Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Granite Point Mortgage Trust Inc. | gpmtq3-2020earningsrel.htm |

| 8-K - 8-K - Granite Point Mortgage Trust Inc. | gpmt-20201109.htm |

Third Quarter 2020 Earnings Presentation November 10, 2020

Safe Harbor Statement This presentation contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. By their nature, forward- looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify, in particular due to the uncertainties created by the COVID-19 pandemic, including its impact of COVID-19 on our business, financial performance and operating results. Our expectations, beliefs and estimates are expressed in good faith and it believes there is a reasonable basis for them. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2019 and any subsequent Form 10-Q and Form 8-K filings made with the SEC, under the caption “Risk Factors.” These risks may also be further heightened by the continued impact of the COVID-19 pandemic. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. This presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 2

Company Update • On October 10, 2020, entered into an Internalization Agreement with our Manager pursuant to which we will internalize our management function effective as of December 31, 2020. • Defensively positioned, highly diversified portfolio consisting of 99% first mortgage loans with a weighted-average initial LTV of 66.3%. ▪ Defensively positioned portfolio comprised of 99% senior first mortgage loans with no exposure to securities; weighted average initial LTV of 66.3%(1) means sponsors have significant equity in their properties. PORTFOLIO ▪ No loan impairments or non-accruals as of September 30, 2020. CREDIT ▪ Strong collections of debt service in Q3 and October with over 99% of borrowers making their payments in QUALITY accordance with loan agreements.(2) ▪ Active and constructive dialogue with borrowers who own properties impacted by the COVID-19 pandemic, providing short-term relief so they can sustain their business through temporary disruptions. ▪ Substantially enhanced liquidity and financial flexibility through the $300 million strategic financing commitment in the form of five-year term loan facilities with an initial draw of $225 million.(3) ▪ Ongoing proactive and constructive dialogue with our lenders regarding creating greater balance sheet stability and flexibility through potential additional margin call holidays and other arrangements. FINANCING ▪ Facilities are generally term-matched with most having no capital markets mark-to-market conditions. ▪ 100% of hotel and almost all retail loans financed with repurchase facilities have been de-levered. ▪ No corporate debt maturity before December 2022. ▪ Current liquidity of approximately $325 million(4); option to borrow an additional $75 million in proceeds under the term loan facilities through September 2021. LIQUIDITY ▪ Through November 9, 2020, funded approximately $18.1 million of commitments on the existing loan portfolio; no new loan commitments. ▪ In Q4 realized approximately $158.2 million of loan repayments through November 9, 2020. 3 (1) See footnote (4) on p. 15. (2) Includes loan modifications. (3) Gross proceeds before deduction of transaction related expenses. (4) As of November 6, 2020.

