Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 3D SYSTEMS CORP | ddd-20201105.htm |

| EX-99.1 - EX-99.1 - 3D SYSTEMS CORP | ddd2020-09x30earningsr.htm |

EXHIBIT 99.2 Third Quarter 2020 Financial Results November 6, 2020 ©2019 3D Systems, Inc. | All Rights Reserved.

Welcome and Participants Dr. Jeffrey Graves President and Chief Executive Officer Jagtar Narula To participate via phone, Chief Financial Officer please dial: Andrew Johnson 1-201-689-8345 Executive Vice President and Chief Legal Officer Melanie Solomon Investor Relations 2

Forward Looking Statements Certain statements made in this presentation that are not statements of historical or current facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terms such as “believes,” “beliefs,” ''may,'' ''will,'' ''should,'' expects,'' ''intends,'' ''plans,'' ''anticipates,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward- looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described in this message including those set forth below. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations concerning future events and trends, using information currently available, and are necessarily subject to uncertainties, many of which are outside our control. In addition, we undertake no obligation to update or revise any forward-looking statements made by us or on our behalf, whether as a result of future developments, subsequent events or circumstances, or otherwise, or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation. Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. 3D Systems' actual results could differ materially from those stated or implied in forward-looking statements. Past performance is not necessarily indicative of future results. We do not undertake any obligation to and do not intend to update any forward-looking statements whether as a result of future developments, subsequent events or circumstances or otherwise. Further, we encourage you to review “Risk Factors” in Part 1 of our Annual Report on Form 10-K and Part II of our quarterly reports on Form 10-Q filed with the SEC as well as other information about us in our filings with the SEC. These are available at www.SEC.gov. 3

Dr. Jeffrey Graves President & Chief Executive Officer 4

3D Systems' Purpose Statement We are the leaders in enabling additive manufacturing solutions for applications in growing markets that demand high reliability products. 5

Transformation Framework 6

Reorganize Focus on Key Applications within Healthcare and Industrial Markets Management Team Complete 7

Restructure On Track to Achieve $60M Run-Rate Cost Savings by End of 2020 Key Operating Principles Guide Our Company 8

Divest/Invest Divest Non-Core Assets and Invest for Growth Agreement Signed to Divest Cimatron and GibbsCAM Subtractive Manufacturing Software Businesses 9

