Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REVIVA PHARMACEUTICALS HOLDINGS, INC. | tm2035201d1_8k.htm |

Exhibit 99.1

Reviva Pharmaceuticals, Inc. Business Combination with Tenzing Acquisition Corp. (NASDAQ: TZAC/TZACW) November 2020 Confidential

Disclaimer and Other Important Information Disclaimer and Other Important Information This presentation (the “Presentation”) is for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Tenzing Acquisition Corporation ( “Tenzing”) and Reviva Pharmaceuticals, Inc . (“Reviva” or the “Company”) and related transactions (the “Transaction”) and for no other purpose . Neither the Company nor Tenzing makes, and each hereby expressly disclaims, any representation or warranty, express or implied, as to the reasonableness of the assumptions made in this Presentation or the accuracy or completeness of the information, including any projections, contained in or incorporated by reference into this Presentation . Neither the Company nor Tenzing shall have any liability for any representations or warranties, express or implied, contained in, or omissions from, this Presentation or any other written or oral communications communicated to the recipient in the course of the recipient’s evaluation of the Company or Tenzing . Neither Tenzing nor the Company assume any obligation to provide recipient with access to any additional information . Investors should not construe the contents of this Presentation, or any prior or subsequent communication from or with Tenzing or the Company or their respective representatives as investment, legal or tax advice . This presentation and the information contained herein are confidential and may not be copied, distributed or disclosed to any other person . No securities commission or securities regulatory authority or other authority in the United States or any other jurisdiction has in any way passed upon the merits of the Transaction or the accuracy or adequacy of this Presentation . No Offer or Solicitation This Presentation is neither an offer to sell nor a solicitation of an offer to purchase any particular securities, or the solicitation of any vote in any jurisdiction pursuant to the proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law . No offer shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Use of Projections This Presentation contains financial forecasts with respect to Reviva’s estimated budgets and projected financing . Neither Tenzing’s independent auditors nor the independent auditors of Reviva audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation and, accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . This Presentation also contains forecasts with respect to Reviva’s research and clinical trials . These projections should not be relied upon as being necessarily indicative of future results . In this Presentation certain of the above - mentioned forecasts have been included (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein) for purposes of providing comparisons with historical data . The assumptions and estimates underlying the forecasts are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective information . Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Reviva or Tenzing or that actual results will not differ materially from those presented in the prospective information . Inclusion of the prospective information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective information will be achieved . Forward - Looking Statements This Presentation contains “forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on the beliefs and assumptions and on information currently available to management of the Company . All statements other than statements of historical fact contained in this presentation are forward - looking statements, including statements concerning the Company’s expected capital needs, cash runway and use of proceeds ; the Company’s planned and ongoing non - clinical and clinical studies for the Company’s product candidates and the potential advantages of those product candidates ; the initiation, enrollment, timing, progress, release of data from and results of those planned and ongoing non - clinical and clinical studies ; the potential advantages of the Company’s products ; the Company’s goals with respect to the development and potential use, if approved, of each of its product candidates ; and the utility of prior non - clinical and clinical data in determining future clinical results . In some cases, you can identify forward - looking statements by terminology such as “may,” “will,” “should,” “projects,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology . Forward - looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside the control of Tenzing and the Company, that may cause the Company’s actual results, performance or achievements to differ materially, and potentially adversely, from any future results, performance or achievements expressed or implied by the forward - looking statements . These risks and uncertainties include, but are not limited to, the risks and uncertainties described in the definitive legal agreements with respect to the purchase of any securities . Forward - looking statements represent the Company’s beliefs and assumptions only as of the date of this Presentation . Although the Company believes that the expectations reflected in the forward - looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements . Except as required by law, the Company assumes no obligation to publicly update any forward - looking statements for any reason after the date of this Presentation to conform any of the forward - looking statements to actual results or to changes in its expectations . Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms . None of Tenzing, the Company, and their respective affiliates and any third parties that provide information to Tenzing or the Company, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information . None of Tenzing, the Company, and their respective affiliates and any third parties that provide information to Tenzing or the Company, such as market research firms, are responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content . None of Tenzing, the Company, and their respective affiliates give any express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein . Additional Information ; Participants in the Solicitation This Presentation does not contain all the information that should be considered concerning the proposed Transaction . It is not intended to form the basis of any investment decision or any other decision in respect to the proposed Transaction . In connection with the proposed Transaction, Tenzing has filed a registration statement on Form S - 4 , as amended and supplemented from time to time (the “Registration Statement”), which contains a preliminary proxy statement/prospectus relating to the Transaction and will mail to the stockholders of Tenzing a definitive proxy statement/final prospectus and other relevant documents . This Presentation is not a substitute for the proxy statement/prospectus or for any other document that Tenzing may file with the SEC and send to its stockholders in connection with Tenzing’s solicitation of proxies for the special meeting to be held to approve the proposed Transaction . INVESTORS AND SECURITIES HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIREETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION . Tenzing and Reviva, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Tenzing ordinary shares in connection with the proposed Transaction . Information about Tenzing’s directors and executive officers and their ownership of Tenzing’s ordinary shares is set forth in Tenzing’s Annual Report on Form 10 - K for the year ended February 29 , 2020 filed with the SEC, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing . Other information regarding the interests of the participants in the proxy solicitation is included in Tenzing's Registration Statement . These documents and other documents filed with the SEC by Tenzing through the SEC’s web site at www . sec . gov . Copies of the documents filed with the SEC by Tenzing are available free of charge by contacting Tenzing Acquisition Corp . , 250 West 55 th Street, New York, New York 10019 . 2

