Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Seritage Growth Properties | srg-ex992_7.htm |

| EX-99.1 - EX-99.1 - Seritage Growth Properties | srg-ex991_6.htm |

| 8-K - 8-K - Seritage Growth Properties | srg-8k_20201105.htm |

CORPORATE PROFILE AND COVID-19 BUSINESS UPDATE November 2020 Exhibit 99.3

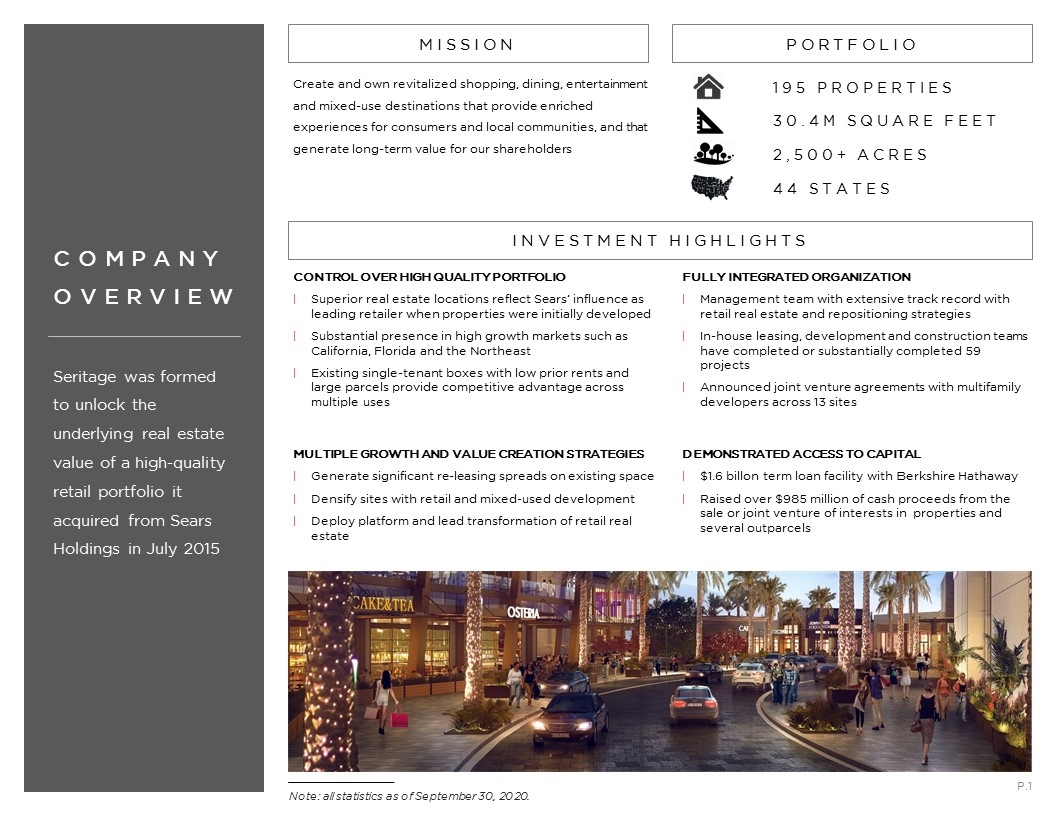

Note: all statistics as of September 30, 2020. COMPANY OVERVIEW Seritage was formed to unlock the underlying real estate value of a high-quality retail portfolio it acquired from Sears Holdings in July 2015 Create and own revitalized shopping, dining, entertainment and mixed-use destinations that provide enriched experiences for consumers and local communities, and that generate long-term value for our shareholders 195 PROPERTIES 30.4M SQUARE FEET 2,500+ ACRES 44 STATES MISSION PORTFOLIO P.1 INVESTMENT HIGHLIGHTS CONTROL OVER HIGH QUALITY PORTFOLIO Superior real estate locations reflect Sears’ influence as leading retailer when properties were initially developed Substantial presence in high growth markets such as California, Florida and the Northeast Existing single-tenant boxes with low prior rents and large parcels provide competitive advantage across multiple uses FULLY INTEGRATED ORGANIZATION Management team with extensive track record with retail real estate and repositioning strategies In-house leasing, development and construction teams have completed or substantially completed 59 projects Announced joint venture agreements with multifamily developers across 13 sites MULTIPLE GROWTH AND VALUE CREATION STRATEGIES Generate significant re-leasing spreads on existing space Densify sites with retail and mixed-used development Deploy platform and lead transformation of retail real estate DEMONSTRATED ACCESS TO CAPITAL $1.6 billon term loan facility with Berkshire Hathaway Raised over $985 million of cash proceeds from the sale or joint venture of interests in properties and several outparcels

