Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Kaleyra, Inc. | d37850dex991.htm |

| 8-K - 8-K - Kaleyra, Inc. | d37850d8k.htm |

The Trusted CPaaS Investors Presentation November 2020 Copyright © Kaleyra, Inc. 2020 AMERICAN Exhibit 99.2

LEGAL DISCLAIMER INVESTOR PRESENTATION This communication is for informational purposes only. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modelling or back-testing or any other information contained herein. Any data on past performance, modelling or back-testing contained herein is no indication as to future performance. Kaleyra, Inc. (“Kaleyra” or, the “Company”) assumes no obligation to update the information in this communication. This presentation is not an offer to buy or the solicitation of an offer to sell Kaleyra securities. FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of U.S. federal securities laws. Such forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions, plans, prospects or strategies regarding the future business plans of Kaleyra’s management team and the Company’s financial results. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intends," "may," "might,” "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this presentation are based on certain assumptions of Kaleyra’s management in light of its experience and perception of historical trends, current conditions and expected future developments and their potential effects on Kaleyra as well as other factors Kaleyra’s management believes are appropriate in the circumstances. There can be no assurance that future developments affecting Kaleyra will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of Kaleyra) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions being made prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Kaleyra undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Certain industry and market data information in this presentation is based on the estimates of Kaleyra’s management. Kaleyra’s management obtained the industry, market and competitive position data used throughout this presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. Kaleyra’s management believes these estimates to be accurate as of the date of this presentation. However, this information may prove to be inaccurate because of the method by which management obtained some of the data for its estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process. NON-GAAP FINANCIAL MEASURE AND RELATED INFORMATION This presentation includes reference to Adjusted EBITDA, a financial measure that is not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is defined as of any date of calculation, the consolidated pro forma earnings of Kaleyra and its subsidiaries, before finance income and finance cost (including bank charges), tax, depreciation and amortization calculated from the unaudited consolidated financial statements of such party and its subsidiaries, plus (i) transaction expenses, (ii) without duplication of clause (i), severance or change of control payments, (iii) any expenses related to company restructuring, (iv) the Adjusted EBITDA for pre-acquisition period of subsidiaries, (v) any compensation expenses relating to stock options, restricted stock units, restricted stock or similar equity interests as may be issued by Kaleyra or any of its subsidiaries to its or their employees and (vi) any provision for the write down of assets. The pre-2019 pro forma earnings of Kaleyra, which is an Italian company, and its subsidiaries, which include subsidiaries outside of the U.S., may not be prepared in conformance with Article 11 of Regulation S-X of the U.S. Securities and Exchange Commission (the "SEC"). Kaleyra’s management believes that this non-GAAP measure of Kaleyra’s financial results will provide useful information to investors regarding certain financial and business trends relating to Kaleyra’s anticipated financial condition and results of operations. Investors should not rely on any single financial measure to evaluate Kaleyra’s anticipated business. Certain of the financial metrics in this presentation can be found in Kaleyra’s Form 10-K for the fiscal year ended December 31, 2019, filed with the “SEC” on April 22, 2020, and in Kaleyra's Form 10-Q for the quarter ended September 30, 2020 filed with the SEC on November 9, 2020, and the reconciliation of Adjusted EBITDA can be found on slide 22 of this presentation. TRADEMARKS AND INTELLECTUAL PROPERTY All trademarks, service marks, and trade names of Kaleyra and its subsidiaries or affiliates used herein are trademarks, service marks, or registered trademarks of Kaleyra as noted herein. Any other product, company names, or logos mentioned herein are the trademarks and/or intellectual property of their respective owners. Copyright © Kaleyra, Inc. 2020

