Attached files

| file | filename |

|---|---|

| 8-K - TIVITY HEALTH FORM 8-K - TIVITY HEALTH, INC. | tvty-8k_20201105.htm |

| EX-99.1 - EX-99.1 - TIVITY HEALTH, INC. | tvty-ex991_24.htm |

Tivity Health November 5, 2020 Q3 2020 Earnings Release Supplemental Material Exhibit 99.2

Introduction

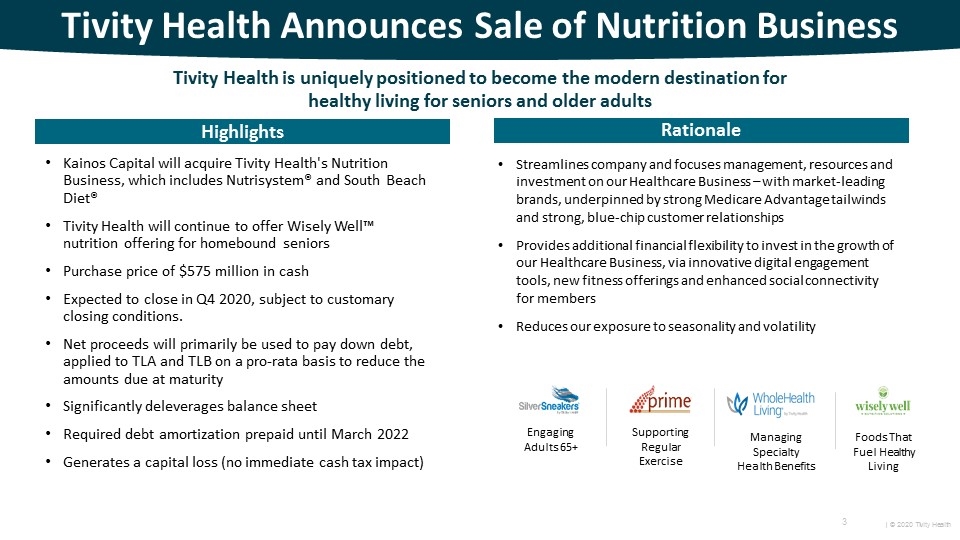

Kainos Capital will acquire Tivity Health's Nutrition Business, which includes Nutrisystem® and South Beach Diet® Tivity Health will continue to offer Wisely Well™ nutrition offering for homebound seniors Purchase price of $575 million in cash Expected to close in Q4 2020, subject to customary closing conditions. Net proceeds will primarily be used to pay down debt, applied to TLA and TLB on a pro-rata basis to reduce the amounts due at maturity Significantly deleverages balance sheet Required debt amortization prepaid until March 2022 Generates a capital loss (no immediate cash tax impact) Tivity Health Announces Sale of Nutrition Business Tivity Health is uniquely positioned to become the modern destination for healthy living for seniors and older adults Supporting Regular Exercise Engaging Adults 65+ Highlights Rationale Streamlines company and focuses management, resources and investment on our Healthcare Business – with market-leading brands, underpinned by strong Medicare Advantage tailwinds and strong, blue-chip customer relationships Provides additional financial flexibility to invest in the growth of our Healthcare Business, via innovative digital engagement tools, new fitness offerings and enhanced social connectivity for members Reduces our exposure to seasonality and volatility Managing Specialty Health Benefits Foods That Fuel Healthy Living

