Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PARKER HANNIFIN CORP | exhibit9911qfy21.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | ph-20201105.htm |

Exhibit 99.2 Parker Hannifin Corporation 1st Quarter Fiscal Year 2021 Earnings Release November 5, 2020

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. Additionally, the actual impact of changes in tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof on future performance and earnings projections may impact the company’s tax calculations. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: the impact of the global outbreak of COVID-19 and governmental and other actions taken in response; changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of CLARCOR, LORD Corporation or Exotic Metals; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential labor disruptions; threats associated with and efforts to combat terrorism and cyber- security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; global competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability, as well as uncertainties associated with the timing and conditions surrounding the return to service of the Boeing 737 MAX. The company makes these statements as of the date of this disclosure and undertakes no obligation to update them unless otherwise required by law. This presentation contains references to non-GAAP financial information for Parker, including organic sales for Parker and by segment, adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin, and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. For Parker, adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, and acquisition related expenses. Free cash flow is defined as cash flow from operations less capital expenditures. Although organic sales, adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information 2

Agenda CEO Comments and Highlights of Quarter Results Results & Outlook Questions & Answers 3

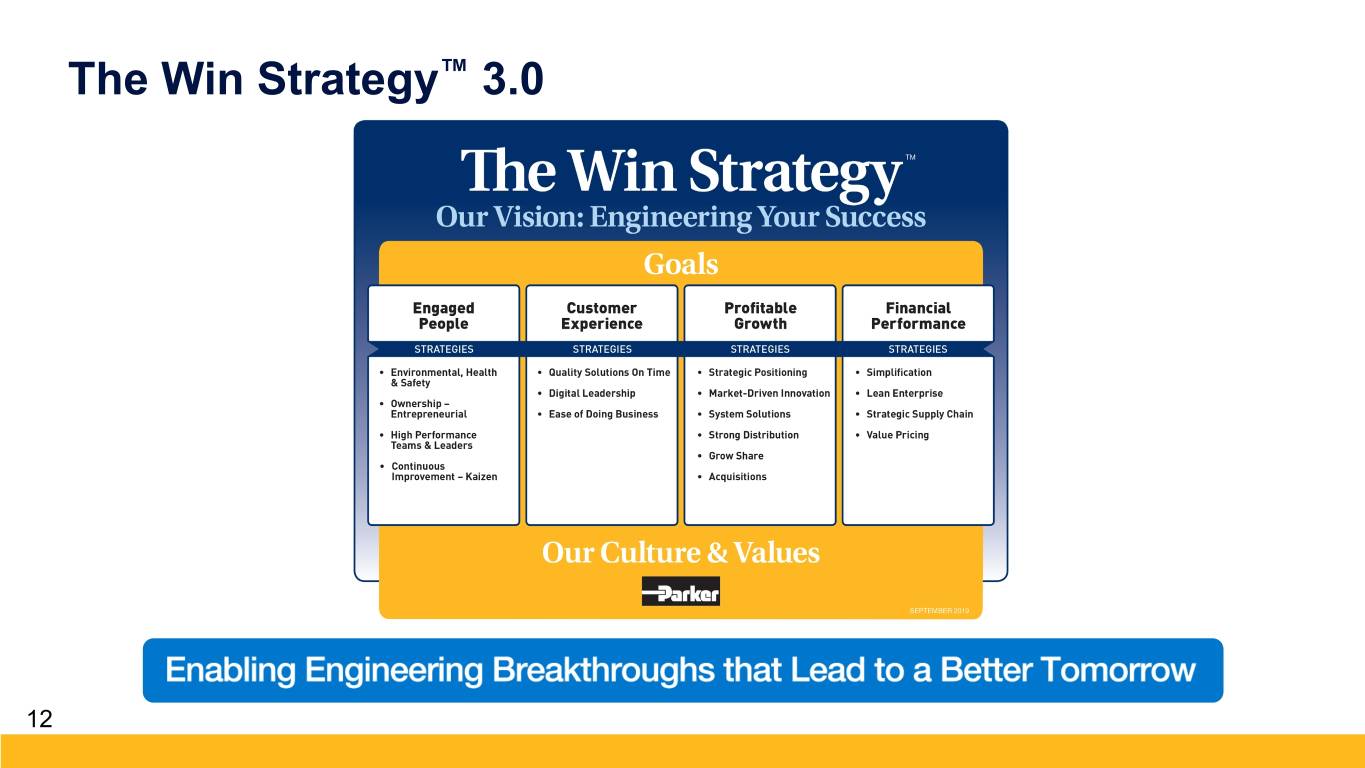

Parker’s Competitive Differentiators ▪ The Win Strategy™ ▪ Decentralized business model ▪ Technology breadth & interconnectivity ▪ Engineered products with intellectual property ▪ Long product life cycles ▪ Global distribution, service & support ▪ Low capital investment requirements ▪ Great generators and deployers of cash over the cycle 4

