Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - II-VI INC | exh_991.htm |

| 8-K - FORM 8-K - II-VI INC | f8k_110520.htm |

EXHIBIT 99.2

Copyright 2020, II - VI Incorporated. All rights reserved. November 2020 Investor Presentation

Page 2 Copyright 2020, II - VI Incorporated. All rights reserved. Safe Harbor Statement This presentation contains forward - looking statements relating to future events and expectations that are based on certain assum ptions and contingencies. The forward - looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and relate to the Company’s perfor man ce on a going - forward basis. The forward - looking statements in this presentation involve risks and uncertainties, which could cause actual results, performance or trends to differ materially from those expr ess ed in the forward - looking statements herein or in previous disclosures. The Company believes that all forward - looking statements made by it in this presentation have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections (including the Company's updated guidance for the second quarter of fiscal 2021 set forth in this presentation) as expressed in the forward - looking statements will actually occur or prove to be correct. In addition to general industry and global economic conditions, factors that could cause actual results to differ materially fro m t hose discussed in the forward - looking statements in this presentation include, but are not limited to: (i) the failure of any one or more of the assumptions stated above to prove to be correct; (ii) the risks re lating to forward - looking statements and other “Risk Factors” discussed in the Company’s Annual Report on Form 10 - K for the fiscal year ended June 30, 2020 and the Company’s other reports filed with the U.S. Securities and Exchange Commission ("SEC"); (iii) the purchasing patterns of customers and end - users; (iv) the timely release of new products, and acceptance of such new products by the market; (v) the int roduction of new products by competitors and other competitive responses; (vi) the Company’s ability to assimilate recently acquired businesses, and risks, costs and uncertainties associated with such acq uis itions; (vii) the Company’s ability to devise and execute strategies to respond to market conditions; (viii) the anticipated use of the net proceeds from the proposed offerings; and/or (ix) the risks of busin ess and economic disruption related to the currently ongoing Coronavirus outbreak and any other worldwide health epidemics and outbreaks that may arise. The Company disclaims any obligation to update information c ontained in these forward - looking statements whether as a result of new information, future events or developments, or otherwise. This presentation contains non - GAAP financial measures and key metrics relating to the Company's past performance. These non - GAA P financial measures are in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations relate d t o the use of these non - GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non - GAAP financial measures differently or may use other measures to eva luate their performance, all of which could reduce the usefulness of our non - GAAP financial measures as tools for comparison. As required by Regulation G, we have provided reconciliations of those meas ures to the most directly comparable GAAP measures, which are available in the Appendix.

Company Overview

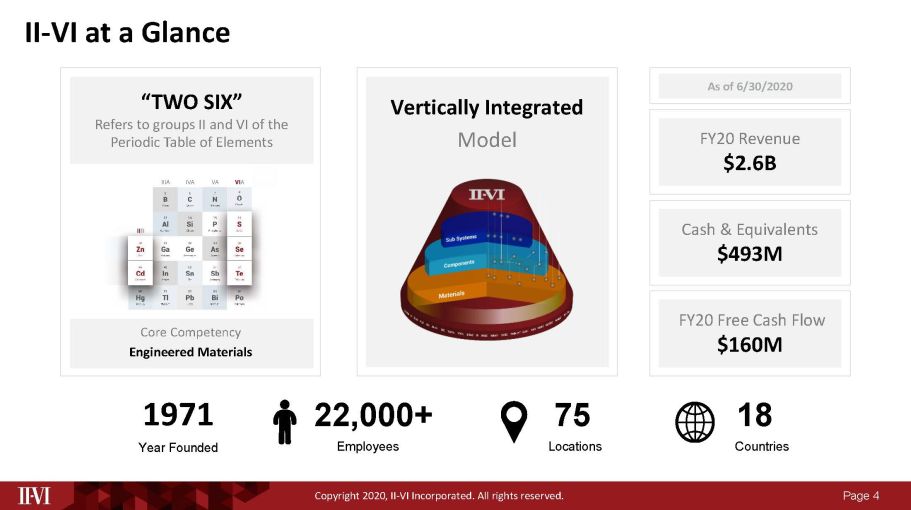

Page 4 Copyright 2020, II - VI Incorporated. All rights reserved. II - VI at a Glance As of 6/30/2020 FY20 Revenue $2.6B Cash & Equivalents $493M FY20 Free Cash Flow $160M Vertically Integrated Model “TWO SIX” Refers to groups II and VI of the Periodic Table of Elements 18 Countries 75 Locations 22,000+ Employees Core Competency Engineered Materials 1971 Year Founded

Page 5 Copyright 2020, II - VI Incorporated. All rights reserved. Megatrends A world transformed through innovative materials vital to a better life today and the sustainability of future generations Adoption of 3D Sensing Increased Data and Video Consumption Deployment of 5G Wireless Growth in Electric & Autonomous Vehicles Intelligent Mobile Electric Proliferation of Cloud Services

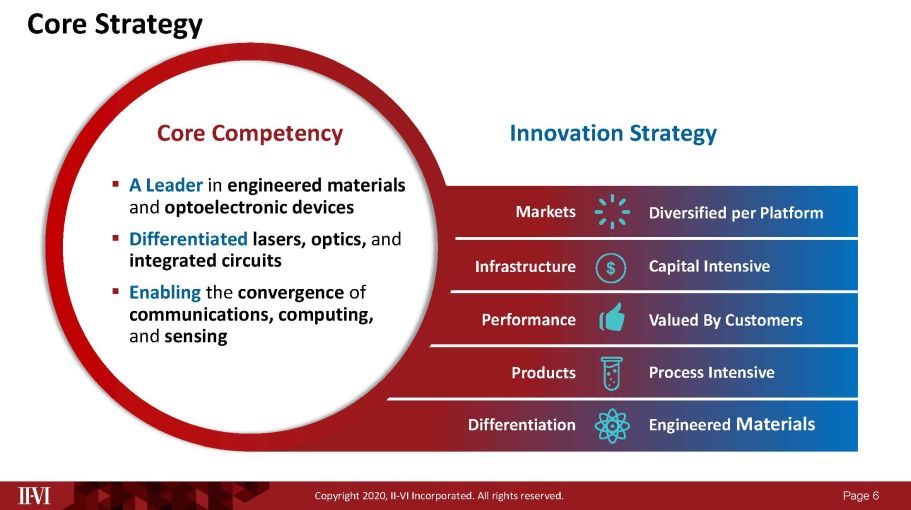

Page 6 Copyright 2020, II - VI Incorporated. All rights reserved. Diversified per Platform Capital Intensive Markets ▪ A Leader in engineered materials and optoelectronic devices ▪ Differentiated lasers, optics, and integrated circuits ▪ Enabling the convergence of communications, computing, and sensing Infrastructure Core Competency Innovation Strategy Engineered Materials Differentiation Valued By Customers Performance Process Intensive Products Core Strategy

