Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LUNA INNOVATIONS INC | ex991pressrelease20209.htm |

| 8-K - 8-K - LUNA INNOVATIONS INC | luna-20201109.htm |

Third-quarter Fiscal 2020 Earnings Investor Supplemental Materials November 9, 2020

Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding the company's future financial performance, including 2020 guidance, and the potential demand for its products, the company's growth potential, its balance sheet and capitalization and access to capital, its technological advantages, the potential impacts of the COVID-19 pandemic on its business, operations and financial results, its strategic position, corporate culture, operational efficiency and market trends. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target markets to grow and expand, technological, operational and strategic challenges, uncertainties related to the ultimate impact of the COVID-19 pandemic and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation, November 9, 2020, and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA, a non-GAAP financial measure. This non-GAAP financial measure is in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to Net Income is included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

3Q FY20 Results

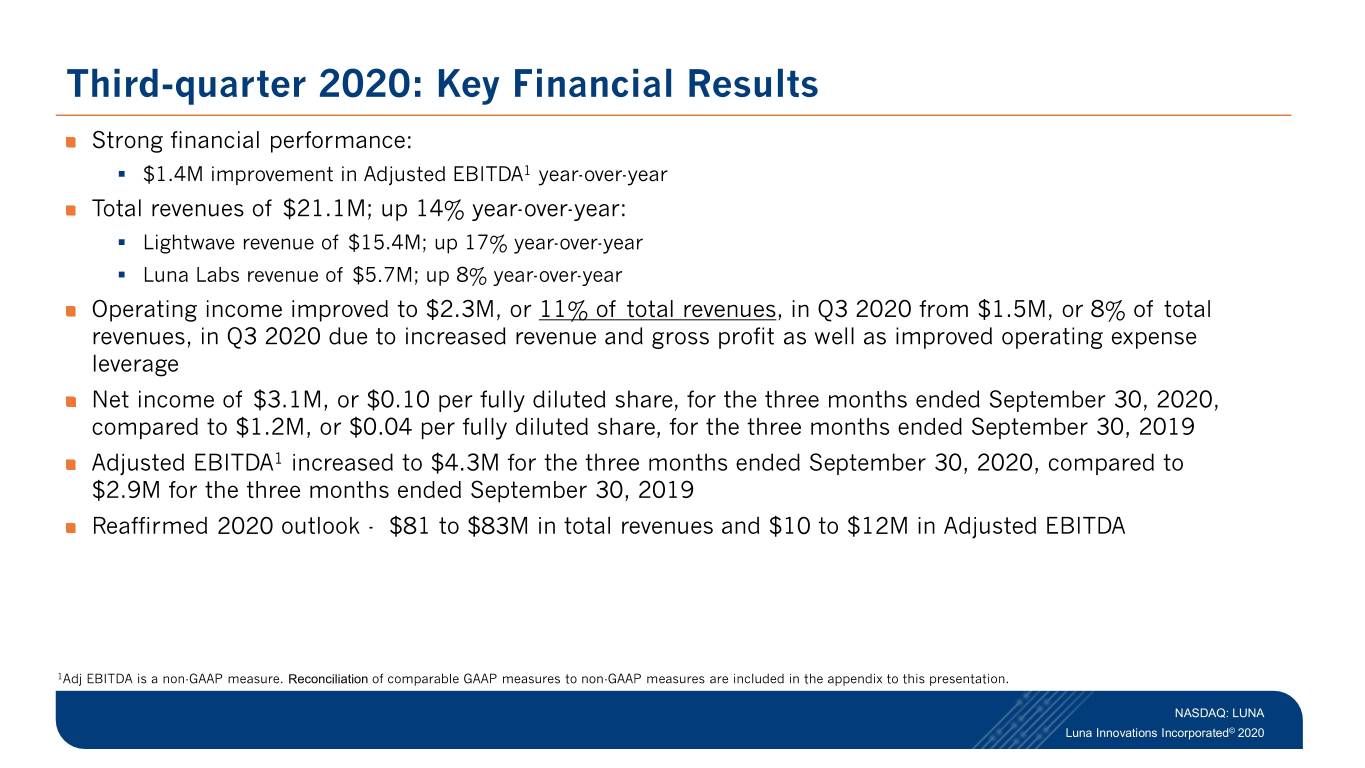

Third-quarter 2020: Key Financial Results Strong financial performance: . $1.4M improvement in Adjusted EBITDA1 year-over-year Total revenues of $21.1M; up 14% year-over-year: . Lightwave revenue of $15.4M; up 17% year-over-year . Luna Labs revenue of $5.7M; up 8% year-over-year Operating income improved to $2.3M, or 11% of total revenues, in Q3 2020 from $1.5M, or 8% of total revenues, in Q3 2020 due to increased revenue and gross profit as well as improved operating expense leverage Net income of $3.1M, or $0.10 per fully diluted share, for the three months ended September 30, 2020, compared to $1.2M, or $0.04 per fully diluted share, for the three months ended September 30, 2019 Adjusted EBITDA1 increased to $4.3M for the three months ended September 30, 2020, compared to $2.9M for the three months ended September 30, 2019 Reaffirmed 2020 outlook - $81 to $83M in total revenues and $10 to $12M in Adjusted EBITDA 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Third-quarter 2020 and Other Recent Accomplishments Reported strong third-quarter 2020 financial results in challenging COVID environment Acquired New Ridge Technologies . Brings advanced measurement capabilities to our