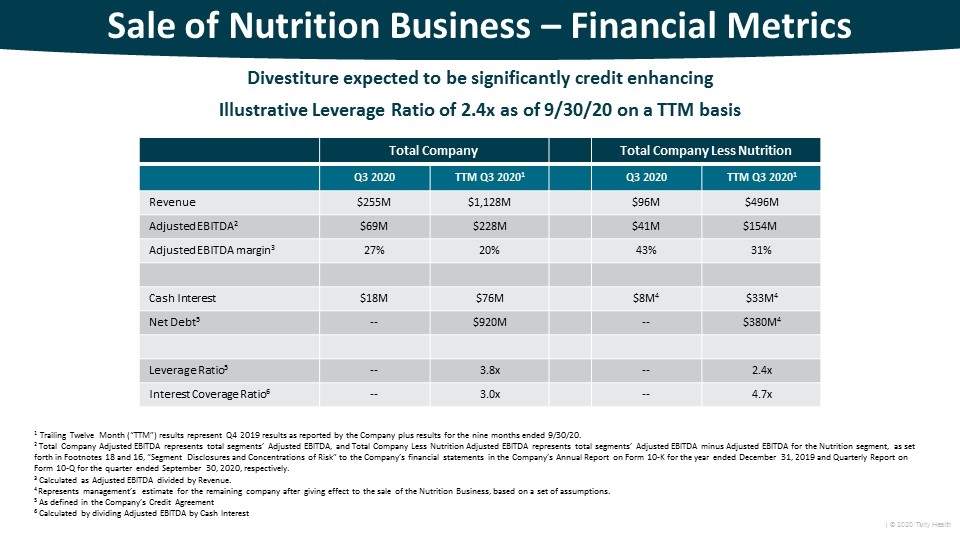

Sale of Nutrition Business – Financial Metrics Total Company Total Company Less Nutrition Q3 2020 TTM Q3 20201 Q3 2020 TTM Q3 20201 Revenue $255M $1,128M $96M $496M Adjusted EBITDA2 $69M $228M $41M $154M Adjusted EBITDA margin3 27% 20% 43% 31% Cash Interest $18M $76M $8M4 $33M4 Net Debt5 -- $920M -- $380M4 Leverage Ratio5 -- 3.8x -- 2.4x Interest Coverage Ratio6 -- 3.0x -- 4.7x 1 Trailing Twelve Month (“TTM”) results represent Q4 2019 results as reported by the Company plus results for the nine months ended 9/30/20. 2 Total Company Adjusted EBITDA represents total segments’ Adjusted EBITDA, and Total Company Less Nutrition Adjusted EBITDA represents total segments’ Adjusted EBITDA minus Adjusted EBITDA for the Nutrition segment, as set forth in Footnotes 18 and 16, “Segment Disclosures and Concentrations of Risk” to the Company’s financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, respectively. 3 Calculated as Adjusted EBITDA divided by Revenue. 4 Represents management’s estimate for the remaining company after giving effect to the sale of the Nutrition Business, based on a set of assumptions. 5 As defined in the Company’s Credit Agreement 6 Calculated by dividing Adjusted EBITDA by Cash Interest Divestiture expected to be significantly credit enhancing Illustrative Leverage Ratio of 2.4x as of 9/30/20 on a TTM basis

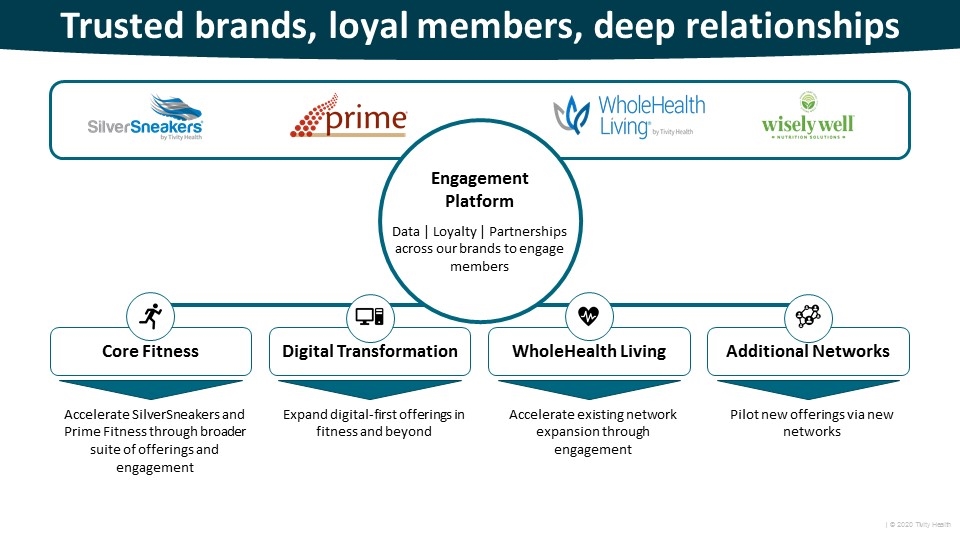

Accelerate SilverSneakers and Prime Fitness through broader suite of offerings and engagement Pilot new offerings via new networks Accelerate existing network expansion through engagement Expand digital-first offerings in fitness and beyond Core Fitness Digital Transformation WholeHealth Living Additional Networks Engagement Platform Data | Loyalty | Partnerships across our brands to engage members Trusted brands, loyal members, deep relationships

