Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spirit of Texas Bancshares, Inc. | d68523d8k.htm |

Spirit of Texas Bancshares, Inc. Raymond James Texas Virtual Bank Tour 2020 November 5, 2020 Exhibit 99.1

Important Information ABOUT SPIRIT OF TEXAS BANCSHARES, INC. Spirit of Texas Bancshares, Inc. (“Spirit,” “STXB,” “Company,” “we,” “our” or “us”), through its wholly-owned subsidiary, Spirit of Texas Bank (the “Bank”), provides a wide range of relationship-driven commercial banking products and services tailored to meet the needs of businesses, professionals and individuals. Spirit of Texas Bank has 39 locations in the Houston, Dallas/Fort Worth, Bryan/College Station, San Antonio-New Braunfels, Austin, Tyler and Corpus Christi metropolitan areas, as well as in North Central and North East Texas. Please visit www.sotb.com for more information. Our website is an inactive textual reference only. FORWARD-LOOKING STATEMENTS This presentation contains, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, predictions, protections, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements are typically, but not exclusively, identified by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will, “should,” “seeks,” “likely,” “intends” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the impact of the COVID-19 pandemic on our business, including the impact of actions taken by governmental and regulatory authorities in response to such; risks relating to the possibility that the anticipated benefits related to the pending sale of our Jacksboro branch to First State Bank (the “branch sale”) will not be realized or will not be realized within the expected time period; the possibility that the conversion of operations in connection with the branch sale will be materially delayed or will be more difficult than expected; the possibility that the branch sale may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement of the branch sale on customer relationships and operating results; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses and any future acquisitions; our ability to successfully identify and address the risks associated with our recent, pending and possible future acquisitions; changes in management personnel; interest rate risk; credit risk associated with our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates and projections; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures and those of companies we acquire; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, and their application by our regulators; governmental monetary and fiscal policies; increases in our capital requirements; and other risks identified in Spirit’s Annual Report on Form 10-K for the year ended December 31, 2019, filed with the Securities and Exchange Commission (“SEC”) on March 16, 2020, its Quarterly Reports on Form 10-Q, its Current Reports on form 8-K and its other filings with the SEC. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law.

Experienced Executive Leadership Dean O. Bass Chairman and Chief Executive Officer David M. McGuire President, Director and Chief Lending Officer Founded the Company in 2008 Over 45 years of banking experience Founder, President and Chief Executive Officer of Royal Oaks Bank Former National Bank Examiner for the Office of the Comptroller of the Currency Former Director of the Texas Bankers Association Over 38 years of banking experience Co-Founder, President and Chief Lending Officer of Royal Oaks Bank Former Chief Executive Officer of Sterling Bank’s Fort Bend office Jerry D. Golemon Executive Vice President and Chief Operating Officer Over 39 years of banking experience Former Chief Financial Officer of Bank4Texas Holdings Former Chief Financial Officer, Director and Founder of Texas National Bank Certified Public Accountant Allison S. Johnson Interim Chief Financial Officer and Chief Accounting Officer Over 10 years of financial services experience Former SEC Reporting Manager for Florida Community Bank Certified Public Accountant Source: SEC Filings and Management

