Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Holdings USA, Inc. | q32020santanderholding.htm |

SANTANDER HOLDINGS USA, INC. Fixed Income Investor Presentation Third Quarter 2020 November 9, 2020

DISCLAIMER This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such as “may,” “could,” “should,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “goal” or similar expressions are intended to indicate forward-looking statements. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre- Tax Pre- Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. The enhanced prudential standards mandated by Section 165 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "DFA") (the “Final Rule") were enacted by the Board of Governors of the Federal Reserve System (the "Federal Reserve") to strengthen regulatory oversight of foreign banking organizations ("FBOs"). Under the Final Rule, FBOs with over $50 billion of U.S. Non-branch assets, including Santander, were required to consolidate U.S. subsidiary activities under an intermediate holding company (“IHC”). Due to its U.S. non-branch total consolidated asset size, Santander is subject to the Final Rule. As a result of this rule, Santander transferred substantially all of its equity interests in U.S. bank and non-bank subsidiaries previously outside the Company to the Company, which became an IHC effective July 1, 2016. These subsidiaries included Santander Bancorp (“SBC”), Banco Santander International (“BSI”), Santander Investment Securities, Inc. (“SIS”), Santander Securities LLC (“SSLLC”), as well as several other subsidiaries. On July 1, 2017, an additional Santander subsidiary, SFS, a finance company located in Puerto Rico, was transferred to the Company. Additionally, effective July 2, 2018, Santander transferred Santander Asset Management, LLC to the IHC. Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, these statements are not guarantees of future performance and involve risks and uncertainties based on various factors and assumptions, many of which are beyond SHUSA’s control. Among the factors that could cause SHUSA’s financial performance to differ materially from that suggested by forward-looking statements are: (1) the adverse impact of a novel strain of coronavirus (“COVID-19”) on our business, financial condition, liquidity and results of operations; (2) the effects of regulation, actions and/or policies of the Federal Reserve, the Federal Deposit Insurance Corporation (the "FDIC"), the Office of the Comptroller of the Currency (the “OCC”) and the Consumer Financial Protection Bureau (the “CFPB”), and other changes in monetary and fiscal policies and regulations, including policies that affect market interest rates and money supply, actions related to COVID-19 as well as in the impact of changes in and interpretations of generally accepted accounting principles in the United States of America ("GAAP"), including adoption of the Financial Accounting Standards Board’s current expected credit losses credit reserving framework, the failure to adhere to which could subject SHUSA and/or its subsidiaries to formal or informal regulatory compliance and enforcement actions and result in fines, penalties, restitution and other costs and expenses, changes in our business practices, and reputational harm; (3) SHUSA’s ability to manage credit risk that may increase to the extent our loans are concentrated by loan type, industry segment, borrower type or location of the borrower of collateral; (4) the extent of recessionary conditions in the U.S. related to COVID-19 and the strength of the U.S. economy in general and regional and local economies in which SHUSA conducts operations in particular, which may affect, among other things, the level of non-performing assets, charge-offs, and provisions for credit losses; (5) acts of God, including pandemics and other significant public health emergencies, and other natural or man-made disasters and SHUSA’s ability to deal with disruptions caused by such acts, emergencies, and disasters; (6) inflation, interest rate, market and monetary fluctuations, including effects from the pending discontinuation of the London Interbank Offered Rate as an interest rate benchmark, may, among other things, reduce net interest margins, and impact funding sources and the ability to originate and distribute financial products in the primary and secondary markets; (7) the pursuit of protectionist trade or other related policies, including tariffs by the U.S., its global trading partners, and/or other countries, and/or trade disputes generally; (8) the ability of certain European member countries to continue to service their debt and the risk that a weakened European economy could negatively affect U.S.-based financial institutions, counterparties with which SHUSA does business, as well as the stability of global financial markets, including economic instability and recessionary conditions in Europe and the eventual exit of the United Kingdom from the European Union; (9) adverse movements and volatility in debt and equity capital markets and adverse changes in the securities markets, including those related to the financial condition of significant issuers in SHUSA’s investment portfolio; (10) SHUSA's ability to grow revenue, manage expenses, attract and retain highly-skilled people and raise capital necessary to achieve its business goals and comply with regulatory requirements; (11) SHUSA’s ability to effectively manage its capital and liquidity, including approval of its capital plans by its regulators and its subsidiaries’ ability to pay dividends to it; (12) changes in credit ratings assigned to SHUSA or its subsidiaries that could change the cost of funding or limit our access to capital markets; (13) the ability to manage risks inherent in our businesses, including through effective use of systems and controls, insurance, derivatives and capital management; (14) SHUSA’s ability to timely develop competitive new products and services in a changing environment that are responsive to the needs of SHUSA's customers and are profitable to SHUSA, the success of our marketing efforts to customers, and the potential for new products and services to impose additional unexpected costs, losses or other liabilities not anticipated at their initiation, and expose SHUSA to increased operational risk; (15) competitors of SHUSA may have greater financial resources or lower costs, or be subject to different regulatory requirements than SHUSA, may innovate more effectively, or may develop products and technology that enable those competitors to compete more successfully than SHUSA and cause SHUSA to lose business or market share; (16) Santander Consumer USA Inc.’s (“SC’s”) agreement with Fiat Chrysler Automobiles US LLC (“FCA”) may not result in currently anticipated levels of growth and is subject to performance conditions that could result in termination of the agreement; (17) consumers and small businesses may decide not to use banks for their financial transactions, which could impact our net income; (18) changes in customer spending, investment or savings behavior; (19) loss of customer deposits that could increase our funding costs; (20) the ability of SHUSA and its third-party vendors to convert, maintain and upgrade, as necessary, SHUSA’s data processing and other information technology (“IT”) infrastructure on a timely and acceptable basis, within projected cost estimates and without significant disruption to our business; (21) SHUSA’s ability to control operational risks, data security breach risks and outsourcing risks, and the possibility of errors in quantitative models and software SHUSA uses to manage its business, including as a result of cyber-attacks, technological failure, human error, fraud or malice, and the possibility that SHUSA’s controls will prove insufficient, fail or be circumvented; (22) changes to tax laws and regulations and the outcome of ongoing tax audits by federal, state and local income tax authorities that may require SHUSA to pay additional taxes or recover fewer overpayments compared to what has been accrued or paid as of period-end; (23) the costs and effects of regulatory or judicial actions or proceedings, including possible business restrictions resulting from such actions or proceedings; and (24) adverse publicity and negative public opinion, whether specific to SHUSA or regarding other industry participants or industry-wide factors, or other reputational harm; and (25) acts of terrorism or domestic or foreign military conflicts; and (26) the other factors that are described in Part I, Item IA – Risk Factors of SHUSA’s 2019 Annual Report on Form 10-K. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“Santander Bank” or “SBNA”), SC or any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. 2

SANTANDER GROUP Santander (SAN SM, STD US, BNC LN) is a leading retail and commercial bank headquartered in Spain. It has a meaningful presence in 10 core markets in Europe and the Americas, and is one of the largest banks in the world by market capitalization. The United States is a core market for the Santander Group, contributing 9% to 9M 2020 underlying attributable profit 9M 2020 Loans & Advances to Customers1 Contribution to 9M 2020 Underlying attributable profit2 Spain, 9% Europe Brazil, 30% SCF, 15% €3.7B South Underlying America Attributable UK, 6% Profit Chile, 5% Portugal, 5% Argentina, 3% Poland, 3% Other Europe, 1% Other South Am., 3% Mexico, 11% USA, 9% North America 3 1 Loans and advances to customers excluding reverse repos 2 As a % of operating areas. Excluding Corporate Center and Santander Global Platform