communications test portfolio Hired key positions in operations and corporate shared services Held 9 customer-facing technology educational webinars: ~1,300 live attendees and more than 1,400 leads Progressing towards NetSuite go-live in Q1 2021 Continued to monitor employee feedback with a focus on safety and well-being Consolidated Luna Labs facility footprint to increase division efficiency and drive collaboration and growth Selected by Lockheed Martin as the supplier of corrosion sensors for NASA’s Artemis mission NASDAQ: LUNA Luna Innovations Incorporated© 2020

Strong Financial Results Revenue1 Adjusted EBITDA1, 2 (millions) (millions) FY20 Guidance FY20 Guidance $10.0 to $12.0 $81.0 - $83.0 $9.5 $70.5 $42.9 $3.1 $8.8 $33.1 $29.6 $56.8 $0.3 ($2.0) FY16 FY17 FY18 FY19 FY20 FY16 FY17 FY18 FY19 FY20 1 Based on management’s estimates of the impact from the divestiture of Optoelectronics. Includes the acquisitions of Micron Optics and General Photonics. 2Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

A Flexible Balance Sheet and Strong Cash Position Strong balance sheet on September 30, 2020: . $95.9M in total assets • $26.4M in cash and cash equivalents • $49.3M in working capital Access to $10M revolving credit facility, if needed Continued focus on working capital and reinvestment in business in order to generate long-term sustainable growth NASDAQ: LUNA Luna Innovations Incorporated© 2020

COVID-19 Business Update Took immediate action to create a safer work environment, including open and frequent communication with employees regarding benefits, resources and safety information No staff reduction to date; none anticipated Continued focus on building sales pipeline and interacting with customers through frequent videoconferencing calls, virtual sales conference, tradeshows and Luna-hosted product education webinars Strong cash position; adequate access to capital Well positioned to take advantage of continued strong trends in 5G, lightweighting and infrastructure monitoring Continue to be as transparent as possible through pandemic and to keep stakeholders apprised, publicly, of significant operation and financial shifts NASDAQ: LUNA Luna Innovations Incorporated© 2020

2020 Financial Outlook Maintaining FY2020 outlook: . Total revenues of $81M to $83M . Adjusted EBITDA1 of $10M to $12M 1 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. The outlook above does not include any future acquisitions, divestitures, or unanticipated events. NASDAQ: LUNA Luna Innovations Incorporated© 2020