Quarterly Performance

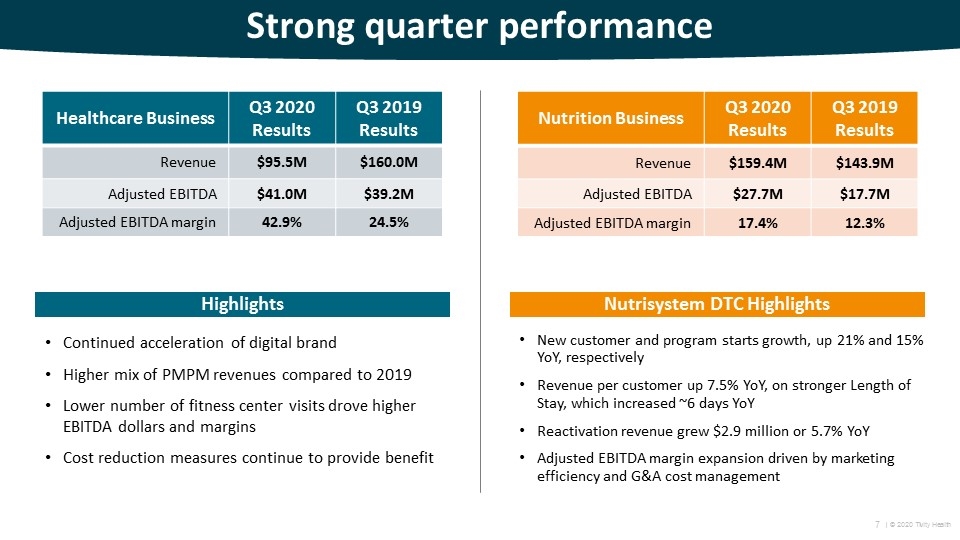

Strong quarter performance Continued acceleration of digital brand Higher mix of PMPM revenues compared to 2019 Lower number of fitness center visits drove higher EBITDA dollars and margins Cost reduction measures continue to provide benefit Highlights Nutrisystem DTC Highlights New customer and program starts growth, up 21% and 15% YoY, respectively Revenue per customer up 7.5% YoY, on stronger Length of Stay, which increased ~6 days YoY Reactivation revenue grew $2.9 million or 5.7% YoY Adjusted EBITDA margin expansion driven by marketing efficiency and G&A cost management Healthcare Business Q3 2020 Results Q3 2019 Results Revenue $95.5M $160.0M Adjusted EBITDA $41.0M $39.2M Adjusted EBITDA margin 42.9% 24.5% Nutrition Business Q3 2020 Results Q3 2019 Results Revenue $159.4M $143.9M Adjusted EBITDA $27.7M $17.7M Adjusted EBITDA margin 17.4% 12.3%

Healthcare Division

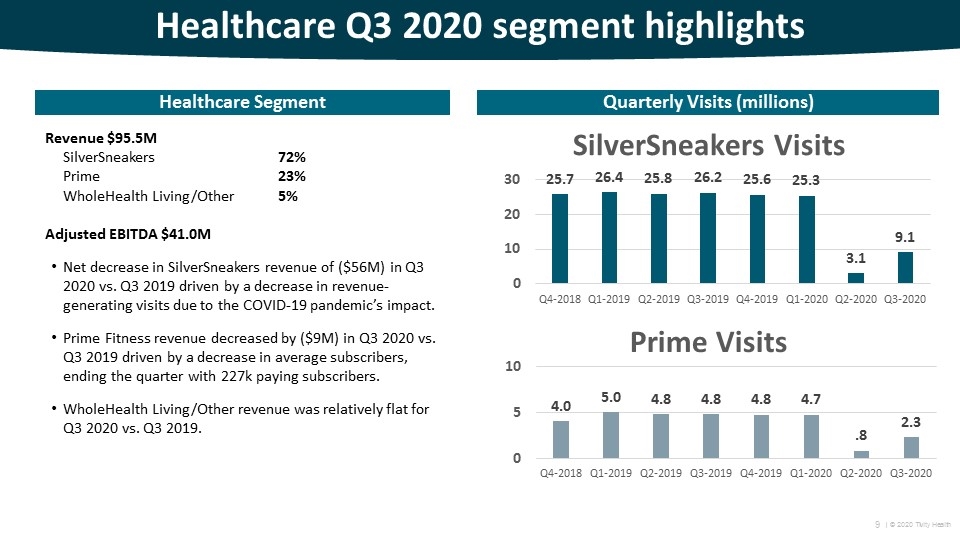

Healthcare Q3 2020 segment highlights Healthcare Segment Revenue $95.5M SilverSneakers 72% Prime23% WholeHealth Living/Other5% Adjusted EBITDA $41.0M Net decrease in SilverSneakers revenue of ($56M) in Q3 2020 vs. Q3 2019 driven by a decrease in revenue-generating visits due to the COVID-19 pandemic’s impact. Prime Fitness revenue decreased by ($9M) in Q3 2020 vs. Q3 2019 driven by a decrease in average subscribers, ending the quarter with 227k paying subscribers. WholeHealth Living/Other revenue was relatively flat for Q3 2020 vs. Q3 2019. Quarterly Visits (millions)