SANTANDER HOLDINGS USA, INC. SHUSA is an intermediate holding company (“IHC”) for Santander US entities and issues under the ticker symbol “SANUSA” SHUSA Highlights 7 major locations $146B in assets 16,900 employees 5M customers Santander SHUSA 100% Ownership SBNA – Retail Bank SC – Auto Finance BSI – Private Banking SIS – Broker Dealer 100% Ownership 80% Ownership* 100% Ownership 100% Ownership $85B Assets $49B Assets $7B Assets $3B Assets Products include: • Preferred auto finance • Private wealth Investment banking • Commercial and provider to FCA management for HNW services include: industrial (“C&I”) • Leading auto loan and and UHNW clients • Global markets • Multi-family lease originator and • Global transaction • Residential mortgage servicer banking • Auto and dealer • #1 auto asset-backed • Global debt financing floorplan financing securities (“ABS”) • Corporate finance issuer in 2019 4 * As of September 30, 2020

SANTANDER BANK SBNA is a regional Northeast retail consumer bank with a stable deposit base SBNA Highlights 579 branches 10,000 employees 2.1 million customers Other Loans, 1% Goodwill, 2% Home Equity, 5% C&I and Other Commercial, Other Assets, 6% 22% Auto Loans SBNA, 9% $85B ► Improve customer experience and loyalty across segments ► Improve margins through focus on integration of U.S. CRE, 9% Assets operations ► Leverage strong deposit base to support lending in commercial real estate (“CRE”), corporate and investment Cash, 8% banking (“CIB”) businesses as well as auto partnerships Investments, 20% ► Manage the COVID-19 crisis to support customers, Residential, 8% Multi-family, 10% employees and communities 5

SANTANDER CONSUMER USA SC is a large and established, nationwide auto finance provider across the full credit spectrum with demonstrated success through credit cycles SC Highlights 9 servicing centers 1.1M loans/leases 5,000 employees 3.1M customers Indirect Auto and OEM Direct Auto Relationships ► $63 billion in managed assets (includes $34B of loans, $17B of leases and $12B of assets serviced for others) ► Preferred auto finance provider for FCA providing loans, leases, dealer floorplan Digital Auto ► Leading auto ABS issuer in 2019 6

EARNINGS HIGHLIGHTS Q3 results reflect unique environment with low losses and strong auto recoveries; liquidity, reserves and capital remain strong Deposits & ► Santander Bank deposits of $64.4B, up 17% YoY in-line with balance sheet growth ► SC total auto originations of $8.4B, including $1.1B in loans generated through Santander Bank Auto Volume ► SC’s penetration rate with FCA 36% YTD, up from 35% YTD 2019 ► Santander Bank non-performing loans plus loans 30+ days past due (“DPD”) (“NPLs”) ratio of 0.33% down 17bps YoY Credit ► SC net charge-off ratio of 0.6%, down 750bps YoY and a 91% recovery rate in Q3 Performance ► SC – 86% of unique accounts that received deferrals have had those deferrals expire and 80% of these accounts remain <30 days past due Balance Sheet ► Completed the sale of Santander BanCorp (“SBC”) for a total net gain after tax of $50M, balance sheet decreased 4% QoQ due to the sale & Liquidity ► ABS market demand at recent highs, issued $3.3B in new ABS ► $312M of incremental reserves due to portfolio growth, allowance ratio of 8.1% up 30 bps QoQ Reserves & ► SHUSA’s ownership of SC increased to 80% providing certain tax consolidation and capital benefits Capital ► CET1 ratio of 15.4% ► Capital and reserves combine for strong loss absorbing capacity to manage through the pandemic 7

CAPITAL PLAN UPDATE ►Based on the June 2020 Dodd-Frank Act Stress Test (“DFAST”) results, SHUSA’s minimum capital ratios ranked in the top quartile among participating banks. ►During Q3, SHUSA requested and received approval for certain exceptions to the Federal Reserve’s interim policy related to DFAST and Comprehensive Capital Analysis and Review. ►With this exception, SC paid a dividend of $0.22 per share of common stock and continued to repurchase its shares increasing SHUSA’s ownership in SC to more than 80%, providing certain tax consolidation and capital benefits. ►On September 30, 2020, the Federal Reserve extended to the fourth quarter its interim policy applicable to all CCAR banks prohibiting share repurchases and limiting dividends to average trailing net income. ►Although SC’s standalone income is sufficient to support a dividend, it is consolidated into SHUSA’s capital plan and therefore is subject to the Federal Reserve’s interim policy that utilizes SHUSA’s average trailing income to determine the cap on common stock dividends. SC does not currently expect to declare or pay a dividend in the fourth quarter of 2020. 8

ALLOWANCE FOR CREDIT LOSSES (“ACL”) Allowance Ratios September 30, 2020 June 30, 2020 December 31, 2019 (Dollars in Millions) (Unaudited) (Unaudited) (Audited) Total loans held for investment (“LHFI”) $92,777 $91,294 $92,705 Total ACL1,2 $7,548 $7,236 $3,738 Total Allowance Ratio 8.1% 7.8% 4.0% ►As of the end of Q3 2020, total allowance increased $312M compared to Q2 2020, driven by portfolio growth. ►Allowance is ~88% of DFAST losses under the severely adverse scenario (June 2020 results) 9 1 Includes ACL for unfunded commitments

SHUSA QUARTERLY PROFITABILITY Q3 results driven by strong credit performance, the tax consolidation benefit from increased SC ownership (~$300M) and gains related to the sale of Santander BanCorp (~$50M after tax)* NET INTEREST INCOME ($M) PRE-TAX PRE-PROVISION INCOME ($M) $1,619 $1,599 $1,586 1,621 $1,228 1,539 $987 $1,030 $821 $743 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 $(1,105) PRE-TAX INCOME ($M) NET INCOME1,2 ($M) $822 $875 $383 $213 $270 $126 $(156) $(234) $(123) $(180) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 $(1,896) $(2,082) 10 1 Net income includes noncontrolling interest (“NCI”). 2 See page 22 for the consolidating income statement. Non-GAAP measure, excludes goodwill impairment * See slide 27 for further details

NIM AND INTEREST RATE RISK (IRR) SENSITIVITY SHUSA’s asset-sensitive position has decreased since Q1 2019 NET INTEREST MARGIN SHUSA INTEREST RATE RISK (Change in annual net interest income for parallel rate movements) SC Up 100bps 10.0% 9.9% 9.5% 1.9% 1.9% 9.2% 1.8% 1.5% 8.4% 1.3% SHUSA 0.0% 5.6% 5.4% 5.3% 5.3% 4.9% 3Q19 4Q19 1Q20 2Q20 3Q20 SBNA -0.7% 3.0% 2.8% Down 100bps 2.7% 2.5% 2.7% -1.1% -1.1% -1.9% 3Q19 4Q19 1Q20 2Q20 3Q20 11

