Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTE ENERGY CO | dte-20201106.htm |

EXHIBIT 99.1 EEI FINANCIAL CONFERENCE NOVEMBER 9 - 10, 2020

Safe harbor statement The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “would,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This document contains forward-looking statements about DTE Energy’s and DTE Midstream’s financial results and estimates of future prospects, and actual results may differ materially. This document contains forward-looking statements about DTE Energy’s intent to spin-off DTE Midstream and DTE Energy’s preliminary strategic, operational and financial considerations related thereto. The statements with respect to the separation transaction are preliminary in nature and subject to change as additional information becomes available. The separation transaction will be subject to the satisfaction of a number of conditions, including the final approval of DTE Energy’s Board of Directors, and there is no assurance that such separation transaction will in fact occur. Many factors impact forward-looking statements including, but not limited to, the following: risks related to the separation transaction, including that the process of exploring the transaction and potentially completing the transaction could disrupt or adversely affect the consolidated or separate businesses, results of operations and financial condition, that the transaction may not achieve some or all of any anticipated benefits with respect to either business, and that the transaction may not be completed in accordance with DTE Energy’s expected plans or anticipated timelines, or at all; the duration and impact of the COVID-19 pandemic on DTE Energy and customers, impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility of prices in the oil and gas markets on DTE Energy’s gas storage and pipelines operations and the volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility in prices in the international steel markets on DTE Energy’s power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. 2

Overview Spin transaction Long-term growth Environmental, Social and Governance (ESG) Appendix 3

Positioned to deliver significant shareholder value Strategic separation of DTE and Midstream1 • Positions DTE as a predominantly pure-play utility ✓ ~90% of operating earnings2 and investments in utility operations ✓ 5-year utility investment $2 billion higher than prior plan ✓ Delivering clean, safe, reliable and affordable energy in top-tier regulatory environment • Establishes Midstream as an independent, natural gas midstream company ✓ Building on history of success with experienced management team ✓ Providing increased flexibility and opportunity for growth Continuing long track record of delivering value for shareholders with strong performance in 2020; well-positioned for 2021 ✓ Targeting 5% - 7% long-term operating EPS growth from 2020 original guidance midpoint ✓ 2021 operating EPS early outlook provides growth of 7% from 2020 original guidance midpoint ✓ Raising 2021 dividend by 7% while maintaining strong balance sheet and credit profile ✓ Focusing on environmental, social and governance priorities 1. Refers to DTE Midstream business, DTE’s natural gas pipeline, storage and gathering business post-transaction 2. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 4

Overview Spin transaction Long-term growth Environmental, Social and Governance (ESG) Appendix 5

Delivering greater shareholder value by creating a predominantly regulated utility and a uniquely positioned high-quality midstream business • Positions DTE Energy as a high-growth, predominantly pure-play, best-in-class regulated Michigan-based utility • Establishes Midstream as an independent, natural gas midstream company with assets in premium basins connected to major demand markets • Enables each business to pursue separate and distinct strategies led by proven, experienced teams • Positions both companies to generate long-term shareholder value and serve their stakeholders • Provides capital allocation flexibility and capital structures that support distinct business models and growth objectives • Generates a combined dividend that is expected to be higher than DTE’s current, pre-transaction dividend − Expect 8% - 10% post-spin dividend increase from 2021 to 2022 versus planned 6% pre-spin − DTE Energy plans to continue a payout ratio and dividend growth target consistent with pure-play utility companies − Midstream plans to establish a growing dividend with an initial level competitive with midstream peers Unlocks full value of two premier businesses 6

Transaction overview • Spin-off of Midstream designed to be tax-free • Immediately after closing, DTE shareholders will: Structure − Retain current DTE shares − Receive pro-rata dividend of Midstream shares • Expected close mid-year 2021 • Multiple workstreams well underway Timing / approvals • Subject to a Form 10 registration statement being declared effective by the SEC, regulatory approvals and satisfaction of other conditions • Requires final Board of Directors approval DTE Energy Midstream • CEO: Jerry Norcia • CEO Elect: David Slater Leadership • Executive Chairman: Gerry Anderson • Executive Chairman Elect: Robert Skaggs, Jr.1 • Lead Independent Director: Ruth Shaw DTE Energy Midstream • DTE Electric • Pipelines: Vector, Millennium, NEXUS, Birdsboro, Post-transaction • DTE Gas Generation businesses • Power & Industrial Projects and Energy Trading • Storage: Washington complex • Gathering and Laterals: Bluestone, Link, Blue Union / LEAP, Tioga, Michigan Gathering 1. Expected to remain an independent Director of DTE Energy post-transaction 7

Numerous benefits for DTE Energy as a predominantly pure-play regulated utility Enhanced strategic ✓ Premier, predominantly pure-play regulated electric and natural Operating earnings transformation focus gas utility 70% 90% Substantially growing rate base with $17 billion of utility growth ✓ Post- Investments in capital investment, a 13% increase over prior plan growth Today transaction Aligned with aggressive ESG targets, net zero greenhouse gas Diversified Predominantly opportunities ✓ emissions by 2050 energy pure-play company regulated ✓ 5% - 7% operating EPS1 growth target from 2020 original utility guidance midpoint 30% 10% Distinguished growth profiles − Targeting average annual operating earnings growth of 7% - 8% at DTE Electric and 9% at DTE Gas from 2020 original Capital investment guidance midpoint 80% 92% Improved investor ✓ Attracts shareholders desiring predictable, low-risk growth alignment associated with regulated utilities Post- Previous transaction Track record of providing clean, safe, reliable and affordable 5-year plan 2 Seasoned ✓ 5-year plan energy to our customers and being a force for growth in the 2020 - 2024 2021 - 2025 management team communities where we live and serve 20% 8% Competitive ✓ Targeting dividend growth and payout ratio consistent with dividends pure-play utility peers Utility Non-utility 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Excludes Midstream capital 8

Midstream will be well-positioned with experienced leadership and unique, high-quality assets Enhanced strategic ✓ Positioned to be a premier, publicly traded natural gas midstream company with high-quality assets strategically focus located in premium basins connected to major demand markets Experienced ✓ Proven, experienced leadership and highly engaged employees leadership ✓ Among the best safety and reliability rankings in the industry Valuable growth ✓ Highly accretive organic growth on existing platforms opportunities ✓ Contracted growth on Haynesville assets ✓ Assets backed by long-term contracts Distinguished Diversified counterparties with solid credit profile growth profile ✓ ✓ Growing cash flows ✓ Only independent, mid-cap, gas-focused midstream investment opportunity in Marcellus / Utica and Haynesville Better investor Attracts shareholders desiring higher dividends and upside opportunities associated with high-quality midstream alignment ✓ companies Strong capital ✓ Improved flexibility to pursue accretive growth projects structure and Initially targeting ~4x debt / adjusted EBITDA1 and ~2x dividend coverage ratio2 in 2021 dividend policy ✓ 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 2. The dividend coverage ratio represents the total distributable cash flow (“DCF”) divided by total dividends paid to investors. Definition of DCF (non-GAAP) included in the appendix 9

Overview Spin transaction Long-term growth Environmental, Social and Governance (ESG) Appendix 10

Delivering premium results through disciplined planning and management Delivering 2008 - 2019 operating EPS1 CAGR near Delivering total shareholder return2 well above top of Midwest pure-play utility peers industry average 438% 8.1% 7.3% 6.5% 5.6% 5.6% 281% 3.4% 78% 5-year 10-year 15-year Midwest pure-play peers DTE S&P 500 Utilities DTE Continuing strong growth relative to Midwest pure-play peers 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Bloomberg as of 10/31/2020 11

