Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mylan II B.V. | myl-20201106.htm |

| EX-99.1 - EX-99.1 - Mylan II B.V. | exhibit991-3q20earning.htm |

Mylan Q3 2020 EARNINGS November 6, 2020 Q3 2020 Earnings – All Results are Unaudited

Forward-Looking Statements This presentation contains “forward-looking statements.” Such forward-looking statements may include, without limitation, and any other statements about the proposed transaction pursuant to which Mylan will combine with Pfizer Inc.’s (“Pfizer”) Upjohn business (the “Upjohn Business”) in a Reverse Morris Trust transaction (the “Combination”), the expected timetable for completing the Combination, the benefits and synergies of the Combination, future opportunities for the combined company and products and any other statements regarding Mylan’s, the Upjohn Business’s or the combined company’s future operations, financial or operating results, capital allocation, dividend policy, debt ratio, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets for future periods. These may often be identified by the use of words such as “will,” “may,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “plan,” “estimate,” “forecast,” “potential,” “pipeline,” “intend,” “continue,” “target,” “seek,” and variations of these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: with respect to the Combination, the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the Combination, changes in relevant tax and other laws, the parties’ ability to consummate the Combination, the conditions to the completion of the Combination not being satisfied or waived on the anticipated timeframe or at all, the integration of Mylan and the Upjohn Business being more difficult, time consuming or costly than expected, Mylan’s and the Upjohn Business’s failure to achieve expected or targeted future financial and operating performance and results, the possibility that the combined company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the Combination within the expected timeframes or at all or to successfully integrate Mylan and the Upjohn Business, customer loss and business disruption being greater than expected following the Combination, the retention of key employees being more difficult following the Combination, changes in third-party relationships and changes in the economic and financial conditions of the business of Mylan or the Upjohn Business; the potential impact of public health outbreaks, epidemics and pandemics, such as the COVID-19 pandemic; actions and decisions of healthcare and pharmaceutical regulators; failure to achieve expected or targeted future financial and operating performance and results; uncertainties regarding future demand, pricing and reimbursement for our or the Upjohn Business’s products; any regulatory, legal or other impediments to Mylan's or the Upjohn Business’s ability to bring new products to market, including, but not limited to, where Mylan or the Upjohn Business uses its business judgment and decides to manufacture, market and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent infringement(s) have not been finally resolved by the courts (i.e., an “at-risk launch”); success of clinical trials and Mylan's or the Upjohn Business’s ability to execute on new product opportunities; any changes in or difficulties with our or the Upjohn Business’s manufacturing facilities, including with respect to remediation and restructuring activities, supply chain or inventory or the ability to meet anticipated demand; the scope, timing and outcome of any ongoing legal proceedings, including government investigations, and the impact of any such proceedings on our or the Upjohn Business’s financial condition, results of operations and/or cash flows; the ability to meet expectations regarding the accounting and tax treatments of acquisitions; changes in relevant tax and other laws, including but not limited to changes in the U.S. tax code and healthcare and pharmaceutical laws and regulations in the U.S. and abroad; any significant breach of data security or data privacy or disruptions to our or the Upjohn Business’s information technology systems; the ability to protect intellectual property and preserve intellectual property rights; the effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; the impact of competition; identifying, acquiring, and integrating complementary or strategic acquisitions of other companies, products, or assets being more difficult, time-consuming or costly than anticipated; the possibility that Mylan may be unable to achieve expected synergies and operating efficiencies in connection with business transformation initiatives, strategic acquisitions, strategic initiatives or restructuring programs within the expected timeframes or at all; uncertainties and matters beyond the control of management, including but not limited to general political and economic conditions and global exchange rates; and inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements, and the providing of estimates of financial measures, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related standards or on an adjusted basis. For more detailed information on the risks and uncertainties associated with Mylan’s business activities, see the risks described in Mylan's Annual Report on Form 10-K for the year ended December 31, 2019, as amended, Mylan’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 and our other filings with the Securities and Exchange Commission (the “SEC”). These risks, as well as other risks associated with Mylan, the Upjohn Business, the combined company and the Combination are also more fully discussed in the Registration Statement on Form S-4, as amended, which includes a proxy statement/prospectus, which was filed by Upjohn Inc. (“Upjohn”), a wholly-owned subsidiary of Pfizer, with the SEC on October 25, 2019 and declared effective by the SEC on February 13, 2020, the Registration Statement on Form 10, which includes an information statement, which was filed by Upjohn with the SEC on June 12, 2020 and declared effective by the SEC on June 30, 2020, a final information statement furnished with the Current Report on Form 8-K filed by Upjohn with the SEC on August 6, 2020, a definitive proxy statement, which was filed by Mylan with the SEC on February 13, 2020, and a prospectus, which was filed by Upjohn with the SEC on February 13, 2020. You can access Mylan's filings with the SEC through the SEC website at www.sec.gov or through our website, and Mylan strongly encourages you to do so. Mylan routinely posts information that may be important to investors on our website at investor.mylan.com, and we use this website address as a means of disclosing material information to the public in a broad, non-exclusionary manner for purposes of the SEC's Regulation Fair Disclosure (Reg FD). The contents of our website are not incorporated into this presentation. Mylan undertakes no obligation to update any statements herein for revisions or changes after the date of this presentation other than as required by law. 2 Q3 2020 Earnings – All Results are Unaudited

