Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | pnw-20201106.htm |

POWERING GROWTH DELIVERING VALUE Investor Meetings November 2020 Powering the Future | 1

FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could" and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: the potential effects of the continued COVID-19 pandemic, including on demand for energy, economic growth, our employees and contractors, supply chain, expenses, capital markets, capital projects, operations and maintenance activities, uncollectable accounts, liquidity, cash flows, or other unpredictable events; our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather, seasonality, the general economy or social conditions, customer and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, droughts, or other catastrophic events, such as fires, explosions, pandemic health events or similar occurrences; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or continue or discontinue power plant operations consistent with our corporate interests; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and in Part II, Item 1A in of the Pinnacle West/APS Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. Powering the Future | 2

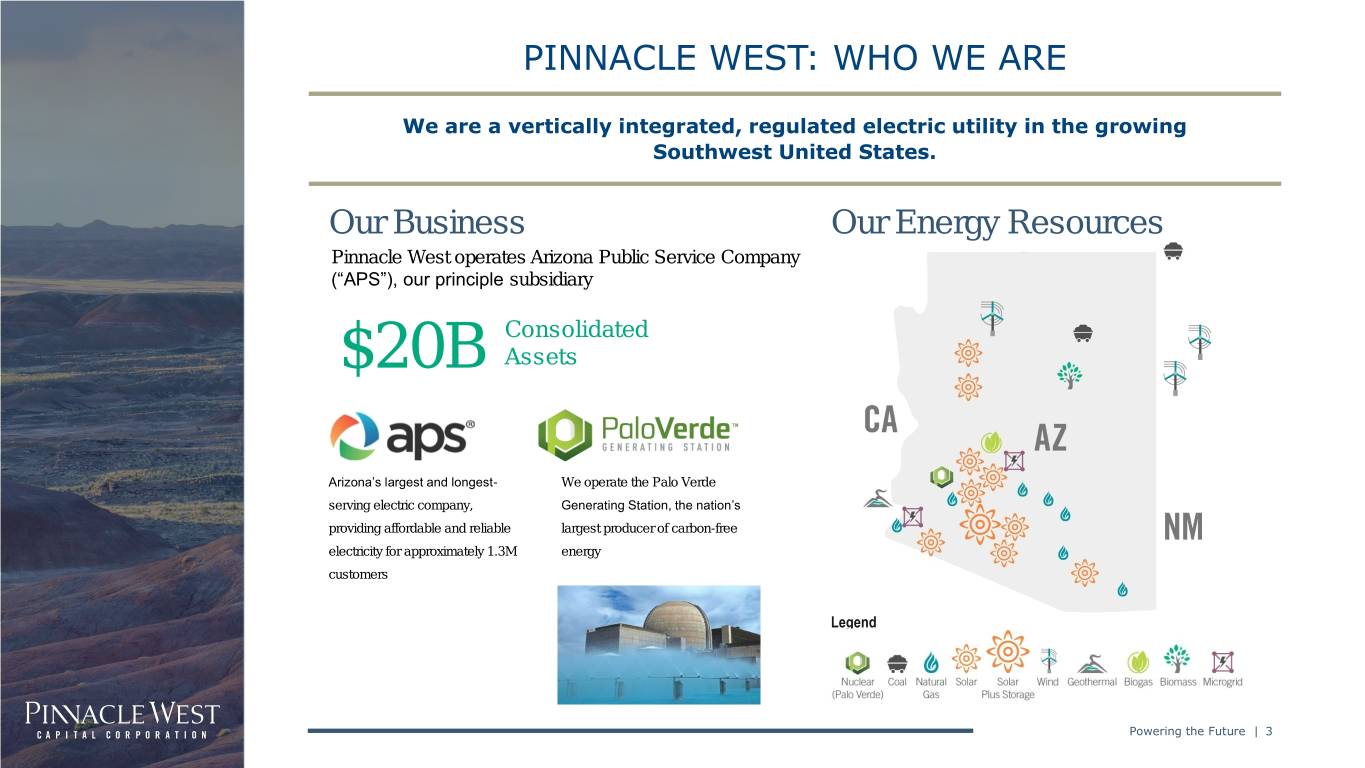

PINNACLE WEST: WHO WE ARE We are a vertically integrated, regulated electric utility in the growing Southwest United States. Our Business Our Energy Resources Pinnacle West operates Arizona Public Service Company (“APS”), our principle subsidiary Consolidated $20B Assets Arizona’s largest and longest- We operate the Palo Verde serving electric company, Generating Station, the nation’s providing affordable and reliable largest producer of carbon-free electricity for approximately 1.3M energy customers Legend Powering the Future | 3

SENIOR MANAGEMENT TEAM We maintain a robust pipeline of talent to serve our complex operations and facilitate effective succession planning in a highly competitive talent environment Jeff Guldner Jim Hatfield Chairman of the Board, President and Executive Vice President, Chief Administrative “We have strategically Chief Executive Officer, Pinnacle West and Officer and Treasurer, Pinnacle West & APS selected successors for our Chairman and Chief Executive Officer, APS management team who we believe will lead our • Joined APS in 2004 from Snell & • Joined as SVP and CFO in 2008 Wilmer from OGE Energy Corp. company successfully into • Promoted to President in 2018 • Promoted to EVP and CAO in the future with continued • Elected to Pinnacle West Board January 2020 strong and sustainable and named Chairman, CEO in • Responsible for corporate performance.” Kathy Munro, 2019 functions including tax, audit Lead Director • Significant experience in public and strategy utility and energy law and • 40+ years of financial regulation experience in the utility and energy business Ted Geisler Daniel Froetscher Maria Lacal Senior Vice President and Chief Financial President and Chief Operating Officer, APS Executive Vice President and Chief Nuclear Officer, Pinnacle West & APS Officer, APS • Joined APS in 2001 • Joined APS in 1980 • Joined APS as VP Operations • Promoted to SVP and CFO, • Promoted to President and Support in 2007 from Florida January 2020 COO, January 2020 Power and Light Company • Responsible for financial and • Responsible for customer • Responsible for all-nuclear technology functions, including service, T&D, non-nuclear related activities associated with finance and treasury, investor generation, resource Palo Verde Generating Station relations, enterprise-wide management, environmental, including nuclear assurance technology applications and supply chain, external division, employee concerns and infrastructure communications and safety culture programs corporate development Powering the Future | 4

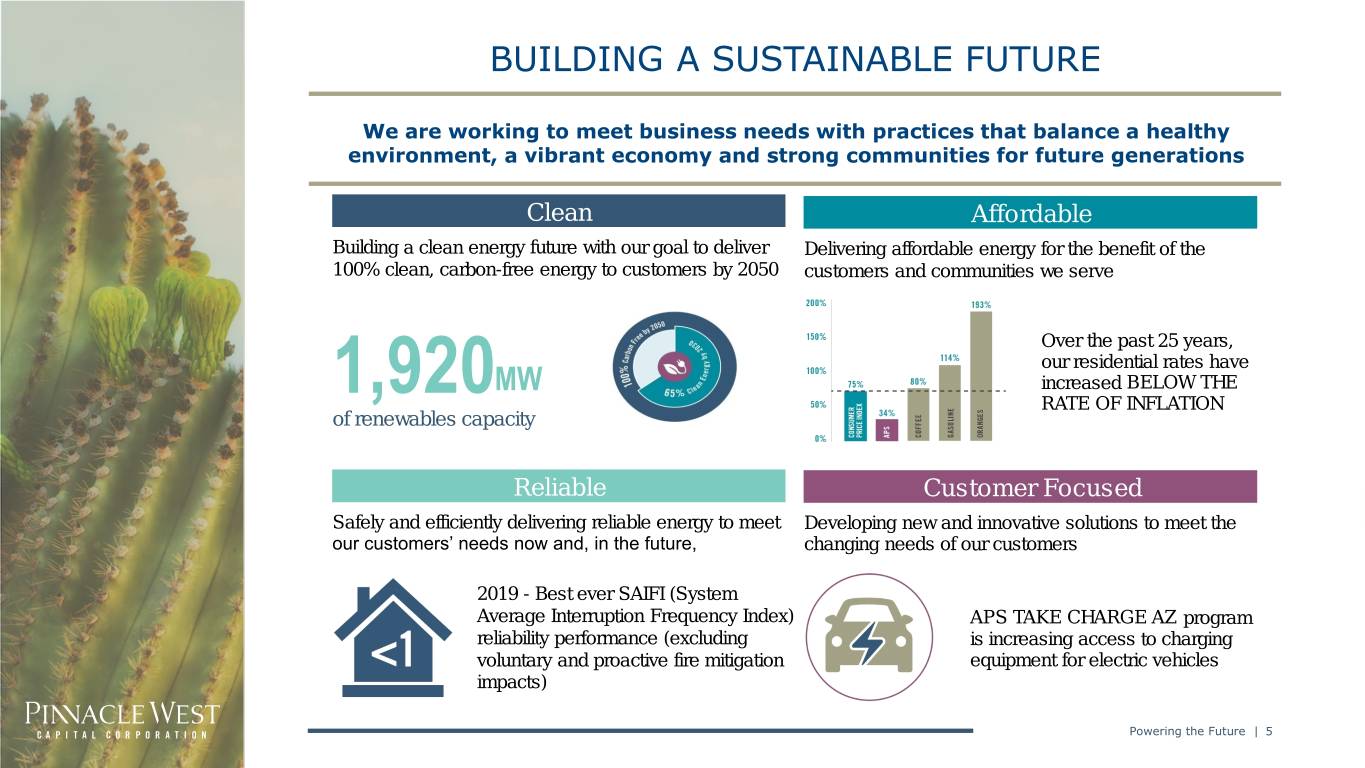

BUILDING A SUSTAINABLE FUTURE We are working to meet business needs with practices that balance a healthy environment, a vibrant economy and strong communities for future generations Clean Affordable Building a clean energy future with our goal to deliver Delivering affordable energy for the benefit of the 100% clean, carbon-free energy to customers by 2050 customers and communities we serve Over the past 25 years, our residential rates have 1,920MW increased BELOW THE RATE OF INFLATION of renewables capacity Reliable Customer Focused Safely and efficiently delivering reliable energy to meet Developing new and innovative solutions to meet the our customers’ needs now and, in the future, changing needs of our customers 2019 - Best ever SAIFI (System Average Interruption Frequency Index) APS TAKE CHARGE AZ program reliability performance (excluding is increasing access to charging voluntary and proactive fire mitigation equipment for electric vehicles impacts) Powering the Future | 5

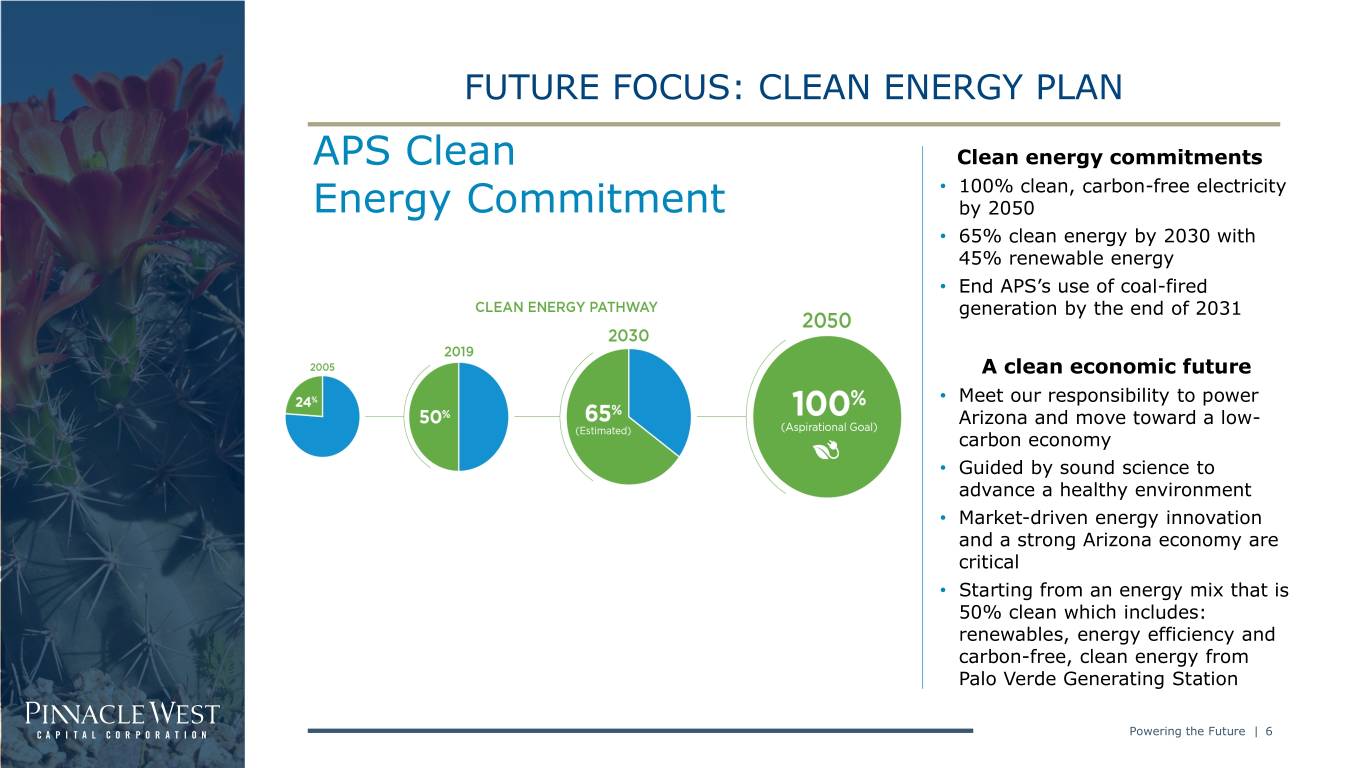

FUTURE FOCUS: CLEAN ENERGY PLAN APS Clean Clean energy commitments • 100% clean, carbon-free electricity Energy Commitment by 2050 • 65% clean energy by 2030 with 45% renewable energy • End APS’s use of coal-fired generation by the end of 2031 A clean economic future • Meet our responsibility to power Arizona and move toward a low- carbon economy • Guided by sound science to advance a healthy environment • Market-driven energy innovation and a strong Arizona economy are critical • Starting from an energy mix that is 50% clean which includes: renewables, energy efficiency and carbon-free, clean energy from Palo Verde Generating Station Powering the Future | 6

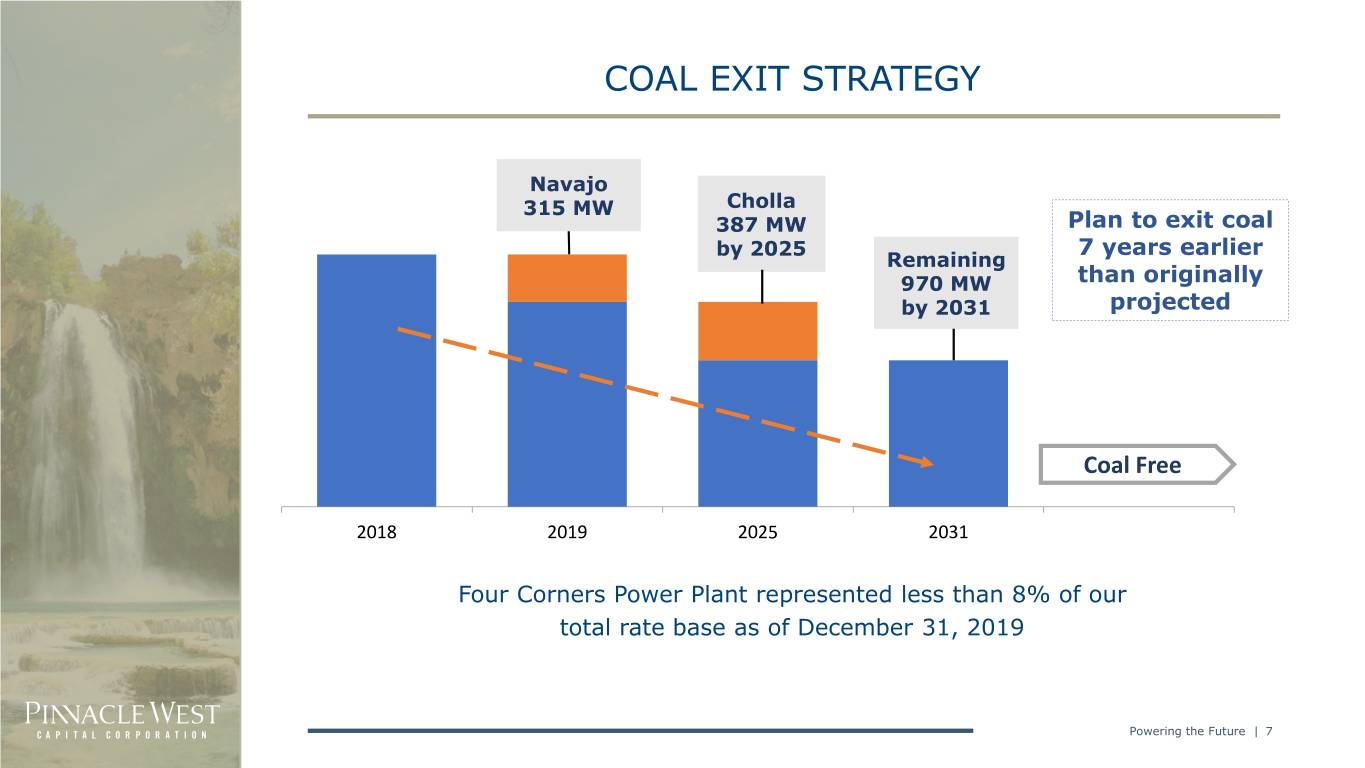

COAL EXIT STRATEGY Navajo 315 MW Cholla 387 MW Plan to exit coal by 2025 7 years earlier Remaining 970 MW than originally by 2031 projected Coal Free 2018 2019 2025 2031 Four Corners Power Plant represented less than 8% of our total rate base as of December 31, 2019 Powering the Future | 7