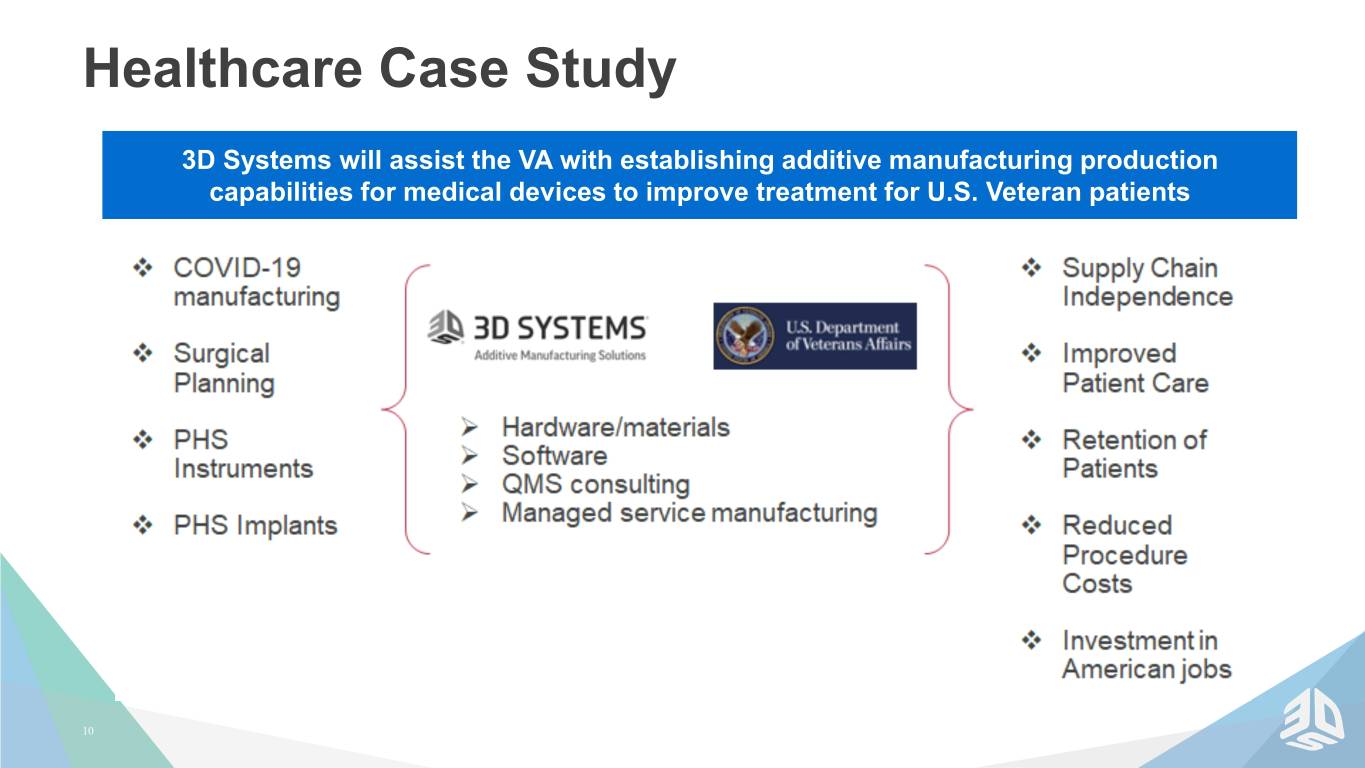

Healthcare Case Study 3D Systems will assist the VA with establishing additive manufacturing production capabilities for medical devices to improve treatment for U.S. Veteran patients 10

Applications Approach 3D Systems enables additive manufacturing applications through its unique capabilities and advancements in hardware, software and materials technology 11

Jagtar Narula Chief Financial Officer 12

Third Quarter Summary Third Quarter (in millions, except per share amounts) 2020 2019 Revenue $ 135.1 $ 155.3 • Revenue decrease 13% YoY Operating Loss (67.6) (11.9) • Revenue increase 21% vs Q2 2020 Net Loss (72.9) (16.8) • $11.9M of restructuring related charges Loss Per Share $ (0.61) $ (0.15) • 3Q20 Net Loss includes $48.3M impairment charge Non-GAAP Operating Loss $ — $ (0.3) Non-GAAP Net Loss (4.1) (4.5) Non-GAAP Loss Per Share $ (0.03) $ (0.04) 13 * See Appendix for reconciliation of GAAP and non-GAAP operating loss, net loss and net loss per share.

