Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Customers Bancorp, Inc. | cubi-20201110.htm |

Q3 2020 Update • Q3 pro forma core revenue of $18.2mm, represents 19.5% YoY growth Q3 Financial Overview • Q3 pro forma core EBITDA of $3.6mm • YTD pro forma core EBITDA of $2.0mm • Q3 End of Period (EOP) serviced deposits rise to $944mm, represents 42% YoY growth • Q3 Card Spend of $741mm, represents 24% YoY growth • Strong growth in new businesses (White Label & Workplace) with rapidly improving account metrics Strong Growth • 150K new accounts LTM (9/30/20) • EOP serviced deposit balances up ~150% per account YoY • Quarterly Card Spend per account increased 60% YoY • Expect 99.7% retention of disbursement services by campuses this year Higher Ed • NACUBO reports that more than half of higher ed institutions are offering remote options for some or all Business Adapts classes, impacting the amount of students on campus (1) • Disbursement dollars are highly persistent as Aug. & Sept. down only ~1.6% YoY ($2.87B vs $2.91B) while YTD to COVID serviced organic deposits have grown 32% and end of period Q3 serviced deposits are up 8% YoY • Corporate restructuring, implementation of automation projects, and vendor negotiations lead to Continued focus on projected $1.7mm of Q4 savings and annualized $7mm of savings starting in 2021 • Expected realization of $10mm annualized expense savings in 2020 resulting from vendor negotiations Operating Leverage and contract restructurings in 2019 • T-Mobile Money product has been extended to the entire Sprint customer base • Officially launched Workplace Banking vertical in Q3 with BenefitHub, one of the largest HR benefits Other Key Developments marketplaces with access to over 6 million potential customers • Hired Jamie Donahue as Chief Digital Officer. Jamie was formerly Head of Cloud Architecture, Engineering & Delivery at Finastra. Note: Q3 2020 financials are still preliminary 1) NACUBO Flash Poll: Fall 2020 Institutional Plans; NACUBO is National Association of College and University Business Officers | 5

Where Does BankMobile Technologies Stand Today? Delivering Full-Featured Digital Banking Platform to Large Scale Non-Bank Partners One of America’s Largest Digital Expert in B2B2C Banking… …Award Winning Banking Technology, Banking Platforms… Focused on Banking Services for Millennials & Middle Income Americans… Over 2M accounts (1) Proprietary Banking-as-a-Service (“BaaS”) Customer-centric approach technology ~300K accounts opened annually (2) Provides an affordable, easy-to-use product Allows for greater speed and cost effectiveness in ~$944M in serviced deposits as of 9/30/20 Simplifies banking for the consumer bank roll out for partners $49M in pro forma core revenue YTD Creates customers for life with full suite of High-volume, low-cost customer acquisition banking products, including checking, $2.0M YTD pro forma core EBITDA (3) model savings, personal loans, credit cards and Serves ~1 in 3 U.S. students on approximately 725 student refinancing campuses (4) Creates attractive returns Launched partnership with T-Mobile via the T- Mobile MONEY checking account Planned 2021 launch of digital bank account with Google Pay 1) Data as of 9/30/2020 4) Based on market share for Signed Student Enrollments (“SSEs”) (the number of students enrolled at higher-ed institutions); Assumes ~3M SSEs are considered non-addressable 2) Per BankMobile management (beauty schools, trucking schools, etc.); Data per BankMobile’s internal sales database and estimated student market size and National Center for Education Statistics “Enrollment 3) EBITDA is a Non-GAAP financial measure; see page 45 and 46 for reconciliations to Non- | 6 and Employees in Postsecondary Institutions, Fall 2015; Financial Statistics Academic Libraries, Fiscal Year 2015”, February 2017 GAAP financial measures and disclaimers on forward looking financials

