Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Elevate Credit, Inc. | a991-09x2020pressrelea.htm |

| 8-K - 8-K - Elevate Credit, Inc. | elvt-20201109.htm |

Third Quarter 2020 Earnings Call November 2020

Forward-Looking Statements This presentation and responses to various questions contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements present our current expectations and projections relating to our business, financial condition and results of operations, and do not refer to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning. The forward-looking statements include statements regarding: the Company’s belief that it is well equipped with the right tools and models to reaccelerate growth as customer loan demand returns; our expectations regarding the impact of COVID-19 as well as related government actions and stimulus programs, on our business, customers, results of operations and financial condition, including on loan originations, demand for our products, credit quality, marketing expense and net charge-offs; our expectations regarding the cumulative loss rate as a percentage of originations for the 2019 and 2020 vintages; our expectations with respect to our liquidity position and requirements for additional debt to fund loans; our expectations with respect to our stock repurchase plan; and our expectations regarding the cost of customer acquisition, new customer originations, and the efficacy and cost of our marketing efforts. Forward‐looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. These risks and uncertainties include, but are not limited to: the effect of the COVID-19 pandemic and various policies being implemented to prevent its spread on the Company’s business, financial condition and results of operations; the Company’s limited operating history in an evolving industry; the Company’s ability to grow revenue and maintain or achieve consistent profitability in the future; new laws and regulations in the consumer lending industry in many jurisdictions that could restrict the consumer lending products and services the Company offers, impose additional compliance costs on the Company, render the Company’s current operations unprofitable or even prohibit the Company’s current operations; scrutiny by regulators and payment processors of certain online lenders’ access to the Automated Clearing House system to disburse and collect loan proceeds and repayments; a lack of sufficient debt financing at acceptable prices or disruptions in the credit markets; the impact of competition in our industry and innovation by our competitors; our ability to prevent security breaches, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service loans; and other risks related to litigation, compliance and regulation. Additional factors that could cause actual results to differ are discussed under the heading "Risk Factors" and in other sections of the most recent Annual Report on Form 10-K; most recent Form 10-Q and in the Company's other current and periodic reports filed from time to time with the SEC. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements regarding risks and uncertainties that are included in our public communications. You should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties. Neither we nor any of our respective agents, employees or advisors intend or have any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. The information and opinions contained in this presentation are provided as of the date of this presentation and are subject to change without notice. This presentation has not been approved by any regulatory or supervisory agency. See Appendix for additional information and definitions. 2

Elevate is reinventing non-prime credit with online products that provide financial relief today, and help people build a brighter financial future. We, along with the banks that license our technology, have originated $8.6 billion to 2.5 million customers1 and have saved them more than $7.6 billion over payday loans2 33

Third Quarter 2020 Summary Revenue of Record net Adjusted Record $94.2 million, a income from earnings of Adjusted decrease of continuing $17.4 million, EBITDA 43% YoY1 operations of or $0.42 per margin of $16.6 million, a fully diluted 42.3%2 527% increase share2 YoY 1 Adjusted earnings and Adjusted EBITDA margin are non-GAAP financial measures. See appendix for a reconciliation to a GAAP measure. 4

Non-Prime Sentiment Tracker “Overall, how stable do you feel your current employment is?” CNMC Non-prime Tracker, October 2020 Pre-COVID avg reflects March 2019 through February 2020 5

Business Updates • Expansion of Rise Brand – Additional bank partner – Geographic additions • Consolidation of Product and Bank Relationship Teams – Scott Greever named Chief Product Officer – Unified platforms and teams for all products • Recognized as a Great Place to Work for 5th Consecutive Year – Record high satisfaction scores 6