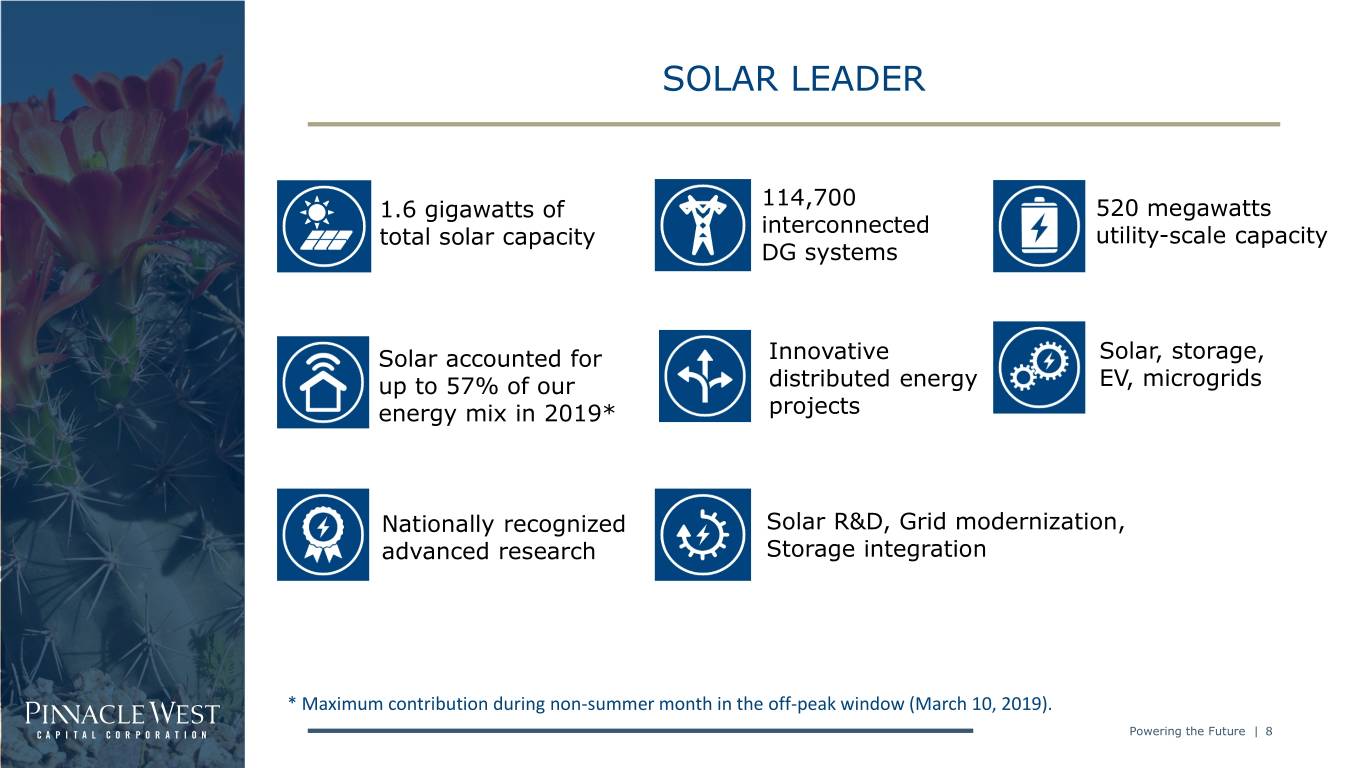

SOLAR LEADER 114,700 1.6 gigawatts of 520 megawatts interconnected total solar capacity utility-scale capacity DG systems Solar accounted for Innovative Solar, storage, up to 57% of our distributed energy EV, microgrids energy mix in 2019* projects Nationally recognized Solar R&D, Grid modernization, advanced research Storage integration * Maximum contribution during non-summer month in the off-peak window (March 10, 2019). Powering the Future | 8

HYDROGEN Palo Verde collaborates on a pilot project to explore the production of hydrogen at Palo Verde Generating Station Idaho Xcel Energy Palo Verde National Harbor Collaborators Include Energy Laboratory • The pilot program will examine the long-term cost-effectiveness of hydrogen production at utility scale and is expected to run from 2020 to 2023. • Idaho National Laboratory will prepare technical & economic feasibility assessment. The assessment will consider regional power prices in order to determine the cost-effectiveness of producing hydrogen using Palo Verde Generating Station electricity. • APS will look at the technical feasibility of electrolysis, a method that splits water into oxygen and hydrogen, and the cost of equipment, principally the electrolyzer. Powering the Future | 9

CUSTOMER SUPPORT Customer Outreach Payment Assistance Customer Advisory Board Crisis Bill Assistance • Gathers direct insight from residential • Provided to limited-income customers customers • Up to $800 per year to assist with bills • Identify customer concerns to shape • Requesting ACC approval for funding and co-create solutions increase to $2.5 million annually with expanded enrollment criteria COVID-19 Support Customer Support Fund Energy Support Program • $6.15 million in funding for • 25% discount on monthly bill for residential and small business qualifying limited income customers • $100 residential one-time bill • Currently funded at $48 million annually credit with a delinquency of 2 or more • 24% enrollment increase during 2019 months or a limited income customer • $1,000 one-time small business bill credit Disconnect Moratorium Extended • Through December 2020 Expansion of Call Center Hours • 24/7 365 days per year Powering the Future | 10

CUSTOMER SUPPORT Pro-Forma Billing • On-bill rate plan analysis showing customers lowest cost plan, current month savings, and cumulative 12-month savings Payment Strategy • New payment options such as PayPal and Venmo APS Marketplace • Online tool informing customers about energy efficiency appliances and products to reduce energy use • Provide customers with an easy way to compare products, read reviews, compare efficiency scores and enroll in APS programs Digital Engagement Focus • Improved functionality and experience on aps.com • Expand customer affordability by engaging more customers in digital channels Bill Redesign • Redesign, simplify and enhance customer bill • Rooted in customer research and insight to improve customer bill experience • Provides right level of detail, delivered in channel of choice (print, aps.com, mobile) Powering the Future | 11

CUSTOMER PROGRAMS Demand Response (DR) Programs Energy Efficiency Program Offerings Cool Rewards Proposed programs: • 18,182 connected smart thermostats • Reduced peak demand up to 42 MW o Subscription rate pilot offering rate-optimized Storage Rewards smart thermostats to influence energy use • 33 Residential and 3 commercial battery patterns systems o EV-ready pre-wiring, connected water heating and Reserve Rewards induction cooking in the Residential New • 226 grid interactive water heaters Construction program o Solutions for Business energy education and training, access to qualified trade allies, and rebates for technology Program Awards • Smart Electric Power Alliance’s 2019 Innovative Partner of the Year Award (with EnergyHub) • Alliance of Energy Service Professionals’ 2020 Energy Award for Outstanding Achievement in the category of Emerging Tools & Technologies • Peak Load Management Association's Program Pacesetter Award (with EnergyHub) Powering the Future | 12

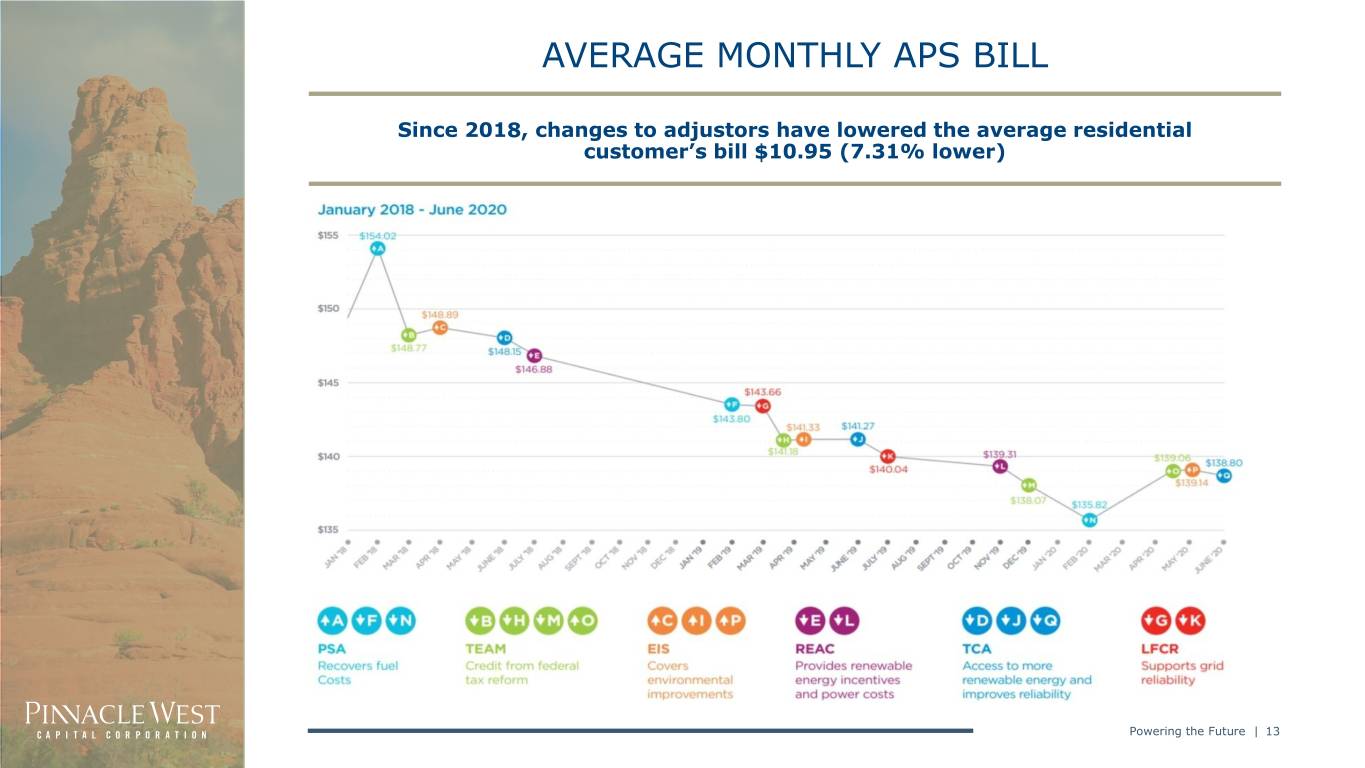

AVERAGE MONTHLY APS BILL Since 2018, changes to adjustors have lowered the average residential customer’s bill $10.95 (7.31% lower) Powering the Future | 13

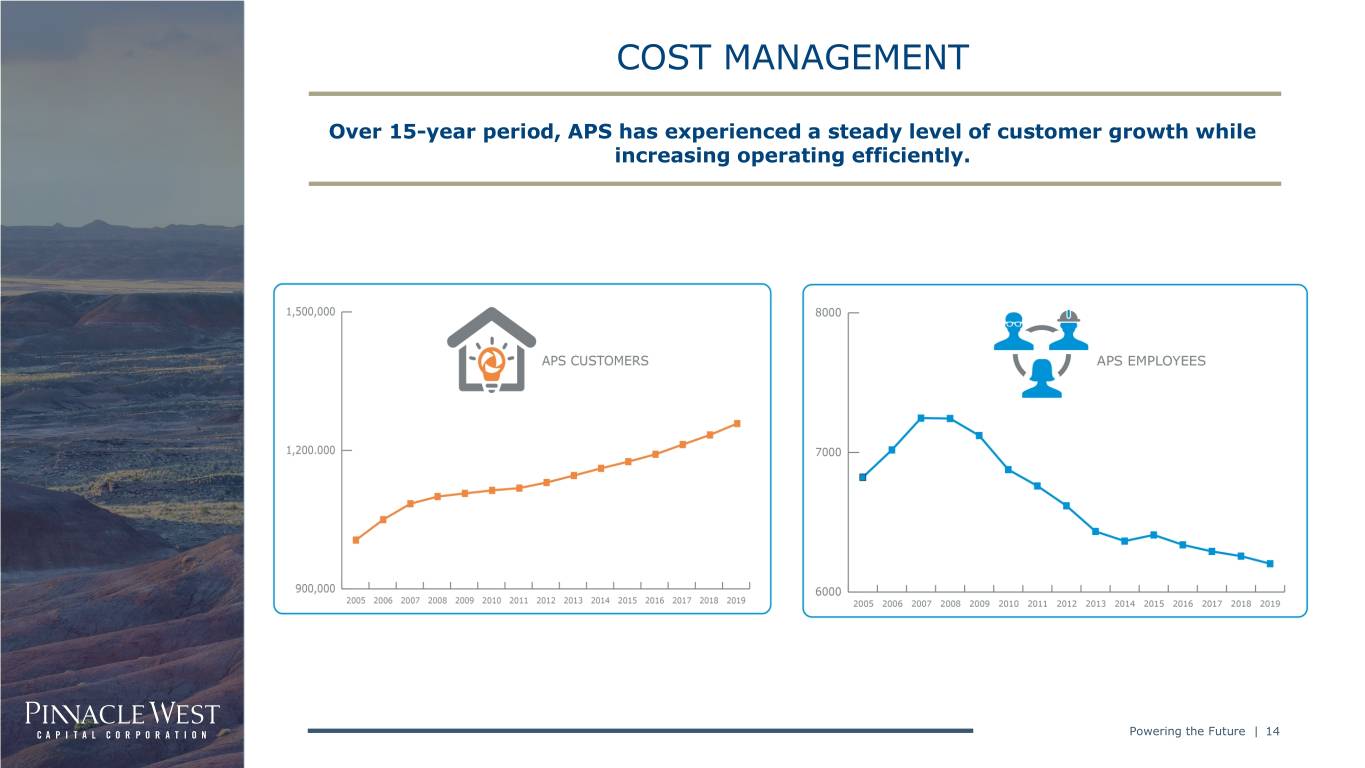

COST MANAGEMENT Over 15-year period, APS has experienced a steady level of customer growth while increasing operating efficiently. Powering the Future | 14

