Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOVER MOTORSPORTS INC | tm2035296-1_8k.htm |

Exhibit 10.1

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (the “Agreement”) is made and entered into effective as of November 5, 2020 (the “Effective Date”) by and between PD TN/FL, LLC (the “Purchaser”), and Nashville Speedway, USA, Inc. (the “Seller”).

WITNESSETH:

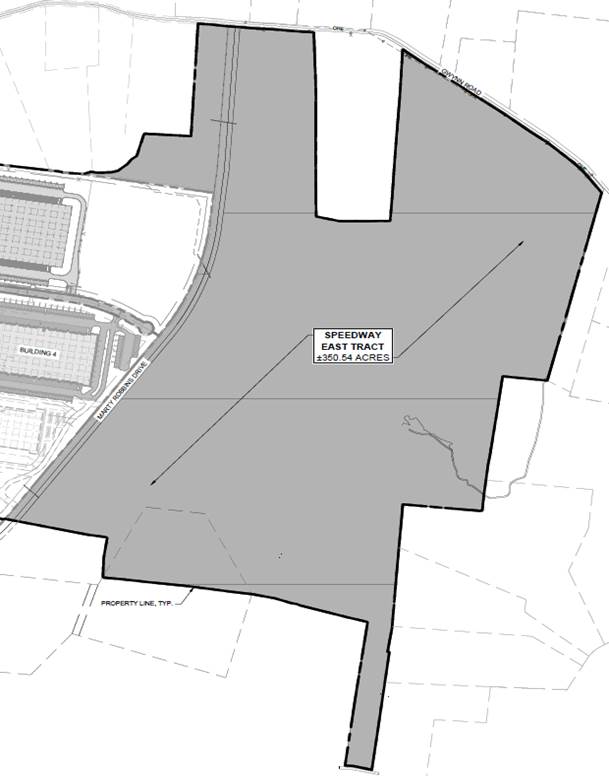

WHEREAS, Seller is the owner in fee simple of all that parcel of land located at approximately 350 acres with approximately 319 useable acres located east of Marty Robbins Drive, Lebanon, Wilson County, Tennessee 37090, being identified as a portion of Map 141, Parcel 26.05 (hereinafter referred to as the “Land”) and being more particularly describe on Exhibit A attached hereto and incorporated herein by reference;

WHEREAS, Purchaser desires to purchase from Seller the Land, water, mineral and air rights and any rights, privileges, and easements, if any, appurtenant to the Land, and 26,868 gallons per day in sanitary sewer capacity (collectively the “Property”) and Seller desires to sell and transfer the same to Purchaser;

NOW, THEREFORE, in consideration of the premises and the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE 1: PROPERTY TO BE SOLD

1.1 Property to be Sold. Purchaser agrees to buy and Seller agrees to sell and convey all of Seller’s right, title and interest in and to the Property, pursuant to the terms and conditions set forth herein.

ARTICLE 2: PURCHASE PRICE; EARNEST MONEY

2.1 Purchase Price. The purchase price (the “Purchase Price”) for the Property shall be $14,355,000.00 and shall be paid at Closing (as defined herein) by wire transfer received by Seller or the closing agent, as applicable, subject to a credit to Purchaser for the Earnest Money (as defined in Section 2.2 below) and closing adjustments as set forth herein.

2.2 Earnest Money. Within ten (10) business days from the full execution of this Agreement, Purchaser shall deposit with Seller the sum of Five Hundred Thousand Dollars ($500,000.00) (the “Earnest Money”). The Earnest Money shall be held in trust for the mutual benefit of the parties subject to the terms and conditions of this Agreement. If the sale of the Property closes as contemplated, Purchaser will receive the benefit of the Earnest Money. The Earnest Money shall be non-refundable except in the event of a default by Seller under this Agreement that is not cured within the applicable cure period.

1

ARTICLE 3: REPRESENTATIONS, WARRANTIES AND COVENANTS

Seller hereby represents, warrants and covenants to Purchaser as follows, which shall be true as of the Effective Date and as of the Closing Date:

3.1 Authority of Seller. Seller has the right and authority to enter into this Agreement and to sell the Property in accordance with the terms and conditions hereof. The individual executing this Agreement on behalf of Seller has the right and authority to bind Seller to the terms and conditions of this Agreement without joinder or approval of any other party.

3.2 No Leases or Service Contracts. There are no leases, leasing agreements, maintenance agreements, security contracts, service contracts, or any other agreements with respect to the Property.