Q3 2020 Financial Highlights ($ in millions) Q3 2020 Q3 2019 Change Total Revenues $2,972.1 $2,961.7 ~Flat U.S. GAAP Gross Margins 39.0% 36.2% +280 bps Adjusted Gross Margins* 54.8% 52.8% +200 bps U.S. GAAP R&D as % of Total Revenues 4.4% 5.7% (130 bps) Adjusted R&D* as % of Total Revenues 4.2% 4.3% (10 bps) U.S. GAAP SG&A as % of Total Revenues 22.2% 21.4% +80 bps Adjusted SG&A* as % of Total Revenues 19.1% 19.5% (40 bps) U.S. GAAP Net Earnings $185.7 $189.8 (2%) Adjusted Net Earnings* $679.7 $604.4 +12% EBITDA $794.1 $794.8 ~Flat Adjusted EBITDA* $1,009.7 $922.8 +9% U.S. GAAP Net Cash Provided by Operating Activities $525.0 $487.8 +8% Adjusted Net Cash Provided by Operating Activities* $668.2 $584.4 +14% Capital Expenditures $37.5 (1) $42.3 (11%) Adjusted Free Cash Flow* $630.7 $542.1 +16% (1) Q3 2020 amount includes $0.7 million of proceeds from sale of certain property, plant and equipment. 3 Q3 2020 Earnings – All Results are Unaudited *Adjusted metrics are non-GAAP financial measures. Please see the Appendix or investor.mylan.com for the most directly comparable U.S. GAAP financial measures and reconciliations of such non-GAAP financial measures to those GAAP measures.

Q3 2020 Segment Performance ($ in millions) Net Sales Segment Profitability* Net Sales + New Product Sales, Including Dimethyl Fumarate $489.9 $497.9 − Lower Volumes of Existing Products Primarily Driven By Lower EpiPen® Volumes, Partially Due to the Negative Impact of COVID-19 Which Resulted in Lower Back to $1,088.6 $1,028.8 School Sales, Partially Offset by Higher Volumes of WixelaTM InhubTM − Lower Pricing on Existing Products Driven by Changes in the Competitive North (1) Environment, Including for Levothyroxine Sodium (1) (1) America $548.2 $563.2 Segment Profitability + Impact of New Product Sales + Certain Lower Operating Costs, Including Less One-time R&D Q3 2019 Q3 2020 Q3 2019 Q3 2020 − Unfavorable Product Mix Net Sales + 5% Favorable FX Impacts $1,123.8 $1,045.9 + New Product Sales − Lower Volumes of Existing Products Primarily Due to COVID-19 Europe Segment Profitability + Same Drivers as Net Sales $325.1 $348.1 Q3 2019 Q3 2020 Q3 2019 Q3 2020 Net Sales ~Flat + New Product Sales, Primarily Remdesivir in India − Lower Volumes of Existing Products Partially Driven By the Negative Impact of COVID-19, Primarily in China, Russia and Japan, Partially Offset By Higher ARV Rest of $793.7 $795.5 Volumes − Lower Pricing on Existing Products, Primarily Due to Government Price Cuts in Japan and Australia. World − 2% Unfavorable FX Impacts $170.3 $120.3 Segment Profitability + Positive Impact − Impact of Lower Volumes and Pricing – Negative Impact Q3 2019 Q3 2020 Q3 2019 Q3 2020 − Higher Operating Costs 4 Q3 2020 Earnings – All Results are Unaudited *Segment Profitability represents segment gross profit less direct R&D expenses and direct SG&A expenses. See Mylan’s Form 10-K for the year ended December 31, 2019 for more information. (1) Adjusted segment profitability for North America is a non-GAAP financial measure. Please see the Appendix or investor.mylan.com for the most directly comparable U.S GAAP financial measures and reconciliations of such non-GAAP financial measures to those GAAP measures

Q3 2020 YTD Financial Highlights ($ in millions) Q3 2020 YTD Q3 2019 YTD Change Total Revenues $8,322.5 $8,308.7 ~Flat U.S. GAAP Gross Margins 37.1% 33.8% +330 bps Adjusted Gross Margins* 54.0% 53.4% +60 bps U.S. GAAP R&D as % of Total Revenues 4.8% 5.9% (110 bps) Adjusted R&D* as % of Total Revenues 4.2% 4.6% (40 bps) U.S. GAAP SG&A as % of Total Revenues 23.8% 23.0% +80 bps Adjusted SG&A* as % of Total Revenues 20.3% 21.3% (100 bps) U.S. GAAP Net Earnings (Loss) $245.9 ($3.7) NM Adjusted Net Earnings* $1,721.2 $1,559.1 +10% EBITDA $1,946.1 $1,925.7 +1% Adjusted EBITDA* $2,639.0 $2,480.4 +6% U.S. GAAP Net Cash Provided by Operating Activities $1,195.6 $1,117 +7% Adjusted Net Cash Provided by Operating Activities* $1,633.4 $1,432.4 +14% Capital Expenditures $124.1 (1) $139.6 (11%) Adjusted Free Cash Flow* $1,509.3 $1,292.8 +17% (1) Q3 2020 YTD amount includes $2.0 million of proceeds from sale of certain property, plant and equipment. 5 Q3 2020 Earnings – All Results are Unaudited *Adjusted metrics are non-GAAP financial measures. Please see the Appendix or investor.mylan.com for the most directly comparable U.S. GAAP financial measures and reconciliations of such non-GAAP financial measures to those GAAP measures.