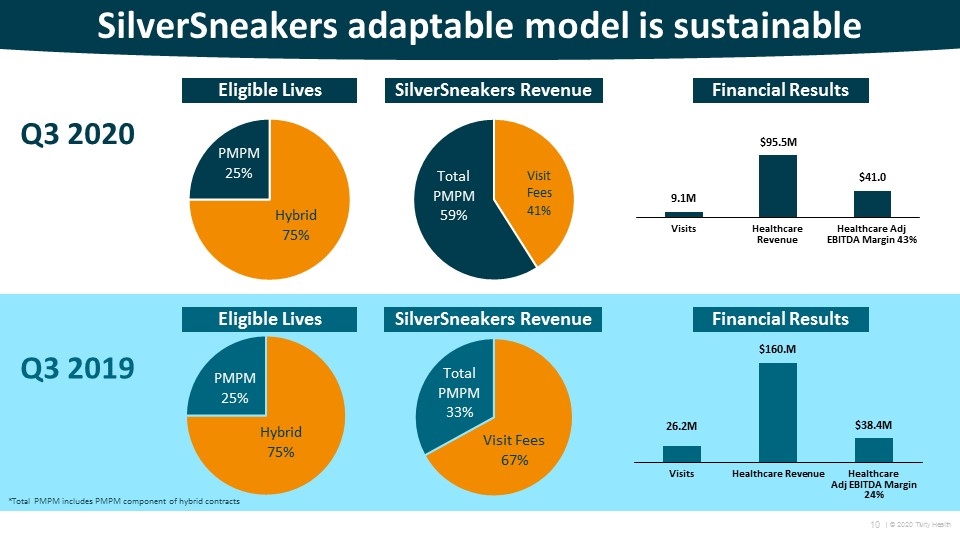

SilverSneakers adaptable model is sustainable Q3 2020 Eligible Lives SilverSneakers Revenue Financial Results Q3 2019 *Total PMPM includes PMPM component of hybrid contracts Eligible Lives SilverSneakers Revenue Financial Results

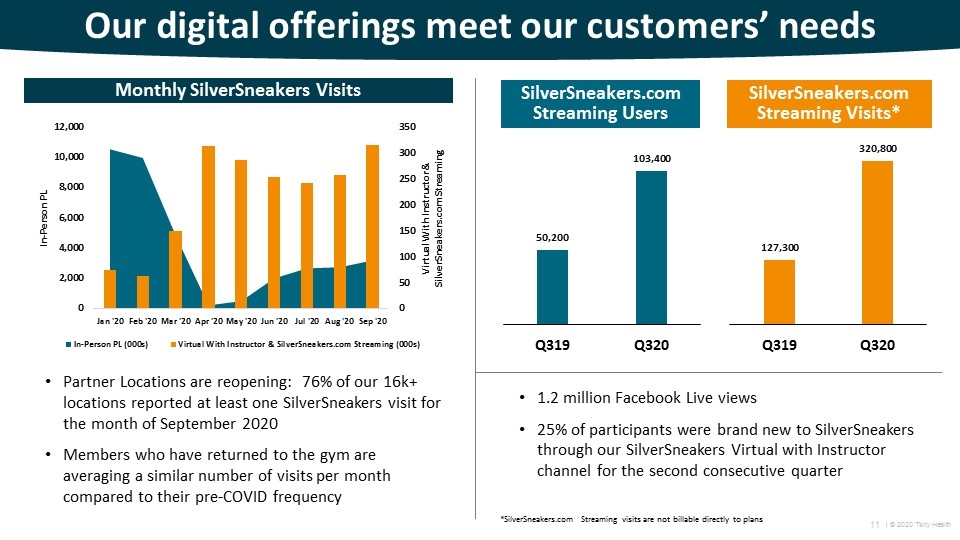

Our digital offerings meet our customers’ needs Monthly SilverSneakers Visits SilverSneakers.com Streaming Users SilverSneakers.com Streaming Visits* Partner Locations are reopening: 76% of our 16k+ locations reported at least one SilverSneakers visit for the month of September 2020 Members who have returned to the gym are averaging a similar number of visits per month compared to their pre-COVID frequency 1.2 million Facebook Live views 25% of participants were brand new to SilverSneakers through our SilverSneakers Virtual with Instructor channel for the second consecutive quarter *SilverSneakers.com Streaming visits are not billable directly to plans

