Attached files

| file | filename |

|---|---|

| 8-K - 8-K EARNINGS RELEASE Q3-20 - CrossAmerica Partners LP | capl-8k_20201104.htm |

| EX-99.1 - EX-99.1 EARNINGS RELEASE Q3-20 - CrossAmerica Partners LP | capl-ex991_6.htm |

November 2020 Third Quarter 2020 Earnings Call Exhibit 99.2

Forward Looking Statements Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “anticipates,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission and available on the Partnership’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

CrossAmerica Business Overview Charles Nifong, CEO & President

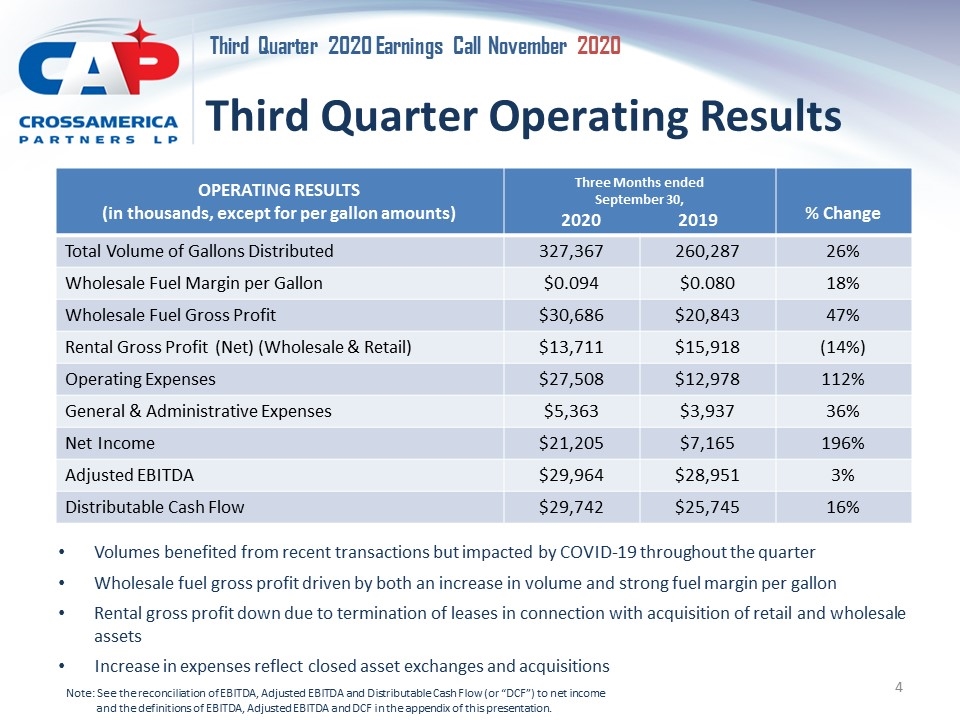

Third Quarter Operating Results OPERATING RESULTS (in thousands, except for per gallon amounts) Three Months ended September 30, 2020 2019 % Change Total Volume of Gallons Distributed 327,367 260,287 26% Wholesale Fuel Margin per Gallon $0.094 $0.080 18% Wholesale Fuel Gross Profit $30,686 $20,843 47% Rental Gross Profit (Net) (Wholesale & Retail) $13,711 $15,918 (14%) Operating Expenses $27,508 $12,978 112% General & Administrative Expenses $5,363 $3,937 36% Net Income $21,205 $7,165 196% Adjusted EBITDA $29,964 $28,951 3% Distributable Cash Flow $29,742 $25,745 16% Volumes benefited from recent transactions but impacted by COVID-19 throughout the quarter Wholesale fuel gross profit driven by both an increase in volume and strong fuel margin per gallon Rental gross profit down due to termination of leases in connection with acquisition of retail and wholesale assets Increase in expenses reflect closed asset exchanges and acquisitions Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