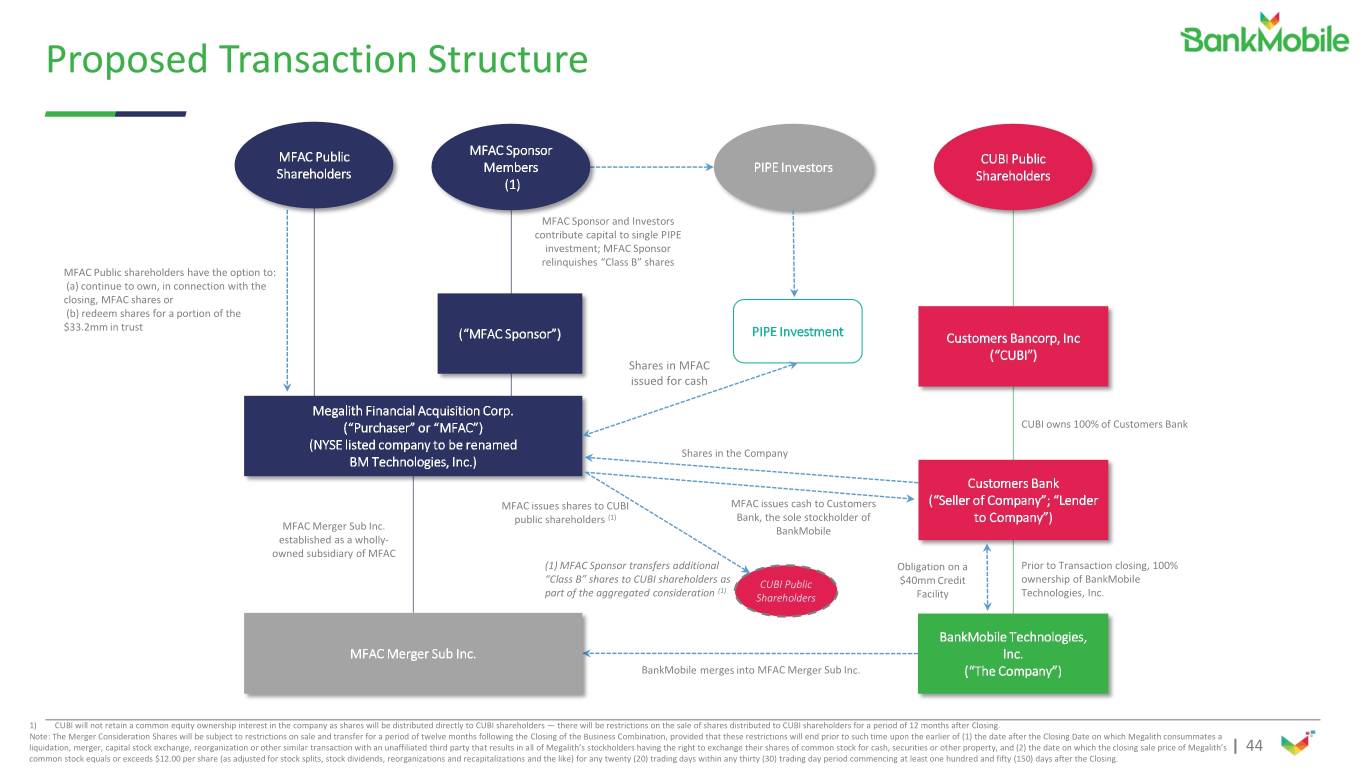

BankMobile Evolving into a Premier Brand . Megalith Financial Acquisition Corp (NYSE: MFAC) has entered into a definitive agreement to acquire BankMobile Transaction Structure (1) Technologies . This transaction is subject to customary regulatory approvals . Transaction valued at an implied post-money enterprise value of $140mm (2), which equates to (3) Valuation 1.3x multiple on 2021E Revenue of $104.0mm 6.5x multiple on 2021E EBITDA of $21.5mm (3) . Transaction to be funded through a combination of MFAC common stock, cash held in the MFAC trust account, (2) Cap Structure & Leverage proceeds received from newly issued shares through a PIPE transaction and assumed debt of $40mm . Pro forma net leverage of 3.5x based upon 2020E pro forma core EBITDA of $3.8mm (3)(4) . MFAC public equity investors (original SPAC investors) are expected to own 28.3% of the combined (5) . Shares issued to PIPE Investors are expected to own 25.0% (5) Pro Forma Ownership . Customers Bancorp shareholders are expected to own 46.7% (5) . Customers Bancorp will own 0.0% . MFAC will remain a Delaware corporation, the post-closing company is expected to remain listed on the NYSE American Listing . The public company will be renamed BM Technologies, Inc. 1) See “Proposed Transaction Structure” on slide 44 and “Proposed Capitalization and Ownership” on slide 43 4) Net leverage defined as net debt at closing / 2020E pro forma core EBITDA; See “Reconciliation to Non-GAAP Financial Measures” on slide 47 2) See “Proposed Capitalization and Ownership” on slide 43 for calculation; Reflects debt prior to partial paydown from cash in MFAC’s trust account 5) See ownership table on slide 43 “Proposed Capitalization and Ownership”; Assumes the full $33.2 million cash held in the trust account by MFAC related to 3) Pro forma core revenue and EBITDA are set forth on “Income Statement History and Forecast“ and “Reconciliation to Non-GAAP Financial existing MFAC public stockholders will not be redeemed upon Transaction closing, shares will remain outstanding and cash will be available for use in the | 11 Measures” on slides 23, 33 and 46, respectively Transaction; includes aggregate PIPE investment of $20.0mm; See slide 43 for material assumptions

