Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Argo Group International Holdings, Ltd. | d923191d8k.htm |

ARGO GROUP INVESTOR PRESENTATION NOVEMBER 2020 Exhibit 99.1

Forward-Looking Statements This presentation may include forward-looking statements, both with respect to Argo Group and its industry, that reflect our current views with respect to future events and financial performance. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "expect," "intend," "plan," "believe," “do not believe,” “aim,” "project," "anticipate," “seek,” "will," “likely,” “assume,” “estimate,” "may," “continue,” “guidance,” “objective,” “remain optimistic,” "path toward," “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “on track” and similar expressions of a future or forward-looking nature. There can be no assurance that actual developments will be those anticipated by Argo Group. Actual results may differ materially as a result of significant risks and uncertainties including but not limited to: the continuing impact of the novel coronavirus (COVID-19) pandemic and related economic matters; changes in the pricing environment including those due to the cyclical nature of the insurance and reinsurance industry; increased competition; the adequacy of our projected loss reserves including development of claims that varies from that which was expected when loss reserves were established, adverse legal rulings which may impact the liability under insurance and reinsurance contracts beyond that which was anticipated when the reserves were established, development of new theories related to coverage which may increase liabilities under insurance and reinsurance contracts beyond that which were anticipated when the loss reserves were established, reinsurance coverage being other than what was anticipated when the loss reserves were established; changes to regulatory and tax conditions and legislation; natural and/or man-made disasters, including terrorist acts and civil unrest; impact of global climate change; the inability to secure reinsurance; the inability to collect reinsurance recoverables; a downgrade in our financial strength ratings; changes in interest rates; changes in the financial markets that impact investment income and the fair market values of our investments; changes in asset valuations; failure to execute information technology strategies; exposure to information security breach; failure of outsourced service providers; failure to execute expense targets; inability to successfully execute mergers or acquisitions; and costs associated with shareholder activism. For a more detailed discussion of such risks and uncertainties, see Item 1A, “Risk Factors” in Argo’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as supplemented in Part II, Item 1A, “Risk Factors” of Argo’s subsequent Quarterly Reports on Form 10-Q and in other filings with the Securities and Exchange Commission. The inclusion of a forward-looking statement herein should not be regarded as a representation by Argo that Argo’s objectives will be achieved. Argo undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You should not place undue reliance on any such statements.

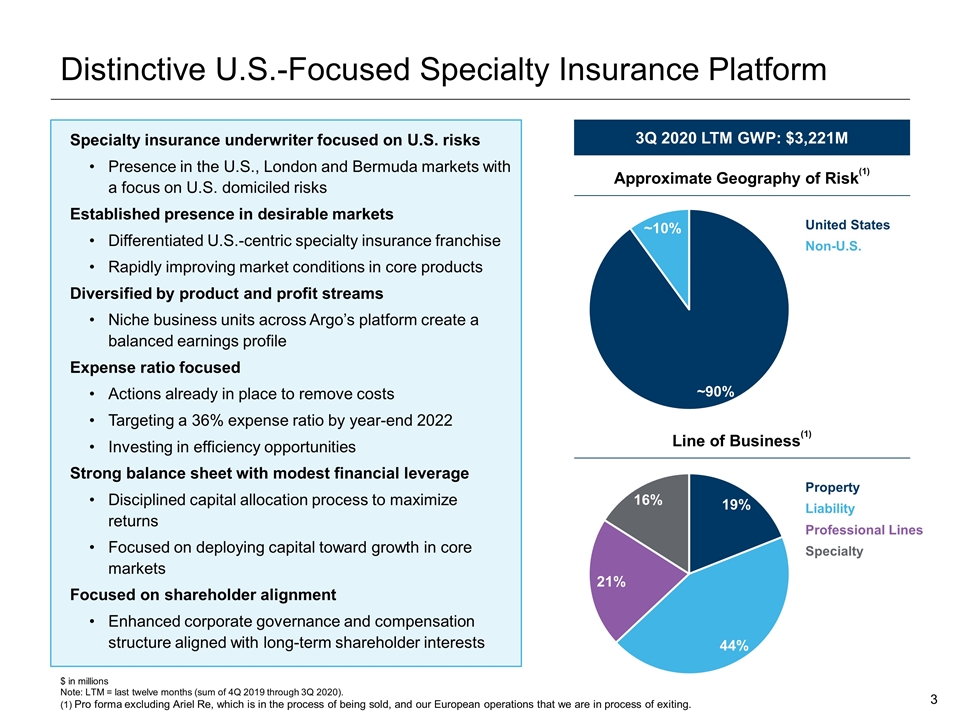

Distinctive U.S.-Focused Specialty Insurance Platform Specialty insurance underwriter focused on U.S. risks Presence in the U.S., London and Bermuda markets with a focus on U.S. domiciled risks Established presence in desirable markets Differentiated U.S.-centric specialty insurance franchise Rapidly improving market conditions in core products Diversified by product and profit streams Niche business units across Argo’s platform create a balanced earnings profile Expense ratio focused Actions already in place to remove costs Targeting a 36% expense ratio by year-end 2022 Investing in efficiency opportunities Strong balance sheet with modest financial leverage Disciplined capital allocation process to maximize returns Focused on deploying capital toward growth in core markets Focused on shareholder alignment Enhanced corporate governance and compensation structure aligned with long-term shareholder interests Approximate Geography of Risk(1) 3Q 2020 LTM GWP: $3,221M United States Non-U.S. Line of Business(1) Property Liability Professional Lines Specialty $ in millions Note: LTM = last twelve months (sum of 4Q 2019 through 3Q 2020). (1) Pro forma excluding Ariel Re, which is in the process of being sold, and our European operations that we are in process of exiting.