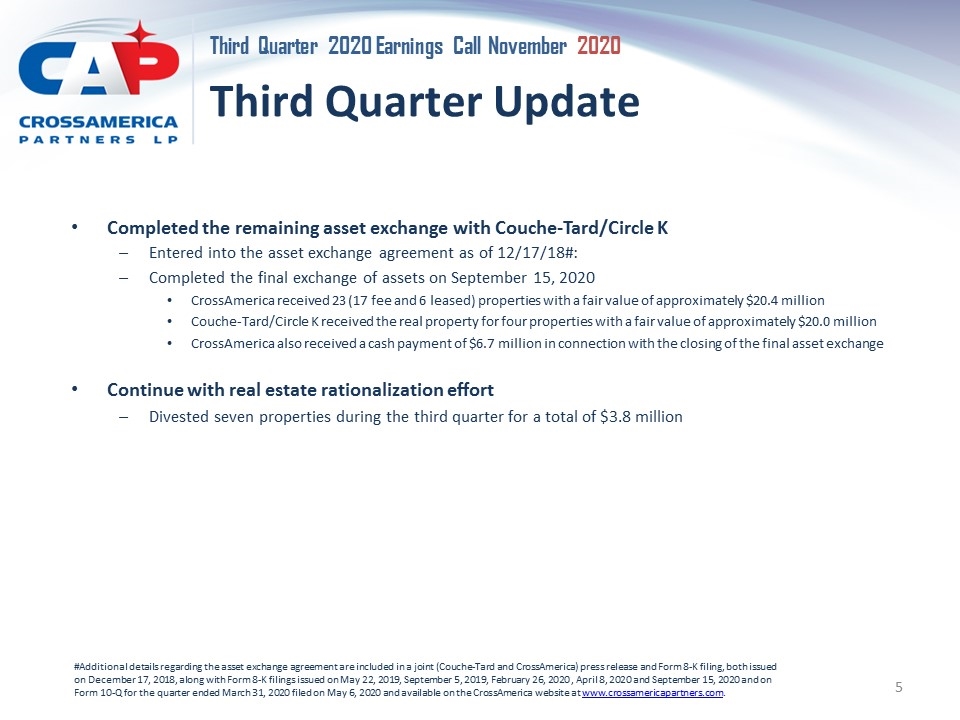

Third Quarter Update Completed the remaining asset exchange with Couche-Tard/Circle K Entered into the asset exchange agreement as of 12/17/18#: Completed the final exchange of assets on September 15, 2020 CrossAmerica received 23 (17 fee and 6 leased) properties with a fair value of approximately $20.4 million Couche-Tard/Circle K received the real property for four properties with a fair value of approximately $20.0 million CrossAmerica also received a cash payment of $6.7 million in connection with the closing of the final asset exchange Continue with real estate rationalization effort Divested seven properties during the third quarter for a total of $3.8 million #Additional details regarding the asset exchange agreement are included in a joint (Couche-Tard and CrossAmerica) press release and Form 8-K filing, both issued on December 17, 2018, along with Form 8-K filings issued on May 22, 2019, September 5, 2019, February 26, 2020 , April 8, 2020 and September 15, 2020 and on Form 10-Q for the quarter ended March 31, 2020 filed on May 6, 2020 and available on the CrossAmerica website at www.crossamericapartners.com.