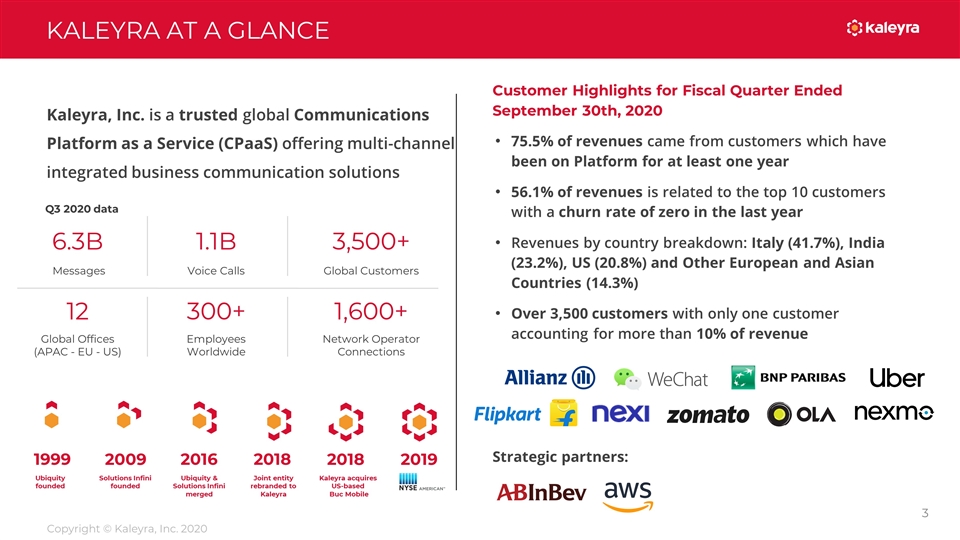

Kaleyra, Inc. is a trusted global Communications Platform as a Service (CPaaS) offering multi-channel integrated business communication solutions KALEYRA AT A GLANCE Copyright © Kaleyra, Inc. 2020 Customer Highlights for Fiscal Quarter Ended September 30th, 2020 75.5% of revenues came from customers which have been on Platform for at least one year 56.1% of revenues is related to the top 10 customers with a churn rate of zero in the last year Revenues by country breakdown: Italy (41.7%), India (23.2%), US (20.8%) and Other European and Asian Countries (14.3%) Over 3,500 customers with only one customer accounting for more than 10% of revenue Strategic partners: Global Customers Messages 6.3B Voice Calls 1.1B Network Operator Connections 1,600+ Global Offices (APAC - EU - US) 12 Employees Worldwide 300+ 3,500+ 1999 Ubiquity founded 2009 Solutions Infini founded 2016 Ubiquity & Solutions Infini merged 2018 Joint entity rebranded to Kaleyra 2018 Kaleyra acquires US-based Buc Mobile 2019 Q3 2020 data

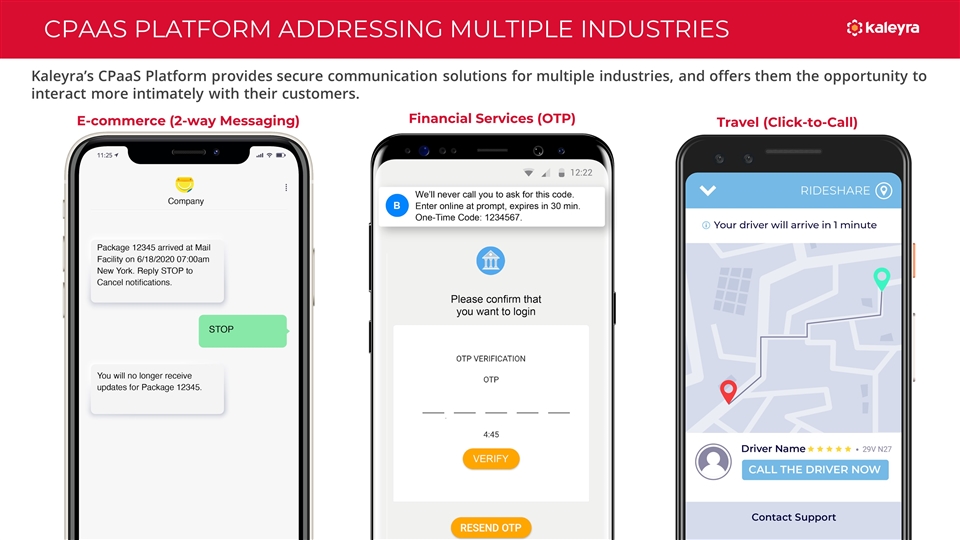

CPAAS PLATFORM ADDRESSING MULTIPLE INDUSTRIES Travel (Click-to-Call) E-commerce (2-way Messaging) Kaleyra’s CPaaS Platform provides secure communication solutions for multiple industries, and offers them the opportunity to interact more intimately with their customers. Financial Services (OTP)

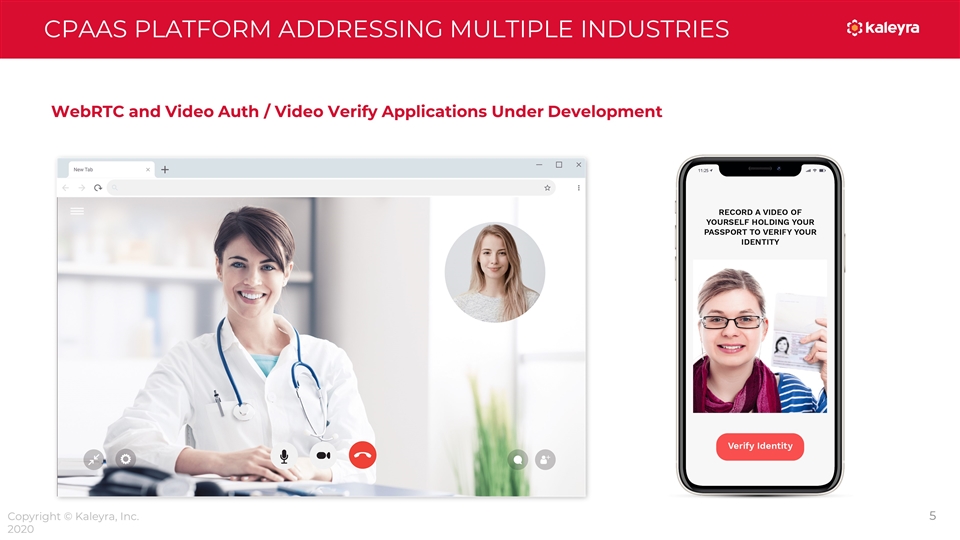

CPAAS PLATFORM ADDRESSING MULTIPLE INDUSTRIES WebRTC and Video Auth / Video Verify Applications Under Development Copyright © Kaleyra, Inc. 2020