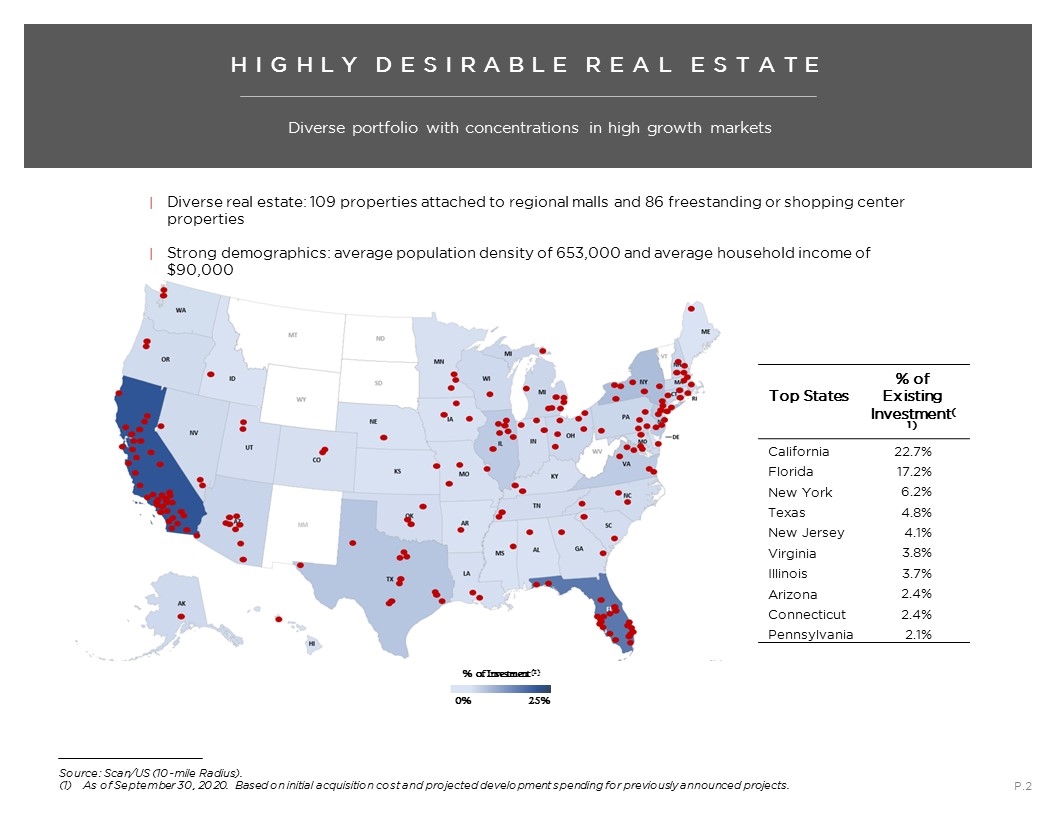

HIGHLY DESIRABLE REAL ESTATE Diverse portfolio with concentrations in high growth markets Source: Scan/US (10-mile Radius). As of September 30, 2020. Based on initial acquisition cost and projected development spending for previously announced projects. P.2 Diverse real estate: 109 properties attached to regional malls and 86 freestanding or shopping center properties Strong demographics: average population density of 653,000 and average household income of $90,000 % of Investment (1) 0% 25% Top States % of Existing Investment(1) California 22.7% Florida 17.2% New York 6.2% Texas 4.8% New Jersey 4.1% Virginia 3.8% Illinois 3.7% Arizona 2.4% Connecticut 2.4% Pennsylvania 2.1%