Revenue by Market $ in millions 19.7% 21.3% 6.1% (23.8)% 14

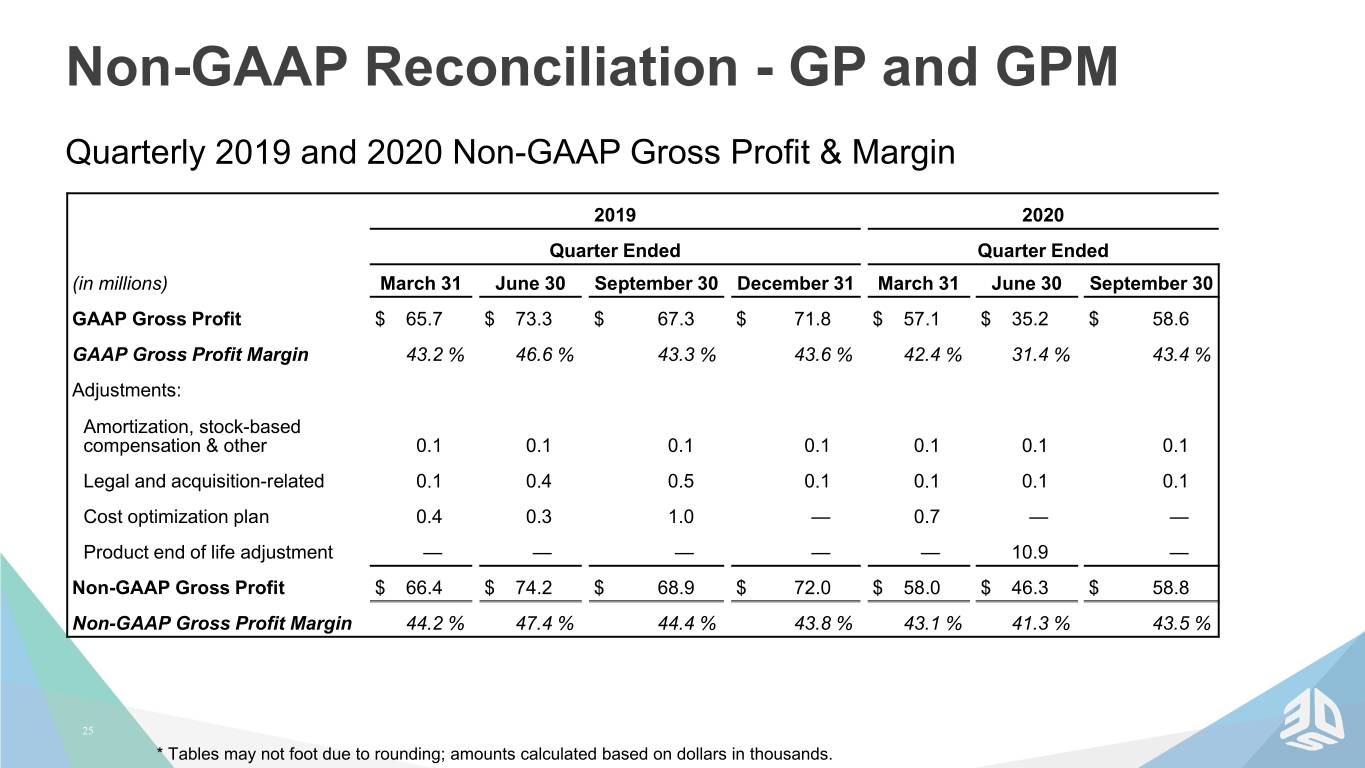

Gross Profit Margin • Q3 GAAP gross profit margin was 43.4% • Q3 non-GAAP gross profit margin was 43.5% 15 See appendix for a reconciliation of non-GAAP gross profit.