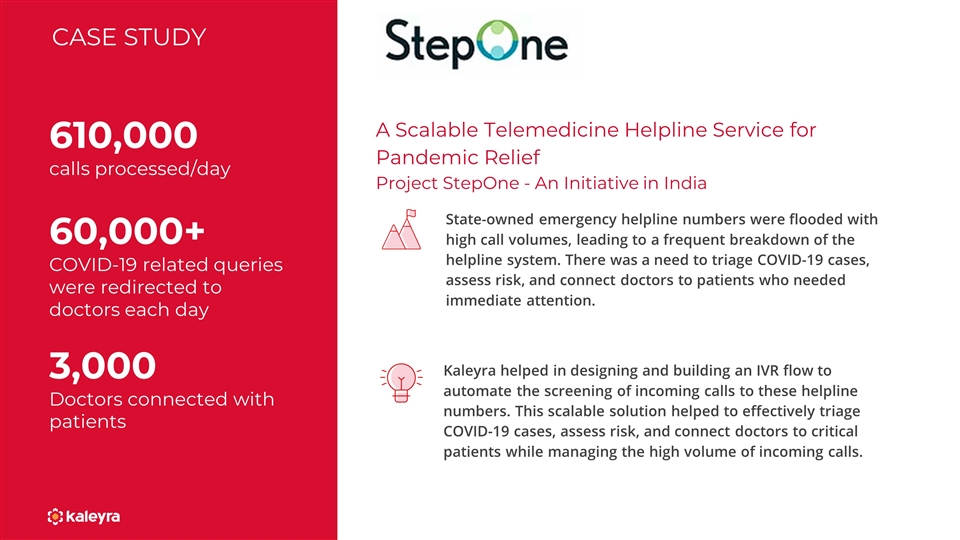

A Scalable Telemedicine Helpline Service for Pandemic Relief Project StepOne - An Initiative in India 610,000 calls processed/day 60,000+ COVID-19 related queries were redirected to doctors each day 3,000 Doctors connected with patients Kaleyra helped in designing and building an IVR flow to automate the screening of incoming calls to these helpline numbers. This scalable solution helped to effectively triage COVID-19 cases, assess risk, and connect doctors to critical patients while managing the high volume of incoming calls. State-owned emergency helpline numbers were flooded with high call volumes, leading to a frequent breakdown of the helpline system. There was a need to triage COVID-19 cases, assess risk, and connect doctors to patients who needed immediate attention. CASE STUDY

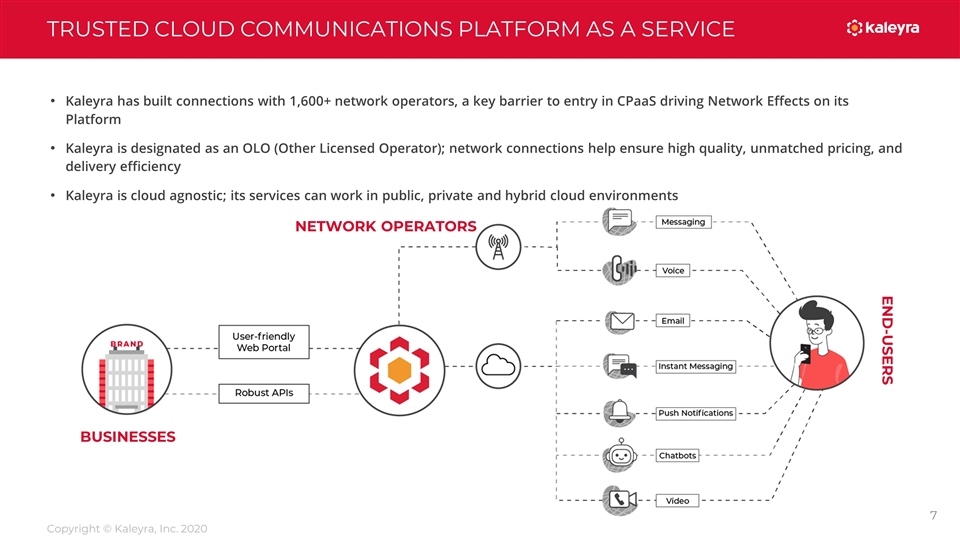

TRUSTED CLOUD COMMUNICATIONS PLATFORM AS A SERVICE NETWORK OPERATORS END-USERS BUSINESSES Kaleyra has built connections with 1,600+ network operators, a key barrier to entry in CPaaS driving Network Effects on its Platform Kaleyra is designated as an OLO (Other Licensed Operator); network connections help ensure high quality, unmatched pricing, and delivery efficiency Kaleyra is cloud agnostic; its services can work in public, private and hybrid cloud environments Copyright © Kaleyra, Inc. 2020