Key Financial Measures ($ in millions) Ending Combined Loans Revenue 1 Receivables - Principal $649 $618 $607 $586 $787 $481 $673 $639 $580 $377 $356 $475 $434 $375 $202 $274 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 Adjusted EBITDA2 Adjusted Earnings / (Loss) 3 $46 $127 $116 $120 $26 $100 $22 $87 $13 $60 $6 $19 As adjusted As adjusted As adjusted As adjusted (-$20) (-$22) (-$55) (-$53) 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 2014 2015 2016 2017 2018 2019 YTD 2019 YTD 2020 Ending combined loans receivable – principal, Adjusted EBITDA and Adjusted Earnings are non-GAAP financial measures. See appendix for a reconciliation to a GAAP measure. U.K. operations presented in 2014-2018 only. 7

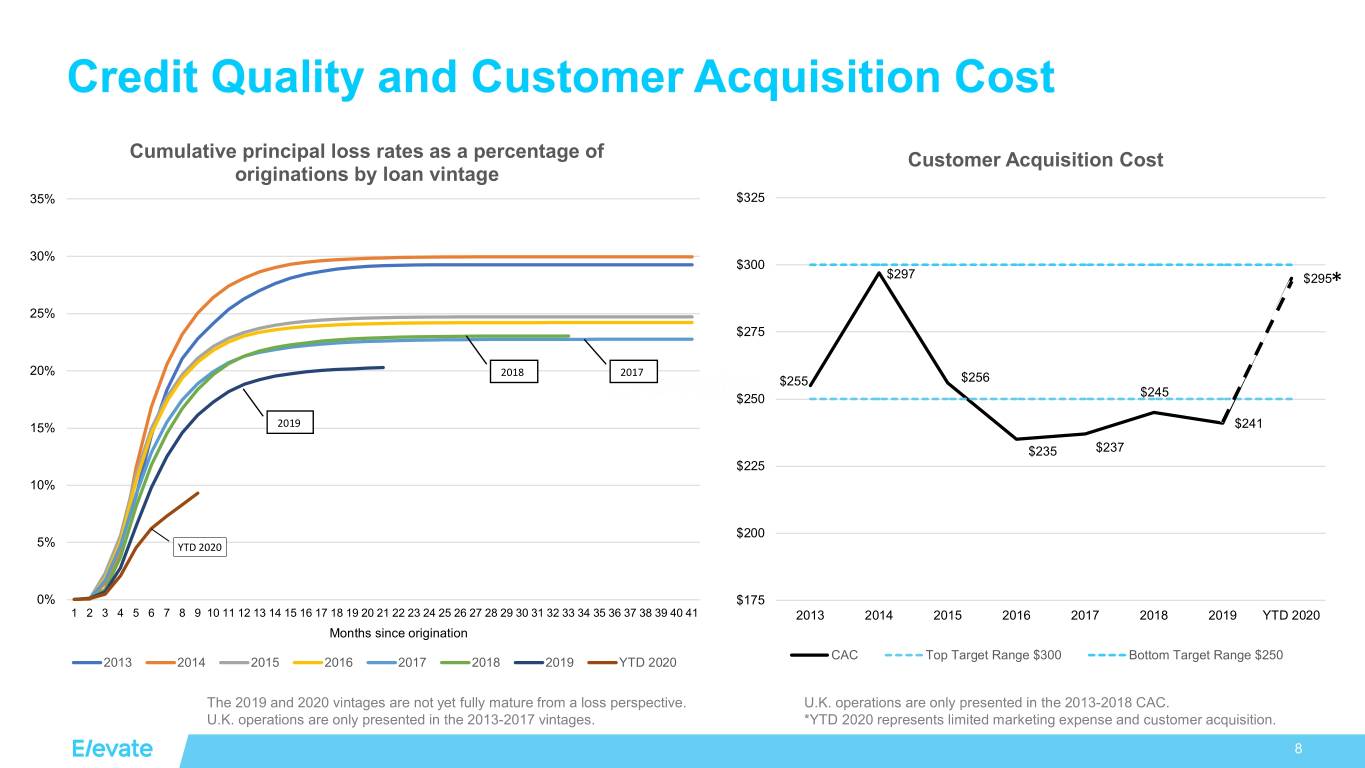

Credit Quality and Customer Acquisition Cost Cumulative principal loss rates as a percentage of Customer Acquisition Cost originations by loan vintage 35% $325 30% $300 $297 $295* 25% $275 20% 2018 2017 $255 $256 $245 $250 15% 2019 $241 $235 $237 $225 10% $200 5% YTD 2020 0% $175 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 2013 2014 2015 2016 2017 2018 2019 YTD 2020 Months since origination CAC Top Target Range $300 Bottom Target Range $250 2013 2014 2015 2016 2017 2018 2019 YTD 2020 The 2019 and 2020 vintages are not yet fully mature from a loss perspective. U.K. operations are only presented in the 2013-2018 CAC. U.K. operations are only presented in the 2013-2017 vintages. *YTD 2020 represents limited marketing expense and customer acquisition. 8

Margin Profile % of Gross Revenues 2017 2018 2019 3Q 2019 3Q 2020 Gross Revenue 100% 100% 100% 100% 100% Loan Loss Provision 53% 52% 51% 56% 14% Direct Marketing and 14% 13% 7% 8% 5% Other Cost of Sales Gross Margin 33% 35% 42% 36% 81% Operating Expenses 20% 20% 22% 21% 39% Adjusted EBITDA 1 13% 15% 20% 15% 42% Margin Adjusted EBITDA margin is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure. U.K. operations presented in 2017-2018 only. 9

We believe everyone deserves a lift. 1010

Appendix 11

Footnotes Page 3: 1 Originations and customers from 2002-September 2020, attributable to the combined current, predecessor direct, discontinued operations and branded products. 2 For the period from 2013 to September 30, 2020. Based on the average effective APR of 104% for the nine months ended September 30, 2020. This estimate, which has not been independently confirmed, is based on our internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or the "CFPB.“ Page 4: 1 Excludes results from discontinued operations in accordance with GAAP. 2 Adjusted earnings and Adjusted EBITDA margin are not financial measures prepared in accordance with GAAP. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. See the appendix for a definition and reconciliation to a GAAP measure. Page 7: 1 Ending combined loans receivable - principal is a non-GAAP financial measure. See the appendix for a definition and reconciliation to a GAAP measure. 2 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. See the appendix for a definition and reconciliation to a GAAP measure. 3 Adjusted earnings is not a financial measure prepared in accordance with GAAP. See the appendix for a definition and reconciliation to a GAAP measure. Page 9: 1 Adjusted EBITDA margin is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. See the appendix for a definition and reconciliation of Adjusted EBITDA to a GAAP measure. 12

Non-GAAP financials reconciliation – Adjusted EBITDA Three months ended Nine months ended Year ended September 30, September 30, December 31, ($mm) 2020 2019 2020 2019 2019 Net income from continuing operations $ 17 3 41 22 $ 26 Adjustments: Net interest expense 12 14 37 49 63 Stock-based compensation 1 2 7 7 10 Depreciation and amortization 5 4 13 12 16 Non-operating expense 1 1 7 1 1 Income tax expense 4 1 15 9 11 Adjusted EBITDA $ 40 25 120 100 $ 127 Adjusted EBITDA Margin 42% 15% 32% 21% 20% UK operations excluded as discontinued operations in 2019-2020. Adjusted EBITDA is a non-GAAP financial measure. The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior periods, such as the impact of income tax benefit or expense, non-operating income, net interest expense, goodwill impairment loss, share-based compensation expense, and depreciation and amortization expense, among others. The Company is not able to provide a reconciliation of the Company’s non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. 13

Non-GAAP financials reconciliation – Adjusted EBITDA (continued) For the years ended December 31, ($mm) 2018 2017 2016 2015 2014 Net income (loss) $ 13 (7) (22) (20) $ (55) Adjustments: Net interest expense 79 73 64 37 13 Stock-based compensation 8 6 2 1 1 Foreign currency transaction (gain) loss 2 (3) 9 2 1 Depreciation and amortization 13 10 11 9 8 Non-operating expense (income) - (2) - (6) - Income tax expense (benefit) 1 10 (3) (5) (21) Adjusted EBITDA $ 116 87 60 19 $ (53) Adjusted EBITDA Margin 15% 13% 10% 4% -19% UK operations presented in 2014-2018. Adjusted EBITDA is a non-GAAP financial measure. The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior periods, such as the impact of income tax benefit or expense, non-operating income, net interest expense, goodwill impairment loss, share-based compensation expense, and depreciation and amortization expense, among others. The Company is not able to provide a reconciliation of the Company’s non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. 14

