Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZAGG Inc | zagg-20201109.htm |

| EX-99.2 - EX-99.2 - ZAGG Inc | a0930208kex992.htm |

| EX-99.1 - EX-99.1 - ZAGG Inc | a0930208kex991.htm |

November 9, 2020

ZAGG Inc Supplemental Financial Information - CFO Commentary

Document reference information

ZAGG Inc's (“we,” “us,” “our,” “ZAGG,” or the “Company”) CFO commentary in this document can be referenced in the financial information found in the press release announcing the results of operations for the three and nine months ended September 30, 2020, and 2019, including certain supplemental financial information, issued earlier today. The release can be found at investors.ZAGG.com, or in the Form 8-K furnished to the Securities and Exchange Commission website at sec.gov (the URLs are included in this exhibit as inactive textual references and information contained on, or accessible through, our websites is not a part of, and is not incorporated by reference into, this report).

Summary of Results For the Three Months Ended September 30, 2020, and 2019

(Amounts in millions, except per share amounts)

| For the Three Months Ended | |||||||||||

| Summary of quarter-to-date financial results | September 30, 2020 | September 30, 2019 | |||||||||

| Net sales | $ | 115.5 | $ | 146.5 | |||||||

| Gross profit | $ | 38.4 | $ | 54.3 | |||||||

| Gross profit margin | 33 | % | 37 | % | |||||||

| Net income | $ | 6.2 | $ | 8.7 | |||||||

| Diluted earnings per share | $ | 0.21 | $ | 0.30 | |||||||

| Adjusted EBITDA | $ | 14.7 | $ | 20.8 | |||||||

| Diluted shares outstanding | 29.8 | 29.1 | |||||||||

| For the Three Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by category | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Protection (screen protection and cases) | 63 | % | $ | 73.3 | 59 | % | $ | 85.5 | |||||||||||||||

| Power (power management and power cases) | 26 | % | $ | 29.8 | 31 | % | $ | 45.8 | |||||||||||||||

| Productivity (keyboards and other) | 6 | % | $ | 7.3 | 7 | % | $ | 10.5 | |||||||||||||||

| Audio | 5 | % | $ | 5.1 | 3 | % | $ | 4.7 | |||||||||||||||

| For the Three Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by channel | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Indirect channel | 84 | % | $ | 97.1 | 86 | % | $ | 126.2 | |||||||||||||||

Online 1 | 12 | % | $ | 13.7 | 9 | % | $ | 13.0 | |||||||||||||||

| Franchisees | 4 | % | $ | 4.7 | 5 | % | $ | 7.0 | |||||||||||||||

1 During the three months ended September 30, 2020, the Company revised the online channel to include sales to a key direct-to-consumer customer whose sales were previously included within the indirect channel in prior periods. The Company also made the same change to 2019 net sales by key distribution channels to make the net sales comparable.

| For the Three Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by region | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Domestic | 74 | % | $ | 85.5 | 79 | % | $ | 115.2 | |||||||||||||||

| International | 26 | % | $ | 30.0 | 21 | % | $ | 31.3 | |||||||||||||||

Discussion of Results For the Three Months Ended September 30, 2020

(All comparisons are 2020 consolidated versus 2019 consolidated, unless otherwise noted)

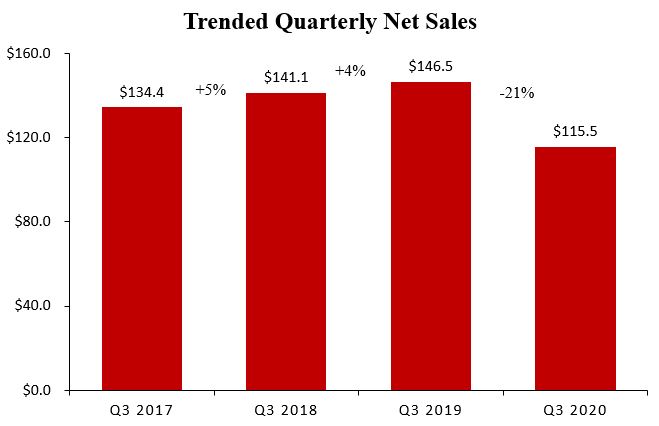

Net sales

Net sales decreased 21% to $115.5 million, compared to $146.5 million. The decrease in net sales was primarily attributable to retail store closures and related demand reductions due to the global COVID-19 pandemic and the delay of the 2020 launch of Apple's newest iPhones into the early fourth quarter of 2020.