KALEYRA’S TECHNOLOGY Cloud And On-premise In line with customers’ needs, Kaleyra continues investing in its data centers while enabling public cloud (99.99% uptime), hybrid cloud, private cloud and on-premise deployments Connectivity Kaleyra is an OLO (Other Licensed Operator). It has over 1,600 connections to operators to ensure high quality, unmatched pricing, and delivery efficiency High Deliverability Intelligent high-priority routing assures unparalleled speed, consistency and pricing Scalability With the ability to transmit high volumes of messages and easily handle traffic spikes, Kaleyra answers to the requests of customers for scalability and flexibility Support Kaleyra provides 24/7 global customer service, as well as consulting services and comprehensive documentation to support customers with any technical queries APIs Platform functionality is available through easy-to-use, frequently-updated APIs along with error logs Copyright © Kaleyra, Inc. 2020

PRODUCT OFFERINGS Copyright © Kaleyra, Inc. 2020 Kaleyra provides secure and reliable customer communication that every business requires. Our wide range of products can be accessed easily through a user-friendly web portal and via robust APIs too. We cater to businesses across many verticals including financial services (42.0%), e-commerce (8.1%), and other enterprise services as travel, retail, education (21.0%). We also provide global connectivity solutions to carriers and ISPs in 190+ countries, driven by strong worldwide demand. Messaging WhatsApp Voice Chatbot Email Flow Builder Push Notifications Verify Numbers Contact Center Conversations Look Up Video WebRTC Verified Calls Verified SMS

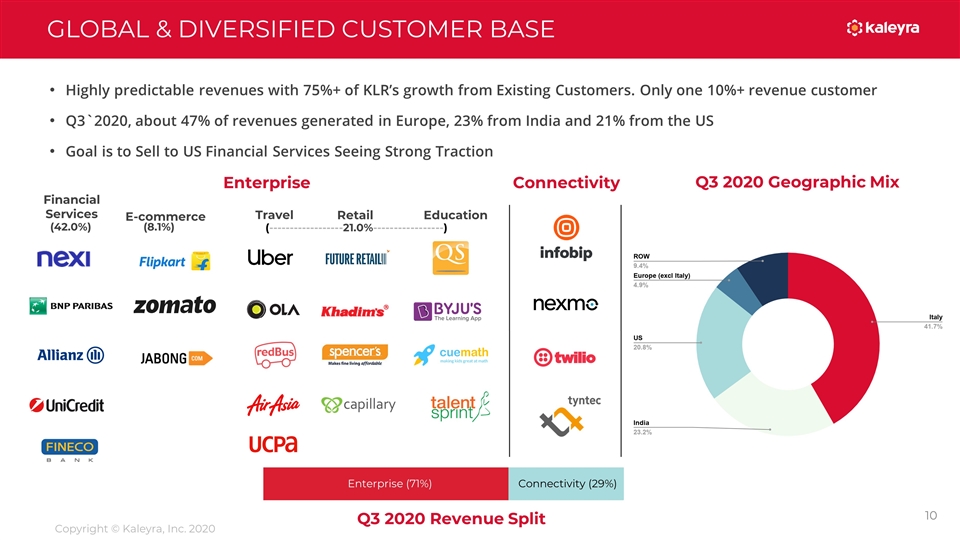

Highly predictable revenues with 75%+ of KLR’s growth from Existing Customers. Only one 10%+ revenue customer Q3`2020, about 47% of revenues generated in Europe, 23% from India and 21% from the US Goal is to Sell to US Financial Services Seeing Strong Traction GLOBAL & DIVERSIFIED CUSTOMER BASE Enterprise Connectivity Financial Services E-commerce Travel Retail Education Q3 2020 Geographic Mix Enterprise (71%) Connectivity (29%) Q3 2020 Revenue Split Copyright © Kaleyra, Inc. 2020 (------------------21.0%-----------------) (42.0%) (8.1%)

Dario Calogero Chief Executive Officer Nicola Junior Vitto Chief Product Officer Filippo Monastra Chief of Staff Aniketh Jain Chief Revenue Officer Ashish Agarwal Chief Technology Officer Giacomo Dall’Aglio Chief Financial Officer Soren Schafft General Manager, Connectivity and Industry Solutions THE MANAGEMENT TEAM Copyright © Kaleyra, Inc. 2020 Martino Stefanoni Chief Audit Executive

Avi Katz, Ph.D Chairman John Mikulsky Director Emilio Hirsch, Ph.D Director Matteo Lodrini Director Neil Miotto Director THE BOARD OF DIRECTORS Esse Effe, S.p.A. Dario Calogero Director Copyright © Kaleyra, Inc. 2020