BALANCE SHEET OVERVIEW 1 SHUSA’s balance sheet QoQ decrease driven by sale of Santander BanCorp (“SBC”) CDs, 3% Credit facilities, 2% CRE, 5% Savings, 3% Multi-family, 6% FHLB borrowings, 2% Money market, 22% Auto Loans, 28% Cash, 6% Other liabilities, 5% Interest- bearing Goodwill & demand , 7% Other Assets,2 $125B 7% $146B Liabilities Other Residential & borrowings, Home Equity, Assets 10% $21B 8% Secured Equity structured financings, 19% C&I , 16% 3 Noninterest- Auto Leases, 11% bearing demand, 12% Equity, 15% Investments, 13% 12 1 See page 23 for the consolidated balance sheet 2 Includes restricted cash, other intangibles, and other consumer loans 3 Operating lease

BALANCE SHEET TRENDS Deposit growth of 3% YoY, QoQ decrease driven by sale of Santander BanCorp (“SBC”) ASSETS ($B) LIABILITIES & EQUITY ($B) Gross Loans Investments Leases Other Assets Short-Term Funds IB Deposits* Borrowed Funds Equity NIB Deposits** Other Liabilities $152 $152 $147 $149 $146 $147 $149 $152 $152 $146 12 11 7 8 8 9 7 7 8 8 12 12 11 9 9 15 17 15 19 18 16 16 17 16 16 25 24 22 20 18 19 18 19 18 21 49 51 53 50 48 93 94 94 97 94 51 53 53 55 51 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 LOANS & LEASES ($B) DEPOSITS ($B) Auto C&I Leases CRE Res. Mtg Other Money Market NIB** IB* CDs Savings Other $110 $111 $113 $110 $109 $74 4 3 3 7 2 $67 $68 $70 $69 14 14 13 12 11 6 1 6 6 6 5 16 6 5 17 17 17 16 8 9 10 12 10 16 11 16 16 17 16 10 10 19 18 24 17 24 24 24 25 15 15 31 31 34 36 37 37 41 26 27 28 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 13 1 See pages 33 and 34 for trend detail on SBNA loan portfolio * Interest Bearing Deposits ** Non-Interest Bearing Deposits

BORROWED FUNDS PROFILE Total funding of $48.1 in Q3 down 3.6% QoQ ►Reduction in FHLB driven by significant deposit growth at a rate higher than loan growth ►Third party secured funding reduction driven by increase in intragroup funding Total Funding ($ in Billions) $53.0 $50.7 $49.9 $49.2 $48.1 2.0 7.2 9.0 6.9 5.4 4.0 3.1 3Q20 2Q20 3Q19 QoQ (%) YoY (%) 10.0 9.4 9.9 11.0 10.9 Senior Unsecured Debt 10.9 11.0 9.9 (0.9) 10.1 FHLB1 3.1 5.4 6.9 (42.6) (55.1) Third Party Secured Funding 2.8 3.9 5.5 (28.2) (49.1) 33.5 34.6 32.4 31.5 30.1 Amortizing Notes 8.5 9.7 7.3 (12.4) 16.4 Public Securitizations 18.8 17.9 19.6 5.0 (4.1) SC - BSSA 4.0 2.0 - 100.0 NA 3Q19 4Q19 1Q20 2Q20 3Q20 Total SHUSA Funding 48.1 49.9 49.2 (3.6) (2.2) SC Holdco SBNA SC - BSSA 14 1 3Q19 FHLB includes real estate investment trust ("REIT") preferred notes

