Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMMUNITY WEST BANCSHARES / | brhc10016614_8k.htm |

Exhibit 99.1

To the Shareholders of Community West Bancshares:

We are happy to report that Community West Bancshares recently released its financial results for the third quarter of 2020. Among the highlights was net income of $2.9 million for the quarter ending on September 30, compared to $1.2 million for

the prior quarter, and net income of $5.6 million for the first nine months of 2020, compared to $5.2 million in the first nine months of 2019. Attached is an investor fact sheet for your review, providing information about growth in deposits,

stockholders’ equity and other benchmarks.

Community West produced strong earnings for the third quarter, with solid top and bottom line results, core deposit growth and a slightly expanded net interest margin. Loan growth has been steady, with a 8% increase in the loan portfolio

compared to a year ago, along with strong growth in total demand deposits, which increased 21% year-over-year. We continue to focus on high quality earnings growth, while managing our operating efficiencies.

Our bank generated 517 Paycheck Protection Program (PPP) loans, which are 100% guaranteed by the Small Business Administration (SBA), totaling $75.7 million to our clients since the program’s inception in April. The effect of the pandemic on our

employees, clients and communities remains our primary concern. Since the start of the pandemic, we have maintained all branch activity, taking conservative measures to keep our employees and clients safe. We remain focused on assessing the risks

in our loan portfolio and working with our clients to minimize losses, and have implemented a loan modification program to assist clients impacted by the pandemic with loan deferrals.

The Board of Directors declared a quarterly cash dividend of $0.05 per common share, payable November 30, 2020 to common shareholders of record on November 13, 2020. Book value per common share increased to $10.23 at September 30, 2020, compared

to $9.93 at June 30, 2020, and $9.40 at September 30, 2019.

From Ventura County in the south to Paso Robles in the north, Community West Bank is the largest publicly traded and only community bank headquartered and serving all of Ventura, Santa Barbara and San Luis Obispo counties. And we are

proud that our bank was again awarded a “Premier” rating in April 2020, by The Findley Reports. For 50 years, Findley has recognized the financial performance of banking institutions in California and the western United States, focusing on four

ratios: growth, return on beginning equity, net operating income as a percentage of average assets, and loan losses as a percentage of gross loans.

Community West Bank is also rated 5-star Superior by Bauer Financial. It is an honor to be recognized so favorably.

We appreciate the continued support from you, our shareholders, as we pursue our growth opportunities.

Sincerely,

|

|

|

William R. Peeples

|

Martin E. Plourd

|

|

Chairman of the Board

|

President and Chief Executive Officer

|

|

FACT SHEET

|

|

THIRD QUARTER 2020

HIGHLIGHTS

|

||

|

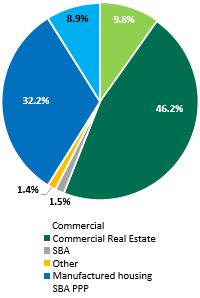

Total Loan Portfolio

$854.5 Million at 9/30/20

|

◇ Net income of $2.9 million, or $0.33 per diluted share, in 3Q20, compared to $1.2 million, or $0.14 per diluted share in 2Q20, and $2.2 million, or $0.25 per diluted share in

3Q19.

◇ Net interest income was $9.6 million for the quarter, compared to $8.8 million for both 2Q20 and 3Q19, respectively.

◇ Provision for loan losses was $113,000 for the quarter, compared to $762,000 for 2Q20, and a credit to the provision for loan losses of $75,000 for 3Q19. The resulting allowance

was 1.24% of total loans held for investment at September 30, 2020 (1.37% of total loans held for investment at September 30, 2020 excluding the $75.7 million of Paycheck Protection Program (“PPP”) loans which are 100% guaranteed by

the Small Business Administration (“SBA”)).*

◇ Net interest margin was 3.76% for 3Q20, compared to 3.72% for 2Q20, and 4.10% for 3Q19.