1. See slide 9 for details and assumptions ; assuming no redemptions by Tenzing shareholders and assuming no other equity issuances by Tenzing, except for shares issuable pursuant to the Backstop Agreements as described in Footnote 4 and conversion of working capital loans from Tenzing Sponsors of up to $ 1 , 775 , 000 to 177 , 500 private placement units . 2. Assumes $ 34 . 5 million in primary funding from cash in trust and no redemptions from Tenzing public shareholders ; excludes approximately 6 . 9 mm outstanding warrants with a strike price of $ 11 . 50 per share and an additional 1 mm shares after closing of the business combination if certain stock price ( $ 15 . 00 per share) and product development milestones are met within three years after the closing . 3. Excludes Reviva’s outstanding options and warrants to acquire capital stock of Reviva, which will be assumed by Tenzing . 4. Includes up to 44 , 062 ordinary shares Tenzing may issue to investors pursuant to certain backstop agreements entered into by Tenzing in October 2020 , as more fully described in the Registration Statement . Tenzing may enter into additional backstop arrangements and/or private placements of equity securities of Tenzing . Transaction Overview • Tenzing Acquisition Corp . (NASDAQ : TZAC/TZACW) to acquire Reviva Pharmaceuticals, Inc .; as the combined company, Tenzing to be renamed Reviva Pharmaceuticals Holdings, Inc . (the “Company”) . • Reviva is a clinical stage pharmaceutical company developing therapies that address unmet medical needs in the areas of central nervous system, cardiovascular, metabolic, and inflammatory diseases . • Total post - money market capitalization of the combined company estimated to be equal to approximately $ 120 . 4 1 2 3 4 million, assuming $ 34 . 5 million stays in Tenzing’s trust account in connection with the closing of the Transaction, and assuming no other equity issuances by Tenzing and excluding options and warrants . Exceptional Projected Growth • Reviva’s primary focus is developing its lead product candidate, Brilaroxazine (RP 5063 ) . Safety data from Reviva’s Phase 2 study for RP 5063 in acute schizophrenia and schizoaffective patients did not reveal any serious and unexpected adverse events 5 . • Brilaroxazine also compared favorably to approved drugs in proven translational models for pulmonary arterial hypertension (PAH) and idiopathic pulmonary fibrosis (IPF) and gained “Orphan Drug Designation” from FDA for treatment of PAH and IPF, and has successfully completed phase 1 clinical trials . • The global addressable market size for Reviva’s product candidate Brilaroxazine (RP 5063 ) : o $ 7 . 9 billion for schizophrenia by 2022 6 o $ 5 . 4 billion for bipolar disorder by 2024 7 o $ 15 . 9 billion for depression by 2023 8 o $ 14 . 6 billion for PAH by 2026 9 o $ 5 . 9 billion for IPF by 2023 10 Transaction Overview – 1/2 5. The most common adverse events were insomnia and agitation. RP5063 showed lower discontinuation rate than placebo. 6. Research report from Grand View Research, Inc., 2017. 7. Research report from Bipolar Disorder: Market Data Forecast 2020. 8. Research report from Depression: Allied Market Research 2018. 9. Research report from PAH: Credence Research, 2018. 10. Research report from IPF: iHealthcare Analyst 2018. 3

Ownership • Current Reviva equity holders r olling 100 % of equity in exchange for approximately 5 . 8 mm shares valued at $ 62 . 4 million 1 • Reviva shareholders will have the ability to earn an additional 1 . 0 mm shares after the closing, if a stock price milestone ( $ 15 . 00 per share for any 20 trading days within any 30 day period) and product development milestones are met within 3 years after closing • Outstanding Reviva options and warrants to be assumed by the combined company • Pro forma market capitalization of the combined company estimated to be equal to approximately $ 120 . 4 mm 2 3 4 5 • Pro forma ownership expected immediately after closing o Existing Reviva shareholders : ~ 51 . 8 % 2 3 4 5 o TZAC Public shareholders : ~ 28 . 7 % 2 3 4 5 o TZAC Sponsor : ~ 19 . 1 % 2 3 4 5 6 o Additional shares issued to backstop investors : ~ 0 . 4 % 2 3 4 5 Management & Governance • Current CEO of Reviva, Laxminarayan Bhat, PhD, will lead the combined company as Chief Executive Officer • Parag Saxena will continue to serve as the Chairman of the Board of Directors post - closing • Current Reviva management team will remain in their current roles post - closing • Board of Directors for the combined entity will consist of a minimum of five ( 5 ) members, initially consisting of three ( 3 ) directors designated by Reviva and two ( 2 ) directors designated by Tenzing Approvals / Timing • No minimum cash requirement to close the Transaction ; currently expected to close no later than December 25 , 2020 7 1. Certain convertible promissory notes of Reviva will be required to convert into shares of Reviva common stock prior to the closing, and will share in the merger consideration . 2. See slide 9 for details and assumptions ; assuming no redemptions by Tenzing shareholders and assuming no other equity issuances by Tenzing, except for shares issuable pursuant to the Backstop Agreements as described in Footnote 5 and conversion of the working capital loans from Tenzing Sponsors of up to $ 1 , 775 , 000 to 177 , 500 private placement units . 3. Assumes $ 34 . 5 million in primary funding from cash in trust and no redemptions from Tenzing public shareholders ; excludes approximately 6 . 9 mm outstanding warrants with a strike price of $ 11 . 50 per share and an additional 1 mm shares after closing of the business combination if certain stock price ( $ 15 . 00 per share) and product development milestones are met within three years after the closing . 4. Excludes Reviva’s outstanding options and warrants to acquire capital stock of Reviva, which will be assumed by Tenzing . 5. Includes up to 44 , 062 ordinary shares Tenzing may issue to investors pursuant to certain backstop agreements entered into by Tenzing in October 2020 , as more fully described in the Registration Statement . Tenzing may enter into additional backstop arrangements and/or private placements of equity securities of Tenzing . 6. Assumes conversion of working capital loans of up to $ 1 , 775 , 000 to 177 , 500 private placement units . Tenzing Sponsor ownership includes units issued to IPO Underwriter, Maxim Group LLC . 7. The transaction may be terminated by either Tenzing or Reviva if any of the conditions to closing have not been satisfied or waived by December 25 , 2020 . Transaction Overview – 2/2 4