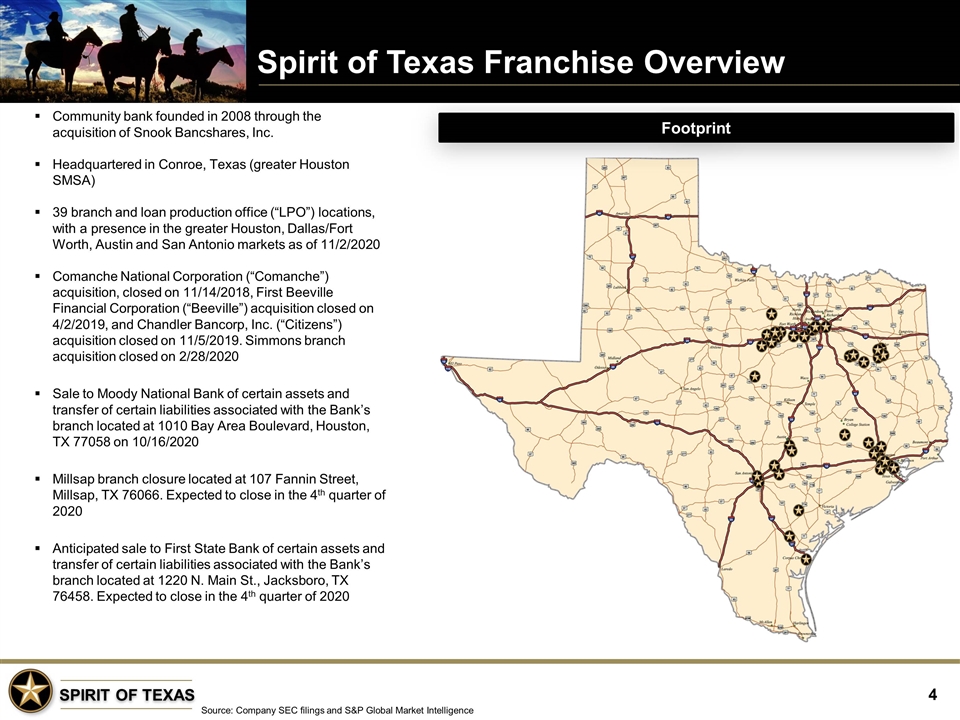

Spirit of Texas Franchise Overview Source: Company SEC filings and S&P Global Market Intelligence Community bank founded in 2008 through the acquisition of Snook Bancshares, Inc. Headquartered in Conroe, Texas (greater Houston SMSA) 39 branch and loan production office (“LPO”) locations, with a presence in the greater Houston, Dallas/Fort Worth, Austin and San Antonio markets as of 11/2/2020 Comanche National Corporation (“Comanche”) acquisition, closed on 11/14/2018, First Beeville Financial Corporation (“Beeville”) acquisition closed on 4/2/2019, and Chandler Bancorp, Inc. (“Citizens”) acquisition closed on 11/5/2019. Simmons branch acquisition closed on 2/28/2020 Sale to Moody National Bank of certain assets and transfer of certain liabilities associated with the Bank’s branch located at 1010 Bay Area Boulevard, Houston, TX 77058 on 10/16/2020 Millsap branch closure located at 107 Fannin Street, Millsap, TX 76066. Expected to close in the 4th quarter of 2020 Anticipated sale to First State Bank of certain assets and transfer of certain liabilities associated with the Bank’s branch located at 1220 N. Main St., Jacksboro, TX 76458. Expected to close in the 4th quarter of 2020 Footprint

