Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Veritiv Corp | tm2035027d1_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Veritiv Corp | tm2035027d1_ex99-1.htm |

1 THIRD QUARTER 2020 FINANCIAL RESULTS November 5, 2020 Exhibit 99.2

2 Scott Palfreeman Director of Finance and Investor Relations

3 Safe Harbor Provision Certain statements contained in this press release regarding Veritiv Corporation’s (the "Company") future operating results, per formance, business plans, including prospects, guidance, the 2020 Restructuring Plan and any other restructuring, statements related to the impact of COVID - 19 and any other st atements not constituting historical fact are "forward - looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where p ossible, the words "believe," "expect," "anticipate," "continue," "intend," "should," "will," "would," "planned," "estimated," "potential," "goal," "outlook," "may," "p redicts," "could," or the negative of such terms, or other comparable expressions, as they relate to the Company or its business, have been used to identify such forward - looking statement s. All forward - looking statements reflect only the Company’s current beliefs and assumptions with respect to future operating results, performance, business plans, prospect s, guidance and other matters, and are based on information currently available to the Company. Accordingly, the statements are subject to significant risks, uncertainties a nd contingencies, which could cause the Company’s actual operating results, performance, business plans, prospects or guidance to differ materially from those expressed in, or im plied by, these statements. Factors that could cause actual results to differ materially from current expectations include risks and other factors descri bed under "Risk Factors" in our Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q and elsewhere in the Company’s publicly available reports filed with the Secu rities and Exchange Commission ("SEC"), which contain a discussion of various factors that may affect the Company’s business or financial results. Such risks and oth er factors, which in some instances are beyond the Company’s control, include: the industry - wide decline in demand for paper and related products; adverse impacts of the COVID - 19 pandemic; uncertainties as to the structure, timing, benefits and costs of the 2020 Restructuring Plan or any future restructuring plan that the Company may undertake; in cre ased competition from existing and non - traditional sources; adverse developments in general business and economic conditions as well as conditions in the global cap ita l and credit markets impacting our Company and our customers; foreign currency fluctuations; our ability to attract, train and retain highly qualified employees; the ef fec ts of work stoppages, union negotiations and labor disputes; the loss of any of our significant customers; changes in business conditions in our international operations; procu rem ent and other risks in obtaining packaging, facility products and paper from our suppliers for resale to our customers; changes in prices for raw materials; increases in the cost of fuel and third - party freight and the availability of third - party freight providers; changes in trade policies and regulations; inclement weather, widespread outbreak of an illness o r responses thereto, anti - terrorism measures and other disruptions to our supply chain, distribution system and operations; our dependence on a variety of information technol ogy and telecommunications systems and the Internet; our reliance on third - party vendors for various services; cybersecurity risks; costs to comply with laws, rules and re gulations, including environmental, health and safety laws, and to satisfy any liability or obligation imposed under such laws; regulatory changes and judicial rulings impacting o ur business; adverse results from litigation, governmental investigations or audits, or tax - related proceedings or audits; our ability to adequately protect our material inte llectual property and other proprietary rights, or to defend successfully against intellectual property infringement claims by third parties; our pension and health care costs and pa rticipation in multi - employer pension, health and welfare plans; increasing interest rates; our ability to generate sufficient cash to service our debt; our ability to comply wit h the covenants contained in our debt agreements; our ability to refinance or restructure our debt on reasonable terms and conditions as might be necessary from time to time; chan ges in accounting standards and methodologies; and other events of which we are presently unaware or that we currently deem immaterial that may result in unexpected adverse op erating results. The Company is not responsible for updating the information contained in this presentation beyond the published date, or for changes made to thi s d ocument by wire services or Internet service providers. This presentation is being furnished to the SEC through a Form 8 - K. The Company’s Quarterly Report on Form 10 - Q for t he three and nine months ended September 30, 2020 to be filed with the SEC may contain updates to the information included in this presentation. We reference non - GAAP financial measures in this presentation. Please see the appendix for reconciliations of non - GAAP measures to the most comparable United States ("U.S.") GAAP measures.