Leadership Team Leadership Team Current/Previous Affiliation Laxminarayan Bhat, PhD (Chief Executive Officer) Marc Cantillon, MD (Chief Medical Officer) Narayan Prabhu 1 (Chief Financial Officer) 1. At closing of Merger with Tenzing . 5

Board of Directors Board of Directors Current/Previous Affiliation Parag Saxena 1 (Chairman) Laxminarayan Bhat, PhD (CEO) Les Funtleyder , MPH 1 Richard Margolin, MD 1 Purav Patel 1. At closing of Merger with Tenzing . 6

Board of Advisors 1 Current/Previous Affiliation Daphne Karydas John M. Kane, MD Senior Vice President, Behavioral Health Services, Northwell Health Chair, Psychiatry, Zucker Hillside Hospital Chair, Psychiatry, Donald and Barbara Zucker School of Medicine at Hofstra/Northwell Leslie Citrome , MD, MPH Clinical Professor of Psychiatry and Behavioral Sciences at New York Medical College in Valhalla, New York . Dr . Citrome is a member of the Board of Directors, Treasurer, and President - Elect of the American Society of Clinical Psychopharmacology Martin Kolb, MD, PhD Professor, Moran Campbell Chair in Respiratory Medicine; Respirology Division Director; Research director, Firestone Institute for Respiratory Health Roham Zamanian, MD Associate Professor of Medicine; Director, Adult Pulmonary Hypertension Program; Vera Moulton Wall Center for Pulmonary Vascular Disease; Division of Pulmonary & Critical Care Medicine at Stanford University School of Medicine Board of Advisors 7 1. At closing of Merger with Tenzing .

Financing & Transaction Structure 8

Reviva Rollover Shareholders 51.8% Public Shareholders 28.7% Tenzing Sponsor 19.1% Additional shares issued to backstop investors 0.4% Transaction Overview Pro Forma Equity Ownership 2 3 4 5 1. Based on $ 34 . 5 million cash in trust and 3 , 184 , 368 public shares outstanding . 2. Excludes Reviva’s outstanding options and warrants to acquire capital stock of Reviva, which will be assumed by Tenzing . 3. Assumes $ 34 . 5 million in primary funding from cash in trust and no redemptions from Tenzing public shareholders ; excludes any new equity issuances by Tenzing, except for shares issuable pursuant to the Backstop Agreements as described in Footnote 5 and conversion of working capital loans from Tenzing Sponsors of up to $ 1 , 775 , 000 to 177 , 500 private placement units ; excludes approximately 6 . 9 mm outstanding warrants with a strike price of $ 11 . 50 per share and an additional 1 mm shares after closing of the business combination if certain stock price ( $ 15 . 00 per share) and product development milestones are met within three years after the closing . 4. Assumes conversion of working capital loans of up to $ 1 , 775 , 000 to 177 , 500 private placement units . Tenzing Sponsor ownership includes units issued to IPO Underwriter, Maxim Group LLC . 5. Includes up to 44 , 062 ordinary shares Tenzing may issue to investors pursuant to certain backstop agreements entered into by Tenzing in October 2020 , as more fully described in the Registration Statement . Tenzing may enter into additional backstop arrangements and/or private placements of equity securities of Tenzing . 9 Pro Forma Valuation Sources and Uses ($mm) Illustrative Tenzing Share Price 1 $10.85 Sources Uses Pro Forma Shares Outstanding (mm) 1 11.1 Reviva Rollover Equity 2 $62.4 Reviva Rollover Equity $62.4 Equity Value ($mm) 2 3 4 5 120.4 Tenzing Cash in Trust 3 34.5 Cash to Balance Sheet 29.6 Less: Cash 34.5 Estimated Transaction Costs 4.9 Enterprise Value ($mm) $85.8 Total Sources $96.9 Total Uses $96.9