Transaction Background Why is BankMobile Technologies (“BMT”) Being Divested? Why is BMT Positioned as an Independent Company? 1 Customers Bank (“CUBI”) is divesting BMT 2 Transaction Related 3 Independent Platform Better Positioned Reasons for Divestment BMT - A standalone company Benefits to the pro forma company . Remove Growth Constraints overlaid by parent A. “Durbin Fee Challenge” 1) Customers is divesting BankMobile Technologies . Aligns management, board and investors primary focus 2) BMT will also have debt outstanding held by CUBI in without distraction of other businesses B. Realigned Priorities & Focus amount of $40(1) million; which is also part of the purchase price paid (it is BM Technologies Inc.’s . Enables BMT to more easily develop new bank partners C. Regulation intention to pay off the debt as soon as possible) who will enable BMT to offer credit and other financial products to existing customers. 3) Customers will contractually agree to provide the A. BankMobile Technologies (“BMT”), a subsidiary of same Deposit Related Fees and Durbin Exempt . Enables BMT to be a technology provider to other Customers Bank (“Customers”), will be subject to Interchange Rate (Fees) through 2022 to enable BMT chartered banks reduced interchange income if it remains wholly-owned a stable “runway” of revenue while BMT establishes by CUBI, due to the Durbin Amendment (part of Dodd- additional bank partnerships to replace CUBI . BMT becomes a stand alone FinTech company with its Frank banking reform of 2011). When a bank crosses own capital sources and sector valuation metrics; and $10b in assets on December 31st, it becomes subject to 4) CUBI will have no role on management and no seats the Durbin Amendment, and interchange income is on the board of the pro forma company not governed by bank valuations significantly reduced. Customers is now subject to the . Better positioned to capitalize on trends away from Durbin Amendment. 5) CUBI will not retain a common equity ownership interest in the company as shares will be distributed branch-based banking B. Customers Bancorp (“CUBI”) has made recent strategic directly to CUBI shareholders — there will be decisions to focus on its largest commercial lending lines restrictions on the sale of shares distributed to CUBI of business. BMT is a smaller operating unit which shareholders for a period of 12 months after focuses on retail deposit customers and retail banking- Closing(2) as-a-service (BaaS); BMT does not fit CUBI’s core commercial banking focus and is being divested. 6) A limited Transition Services Agreement will be signed prior to closing C. From a regulatory and business focus point of view, CUBI wishes to be a “Business oriented Community Bank.” See Proposed Capitalization and Ownership and . Proposed Transaction Structure on pages 43 and 44, respectively 1)Reflects debt prior to partial paydown from cash in MFAC’s trust account 2)The Merger Consideration Shares will be subject to restrictions on sale and transfer for a period of twelve months following the Closing of the Business Combination, provided that these restrictions will end prior to such time upon the earlier of (1) the date after the Closing Date on which Megalith consummates a liquidation, merger, capital stock exchange, reorganization or other similar transaction with an unaffiliated third party that results in all of Megalith’s stockholders having the right to exchange their shares of common stock for cash, securities or other property, and (2) the date on | 12 which the closing sale price of Megalith’s common stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations and the like) for any 20 trading days within any 30 trading day period commencing at least 150 days after the Closing.