CrossAmerica Financial Overview Jon Benfield, Interim Chief Financial Officer

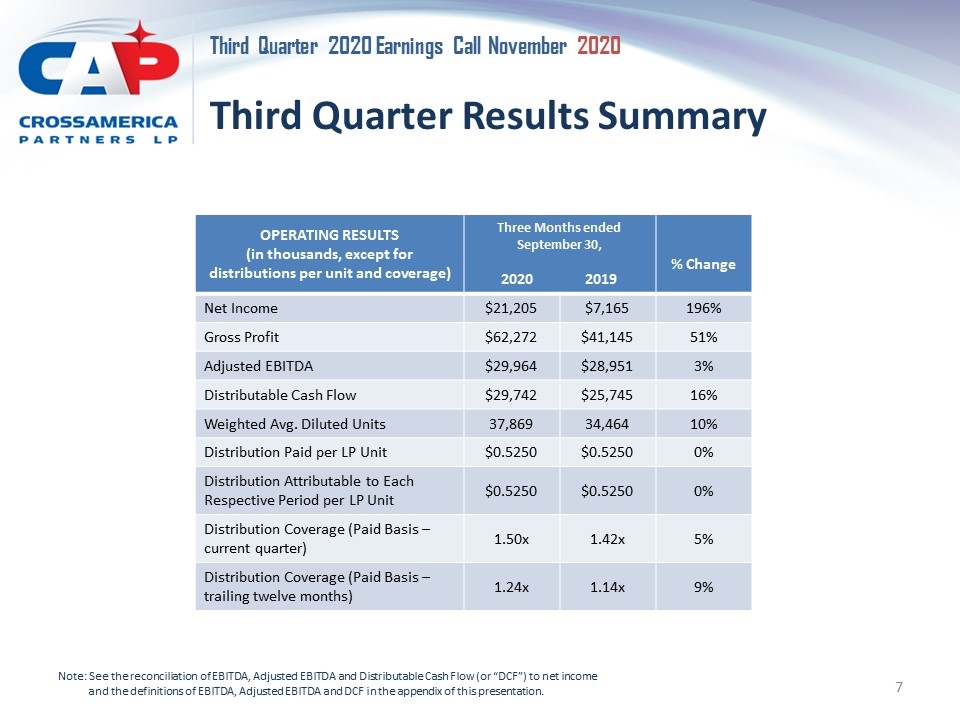

Third Quarter Results Summary OPERATING RESULTS (in thousands, except for distributions per unit and coverage) Three Months ended September 30, 2020 2019 % Change Net Income $21,205 $7,165 196% Gross Profit $62,272 $41,145 51% Adjusted EBITDA $29,964 $28,951 3% Distributable Cash Flow $29,742 $25,745 16% Weighted Avg. Diluted Units 37,869 34,464 10% Distribution Paid per LP Unit $0.5250 $0.5250 0% Distribution Attributable to Each Respective Period per LP Unit $0.5250 $0.5250 0% Distribution Coverage (Paid Basis – current quarter) 1.50x 1.42x 5% Distribution Coverage (Paid Basis – trailing twelve months) 1.24x 1.14x 9% Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Capital Strength Leverage, as defined under our credit facility, was 3.83X as of September 30, 2020 Increase in credit facility availability Maintain Distribution Rate Distributable Cash Flow of $30.0 million for the three-month period ended September 30, 2020 Distribution rate of $0.5250 per unit ($2.10 per unit annualized) attributable to the third quarter of 2020 TTM coverage ratio to 1.24 times for period ending 09/30/20 from 1.14 times for the TTM ending 09/30/19 Financial Position Leverage and coverage Capital expenditures Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Appendix Third Quarter 2020 Earnings Call