Appendix Q3 2020 Earnings – All Results are Unaudited

Non-GAAP Financial Measures This presentation includes the presentation and discussion of certain financial information that differs from what is reported under U.S. GAAP. These non-GAAP financial measures, including, but not limited to, adjusted gross profit, adjusted gross margins, adjusted net earnings, EBITDA, adjusted EBITDA, adjusted R&D and as a % of total revenues, adjusted SG&A and as a % of total revenues, adjusted earnings from operations, adjusted interest expense, adjusted other (income) expense, net adjusted effective tax rate, notional debt to Credit Agreement Adjusted EBITDA leverage ratio, long-term average debt to Credit Agreement Adjusted EBITDA leverage ratio target, adjusted net cash provided by operating activities, adjusted free cash flow, adjusted capital expenditures, constant currency total revenues, constant currency net sales and adjusted segment profitability for North America are presented in order to supplement investors' and other readers' understanding and assessment of the financial performance of Mylan N.V. (“Mylan” or the “Company”). Mylan has provided reconciliations of such non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures. Investors and other readers are encouraged to review the related U.S. GAAP financial measures and the reconciliations of the non-GAAP measures to their most directly comparable U.S. GAAP measures set forth in this presentation and this appendix, and investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with U.S. GAAP. 7 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Adjusted Net Earnings Three Months Ended Nine months Ended September 30, September 30, (in millions) 2020 2019 2020 2019 U.S. GAAP net earnings (loss) $ 185.7 $ 189.8 $ 245.9 $ (3.7) Purchase accounting related amortization (primarily included in cost of sales) 368.5 408.5 1,072.5 1,283.9 Litigation settlements and other contingencies, net 18.9 (51.9) 36.5 (30.3) Interest expense (primarily clean energy investment financing and accretion of contingent consideration) 5.3 6.6 16.6 20.8 Clean energy investments pre-tax loss 2.9 10.4 37.4 43.6 Acquisition related costs (primarily included in SG&A) (a) 72.3 43.0 218.2 56.6 Restructuring related costs (b) 14.5 0.8 47.0 78.3 Share-based compensation expense 15.1 16.1 49.8 50.9 Other special items included in: Cost of sales (c) 83.6 70.9 299.3 268.1 Research and development expense (d) 3.7 40.3 45.8 100.5 Selling, general and administrative expense 7.5 8.4 12.9 33.1 Other expense, net — — (16.4) — Tax effect of the above items and other income tax related items (98.3) (138.5) (344.3) (342.7) Adjusted net earnings $ 679.7 $ 604.4 $1,721.2 $1,559.1 (a) Acquisition related costs consist primarily of transaction costs including legal and consulting fees and integration activities. The increase for the three and nine months ended September 30, 2020 relates to transaction costs for the pending Combination, including approximately $30.0 million and $115.0 million, respectively, related to the Company’s obligation to reimburse Pfizer for certain financing costs under the Business Combination Agreement (as amended), dated as of July 29, 2019, between Mylan, Pfizer Inc., Upjohn Inc. and certain other affiliated entities and the Separation and Distribution Agreement (as amended), dated as of July 29, 2019, between Pfizer Inc. and Upjohn Inc. (b) For the three months ended September 30, 2020, charges of approximately $8.7 million are included in cost of sales, approximately $0.1 million is included in R&D, and approximately $5.7 million is included in SG&A. For the nine months ended September 30, 2020, charges of approximately $17.6 million are included in cost of sales, approximately $0.3 million is included in R&D, and approximately $29.0 million is included in SG&A. Refer to Note 15 Restructuring included in Part I, Item 1 of our Form 10-Q for the quarter ended September 30, 2020 for additional information. (c) Costs incurred during the three and nine months ended September 30, 2020 include incremental manufacturing variances and site remediation activities as a result of the activities at the Company’s Morgantown plant of approximately $57.8 million and $179.6 million, respectively. In addition, the three and nine months ended September 30, 2020 includes incremental manufacturing variances incurred as a result of the COVID-19 pandemic of approximately $8.0 million and $32.0 million, respectively. Also, the nine months ended September 30, 2020 includes $27.0 million related to a special bonus for plant employees as a result of the COVID-19 pandemic. The three months ended September 30, 2019 includes costs related to incremental manufacturing variances and site remediation activities as a result of the activities at the Company’s Morgantown plant of approximately $50.0 million. The nine months ended September 30, 2019 includes charges for certain incremental manufacturing variances and site remediation activities as a result of the activities at the Company’s Morgantown plant, product recall costs, including inventory write-offs, and charges related to the cancellation of a contract. (d) R&D expense for the three and nine months ended September 30, 2020 consists primarily of amounts for product development arrangements, including with Revance Therapeutics, Inc., of approximately $3.0 million and $41.0 million, respectively. R&D expense for the three months ended September 30, 2019 consists primarily of payments for product development. R&D expense for the nine months ended September 30, 2019 consists primarily of payments for product development arrangements of approximately $46.8 million, including $18.5 million for the expansion of the Yupelri® agreement and $23.3 million related to non-refundable upfront licensing amounts for a product in development. The remaining expense relates to on-going development collaborations. 8 Q3 2020 Earnings – All Results are Unaudited