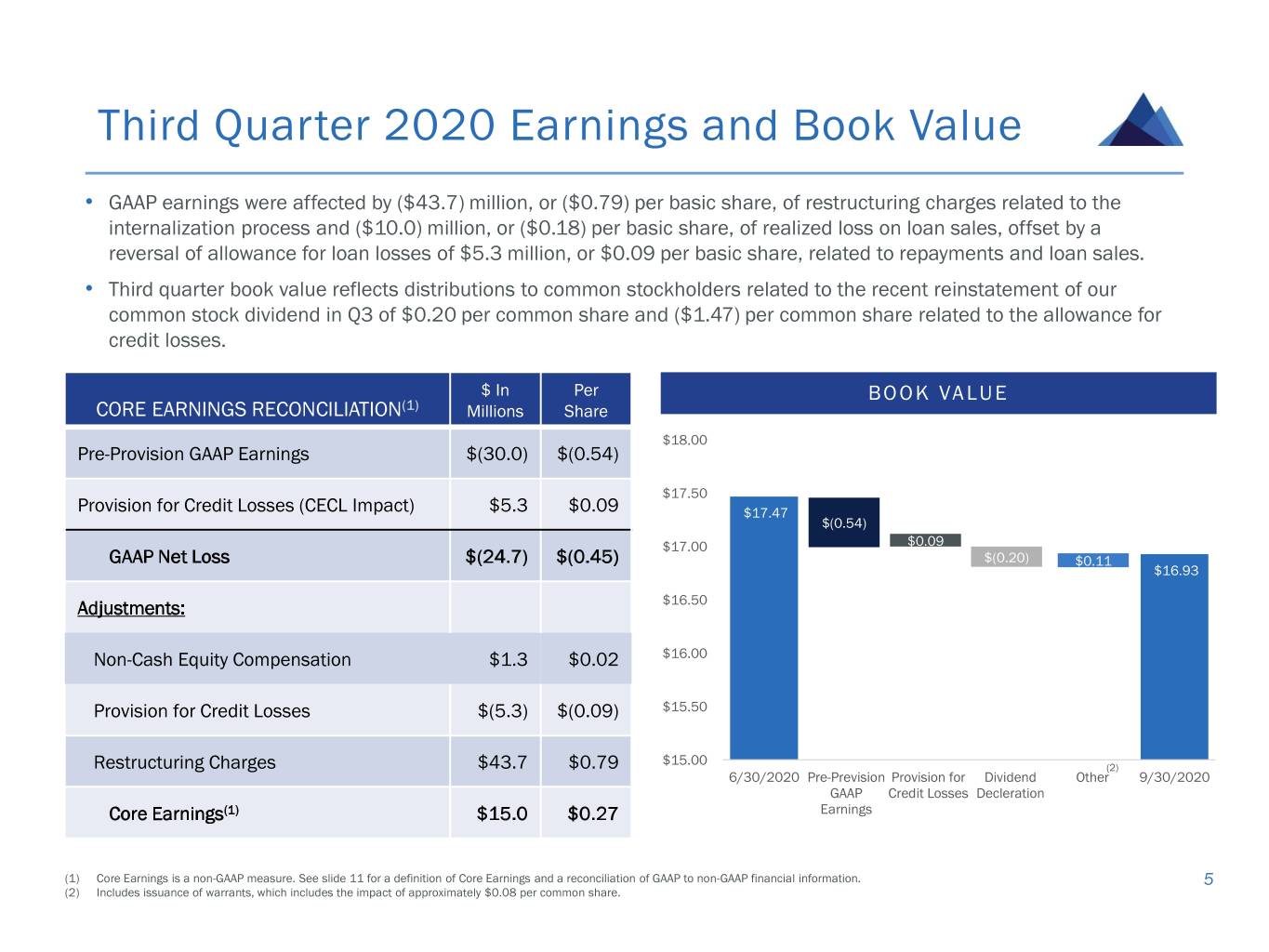

Third Quarter 2020 Highlights ▪ GAAP net loss of ($24.7) million, or ($0.45) per basic share, inclusive of ($43.7) million, or ($0.79) per basic share, of one-time restructuring charges related to the internalization process.(1) FINANCIAL ▪ Core Earnings(2) of $15.0 million, or $0.27 per basic share, excluding the one-time restructuring charges. SUMMARY ▪ Book value of $16.93 per common share, inclusive of ($1.47) per common share related to the allowance for credit losses; declared a dividend of $0.20 per common share. ▪ Realized prepayments and principal amortization of $209.2 million in UPB, including two CRE securities positions, totaling $24.5 million, that were repaid at par. PORTFOLIO ▪ Sold 6 loans with an aggregate principal amount of approximately $191.4 million resulting in ACTIVITY approximately $10.0 million realized loss on sale. ▪ Funded $54.5 million of existing loan commitments. ▪ Principal balance of $4.1 billion and $4.7 billion in total commitments. PORTFOLIO ▪ 99% senior first mortgage loans and over 98% floating rate; no exposure to securities. OVERVIEW ▪ Weighted average stabilized LTV of 63.6%(3) and weighted average yield at origination of LIBOR + 4.18%.(4) ▪ Office, multifamily and industrial assets represent over 74% of the investment portfolio. ▪ Ended Q3 with over $353 million in cash on hand. ▪ Over $1.5 billion of borrowings is non-mark-to-market, including two CLOs, an asset-specific financing LIQUIDITY & facility, senior secured term loan facilities and senior unsecured convertible bonds. CAPITALIZATION ▪ Closed a strategic financing commitment of up to $300 million, in the form of five-year senior term loan facilities and 6.066 million warrants to purchase GPMT common stock.(5) ▪ Arranged a short-term $54.1 million increase in borrowings on the J.P Morgan financing facility. (1) On October 10, 2020, we entered into an internalization agreement with our manager, pursuant to which we will internalize our management function, effective as of 11:59 p.m. on December 31, 2020. (2) Core Earnings is a non-GAAP measure. See slide 11 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. (3) See footnote (5) on p. 15. 4 (4) See footnote (2) and (3) on p. 15. (5) 1.516 million warrants are subject to vesting depending on future draws of the term loan facilities pursuant to the term of the facilities.