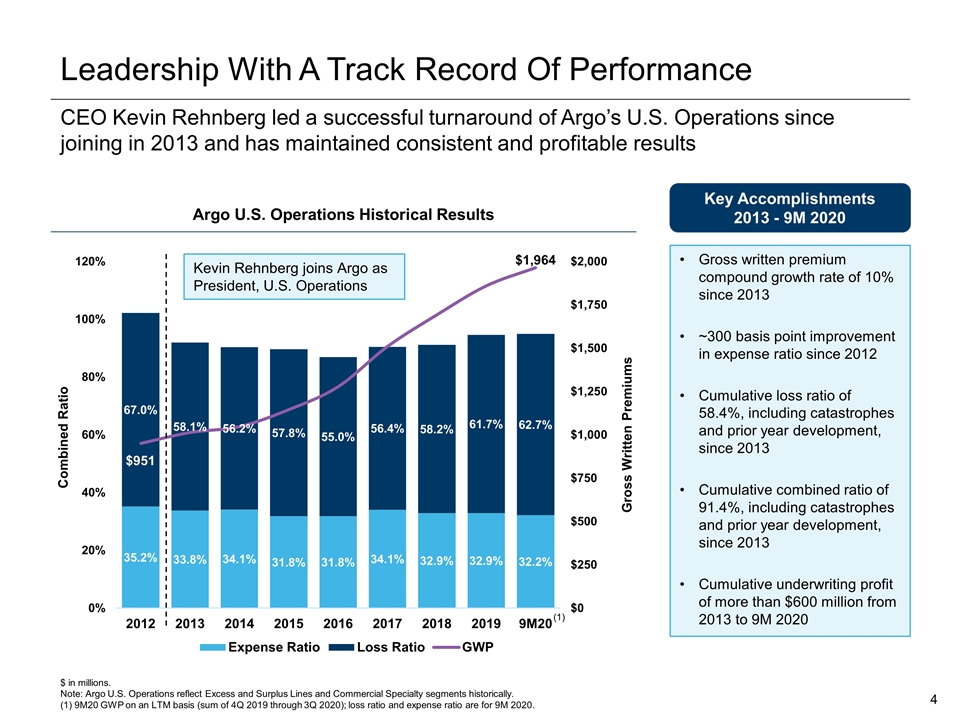

Leadership With A Track Record Of Performance $ in millions. Note: Argo U.S. Operations reflect Excess and Surplus Lines and Commercial Specialty segments historically. (1) 9M20 GWP on an LTM basis (sum of 4Q 2019 through 3Q 2020); loss ratio and expense ratio are for 9M 2020. Gross written premium compound growth rate of 10% since 2013 ~300 basis point improvement in expense ratio since 2012 Cumulative loss ratio of 58.4%, including catastrophes and prior year development, since 2013 Cumulative combined ratio of 91.4%, including catastrophes and prior year development, since 2013 Cumulative underwriting profit of more than $600 million from 2013 to 9M 2020 Key Accomplishments 2013 - 9M 2020 CEO Kevin Rehnberg led a successful turnaround of Argo’s U.S. Operations since joining in 2013 and has maintained consistent and profitable results Argo U.S. Operations Historical Results Kevin Rehnberg joins Argo as President, U.S. Operations (1)