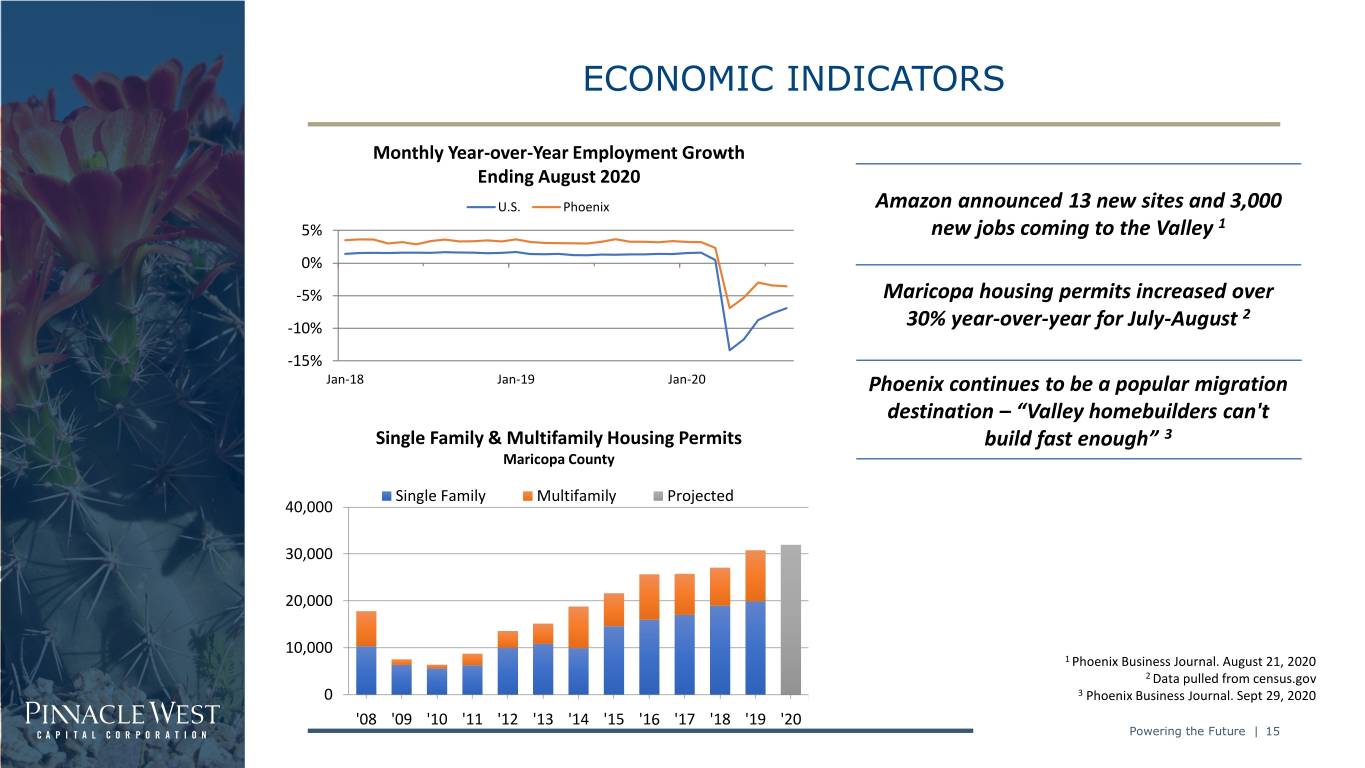

ECONOMIC INDICATORS Monthly Year-over-Year Employment Growth Ending August 2020 U.S. Phoenix Amazon announced 13 new sites and 3,000 5% new jobs coming to the Valley 1 0% -5% Maricopa housing permits increased over 2 -10% 30% year-over-year for July-August -15% Jan-18 Jan-19 Jan-20 Phoenix continues to be a popular migration destination – “Valley homebuilders can't Single Family & Multifamily Housing Permits build fast enough” 3 Maricopa County Single Family Multifamily Projected 40,000 30,000 20,000 10,000 1 Phoenix Business Journal. August 21, 2020 2 Data pulled from census.gov 0 3 Phoenix Business Journal. Sept 29, 2020 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 Powering the Future | 15

ECONOMIC DEVELOPMENT FUTURE EXPANSIONS OUR APPROACH FOCUSES ON FOUR MAIN AREAS o Microsoft is constructing all three of its new mega data Business Attraction & Expansion - constructive engagement centers in the West Valley. These datacenters are with economic development community partners and timely, projected to create 100 permanent jobs and 1,000 strategic engagement with economic development prospects, construction jobs. site selectors, and local developers o Stream Data Centers has launched a 418,000 sq ft facility in the West Valley. At full build, the entire campus will support up to 200MW of load. Community Development - provide financial and strategic economic development support in both rural and metro o Stack Infrastructure plans to build a 1 million-square- communities foot data center on 79 acres in the West Valley less than half a mile from one of Microsoft’s data centers. Entrepreneurial Support - advance the entrepreneurial o White Claw/Mark Anthony Brewing Inc. announced ecosystem by supporting the strategies of organizations that plans to build a 916,000-square-foot facility co-located are making an impact, whether through job creation, capital next to Red Bull in Glendale creating an estimated 200 raised, quality programming or helping to change the jobs. perception of the region o Red Bull announced a 700,000-square-foot distribution center, in addition to the 700,000 square foot facility Infrastructure Support - drive commercial real estate announced in 2019, adding an estimated 115 new jobs development by working closely with developers and the and an additional $84 million in capital investment. Arizona State Land Department to make large commercial land parcels “shovel ready” What others are saying: • Census report ranks Arizona 3rd in percentage growth rate; AZ Business Magazine, Jan. 2, 2020 • Arizona gaining as top state for newcomers, study says; Arizona Republic, Jan. 2, 2020 Powering the Future | 16

APPENDIX Powering the Future | 17

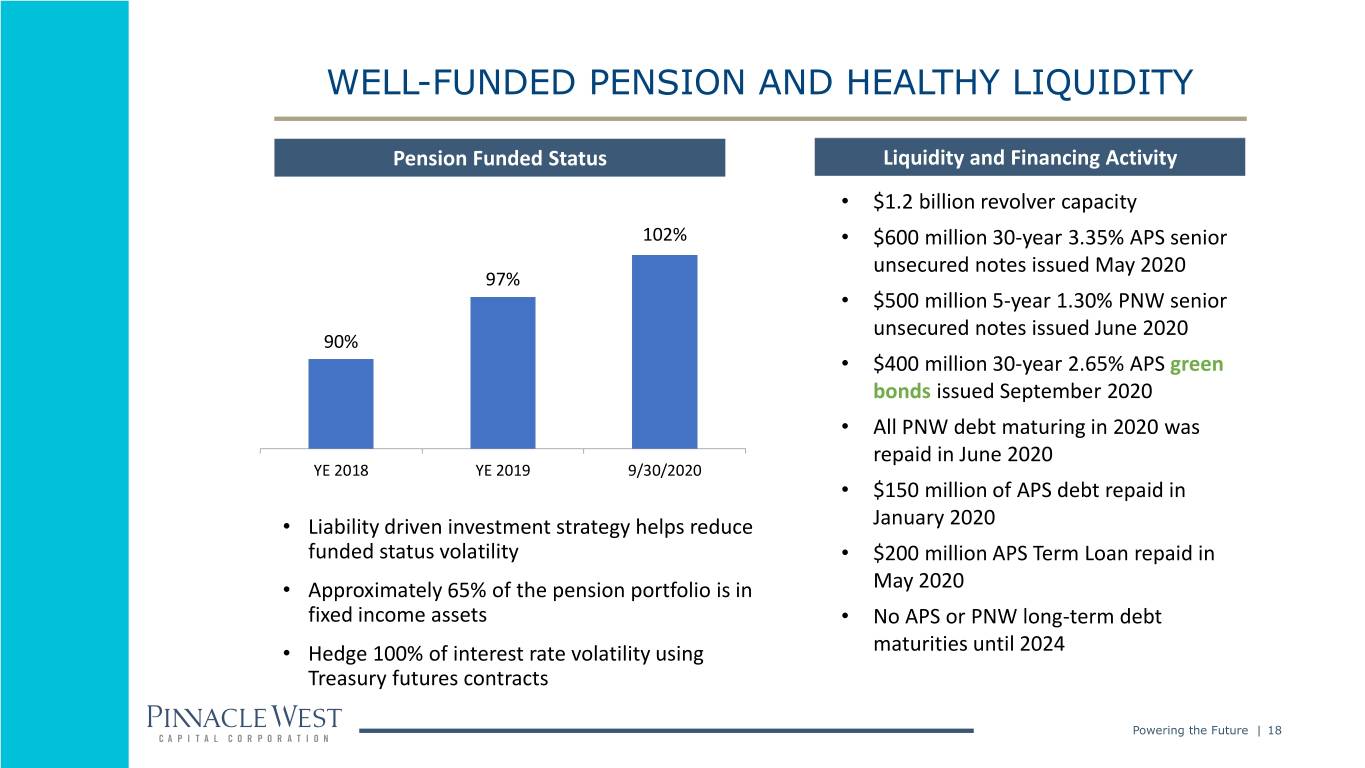

WELL-FUNDED PENSION AND HEALTHY LIQUIDITY Pension Funded Status Liquidity and Financing Activity • $1.2 billion revolver capacity 102% • $600 million 30-year 3.35% APS senior unsecured notes issued May 2020 97% • $500 million 5-year 1.30% PNW senior unsecured notes issued June 2020 90% • $400 million 30-year 2.65% APS green bonds issued September 2020 • All PNW debt maturing in 2020 was repaid in June 2020 YE 2018 YE 2019 9/30/2020 • $150 million of APS debt repaid in • Liability driven investment strategy helps reduce January 2020 funded status volatility • $200 million APS Term Loan repaid in • Approximately 65% of the pension portfolio is in May 2020 fixed income assets • No APS or PNW long-term debt • Hedge 100% of interest rate volatility using maturities until 2024 Treasury futures contracts Powering the Future | 18

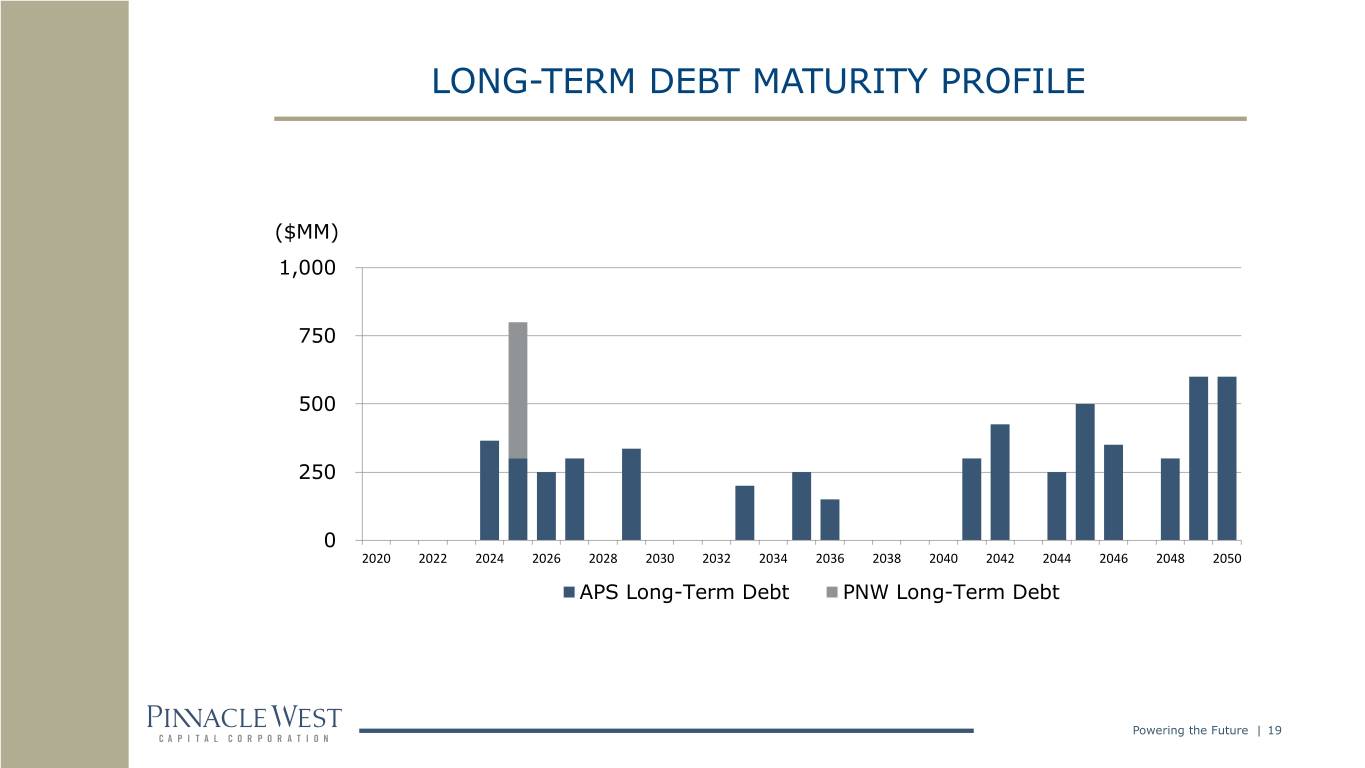

LONG-TERM DEBT MATURITY PROFILE ($MM) 1,000 750 500 250 0 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050 APS Long-Term Debt PNW Long-Term Debt Powering the Future | 19

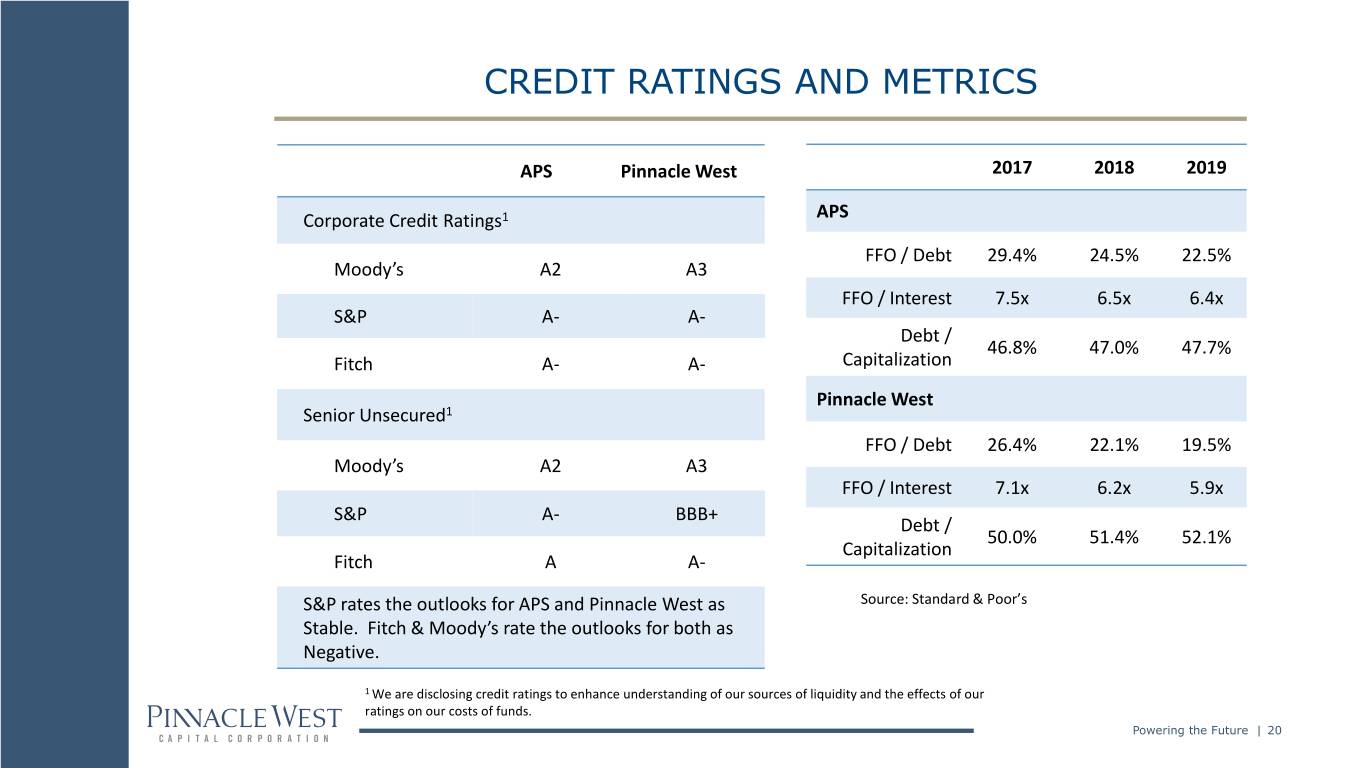

CREDIT RATINGS AND METRICS APS Pinnacle West 2017 2018 2019 Corporate Credit Ratings1 APS FFO / Debt 29.4% 24.5% 22.5% Moody’s A2 A3 FFO / Interest 7.5x 6.5x 6.4x S&P A- A- Debt / 46.8% 47.0% 47.7% Fitch A- A- Capitalization Pinnacle West Senior Unsecured1 FFO / Debt 26.4% 22.1% 19.5% Moody’s A2 A3 FFO / Interest 7.1x 6.2x 5.9x S&P A- BBB+ Debt / 50.0% 51.4% 52.1% Capitalization Fitch A A- S&P rates the outlooks for APS and Pinnacle West as Source: Standard & Poor’s Stable. Fitch & Moody’s rate the outlooks for both as Negative. 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Powering the Future | 20