Third Quarter 2020 Earnings and Book Value • GAAP earnings were affected by ($43.7) million, or ($0.79) per basic share, of restructuring charges related to the internalization process and ($10.0) million, or ($0.18) per basic share, of realized loss on loan sales, offset by a reversal of allowance for loan losses of $5.3 million, or $0.09 per basic share, related to repayments and loan sales. • Third quarter book value reflects distributions to common stockholders related to the recent reinstatement of our common stock dividend in Q3 of $0.20 per common share and ($1.47) per common share related to the allowance for credit losses. $ In Per BOOK VA LU E CORE EARNINGS RECONCILIATION(1) Millions Share $18.00 Pre-Provision GAAP Earnings $(30.0) $(0.54) $17.50 Provision for Credit Losses (CECL Impact) $5.3 $0.09 $17.47 $(0.54) $17.00 $0.09 GAAP Net Loss $(24.7) $(0.45) $(0.20) $0.11 $16.93 Adjustments: $16.50 Non-Cash Equity Compensation $1.3 $0.02 $16.00 Provision for Credit Losses $(5.3) $(0.09) $15.50 $15.00 Restructuring Charges $43.7 $0.79 (2) 6/30/2020 Pre-Prevision Provision for Dividend Other 9/30/2020 GAAP Credit Losses Decleration Core Earnings(1) $15.0 $0.27 Earnings (1) Core Earnings is a non-GAAP measure. See slide 11 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. 5 (2) Includes issuance of warrants, which includes the impact of approximately $0.08 per common share.

CONFIDENTIAL Financial Statements Impact at September 30 • Overall allowance for credit losses of $80.7 million, of which $7.4 million is related to future funding obligations and recorded in other liabilities, largely reflects an updated macroeconomic forecast that indicates continued impact of the COVID-19 pandemic. • Loans reported on the balance sheet net of the allowance for credit losses. ($ in thousands) At Adoption At 3/31/20 At 6/30/20 At 9/30/20 ($ in thousands) Q3 2020 ASSETS Change in provision for credit losses on: Loans and $4,257,086 $4,338,392 $4,391,281 $4,052,201 Loans held-for- securities $3,371 investment Allowance for Available-for-sale $(16,692) $(64,274) $(77,904) $(73,339) $256 credit losses securities Held-to-maturity Carrying Value $4,240,394 $4,274,118 $4,313,377 $3,978,862 $938 securities LABILITIES Other liabilities $735 Other liabilities $1,780 $7,534 $8,109 $7,374 Total provision for impact(1) $5,300 credit losses STOCKHOLDERS’ EQUITY Cumulative $(18,472) $(71,808) $(86,013) $(80,713) earnings impact Per share impact ($0.34) $(0.97) $(0.26) $0.09 (1) Represents expected loss on unfunded loan commitments. 6

Historical Portfolio Principal Balance 2020 YEAR TO DATE PORTFOLIO ACTIVITY(2) PORTFOLIO SINCE INCEPTION(3) $5,000 $4,288 $5,000 Total maximum $4,669 commitments $4,073 $4,000 $318 Future funding $(533) $596 commitments $4,288 $4,000 $3,233 $4,073 $3,000 $2,379 $3,000 $ In Millions $ In Millions $2,000 $1,437 $2,000 $1,000 $667 $1,000 (1) $- 12/31/2019 2020 Fundings 2020 9/30/2020 Portfolio Prepayments, Sales & Amortization (1) Includes fundings of prior loan commitments and deferred interest of $188 million and $4.5 million, respectively. (2) Data based on principal balance of investments. (3) Portfolio principal balance as of 12/31/2015, 12/31/2016, 12/31/2017, 12/31/2018, 12/31/2019, and 9/30/2020. 7

