No need for overlays that compromises image quality x Works with any input x High scanning frequency x Enable the use of any material as a touch surface x Enable replacement of mechanical switches and controls x Allows for contactless operation, i.e. in - air touch and gesture control Neonode’s Technology at a Glance: Business Concept • Business area focused on sales of standardized sensor modules towards Interactive Kiosk and Elevator market segments, suitable for touch on display, surfaces and in - air. • Sensor modules easy to integrate and ideal for both new designs and retrofit solutions . • Enables high level of design freedom and superior customer experience • Suitable for applications in a wide range of industries and segments that require high accuracy . • Sales and distribution is managed through a global network of distributors, value - add partners, sales representatives and to some extent direct sales. The sensor modules identify and trace objects by detecting reflected infrared light. The touch active area is determined by the module length.

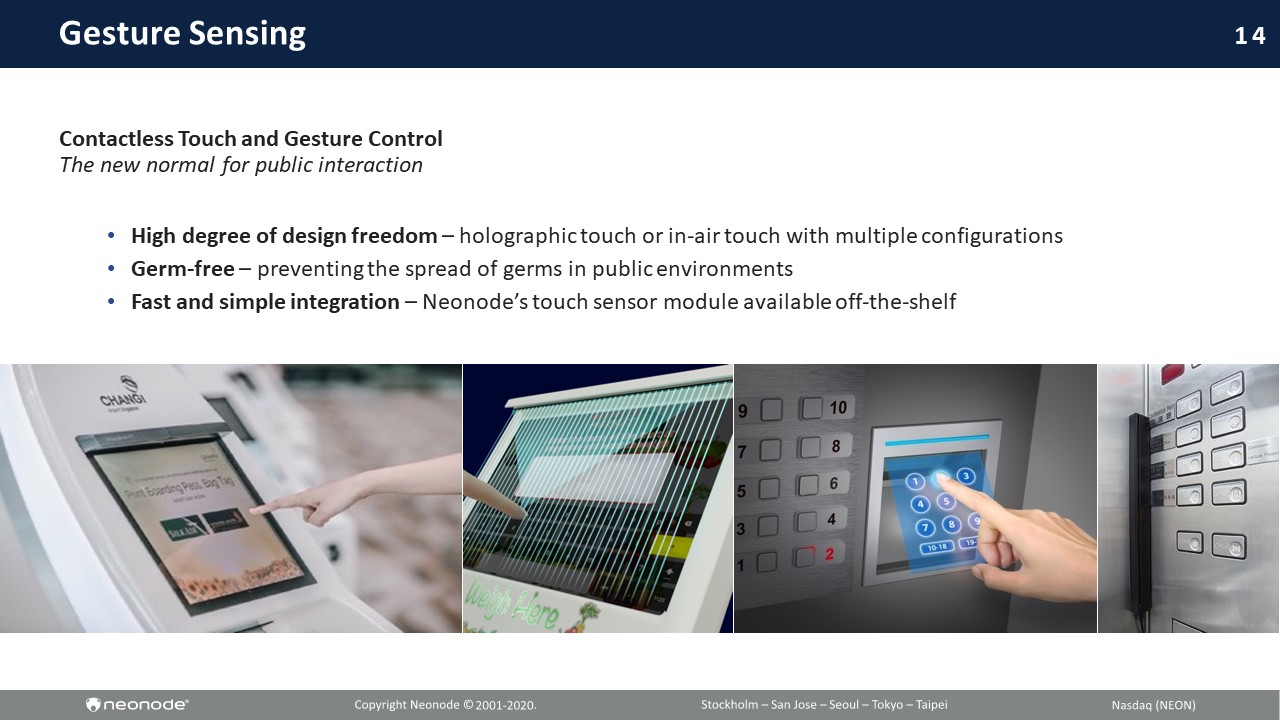

14 Gesture Sensing Contactless Touch and Gesture Control The new normal for public interaction • High degree of design freedom – holographic touch or in - air touch with multiple configurations • Germ - free – preventing the spread of germs in public environments • Fast and simple integration – Neonode’s touch sensor module available off - the - shelf