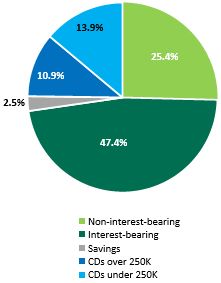

◇ Total demand deposits increased $41.2 million to $545.2 million at September 30, 2020, compared to $504.1 million at June 30, 2020, and increased $97.2 million compared to

$448.0 million at September 30, 2019. Total demand deposits represented 72.8% of total deposits at September 30, 2020, compared to 67.2% at June 30, 2020, and 58.8% at September 30, 2019.

◇ Total loans were $854.5 million at September 30, 2020, compared to $856.0 million at June 30, 2020, and $789.5 million at September 30, 2019.

◇ Book value per common share increased to $10.23 at September 30, 2020, compared to $9.93 at June 30, 2020, and $9.40 at September 30, 2019.

◇ Total risked-based capital improved to 12.21% for the Bank at September 30, 2020, compared to 11.63% at June 30, 2020 and 11.18% at September 30, 2019.

◇ Net non-accrual loans were $2.3 million at September 30, 2020 compared to $2.6 million and at June 30, 2020, and $5.5 million at September 30, 2019.

◇ Other assets acquired through foreclosure, net, was $2.7 million at September 30, 2020 and at June 30, 2020, compared to $317,000 at September 30, 2019.

*Non GAAP

|

|

|

FINANCIAL HIGHLIGHTS

|

|

Deposit Portfolio

$749 Million at 9/30/20

|

Period

|

EPS

|

Total Assets*

|

Nonaccrual

loans, net/total

loans

|

ALL/loans held

for

investment**

|

Net Interest

Margin

|

|||||||||||||||||

|

3Q20

|

$

|

0.33

|

$

|

1,042

|

0.26

|

%

|

1.37

|

%

|

3.76

|

%

|

|||||||||||||

|

3Q19

|

$

|

0.25

|

$

|

903

|

0.69

|

%

|

1.19

|

%

|

4.10

|

%

|

|||||||||||||

|

2019

|

$

|

0.93

|

$

|

914

|

0.31

|

%

|

1.19

|

%

|

4.06

|

%

|

|||||||||||||

|

2018

|

$

|

0.88

|

$

|

877

|

0.44

|

%

|

1.21

|

%

|

4.07

|

%

|

|||||||||||||

|

2017

|

$

|

0.57

|

$

|

833

|

0.61

|

%

|

1.24

|

%

|

4.34

|

%

|

|||||||||||||

|

$ in millions except per share data * at end of period ** excluding PPP loans

|

|||||||||||||||||||||||

|

ABOUT COMMUNITY WEST BANCSHARES

Community West Bancshares is a financial services company with headquarters in Goleta, California. The Company is the holding company for Community West Bank, the largest publicly traded community bank

serving California’s Central Coast area of Ventura, Santa Barbara and San Luis Obispo counties. Community West Bank has seven full-service California branch banking offic- es, in Goleta, Santa Barbara, Santa Maria, Ventura, San Luis

Obispo, Oxnard and Paso Robles. The principal business activities of the Company are Relationship business banking, Manufactured Housing lending and Government Guaranteed lending.

|

|||||||||||||||||||||||

|

CWBC

|

|

Recent Price

|

$8.09

|

Market Cap

|

$68.5M

|

|

Shares Outstanding

|

8.5M

|

Book Value per Common Share

|

$10.23

|

|

Estimated Float

|

5.7M | ||

|

52-Week Range

|

$5.27-$11.86

|

Price/Book

|

0.79x

|

|

Net Interest Margin*

|

3.76%

|

Institutional Ownership

|

29.3%

|

|

*most recent quarter

|

Insider Ownership

|

20.0%

|

|

FINANCIAL HIGHLIGHTS

(in thousands, except per share)

|

|

Income Statement

|

Three Months Ended

|

|||||||||||

|

30-Sep-20

|

30-Jun-20

|

30-Sep-19

|

||||||||||

|

Interest income

|

$

|

11,116

|

$

|

10,777

|

$

|

11,719

|

||||||

|

Interest expense

|

1,564

|

1,996

|

2,921

|

|||||||||

|

Net interest income before provision for loan losses

|

9,552

|

8,781

|

8,798

|

|||||||||

|

Provision (credit) for loan losses

|

113

|

762

|

(75

|

)