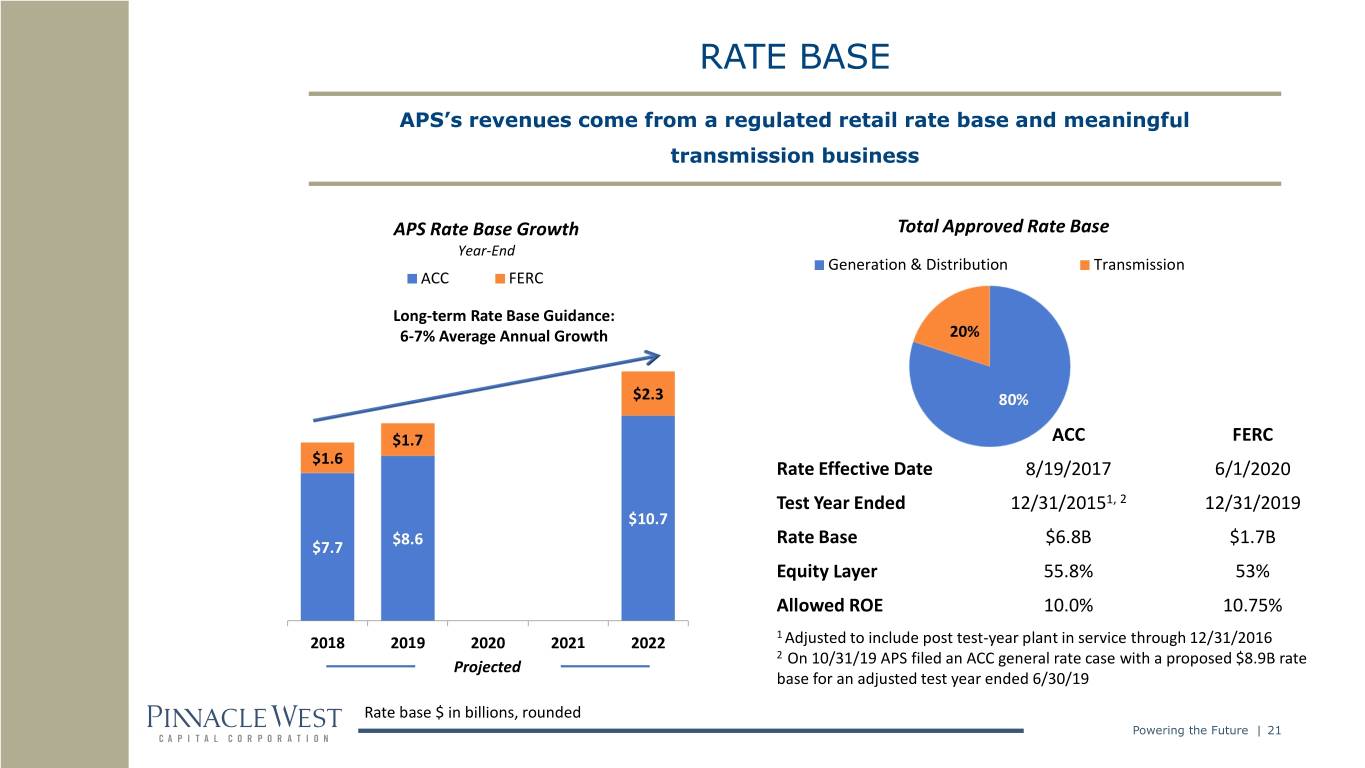

RATE BASE APS’s revenues come from a regulated retail rate base and meaningful transmission business APS Rate Base Growth Total Approved Rate Base Year-End Generation & Distribution Transmission ACC FERC Long-term Rate Base Guidance: 6-7% Average Annual Growth 20% $2.3 80% $1.7 ACC FERC $1.6 Rate Effective Date 8/19/2017 6/1/2020 Test Year Ended 12/31/20151, 2 12/31/2019 $10.7 $8.6 Rate Base $6.8B $1.7B $7.7 Equity Layer 55.8% 53% Allowed ROE 10.0% 10.75% 1 2018 2019 2020 2021 2022 Adjusted to include post test-year plant in service through 12/31/2016 2 On 10/31/19 APS filed an ACC general rate case with a proposed $8.9B rate Projected base for an adjusted test year ended 6/30/19 Rate base $ in billions, rounded Powering the Future | 21

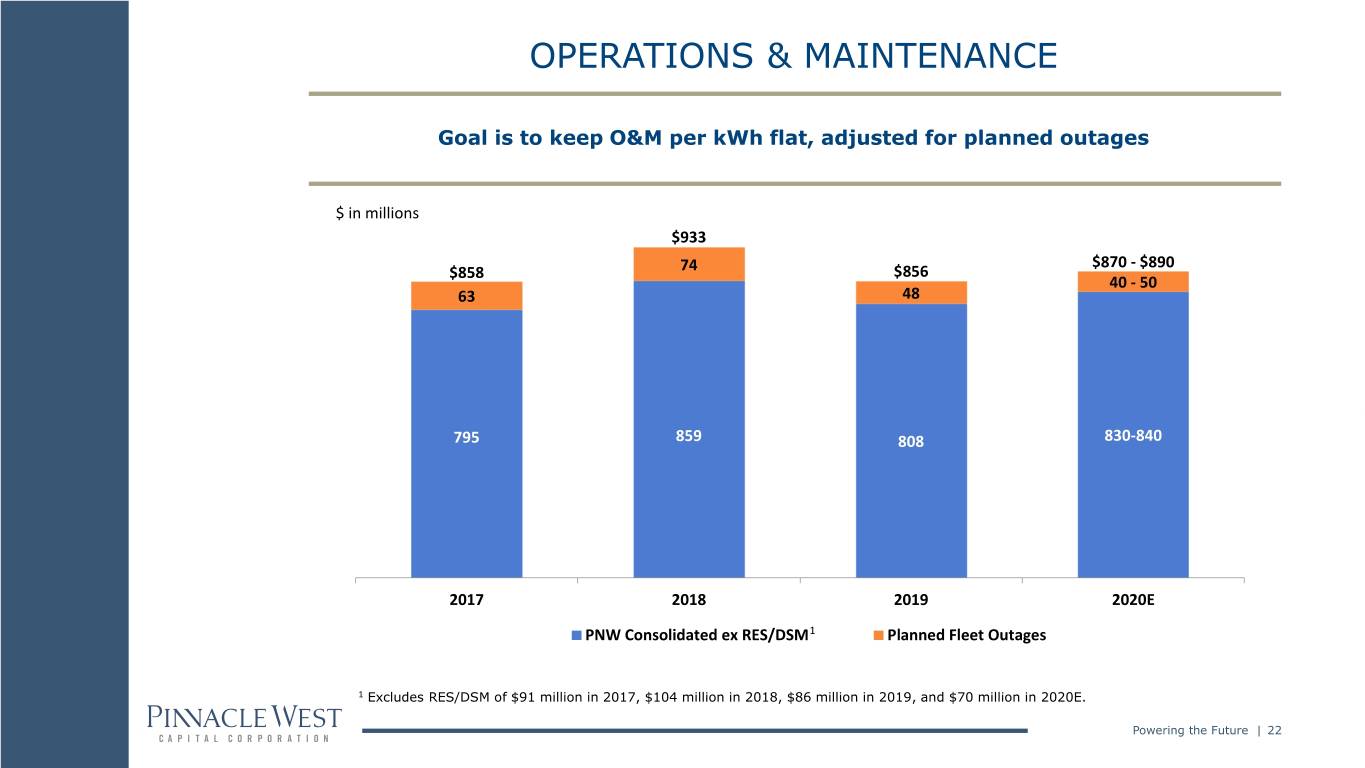

OPERATIONS & MAINTENANCE Goal is to keep O&M per kWh flat, adjusted for planned outages $ in millions $933 $870 - $890 $858 74 $856 40 - 50 63 48 795 859 808 830-840 2017 2018 2019 2020E PNW Consolidated ex RES/DSM1 Planned Fleet Outages 1 Excludes RES/DSM of $91 million in 2017, $104 million in 2018, $86 million in 2019, and $70 million in 2020E. Powering the Future | 22

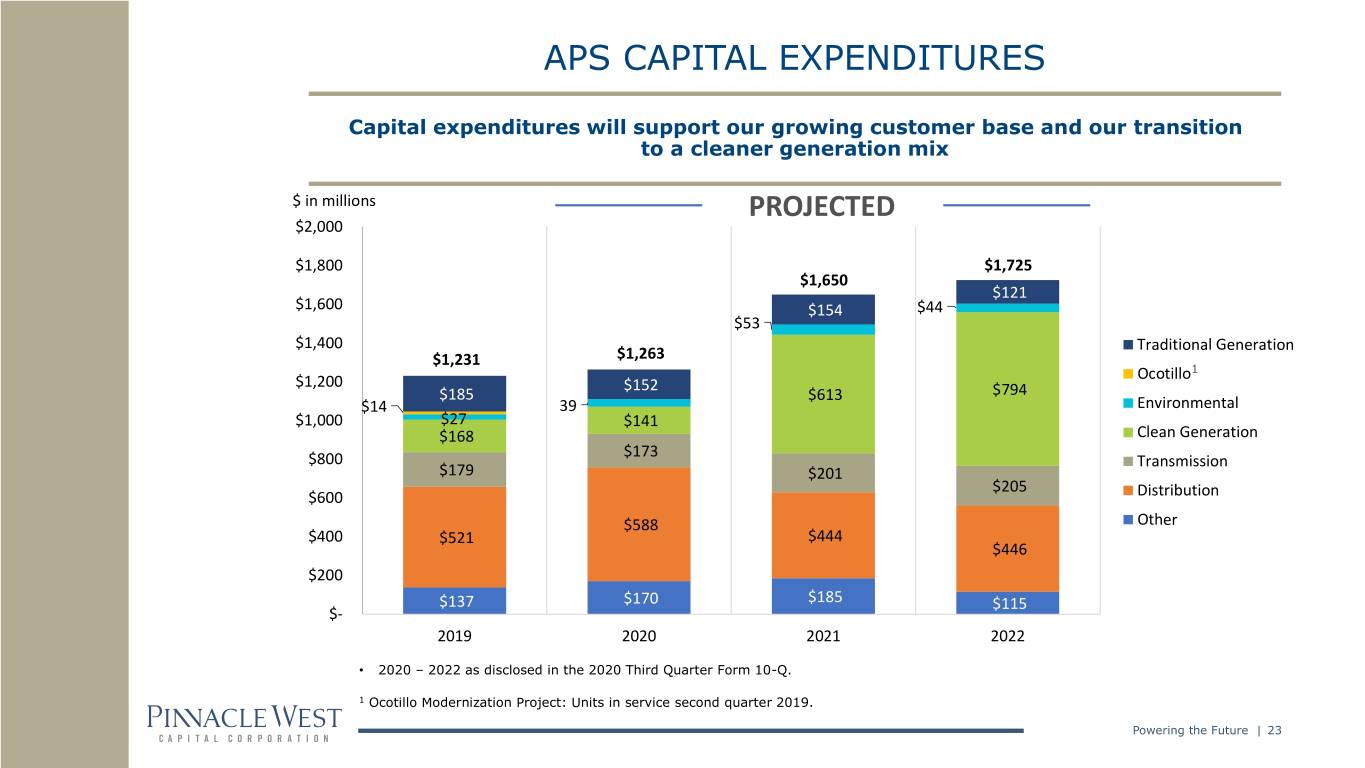

APS CAPITAL EXPENDITURES Capital expenditures will support our growing customer base and our transition to a cleaner generation mix $ in millions PROJECTED $2,000 $1,800 $1,725 $1,650 $121 $1,600 $154 $44 $53 $1,400 Traditional Generation $1,231 $1,263 Ocotillo1 $1,200 $152 $185 $613 $794 $14 39 Environmental $1,000 $27 $141 $168 Clean Generation $173 $800 Transmission $179 $201 $205 $600 Distribution $588 Other $400 $521 $444 $446 $200 $137 $170 $185 $115 $- 2019 2020 2021 2022 • 2020 – 2022 as disclosed in the 2020 Third Quarter Form 10-Q. 1 Ocotillo Modernization Project: Units in service second quarter 2019. Powering the Future | 23

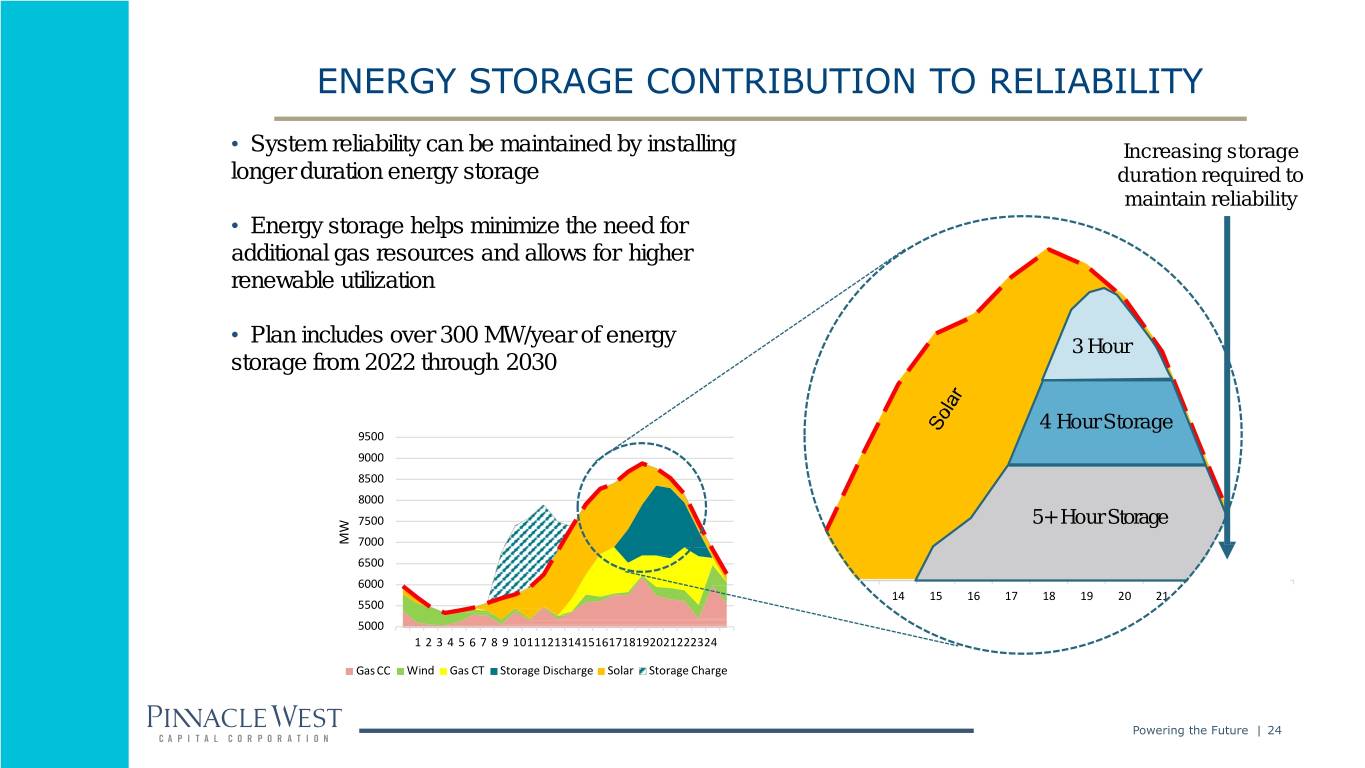

ENERGY STORAGE CONTRIBUTION TO RELIABILITY • System reliability can be maintained by installing Increasing storage longer duration energy storage duration required to maintain reliability • Energy storage helps minimize the need for additional gas resources and allows for higher renewable utilization • Plan includes over 300 MW/year of energy 3 Hour storage from 2022 through 2030 4 Hour Storage 9500 9000 8500 8000 7500 5+ Hour Storage MW 7000 6500 6000 12 13 14 15 16 17 18 19 20 21 22 23 24 5500 5000 1 2 3 4 5 6 7 8 9 101112131415161718192021222324 GasCC Wind Gas CT Storage Discharge Solar Storage Charge Powering the Future | 24