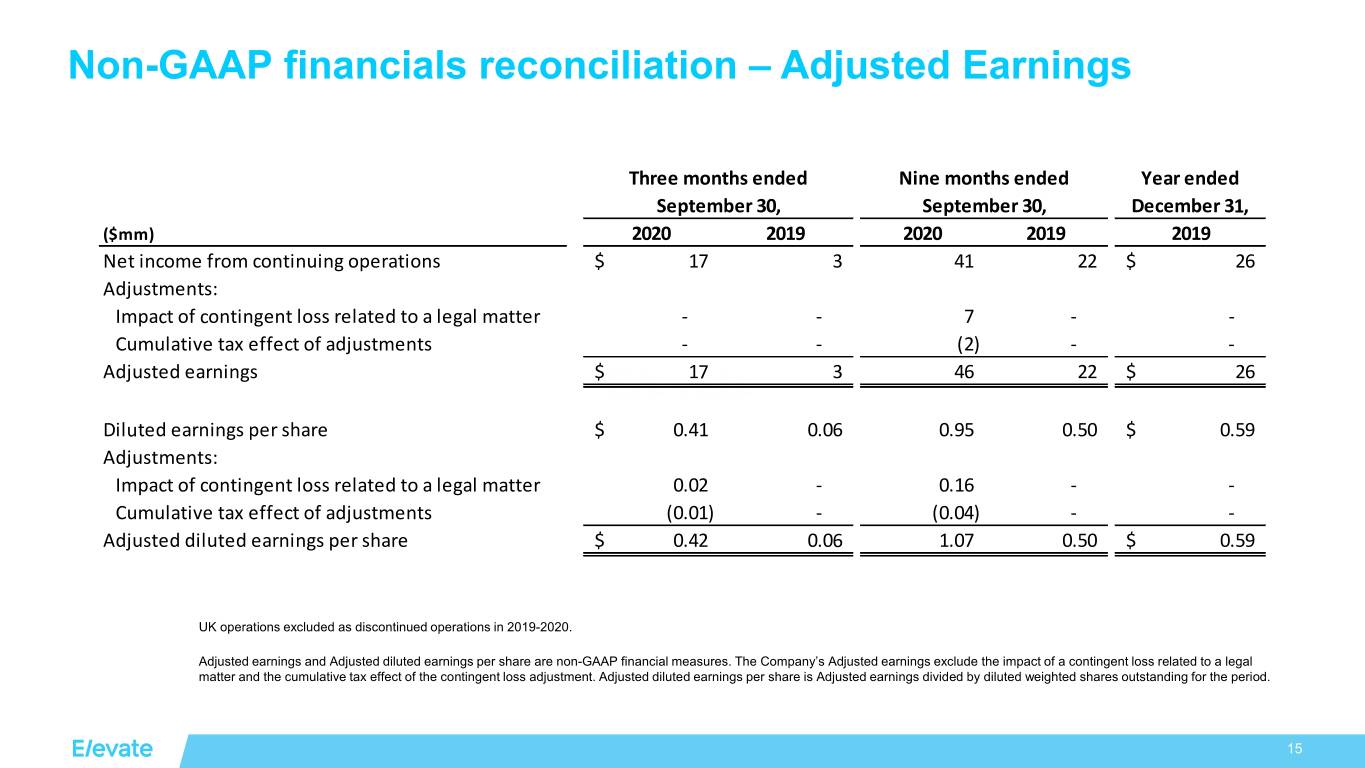

Non-GAAP financials reconciliation – Adjusted Earnings Three months ended Nine months ended Year ended September 30, September 30, December 31, ($mm) 2020 2019 2020 2019 2019 Net income from continuing operations $ 17 3 41 22 $ 26 Adjustments: Impact of contingent loss related to a legal matter - - 7 - - Cumulative tax effect of adjustments - - (2) - - Adjusted earnings $ 17 3 46 22 $ 26 Diluted earnings per share $ 0.41 0.06 0.95 0.50 $ 0.59 Adjustments: Impact of contingent loss related to a legal matter 0.02 - 0.16 - - Cumulative tax effect of adjustments (0.01) - (0.04) - - Adjusted diluted earnings per share $ 0.42 0.06 1.07 0.50 $ 0.59 UK operations excluded as discontinued operations in 2019-2020. Adjusted earnings and Adjusted diluted earnings per share are non-GAAP financial measures. The Company’s Adjusted earnings exclude the impact of a contingent loss related to a legal matter and the cumulative tax effect of the contingent loss adjustment. Adjusted diluted earnings per share is Adjusted earnings divided by diluted weighted shares outstanding for the period. 15