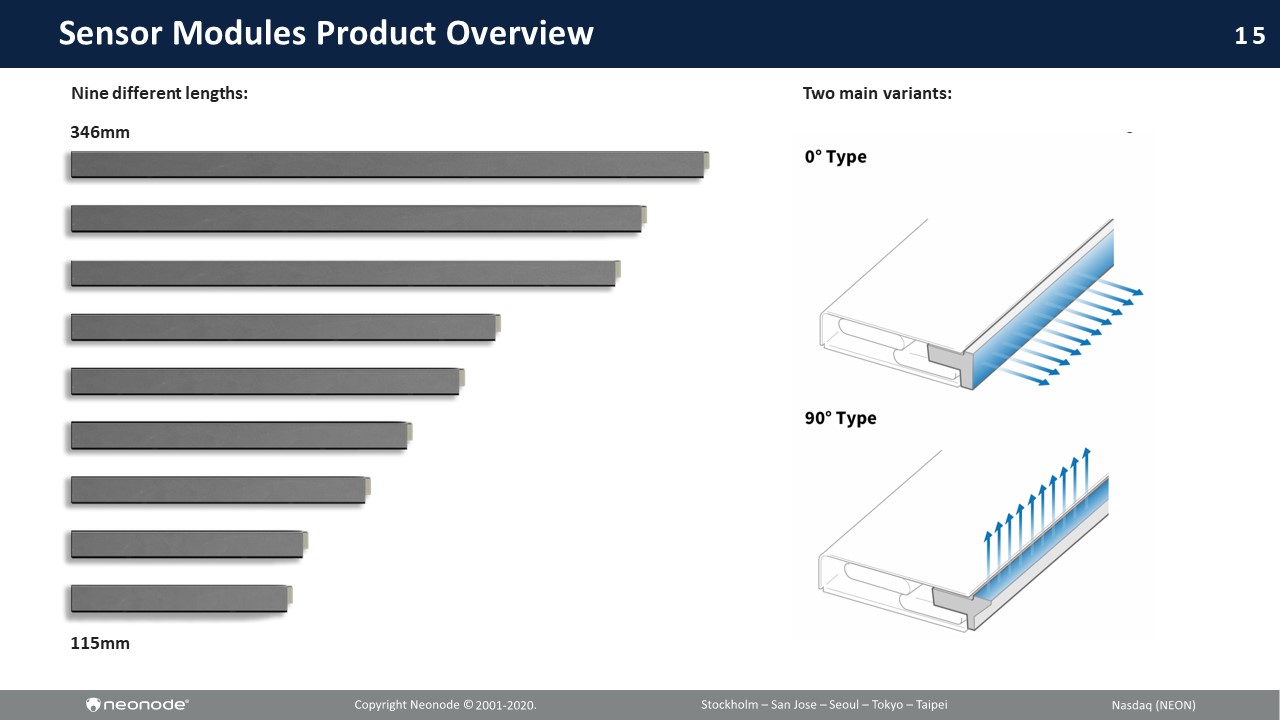

15 Sensor Modules Product Overview 115mm 346mm Nine different lengths: Two main variants :

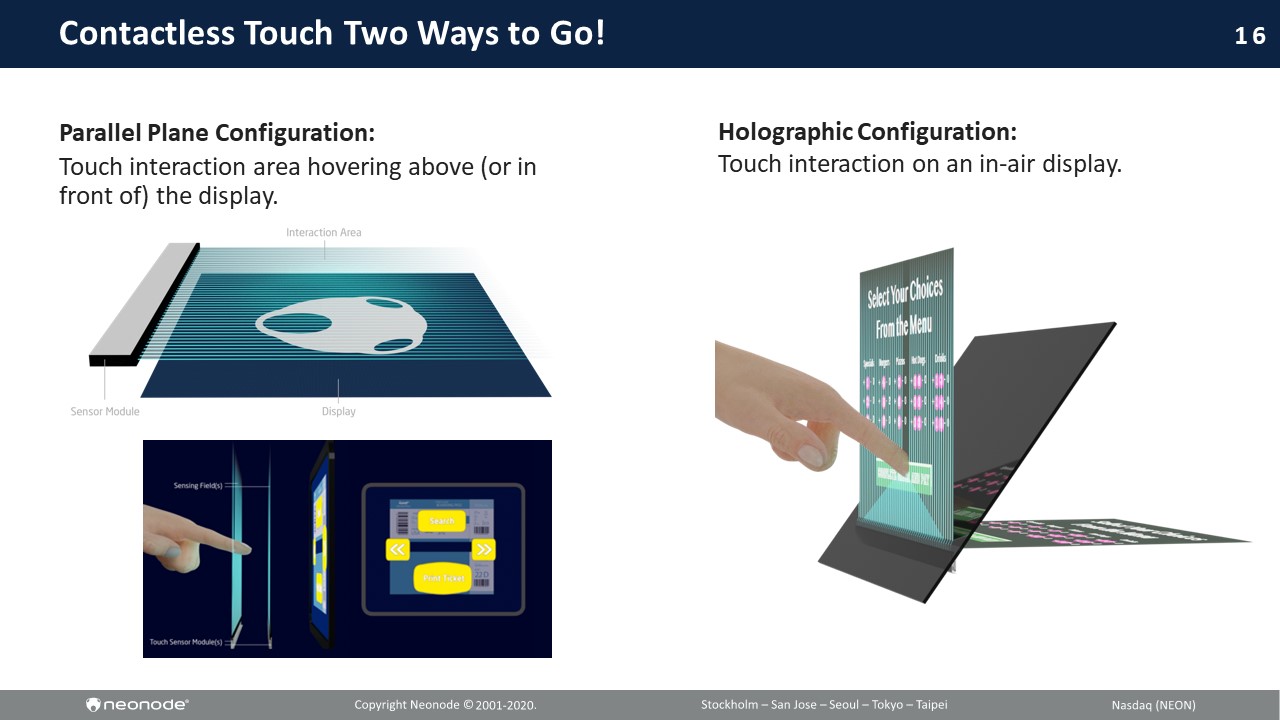

16 Contactless Touch Two Ways to Go! Parallel Plane Configuration: Touch interaction area hovering above (or in front of) the display. Holographic Configuration: Touch interaction on an in - air display.

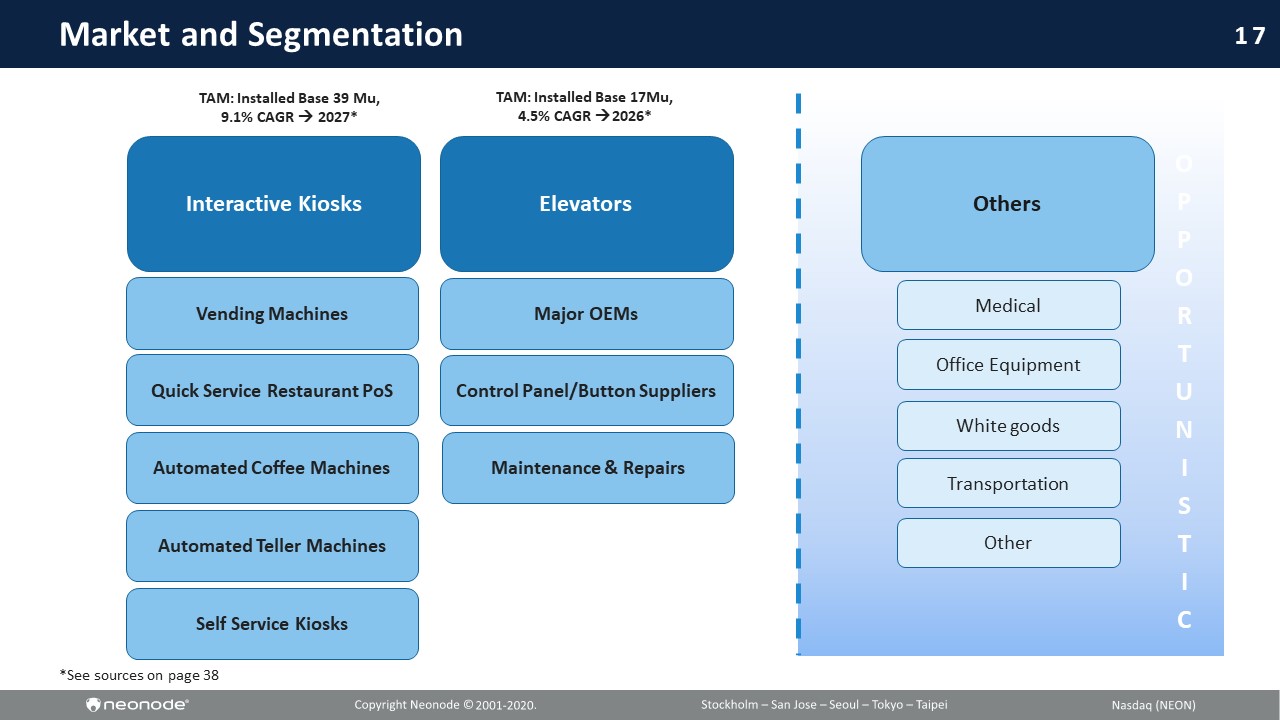

17 Medical Office Equipment Market and Segmentation Interactive Kiosks Elevators Others Vending Machines Quick Service Restaurant PoS Transportation White goods Other Major OEMs Control Panel/ Button Suppliers TAM: Installed Base 39 Mu, 9.1% CAGR 2027* TAM: Installed Base 17 Mu, 4.5% CAGR 2026* O P P O R T U N I S T I C Automated Coffee Machines Automated Teller Machines Self Service Kiosks Maintenance & Repairs *See sources on page 38