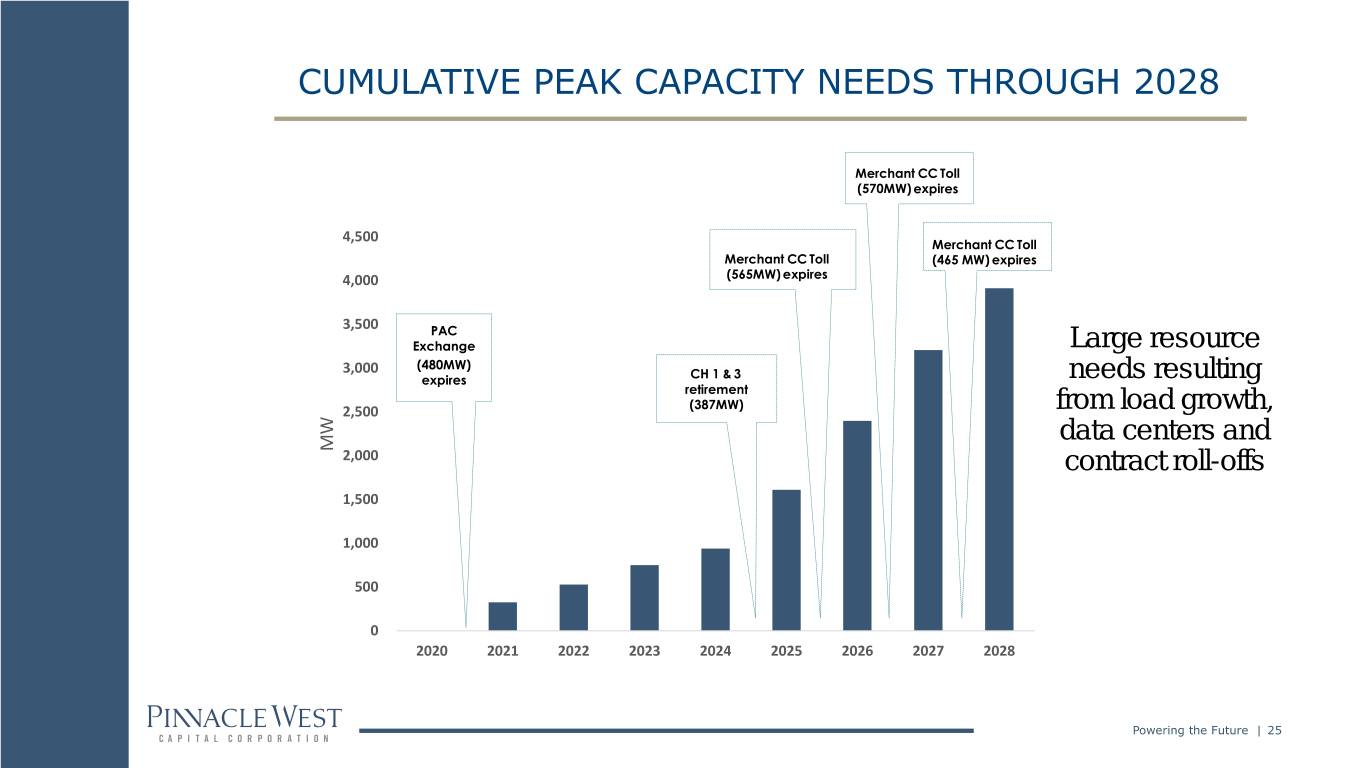

CUMULATIVE PEAK CAPACITY NEEDS THROUGH 2028 Merchant CC Toll (570MW) expires 4,500 Merchant CC Toll Merchant CC Toll (465 MW) expires 4,000 (565MW) expires 3,500 PAC Exchange Large resource 3,000 (480MW) expires CH 1 & 3 needs resulting retirement 2,500 (387MW) from load growth, data centers and MW 2,000 contract roll-offs 1,500 1,000 500 0 2020 2021 2022 2023 2024 2025 2026 2027 2028 Powering the Future | 25

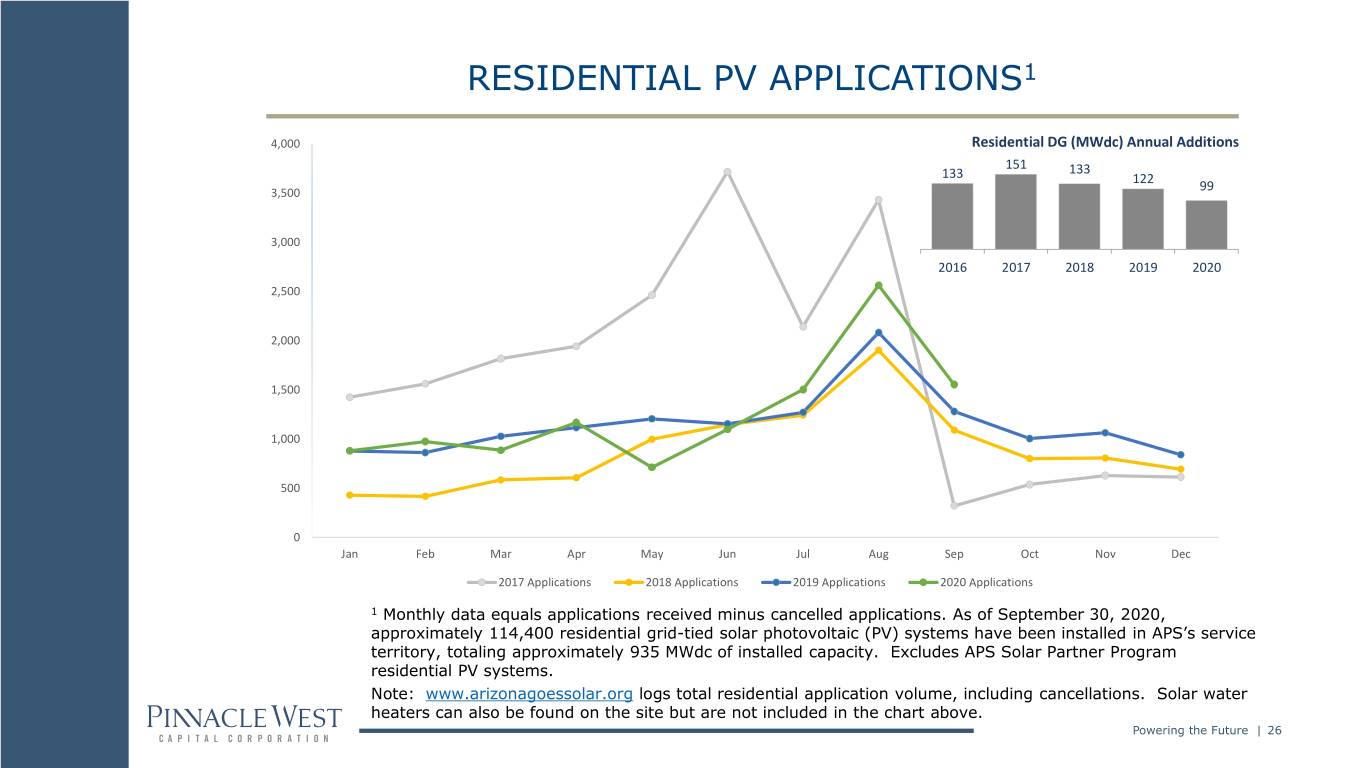

RESIDENTIAL PV APPLICATIONS1 4,000 Residential DG (MWdc) Annual Additions 151 133 133 122 3,500 99 3,000 2016 2017 2018 2019 2020 2,500 2,000 1,500 1,000 500 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2017 Applications 2018 Applications 2019 Applications 2020 Applications 1 Monthly data equals applications received minus cancelled applications. As of September 30, 2020, approximately 114,400 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 935 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site but are not included in the chart above. Powering the Future | 26

ARIZONA CORPORATION COMMISSION Terms to January 2023 Terms to January 2021 Sandra Justin Robert Boyd Lea Márquez Kennedy (D) Olson (R) “Bob” Dunn (R) Peterson Burns (R)* (R)** Chairman Other State Officials ACC Executive Director – Matthew Neubert RUCO Director – Jorge “Jordy” Fuentes *Term limited - elected to four-year terms (limited to two consecutive) **Governor Doug Ducey appointed Lea Márquez Peterson. Powering the Future | 27

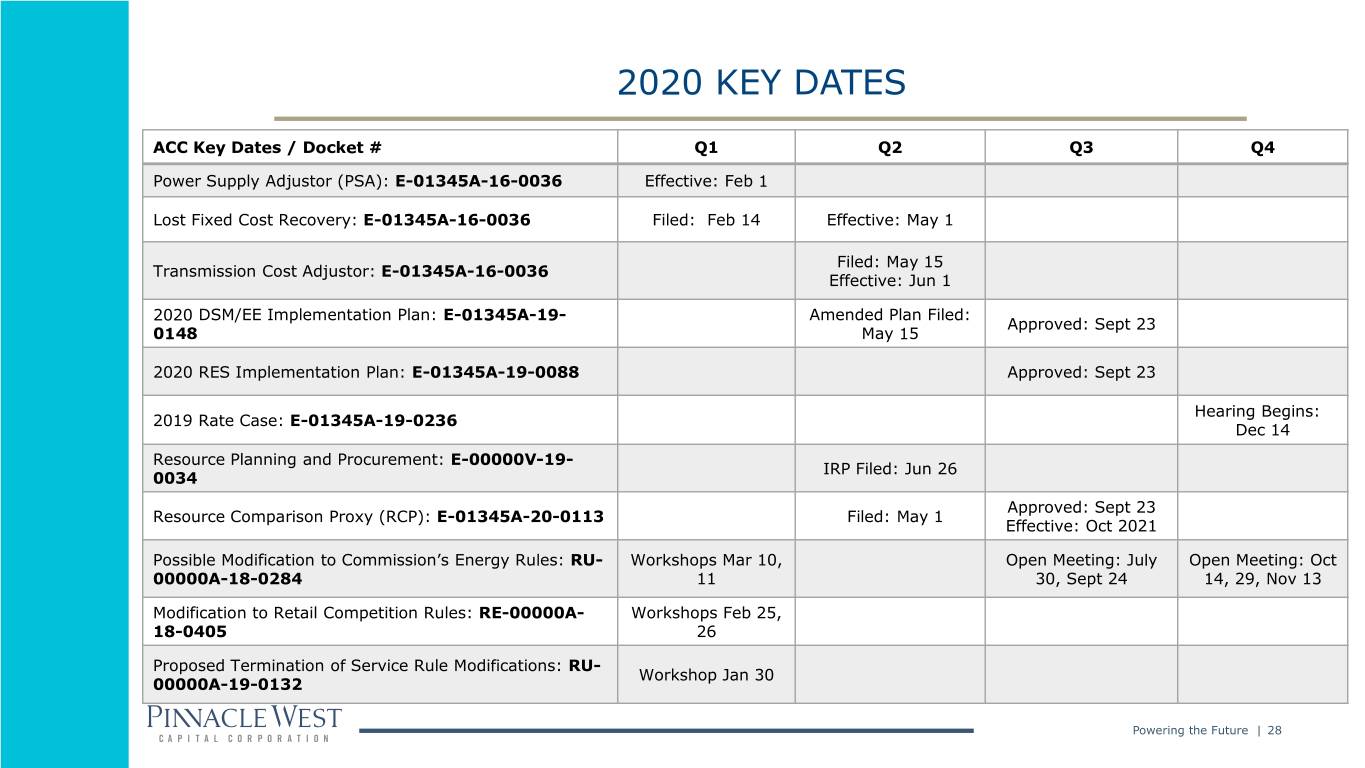

2020 KEY DATES ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Power Supply Adjustor (PSA): E-01345A-16-0036 Effective: Feb 1 Lost Fixed Cost Recovery: E-01345A-16-0036 Filed: Feb 14 Effective: May 1 Filed: May 15 Transmission Cost Adjustor: E-01345A-16-0036 Effective: Jun 1 2020 DSM/EE Implementation Plan: E-01345A-19- Amended Plan Filed: Approved: Sept 23 0148 May 15 2020 RES Implementation Plan: E-01345A-19-0088 Approved: Sept 23 Hearing Begins: 2019 Rate Case: E-01345A-19-0236 Dec 14 Resource Planning and Procurement: E-00000V-19- IRP Filed: Jun 26 0034 Approved: Sept 23 Resource Comparison Proxy (RCP): E-01345A-20-0113 Filed: May 1 Effective: Oct 2021 Possible Modification to Commission’s Energy Rules: RU- Workshops Mar 10, Open Meeting: July Open Meeting: Oct 00000A-18-0284 11 30, Sept 24 14, 29, Nov 13 Modification to Retail Competition Rules: RE-00000A- Workshops Feb 25, 18-0405 26 Proposed Termination of Service Rule Modifications: RU- Workshop Jan 30 00000A-19-0132 Powering the Future | 28

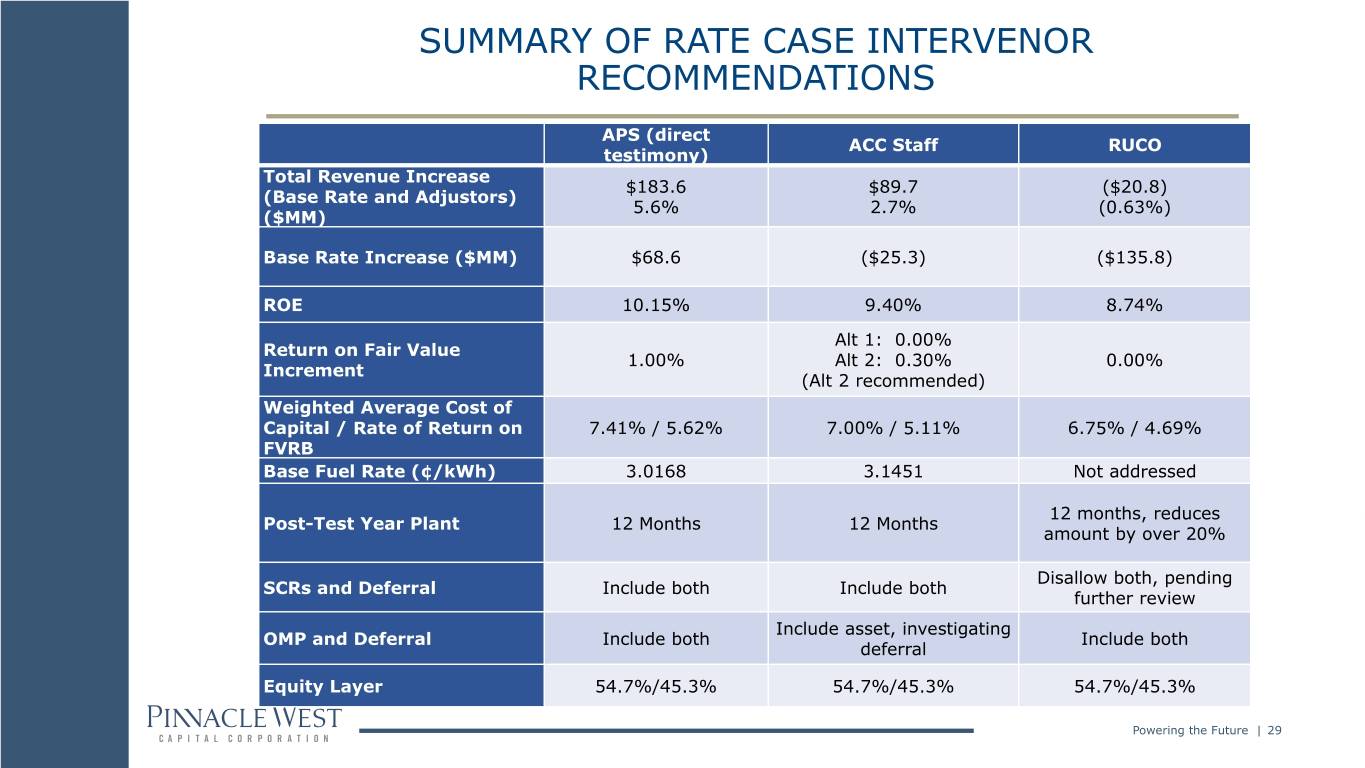

SUMMARY OF RATE CASE INTERVENOR RECOMMENDATIONS APS (direct ACC Staff RUCO testimony) Total Revenue Increase $183.6 $89.7 ($20.8) (Base Rate and Adjustors) 5.6% 2.7% (0.63%) ($MM) Base Rate Increase ($MM) $68.6 ($25.3) ($135.8) ROE 10.15% 9.40% 8.74% Alt 1: 0.00% Return on Fair Value 1.00% Alt 2: 0.30% 0.00% Increment (Alt 2 recommended) Weighted Average Cost of Capital / Rate of Return on 7.41% / 5.62% 7.00% / 5.11% 6.75% / 4.69% FVRB Base Fuel Rate (¢/kWh) 3.0168 3.1451 Not addressed 12 months, reduces Post-Test Year Plant 12 Months 12 Months amount by over 20% Disallow both, pending SCRs and Deferral Include both Include both further review Include asset, investigating OMP and Deferral Include both Include both deferral Equity Layer 54.7%/45.3% 54.7%/45.3% 54.7%/45.3% Powering the Future | 29