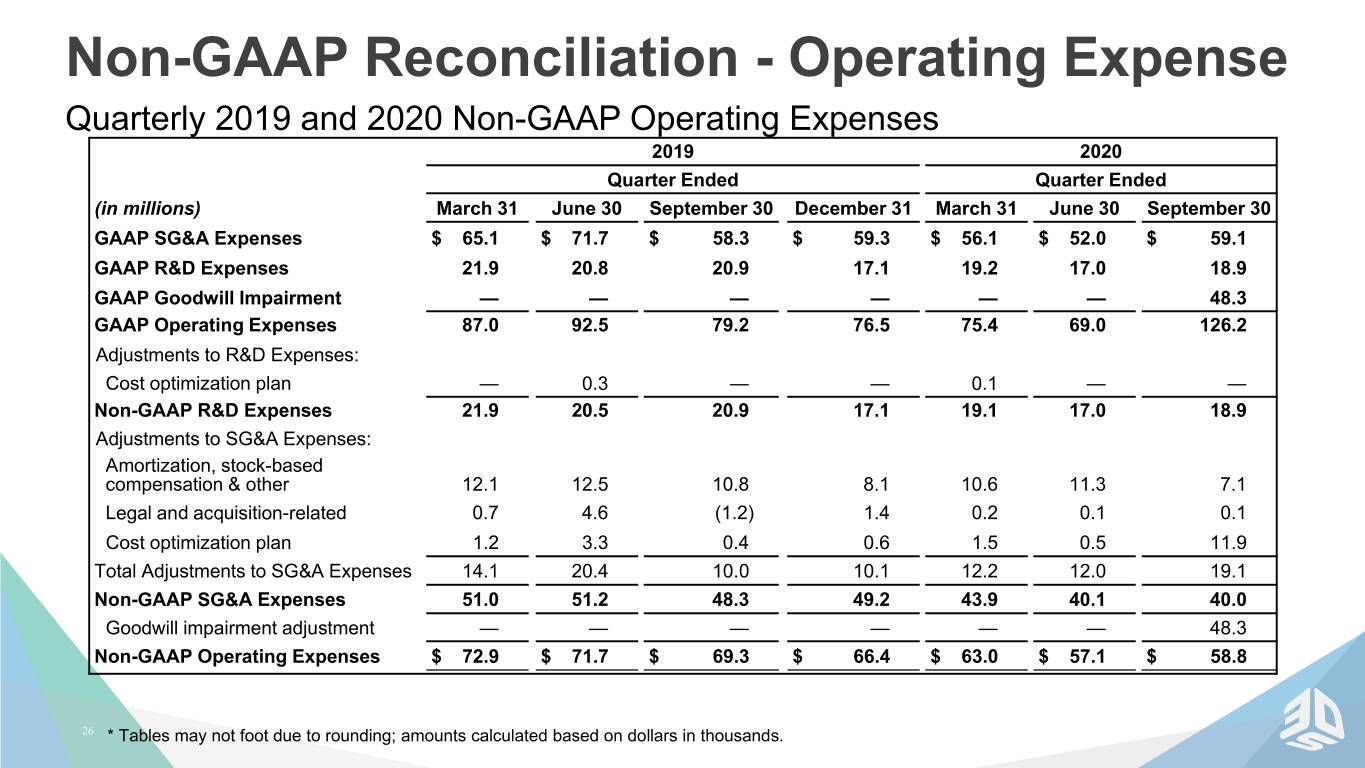

Operating Expenses • GAAP operating expenses increased 59.4% due to one-time costs, including $11.9 million of restructuring costs • Non-GAAP operating expenses decreased 15.2% compared to the third quarter of the prior year as cost actions are implemented 16 See appendix for a reconciliation of non-GAAP operating expenses.

Cash and Liquidity at September 30, 2020 • $75 million of cash and cash equivalents • Term Loan of $22 million • $100 million undrawn revolver with $31 million of availability • Continue to focus on reducing inventories • ATM Update ◦ Not planning to issue additional shares under ATM in Q4 ◦ Following the closure of the sale of Cimatron and GibbsCAM and the receipt of proceeds we plan to evaluate the continued need for the ATM program and may elect to terminate 17

Dr. Jeffrey Graves President & Chief Executive Officer 18

Summary Our Transformation Journey: • Reorganization complete • Restructuring continues, on track to achieve $60M run-rate cost savings by end of 2020 • Strengthening balance sheet • Sales improving and expect continued strength of the business moving forward 19

Q&A Session 1-201-689-8345 20

Thank You Find out more at: www.3dsystems.com 2 21 1 ©2019 3D Systems, Inc. | All Rights Reserved.

Appendix ©2019 3D Systems, Inc. | All Rights Reserved.