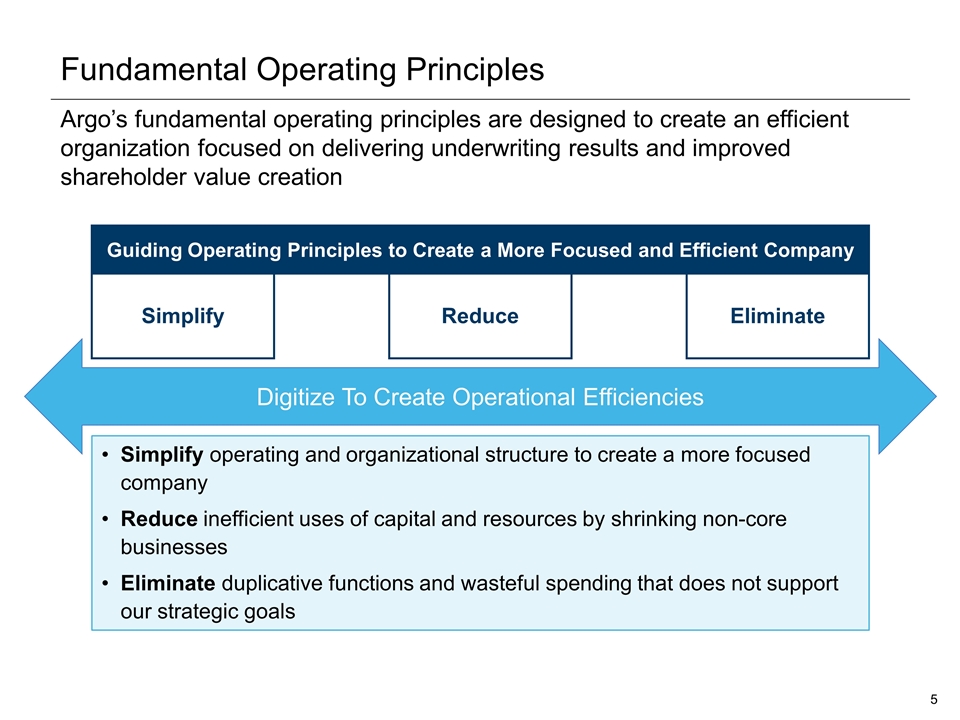

Fundamental Operating Principles Argo’s fundamental operating principles are designed to create an efficient organization focused on delivering underwriting results and improved shareholder value creation Simplify operating and organizational structure to create a more focused company Reduce inefficient uses of capital and resources by shrinking non-core businesses Eliminate duplicative functions and wasteful spending that does not support our strategic goals Digitize To Create Operational Efficiencies Guiding Operating Principles to Create a More Focused and Efficient Company Eliminate Simplify Reduce

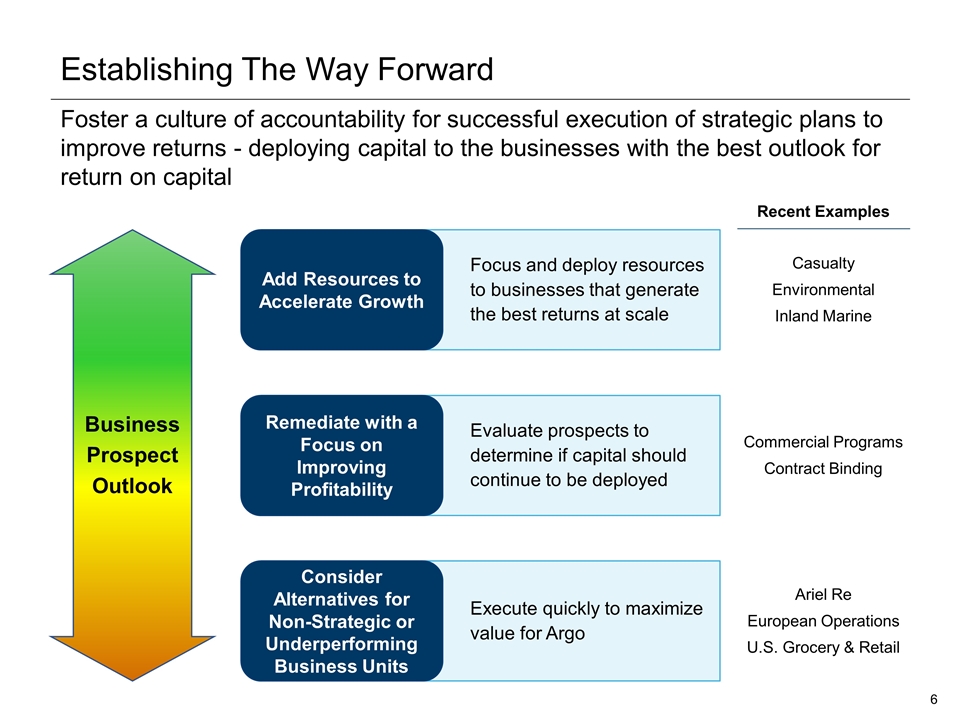

Execute quickly to maximize value for Argo Evaluate prospects to determine if capital should continue to be deployed Establishing The Way Forward Foster a culture of accountability for successful execution of strategic plans to improve returns - deploying capital to the businesses with the best outlook for return on capital Focus and deploy resources to businesses that generate the best returns at scale Add Resources to Accelerate Growth Remediate with a Focus on Improving Profitability Consider Alternatives for Non-Strategic or Underperforming Business Units Business Prospect Outlook Recent Examples Ariel Re European Operations U.S. Grocery & Retail Casualty Environmental Inland Marine Commercial Programs Contract Binding