18 Interactive Kiosks Market* * See sources on page 38 * * Based on number of commercial airports (17,678), 80% of airports have self check - in kiosks and assume 50 kiosks per airport in average. 6. Self checkout 5. Self Check - in 4. ATMs 3. Quick Service Restaurants 2. Automatic Coffee Dispensing Machines 1. Vending Machines 4. Automated Teller Machines China, the United States, Japan, Brazil and India: >50% of all units. All except India are in decline. Growth in developing markets. Units (2019): 3.2M CAGR 0% 5. Self Check - in** North America and Europe > 50% Units (2019): 700K CAGR 12% 6. Self Checkout Units (2019): 400K CAGR 14% 1. Vending Machines North America is largest market Asia - Pacific has largest CAGR Units (2019): 15M CAGR 11% 2. Automated Coffee Machines Asia - Pacific & North America are the largest markets. Middle East, Africa, and South America expected to expand rapidly. Units (2019): 10M CAGR 4.6% 3. Quick Service Restaurants ( PoS )* North America & Europe largest markets, Asia - Pacific largest CAGR Units (2019):10M CAGR 13%

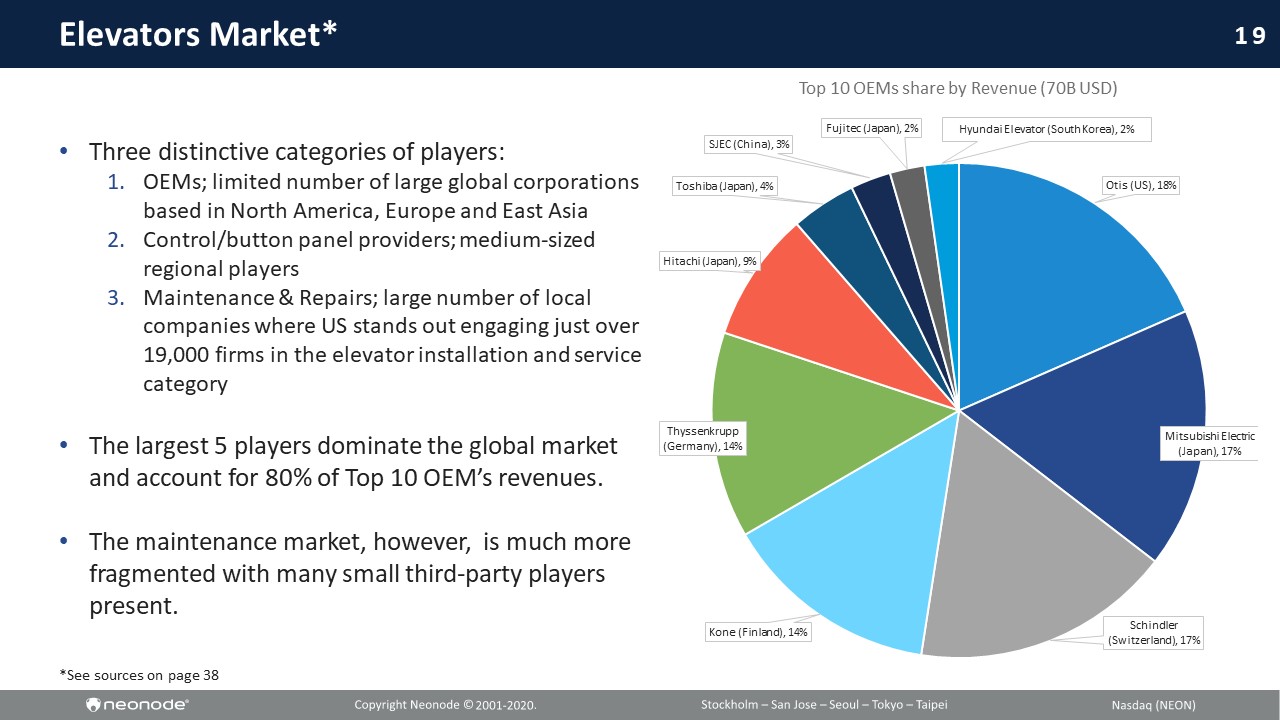

19 Elevators Market* • Three distinctive categories of players: 1. OEMs; limited number of large global corporations based in North America, Europe and East Asia 2. Control/button panel providers; medium - sized regional players 3. Maintenance & Repairs; large number of local companies where US stands out engaging just over 19,000 firms in the elevator installation and service category • The largest 5 players dominate the global market and account for 80% of Top 10 OEM’s revenues. • The maintenance market, however, is much more fragmented with many small third - party players present. Otis (US) , 18% Mitsubishi Electric (Japan) , 17% Schindler (Switzerland) , 17% Kone (Finland) , 14% Thyssenkrupp (Germany) , 14% Hitachi (Japan) , 9% Toshiba (Japan) , 4% SJEC (China) , 3% Fujitec (Japan) , 2% Hyundai Elevator (South Korea) , 2% Top 10 OEMs share by Revenue ( 70B USD) *See sources on page 38

20 Partner Network Distributors Value - added Resellers Other Partners

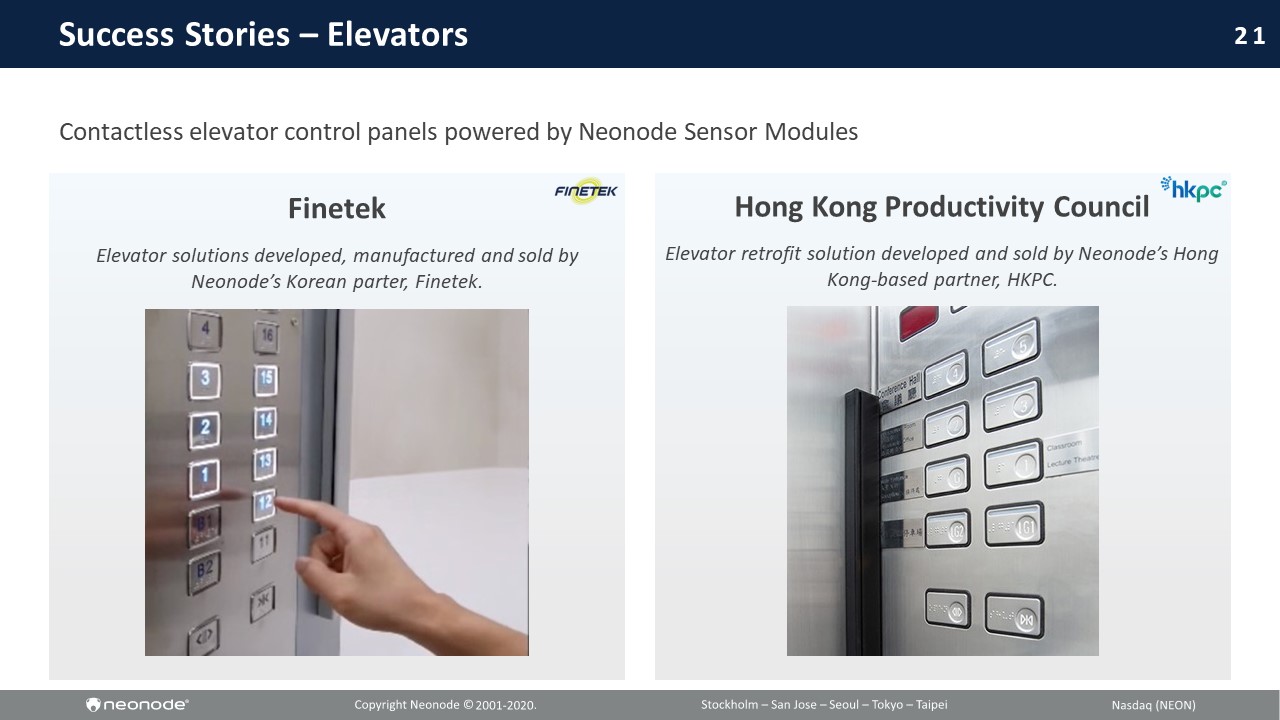

21 Hong Kong Productivity Council Elevator retrofit solution developed and sold by Neonode’s Hong Kong - based partner, HKPC. Success Stories – Elevators Finetek Elevator solutions developed , manufactured and sold by Neonode’s Korean parter, Finetek . Contactless elevator control panels powered by Neonode Sensor Modules