Page 7 Copyright 2020, II - VI Incorporated. All rights reserved. $487 $516 $551 $683 $742 $827 $972 $1,159 $1,362 $2,380 $2,638 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY20PF 10 Years of continuous revenue growth (1) 4 Transformative Acquisitions Optical Network & China Market InP Technology Platform Epitaxial Wafer and SiC Electronic Device Platform GaAs Technology Platform 2010 2013 2016 2019 History of Insightful Targeting and Successful Integration of Strategic Acquisitions 5G (1) Figures prior to FY2019 do not reflect the adoption of ASC 606. (2) Includes FY20 Q1 Pro forma: Three Months Ended 09/30/2019 for II - VI and Three Months Ended 10/28/2019 for Finisar. (2) CAGR: 19%

Page 8 Copyright 2020, II - VI Incorporated. All rights reserved. Sampling of representative customers based on approvals for public release Thousands of Market Leading Customers Across Diverse Markets

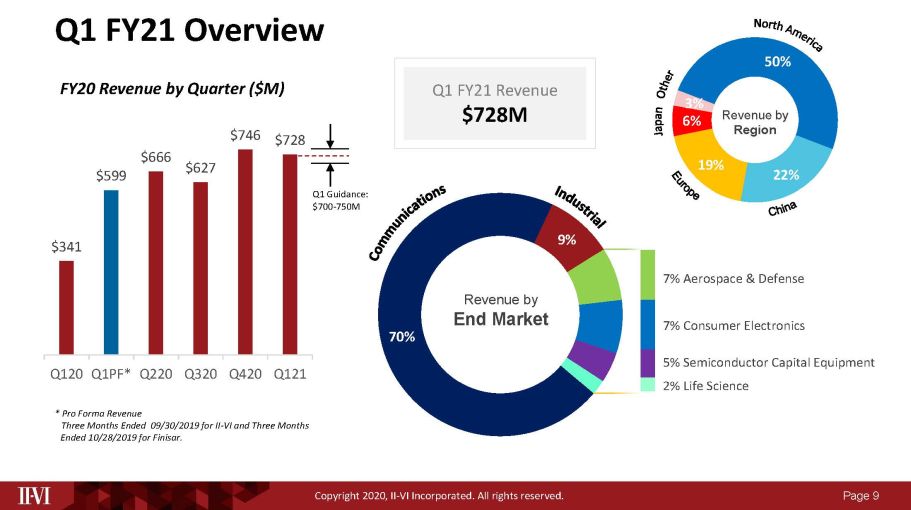

Page 9 Copyright 2020, II - VI Incorporated. All rights reserved. Q1 FY21 Overview $341 $599 $666 $627 $746 $728 Q120 Q1PF* Q220 Q320 Q420 Q121 * Pro Forma Revenue Three Months Ended 09/30/2019 for II - VI and Three Months Ended 10/28/2019 for Finisar. FY20 Revenue by Quarter ($M) 9% 70% Revenue by End Market 5% Semiconductor Capital Equipment 2% Life Science 7% Consumer Electronics 7% Aerospace & Defense 50% 22% 19% 6% 3% Q1 FY21 Revenue $728M Revenue by Region Q1 Guidance: $700 - 750M

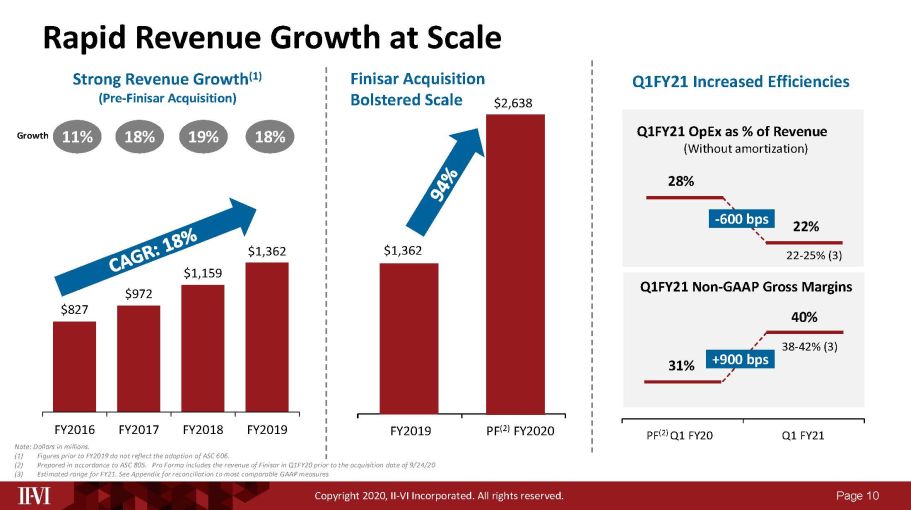

Page 10 Copyright 2020, II - VI Incorporated. All rights reserved. $827 $972 $1,159 $1,362 FY2016 FY2017 FY2018 FY2019 Rapid Revenue Growth at Scale Strong Revenue Growth (1) (Pre - Finisar Acquisition) Q1FY21 Increased Efficiencies 11% 18% 19% 18% Note: Dollars in millions. (1) Figures prior to FY2019 do not reflect the adoption of ASC 606. (2) Prepared in accordance to ASC 805. Pro Forma includes the revenue of Finisar in Q1FY20 prior to the acquisition date of 9/2 4/2 0 (3) Estimated range for FY21. See Appendix for reconciliation to most comparable GAAP measures Finisar Acquisition Bolstered Scale Growth PF (2) Q1 FY20 Q1 FY21 $1,362 $2,638 FY2019 PF (2) FY2020 Q1FY21 OpEx as % of Revenue (Without amortization) 28% 22% 31% 40 % Q1FY21 Non - GAAP Gross Margins 38 - 42% (3) 22 - 25% (3) - 600 bps +900 bps

