Attached files

| file | filename |

|---|---|

| EX-99.1 - QUARTERLY REPORT 10Q OF AMALGAMATED BANK - Amalgamated Financial Corp. | a3q20amal10-qxex991.htm |

| EX-32.1 - RULE 1350 CERTIFICATION OF CHIEF EXECUTIVE OFFICER - Amalgamated Financial Corp. | a202009amal-ex321.htm |

| EX-31.2 - RULE 302 CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - Amalgamated Financial Corp. | a202009amal-ex312.htm |

| EX-31.1 - RULE 302 CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - Amalgamated Financial Corp. | a202009amal-ex311.htm |

| 10-Q - 10Q SHORT FORM - Amalgamated Financial Corp. | a3q20amal10-qshortform.htm |

FEDERAL DEPOSIT INSURANCE CORPORATION WASHINGTON, D.C. 20006

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 14, 2020 (October 7, 2020)

AMALGAMATED BANK

(Exact name of registrant as specified in its charter)

New York 13-4920330

(State or other jurisdiction (IRS employer

of incorporation) identification no.)

275 Seventh Avenue, New York, New York 10001

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 895-8988 Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, $0.01 par value per share | AMAL | The Nasdaq Global Market | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company S

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 14, 2020, Amalgamated Bank (the “Bank”) issued a press release announcing certain preliminary financial results for the third quarter of 2020. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Chief Executive Officer

On October 7, 2020, Keith R. Mestrich, the President and Chief Executive Officer and a director of the Bank, notified the board of directors of the Bank that he will step down from his positions as President, Chief Executive Officer and director of the Bank, effective January 31, 2021. Mr. Mestrich’s departure is not due to any disagreement with the Bank regarding its operations, policies or practices.

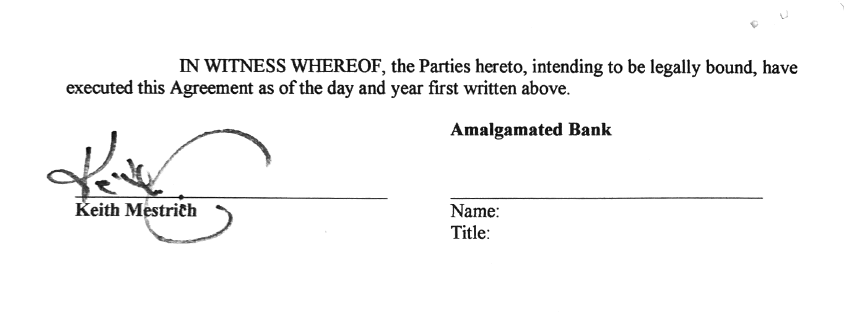

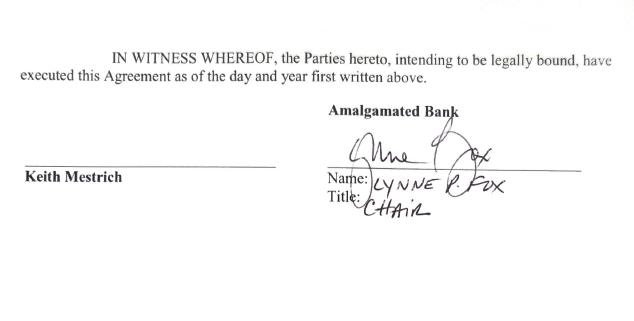

Transition and Separation Agreement

In order to ensure an orderly transition, on October 12, 2020, the Bank and Mr. Mestrich entered into a transition and separation agreement (the “transition agreement”). The transition agreement provides that Mr.

Mestrich will continue to serve as the Bank’s Chief Executive Officer through January 31, 2021, unless before such date, his employment is terminated pursuant to his employment agreement (as defined below) (such period, the

“transition period”). The transition agreement further provides that if Mr. Mestrich is employed by the Bank on January 31, 2021, effective February 1, 2021, he will transition to the role of a special advisor to the Bank’s board of directors until July 31, 2021, unless earlier terminated under the terms of the transition agreement (such period, the

“special advisor period”); provided, that, the board may determine to accelerate the date on which Mr. Mestrich becomes a special advisor to the Bank (the “transition date”) and such date will end the transition period and begin the special advisor period.

Under the transition agreement, Mr. Mestrich will continue to receive his current base salary, annual bonus, continued vesting of his outstanding equity awards and other employee benefits through January 31, 2021 (irrespective of whether the board accelerates the transition date), as provided under his amended and restated employment agreement effective as of July 17, 2020, as amended through April 23, 2020 (the “employment

agreement”); provided, that, any service requirement with respect to his 2020 annual bonus will be deemed to be met if he is serving as a special advisor on February 1, 2021, and, if his employment is terminated without “Cause,” or he terminates his employment for “Good Reason,” each as defined in his employment agreement, the Bank will pay Mr. Mestrich his 2020 annual bonus at target. In addition, if Mr. Mestrich’s employment is terminated before February 1, 2021, and he does not transition immediately to the role of special advisor, he will be entitled to the severance benefits, if any, in accordance with Section 5 of his employment agreement, based on the reason for such termination; provided, that, a reduction in Mr. Mestrich’s duties or responsibilities during the transition period will not qualify as “Good Reason.”

Under the transition agreement, during the special advisor period, Mr. Mestrich will provide services to the board of directors of the Bank as an independent contractor, as requested by the Chair of the board, not to exceed 20 hours per week on average. During any portion of the special advisor period occurring after January 31, 2021, Mr. Mestrich will be paid $60,000 per month (the “special advisor cash compensation”). In addition, his outstanding equity awards will continue to vest as if he had not experienced a “Separation from Service,” as defined in the Bank’s applicable equity plan, however, on the day following the transition date, his participation in the Bank’s employee benefit programs and plans will end. Furthermore, on the transition date, all of Mr. Mestrich’s vested options (or options scheduled to vest on our before January 1, 2021) will generally remain exercisable until one year following the date his special advisor period ends, subject to certain exceptions. If, during the special advisor period, Mr. Mestrich’s role as a special advisor is terminated by the Bank without “Cause” or not due to his “Poor Performance,” or by him with “Good Reason,” each as defined in the transition agreement, he will be entitled to

receive (a) any accrued but unpaid compensation and expense reimbursements, (b) payment of his special advisor cash compensation from his termination date through July 31, 2021, (c) payment of his 2020 annual cash bonus to the extent not yet paid, (d) pro rata vesting of the unvested portion of any time-based restricted stock units based on the number of full months beginning on the date of the applicable vesting period and ending on the date of his termination as special advisor, (e) pro rata vesting of any performance-based restricted stock units, at target, based on the number of full months beginning on the date of the applicable performance period and ending on the date of his termination as special advisor, and (f) vesting of any options that would otherwise have vested on January 1, 2021. If, however, during the special advisor period, Mr. Mestrich’s role as a special advisor is terminated by the Bank for “Cause” or due to his “Poor Performance,” or because of Mr. Mestrich’s death or disability, he will not be entitled to any severance payments or pro rata vesting of his restricted stock units, however, he will be entitled to any accrued but unpaid compensation and expense reimbursements and any of his stock options that would otherwise have vested on January 1, 2021 will vest (to the extent not already vested).