4 Sal Abbate Chief Executive Officer

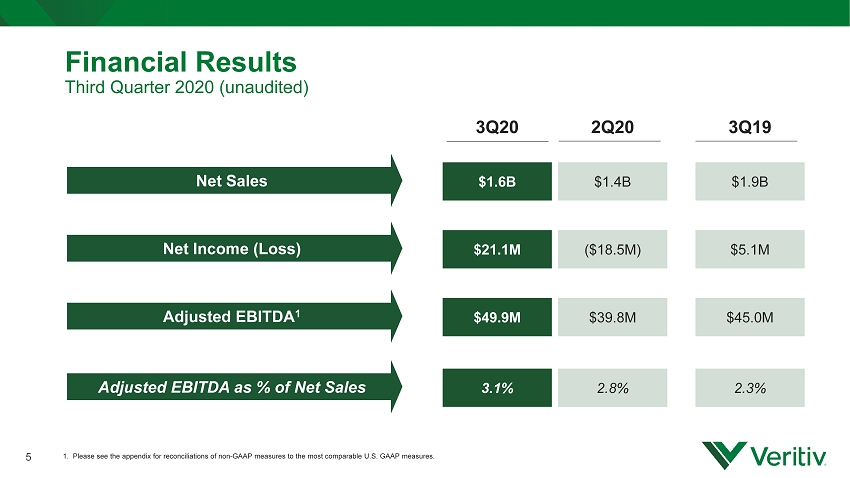

Net Sales Financial Results Third Quarter 2020 (unaudited) 5 1. Please see the appendix for reconciliations of non - GAAP measures to the most comparable U.S. GAAP measures. $ 1.6B $ 1.4B $ 1.9B 3Q20 2Q20 3Q19 Net Income (Loss) $ 21.1M ($ 18.5M ) $ 5.1M Adjusted EBITDA 1 $ 49.9M $ 39.8M $ 45.0M Adjusted EBITDA as % of Net Sales 3.1% 2.8% 2.3%

6 Steve Smith Chief Financial Officer

Segment Financial Results Third Quarter 2020 (unaudited) 7 Packaging 3Q20 2Q20 3Q19 Net Sales $848M $782M $871M Adjusted EBITDA $85.9M $69.9M $67.4M Adj. EBITDA as % of net sales 10.1% 8.9% 7.7% Facility Solutions 3Q20 2Q20 3Q19 Net Sales $231M $203M $308M Adjusted EBITDA $13.1M $11.4M $11.0M Adj. EBITDA as % of net sales 5.7% 5.6% 3.6% Print 3Q20 2Q20 3Q19 Net Sales $365M $282M $523M Adjusted EBITDA $8.8M $1.3M $10.6M Adj. EBITDA as % of net sales 2.4% 0.5% 2.0% Publishing 3Q20 2Q20 3Q19 Net Sales $119M $115M $190M Adjusted EBITDA $3.5M ($0.2M) $4.6M Adj. EBITDA as % of net sales 2.9% (0.2%) 2.4%

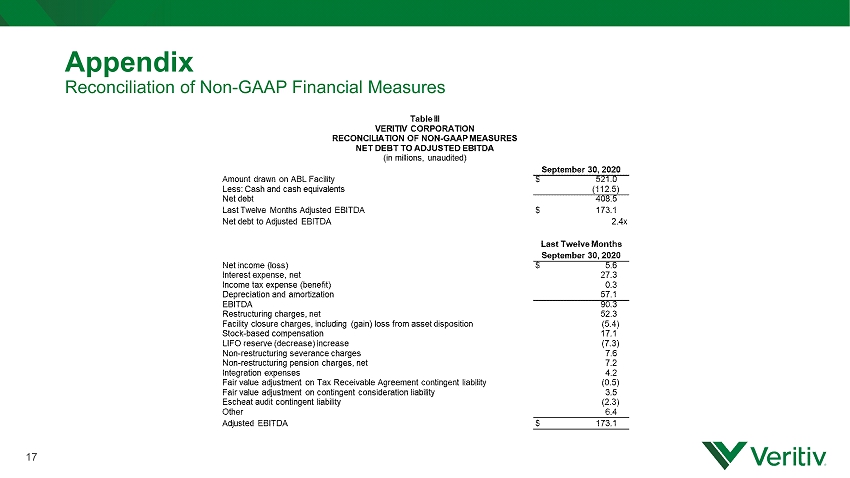

Asset - Based Lending Facility & Capital Allocation Third Quarter 2020 (unaudited) 8 Capital Structure Capital Allocation Priorities: • Maintain adequate liquidity and appropriate debt levels • Support restructuring initiatives • Invest in the business • Return value to shareholders At the end of September 2020: • The borrowing base availability for the ABL Facility was $ 892M • $ 521M drawn against the ABL Facility • $ 359M of available borrowing capacity • Net debt to Adjusted EBITDA: 2.4x utilizing the last twelve months AEBITDA Capital Allocation

9 Sal Abbate Chief Executive Officer

Outlook FY 2020 • Significant uncertainty remains related to COVID - 19 impacts on our business. • Fourth quarter sales expected to remain similar to or slightly better than third quarter levels, adjusted for two less shipping days. • 2020 Restructuring Plan as announced in July remains on schedule and on target. • Full year 2020 Adjusted EBITDA expected to be higher than prior year. 10

