Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SelectQuote, Inc. | selectquoteincseptembe.htm |

| EX-99.1 - EX-99.1 - SelectQuote, Inc. | selectquoteincseptember302.htm |

Exhibit 99.2 1st Quarter Fiscal Year 2021 Earnings Conference Call Presentation November 5, 2020

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: the ultimate duration and impact of the ongoing COVID-19 pandemic, our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/ or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; potential litigation and claims, including IP litigation; our existing and future indebtedness; developments with respect to LIBOR; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; and failure to market and sell Medicare plans effectively or in compliance with laws. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in the most recent Annual Report on Form 10-K (the “Annual Report”) filed by us with the Securities Exchange Commission. Accordingly, you should not place undue reliance on any such forward- looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Certain information contained in this presentation and statements made orally during this presentation relates to or are based on publications and other data obtained from third-party sources. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. No Offer or Solicitation; Further Information This presentation is for informational purposes only and is not an offer to sell with respect to any securities. This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in the Annual Report. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this presentation Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP financial measures. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We define Adjusted EBITDA as income before interest expense, income tax expense, depreciation and amortization, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income. We monitor and have presented in this presentation Adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. For further discussion regarding this non-GAAP measure, please see today’s press release. 2

1st Quarter Earnings Summary SelectQuote drove top line and profit results for 1st quarter 2021 that were ahead of internal expectations. Results were primarily driven by continued strength in the Senior and Life divisions Consolidated revenue totaled $124 million, up 91% year-over-year Consolidated Adjusted EBITDA* totaled $12 million, up $11 million year-over-year Consolidated net income totaled $1 million or $0.01 per diluted share Senior revenue totaled $73 million, up 165% year-over-year, and Adjusted EBITDA* totaled $9 million, up $11 million year-over-year 1st Quarter Highlights: • 8% increase in Senior agent productivity with 100% increase in avg. productive agents • Successfully hired and onboarded over 2,000 new associates to support AEP • Added SCAN Health Plan and Devoted Health to our Medicare carrier platform Raising FY 2021 Revenue and Adjusted EBITDA guidance *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20 3

Why SelectQuote is Different Market 10% 27M +20% Dynamics Estimated Annual MA Estimated 2021 Average Beneficiary Enrollment Growth MA Enrollees Plan Choices Marketing People Technology Pillars of Growth +30% >2,000 $25M+ YoY Increase in Associates Hired FY2020 Technology Per Unit AEP Rep Investment Appointments Differentiated +8% 25% Outcomes YoY Increase in Lower Intra-Year First Term Industry Leading 1QFY21 Agent Lapse Rates Recapture Rate Productivity Source: CMS 4

CCA is a Competitive Differentiator Policyholder SelectQuote Favorable Decision Factors Strategy Outcomes CCA 25% agents Recapture Rate Changing Medications 300+ up 2x over 2020 200+ Cross-sell opportunities / day Changing Locations Policyholder contacts per month Incremental 150,000+ revenue Changing Doctors opportunity 5

Final Expense Life Final Expense Premiums ($MM) • Growing total addressable market ◦ Up to $10Bn in annual revenue ◦ Similar growth tailwinds to Senior 50 • Strong unit economics ◦ ~1-year payback period ◦ Attractive margins • Cross-Sell opportunities ◦ Over 50% of enrollees are over age 65 ◦ Increasing our cross-sell efficiency with MA and MS policies ◦ Ability to generate zero cost Senior division leads 14 • Prime example of the power of 6 SelectQuote's approach and strategy 4 1Q FY2018 - 1Q FY2019 - 1Q FY2020 - 1Q FY2021 - LTM LTM LTM LTM 6

We have a High Growth, Scalable Business Model LTM 1Q Revenue(1)(2) LTM 1Q Adj. EBITDA(1)(2)(3) ($MM) ($MM) Adj. EBITDA 21% 29% 28% Margin(3) 591 41 165 10 CAGR: 56% 145 32 CAGR: 78% 347 101 38 9 244 25 111 32 52 157 407 9 102 26 86 199 110 37 (19) (19) LTM 1Q FY19 LTM 1Q FY20 LTM 1Q FY21 (34) Senior Life Auto & Home Corp LTM 1Q FY19 LTM 1Q FY20 LTM 1Q FY21 Senior Life Notes: Auto & Home Corporate 1. LTM represents Last Twelve Months financial results. 2. The sum of the segments may not equal the total due to rounding. 3. See reconciliations from Adjusted EBITDA to net income on slides 16-20. 7

SelectQuote – Consolidated Financial Summary Revenue Adj. EBITDA* ($MM) ($MM) 124 91% 12 65 1 1Q FY 20 1Q FY 21 1Q FY20 1Q FY21 Adj. EBITDA Margin 1% 10% *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20. 8

SelectQuote Senior – Financial Summary Revenue Adj. EBITDA* ($MM) ($MM) Adj. EBITDA Margin (7)% 12% 73 165% 9 28 1Q 2020 1Q 2021 (2) 1Q 2020 1Q 2021 *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20. 9