Investment Portfolio as of September 30, 2020 • High quality, well-diversified portfolio comprised of 99% senior first mortgage loans with a weighted average stabilized LTV at origination of 63.6%.(3) KEY PORTFOLIO STATISTICS PROPERTY TYPE(1) GEOGRAPHY Industrial, Other, Outstanding 6.2% 1.0% $4,072.8m Retail, Principal Balance 8.4% Southeast, 16.4% Northeast, 26.8% Total Loan Hotel, Office, $4,669.2m 16.2% 44.2% Midwest, Commitments 18.0% Southwest, Multifamily, 20.6% Number of 24.0% West, 110 18.2% Investments Average UPB ~$37.0m COUPON STRUCTURE INVESTMENT TYPE Weighted Average Yield at L + 4.18% Origination(2) Floating, Weighted 98.4% Senior Loans, 99.3% Average Stabilized 63.6% LTV(3) Weighted Average 3.1 years Subordinated Original Maturity Fixed, 1.6% Loans, 0.7% (1) Includes mixed-use properties. 8 (2) See footnote (2) and (3) on p. 15. (3) See footnote (5) on p. 15.

Diversified Capital Sources WELL-DIVERSIFIED CAPITALIZATION PROFILE WITH MODERATE LEVERAGE ▪ Outstanding borrowings of $1.9 billion across LEVERAGE REPURCHASE 5 large institutional lenders. 4.0x FACILITIES ▪ Weighted average advance rate of 72.3%. 3.2x 3.0x ▪ $928.6 million of fully term-matched, non- 2.2x CRE CLOs(1) recourse and non-mark-to-market financing. 2.0x CONVERTIBLE ▪ $143.8 million due December 2022. 1.0x SENIOR NOTES(1) 9/30/2020 ▪ $131.6 million due October 2023. (3) (4) Recourse Leverage Total Leverage ASSET-SPECIFIC ▪ $150 million non-mark-to-market financing FINANCING MIX(5) FINANCING facility; $123 million outstanding balance. Senior Term Loan Asset Specific Facilities ▪ $225 million senior term loan facilities due in Convertible SENIOR TERM 2025; option to borrow an additional $75 Notes LOAN FACILITIES(2) million through September 2021. Repurchase CLOs Facilities STOCKHOLDERS’ ▪ Over $930 million of equity capital. EQUITY (1) Outstanding principal balance excluding deferred debt issuance costs. (2) Includes an option to draw up to an additional $75 million of proceeds on a delayed draw basis under the secured term loan credit agreement during the sixth-month period after September 25, 2020, which period may be extended for an additional six months upon payment of an extension fee. Please note $225 million is outstanding principal balance excluding deferred debt issuance costs. (3) Defined as recourse debt, less cash, divided by total equity. 9 (4) Defined as total borrowings, less cash, divided by total equity. (5) Outstanding balance as of 9/30/2020.

Investment Portfolio LIBOR Floors WEIGHTED AVERAGE LIBOR FLOOR BY LOAN VINTAGE 3.0% 45.0% 40.3% 40.0% 2.5% 35.0% 30.5% 30.0% 2.0% 25.0% 18.2% 20.0% 1.5% % Portfolio of Month Month U.S. LIBOR - 1 15.0% 10.0% 1.0% 5.1% 5.0% 2.6% 3.3% 0.5% 0.0% 2015 2016(1) 2017 2018 2019 2020 % of Floating Rate Loan Portfolio Wtd. Avg. LIBOR Floor by Loan Vintage Wtd. Avg. Portfolio LIBOR Floor (1) Reflects changes to LIBOR floors arising from loan modifications in prior periods. 10