COVID-19 BUSINESS UPDATE Advancing response with emphasis on people, liquidity and value First priority remains the health and safety of our team, our families, our communities and our partners Focused on preserving the medium- and long-term value of our assets and platform, balanced with the need to make necessary changes in response to the current environment 95% of tenants open or partially open as of October 30, 2020 Collected 86% of cash rents in Q3 2020, and executed deferral agreements for 10% Sold $284.4 million of assets year to date, including $113.6 million in Q3 2020 Executed on initiatives to reduce general and administrative and property operating expenses P.3

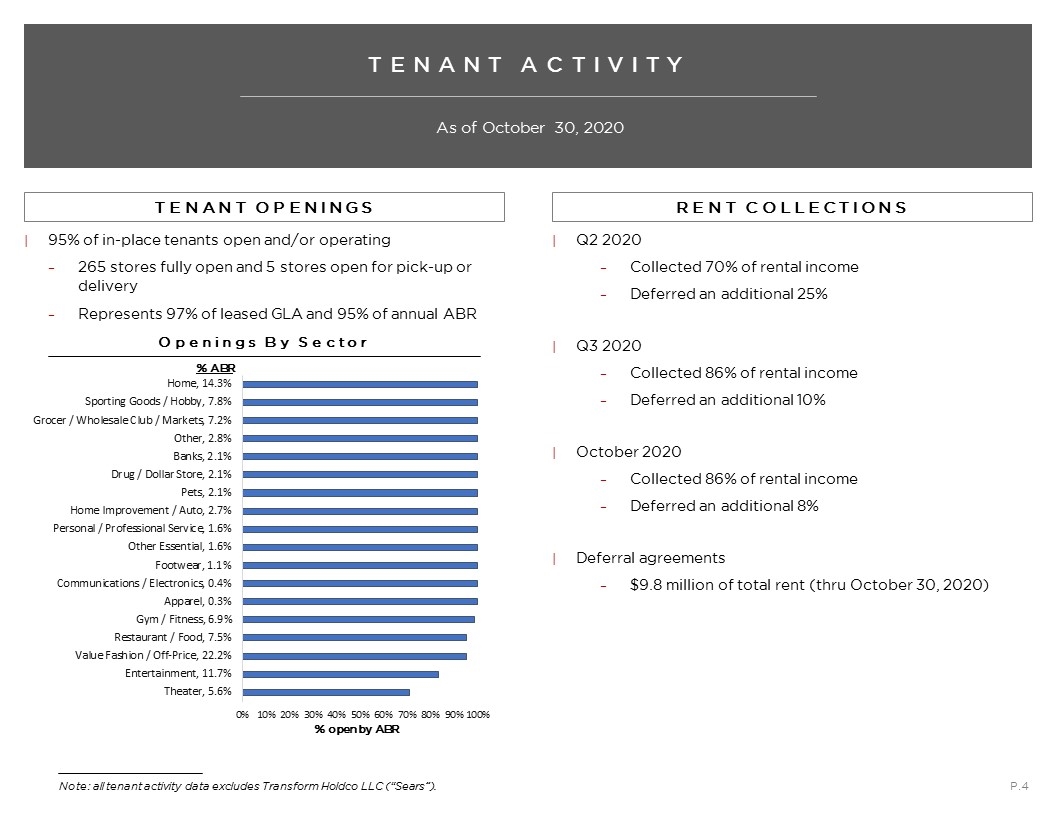

TENANT ACTIVITY As of October 30, 2020 95% of in-place tenants open and/or operating 265 stores fully open and 5 stores open for pick-up or delivery Represents 97% of leased GLA and 95% of annual ABR P.4 TENANT OPENINGS RENT COLLECTIONS Openings By Sector % ABR Q2 2020 Collected 70% of rental income Deferred an additional 25% Q3 2020 Collected 86% of rental income Deferred an additional 10% October 2020 Collected 86% of rental income Deferred an additional 8% Deferral agreements $9.8 million of total rent (thru October 30, 2020) Note: all tenant activity data excludes Transform Holdco LLC (“Sears”). % open by ABR