3.3 Compliance with Existing Laws. To Seller’s actual knowledge, the Property is not in violation of any laws, rules, statutes or regulations applicable to the Property, including, without limitation, any laws, rules, statutes or regulations related to environmental protection, wetlands, or public health and safety. From the Effective Date until the Closing, Seller shall comply in all material respects with any laws, rules, statutes or regulations applicable to the Property.

3.4 Environmental Condition of Property. Seller has not received written notice from any federal, state, or other agency with jurisdiction over the Property (a) that the Property is in violation of any applicable federal, state or other law, ordinance or regulation regarding hazardous materials, or (b) that Seller is in violation of any environmental laws.

3.5 Operation of the Property. Seller covenants that, to the extent it is within Seller’s control, Seller will not voluntarily create or cause or permit a lien or encumbrance to attach to or on the Property between the Effective Date and Closing. Seller shall operate the Property in the ordinary course of business prior to the Closing. Seller shall not enter into any lease or service contract affecting the Property without Purchaser’s prior written consent. The Property shall be in substantially the same condition at Closing as existed on the Effective Date.

3.6 Survival. The representations and warranties by Seller in this Agreement shall survive the Closing and the recording of the deed for a period of six (6) months after the date of Closing.

3.7 AS IS. Subject to the foregoing representations and warranties and any representations and warranties set forth in the closing documents provided by Seller at Closing, Purchaser understands and acknowledges that Seller has not made and does not make any representation or warranties whatsoever, oral or written, express or implied, to Purchaser with respect to the condition, state of repair or operations of the Property, with respect to the suitability or fitness for the Purchaser’s intended use or purpose, or any other matter whatsoever. Purchaser further hereby acknowledges and agrees that Purchaser has investigated or will investigate all matters of concern to Purchaser with respect to the Property and that Purchaser is not relying and hereby expressly waives any reliance on any representation or warranty, oral or written, express or implied, of Seller with respect to such matters. Purchaser agrees to purchase the Property, as is, where is, with all faults. The provisions in the foregoing paragraph shall survive the Closing.

2

ARTICLE 4: TITLE AND SURVEY

4.1 Title Insurance. Purchaser shall, at Purchaser’s expense, within thirty (30) days from the Effective Date, obtain a commitment for owner’s title insurance on the standard ALTA Owner’s Policy Form 2006 (the “Title Commitment”). The Title Commitment and the title policy shall be issued by Fidelity National Title Insurance Company, Attn: Stuart Jones, Esq., 6840 Carothers Parkway, Suite 200, Franklin, TN 37067 (the “Title Company”) and shall be provided by Purchaser’s attorney. The Title Commitment shall indicate that title is owned by Seller, free and clear of all liens and encumbrances except for the matters agreed to by Purchaser prior to Closing (the “Permitted Exceptions”). At the Closing, the Title Company (i) shall insure that Purchaser is vested with good and marketable fee simple title to the Property, subject only to the Permitted Exceptions and (ii) shall delete the standard exceptions for mechanics and materialmen’s liens, parties in possession, “gap” coverage, and matters which an accurate survey would disclose. Seller agrees to remove, at or before Closing, any monetary liens encumbering the Property.

4.2 Survey; Plat. Purchaser shall obtain, at Purchaser’s expense, a survey of the Land (the “Survey”) certified by a licensed surveyor as of a date which follows the Effective Date and shows the acreage of the Land. The Survey shall explicitly delineate the area of the cemetery and the area of the cornflower preserve as well as the total acreage and boundaries of the Land to be purchased. Purchaser shall obtain the Survey within 120 days from the Effective Date and provide Seller with a copy of the Survey. Seller shall have the right to approve the Survey within ten (10) days from receipt, which approval will not be unreasonably withheld, conditioned or delayed. In the event that Seller fails to provide notice of approval or disapproval within such 10-day period, then Seller shall be deemed to have approved the Survey. The legal description on the Survey shall be conveyed to Purchaser at Closing. To the extent that a subdivision or plat is required in connection with the sale of the Property, Purchaser shall be responsible for the cost of any such subdivision or plat.