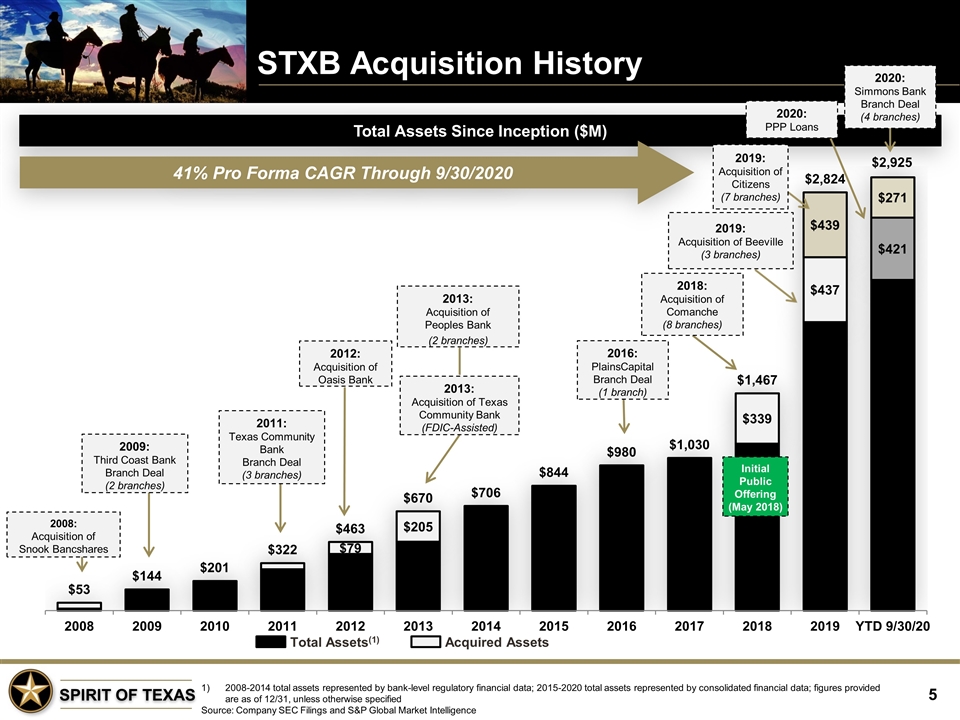

STXB Acquisition History 2008-2014 total assets represented by bank-level regulatory financial data; 2015-2020 total assets represented by consolidated financial data; figures provided are as of 12/31, unless otherwise specified Source: Company SEC Filings and S&P Global Market Intelligence Total Assets Since Inception ($M) 2009: Third Coast Bank Branch Deal (2 branches) 2011: Texas Community Bank Branch Deal (3 branches) 2012: Acquisition of Oasis Bank 2013: Acquisition of Peoples Bank (2 branches) 2016: PlainsCapital Branch Deal (1 branch) 2013: Acquisition of Texas Community Bank (FDIC-Assisted) Total Assets(1) Acquired Assets 2018: Acquisition of Comanche (8 branches) 2019: Acquisition of Citizens (7 branches) 2019: Acquisition of Beeville (3 branches) 2008: Acquisition of Snook Bancshares Initial Public Offering (May 2018) 41% Pro Forma CAGR Through 9/30/2020 2020: Simmons Bank Branch Deal (4 branches) 2020: PPP Loans

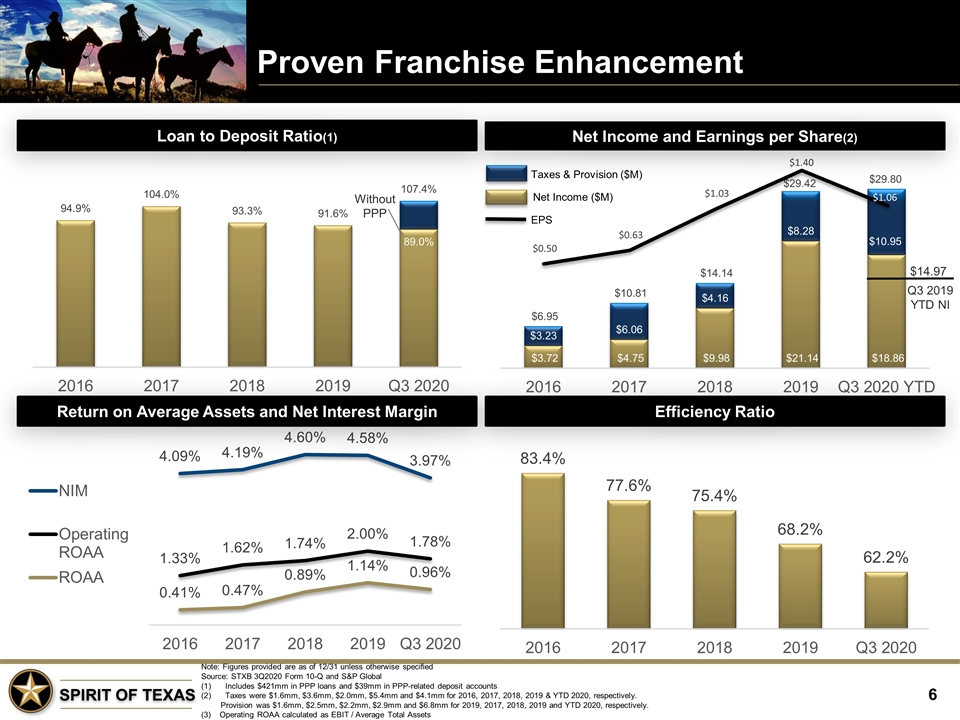

Q3 2019 YTD NI Proven Franchise Enhancement Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 3Q2020 Form 10-Q and S&P Global Includes $421mm in PPP loans and $39mm in PPP-related deposit accounts Taxes were $1.6mm, $3.6mm, $2.0mm, $5.4mm and $4.1mm for 2016, 2017, 2018, 2019 & YTD 2020, respectively. Provision was $1.6mm, $2.5mm, $2.2mm, $2.9mm and $6.8mm for 2019, 2017, 2018, 2019 and YTD 2020, respectively. (3) Operating ROAA calculated as EBIT / Average Total Assets Efficiency Ratio Loan to Deposit Ratio(1) Return on Average Assets and Net Interest Margin Net Income and Earnings per Share(2) EPS Net Income ($M) Taxes & Provision ($M) Without PPP $14.97