Gross profit

Gross profit decreased from $54.3 million (37% of net sales) to $38.4 million (33% of net sales). The decrease in gross profit margin percentage was primarily attributable to (1) increased freight rates and expedited freight charges as we chased demand at the end of the third quarter, and (2) the sale of excess inventory at margins lower than our historical average. The decrease was partially offset by (1) lower duty rates from the extensions of the screen protection and wireless charging exemptions to the end of 2020, and (2) the recognition of expected duty refunds partially offset by the reduction in capitalized duties which were expensed as inventory was sold during the quarter.

Operating expenses

Operating expenses decreased 29% to $30.5 million (26% of net sales) compared to $42.7 million (29% of net sales). The decrease in operating expenses was primarily attributable to cost reduction initiatives in response to COVID-19, including (1) a decrease in salaries and related expenses from the furlough of certain employees, (2) reduced in-channel marketing spend, and (3) the elimination of global discretionary spend.

Net income

As a result of the factors noted above, we reported net income of $6.2 million, or diluted earnings per share of $0.21, for the three months ended September 30, 2020, compared to net income of $8.7 million, or diluted earnings per share of $0.30, for the three months ended September 30, 2019.

Adjusted EBITDA

Adjusted EBITDA was $14.7 million for the three months ended September 30, 2020, compared to $20.8 million for the three months ended September 30, 2019.

Summary of Results For the Nine Months Ended September 30, 2020, and 2019

(Amounts in millions, except per share amounts)

| For the Nine Months Ended | |||||||||||

| Summary of quarter-to-date financial results | September 30, 2020 | September 30, 2019 | |||||||||

| Net sales | $ | 283.6 | $ | 332.0 | |||||||

| Gross profit | $ | 42.8 | $ | 115.9 | |||||||

| Gross profit margin | 15 | % | 35 | % | |||||||

| Adjusted gross profit (excluding March 2020 inventory write-down) | $ | 87.6 | $ | 115.9 | |||||||

| Adjusted gross profit margin (excluding March 2020 inventory write-down) | 31 | % | 35 | % | |||||||

| Net loss | $ | (72.7) | $ | (11.1) | |||||||

| Diluted loss per share | $ | (2.44) | $ | (0.38) | |||||||

| Adjusted EBITDA | $ | 7.3 | $ | 14.2 | |||||||

| Diluted shares outstanding | 29.8 | 29.0 | |||||||||

| For the Nine Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by category | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Protection (screen protection and cases) | 60 | % | $ | 170.2 | 57 | % | $ | 189.4 | |||||||||||||||

| Power (power management and power cases) | 28 | % | $ | 80.3 | 31 | % | $ | 104.5 | |||||||||||||||

| Productivity (keyboards and other) | 9 | % | $ | 24.2 | 8 | % | $ | 26.0 | |||||||||||||||

| Audio | 3 | % | $ | 8.9 | 4 | % | $ | 12.1 | |||||||||||||||

| For the Nine Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by channel | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Indirect channel | 82 | % | $ | 231.8 | 82 | % | $ | 273.4 | |||||||||||||||

Online 1 | 14 | % | $ | 40.0 | 12 | % | $ | 40.2 | |||||||||||||||

| Franchisees | 4 | % | $ | 11.8 | 6 | % | $ | 18.2 | |||||||||||||||

1 During the nine months ended September 30, 2020, the Company revised the online channel to include sales to a key direct-to-consumer customer whose sales were previously included within the indirect channel in prior periods. The Company also made the same change to 2019 net sales by key distribution channels to make the net sales comparable.

| For the Nine Months Ended | |||||||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||||||

| Net sales by region | (%) | ($) | (%) | ($) | |||||||||||||||||||

| Domestic | 78 | % | $ | 220.7 | 75 | % | $ | 249.5 | |||||||||||||||

| International | 22 | % | $ | 62.9 | 25 | % | $ | 82.5 | |||||||||||||||

Discussion of Results For the Nine Months Ended September 30, 2020

(All comparisons are 2020 consolidated versus 2019 consolidated, unless otherwise noted)