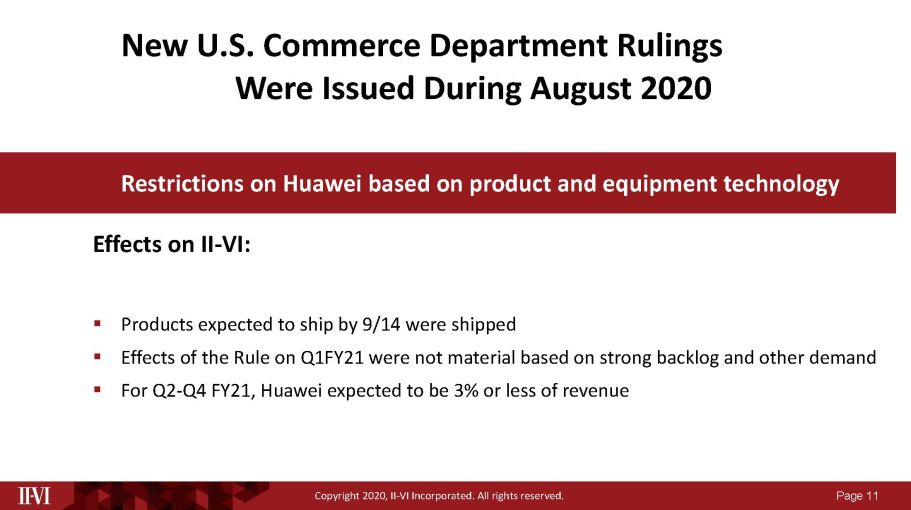

Page 11 Copyright 2020, II - VI Incorporated. All rights reserved. New U.S. Commerce Department Rulings Were Issued During August 2020 Restrictions on Huawei based on product and equipment technology ▪ Products expected to ship by 9/14 were shipped ▪ Effects of the Rule on Q1FY21 were not material based on strong backlog and other demand ▪ For Q2 - Q4 FY21, Huawei expected to be 3% or less of revenue Effects on II - VI:

Page 12 Copyright 2020, II - VI Incorporated. All rights reserved. Remote Radio Head Beam - forming Antenna 5G WIRELESS 4G WIRELESS Bi - Directional Converter/ Inverter/ Electric Motor DC - DC Converter Electric Charger / HV Battery EV/HEV GREEN ENERGY Solar & Wind Energy Smart Grid Power Switching Enabling Mobility & Electrification Ramping silicon carbide substrate capacity 5 - 10x including 200mm as well as qualifying a SiC epitaxial platform over the next 5 years ▪ 100 and 150 mm diameter conductive substrates ▪ 2015: Believed to be world’s first 200 mm conductive substrates ▪ For SiC MOSFET and other power devices ▪ About 10% more driving distance on the same charge POWER ELECTRONICS FOR ELECTRIC VEHICLES ▪ 100 and 150 mm diameter semi - insulating substrates ▪ 2019: Believed to be word’s first 200 mm semi - insulating substrates ▪ For SiC - based GaN HEMT devices ▪ GaN/SiC enables high - bandwidth 5G bands RF ELECTRONICS FOR WIRELESS BASE STATIONS AND RADAR

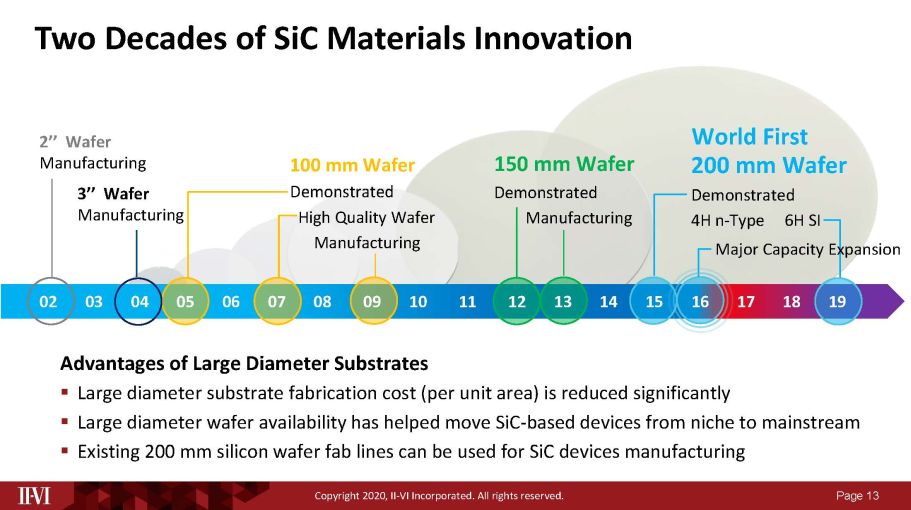

Page 13 Copyright 2020, II - VI Incorporated. All rights reserved. Advantages of Large Diameter Substrates ▪ Large diameter substrate fabrication cost (per unit area) is reduced significantly ▪ Large diameter wafer availability has helped move SiC - based devices from niche to mainstream ▪ Existing 200 mm silicon wafer fab lines can be used for SiC devices manufacturing 2’’ Wafer Manufacturing 3’’ Wafer Manufacturing 100 mm Wafer Demonstrated High Quality Wafer Manufacturing 150 mm Wafer Demonstrated Manufacturing 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 World First 200 mm Wafer Demonstrated 4H n - Type 6H SI Major Capacity Expansion Two Decades of SiC Materials Innovation