Unmatched Breadth of Technologies 5

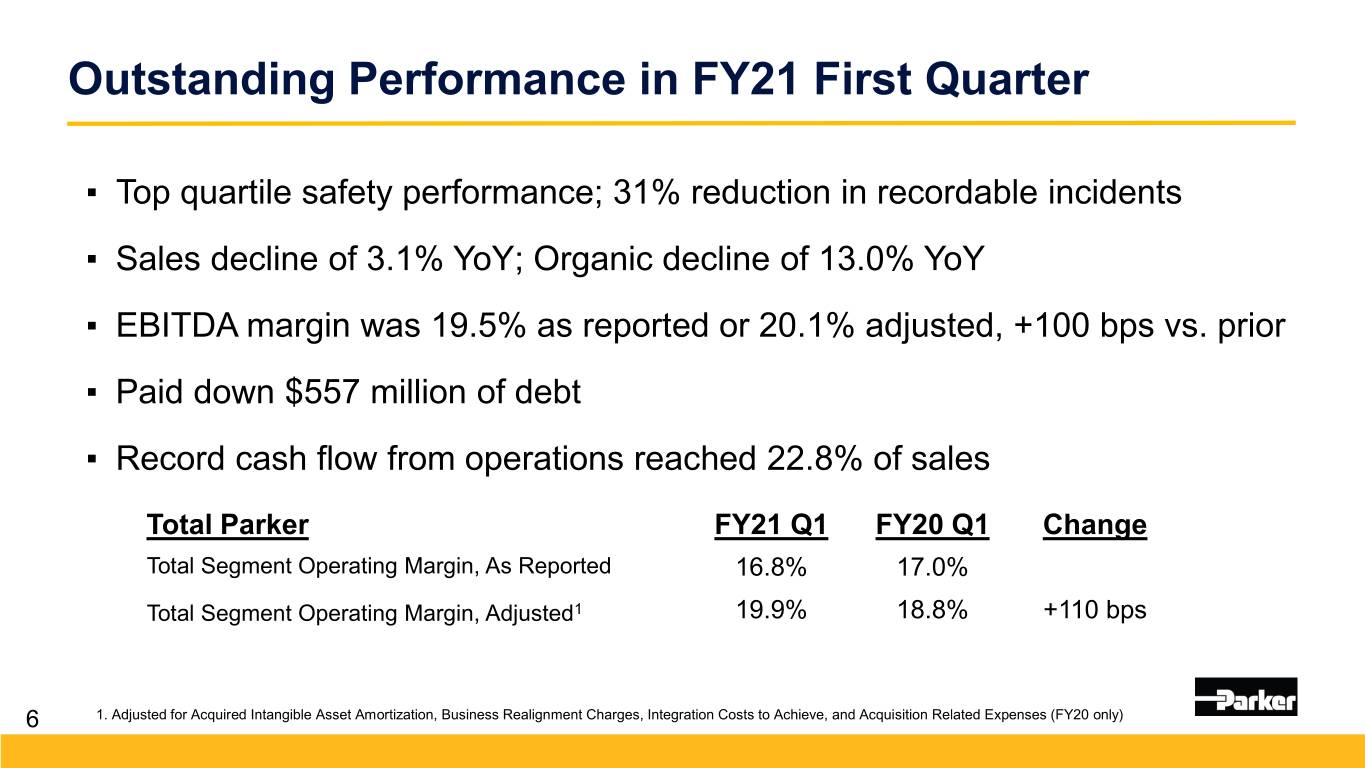

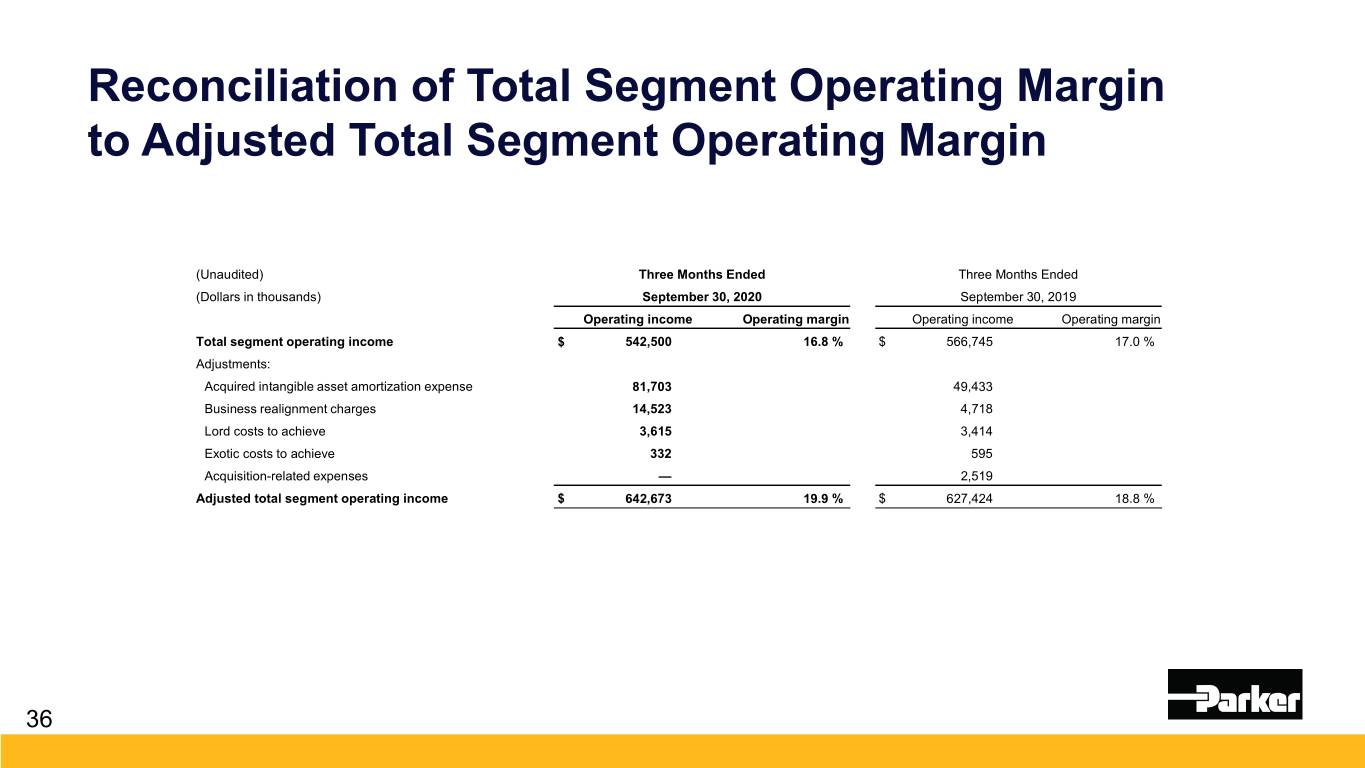

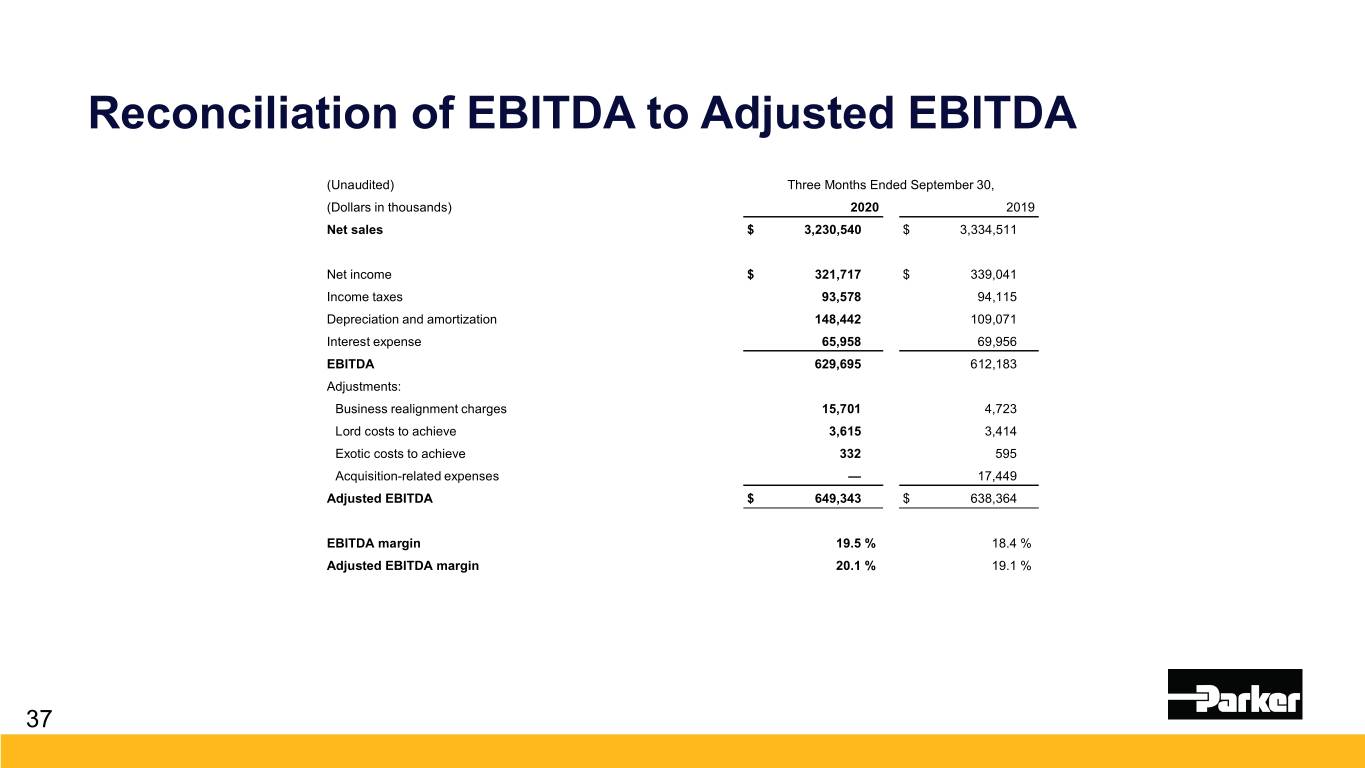

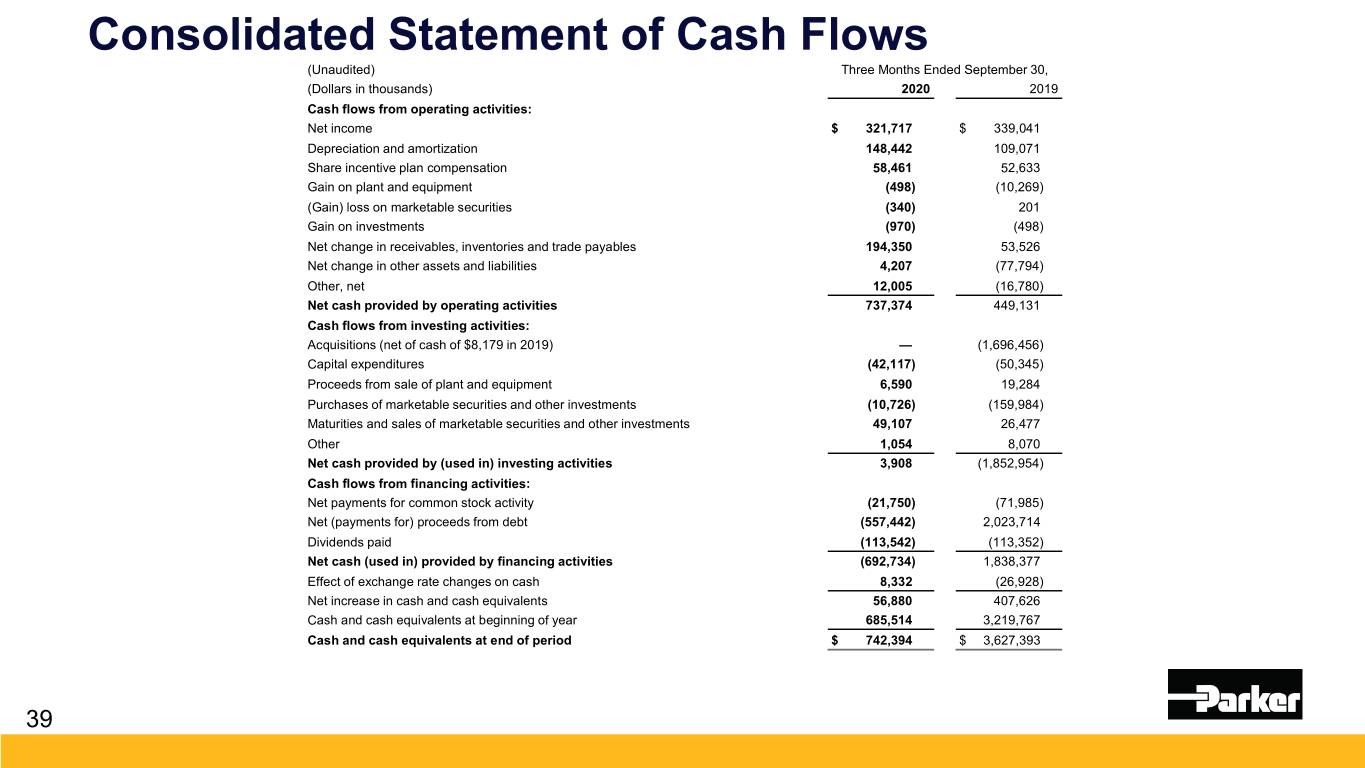

Outstanding Performance in FY21 First Quarter ▪ Top quartile safety performance; 31% reduction in recordable incidents ▪ Sales decline of 3.1% YoY; Organic decline of 13.0% YoY ▪ EBITDA margin was 19.5% as reported or 20.1% adjusted, +100 bps vs. prior ▪ Paid down $557 million of debt ▪ Record cash flow from operations reached 22.8% of sales Total Parker FY21 Q1 FY20 Q1 Change Total Segment Operating Margin, As Reported 16.8% 17.0% Total Segment Operating Margin, Adjusted1 19.9% 18.8% +110 bps 6 1. Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, and Acquisition Related Expenses (FY20 only)

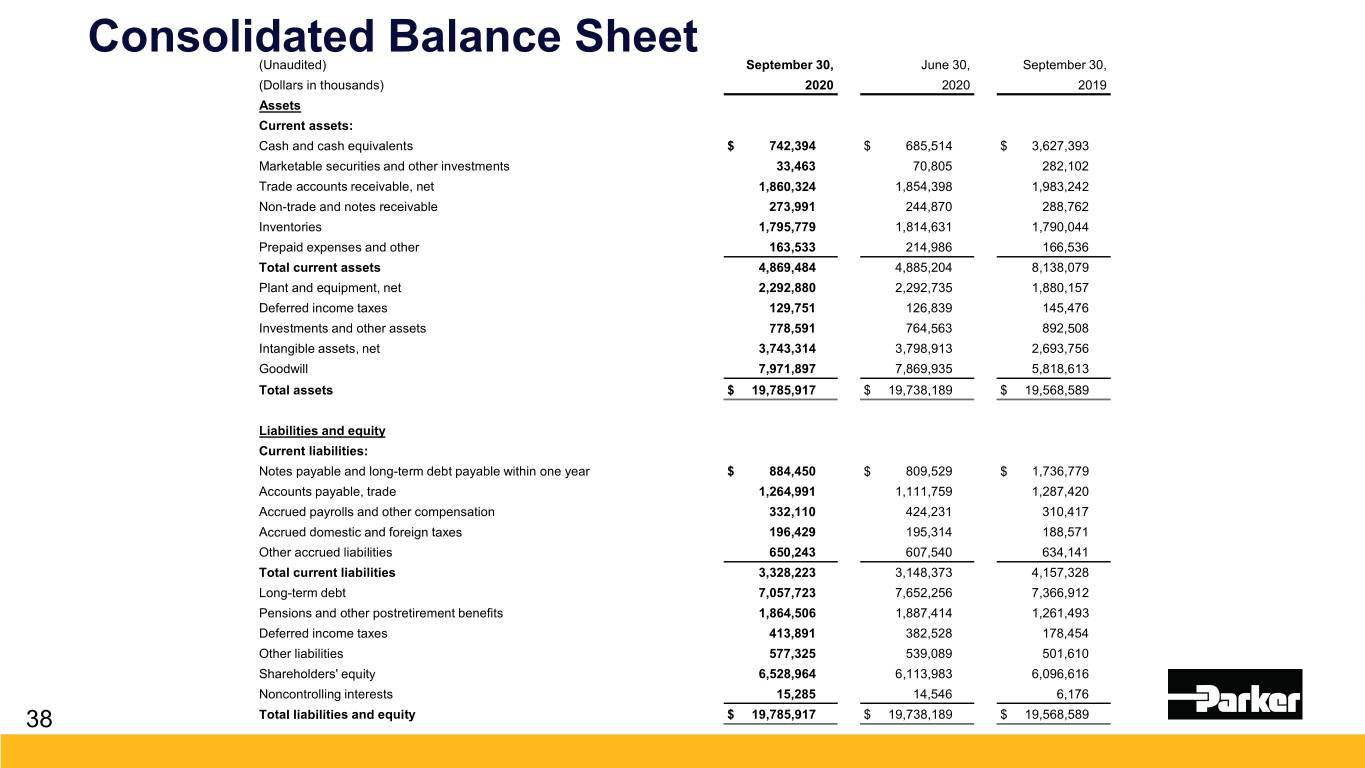

Progress on Deleveraging Rapid Debt Reduction ▪ ~$2 billion debt reduction in last eleven months ▪ Paid back 37% of the LORD & Exotic transaction debt ▪ Gross debt to EBITDA reduced to 3.4x from 3.6x at June 30, 2020 ▪ Net debt to EBITDA reduced to 3.0x from 3.3x at June 30, 2020 7

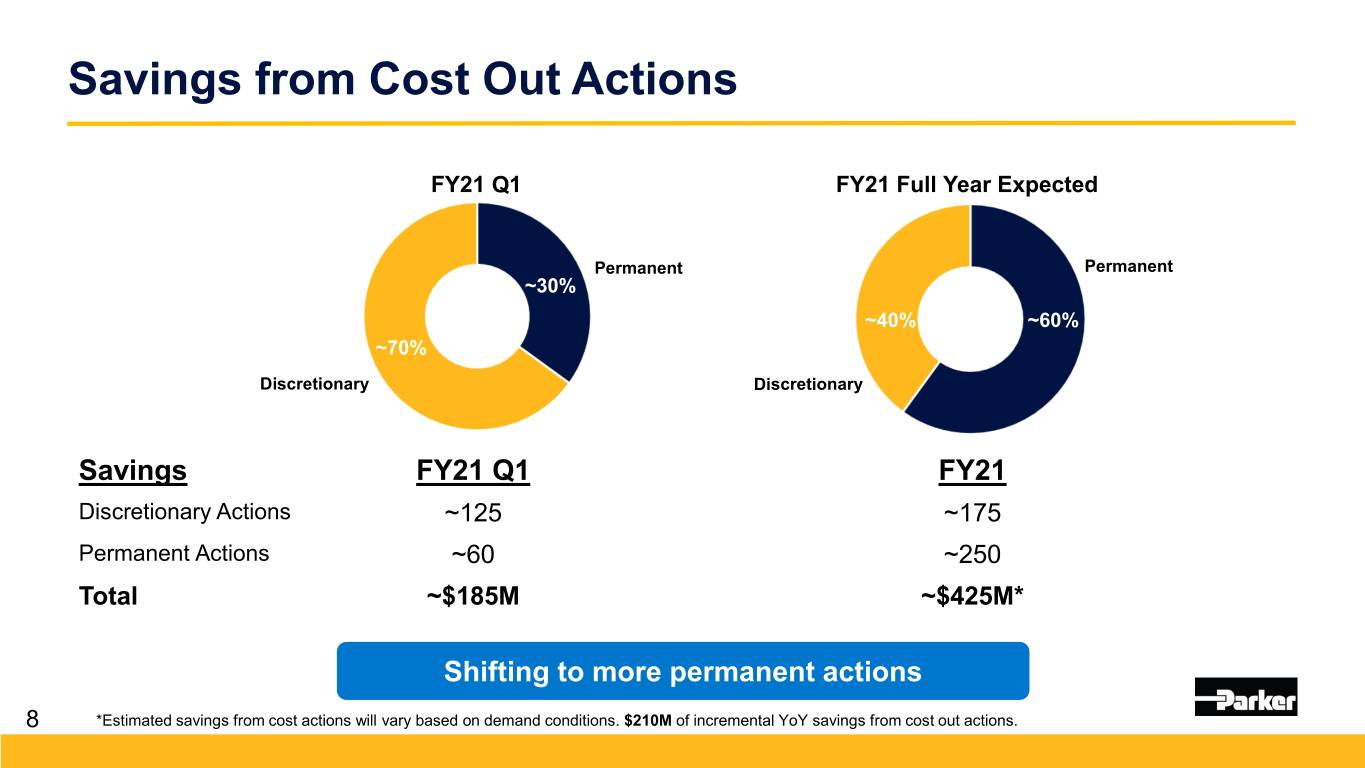

Savings from Cost Out Actions FY21 Q1 FY21 Full Year Expected Permanent Permanent ~30% ~40% ~60% ~70% Discretionary Discretionary Savings FY21 Q1 FY21 Discretionary Actions ~125 ~175 Permanent Actions ~60 ~250 Total ~$185M ~$425M* Shifting to more permanent actions 8 *Estimated savings from cost actions will vary based on demand conditions. $210M of incremental YoY savings from cost out actions.

Parker Transformed by Portfolio & Performance Actions ▪ Two major updates to the Parker Business System: • 2015 – The Win Strategy™ 2.0 • 2019 – The Win Strategy™ 3.0 ▪ Simplification has streamlined organization structure: • 126 to 84 divisions inclusive of acquisitions ▪ Acquired companies with higher growth trajectory and margins: 10

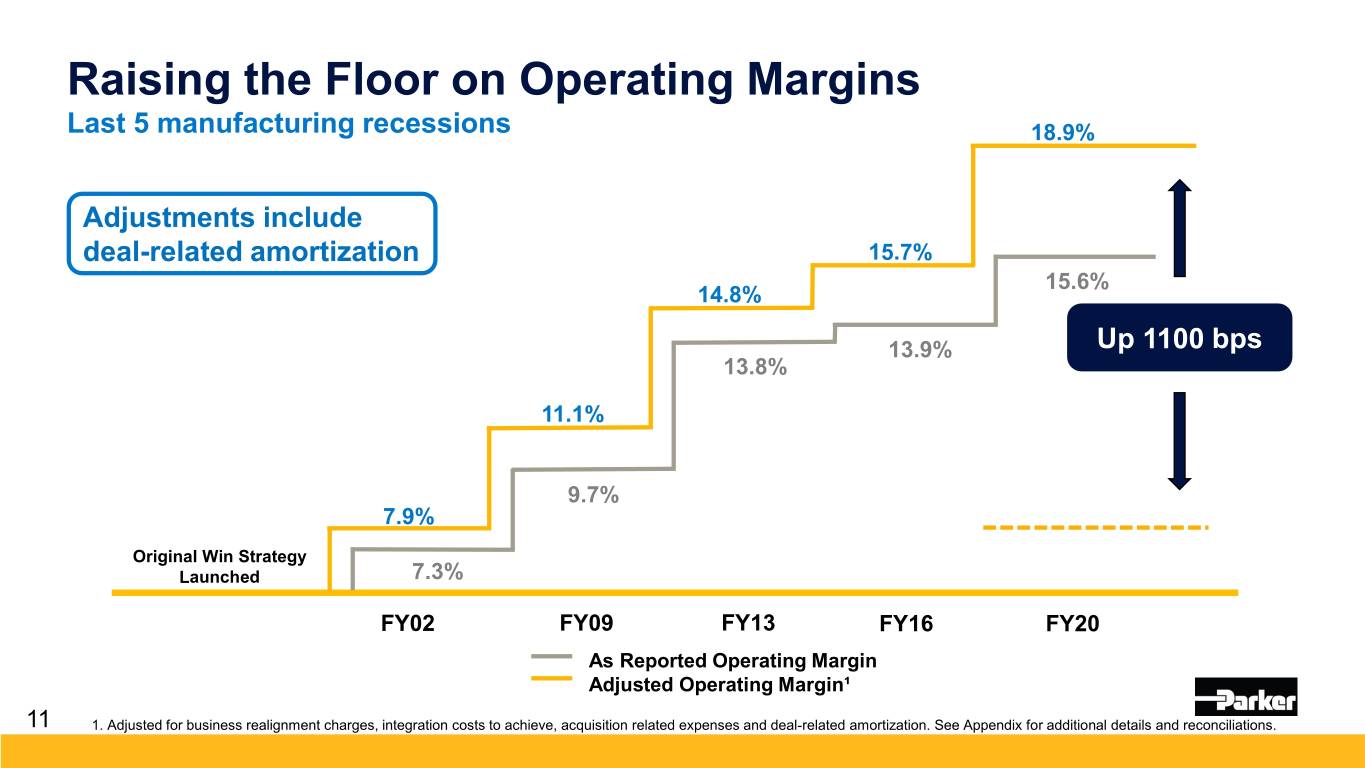

Raising the Floor on Operating Margins Last 5 manufacturing recessions 18.9% Adjustments include deal-related amortization 15.7% 15.6% 14.8% 13.9% Up 1100 bps 13.8% 11.1% 9.7% 7.9% Original Win Strategy Launched 7.3% FY02 FY09 FY13 FY16 FY20 As Reported Operating Margin Adjusted Operating Margin¹ 11 1. Adjusted for business realignment charges, integration costs to achieve, acquisition related expenses and deal-related amortization. See Appendix for additional details and reconciliations.