Capital Sources and Uses Near-term cash resources and capital allocation P.5 Asset Monetization Year to date, sold 21 assets and 13 outparcels generating $284.4 million of cash proceeds Since July 2017, monetized 86 assets and several outparcels generating over $985 million of cash proceeds Capital allocation Managing negative operating cash flow through expense reduction and ability to defer interest expense, if necessary Restarted components of select redevelopment projects – $45.8 million of potential investment to generate $13.5 million of potential rental income over next 12 months Term Loan Amendment Amended terms in May 2020 to provide flexibility to defer interest expense under certain circumstances Up to $9.3 million of average monthly interest, if cash balances below specified levels Reaffirmation of continued lender support for asset sales $1.6 billion outstanding per existing terms with July 2023 maturity Asset Sales Closed $272.5 million of asset sales through September 30, 2020 5.9% blended cap rate for income-producing assets $37 PSF for vacant assets Closed $11.8 million of asset sales subsequent to September 30, 2020 $62.5 million of assets under contract for sale as of October 30, 2020, subject to buyer diligence and closing conditions

UNLOCKING VALUE P.6 We believe there will be an immense need to convert well-located real estate for revitalized uses to serve today’s communities To be a leader in this transformation, we are focused on: Utilizing the quality and diversity of our asset base to our advantage Leveraging our track record in intensive redevelopment and our extensive relationships with tenants, development partners and capital providers Continuing to expand our opportunity set beyond retail, with a focus on multi-family and mixed-use environments Prioritizing capital for our more differentiated redevelopments, those projects with stronger return metrics, and those redevelopments that we can restart quickly to generate near-term income Strategies as we move forward

Culture and Commitment P.7 Our core principles will continue to guide how we conduct ourselves and approach the challenges and necessary strategic changes that we may make in the months ahead Be a diverse and inclusive culture based on respect Build relationships for the long term Create an environment of constant improvement Be entrepreneurial and proactive Inspire people and communities through our projects We believe that our team, track record, tenant relationships and partnerships with non-retail developers and capital providers can position us to be a leader in the transformation of real estate that will likely need to be part of the larger economic recovery in our communities We will work through this together by being proactive and decisive in the short term, while preserving the medium- and long-term value of our assets and platform Seritage principles and values