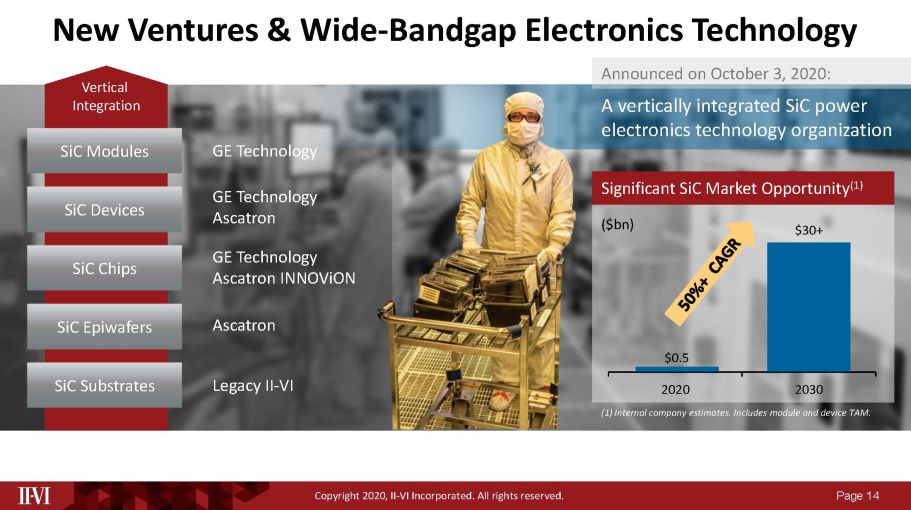

Page 14 Copyright 2020, II - VI Incorporated. All rights reserved. New Ventures & Wide - Bandgap Electronics Technology SiC Modules GE Technology SiC Epiwafers Ascatron SiC Chips GE Technology Ascatron INNOViON SiC Devices GE Technology Ascatron Vertical Integration SiC Substrates Legacy II - VI Significant SiC Market Opportunity (1) ($bn) (1) Internal company estimates. Includes module and device TAM. $0.5 $30+ 2020 2030 A vertically integrated SiC power electronics technology organization Announced on October 3, 2020:

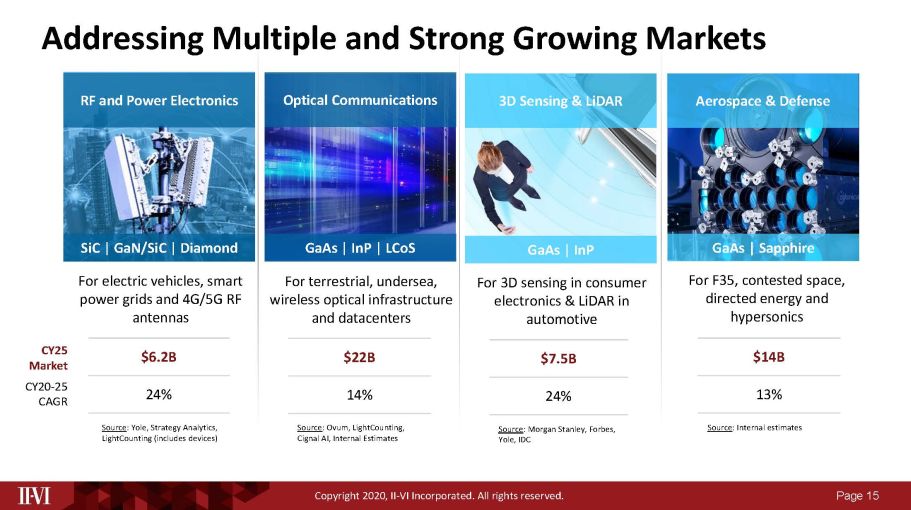

Page 15 Copyright 2020, II - VI Incorporated. All rights reserved. Addressing Multiple and Strong Growing Markets Aerospace & Defense RF and Power Electronics Optical Communications 3D Sensing & LiDAR $7.5B CY25 Market For 3D sensing in consumer electronics & LiDAR in automotive For terrestrial, undersea, wireless optical infrastructure and datacenters 14% CY20 - 25 CAGR $6.2B For electric vehicles, smart power grids and 4G/5G RF antennas 24% For F35, contested space, directed energy and hypersonics $22B 24% GaAs | InP | LCoS GaAs | InP GaAs | Sapphire Source : Ovum, LightCounting, Cignal AI, Internal Estimates $14B 13% SiC | GaN/SiC | Diamond Source : Morgan Stanley, Forbes, Yole, IDC Source : Yole, Strategy Analytics, LightCounting (includes devices) Source : Internal estimates

Page 16 Copyright 2020, II - VI Incorporated. All rights reserved. 5G RADIO ACCESS 5G OPTICAL ACCESS Backbone Network Front - & Backhaul Network Base Stations Handsets Photonic Solutions Segment Compound Semiconductors Segments GaAs RF GaN/SiC RF Line Cards Amplifiers OCM/OTDR LPC WSS Subsystems Bidi DWDM TRx 100G BH TRx 25G FH TRx HPC WSS Coherent TRx DWDM Filters II - VI Finisar Growth Opportunities in 5G Mobile Infrastructure Mobile subscribers quickly migrating to 5G Carriers rearchitecting their networks for 5G Accelerated need to deploy new 5G infrastructure worldwide

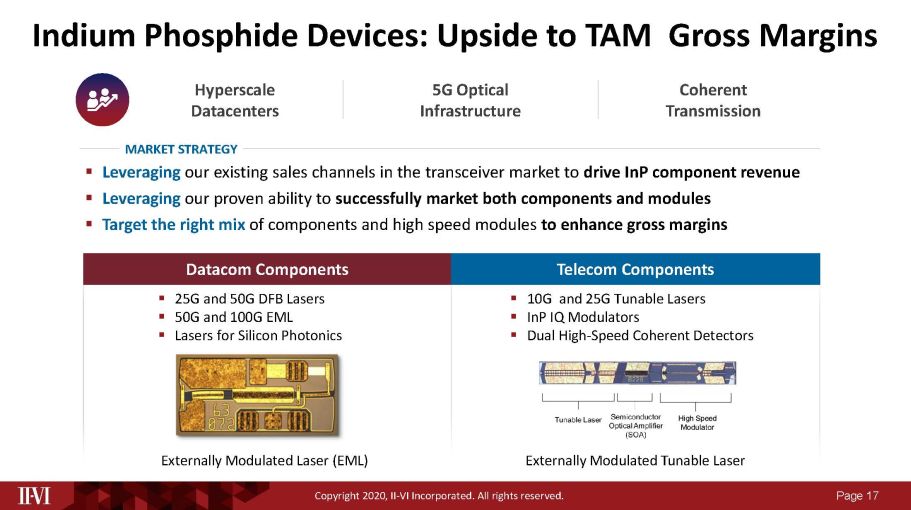

Page 17 Copyright 2020, II - VI Incorporated. All rights reserved. Datacom Components Telecom Components ▪ 25G and 50G DFB Lasers ▪ 50G and 100G EML ▪ Lasers for Silicon Photonics Externally Modulated Laser (EML) Externally Modulated Tunable Laser ▪ 10G and 25G Tunable Lasers ▪ InP IQ Modulators ▪ Dual High - Speed Coherent Detectors ▪ Leveraging our existing sales channels in the transceiver market to drive InP component revenue ▪ Leveraging our proven ability to successfully market both components and modules ▪ Target the right mix of components and high speed modules to enhance gross margins MARKET STRATEGY Hyperscale Datacenters 5G Optical Infrastructure Coherent Transmission Indium Phosphide Devices: Upside to TAM Gross Margins