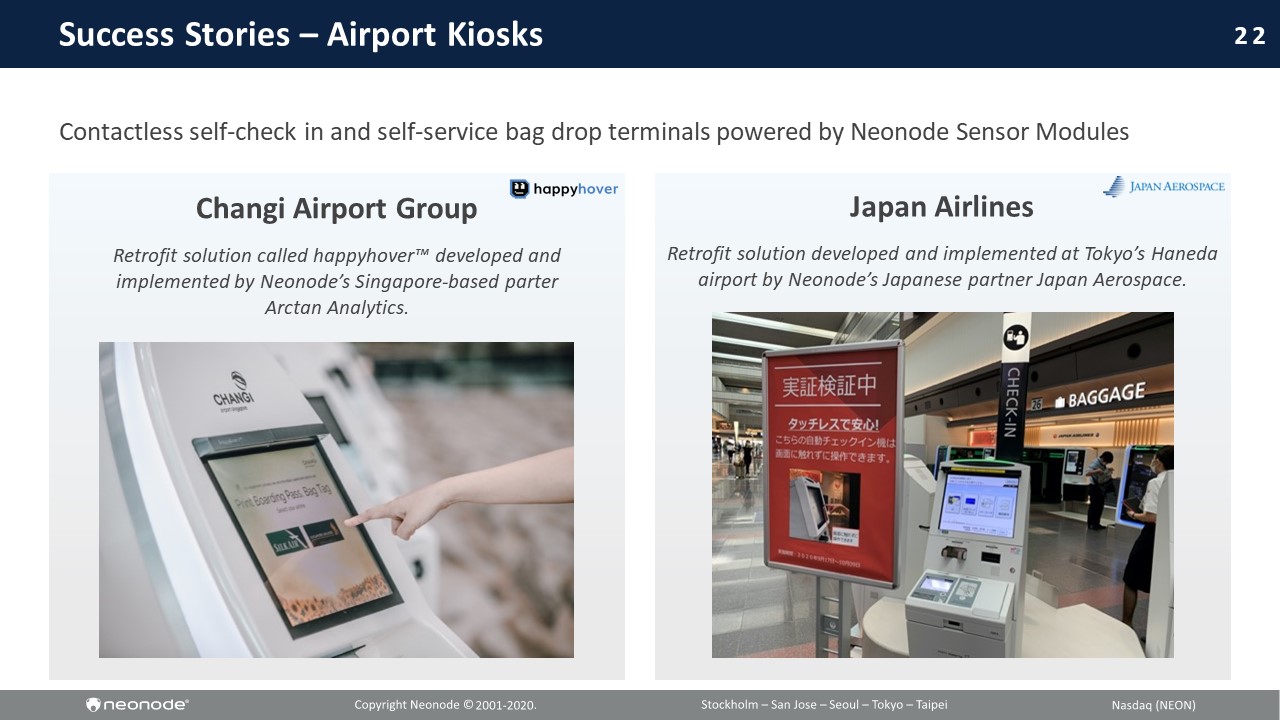

22 Japan Airlines Retrofit solution developed and implemented at Tokyo’s Haneda airport by Neonode’s Japanese partner Japan Aerospace. Success Stories – Airport Kiosks Changi Airport Group Retrofit solution called happyhover Ρ developed and implemented by Neonode’s Singapore - based parter Arctan Analytics . Contactless self - check in and self - service bag drop terminals powered by Neonode Sensor Modules

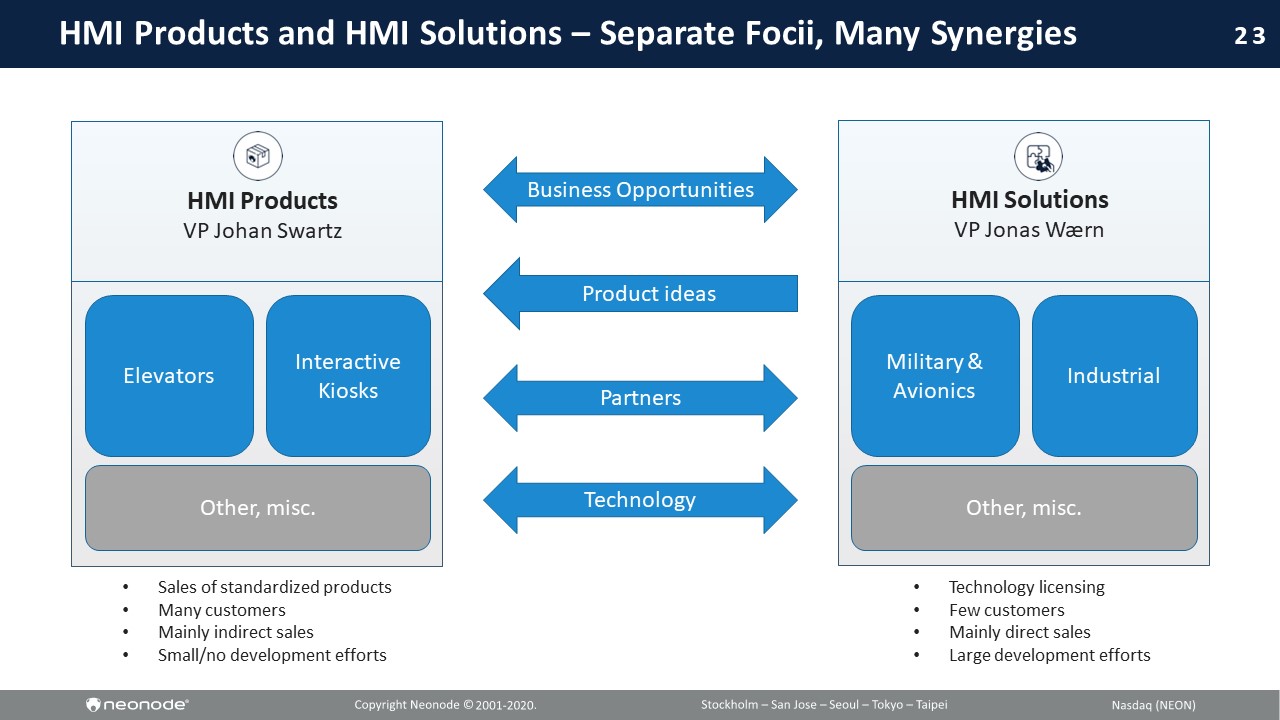

23 HMI Products and HMI Solutions – Separate Focii , Many Synergies HMI Solutions VP Jonas Wærn Military & Avionics Industrial Other , misc . HMI Products VP Johan Swartz Elevators Interactive Kiosks Other , misc . Product ideas Partners Technology • Sales of standardized products • Many customers • Mainly indirect sales • Small/no development efforts • Technology licensing • Few customers • Mainly direct sales • Large development efforts Business Opportunities

24 Business Area – Remote Sensing Solutions Focuses on driver and in - cabin monitoring in vehicles . Addressing the need for robust, cost - effective driver and in - cabin monitoring systems that enable OEMs to be compliant with the new EU general safety regulations (GSR) and meet the Euro NCAP guidelines, applicable for all new vehicles from 2024 .