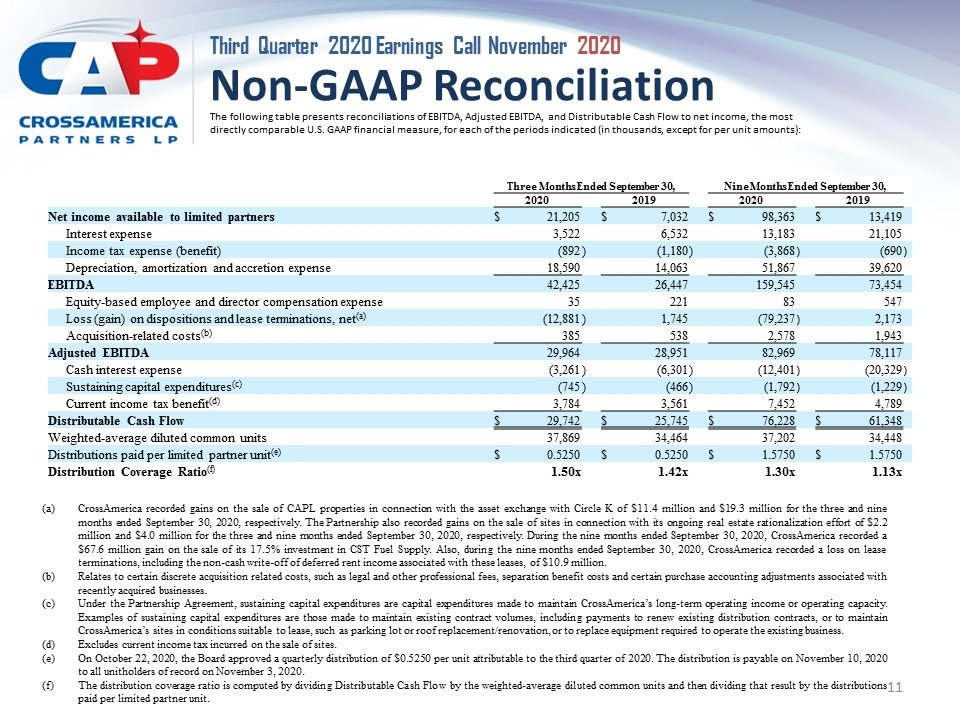

Non-GAAP Financial Measures We use the non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income available to us before deducting interest expense, income taxes and depreciation, amortization and accretion, which includes certain impairment charges. Adjusted EBITDA represents EBITDA as further adjusted to exclude equity-based employee and director compensation expense, gains or losses on dispositions and lease terminations, certain acquisition related costs, such as legal and other professional fees and separation benefit costs, and certain other non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. The Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess our operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess our ability to generate cash sufficient to make distributions to our unit-holders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing our financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Non-GAAP Reconciliation The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Net income available to limited partners $ 21,205 $ 7,032 $ 98,363 $ 13,419 Interest expense 3,522 6,532 13,183 21,105 Income tax expense (benefit) (892 ) (1,180 ) (3,868 ) (690 ) Depreciation, amortization and accretion expense 18,590 14,063 51,867 39,620 EBITDA 42,425 26,447 159,545 73,454 Equity-based employee and director compensation expense 35 221 83 547 Loss (gain) on dispositions and lease terminations, net(a) (12,881 ) 1,745 (79,237 ) 2,173 Acquisition-related costs(b) 385 538 2,578 1,943 Adjusted EBITDA 29,964 28,951 82,969 78,117 Cash interest expense (3,261 ) (6,301 ) (12,401 ) (20,329 ) Sustaining capital expenditures(c) (745 ) (466 ) (1,792 ) (1,229 ) Current income tax benefit(d) 3,784 3,561 7,452 4,789 Distributable Cash Flow $ 29,742 $ 25,745 $ 76,228 $ 61,348 Weighted-average diluted common units 37,869 34,464 37,202 34,448 Distributions paid per limited partner unit(e) $ 0.5250 $ 0.5250 $ 1.5750 $ 1.5750 Distribution Coverage Ratio(f) 1.50x 1.42x 1.30x 1.13x CrossAmerica recorded gains on the sale of CAPL properties in connection with the asset exchange with Circle K of $11.4 million and $19.3 million for the three and nine months ended September 30, 2020, respectively. The Partnership also recorded gains on the sale of sites in connection with its ongoing real estate rationalization effort of $2.2 million and $4.0 million for the three and nine months ended September 30, 2020, respectively. During the nine months ended September 30, 2020, CrossAmerica recorded a $67.6 million gain on the sale of its 17.5% investment in CST Fuel Supply. Also, during the nine months ended September 30, 2020, CrossAmerica recorded a loss on lease terminations, including the non-cash write-off of deferred rent income associated with these leases, of $10.9 million. Relates to certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain purchase accounting adjustments associated with recently acquired businesses. Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica’s long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain CrossAmerica’s sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. Excludes current income tax incurred on the sale of sites. On October 22, 2020, the Board approved a quarterly distribution of $0.5250 per unit attributable to the third quarter of 2020. The distribution is payable on November 10, 2020 to all unitholders of record on November 3, 2020. The distribution coverage ratio is computed by dividing Distributable Cash Flow by the weighted-average diluted common units and then dividing that result by the distributions paid per limited partner unit.