Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTERPOINT ENERGY INC | q32020earningsreleasep.htm |

| 8-K - 8-K - CENTERPOINT ENERGY INC | cnp-20201105.htm |

Exhibit 99.2 THIRD QUARTER 2020 INVESTOR UPDATE NOVEMBER 5, 2020

CAUTIONARY STATEMENT This presentation and the oral statements made in connection herewith contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this presentation and the oral statements made in connection herewith are forward-looking statements made in good faith by CenterPoint Energy, Inc. (“CenterPoint Energy” or the “Company”) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995, including statements concerning CenterPoint Energy’s expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings and guidance, growth, impact of COVID- 19, costs, prospects, capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs and rate base or customer growth) and other statements that are not historical facts. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation include statements about our growth and guidance (including earnings and customer growth, capital investment opportunities, utility and rate base growth expectations, taking into account assumptions and scenarios related to COVID-19), the impacts of COVID-19 on our business, O&M expense management initiatives and projected savings therefrom, commitment to investment-grade credit, balance sheet strengthening and target FFO/Debt ratio, the performance of Enable Midstream Partners, LP (“Enable”), including anticipated distributions received on its common units, our regulatory filings and projections (including the recovery and/or deferral of COVID-19 expenses and the Integrated Resources Plan as proposed in Indiana, including the anticipated timeline and benefits under its preferred portfolio), our credit quality and balance sheet expectations, the activities of the Business Review and Evaluation Committee of the Board of Directors (including the recommendations or other outcomes or actions from its review process), environmental, social and governance related matters, including our carbon emissions reduction targets, among other statements. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to (1) the performance of Enable, the amount of cash distributions CenterPoint Energy receives from Enable, and the value of CenterPoint Energy’s interest in Enable; (2) CenterPoint Energy's expected benefits of the merger with Vectren Corporation (Vectren) and integration, including the ability to successfully integrate the Vectren businesses and to realize anticipated benefits and commercial opportunities; (3) financial market and general economic conditions, including access to debt and equity capital and the effect on sales, prices and costs; (4) industrial, commercial and residential growth in CenterPoint Energy’s service territories and changes in market demand; (5) actions by credit rating agencies, including any potential downgrades to credit ratings; (6) the timing and impact of future regulatory and legal proceedings; (7) legislative decisions, including tax and developments relating to the environment such as global climate change, air emissions, carbon, waste water discharges and the handling of coal combustion residuals, among others, and CenterPoint Energy’s carbon reduction targets; (8) the impact of the COVID-19 pandemic; (9) the recording of impairment charges, including any impairments related to CenterPoint Energy’s investment in Enable; (10) weather variations and CenterPoint Energy’s ability to mitigate weather impacts; (11) changes in business plans; (12) CenterPoint Energy's ability to fund and invest planned capital, including timely and appropriate rate actions that allow recovery of costs and a reasonable return on investment; (13) CenterPoint Energy’s or Enable’s potential business strategies and strategic initiatives, including the recommendations and outcomes of the Business Review and Evaluation Committee, restructurings, joint ventures and acquisitions or dispositions of assets or businesses, which may not be completed or result in the benefits anticipated to CenterPoint Energy or Enable; (14) CenterPoint Energy’s ability to execute operations and maintenance management initiatives; and (15) other factors described in CenterPoint Energy’s Form 10- Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020 and in CenterPoint Energy’s Form 10-K for the year ended December 31, 2019 under “Risk Factors,” “Cautionary Statements Regarding Forward-Looking Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Certain Factors Affecting Future Earnings” in such reports and in other filings with the Securities and Exchange Commission’s (“SEC”) by the Company, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC website at www.sec.gov. A portion of slide 21 is derived from Enable’s investor presentation as presented during its Q3 2020 earnings presentation dated November 4, 2020. The information in this slide is included for informational purposes only. The content has not been verified by us, and we assume no liability for the same. You should consider Enable’s investor materials in the context of its SEC filings and its entire investor presentation, which is available at http://investors.enablemidstream.com. This presentation contains time sensitive information that is accurate as of the date hereof (unless otherwise specified as accurate as of another date). Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. 2