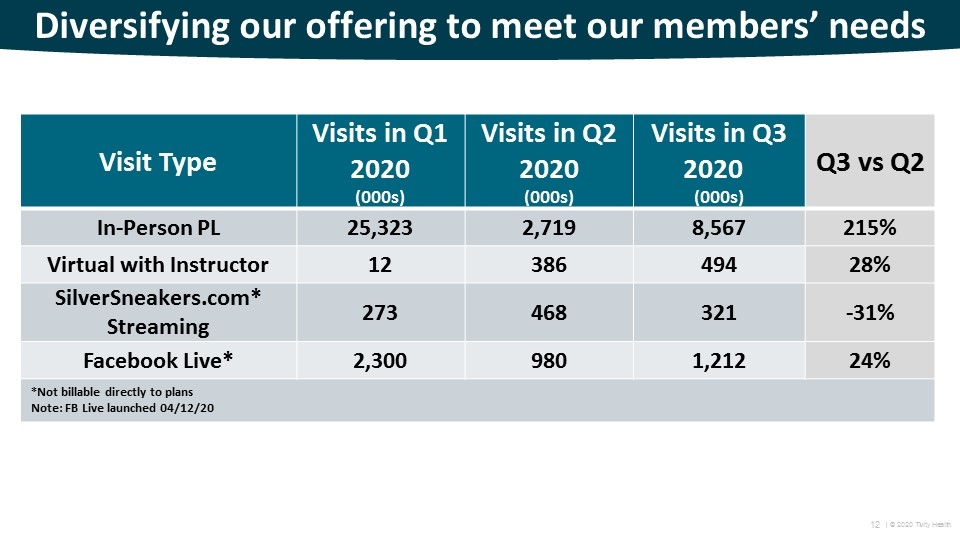

Diversifying our offering to meet our members’ needs Visit Type Visits in Q1 2020 (000s) Visits in Q2 2020 (000s) Visits in Q3 2020 (000s) Q3 vs Q2 In-Person PL 25,323 2,719 8,567 215% Virtual with Instructor 12 386 494 28% SilverSneakers.com* Streaming 273 468 321 -31% Facebook Live* 2,300 980 1,212 24% *Not billable directly to plans Note: FB Live launched 04/12/20

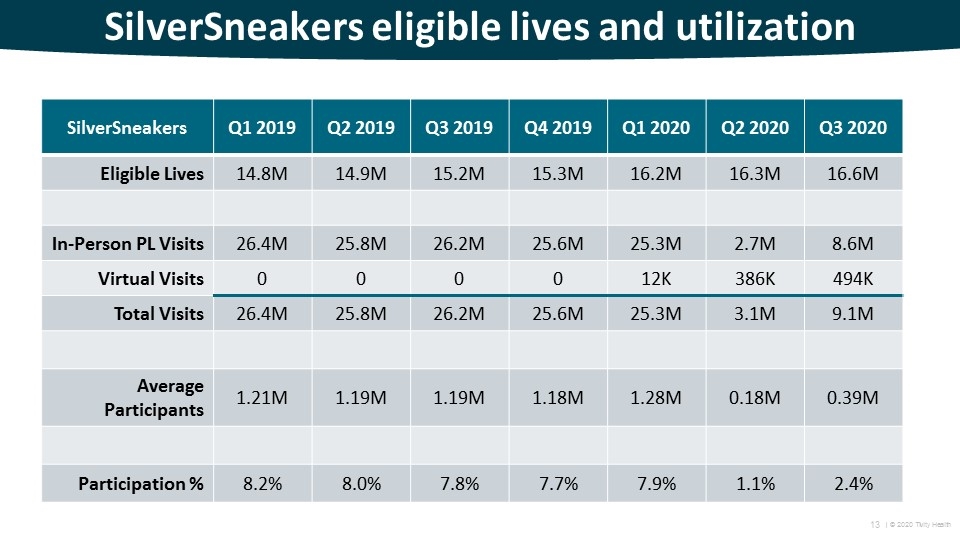

SilverSneakers eligible lives and utilization SilverSneakers Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Eligible Lives 14.8M 14.9M 15.2M 15.3M 16.2M 16.3M 16.6M In-Person PL Visits 26.4M 25.8M 26.2M 25.6M 25.3M 2.7M 8.6M Virtual Visits 0 0 0 0 12K 386K 494K Total Visits 26.4M 25.8M 26.2M 25.6M 25.3M 3.1M 9.1M Average Participants 1.21M 1.19M 1.19M 1.18M 1.28M 0.18M 0.39M Participation % 8.2% 8.0% 7.8% 7.7% 7.9% 1.1% 2.4%