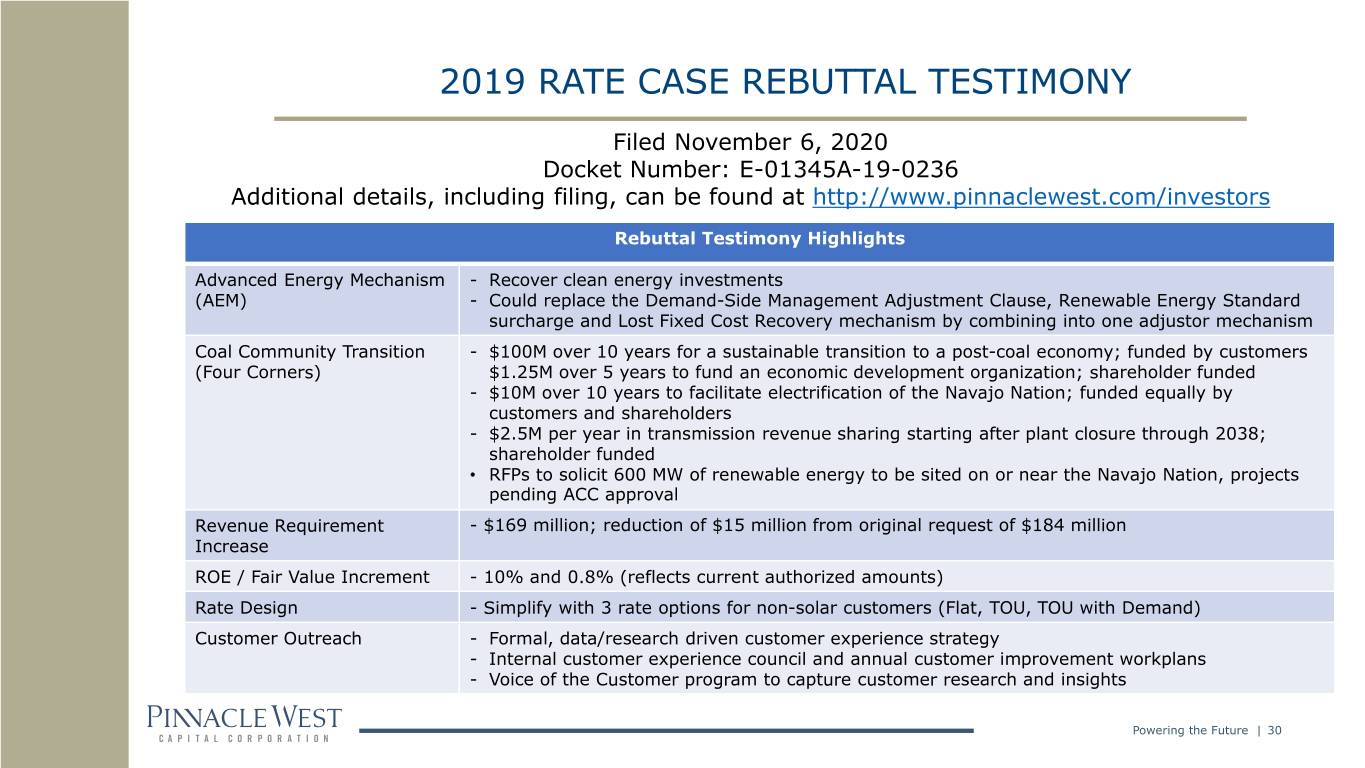

2019 RATE CASE REBUTTAL TESTIMONY Filed November 6, 2020 Docket Number: E-01345A-19-0236 Additional details, including filing, can be found at http://www.pinnaclewest.com/investors Rebuttal Testimony Highlights Advanced Energy Mechanism - Recover clean energy investments (AEM) - Could replace the Demand-Side Management Adjustment Clause, Renewable Energy Standard surcharge and Lost Fixed Cost Recovery mechanism by combining into one adjustor mechanism Coal Community Transition - $100M over 10 years for a sustainable transition to a post-coal economy; funded by customers (Four Corners) $1.25M over 5 years to fund an economic development organization; shareholder funded - $10M over 10 years to facilitate electrification of the Navajo Nation; funded equally by customers and shareholders - $2.5M per year in transmission revenue sharing starting after plant closure through 2038; shareholder funded • RFPs to solicit 600 MW of renewable energy to be sited on or near the Navajo Nation, projects pending ACC approval Revenue Requirement - $169 million; reduction of $15 million from original request of $184 million Increase ROE / Fair Value Increment - 10% and 0.8% (reflects current authorized amounts) Rate Design - Simplify with 3 rate options for non-solar customers (Flat, TOU, TOU with Demand) Customer Outreach - Formal, data/research driven customer experience strategy - Internal customer experience council and annual customer improvement workplans - Voice of the Customer program to capture customer research and insights Powering the Future | 30

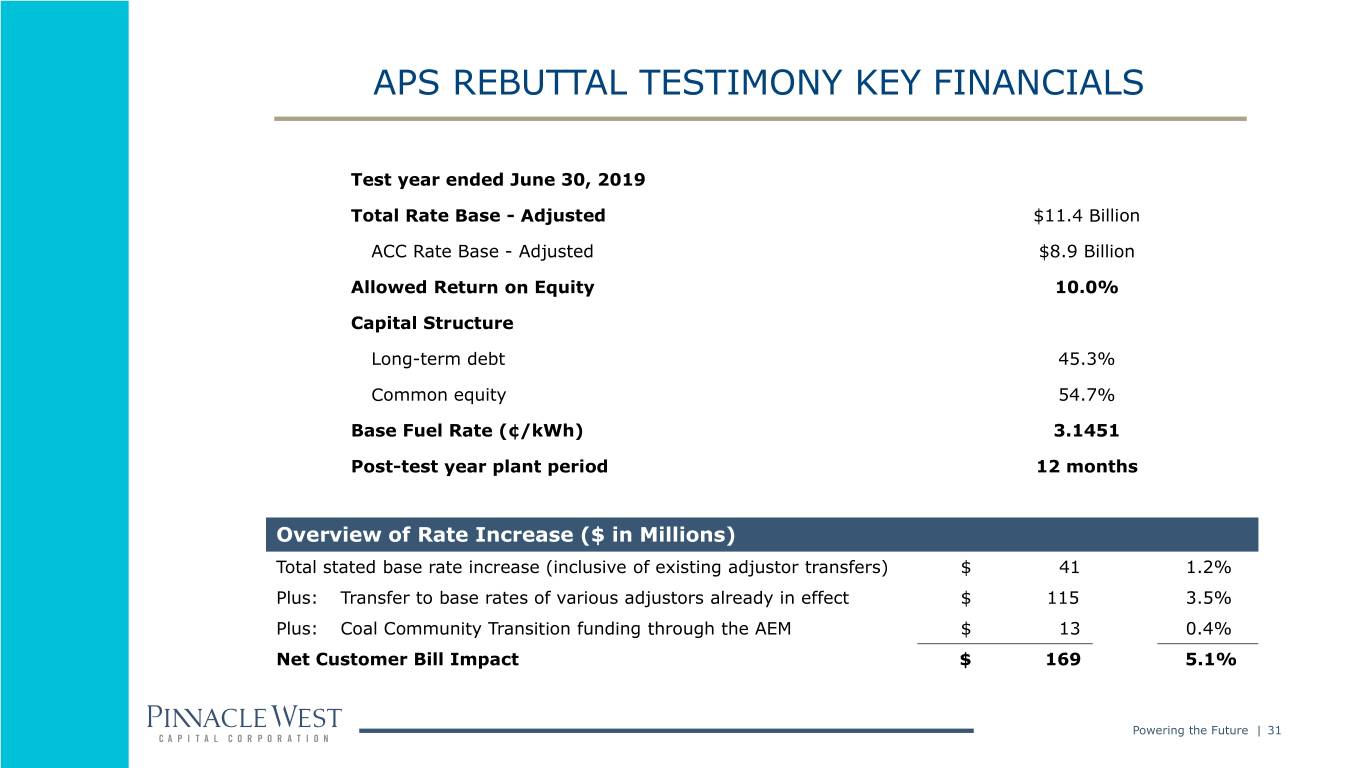

APS REBUTTAL TESTIMONY KEY FINANCIALS Test year ended June 30, 2019 Total Rate Base - Adjusted $11.4 Billion ACC Rate Base - Adjusted $8.9 Billion Allowed Return on Equity 10.0% Capital Structure Long-term debt 45.3% Common equity 54.7% Base Fuel Rate (¢/kWh) 3.1451 Post-test year plant period 12 months Overview of Rate Increase ($ in Millions) Total stated base rate increase (inclusive of existing adjustor transfers) $ 41 1.2% Plus: Transfer to base rates of various adjustors already in effect $ 115 3.5% Plus: Coal Community Transition funding through the AEM $ 13 0.4% Net Customer Bill Impact $ 169 5.1% Powering the Future | 31

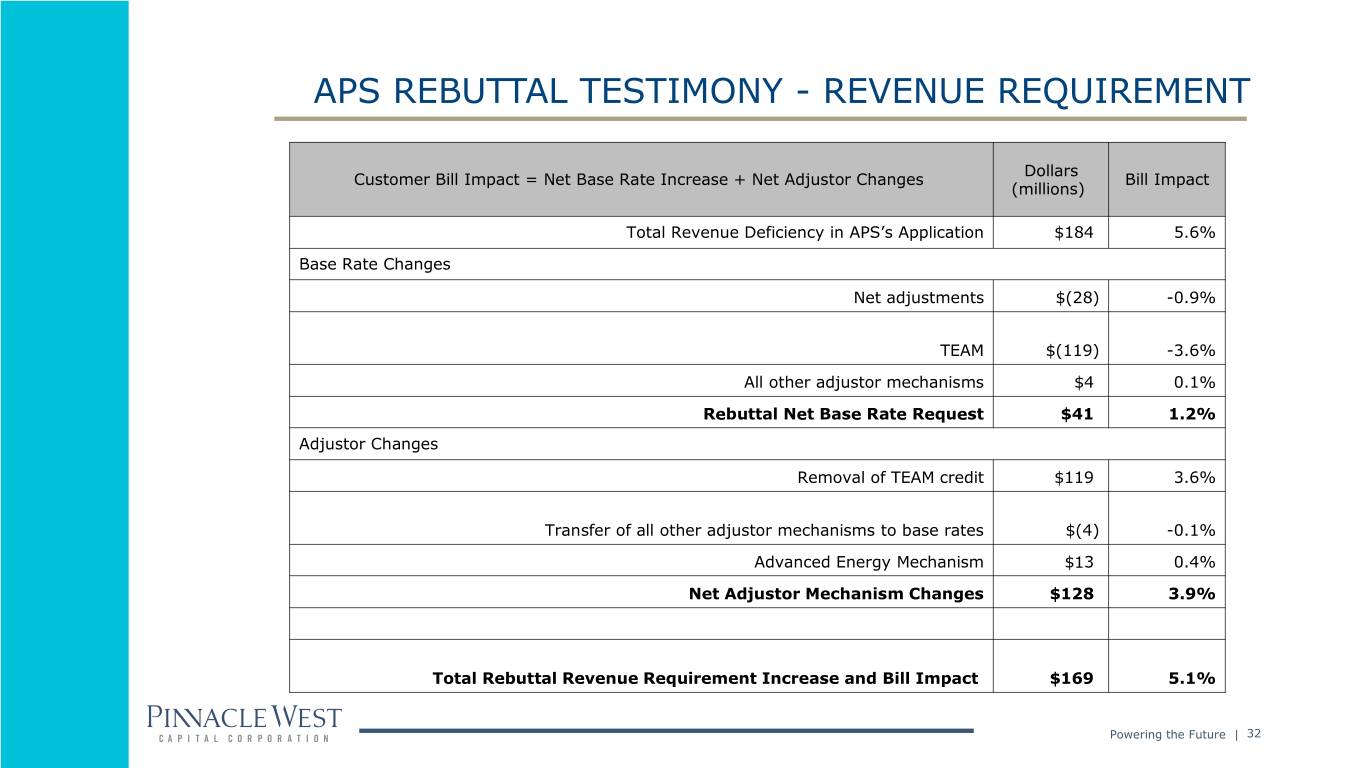

APS REBUTTAL TESTIMONY - REVENUE REQUIREMENT Dollars Customer Bill Impact = Net Base Rate Increase + Net Adjustor Changes Bill Impact (millions) Total Revenue Deficiency in APS’s Application $184 5.6% Base Rate Changes Net adjustments $(28) -0.9% TEAM $(119) -3.6% All other adjustor mechanisms $4 0.1% Rebuttal Net Base Rate Request $41 1.2% Adjustor Changes Removal of TEAM credit $119 3.6% Transfer of all other adjustor mechanisms to base rates $(4) -0.1% Advanced Energy Mechanism $13 0.4% Net Adjustor Mechanism Changes $128 3.9% Total Rebuttal Revenue Requirement Increase and Bill Impact $169 5.1% Powering the Future | 32

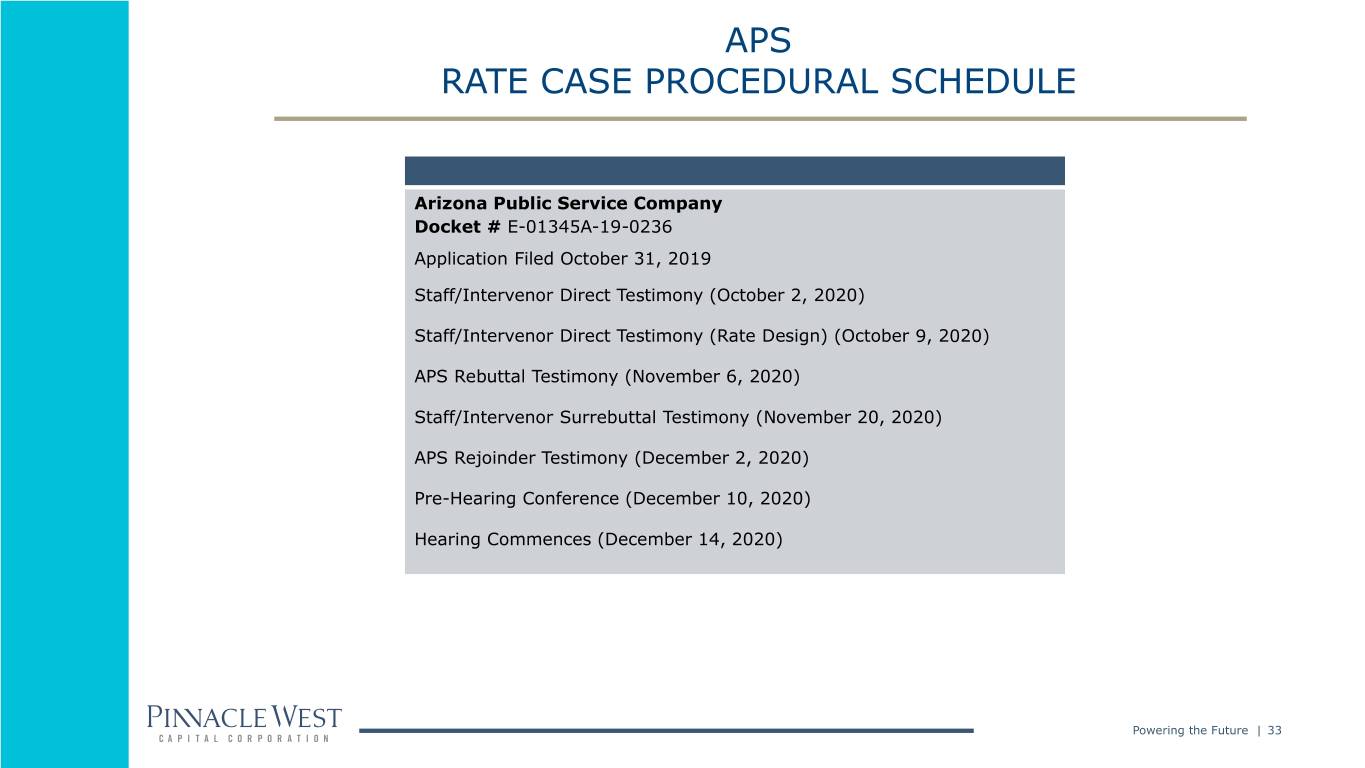

APS RATE CASE PROCEDURAL SCHEDULE Arizona Public Service Company Docket # E-01345A-19-0236 Application Filed October 31, 2019 Staff/Intervenor Direct Testimony (October 2, 2020) Staff/Intervenor Direct Testimony (Rate Design) (October 9, 2020) APS Rebuttal Testimony (November 6, 2020) Staff/Intervenor Surrebuttal Testimony (November 20, 2020) APS Rejoinder Testimony (December 2, 2020) Pre-Hearing Conference (December 10, 2020) Hearing Commences (December 14, 2020) Powering the Future | 33