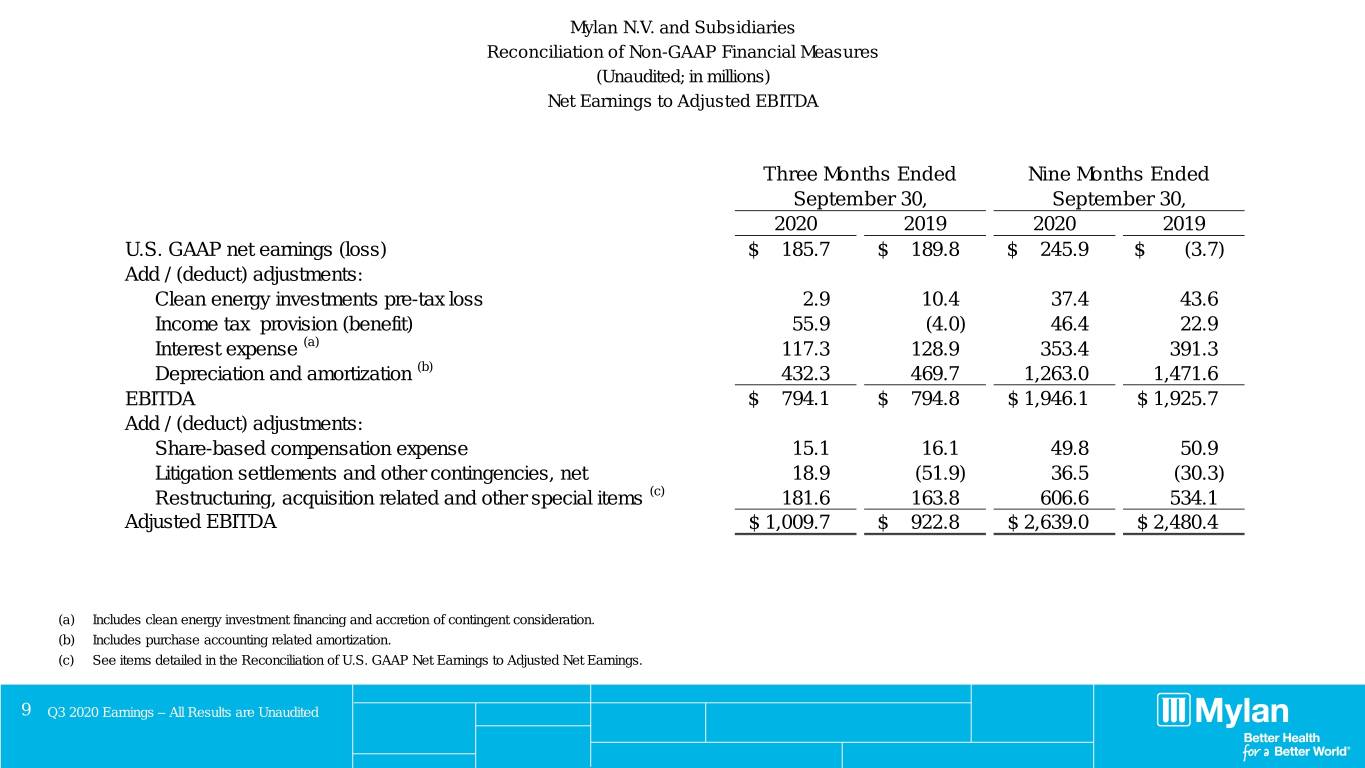

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Net Earnings to Adjusted EBITDA Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP net earnings (loss) $ 185.7 $ 189.8 $ 245.9 $ (3.7) Add / (deduct) adjustments: Clean energy investments pre-tax loss 2.9 10.4 37.4 43.6 Income tax provision (benefit) 55.9 (4.0) 46.4 22.9 Interest expense (a) 117.3 128.9 353.4 391.3 Depreciation and amortization (b) 432.3 469.7 1,263.0 1,471.6 EBITDA $ 794.1 $ 794.8 $ 1,946.1 $ 1,925.7 Add / (deduct) adjustments: Share-based compensation expense 15.1 16.1 49.8 50.9 Litigation settlements and other contingencies, net 18.9 (51.9) 36.5 (30.3) Restructuring, acquisition related and other special items (c) 181.6 163.8 606.6 534.1 Adjusted EBITDA $ 1,009.7 $ 922.8 $ 2,639.0 $ 2,480.4 (a) Includes clean energy investment financing and accretion of contingent consideration. (b) Includes purchase accounting related amortization. (c) See items detailed in the Reconciliation of U.S. GAAP Net Earnings to Adjusted Net Earnings. 9 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Summary of Total Revenues by Segment Three Months Ended September 30, 2020 2020 Constant Constant Currency Currency Currency % 2020 2019 % Change Impact (1) Revenues Change (2) Net sales North America $ 1,028.8 $ 1,088.6 (5)% $ 0.8 $ 1,029.6 (5)% Europe 1,123.8 1,045.9 7 % (57.9) 1,065.9 2 % Rest of World 795.5 793.7 —% 18.7 814.2 3 % Total net sales 2,948.1 2,928.2 1 % (38.4) 2,909.7 (1)% Other revenues (3) 24.0 33.5 (28)% (0.2) 23.8 (29)% Consolidated total revenues (4) $ 2,972.1 $ 2,961.7 —% $ (38.6) $ 2,933.5 (1)% Nine Months Ended September 30, 2020 2020 Constant Constant Currency Currency Currency % 2020 2019 % Change Impact (1) Revenues Change (2) Net sales North America $ 3,023.3 $ 3,035.0 —% $ 4.1 $ 3,027.4 —% Europe 3,080.7 2,930.7 5 % (3.3) 3,077.4 5 % Rest of World 2,128.2 2,241.3 (5)% 92.7 2,220.9 (1)% Total net sales 8,232.2 8,207.0 —% 93.5 8,325.7 1 % Other revenues (3) 90.3 101.7 (11)% — 90.3 (11)% Consolidated total revenues (4) $ 8,322.5 $ 8,308.7 —% $ 93.5 $ 8,416.0 1 % (1) Currency impact is shown as unfavorable (favorable). (2) The constant currency percentage change is derived by translating net sales or revenues for the current period at prior year comparative period exchange rates, and in doing so shows the percentage change from 2020 constant currency net sales or revenues to the corresponding amount in the prior year. (3) For the three months ended September 30, 2020, other revenues in North America, Europe, and Rest of World were approximately $17.4 million, $3.4 million, and $3.2 million, respectively. For the nine months ended September 30, 