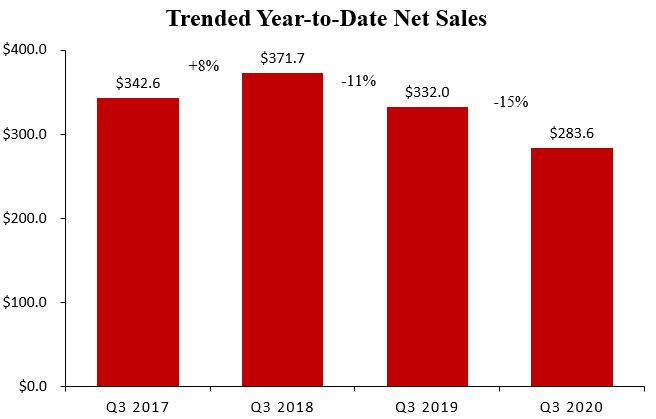

Net sales

Net sales decreased 15% to $283.6 million, compared to $332.0 million. The decrease in net sales was primarily attributable to retail store closures and related demand reductions due to the global COVID-19 pandemic and the delay of the 2020 launch of Apple's newest iPhones into the early fourth quarter of 2020.

Gross profit

Gross profit was $42.8 million (15% of net sales) compared to $115.9 million (35% of net sales). The decrease in gross profit margin percentage was primarily attributable to (1) the March 2020 inventory write-downs of $44.8 million primarily linked to the discontinuation of certain brands and product lines resulting from our March 2020 strategic review of long-term profitability of all brands and product lines and the recoverability of inventory on-hand, combined with decreased demand due to the effects of COVID-19, (2) increased freight rates and expedited freight charges, and (3) the sale of excess inventory at margins lower than our historical average. Excluding the impact from the inventory write-downs, the adjusted gross profit margin was 31% for the nine months ended September 30, 2020, compared to 35% for the nine months ended September 30, 2019.

Operating expenses

Operating expenses decreased 3% to $123.3 million (43% of net sales) compared to $127.5 million (38% of net sales). The decrease in operating expenses was primarily attributable to cost reduction initiatives in response to COVID-19, including (1) a decrease in salaries and related expenses from the furlough of certain employees, elimination of bonuses in the second quarter of 2020, and reductions in salary of executives and senior management, (2) reduced in-channel marketing spend, and (3) the elimination of global discretionary spend. The decrease was partially offset by (1) an $18.6 million impairment charge to goodwill resulting from the carrying value of our net assets exceeding our market capitalization, (2) a $2.5 million charge from the write-off of product tooling linked to discontinued brands and product lines, (3) a $1.1 million write-off recorded for the intangible assets resulting from discontinued brands and product lines, and (4) $0.8 million incurred in connection with the lay-off of certain employees in 2020.

Net loss

As a result of the factors noted above, we reported net loss of $72.7 million, or diluted loss per share of $2.44, for the nine months ended September 30, 2020, compared to net loss of $11.1 million, or diluted loss per share of $0.38, for the nine months ended September 30, 2019.

Adjusted EBITDA

Adjusted EBITDA was $7.3 million for the nine months ended September 30, 2020, compared to $14.2 million for the nine months ended September 30, 2019.

Balance Sheet Highlights (as of September 30, 2020, December 31, 2019, and September 30, 2019)

| September 30, 2020 | December 31, 2019 | September 30, 2019 | |||||||||||||||

| Cash and cash equivalents | $ | 16.1 | $ | 17.8 | $ | 14.7 | |||||||||||

| Accounts receivable, net of allowances | $ | 91.2 | $ | 142.8 | $ | 135.3 | |||||||||||

| Inventories | $ | 80.0 | $ | 144.9 | $ | 138.5 | |||||||||||

| Line of credit | $ | 87.7 | $ | 107.1 | $ | 111.4 | |||||||||||

| CARES Act - Paycheck Protection Program loan | $ | 9.4 | $ | — | $ | — | |||||||||||

| Total debt outstanding | $ | 97.1 | $ | 107.1 | $ | 111.4 | |||||||||||

| Net debt (Total debt outstanding less cash) | $ | 81.0 | $ | 89.3 | $ | 96.7 | |||||||||||