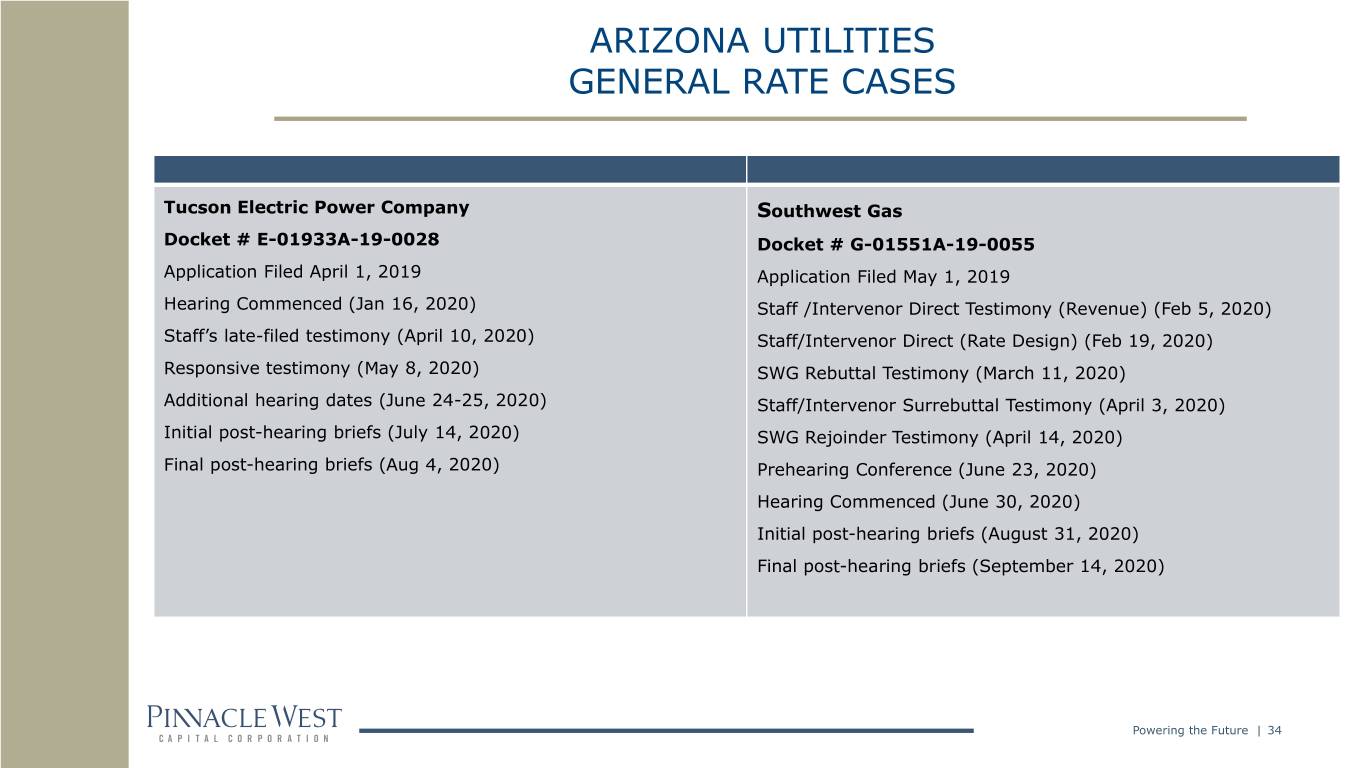

ARIZONA UTILITIES GENERAL RATE CASES Tucson Electric Power Company Southwest Gas Docket # E-01933A-19-0028 Docket # G-01551A-19-0055 Application Filed April 1, 2019 Application Filed May 1, 2019 Hearing Commenced (Jan 16, 2020) Staff /Intervenor Direct Testimony (Revenue) (Feb 5, 2020) Staff’s late-filed testimony (April 10, 2020) Staff/Intervenor Direct (Rate Design) (Feb 19, 2020) Responsive testimony (May 8, 2020) SWG Rebuttal Testimony (March 11, 2020) Additional hearing dates (June 24-25, 2020) Staff/Intervenor Surrebuttal Testimony (April 3, 2020) Initial post-hearing briefs (July 14, 2020) SWG Rejoinder Testimony (April 14, 2020) Final post-hearing briefs (Aug 4, 2020) Prehearing Conference (June 23, 2020) Hearing Commenced (June 30, 2020) Initial post-hearing briefs (August 31, 2020) Final post-hearing briefs (September 14, 2020) Powering the Future | 34

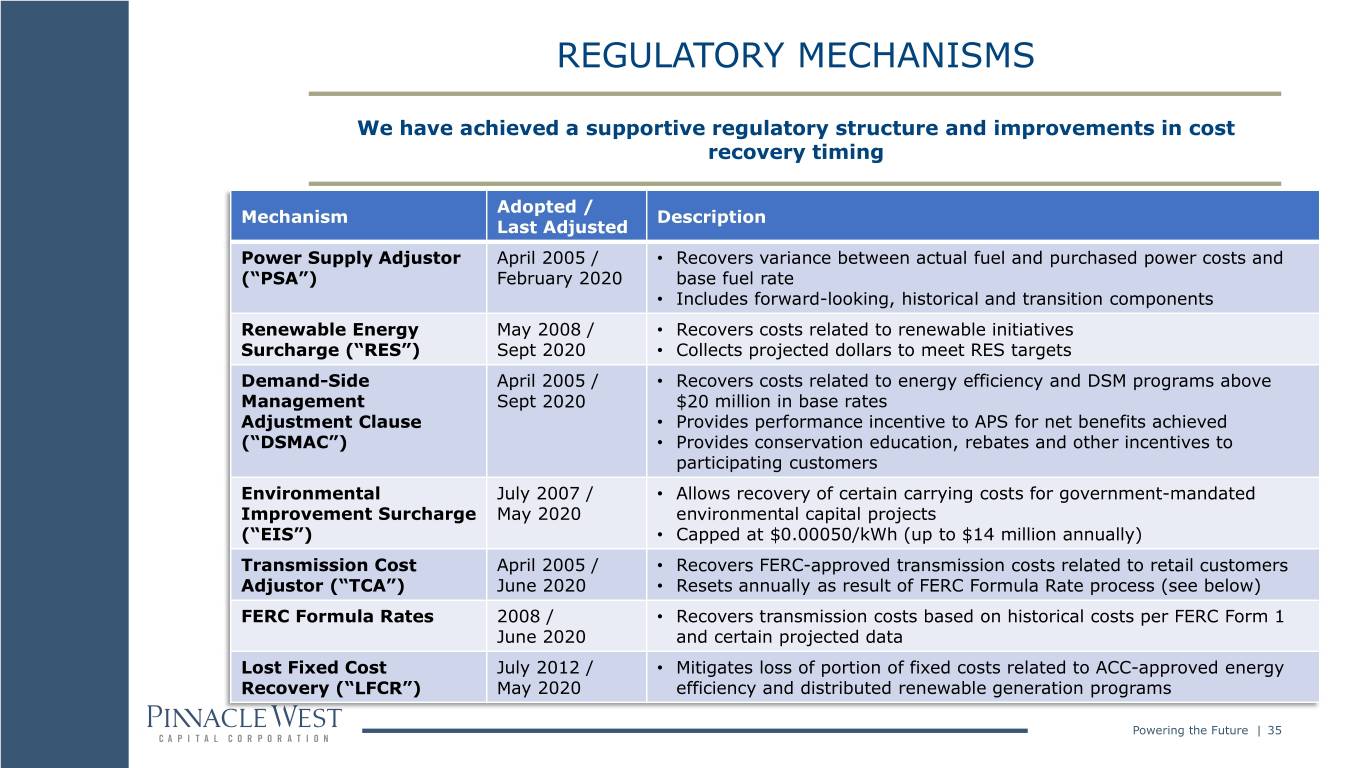

REGULATORY MECHANISMS We have achieved a supportive regulatory structure and improvements in cost recovery timing Adopted / Mechanism Description Last Adjusted Power Supply Adjustor April 2005 / • Recovers variance between actual fuel and purchased power costs and (“PSA”) February 2020 base fuel rate • Includes forward-looking, historical and transition components Renewable Energy May 2008 / • Recovers costs related to renewable initiatives Surcharge (“RES”) Sept 2020 • Collects projected dollars to meet RES targets Demand-Side April 2005 / • Recovers costs related to energy efficiency and DSM programs above Management Sept 2020 $20 million in base rates Adjustment Clause • Provides performance incentive to APS for net benefits achieved (“DSMAC”) • Provides conservation education, rebates and other incentives to participating customers Environmental July 2007 / • Allows recovery of certain carrying costs for government-mandated Improvement Surcharge May 2020 environmental capital projects (“EIS”) • Capped at $0.00050/kWh (up to $14 million annually) Transmission Cost April 2005 / • Recovers FERC-approved transmission costs related to retail customers Adjustor (“TCA”) June 2020 • Resets annually as result of FERC Formula Rate process (see below) FERC Formula Rates 2008 / • Recovers transmission costs based on historical costs per FERC Form 1 June 2020 and certain projected data Lost Fixed Cost July 2012 / • Mitigates loss of portion of fixed costs related to ACC-approved energy Recovery (“LFCR”) May 2020 efficiency and distributed renewable generation programs Powering the Future | 35

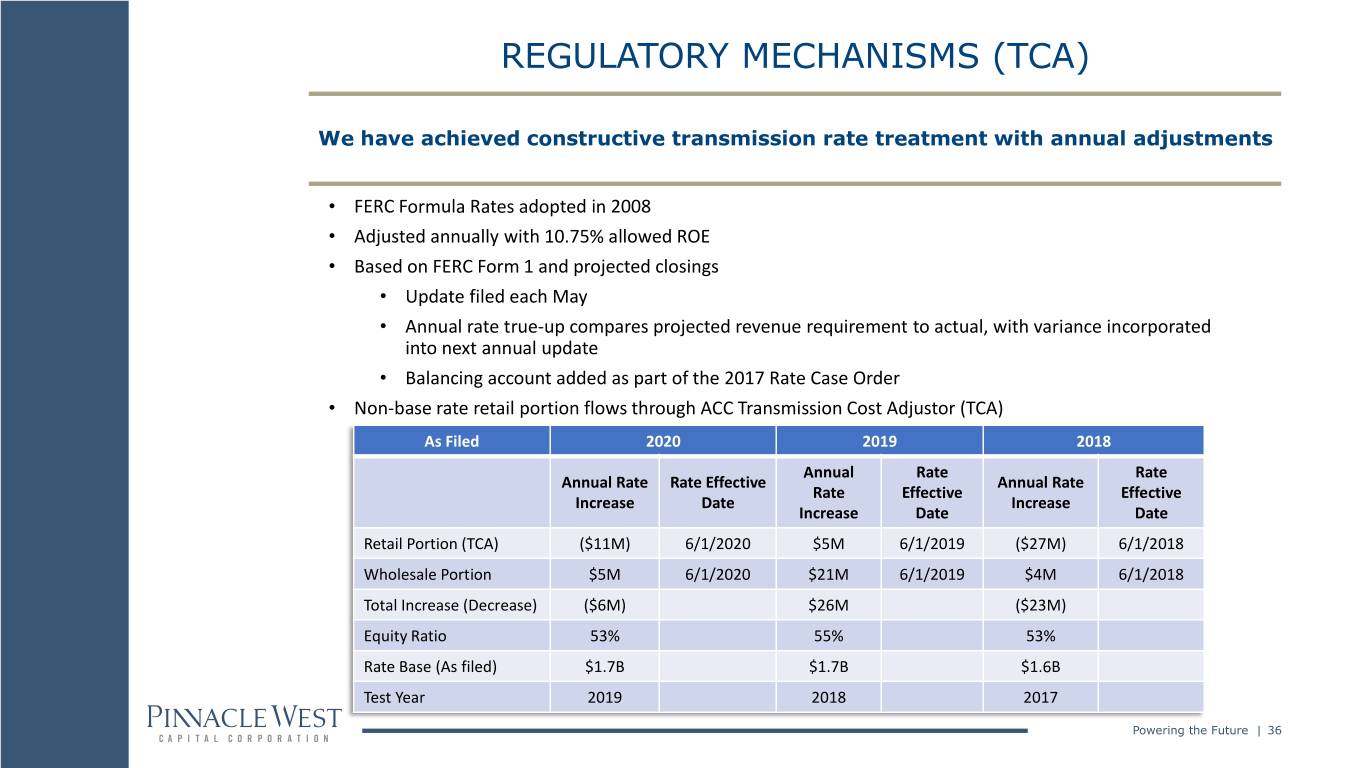

REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments • FERC Formula Rates adopted in 2008 • Adjusted annually with 10.75% allowed ROE • Based on FERC Form 1 and projected closings • Update filed each May • Annual rate true-up compares projected revenue requirement to actual, with variance incorporated into next annual update • Balancing account added as part of the 2017 Rate Case Order • Non-base rate retail portion flows through ACC Transmission Cost Adjustor (TCA) As Filed 2020 2019 2018 Annual Rate Rate Annual Rate Rate Effective Annual Rate Rate Effective Effective Increase Date Increase Increase Date Date Retail Portion (TCA) ($11M) 6/1/2020 $5M 6/1/2019 ($27M) 6/1/2018 Wholesale Portion $5M 6/1/2020 $21M 6/1/2019 $4M 6/1/2018 Total Increase (Decrease) ($6M) $26M ($23M) Equity Ratio 53% 55% 53% Rate Base (As filed) $1.7B $1.7B $1.6B Test Year 2019 2018 2017 Powering the Future | 36