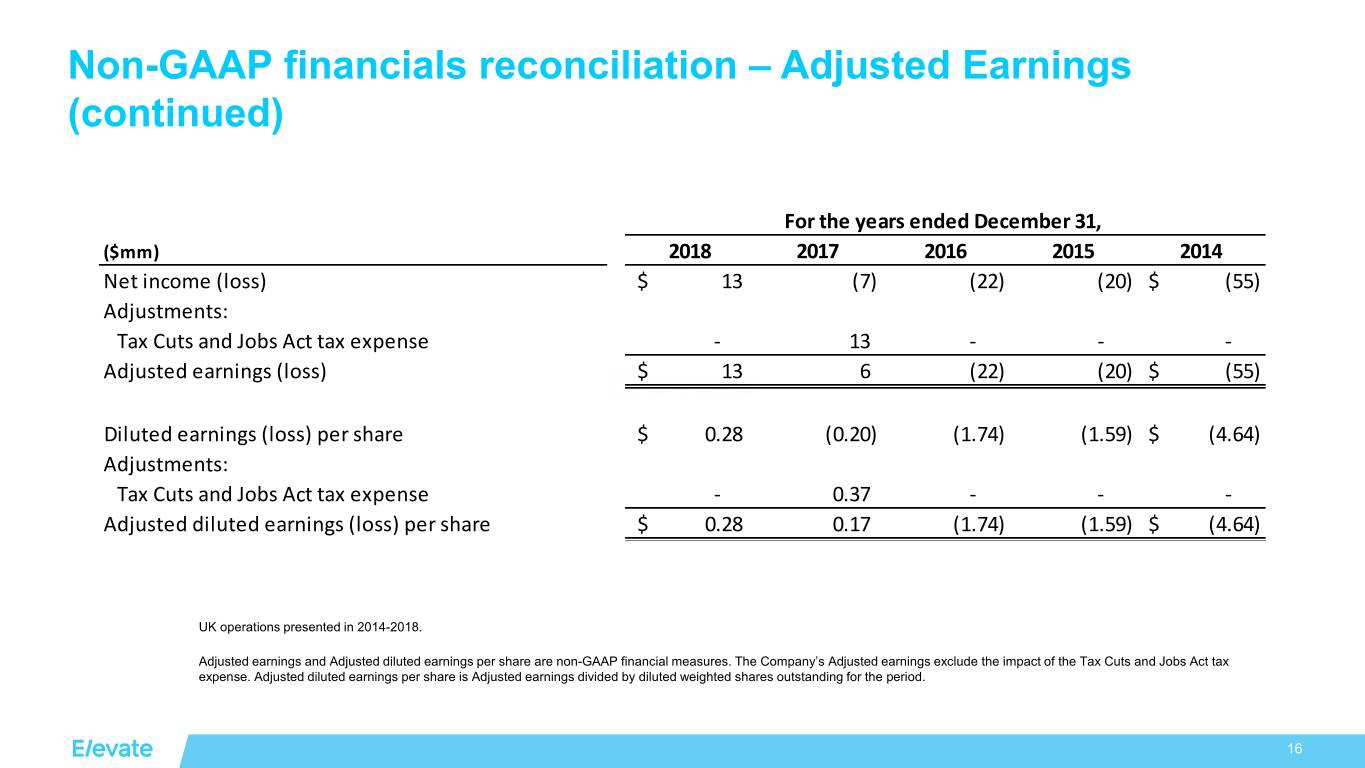

Non-GAAP financials reconciliation – Adjusted Earnings (continued) For the years ended December 31, ($mm) 2018 2017 2016 2015 2014 Net income (loss) $ 13 (7) (22) (20) $ (55) Adjustments: Tax Cuts and Jobs Act tax expense - 13 - - - Adjusted earnings (loss) $ 13 6 (22) (20) $ (55) Diluted earnings (loss) per share $ 0.28 (0.20) (1.74) (1.59) $ (4.64) Adjustments: Tax Cuts and Jobs Act tax expense - 0.37 - - - Adjusted diluted earnings (loss) per share $ 0.28 0.17 (1.74) (1.59) $ (4.64) UK operations presented in 2014-2018. Adjusted earnings and Adjusted diluted earnings per share are non-GAAP financial measures. The Company’s Adjusted earnings exclude the impact of the Tax Cuts and Jobs Act tax expense. Adjusted diluted earnings per share is Adjusted earnings divided by diluted weighted shares outstanding for the period. 16

Combined loans reconciliation (excluding UK) (dollars in thousands) Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 Sep 30, 2019 Company Owned Loans Loans receivable – principal, current, company owned 346,380 387,939 486,396 530,463 507,551 Loans receivable – principal, past due, company owned 21,354 18,917 53,923 58,489 59,240 Loans receivable – principal, total, company owned 367,734 406,856 540,319 588,952 566,791 Loans receivable – finance charges, company owned 24,117 25,606 31,621 33,033 31,698 Loans receivable – company owned 391,851 432,462 571,940 621,985 598,489 Allowance for loan losses on loans receivable, company owned (49,909) (59,438) (76,188) (79,912) (80,537) Loans receivable, net, company owned 341,942 373,024 495,752 542,073 517,952 Third Party Loans Guaranteed by the Company Loans receivable – principal, current, guaranteed by company 9,129 6,755 12,606 17,474 18,633 Loans receivable – principal, past due, guaranteed by