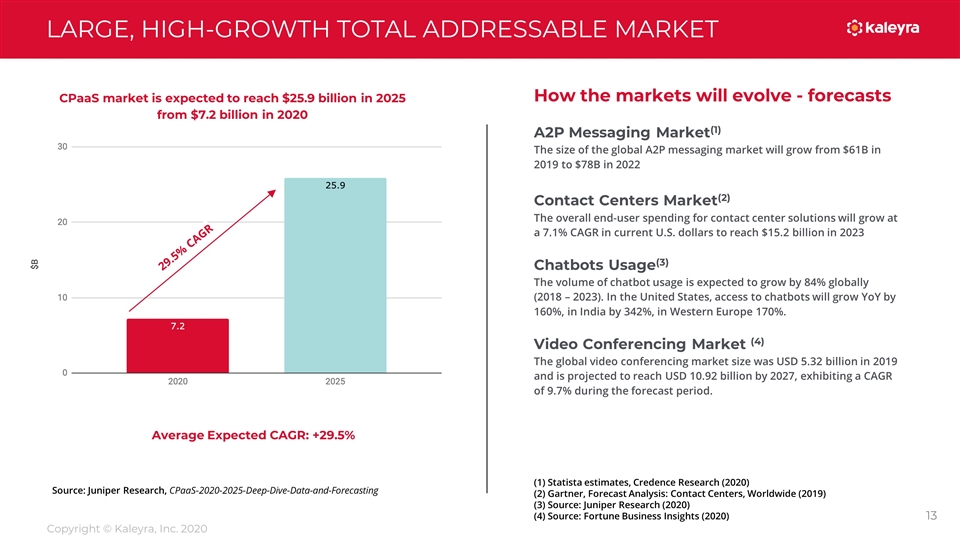

LARGE, HIGH-GROWTH TOTAL ADDRESSABLE MARKET Source: Juniper Research, CPaaS-2020-2025-Deep-Dive-Data-and-Forecasting Average Expected CAGR: +29.5% How the markets will evolve - forecasts A2P Messaging Market(1) The size of the global A2P messaging market will grow from $61B in 2019 to $78B in 2022 Contact Centers Market(2) The overall end-user spending for contact center solutions will grow at a 7.1% CAGR in current U.S. dollars to reach $15.2 billion in 2023 Chatbots Usage(3) The volume of chatbot usage is expected to grow by 84% globally (2018 – 2023). In the United States, access to chatbots will grow YoY by 160%, in India by 342%, in Western Europe 170%. Video Conferencing Market (4) The global video conferencing market size was USD 5.32 billion in 2019 and is projected to reach USD 10.92 billion by 2027, exhibiting a CAGR of 9.7% during the forecast period. (1) Statista estimates, Credence Research (2020) (2) Gartner, Forecast Analysis: Contact Centers, Worldwide (2019) (3) Source: Juniper Research (2020) (4) Source: Fortune Business Insights (2020) Copyright © Kaleyra, Inc. 2020 29.5% CAGR CPaaS market is expected to reach $25.9 billion in 2025 from $7.2 billion in 2020