Page 18 Copyright 2020, II - VI Incorporated. All rights reserved. ▪ Market drivers • Face biometrics, auto - focus, augmented reality, automotive in - cabin & LiDAR, machine vision ▪ GaAs compound semiconductors technology platform on 6 - inch • Warren, NJ: Shipped hundreds of millions of 3D sensing VSCEL arrays since 2017 • Sherman, TX : Shipping 3D Sensing VCSEL arrays in high volume since early 2020 • Zurich, Switzerland : Edge emitters on 6 - inch in volume production in 2020 • Vertically integrated : Epitaxial growth, device fabrication and automated wafer testing ▪ Broad portfolio of products: Lasers, detectors, optics & integrated circuits • Integration and miniaturization capabilities WIDE INCIDENCE ANGLE MIRRORS GaAs VCSEL ARRAYS 940 GaAs EDGE - EMITTING LASERS 3D Sensing & LiDAR DIFFRACTIVE OPTICAL ELEMENTS (DOE) DIFFRACTIVE OPTICS - FLAT LENSES DIFFRACTIVE OPTICS - DIFFUSERS

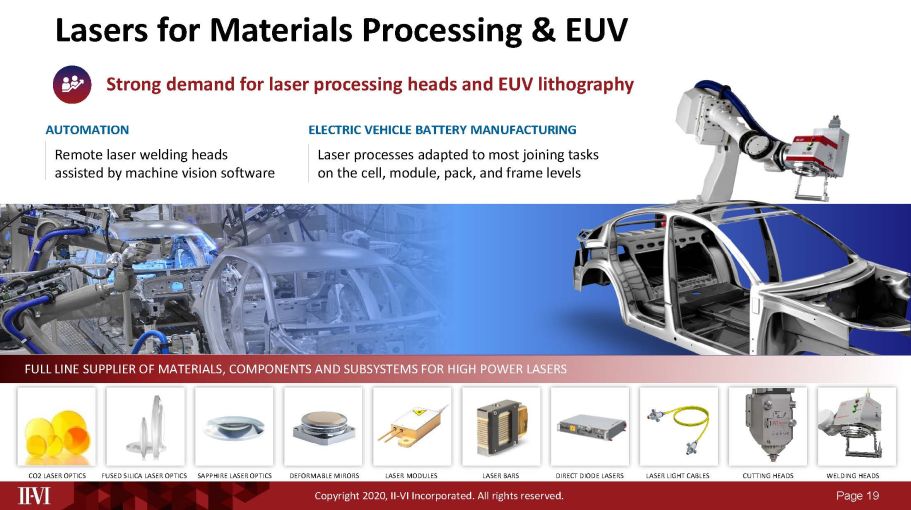

Page 19 Copyright 2020, II - VI Incorporated. All rights reserved. CO2 LASER OPTICS FUSED SILICA LASER OPTICS SAPPHIRE LASER OPTICS DEFORMABLE MIRORS LASER MODULES LASER BARS DIRECT DIODE LASERS LASER LIGHT CABLES CUTTING HEADS WELDING HEADS Lasers for Materials Processing & EUV Strong demand for laser processing heads and EUV lithography ELECTRIC VEHICLE BATTERY MANUFACTURING Remote laser welding heads assisted by machine vision software AUTOMATION Laser processes adapted to most joining tasks on the cell, module, pack, and frame levels FULL LINE SUPPLIER OF MATERIALS, COMPONENTS AND SUBSYSTEMS FOR HIGH POWER LASERS

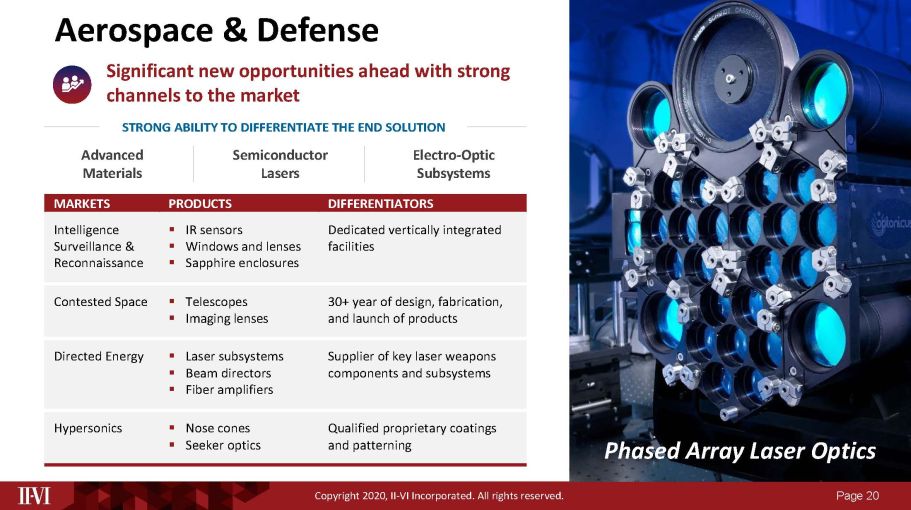

Page 20 Copyright 2020, II - VI Incorporated. All rights reserved. Significant new opportunities ahead with strong channels to the market STRONG ABILITY TO DIFFERENTIATE THE END SOLUTION Advanced Materials Semiconductor Lasers Electro - Optic Subsystems MARKETS PRODUCTS DIFFERENTIATORS Intelligence Surveillance & Reconnaissance ▪ IR sensors ▪ Windows and lenses ▪ Sapphire enclosures Dedicated vertically integrated facilities Contested Space ▪ Telescopes ▪ Imaging lenses 30+ year of design, fabrication, and launch of products Directed Energy ▪ Laser subsystems ▪ Beam directors ▪ Fiber amplifiers Supplier of key laser weapons components and subsystems Hypersonics ▪ Nose cones ▪ Seeker optics Qualified proprietary coatings and patterning Phased Array Laser Optics Aerospace & Defense