Maintaining operating EPS1 growth of 5% - 7% while becoming a predominantly pure-play utility DTE annualized proforma2 operating EPS excluding Midstream • 7.4% proforma operating EPS growth from 2020 original guidance midpoint to 2021 DTE early outlook midpoint • Continuing 5% - 7% long-term operating EPS growth through significant milestones − Generating 90% of future operating earnings from regulated utilities $5.51 − Delivering higher than targeted 5-year average utility operating earnings growth in early years of plan $5.13 − Converting $1.3 billion of mandatory equity in 2022 − Sunsetting REF business after 2021 2020 2021 2022E 2023E 2024E 2025E original early guidance outlook midpoint midpoint Total DTE operating $6.61 $7.073 EPS midpoint 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Reasonable proxy for DTE operating EPS excluding Midstream; additional disclosures are expected to occur by mid-year 2021 and any post-spin guidance will be provided later in the process 12 3. Guidance is with respect to the current consolidated pre-spin version of DTE; the spin is currently expected to occur by mid-year 2021 and any post-spin guidance will be provided later in the process

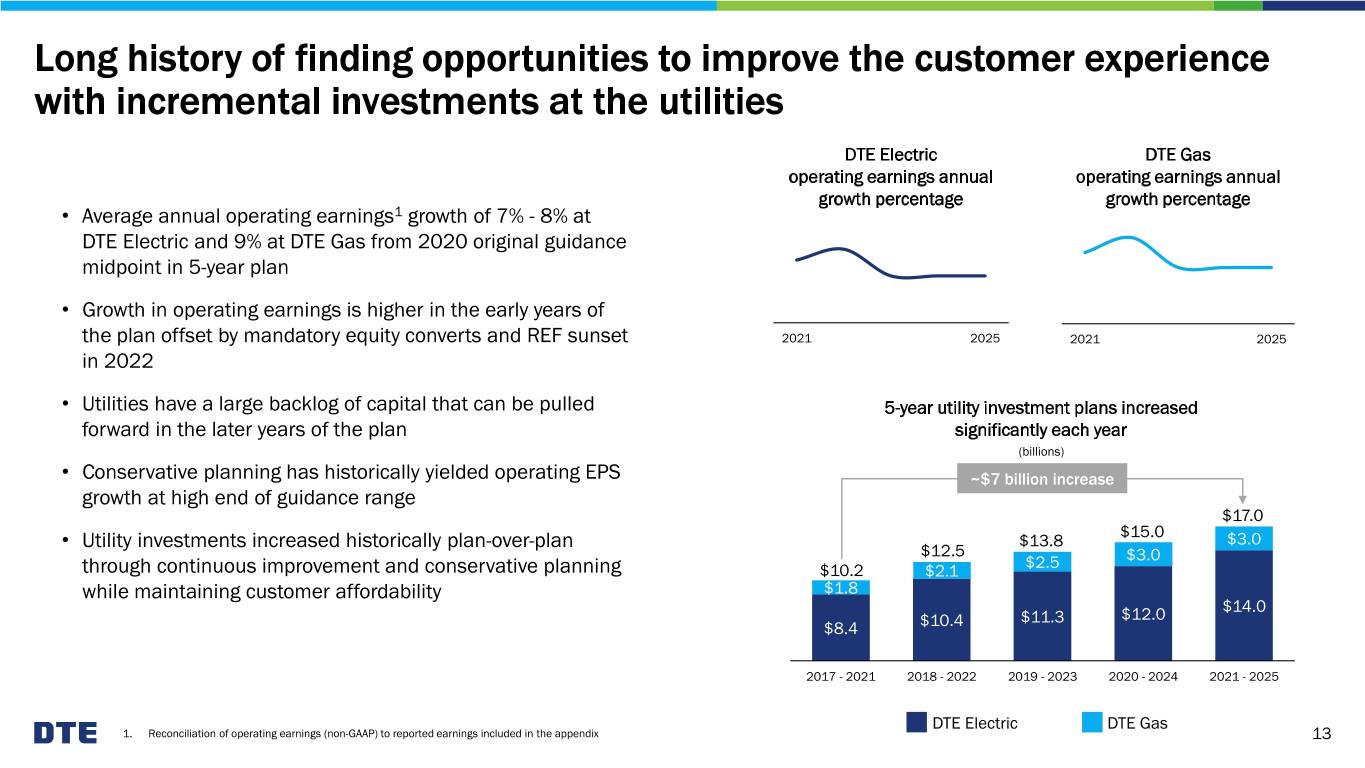

Long history of finding opportunities to improve the customer experience with incremental investments at the utilities DTE Electric DTE Gas operating earnings annual operating earnings annual growth percentage growth percentage • Average annual operating earnings1 growth of 7% - 8% at DTE Electric and 9% at DTE Gas from 2020 original guidance midpoint in 5-year plan • Growth in operating earnings is higher in the early years of the plan offset by mandatory equity converts and REF sunset 2021 2025 2021 2025 in 2022 • Utilities have a large backlog of capital that can be pulled 5-year utility investment plans increased forward in the later years of the plan significantly each year (billions) • Conservative planning has historically yielded operating EPS ~$7 billion increase growth at high end of guidance range $17.0 $15.0 $13.8 $3.0 • Utility investments increased historically plan-over-plan $12.5 $2.5 $3.0 through continuous improvement and conservative planning $10.2 $2.1 while maintaining customer affordability $1.8 $14.0 $11.3 $12.0 $8.4 $10.4 2017 - 2021 2018 - 2022 2019 - 2023 2020 - 2024 2021 - 2025 DTE Electric DTE Gas 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 13