FINANCIAL OVERVIEW

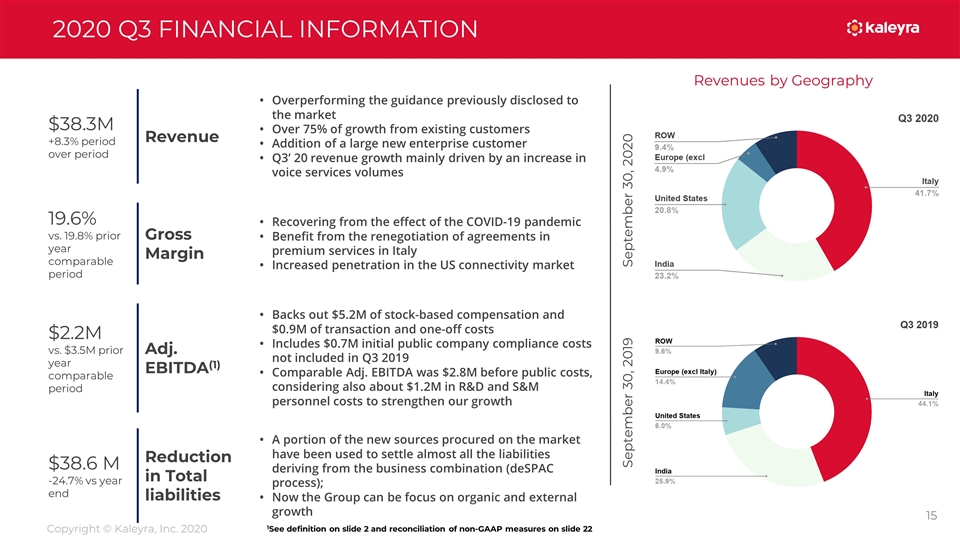

2020 Q3 FINANCIAL INFORMATION 1See definition on slide 2 and reconciliation of non-GAAP measures on slide 22 Revenues by Geography September 30, 2020 September 30, 2019 Copyright © Kaleyra, Inc. 2020 $38.3M +8.3% period over period Revenue Overperforming the guidance previously disclosed to the market Over 75% of growth from existing customers Addition of a large new enterprise customer Q3’ 20 revenue growth mainly driven by an increase in voice services volumes 19.6% vs. 19.8% prior year comparable period Gross Margin Recovering from the effect of the COVID-19 pandemic Benefit from the renegotiation of agreements in premium services in Italy Increased penetration in the US connectivity market $2.2M vs. $3.5M prior year comparable period Adj. EBITDA(1) Backs out $5.2M of stock-based compensation and $0.9M of transaction and one-off costs Includes $0.7M initial public company compliance costs not included in Q3 2019 Comparable Adj. EBITDA was $2.8M before public costs, considering also about $1.2M in R&D and S&M personnel costs to strengthen our growth $38.6 M -24.7% vs year end Reduction in Total liabilities A portion of the new sources procured on the market have been used to settle almost all the liabilities deriving from the business combination (deSPAC process); Now the Group can be focus on organic and external growth

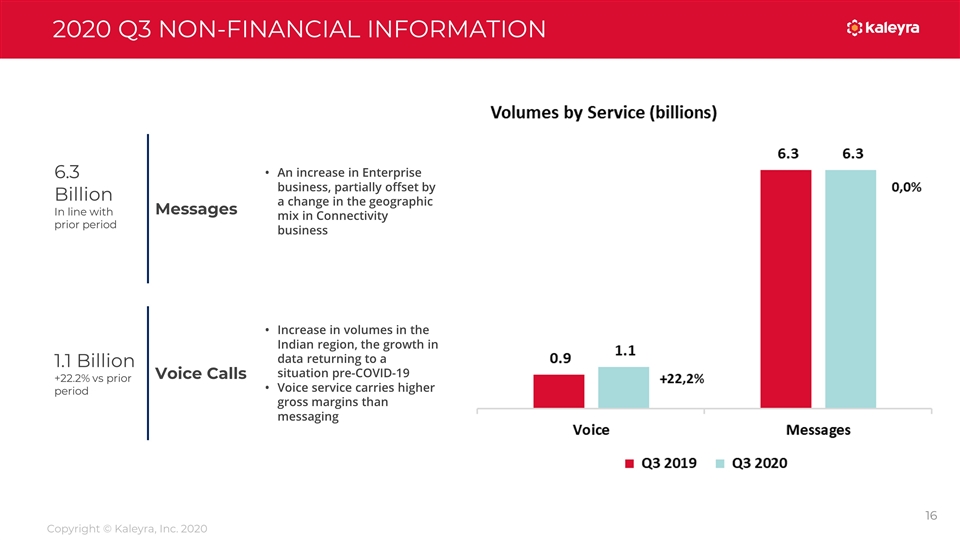

2020 Q3 NON-FINANCIAL INFORMATION 6.3 Billion In line with prior period Messages An increase in Enterprise business, partially offset by a change in the geographic mix in Connectivity business 1.1 Billion +22.2% vs prior period Voice Calls Increase in volumes in the Indian region, the growth in data returning to a situation pre-COVID-19 Voice service carries higher gross margins than messaging Copyright © Kaleyra, Inc. 2020