7 Highly Attractive Business Model Income Statement – Historical & Forecasted Revenue Breakout by Major Categories Historical & Projected Income Statement 2019 Pro Forma Core (1) 2020E 2021E 2022E Interchange and MasterCard incentive income based Pro Forma Core Revenues ($mm) $61.3 $66.9 $104.0 $144.4 Card Revenue on card activity and out-of-network ATM fees Less: Pro Forma Core OpEx (Excl. Deprec. & Amort.) ($mm) 63.6 63.0 82.6 94.1 Pro Forma Core EBITDA ($mm)(2) ($2.2) $3.8 $21.5 $50.3 Less: Interest Expense ($mm) 0.5 1.4 0.6 0.3 Less: Deprec. & Amort. ($mm) 9.3 11.7 14.7 16.7 Deposit Servicing Fee charged to partner bank(s) based on average Fees balances of serviced deposits Pro Forma Core Pre-Tax Income ($mm) ($12.1) ($9.3) $6.2 $33.3 Less: Tax Expense ($mm) 0.0 0.0 1.5 8.0 Pro Forma Core Net Income ($mm) ($12.1) ($9.3) $4.7 $25.3 Account Fees Monthly account fees, wire fees and card Average Serviced Deposits ($mm) $548.5 $743.9 $1,381.4 $2,335.0 replacement fees YoY Growth Average Serviced Deposits 36% 86% 69% Pro Forma Core Revenues 9% 56% 39% Pro Forma Core OpEx (Excl. Depreciation & Amortization) (1%) 31% 14% University Fees Subscription and transactional fees charged to Pro Forma Core EBITDA - 458% 134% colleges based on enrollment size, competitive marketplace and disbursement channels and options Pro Forma Core Net Income - - 442% Various nominal other fees, including fees associated Other Fees with cash deposits Note: 2020 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial projections 1) 2019 financials are shown pro forma for BankMobile’s current deposit servicing and expense agreements with assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and competitive Customers Bank; see page 45 for reconciliations to Pro Forma Core Financials | 23 uncertainties and contingencies, many of which are beyond the control of the Company and its management. 2) EBITDA is a Non-GAAP financial measure; see page 46 for reconciliations to Non-GAAP financial measures

Demonstrating Strong Performance Across Key Metrics Key Performance Indicators – Metrics of Company Success Card Spend Q3 Card Spend YTD EoP Serviced Deposits Organic Deposits YTD Higher Ed Account Interchange Retention Rate YTD 24% 16% 42% 32% 1% 13% $944mm $741mm $2.1bn $1.4bn 98.5% 79bps 99.7% $1.8bn 69bps $597M $666mm $1.1bn Q3' 19 Q3' 20 (1) Q3' 19 Q3' 20 Q3' 19 YTD Q3' 20 YTD Q3' 19 YTD Q3' 20 YTD 3-Year Today Q3' 19 YTD Q3' 20 YTD Trailing Avg. Comments: Strong growth driven by After falling 2% YOY in Growth driven by increase Growth driven by 2020 retention is Decline due to impacts of significant increases in Q1, Debit Card spend in accounts, organic stronger performing tracking above COVID (increase in average both Higher Ed and White grew 32% in Q2 and deposits, and boosted by accounts and boosted by average of trailing 3 ticket size and changing Label 24% in Q3 federal stimulus programs federal stimulus programs years’ retention consumer merchant mix). We expect some positive revision in this rate in 2021 Definition: The aggregate amount of The aggregate amount of Aggregate, end of period Cash inflows to end user Calculated as one minus the Represents the amount of spend on debit cards in Q3 spend on debit cards in Q1- balance of serviced customer deposit accounts, not annual SSE attrition over revenue for each debit card 2020 vs Q3 2019 Q3 2020 vs Q1-Q3 2019 deposits across all business attributable to higher beginning of the year SSE transaction, including interchange lines education disbursements or count maintenance paid by partner white label partner incentive bank, net of network costs, as a % payments of debit spend Note: Q3 2020 financials are still preliminary 1) Management estimate for performance through end of 2020 based on seasonal renewals and performance YTD | 24

Income Statement – Pro Forma Core Historical & Forecasted 2019 Pro Forma Core (1) 2020E 2021E 2022E Pro Forma Core Revenues ($mm) $61.3 $66.9 $104.0 $144.4 Less: Pro Forma Core OpEx (Excl. Deprec. & Amort.) ($mm) 63.6 63.0 82.6 94.1 Pro Forma Core EBITDA ($mm)(2) ($2.2) $3.8 $21.5 $50.3 Less: Interest Expense ($mm) 0.5 1.4 0.6 0.3 Less: Deprec. & Amort. ($mm) 9.3 11.7 14.7 16.7 Pro Forma Core Pre-Tax Income ($mm) ($12.1) ($9.3) $6.2 $33.3 Less: Tax Expense ($mm) 0.0 0.0 1.5 8.0 Pro Forma Core Net Income ($mm) ($12.1) ($9.3) $4.7 $25.3 Average Serviced Deposits ($mm) $548.5 $743.9 $1,381.4 $2,335.0 YoY Growth Average Serviced Deposits 36% 86% 69% Pro Forma Core Revenues 9% 56% 39% Pro Forma Core OpEx (Excl. Depreciation & Amortization) (1%) 31% 14% Pro Forma Core EBITDA - 458% 134% Pro Forma Core Net Income - - 442% Note: 2020 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial projections 1) 2019 financials are shown pro forma for BankMobile’s current deposit servicing and expense agreements with assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and competitive Customers Bank; see page 45 for reconciliations to Pro Forma Core Financials | 33 uncertainties and contingencies, many of which are beyond the control of the Company and its management. 2) EBITDA is a Non-GAAP financial measure; see page 46 for reconciliations to Non-GAAP financial measures