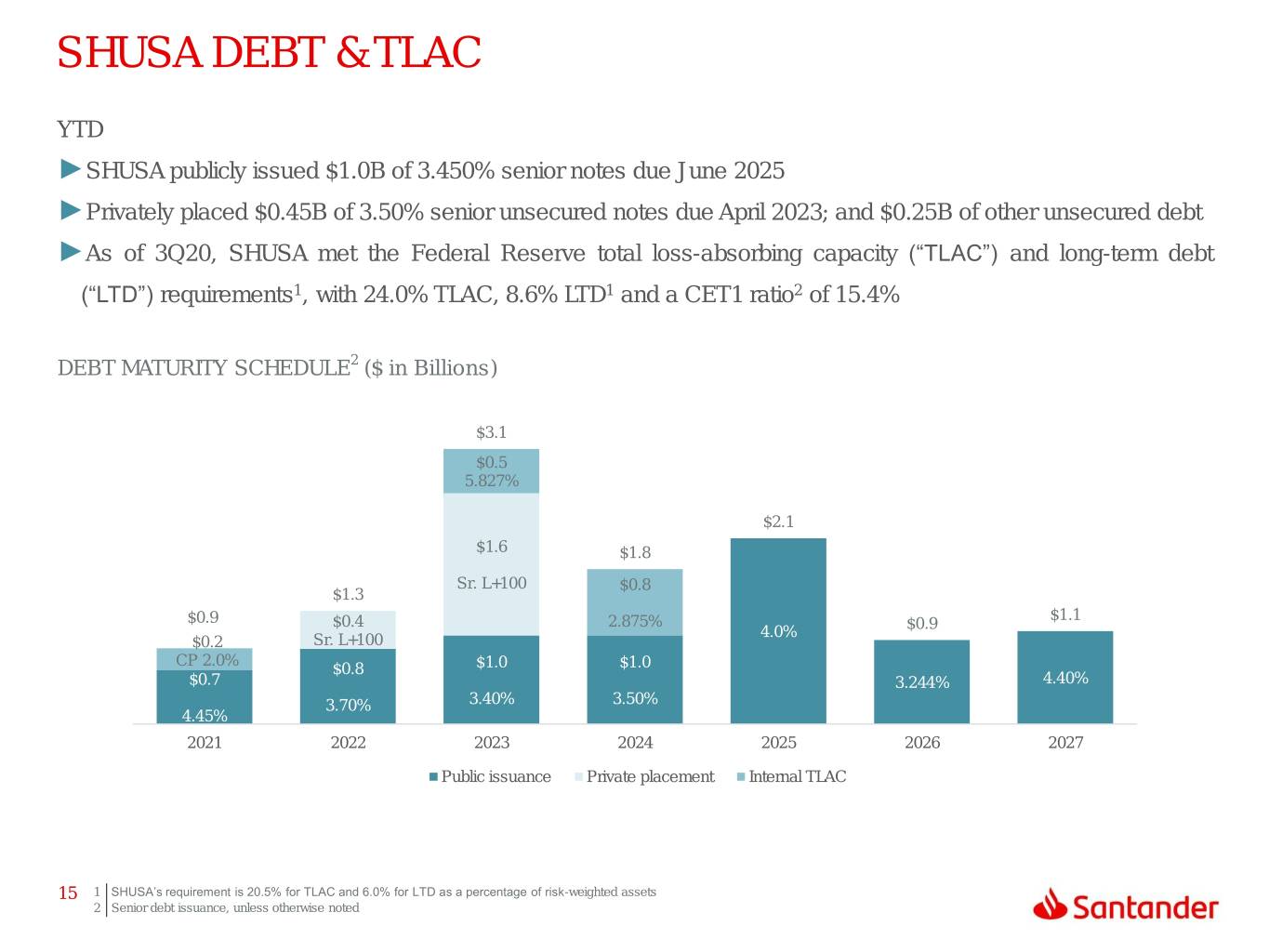

SHUSA DEBT & TLAC YTD ►SHUSA publicly issued $1.0B of 3.450% senior notes due June 2025 ►Privately placed $0.45B of 3.50% senior unsecured notes due April 2023; and $0.25B of other unsecured debt ►As of 3Q20, SHUSA met the Federal Reserve total loss-absorbing capacity (“TLAC”) and long-term debt (“LTD”) requirements1, with 24.0% TLAC, 8.6% LTD1 and a CET1 ratio2 of 15.4% DEBT MATURITY SCHEDULE2 ($ in Billions) $3.1 $0.5 5.827% $2.1 $1.6 $1.8 Sr. L+100 $0.8 $1.3 $1.1 $0.9 $0.4 2.875% $0.9 4.0% $0.2 Sr. L+100 CP 2.0% $0.8 $1.0 $1.0 $0.7 3.244% 4.40% 3.70% 3.40% 3.50% 4.45% 2021 2022 2023 2024 2025 2026 2027 Public issuance Private placement Internal TLAC 15 1 SHUSA’s requirement is 20.5% for TLAC and 6.0% for LTD as a percentage of risk-weighted assets 2 Senior debt issuance, unless otherwise noted

CAPITAL RATIOS CET1 TIER 1 LEVERAGE RATIO 15.4% 15.0% 13.6% 14.6% 13.1% 13.2% 14.3% 14.3% 12.6% 12.5% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 TIER 1 RISK-BASED CAPITAL RATIO TOTAL RISK-BASED CAPITAL RATIO 18.3% 16.9% 17.7% 16.2% 17.2% 17.1% 15.8% 15.7% 16.7% 15.3% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 16

SBNA ASSET QUALITY CECL and macroeconomic reserves contributed to allowance increases in 2020 ANNUALIZED NET CHARGE-OFF RATIO NPL RATIO 0.82% 0.75% 0.78% 0.75% 0.67% 0.57% 0.50% 0.46% 0.45% 0.33% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 ALLL TO TOTAL LOANS RESERVE COVERAGE (ALLL/NPL) 2.25% 300.6% 2.19% 270.1% 281.8% 1.80% 0.97% 0.96% 118.3% 128.1% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 17

SC AUTO ORIGINATIONS (QUARTERLY) Three Months Ended Originations % Variance ($ in Millions) Q3 2020 Q2 2020 Q3 2019 QoQ YoY Total Core Retail Auto $ 2,690 $ 2,135 $ 2,572 26% 5% Chrysler Capital Loans (<640)1 1,353 1,131 1,500 20% (10%) Chrysler Capital Loans (≥640)1 2,482 3,557 2,119 (30%) 17% Total Chrysler Capital Retail 3,835 4,688 3,619 (18%) 6% Total Leases2 1,860 989 2,230 88% (17%) Total Auto Originations3 $ 8,385 $ 7,812 $ 8,421 7% Flat Asset Sales4 $ 636 $ 512 - 21% NM SBNA Originations4 $ 1,100 $ 1,724 $ 2,112 (36%) (48%) 1 Approximate FICOs 18 2 Includes nominal capital lease originations 3 Includes SBNA originations 4 Asset sales and SBNA originations remain off SC’s balance sheet in the serviced for others portfolio

SC DELINQUENCY AND LOSS (QUARTERLY) Delinquency Ratios: 30-59 Days Delinquent, retail installment contracts (“RICs”), LHFI COVID-19 hardship relief programs and strong payment rates led to lower delinquencies and charge- 9.5% 9.7% 8.3% offs during the period 4.3% 5.0% Early stage delinquencies decreased 450 bps YoY Delinquency Ratios: >59 Days Delinquent, RICs, HFI 5.1% 4.7% 4.6% 2.4% 2.4% Late stage delinquencies decreased 230 bps YoY Gross Charge-off Rates 18.3% 17.3% 15.5% 11.1% 6.8% Gross charge-off rates decreased 1150 bps YoY SC Recovery Rates1 55.9% 52.2% 91.4% 50.1% 45.7% SC’s Q3 recovery rate of 91% driven by record wholesale prices at auction and low gross losses for the quarter Net Charge-off Rates2 8.1% 8.3% 7.7% 6.0% Net charge-offs decreased 750 bps YoY 0.6% Q3 2019 Q4 2019 1Q 2020 2Q 2020 Q3 2020 19 1 Recovery Rate – Includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts 2 Net charge-off rates on RICs, LHFI

RATING AGENCIES SHUSA and SBNA ratings impacted by the overall ratings of Santander SR. DEBT RATINGS BY SANTANDER ENTITY Santander1 A Negative outlook SHUSA BBB+ (June 30, 2020) SBNA BBB+ Santander1 A2 Stable outlook SHUSA (April 22, 2020) Baa3 SBNA2 Baa1 Santander1 A Negative outlook (July 10, 2020) SHUSA BBB+ SBNA A- 20 1 Senior preferred rating 2 SBNA long-term issuer rating

APPENDIX

CONSOLIDATING INCOME STATEMENT For the three-month period ended September 30, 2020 ($ in Millions) SBNA SC Other(1) IHC Entities(2) SHUSA Interest income $ 572 $ 1,352 $ 7 $ 60 $ 1,991 Interest expense (57) (292) (17) (4) (370) Net interest income $ 515 $ 1,060 $ (10) $ 56 $ 1,621 Fees & other income/(expense) 151 831 66 127 1,175 Other non-interest income - - 1 $ (1) - Net revenue/(loss) $ 666 $ 1,891 $ 57 $ 182 $ 2,796 General, administrative and other expenses (517) (888) (42) (121) (1,568) Provision for credit losses (68) (341) - 3 (406) Income/(loss) before taxes $ 81 $ 662 $ 15 $ 64 $ 822 Income tax (expense)/benefit (33) (172) 274 (16) 53 Net income/(loss) 48 490 289 48 875 Less: Net income attributable to NCI(3) - 102 - - 102 Net income attributable to SHUSA 48 388 289 48 773 22 1 Includes holding company activities, IHC eliminations, and eliminations and purchase accounting marks related to SC consolidation. 2 The entities acquired in the formation of the IHC are presented within "other" in SHUSA’s financial statement segment presentation due to immateriality. 3 SHUSA net income includes NCI.