Third Quarter 2020 Earnings Summary SUMMARY INCOME STATEMENT GAAP NET LOSS TO CORE EARNINGS RECONCILIATION(1) ($ IN MILLIONS, EXCEPT PER SHARE DATA) ($ IN MILLIONS, EXCEPT PER SHARE DATA) Net Interest Income $33.8 GAAP Net Loss $(24.7) Realized (loss) on sale of loans held- $(10.0) Adjustments: for-sale Provision for Credit Losses $5.3 Provision for Credit Losses $(5.3) Other Income $0.6 Non-Cash Equity Compensation $1.3 Operating Expenses $(54.4) Restructuring Charges $43.7 GAAP Net Loss $(24.7) Core Earnings $15.0 Wtd. Avg. Basic Common Shares 55, 205,082 Wtd. Avg. Basic Common Shares 55,205,082 Net Income Loss Per Basic Share $(0.45) Core Earnings Per Basic Share $0.27 Dividend Per Share $0.20 (1) We use Core Earnings to evaluate our performance excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan activity and operations. Core Earnings is a measure that is not prepared in accordance with GAAP. For reporting purposes, we define Core Earnings as net income (loss) attributable to our stockholders computed in accordance with GAAP, excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income or loss or in net income for such period) and (iv) certain non-cash items and one-time expenses. Core Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Core Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. We believe providing Core Earnings on a supplemental basis to our net income (loss) and cash flow 11 from operating activities as determined in accordance with GAAP is helpful to stockholders in assessing the overall performance of our business. Although our management agreement requires us to calculate the incentive and base management fees due to our manager using Core Earnings before our incentive fee expense, we report Core Earnings after our incentive fee expense because we believe the latter is a more meaningful presentation of the economic performance of our common stock.

Financing & Liquidity as of September 30, 2020 SUMMARY BALANCE SHEET FINANCING SUMMARY ($ IN MILLIONS, EXCEPT PER SHARE DATA) ($ IN MILLIONS) Total Outstanding Wtd. Avg Cash $353.7 Capacity Balance Coupon(4) Repurchase Investment Portfolio, net $3,978.9 $2,354.1(2) $1,850.8 L+2.12% Agreements(1) Repurchase Agreements $1,850.8 Securitized (CLO) $928.6 L+1.64% Debt Securitized (CLO) Debt $928.6 Senior Term Loan $300.0 $205.6 8.00% Facilities(3) Senior Term Loan Facilities(5) $205.6 Asset-Specific $150.0 $123.1 L+1.78% Financing Asset-Specific Financing $123.1 Convertible Debt $270.8 5.98% Convertible Debt $270.8 Total Borrowings $3,378.9 Stockholders’ Equity $934.5 Stockholders’ Equity $934.5 Common Stock Outstanding 55,205,082 Total Leverage(6) 3.2x Book Value Per Common Share $16.93 Recourse Leverage(7) 2.2x (1) Includes all loan repurchase agreements. (2) Includes option to be exercised at the company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Wells Fargo facility from $275 million to up to $350 million. (3) Includes an option to draw up to an additional $75 million of proceeds on a delayed draw basis under the secured term loan credit agreement during the sixth-month period after September 25, 2020, which period may be extended for an additional six months upon payment of an extension fee. 12 (4) Does not include fees and other transaction related expenses. (5) Net outstanding balance after deduction of transaction related expenses and warrants. (6) Defined as total borrowings, less cash, divided by total equity. (7) Defined as recourse debt, less cash, divided by total equity.

Appendix

Summary of Investment Portfolio Original Maximum Loan Principal Carrying Cash All-in Yield at Maturity Stabilized ($ in millions) Commitment Balance Value Coupon(1) Origination(2) (Years) Initial LTV(4) LTV(5) Senior Loans $4,642.3 $4,045.9 $3,953.7 L + 3.50% L + 4.16% 3.1 66.1% 63.7% Subordinated Loans 26.9 26.9 25.2 L + 9.50% L + 9.84% 8.2 55.8% 49.8% Total Weighted/Average $4,669.2 $4,072.8 $3,978.9 L + 3.51% L + 4.18%(3) 3.1 66.0% 63.6% (1) See footnote (1) on p. 15. (2) See footnote (2) on p. 15. (3) See footnote (3) on p. 15. 14 (4) See footnote (4) on p. 15. (5) See footnote (5) on p. 15.