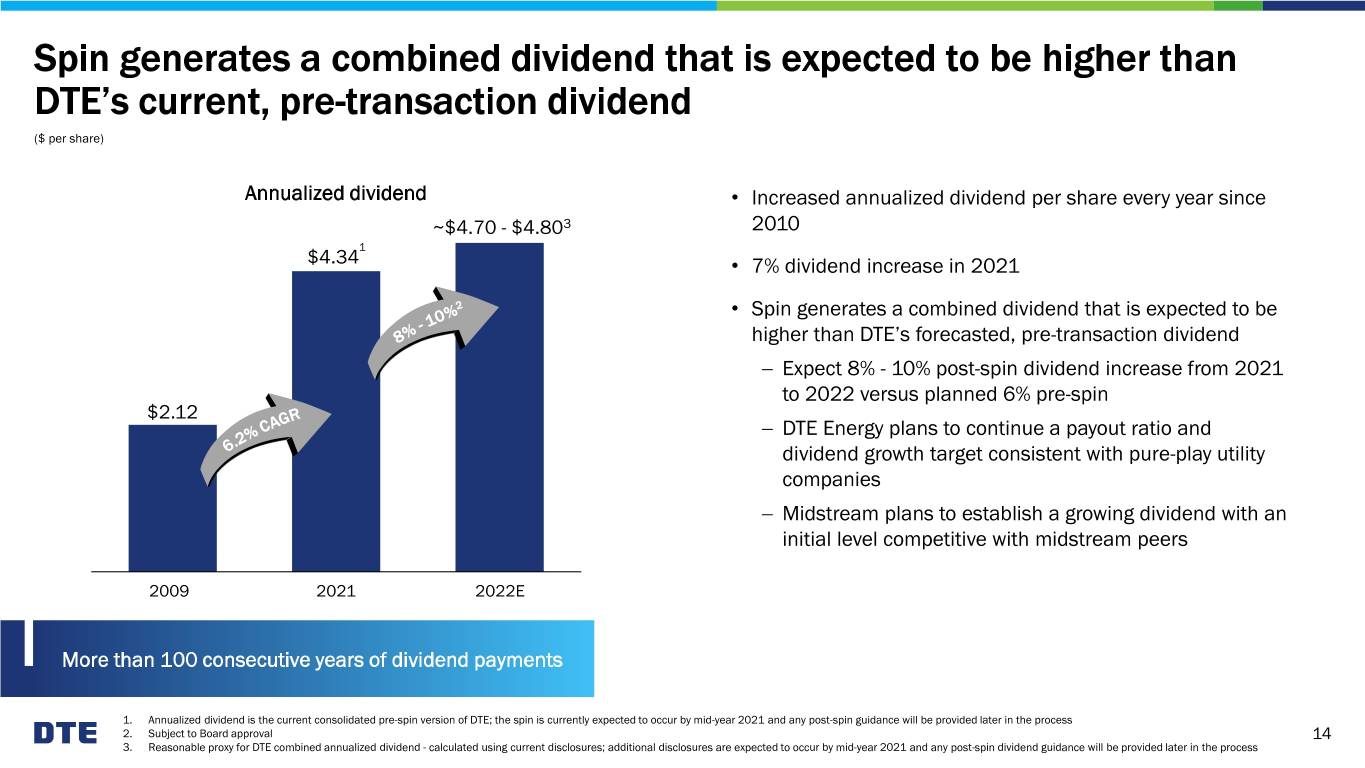

Spin generates a combined dividend that is expected to be higher than DTE’s current, pre-transaction dividend ($ per share) Annualized dividend • Increased annualized dividend per share every year since ~$4.70 - $4.803 2010 1 $4.34 • 7% dividend increase in 2021 • Spin generates a combined dividend that is expected to be higher than DTE’s forecasted, pre-transaction dividend − Expect 8% - 10% post-spin dividend increase from 2021 to 2022 versus planned 6% pre-spin $2.12 − DTE Energy plans to continue a payout ratio and dividend growth target consistent with pure-play utility companies − Midstream plans to establish a growing dividend with an initial level competitive with midstream peers 2009 2021 2022E More than 100 consecutive years of dividend payments 1. Annualized dividend is the current consolidated pre-spin version of DTE; the spin is currently expected to occur by mid-year 2021 and any post-spin guidance will be provided later in the process 2. Subject to Board approval 14 3. Reasonable proxy for DTE combined annualized dividend - calculated using current disclosures; additional disclosures are expected to occur by mid-year 2021 and any post-spin dividend guidance will be provided later in the process

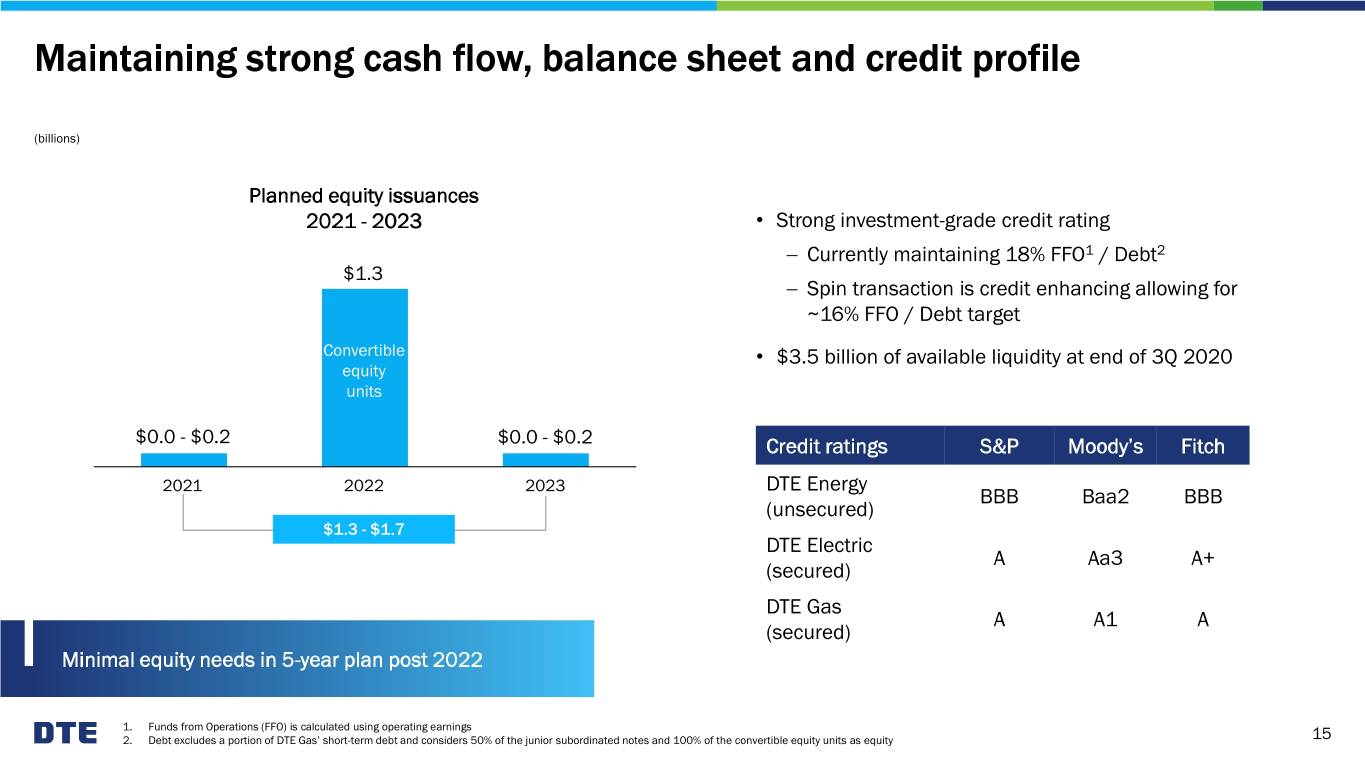

Maintaining strong cash flow, balance sheet and credit profile (billions) Planned equity issuances 2021 - 2023 • Strong investment-grade credit rating − Currently maintaining 18% FFO1 / Debt2 $1.3 − Spin transaction is credit enhancing allowing for ~16% FFO / Debt target Convertible • $3.5 billion of available liquidity at end of 3Q 2020 equity units $0.0 - $0.2 $0.0 - $0.2 Credit ratings S&P Moody’s Fitch 2021 2022 2023 DTE Energy BBB Baa2 BBB (unsecured) $1.3 - $1.7 DTE Electric A Aa3 A+ (secured) DTE Gas A A1 A (secured) Minimal equity needs in 5-year plan post 2022 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 15

Distinctive continuous improvement culture drives strong track record of cost management vs. peer average All 10,000+ employees engaged in CI to surface and Average annual percentage change in O&M costs solve problems 2008 - 2019 Electric utility1 • Controlling costs while improving the customer experience and 2% targeting rate increases below 3% 1% − Productivity enhancements − Technology innovations − Automation DTE Electric Peer average − Infrastructure replacements Gas utility1 − Transition to cleaner energy 3% • Lowered average electric industrial customer rate 11% since 2012 1% DTE Gas Peer average 1. Source: SNL Financial, FERC Form 1 and FERC Form 2; excluding electric fuel and purchase power and gas production expense 16

Two high-quality utilities operating in a constructive regulatory environment Ranking of U.S. regulatory jurisdictions1 DTE Electric ROE (Michigan in tier 1) Tier 1 8 10.3% 10.3% 10.1% 10.0% 10.0% Tier 2 9 2015 2016 2017 2018 2019 Tier 3 18 Authorized ROE Earned ROE DTE Gas ROE Tier 4 9 Tier 5 7 10.5% 10.1% 10.1% 10.0% 10.0% 10-month rate cases supported by legislation; recovery mechanisms for renewables and gas infrastructure; 2015 2016 2017 2018 2019 5-year distribution planning Authorized ROE Earned ROE 1. UBS, March 2020 (50 states and Washington, D.C.) 17

Electric and gas utilities targeting net zero emissions by 2050 DTE Electric delivering clean and reliable energy to customers DTE Electric carbon emissions reductions • 80% carbon emissions reduction by 2040; net zero by 2050 • $3 billion invested in renewable energy since 2009, increasing to nearly $5 billion by 2024 • Renewables to account for 25% - 30% of generated energy by 2030 • Reducing customer usage with energy efficiency programs 32% 50% 80% Net Zero by 2023 by by 2040 by 2050 • Enabling customers to invest in renewable energy and drive Michigan to a Percent Percent emissioncarbon reduction 2030 cleaner energy future DTE Gas working with suppliers, enhancing operations and partnering with 18 customers to achieve net zero greenhouse gas emissions DTE Gas greenhouse gas emissions reductions • Lowering greenhouse gas emissions by more than 6 million metric tons annually 45% • Incorporating emissions reductions as purchasing criteria 65% 80% • Continuing main renewal upgrades and operational improvements 100% • Assisting customers to reduce usage through energy efficiency programs • Exploring new initiatives such as a voluntary emissions offset program and advanced technologies such as hydrogen and carbon capture 2005 2020 2030 2040 2050 18