The Win Strategy™ 3.0 12

Win Strategy 3.0 Accelerates Performance ▪ Simplification – 80/20 + Simple by Design™ ▪ Innovation - Winovation Updates ▪ Digital Leadership ▪ Expand and Grow Distribution ▪ Kaizen, HPT and Lean ▪ Acquisitions – Consolidator of Choice ▪ Annual Cash Incentive Program (ACIP) Portfolio & Performance Transformation Continues 13

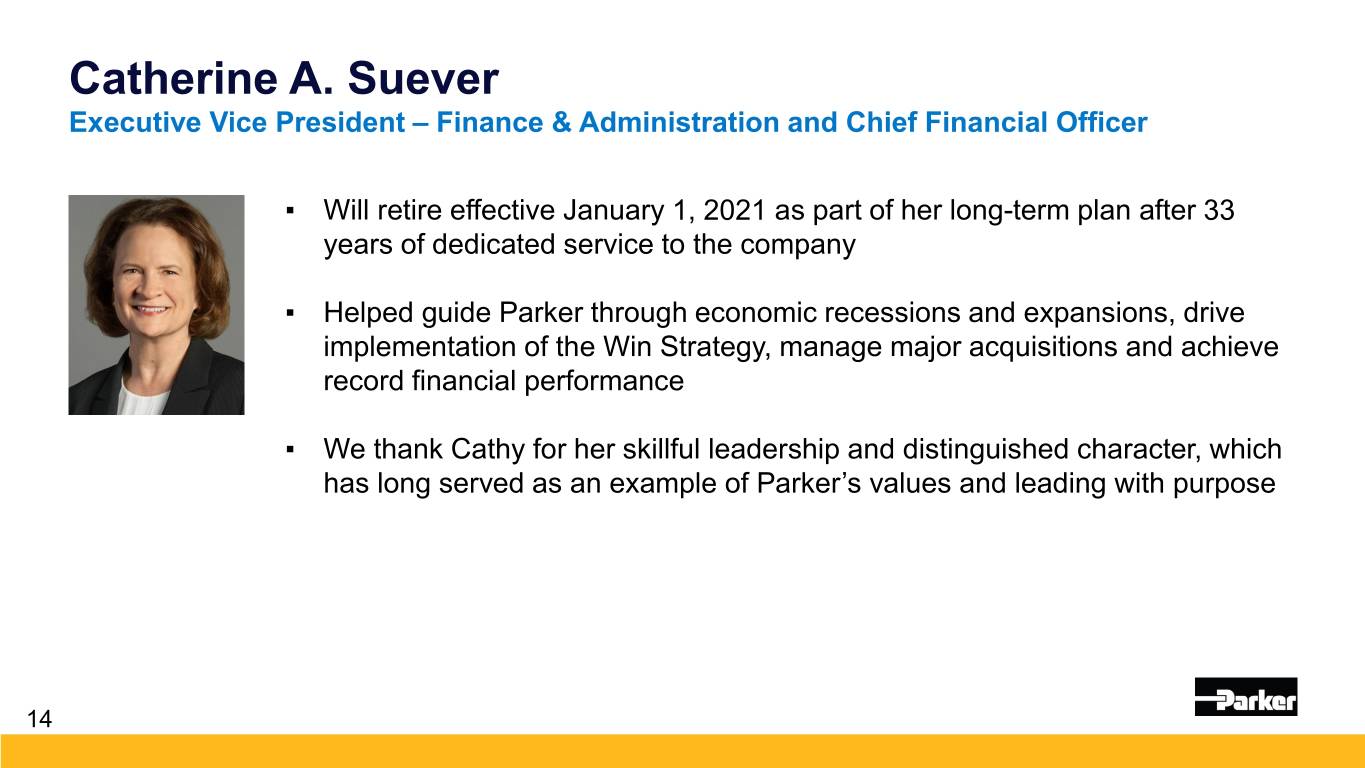

Catherine A. Suever Executive Vice President – Finance & Administration and Chief Financial Officer ▪ Will retire effective January 1, 2021 as part of her long-term plan after 33 years of dedicated service to the company ▪ Helped guide Parker through economic recessions and expansions, drive implementation of the Win Strategy, manage major acquisitions and achieve record financial performance ▪ We thank Cathy for her skillful leadership and distinguished character, which has long served as an example of Parker’s values and leading with purpose 14

Todd M. Leombruno Executive Vice President and Chief Financial Officer ▪ Currently Vice President and Controller, will succeed Cathy as CFO on January 1, 2021 ▪ 27 years with Parker, in-depth knowledge of our organization and business groups ▪ Has worked closely with our shareholders and analysts in the IR function ▪ Strong financial expertise and proven leadership make Todd an excellent fit and enables a seamless transition 15

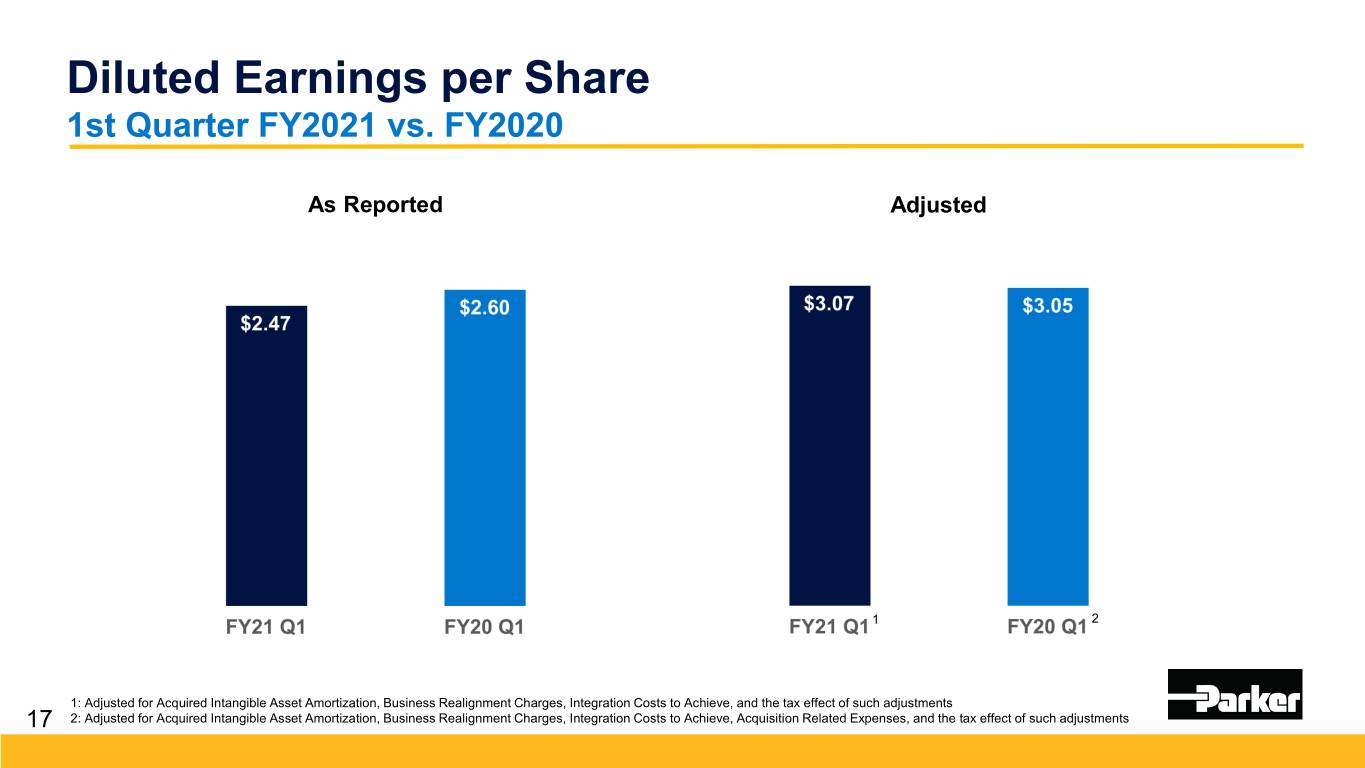

Diluted Earnings per Share 1st Quarter FY2021 vs. FY2020 As Reported Adjusted 1 2 1: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, and the tax effect of such adjustments 17 2: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, Acquisition Related Expenses, and the tax effect of such adjustments

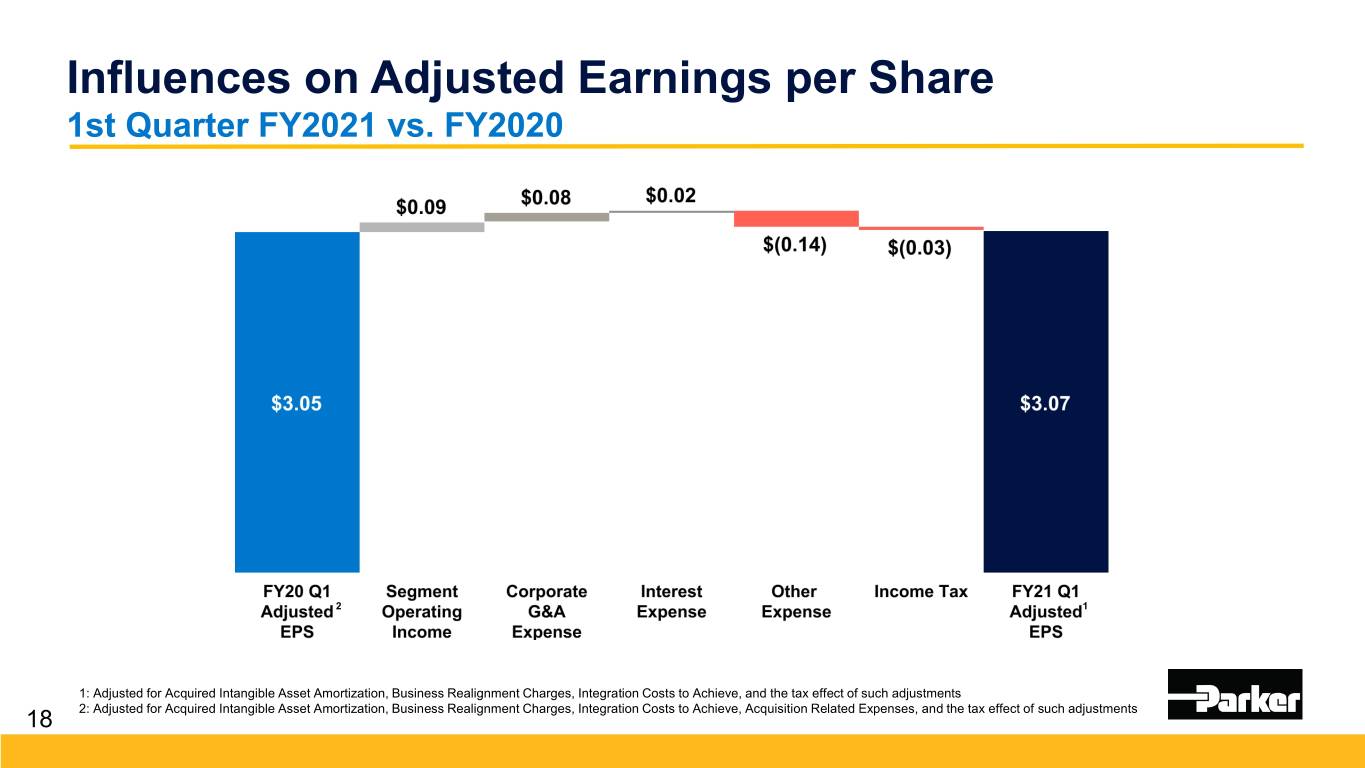

Influences on Adjusted Earnings per Share 1st Quarter FY2021 vs. FY2020 2 1 1: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, and the tax effect of such adjustments 2: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, Acquisition Related Expenses, and the tax effect of such adjustments 18