CONSOLIDATING BALANCE SHEET ($ in Millions, unaudited) For the three-month period ended June 30, 2020 (1) (2) Assets SBNA SC Other IHC Entities SHUSA Cash and cash equivalents $ 6,918 $ 106 $ 476 $ 1,372 $ 8,872 Investments available-for-sale at fair value 10,863 96 120 - 11,079 Investments held-to-maturity 4,945 50 (120) 614 5,489 Other investment securities(3) 899 1 8 750 1,658 LHFI 54,948 33,602 (38) 4,265 92,777 Less ALLL (1,244) (6,152) 2 (6) (7,400) Total LHFI, net $ 53,704 $ 27,450 $ (36) $ 4,259 $ 85,377 Goodwill 1,554 74 968 - 2,596 Other assets 6,498 20,671 3,336 164 30,669 Total assets $ 85,381 $ 48,448 $ 4,752 $ 7,159 $ 145,740 Liabilities and Stockholder's Equity Deposits $ 67,793 $ - $ (3,954) $ 5,407 $ 69,246 Borrowings and other debt obligations 3,050 41,369 3,708 8 48,135 Other liabilities 2,593 1,984 2,834 143 7,554 Total liabilities $ 73,436 $ 43,353 $ 2,588 $ 5,558 $ 124,935 Stockholder's equity including NCI 11,945 5,095 2,164 1,601 20,805 Total liabilities and stockholder's equity $ 85,381 $ 48,448 $ 4,752 $ 7,159 $ 145,740 23 1 Includes holding company activities, IHC eliminations, and eliminations and purchase accounting marks related to SC consolidation. 2 The entities acquired in the formation of the IHC are presented within "other" in SHUSA’s financial statement segment presentation due to immateriality. 3 Other investment securities include trading securities.

SHUSA: QUARTERLY TRENDED STATEMENT OF OPERATIONS ($ in Millions) 3Q19 4Q19 1Q20 2Q20 3Q20 Interest income $ 2,185 $ 2,148 $ 2,110 $ 1,968 $ 1,991 Interest expense (566) (549) (524) (429) (370) Net interest income $ 1,619 $ 1,599 $ 1,586 $ 1,539 $ 1,621 Fees & other income 999 866 1,018 764 1,175 Other non-interest income 2 3 9 23 - Net revenue $ 2,620 $ 2,468 $ 2,613 $ 2,326 $ 2,796 General, administrative, and other expenses (1,633) (1,647) (1,583) (3,431) (1,568) Provision for credit losses (604) (608) (1,186) (977) (406) Income before taxes $ 383 $ 213 $ (156) $ (2,082) $ 822 Income tax (expense)/benefit (113) (87) 33 186 53 Net income 270 126 (123) (1,896) 875 Less: Net income attributable to NCI 67 39 4 (23) 102 Net income attributable to SHUSA 203 87 (127) (1,873) 773 3Q19 4Q19 1Q20 2Q20 3Q20 NIM 5.6% 5.4% 5.3% 4.9% 5.3% 24

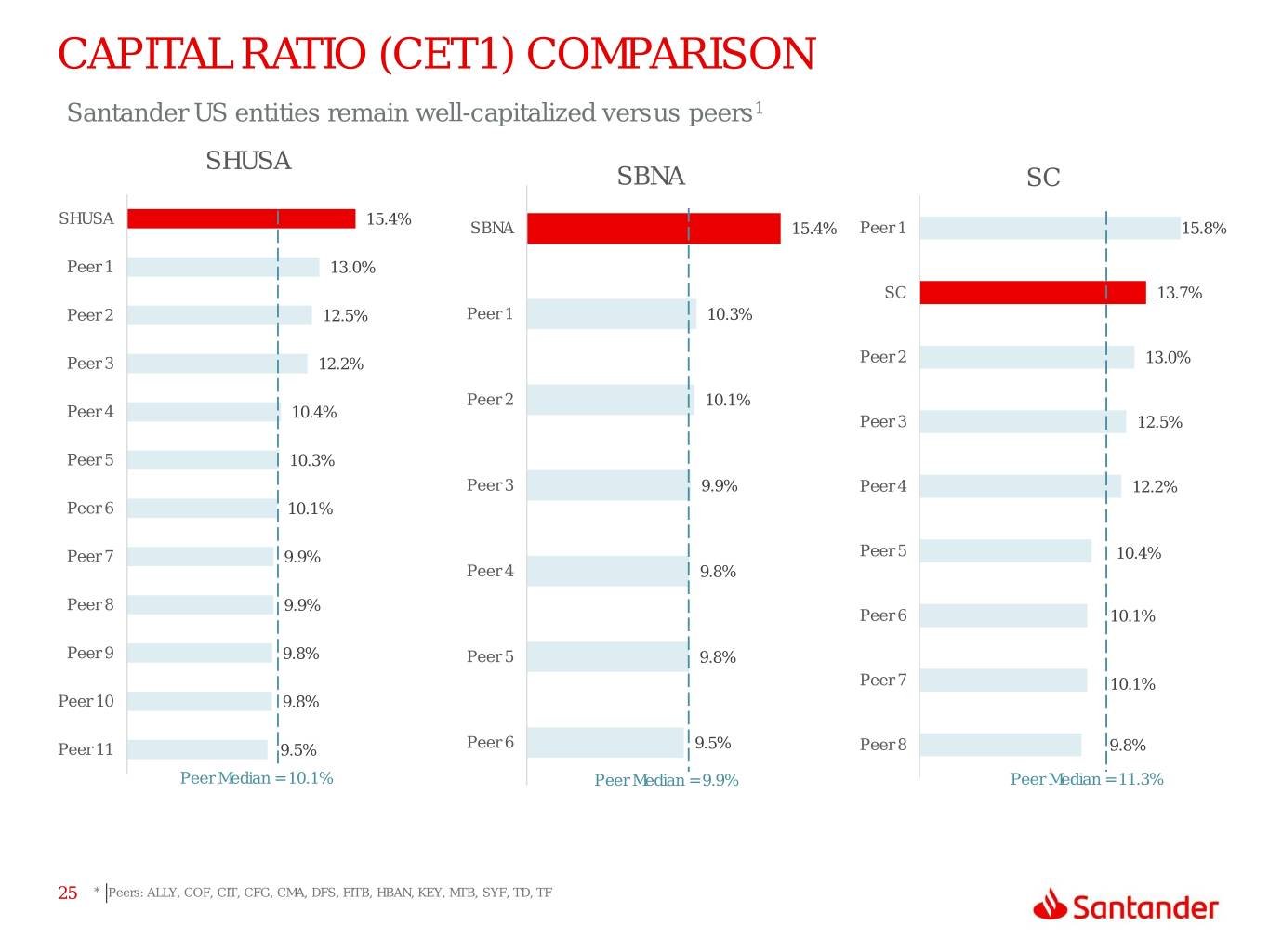

CAPITAL RATIO (CET1) COMPARISON Santander US entities remain well-capitalized versus peers1 SHUSA SBNA SC SHUSA 15.4% SBNA 15.4% Peer 1 15.8% Peer 1 13.0% SC 13.7% Peer 2 12.5% Peer 1 10.3% Peer 3 12.2% Peer 2 13.0% Peer 2 10.1% Peer 4 10.4% Peer 3 12.5% Peer 5 10.3% Peer 3 9.9% Peer 4 12.2% Peer 6 10.1% Peer 7 9.9% Peer 5 10.4% Peer 4 9.8% Peer 8 9.9% Peer 6 10.1% Peer 9 9.8% Peer 5 9.8% Peer 7 10.1% Peer 10 9.8% Peer 11 9.5% Peer 6 9.5% Peer 8 9.8% Peer Median = 10.1% Peer Median = 9.9% Peer Median = 11.3% 25 * Peers: ALLY, COF, CIT, CFG, CMA, DFS, FITB, HBAN, KEY, MTB, SYF, TD, TF