SelectQuote Senior – Policies Total Policies Submitted Total Policies Approved CAGR 79,617 CAGR 118% 129% 101% 125% 24,350 108% 141% 69,493 130% 130% 7,276 20,695 36,473 6,325 12,121 30,319 47,991 3,501 9,214 42,473 2,626 20,851 18,479 1Q 2020 1Q 2021 1Q 2020 1Q 2021 MA MS Other MA MS Other 10

SelectQuote Life – Financial Summary Life Premium Revenue ($MM) ($MM) 55% 43 CAGR 28 70% 31% Q1 FY2020 Q1 FY2021 397% 39 Adj. EBITDA* 1% 1 ($MM) 19 23 1 4 80% 10 18 19 6 Q1 FY2020 Q1 FY2021 Q1 FY2020 Q1 FY2021 Core Premium Final Expense Adj. Ancillary Premium EBITDA 21% 24% Margin *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20. 11

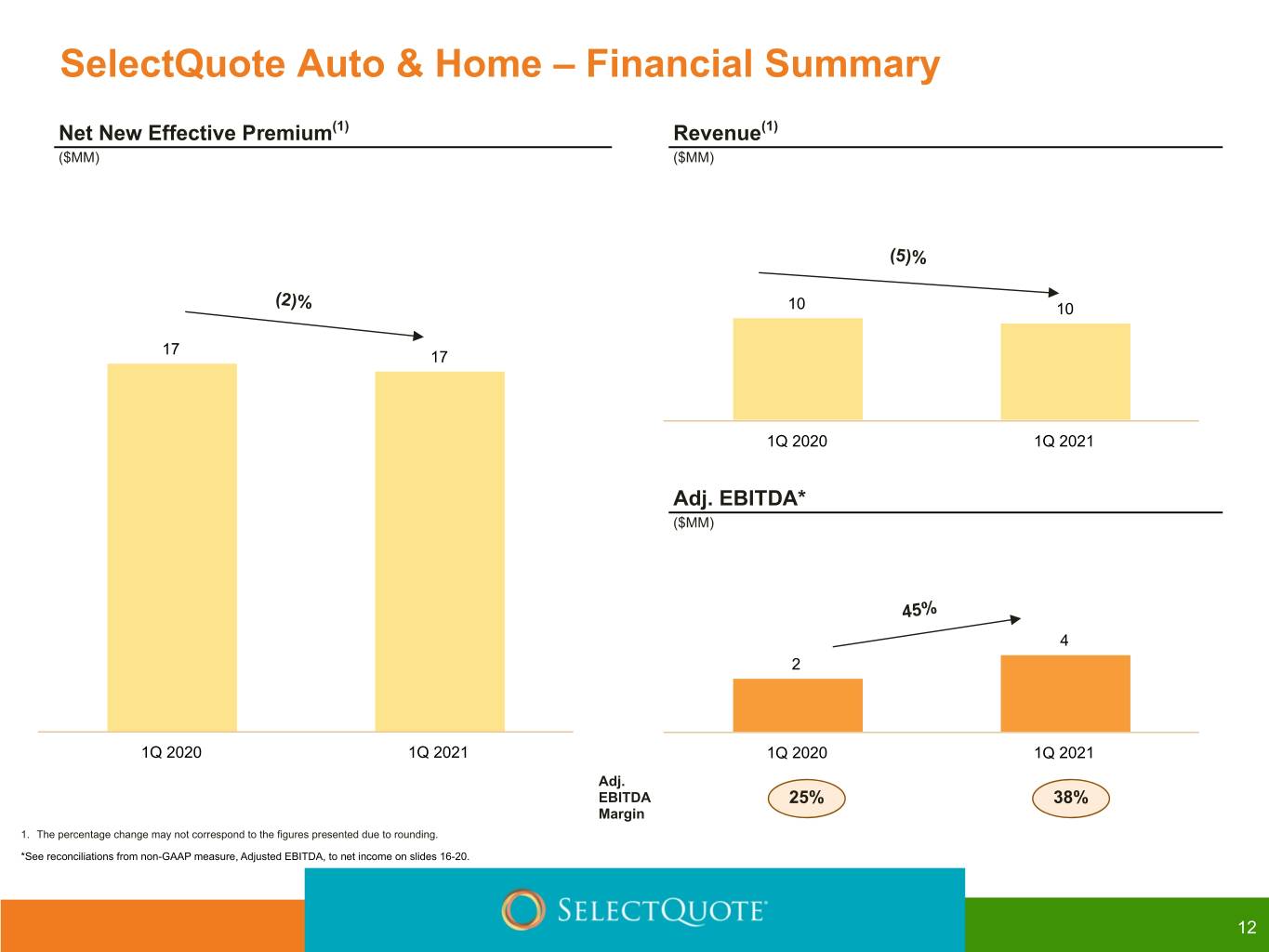

SelectQuote Auto & Home – Financial Summary Net New Effective Premium(1) Revenue(1) ($MM) ($MM) (5)% (2)% 10 10 17 17 1Q 2020 1Q 2021 Adj. EBITDA* ($MM) 45% 4 2 1Q 2020 1Q 2021 1Q 2020 1Q 2021 Adj. EBITDA 25% 38% Margin 1. The percentage change may not correspond to the figures presented due to rounding. *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20. 12