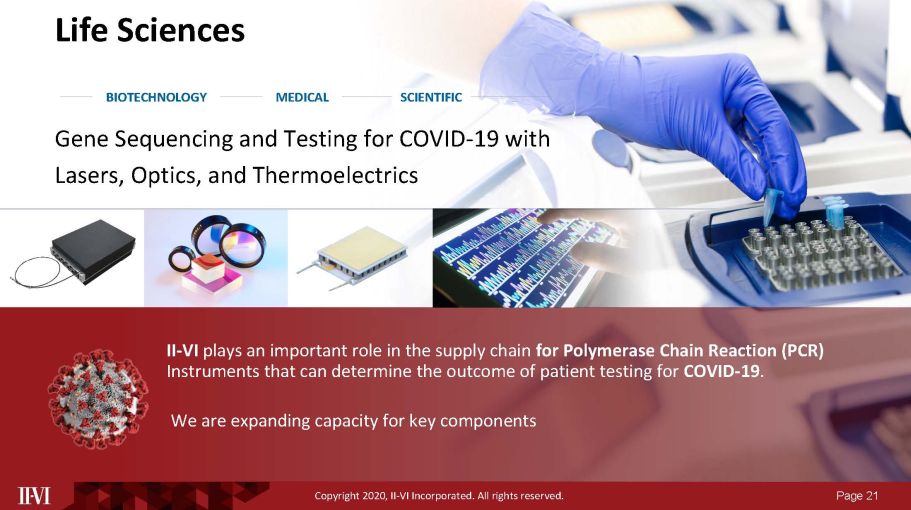

Page 21 Copyright 2020, II - VI Incorporated. All rights reserved. Life Sciences Gene Sequencing and Testing for COVID - 19 with Lasers, Optics, and Thermoelectrics II - VI plays an important role in the supply chain for Polymerase Chain Reaction (PCR) Instruments that can determine the outcome of patient testing for COVID - 19 . We are expanding capacity for key components BIOTECHNOLOGY MEDICAL SCIENTIFIC

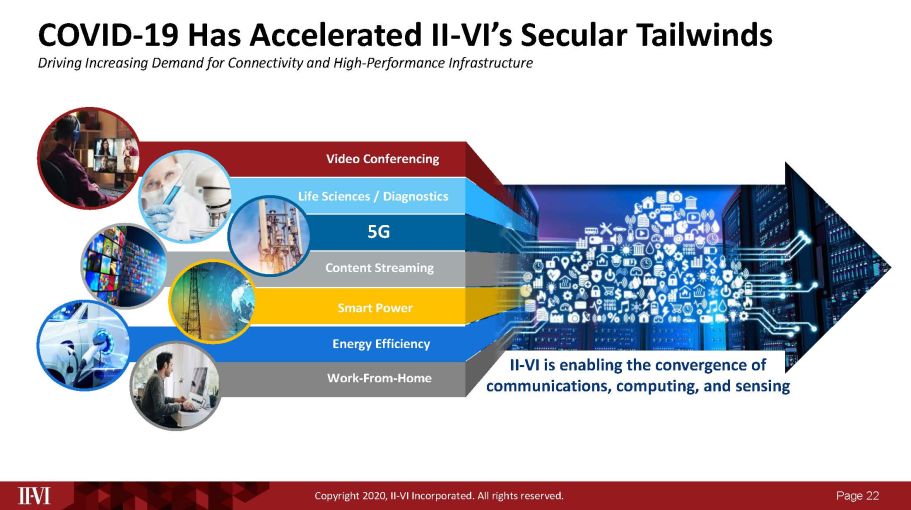

Page 22 Copyright 2020, II - VI Incorporated. All rights reserved. COVID - 19 Has Accelerated II - VI’s Secular Tailwinds Driving Increasing Demand for Connectivity and High - Performance Infrastructure Video Conferencing Life Sciences / Diagnostics Content Streaming 5G Smart Power Energy Efficiency Work - From - Home II - VI is enabling the convergence of communications, computing, and sensing

Financial Overview

Page 24 Copyright 2020, II - VI Incorporated. All rights reserved. Attractive and Increasing Gross and Operating Margins (1) All non - GAAP amounts exclude certain adjustments for share - based compensation, acquired intangible amortization expense, certain one - time transaction expenses, debt extinguishment expense, fair value measurement period adjustments and restructuring and related items. See Appendix for reconciliation to most comparable GAAP measures (2) II - VI figures are for the three months ended September 30, 2019 and Finisar figures are for the three months ended July 28, 2019 . Strong Execution and Synergy Realization Post Finisar Transaction Close Driving Margins Non - GAAP Gross Margin (1) Non - GAAP Operating Margin (1) 38% 31% 38% Last Quarter Before Close (2) Q3 FY20 Q4 FY20 42% Q1 FY21 40 % 16 % 9 % 13 % Last Quarter Before Close (2) Q3 FY20 Q4 FY20 17 % Q1 FY21 19%

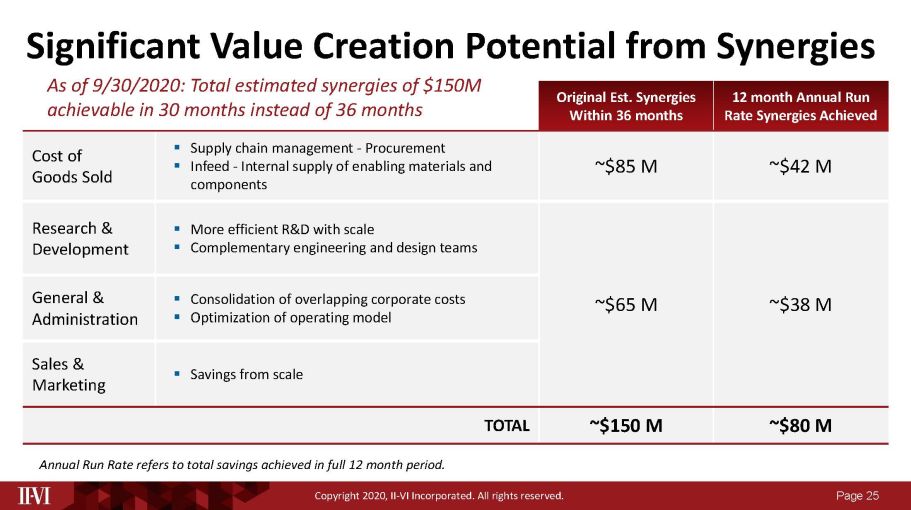

Page 25 Copyright 2020, II - VI Incorporated. All rights reserved. Significant Value Creation Potential from Synergies Original Est. Synergies Within 36 months 12 month Annual Run Rate Synergies Achieved Cost of Goods Sold ▪ Supply chain management - Procurement ▪ Infeed - Internal supply of enabling materials and components ~$85 M ~$42 M Research & Development ▪ More efficient R&D with scale ▪ Complementary engineering and design teams ~$65 M ~$38 M General & Administration ▪ Consolidation of overlapping corporate costs ▪ Optimization of operating model Sales & Marketing ▪ Savings from scale TOTAL ~$150 M ~$80 M Annual Run Rate refers to total savings achieved in full 12 month period. As of 9/30/2020: Total estimated synergies of $150M achievable in 30 months instead of 36 months