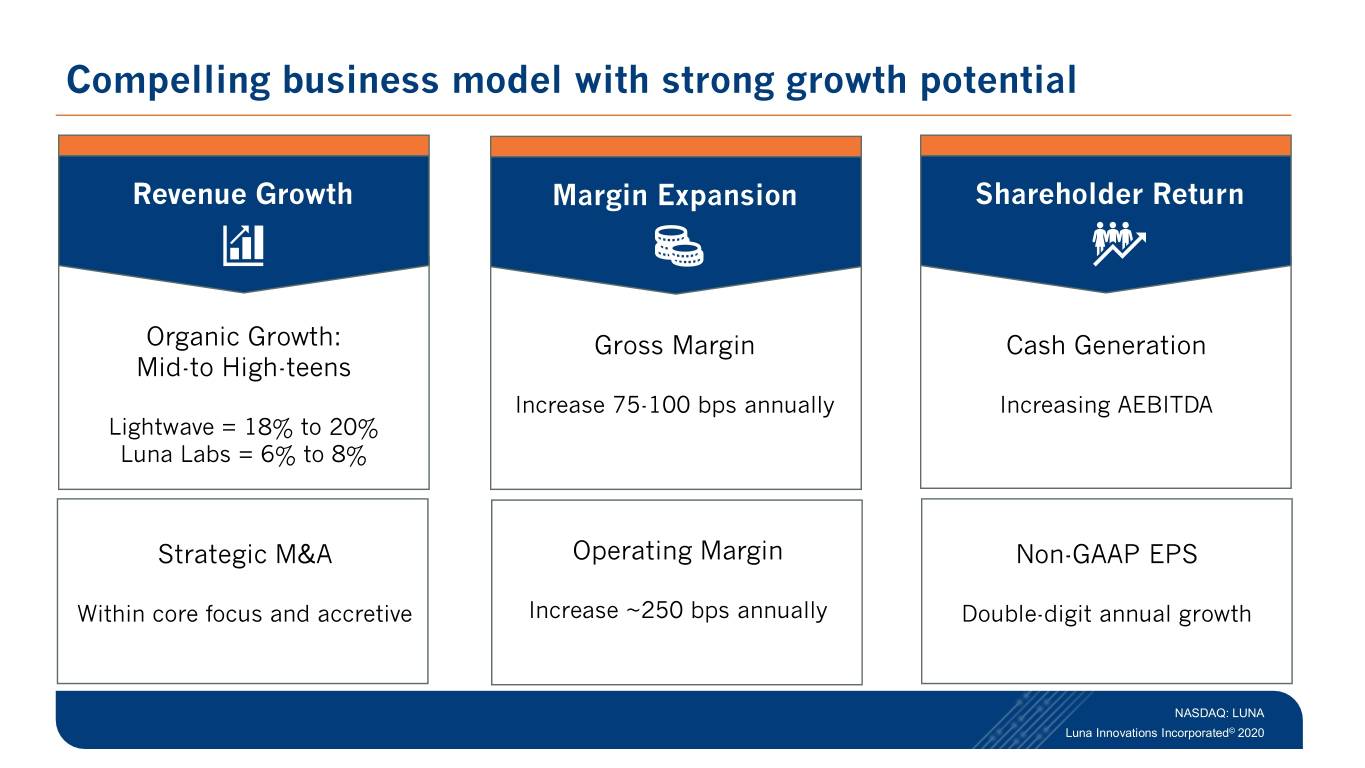

Compelling business model with strong growth potential Revenue Growth Margin Expansion Shareholder Return Organic Growth: Gross Margin Cash Generation Mid-to High-teens Increase 75-100 bps annually Increasing AEBITDA Lightwave = 18% to 20% Luna Labs = 6% to 8% Strategic M&A Operating Margin Non-GAAP EPS Within core focus and accretive Increase ~250 bps annually Double-digit annual growth NASDAQ: LUNA Luna Innovations Incorporated© 2020