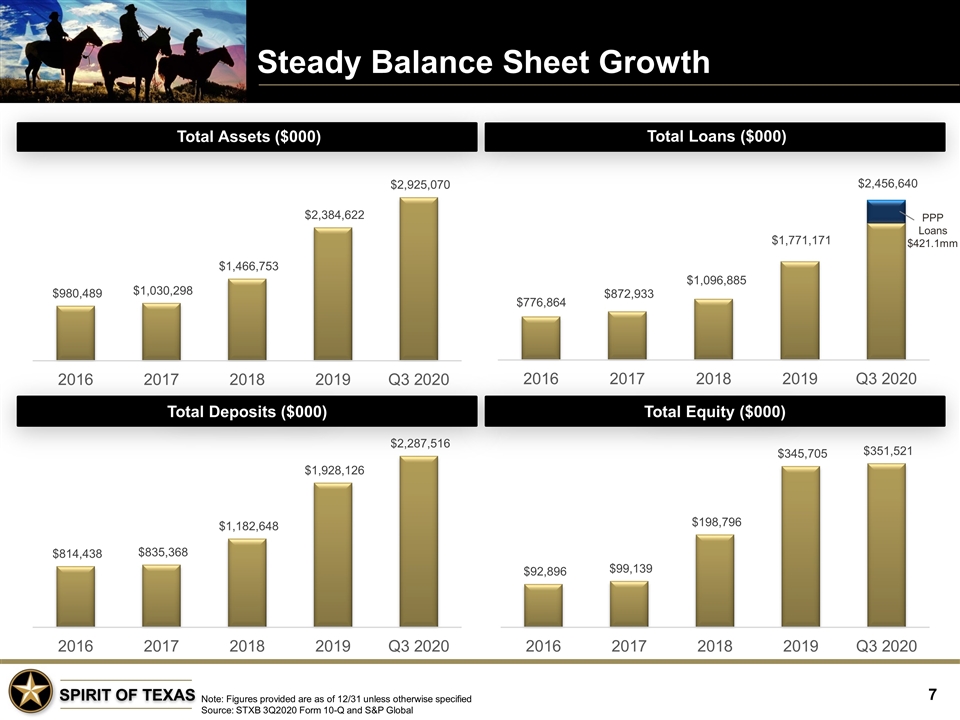

Steady Balance Sheet Growth Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 3Q2020 Form 10-Q and S&P Global Total Equity ($000) Total Deposits ($000) PPP Loans $421.1mm Total Assets ($000) Total Loans ($000)

