Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CASEYS GENERAL STORES INC | brhc10016744_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - CASEYS GENERAL STORES INC | brhc10016744_ex99-1.htm |

Exhibit 99.2

Casey’s Acquisition of Bucky’s Convenience stores November 9, 2020

Safe harbor statements This presentation is dated as of November 9, 2020 and speaks as of that

date. Forward-Looking StatementsThis presentation contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include any

statements, with respect to the Company and the acquisition, relating to our expectations for future periods, possible or assumed future results of operations, financial conditions, liquidity and related sources or needs, business and/or

integration strategies, plans and synergies, supply chain, growth opportunities, performance at our stores, and the potential effect of COVID-19. There are a number of known and unknown risks, uncertainties, and other factors that may cause

our actual results to differ materially from any future results expressed or implied by those forward-looking statements, including but not limited to integration of the acquisition, executing our strategic plan, the impact and duration of

COVID-19 and related governmental actions, as well as other risks, uncertainties and factors which are described in the Company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as filed with the Securities and

Exchange Commission and available on our website. Any forward-looking statements contained in this presentation represent our current views as of the date of this presentation with respect to future events, and Casey’s disclaims any intention

or obligation to update or revise any forward-looking statements in the presentation whether as a result of new information, future events, or otherwise.Use of Non-GAAP MeasuresThis presentation contains references to “EBITDA” which we define

EBITDA as net income before net interest expense, income taxes, depreciation and amortization. EBITDA is not considered a GAAP measure, and should not be considered as a substitute for net income, cash flows from operating activities or other

income or cash flow statement data. These measures have limitations as analytical tools, and should not be considered in isolation or as substitutes for analysis of results as reported under GAAP. We strongly encourage investors to review our

financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. We believe EBITDA is useful to investors in evaluating operating performance because securities analysts and other interested

parties use such calculations as a measure of financial performance and debt service capabilities, and they are regularly used by management for internal purposes including our capital budgeting process, evaluating acquisition targets, and

assessing performance. Because non-GAAP financial measures are not standardized, EBITDA, as defined by us, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare our use of

these non-GAAP financial measures with those used by other companies. Reconciliations of EBITDA to GAAP net income for completed fiscal quarters and years for Casey’s can be found in our quarterly reports on Form 10-Q and annual reports on

Form 10-K as filed with the SEC, respectively.

Our Strategy As shown on January 2020 Investor Day Reinvent the Guest ExperienceContemporize our

food proposition, optimize & localize assortment, and deliver compelling experiences Invest in Our Talent Create a culture that drives performance and exceeds guests’ expectations Accelerate Unit GrowthAccelerate our new store builds

and acquisitions, including market and store format expansion Transaction is consistent with our strategy to accelerate unit growth Create Capacity through EfficienciesDrive efficiencies to improve the shape of the business and fund future

growth

TRANSACTION OVERVIEW Casey’s General Stores to acquire Buchanan Energy for $580 million in an

all-cash transactionIncludes tax benefits valued at $80 million for a net after-tax purchase price of $500 millionBucky’s operates convenience stores primarily in Illinois and Nebraska94 owned retail store locations and 79 dealer

locations Transaction includes multiple parcels of real estate for future new store constructionDealer network provides new income stream as well as flexibility with future M&A transactionsLTM-July 2020 EBITDA of approximately $47

millionContinues the expansion of Casey’s in strong markets across the Midwestern United States Expected to generate approximately $23 million in pre-tax annual synergies within 36 months post-closing Anticipated to close by the end of

calendar year 2020, subject to customary closing conditions and regulatory approval

Overview of Bucky’s Convenience Stores 1 Based on LTM July-2020. Includes estimated June and July 2020

dealer gallons. Family operated convenience store chain founded in 1980 Store network consists of company-owned stores and dealer-operated storesPrimary operating categories include fuel, grocery and other merchandise, and prepared food

salesCar wash, lottery, ATM and rental income provide additional streams of income Store Network Key Financials1 ~$150mmINSIDE SALES ~$47mmEBITDA 94Convenience Store Locations 79Dealer Network Locations ~270mmFuel Gallons

BUCKY’S STORE NETWORK Note: Bucky’s sales mix LTM Jul-20; Casey’s sales mix FYE Apr-20. Avg. store

format of ~3,000 sq. ft. Grab-and-go and ready-to-eat food offeringsFull kitchens included at new store locationsAutomated car wash at ~90% of stores Retail Store Markets Bucky’s Inside Sales Mix:Opportunity to expand Prepared