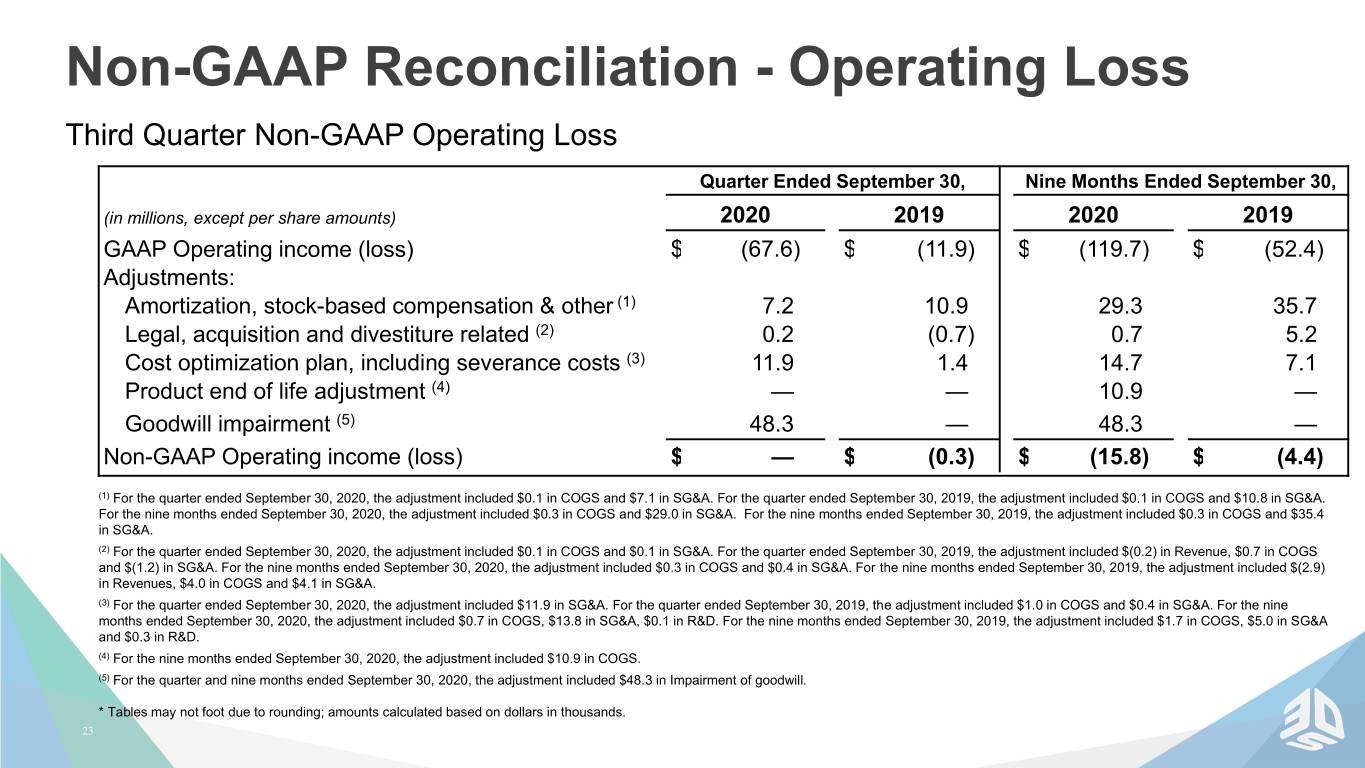

Non-GAAP Reconciliation - Operating Loss Third Quarter Non-GAAP Operating Loss Quarter Ended September 30, Nine Months Ended September 30, (in millions, except per share amounts) 2020 2019 2020 2019 GAAP Operating income (loss) $ (67.6) $ (11.9) $ (119.7) $ (52.4) Adjustments: Amortization, stock-based compensation & other (1) 7.2 10.9 29.3 35.7 Legal, acquisition and divestiture related (2) 0.2 (0.7) 0.7 5.2 Cost optimization plan, including severance costs (3) 11.9 1.4 14.7 7.1 Product end of life adjustment (4) — — 10.9 — Goodwill impairment (5) 48.3 — 48.3 — Non-GAAP Operating income (loss) $ — $ (0.3) $ (15.8) $ (4.4) (1) For the quarter ended September 30, 2020, the adjustment included $0.1 in COGS and $7.1 in SG&A. For the quarter ended September 30, 2019, the adjustment included $0.1 in COGS and $10.8 in SG&A. For the nine months ended September 30, 2020, the adjustment included $0.3 in COGS and $29.0 in SG&A. For the nine months ended September 30, 2019, the adjustment included $0.3 in COGS and $35.4 in SG&A. (2) For the quarter ended September 30, 2020, the adjustment included $0.1 in COGS and $0.1 in SG&A. For the quarter ended September 30, 2019, the adjustment included $(0.2) in Revenue, $0.7 in COGS and $(1.2) in SG&A. For the nine months ended September 30, 2020, the adjustment included $0.3 in COGS and $0.4 in SG&A. For the nine months ended September 30, 2019, the adjustment included $(2.9) in Revenues, $4.0 in COGS and $4.1 in SG&A. (3) For the quarter ended September 30, 2020, the adjustment included $11.9 in SG&A. For the quarter ended September 30, 2019, the adjustment included $1.0 in COGS and $0.4 in SG&A. For the nine months ended September 30, 2020, the adjustment included $0.7 in COGS, $13.8 in SG&A, $0.1 in R&D. For the nine months ended September 30, 2019, the adjustment included $1.7 in COGS, $5.0 in SG&A and $0.3 in R&D. (4) For the nine months ended September 30, 2020, the adjustment included $10.9 in COGS. (5) For the quarter and nine months ended September 30, 2020, the adjustment included $48.3 in Impairment of goodwill. * Tables may not foot due to rounding; amounts calculated based on dollars in thousands. 23