2020, other revenues in North America, Europe, and Rest of World were approximately $51.8 million, $11.1 million, and $27.4 million, respectively. For the three months ended September 30, 2019, other revenues in North America, Europe, and Rest of World were approximately $17.6 million, $3.8 million, and $12.1 million, respectively. For the nine months ended September 30, 2019, other revenues in North America, Europe, and Rest of World were approximately $58.8 million, $12.3 million, and $30.6 million, respectively. (4) Amounts exclude intersegment revenue that eliminates on a consolidated basis. 10 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Cost of Sales Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP cost of sales $ 1,813.6 $ 1,889.3 $ 5,232.2 $ 5,498.5 Deduct: Purchase accounting amortization and other related items (368.5) (408.6) (1,072.5) (1,284.0) Acquisition related items (9.4) (0.8) (11.5) (2.9) Restructuring and related costs (8.7) (11.4) (17.6) (72.2) Share-based compensation expense (0.4) (0.3) (1.1) (0.8) Other special items (83.6) (70.9) (299.3) (268.1) Adjusted cost of sales $ 1,343.0 $ 1,397.3 $ 3,830.2 $ 3,870.5 Adjusted gross profit (a) $ 1,629.1 $ 1,564.4 $ 4,492.3 $ 4,438.2 Adjusted gross margin (a) 55 % 53 % 54 % 53 % (a) U.S. GAAP gross profit is calculated as total revenues less U.S. GAAP cost of sales. U.S. GAAP gross margin is calculated as U.S. GAAP gross profit divided by total revenues. Adjusted gross profit is calculated as total revenues less adjusted cost of sales. Adjusted gross margin is calculated as adjusted gross profit divided by total revenues. 11 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) R&D Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP R&D $ 129.8 $ 167.9 $ 400.3 $ 488.1 Deduct: Acquisition related costs (0.1) (0.3) (0.3) (0.6) Restructuring and related costs 0.1 0.1 (0.3) — Share-based compensation expense (0.5) (0.6) (1.6) (1.6) Other special items (3.7) (40.3) (45.8) (100.5) Adjusted R&D $ 125.6 $ 126.8 $ 352.3 $ 385.4 Adjusted R&D as % of total revenues 4 % 4 % 4 % 5 % 12 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) SG&A Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP SG&A $ 658.4 $ 632.7 $ 1,983.2 $ 1,909.2 Add / (deduct): Acquisition related costs (62.9) (41.9) (206.5) (53.1) Restructuring and related costs (5.7) 10.5 (29.0) (6.1) Purchase accounting amortization and other related items — 0.1 — 0.1 Share-based compensation expense (14.2) (15.2) (47.1) (48.5) Other special items and reclassifications (7.5) (8.4) (12.9) (33.1) Adjusted SG&A $ 568.1 $ 577.8 $ 1,687.7 $ 1,768.5 Adjusted SG&A as % of total revenues 19 % 20 % 20 % 21 % 13 Q3 2020 Earnings – All Results are Unaudited