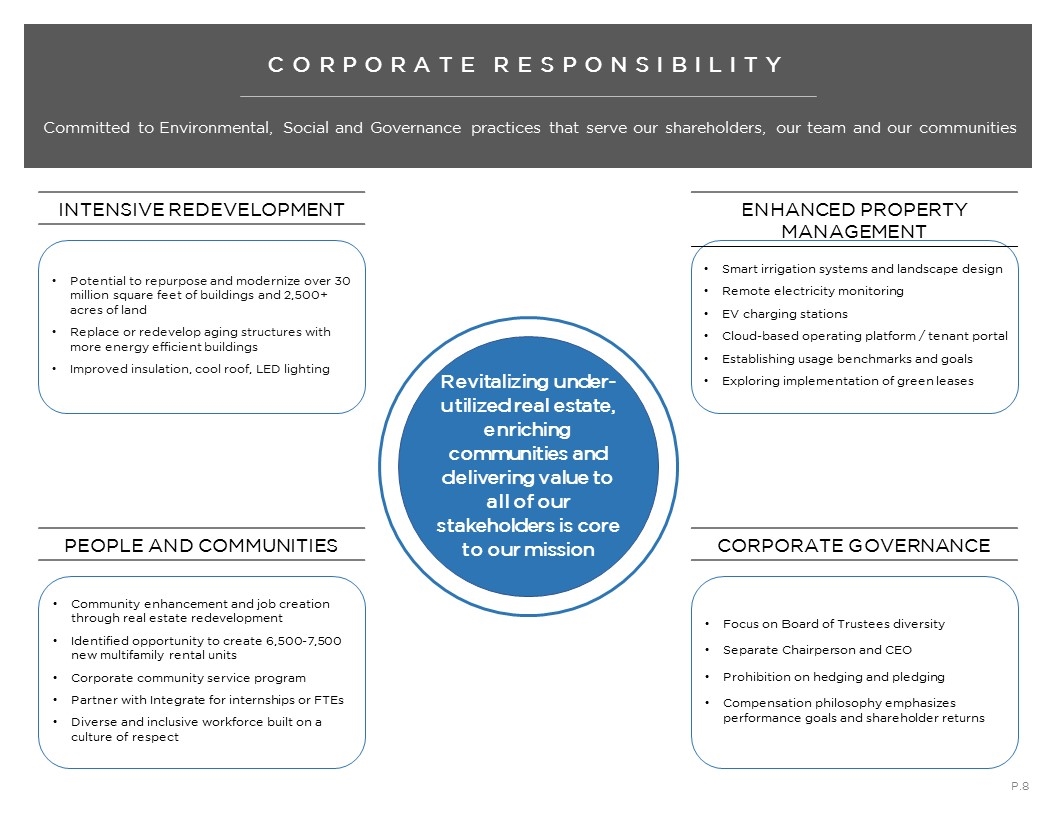

CORPORATE RESPONSIBILITY Committed to Environmental, Social and Governance practices that serve our shareholders, our team and our communities Revitalizing under-utilized real estate, enriching communities and delivering value to all of our stakeholders is core to our mission Potential to repurpose and modernize over 30 million square feet of buildings and 2,500+ acres of land Replace or redevelop aging structures with more energy efficient buildings Improved insulation, cool roof, LED lighting Smart irrigation systems and landscape design Remote electricity monitoring EV charging stations Cloud-based operating platform / tenant portal Establishing usage benchmarks and goals Exploring implementation of green leases Focus on Board of Trustees diversity Separate Chairperson and CEO Prohibition on hedging and pledging Compensation philosophy emphasizes performance goals and shareholder returns Community enhancement and job creation through real estate redevelopment Identified opportunity to create 6,500-7,500 new multifamily rental units Corporate community service program Partner with Integrate for internships or FTEs Diverse and inclusive workforce built on a culture of respect INTENSIVE REDEVELOPMENT ENHANCED PROPERTY MANAGEMENT PEOPLE AND COMMUNITIES CORPORATE GOVERNANCE P.8

Seritage Growth Properties | Forward Looking Statements This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that could cause or contribute to such differences include, but are not limited to: our historical exposure to Sears Holdings and the effects of its previously announced bankruptcy filing; the litigation filed against us and other defendants in the Sears Holdings adversarial proceeding pending in bankruptcy court; Holdco’s termination and other rights under its master lease with us; competition in the real estate and retail industries; risks relating to our recapture and redevelopment activities; contingencies to the commencement of rent under leases; the terms of our indebtedness; restrictions with which we are required to comply in order to maintain REIT status and other legal requirements to which we are subject; failure to achieve expected occupancy and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on our ability to fund operations and ongoing development; our ability to access or obtain sufficient sources of financing to fund our liquidity needs; our relatively limited history as an operating company; and the impact of the COVID-19 pandemic on the business of our tenants and our business, income, cash flow, results of operations, financial condition, liquidity, prospects, ability to service our debt obligations and our ability to pay dividends and other distributions to our shareholders. For additional discussion of these and other applicable risks, assumptions and uncertainties, see the “Risk Factors” and forward-looking statement disclosure contained in our filings with the Securities and Exchange Commission, including the risk factors relating to Sears Holdings and Holdco. While we believe that our forecasts and assumptions are reasonable, we caution that actual results may differ materially. We intend the forward-looking statements to speak only as of the time made and do not undertake to update or revise them as more information becomes available, except as required by law.

500 Fifth Avenue | New York, NY 10110 212-355-7800 | www.seritage.com