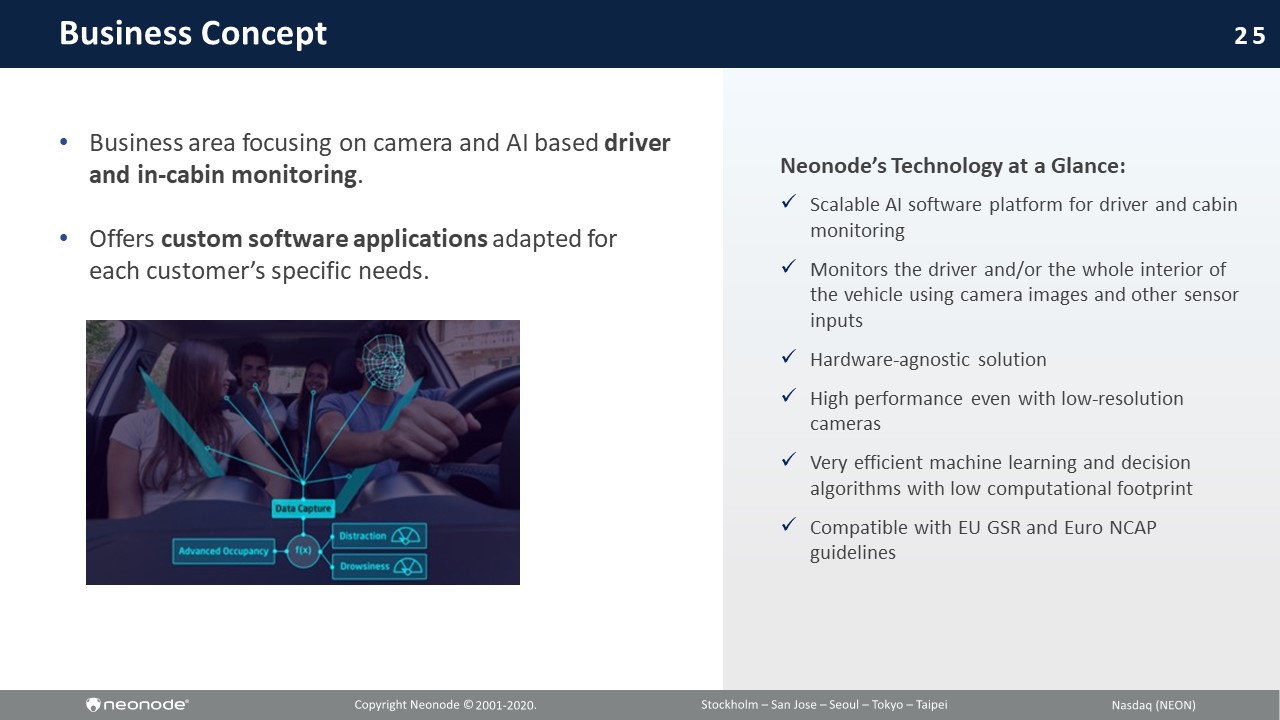

25 Business Concept • Business area focusing on camera and AI based driver and in - cabin monitoring . • Offers custom software applications adapted for each customer’s specific needs. Neonode’s Technology at a Glance: x Scalable AI software platform for driver and cabin monitoring x M onitors the driver and/or the whole interior of the vehicle using camera images and other sensor inputs x Hardware - agnostic solution x High performance even with low - resolution cameras x Very efficient machine learning and decision algorithms with low computational footprint x Compatible with EU GSR and Euro NCAP guidelines

26 • Scalable – Fits many different applications and supports different features and performance levels • Hardware agnostic – The software can be integrated and run on different processor units and use different types of input signals • Low computational footprint – Supports low - cost system designs • Increases safety – Compliant with the new EU general safety regulations (GSR) and meets the Euro NCAP guidelines, applicable for all new vehicles from 2024 MultiSensing Neonode’s MultiSensing software platform a ddresses the need for robust, cost - effective driver and in - cabin monitoring systems