company 314 117 564 723 697 Loans receivable – principal, total, guaranteed by company1 9,443 6,872 13,170 18,197 19,330 Loans receivable – finance charges, guaranteed by company2 679 550 1,150 1,395 1,553 Loans receivable – guaranteed by company 10,122 7,422 14,320 19,592 20,883 Liability for losses on loans receivable, guaranteed by company (1,421) (1,156) (1,571) (2,080) (1,972) Loans receivable, net, guaranteed by company2 8,701 6,266 12,749 17,512 18,911 1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial statements. 2 Represents finance charges earned by third-party lenders through CSO programs, which are not included in our financial statements. 3 Non-GAAP measure. . 17

Combined loans reconciliation - continued (excluding UK) (dollars in thousands) Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Dec 31, 2019 Sep 30, 2019 Combined Loans Receivable3 Combined loans receivable – principal, current 355,509 394,694 499,002 547,937 526,184 Combined loans receivable – principal, past due 21,668 19,034 54,487 59,212 59,937 Combined loans receivable – principal 377,177 413,728 553,489 607,149 586,121 Combined loans receivable – finance charges 24,796 26,156 32,771 34,428 33,251 Combined loans receivable 401,973 439,884 586,260 641,577 619,372 Combined Loan Loss Reserve3 Allowance for loan losses on loans receivable, company owned (49,909) (59,438) (76,188) (79,912) (80,537) Liability for losses on loans receivable, guaranteed by company (1,421) (1,156) (1,571) (2,080) (1,972) Combined loan loss reserve (51,330) (60,594) (77,759) (81,992) (82,509) 1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial statements. 2 Represents finance charges earned by third-party lenders through CSO programs, which are not included in our financial statements. 3 Non-GAAP measure. . 18

© 2017 Elevate. All Rights Reserved.