Page 26 Copyright 2020, II - VI Incorporated. All rights reserved. Key Takeaways One of the Largest Photonics and Compound Semiconductor Companies 1 Materials Expertise Drives Differentiation in Multiple Growing Markets 2 Vertically Integrated, Diverse Global Manufacturing Footprint 3 History of Insightful Targeting and Successful Integration of Strategic Acquisitions 4 Strong Execution: Integration and Synergies Ahead of Plan; Resilient Growth 5

Page 27 Copyright 2020, II - VI Incorporated. All rights reserved. Transaction Overview Appendix

Page 28 Copyright 2020, II - VI Incorporated. All rights reserved. End Market Distribution of Q1FY21 QTD Revenue Reported Segments Q1FY20 Revenue Q1FY21 Revenue Q1FY21 Op Margin – GAAP / Non - GAAP Q1FY21/ Q1FY20 Revenue Growth Pro Forma* Revenue Change FY21 Q1/ FY20 Q1 Industrial (Automotive) Fiber O ptic & Wireless Comm. Aerospace & Defense Semi Cap Life Science, Consumer, Other Photonic Solutions $163M (1) $498M 10% / 16% 205% 2% 95% 0% 0% 3% Compound Semiconductors $177M $230M 22% / 26% 30% 23% (1%) 23% 21% 11% 21% II - VI Consolidated $340M $728M 14% / 19% 114% 22% 9% (0%) 70% 7% 4% 10% II - VI Segment Revenue by End Markets for Q1FY21 QTD * Pro Forma calculation in accordance with ASC 805. 1: Includes the revenue presented in “Finisar and Other” for the prior period of approximately $22M.

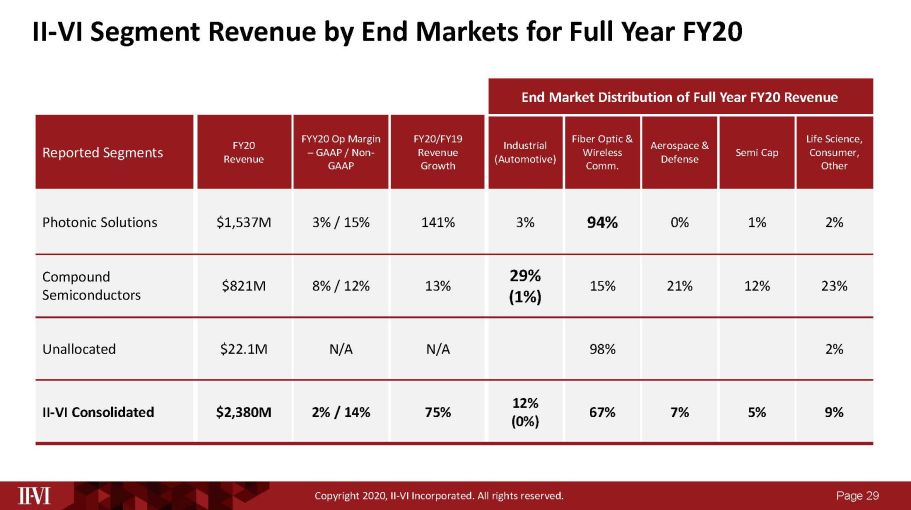

Page 29 Copyright 2020, II - VI Incorporated. All rights reserved. End Market Distribution of Full Year FY20 Revenue Reported Segments FY20 Revenue FYY20 Op Margin – GAAP / Non - GAAP FY20/FY19 Revenue Growth Industrial (Automotive) Fiber O ptic & Wireless Comm. Aerospace & Defense Semi Cap Life Science, Consumer, Other Photonic Solutions $1,537M 3% / 15% 141% 3% 94% 0% 1% 2% Compound Semiconductors $821M 8% / 12% 13% 29% (1%) 15% 21% 12% 23% Unallocated $22.1M N/A N/A 98% 2% II - VI Consolidated $2,380M 2% / 14% 75% 12% (0%) 67% 7% 5% 9% II - VI Segment Revenue by End Markets for Full Year FY20