4.3 Title and Survey Review. If the Title Commitment or Survey shows matters which are not satisfactory to Purchaser, Purchaser shall give Seller written notice thereof within thirty (30) days following the last to be received by Purchaser of the Title Commitment or Survey, and shall state in writing its objection to the same. Failure to give such notice within said thirty (30) day period shall constitute approval of the Title Commitment and the Survey. Seller agrees, at or before Closing, to (i) satisfy or pay all mortgages, deeds of trust, security agreements, financing statements, conditional assignments, or other instruments by which Seller has granted the Property or any part thereof as collateral and (ii) remove from title any mechanics, materialmen and laborer’s liens affecting the Property. Subject to the foregoing, within thirty (30) days after receipt of such objections, Seller shall have the right, but shall not be obligated, to cure any objections. If Seller shall fail within such thirty (30) day period to cure or commit to cure such objections, then Purchaser may elect, by written notice to Seller, either to: (i) terminate this Agreement and receive a refund of the Earnest Money, upon which termination Seller and Purchaser shall have no further obligations to one another pursuant to this Agreement except those obligations herein that specifically survive the termination of this Agreement or (ii) waive all title defects which Seller is unwilling to cure and proceed with Closing hereunder as if said title defects did not exist. Closing may be extended for up to 30 days in order for Seller to cure any title or survey defect which it has committed to cure.

4.4 Access and Inspection Rights. Purchaser shall have full right of access over, under and above the Property prior to Closing and Seller shall cooperate with Purchaser in the course of Purchaser’s investigation. Without limiting the foregoing, Seller hereby authorizes Purchaser, at Purchaser’s expense, to complete soil testing and sampling, environmental sampling and to clear access paths using a bulldozer or similar equipment for applicable drill rigs, consistent with reasonable local commercial real estate practice. Purchaser shall indemnify and hold harmless Seller from any liability, claim or demand arising out of the acts or omissions of Purchaser or its agents, contractors, employees or other parties conducting activities on the Property on behalf of Purchaser and such obligation shall survive the termination of this Agreement. Seller hereby authorizes Purchaser, at Purchaser’s expense, to seek and obtain any and all permits, licenses, site and development plan approvals, permits and authorizations, zoning approvals, curb-cut approvals, and any and all other approvals or consents as Purchaser may deem necessary in connection with its proposed acquisition and/or proposed development of the Property. Seller, at no cost to Seller, shall cooperate with Purchaser in seeking such approvals and consents and, if any such applications, approvals or permits are required to be sought in Seller’s name, Seller shall seek such approvals upon Purchaser’s written request.

3

ARTICLE 5: CLOSING DELIVERIES

5.1 Closing Documents. Seller shall deliver to Purchaser at or before the Closing a FIRPTA form, an IRS 1099 form, a Closing Statement, an assignment of the sanitary sewer capacity, a sale restriction document consistent with Article 9 herein, and a Special Warranty Deed, conveying title to the Property to Purchaser, free and clear of all liens, encumbrances, easements and restrictions, except the Permitted Exceptions. At Closing, Seller shall also provide a certification that all of Seller’s representations and warranties remain in full force and effect as of the date of Closing.

5.2 Title Affidavit. Seller shall deliver at or before the Closing an affidavit and indemnity of Seller, in the form required by the Title Company, stating, among other things, that there are no outstanding unpaid bills for which liens can be attached to the Property and in form sufficient for the Title Company to provide “gap” coverage.

ARTICLE 6: CLOSING

6.1 Closing; Extension Right. The purchase and sale contemplated herein shall be consummated at the Closing (referred to herein as the “Closing”) which shall occur on or before May 31, 2021, or such earlier date as may be mutually agreed upon by Seller and Purchaser. Possession of the Property shall be transferred to Purchaser on the date of the Closing, subject only to the Permitted Exceptions.

6.2 Closing Costs. Seller shall pay at Closing any liens against the Property that are not Permitted Exceptions. Purchaser shall all costs related to the Title Commitment, title search fees, title policies and title endorsements, the Survey costs, the recording fees, transfer taxes, loan title insurance costs, title insurance endorsement costs, and the costs of any environmental site assessment or other inspection reports related to this transaction. Each party shall pay its own attorney’s fees in connection with this transaction.

6.3 Tax Prorations. All real property and personal taxes with respect to the Property shall be prorated between the parties as of the date of Closing. Any back taxes assessed for any year prior to the year in which Closing occurs shall be paid in full by Seller at Closing, including all delinquent and/or interest charges. Any expense related to a period subject to proration, the amount of which is not known with certainty at Closing, shall be estimated for purposes of proration and subject to post-closing adjustments as set forth herein.