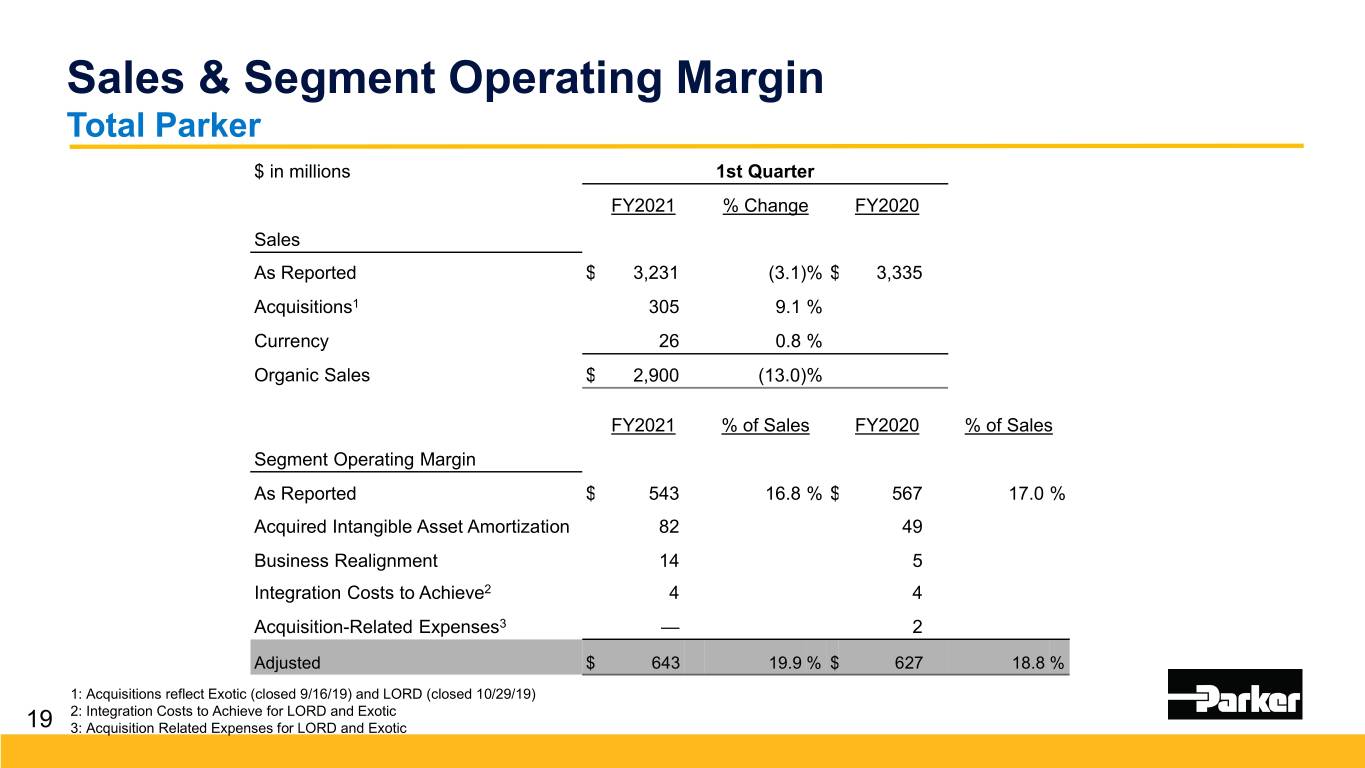

Sales & Segment Operating Margin Total Parker $ in millions 1st Quarter FY2021 % Change FY2020 Sales As Reported $ 3,231 (3.1)% $ 3,335 Acquisitions1 305 9.1 % Currency 26 0.8 % Organic Sales $ 2,900 (13.0)% FY2021 % of Sales FY2020 % of Sales Segment Operating Margin As Reported $ 543 16.8 % $ 567 17.0 % Acquired Intangible Asset Amortization 82 49 Business Realignment 14 5 Integration Costs to Achieve2 4 4 Acquisition-Related Expenses3 — 2 Adjusted $ 643 19.9 % $ 627 18.8 % 1: Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2: Integration Costs to Achieve for LORD and Exotic 19 3: Acquisition Related Expenses for LORD and Exotic

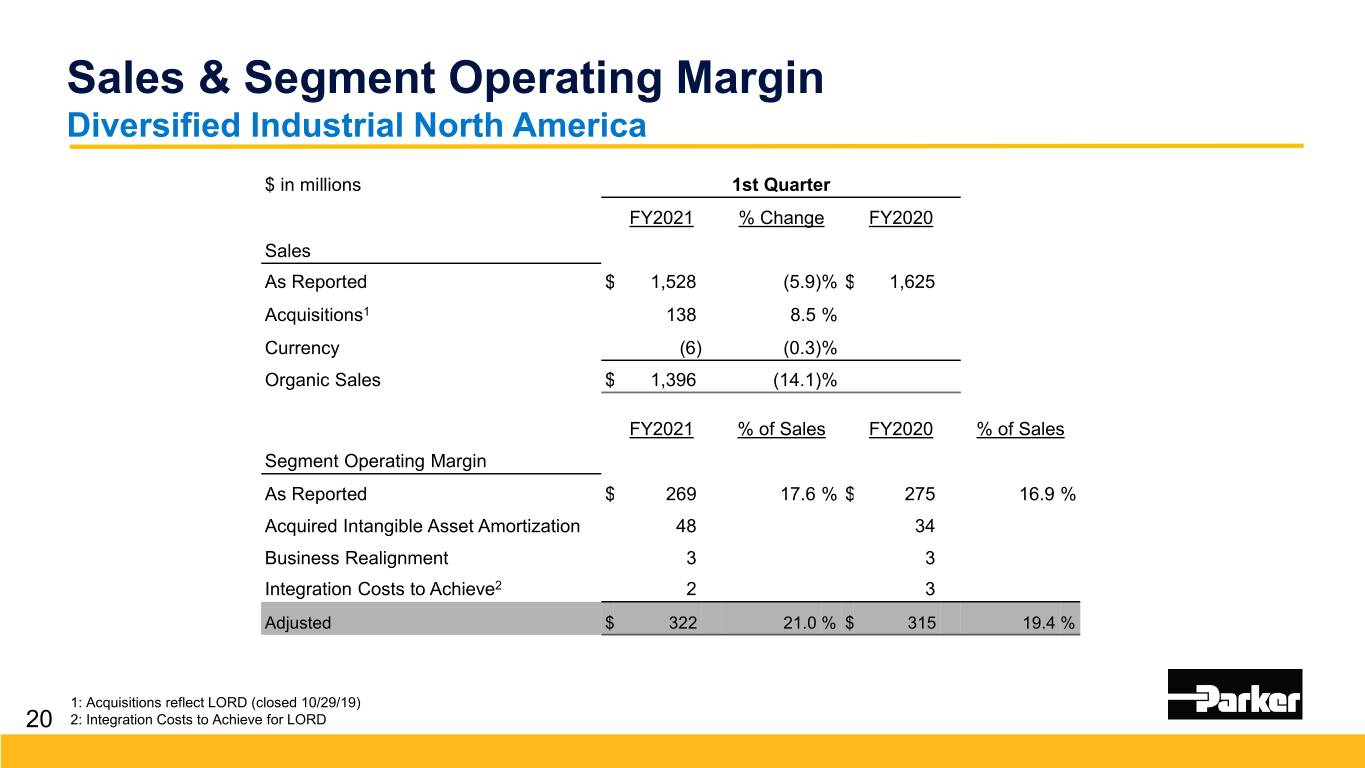

Sales & Segment Operating Margin Diversified Industrial North America $ in millions 1st Quarter FY2021 % Change FY2020 Sales As Reported $ 1,528 (5.9)% $ 1,625 Acquisitions1 138 8.5 % Currency (6) (0.3)% Organic Sales $ 1,396 (14.1)% FY2021 % of Sales FY2020 % of Sales Segment Operating Margin As Reported $ 269 17.6 % $ 275 16.9 % Acquired Intangible Asset Amortization 48 34 Business Realignment 3 3 Integration Costs to Achieve2 2 3 Adjusted $ 322 21.0 % $ 315 19.4 % 1: Acquisitions reflect LORD (closed 10/29/19) 20 2: Integration Costs to Achieve for LORD

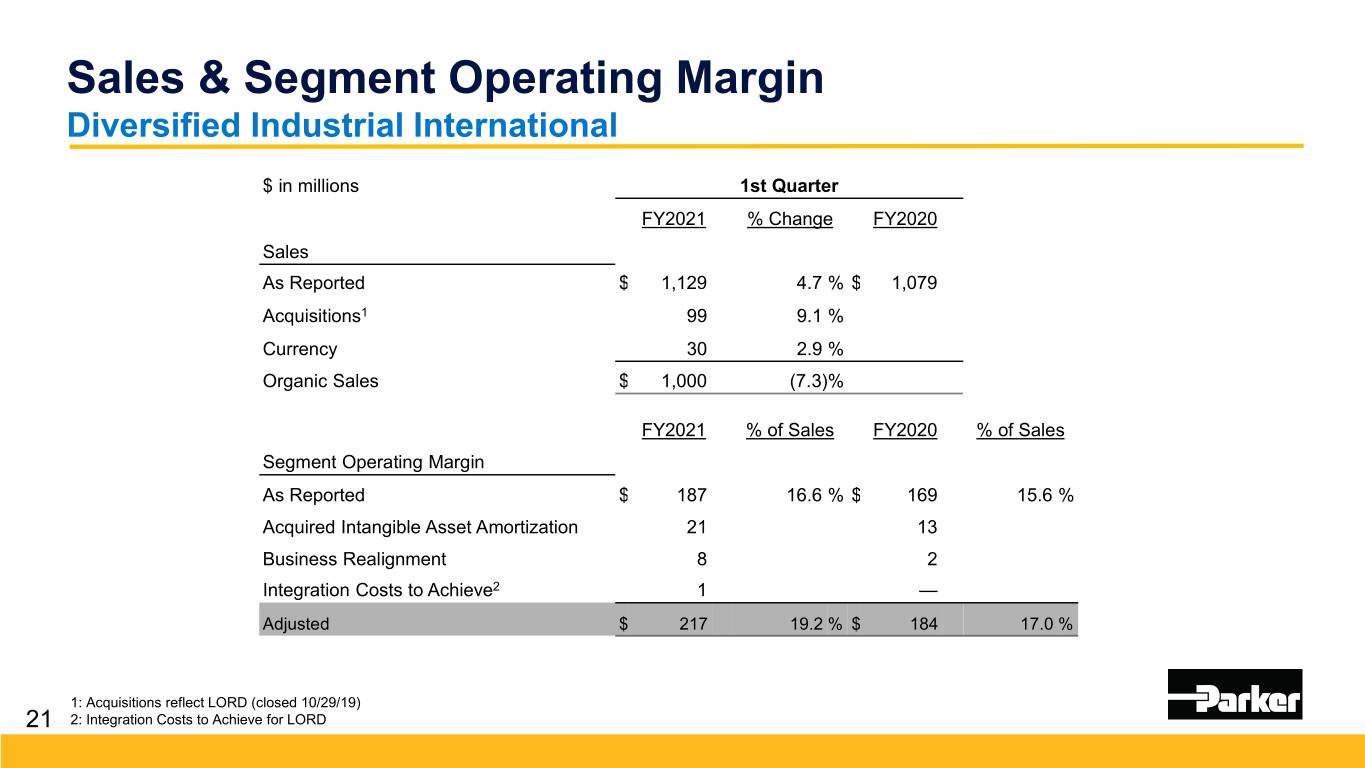

Sales & Segment Operating Margin Diversified Industrial International $ in millions 1st Quarter FY2021 % Change FY2020 Sales As Reported $ 1,129 4.7 % $ 1,079 Acquisitions1 99 9.1 % Currency 30 2.9 % Organic Sales $ 1,000 (7.3)% FY2021 % of Sales FY2020 % of Sales Segment Operating Margin As Reported $ 187 16.6 % $ 169 15.6 % Acquired Intangible Asset Amortization 21 13 Business Realignment 8 2 Integration Costs to Achieve2 1 — Adjusted $ 217 19.2 % $ 184 17.0 % 1: Acquisitions reflect LORD (closed 10/29/19) 21 2: Integration Costs to Achieve for LORD

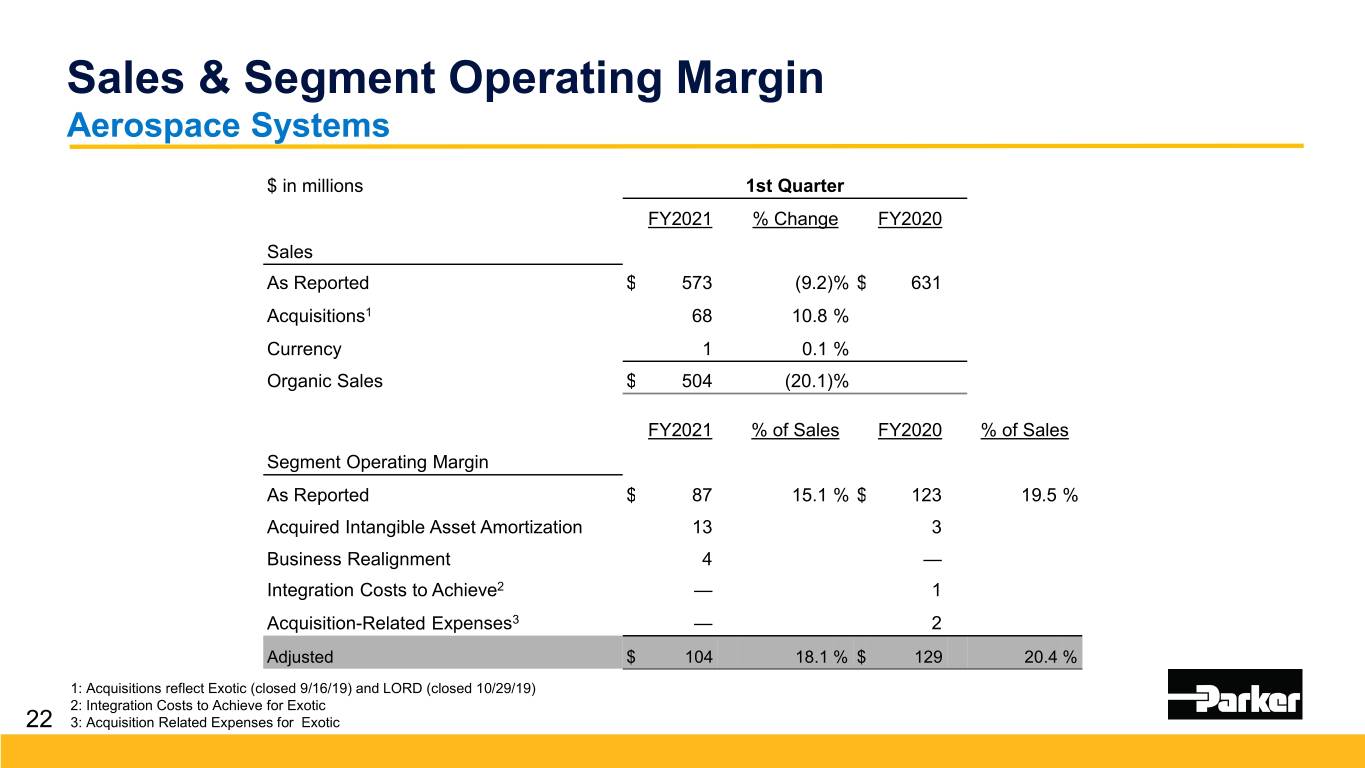

Sales & Segment Operating Margin Aerospace Systems $ in millions 1st Quarter FY2021 % Change FY2020 Sales As Reported $ 573 (9.2)% $ 631 Acquisitions1 68 10.8 % Currency 1 0.1 % Organic Sales $ 504 (20.1)% FY2021 % of Sales FY2020 % of Sales Segment Operating Margin As Reported $ 87 15.1 % $ 123 19.5 % Acquired Intangible Asset Amortization 13 3 Business Realignment 4 — Integration Costs to Achieve2 — 1 Acquisition-Related Expenses3 — 2 Adjusted $ 104 18.1 % $ 129 20.4 % 1: Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2: Integration Costs to Achieve for Exotic 22 3: Acquisition Related Expenses for Exotic