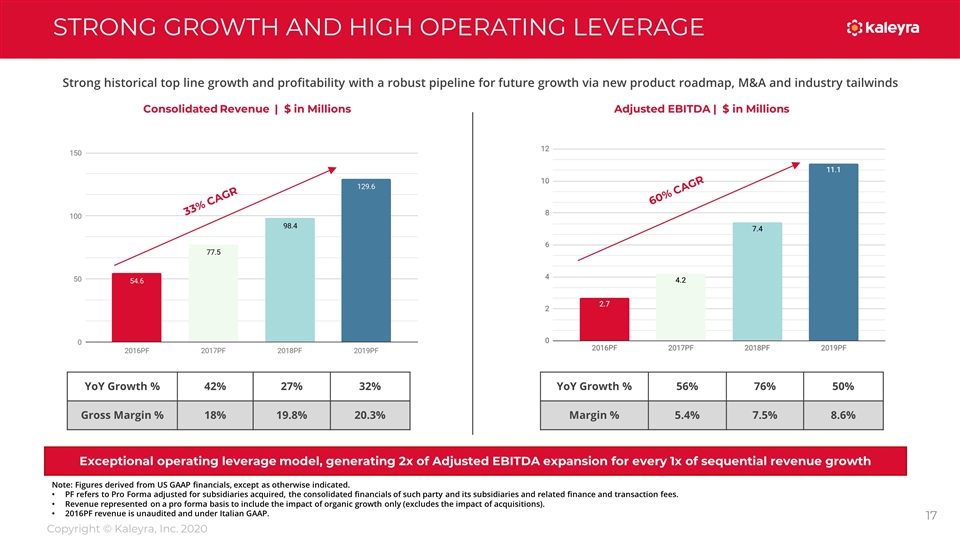

Strong historical top line growth and profitability with a robust pipeline for future growth via new product roadmap, M&A and industry tailwinds Exceptional operating leverage model, generating 2x of Adjusted EBITDA expansion for every 1x of sequential revenue growth YoY Growth % 42% 27% 32% Gross Margin % 18% 19.8% 20.3% STRONG GROWTH AND HIGH OPERATING LEVERAGE Note: Figures derived from US GAAP financials, except as otherwise indicated. PF refers to Pro Forma adjusted for subsidiaries acquired, the consolidated financials of such party and its subsidiaries and related finance and transaction fees. Revenue represented on a pro forma basis to include the impact of organic growth only (excludes the impact of acquisitions). 2016PF revenue is unaudited and under Italian GAAP. Consolidated Revenue | $ in Millions Adjusted EBITDA | $ in Millions 33% CAGR Copyright © Kaleyra, Inc. 2020 YoY Growth % 56% 76% 50% Margin % 5.4% 7.5% 8.6% 33% CAGR 60% CAGR

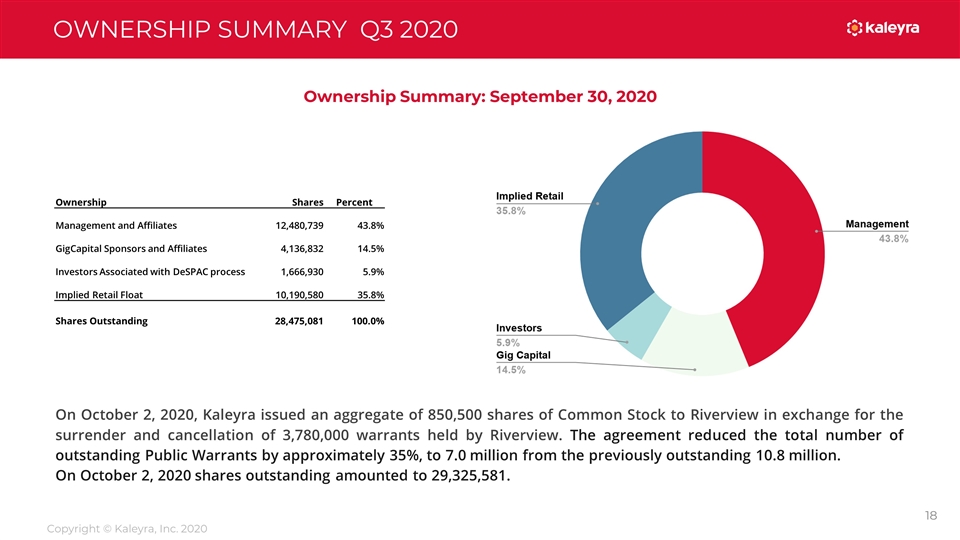

OWNERSHIP SUMMARY Q3 2020 Ownership Summary: September 30, 2020 Copyright © Kaleyra, Inc. 2020 Ownership Shares Percent Management and Affiliates 12,480,739 43.8% GigCapital Sponsors and Affiliates 4,136,832 14.5% Investors Associated with DeSPAC process 1,666,930 5.9% Implied Retail Float 10,190,580 35.8% Shares Outstanding 28,475,081 100.0% On October 2, 2020, Kaleyra issued an aggregate of 850,500 shares of Common Stock to Riverview in exchange for the surrender and cancellation of 3,780,000 warrants held by Riverview. The agreement reduced the total number of outstanding Public Warrants by approximately 35%, to 7.0 million from the previously outstanding 10.8 million. On October 2, 2020 shares outstanding amounted to 29,325,581.

APPENDIX

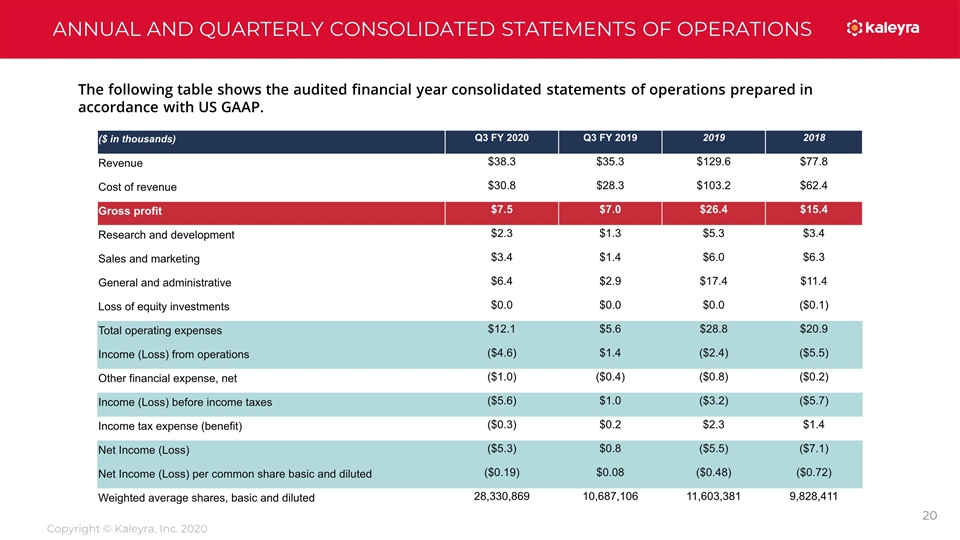

ANNUAL AND QUARTERLY CONSOLIDATED STATEMENTS OF OPERATIONS The following table shows the audited financial year consolidated statements of operations prepared in accordance with US GAAP. Copyright © Kaleyra, Inc. 2020