Luna – Enabling the Future with Fiber Proprietary, measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Military and Defense, Communications, Infrastructure, Energy, and Automotive Positioned to take advantage of trends such as vehicle lightweighting and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Overview NASDAQ: LUNA Luna Innovations Incorporated© 2020

Appendix

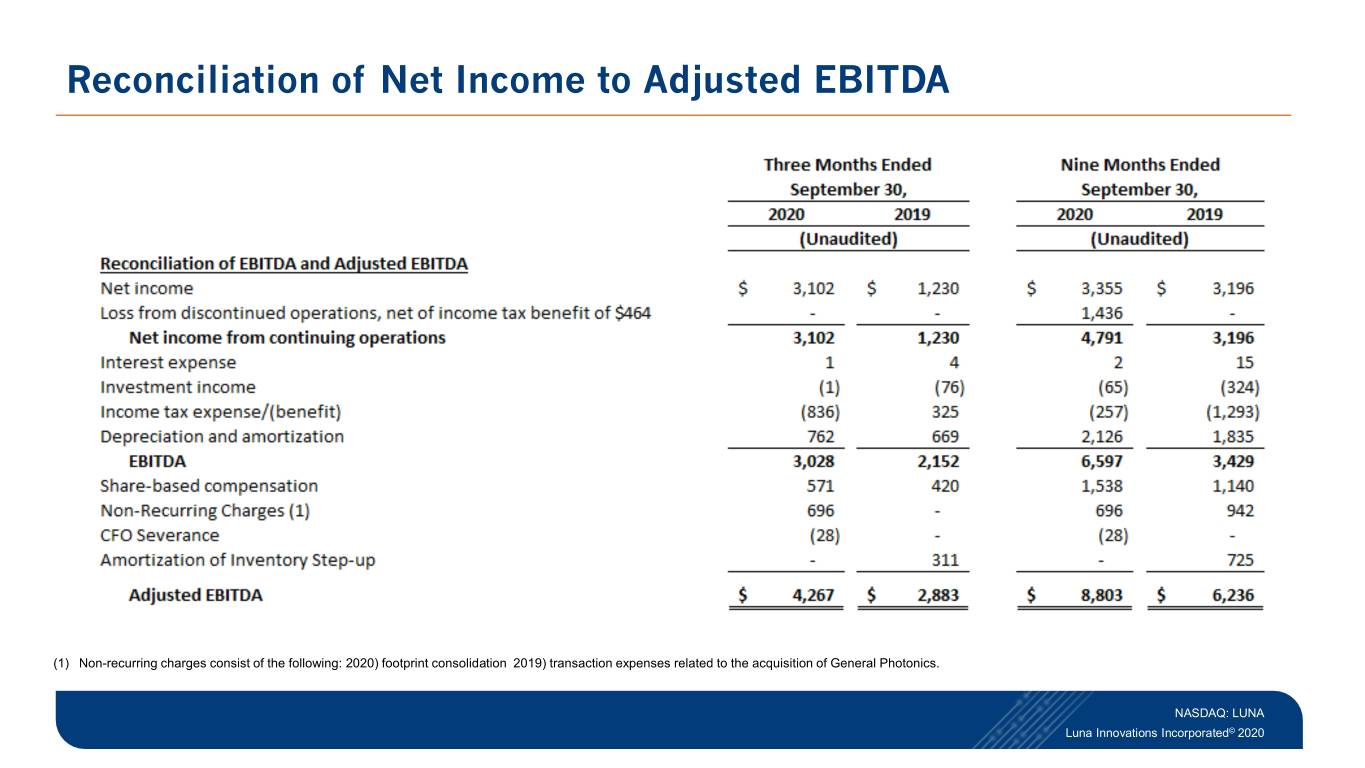

Reconciliation of Net Income to Adjusted EBITDA (1) Non-recurring charges consist of the following: 2020) footprint consolidation 2019) transaction expenses related to the acquisition of General Photonics. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Reconciliation of Net Income to Adjusted EBITDA: Full Year (1) Non-recurring charges include the following: 2017) CEO separation costs and other share-based compensation; 2018) Transaction-related expenses associated with the acquisition of Micron Optics, Inc.; 2019) Transaction related expenses and inventory step-up amortization relate to General Photonics acquisition and CFO transition expenses NASDAQ: LUNA Luna Innovations Incorporated© 2020