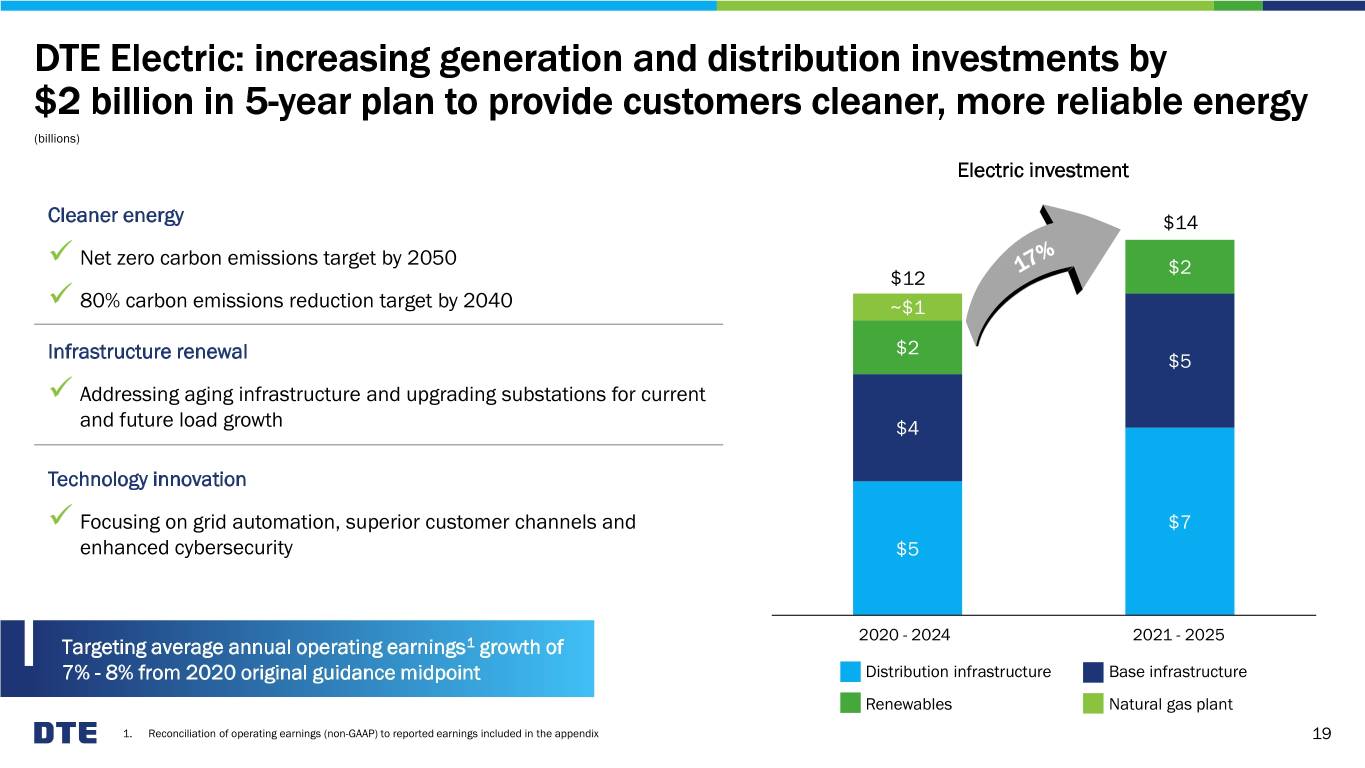

DTE Electric: increasing generation and distribution investments by $2 billion in 5-year plan to provide customers cleaner, more reliable energy (billions) Electric investment Cleaner energy $14 ✓ Net zero carbon emissions target by 2050 $2 $12 ✓ 80% carbon emissions reduction target by 2040 ~$1 $2 Infrastructure renewal $5 ✓ Addressing aging infrastructure and upgrading substations for current and future load growth $4 Technology innovation ✓ Focusing on grid automation, superior customer channels and $7 enhanced cybersecurity $5 2020 - 2024 2021 - 2025 Targeting average annual operating earnings1 growth of 7% - 8% from 2020 original guidance midpoint Distribution infrastructure Base infrastructure Renewables Natural gas plant 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 19

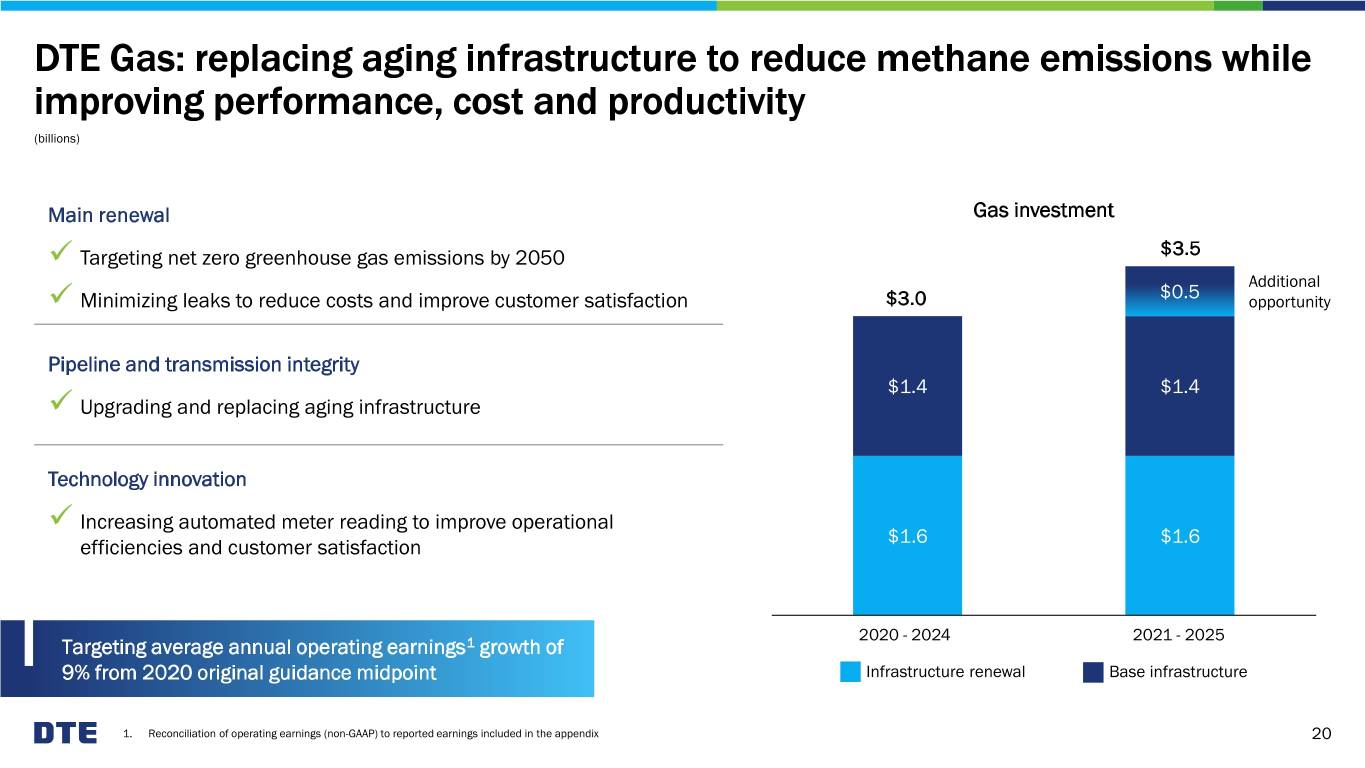

DTE Gas: replacing aging infrastructure to reduce methane emissions while improving performance, cost and productivity (billions) Main renewal Gas investment ✓ Targeting net zero greenhouse gas emissions by 2050 $3.5 Additional $0.5 ✓ Minimizing leaks to reduce costs and improve customer satisfaction $3.0 opportunity Pipeline and transmission integrity $1.4 $1.4 ✓ Upgrading and replacing aging infrastructure Technology innovation ✓ Increasing automated meter reading to improve operational $1.6 $1.6 efficiencies and customer satisfaction 2020 - 2024 2021 - 2025 Targeting average annual operating earnings1 growth of 9% from 2020 original guidance midpoint Infrastructure renewal Base infrastructure 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 20