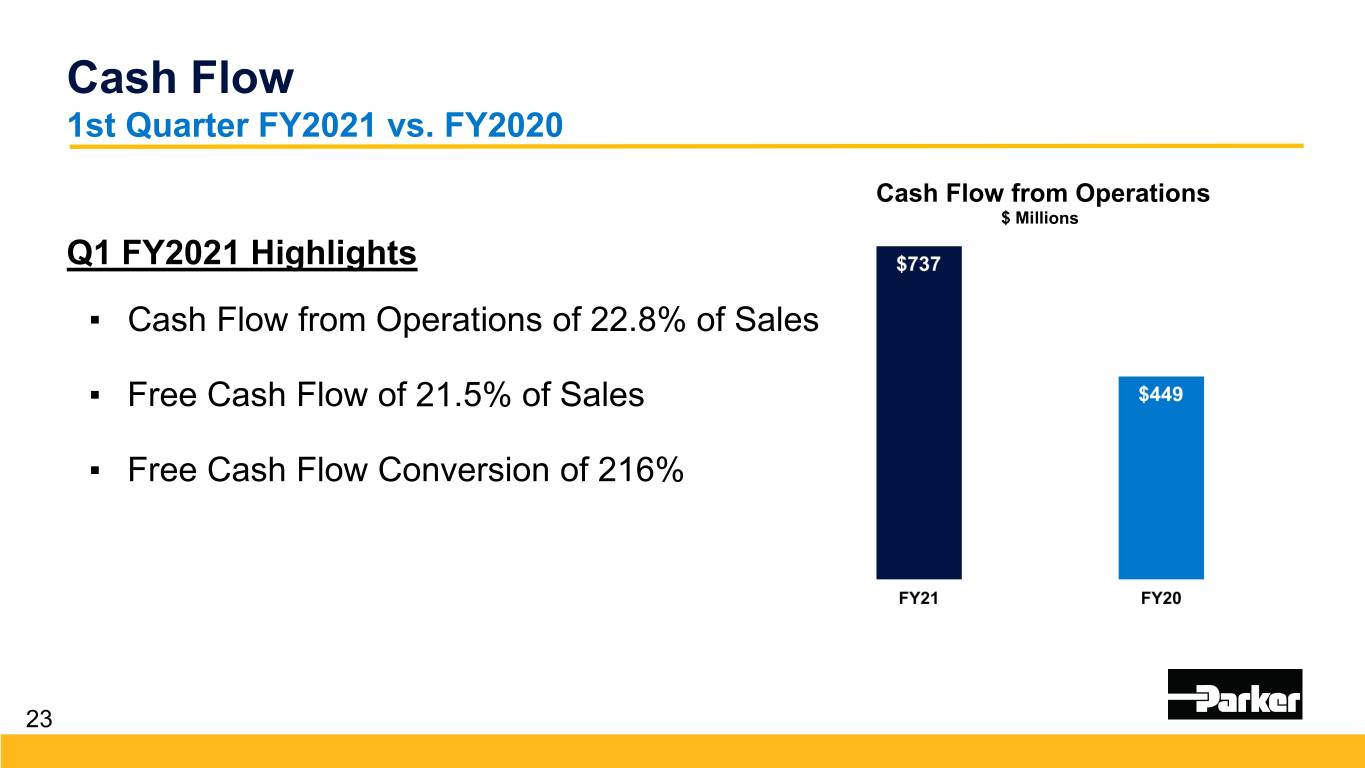

Cash Flow 1st Quarter FY2021 vs. FY2020 Cash Flow from Operations $ Millions Q1 FY2021 Highlights ▪ Cash Flow from Operations of 22.8% of Sales ▪ Free Cash Flow of 21.5% of Sales ▪ Free Cash Flow Conversion of 216% 23

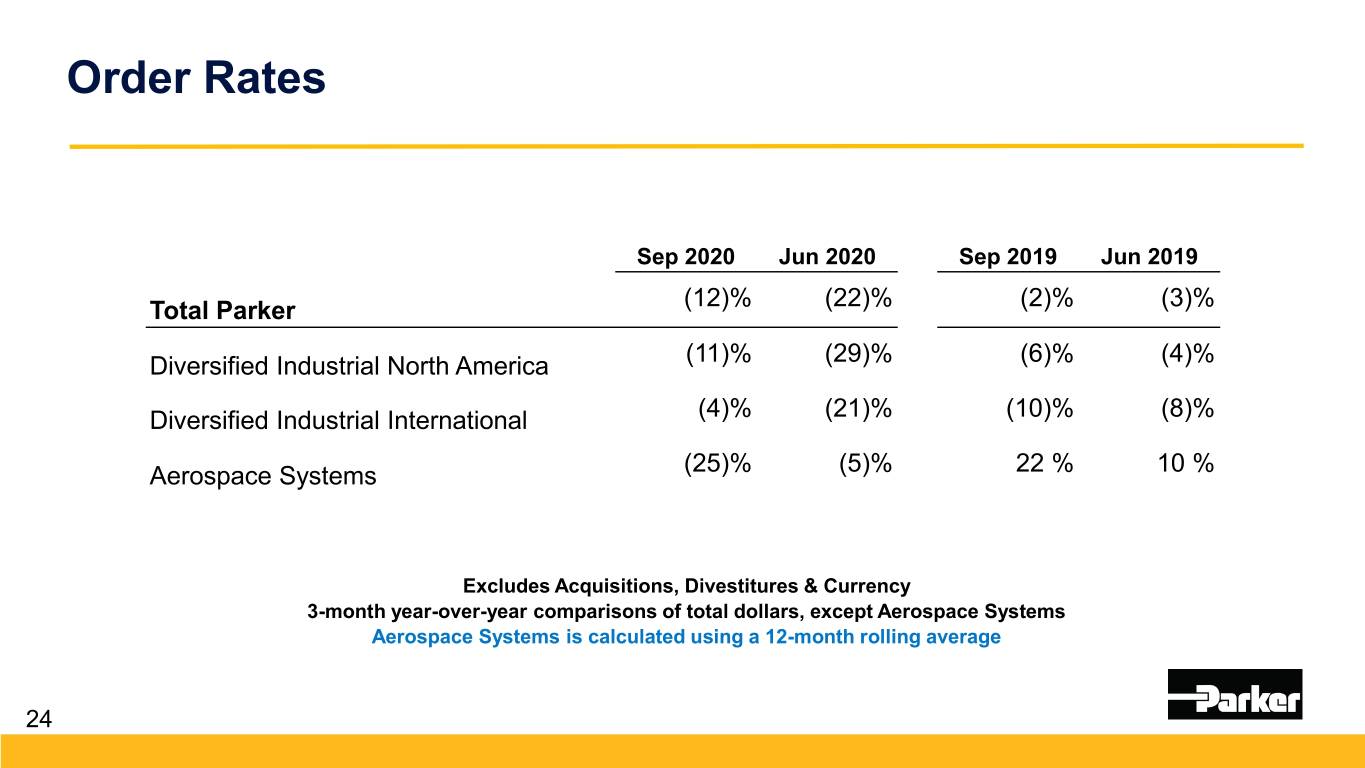

Order Rates Sep 2020 Jun 2020 Sep 2019 Jun 2019 (12)% (22)% (2)% (3)% Total Parker (11)% (29)% (6)% (4)% Diversified Industrial North America Diversified Industrial International (4)% (21)% (10)% (8)% (25)% (5)% 22 % 10 % Aerospace Systems Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average 24

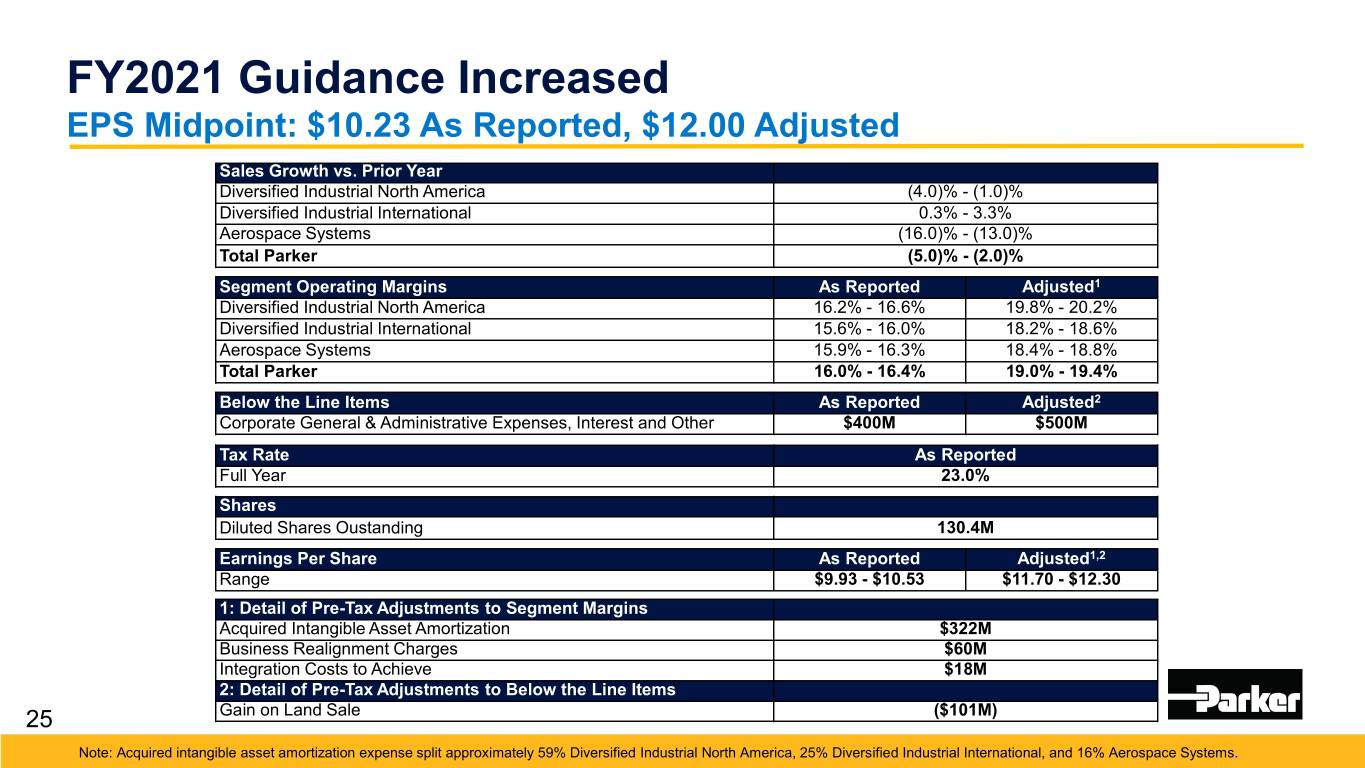

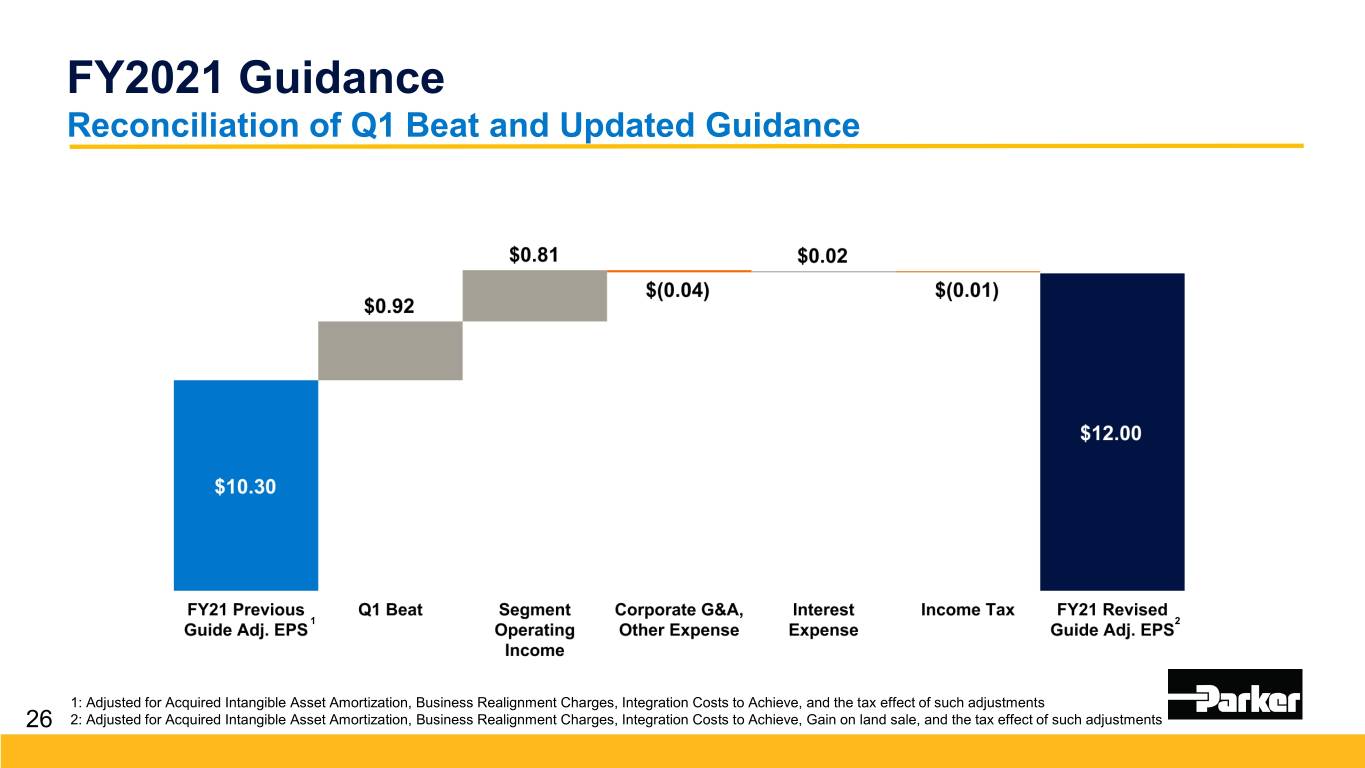

FY2021 Guidance Increased EPS Midpoint: $10.23 As Reported, $12.00 Adjusted Sales Growth vs. Prior Year Diversified Industrial North America (4.0)% - (1.0)% Diversified Industrial International 0.3% - 3.3% Aerospace Systems (16.0)% - (13.0)% Total Parker (5.0)% - (2.0)% Segment Operating Margins As Reported Adjusted1 Diversified Industrial North America 16.2% - 16.6% 19.8% - 20.2% Diversified Industrial International 15.6% - 16.0% 18.2% - 18.6% Aerospace Systems 15.9% - 16.3% 18.4% - 18.8% Total Parker 16.0% - 16.4% 19.0% - 19.4% Below the Line Items As Reported Adjusted2 Corporate General & Administrative Expenses, Interest and Other $400M $500M Tax Rate As Reported Full Year 23.0% Shares Diluted Shares Oustanding 130.4M Earnings Per Share As Reported Adjusted1,2 Range $9.93 - $10.53 $11.70 - $12.30 1: Detail of Pre-Tax Adjustments to Segment Margins Acquired Intangible Asset Amortization $322M Business Realignment Charges $60M Integration Costs to Achieve $18M 2: Detail of Pre-Tax Adjustments to Below the Line Items 25 Gain on Land Sale ($101M) Note: Acquired intangible asset amortization expense split approximately 59% Diversified Industrial North America, 25% Diversified Industrial International, and 16% Aerospace Systems.