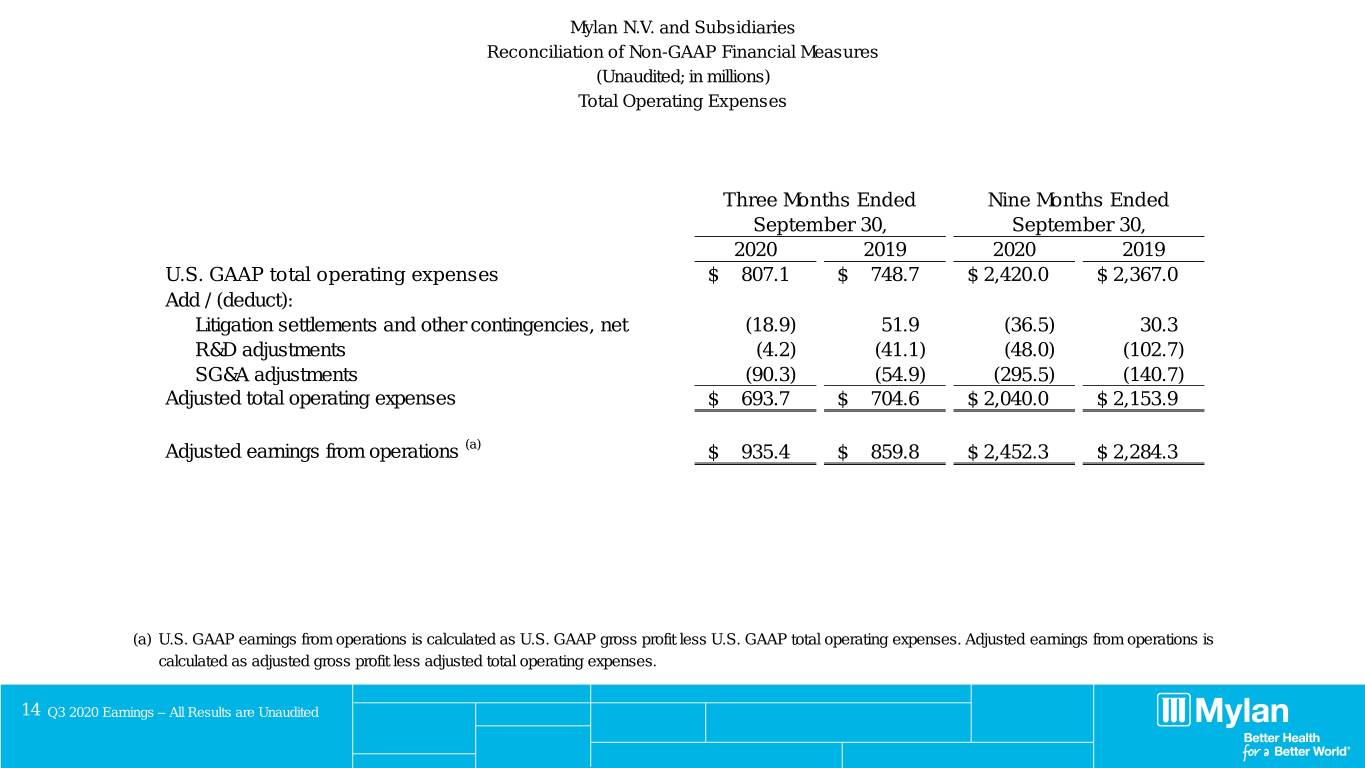

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Total Operating Expenses Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP total operating expenses $ 807.1 $ 748.7 $ 2,420.0 $ 2,367.0 Add / (deduct): Litigation settlements and other contingencies, net (18.9) 51.9 (36.5) 30.3 R&D adjustments (4.2) (41.1) (48.0) (102.7) SG&A adjustments (90.3) (54.9) (295.5) (140.7) Adjusted total operating expenses $ 693.7 $ 704.6 $ 2,040.0 $ 2,153.9 Adjusted earnings from operations (a) $ 935.4 $ 859.8 $ 2,452.3 $ 2,284.3 (a) U.S. GAAP earnings from operations is calculated as U.S. GAAP gross profit less U.S. GAAP total operating expenses. Adjusted earnings from operations is calculated as adjusted gross profit less adjusted total operating expenses. 14 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Interest Expense Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2019 2018 U.S. GAAP interest expense $ 117.3 $ 128.9 $ 353.4 $ 391.3 Deduct: Interest expense related to clean energy investments (0.9) (1.4) (3.0) (4.6) Accretion of contingent consideration liability (3.0) (3.8) (9.4) (12.0) Other special items (1.4) (1.4) (4.2) (4.2) Adjusted interest expense $ 112.0 $ 122.3 $ 336.8 $ 370.5 15 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Other Expense Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP other (income) expense, net $ (7.5) $ 9.0 $ 24.6 $ 32.7 Add / (Deduct): Clean energy investments pre-tax loss (a) (2.9) (10.4) (37.4) (43.6) Other items — — 16.4 — Adjusted other (income) expense, net $ (10.4) $ (1.4) $ 3.6 $ (10.9) (a) Adjustment represents exclusion of activity related to Mylan’s clean energy investments, the activities of which qualify for income tax credits under section 45 of the U.S. Internal Revenue Code of 1986, as amended. 16 Q3 2020 Earnings – All Results are Unaudited