The transition agreement also requires Mr. Mestrich to comply with certain terms of his employment agreement regarding confidential information, cooperation, return of Bank property, work product, non-solicitation, and non-disparagement. In addition, for a period of one year following the date his service as a special advisor ends, he is prohibited from directly or indirectly, without the Bank’s prior written consent, organizing, establishing, owning, operating, managing, controlling, engaging in, participating in, investing in or permitting his name to be used by, consulting or advising or rendering services for, or otherwise engaging in a “Business,” as defined in the transition agreement, except to the extent the Bank does not engage in the Business and is not in the process of evaluating, or planning, to engage in the Business.

The transition agreement also provides that the Bank will reimburse Mr. Mestrich for reasonable expenses of counsel, not to exceed $60,000, incurred regarding the review and negotiation of his employment relationship with the Bank and his relationship as a special advisor to the Bank.

The foregoing description of Mr. Mestrich’s transition agreement does not purport to be complete and is qualified in its entirety by reference to the transition agreement, which is incorporated herein by reference as Exhibit 10.1.

Item 7.01 Regulation FD Disclosure.

On October 14, 2020, the Bank issued a press release announcing the matters set forth in Item 5.02 of this Current Report on Form 8-K, which press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits. See Exhibit Index below. EXHIBIT INDEX | ||||

Exhibit Number 10.1 | Description Transition and Separation Agreement between Amalgamated Bank and Keith Mestrich dated October 12, 2020 | ||||

| 99.1 | Press Release Announcing Certain Preliminary Financial Results dated October 14, 2020 | ||||

| 99.2 | Press Release Regarding Keith Mestrich’s Planned Departure dated October 14, 2020 | ||||

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AMALGAMATED BANK

By: /s/ Andrew LaBenne Name: Andrew LaBenne

Title: Chief Financial Officer

Date: October 14, 2020

3

Exhibit 10.1

Execution Copy

Privileged & Confidential

TRANSITION AND SEPARATION AGREEMENT AND RELEASE

This Transition and Separation Agreement and Release (the “Agreement”), has been made and entered into as of October 12, 2020, by and between Amalgamated Bank (the “Company”) and Keith Mestrich (the “Executive”) (each a “Party” and collectively the “Parties”).

WHEREAS, the Executive has been employed by the Company as Chief Executive Officer since August 1, 2014;

WHEREAS, the Executive is a party to the Amended and Restated Employment Agreement between the Parties effective as of July 1, 2017, as amended through April 23, 2020 (the “Employment Agreement”);

WHEREAS, the Executive’s employment with the Company will duly and effectively terminate on the Transition Date (as defined below);

WHEREAS, the Executive will serve as a “Special Advisor” to the Board of the Directors of the Company (the “Board”) from the Transition Date to the End of Service Date (as defined below); and

WHEREAS, the Executive and the Company desire to set forth their respective rights and obligations in respect of the termination of the Executive’s employment with the Company.

WHEREAS, this Agreement incorporates certain provisions of the Employment Agreement by reference, such agreement is attached hereto as Exhibit A.

NOW, THEREFORE, in consideration of the covenants and conditions set forth herein, the Parties, intending to be legally bound, hereby agree as follows:

1.Employment Status.

(a)The Executive shall serve as Chief Executive Officer of the Company through January 31, 2021 unless, prior to January 31, 2021, the Executive’s employment is terminated pursuant to the Employment Agreement.

(b)Provided the Executive is employed by the Company on January 31, 2021, effective February 1, 2021 (February 1, 2021 or such earlier date established by the Board pursuant to Section 1(c), the “Transition Date”), Executive shall serve as a “Special Advisor” to the Board from the Transition Date to July 31, 2021, unless earlier terminated in accordance with this Agreement (the “End of Service Date”).

(c)Notwithstanding the forgoing, the Board may determine to accelerate the date on which the Executive becomes a Special Advisor. If the Board makes such a determination, the earlier date on which the Executive becomes a Special Advisor shall be the Transition Date.

a.The period from the date of this Agreement through the Transition Date will be referred to herein as the “Transition Period.” The period from the Transition Date to the End of Service Date will be referred to herein as the “Special Advisor Period.”

1.Transition Period.

a.Executive’s Duties through the Transition Date. During the Transition Period, the Executive will perform the duties of the Chief Executive Officer of the Company in accordance with the Employment Agreement in addition to duties as reasonably requested by the Chair of the Board to ensure a smooth transition of the Executive’s duties to other employees of the Company and the individual chosen by the Board to be the Executive’s successor. Prior to the Transition Date, the Chair of the Board shall have the right to take away or reduce any of the Executive’s duties and/or require the Executive to remain away from the Company’s offices.

b.Compensation During the Transition Period. The Executive shall be entitled to the Executive’s salary, annual bonus, continued vesting of outstanding equity compensation and employee benefits through January 31, 2021 to the extent provided under the Employment Agreement (irrespective of whether the Board accelerates the Transition Date prior to January 31, 2021 pursuant to Section 1(c) of this Agreement). Notwithstanding the forgoing,

(i)any service requirement applicable to the 2020 Annual Bonus (the “2020 Annual Bonus”) will be deemed to be satisfied if the Executive is serving as the Special Advisor on February 1, 2021,

(ii)the Company will pay the 2020 Annual Bonus at target if the Company terminates the Executive’s service without “Cause” or the Executive terminates for “Good Reason” (as each is defined under the Employment Agreement if the Executive is serving as the Chief Executive Officer of the Company on the date of termination, or this Agreement if the Executive is serving as the Special Advisor on the date of termination); and (iii) for the avoidance of doubt, the Executive will not be eligible to receive a bonus or a grant of Company equity awards of any type, in each case, with respect to 2021 services.

i.Severance Benefits upon Termination of Employment During the Transition Period. If the Executive’s employment terminates prior to February 1, 2021, and the Executive does not transition to the role of Special Advisor immediately following the date of such termination, the Executive shall be entitled to severance benefits, if any, in accordance with Section 5 of the Employment Agreement based on the reason for such termination (as defined in the Employment Agreement); provided, however, that: (i) if the Chair of the Board terminates the Executive’s employment prior to February 1, 2021 and the Executive transitions to the role of Special Advisor on the date of such termination, such termination will not be considered without “Cause” (as defined in the Employment Agreement) and (ii) if the Chair of the Board takes away or reduces the Executive’s duties or responsibilities during the Transition Period in accordance with Section 2(a) above, such a reduction will not qualify as “Good Reason” (as defined in the Employment Agreement).

2.Special Advisor Period.