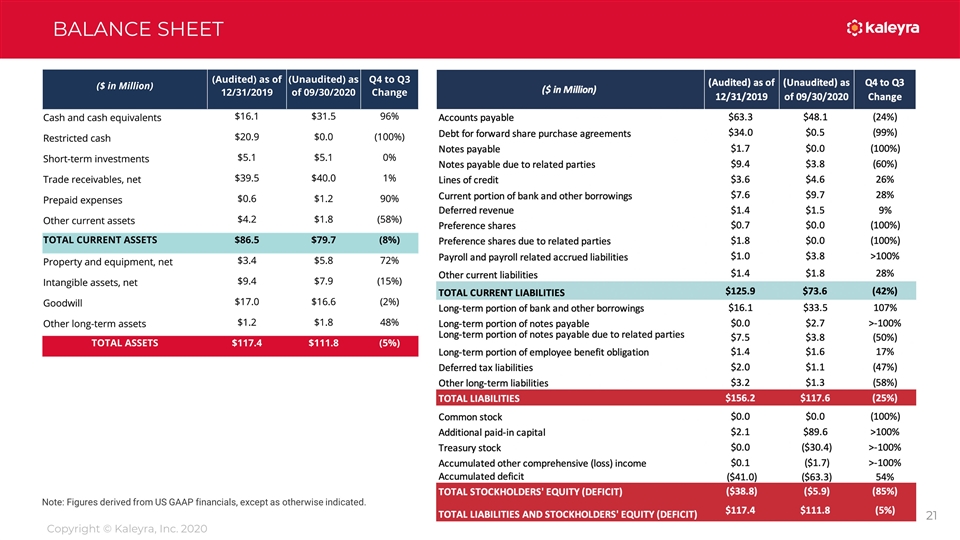

BALANCE SHEET Note: Figures derived from US GAAP financials, except as otherwise indicated. Copyright © Kaleyra, Inc. 2020

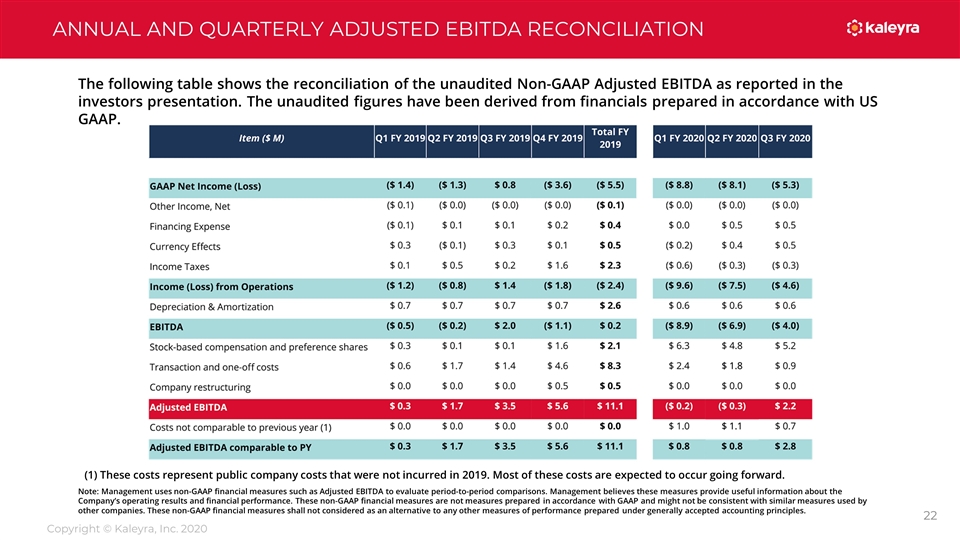

ANNUAL AND QUARTERLY ADJUSTED EBITDA RECONCILIATION The following table shows the reconciliation of the unaudited Non-GAAP Adjusted EBITDA as reported in the investors presentation. The unaudited figures have been derived from financials prepared in accordance with US GAAP. Note: Management uses non-GAAP financial measures such as Adjusted EBITDA to evaluate period-to-period comparisons. Management believes these measures provide useful information about the Company’s operating results and financial performance. These non-GAAP financial measures are not measures prepared in accordance with GAAP and might not be consistent with similar measures used by other companies. These non-GAAP financial measures shall not considered as an alternative to any other measures of performance prepared under generally accepted accounting principles. Copyright © Kaleyra, Inc. 2020 (1) These costs represent public company costs that were not incurred in 2019. Most of these costs are expected to occur going forward.