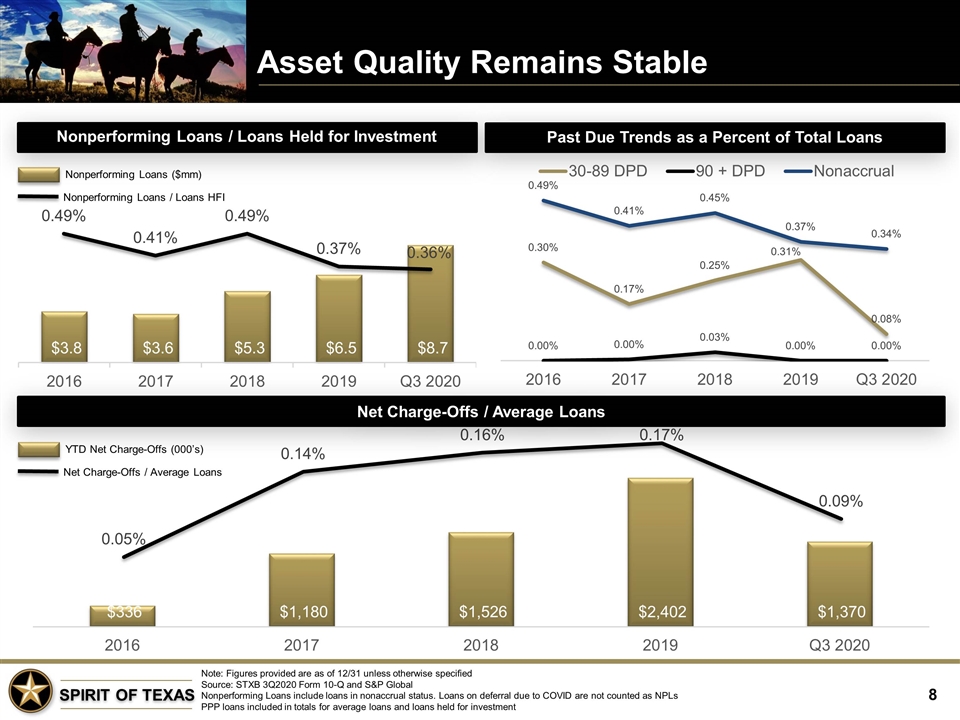

Asset Quality Remains Stable Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 3Q2020 Form 10-Q and S&P Global Nonperforming Loans include loans in nonaccrual status. Loans on deferral due to COVID are not counted as NPLs PPP loans included in totals for average loans and loans held for investment Net Charge-Offs / Average Loans Net Charge-Offs / Average Loans YTD Net Charge-Offs (000’s) Nonperforming Loans / Loans HFI Nonperforming Loans ($mm) Nonperforming Loans / Loans Held for Investment Past Due Trends as a Percent of Total Loans

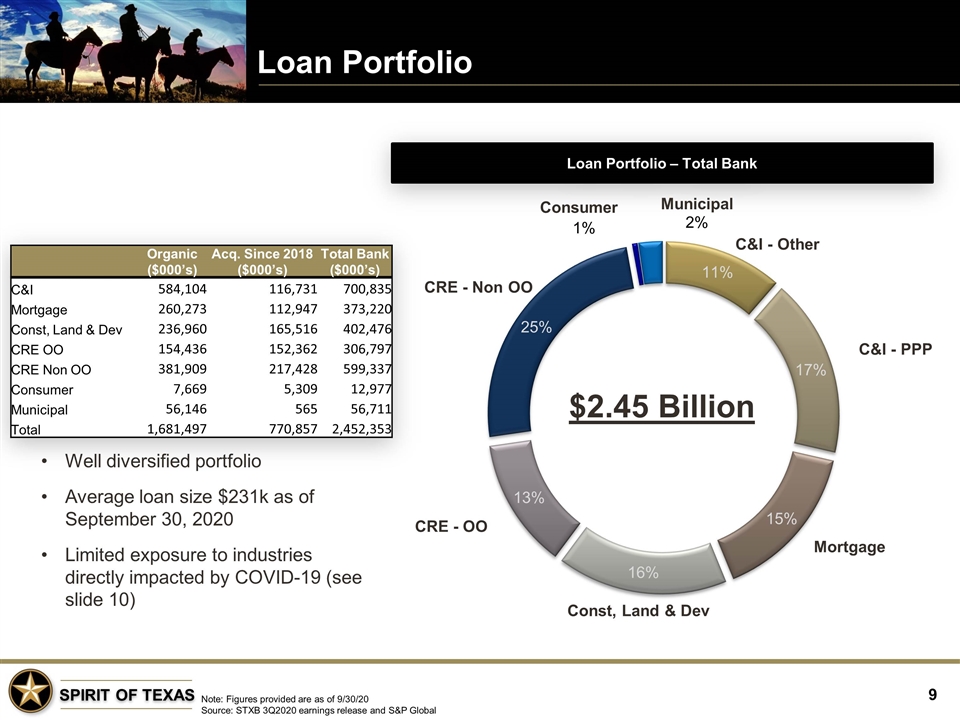

Loan Portfolio Note: Figures provided are as of 9/30/20 Source: STXB 3Q2020 earnings release and S&P Global Well diversified portfolio Average loan size $231k as of September 30, 2020 Limited exposure to industries directly impacted by COVID-19 (see slide 10) Loan Portfolio – Total Bank Municipal CRE - Non OO C&I - Other C&I - PPP Mortgage Const, Land & Dev CRE - OO Organic ($000’s) Acq. Since 2018 ($000’s) Total Bank ($000’s) C&I 584,104 116,731 700,835 Mortgage 260,273 112,947 373,220 Const, Land & Dev 236,960 165,516 402,476 CRE OO 154,436 152,362 306,797 CRE Non OO 381,909 217,428 599,337 Consumer 7,669 5,309 12,977 Municipal 56,146 565 56,711 Total 1,681,497 770,857 2,452,353 Consumer $2.45 Billion