Questions 11

12 Sal Abbate Chief Executive Officer

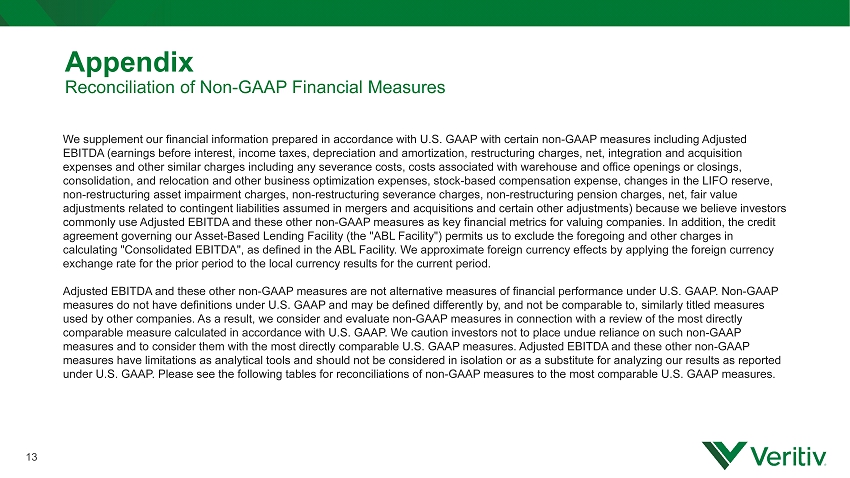

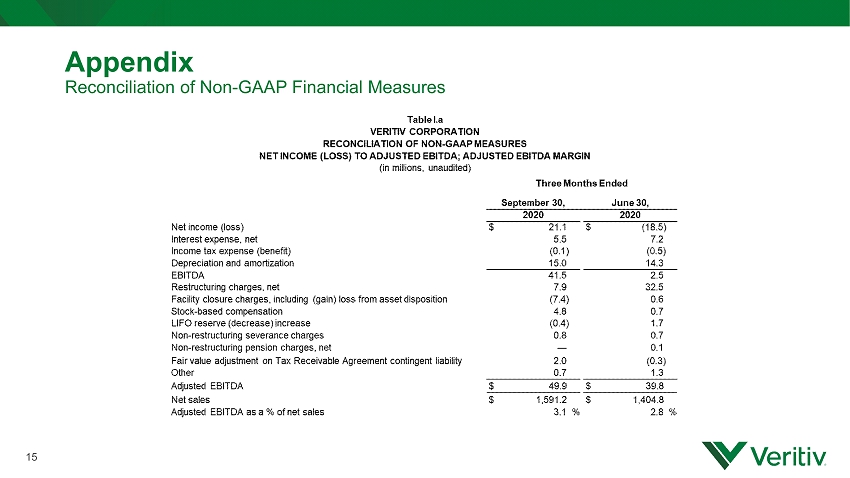

Appendix Reconciliation of Non - GAAP Financial Measures 13 We supplement our financial information prepared in accordance with U.S. GAAP with certain non - GAAP measures including Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, restructuring charges, net, integration and ac qui sition expenses and other similar charges including any severance costs, costs associated with warehouse and office openings or clos ing s, consolidation, and relocation and other business optimization expenses, stock - based compensation expense, changes in the LIFO re serve, non - restructuring asset impairment charges, non - restructuring severance charges, non - restructuring pension charges, net, fair va lue adjustments related to contingent liabilities assumed in mergers and acquisitions and certain other adjustments) because we b eli eve investors commonly use Adjusted EBITDA and these other non - GAAP measures as key financial metrics for valuing companies. In addition, the credit agreement governing our Asset - Based Lending Facility (the " ABL Facility") permits us to exclude the foregoing and other charges in calculating "Consolidated EBITDA", as defined in the ABL Facility. We approximate foreign currency effects by applying the foreign currency exchange rate for the prior period to the local currency results for the current period. Adjusted EBITDA and these other non - GAAP measures are not alternative measures of financial performance under U.S. GAAP. Non - GAA P measures do not have definitions under U.S. GAAP and may be defined differently by, and not be comparable to, similarly title d m easures used by other companies. As a result, we consider and evaluate non - GAAP measures in connection with a review of the most directl y comparable measure calculated in accordance with U.S. GAAP. We caution investors not to place undue reliance on such non - GAAP measures and to consider them with the most directly comparable U.S. GAAP measures. Adjusted EBITDA and these other non - GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analyzing our res ults as reported under U.S. GAAP. Please see the following tables for reconciliations of non - GAAP measures to the most comparable U.S. GAAP measu res.

14 Appendix Reconciliation of Non - GAAP Financial Measures

Appendix Reconciliation of Non - GAAP Financial Measures 15

16 Appendix Reconciliation of Non - GAAP Financial Measures

17 Appendix Reconciliation of Non - GAAP Financial Measures

18 THIRD QUARTER 2020 FINANCIAL RESULTS November 5, 2020