SHUSA: NON-GAAP RECONCILIATIONS ($ in Millions) 3Q19 4Q19 1Q20 2Q20 3Q20 SHUSA pre-tax pre-provision income Pre-tax income, as reported $ 383 $ 213 $ (156) $ (2,082) $ 822 Provision for credit losses 604 608 1,186 977 406 Pre-tax pre-provision Income $ 987 $ 821 1,030 (1,105) 1,228 CET 1 to risk-weighted assets CET 1 capital $ 17,504 $ 17,392 $ 17,113 $ 17,173 $ 17,921 Risk-weighted assets 116,652 118,898 120,055 119,862 116,060 Ratio 15.0% 14.6% 14.3% 14.3% 15.4% Tier 1 leverage Tier 1 capital $ 18,888 $ 18,781 $ 18,311 $ 18,825 $ 19,570 Avg total assets, leverage capital purposes 139,301 143,057 144,758 151,148 148,387 Ratio 13.6% 13.1% 12.6% 12.5% 13.2% Tier 1 risk-based Tier 1 capital $ 18,888 $ 18,781 $ 18,311 $ 18,825 $ 19,570 Risk-weighted assets 116,652 118,898 120,055 119,862 116,060 Ratio 16.2% 15.8% 15.3% 15.7% 16.9% Total risk-based Risk-based capital $ 20,601 $ 20,480 $ 20,007 $ 20,502 $ 21,190 Risk-weighted assets 116,652 118,898 120,055 119,862 116,060 Ratio 17.7% 17.2% 16.7% 17.1% 18.3% 26

SHUSA: Q3 NON-GAAP RECONCILIATION SHUSA Pre-tax Pre-Provision Income 3Q20 Pre-tax pre-provision income, as reported $ 1,228 Subtract: SBC sale profit (61) Pre-tax Pre-Provision Income, adjusted 1,167 Pre-Tax Income 3Q20 Pre-tax income, as reported $ 822 Subtract: SBC sale profit (61) Pre-Tax Income, adjusted 761 Net Income, as reported 3Q20 Pre-tax income, as reported $ 822 Tax rate 6.4% Income tax benefit, as reported 53 Net Income, as reported 875 Income Tax Expense Income tax benefit, as reported $ 53 Subtract: 80% ownership of SC tax consolidation benefit (307) Add: SBC sale profit tax expense 12 Income tax expense, adjusted (242) Net Income, adjusted 3Q20 Pre-tax income, adjusted $ 761 Tax rate (31.8%) Income tax expense, adjusted (242) Net Income, adjusted 519 27

SBNA: QUARTERLY PROFITABILITY NET INTEREST INCOME ($M) PRE-TAX PRE-PROVISION INCOME ($M)1 $600 $531 4.00% $520 $508 502 515 $500 3.50% $400 3.00% $145 $62 $134 $149 2.97% $300 2.50% 2.81% 2.72% 3Q19 4Q19 1Q20 2Q20 3Q20 2.54% 2.65% $200 2.00% $100 1.50% $- 1.00% 3Q19 4Q19 1Q20 2Q20 3Q20 $(1,687) PRE-TAX INCOME ($M)1 NET INCOME/(LOSS) ($M)1 $95 $87 $81 $(2) $48 $(1) $(121) $(79) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 $(1,953) $(1,755) 28 1 Includes non-recurring goodwill impairment in Q2 2020

SBNA: QUARTERLY TRENDED STATEMENT OF OPERATIONS OPS ($ in Millions) 3Q19 4Q19 1Q20 2Q20 3Q20 Interest income $ 712 $ 695 $ 665 $ 591 $ 572 Interest expense (181) (175) (157) (89) (57) Net interest income $ 531 $ 520 $ 508 $ 502 $ 515 Fees & other income 180 151 135 132 151 Other non-interest income 2 3 11 22 - Net revenue $ 713 $ 674 $ 654 $ 656 $ 666 General, administrative & other expenses (568) (612) (520) (2,343) (517) Release of/(provision for) credit losses (50) (63) (255) (266) (68) Income before taxes $ 95 $ (1) $ (121) $ (1,953) $ 81 Income tax expense (8) (1) 42 198 (33) Net income/(loss) 87 (2) (79) (1,755) 48 3Q19 4Q19 1Q20 2Q20 3Q20 Net interest margin before provision 3.0% 2.8% 2.7% 2.5% 2.7% 29 1 Includes non-recurring goodwill impairment in Q2 2020

SBNA: QUARTERLY AVERAGE BALANCE SHEET SBNA: QUARTERLY AVERAGE BALANCE SHEET 3Q20 2Q20 QoQ Change 3Q19 Average Yield/ Average Yield/ Average Yield/ Average Yield/ ($ in Millions, unaudited) Balance Rate Balance Rate Balance Rate Balance Rate Assets Deposits and investments $ 21,570 1.17% $ 21,766 1.34% $ (196) (0.17%) $ 16,207 2.25% Loans 56,367 3.61% 57,233 3.62% (866) (0.01%) 55,337 4.49% Allowance for loan losses (1,229) --- (1,035) --- (194) --- (553) --- Other assets 9,253 --- 11,080 --- $ (1,827) --- 9,757 --- Total assets $ 85,961 2.66% $ 89,044 2.66% $ (3,083) --- $ 80,748 3.53% Liabilities and stockholder's equity Interest-bearing demand deposits $ 10,103 0.07% $ 9,844 0.03% $ 259 --- $ 8,920 0.69% Noninterest-bearing demand deposits 16,014 --- 14,930 --- 1,084 --- 12,245 --- Savings 4,556 0.05% 4,215 0.04% 341 0.01% 3,813 0.07% Money market 31,563 0.39% 30,254 0.51% 1,309 (0.12%) 26,357 1.28% Certificates of deposit 4,761 1.45% 5,967 1.59% (1,206) (0.14%) 7,077 2.06% Borrowed funds 4,015 0.67% 7,205 1.41% (3,190) (0.74%) 6,255 2.82% Other liabilities 2,888 --- 2,825 --- 63 --- 2,226 --- Equity 12,061 --- 13,807 --- $ (1,746) --- 13,855 --- Total liabilities and stockholder's equity $ 85,961 0.26% $ 89,047 0.40% $ (3,086) (0.14%) $ 80,748 0.90% Net interest margin 2.65% 2.54% 0.11% 2.97% 30

SBNA: FUNDING – DEPOSITS AVERAGE NON-MATURITY DEPOSIT AVERAGE TOTAL DEPOSIT BALANCE1 ($B) BALANCES1 ($B) Non-Maturity Deposit Balances Avg. Interest Cost Total Deposits Avg. Interest Cost 70.0 1.60% 70.0 $64.4 $59.4 $62.6 1.60% 60.0 $56.7 $58.4 1.40% 60.0 $57.8 $50.0 $50.7 $55.2 1.40% $48.1 50.0 1.20% 50.0 1.20% 40.0 1.00% 0.96% 1.00% 0.80% 40.0 0.89% 0.74% 0.80% 0.78% 0.80% 30.0 0.64% 30.0 0.60% 0.60% 20.0 20.0 0.40% 0.28% 0.40% 0.31% 0.40% 0.22% 10.0 10.0 0.20% 0.20% - 0.00% - 0.00% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 31 1 Represents average quarterly balances. * SBNA total deposits less the SHUSA cash deposit held at SBNA.