2

ii.Executive’s Duties During the Special Advisor Period. During the Special Advisor Period, the Executive will provide services to the Board as an independent

contractor to the Company and will no longer serve as a member of the Board or on any Committees of the Board. As Special Advisor, the Executive shall report directly to the Chair of the Board. The Chair of the Board shall direct the Executive with respect to the Executive’s duties and actions as Special Advisor. The Executive shall act in accordance with the Chair of the Board’s reasonable directives in the Executive’s capacity as Special Advisor. The Executive will provide services commensurate with the Executive’s role as Special Advisor as requested from time to time by the Chair of the Board, but not to exceed 20 hours a week on average, which services (the “Special Advisor Duties”) shall include, but not be limited to, assisting the Board and the Company by providing advice and aiding in the transition of the Executive’s prior duties to a new Chief Executive Officer with respect to, inter alia, regulators, clients, prospective clients, service providers, investors and organizations in which the Company participates (the duties specifically identified herein, the "Enumerated Special Advisor Duties"). For the avoidance of doubt, the Special Advisor Duties are not intended to regularly involve duties typical of an individual serving in the role of a chief executive officer of a public company provided that, the Enumerated Special Advisor Duties shall not be considered duties typical of an individual serving in the role of a chief executive officer of a public company.

i.Special Advisor Cash Compensation. During any portion of the Special Advisor Period occurring after January 31, 2021, Executive will be paid $60,000 per month (the “Special Advisor Cash Compensation”), subject to Section 3(f) of this Agreement. During the Special Advisor Period, the Executive shall be liable for payment of all applicable federal, state and local taxes.

ii.Equity Compensation. During the Special Advisor Period, the Executive will continue to vest in any Company equity awards outstanding on the Transition Date, including any outstanding Non-Qualified Stock Options (each, an “Option”), Restricted Stock Units (each, an “RSU”) and Performance Units (each, a “PSU”), as if the Executive had not had a “Separation from Service” (as defined in the Amalgamated Bank 2017 Equity Incentive Plan or the Amalgamated Bank 2019 Equity Incentive Plan, as applicable), subject to Section 3(f) of this Agreement. Effective as of the Transition Date, solely with respect to any Options that vested or are scheduled to vest on or prior to January 1, 2021, the Board will cause such Options to remain exercisable until one (1) year following the End of Service Date; provided, however, that the term of such Option will not be extended (and the term of such Option as set forth in the applicable Option award agreement shall apply treating the End of Service Date as the date of the Executive's Separation from Service) if, either (i) during Transition Period, the Executive’s employment as Chief Executive Officer of the Company terminates, other than a termination by the Company without “Cause” or by the Executive for “Good Reason” (each as defined in the Employment Agreement) or (ii) during the Special Advisor Period, Executive’s services as Special Advisor are terminated, other than a termination by the Company without Cause or by the Executive for Good Reason (each as defined in Section 3(f) of this Agreement). For the avoidance of doubt, the one (1) year extension referenced in this

3

Section 3(c) shall not cause an Option to be exercisable for a period longer than the later of (a) the one (1) year anniversary of the End of Service Date or (b) the term of the Option as set forth in the applicable Option award agreement.

iii.Benefits During the Special Advisor Period. Executive’s participation in the Company’s employee benefit programs and plans will cease on the date

following the Transition Date on which the Executive becomes ineligible for benefits as set forth by the terms governing such employee benefit plan or program, as may be in effect from time to time. After such date, the Executive will be entitled to elect, under COBRA, to continue group health coverage, at Executive’s own expense, pursuant to applicable law. Information regarding continuation coverage will be provided to Executive under separate cover.

i.Expenses. During the Special Advisor Period, the Executive will be entitled to receive reimbursement of all appropriate business expenses incurred as Special Advisor in accordance with the policies of the Company as in effect from time to time, subject to the Company’s requirements with respect to reporting and documentation of such expenses.

ii.Severance Benefits During the Special Advisor Period.

a.Termination By the Company for Cause or due to Poor Performance, by the Executive without Good Reason, or due to the Executive’s Death or Disability. If, during the Special Advisor Period: (1) the Company terminates the Executive’s position as Special Advisor for Cause (as defined in this Section 3(f)) upon written notice; (2) the Company terminates the Executive’s position as Special Advisor due to the Executive’s Poor Performance (as defined in this Section 3(f)) upon written notice; (3) the Executive terminates the Executive’s position as Special Advisor without Good Reason (as defined in this Section 3(f)) upon forty-five (45) days’ advance written notice (which notice period the Company may shorten in its sole discretion and which shall not be deemed a termination without Cause); (4) the Company terminates the Executive’s position as Special Advisor by reason of the Executive’s Disability upon written notice (as defined in this Section 3(f)), or (5) the Executive’s position as Special Advisor terminates upon the Executive’s death, the Executive (or following the Executive’s death, the Executive’s estate) shall be entitled to receive: (a) the Executive’s accrued but unpaid Special Advisor Cash Compensation pursuant to Section 3(b) above through the date of termination and any employee benefits that the Executive is entitled to receive pursuant to the employee benefit plans of the Company (other than any severance plans) in accordance with the terms of such employee benefit plans; (b) expenses reimbursable under Section 3(e) above incurred but not yet reimbursed to the Executive to the date of termination; and (c) vesting of the Executive’s Options that otherwise vest on January 1, 2021 (except to the extent such Options are already vested upon termination)(the items under (a), (b) and (c), collectively, the “Accrued Benefits”).

b.Termination By the Company without Cause or not due to Poor Performance, or by the Executive with Good Reason. If, during the Special Advisor Period: (1) the Company terminates the Executive’s position as Special Advisor without Cause (as defined in this Section 3(f)) other than due to Poor Performance or Disability (each, as

4

defined in this Section 3(f)), or (2) the Executive terminates the Executive’s position as Special Advisor with Good Reason (as defined in this Section 3(f)) other than following the occurrence of an event or events that could reasonably be expected to result in a termination of the Executive’s position as Special Advisor by the Company for Cause or for Poor Performance, the Executive shall be entitled to receive: (a) the Accrued Benefits; (b) without duplication, payment of the Special Advisor Cash Compensation from the termination date through July 31, 2021; (c) payment of the 2020 Annual Bonus to the extent not yet paid; (d) vesting of the unvested portion of any RSUs, with such vesting pro-rated based on the number of full months beginning on the

date of the applicable vesting period and ending on the date of the Executive’s termination as Special Advisor; and (e) vesting of any unvested PSUs at target levels of performance achievement, with such vesting pro-rated based on the number of full months beginning on the start of the applicable performance period and ending on the date of the Executive’s termination as Special Advisor.

a.For the purposes of this Section 3(f) of this Agreement, the following terms shall have the meanings set forth below:

1.“Cause” means, (a) the Executive’s conviction of a felony or any crime involving dishonesty or theft; (b) the Executive’s conduct in connection with the Executive’s duties or responsibilities as Special Advisor that is fraudulent, unlawful or grossly negligent; (c) the Executive’s willful misconduct; (d) the Executive’s willful contravention of specific lawful directions related to a material duty or responsibility which is directed to be undertaken from the Chair of the Board; (e) the Executive’s material breach of the Executive’s obligations under this Agreement, including, but not limited to breach of the Executive’s restrictive covenants set forth in Section 7 hereof; (f) any acts of dishonesty by the Executive resulting or intending to result in personal gain or enrichment at the expense of the Company, its subsidiaries or affiliates; or (g) the Executive’s willful failure to comply with a material policy of the Company, its subsidiaries or affiliates; provided that, that the Executive shall have fifteen

(15)days after receipt of notice from the Company in writing specifying the deficiency to cure the deficiency, to the extent curable, that would result in Cause; provided, further, that the Company shall have ninety (90) days from the occurrence of the event that constitutes Cause to provide notice to the Executive that the Company intends to terminate the Executive’s position as Special Advisor for Cause; provided, further, that the notice and cure periods in this Section 3(f)(iii)(1) shall be reduced if, during the Transition Period, the Executive receives notice from the Company of a deficiency allowing the Company to terminate the Executive’s employment for “Cause” (as defined in the Employment Agreement), by the number of days in the Transition Period following such notice.

(a)“Disability” means that, as a result of a permanent physical or mental injury or illness, the Executive has been unable to perform the essential functions of the Executive’s role as Special Advisor with or without reasonable accommodation for (a) 60 consecutive days or (b) a period of 150 days in any 12-month period; provided, that the time periods in this Section 3(f)(iii)(2) shall be reduced if, during the Transition Period, the Executive

5

becomes subject to a “Disability” (as defined in the Employment Agreement), by the number of days in the Transition Period the Executive is subject to such Disability.