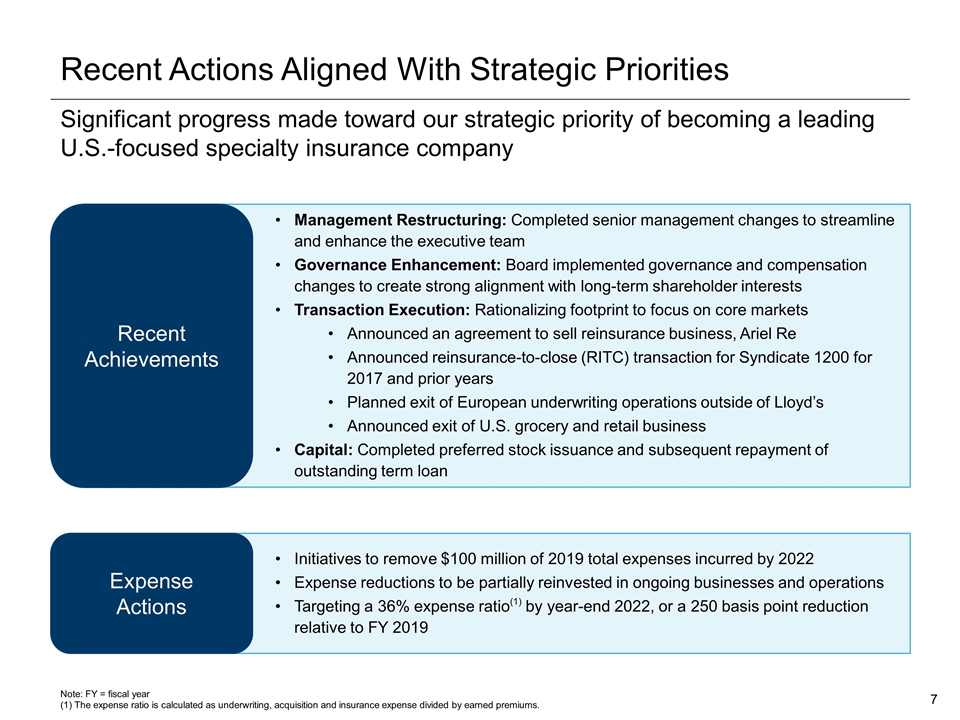

Recent Actions Aligned With Strategic Priorities Significant progress made toward our strategic priority of becoming a leading U.S.-focused specialty insurance company Management Restructuring: Completed senior management changes to streamline and enhance the executive team Governance Enhancement: Board implemented governance and compensation changes to create strong alignment with long-term shareholder interests Transaction Execution: Rationalizing footprint to focus on core markets Announced an agreement to sell reinsurance business, Ariel Re Announced reinsurance-to-close (RITC) transaction for Syndicate 1200 for 2017 and prior years Planned exit of European underwriting operations outside of Lloyd’s Announced exit of U.S. grocery and retail business Capital: Completed preferred stock issuance and subsequent repayment of outstanding term loan Recent Achievements Initiatives to remove $100 million of 2019 total expenses incurred by 2022 Expense reductions to be partially reinvested in ongoing businesses and operations Targeting a 36% expense ratio(1) by year-end 2022, or a 250 basis point reduction relative to FY 2019 Expense Actions Note: FY = fiscal year (1) The expense ratio is calculated as underwriting, acquisition and insurance expense divided by earned premiums.

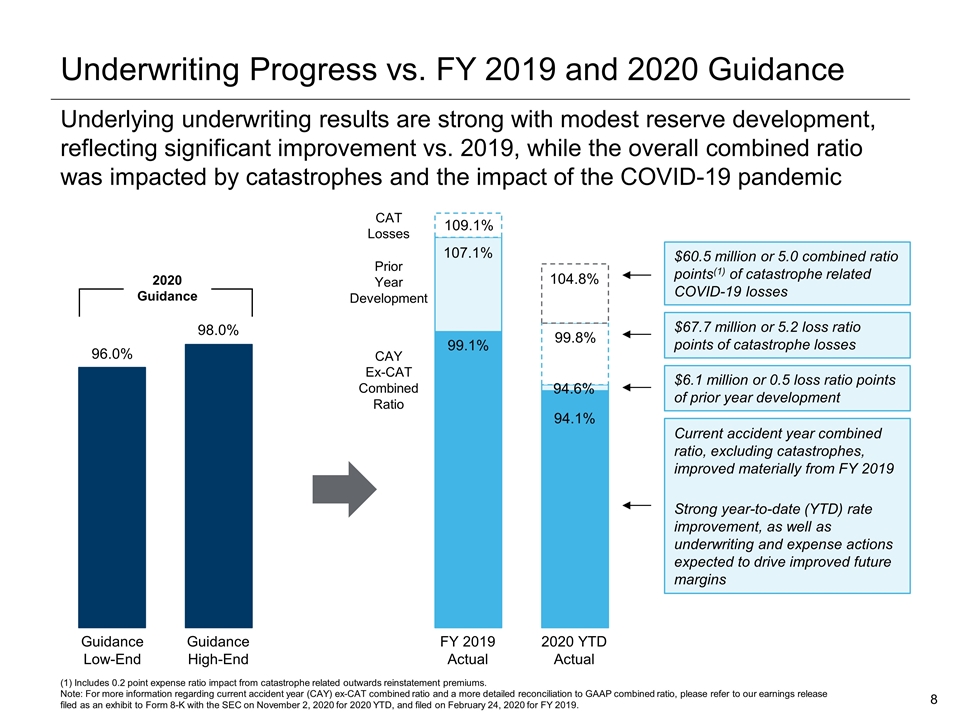

Underwriting Progress vs. FY 2019 and 2020 Guidance Underlying underwriting results are strong with modest reserve development, reflecting significant improvement vs. 2019, while the overall combined ratio was impacted by catastrophes and the impact of the COVID-19 pandemic Guidance Low-End Guidance High-End 2020 YTD Actual 96.0% 94.1% 99.8% 104.8% $67.7 million or 5.2 loss ratio points of catastrophe losses $60.5 million or 5.0 combined ratio points(1) of catastrophe related COVID-19 losses Current accident year combined ratio, excluding catastrophes, improved materially from FY 2019 Strong year-to-date (YTD) rate improvement, as well as underwriting and expense actions expected to drive improved future margins (1) Includes 0.2 point expense ratio impact from catastrophe related outwards reinstatement premiums. Note: For more information regarding current accident year (CAY) ex-CAT combined ratio and a more detailed reconciliation to GAAP combined ratio, please refer to our earnings release filed as an exhibit to Form 8-K with the SEC on November 2, 2020 for 2020 YTD, and filed on February 24, 2020 for FY 2019. FY 2019 Actual 94.6% 109.1% 107.1% 99.1% $6.1 million or 0.5 loss ratio points of prior year development 2020 Guidance 98.0% CAT Losses Prior Year Development CAY Ex-CAT Combined Ratio