Investment Portfolio Detail Maximum All-in Original Origination Loan Principal Carrying Cash Yield at Maturity Property Stabilized ($ in millions) Type Date Commitment Balance Value Coupon(1) Origination(2) (Years) State Type Initial LTV(4) LTV(5) Asset 1 Senior 07/18 $127.4 $110.8 $108.1 L + 3.34% L + 4.27% 2.0 CA Retail 50.7% 55.9% Asset 2 Senior 12/15 120.4 120.4 117.8 L + 3.65% L + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 3 Senior 10/19 120.0 88.8 86.7 L + 3.24% L + 3.86% 3.0 CA Office 63.9% 61.1% Asset 4 Senior 12/19 101.6 84.2 82.7 L + 2.75% L + 3.23% 3.0 IL Multifamily 76.5% 73.0% Asset 5 Senior 08/19 100.3 85.1 83.9 L + 2.80% L + 3.26% 3.0 MN Office 73.1% 71.2% Asset 6 Senior 07/19 94.0 72.6 70.9 L + 3.69% L + 4.32% 3.0 IL Office 70.0% 64.4% Asset 7 Senior 06/19 92.7 70.6 68.1 L + 3.45% L + 3.88% 3.0 TX Hotel 56.1% 48.1% Asset 8 Senior 12/18 92.0 59.7 58.9 L + 3.75% L + 5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 9 Senior 10/19 87.8 66.2 64.5 L + 2.55% L + 3.05% 3.0 TN Office 70.2% 74.2% Asset 10 Senior 05/17 86.8 82.6 82.0 L + 3.50% L + 4.82% 4.0 MA Office 71.3% 71.5% Asset 11 Senior 01/20 81.9 50.5 49.6 L + 3.25% L + 3.93% 3.0 CO Industrial 47.2% 47.5% Asset 12 Senior 06/19 80.8 80.3 79.4 L + 2.69% L + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 13 Senior 09/19 75.6 70.4 69.7 L + 3.07% L + 3.58% 3.0 NY Multifamily 62.7% 67.1% Asset 14 Senior 10/19 75.4 75.4 71.2 L + 3.36% L + 3.73% 3.0 FL Mixed-Use 67.7% 62.9% Asset 15 Senior 10/17 74.8 53.9 52.4 L + 4.07% L + 4.47% 4.0 DC Office 67.0% 66.0% Assets 16-110 Various Various 3,257.7 2,901.3 2,833.0 L + 3.61% L + 4.28% 3.2 Various Various 67.1% 63.7% Total/Weighted Average $4,669.2 $4,072.8 $3,978.9 L + 3.51% L + 4.18%(3) 3.1 66.0% 63.6% (1) Cash coupon does not include origination or exit fees. (2) Provided for illustrative purposes only. Calculations of all-in yield at origination are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. (3) Calculations of all-in weighted average yield at origination exclude fixed rate loans. (4) Initial loan-to-value ratio (LTV) is calculated as the initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. (5) Stabilized LTV is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as 15 stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re- tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies.