|

||||||||

|

Net interest income after provision for loan losses

|

9,439

|

8,019

|

8,873

|

|||||||||

|

Non-interest income

|

1,352

|

640

|

647

|

|||||||||

|

Non-interest expenses

|

6,722

|

7,003

|

6,464

|

|||||||||

|

Income before income taxes

|

4,069

|

1,656

|

3,056

|

|||||||||

|

Provision for income taxes

|

1,209

|

496

|

902

|

|||||||||

|

Net income

|

2,860

|

1,160

|

2,154

|

|||||||||

|

Earnings per common share:

|

||||||||||||

|

Basic

|

$

|

0.34

|

$

|

0.14

|

$

|

0.25

|

||||||

|

Diluted

|

$

|

0.33

|

$

|

0.14

|

$

|

0.25

|

||||||

|

Balance Sheet

|

30-Sep-20

|

30-Jun-20

|

30-Sep-19

|

|||||||||

|

Total assets

|

$

|

1,042,099

|

$

|

1,060,847

|

$

|

903,252

|

||||||

|

Total stockholders’ equity

|

$

|

86,717

|

$

|

84,093

|

$

|

79,596

|

||||||

|

Total deposits

|

$

|

749,180

|

$

|

750,158

|

$

|

761,672

|

||||||

|

Net loans

|

$

|

844,273

|

$

|

846,021

|

$

|

780,589

|

||||||

|

Asset Quality

|

30-Sep-20

|

30-Jun-20

|

30-Sep-19

|

|||||||||

|

Nonaccrual loans, net

|

$

|

2,258

|

$

|

2,640

|

$

|

5,476

|

||||||

|

Nonaccrual loans, net/total loans

|

0.26

|

%

|

0.31

|

%

|

0.69

|

%

|

||||||

|

Nonaccrual loans plus other assets acquired through foreclosure, net

|

$

|

4,965

|

$

|

5,347

|

$

|

5,793

|

||||||

|

Nonaccrual loans plus other assets acquired through foreclosure, net/total assets

|

0.48

|

%

|

0.50

|

%

|

0.64

|

%

|

||||||

|

Net loan (recoveries) charge-offs in the quarter

|

$

|

(76

|

)

|

$

|

(79

|

)

|

$

|

(69

|

)

|

|||

|

Net loan (recoveries) charge-offs

in the quarter/total loans

|

(0.01

|

%)

|

(0.01

|

%)

|

(0.01

|

%)

|

||||||

|

CORPORATE HEADQUARTERS

|

Community West Bank

445 Pine Avenue

Goleta, CA 93117

Phone (805) 692-5821

www.communitywestbank.com

|

TOP INSTITUTIONAL

SHAREHOLDERS *

|

|

First Securities America

|

6.71%

|

|

Wellington Management

|

4.40%

|

|

Cutler Capital

|

3.28%

|

|

Siena Capital

|

2.30%

|

|

PL Capital Advisors

|

2.13%

|

|

Stilwell Value

|

1.86%

|

|

Dimensional Fund

|

1.82%

|

|

M3F

|

1.59%

|

|

BHZ Capital Management

|

0.84%

|

|

Vanguard

|

0.65%

|

|

Fourthstone

|

0.59%

|

|

Bridgeway Capital

|

0.58%

|

*information from S&P Global as of 8/15/20

|

MANAGEMENT TEAM

|

Martin E. Plourd

President & Chief Executive Officer

Susan C. Thompson

EVP & Chief Financial Officer

T. Joseph Stronks

EVP , Chief Operating Officer

William F. Filippin

EVP & Chief Credit Officer & Chief Administrative Officer

|

The company described in this report is a client of The IR Group, Inc., a securities industry relations firm. This report was prepared using information obtained from management and from publications available

to the public. This report does not purport to be a complete statement of all material facts and is not to be construed as a recommendation or solicitation to buy or sell securities of the company described herein. Upon receiving a written

request sent to its website www.theIRgroup.com. The IR Group will provide a package of detailed information on the client company. The IR Group is compensated by the client company for services rendered on a continuing basis and

consequently, the amount of such compensation related to the preparation and distribution of this report is not separately determinable. The IR Group and/or its employees and/or members of their families, may have a long position in the

securities of the company described herein.

|

Issued: October 26, 2020