Midstream: diversified, long-term contracts and well-capitalized balance sheet bolster cash flow quality and growth potential Unique midstream investment opportunity Percentage of revenue from demand-based • Only independent, mid-cap, gas-focused midstream company with contracts or MVCs / flowing gas exposure to the most well-positioned gas basins: Marcellus / Utica and Haynesville and connected to key demand centers 100% Growing cash flows 92% 93% • Over 90% of revenue from contracts with average tenor of 9 - 10 years • Diversified counterparties with solid credit profiles Contract credit provisions • Producers hedged over 75% in 2021 at ~$2.75 Well-capitalized balance sheet and capital discipline • Initially targeting ~4x debt / adjusted EBITDA1 and ~2x dividend Average contract 10 9 10 coverage ratio2 in 2021 tenor (years) Visibility to long-term growth • Organic growth on existing platforms Regulated Gathering Gathering pipelines and pipelines • Best-in-class forecasted free cash flow storage 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 2. The dividend coverage ratio represents the total distributable cash flow (“DCF”) divided by total dividends paid to investors. Definition of DCF (non-GAAP) included in the appendix 21

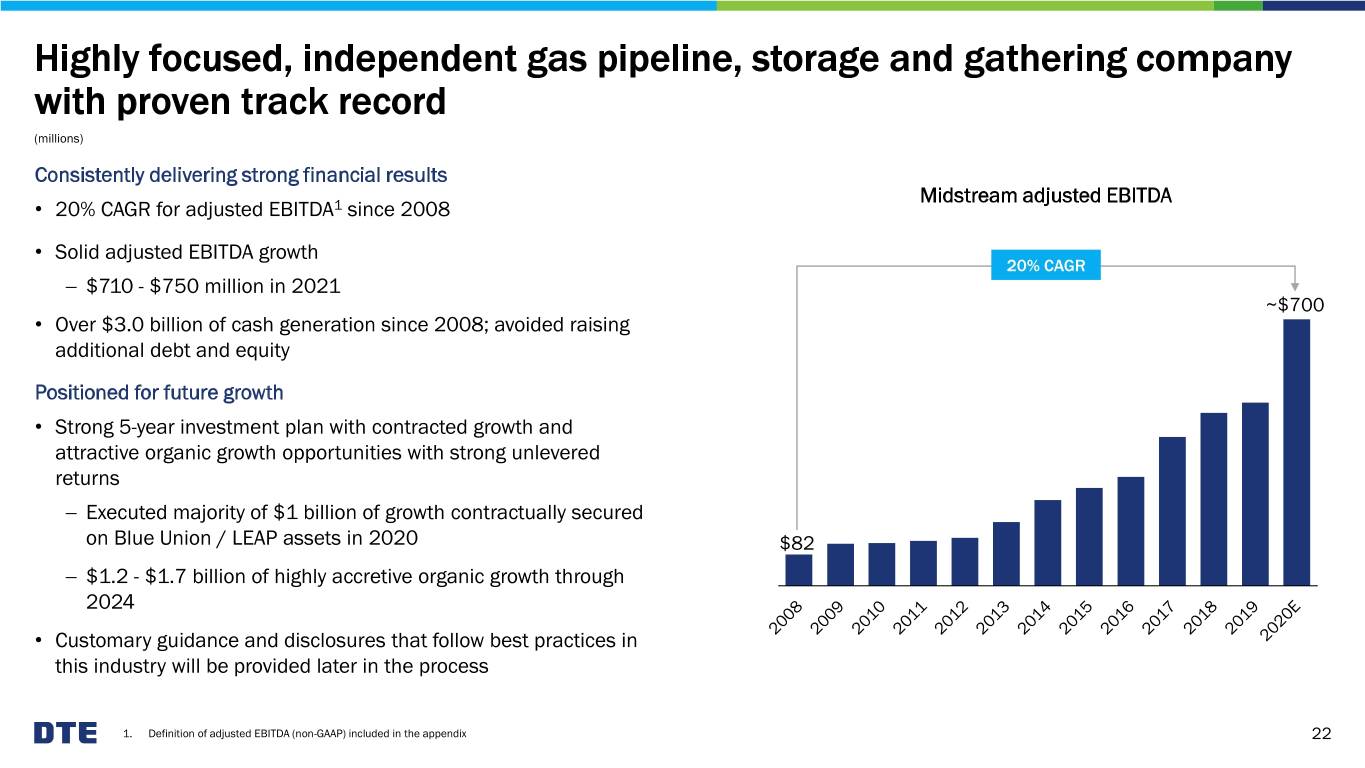

Highly focused, independent gas pipeline, storage and gathering company with proven track record (millions) Consistently delivering strong financial results Midstream adjusted EBITDA • 20% CAGR for adjusted EBITDA1 since 2008 • Solid adjusted EBITDA growth 20% CAGR − $710 - $750 million in 2021 ~$700 • Over $3.0 billion of cash generation since 2008; avoided raising additional debt and equity Positioned for future growth • Strong 5-year investment plan with contracted growth and attractive organic growth opportunities with strong unlevered returns − Executed majority of $1 billion of growth contractually secured on Blue Union / LEAP assets in 2020 $82 − $1.2 - $1.7 billion of highly accretive organic growth through 2024 • Customary guidance and disclosures that follow best practices in this industry will be provided later in the process 1. Definition of adjusted EBITDA (non-GAAP) included in the appendix 22

P&I: operating earnings1 are underpinned by RNG and cogeneration growth opportunities (millions) Operating earnings Industrial energy services $147 - $163 ✓ Developing new cogeneration projects to improve customer $135 - $150 environmental attributes and lower energy costs Renewable energy ✓ Expanding RNG business at landfill and agricultural sites to meet growing demand for carbon reduction 2021 early 2025E Power & Industrial Projects continuing origination success outlook with $1.0 - $1.4 billion 5-year capital investment 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 23

Overview Spin transaction Long-term growth Environmental, Social and Governance (ESG) Appendix 24

Focusing on our employees, customers and communities while delivering on our financial targets Employees • Ensuring the health and safety of our employees • Ranked among the top 3% globally for employee engagement by Gallup • Devoted to diversity, equity, inclusion and a discrimination-free culture for our employees Customers • Delivering safe and reliable energy • Supporting customers with streamlined energy assistance • Ranked in the top 10 nationally for energy efficiency and customer savings • Top quartile at both utilities for residential satisfaction as ranked by J.D. Power Community • Addressing our communities’ most vital needs through philanthropy and volunteerism − Donating resources to provide food, shelter and access to medical services for families • Creating more than 34,000 jobs through local procurement since 2010 • Assisting our most vulnerable customers with 22 customer assistance days and $5 million of donations to outreach agencies in 2019 Investors • 5% - 7% operating EPS1 growth target; 7% dividend increase in 2020 and 2021 • Driving utility growth by investing in utility infrastructure and cleaner energy • Continuing strategic and sustainable growth in non-utility businesses • Ensuring strong balance sheet and liquidity position; delivering on cash flow and capital investment targets 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 25

Environmental, social and governance efforts are key priorities; aspiring to be the best in the industry Environmental Transitioning towards net zero greenhouse gas emissions Delivering clean and reliable energy to customers Protecting our natural resources Social Focusing on the diversity, safety, well-being and success of our employees Committing to a strong culture provides a solid framework for success Revitalizing neighborhoods and investing in communities World-class volunteerism Governance Focusing on the oversight of environmental sustainability, social and governance Ensuring board diversity Providing incentive plans tied to safety and customer satisfaction targets 26