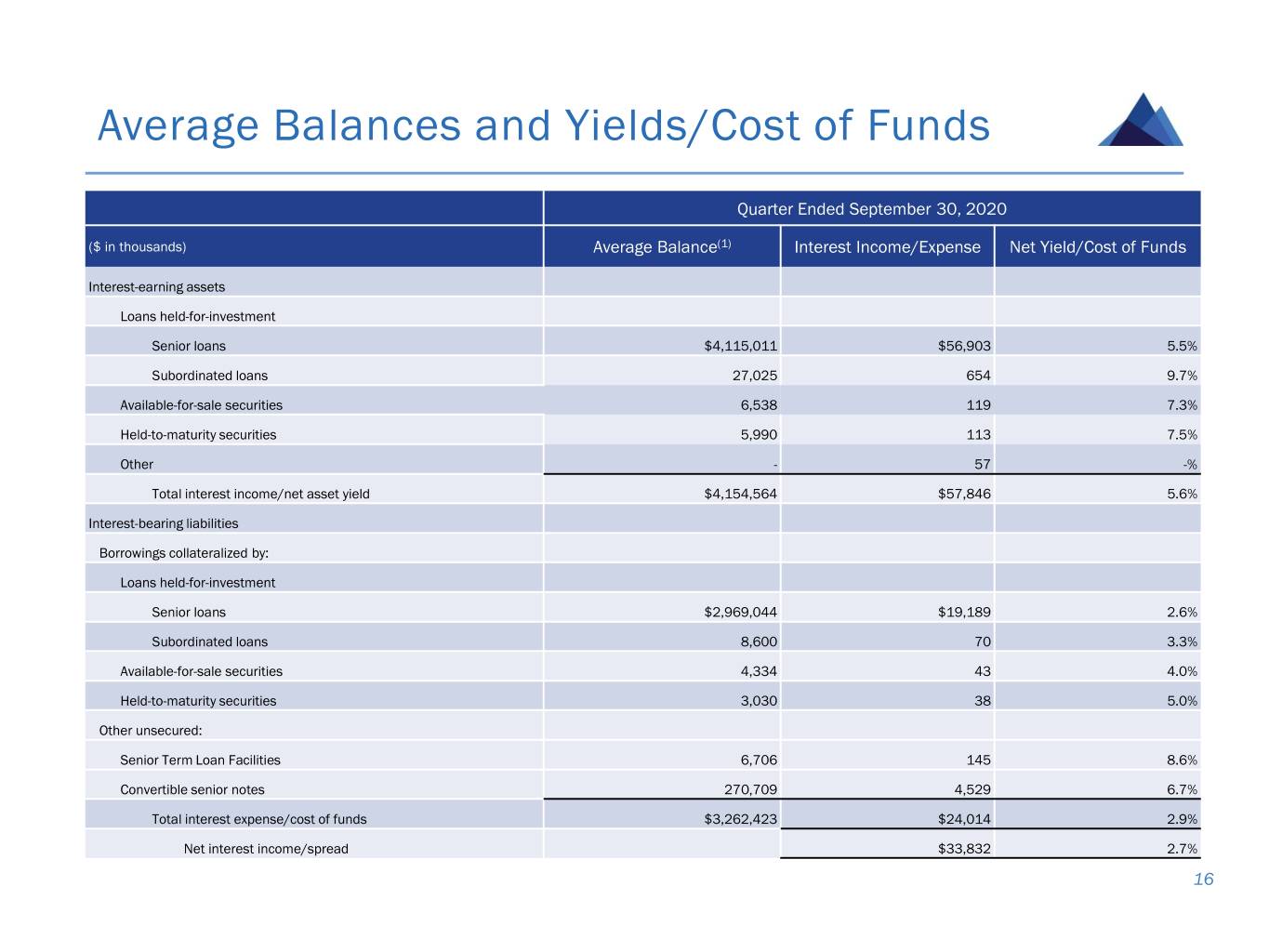

Average Balances and Yields/Cost of Funds Quarter Ended September 30, 2020 ($ in thousands) Average Balance(1) Interest Income/Expense Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans $4,115,011 $56,903 5.5% Subordinated loans 27,025 654 9.7% Available-for-sale securities 6,538 119 7.3% Held-to-maturity securities 5,990 113 7.5% Other - 57 -% Total interest income/net asset yield $4,154,564 $57,846 5.6% Interest-bearing liabilities Borrowings collateralized by: Loans held-for-investment Senior loans $2,969,044 $19,189 2.6% Subordinated loans 8,600 70 3.3% Available-for-sale securities 4,334 43 4.0% Held-to-maturity securities 3,030 38 5.0% Other unsecured: Senior Term Loan Facilities 6,706 145 8.6% Convertible senior notes 270,709 4,529 6.7% Total interest expense/cost of funds $3,262,423 $24,014 2.9% Net interest income/spread $33,832 2.7% 16