| QTD Days sales outstanding (DSOs) | 73 | 69 | 87 | ||||||||||||||

Market Share Information

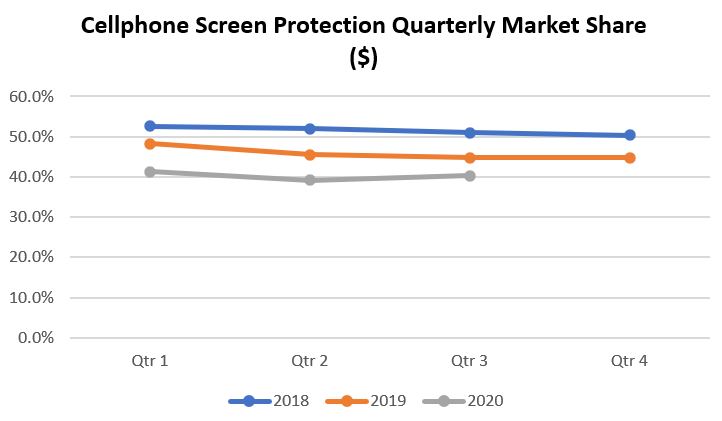

Screen Protection

ZAGG's screen protection market share has experienced headwinds over the last few years as competition has increased at several retail outlets. However, market share stabilized at approximately 44% during the second half of 2019 and into the first quarter of 2020. During the latter half of the first quarter of 2020, the COVID-19 pandemic caused a shift in purchasing from wireless and big box retail to more online channels, which resulted in reduced screen protection market share during the first half of 2020. During the third quarter of 2020, the screen protection market share started increasing after wireless and big box retailers re-opened. As such, management expects market share to return to 2019 levels by the end of 2020.

(Source: The NPD Group / Retail Tracking Service for each quarterly period; NPD data refers to dollar share and pertains only to U.S. retail sales)

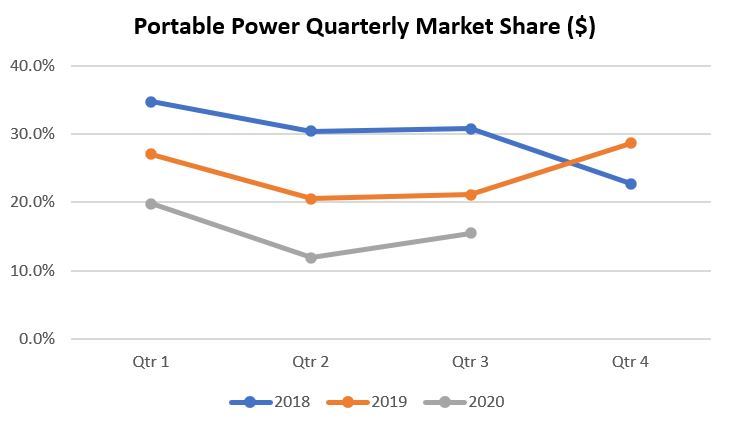

Portable Power

The quarterly market share increases in the fourth quarters of 2019 were driven primarily by on-air sales of HALO products. During the latter half of the first quarter of 2020, the COVID-19 pandemic caused a shift in purchasing from wireless and big box retail to more online channels, which resulted in reduced portable power market share during the first half of 2020. During the third quarter of 2020, the portable power market share started increasing after wireless and big box retailers re-opened. As such, management expects market share to return to 2019 levels by the end of 2020.

(Source: The NPD Group / Retail Tracking Service for each quarterly period; NPD data refers to dollar share and pertains only to U.S. retail sales)

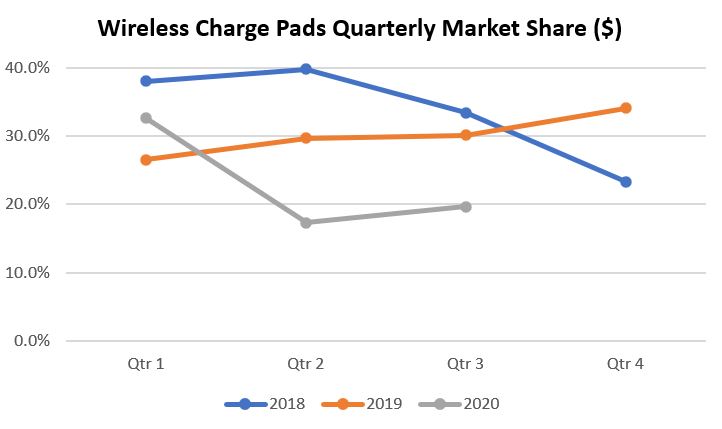

Wireless Charge Pads

mophie-branded wireless charge pads have been a market leader since the charge pad product's introduction in 2017. Though we saw some decline in market share during the first three quarters of 2018, we re-gained lost share in 2019 and had an increase in market share in the fourth quarter of 2019 following the releases of new wireless charging products in September 2019. During the latter half of the first quarter of 2020, the COVID-19 pandemic caused a shift in purchasing from wireless and big box retail to more online channels, which resulted in reduced wireless charge pads market share during the first half of 2020. During the third quarter of 2020, the wireless charge pads market share started increasing after wireless and big box retailers re-opened. As such, management expects market share to return to 2019 levels by the end of 2020.