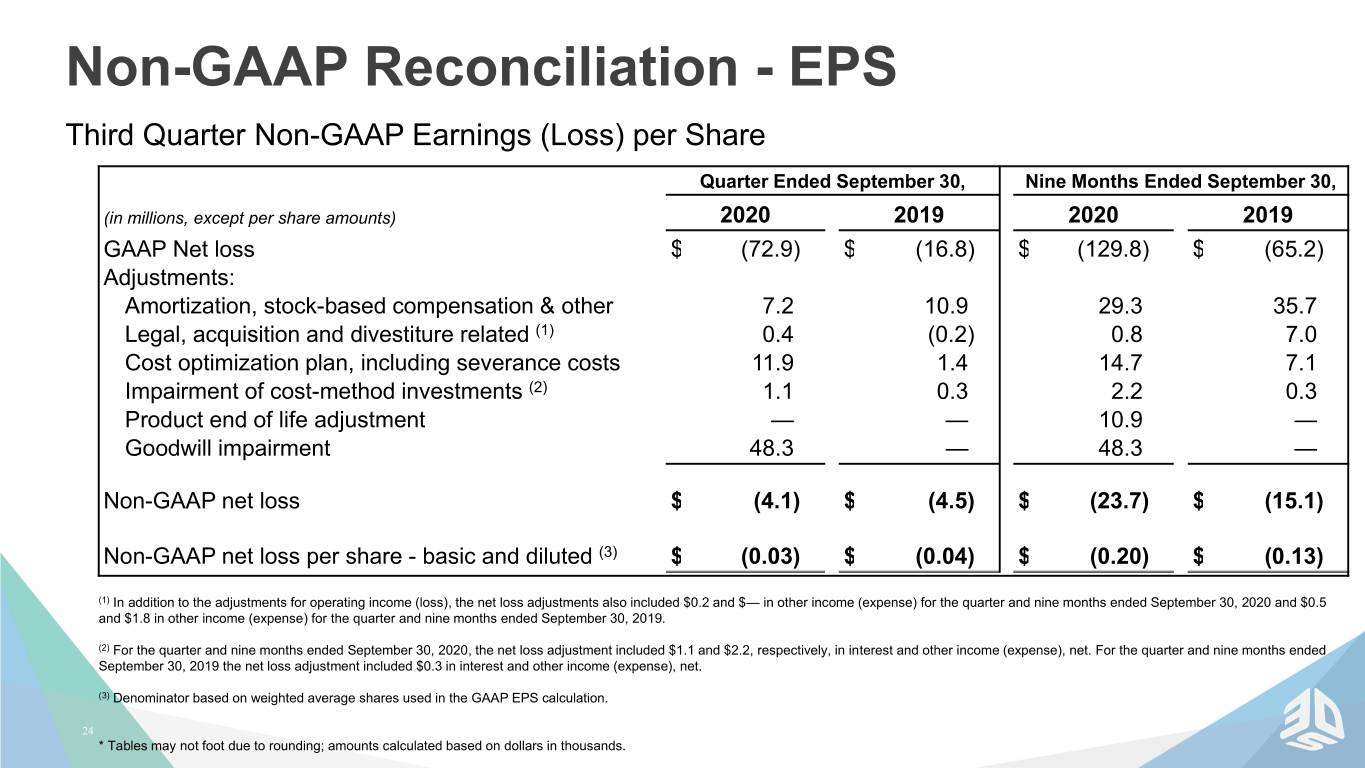

Non-GAAP Reconciliation - EPS Third Quarter Non-GAAP Earnings (Loss) per Share Quarter Ended September 30, Nine Months Ended September 30, (in millions, except per share amounts) 2020 2019 2020 2019 GAAP Net loss $ (72.9) $ (16.8) $ (129.8) $ (65.2) Adjustments: Amortization, stock-based compensation & other 7.2 10.9 29.3 35.7 Legal, acquisition and divestiture related (1) 0.4 (0.2) 0.8 7.0 Cost optimization plan, including severance costs 11.9 1.4 14.7 7.1 Impairment of cost-method investments (2) 1.1 0.3 2.2 0.3 Product end of life adjustment — — 10.9 — Goodwill impairment 48.3 — 48.3 — Non-GAAP net loss $ (4.1) $ (4.5) $ (23.7) $ (15.1) Non-GAAP net loss per share - basic and diluted (3) $ (0.03) $ (0.04) $ (0.20) $ (0.13) (1) In addition to the adjustments for operating income (loss), the net loss adjustments also included $0.2 and $— in other income (expense) for the quarter and nine months ended September 30, 2020 and $0.5 and $1.8 in other income (expense) for the quarter and nine months ended September 30, 2019. (2) For the quarter and nine months ended September 30, 2020, the net loss adjustment included $1.1 and $2.2, respectively, in interest and other income (expense), net. For the quarter and nine months ended September 30, 2019 the net loss adjustment included $0.3 in interest and other income (expense), net. (3) Denominator based on weighted average shares used in the GAAP EPS calculation. 24 * Tables may not foot due to rounding; amounts calculated based on dollars in thousands.