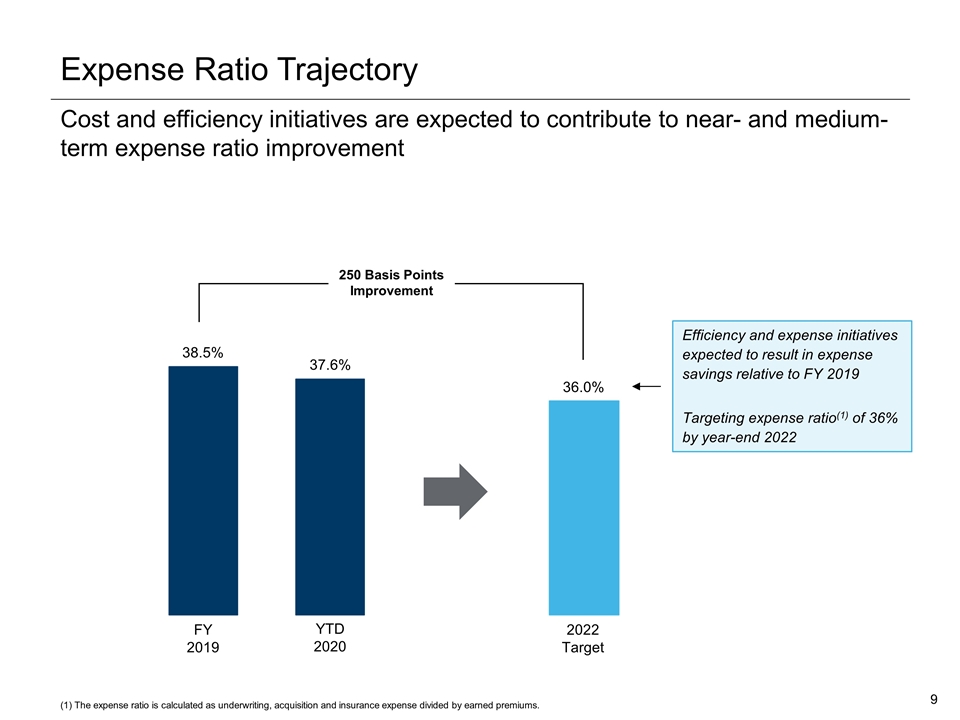

Expense Ratio Trajectory Cost and efficiency initiatives are expected to contribute to near- and medium-term expense ratio improvement 250 Basis Points Improvement FY 2019 YTD 2020 2022 Target 38.5% 37.6% 36.0% Efficiency and expense initiatives expected to result in expense savings relative to FY 2019 Targeting expense ratio(1) of 36% by year-end 2022 (1) The expense ratio is calculated as underwriting, acquisition and insurance expense divided by earned premiums.