Condensed Balance Sheets GRANITE POINT MORTGAGE TRUST INC. September 30, December 31, CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share data) 2020 2019 ASSETS (unaudited) Loans held-for-investment $ 4,052,201 $ 4,226,212 Allowance for credit losses (73,339) — Loans held-for-investment, net 3,978,862 4,226,212 Available-for-sale securities, at fair value — 12,830 Held-to-maturity securities — 18,076 Cash and cash equivalents 353,679 80,281 Restricted cash 5,326 79,483 Accrued interest receivable 11,933 11,323 Other assets 53,052 32,657 Total Assets $ 4,402,852 $ 4,460,862 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Repurchase agreements $ 1,850,845 $ 1,924,021 Securitized debt obligations 928,623 1,041,044 Asset-specific financings 123,091 116,465 Revolving credit facilities — 42,008 Convertible senior notes 270,847 269,634 Senior term loan facilities 205,647 — Dividends payable 11,065 23,063 Other liabilities 77,272 24,491 Total Liabilities 3,467,390 3,440,726 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 1,000 shares issued and outstanding, respectively 1,000 1,000 Stockholders’ Equity Common stock, par value $0.01 per share; 450,000,000 shares authorized and 55,205,082 and 54,853,205 shares issued and outstanding, respectively 552 549 Additional paid-in capital 1,057,016 1,048,484 Accumulated other comprehensive (loss) income — 32 Cumulative earnings 80,014 162,076 Cumulative distributions to stockholders (203,121) (192,005) Total Stockholders’ Equity 934,462 1,019,136 Total Liabilities and Stockholders’ Equity $ 4,402,852 $ 4,460,862 17

Condensed Statements of Comprehensive Income GRANITE POINT MORTGAGE TRUST INC. Three Months Ended Nine Months Ended CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME September 30, September 30, (in thousands, except share data) 2020 2019 2020 2019 Interest income: (unaudited) (unaudited) Loans held-for-investment $ 56,783 $ 61,796 $ 180,341 $ 176,594 Loans held-for-sale 774 — 895 — Available-for-sale securities 119 308 646 927 Held-to-maturity securities 113 530 659 1,804 Cash and cash equivalents 57 810 424 2,228 Total interest income 57,846 63,444 182,965 181,553 Interest expense: Repurchase agreements 12,791 17,951 46,742 48,469 Securitized debt obligations 5,431 12,467 21,367 35,880 Convertible senior notes 4,529 4,503 13,570 13,459 Asset-specific financing 901 1,119 2,962 1,717 Revolving credit facilities 217 322 779 1,182 Senior term loan facilities 145 — 145 — Total Interest Expense 24,014 36,362 85,565 100,707 Net interest income 33,832 27,082 97,400 80,846 Other (loss) income: Provision for credit losses 5,300 — (62,241) — Realized losses on sales (10,019) — (16,913) — Fee income 595 — 1,117 1,115 Total other (loss) income (4,124) — (78,037) 1,115 Expenses: Management fees 3,974 3,801 11,840 11,013 Incentive fees — — — 244 Servicing expenses 914 1,013 3,025 2,671 General administrative expenses 5,808 4,877 24,421 15,499 Restructuring charges 43,682 — 43,682 — Total expenses 54,378 9,691 82,968 29,427 (Loss) income before income taxes (24,670) 17,391 (63,605) 52,534 (Benefit from) provision for income taxes (4) (1) (15) (4) Net (loss) income (24,666) 17,392 (63,590) 52,538 Dividends on preferred stock 25 25 75 75 Net (loss) income attributable to common stockholders $ (24,691) $ 17,367 $ (63,665) $ 52,463 Basic (loss) earnings per weighted average common share $ (0.45) $ 0.32 $ (1.15) $ 1.00 Diluted (loss) earnings per weighted average common share $ (0.45) $ 0.32 $ (1.15) $ 1.00 Dividends declared per common share $ 0.20 $ 0.42 $ 0.20 $ 1,26 Weighted average number of shares of common stock outstanding: Basic 55,205,082 54,853,205 55,140,163 52,492,324 Diluted 55,205,082 54,853,205 55,140,163 52,492,324 Comprehensive (loss) income: Net (loss) income attributable to common stockholders $ (24,691) $ 17,367 $ (63,665) $ 52,463 Other comprehensive (loss) income, net of tax: Unrealized (loss) gain on available-for-sale securities — — — 224 Other comprehensive (loss) income — — — 224 18 Comprehensive (loss) income $ (24,691) $ 17,367 $ (63,665) $ 52,687