Non-GAAP Reconciliation - GP and GPM Quarterly 2019 and 2020 Non-GAAP Gross Profit & Margin 2019 2020 Quarter Ended Quarter Ended (in millions) March 31 June 30 September 30 December 31 March 31 June 30 September 30 GAAP Gross Profit $ 65.7 $ 73.3 $ 67.3 $ 71.8 $ 57.1 $ 35.2 $ 58.6 GAAP Gross Profit Margin 43.2 % 46.6 % 43.3 % 43.6 % 42.4 % 31.4 % 43.4 % Adjustments: Amortization, stock-based compensation & other 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Legal and acquisition-related 0.1 0.4 0.5 0.1 0.1 0.1 0.1 Cost optimization plan 0.4 0.3 1.0 — 0.7 — — Product end of life adjustment — — — — — 10.9 — Non-GAAP Gross Profit $ 66.4 $ 74.2 $ 68.9 $ 72.0 $ 58.0 $ 46.3 $ 58.8 Non-GAAP Gross Profit Margin 44.2 % 47.4 % 44.4 % 43.8 % 43.1 % 41.3 % 43.5 % 25 * Tables may not foot due to rounding; amounts calculated based on dollars in thousands.

Non-GAAP Reconciliation - Operating Expense Quarterly 2019 and 2020 Non-GAAP Operating Expenses 2019 2020 Quarter Ended Quarter Ended (in millions) March 31 June 30 September 30 December 31 March 31 June 30 September 30 GAAP SG&A Expenses $ 65.1 $ 71.7 $ 58.3 $ 59.3 $ 56.1 $ 52.0 $ 59.1 GAAP R&D Expenses 21.9 20.8 20.9 17.1 19.2 17.0 18.9 GAAP Goodwill Impairment — — — — — — 48.3 GAAP Operating Expenses 87.0 92.5 79.2 76.5 75.4 69.0 126.2 Adjustments to R&D Expenses: Cost optimization plan — 0.3 — — 0.1 — — Non-GAAP R&D Expenses 21.9 20.5 20.9 17.1 19.1 17.0 18.9 Adjustments to SG&A Expenses: Amortization, stock-based compensation & other 12.1 12.5 10.8 8.1 10.6 11.3 7.1 Legal and acquisition-related 0.7 4.6 (1.2) 1.4 0.2 0.1 0.1 Cost optimization plan 1.2 3.3 0.4 0.6 1.5 0.5 11.9 Total Adjustments to SG&A Expenses 14.1 20.4 10.0 10.1 12.2 12.0 19.1 Non-GAAP SG&A Expenses 51.0 51.2 48.3 49.2 43.9 40.1 40.0 Goodwill impairment adjustment — — — — — — 48.3 Non-GAAP Operating Expenses $ 72.9 $ 71.7 $ 69.3 $ 66.4 $ 63.0 $ 57.1 $ 58.8 26 * Tables may not foot due to rounding; amounts calculated based on dollars in thousands.