Financial Summary Pro Forma Core Financial Metrics ($ in millions) 2019 Q3 2020 Q3 YoY Chg % 2019Q3 YTD 2020Q3YTD YoY Chg % Commentary Interchange and card revenue $6.7 $7.4 11% $21.8 $20.1 (8%) • Interchange and card revenues declined, despite significant Deposit servicing fees 4.0 5.7 43% 12.4 15.5 26% growth in card spend due to $1mm drop in ATM related revenue and reduced interchange fee rates Account fees 3.0 2.8 (9%) 7.9 8.5 8% • Deposit servicing fees increased, driven by 25% growth in average University fees 1.3 1.3 6% 3.7 4.0 8% deposit balances • University fees benefitted from COVID-related services provided Other 0.3 1.0 NM 0.7 1.3 91% to new, non-subscription clients Pro Forma Core Revenues $15.2 $18.2 20% $46.5 $49.4 6% Pro Forma Core OpEx (Excl. Depr. & Amort.) 13.9 14.7 6% 48.7 47.4 (3%) • 2020 expense levels benefitted from contract optimization initiatives launched in 2019H2 • Additional benefits expected to be realized from operating Pro Forma Core EBITDA $1.4 $3.6 NM ($2.3) $2.0 NM leverage initiatives implemented in October 2020 Less: Interest Expense 0.1 0.4 NM 0.1 1.1 NM • Interest on debt Less: Depreciation & Amortization 3.2 2.6 (18%) 6.1 8.8 45% • Increase in depreciation and amortization expense in 2020 driven Pro Forma Core Pre-Tax Income ($2.0) $0.6 NM ($8.5) ($7.9) NM by launch of white label products and amortization of capitalized development expenses Total Serviced Deposits - EoP $666 $944 42% $666 $944 42% Total Debit Spend $597 $741 24% $1,813 $2,109 16% Source: Company management Note: Q3’20 financial metrics are preliminary and subject to change Note: Refer to Reconciliation to Pro Forma Core Financials on page 45; Growth rates over 150% deemed not meaningful – “NM” | 34

FY 2020 Update COVID Impact of Updated Financials Revenue Growth Returned to Expected Levels After Pandemic Related Slowdown in Early 2020 2020 projections were established at the start of the year. Expectations have been revised based on actual year-to-date experience and updated expectations for the YoY Change in Pro Forma Core Revenues fourth quarter. Management attributes at least $3.8mm of the decline in expected revenues directly to Pre-COVID ‘20 – ’21 Pro Forma 20% 18% COVID: Core Rev Growth Projection: 18% . $2.4 million reduction in interchange revenues reflecting revised net interchange rate of 71 bps, vs. 81 bps in original projection; COVID resulted in shifts in purchase mix and 7% larger average transaction sizes which reduced the effective interchange rate . $1mm impact from delays in implementing new product for white label partnership, primarily due to COVID -6% . $0.4 million estimated impact of COVID on foreign ATM fees from February through April, given the portion ATM usage declines we attribute to COVID Q1 '20 Q2 '20 Q3 '20 EST Q4'20 Estimated revision to EBITDA is approximately $1.5mm despite the impact of COVID-19 2019 Pro Forma Core Beginning of the Year Revised 2020 “Pre-COVID” 2020E Pro Forma Core $61.3 $72.4 $66.9 Revenues ($mm) Pro Forma Core ($2.2) $5.3 $3.8 EBITDA ($mm) Pro forma Core Net ($12.1) ($7.0) ($9.3) Income ($mm) Source: Company management Note: Q3’20 financial metrics are preliminary and subject to change | 35