Award-winning commitment to being a top ESG employer in the country Superior corporate citizenship Company diversity Veteran friendly employer Named as one of America’s best and community involvement large employers Gallup Great Workplace Award Inclusion of women-owned Overall excellence 8 consecutive years businesses in their supply chains in diversity 27

Environmental sustainability is critical to the creation of long-term shareholder value Driving collaboration in the fight against climate change • Leading by example with aggressive goal to achieve net zero carbon emissions by 2050 • Active participant in coalitions that advocate for strong environmental public policies • Key participant in Governor Whitmer’s initiative to develop and implement pathways to meet the state of Michigan’s economy-wide climate goals • Leading EEI’s strategic plan for effective federal climate policy Protecting our natural resources and promoting environmental sustainability through stewardship and conservation • Targeting a 25% reduction of energy, water and waste at our facilities by 2022 compared to 2016 levels • Providing habitats for hundreds of species of birds, mammals, fish and insects in our service territory • Over 35 sites certified under the Wildlife Habitat Council • Received Corporate Conservation Leadership award from the Wildlife Habitat Council for leadership in wildlife management • Corporate-wide certification to the ISO14001 Standard for Environmental Management Systems 28

More than doubling renewable energy by 2024 Cleaner generation mix 1% 2% 17% 20% 25 – 30% Renewables 18% 20 - 25% Natural gas 20% 77% 20% Nuclear & other 45% 30% Coal 2005 2023E 2030E River St. Trenton Belle Monroe Rouge Clair Channel River 2021 2022 2030 2040 29

A force for growth and prosperity in the Michigan communities we serve World class volunteerism improves our communities Our efforts include education and mentoring programs and contributes to employee engagement Partnering with a correctional facility to train inmates to Consistently recognized as a top employer become tree trimmers upon their release 1,700 1,000 high school and college individuals with multiple students hired or sponsored barriers to employment in 2019, providing committed to be hired experience in different office over the next five years or skilled trade careers Revitalizing neighborhoods and investing in communities DTE’s commitment to community involvement has led to increasing customer satisfaction ratings and DTE being $11 billion 34,000 named #1 utility in the “Civic 50” by Points of Light purchased from Michigan local jobs have been businesses since 2010 created as a result of 50 Only our investments into companies nationwide company in Michigan to our communities received this honor from be recognized Points of Light 30 30

Helping employees, communities and customers through COVID-19 Employees Successfully implemented work from home for over half of our employees New procedures to ensure plant and employee safety Providing personal protective equipment for employees Communities Led $23 million initiative that provided 51,000 education tablets and internet access to Detroit Public Schools 2 million KN95 masks donated to emergency managers, first responders and hospitals Foundation has contributed over $21 million to COVID-19 relief efforts in addition to annual foundation grants of $20 million Customers DTE trained over 60 employees to guide customers through enrollment process with thousands of customers set to receive State Emergency Relief payments during COVID-19 Significantly streamlined payment plans for customers who were impacted by COVID-19 31

Health and safety of our people is a priority • Multiple safety committees spanning all levels of the company providing input into seasonal safety plans, addressing unique challenges of each business unit • Regular employee safety training − Leading industry OSHA rate in 2020 with recordable injury rate of 0.40 − Established categories of highest risk work and include training on these activities in people’s daily work to mitigate risk of serious injuries − Embedded the concept in our culture that everyone at DTE is “200% accountable for safety” – 100% accountable for their own safety and 100% accountable for the safety of everyone around them • Received American Gas Association Safety Achievement Award for excellence in employee safety • Recognized in the top 2% of companies surveyed in company safety culture by the National Safety Council • Led the development of statewide COVID-19 prevention campaign (Rona4Real) aimed at young adults 32

Committed to diversity, equity and inclusion, creating an environment where all are welcome Office of Diversity, Equity and Inclusion 9 active employee resource groups that promote a safe and • Led by our CEO and key executive leaders welcoming environment, and offer professional development, networking, mentoring and support • Focused on sustaining a diverse workforce which is representative of the communities we serve Commitment to create a diverse, equitable and inclusive workforce and supplier base influences our hiring strategies and business practices Annual review of compensation practices to ensure equitable pay Black professionals LGBTQ group Young professionals • group group • Formal training programs including unconscious bias training for employees and leaders • Hiring people with disabilities and returning citizens • $600 million invested with certified minority and women suppliers in Family oriented Differently-abled Latinx professionals 2019 as part of our award-winning Supplier Diversity Program group group group • Public advocacy and financial support − Michigan civil rights reform − Removing the digital divide − Equity funding for schools Women’s group Asian and Middle Veteran Eastern group empowerment group 33

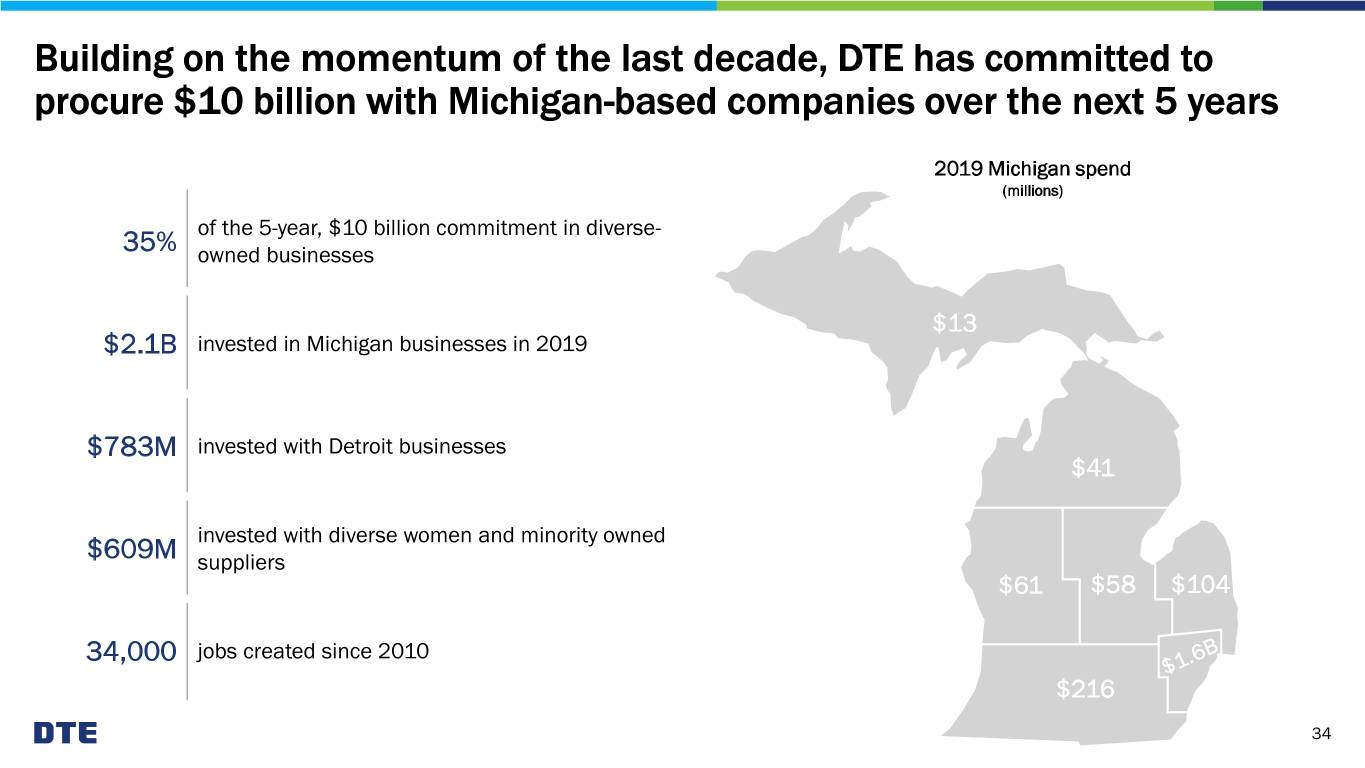

Building on the momentum of the last decade, DTE has committed to procure $10 billion with Michigan-based companies over the next 5 years 2019 Michigan spend (millions) of the 5-year, $10 billion commitment in diverse- 35% owned businesses $13 $2.1B invested in Michigan businesses in 2019 $783M invested with Detroit businesses $41 invested with diverse women and minority owned $609M suppliers $61 $58 $104 34,000 jobs created since 2010 $216 34