Current Financing Round & Use of Proceeds 1. Projected amounts for debt financing and licensing deals based on estimates and goals of Reviva management . Such figures are based on assumptions and not on contractual terms and, therefore, are inherently uncertain, and no assurance can be given regarding the accuracy or appropriateness of such estimates, goals and assumptions . No assurance can be given that such additional debt financing and licensing deals will be available on terms acceptable to Reviva, if at all . 2. There is no minimum cash condition and all of the trust funds may be redeemed in connection with the closing, subject to Tenzing meeting the $ 5 , 000 , 001 net tangible asset requirements in its charter and IPO prospectus . 3. Budget Estimates assume receipt of additional projected debt financing and licensing deals . No assurance can be given that such additional funds will be available on terms acceptable to Reviva, if at all . If such additional funds are not available to Reviva, it may be required to delay or terminate planned expenditures for certain of its programs that it would otherwise seek to develop as reflected in these Budget Estimates . Fundraising Plans 1 : • Anticipated to raise $ 34 . 5 million in funding from Tenzing’s trust, which is subject to reduction from redemptions by stockholders, and potential equity financing investments that are not committed 2 • Seek to raise approx . $ 5 million in debt financing post closing • Seek to raise approx . $ 5 million in licensing deals for Asia and South America post closing Budget Estimates 3 : • Anticipated clinical trial programs : (i) 1 st Phase 3 study in acute Schizophrenia, (ii) Phase 2 Study in Bipolar Disorder (BD), (iii) Phase 2 Study in Major Depressive Disorder (MDD), (iv) Phase 2 Study in Pulmonary Arterial Hypertension (PAH), and (v) Phase 2 Study in Idopathic Pulmonary Fibrosis (IPF) • Estimated R&D cost for clinical trial programs and G&A expenses for 2 years : ~ $ 39 million • Estimated transaction expenses : $ 4 . 9 million 10

Comparable Companies in Neuroscience Space 1. Reviva : post Merger with Tenzing - assuming no redemptions by Tenzing shareholders and assuming no other equity issuances by Tenzing, except for shares issuable pursuant to the Backstop Agreements as described in Footnote 5 and conversion of working capital loans from Tenzing Sponsors of up to $ 1 , 775 , 000 to 177 , 500 private placement units . 2. See slide 9 for details and assumptions ; assuming no redemptions by Tenzing shareholders and assuming no other equity issuances by Tenzing, except for shares issuable pursuant to the Backstop Agreements as described in Footnote 5 and conversion of working capital loans from Tenzing Sponsors of up to $ 1 , 775 , 000 to 177 , 500 private placement units . 3. Assumes $ 34 . 5 million in primary funding from cash in trust and no redemptions from Tenzing public shareholders ; excludes approximately 6 . 9 mm outstanding warrants with a strike price of $ 11 . 50 per share and an additional 1 mm shares after closing of the business combination if certain stock price ( $ 15 . 00 per share) and product development milestones are met within three years after the closing . 4. Excludes Reviva’s outstanding options and warrants to acquire capital stock of Reviva, which will be assumed by Tenzing . 5. Includes up to 44 , 062 ordinary shares Tenzing may issue to investors pursuant to certain backstop agreements entered into by Tenzing in October 2020 , as more fully described in the Registration Statement . Tenzing may enter into additional backstop arrangements and/or private placements of equity securities of Tenzing . 6. The “Comparable Companies” referenced in this presentation serve as illustrative purposes only and neither Tenzing nor Reviva guarantee similar future results, levels of activity, performance or achievements as such “Comparable Companies” . 7. Source : Thomson Reuters Eikon . 8. Market Capitalization per Thomson Reuters Eikon as of November 2 , 2020 . 9. Source : https : //investors . karunatx . com/news - releases/news - release - details/karuna - therapeutics - announces - closing - initial - public - offering . 10. Source : https : //ir . intracellulartherapies . com/news - releases/news - release - details/intra - cellular - therapies - announces - completion - public - offering . 11. Reviva does not intend to commence trials for depression related indications unless and until Reviva raises additional funds . No assurance can be given that such additional funds will be available on terms acceptable to Reviva, if at all . If such additional funds are not available to Reviva, it may be required to delay or terminate programs that it would otherwise seek to develop, including for depression related indications . 12. Source : https : //investor . sagerx . com/news - releases/news - release - details/sage - therapeutics - announces - closing - initial - public - offering . Company 1 5 Indication Stage at NASDAQ listing NASDAQ listing date Amount raised at NASDAQ listing ($mm) Market Cap. at NASDAQ listing 7 ($mm) Current Market Cap 8 ($mm) Schizophrenia Ph. II data readout N/A $34 3 N/A N/A Schizophrenia Ph. II in progress Jun 2019 $103 9 $469 $2,223 Schizophrenia Ph. II data readout Jan 2014 $124 10 $540 $1,873 Depression 11 Ph. I/II preliminary data July 2014 $104 12 $751 $3,726 Pro forma market capitalization of the combined company estimated to be equal to approximately $120.4mm 1 2 3 4 5 11