Nutrition Division

Nutrisystem Highlights Q3 Revenue increased 10.8% YOY; Adjusted EBITDA increased 57% YOY Continued new customer growth for Nutrisystem brand DTC in Q3 – 21% increase YOY Double digit new customer growth last 6 months Cost per order decrease last 6 months Q3 revenue per customer increased $70 YOY Announced launch of Nutrisystem Partner Plan, a program designed to enable two people living in the same home to experience the benefits of losing weight together Announced definitive agreement to sell Tivity Health’s Nutrition Business October continued momentum

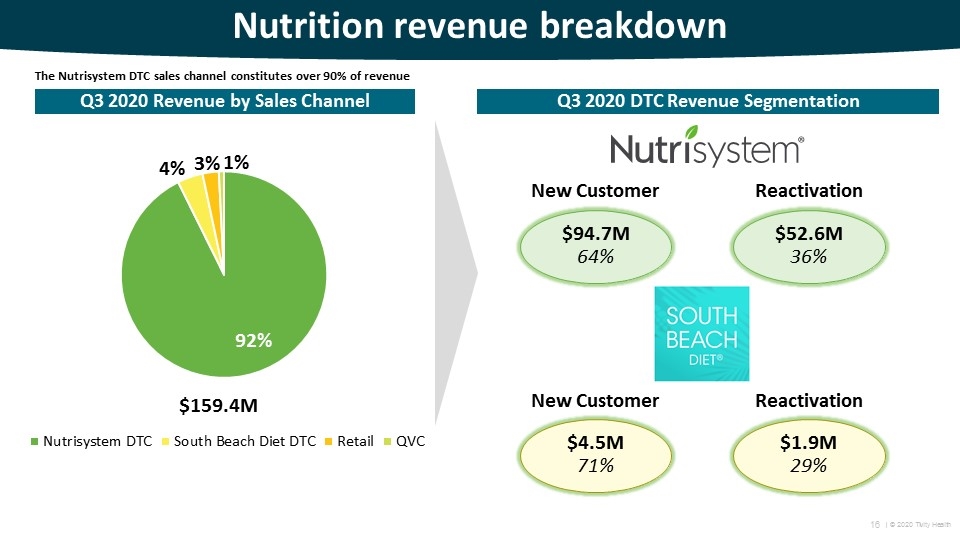

Nutrition revenue breakdown Q3 2020 Revenue by Sales Channel Q3 2020 DTC Revenue Segmentation $159.4M $4.5M 71% $1.9M 29% New Customer Reactivation $94.7M 64% $52.6M 36% New Customer Reactivation The Nutrisystem DTC sales channel constitutes over 90% of revenue