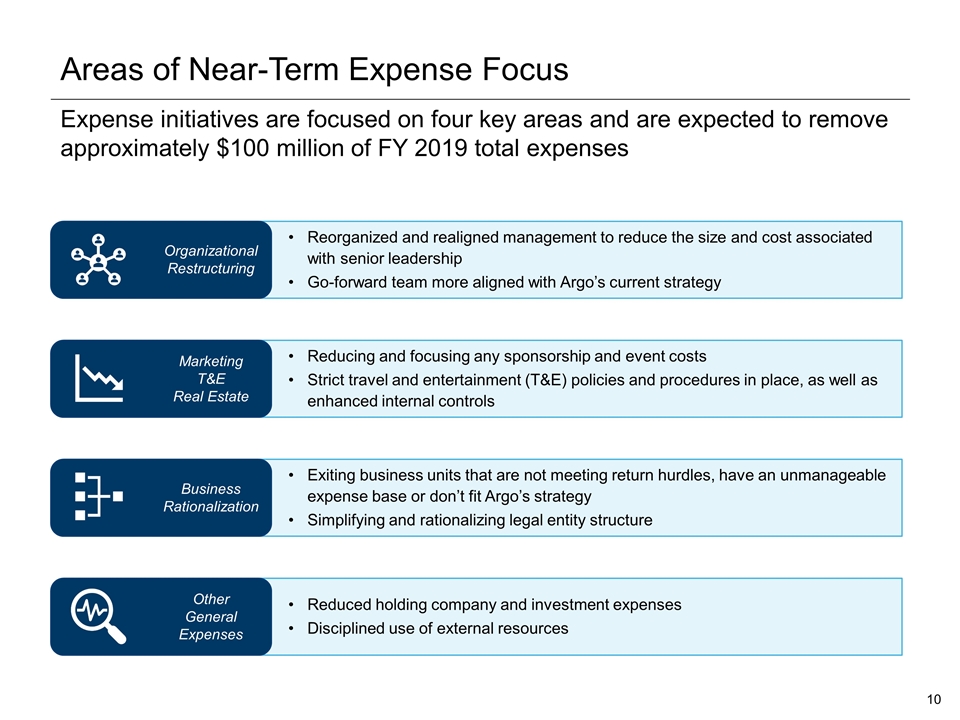

Reorganized and realigned management to reduce the size and cost associated with senior leadership Go-forward team more aligned with Argo’s current strategy Reducing and focusing any sponsorship and event costs Strict travel and entertainment (T&E) policies and procedures in place, as well as enhanced internal controls Exiting business units that are not meeting return hurdles, have an unmanageable expense base or don’t fit Argo’s strategy Simplifying and rationalizing legal entity structure Reduced holding company and investment expenses Disciplined use of external resources Areas of Near-Term Expense Focus Expense initiatives are focused on four key areas and are expected to remove approximately $100 million of FY 2019 total expenses Organizational Restructuring Marketing T&E Real Estate Business Rationalization Other General Expenses

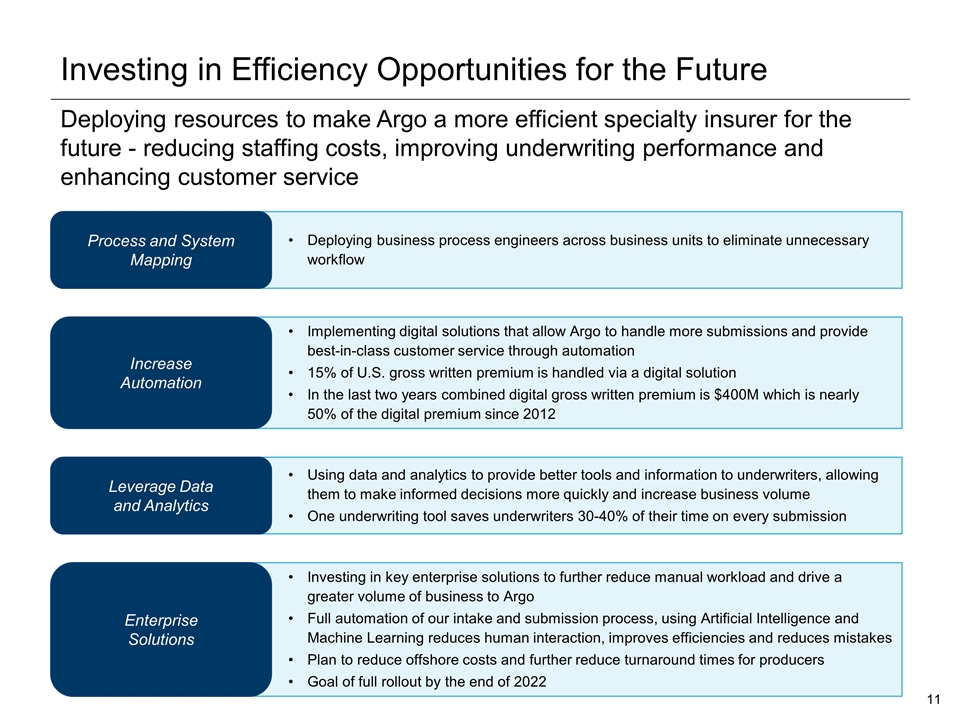

Deploying business process engineers across business units to eliminate unnecessary workflow Implementing digital solutions that allow Argo to handle more submissions and provide best-in-class customer service through automation 15% of U.S. gross written premium is handled via a digital solution In the last two years combined digital gross written premium is $400M which is nearly 50% of the digital premium since 2012 Using data and analytics to provide better tools and information to underwriters, allowing them to make informed decisions more quickly and increase business volume One underwriting tool saves underwriters 30-40% of their time on every submission Investing in key enterprise solutions to further reduce manual workload and drive a greater volume of business to Argo Full automation of our intake and submission process, using Artificial Intelligence and Machine Learning reduces human interaction, improves efficiencies and reduces mistakes Plan to reduce offshore costs and further reduce turnaround times for producers Goal of full rollout by the end of 2022 Investing in Efficiency Opportunities for the Future Deploying resources to make Argo a more efficient specialty insurer for the future - reducing staffing costs, improving underwriting performance and enhancing customer service Process and System Mapping Enterprise Solutions Leverage Data and Analytics Increase Automation