R&D Focus and Product Pipeline 12

Product Pipeline: Overview Therapeutic Areas of Focus ▪ Focused on development of next generation Platform Therapies using chemical genomics driven discovery approach and proprietary drug molecules ▪ Therapeutic areas of focus are the CNS, inflammatory and cardiometabolic diseases ▪ Company has 2 new chemical entities (NCEs) in development – RP 5063 ( brilaroxazine ) and RP 1208 , discovered and developed in - house ▪ RP 5063 is a serotonin, dopamine, & nicotinic receptor active drug candidate in clinical studies ▪ RP 1208 , a drug candidate with triple reuptake inhibitor activities, may be in IND - enabling studies for depression and may be in animal efficacy studies for obesity within a short time frame following the receipt of adequate additional financing ▪ Granted Composition of Matter Patents for RP 5063 and RP 1208 in USA, Europe and other countries FDA (USA) granted Orphan Drug Designation to RP5063 for PAH and IPF indications 13

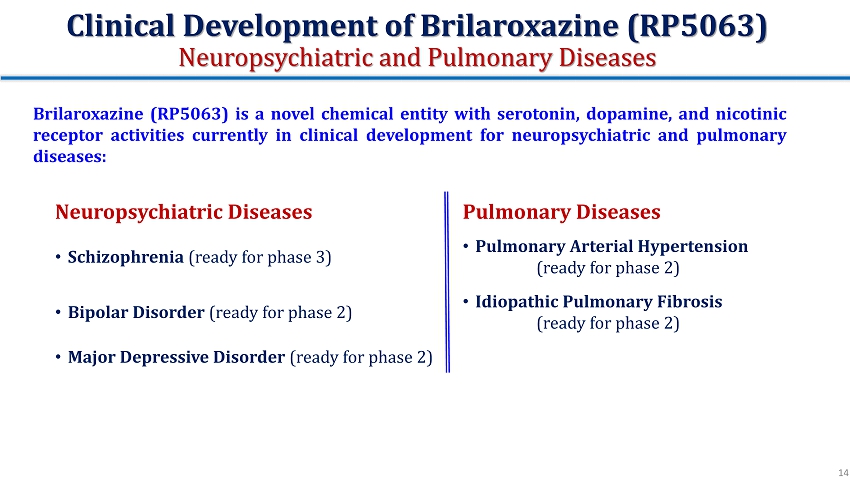

Clinical Development of Brilaroxazine (RP5063) Neuropsychiatric and Pulmonary Diseases Neuropsychiatric Diseases Pulmonary Diseases • Schizophrenia (ready for phase 3) • Pulmonary Arterial Hypertension (ready for phase 2) • Bipolar Disorder (ready for phase 2) • Idiopathic Pulmonary Fibrosis (ready for phase 2 ) • Major Depressive Disorder (ready for phase 2) Brilaroxazine (RP 5063 ) is a novel chemical entity with serotonin, dopamine, and nicotinic receptor activities currently in clinical development for neuropsychiatric and pulmonary diseases : 14

U.S. Regulatory Status Successful End of Phase 2 (EOP2) meeting with U.S. FDA FDA guidance for p otential “Superior Safety” label claim FDA waived the requirement of CYP2D6 drug interaction clinical study FDA reviewed the phase 3 protocol, CMC, and long - term toxicology package ▪ New chemical entity (NCE) with granted U.S. and European patents ▪ Clinically differentiated drug candidate with respect to adherence to treatment ▪ As promptly as practicable following the Business Combination, Reviva intends to commence clinical phase 3 studies for acute and maintenance schizophrenia : x Generally well - tolerated in phase 1B and phase 2 studies for schizophrenia in >250 patients x Completed long term regulatory toxicology studies x Manufactured API and drug products (clinical trial materials) ▪ Oral once daily dosing, potential to develop once monthly depot (i.m.) dose for enhanced compliance Overview of Brilaroxazine Neuropsychiatry Program Schizophrenia Phase 3 Clinical Trials to NDA 15

16 Prevalence • Schizophrenia : Worldwide prevalence of schizophrenia is approximately 1 . 1 % regardless of racial, ethnic or economic background, with approximately 3 . 5 million people diagnosed in the US . 1 , 2 • Bipolar Disorder : Global prevalence of bipolar spectrum disorders is approximately 2 . 4 % , with approximately 0 . 6 % for bipolar I, and approximately 0 . 4 % for bipolar II . 3 • Major Depressive Disorder (MDD) : The prevalence of MDD among U . S . adults aged 18 or older was estimated at 17 . 3 million in 2017 . The prevalence was also higher among females, 8 . 7 % , compared to males, 5 . 3 % . 4 • Chronic disabling conditions with significant unmet needs; varying degrees of overlapping symptoms • Antipsychotic drug is the first - line treatment for these neuropsychiatric diseases $7.9 B by 2022 $5.4 B by 2024 $15.9 B by 2023 Global Market Insights 5 1. World Health Organization: https://www.who.int/news - room/fact - sheets/detail/schizophrenia accessed on July 27, 2020. 2. Schizophrenia and Related Disorders Alliance of America (SARDAA): https://sardaa.org/resources/about - schizophrenia/ , accessed on July 27, 2020. 3. Rowland T.A. and Marwaha, S. Ther Adv Psychopharmacol 2018, 8(9): 251 - 269. 4. The National Institute of Mental Health (NIMH): https://www.nimh.nih.gov/health/statistics/major - depression.shtml , July 27, 202 0. 5. Market Research Sources: (i) Schizophrenia: Grand View Market Res 2017; (ii) Bipolar Disorder: Market Data Forecast 2020; (iii) Depression: Allied Market Research 2018. Neuropsychiatric or Mental Disorders Prevalence and Global Market Insights