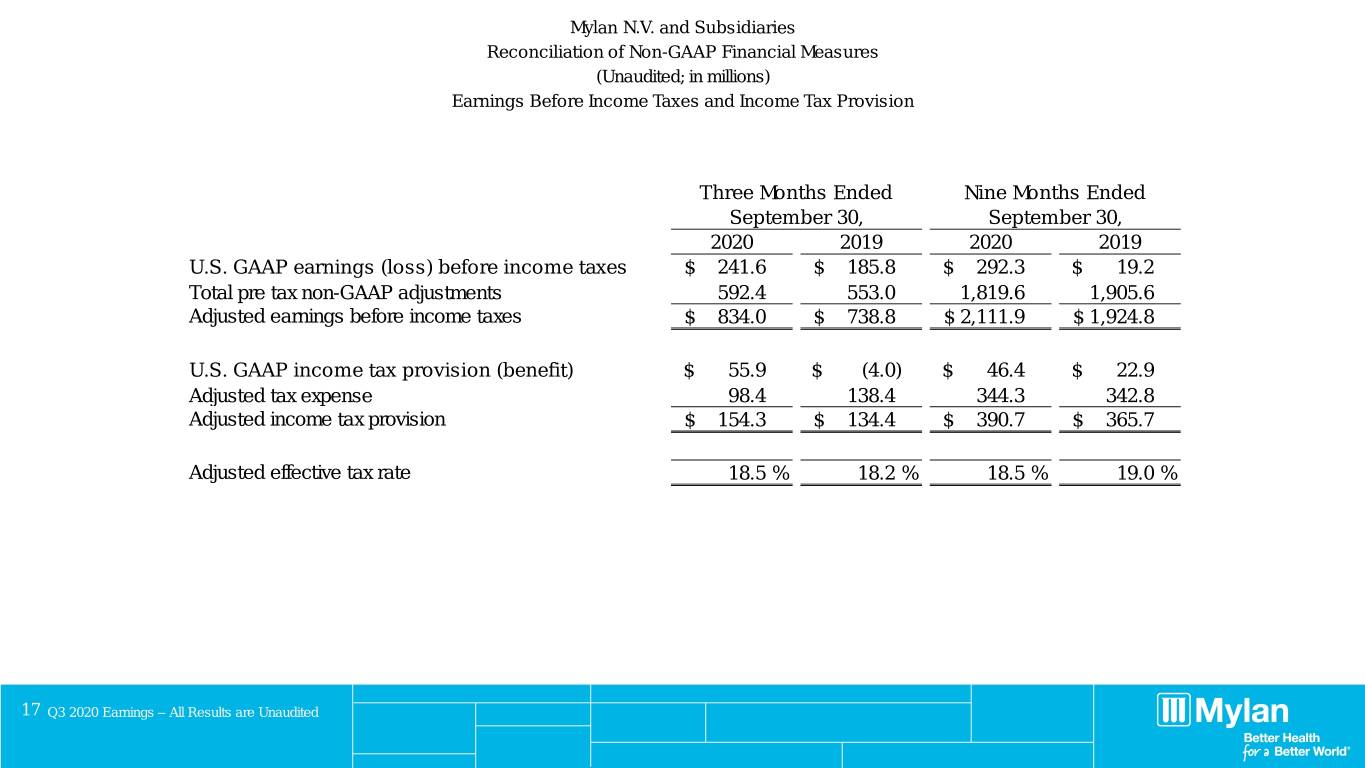

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Earnings Before Income Taxes and Income Tax Provision Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP earnings (loss) before income taxes $ 241.6 $ 185.8 $ 292.3 $ 19.2 Total pre tax non-GAAP adjustments 592.4 553.0 1,819.6 1,905.6 Adjusted earnings before income taxes $ 834.0 $ 738.8 $ 2,111.9 $ 1,924.8 U.S. GAAP income tax provision (benefit) $ 55.9 $ (4.0) $ 46.4 $ 22.9 Adjusted tax expense 98.4 138.4 344.3 342.8 Adjusted income tax provision $ 154.3 $ 134.4 $ 390.7 $ 365.7 Adjusted effective tax rate 18.5 % 18.2 % 18.5 % 19.0 % 17 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Adjusted Net Cash Provided by Operating Activities Three Months Ended Nine Months Ended September 30, September 30, 2020 2019 2020 2019 U.S. GAAP net cash provided by (used in) operating activities $ 525.0 $ 487.8 $ 1,195.6 $ 1,117.0 Add / (deduct): Restructuring and related costs (a) 61.6 58.4 192.3 198.6 Corporate contingencies 1.0 (43.5) 16.2 (50.1) Acquisition related costs 27.1 22.2 80.8 22.2 R&D expense 34.9 59.5 85.1 125.5 Other 18.6 — 63.4 19.2 Adjusted net cash provided by operating activities $ 668.2 $ 584.4 $ 1,633.4 $ 1,432.4 Deduct: Capital expenditures (38.2) (42.3) (126.1) (139.6) Proceeds from sale of property, plant and equipment 0.7 — 2.0 — Adjusted free cash flow $ 630.7 $ 542.1 $ 1,509.3 $ 1,292.8 (a) For the three and nine months ended September 30, 2020 includes approximately $54.6 million and $172.6 million, respectively, of certain incremental manufacturing variances and site remediation expenses as a result of the activities at the Company’s Morgantown plant. 18 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) Net Earnings to Adjusted EBITDA Three Months Ended December 31, March 31, June 30, September 30, 2019 2020 2020 2020 U.S. GAAP net earnings (loss) $ 20.5 $ 20.8 $ 39.4 $ 185.7 Add / (deduct) adjustments: Clean energy investments pre-tax loss 18.5 17.3 17.2 2.9 Income tax (benefit) provision 114.7 9.9 (19.4) 55.9 Interest expense 126.0 119.9 116.2 117.3 Depreciation and amortization 547.7 415.0 415.7 432.3 EBITDA $ 827.4 $ 582.9 $ 569.1 $ 794.1 Add / (deduct) adjustments: Share-based compensation expense 5.9 19.4 15.3 15.1 Litigation settlements and other contingencies, net 8.9 1.8 15.8 18.9 Restructuring, acquisition related and other special items 217.1 146.6 278.4 181.6 Adjusted EBITDA $ 1,059.3 $ 750.7 $ 878.6 $ 1,009.7 19 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) September 30, 2020 Notional Debt to Twelve Months Ended September 30, 2020 Mylan N.V. Adjusted EBITDA as calculated under our Credit Agreement ("Credit Agreement Adjusted EBITDA") Leverage Ratio The stated non-GAAP