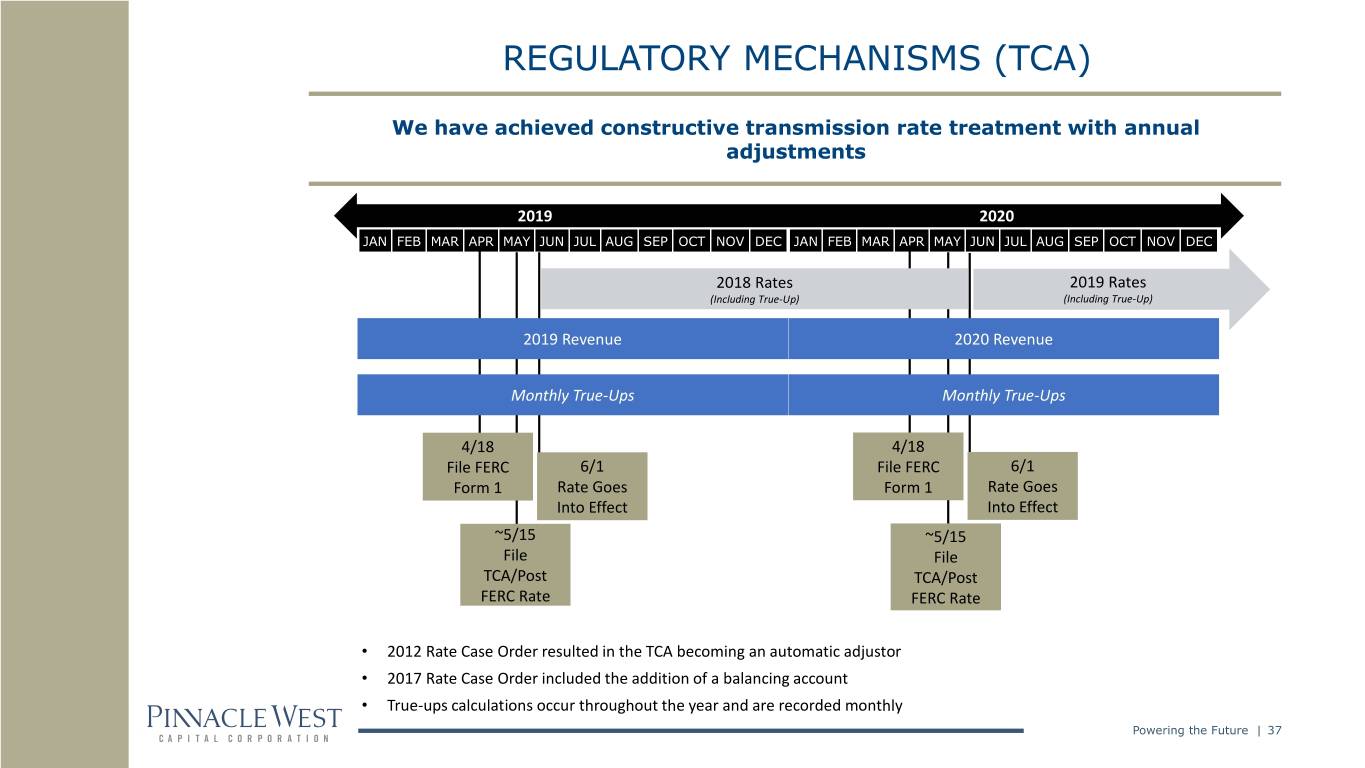

REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments 2019 2020 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 2018 Rates 2019 Rates (Including True-Up) (Including True-Up) 2019 Revenue 2020 Revenue Monthly True-Ups Monthly True-Ups 4/18 4/18 File FERC 6/1 File FERC 6/1 Form 1 Rate Goes Form 1 Rate Goes Into Effect Into Effect ~5/15 ~5/15 File File TCA/Post TCA/Post FERC Rate FERC Rate • 2012 Rate Case Order resulted in the TCA becoming an automatic adjustor • 2017 Rate Case Order included the addition of a balancing account • True-ups calculations occur throughout the year and are recorded monthly Powering the Future | 37

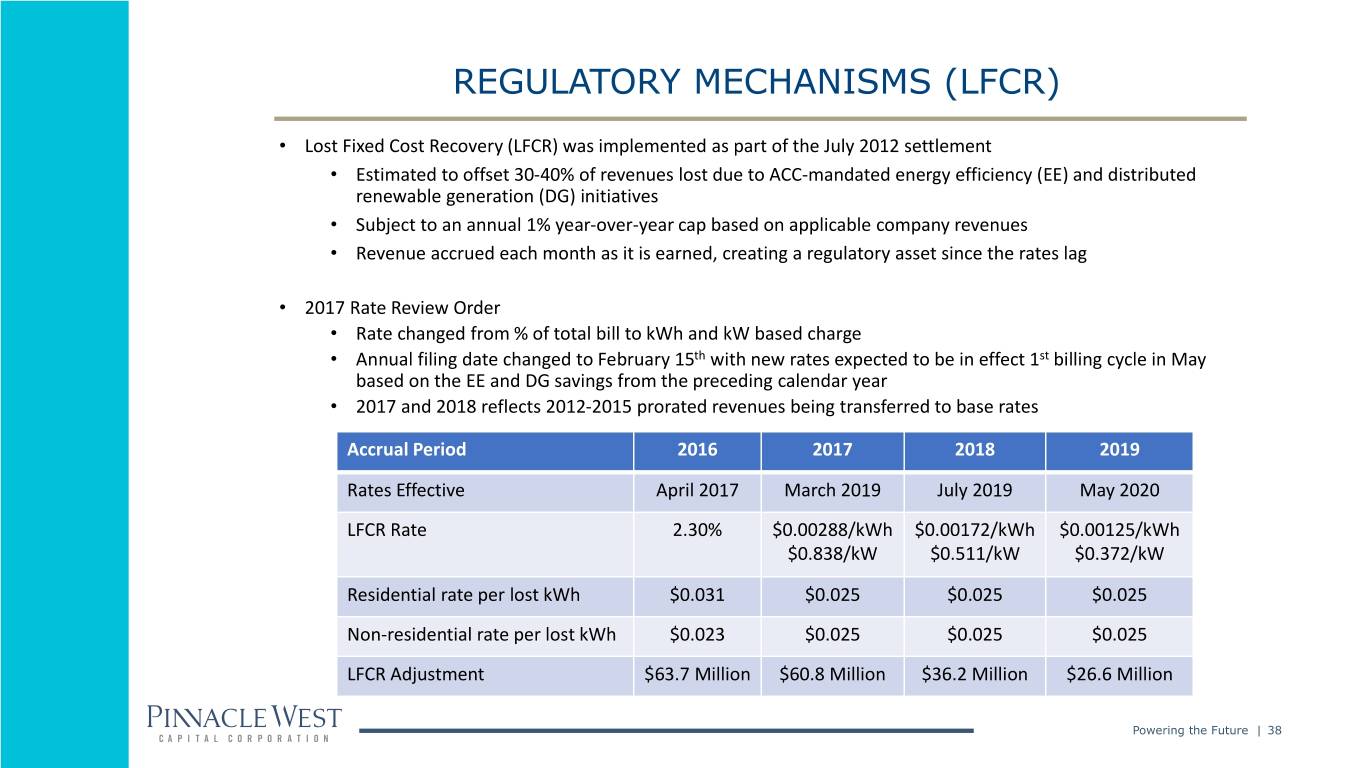

REGULATORY MECHANISMS (LFCR) • Lost Fixed Cost Recovery (LFCR) was implemented as part of the July 2012 settlement • Estimated to offset 30-40% of revenues lost due to ACC-mandated energy efficiency (EE) and distributed renewable generation (DG) initiatives • Subject to an annual 1% year-over-year cap based on applicable company revenues • Revenue accrued each month as it is earned, creating a regulatory asset since the rates lag • 2017 Rate Review Order • Rate changed from % of total bill to kWh and kW based charge • Annual filing date changed to February 15th with new rates expected to be in effect 1st billing cycle in May based on the EE and DG savings from the preceding calendar year • 2017 and 2018 reflects 2012-2015 prorated revenues being transferred to base rates Accrual Period 2016 2017 2018 2019 Rates Effective April 2017 March 2019 July 2019 May 2020 LFCR Rate 2.30% $0.00288/kWh $0.00172/kWh $0.00125/kWh $0.838/kW $0.511/kW $0.372/kW Residential rate per lost kWh $0.031 $0.025 $0.025 $0.025 Non-residential rate per lost kWh $0.023 $0.025 $0.025 $0.025 LFCR Adjustment $63.7 Million $60.8 Million $36.2 Million $26.6 Million Powering the Future | 38

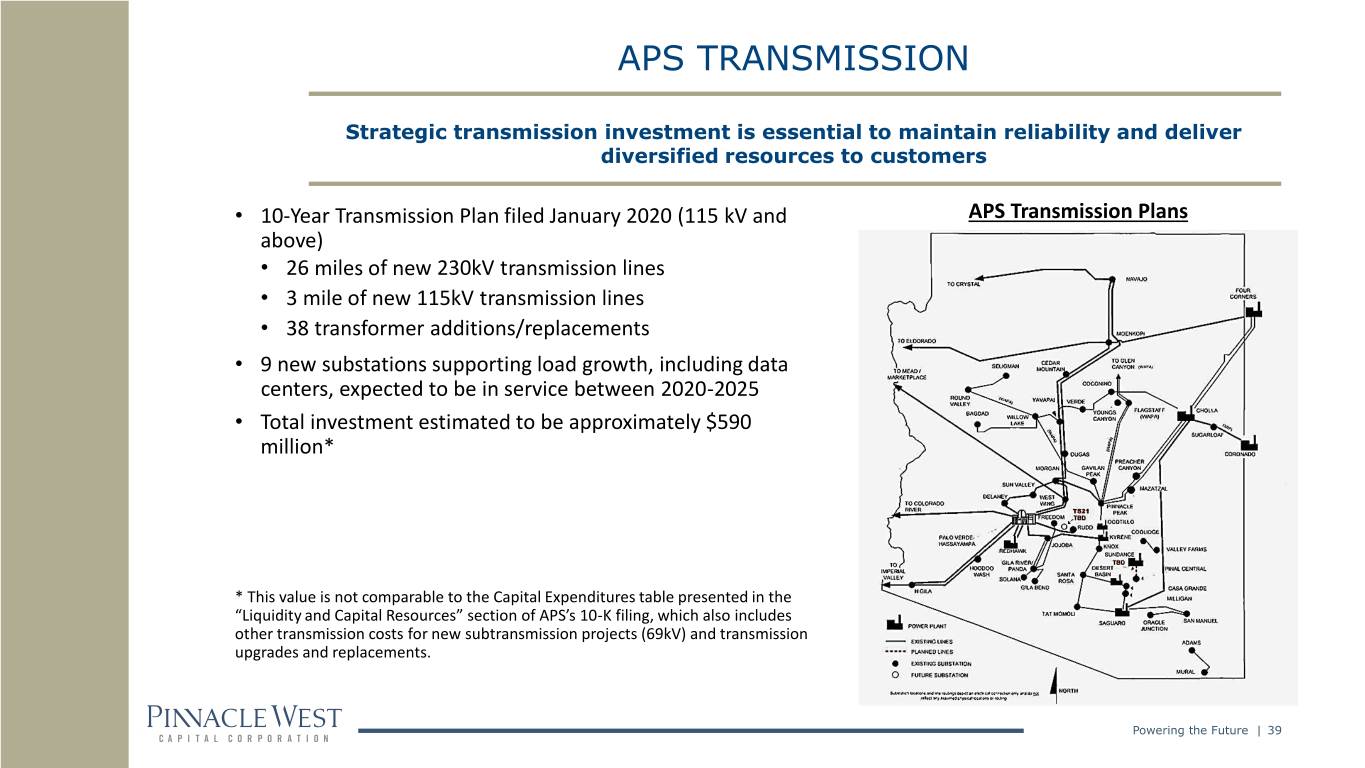

APS TRANSMISSION Strategic transmission investment is essential to maintain reliability and deliver diversified resources to customers • 10-Year Transmission Plan filed January 2020 (115 kV and APS Transmission Plans above) • 26 miles of new 230kV transmission lines • 3 mile of new 115kV transmission lines • 38 transformer additions/replacements • 9 new substations supporting load growth, including data centers, expected to be in service between 2020-2025 • Total investment estimated to be approximately $590 million* * This value is not comparable to the Capital Expenditures table presented in the “Liquidity and Capital Resources” section of APS’s 10-K filing, which also includes other transmission costs for new subtransmission projects (69kV) and transmission upgrades and replacements. Powering the Future | 39

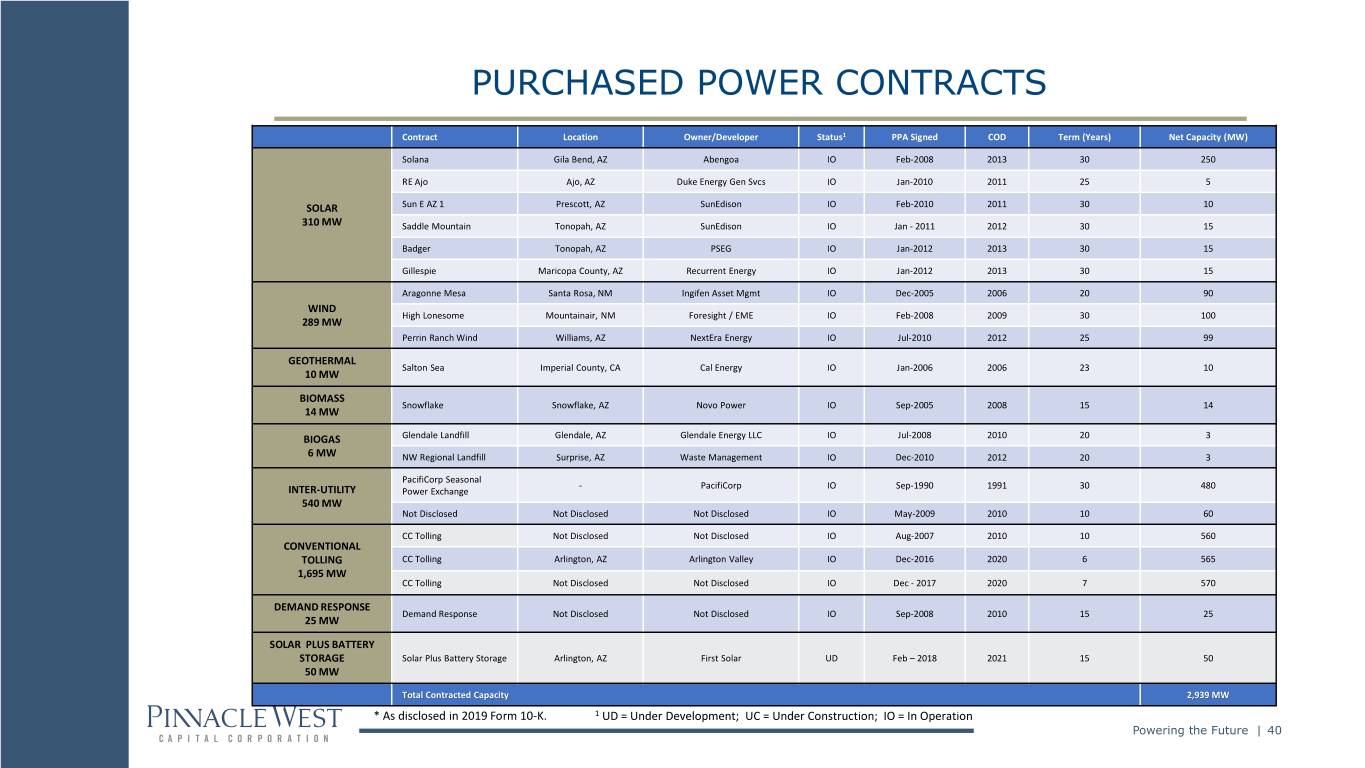

PURCHASED POWER CONTRACTS Contract Location Owner/Developer Status1 PPA Signed COD Term (Years) Net Capacity (MW) Solana Gila Bend, AZ Abengoa IO Feb-2008 2013 30 250 RE Ajo Ajo, AZ Duke Energy Gen Svcs IO Jan-2010 2011 25 5 SOLAR Sun E AZ 1 Prescott, AZ SunEdison IO Feb-2010 2011 30 10 310 MW Saddle Mountain Tonopah, AZ SunEdison IO Jan - 2011 2012 30 15 Badger Tonopah, AZ PSEG IO Jan-2012 2013 30 15 Gillespie Maricopa County, AZ Recurrent Energy IO Jan-2012 2013 30 15 Aragonne Mesa Santa Rosa, NM Ingifen Asset Mgmt IO Dec-2005 2006 20 90 WIND High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 2009 30 100 289 MW Perrin Ranch Wind Williams, AZ NextEra Energy IO Jul-2010 2012 25 99 GEOTHERMAL Salton Sea Imperial County, CA Cal Energy IO Jan-2006 2006 23 10 10 MW BIOMASS Snowflake Snowflake, AZ Novo Power IO Sep-2005 2008 15 14 14 MW BIOGAS Glendale Landfill Glendale, AZ Glendale Energy LLC IO Jul-2008 2010 20 3 6 MW NW Regional Landfill Surprise, AZ Waste Management IO Dec-2010 2012 20 3 PacifiCorp Seasonal - PacifiCorp IO Sep-1990 1991 30 480 INTER-UTILITY Power Exchange 540 MW Not Disclosed Not Disclosed Not Disclosed IO May-2009 2010 10 60 CC Tolling Not Disclosed Not Disclosed IO Aug-2007 2010 10 560 CONVENTIONAL TOLLING CC Tolling Arlington, AZ Arlington Valley IO Dec-2016 2020 6 565 1,695 MW CC Tolling Not Disclosed Not Disclosed IO Dec - 2017 2020 7 570 DEMAND RESPONSE Demand Response Not Disclosed Not Disclosed IO Sep-2008 2010 15 25 25 MW SOLAR PLUS BATTERY STORAGE Solar Plus Battery Storage Arlington, AZ First Solar UD Feb – 2018 2021 15 50 50 MW Total Contracted Capacity 2,939 MW * As disclosed in 2019 Form 10-K. 1 UD = Under Development; UC = Under Construction; IO = In Operation Powering the Future | 40