(Source: The NPD Group / Retail Tracking Service for each quarterly period; NPD data refers to dollar share and pertains only to U.S. retail sales)

2020 Business Outlook

As a result of ongoing disruption and uncertainty related to the global COVID-19 pandemic, ZAGG previously withdrew its full-year 2020 outlook. The Company is not providing an update at this time.

About Non-U.S. GAAP Financial Information

This Supplemental Financial Information - CFO Commentary (“CFO Commentary”) includes Adjusted EBITDA and adjusted gross profit excluding March 2020 inventory write-downs (and corresponding adjusted gross profit margin) . Readers are cautioned that (1) Adjusted EBITDA (earnings before stock-based compensation expense, depreciation and amortization, other expense, net, transaction costs, BRAVEN employee retention bonus, former CFO retention bonus, inventory step-up amount in connection with the acquisition of HALO, severance expense, March 2020 inventory write-down, impairment of goodwill, loss on disposal of intangible assets and equipment (loss of discontinued brands, product lines, and related product tooling), adjustments to fair value of acquisition contingent consideration, and income tax provision (benefit)) and (2) adjusted gross profit excluding March 2020 inventory write-downs (and corresponding adjusted gross profit margin) are not financial measures prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). In addition, this financial information should not be construed as an alternative to any other measure of performance determined in accordance with U.S. GAAP, or as an indicator of operating performance, liquidity, or cash flows generated by operating, investing, and financing activities, as there may be significant factors or trends that it fails to address. As such, it should be read only in conjunction with our consolidated financial statements prepared in accordance with U.S. GAAP. We present Adjusted EBITDA and adjusted gross profit excluding March 2020 inventory write-downs (and corresponding adjusted gross profit margin) because we believe that these measures are helpful to some investors as a measure of performance and to normalize the impact of recent non-recurring events. We caution readers that non-U.S. GAAP financial information, by its nature, departs from traditional accounting conventions. Accordingly, its use can make it difficult to compare current results with results from other reporting periods and with the financial results of other companies. We have provided a reconciliation of Adjusted EBITDA and adjusted gross profit excluding March 2020 inventory write-downs (and corresponding adjusted gross profit margin) to the most directly comparable U.S. GAAP measures in the supplemental financial information attached to the press release to which this CFO Commentary is also attached.

Cautionary Note Regarding Forward-Looking Statements

This CFO Commentary contains (and oral communications made by us may contain) “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “project,” “target,” “future,” “seek,” “likely,” “strategy,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our outlook for the Company and statements that estimate or project future results of operations or the performance of the Company.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

a.the impacts of certain environmental and health risks, including the recent outbreak of the coronavirus (COVID-19) and its potential effects on the Company's operations, sourcing from China, and future demand for the Company's products for an uncertain duration of time;

b.the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to attract new customers;

c.building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for our products;

d.the ability to respond quickly with appropriate products after the adoption and introduction of new mobile devices by major manufacturers like Apple®, Samsung®, and Google®;

e.changes or delays in announced launch schedules for (or recalls or withdrawals of) new mobile devices by major manufacturers like Apple, Samsung, and Google;

f.the ability to successfully integrate new operations or acquisitions;

g.the impacts of inconsistent quality or reliability of new product offerings;

h.the impacts of lower profit margins in certain new and existing product categories, including certain mophie products;

i.the impacts of changes in economic conditions, including on customer demand;

j.managing inventory in light of constantly shifting consumer demand;

k.the failure of information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the Company from cyber-attacks, terrorist incidents or the threat of terrorist incidents;

l.changes in U.S. and international trade policy and tariffs, including the effect of increases in U.S.-China tariffs on selected materials used in the manufacture of products sold by the Company which are sourced from China;

m.adoption of or changes in accounting policies, principles, or estimates; and

n.changes in the law, economic and financial conditions, including the effect of enactment of U.S. tax reform or other tax law changes.

Any forward-looking statement made by us in this CFO Commentary speaks only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in our most recent Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission, including (but not limited to) Item 1A - “Risk Factors” in the Form 10-K and Management's Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. The forward-looking statements contained in this CFO Commentary are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.