financial measure September 30, 2020 notional debt to twelve months ended September 30, 2020 Credit Agreement Adjusted EBITDA leverage ratio is based on the sum of (i) Mylan's adjusted EBITDA for the quarters ended December 31, 2019, March 31, 2020, June 30, 2020 and September 30, 2020 and (ii) certain adjustments permitted to be included in Credit Agreement Adjusted EBITDA as of September 30, 2020 pursuant to the revolving credit facility dated as of July 27, 2018 (as amended, supplemented or otherwise modified from time to time), among Mylan Inc., as borrower, the Company, as guarantor, certain affiliates and subsidiaries of the Company from time to time party thereto as guarantors, each lender from time to time party thereto and Bank of America, N.A., as administrative agent (the "Credit Agreement") as compared to Mylan’s September 30, 2020 total debt and other current obligations at notional amounts. Three Months Ended Twelve Months Ended December 31, March 31, June 30, Sepember 30, 2019 2020 2020 2020 Sepember 30, 2020 Mylan N.V. Adjusted EBITDA $ 1,059.3 $ 750.7 $ 878.6 $ 1,009.7 $ 3,698.3 Add: other adjustments including estimated synergies (4.8) Credit Agreement Adjusted EBITDA $ 3,693.5 Reported debt balances: Long-term debt, including current portion $ 12,284.1 Short-term borrowings and other current obligations 1.4 Total $ 12,285.5 Add / (deduct): Net discount on various debt issuances 28.0 Deferred financing fees 52.0 Fair value adjustment for hedged debt (35.4) Total debt at notional amounts $ 12,330.1 Notional debt to Credit Agreement Adjusted EBITDA Leverage Ratio 3.3 Long-term average debt to Credit Agreement Adjusted EBITDA leverage ratio target of ~3.0x The stated forward-looking non-GAAP financial measure, targeted long term average leverage of ~3.0x debt-to-Credit Agreement Adjusted EBITDA, is based on the ratio of (i) targeted long-term average debt, and (ii) targeted long-term Credit Agreement Adjusted EBITDA. However, the Company has not quantified future amounts to develop the target but has stated its goal to manage long-term average debt and adjusted earnings and EBITDA over time in order to generally maintain the target. This target does not reflect Company guidance. 20 Q3 2020 Earnings – All Results are Unaudited

Mylan N.V. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited; in millions) North America Segment Profitability to Adjusted North America Segment Profitability Three Months Ended September 30, 2020 2019 North America Segment Profitability $ 497.9 $ 489.9 Add: Morgantown Restructuring & Remediation Expenses 65.3 58.3 Adjusted North America Segment Profitability $ 563.2 $ 548.2 21 Q3 2020 Earnings – All Results are Unaudited

Q3 2020 Earnings – All Results are Unaudited