Investment Thesis Unique Opportunity to Invest in a Premier Brand Positioned for Significant Growth Recognized Rapid Market Best-in-Class Positioned For Strong Market Leader Expansion Digital Bank Significant Growth Financial Profile Among the Largest Sophisticated Planned 2021 Launch ~$66.9M Digital Banking Capabilities of Collaboration with Platforms Google Pay 2020E Pro Forma Core Revenue Higher-Ed Frictionless White-Label Partner 30% Proprietary “BaaS” Onboarding Expansion 2019 - 2021E Pro Forma Core Technology Revenue CAGR White-Label Powerful New White-Label ~$889M Customer Acquisition Partnerships Partner Additions 2020E EoP Serviced Deposits High Volume, Low Cost Acquisition Model Proprietary Distribution Channel 36% Infrastructure and Product Offering Workplace 2020E Avg. Service Deposit Growth Expansion Full Suite of Banking Banking Products Through Dynamic 17% Consumer Data Strategic M&A Partner Banks 2020E Debit Spend Growth | 39

Proposed Capitalization and Ownership Proposed Sources & Uses Analysis Capitalization at Closing Proposed Sources ($mm) Share Price $10.38 CUBI Rollover Equity (1) $54.7 Total Shares Outstanding 11.3 PIPE Proceeds 20.0 Pre-Closing Cash on B/S at MFAC 33.2 BMT Pro Forma Equity Value $117.2 Net Debt at Close (2) 13.4 NWC Adjustment (0.9) BankMobile Excess Cash Net of Reserve Adjustment (3) 5.3 Estimated Transaction Expenses 5.0 Total $126.6 BankMobile Excess Cash Net of Reserve Adjustment (3) 5.3 Proposed Uses ($mm) Adjusted Equity Value $126.6 Cash - Consideration to Equity (1)(4) $31.9 Debt at Close (8) 28.4 Stock Consideration: $10.38 per share (1) 54.7 Cash at Close(9) (15.0) Estimated Transaction Expenses 5.0 Enterprise Value $140.0 Cash to Pro Forma Balance Sheet 10.0 (10) Debt Repayment 11.6 BMT 2020E Pro Forma Core EBITDA ($mm) $3.8 (10) Net Debt at Close (2) 13.4 BMT 2021E Pro Forma Core EBITDA ($mm) $21.5 Total $126.6 BMT 2021E Pro Forma Core Revenue ($mm)(10) $104.0 Proposed Equity Capitalization Summary(1) EV / 2020E Pro Forma Core EBITDA 36.4x Share Count % of Party (millions) Total EV / 2021E Pro Forma Core EBITDA 6.5x MFAC Shareholders (5) 3.2 28.3% EV / 2021E Pro Forma Core Revenue 1.3x PIPE Investors (6) 2.8 25.0% (7) Shares Issued to CUBI Shareholders 5.3 46.7% Total 11.3 100.0% Note: Analysis assumes the full $33.2 million cash held in the trust account by MFAC related to existing MFAC public stockholders will not be redeemed upon Transaction closing, shares will remain outstanding and cash will be available for use in the Transaction Note: Net Working Capital at close is $0.9mm above target level resulting in an upward adjustment to the merger consideration 1) Total non-cash merger consideration to equity includes downward deal value adjustment of $13.4mm related to sponsor equity adjustments, net working capital adjustments and transaction expenses 2) Estimated at closing 12/31/2020; See page 47 “Reconciliation to Non-GAAP Financial Measures” for closing net debt calculation 3) Cash held by BankMobile in excess of $5.0mm will serve as additional cash consideration to Customers Bank; Based on estimated cash at closing of $10.3mm 4) Cash consideration includes $20.0mm of proceeds related to the PIPE offering (net of $5.0mm in estimated transaction expenses), $5.3mm excess cash held by BankMobile at close and an additional $11.6mm of cash held in escrow in MFAC’s trust account 5) Assuming no redemptions for public stockholders 6) Based on total PIPE investment of $20.0mm and MFAC’s share price $10.38; Includes retained founder shares of 0.7m from initial founder investment; Excludes .3m founder shares subject to vesting and forfeiture unless the stock price reaches $15 per share for 20 out of 30 days 7) Reflects total non-cash merger consideration to equity, issuance based on MFAC share price of $10.38 8) Reflects pro forma intercompany debt after partial paydown 9) Includes maximum cash reserve of $5.0mm held by BankMobile and an estimated $10.3mm of cash allocated to BankMobile’s balance sheet by cash held in the trust account by MFAC | 43 10) Pro forma core Revenue and EBITDA set forth on “Income Statement History and Forecast“ and “Reconciliation to Non-GAAP Financial Measures” on slides 33 and 46, respectively