FY2021 Guidance Reconciliation of Q1 Beat and Updated Guidance 1 2 1: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, and the tax effect of such adjustments 26 2: Adjusted for Acquired Intangible Asset Amortization, Business Realignment Charges, Integration Costs to Achieve, Gain on land sale, and the tax effect of such adjustments

Key Messages ▪ Strength & interconnectivity of Parker’s portfolio ▪ Strategic portfolio transformation – CLARCOR, LORD & Exotic ▪ Improving financial performance over the cycle ▪ The Win Strategy™ 3.0 & Purpose Statement will accelerate performance Confident in achieving updated FY23 Targets 27

Appendix ▪ Consolidated Statement of Income ▪ Adjusted Amounts Reconciliation ▪ Reconciliation of EPS ▪ Business Segment Information ▪ Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin ▪ Reconciliation of EBITDA to Adjusted EBITDA ▪ Consolidated Balance Sheet ▪ Consolidated Statement of Cash Flows ▪ Reconciliation of Free Cash Flow Conversion ▪ Reconciliation of Forecasted EPS ▪ Supplemental Sales Information – Global Technology Platforms 29

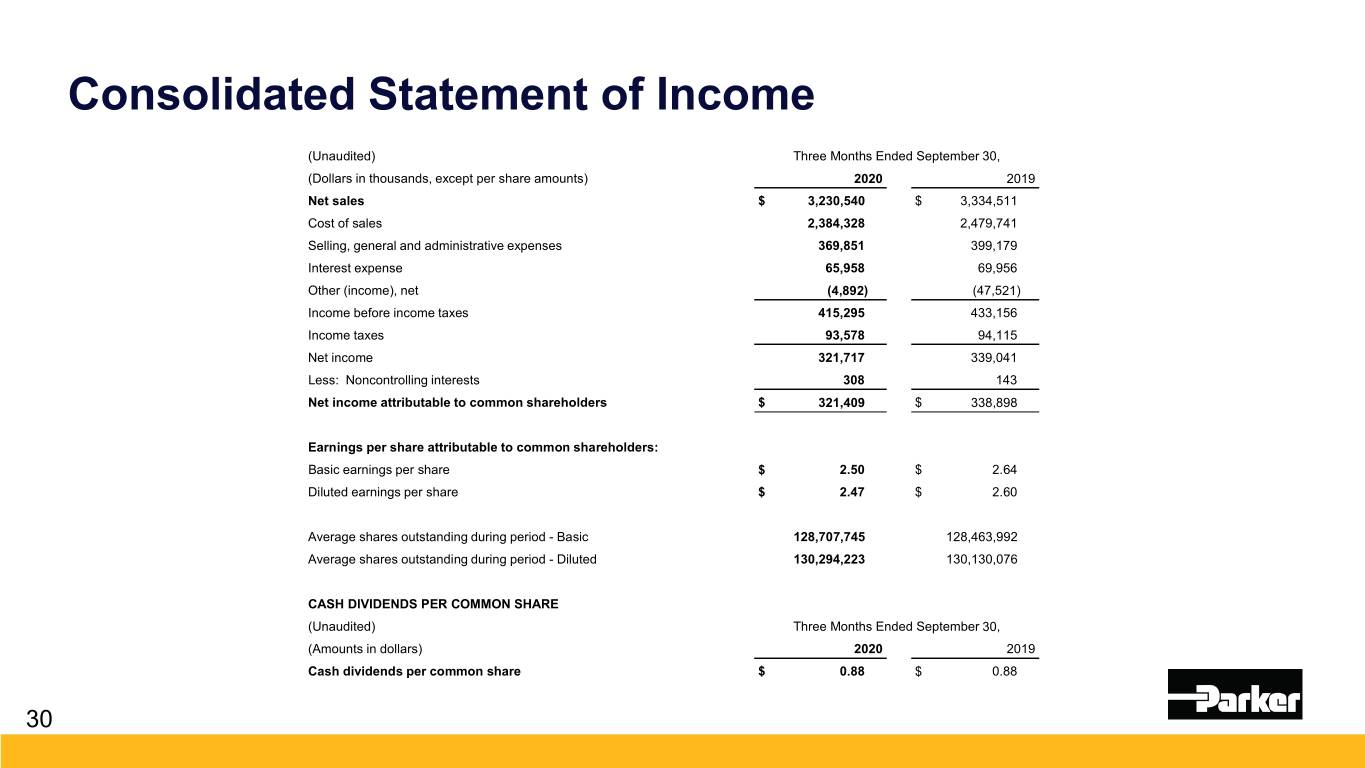

Consolidated Statement of Income (Unaudited) Three Months Ended September 30, (Dollars in thousands, except per share amounts) 2020 2019 Net sales $ 3,230,540 $ 3,334,511 Cost of sales 2,384,328 2,479,741 Selling, general and administrative expenses 369,851 399,179 Interest expense 65,958 69,956 Other (income), net (4,892) (47,521) Income before income taxes 415,295 433,156 Income taxes 93,578 94,115 Net income 321,717 339,041 Less: Noncontrolling interests 308 143 Net income attributable to common shareholders $ 321,409 $ 338,898 Earnings per share attributable to common shareholders: Basic earnings per share $ 2.50 $ 2.64 Diluted earnings per share $ 2.47 $ 2.60 Average shares outstanding during period - Basic 128,707,745 128,463,992 Average shares outstanding during period - Diluted 130,294,223 130,130,076 CASH DIVIDENDS PER COMMON SHARE (Unaudited) Three Months Ended September 30, (Amounts in dollars) 2020 2019 Cash dividends per common share $ 0.88 $ 0.88 30

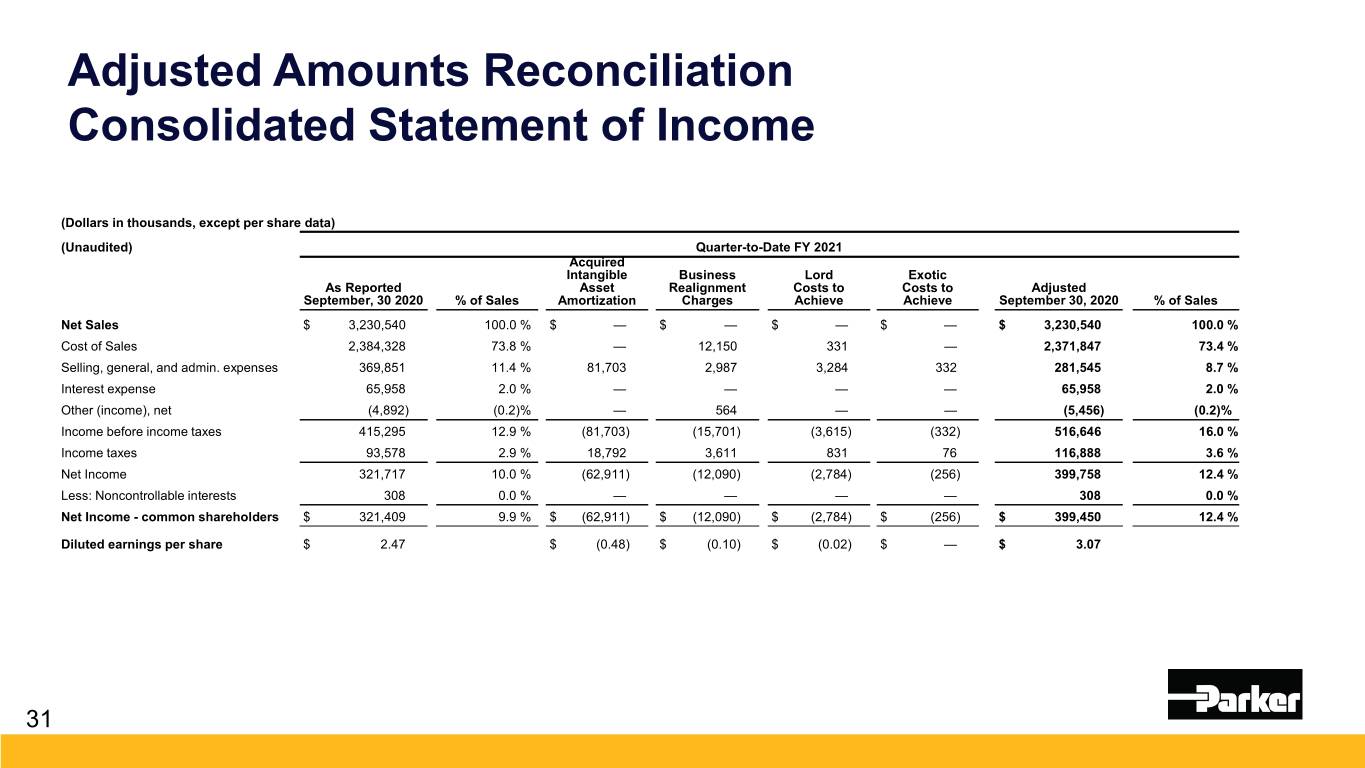

Adjusted Amounts Reconciliation Consolidated Statement of Income (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2021 Acquired Intangible Business Lord Exotic As Reported Asset Realignment Costs to Costs to Adjusted September, 30 2020 % of Sales Amortization Charges Achieve Achieve September 30, 2020 % of Sales Net Sales $ 3,230,540 100.0 % $ — $ — $ — $ — $ 3,230,540 100.0 % Cost of Sales 2,384,328 73.8 % — 12,150 331 — 2,371,847 73.4 % Selling, general, and admin. expenses 369,851 11.4 % 81,703 2,987 3,284 332 281,545 8.7 % Interest expense 65,958 2.0 % — — — — 65,958 2.0 % Other (income), net (4,892) (0.2)% — 564 — — (5,456) (0.2)% Income before income taxes 415,295 12.9 % (81,703) (15,701) (3,615) (332) 516,646 16.0 % Income taxes 93,578 2.9 % 18,792 3,611 831 76 116,888 3.6 % Net Income 321,717 10.0 % (62,911) (12,090) (2,784) (256) 399,758 12.4 % Less: Noncontrollable interests 308 0.0 % — — — — 308 0.0 % Net Income - common shareholders $ 321,409 9.9 % $ (62,911) $ (12,090) $ (2,784) $ (256) $ 399,450 12.4 % Diluted earnings per share $ 2.47 $ (0.48) $ (0.10) $ (0.02) $ — $ 3.07 31

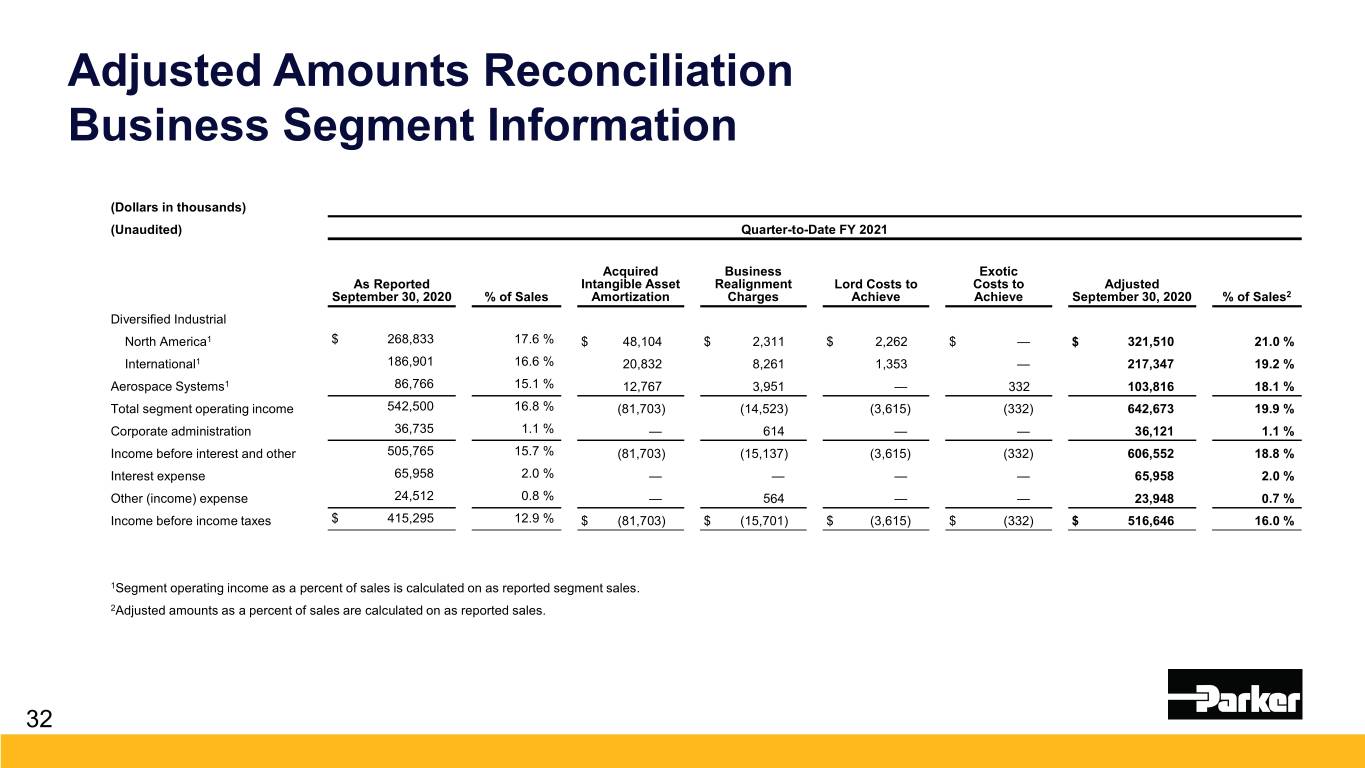

Adjusted Amounts Reconciliation Business Segment Information (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2021 Acquired Business Exotic As Reported Intangible Asset Realignment Lord Costs to Costs to Adjusted September 30, 2020 % of Sales Amortization Charges Achieve Achieve September 30, 2020 % of Sales2 Diversified Industrial North America1 $ 268,833 17.6 % $ 48,104 $ 2,311 $ 2,262 $ — $ 321,510 21.0 % International1 186,901 16.6 % 20,832 8,261 1,353 — 217,347 19.2 % Aerospace Systems1 86,766 15.1 % 12,767 3,951 — 332 103,816 18.1 % Total segment operating income 542,500 16.8 % (81,703) (14,523) (3,615) (332) 642,673 19.9 % Corporate administration 36,735 1.1 % — 614 — — 36,121 1.1 % Income before interest and other 505,765 15.7 % (81,703) (15,137) (3,615) (332) 606,552 18.8 % Interest expense 65,958 2.0 % — — — — 65,958 2.0 % Other (income) expense 24,512 0.8 % — 564 — — 23,948 0.7 % Income before income taxes $ 415,295 12.9 % $ (81,703) $ (15,701) $ (3,615) $ (332) $ 516,646 16.0 % 1Segment operating income as a percent of sales is calculated on as reported segment sales. 2Adjusted amounts as a percent of sales are calculated on as reported sales. 32