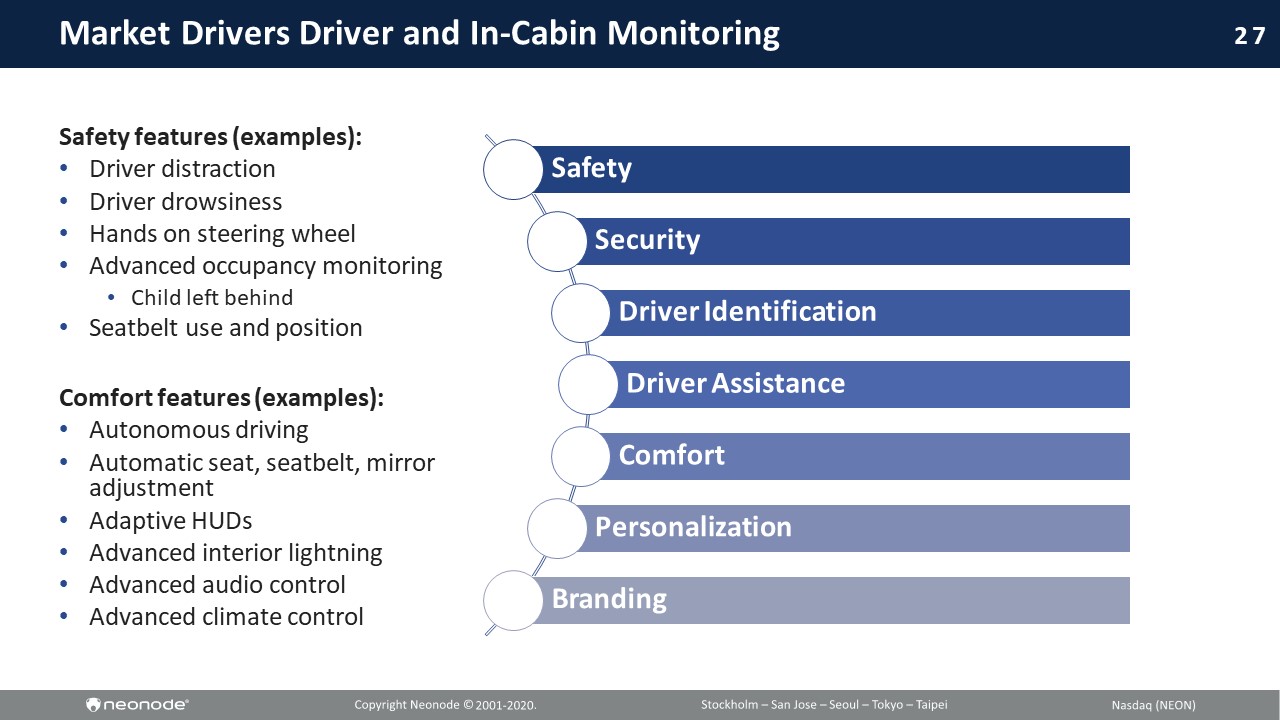

27 Market Drivers Driver and In - Cabin Monitoring Safety features (examples): • Driver distraction • Driver drowsiness • Hands on steering wheel • Advanced occupancy monitoring • Child left behind • Seatbelt use and position Comfort features (examples): • Autonomous driving • Automatic seat, seatbelt, mirror adjustment • Adaptive HUDs • Advanced interior lightning • Advanced audio control • Advanced climate control Safety Security Driver Identification Driver Assistance Comfort Personalization Branding

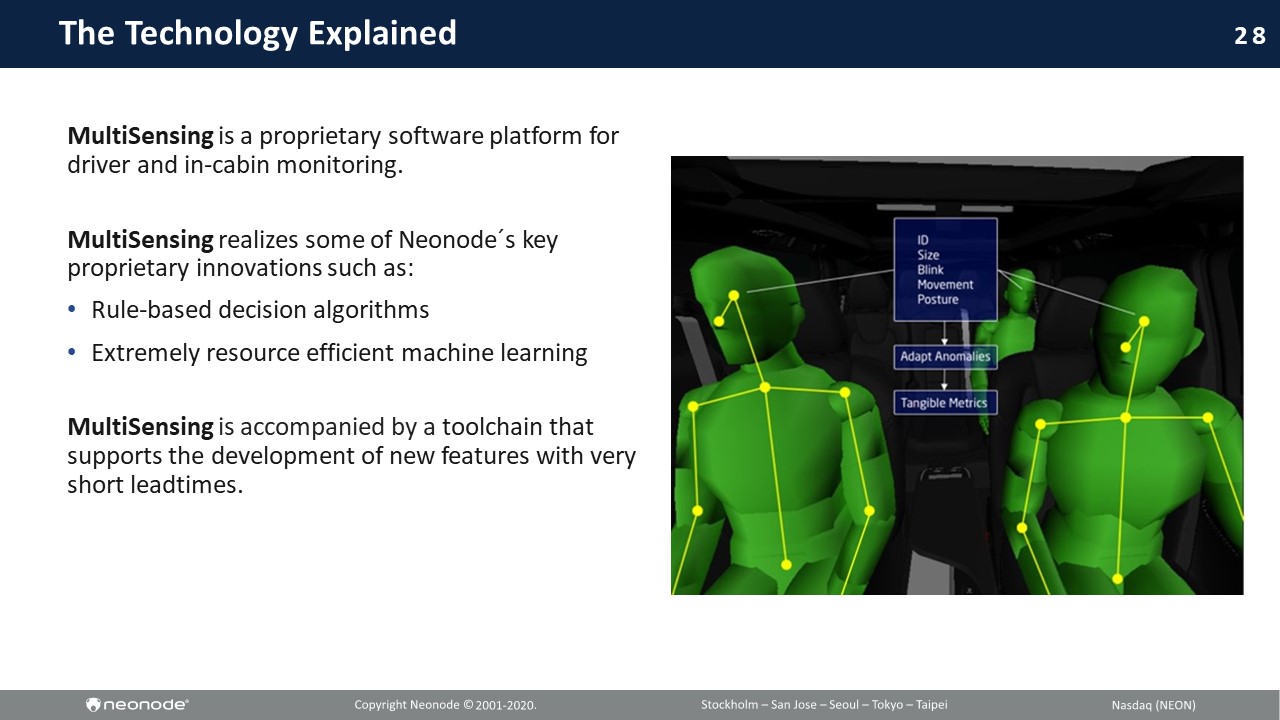

28 The Technology Explained MultiSensing is a proprietary software platform for driver and in - cabin monitoring. MultiSensing realizes some of Neonode Dz s key proprietary innovations such as: • Rule - based decision algorithms • Extremely resource efficient machine learning MultiSensing is accompanied by a toolchain that supports the development of new features with very short leadtimes .