Capitalization Summary • Ample liquidity for growth and business model investment • Net cash position of $22 million ◦ $347 million of cash, cash equivalents, and restricted cash ◦ $325 million of term debt • Available borrowing capacity of $75 million on undrawn revolver • Accounts receivable, short and long term commissions receivable balance of $628 million Note: As of September 30, 2020 13

SelectQuote – FY2021 Consolidated Guidance ($'s in millions) Range Implied YoY Growth Revenue $840 - $880 58% - 65% Net Income $130 - $141 60% - 74% Adjusted EBITDA* $220 - $235 43% - 53% *See reconciliations from non-GAAP measure, Adjusted EBITDA, to net income on slides 16-20. 14

Strategic Focus and Competitive Differentiators ◦ Our strategy is to maximize absolute profitability at attractive returns on invested capital divisions ◦ Our choice model paired with highly trained, in- house agents and dedicated customer care teams was purpose-built to ensure customers buy the right plan for their specific needs which leads to high retention rates ◦ Our market-leading Lifetime Value and Adjusted EBITDA per policy are a function of the way we have built and refined our business over 35 years ◦ Predictable cash flows are driven by high quality of policies written ◦ We have a strong record of attractive returns on invested capital and have a long runway to replicate those returns at scale 15

Supplemental information 16

FY20-FY21 Adjusted EBITDA to Net Income Reconciliation 1Q FY 2021 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 73,199 $ 42,823 $ 9,538 $ (1,391) $ 124,169 Operating expenses (64,297) (32,346) (5,922) (9,518) (112,083) Other expenses, net — — — (21) (21) Adjusted EBITDA 8,902 10,477 3,616 (10,930) 12,065 Share-based compensation expense (924) Non-recurring expenses (438) Fair value adjustments to contingent earnout obligations (759) Restructuring expenses (21) Depreciation and amortization (3,347) Loss on disposal of property, equipment, and software (82) Interest expense, net (6,761) Income tax benefit 1,104 Net income $ 837 1Q FY 2020 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 27,584 $ 27,607 $ 10,052 $ (76) $ 65,167 Operating expenses (29,523) (21,789) (7,562) (5,413) (64,287) Other expenses, net — — — (13) (13) Adjusted EBITDA (1,939) 5,818 2,490 (5,502) 867 Share-based compensation expense (22) Non-recurring expenses (832) Restructuring expenses 2 Depreciation and amortization (1,440) Gain on disposal of property, equipment, and software 2 Interest expense (705) Income tax benefit 440 Net loss $ (1,688) 17

LTM Adjusted EBITDA to Net Income Reconciliation LTM 1Q FY 2021 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 407,288 $ 145,183 $ 40,674 $ (2,628) $ 590,517 Operating expenses (250,708) (112,712) (30,850) (30,986) (425,256) Other expenses, net — — — (38) (38) Adjusted EBITDA 156,580 32,471 9,824 (33,652) 165,223 Share-based compensation expense (10,400) Non-recurring expenses (3,326) Fair value adjustments to contingent earnout obligations (1,134) Restructuring expenses (177) Depreciation and amortization (9,900) Loss on disposal of property, equipment, and software (443) Interest expense, net (31,817) Income tax expense (24,351) Net Income $ 83,675 LTM 1Q FY 2020 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 198,610 $ 110,920 $ 37,521 $ (335) $ 346,716 Operating expenses (112,292) (86,132) (29,010) (18,333) (245,767) Other expenses, net — — — (26) (26) Adjusted EBITDA 86,318 24,788 8,511 (18,694) 100,923 Share-based compensation expense (90) Non-recurring expenses (2,306) Restructuring expenses (2,138) Depreciation and amortization (5,055) Loss on disposal of property, equipment, and software (220) Interest expense (2,098) Income tax expense (20,917) Net Income $ 68,099 18

LTM Adjusted EBITDA to Net Income Reconciliation (Cont.) LTM 1Q FY 2019 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 109,928 $ 101,864 $ 32,208 $ (272) $ 243,728 Operating expenses (73,048) (76,288) (23,180) (19,193) (191,709) Other expenses, net — — — (10) (10) Adjusted EBITDA 36,880 25,576 9,028 (19,475) 52,009 Share-based compensation expense (48) Non-recurring expenses (595) Restructuring expenses (2,969) Depreciation and amortization (3,861) Loss on disposal of property, equipment, and software (700) Interest expense (1,045) Income tax expense (7,560) Net Income $ 35,231 19

FY21 Guidance Adjusted EBITDA to Net Income Reconciliation (in thousands) Range Net Income $ 130,000 $ 141,000 Income tax expense 44,000 48,000 Interest expense 26,000 26,000 Depreciation and amortization 11,000 11,000 Fair value adjustments to contingent earnout obligations 2,000 2,000 Non-recurring expenses 2,000 2,000 Share-based compensation expense 5,000 5,000 Adjusted EBITDA $ 220,000 $ 235,000 20