(b)“Good Reason” means, without the Executive’s written consent: (A) a reduction in the Executive’s Special Advisor Cash Compensation; (B) assignment of duties to the Executive by the Chair of the Board that are inappropriate for the Executive’s role as Special Advisor (provided, that for the avoidance of any doubt, the Chair of the Board not assigning a certain duty or duties to the Executive in the Executive’s role as Special Advisor is not the assignment of inappropriate duties for the Executive’s role as Special Advisor); (C) the Company’s breach of any material covenant or obligation under this Agreement; or (D) relocation of the Executive’s principal work location to a location outside of New York county; provided that, that the Company shall have thirty (30) days after receipt of notice from the

Executive in writing specifying the deficiency to cure the deficiency, to the extent curable, that would result in Good Reason; provided, further, that the Executive shall have ninety (90) days from the occurrence of the event that constitutes Good Reason to provide notice to the Company that the Executive intends to resign as Special Advisor for Good Reason; provided, further, that the notice and cure periods in this Section 3(f)(iii)(3) shall be reduced if, during the Transition Period, the Company receives notice from the Executive of a deficiency allowing the Executive to terminate the Executive’s employment for “Good Reason” (as defined in the Employment Agreement), by the number of days in the Transition Period following such notice.

a.“Poor Performance” means, the Executive’s continued failure to substantially perform the Executive’s duties as Special Advisor hereunder in a satisfactory manner after a written demand for substantial performance from the Chair of the Board is delivered to him, which specifically identifies the nature of such failure, and which failure, if curable, is not cured by him within a reasonable period (not less than ten (10) days and not to exceed thirty (30) days) as determined by the Chair of the Board; provided, that the notice and cure periods in this Section 3(f)(iii)(4) shall be reduced if, during the Transition Period, the Executive receives notice from the Company of a deficiency allowing the Company to terminate the Executive’s employment for “Poor Performance” (as defined in the Employment Agreement), by the number of days in the Transition Period following such notice.

1.Attorney’s Fees. Subject to the Executive’s execution and delivery of

this Agreement, the Company shall reimburse the Executive for reasonable expenses of counsel incurred during the review and negotiation of the agreement governing his employment relationship with the Company until December 31, 2020 and governing his relationship with the Company as Special Advisor upon presentation of appropriate documentation indicating the total amount of such expenses, up to a maximum of $60,000. For the avoidance of doubt, the Executive is not entitled to reimbursement of expenses for counsel’s services rendered after the execution of this Agreement.

2.Acknowledgments. Executive acknowledges and agrees that, other than as set forth in Sections 2, 3 and 4 of this Agreement, Executive is not entitled to and will not be entitled to any other compensation or benefits of any kind or description from the Company.

6

This constitutes the total consideration to be paid to Executive by the Company and is in lieu of any and all payments and/or other consideration of any kind which at any time has been the subject of any prior discussion, representations, inducements or promises, oral or written, direct or indirect, contingent or otherwise. Executive acknowledges that as of the date of this Agreement, Executive has received all compensation the Executive was entitled to receive as of the date of this Agreement.

3.Confidentiality of Agreement. Executive agrees that the terms and conditions of this Agreement are confidential and that Executive will not disclose the terms and conditions of this Agreement to any third parties, except to the extent the terms and conditions of this Agreement are publicly disclosed by the Company; provided, however, that Executive may disclose terms and conditions of this Agreement (a) to Executive’s spouse, attorney or accountant, if Executive instructs such persons not to disclose the terms and conditions of this Agreement to any third party, and provided that if any person to whom Executive discloses information pursuant to this Section 6 discloses, in whole or in part, such information, Executive

7

will be deemed to have breached this Agreement, or (b) as required by law or as may be necessary to enforce this Agreement or to comply with its terms. Notwithstanding the foregoing, Executive may disclose Executive’s continuing obligations under this Agreement to potential and/or future employers.

1.Continuing Obligations. Executive represents and warrants that Executive has complied with and agrees to continue to comply with Executive’s ongoing obligations under the Employment Agreement. Such obligations include but are not limited to obligations set forth in Section 6 of the Employment Agreement regarding confidential information, cooperation, Company property, work product, non-solicitation, non-competition, non-disparagement and the dispute resolution provisions, as well as the arbitration and availability of injunctive relief provisions set forth in Sections 9, 10 and 17 of this Agreement; provided, however, that:

i.The definition of “Restricted Period” in Section 6.3 of the Employment Agreement shall be replaced in its entirety with the following:

a.The period the Executive is employed by the Company and for a period of one (1) year following the End of Service Date (the “Restricted Period”).

ii.Section 6.4 of the Employment Agreement shall be replaced in its entirety with the following:

b.During the Restricted Period, the Executive shall not, without the Company’s prior written consent, whether individually, as a director, manager, member, stockholder, partner, owner, employee, consultant or agent of any business, or in any other capacity, organize, establish, own, operate, manage, control, engage in, participate in, invest in, permit his name to be used by, act as a consultant or advisor to, render services for (alone or in association with any person, firm, corporation or business organization), or otherwise engage in the “Business,” as defined below, except to the extent the Company does not engage in the Business and is not in the process of evaluating, or planning, to engage in the Business. “Business” shall include commercial treasury management services or custody/investment management services provided to unions or related funds, foundations, social justice organizations or political organizations, offering ESG investment funds to clients, financing multifamily housing, offering property assessed clean energy loans and financing renewable energy. The Executive may, however, provide services in a defined area of a larger entity for which the Executive would have no direct or indirect responsibility in connection with the Business.

c.During the Restricted Period, the Executive agrees to provide the Company with at least fourteen (14) days’ advance written notice before entering into any full-time employment, part-time employment, or consulting relationship with another person or entity. Such notice will specify the person or entity to which the services would be provided and the nature of the Executive’s services. If, after the Executive provides such written notice, the Company advises the Executive that the Executive’s proposed services violate the

8

Non-Compete, and the Company is unwilling to provide a waiver (which such advice shall come within seven (7) business days following receipt by the Company of such written notice from the

Executive), the Executive agrees to consult with the Board and shall not commence such services without the Company’s written consent for seven (7) business days following receipt by the Executive of the advice. For the avoidance of doubt, after the seven (7) business day period, the Company and Executive may each return their respective positions as to whether the proposed services violate the covenants in Section 7 of this Agreement.

1.Return of Company Property. Executive agrees that Executive will return to the Company, on or before the End of Service Date or immediately upon request of the Company at any time, all property of the Company and its affiliates and affiliated funds (the “Company Entities”) and copies thereof in Executive’s possession, including, but not limited to, credit cards, office keys, computer software or hardware, mobile telecommunications devices, records, correspondence, other books or manuals issued by the Company and any confidential information in Executive’s possession. After giving effect to such return, Executive represents and warrants that Executive has no property of the Company Entities in Executive’s possession, other than documents relating to Executive’s own relationship with the Company. Executive also represents and warrants that Executive has no debts to the Company Entities, and the Company Entities are not indebted to Executive.