1. Suboptimal efficacy for residual symptoms 1 2 • Negative symptoms • Cognitive deficits • Mood symptoms 2. Poor tolerability / High Side effects 2 • Neurological (EPS, akathisia) • Metabolic (obesity, diabetes, cholesterol) • Endocrine (sexual dysfunction) 3 . High Discontinuation / Non - compliance 3 • Reviva estimates discontinuation rates of 30 - 50 % in the short - term treatment in acute patients, and 42 - 74 % in the long - term treatment in maintenance or stable patients . Discontinuation/ Non - Compliance 4 Sub - optimal Efficacy Side Effects / Tolerability 1. Torres - Gonzalez F et al, Neuropsychiatric Disease and Treatment 2014, 10:97 - 110. 2. Stroup T S and Gray N, World Psychiatry 2018, 17:341 - 356. 3. Bhat L et al, J Neurology and Neuromedicine 2018 , 3(5): 39 - 50. 4. Levin, S.Z. et al., Schizophrenia Research 2015, 164:122 - 126. Why Are New Antipsychotics Needed for Schizophrenia? Current therapies do not adequately address key unmet needs 17

x Cognition improvement supported by pharmacology profile, and translational studies data in rodents 2 1. Cantillon M. et al. Clinical & Translational Science 2018, 11: 387 - 396. 2. Rajagopal, L. et al. Behavioral Brain Research 2017, 332: 180 - 199. Improvement in Cognition Trails A & B Data Decrease in Positive Symptoms PANSS Positive Data * • PANSS Baseline for sub - analysis: 50 • Pooled data of RP5063 (10 - 100mg), N = 19 • PANSS Baseline Scores: 39 - 69 • Pooled data of RP5063 (10 - 100mg), N=32 - 4.4 secs - 5.3 secs - 9.4 secs Brilaroxazine (RP5063) Phase 1B Clinical Study in Stable Schizophrenia Decrease in Positive Symptoms and Improvement in Cognition (10 Days Treatment) 1 18 *P = 0.023 vs placebo

Efficacy for Schizophrenia (PANSS reduction: – 20 points) Decrease in Positive Symptoms (PANSS) Improvement in Social Functioning (PANSS) Decrease in Negative Symptoms (PANSS) Cantillon, M. et al. Schizophrenia Research 2017, 189: 126 - 133 Brilaroxazine (RP5063) Phase 2 Clinical Data for Acute Schizophrenia The study met primary and secondary end points (4 - week, N=234) 19

CNS / Neuroleptic Side Effects Endocrine Side Effects Metabolic Side Effects Brilaroxazine (RP5063) has an Extremely Clean Side Effect Profile Neuroleptic, Endocrine and Metabolic Side Effects Comparable to Placebo Cantillon, M. et al. Schizophrenia Research 2017, 189: 126 - 133 20 Extrapyramidal Side Effect (%) Change in Prolactin (mIU/L) Akathisia (%) Change in Thyroid - T4 (pmol/L) Ari: Aripiprazole; RP: Brilaroxazine (RP5063) Body Weight Increase (%) Diabetes/Blood Sugar (mmol/L) Lipids/Triglycerides (mmol/L) Cholesterol (mmol/L) RP: 15mg projected, widely used dose

Therapeutic Benefits • Safety data from Reviva’s Phase 2 study for RP 5063 in acute schizophrenia and schizoaffective patients did not reveal any serious and unexpected adverse events . The most common adverse events were insomnia and agitation . RP 5063 showed lower discontinuation rate than placebo . • During the phase 2 clinical trial as compared to the placebo, showed w ell tolerated with No metabolic, No endocrine, and No cardiac side effects, and No suicidal ideation . Potential “Superior Safety Label Claim” (EOP 2 meeting with FDA) • Robust Compliance - Low discontinuation rates in 15 mg ( 14 % ) and 50 mg ( 12 % ) groups compared to approved antipsychotics . No side effects related discontinuation in 15 mg and 30 mg, but in higher dose 50 mg group 1 - patient (< 2 % ) with remission of symptoms had EPS related dropout . • Good Bioavailability: Oral absorption with predictable linear pharmacokinetics. • Ease of administration : One tablet a day, no dose titration required, no food required with dosing. Remission of Schizophrenia Compliance: Discontinuation due to Side Effects, <2% 1. Bhat, L. et a. . J Neurology and Neuromedicine 2018 , 3(5): 39 - 50. 2. Cantillon, M. et al. Schizophrenia Research 2017, 189:126 - 13. Ari = aripiprazole, RP = RP5063, Brilaroxazine Brilaroxazine (RP5063) Phase 2 Study in Schizophrenia Remission of Schizophrenia, Compliance, and Therapeutic Benefits 1 2 21