Financial & Operating Highlights

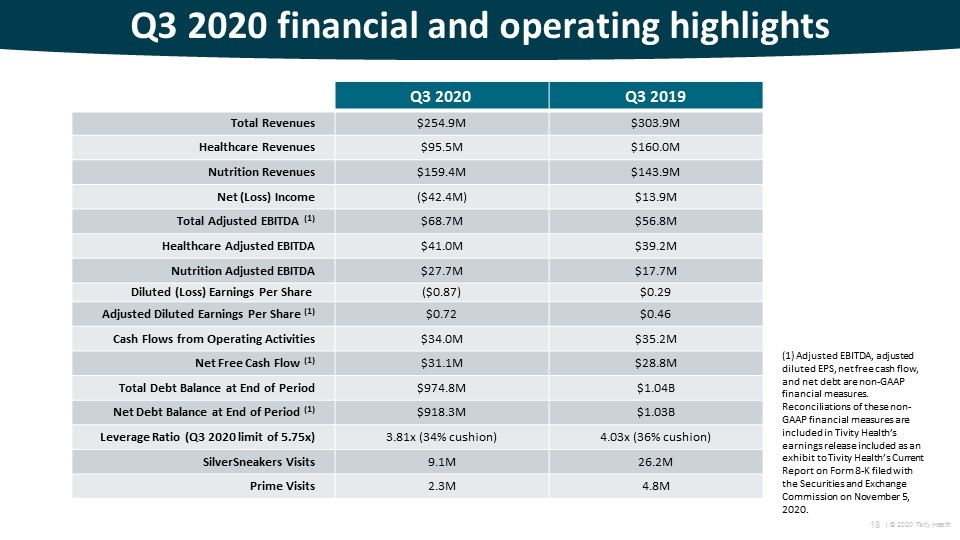

Q3 2020 financial and operating highlights Q3 2020 Q3 2019 Total Revenues $254.9M $303.9M Healthcare Revenues $95.5M $160.0M Nutrition Revenues $159.4M $143.9M Net (Loss) Income ($42.4M) $13.9M Total Adjusted EBITDA (1) $68.7M $56.8M Healthcare Adjusted EBITDA $41.0M $39.2M Nutrition Adjusted EBITDA $27.7M $17.7M Diluted (Loss) Earnings Per Share ($0.87) $0.29 Adjusted Diluted Earnings Per Share (1) $0.72 $0.46 Cash Flows from Operating Activities $34.0M $35.2M Net Free Cash Flow (1) $31.1M $28.8M Total Debt Balance at End of Period $974.8M $1.04B Net Debt Balance at End of Period (1) $918.3M $1.03B Leverage Ratio (Q3 2020 limit of 5.75x) 3.81x (34% cushion) 4.03x (36% cushion) SilverSneakers Visits 9.1M 26.2M Prime Visits 2.3M 4.8M (1) Adjusted EBITDA, adjusted diluted EPS, net free cash flow, and net debt are non-GAAP financial measures. Reconciliations of these non-GAAP financial measures are included in Tivity Health’s earnings release included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 5, 2020.

Cautionary note on forward-looking statements Note on Forward-Looking Statements This communication contains certain statements that are “forward-looking” statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based upon current expectations and include all statements that are not historical statements of fact and those regarding the intent, belief or expectations, including, without limitation, statements that are accompanied by words such as “will,” “expect,” “outlook,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the Company’s divestiture of its Nutrition business, future opportunities and anticipated future performance. Readers of this communication should understand that these statements are not guarantees of performance or results. Many risks and uncertainties could affect actual results and cause them to vary materially from the forward-looking statements. These risks and uncertainties include, among other things: the Company's ability to consummate the announced transaction on the terms set forth in the purchase agreement; the risk that the conditions to the consummation of the announced transaction may not be satisfied on the terms expected or on the anticipated schedule; the risk of the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement; the failure to receive the anticipated benefits from the transaction; the risk of business disruption and customer loss (including, without limitation, difficulties in maintaining relationships with employees, customers or vendors); the risk that the Company’s expectations regarding the effect of the announced transaction on the Company’s leverage profile may not be achieved; risks related to diverting management attention from ongoing business operations; the outcome of any legal proceedings that may be instituted against the Company related to the transaction; the profitability of the Company’s healthcare business following consummation of the announced transaction; impacts from the COVID-19 pandemic (including the response of governmental authorities to combat and contain the pandemic and the closure of fitness centers in the Company’s national network) on the Company’s business, operations or liquidity; the risk that the significant indebtedness incurred in connection with the acquisition of Nutrisystem, Inc. may limit the Company’s ability to adapt to changes in the economy or market conditions, expose the Company to interest rate risk for the variable rate indebtedness and require a substantial portion of cash flows from operations to be dedicated to the payment of indebtedness; the Company’s ability to service its debt, make principal and interest payments as those payments become due, and remain in compliance with its debt covenants; the risks associated with changes in macroeconomic conditions (including the impacts of any recession resulting from the COVID-19 pandemic), widespread epidemics, pandemics (such as the current COVID-19 pandemic) or other outbreaks of disease, geopolitical turmoil, and the continuing threat of domestic or international terrorism; the Company’s ability to collect accounts receivable from its customers and amounts due under its sublease agreements; the market’s acceptance of the Company’s new products and services; the Company’s ability to develop and implement effective strategies and to anticipate and respond to strategic changes, opportunities, and emerging trends in the Company’s industry and/or business, as well as to accurately forecast the related impact on the Company’s revenues and earnings; counterparty risk associated with the Company’s interest rate swap agreements; the Company’s ability to obtain adequate financing to provide the capital that may be necessary to support its current or future operations; the impact of any additional impairment of the Company’s goodwill, intangible assets, or other long-term assets; the risks associated with potential failures of the Company’s information systems, including as a result of telecommuting issues associated with the Company’s employees working remotely; the risks associated with data privacy or security breaches, computer hacking, network penetration and other illegal intrusions of the Company’s information systems or those of third-party vendors or other service providers, which may result in unauthorized access by third parties, loss, misappropriation, disclosure or corruption of customer, employee or the Company’s information, or other data subject to privacy laws and may lead to a disruption in the Company’s business, costs to modify, enhance, or remediate its cybersecurity measures, enforcement actions, fines or litigation against the Company, or damage to its business reputation; the impact of any new or proposed legislation, regulations and interpretations relating to Medicare, Medicare Advantage, Medicare Supplement, e-commerce, advertising, and privacy and security laws; the impact of a reduction in Medicare Advantage health plan reimbursement rates or changes in plan design; the Company’s ability to attract, hire, or retain key personnel or other qualified employees and to control labor costs; the risks associated with changes to traditional office-centered business processes and/or conducting operations out of the office in a work-from-home or remote model during adverse situations (e.g., during a crisis, disaster, or pandemic),