SBNA: ASSET QUALITY NPLs CRITICIZED BALANCES1 Criticized Balances Criticized Ratio $453 $443 $3,000 $2,760 $2,822 10.00% $416 $414 9.00% $370 $2,500 $2,093 $2,065 $2,069 8.00% $2,000 7.00% $1,500 6.00% -13% 5.00% $1,000 5.1% 4.8% 4.00% $500 3.8% 3.7% 3.7% 3.00% $0 2.00% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 DELINQUENCY2 TEXAS RATIO3 0.75% 6.43% 0.60% 5.31% 5.02% 5.16% 0.55% 0.54% 0.50% 4.41% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 32 1 Criticized = loans that are categorized as special mention, substandard, doubtful, or loss 2 Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD 3 See page 37 for non-GAAP measurement reconciliation of Texas Ratio

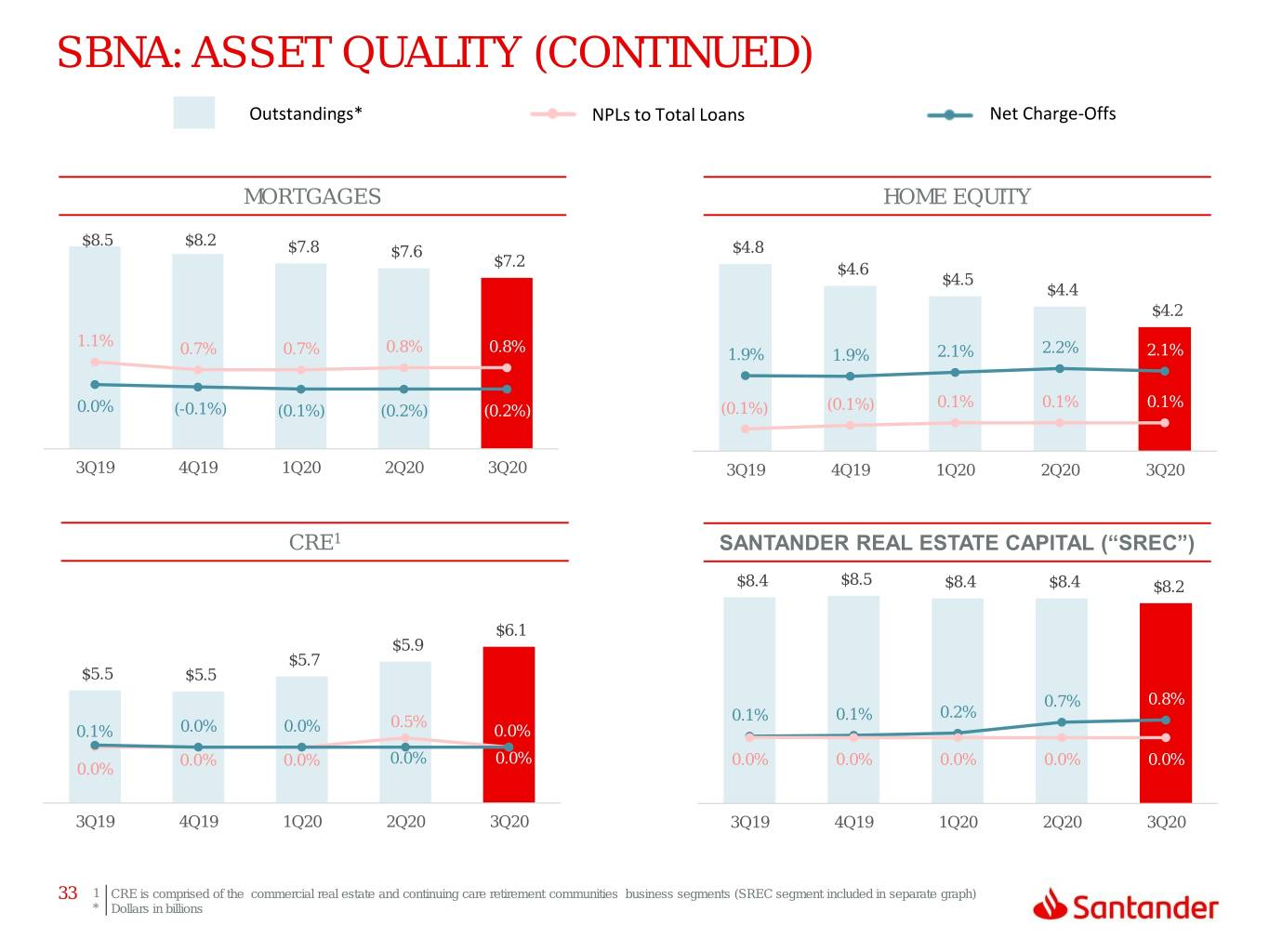

SBNA: ASSET QUALITY (CONTINUED) Outstandings* NPLs to Total Loans Net Charge-Offs MORTGAGES HOME EQUITY $9.0 7.0% $8.5 $8.2 $7.8 $5.0 $4.8 7.0% 6.0% $8.0 $7.6 $7.2 $4.8 $4.6 6.0% 5.0% $7.0 $4.6 $4.5 $4.4 5.0% 4.0% $6.0 $4.4 $4.2 3.0% 4.0% $4.2 $5.0 2.0% 1.1% $4.0 3.0% $4.0 0.8% 0.8% 0.7% 0.7% 1.9% 1.9% 2.1% 2.2% 2.1% 1.0% $3.8 2.0% $3.0 0.0% $3.6 1.0% $2.0 (-1.0%) 0.1% 0.1% 0.1% 0.0% (-0.1%) (0.1%) (0.2%) (0.2%) $3.4 (0.1%) (0.1%) $1.0 0.0% (-2.0%) $3.2 - (-3.0%) $3.0 (-1.0%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 CRE1 SANTANDER REAL ESTATE CAPITAL (“SREC”) $9.0 $8.4 $8.5 $8.4 $8.4 $8.2 7.0% 6.0% $8.0 $6.5 7.0% 5.0% $7.0 $6.1 6.0% $5.9 4.0% $6.0 5.0% $5.7 $6.0 3.0% 4.0% $5.5 $5.5 $5.0 $5.5 3.0% 2.0% $4.0 0.7% 0.8% 2.0% 0.1% 0.1% 0.2% 1.0% $5.0 0.5% 1.0% 0.0% 0.0% $3.0 0.1% 0.0% 0.0% 0.0% $2.0 0.0% 0.0% (-1.0%) $4.5 0.0% 0.0% (-1.0%) 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $1.0 (-2.0%) (-2.0%) $4.0 (-3.0%) - (-3.0%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 33 1 CRE is comprised of the commercial real estate and continuing care retirement communities business segments (SREC segment included.in separate graph) * Dollars in billions