2.Remedy for Breach; Reformation and Severability. Executive acknowledges that the Company will be irreparably injured if Executive violates any of Executive’s obligations set forth in Sections 6 through 8 of this Agreement, and that the Company would be entitled to the remedies provided in Section 7 of the Employment Agreement, which is incorporated into this Agreement by reference. It is the intention of the Parties that Sections 6 through 8 of this Agreement be enforced to the fullest extent possible permitted by law. In case any provision of Sections 6 through 8 of this Agreement is declared by a court of competent jurisdiction to be invalid, illegal or unenforceable as written, Executive and the Company agree that the court will modify and reform such provision to permit enforcement to the greatest extent possible permitted by law. If any term, provision, covenant or restriction of this Agreement, or any part thereof, is held by a court of competent jurisdiction of any foreign, federal, state, county or local government or any other governmental, regulatory or administrative agency or authority to be invalid, void, unenforceable or against public policy for any reason, the remainder of the terms, provisions, covenants and restrictions of this Agreement will remain in full force and effect and will in no way be affected, impaired or invalidated.

3.Effect of Breach. In addition to any remedies the Company would be entitled to under Section 9, in the event Executive breaches any of Executive’s obligations set forth in this Agreement, any outstanding obligations of the Company hereunder will immediately terminate, and the Company shall be entitled to damages caused by the Executive’s breach as set forth in Section 7 of the Employment Agreement, which is incorporated into this Agreement by reference.

9

4.Claw-Back and Forfeiture. This Agreement and any 2020 Annual Bonus, equity or other incentive or performance-based compensation paid or payable to the Executive pursuant to this Agreement or under any other plan or arrangement adopted by the Company (collectively, the “Incentive Compensation”) shall be subject in all respects to the Company’s Policy on Sound Executive Compensation and any other compensation claw-back or forfeiture policy implemented by the Company from time to time and applicable to all officers of

the Company on the same terms and conditions, including without limitation, any such policy adopted to comply with the requirements of applicable law or the rules and regulations of any stock exchange applicable to the Company, and any revisions or amendments to any of the foregoing policies adopted by the Company from time to time and applicable to all officers of the Company on the same terms and conditions (collectively, the “Claw-Back Policy”). The Executive acknowledges and agrees that, if the Company is permitted to effect a claw-back or forfeiture of Incentive Compensation pursuant to the Claw-Back Policy, the Company shall be entitled to recover or retain any Incentive Compensation paid or payable to the Executive in accordance with the terms and conditions of the Claw-Back Policy.

1.Miscellaneous.

i.Executive acknowledges that Executive is not otherwise entitled to receive the benefits from the Company as set forth in this Agreement by virtue of Executive’s employment with the Company or otherwise.

ii.Executive represents and warrants that Executive fully understands the terms of this Agreement and that Executive knowingly and voluntarily, of Executive’s own free will without any duress, being fully informed and after due deliberation, accepts its terms and signs the same as Executive e’s own free act. Executive further represents and warrants that, except as set forth herein, no promises or inducements for this Agreement have been made, and Executive is entering into this Agreement without reliance upon any statement or representation by any of the Company or any other person, concerning any fact material hereto.

iii.Executive agrees that the Company has provided Executive the opportunity to review and consider this Agreement for a sufficient period of time.

2.Notice of Rights and Exceptions.

iv.Executive understands that nothing contained in this Agreement limits Executive’s ability to file a charge or complaint with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and Exchange Commission, law enforcement, the New York State Division of Human Rights or a local commission of human rights, or any other Federal, State or local governmental agency or commission (“Government Agencies”). Executive further understands that this Agreement does not limit Executive’s ability to (i) file or disclose any facts necessary to receive unemployment insurance, Medicaid or other public benefits to which Executive may be entitled, (ii) speak with Executive’s attorney, (iii) communicate with any Government Agencies, including to report possible violations of federal law or regulation or

10

making other disclosures that are protected under the whistleblower provisions of federal law or regulation, or (iv) otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information, without notice to the Company. This Agreement does not limit Executive’s right to receive an award for information provided to any Government Agencies.

v.Executive will not be criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that (i) is made (a) in confidence to a

Federal, State, or local government official, either directly or indirectly, or to an attorney; and (b) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

1.Non-Admission; Inadmissibility. This Agreement does not constitute an admission by the Company that any action it took with respect to Executive was wrongful, unlawful or in violation of any local, state or federal act, statute, or constitution, or susceptible of inflicting any damages or injury on Executive, and the Company specifically denies any such wrongdoing or violation. This Agreement is entered into solely to resolve all matters related to or arising out of Executive’s employment with the Company and the termination of such employment, and its execution and implementation may not be used as evidence, and will not be admissible in a subsequent proceeding of any kind, except one alleging a breach of this Agreement.

2.Entire Agreement. This Agreement, including provisions of the Employment Agreement incorporated herein by reference, constitutes the entire understanding between the Parties, and except as set forth herein, supersedes any and all prior agreements or understandings between the Parties arising out of or relating to Executive’s employment with the Company and the cessation thereof.

3.Amendments and Waivers. No provisions of this Agreement may be amended, modified, waived or discharged except as agreed to in writing by the Parties hereto. The failure of a Party to insist upon strict adherence to any term or provision of this Agreement on any occasion will not be considered a waiver thereof or deprive that Party of the right thereafter to insist upon strict adherence to that term or provision or any other term of this Agreement.

4.Governing Law, Dispute Resolution and Venue. The Parties acknowledge and agree that any claims, disputes or controversies between the Parties relating to or arising out of this Agreement will be resolved in accordance with the governing law, dispute resolution and venue provisions provided in Section 8.5 of the Employment Agreement, which is incorporated into this Agreement by reference.

5.Headings. The headings in this Agreement are for convenience of reference only and will not limit or otherwise affect the meaning of terms contained herein.

11

6.Successors and Assigns. Each of the Parties agrees and acknowledges that this Agreement, and all of its terms, will be binding upon their representatives, heirs, executors, administrators, successors and assigns.

7.Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original but all of which will constitute one and the same instrument. Facsimile transmission of signatures on this Agreement will be deemed to be original signatures and will be acceptable to the Parties for all purposes. In addition, transmission by electronic mail of a PDF document created from the originally signed document will be acceptable to the Parties for all purposes.

[Signatures follow on next page.]

12

Execution Copy

Privileged & Confidential

Exhibit A

Employment Agreement

Execution Copy

AMENDED AND RESTATED EMPLOYMENT AGREEMENT

AMENDED AND RESTATED EMPLOYMENT AGREEMENT (this

“Agreement”) dated July 25, 2017, by and between Amalgamated Bank (the “Company”) and Keith Mestrich (the “Executive”) (each a “Party” and together, the “Parties”).

WHEREAS, the Company currently employs the Executive as President and Chief Executive Officer of the Company pursuant to an Employment Agreement dated as of October 1, 2014 (the “Prior Agreement”); and

WHEREAS, the Parties wish to establish the terms of the Executive’s continued employment with the Company as President and Chief Executive Officer effective as of July 1, 2017 (the “Effective Date”).

NOW, THEREFORE, in consideration of the mutual promises and conditions herein set forth, the Parties agree as follows:

1.Employment and Acceptance. The Company shall continue to employ the Executive, and the Executive shall accept such employment, subject to the terms of this Agreement, on the Effective Date.