Proposed Transaction Structure MFAC Sponsor MFAC Public CUBI Public Members PIPE Investors Shareholders Shareholders (1) MFAC Sponsor and Investors contribute capital to single PIPE investment; MFAC Sponsor relinquishes “Class B” shares MFAC Public shareholders have the option to: (a) continue to own, in connection with the closing, MFAC shares or (b) redeem shares for a portion of the $33.2mm in trust (“MFAC Sponsor”) PIPE Investment Customers Bancorp, Inc (“CUBI”) Shares in MFAC issued for cash Megalith Financial Acquisition Corp. (“Purchaser” or “MFAC”) CUBI owns 100% of Customers Bank (NYSE listed company to be renamed Shares in the Company BM Technologies, Inc.) Customers Bank MFAC issues shares to CUBI MFAC issues cash to Customers (“Seller of Company”; “Lender public shareholders (1) Bank, the sole stockholder of to Company”) MFAC Merger Sub Inc. BankMobile established as a wholly- owned subsidiary of MFAC (1) MFAC Sponsor transfers additional Obligation on a Prior to Transaction closing, 100% “Class B” shares to CUBI shareholders as CUBI Public $40mm Credit ownership of BankMobile (1) part of the aggregated consideration Shareholders Facility Technologies, Inc. BankMobile Technologies, MFAC Merger Sub Inc. Inc. BankMobile merges into MFAC Merger Sub Inc. (“The Company”) 1) CUBI will not retain a common equity ownership interest in the company as shares will be distributed directly to CUBI shareholders — there will be restrictions on the sale of shares distributed to CUBI shareholders for a period of 12 months after Closing. Note: The Merger Consideration Shares will be subject to restrictions on sale and transfer for a period of twelve months following the Closing of the Business Combination, provided that these restrictions will end prior to such time upon the earlier of (1) the date after the Closing Date on which Megalith consummates a liquidation, merger, capital stock exchange, reorganization or other similar transaction with an unaffiliated third party that results in all of Megalith’s stockholders having the right to exchange their shares of common stock for cash, securities or other property, and (2) the date on which the closing sale price of Megalith’s | 44 common stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations and the like) for any twenty (20) trading days within any thirty (30) trading day period commencing at least one hundred and fifty (150) days after the Closing.

Reconciliation to Pro Forma Core Financials 2019 Preliminary Financials 2020 Preliminary Financials Pro Forma Core Adjustments Quarterly Financials YTD Full Year Quarterly Financials YTD ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Revenues and expenses have been presented on a “pro forma core” Revenues $19,811 $16,995 $17,900 $17,601 $54,706 $72,307 $15,758 $15,431 $18,338 $49,527 basis to illustrate past periods as if the current deposit servicing Operating Expense 18,444 21,129 20,725 19,310 60,298 79,608 19,891 19,144 17,728 56,763 agreement had been in place, and to remove non-recurring, one-time costs for merger expenses and Department of Education settlement Income/(Loss) Before Taxes & Interest $1,367 ($4,134) ($2,825) ($1,709) ($5,592) ($7,301) ($4,133) ($3,713) $610 ($7,236) Interest Expense 0 0 132 403 132 535 394 399 353 1,146 Pre-Tax Income / (Loss) $1,367 ($4,134) ($2,957) ($2,112) ($5,724) ($7,836) ($4,527) ($4,112) $257 ($8,382) Taxes 7 7 7 6 21 27 7 7 7 21 Net Income / (Loss) $1,360 ($4,141) ($2,964) ($2,118) ($5,745) ($7,863) ($4,534) ($4,119) $250 ($8,403) 2019 Pro Forma Core Financial Reconciliation 2020 Pro Forma Core Financial Reconciliation Quarterly Financials YTD Full Year Quarterly Financials YTD ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Revenues $19,811 $16,995 $17,900 $17,601 $54,706 $72,307 $15,758 $15,431 $18,338 $49,527 Pro Forma adjustment to revenue to reflect BMT’s current deposit 1 servicing agreement in all periods, whereby BMT receives of 1.50% 1 Deposit Servicing Fee Adjustment (3,131) (2,437) (2,665) (2,736) (8,234) (10,970) 0 0 0 0 for deposit servicing plus 1.50% for NIM Sharing 2 Fraud Reimbursement Adjustment - Revenue 0 0 0 0 0 0 (123) 120 (96) (99) Pro Forma adjustment to revenue to reflect BMT’s current deposit Pro Forma Core Revenues $16,680 $14,558 $15,235 $14,865 $46,472 $61,337 $15,635 $15,551 $18,242 $49,428 servicing agreement in all periods, whereby BMT is reimbursed for Operating Expense 18,444 21,129 20,725 19,310 60,298 79,608 19,891 19,144 17,728 56,763 2 operating losses stemming from fraud related transactions. 2 Fraud Reimbursement Adjustment - Expense (838) (965) (2,662) (188) (4,465) (4,653) (123) 120 (96) (99) Additionally, fraud reimbursement (and expense) is netted out of revenue (and expense in applicable periods). 3 Merger / Dept of ED Settlement Expenses 0 0 (1,000) (1,100) (1,000) (2,100) (50) (25) (377) (452) Pro Forma Core Operating Expenses $17,606 $20,164 $17,063 $18,022 $54,833 $72,855 $19,718 $19,239 $17,255 $56,212 Adjustment to remove non-core/nonrecurring merger and 3 Department of Education settlement expenses related to legacy 4 Pro Forma Core Income / (Loss) Before Taxes & Interest ($926) ($5,606) ($1,828) ($3,158) ($8,360) ($11,518) ($4,083) ($3,688) $987 ($6,784) Higher One business now assumed by BankMobile Interest Expense 0 0 132 403 132 535 394 399 353 1,146 Pro Forma Core Pre-Tax Income / (Loss) ($926) ($5,606) ($1,960) ($3,561) ($8,492) ($12,053) ($4,477) ($4,087) $634 ($7,930) 4 Pro Forma Core Revenues minus Pro Forma Core Operating Expenses Taxes 7 7 7 6 21 27 7 7 7 21 Pro Forma Core Net Income / (Loss) ($933) ($5,613) ($1,967) ($3,567) ($8,513) ($12,080) ($4,484) ($4,094) $627 ($7,951) 2019 Pro Forma Core EBITDA Reconciliation 2020 Pro Forma Core EBITDA Reconciliation Quarterly Financials YTD Full Year Quarterly Financials YTD ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Pro Forma Core Pre-Tax Income ($926) ($5,606) ($1,960) ($3,561) ($8,492) ($12,053) ($4,477) ($4,087) $634 ($7,930) Addback Interest 0 0 132 403 132 535 394 399 353 1,146 Addback of Depreciation & Amortization 1,464 1,442 3,187 3,195 6,093 9,288 3,180 3,045 2,605 8,830 Pro Forma Core EBITDA $538 ($4,164) $1,358 $37 ($2,267) ($2,230) ($903) ($643) $3,592 $2,046 Source: Company management Note: Q3’20 financial metrics are preliminary and subject to change | 45