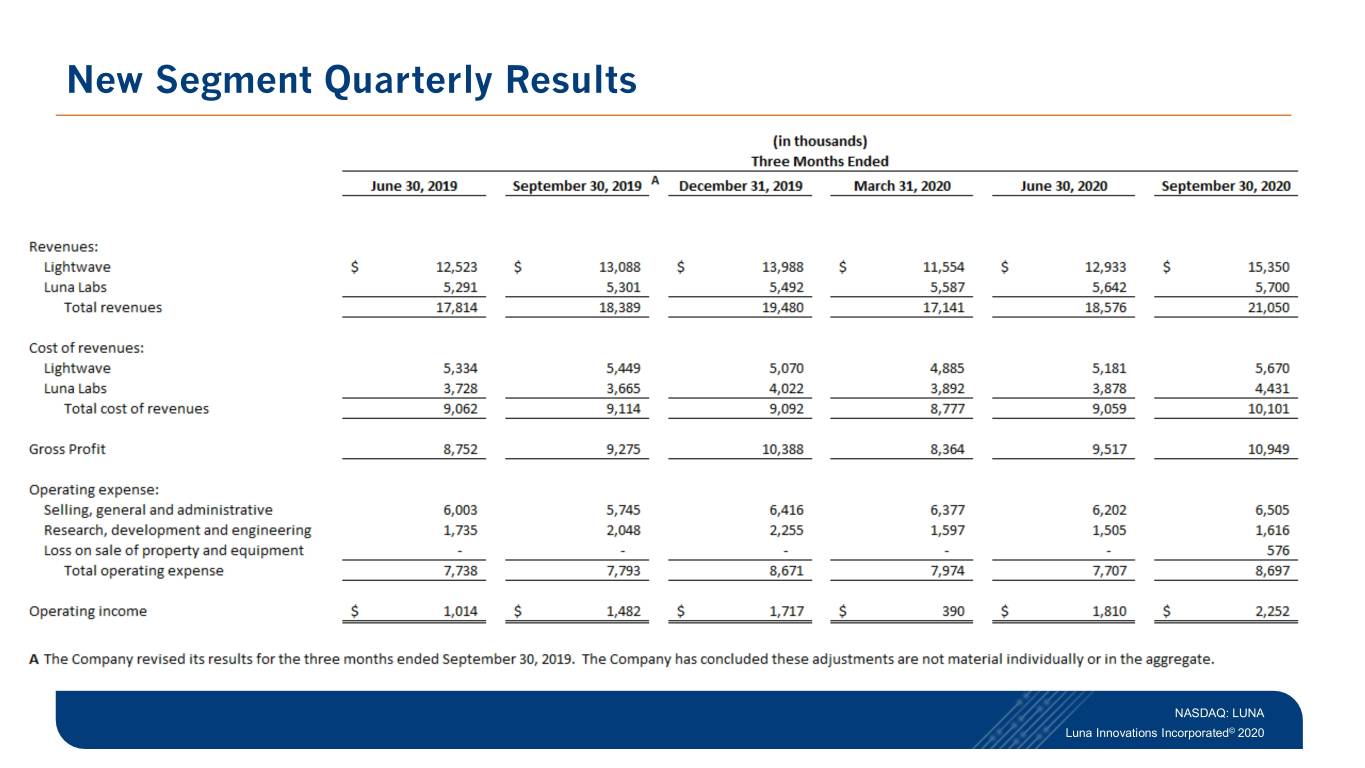

New Segment Quarterly Results NASDAQ: LUNA Luna Innovations Incorporated© 2020