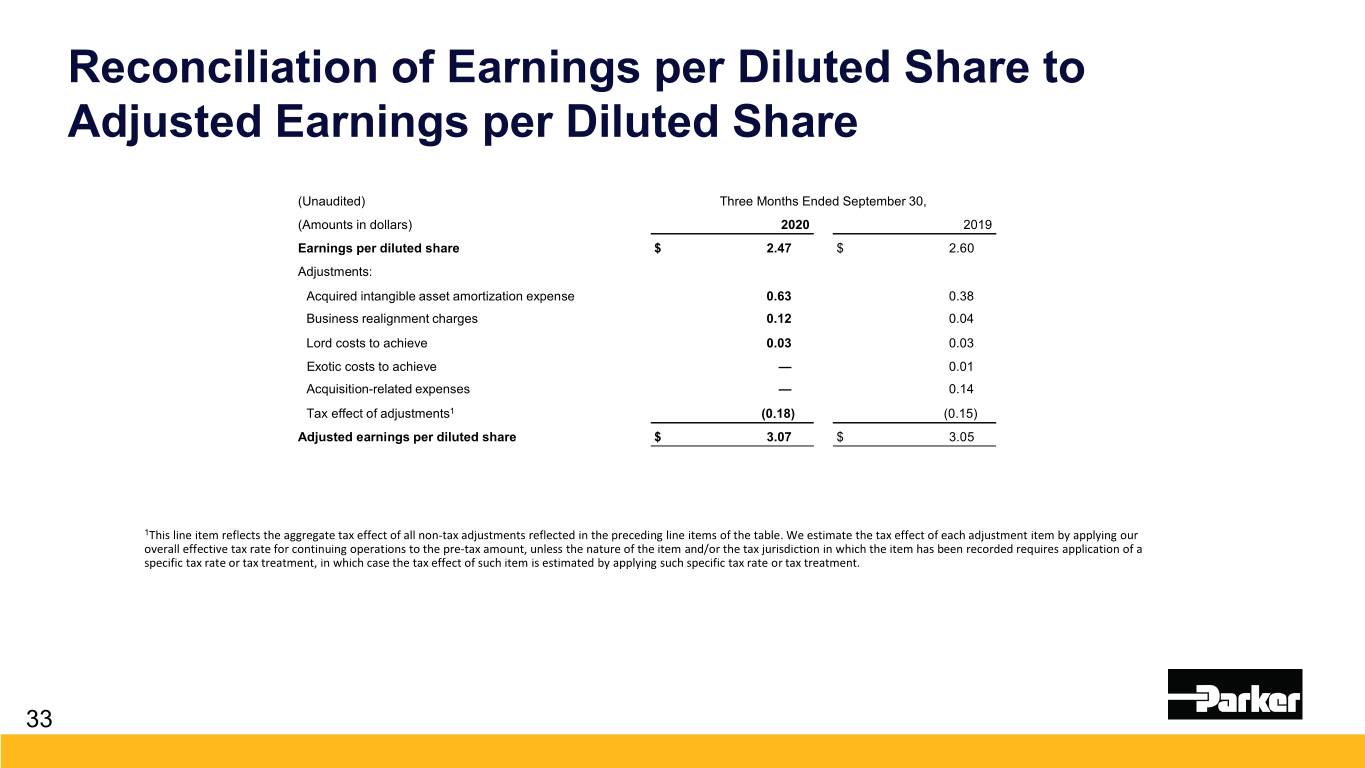

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share (Unaudited) Three Months Ended September 30, (Amounts in dollars) 2020 2019 Earnings per diluted share $ 2.47 $ 2.60 Adjustments: Acquired intangible asset amortization expense 0.63 0.38 Business realignment charges 0.12 0.04 Lord costs to achieve 0.03 0.03 Exotic costs to achieve — 0.01 Acquisition-related expenses — 0.14 Tax effect of adjustments1 (0.18) (0.15) Adjusted earnings per diluted share $ 3.07 $ 3.05 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 33

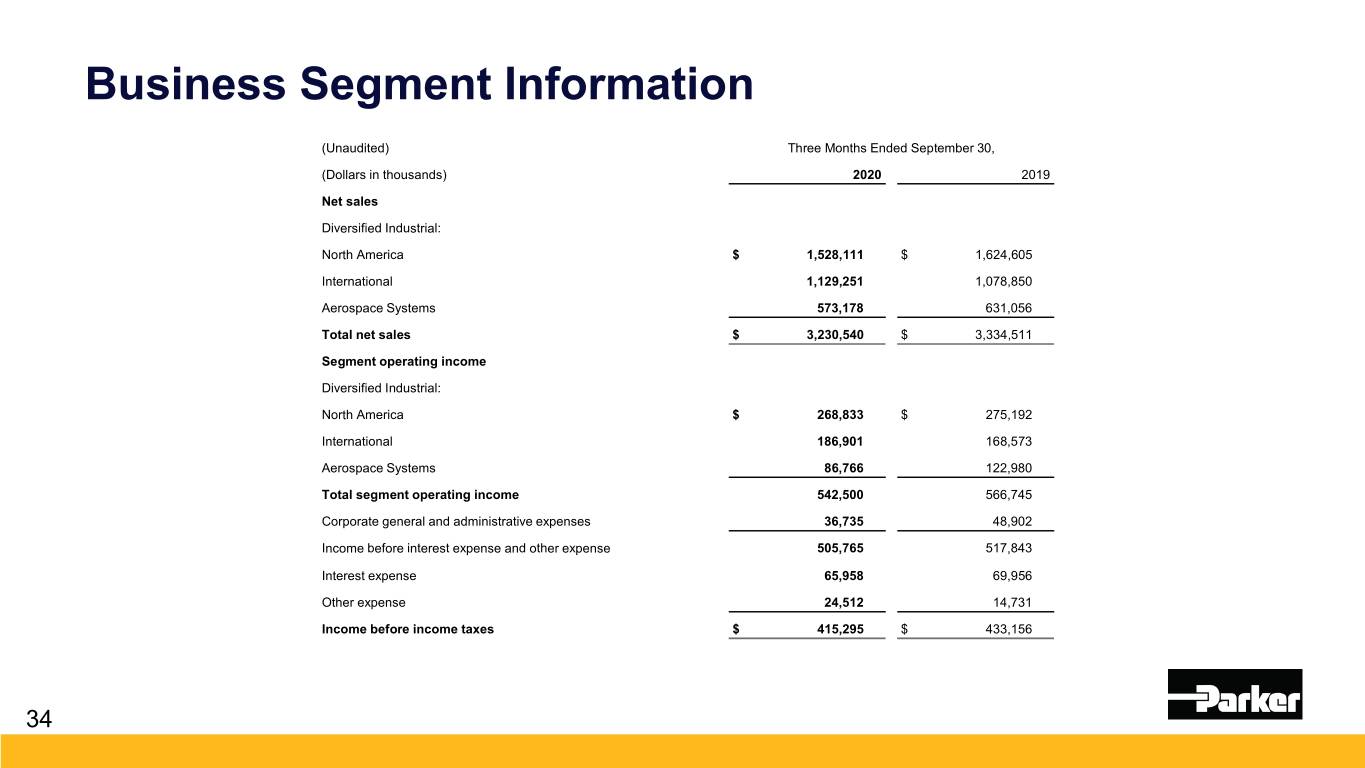

Business Segment Information (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2020 2019 Net sales Diversified Industrial: North America $ 1,528,111 $ 1,624,605 International 1,129,251 1,078,850 Aerospace Systems 573,178 631,056 Total net sales $ 3,230,540 $ 3,334,511 Segment operating income Diversified Industrial: North America $ 268,833 $ 275,192 International 186,901 168,573 Aerospace Systems 86,766 122,980 Total segment operating income 542,500 566,745 Corporate general and administrative expenses 36,735 48,902 Income before interest expense and other expense 505,765 517,843 Interest expense 65,958 69,956 Other expense 24,512 14,731 Income before income taxes $ 415,295 $ 433,156 34

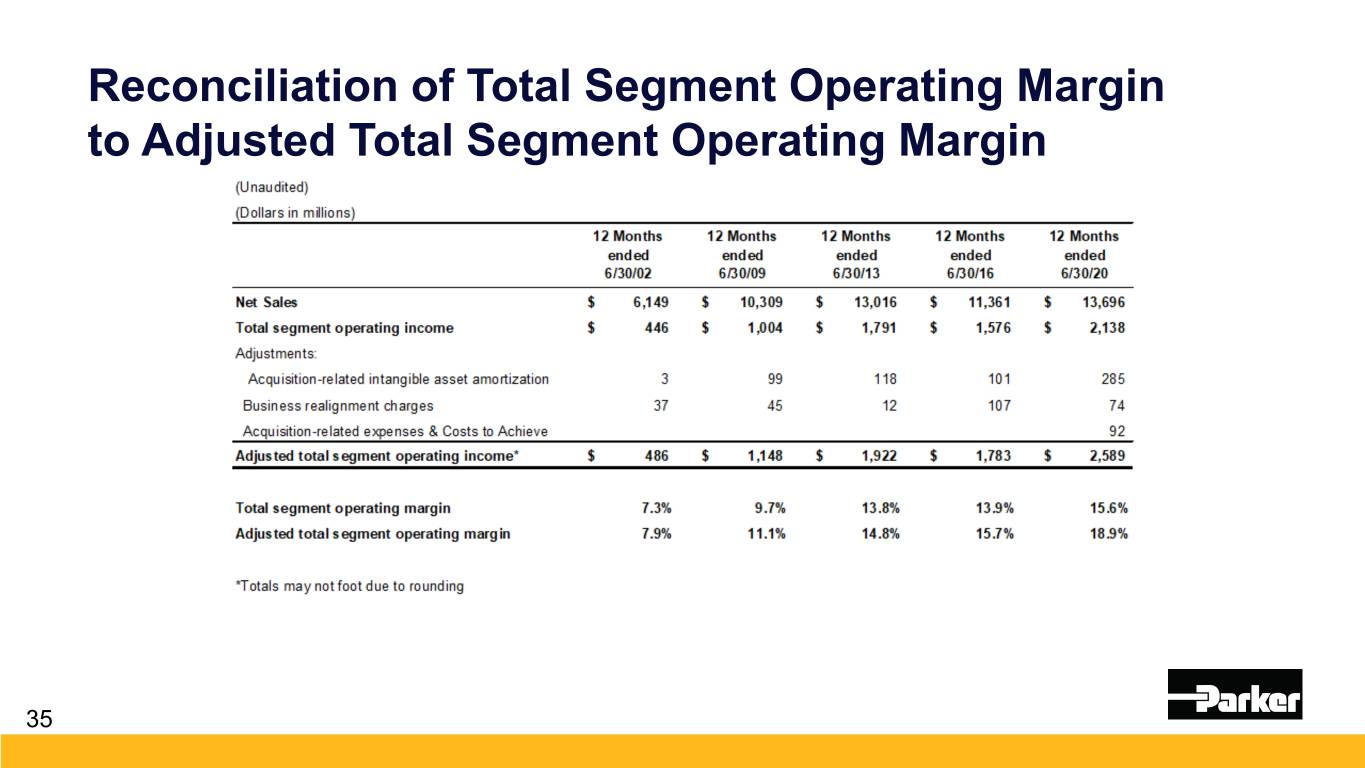

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin 35

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) September 30, 2020 September 30, 2019 Operating income Operating margin Operating income Operating margin Total segment operating income $ 542,500 16.8 % $ 566,745 17.0 % Adjustments: Acquired intangible asset amortization expense 81,703 49,433 Business realignment charges 14,523 4,718 Lord costs to achieve 3,615 3,414 Exotic costs to achieve 332 595 Acquisition-related expenses — 2,519 Adjusted total segment operating income $ 642,673 19.9 % $ 627,424 18.8 % 36

Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2020 2019 Net sales $ 3,230,540 $ 3,334,511 Net income $ 321,717 $ 339,041 Income taxes 93,578 94,115 Depreciation and amortization 148,442 109,071 Interest expense 65,958 69,956 EBITDA 629,695 612,183 Adjustments: Business realignment charges 15,701 4,723 Lord costs to achieve 3,615 3,414 Exotic costs to achieve 332 595 Acquisition-related expenses — 17,449 Adjusted EBITDA $ 649,343 $ 638,364 EBITDA margin 19.5 % 18.4 % Adjusted EBITDA margin 20.1 % 19.1 % 37