2.Term. Subject to earlier termination pursuant to Section 5 of this Agreement, this Agreement and the employment relationship hereunder shall continue from the Effective Date until June 30, 2020 (such date the “Term Date”); provided that, unless the Parties otherwise agree in writing, the Executive may provide a written notice to the Company at least thirty (30) days prior to the Term Date to extend this Agreement and the employment relationship hereunder until September 30, 2020 (such date, the “Term Extension Date,” and the period from the Term Date through the Term Extension Date, the “Extension Period”). As used in this Agreement, the “Term” shall refer to the period beginning on the Effective Date and ending on the Term Date or the Term Extension Date, as applicable, or, if earlier, on the date the Executive’s employment terminates in accordance with Section 5 below.

3.Title and Duties.

3.1 Title. The Executive shall serve in the capacity of President and Chief Executive Officer of the Company and shall report to the Board of Directors of the Company (the “Board”). The Executive shall be classified as an employee exempt from overtime pay pursuant to the executive exemption under federal and state overtime laws.

3.2. Duties. The Executive shall have such authority and responsibilities and shall perform such executive duties customarily performed by the President and Chief Executive Officer of a commercial bank and shall have such other powers and duties as may from time to

DOC ID - 26300860.5

time be prescribed by the Board, provided that such duties are consistent with the Executive’s position or other positions that he may hold from time to time. Without limiting the generality of the foregoing, the Executive shall be charged with the administration of the operations of the Company, including general supervision of the policies of the Company and general and active management of the business of the Company. The Executive agrees that during the Term he

shall devote his entire working time to the performance of his duties under this Agreement and shall not work for anyone else; provided, however, that the Company acknowledges that the Executive may serve on such corporate, civic or charitable boards or committees as have been or in the future are disclosed to, and not objected to by, the Board, such approval not to be unreasonably withheld, and manage the Executive’s personal investments, so long as any such activities do not, individually or in the aggregate, materially interfere with the performance of the Executive’s duties hereunder.

3.3 Location. The Executive’s principal place of performance of his duties hereunder shall be at the Company’s principal office located in New York, New York, subject to reasonable travel requirements on behalf of the Company.

4. Compensation and Benefits.

4.1 Base Salary. During the Term, the Company shall pay to the Executive a base salary (“Base Salary”) at the applicable annual rate set forth in the table below, paid in accordance with the Company’s payroll practice for all employees, which payroll practices the Company reserves the right to modify at any time.

| Period | Annual Rate of Base Salary | ||||

| Effective Date through June 30, 2018 | $670,000 | ||||

| July 1, 2018 through June 30, 2019 | $695,000 | ||||

July 1, 2019 through the Term Date, and if applicable, the Extension Period | $720,000 | ||||

4.2 Bonuses – Incentive Compensation. During the Term, subject to Section

8.15 of this Agreement, the Executive shall be eligible for incentive compensation to be paid to him by the Company as follows:

(a)The Executive shall be eligible to receive an annual bonus (each an “Annual Bonus”) for each fiscal year of the Company during the Term targeted at the applicable percentage of Base Salary (as determined on July 1 of each fiscal year in accordance with Section 4.1) set forth in the table below (the “Annual Bonus Target”), based on the achievement of multiple specific annual quantitative and qualitative performance metrics established by the Board (or a committee thereof), in consultation with the Executive, for such fiscal year.

DOC ID - 26300860.5

| Fiscal Year | Annual Bonus Target (percentage of Base Salary) | ||||

| 2017 | 64.2% | ||||

| 2018 | 65.5% | ||||

| 2019 and thereafter | 66.7% | ||||

(b)The Executive also shall be entitled to incentive compensation pursuant to the Company’s long term incentive plans adopted by the Board in each year of the Term; provided that, the Executive shall not be entitled to receive any grant of incentive compensation during the Extension Period. The aggregate potential value of any annual long

term incentive awards granted to the Executive shall be an amount equal to the sum of (i) 100% of Base Salary in effect at the time, minus (ii) $120,000. Notwithstanding anything to the contrary set forth herein, the Executive’s participation in any such long term incentive plan shall be governed by the terms of such plan, specifically including its vesting and exercise provisions.

4.3 Participation in Employee Benefit Plans. During the Term, the Executive shall be entitled to participate in all of the applicable employee benefit plans and perquisite programs of the Company, which are generally available to other senior executives of the Company, on the same terms as such other senior executives (except as set forth in Section 4.2). The Company may at any time or from time to time amend, modify, suspend or terminate any employee benefit plan, program or arrangement for any reason without the Executive’s consent if such amendment, modification, suspension or termination is consistent with the amendment, modification, suspension or termination for other senior executives of the Company.

4.4 Expense Reimbursement. During the Term, the Executive shall be entitled to receive reimbursement for all appropriate business expenses incurred by him in connection with his duties under this Agreement in accordance with the policies of the Company as in effect from time to time, subject to the Company’s requirements with respect to reporting and documentation of such expenses.

4.5 Attorney’s Fees. Subject to the Executive’s execution and delivery of this Agreement, upon presentation of appropriate documentation thereof, the Company shall reimburse the Executive for his reasonable, out-of-pocket, third-party, documented fees and expenses of counsel incurred in connection with the negotiation, review and execution of the Agreement, up to a maximum of $17,500.

5. Termination of Employment.

5.1 Termination upon the Term Date or the Term Extension Date, By the Company for Cause or due to Poor Performance, by the Executive without Good Reason, or Due to Executive’s Death or Disability. If the Executive’s employment terminates upon the Term Date or the Term Extension Date, as applicable, or if during the Term: (i) the Company terminates the Executive’s employment with the Company for Cause upon written notice; (ii) the Company terminates the Executive’s employment with the Company due to the Executive’s Poor

-2-

Performance upon written notice; (iii) the Executive terminates employment without Good Reason upon forty-five (45) days’ advance written notice (which notice period the Company may shorten in its sole discretion and which shall not be deemed a termination without Cause);

a.the Company terminates the Executive’s employment with the Company by reason of the Executive’s Disability upon written notice, or (v) the Executive’s employment terminates upon the Executive’s death, the Executive (or following the Executive’s death, his estate) shall be entitled to receive the following:

(a)the Executive’s accrued but unpaid Base Salary through the date of termination and any employee benefits that the Executive is entitled to receive pursuant to the employee benefit plans of the Company (other than any severance plans) in accordance with the terms of such employee benefit plans; and

a.expenses reimbursable under Section 4.4 above incurred but not yet reimbursed to the Executive to the date of termination (the items under Sections 5.1(a) and 5.1(b) collectively, the “Accrued Benefits”).

b.As used in this Agreement, the following terms shall have the meanings set forth below:

i.“Cause” means, (A) the Executive’s conviction of a felony or any crime involving dishonesty or theft; (B) the Executive’s conduct in connection with his employment duties or responsibilities that is fraudulent, unlawful or grossly negligent; (C) the Executive’s willful misconduct; (D) the Executive’s willful contravention of specific lawful directions related to a material duty or responsibility which is directed to be undertaken from the Board; (E) the Executive’s material breach of the Executive’s obligations under this Agreement, including, but not limited to breach of the Executive’s restrictive covenants set forth in Section 6 hereof; (F) any acts of dishonesty by the Executive resulting or intending to result in personal gain or enrichment at the expense of the Company, its subsidiaries or affiliates; or (G) the Executive’s willful failure to comply with a material policy of the Company, its subsidiaries or affiliates; provided that, that the Executive shall have fifteen (15) days after receipt of notice from the Company in writing specifying the deficiency to cure the deficiency, to the extent curable, that would result in Cause; provided, further, that the Company shall have ninety (90) days from the occurrence of the event that constitutes Cause to provide notice to the Executive that the Company intends to terminate the Executive’s employment for Cause.