Reconciliation to Non-GAAP Financial Measures ($ shown in millions) 2019 Pro Forma Core (1) 2020E 2021E 2022E Pro Forma Core Pre-Tax Income ($12.1) ($9.3) $6.2 $33.3 Addback of Interest Expense(2) 0.5 1.4 0.6 0.3 Addback of Depreciation & Amortization 9.3 11.7 14.7 16.7 Pro Forma Core EBITDA ($2.2) $3.8 $21.5 $50.3 Pro Forma Core EBITDA ($2.2) $3.8 $21.5 $50.3 Pro Forma Core Revenue 61.3 66.9 104.0 144.4 Pro Forma Core EBITDA Margin (4%) 6% 21% 35% Source: BankMobile management projections Note: 2021 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial 1) Refer to Reconciliation to Pro Forma Core Financials on page 45 projections assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and 2) Reflects cost of intercompany debt | 46 competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management.

Reconciliation to Non-GAAP Financial Measures (Continued) 2020E BankMobile Estimated Debt at Closing $40.0 Trust Cash Allocated for Debt Paydown (1) (11.6) Pro Forma Estimated Debt at Closing $28.4 Beginning BankMobile Cash $10.3 Less: BankMobile Excess Cash Used in Cash Consideration (2) (5.3) Plus: Cash Held in MFAC Trust Allocated to Balance Sheet 10.0 Estimated Closing Cash on Balance Sheet $15.0 Pro Forma Estimated Debt at Closing $28.4 Less: Estimated Closing Cash on Balance Sheet 15.0 Estimated Net Debt at Close $13.4 Pro Forma Core EBITDA 3.8 Net Leverage Ratio (Net Debt / Pro Forma Core EBITDA) 3.5x Source: BankMobile management projections 2) Cash held by BankMobile in excess of $5.0mm will serve as additional cash consideration to Customers Bank 1) Assumes $33.2mm cash held in escrow at MFAC related to existing MFAC investors will not be redeemed upon Transaction closing; Assumes 50% of trust cash in excess of $10.0 mm will serve as proceeds used to partially paydown existing | 47 intercompany debt