ADDITIONAL INFORMATION Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (GAAP), including presentation of income (loss) available to common shareholders and diluted earnings (loss) per share, CenterPoint Energy also provides guidance based on guidance basis income, guidance basis diluted earnings per share and adjusted funds from operations (“FFO”), which are non-GAAP financial measures. CenterPoint Energy also uses the non-GAAP financial measure of adjusted parent-level debt in addition to the presentation of total parent debt. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. To provide greater transparency on utility earnings, CenterPoint Energy’s 2020 guidance will be presented in two components, a guidance basis Utility EPS range and a Midstream Investments EPS expected range. Refer to slide 21 for further detail. The 2020 Utility EPS guidance range includes net income from Houston Electric, Indiana Electric and Natural Gas Distribution business segments, as well as after tax Corporate and Other operating income. The 2020 Utility EPS guidance range reflects dilution and earnings as if the Series C preferred stock were issued as common stock. The 2020 Utility EPS guidance range considers operations performance to date and assumptions for certain significant variables that may impact earnings, such as customer growth (above 2% for electric operations and 1% for natural gas distribution) and usage including normal weather, throughput, recovery of capital invested, effective tax rates, financing activities and related interest rates, regulatory and judicial proceedings and anticipated cost savings as a result of the merger. In addition, the Utility EPS guidance range incorporates a COVID-19 scenario range of $0.10 - $0.15 which assumes reduced demand levels and miscellaneous revenues with the second quarter as the peak and reflects anticipated deferral and recovery of certain incremental expenses, including bad debt. The COVID-19 scenario range also assumes a gradual re-opening of the economy in CenterPoint Energy's service territories, with anticipated reduced demand and lower miscellaneous revenues over the remainder of 2020. To the extent actual recovery deviates from these COVID-19 scenario range assumptions, the 2020 Utility EPS guidance range may not be met and our projected full-year guidance range may change. The 2020 Utility EPS guidance range also assumes an allocation of corporate overhead based upon its relative earnings contribution. Corporate overhead consists of interest expense, preferred stock dividend requirements, income on Enable preferred units and other items directly attributable to the parent along with the associated income taxes. Utility EPS guidance excludes (a) earnings or losses from the change in value of ZENS and related securities, (b) certain expenses associated with merger integration and Business Review and Evaluation Committee activities, (c) severance costs, (d) results related to Infrastructure Services and Energy Services, including costs and impairment resulting from the sale of those businesses and (e) Midstream Investments and associated allocation of corporate overhead. In providing this guidance, with respect to Utility EPS, CenterPoint Energy uses a non-GAAP measure of guidance basis diluted earnings per share that does not include other potential impacts, such as changes in accounting standards, impairments or unusual items, which could have a material impact on GAAP reported results for the applicable guidance period. CenterPoint Energy is unable to present a quantitative reconciliation of forward-looking guidance basis diluted earnings per share because changes in the value of ZENS and related securities, future impairments, and other unusual items are not estimable as they are highly variable and difficult to predict due to various factors outside of management’s control. The 2020 Midstream Investments EPS expected range assumes a 53.7% ownership of Enable’s common units and includes the amortization of the CenterPoint Energy’s basis differential in Enable and assumes an allocation of CenterPoint Energy corporate overhead based upon Midstream Investments relative earnings contribution. The Midstream Investments EPS expected range reflects dilution and earnings as if the CenterPoint Energy Series C preferred stock were issued as common stock. The Midstream Investments EPS expected range takes into account such factors as Enable’s most recent public outlook for 2020 dated November 4, 2020, and effective tax rates. CenterPoint Energy does not include other potential impacts such as any changes in accounting standards, impairments or Enable’s unusual items. With respect to Midstream Investments EPS, CenterPoint Energy uses a non-GAAP measure of guidance basis diluted earnings per share that does not consider other potential impacts such as changes in accounting standards, impairments or Enable’s unusual items, which could have a material impact on GAAP reported results for the applicable guidance period. CenterPoint Energy is unable to present a quantitative reconciliation of forward-looking guidance basis diluted earnings per share because changes in Enable’s outlook, future impairments related to Midstream Investments or Enable’s unusual items are not estimable and are difficult to predict due to various factors outside of CenterPoint Energy management’s control. A reconciliation of income (loss) available to common shareholders and diluted earnings (loss) per share to the basis used in providing guidance is provided in this presentation on slides 22 to 25. A reconciliation of total parent debt to adjusted total parent-level debt is provided in this presentation on slide 26. A reconciliation of net cash from operating activities to adjusted FFO is provided in this presentation on slides 27 and 28. Management evaluates the company’s financial performance in part based on guidance basis income, guidance basis diluted earnings per share, adjusted FFO and adjusted parent level debt. Management believes that presenting these non-GAAP financial measures enhances an investor’s understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods. Management believes that adjusted parent-level debt is an important measure to monitor leverage and credit ratings and evaluate the balance sheet. The adjustments made in these non-GAAP financial measures exclude items that Management believes does not most accurately reflect the Company’s fundamental business performance. These excluded items are reflected in the reconciliation tables, where applicable. CenterPoint Energy’s guidance basis income, guidance basis diluted earnings (loss) per share, adjusted FFO and adjusted parent-level debt non- GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, income (loss) available to common shareholders, diluted earnings per share, net cash from operating activities and total parent debt, which respectively are the most directly comparable GAAP financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies. 3