ii.“Change in Control” means the consummation of a transaction or a series of related transactions resulting in any of the following events: (i) one person or group (other than Workers United) becomes the beneficial owner, directly or indirectly, of more than 50% of the combined voting power of the then issued and outstanding securities of the Company, or (ii) the sale, transfer or other disposition of all or substantially all of the business and assets of the Company, whether by sale of assets, merger or otherwise (determined on a consolidated basis), to one person or group (other than Workers United). Notwithstanding the foregoing, a transaction shall not be considered to be a “Change in Control” if, for purposes of Section 409A of the Internal Revenue Code of 1986, as amended (the

-3-

“Code”), such transaction does not constitute a “change in control event,” as defined under Treasury Regulation Section 1.409A-3(i)(5)(i).

iii.“Disability” means that, as a result of a permanent physical or mental injury or illness, the Executive has been unable to perform the essential functions of his job with or without reasonable accommodation for (a) 60 consecutive days or (b) a period of 150 days in any 12-month period.

iv.“Good Reason” means, without the Executive’s written consent: (A) a reduction in the Executive’s Base Salary; (B) subject to Section 5.3 of this Agreement, a substantial diminution in the Executive’s duties or responsibilities; (C) the Company’s breach of any material covenant or obligation under this Agreement; or (D) relocation of the Executive’s principal work location to a location outside of New York county; provided that, that the Company shall have thirty (30) days after receipt of notice from the Executive in writing specifying the deficiency to cure the deficiency, to the extent curable, that

would result in Good Reason; provided, further, that the Executive shall have ninety (90) days from the occurrence of the event that constitutes Good Reason to provide notice to the Company that the Executive intends to resign for Good Reason.

i.“Poor Performance” means, the Executive’s continued failure to substantially perform his duties hereunder in a satisfactory manner after a written demand for substantial performance from the Board is delivered to him, which specifically identifies the nature of such failure, and which failure, if curable, is not cured by him within a reasonable period (not less than ten (10) days and not to exceed thirty (30) days) as determined by the Board.

a. By the Company Without Cause, or by the Executive with Good Reason. If at any time during the Term, the Company terminates the Executive’s employment without Cause other than due to Poor Performance or Disability, or the Executive terminates his employment upon notice (except as described in the definition of Good Reason) with Good Reason other than following the occurrence of an event that could reasonably be expected to result in a termination of his employment by the Company for Cause or during a period when circumstances exist that could reasonably be expected to result in a termination of his employment by the Company due to Poor Performance, the Executive shall be entitled to receive:

By the Company Without Cause, or by the Executive with Good Reason. If at any time during the Term, the Company terminates the Executive’s employment without Cause other than due to Poor Performance or Disability, or the Executive terminates his employment upon notice (except as described in the definition of Good Reason) with Good Reason other than following the occurrence of an event that could reasonably be expected to result in a termination of his employment by the Company for Cause or during a period when circumstances exist that could reasonably be expected to result in a termination of his employment by the Company due to Poor Performance, the Executive shall be entitled to receive:

By the Company Without Cause, or by the Executive with Good Reason. If at any time during the Term, the Company terminates the Executive’s employment without Cause other than due to Poor Performance or Disability, or the Executive terminates his employment upon notice (except as described in the definition of Good Reason) with Good Reason other than following the occurrence of an event that could reasonably be expected to result in a termination of his employment by the Company for Cause or during a period when circumstances exist that could reasonably be expected to result in a termination of his employment by the Company due to Poor Performance, the Executive shall be entitled to receive:

By the Company Without Cause, or by the Executive with Good Reason. If at any time during the Term, the Company terminates the Executive’s employment without Cause other than due to Poor Performance or Disability, or the Executive terminates his employment upon notice (except as described in the definition of Good Reason) with Good Reason other than following the occurrence of an event that could reasonably be expected to result in a termination of his employment by the Company for Cause or during a period when circumstances exist that could reasonably be expected to result in a termination of his employment by the Company due to Poor Performance, the Executive shall be entitled to receive:1.the Accrued Benefits; and

2.beginning on the 60th day after such termination of employment, but only if the Executive has executed and not revoked within the revocation period a valid release agreement in a form reasonably acceptable to the Company, a severance payment in an amount equal to the sum of (i) (x) eighteen (18) months of the Executive’s Base Salary in effect on the date of such termination, minus (y) $180,000, and (ii) an amount equal to the Annual Target Bonus in effect for the fiscal year in which the date of such termination occurs, payable in equal

-4-

monthly installments for a period of eighteen (18) months; provided that, if (A) such termination occurs within twelve (12) months following a Change in Control or (B) the Company terminates the Executive’s employment without Cause other than due to Poor Performance or Disability within ninety (90) days’ prior to a Change in Control and the Executive reasonably demonstrates that such termination was at the request of the eventual acquirer in connection with such Change in Control, such severance payment shall be in an amount equal to the sum of (i) (x) twenty-four (24) months of the Executive’s Base Salary in effect on the date of such termination, minus (y) $240,000, and (ii) an amount equal to two (2) times the Annual Target Bonus in effect for the fiscal year in which the date of such termination occurs, payable in equal monthly installments for a period of twenty-four (24) months. Payments that would otherwise have been owed to the Executive prior to the 60th day after termination of employment shall be made to the Executive on the 60th day after such termination of employment.

b.Duties prior to Termination. During the Extension Period (if applicable) or at any time following a notice of termination of the Executive’s employment hereunder from either Party and prior to the applicable date of termination, the Company may (a) require the Executive to continue to perform the Executive’s duties hereunder on the Company’s behalf, (b)

limit or impose reasonable restrictions on the Executive’s activities as it deems necessary, or (c) modify the Executive’s authorities, responsibilities and/or duties (including as provided in Section 3.2 of this Agreement) without such action constituting a violation of this Agreement or Good Reason.

a.Continued Employment Beyond the Expiration of the Term. Unless the Parties otherwise agree in writing, continuation of the Executive’s employment with the Company beyond the expiration of the Term shall be deemed an employment at will and shall not be deemed to extend any of the provisions of this Agreement and the Executive’s employment may thereafter be terminated at will by either the Executive or the Company; provided, that any provisions of this Agreement that contemplate performance following the expiration of the Term shall survive any termination of this Agreement or the termination of the Executive’s employment hereunder, including, without limitation, Sections 6, 7 and 8.12 of this Agreement.

b.Removal from any Boards and Position. If the Executive’s employment terminates for any reason, the Executive shall be deemed to resign (a) if a member, from the Board or boards of directors to which he has been appointed or nominated to by or on behalf of the Company and (b) from any position with the Company and its subsidiaries and affiliates.

c.Put Right. Within ninety (90) days following a termination of the Executive’s employment for any reason other than a termination by the Company for Cause, the Executive shall have the right (the “Put Right”) to sell to the Company, the common stock of the Company (the “Common Stock”) acquired by the Executive during the period of his employment with the Company for a per share amount equal to either (a) if as of the date of the termination of the Executive’s employment the Company’s equity is not publicly traded, the tangible book value of such shares as of the date of the termination of the Executive’s employment, or (b) if as

-5-

of the date of the termination of the Executive’s employment the Company’s equity is publicly traded, the per share closing price on the date such purchase is consummated; provided that, the Executive shall not have the right to exercise the Put Right if the Company is prohibited from satisfying the Put Right (i) by applicable law or (ii) by the terms of any agreement to which the Company is then a party. As a condition to the Company’s obligation to purchase the Executive’s Common Stock pursuant to the Put Right, the Executive shall be required to represent and warrant that the Executive has good and marketable title to all such shares of Common Stock subject to the purchase, free and clear of all liens, encumbrances and defects. The purchase of Common Stock by the Company pursuant to the Executive’s exercise of the Put Right shall be paid in cash; provided however that to the extent the amount to be paid upon exercise of the Put Right exceeds $1,000,000, such excess may, at the discretion of the Board, be paid either (x) in cash, or (y) under a note issued by the Company with principal payments made in no more than three (3) equal annual installments and bearing interest, payable annually, at the lowest interest rate required to avoid imputed interest.