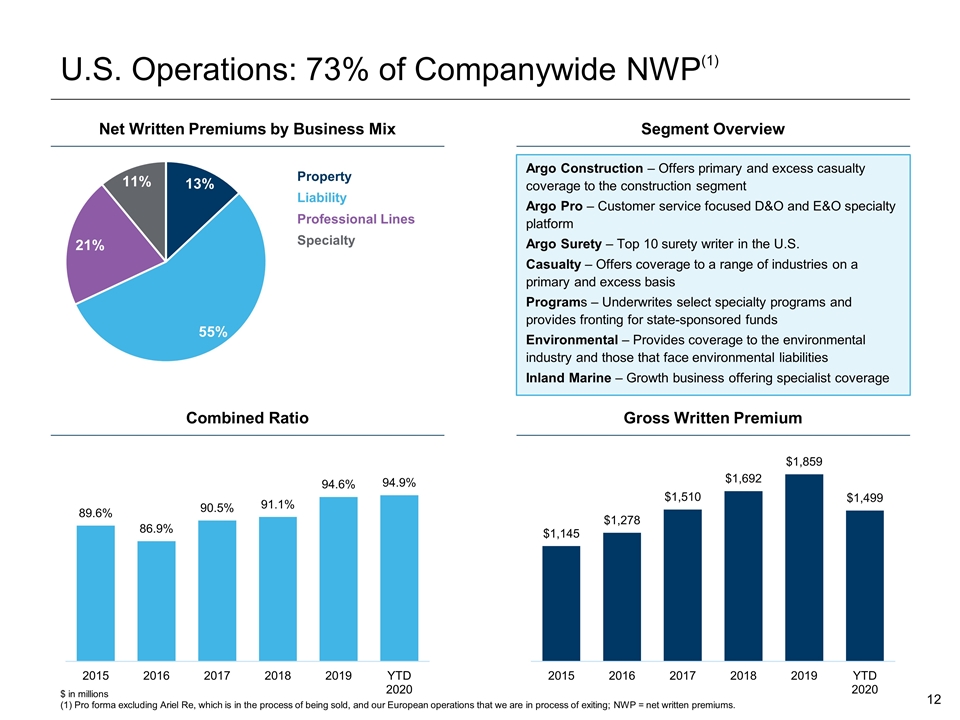

U.S. Operations: 73% of Companywide NWP(1) $ in millions (1) Pro forma excluding Ariel Re, which is in the process of being sold, and our European operations that we are in process of exiting; NWP = net written premiums. Argo Construction – Offers primary and excess casualty coverage to the construction segment Argo Pro – Customer service focused D&O and E&O specialty platform Argo Surety – Top 10 surety writer in the U.S. Casualty – Offers coverage to a range of industries on a primary and excess basis Programs – Underwrites select specialty programs and provides fronting for state-sponsored funds Environmental – Provides coverage to the environmental industry and those that face environmental liabilities Inland Marine – Growth business offering specialist coverage Property Liability Professional Lines Specialty Net Written Premiums by Business Mix Segment Overview Gross Written Premium Combined Ratio

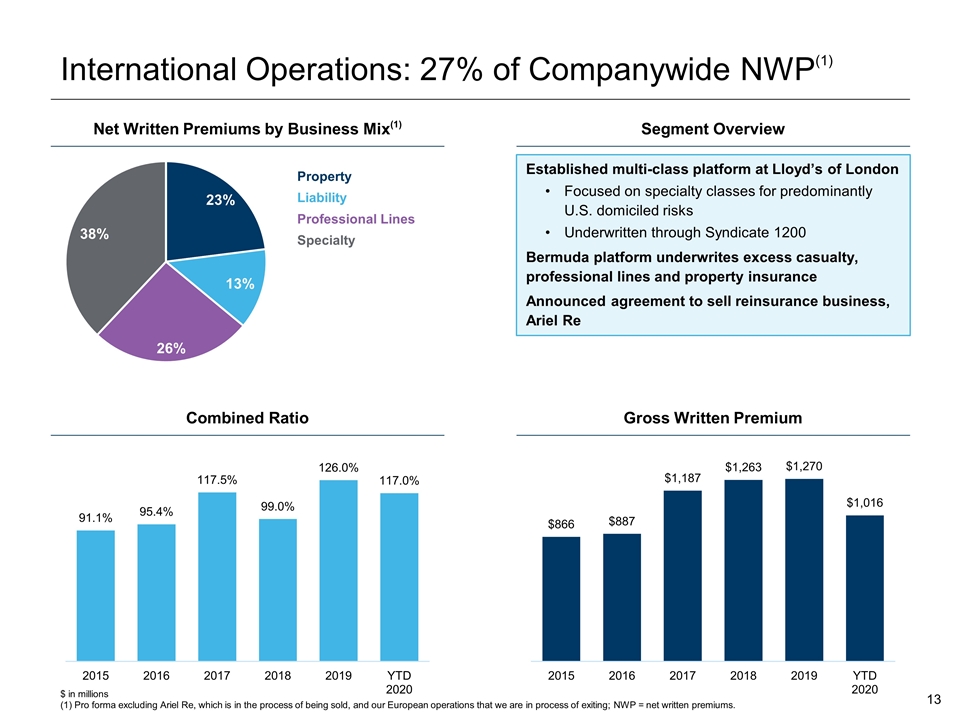

International Operations: 27% of Companywide NWP(1) $ in millions (1) Pro forma excluding Ariel Re, which is in the process of being sold, and our European operations that we are in process of exiting; NWP = net written premiums. Established multi-class platform at Lloyd’s of London Focused on specialty classes for predominantly U.S. domiciled risks Underwritten through Syndicate 1200 Bermuda platform underwrites excess casualty, professional lines and property insurance Announced agreement to sell reinsurance business, Ariel Re Property Liability Professional Lines Specialty Net Written Premiums by Business Mix(1) Segment Overview Gross Written Premium Combined Ratio

Strategic Capital Allocation Argo’s capital allocation process is designed to support our strategic objectives and maximize long-term returns We seek to allocate capital to Argo’s highest performing business units where market conditions allow for growth opportunities In July 2020, Argo closed an offering of $150 million preference shares to refinance an existing term loan and provide additional rating agency and regulatory capital levels to support additional growth Deploy capital into the business for organic growth and investments Support the balance sheet and desired ratings Strategic M&A and opportunistic inorganic growth opportunities Return excess capital to shareholders