ARTICLE 7: NO REAL ESTATE COMMISSION

7.1 No Real Estate Commission. Seller and Purchaser represent and warrant to each other that neither Seller nor Purchaser has dealt with, consulted or engaged any real estate broker, or agent in connection with this transaction. Each party (an “Indemnitor”) hereby agrees to indemnify and hold the other party (the “Indemnitee”) harmless from any liability, claim or demand, cost or expense, including reasonable attorneys’ fees the Indemnitee may suffer or incur by reason of the claims of any real estate broker or agent other than as provided above who may claim to have dealt with, consulted or been engaged by Indemnitor in connection with this transaction. Notwithstanding anything contained herein to the contrary, this indemnity shall survive Closing or termination of this Agreement and shall not be subject to the limitations on remedies contained in Article 8 below.

4

ARTICLE 8: DEFAULT

8.1 Default by Purchaser. In the event that Purchaser fails to perform under this Agreement, including the failure to consummate the purchase of the Property under the terms stated in this Agreement, Seller shall have the following exclusive remedy: Seller shall terminate this Agreement after providing written notice to Purchaser and a ten (10) day period to cure, and Seller shall retain the Earnest Money as liquidated damages. Seller agrees that the remedies set forth in this Agreement are fair and equitable and Seller agrees that it will not assert the lack of mutuality of remedies as a defense in the event of a dispute.

8.2 Default by Seller. If Seller fails to perform under this Agreement, Purchaser shall have the right, after providing written notice to Seller and a ten (10) day period to cure, either (i) to receive back the Earnest Money, and thereby terminate this Agreement, or (ii) to require specific performance on the part of Seller and receive any attorneys’ fees and expenses related to the enforcement of Purchaser’s rights under this Agreement, but shall have no other remedies at law or in equity. Purchaser agrees that the remedies set forth in this Agreement are fair and equitable and Purchaser agrees that it will not assert the lack of mutuality of remedies as a defense in the event of a dispute.

8.3 Indemnity Survival. The foregoing provisions relating to liquidated damages shall not apply in any way to the indemnities provided by each party to the other pursuant to this Agreement.

ARTICLE 9: MISCELLANEOUS PROVISIONS

9.1 Completeness; Waiver. This Agreement constitutes the final and entire agreement between the parties hereto with respect to the transactions contemplated herein, and it supersedes all prior discussions, understandings or agreements between the parties. Failure by Seller and Purchaser to insist upon or enforce any of its rights hereto shall not constitute a waiver thereof, except as provided herein.

9.2 Assignment and Binding Effect. This Agreement shall be binding upon and shall inure to the benefit of each of the parties hereto, their respective heirs, permitted successors, permitted assigns, beneficial owners and representatives.

9.3 Governing Law. This Agreement shall be governed by and construed under the laws of the State of Tennessee. The parties agree that the venue for any litigation arising out of this Agreement shall be the court of competent jurisdiction in Wilson County, Tennessee.

9.4 Counterparts/Facsimiles/PDF. To facilitate execution, this Agreement may be executed in as many counterparts as may be required; and it shall not be necessary that the signature of, or on behalf of, each party, or that the signatures of the persons required to bind any party, appear on one or more such counterparts. All counterparts shall collectively constitute a single agreement. Execution evidenced by facsimile signature and/or PDF signature shall be deemed an original for all purposes.

5

9.5 Notice. All notices, consents and other communications hereunder shall be in writing and shall be (i) personally delivered or (ii) sent by a nationally recognized overnight courier service or (iii) sent by first class, registered or certified mail, return receipt requested, postage prepaid as follows:

| (a) | If to Seller, to the address stated below, or to such address as may have been furnished by Seller to Purchaser in writing: |

Nashville Speedway, USA, Inc.

Attn: Denis McGlynn, Chief Executive Officer

3411 Silverside Road

Tatnall Bldg., Suite 201

Wilmington, DE 19810

With copy to: Price Thompson, Esq.

Rochelle, McCulloch & Aulds, PLLC

109 North Castle Heights Avenue

Lebanon, Tennessee 37087

| (b) | If to Purchaser, to the address stated below, or to such other address as may have been furnished by Purchaser to Seller in writing: |

PDC TN/FL, LLC

Attn: Whitfield Hamilton and Jeff Konieczny

35 Music Square East, Suite 301

Nashville Tennessee 37203

With copy to: C. Mark Carver, Esq.

Sherrard Roe Voigt & Harbison, PLC

150 Third Avenue South, Suite 1100

Nashville, TN 37201

Any such notice, request, consent or other communications shall be deemed received (i) at such time as it is personally delivered by hand, (ii) one business day after deposit with a courier delivery service, or (iii) on the third business day after it is mailed, as the case may be.