Food category through enhanced Casey’s offerings 79Dealer Network Locations Favorable long-term contractsIncremental rental income streams Fuel purchased from multiple suppliersSelf-distribute to dealer sites using own transportation

fleet DEALER NETWORK OPPORTUNITY FUEL PARTNERS AT DEALER SITES Potential for Greater Diversity in Inside Sales Mix Attractive Store Formats Retail Network Dealer Network 56IllinoisLocations26NEBRASKA

Locations5IowaLocations4TEXASLocations3MissouriLocations Casey’s Inside Sales Mix

COMPELLING SYNERGY OPPORTUNITY ~$23mm in Pre-Tax Synergy by Year Three Merchandise

Profitability Retail Fuel Profitability Operations / SG&A Store Upgrades Leverage Casey’s scaleFuel procurement opportunities More sophisticated merchandisingGrow Casey’s Rewards membersAdd Casey’s new private label brandsLeverage

procurement scale Streamlining opportunitiesLeverage Casey’s self-distribution capabilities Implement pizza kitchensRaze and Rebuild opportunities on high volume locationsImage refresh

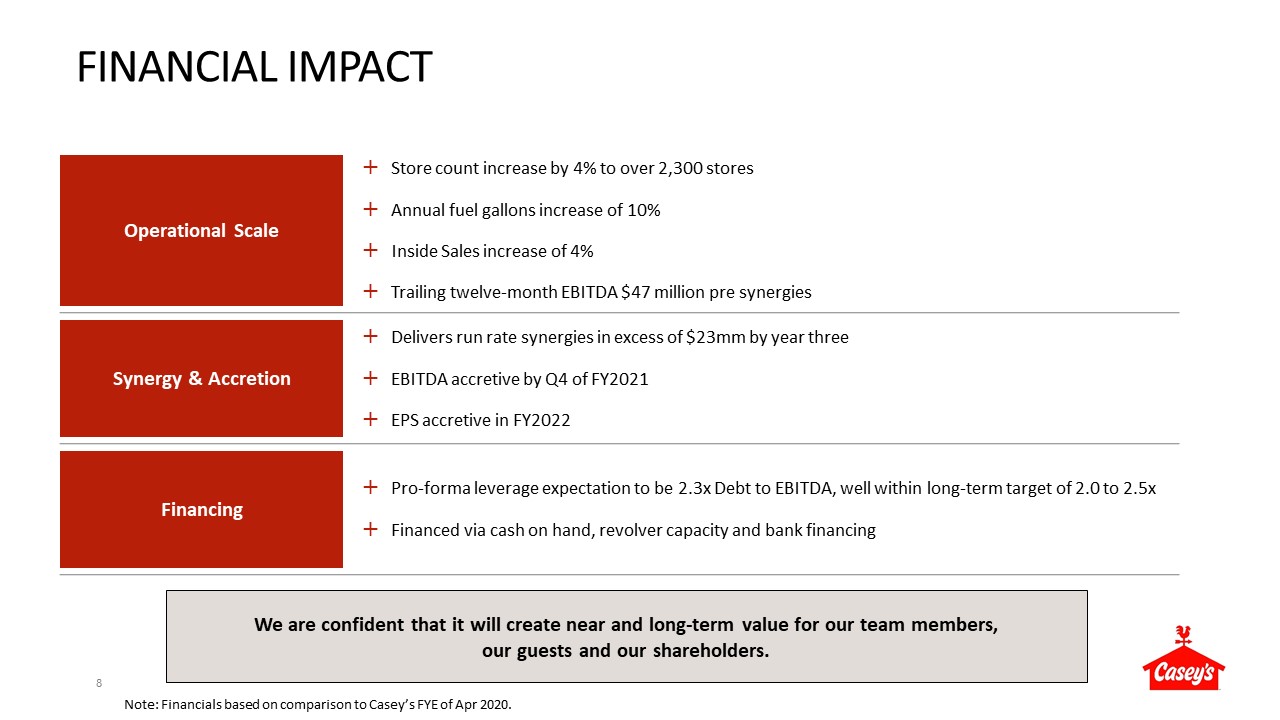

FINANCIAL IMPACT Operational Scale Store count increase by 4% to over 2,300 storesAnnual fuel gallons

increase of 10%Inside Sales increase of 4%Trailing twelve-month EBITDA $47 million pre synergies Synergy & Accretion Delivers run rate synergies in excess of $23mm by year threeEBITDA accretive by Q4 of FY2021EPS accretive in

FY2022 Financing Pro-forma leverage expectation to be 2.3x Debt to EBITDA, well within long-term target of 2.0 to 2.5xFinanced via cash on hand, revolver capacity and bank financing Note: Financials based on comparison to

Casey’s FYE of Apr 2020. We are confident that it will create near and long-term value for our team members, our guests and our shareholders.