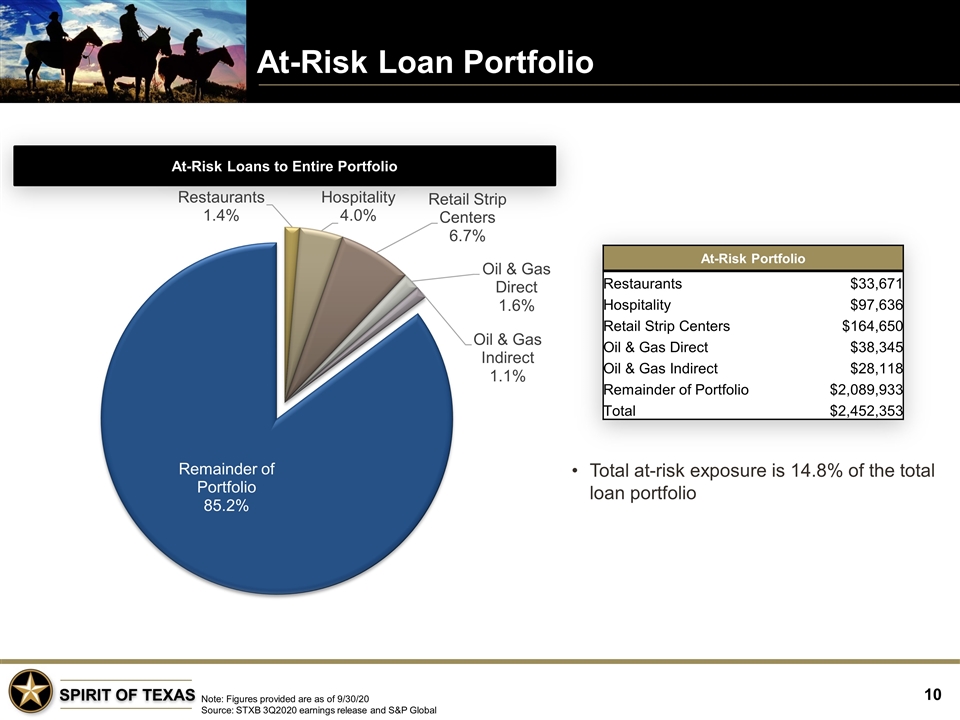

At-Risk Loan Portfolio Note: Figures provided are as of 9/30/20 Source: STXB 3Q2020 earnings release and S&P Global Total at-risk exposure is 14.8% of the total loan portfolio At-Risk Loans to Entire Portfolio At-Risk Portfolio Restaurants $33,671 Hospitality $97,636 Retail Strip Centers $164,650 Oil & Gas Direct $38,345 Oil & Gas Indirect $28,118 Remainder of Portfolio $2,089,933 Total $2,452,353