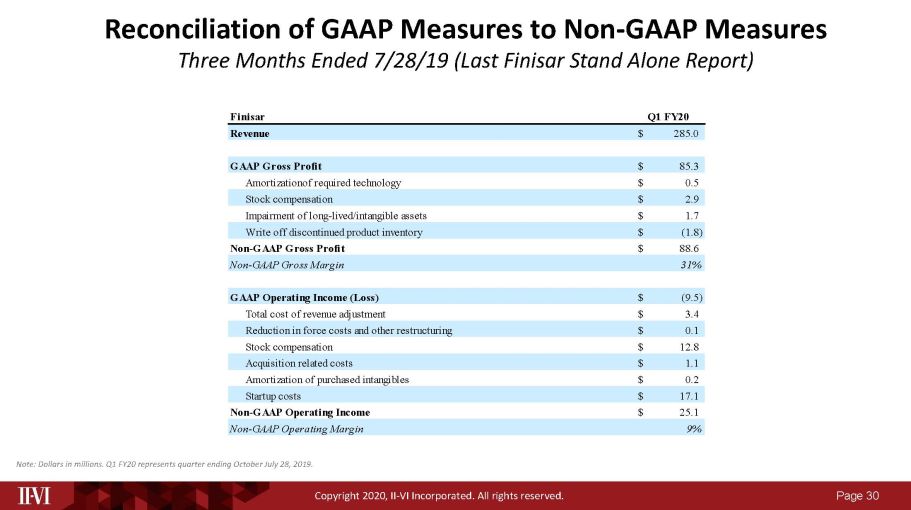

Page 30 Copyright 2020, II - VI Incorporated. All rights reserved. Note: Dollars in millions. Q1 FY20 represents quarter ending October July 28, 2019. Reconciliation of GAAP Measures to Non - GAAP Measures Three Months Ended 7/28/19 (Last Finisar Stand Alone Report) Finisar Q1 FY20 Revenue 285.0$ GAAP Gross Profit 85.3$ Amortizationof required technology 0.5$ Stock compensation 2.9$ Impairment of long-lived/intangible assets 1.7$ Write off discontinued product inventory (1.8)$ Non-GAAP Gross Profit 88.6$ Non-GAAP Gross Margin 31% GAAP Operating Income (Loss) (9.5)$ Total cost of revenue adjustment 3.4$ Reduction in force costs and other restructuring 0.1$ Stock compensation 12.8$ Acquisition related costs 1.1$ Amortization of purchased intangibles 0.2$ Startup costs 17.1$ Non-GAAP Operating Income 25.1$ Non-GAAP Operating Margin 9%

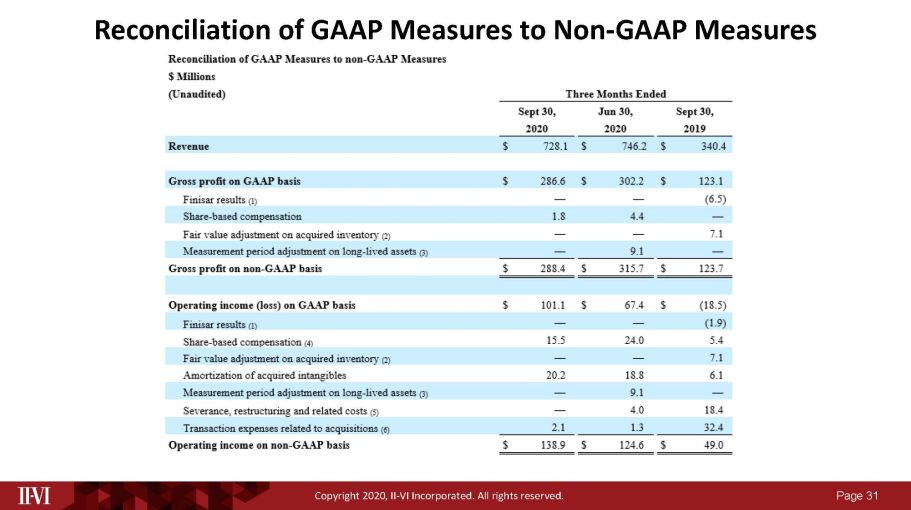

Page 31 Copyright 2020, II - VI Incorporated. All rights reserved. Reconciliation of GAAP Measures to Non - GAAP Measures

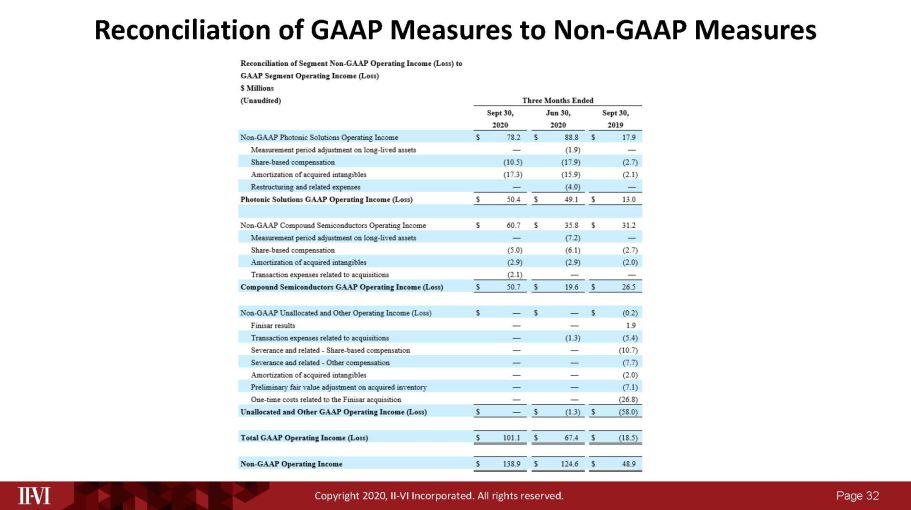

Page 32 Copyright 2020, II - VI Incorporated. All rights reserved. Reconciliation of GAAP Measures to Non - GAAP Measures

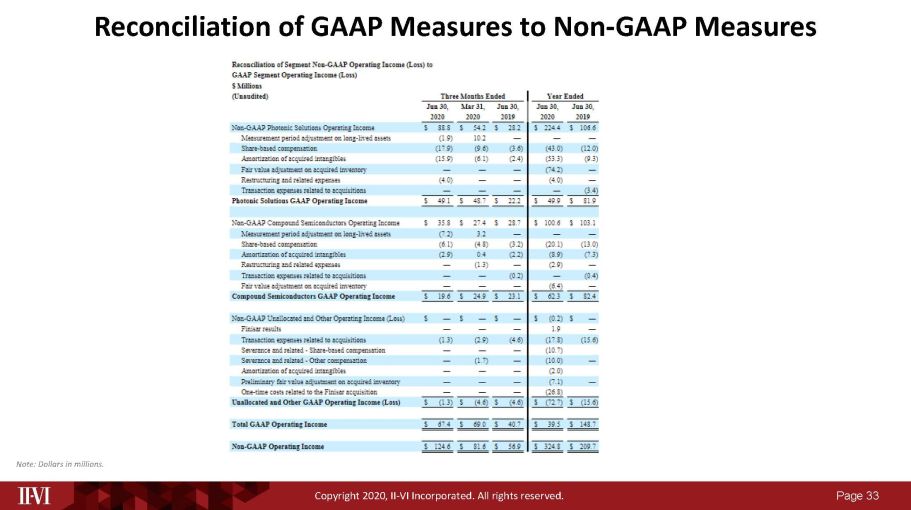

Page 33 Copyright 2020, II - VI Incorporated. All rights reserved. Note: Dollars in millions. Reconciliation of GAAP Measures to Non - GAAP Measures