Governance framework provides shareholder rights and enables sustainable value creation ✓ Lead Independent Director Stock ownership guidelines for non-employee Directors average Directors added ✓ ~8yr tenure 3 since 2018 ✓ Majority voting standard Board diversity ✓ Annual Director elections Best-in-class 2 83% Established corporate governance guidelines governance ✓ 10 independent practices ✓ Publication of Environmental, Social, Governance and Sustainability report ✓ Shareholder ability to call a special meeting 4 33% gender or 8 ethnically diverse ✓ No supermajority voting provisions to approve mergers or amend charter ✓ Overboard policy 35

Executive management compensation plan is aligned with our core priorities Priorities Performance-based compensation elements Annual incentive metrics Long-term metrics • Employee engagement Highly engaged employees • Employee safety Top decile customer • Customer satisfaction satisfaction • Customer complaints Distinctive continuous • Utility operating excellence improvement capability • Customer satisfaction improvement Strong political & regulatory • Customer satisfaction improvement context • Utility operating excellence index Clear growth & value • Relative TSR creation strategy Superior & sustainable • EPS • Balance sheet health financial performance • Cash flow 36

DTE ESG REPORTS & DISCLOSURES 2019 CDP Climate Change (Link) 2019 CDP Water Security (Link) 2019 Energy Waste Reduction Report (Link) 2019 Health & Well-being Report (Link) 2019 Integrated Resource Plan Summary (Link) 2019 - 2020 Corporate Citizenship Highlights (Link) 2019 - 2020 Task Force on Climate-related Financial Disclosures Report (Link) 2019 - 2020 Sustainability Accounting Standards Board Mapping Report (Link) 2020 Environmental Social Governance and Sustainability Report (Link)

Overview Spin transaction Long-term growth Environmental, Social and Governance (ESG) Appendix 38

Increased 2020 operating EPS1 guidance midpoint 6% (millions, except EPS) Original guidance Revised guidance Significant year-over-year growth DTE Electric $759 - $773 $799 - $813 • Revised guidance provides 14% growth from 2019 original guidance DTE Gas 185 - 193 185 - 193 Guidance increase drivers Gas Storage & Pipelines 277 - 293 288 - 294 • On target with economic response cost Power & Industrial Projects 133 - 148 148 - 154 reductions • Favorable summer weather Energy Trading 15 - 25 35 - 45 • Non-utilities continue to track ahead of plan Corporate & Other (122) - (132) (124) - (130) DTE Energy $1,247 - $1,300 $1,331 - $1,369 On track to exceed operating EPS original Operating EPS $6.47 - $6.75 $6.90 - $7.10 guidance midpoint for 12th consecutive year 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 39

2021 early outlook provides 7% operating EPS1 growth over 2020 original guidance (millions, except EPS) 2021 early outlook Primary drivers DTE Electric $826 - $840 Distribution and cleaner generation investments DTE Gas 202 - 212 Continued main renewal and other infrastructure improvements Gas Storage & Pipelines2 296 - 312 Organic growth on early phase platforms Power & Industrial Projects 147 - 163 New RNG and on-site energy projects Energy Trading 15 - 25 Corporate & Other2 (148) - (138) Increased debt issuances DTE Energy2 $1,338 - $1,414 Operating EPS2 $6.88 - $7.26 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Guidance is with respect to the current consolidated pre-spin version of DTE; the spin is currently expected to occur by mid-year 2021 and any post-spin guidance will be provided later in the process 40

DTE Electric and DTE Gas regulatory update DTE Electric DTE Gas • General rate case final order (U-20561) • General rate case settlement approved August 2020 (U-20642) − Effective: May 15, 2020 − Effective: October 1, 2020 − Rate recovery: $188 million − Rate recovery: $110 million along with $20 million of − ROE: 9.9% accelerated deferred tax amortization − Capital structure: 50% equity, 50% debt − ROE: 9.9% − Rate base: $17.9 billion − Capital structure: 52% equity, 48% debt • Renewable energy plan (U-18232) • Voluntary emissions offset plan (U-20839) − Received order: July 9, 2020 − Received order: October 29, 2020 − 350 MW of additional renewable energy by 2022 (225 MW of − Compromised of a combination of both carbon offsets and wind and 125 MW of solar) Renewable Natural Gas (RNG) − 95% of planned emissions reduction is carbon emissions • Alternative rate case strategy (U-20835) − 5% of planned emissions reduction is RNG − Received order: July 9, 2020 − Delays rate case filing until 2021 • Voluntary renewable plan (U-20713) − Filed: August 31, 2020 − Additional 420 MW of solar by 2022 • Innovative, one-time customer refund regulatory liability (U-20921) − Filed: October 26, 2020 − $30 million voluntary refund − Deferring rate case until May 2021 41

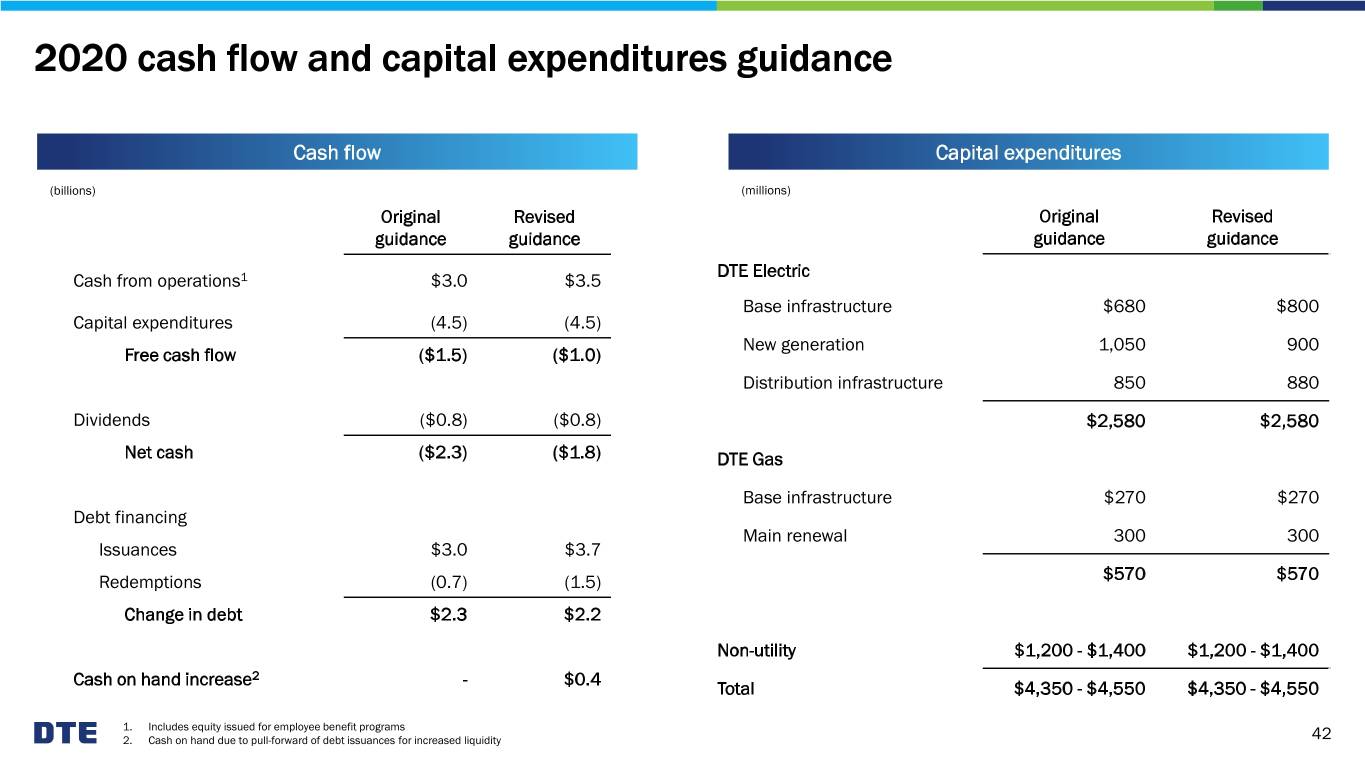

2020 cash flow and capital expenditures guidance Cash flow Capital expenditures (billions) (millions) Original Revised Original Revised guidance guidance guidance guidance DTE Electric Cash from operations1 $3.0 $3.5 Base infrastructure $680 $800 Capital expenditures (4.5) (4.5) New generation 1,050 900 Free cash flow ($1.5) ($1.0) Distribution infrastructure 850 880 Dividends ($0.8) ($0.8) $2,580 $2,580 Net cash ($2.3) ($1.8) DTE Gas Base infrastructure $270 $270 Debt financing Main renewal 300 300 Issuances $3.0 $3.7 Redemptions (0.7) (1.5) $570 $570 Change in debt $2.3 $2.2 Non-utility $1,200 - $1,400 $1,200 - $1,400 2 Cash on hand increase - $0.4 Total $4,350 - $4,550 $4,350 - $4,550 1. Includes equity issued for employee benefit programs 2. Cash on hand due to pull-forward of debt issuances for increased liquidity 42

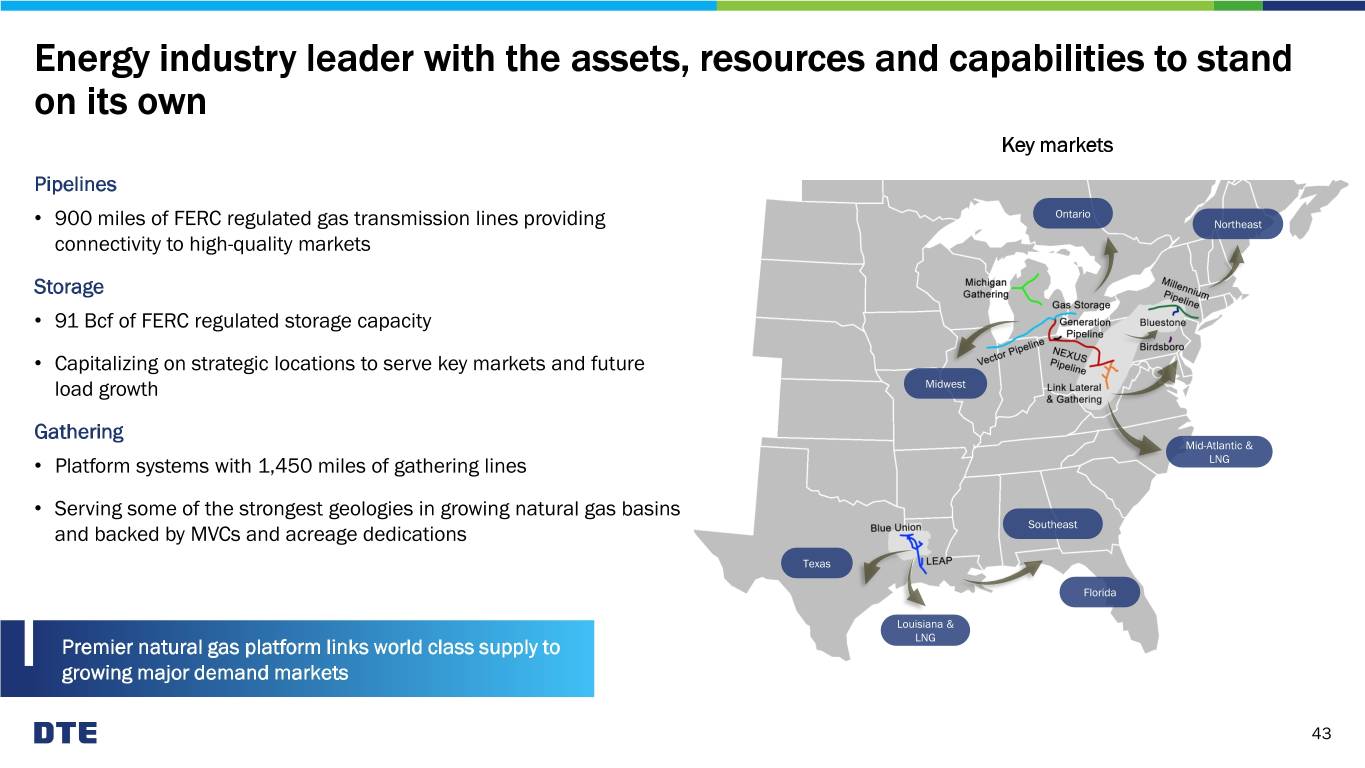

Energy industry leader with the assets, resources and capabilities to stand on its own Key markets Pipelines Ontario • 900 miles of FERC regulated gas transmission lines providing Northeast connectivity to high-quality markets Storage • 91 Bcf of FERC regulated storage capacity • Capitalizing on strategic locations to serve key markets and future load growth Midwest Gathering Mid-Atlantic & • Platform systems with 1,450 miles of gathering lines LNG • Serving some of the strongest geologies in growing natural gas basins and backed by MVCs and acreage dedications Southeast Texas Florida Louisiana & Premier natural gas platform links world class supply to LNG growing major demand markets 43

Visibility into highly accretive Midstream growth projects Platforms Regulation Phase Growth opportunities Blue Union Early Gathering build-outs Gathering build-outs / compression / LEAP System Early market connections NEXUS Pipeline FERC Early Compression / market connections Generation Pipeline PUCO1 Early Market connections Link Lateral and Gathering Early / Mid Gathering build-outs Bluestone Advanced Market connections Compression / Vector Pipeline FERC Advanced bi-directional service / market connections Compression / Millennium Pipeline FERC Advanced bi-directional service / market connections Storage MPSC / FERC Advanced Compression 1. Public Utility Commission of Ohio 44

Adjusted EBITDA and distributable cash flow (DCF) are non-GAAP measures (millions) Adjusted EBITDA is calculated using net income, the most comparable GAAP measure and adding back expenses for interest, taxes, depreciation and amortization. Adjusted EBITDA also includes an adjustment for DTE’s proportional share of joint venture net income, excluding taxes and depreciation. DCF is calculated as Adjusted EBITDA less pre-tax interest expense, maintenance capital investment and cash taxes. For GSP, DTE Energy management believes that Adjusted EBITDA is a meaningful disclosure to investors as it is more commonly used as the primary performance measurement for external communications with analysts and investors in the Midstream industry. DCF is used in the calculation of dividend coverage ratios, which DTE Energy management believes is another meaningful performance measurement to disclose to Midstream analysts and investors. Reconciliation of net income to Adjusted EBITDA or DCF as projected for full-year 2020 is not provided. We do not forecast net income as we cannot, without unreasonable efforts, estimate or predict with certainty the components of net income. These components, net of tax, may include, but are not limited to, impairments of assets and other charges, divesture costs, acquisition costs, or changes in accounting principles. All of these components could significantly impact such financial measures. At this time, management is not able to estimate the aggregate impact, if any, of these items on future period reported earnings. Accordingly, we are not able to provide a corresponding GAAP equivalent for Adjusted EBITDA or DCF. 2008 Gas Storage & Pipelines Reported earnings $ 38 Interest expense 6 Income taxes 24 Depreciation, depletion & amortization 5 Adjustment for joint venture net income 9 Adjusted EBITDA $ 82 45

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 46