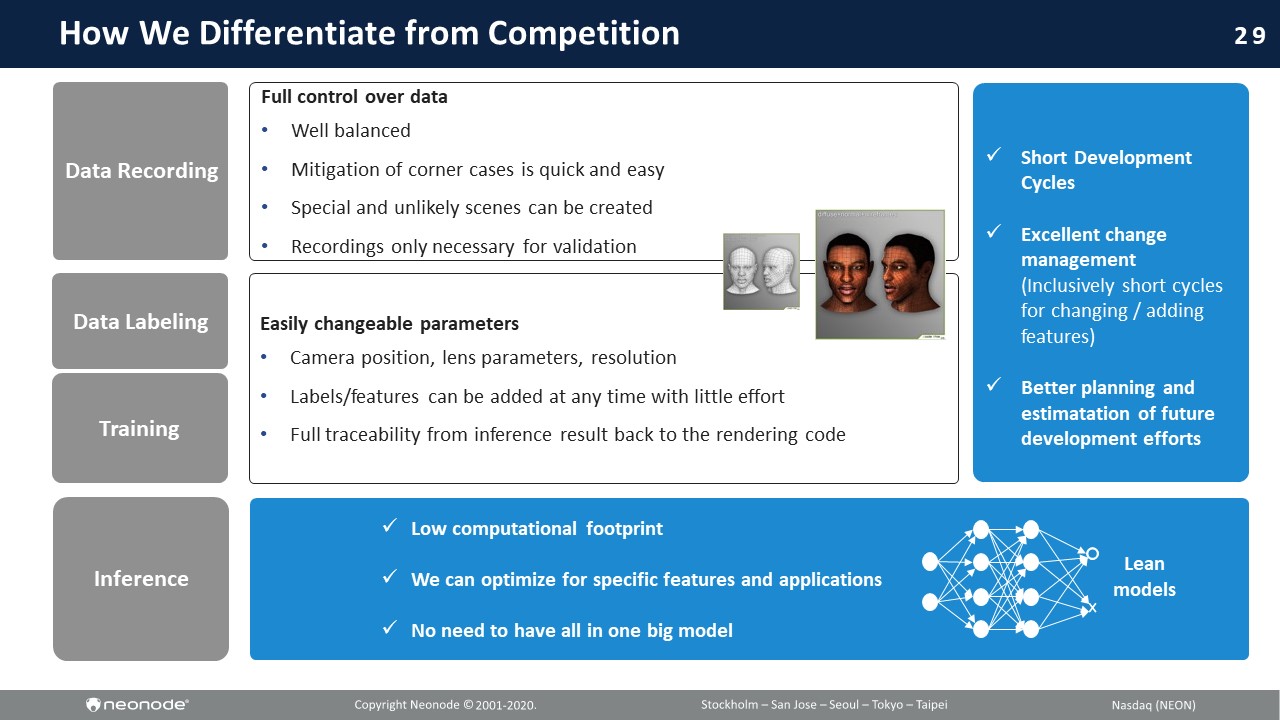

29 How We Differentiate from Competition Data Recording Data Labeling Training Inference x Short Development Cycles x Excellent change management (Inclusively short cycles for changing / adding features) x Better planning and estimatation of future development efforts x Low computational footprint x We can optimize for specific features and applications x No need to have all in one big model Full control over data • Well balanced • Mitigation of corner cases is quick and easy • Special and unlikely scenes can be created • Recordings only necessary for validation Easily change able parameters • C amera position , l ens parameters , resolution • L abels/ f e a t u r e s can be added at any time with little effort • Full traceability from inference result back to the rendering code Le a n m o d e l s

30 Financial Update Third Quarter 2020

31 Q3 2020 Summary • Revenues of $1.5M compared to $1.3M in Q3 2019 • Increase driven by product sales • Operating expenses of $3.0M compared to $2.4M in Q3 2019 • Operating expenses includes one - time costs • Operating loss $1.7M compared to $1.2M loss in Q3 2019 (Operating loss flat excluding litigation costs) • Revenues up by 14.1% compared to same quarter 2019 • Operating expenses up by 24.8% compared to same quarter 2019 0 500 1,000 1,500 2,000 2,500 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenues License Revenues NRE Revenues Product Revenues -3,000 -2,500 -2,000 -1,500 -1,000 -500 0 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Operating Loss

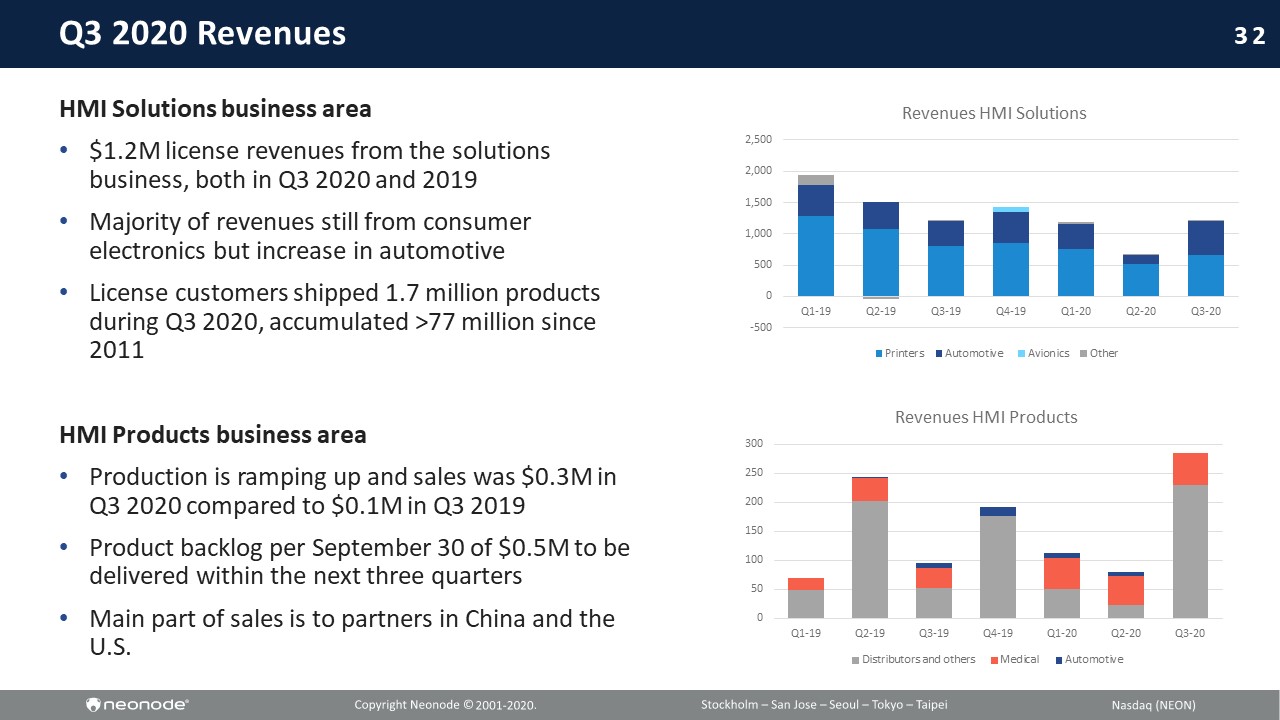

32 Q3 2020 Revenues HMI Solutions business area • $1.2M license revenues from the solutions business, both in Q3 2020 and 2019 • Majority of revenues still from consumer electronics but increase in automotive • License customers shipped 1.7 million products during Q3 2020, accumulated >77 million since 2011 HMI Products business area • Production is ramping up and sales was $0.3M in Q3 2020 compared to $0.1M in Q3 2019 • Product backlog per September 30 of $0.5M to be delivered within the next three quarters • Main part of sales is to partners in China and the U.S. -500 0 500 1,000 1,500 2,000 2,500 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenues HMI Solutions Printers Automotive Avionics Other 0 50 100 150 200 250 300 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenues HMI Products Distributors and others Medical Automotive