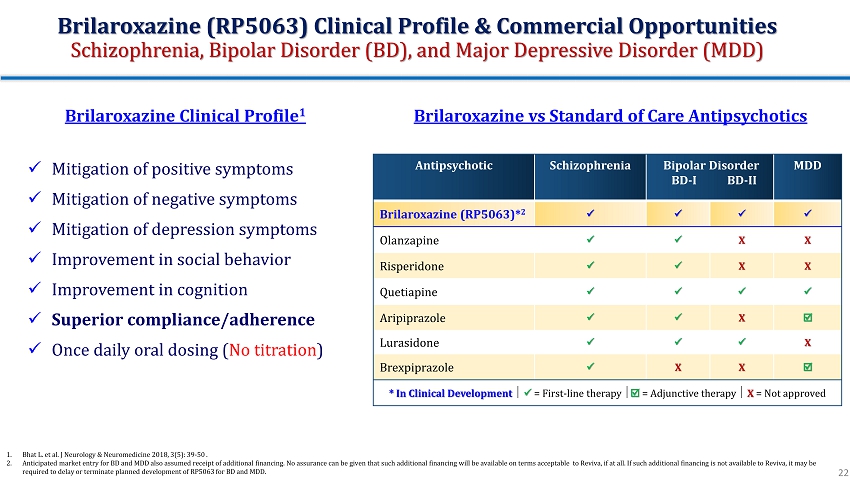

Brilaroxazine vs Standard of Care Antipsychotics Antipsychotic Schizophrenia Bipolar Disorder BD - I BD - II MDD Brilaroxazine (RP5063)* 2 x x x x Olanzapine x x X X Risperidone x x X X Quetiapine x x x x Aripiprazole x x X Lurasidone x x x X Brexpiprazole x X X * In Clinical Development x = First - line therapy = Adjunctive therapy X = Not approved x Mitigation of positive symptoms x Mitigation of negative symptoms x Mitigation of depression symptoms x Improvement in social behavior x Improvement in cognition x Superior compliance/adherence x Once daily oral dosing ( No titration ) Brilaroxazine Clinical Profile 1 1. Bhat L. et al. J Neurology & Neuromedicine 2018, 3(5): 39 - 50 . 2. Anticipated market entry for BD and MDD also assumed receipt of additional financing. No assurance can be given that such add iti onal financing will be available on terms acceptable to Reviva, if at all. If such additional financing is not available to Rev iva, it may be required to delay or terminate planned development of RP5063 for BD and MDD. Brilaroxazine (RP5063) Clinical Profile & Commercial Opportunities Schizophrenia, Bipolar Disorder (BD), and Major Depressive Disorder (MDD) 22

• A novel MOA, potentially disease modifying therapy for PAH and IPF • A new chemical entity (NCE) with granted U.S. and European patents • Clinical phase 2 study stage programs for PAH and IPF : x Generally well - tolerated in the phase 1B and phase 2 studies for schizophrenia in >250 patients x Completed long term regulatory toxicology studies x Manufactured API and drug products (clinical trial materials) • Oral once daily dosing, potential to develop once daily inhaler for enhanced effect and convenience Overview of Brilaroxazine Respiratory Programs Novel therapy for PAH and IPF 23

PAH IPF • Global prevalence of PAH is estimated 6 . 6 – 26 . 0 cases per million with 1 . 1 – 7 . 6 incidences per million adults per year . 1 • PAH is frequently diagnosed in older patients, i . e . 65 years and older . PAH occurs 3 - 5 times more frequently in females as in males, and it tends to affect females between the ages of 30 and 60 . 1 2 • Post - diagnosis of PAH survival rates are approximately 1 year in 87 % , 3 years in 75 % , and 5 years in 65 % of patients . 3 • Currently, there is no cure or therapy to significantly delay the progression of PAH . • Worldwide prevalence of IPF is estimated to be 20 cases per 100 , 000 persons for males and 13 cases per 100 , 000 persons for females . 4 In the US, the prevalence among individuals aged 50 years or older ranges from 27 . 9 to 63 cases per 100 , 000 . 4 • For patients suffering from IPF, the estimated mean survival is 2 - 5 years from the time of diagnosis . 4 Estimated mortality rates are 64 . 3 deaths per million in men and 58 . 4 deaths per million in women . 4 • Currently, there is no cure or therapy to significantly delay the progression of IPF . 1. Hoeper M. M. et al, Lancet Respir Med 2016, 4:306 - 322. 2. National organization for rare disorders (NORD): https://rarediseases.org/rare - diseases/pulmonary - arterial - hypertension/ , July 27, 2020. 3. Archer, S. L. et al, Circ Cardiovasc Qual Outcomes 2018, 11, e003973. 4. Godfrey A.M.K., Medscape July 15, 2019: https://emedicine.medscape.com/article/301226 - overview#a2 , . Prevalence of PAH and IPF Orphan Diseases 24