9.6 Further Assurances. The parties shall execute such additional documents and do such other acts as may be reasonably required to carry out the intent of this Agreement. Without limitation, Seller shall make available resolutions, certificates of existence, by-laws, operating agreements, and such other documents as may be required to evidence Seller’s power and authority to carry out this Agreement.

9.7 Time of the Essence. Time is of the essence with respect to the performance of each of the covenants and agreements under this Agreement.

6

9.8 Attorneys’ Fees. In the event that a party hereto engages attorneys to enforce its rights in connection with or related to this Agreement (including suits after Closing which are based on or related to this Agreement), the prevailing party in any such action shall be entitled to receive from the non-prevailing party its reasonable attorneys’ fees and costs, and court costs.

9.9 Business Day. If any date or any period provided in this Agreement ends on a Saturday, Sunday or legal holiday, the applicable period shall be extended to the first business day following such Saturday, Sunday or legal holiday.

9.10 Representation by Counsel. The parties acknowledge that each party to this Agreement has been represented by counsel and such counsel have participated in the negotiation and preparation of this Agreement. This Agreement shall be construed without regard to any presumption or rule requiring that it be construed or constructed against the party who has drafted or caused the Agreement to be drafted.

9.11 Confidentiality. Seller and Purchaser agree that Seller may disclose the terms of this Agreement and include a copy of the Agreement in an SEC filing. Subject to the foregoing, Seller and Purchaser agree that the terms of this Agreement shall remain strictly confidential but the parties shall have the right to disclose the terms of this Agreement to accountants, attorneys, investors, lenders, zoning officials, planning officials, designers, architects, and other such parties with a need to know so long as such parties agree to maintain the confidentiality of the terms of this Agreement to the extent reasonably possible. In the event that the transaction contemplated by this Agreement closes, then Seller and Purchaser each shall have the right to make public announcements regarding the sale.

9.12 Notice by Counsel. Anything contained in this Agreement to the contrary notwithstanding, all notices pursuant to this Agreement, whether from Seller to Purchaser or from Purchaser to Seller, will be effective if executed by and sent by the attorney of the party sending such notice. Purchaser and Seller hereby agree that if a notice is given hereunder by counsel, such counsel may communicate directly in writing with all principals, as may be required to comply with the notice provisions of this Agreement.

9.13 OFAC for Purchaser. Neither Purchaser (which includes its partners, members, principal stockholders, any other constituent entities or persons, overseers, trustees and senior executive officers) nor any direct or indirect constituents of Purchaser that either directly or indirectly own 25% of Purchaser or directly or indirectly control Purchaser have been designated as a “specifically designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Asset Control at its official website, http://www.treas.gov/ofac/t11 or at any replacement website or other replacement official publication of such list. Purchaser is not in violation of compliance with the regulations of the Office of Foreign Asset Control of the Department of Treasury and any statute, executive order (including the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or any other governmental action relating thereto. This representation will be true at all times from the time this is made and until all obligations under the Agreement are satisfied. Purchaser represents that all OFAC information provided by Purchaser to Seller in connection with this Agreement is true and complete.

9.14 OFAC for Seller. Neither Seller (which includes its partners, members, principal stockholders, any other constituent entities or persons, overseers, trustees and senior executive officers) nor any direct or indirect constituents of Seller that either directly or indirectly own 25% of Seller or directly or indirectly control Seller have been designated as a “specifically designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Asset Control at its official website, http://www.treas.gov/ofac/t11 or at any replacement website or other replacement official publication of such list. Seller is not in violation of compliance with the regulations of the Office of Foreign Asset Control of the Department of Treasury and any statute, executive order (including the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or any other governmental action relating thereto. This representation will be true at all times from the time this is made and until all obligations under the Agreement are satisfied. Seller represents that all OFAC information provided by Seller to Purchaser in connection with this Agreement is true and complete.

SIGNATURES ON FOLLOWING PAGE.

7

IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the Effective Date.

| SELLER: | Nashville Speedway, USA, Inc., a Tennessee corporation | |

| By: | /s/ Denis McGlynn | |

| Title: | Chairman | |

| PURCHASER: | PDC TN/FL, LLC, a Delaware limited liability company | |

| By: | /s/ Whitfield Hamilton | |

| Title: | Partner | |

8

EXHIBIT A

DRAWING SHOWING LOCATION OF THE PROPERTY

9