1.Restrictions and Obligations of the Executive.

a.Confidentiality. (a) During the course of the Executive’s employment by the Company, the Executive has had and shall continue to have access to certain trade secrets and confidential information relating to the Company, its subsidiaries and affiliates (the

“Protected Parties”) which is not readily available from sources outside the Company. The confidential and proprietary information and, in any material respect, trade secrets of the Protected Parties are among their most valuable assets, including but not limited to, their customer, supplier and vendor lists, databases, competitive strategies, computer programs, frameworks, or models, their marketing programs, their sales, financial, marketing, training and technical information, and any other information, whether communicated orally, electronically, in writing or in other tangible forms concerning how the Protected Parties create, develop, acquire or maintain their products and marketing plans, target their potential customers and operate their businesses. The Protected Parties invested, and continue to invest, considerable amounts of time and money in their process, technology, know-how, obtaining and developing the goodwill of their customers, their other external relationships, their data systems and data bases, and all the information described above (hereinafter collectively referred to as “Confidential Information”), and any misappropriation or unauthorized disclosure of Confidential Information in any form would irreparably harm the Protected Parties. The Executive acknowledges that such Confidential Information constitutes valuable, highly confidential, special and unique property of the Protected Parties. The Executive shall hold in a fiduciary capacity for the benefit of the Protected Parties all Confidential Information relating to the Protected Parties and their businesses, which shall have been obtained by the Executive during the Executive’s employment by the Company and which shall not be or become public knowledge (other than by acts by the Executive or representatives of the Executive in violation of this Agreement). During the period the Executive is employed by the Company and at any time thereafter, the Executive shall not disclose any Confidential Information, directly or indirectly, to any person or entity for any reason or purpose whatsoever, nor shall the Executive use it in any way, except (i) in the course of the Executive’s employment with, and for the

-6-

benefit of, the Protected Parties, (ii) to enforce any rights or defend any claims hereunder or under any other agreement to which the Executive is a party with any Protected Party, provided that such disclosure is relevant to the enforcement of such rights or defense of such claims and is only disclosed in the formal proceedings related thereto, (iii) when required to do so by a court of law, by any governmental agency having supervisory authority over the business of any of the Protected Parties or by any administrative or legislative body (including a committee thereof) with jurisdiction to order him to divulge, disclose or make accessible such information, provided that, to the extent permitted by law, the Executive shall give prompt written notice to the Company of such requirement, disclose no more information than is so required, and cooperate with any attempts by the Company to obtain a protective order or similar treatment, (iv) as to such Confidential Information that becomes generally known to the public without his violation of this Section 6.1(a) or (v) to the Executive’s spouse, attorney, and/or his personal tax and financial advisors as reasonably necessary or appropriate to advance the Executive’s tax, financial and other personal planning (each an “Exempt Person”), provided, however, that any disclosure or use of Confidential Information by an Exempt Person other than the exceptions set forth in (i)-(iv) above shall be deemed to be a breach of this Section 6.1(a) by the Executive. The Executive shall take all reasonable steps to safeguard the Confidential Information and to protect it against disclosure, misuse, espionage, loss and theft. The Executive understands and agrees that the Executive shall acquire no rights to any such Confidential Information.

(b)All files, records, documents, drawings, specifications, data, computer programs, evaluation mechanisms and analytics and similar items relating thereto or to the Business (for the purposes of this Agreement, “Business” shall be as defined in Section 6.4

hereof), as well as all customer lists, specific customer information, compilations of product research and marketing techniques of any of the Protected Parties, whether prepared by the Executive or otherwise coming into the Executive’s possession, shall remain the exclusive property of the Protected Parties.

a.It is understood that while employed by the Company, the Executive shall promptly disclose to it, and assign to it the Executive’s interest in any invention, improvement or discovery made or conceived by the Executive, either alone or jointly with others, which arises out of the Executive’s employment. At the Company’s request and expense, the Executive shall assist the Company during the period of the Executive’s employment by the Company and thereafter (but subject to reasonable notice and taking into account the Executive’s schedule) in connection with any controversy or legal proceeding relating to such invention, improvement or discovery and in obtaining domestic and foreign patent or other protection covering the same.

b.The Executive understands that nothing contained in this Agreement limits the Executive’s ability to file a charge or complaint with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Securities and Exchange Commission or any other federal, state or local governmental agency or commission (each, a “Government Agency”). The Executive further understands that this Agreement does not limit the Executive’s ability to communicate with any Government Agency, including to report

-7-

possible violations of federal law or regulation or making other disclosures that are protected under the whistleblower provisions of federal law or regulation, or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information, without notice to the Company.

c.This Agreement does not limit the Executive’s right to receive an award for information provided to any Government Agency. The Executive will not be criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (i) is made (x) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (y) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

a.Cooperation. During the period the Executive is employed by the Company and thereafter, the Executive shall cooperate with any investigation or inquiry by the Company or any governmental or regulatory agency or body that relates to the operations of a Protected Party during the period of the Executive’s employment by the Company; provided that any such cooperation shall take into account the Executive’s then current business and other obligations.

b.Non-Solicitation or Hire. During the period the Executive is employed by the Company and for a period following the termination of the Executive’s employment for any reason equal to the longer of either (a) one (1) year following the Executive’s termination of employment and (b) the applicable period during which the severance payments are scheduled to be paid pursuant to Section 5.2(b) (such longer period, the “Restricted Period”), the Executive shall not (i) directly or indirectly solicit, attempt to solicit or induce (x) any party who is a

customer of a Protected Party, who was a customer of a Protected Party at any time during the twelve (12) month period immediately prior to the date the Executive’s employment terminates or who was a prospective customer that has been identified and targeted by a Protected Party immediately prior to the date the Executive’s employment terminates, for the purpose of marketing, selling or providing to any such party any services or products offered by or available from a Protected Party on the date the Executive’s employment terminates, or (y) any supplier or prospective supplier to a Protected Party as of the date the Executive’s employment terminates to terminate, reduce or alter negatively its relationship with the Protected Party or in any manner interfere with any agreement or contract between the Protected Party and such supplier or (ii) hire any current employee of a Protected Party (a “Current Employee”) or any person who was an employee of a Protected Party during the twelve (12) month period immediately prior to the date the Executive’s employment terminates (a “Former Employee”) or directly or indirectly solicit or induce a Current or Former Employee to terminate such employee’s employment relationship with a Protected Party in order, in either case, to enter into a similar relationship with the Executive, or any other person or any entity.

a.Non-Competition. During the Restricted Period, the Executive shall not, without the Company’s prior written consent, whether individually, as a director, manager, member, stockholder, partner, owner, employee, consultant or agent of any business, or in any

-8-