Consolidated Balance Sheet (Unaudited) September 30, June 30, September 30, (Dollars in thousands) 2020 2020 2019 Assets Current assets: Cash and cash equivalents $ 742,394 $ 685,514 $ 3,627,393 Marketable securities and other investments 33,463 70,805 282,102 Trade accounts receivable, net 1,860,324 1,854,398 1,983,242 Non-trade and notes receivable 273,991 244,870 288,762 Inventories 1,795,779 1,814,631 1,790,044 Prepaid expenses and other 163,533 214,986 166,536 Total current assets 4,869,484 4,885,204 8,138,079 Plant and equipment, net 2,292,880 2,292,735 1,880,157 Deferred income taxes 129,751 126,839 145,476 Investments and other assets 778,591 764,563 892,508 Intangible assets, net 3,743,314 3,798,913 2,693,756 Goodwill 7,971,897 7,869,935 5,818,613 Total assets $ 19,785,917 $ 19,738,189 $ 19,568,589 Liabilities and equity Current liabilities: Notes payable and long-term debt payable within one year $ 884,450 $ 809,529 $ 1,736,779 Accounts payable, trade 1,264,991 1,111,759 1,287,420 Accrued payrolls and other compensation 332,110 424,231 310,417 Accrued domestic and foreign taxes 196,429 195,314 188,571 Other accrued liabilities 650,243 607,540 634,141 Total current liabilities 3,328,223 3,148,373 4,157,328 Long-term debt 7,057,723 7,652,256 7,366,912 Pensions and other postretirement benefits 1,864,506 1,887,414 1,261,493 Deferred income taxes 413,891 382,528 178,454 Other liabilities 577,325 539,089 501,610 Shareholders' equity 6,528,964 6,113,983 6,096,616 Noncontrolling interests 15,285 14,546 6,176 38 Total liabilities and equity $ 19,785,917 $ 19,738,189 $ 19,568,589

Consolidated Statement of Cash Flows (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2020 2019 Cash flows from operating activities: Net income $ 321,717 $ 339,041 Depreciation and amortization 148,442 109,071 Share incentive plan compensation 58,461 52,633 Gain on plant and equipment (498) (10,269) (Gain) loss on marketable securities (340) 201 Gain on investments (970) (498) Net change in receivables, inventories and trade payables 194,350 53,526 Net change in other assets and liabilities 4,207 (77,794) Other, net 12,005 (16,780) Net cash provided by operating activities 737,374 449,131 Cash flows from investing activities: Acquisitions (net of cash of $8,179 in 2019) — (1,696,456) Capital expenditures (42,117) (50,345) Proceeds from sale of plant and equipment 6,590 19,284 Purchases of marketable securities and other investments (10,726) (159,984) Maturities and sales of marketable securities and other investments 49,107 26,477 Other 1,054 8,070 Net cash provided by (used in) investing activities 3,908 (1,852,954) Cash flows from financing activities: Net payments for common stock activity (21,750) (71,985) Net (payments for) proceeds from debt (557,442) 2,023,714 Dividends paid (113,542) (113,352) Net cash (used in) provided by financing activities (692,734) 1,838,377 Effect of exchange rate changes on cash 8,332 (26,928) Net increase in cash and cash equivalents 56,880 407,626 Cash and cash equivalents at beginning of year 685,514 3,219,767 Cash and cash equivalents at end of period $ 742,394 $ 3,627,393 39

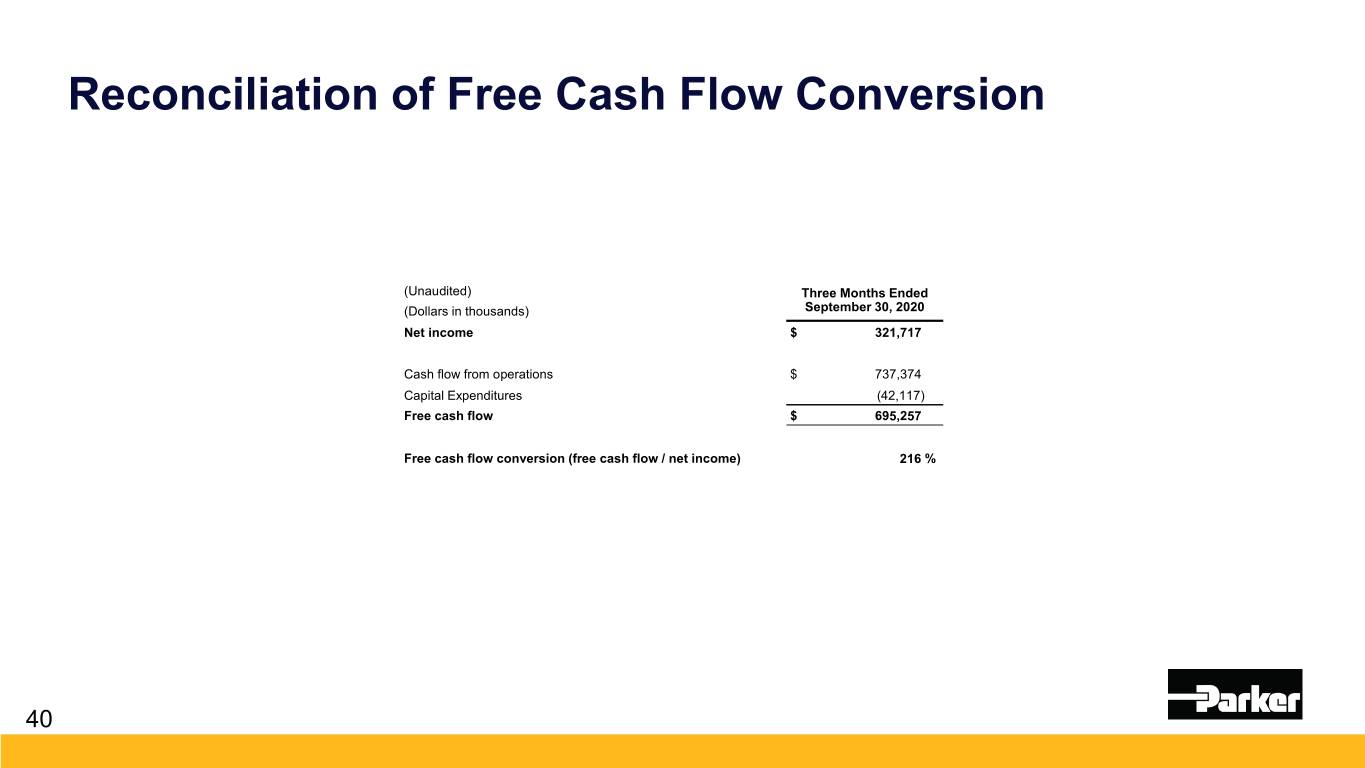

Reconciliation of Free Cash Flow Conversion (Unaudited) Three Months Ended (Dollars in thousands) September 30, 2020 Net income $ 321,717 Cash flow from operations $ 737,374 Capital Expenditures (42,117) Free cash flow $ 695,257 Free cash flow conversion (free cash flow / net income) 216 % 40

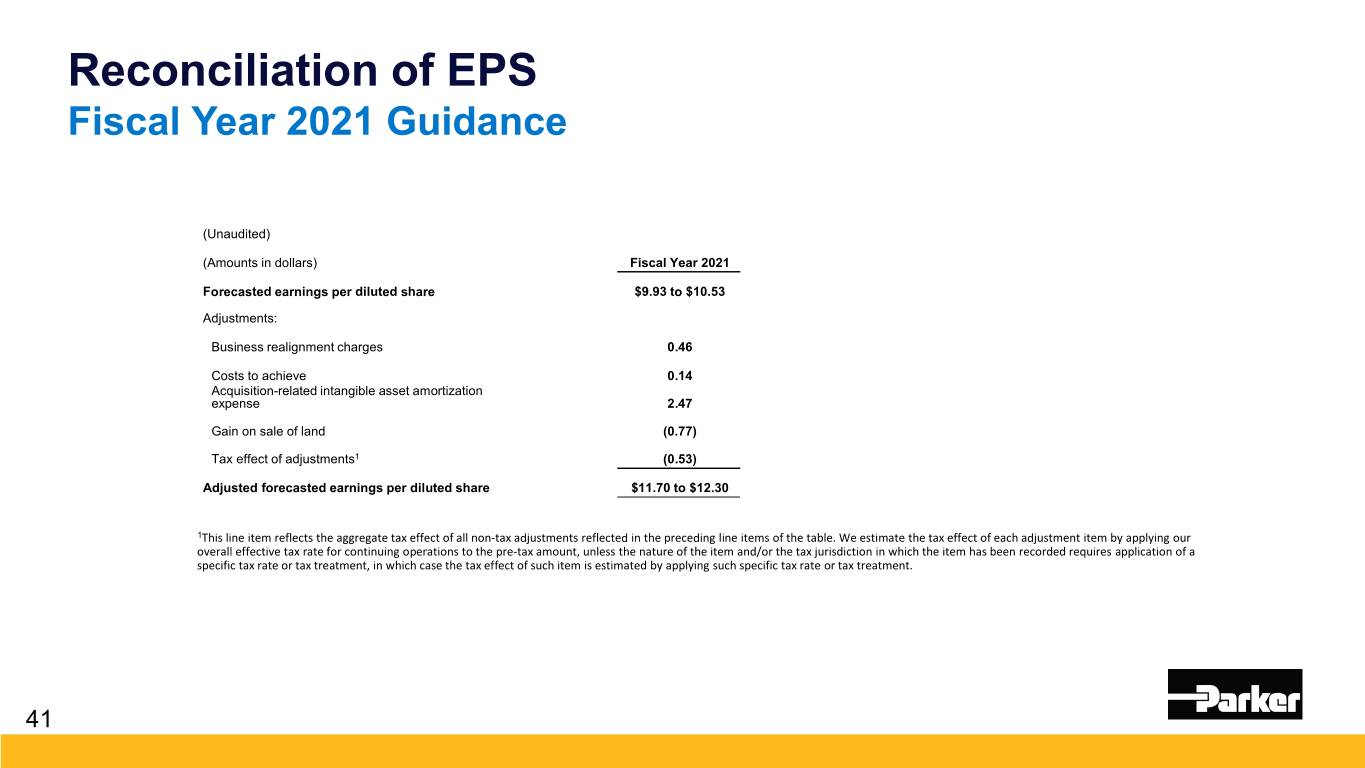

Reconciliation of EPS Fiscal Year 2021 Guidance (Unaudited) (Amounts in dollars) Fiscal Year 2021 Forecasted earnings per diluted share $9.93 to $10.53 Adjustments: Business realignment charges 0.46 Costs to achieve 0.14 Acquisition-related intangible asset amortization expense 2.47 Gain on sale of land (0.77) Tax effect of adjustments1 (0.53) Adjusted forecasted earnings per diluted share $11.70 to $12.30 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 41

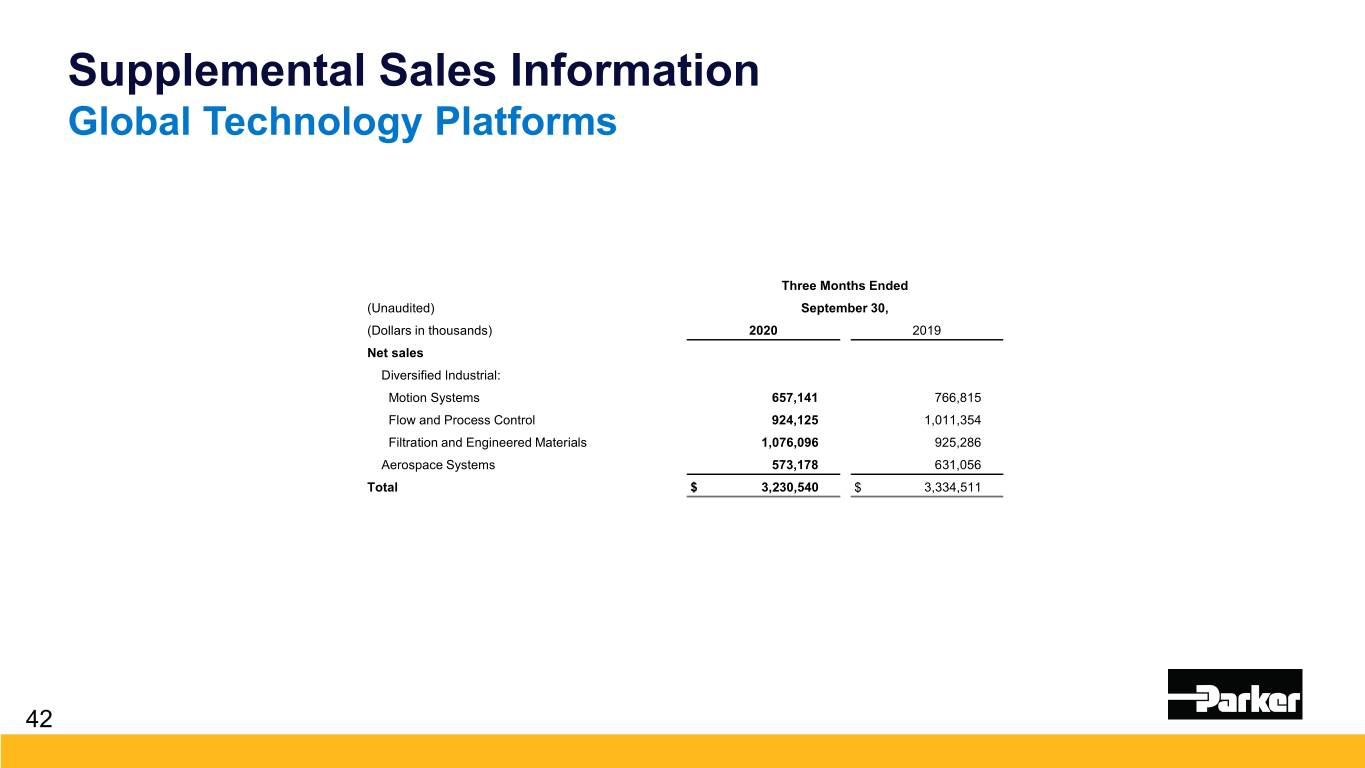

Supplemental Sales Information Global Technology Platforms Three Months Ended (Unaudited) September 30, (Dollars in thousands) 2020 2019 Net sales Diversified Industrial: Motion Systems 657,141 766,815 Flow and Process Control 924,125 1,011,354 Filtration and Engineered Materials 1,076,096 925,286 Aerospace Systems 573,178 631,056 Total $ 3,230,540 $ 3,334,511 42