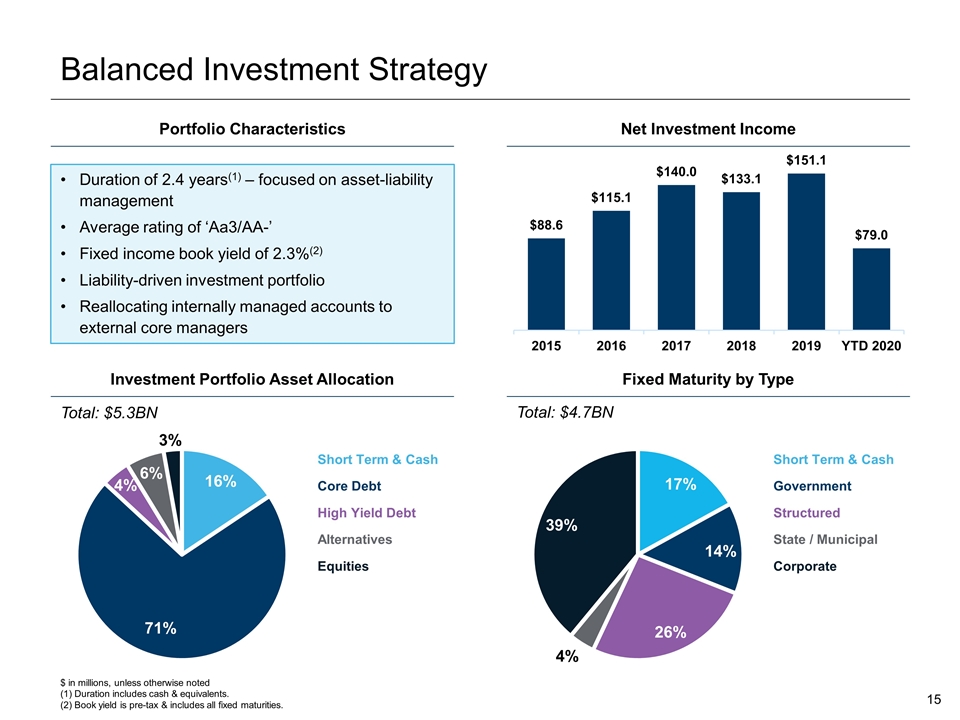

Balanced Investment Strategy Duration of 2.4 years(1) – focused on asset-liability management Average rating of ‘Aa3/AA-’ Fixed income book yield of 2.3%(2) Liability-driven investment portfolio Reallocating internally managed accounts to external core managers Portfolio Characteristics Net Investment Income Total: $5.3BN Total: $4.7BN Short Term & Cash Core Debt High Yield Debt Alternatives Equities Short Term & Cash Government Structured State / Municipal Corporate $ in millions, unless otherwise noted (1) Duration includes cash & equivalents. (2) Book yield is pre-tax & includes all fixed maturities. Investment Portfolio Asset Allocation Fixed Maturity by Type

Argo’s Ongoing Commitment to ESG Argo’s corporate responsibility to stakeholders requires that we hold ourselves to the highest standards by being stewards of the environment, advancing our societal impact and providing transparent corporate governance – see our first Annual ESG Report Environmental Social Governance Argo is a founding member of ClimateWise, which supports the insurance industry so that it can better communicate, disclose and respond to climate risk management issues Argo has provided its first Greenhouse Gas (GHG) Scope 1 , 2 and 3 disclosures, supported by footprint of LEED and EPA Energy Star-certified office locations with electrical conservation programs. Argo is publishing GHG reduction targets for 2021 We are an insurer of companies within the clean energy value chain Argo Group’s research and development (R&D) team creates state-of-the-art models to innovate new solutions to risk management challenges Implemented a diversity and inclusion program to ensure staff have the tools and support necessary to address systemic barriers, build a diverse workforce and maintain a positive work environment Recently introduced policies for paid caregiver leave and increased flexible workplace Have responded flexibly to COVID-19 event by adapting flexible working with an emphasis on staff wellbeing Argo is a signatory with the United Nations Principles for Responsible Investments the leading international network of institutional investors committed to including environmental, social and governance factors in their investment decision making Recently underwent a Board refreshment process, adding 9 new directors since 2017 with diverse skills, backgrounds and perspectives Declassified our Board, with Directors standing for annual elections Lengthened the performance period for the company’s long-term incentive program from one to three years, reduced emphasis on individual performance and increased stock ownership guidelines Concluded an extensive review of governance controls, resulting in changes to Argo’s perquisite policy Engaged with largest shareholders in efforts to improve corporate governance and executive compensation practices

Well Positioned to Create Value in 2021 and Beyond Specialty P&C insurer focused on niche products Positioned for growth in attractive markets, almost entirely U.S. domiciled risks Benefitting from improving market conditions Creating a more focused organization by reducing underperforming businesses Expense initiatives in place to remove costs and achieve a 36% expense ratio by year-end 2022 Investing in technology to improve operating efficiency and risk selection, while reducing overall expenses Balanced investment portfolio to support underwriting operations Strong balance sheet with modest financial leverage ü ü ü ü ü ü ü ü