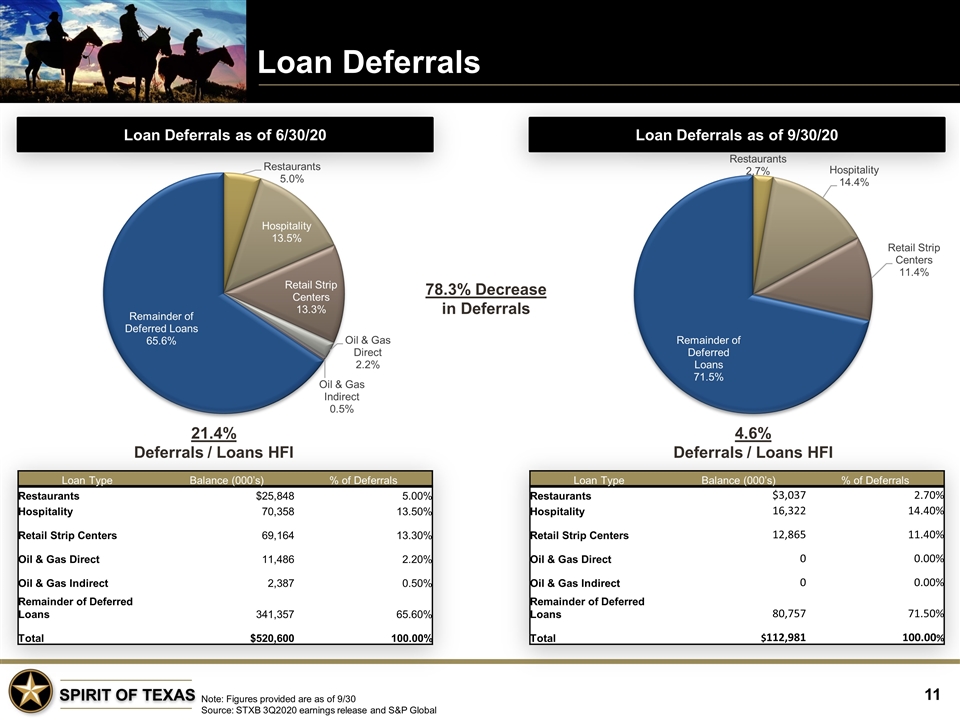

Loan Deferrals Note: Figures provided are as of 9/30 Source: STXB 3Q2020 earnings release and S&P Global Loan Deferrals as of 6/30/20 Loan Deferrals as of 9/30/20 78.3% Decrease in Deferrals Loan Type Balance (000’s) % of Deferrals Restaurants $25,848 5.00% Hospitality 70,358 13.50% Retail Strip Centers 69,164 13.30% Oil & Gas Direct 11,486 2.20% Oil & Gas Indirect 2,387 0.50% Remainder of Deferred Loans 341,357 65.60% Total $520,600 100.00% Loan Type Balance (000’s) % of Deferrals Restaurants $3,037 2.70% Hospitality 16,322 14.40% Retail Strip Centers 12,865 11.40% Oil & Gas Direct 0 0.00% Oil & Gas Indirect 0 0.00% Remainder of Deferred Loans 80,757 71.50% Total $112,981 100.00% 21.4% Deferrals / Loans HFI 4.6% Deferrals / Loans HFI