SBNA: ASSET QUALITY (CONTINUED) Outstandings* NPLs to Total Loans Net Charge-Offs COMMERCIAL BANKING1 CIB $16.0 $15.2 $15.0 7.0% $8.0 $7.4 7.0% $14.6 $14.6 $14.1 6.0% 6.0% $14.0 $7.0 $6.5 $6.1 5.0% $6.0 $6.0 5.0% $12.0 $6.0 4.0% 4.0% $10.0 $5.0 3.0% 3.0% $8.0 1.3% 1.3% 2.0% $4.0 2.0% 0.9% 0.8% 0.9% 0.6% 1.0% 0.4% 1.0% $6.0 $3.0 0.4% 0.3% 0.3% 0.0% 0.0% $4.0 0.7% 0.7% 0.7% $2.0 0.4% 0.6% 0.3% 0.4% 0.4% 0.1% 0.1% (-1.0%) (-1.0%) $2.0 $1.0 (-2.0%) (-2.0%) - (-3.0%) - (-3.0%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 OTHER CONSUMER2 INDIRECT AUTO3 $1.6 $1.5 $9.0 7.0% $1.4 9.0% $7.9 $1.4 $1.3 6.0% $8.0 $7.6 $1.2 7.0% 5.0% $1.2 $6.7 $1.1 $7.0 $6.5 4.0% $6.0 $1.0 5.0% $5.3 5.5% 5.6% 3.0% 5.1% 5.3% 5.4% $5.0 $0.8 2.0% 3.0% 0.9% 1.0% 0.9% $4.0 0.7% 0.8% 1.0% $0.6 $3.0 1.0% 0.0% $0.4 1.4% 1.6% 1.6% 1.7% 1.5% 0.6% 0.6% $2.0 0.3% 0.4% 0.5% (-1.0%) (-1.0%) $0.2 $1.0 (-2.0%) - (-3.0%) - (-3.0%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 1 Commercial Banking = Equipment Finance & Leasing, Commercial Equipment Vehicle Finance-Strategic, Financial Institutions Coverage, International Trade Banking, Middle Market, Asset Based .Lending, Institutional-NonProfit, Government Banking, Life Sciences & Technology, Professional & Business Services, Energy Finance, Mortgage Warehouse, Other Non-Core Commercial, Chrysler .Auto Finance, .Footprint Dealer Floorplan and Commercial Banking Not Classified Elsewhere and all other Commercial Business segments. 34 2 Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Credit Cards, SFC, & Retail run-off 3 Indirect Auto = Origination program assets through SC, full roll-out in Q2’18 * Dollars in billions

SBNA: CAPITAL RATIOS CET1 TIER 1 LEVERAGE RATIO 16.0% 15.8% 13.4% 15.7% 15.2% 15.4% 12.8% 12.6% 11.7% 12.1% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 TIER 1 RISK-BASED CAPITAL RATIO TOTAL RISK-BASED CAPITAL RATIO 17.0% 16.8% 16.8% 16.4% 16.6% 16.0% 15.8% 15.7% 15.2% 15.4% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 35 * Capital ratios through March 31, 2020 calculated under the U.S. Basel III framework on a transitional basis. Capital ratios starting in the first quarter of 2020 calculated .under CECL transition provisions permitted by the CARES Act.

SC AUTO YTD MONTHLY ORIGINATIONS Core Retail Auto ($ in millions) Chrysler Lease ($ in millions)1 $1,200 $1,000 $1,000 $800 $800 $600 $600 $400 $400 $200 $200 $0 $0 Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep YoY -4% -14% -17% -44% -8% 23% 8% -6% 13% YoY 14% 17% -18% -73% -64% -48% -26% -21% 0% Chrysler Capital Loans, <6401 ($ in millions) Chrysler Capital Loans, ≥6401 ($ in millions) $600 $1,400 $500 $1,200 $1,000 $400 $800 $300 $600 $200 $400 $100 $200 $0 $0 Jan Feb Mar Apr May Jun Jul Aug Sep Jan Feb Mar Apr May Jun Jul Aug Sep YoY -7% -13% -12% -40% -24% -5% -11% -19% 2% YoY 22% 22% 45% 125% 79% 45% 23% 6% 23% 36 2019 2020

SC AUTO LOSS & RECOVERY RATIOS (ANNUALIZED) Gross Charge-off Ratio (%) Recovery Rates (%) 25.0% 125.0% 20.0% 100.0% 15.0% 75.0% 10.0% 50.0% 5.0% 25.0% 0.0% 0.0% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 22.3 19.1 17.0 16.1 16.1 15.8 17.9 18.4 18.5 18.3 17.1 16.1 2019 49.0 54.6 66.1 62.5 62.4 56.0 55.2 59.2 53.2 52.9 57.5 46.2 2020 17.2 15.6 13.7 12.9 12.6 8.1 6.7 5.5 7.9 2020 46.0 53.0 52.1 32.1 49.1 62.1 81.7 126.1 76.4 Net Charge-off Ratio (%) 15.0% 12.0% 9.0% 6.0% 3.0% 0.0% -3.0% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 11.3 8.7 5.8 6.1 6.1 7.0 8.0 7.5 8.6 8.6 7.3 8.7 2020 9.3 7.3 6.6 8.7 6.4 3.1 1.2 -1.4 1.9 37 2019 2020

SBNA: NON-GAAP RECONCILIATIONS ($ in Millions) 3Q19 4Q19 1Q20 2Q20 3Q20 SBNA pre-tax pre-provision income Pre-tax income, as reported $ 95 $ (1) $ (121) $ (1,953) $ 81 (Release of)/provision for credit losses 50 63 255 266 68 Pre-tax pre-provision Income $ 145 $ 62 134 (1,687) 149 CET 1 to risk-weighted assets CET 1 capital $ 10,335 $ 10,220 $ 10,173 $ 10,168 $ 10,219 Risk-weighted assets 64,543 64,678 64,971 67,065 66,507 Ratio 16.0% 15.8% 15.7% 15.2% 15.4% Tier 1 leverage Tier 1 capital $ 10,335 $ 10,220 $ 10,173 $ 10,168 $ 10,219 Avg total assets, leverage capital purposes 77,262 80,007 80,825 86,547 84,264 Ratio 13.4% 12.8% 12.6% 11.7% 12.1% Tier 1 risk-based Tier 1 capital $ 10,335 $ 10,220 $ 10,173 $ 10,168 $ 10,219 Risk-weighted assets 64,543 64,678 64,971 67,065 66,507 Ratio 16.0% 15.8% 15.7% 15.2% 15.4% Total risk-based Risk-based capital $ 10,965 $ 10,844 $ 10,930 $ 11,005 $ 11,050 Risk-weighted assets 64,543 64,678 64,971 67,065 66,507 Ratio 17.0% 16.8% 16.8% 16.4% 16.6% 38

SBNA: NON-GAAP RECONCILIATIONS (cont.) SBNA Texas Ratio ($ in Millions) 3Q19 4Q19 1Q20 2Q20 3Q20 Total Equity $13,799 $13,681 $14,014 $12,306 $12,307 Goodwill and other intangibles (3,635) (3,643) (3,637) (1,788) (1,789) Allowance for loan losses 536 533 999 1,249 1,244 Total equity and loss allowances for Texas Ratio $10,700 $10,571 $11,376 $11,767 $11,762 Nonperforming assets $ 470 $ 433 $ 384 $ 453 $ 424 90+ DPD accruing 6 6 6 6 5 Accruing troubled debt restructurings 212 122 112 132 178 Total nonperforming assets $ 688 $ 561 $ 502 $ 591 $ 607 Texas ratio 6.4% 5.3% 4.4% 5.0% 5.2% 39

THANK YOU Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be: