Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clearfield, Inc. | f8k_110620.htm |

Exhibit 99.1

Good afternoon. Welcome to Clearfield’s fiscal fourth quarter and full year 2020 earnings conference call. My name is _____, and I will be your operator this afternoon.

Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions.

I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD The Industry Leader in Craft Friendly Fiber Optic Management and Connectivity Solutions Fiscal Q4 and FY 2020 Earnings Call FieldReport

Please note that during this call, management will be making forward-looking statements regarding future events and the future financial performance of the Company. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements.

It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward-looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10-K filing with the Securities and Exchange Commission and its subsequent filings on Form 10-Q provides descriptions of those risks. As a reminder, the slides in this presentation are not controlled by the speaker but rather by you, the listener. Please advance forward through the presentation as the speakers present their remarks.

With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek.

Please proceed.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “est ima te,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements includ e, for example, statements about the expected impact of COVID - 19 and related economic uncertainty, the Company’s future revenue and operating pe rformance, the impact of the CARES Act or other government programs on the demand for the Company’s products or timing of customer orders , and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important fac tors could have a material impact on the Company's performance, including, without limitation: the as yet - unknown impact of COVID - 19 and related economic uncertainty; to compete effectively, we must continually improve existing products and introduce new products that achieve ma rke t acceptance; our expected growth is based upon the expansion of the telecommunications market; our operating results may fluctuate significant ly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our suc cess depends upon adequate protection of our patent and intellectual property rights; intense competition in our industry may result in price r edu ctions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from co mpleting customer orders, all of which could materially harm our business; a significant percentage of our sales in the last three fiscal years ha ve been made to a small number of customers, and the loss of these major customers or significant decline in business with these major customers woul d a dversely affect us; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency o f b usiness combinations and related integration activities; we may be subject to risks associated with acquisitions that could adversely af fect future operating results; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our busi nes s is dependent on effective management information systems and information technology infrastructure; our results of operations could be advers ely affected by economic conditions and the effects of these conditions on our customers’ businesses; changes in government funding programs may cause our customers and prospective customers to delay or reduce purchases; and other factors set forth in Part I, Item IA. Risk Factor s o f Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2019 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2020 Clearfield, Inc. All Rights Reserved. NASDAQ:CLFD 2

Good afternoon and thank you everyone for joining us today. I hope you are all continuing to stay safe and healthy. It’s a pleasure to speak with you this afternoon to share Clearfield’s results for the fiscal fourth quarter and full year 2020.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Welcome Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 3

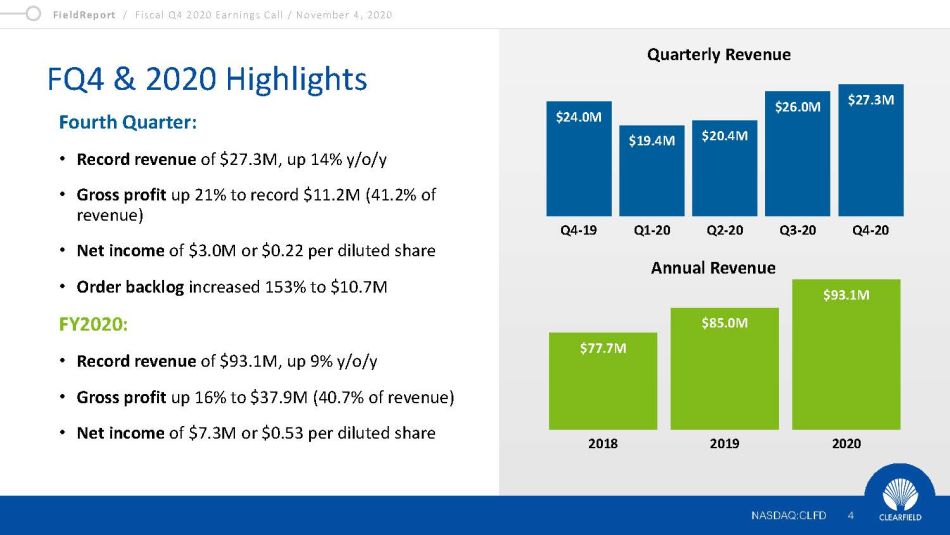

The fourth quarter of fiscal 2020 capped off a record year for Clearfield. From a topline standpoint, this fourth quarter marked the highest quarterly revenue level in our company’s history, bringing our total revenue for the fiscal year 2020 to a record $93.1 million. An integral part of our success has been our employees’ unwavering commitment to providing best-in-class products and customer support, and none of this could have been accomplished without their dedication to our mission.

Looking more specifically at our fourth quarter for fiscal 2020 results, the $27.3 million in revenue we reported was up 14% year-over-year. This robust growth was driven by solid contributions from our MSO and Community Broadband markets, which were up 51% and 25% year-over-year, respectively.

The record topline performance in FY 20 Q4 also helped to drive solid gross profit, which totaled $11.2 million. As a percentage of revenue, the 41.2% margin marked the second highest gross profit margin we’ve achieved as a company in more than two years, just behind the 41.5% we reported last quarter.

From a profitability standpoint, we generated $3.0 million in net income.

We ended the year with a robust order backlog totaling a record $10.7 million, up 153% year-over-year, providing clear visibility into growth in the new fiscal year. I am also encouraged to report that we continue to book at industry-best lead times for our standard products as well.

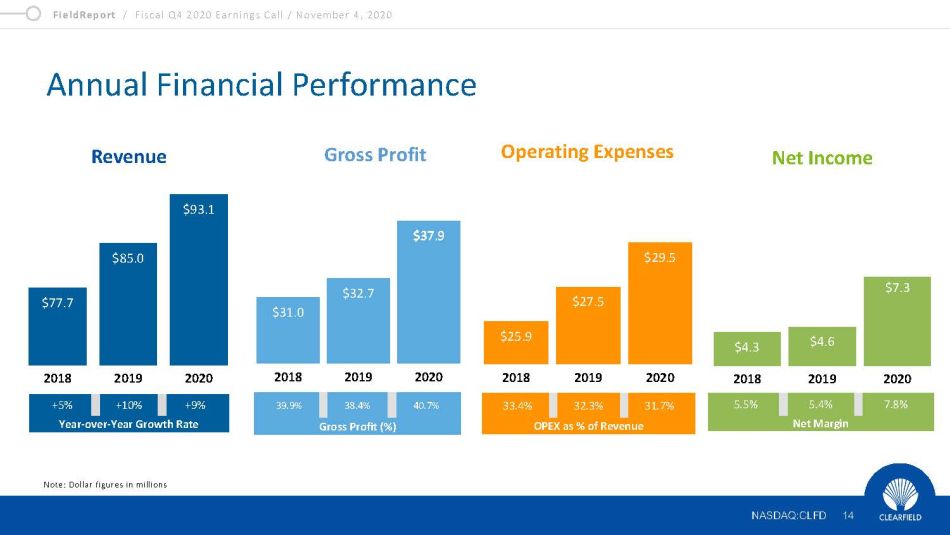

Our solid performance in the fourth quarter drove several additional and noteworthy record results for the year. In addition to the $93.1 million we generated in revenue, we produced record gross profit of $37.9 million, which totaled 40.7% of total revenue. We also realized strong bottom-line results, generating $7.3 million in net income, or $0.53 per diluted share.

The market for Clearfield products was exceptionally strong in the second half of the year, and that strength has carried into our new fiscal year. Along that line, I’d like to spend a moment reviewing some of our recent operational updates and progress in our core end markets. Then, our CFO Dan Herzog will walk you through our financial performance in more detail.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD FQ4 & 2020 Highlights NASDAQ:CLFD 4 Fourth Quarter: • Record revenue of $27.3M, up 14% y/o/y • Gross profit up 21% to record $11.2M (41.2% of revenue) • Net income of $3.0M or $0.22 per diluted share • Order backlog increased 153% to $10.7M FY2020: • Record revenue of $93.1M, up 9% y/o/y • Gross profit up 16% to $37.9M (40.7% of revenue) • Net income of $7.3M or $0.53 per diluted share $24.0M $19.4M $20.4M $26.0M $27.3M Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Quarterly Revenue $77.7M $85.0M $93.1M 2018 2019 2020 Annual Revenue

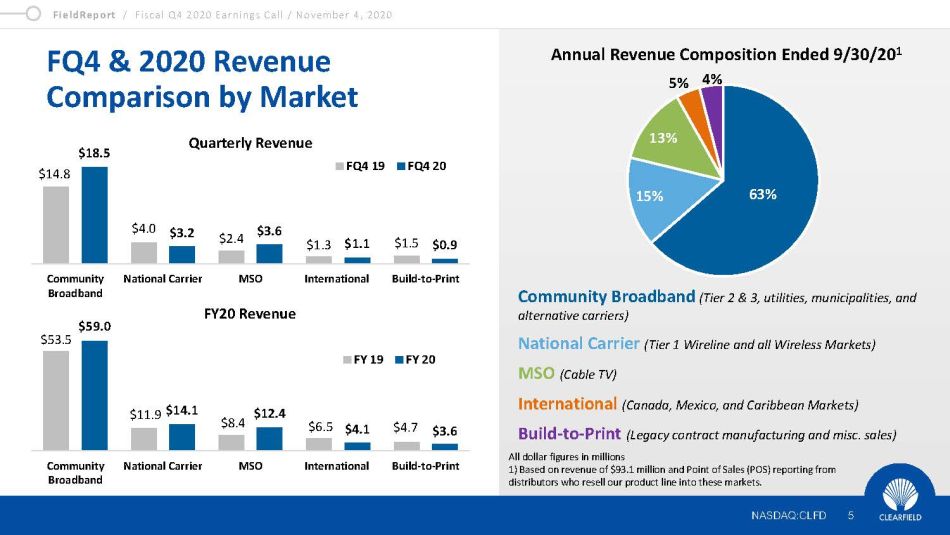

Let’s look at our market segments by revenue, starting first with our core Community Broadband market. In the fourth quarter, we generated revenue of $18.5 million, which was up 25% from the same period last year. For the full fiscal year ended September 30, 2020, Community Broadband market revenue totaled $59 million, which was up 10% from the comparable period last year.

Our MSO business, comprised 13% of our total revenue in fiscal Q4. From a growth standpoint, we built on the momentum we established over the last several quarters, realizing a 51% year-over-year increase in revenue to $3.6 million in Q4 and a 48% year-over-year increase to $12.4 million for fiscal 2020.

Revenue in our National Carrier market was up 18% year-over-year to $14.1 million for the full fiscal year. As I’ve

talked about on past FieldReports, the growth we’re seeing in the National Carrier market is related to the continued demand

from fiber-to-the-home and fiber-to-the-business applications. Due to ordering cycles, revenue for the fourth quarter was down

19% year-over-year to $3.2 million.

Revenue in our International market was down 16% year-over-year in the fourth quarter, and down 37% year-over-year for the full fiscal year.

Revenue in our legacy Build-to-Print business was down 41% year-over-year in Q4 and down 24% year-over-year for the full fiscal year 2020. Revenue remains near the $4.0 million level which is consistent with our expectations for the year.

With that, I’ll now turn the presentation over to Dan, who will walk us through our financial performance for the fourth quarter and full fiscal year of 2020.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD FQ4 & 2020 Revenue Comparison by Market NASDAQ:CLFD 5 All dollar figures in millions 1) Based on revenue of $93.1 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. Annual Revenue Composition Ended 9/30/20 1 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Canada, Mexico, and Caribbean Markets) Build - to - Print (Legacy contract manufacturing and misc. sales) 63% 15% 13% 5% 4% $53.5 $11.9 $8.4 $6.5 $4.7 $14.1 $12.4 $4.1 $3.6 Community Broadband National Carrier MSO International Build-to-Print FY 19 FY 20 Quarterly Revenue FY20 Revenue $14.8 $4.0 $2.4 $1.3 $1.5 $18.5 $3.2 $3.6 $1.1 $0.9 Community Broadband National Carrier MSO International Build-to-Print FQ4 19 FQ4 20 $59.0

Thank you, Cheri, and good afternoon, everyone.

Now, looking at our fourth quarter financial results in more detail…

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Financial Update Dan Herzog CHIEF FINANCIAL OFFICER NASDAQ:CLFD 6

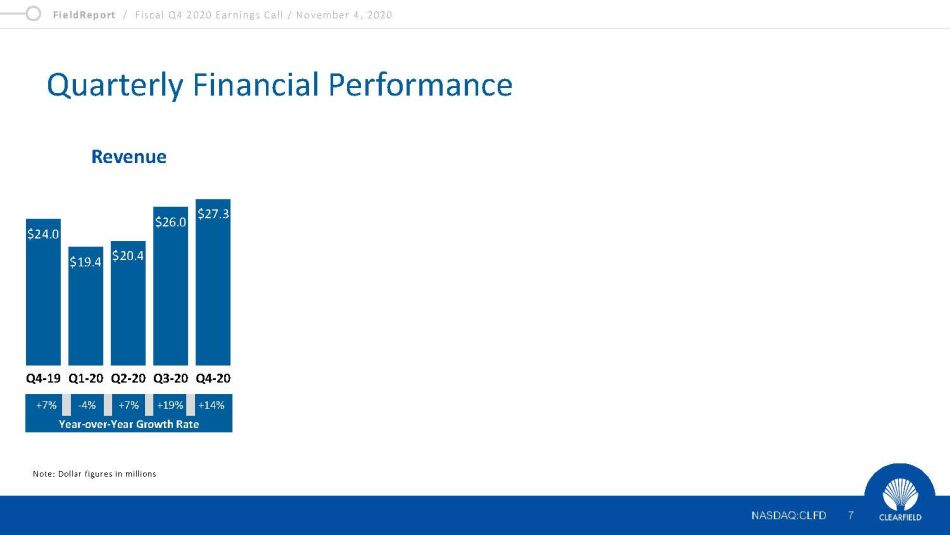

Our revenue in the fourth quarter of fiscal 2020 increased 14% to $27.3 million from $24.0 million in the same year-ago period. The increase in revenue was primarily due to higher sales in our Community Broadband and MSO markets, partially offset by lower National Carrier and International sales as Cheri just mentioned.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Quarterly Financial Performance 7 NASDAQ:CLFD Note: Dollar figures in millions $24.0 $19.4 $20.4 $26.0 $27.3 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Revenue +7% - 4% +7% +19% +14% Year - over - Year Growth Rate

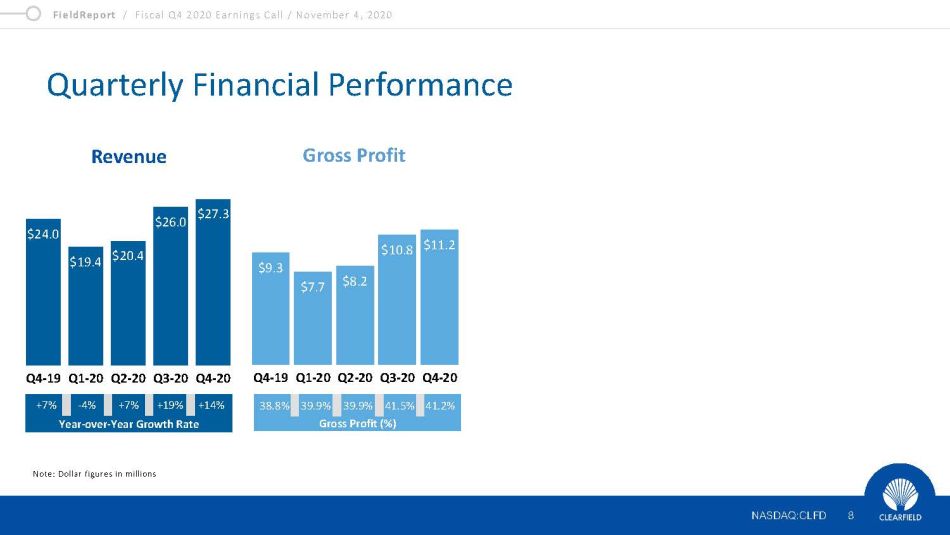

Gross profit for the fourth quarter of fiscal 2020 totaled $11.2 million, or 41.2% of total revenue. This was an improvement from $9.3 million, or 38.8% of total revenue, in the fourth quarter last year. The increase in gross profit dollars was due to increased sales volume. The increase in gross margin was due to a more favorable product mix and cost reduction efforts across our product lines, as well as expanded use of our Mexico manufacturing plants which included adding a second facility in the second quarter of fiscal 2020, also efficiencies realized from our supply chain programs, and lower tariff costs.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Quarterly Financial Performance 8 NASDAQ:CLFD Note: Dollar figures in millions $24.0 $19.4 $20.4 $26.0 $27.3 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Revenue +7% - 4% +7% +19% +14% Year - over - Year Growth Rate $9.3 $7.7 $8.2 $10.8 $11.2 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Gross Profit 38.8% 39.9% 39.9% 41.5% 41.2% Gross Profit (%)

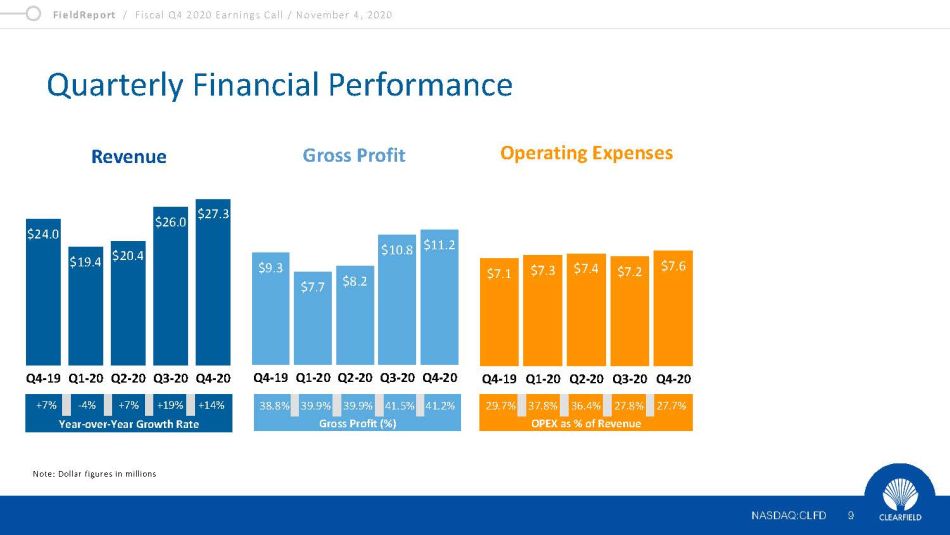

Our operating expenses for the fourth quarter of fiscal 2020 were $7.6 million, which were up from $7.1 million in the same year-ago quarter. As a percentage of total revenue, operating expenses in FY 20 Q4 were 27.7% compared to 29.7% in the same year-ago period. The increase in operating expense dollars was primarily due to higher costs related to performance compensation accruals.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Quarterly Financial Performance 9 NASDAQ:CLFD Note: Dollar figures in millions $24.0 $19.4 $20.4 $26.0 $27.3 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Revenue +7% - 4% +7% +19% +14% Year - over - Year Growth Rate $9.3 $7.7 $8.2 $10.8 $11.2 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Gross Profit 38.8% 39.9% 39.9% 41.5% 41.2% Gross Profit (%) 29.7% 37.8% 36.4% 27.8% 27.7% OPEX as % of Revenue $7.1 $7.3 $7.4 $7.2 $7.6 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Operating Expenses

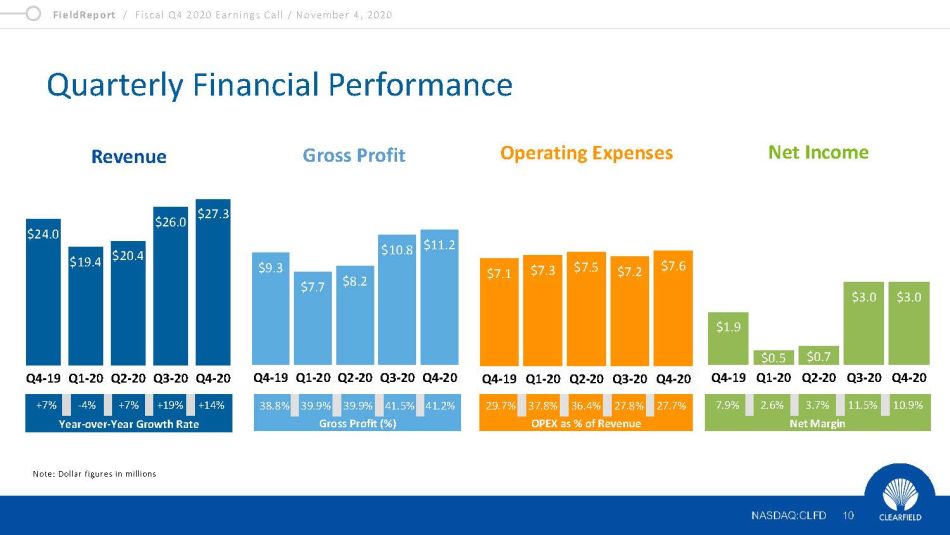

In terms of our profitability measures, income from operations was $3.7 million in the fourth quarter of fiscal 2020, which compares to $2.2 million in the same year-ago quarter. Income tax expense increased to $786,000 in the fourth quarter of fiscal 2020, up from $511,000 in the fourth quarter of 2019. Net income totaled $3.0 million, or $0.22 per diluted share, an improvement from $1.9 million, or $0.14 per diluted share, in the same year-ago quarter.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Quarterly Financial Performance 10 NASDAQ:CLFD Note: Dollar figures in millions $24.0 $19.4 $20.4 $26.0 $27.3 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Revenue +7% - 4% +7% +19% +14% Year - over - Year Growth Rate $9.3 $7.7 $8.2 $10.8 $11.2 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Gross Profit 38.8% 39.9% 39.9% 41.5% 41.2% Gross Profit (%) 29.7% 37.8% 36.4% 27.8% 27.7% OPEX as % of Revenue $7.1 $7.3 $7.5 $7.2 $7.6 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Operating Expenses 7.9% 2.6% 3.7% 11.5% 10.9% Net Margin $1.9 $0.5 $0.7 $3.0 $3.0 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Net Income

Turning now to our annual results....

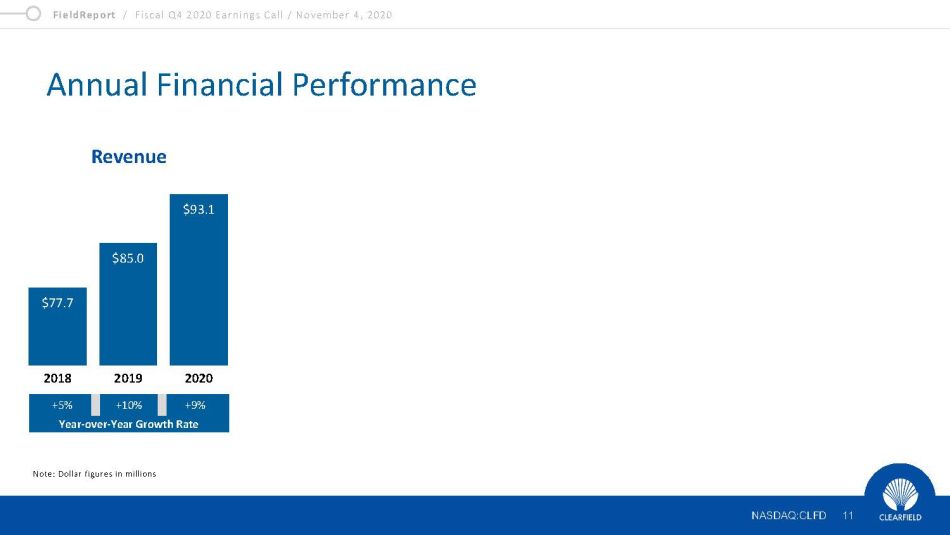

Revenue for fiscal 2020 increased 9% to $93.1 million from $85.0 million in fiscal 2019. As Cheri mentioned, the increase in revenue was driven by growth across our key markets, especially from our Community Broadband customers, which was up 25% or approximately $3.7 million compared to the prior year.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Annual Financial Performance 11 NASDAQ:CLFD Note: Dollar figures in millions $77.7 $85.0 $93.1 2018 2019 2020 Revenue +5% +10% +9% Year - over - Year Growth Rate

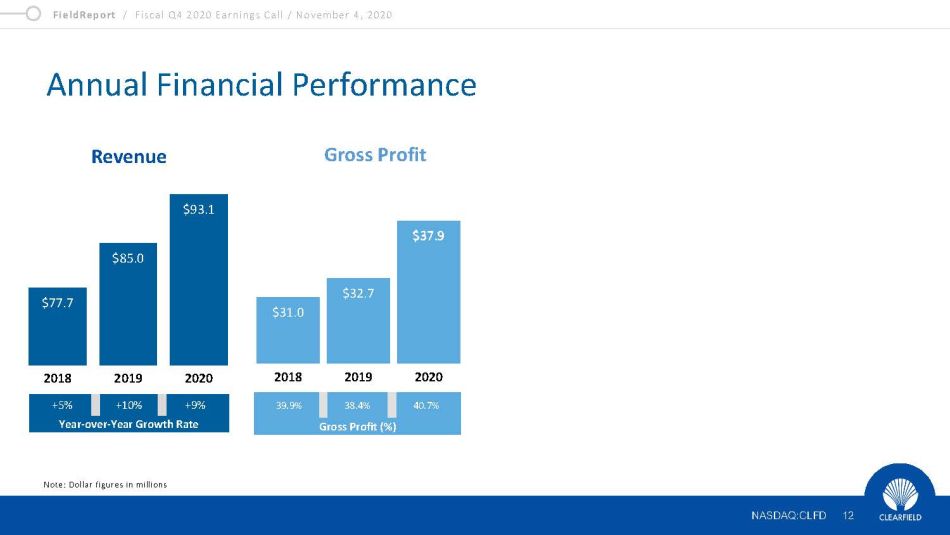

Gross profit for fiscal 2020 totaled $37.9 million, or 40.7% of total revenue. On a dollar basis, this was a 16% improvement from the $32.7 million, or 38.4% of total revenue, we reported in fiscal 2019.The increase in gross profit dollars was due to increased sales volume. The increase in gross profit percent was due to a favorable product mix and cost reduction efforts across the Company’s product lines, including increased production at its Mexico manufacturing plants and efficiencies realized from supply chain programs, and lower tariff costs.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Annual Financial Performance 12 NASDAQ:CLFD Note: Dollar figures in millions $77.7 $85.0 $93.1 2018 2019 2020 Revenue $31.0 $32.7 $37.9 2018 2019 2020 Gross Profit 39.9% 38.4% 40.7% Gross Profit (%) $37.9 +5% +10% +9% Year - over - Year Growth Rate

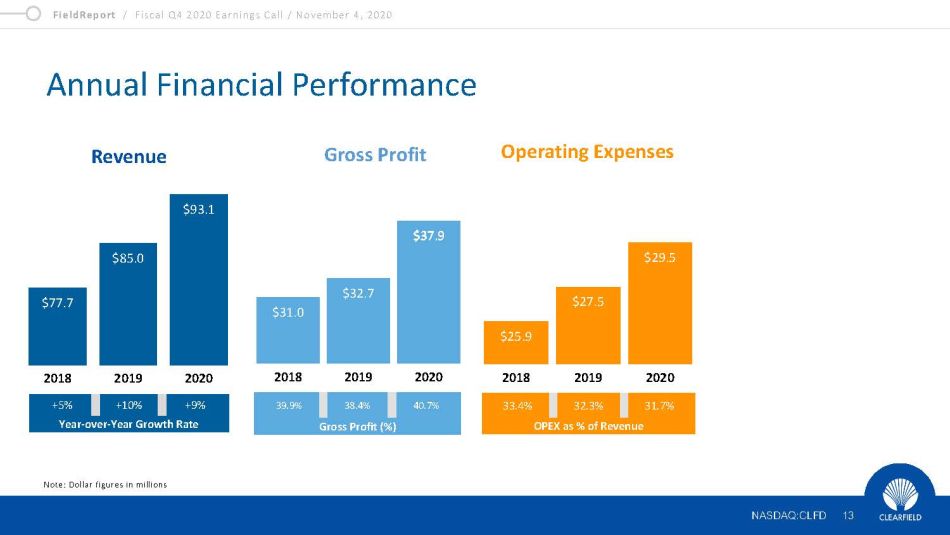

Our operating expenses for fiscal 2020 were $29.5 million, which was up 7% from $27.5 million in fiscal 2019. As a percentage of revenue, operating expenses for fiscal 2020 was 31.7%. The increase in operating expense dollars was primarily due to additional personnel and higher performance-based compensation accruals as well as higher external sales commissions and agent fees, offset by lower stock-based compensation expense and travel, entertainment and marketing costs due to COVID-19 restrictions.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Annual Financial Performance 13 NASDAQ:CLFD Note: Dollar figures in millions $77.7 $85.0 $93.1 2018 2019 2020 Revenue $31.0 $32.7 $37.9 2018 2019 2020 Gross Profit $37.9 $25.9 $27.5 $29.5 2018 2019 2020 Operating Expenses 33.4% 32.3% 31.7% OPEX as % of Revenue +5% +10% +9% Year - over - Year Growth Rate 39.9% 38.4% 40.7% Gross Profit (%)

Income from operations totaled $8.4 million in fiscal 2020, an improvement from $5.2 million in fiscal 2019. Income tax expense was $1.9 million, which was up from $1.4 million in fiscal 2019. Taken together, the resulting net income for fiscal 2020 was $7.3 million, or $0.53 per diluted share, which was an improvement from $4.6 million or $0.34 per diluted share we reported last year.

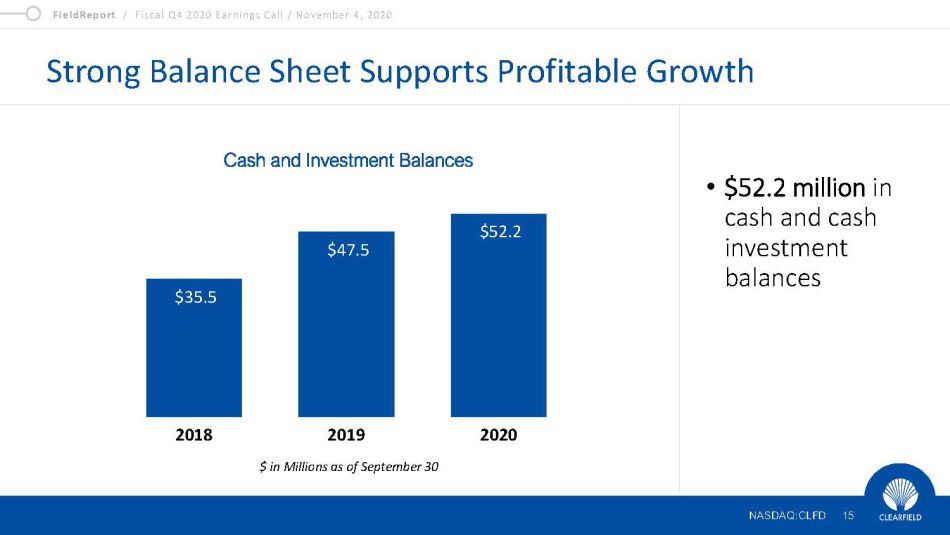

And, finally, now turning to our balance sheet…

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Annual Financial Performance 14 NASDAQ:CLFD Note: Dollar figures in millions $37.9 $4.3 $4.6 $7.3 2018 2019 2020 Net Income 5.5% 5.4% 7.8% Net Margin $77.7 $85.0 $93.1 2018 2019 2020 Revenue $31.0 $32.7 $37.9 2018 2019 2020 Gross Profit $37.9 $25.9 $27.5 $29.5 2018 2019 2020 Operating Expenses +5% +10% +9% Year - over - Year Growth Rate 39.9% 38.4% 40.7% Gross Profit (%) 33.4% 32.3% 31.7% OPEX as % of Revenue

At quarter end, our balance sheet remained strong with $52.2 million in cash, cash equivalents and investments.

As I mentioned on recent FieldReports, our board of directors suspended the company’s share repurchase plan in April to further ensure our financial stability through the current COVID-19 operating environment. Our board and leadership team will continue to evaluate our capital allocation strategy for our shareholders.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Strong Balance Sheet Supports Profitable Growth • $52.2 million in cash and cash investment balances NASDAQ:CLFD 15 $ in Millions as of September 30 Cash and Investment Balances $35.5 $47.5 $52.2 2018 2019 2020

I’d like to spend a few moments providing an update on how we continue to effectively navigate the COVID-19 pandemic and the operational measures we’ve taken since March of this year.

I am encouraged to report that Clearfield remains fully operational despite the unprecedented business closures and slowdown caused by the global health crisis.

Our non-production employees are working remotely, using collaboration tools and video conferencing to stay as connected as possible. Our production operations in both the U.S. and Mexico are working as normal while adhering to state and federal government social distancing guidelines. As a precautionary measure, we have multiple contingency plans in the event our ability to operate is diminished or eliminated at either location. We dual-source most of our components to cover multiple points of failure and have purposeful redundancies to remove potential risks. Thankfully, as of today, many of our supply chain partners remain operational and have continued to provide the necessary components for our products. Our supply chain remains intact thanks to our team’s forward planning to ensure sufficient safety stock inventory levels at both our Minnesota and Mexico facilities. As Cheri has indicated previously, we made the decision to maximize the availability of all product lines at all three of our plants by assuring that each location can manufacture across our broad product portfolio. This strategic decision has allowed us to meet the growing customer orders and enable us to continue to fulfill our increased order backlog going forward.

That concludes my prepared remarks. I will now turn the call back over to Cheri.

Cheri?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD COVID - 19 Operational Update • Critical manufacturer status • Operating at normal capacity while adhering to state and federal government social distancing guidelines • Majority of supply chain remains operational • Established higher minimum stocking levels on component level inventory to ensure customer needs are met NASDAQ:CLFD 16

Thanks, Dan.

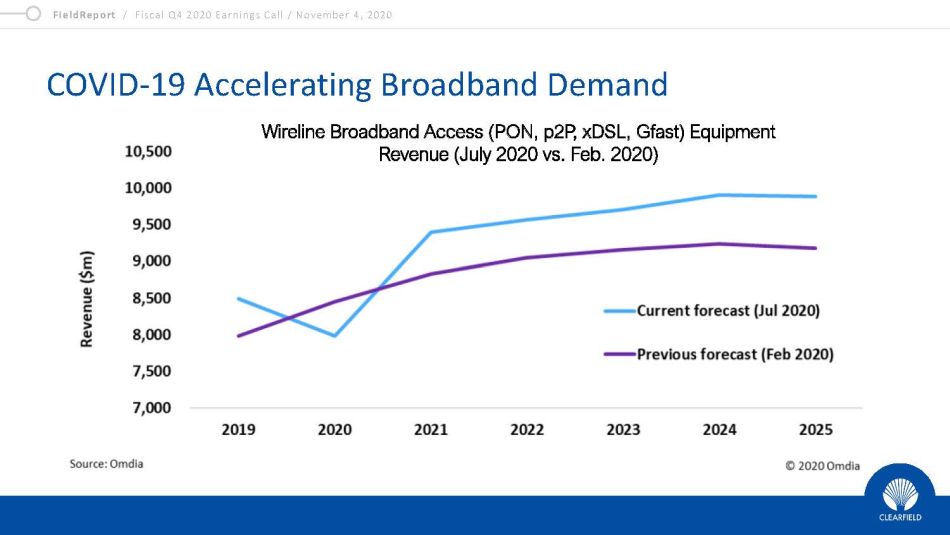

At no time in our history, has the need for high-speed broadband connectivity been more apparent than during the COVID crisis. Working remotely, often from home, has blurred, or even permanently altered, the business versus consumer distinction with all networks now carrying business critical and entertainment data at the same time.

COVID has accelerated the need for and deployment of broadband. Clearfield is well positioned in all our markets to take advantage of this opportunity. As I mentioned earlier, our record results for Q4 and fiscal 2020 were driven by strong performance in our MSO and Community Broadband markets. We saw customers in these areas push forward with their purchasing decisions and deployments in response to COVID-19, which has highlighted the need for high-speed broadband front and center for both consumers and businesses alike.

Much of our success since March has been with our existing customers, especially our base of community broadband providers, where we already had great rapport. These companies have looked to us to help them address the surging demand and need for high-speed internet access.

As you can see from slide 17, COVID’s effect on broadband demand is accelerating. In February of this year, market research firm Omdia published its forecast for wireline broadband access equipment revenue in 2021, estimating approximately $8.6 billion would be spent on equipment. Then, in July, after a dip in 2020, Omdia updated its forecast for 2021, noting that the market would strongly rebound with growth of 20%. While COVID has validated the need for Broadband, the marketplace has responded with accelerated build plans.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD COVID - 19 Accelerating Broadband Demand Wireline Broadband Access (PON, p2P, xDSL, Gfast) Equipment Revenue (July 2020 vs. Feb. 2020)

Now, shifting gears to our ‘Coming of Age Plan,’ which, as most of you know, is our three-year strategic plan designed to strengthen our core business and position our company for disruptive growth opportunities.

As our overall performance in FY 20 Q4 and fiscal 2020 indicate, we are realizing demonstrable results from our commitment to, and execution of, this plan. And with that, I'll now spend a moment providing a brief update on our three major initiatives within that plan.

In terms of expanding our core Community Broadband business, Q4 represented a continuation of Clearfield customers accelerating their purchasing decisions and deployments in response to COVID-19. This trend has carried into fiscal 2021, supported by continued demand for broadband and the government programs helping to fund these deployments.

Clearfield’s position within the Community Broadband market has never been better. Our track record and reputation has positioned us extremely well to take market share and further capitalization on the expansion that’s currently underway. New projects have been initiated as part of The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act.

The other major government funding program is the U.S. Rural Digital Opportunity Fund, or RDOF, which is a 10-year program designed to bridge the digital divide to efficiently fund the deployment of broadband networks in rural America. The FCC will direct up to $20.4 billion over ten years to finance up to gigabit speed broadband networks in unserved rural areas, connecting millions of American homes and businesses to digital opportunity.

On October 8th, the Wireline Competition Bureau and the Office of Economics and Analytics, in coordination with the Rural Broadband Auctions Task Force, announced the release of final eligible census blocks, including certain census blocks primarily located in price capped carrier territories that, based on data from June 2019 and a subsequent challenge process, were not served by the incumbent price cap carrier or an unsubsidized competitor with voice and broadband at speeds of 25 Mbps or higher.

To give you a better sense of the economic opportunity available here, let me explain: through the RDOF program, approximately 540,000 homes will be connected annually. The products we provide, represent an opportunity to Clearfield of $35 per home passed and with a conservative estimate of 40% of homes passed connecting to the service, an additional opportunity of $185 per home. This is an over $50 million annual opportunity for Clearfield. Moreover, it’s not a question of if, but rather how and when these homes will be connected. Regardless of the variable inputs, Clearfield is well positioned to capitalize on this opportunity.

In addition, a major initiative for 2021 is extending our reach within Community Broadband into electrical coops, rural utilities and municipalities that are not currently being serviced by a rural telephone company and are still underserved by the major carriers. As part of this effort, our strategy is to partner with established distributors in these target markets, which we anticipate securing in the coming months.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 18 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate

Turning to our second pillar, enhancing our competitive position and operational effectiveness…

Our execution in this area over the last several quarters is perhaps most evident in our increasing gross profit. One of the chief underlying drivers for this expansion is related to the investments we’ve made to our operations in Mexico, which are starting to yield beneficial results both in improved efficiencies and cost effectiveness.

While we’re able to build any product in all three of our manufacturing plants –Minnesota, and the two in Mexico – we’re also focused on optimization. In addition to process improvements, our success here has largely been a function of the efforts of our manufacturing teams. It’s been an extremely busy year for them, and we are truly grateful for all their efforts.

Also encouraging, we’ve found further opportunities to realize improved productivity from our plants to drive costs down even further. We’re currently launching an extensive training and optimization program to reduce our manufacturing costs by improving floor utilizations and overall labor capacity.

To be sure, we are still seriously investing in our current human capital to not only care for their work quality of life but also their complete health needs. This means supporting our workforce in all measures of their daily lives to ensure their families have what they need to get through these challenging times due to COVID. Like many organizations, our people are our greatest asset, so it’s incredibly important we continue to invest in our most precious resource.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 19 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate Enhancing Competitive Position and Operational Effectiveness Investing in products, manufacturing and supply chain to increase competitiveness and maintain and reduce costs

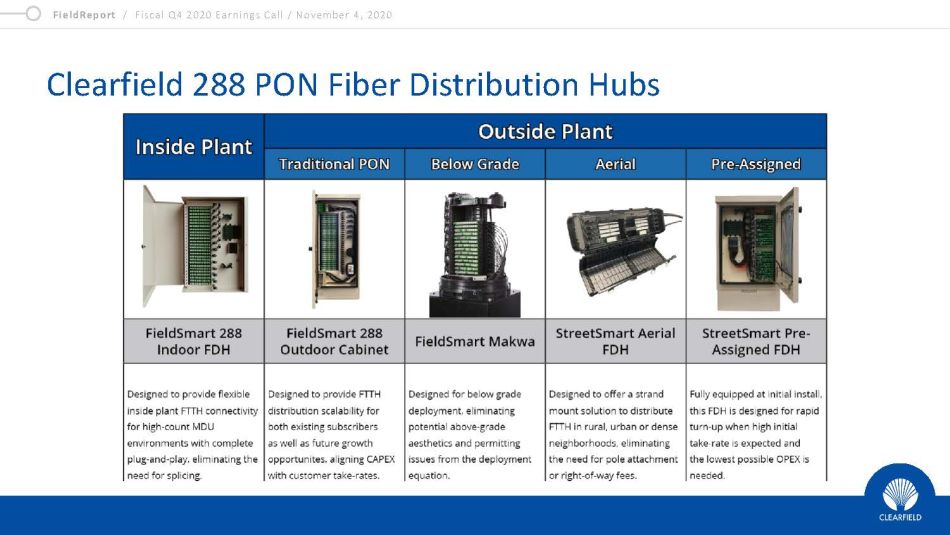

As the fiber to anywhere company, Clearfield is accelerating cost-effective fiber-fed deployments with the industry's most craft-friendly fiber management and pathway product. With the launch of our FieldSmart Fiber Delivery Point Indoor 288-port Wall Box, Clearfield now offers every service provider their optimal configuration for FTTH deployment. Clearfield is the only fiber management provider in the industry to provide enclosures designed for strand mount, below grade, in-building, and outside plant. Further, with the addition of these new products, Clearfield continues to allow service providers to scale their networks as demand or conditions allow, or now with the push toward accelerated deployment, the tools to turn up networks rapidly --- all with the same architecture and design principles.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Clearfield 288 PON Fiber Distribution Hubs

The third initiative of our ‘Coming to Age’ plan involves capitalizing on disruptive growth opportunities within the wireline markets of national carriers and all wireless markets.

Our position in the Tier 1 market remains solid. And our success growing our National Carrier business by 18% in fiscal 2020 reflects the return on the strategic investments we’ve been making over the last couple of years. We continue to execute on our operational initiatives, including rolling out product lines like the StreetSmart transition box, to address the opportunities within this market.

That said, the Tier 1 market has been progressing slower than some of our other end markets. While the national carriers remain committed to capital equipment expenditures, COVID has impacted the deployments plans for 5G both in the near and mid-term. In the second half of our fiscal year, we saw a temporary pause in new deployments by the carriers because of these restrictions. However, deployment of optical components, specifically related to optimizing existing fiber assets to meet exploding bandwidth requirements, has picked up.

Longer term, we’re investigating adjacent product categories to expand our total addressable market. Consistent with our approach of being a ‘fiber to anywhere’ company, we’re looking at investing in product categories or areas that may not be fiber rich today, but ones that would allow us to introduce products to the market that would enable the lifestyle ubiquitous broadband provides.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 21 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate Enhancing Competitive Position and Operational Effectiveness Investing in products, manufacturing and supply chain to increase competitiveness and maintain and reduce costs Capitalizing on Disruptive Growth Opportunities Within National Wireline and Wireless Markets Leveraging customer relationships and application knowledge to capture opportunities related to 5G, NG - PON, and edge computing initiatives

Our comprehensive financial and operational performance in fiscal 2020 speak to the resiliency of our business as well as our strategic positioning within our customer base and industry. Our success in Q4 specifically has given us significant momentum starting Q1 of fiscal year 2021, giving us a bullish outlook for the next year. The business case for optical fiber markets for 5G and Access Networks deployment couldn’t be more evident.

While we are currently unable to provide a concrete financial forecast for the upcoming fiscal year due to the ongoing volatility from COVID, we are confident the demand for fiber-fed broadband will continue in fiscal 2021 and beyond. Based on our robust bookings and pipeline of business, we currently anticipate a strong first quarter of fiscal 2021 compared to the same year-ago period.

And with that, we’re ready to open the call for your questions.

Operator?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Key Takeaways Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion - dollar fiber optics industry, especially with the roll - out of 5G and NG - PON2 technologies Healthy balance sheet: $52.2M in cash and investments Year history of profitability and positive free cash flow 13 NASDAQ:CLFD

Operator

Thank you. We will now be taking questions from the company’s publishing sell-side analysts. [Operator Instructions]

And our first question is from the line of Jaeson Schmidt with Lake Street. Please proceed.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Hey, guys. Thank you for taking my questions. Cheri, just want to follow-up on your last comments in the prepared remark -- remarks. I mean, how should we think about just general seasonality in fiscal 2021 just given the momentum you've seen, and it sounds like expect to continue to see here in the near term?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 23 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Yes, I think the normal seasonality of business kind of coming down in the first quarter, we're not seeing at this point. I mean, we came into the quarter with an extremely strong backlog of over $10 million, with the great majority of that backlog scheduled to ship in the first quarter. So we're seeing a really strong first quarter, we think parts of that are related to the CARES Act. I mean, there's some requirements within the CARES Act for builds to be completed by 12/31. We were worried that there's probability that that will be extended, but at this point in time, people are kind of pushing toward getting things done this first quarter. So I'm thinking first quarter is going to be really strong. That's the outlook that we provided for the forecast. Second quarter, I think we're going to see some of the normal new challenges associated with budgeting and forecasting and weather. But it's going to be -- the demand right now out there in Community Broadband and for fiber in general is really strong, we're very optimistic for the full year.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 24 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. That's helpful. And just given the strength you've been seeing, do you think this is more of a function of sort of a rising tide across the industry? Or do you guys think you're still taking share in your select markets?

Cheri Beranek

Chief Executive Officer, President & Director

I think it's both. I mean, certainly across the entire marketplace, you see a lot of our -- the companies that we partner with, companies like Calix, companies like ADTRAN, Nokia, I mean, their business in the access market is definitely up. And so we're taking advantage of that market increase in market demand. But I also believe, we're uniquely positioned due to our strength and market share in Community Broadband to take advantage of that. We have a very in depth and established sales team that has -- is heavily distributed throughout the marketplace, coupled with what we call our smart guys, our application engineers who are out in the field, to help organizations who are predominantly been underserved or who are new to fiber, to be able to design and run their networks. So I think the marketplace is strong. And I think we're taking advantage of that strength of demand as well as achieving additional share throughout the process.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 25 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. And then just last one for me, and I'll jump back into queue. How should we think about OpEx going forward? It was up here sequentially in September, is this sort of a new level in fiscal 2021?

Cheri Beranek

Chief Executive Officer, President & Director

See, until we get a little bit of seasonality of fourth quarter expenses due to compensation increases for achievement of a revenue thresholds. But that said, we’re a scaling organization, we need to continue to be able to build into our resources as well as build into the infrastructure of our company. So our SG&A levels will not climb significantly. But the percentage of business is probably pretty consistent at fourth quarter levels.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. Perfect. Thanks a lot, guys.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 26 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

You're welcome.

Operator

And our next question is from the line of Tim Savageaux with Northland Capital Markets. Please go ahead.

Tim Savageaux

Northland Capital Markets, Research Division

Thanks very much, and good afternoon and congratulations on the strong results. We certainly have been seeing that, fairly broad based across especially the rural fiber access space. And I kind of want to follow-up on that sort of high level. It's an interesting forecast that you featured in the Field Report and I kind of want to follow-up on that sort of high level. It's an interesting forecast that you featured in the Field Report talking about 20% growth in the industry. And that seems to be somewhat of a recurring theme. With regard to some of your recent results, your community broadband has been growing in excess of at least the last couple of quarters. And to the extent that you don't see normal seasonality in the first quarter, you'll be growing well above that level as well. So that 20% mark seems to be kind of a reasonable target in my view for maybe gauging the company's growth potential in fiscal 2021, I'd be interested in your thoughts on that?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 27 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

I think there's potential by which to get there. There's definitely some strong demand to put that in place. If you look at that chart from Omdia, I’m not sure if I’m pronouncing that correctly. But it calls for that increase in calendar year 2021. So we're a little bit ahead of that right now. What makes me comfortable that we've gained share is that, that showed a pretty heavy reduction in 2020, in regard to reduction of demand. So feel good about where we're at and kind of capitalizing on it. I think the challenge right now in getting too far ahead of ourselves for forecasting 20% for the year, is just the uncertainty of the market that we're living in. The COVID world issues associated potentially with deployment, with having enough availability of labor and resources to associate with we need to -- not get too far out in front of our skis. Appreciate the opportunity and the execution that are necessary. We're continuing to invest, as we pointed out in the multiple facilities so that we can continue to fulfill on these requirements. So we're not getting a long-term guidance, opportunity. But the longer we get into the year, the more comfortable I'll feel with capitalizing on that market demand.

Tim Savageaux

Northland Capital Markets, Research Division

And that's absolutely fair enough. Following up on the backlog, obviously, an impressive number there. Just I have kind of two questions about that.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 28 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Are you still there?

Tim Savageaux

Northland Capital Markets, Research Division

Can you hear me?

Cheri Beranek

Chief Executive Officer, President & Director

Nope. There you are. You're back?

Tim Savageaux

Northland Capital Markets, Research Division

Am I back?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 29 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Yep. We can hear you now.

Daniel Herzog

Chief Financial Officer

Yes. We can hear you.

Tim Savageaux

Northland Capital Markets, Research Division

Great. Sorry about that. Let's see backlog. Yes. And I guess the questions were I would be interested if the composition of the backlog is skewed in any particular direction in terms of your business segments, or is it pretty well distributed across your typical categories. And in particular, what you might be seeing in terms of trends on the cable side, heading into calendar year end, obviously, your fiscal first quarter, but there are some indications that maybe they could finish the year pretty strong. I wonder if you're seeing that at all.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 30 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

We think -- I mean the backlog is strongly distributed across all market categories, with the exception of international. We sell into the Canadian, Latin American, Mexico markets. And those markets have been, especially Mexico and South America, Caribbean markets have been very flat. They've been redeveloped -- redeploying their currency to other places. So you won't see a lot of international in our backlog, although we're optimistic when things stabilized in those spaces that will be better off next year. The rest of it is strong community broadband, cable TV and carrier business. Like I said, the carrier business is a little bit of a bubble in regard to delayed orders. Our strength at cable TV is predominantly Tier 2, cable TV with some business in Charter and Content, but our strength is predominantly Tier 2. We're very pleased, as you can note with the numbers that we're putting together and they continue to build there that are operational. The challenge again with -- as we move into the Tier 1 space with cable TV is some of the delayed orders, the more project based business that we haven't quite got into a run rate level yet to forecast. But I definitely see cable TV responding to some of the funding that's going on in some of the underserved markets, and they're responding to really protect their franchises. So I think that'll certainly play out next, maybe not in fourth quarter of the calendar year, first quarter of our fiscal year. But it's certainly something that we've been investing in for a long time and look to reap some of the fruits of that next year.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 31 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Great. Thanks. And last question for me, as you maybe consider that overall growth potential in fiscal 2021. I wonder if you could address kind of what kind of assumptions you may or may not be making with regard to new product growth. You mentioned the fiber distribution opportunity. I don't know if that $50 million was an annualized number, you felt the market opportunity might be for Clearfield, or how you were defining that. But is there kind of a timeframe that you envision kind of ramping here, maybe towards the back half of the fiscal year?

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 32 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Right. That $50 million opportunity is an annual opportunity for our level of product. Certainly, we're not going to achieve 100% market share, but it's pretty exciting to see that kind of new market opportunity really in spaces that you weren't building before because these are difficult regions or underserved or unserved territory. So they typically have been not economically feasible to be deployed previously. So that’s a really new market for us. That said, at the end of the calendar year, next year, before you're going to see significant revenue smart off, right. I mean, the auctions are currently underway, till they get awarded, and they're engineered and put in place. I think we'll start to see revenue on that maybe 4th of July and fourth quarter of next year, our fourth quarter of next year, which really positions us well for fiscal year 2022. And we have been, it's not like we had to put resources in place for any of that, that's where we shine. We've been building that business for the last 13 years and have been augmenting it now with new resources in the utility space, where we haven't been as strong but really is a replication of the work that we did in the early days of independent telephone. There's about 900 different utilities across the country, similar to how 10 years ago there were 900 independent telephone companies underserved works, it's refreshing actually to get back into those early days of pioneering fiber and look forward to it like I said, probably late next year.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 33 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Okay. Thanks very much, and congrats once again.

Cheri Beranek

Chief Executive Officer, President & Director

Thank you.

Operator

At this time, this concludes the company's question-and-answer session. If your question was not taken you may contact clear fields Investor Relations team at clfd@gatewayir.com. I'd now like to turn the call back over to Ms. Beranek for closing remarks.

Cheri Beranek

Chief Executive Officer, President & Director

Thank you again for joining us today. It's a tumultuous time in our country. I hope you're all safe and appreciative of the country that we live in and look forward to our opportunity to continue to make it a strong organizational environment for all of us to do business. We look forward to updating you again on our progress soon.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 34 Dan Herzog CHIEF FINANCIAL OFFICER

Thank you again for joining us today. We look forward to updating you again on our progress soon.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD

Thank you for joining us today for Clearfield’s fiscal fourth quarter and full year 2020 earnings conference call. You may now disconnect.

FieldReport / Fiscal Q4 2020 Earnings Call / November 4, 2020 NASDAQ:CLFD Contact Us NASDAQ:CLFD 36 COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Tom Colton Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com