Pathophysiology of PAH and IPF: • Lung vascular/alveoli remodeling due to inflammation, proliferation of fibrosis, and microthrombi/blood clots, and pulmonary hypertension are morphological hallmarks in patients with PAH and IPF Pathobiology of PAH and IPF: • Elevated plasma serotonin (5 - HT) levels, increased expression of 5 - HT 2A/2B/7 receptors and inflammatory cytokines in the lungs of patients with PAH and IPF. • 5 - HT 2A/2B/7 receptors in the brain are targets for depression and anxiety, major comorbid symptoms in both PAH and IPF Brilaroxazine (Ki) 5 - H 2A : 2.5nM 5 - HT 2B : 0.19nM 5 - HT 7 : 2.7nM Lofdahl et al, Physiol Rep 2016, 4(15): 212873 Wynn AT, Journal of Experimental Medicine 2011, 208(97): 1339 - 1350 Brilaroxazine’s (RP5063) pleiotropic effects target all 3 major factors contributing to structural modification: vasoconstriction, fibrosis, blood clots and inflammation . [Bhat et al., Eur J Pharmacol 2018, 827:159 - 166] Has the potential to stop or delay the disease progression Treats comorbid mental illness and improves QOL Brilaroxazine acts on upstream target, 5 - HT Signaling Pleiotropic Effects Target the cause Serotonin Signaling Pathways in PAH & IPF Brilaroxazine: A Novel Therapy 25

Treatment Effects on PAH Treatment Effects on Lung Vascular Structure A: PLs in SuHx - only B: PLs in SuHx + RP5063 RP5063 Mitigates Inflammation x Brilaroxazine significantly reduced inflammatory cytokines TNF , IL - β , IL - 6, and chemokine LTB4 Bhat and Salvail, J Rare Dis Res Treat 2017, 2(5): 5 - 12. Bhat, et al. European J Pharmacology 2017, 810:83 - 91 and 92 - 99. Bhat, et al. European J Pharmacology 2018, 827: 159 - 166. • The data suggest brilaroxazine activity is comparable to or better than firstline treatments, with no cardiac side effects Brilaroxazine (RP5063) Pharmacologic Activity for PAH in Rodent Models Alone & co - administered with standard of care for PAH 26

RP5063 Mitigates lung fibrosis/collagen (Decrease in Hydroxyproline) Increase in hydroxyproline is an indicator of collagen deposition which is an underlying pathophysiology in IPF Brilaroxazine, as an adjunct to nintedanib and pirfenidone, significantly augmented the functional effects of nintedanib and pirfenidone, two standard treatments for IPF, as evidenced by reduction in hydroxyproline level and fibrosis in the lungs • Increased lung fibrosis /collagen deposit are the hallmark of pulmonary fibrosis Lung Histopathology Data Bhat et al., European J Pharmacology 2019 (in peer review) Brilaroxazine (RP5063) Mitigates Lung Fibrosis and Inflammation in IPF RP5063 alone, and co - administered with standard of care, Nintedanib & Pirfenidone 27 Decrease in Fibrosis Ashcroft Scores Decrease in Collagen Deposit Masson’s Trichrome Staining

Bhat et al., European J Pharmacology 2019 (in peer review) Mitigates Respiratory Resistance Improves Oxygen Saturation Improves Survival Rate Brilaroxazine (RP5063) Improves Survival Rate in IPF Bleomycin (BLM) Induced IPF Rodent Model 28

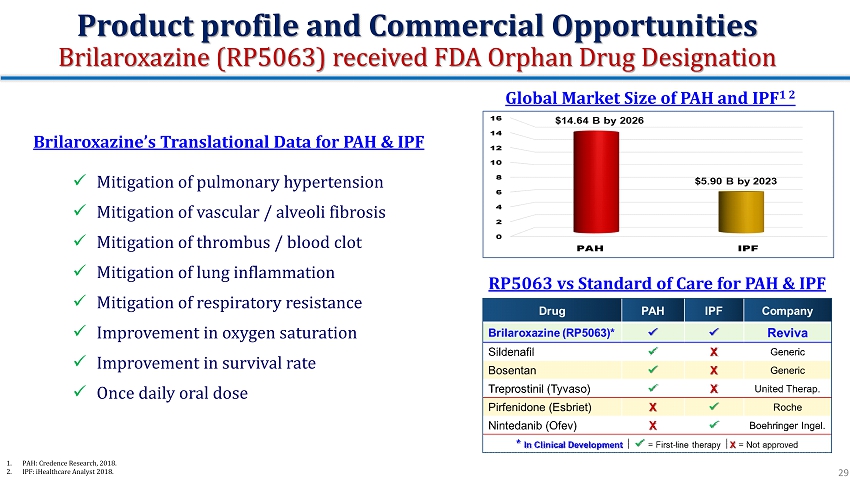

Brilaroxazine’s Translational Data for PAH & IPF x Mitigation of pulmonary hypertension x Mitigation of vascular / alveoli fibrosis x Mitigation of thrombus / blood clot x Mitigation of lung inflammation x Mitigation of respiratory resistance x Improvement in oxygen saturation x Improvement in survival rate x Once daily oral dose Global Market Size of PAH and IPF 1 2 1. PAH: Credence Research, 2018. 2. IPF: iHealthcare Analyst 2018. RP5063 vs Standard of Care for PAH & IPF Product profile and Commercial Opportunities Brilaroxazine (RP5063) received FDA Orphan Drug Designation 29