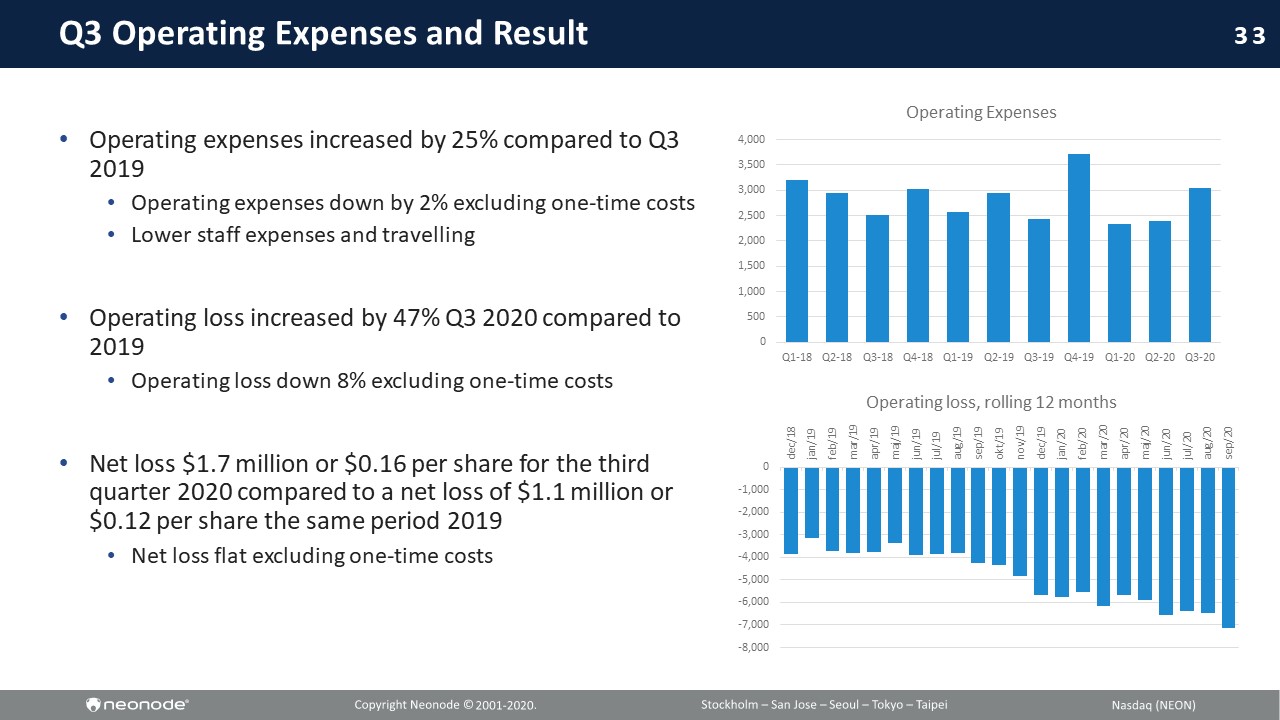

33 Q3 Operating Expenses and Result • Operating expenses increased by 25% compared to Q3 2019 • Operating expenses down by 2% excluding one - time costs • Lower staff expenses and travelling • Operating loss increased by 47% Q3 2020 compared to 2019 • Operating loss down 8% excluding one - time costs • Net loss $1.7 million or $0.16 per share for the third quarter 2020 compared to a net loss of $1.1 million or $0.12 per share the same period 2019 • Net loss flat excluding one - time costs 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Operating Expenses -8,000 -7,000 -6,000 -5,000 -4,000 -3,000 -2,000 -1,000 0 dec/18 jan/19 feb/19 mar/19 apr/19 maj/19 jun/19 jul/19 aug/19 sep/19 okt/19 nov/19 dec/19 jan/20 feb/20 mar/20 apr/20 maj/20 jun/20 jul/20 aug/20 sep/20 Operating loss, rolling 12 months

34 Cash • Net cash used in operating activities during Q3 2020 increased by $0.4M compared to same period last year due to increase in net loss • Cash and accounts receivables of $13.3M per end of September • Still sufficient cash to execute on the business plan -2000 -1800 -1600 -1400 -1200 -1000 -800 -600 -400 -200 0 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Net cash used in operating activities 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Cash balance

35 Highlights • Our zForce technology – patent protected – is an enabling technology ideally positioned to solve for a lifestyle shift to contactless touch solutions brought on by COVID - 19 • High demand for contactless touch solutions – enormous market opportunity to integrate Neonode technology into new and retrofitted equipment , for instance in » Interactive kiosks ( ticketing , vending , self checkout in retail , ATMs etc.) – engaged in cooperations and discussions with several OEMs and value - added partners » Elevators – several customers and value - added partners have developed solutions and secured agreements for retrofitting , engaged in discussions with several OEMs • We also see significant interest for our zForce and MultiSensing technologies from customers in the avionics and industrial control system industries and the automotive industry, respectively • We have adequate cash resources needed to accelerate growth and capitalize on current and future opportunities • The focus the coming 12 - 18 months is on execution

36 Appendices

37 Sources to Market Intelligence on Pp. 10 - 11 Industrial and Military & Avionics https://www.prnewswire.com/news - releases/industrial - display - market - size - worth - 726 - billion - by - 2025 -- cagr - 6 - grand - view - research - in c - 643682123.html https://www.researchandmarkets.com/reports/4655830/glass - cockpit - for - aerospace - global - market https://www.marketsandmarkets.com/Market - Reports/commercial - avionic - system - market - 138098845.html https://www.prnewswire.com/news - releases/industrial - display - market - size - worth - 726 - billion - by - 2025 -- cagr - 6 - grand - view - research - in c - 643682123.html https://www.researchandmarkets.com/reports/4655830/glass - cockpit - for - aerospace - global - market

38 Sources to Market Intelligence on Pp. 17 - 19 Elevators https://www.statista.com/statistics/281177/net - sales - of - otis/ https://www.marketscreener.com/quote/stock/HYUNDAI - ELEVATOR - CO - LTD - 20699232/financials/ https://www.mitsubishielectric.com/en/investors/highlights/segment/index.html https://markets.businessinsider.com/news/stocks/hitachi - s - elevator - and - escalator - production - and - sales - in - 2019 - both - surpass - 100k - unit - milestone - 1028784482# https://www.toshiba.co.jp/about/ir/en/finance/ar/ar2019/tfr2019e.pdf https://www.fujitec.com/common/fjhp/doc/top_global/document/irarchive/204 4/fujitec_E - 2019_ 見開き _200722. pdf https://www.schindler.com/com/internet/en/investor - relations/_jcr_content/contentPar/downloadlist_0_m/downloadList/4_1534477 322382.download.asset.4_1534477322382/2019 - schindler - annual - report - fb - e.pdf https://www.statista.com/statistics/246289/revenue - of - kone/ https://d2zo35mdb530wx.cloudfront.net/_legacy/UCPthyssenkruppAG/assets.fil es/media/investoren/berichterstattung - publikationen/update - 21.11.2019/en/thyssenkrupp - gb - 2018 - 2019 - en - web_neu.pdf https://www.investing.com/equities/sjec - corporati - financial - summary Interactive Kiosks https://www.rbrlondon.com/research/retail - hardware/ https://www.aeronewstv.com/en/lifestyle/in - your - opinion/2954 - how - many - commercial - airports - are - there - in - the - world.html https://data.worldbank.org/indicator/FB.ATM.TOTL.P5 https://thewebminer.com/blog/how - many - restaurants - are - in - the - world/ https://www.futuremarketinsights.com/reports/automatic - coffee - machines - market https://www.businesswire.com/news/home/20200326005348/en/Connecte d - Vending - Machines - Industry - Outlook - 2024 -- https://medium.com/@CravyHQ/the - restaurant - industry - a - global - perspective - 26cea1b91701 https://financesonline.com/number - of - restaurants - in - the - us/ https://www.kioskmarketplace.com/news/self - service - bag - check - in - market - to - grow - more - than - 12 - percent - new - report - says/ https://www.zionmarketresearch.com/report/automatic - coffee - machines - market https://www.globenewswire.com/news - release/2020/06/12/2047221/0/en/The - Global - Vending - Machine - Market - is - expected - to - grow - by - USD - 9 - 82 - bn - during - 2020 - 2024 - progressing - at - a - CAGR - of - 11 - during - the - forecast - period.html

Thank You info@neonode.com neonode.com