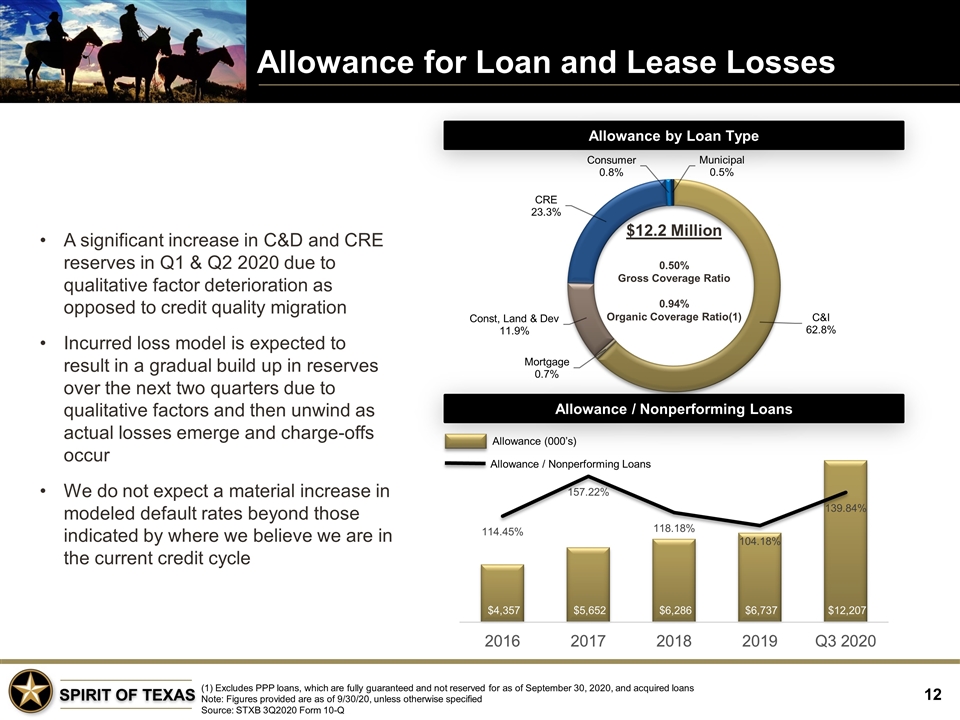

Allowance for Loan and Lease Losses (1) Excludes PPP loans, which are fully guaranteed and not reserved for as of September 30, 2020, and acquired loans Note: Figures provided are as of 9/30/20, unless otherwise specified Source: STXB 3Q2020 Form 10-Q A significant increase in C&D and CRE reserves in Q1 & Q2 2020 due to qualitative factor deterioration as opposed to credit quality migration Incurred loss model is expected to result in a gradual build up in reserves over the next two quarters due to qualitative factors and then unwind as actual losses emerge and charge-offs occur We do not expect a material increase in modeled default rates beyond those indicated by where we believe we are in the current credit cycle Allowance by Loan Type Allowance / Nonperforming Loans Allowance / Nonperforming Loans Allowance (000’s)

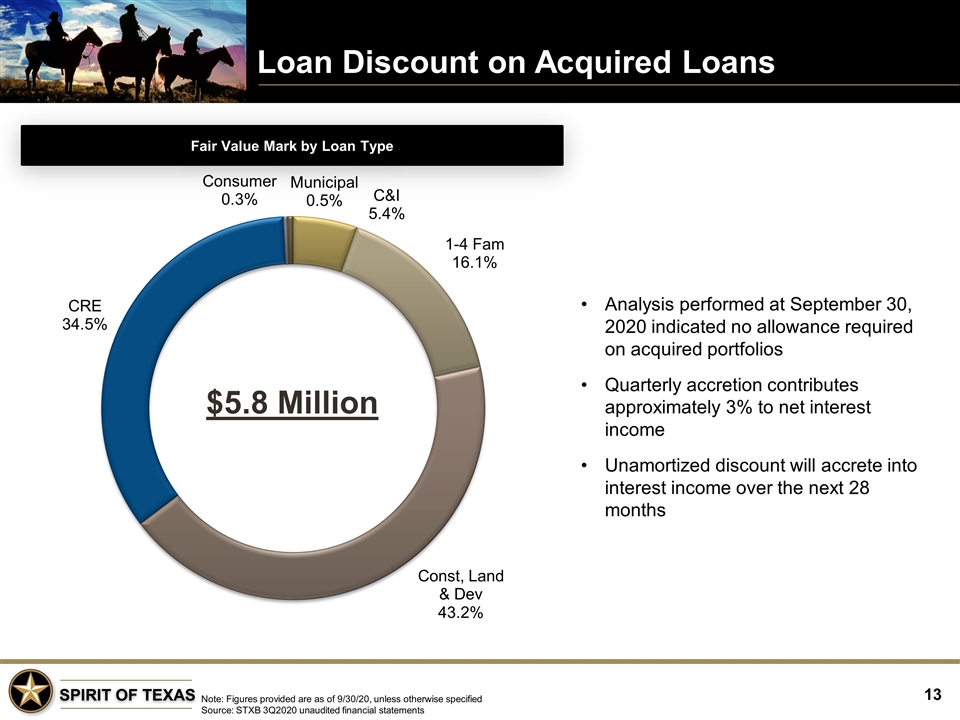

Loan Discount on Acquired Loans Note: Figures provided are as of 9/30/20, unless otherwise specified Source: STXB 3Q2020 unaudited financial statements Analysis performed at September 30, 2020 indicated no allowance required on acquired portfolios Quarterly accretion contributes approximately 3% to net interest income Unamortized discount will accrete into interest income over the next 28 months Fair Value Mark by Loan Type $5.8 Million

Payroll Protection Program (PPP) Note: Figures provided are as of 9/30/20, unless otherwise specified Source: STXB 3Q2020 unaudited financial statements Approved and funded $428.0 million in loans as of June 30, 2020 under the CARES Act, or 3,321 loans As of November 2, 2020, total PPP fee income recognized was $3.7 million, net of deferred costs As of November 2, 2020, 351 forgiveness applications, or $184.7 million in PPP loans submitted to the SBA, and 120 loans have received full forgiveness, or $51.5 million Remaining PPP fee income to be recognized, net of deferred costs is $6.4 million