Cautionary note on forward-looking statements which may negatively impact productivity and cause other disruptions to the Company’s business; the effectiveness of the reorganization of the Company’s business and the Company’s ability to realize the anticipated benefits; the Company’s ability to effectively compete against other entities, whose financial, research, staff, and marketing resources may exceed its resources; the impact of legal proceedings involving the Company and/or its subsidiaries, products, or services, including any claims related to intellectual property rights; the Company’s ability to enforce its intellectual property rights; the risks associated with deriving a significant concentration of revenues from a limited number of the Company’s Healthcare segment customers, many of whom are health plans; the Company’s ability and/or the ability of its Healthcare segment customers to enroll participants and to accurately forecast their level of enrollment and participation in the Company’s programs in a manner and within the timeframe anticipated by the Company; the Company’s ability to sign, renew and/or maintain contracts with its Healthcare segment customers and/or the Company’s fitness partner locations under existing terms or to restructure these contracts on terms that would not have a material negative impact on the Company’s results of operations; the ability of the Company’s Healthcare segment health plan customers to maintain the number of covered lives enrolled in those health plans during the terms of the Company’s agreements; the Company’s ability to add and/or retain paid subscribers in its Prime Fitness program; the impact of severe or adverse weather conditions, the current COVID-19 pandemic, and the potential emergence of additional health pandemics or infectious disease outbreaks on member participation in the Company’s Healthcare segment programs; the impact of healthcare reform on the Company’s business; the effectiveness of the Company’s marketing and advertising programs; loss of, or disruption in the business of, any of the Company’s food suppliers or the Company’s fulfillment provider, or disruptions in the shipping of the Company’s food products for its Nutrition segment; the impact of claims that the Company’s Nutrition segment personnel are unqualified to provide proper weight loss advice; the impact of health- or advertising-related claims by the Company’s Nutrition segment customers; competition from other weight management industry participants or the development of more effective or more favorably perceived weight management methods; loss of any of the Company’s Nutrition segment third-party retailer agreements and any obligations associated with such loss, or a reduction of orders for Company products by any such third-party retailers or reduced promotion by such third-party retailers of Company products; the Company’s ability to continue to develop innovative weight loss programs and enhance its existing programs, or the failure of the Company’s programs to continue to appeal to the market; the impact of claims from the Company’s Nutrition segment competitors regarding advertising or other marketing practices; the Company’s ability to develop and commercially introduce new products and services; the Company’s ability to receive referrals from existing Nutrition segment customers, a decline in which could adversely impact the Company’s customer acquisition costs; failure to attract spokespersons or negative publicity with respect to any of the Company’s spokespersons; the Company’s ability to anticipate change and respond to emerging trends for customer preferences and the impact of the same on demand for the Company’s services and products; the seasonality of the business of the Company’s Nutrition segment, particularly with respect to diet season; negative publicity with respect to the weight loss industry; the impact of increased governmental regulation on the Company’s Nutrition segment; a significant portion of the Company’s Nutrition segment revenue depends on the Company’s ability to sustain subscriptions of its Nutrition segment’s programs, and cancellations could impact the Company’s future operating results; claims arising from the sale of ingested products; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s filings with the SEC. Except as required by law, the Company undertakes no obligation to update any such forward-looking statements to reflect new information, subsequent events or circumstances.