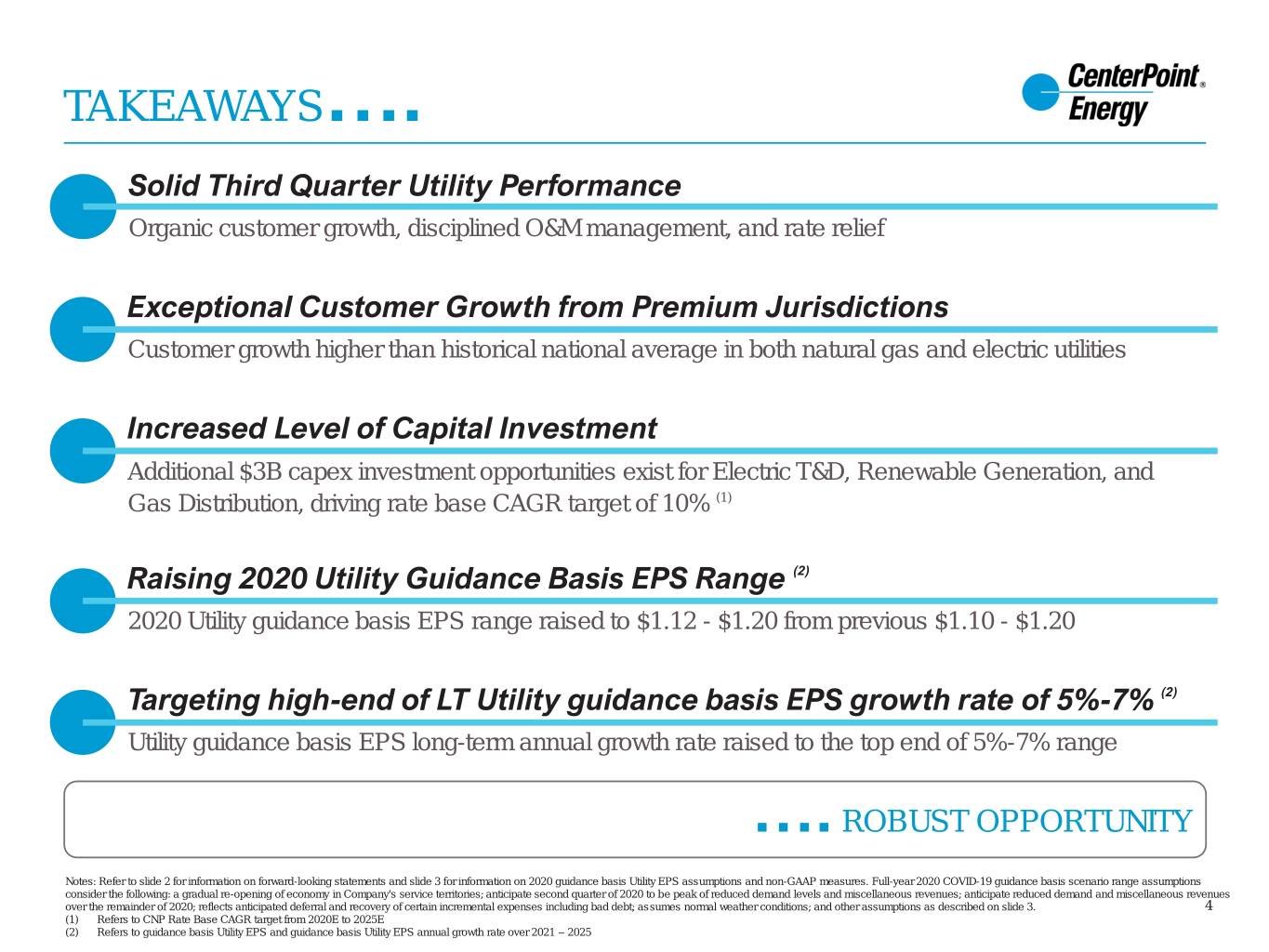

TAKEAWAYS…. Solid Third Quarter Utility Performance Organic customer growth, disciplined O&M management, and rate relief Exceptional Customer Growth from Premium Jurisdictions Customer growth higher than historical national average in both natural gas and electric utilities Increased Level of Capital Investment Additional $3B capex investment opportunities exist for Electric T&D, Renewable Generation, and Gas Distribution, driving rate base CAGR target of 10% (1) Raising 2020 Utility Guidance Basis EPS Range (2) 2020 Utility guidance basis EPS range raised to $1.12 - $1.20 from previous $1.10 - $1.20 Targeting high-end of LT Utility guidance basis EPS growth rate of 5%-7% (2) Utility guidance basis EPS long-term annual growth rate raised to the top end of 5%-7% range …. ROBUST OPPORTUNITY Notes: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company's service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. 4 (1) Refers to CNP Rate Base CAGR target from 2020E to 2025E (2) Refers to guidance basis Utility EPS and guidance basis Utility EPS annual growth rate over 2021 – 2025

THIRD QUARTER ABOVE EXPECTATIONS…. GAAP Diluted EPS was 13¢ for Third Quarter 2020 and ($2.10) Year-to-Date 2020. Please see slide 22 and 23 for a reconciliation from GAAP Diluted EPS to Guidance Basis EPS. 2020 GUIDANCE BASIS EPS Third YTD Full Year Quarter Electric (1) 32¢ 64¢ 72¢ – 75¢ Gas 1 45 62 – 64 Corporate & Other (2) (4) (14) (22) – (19) Guidance Basis Utility EPS 29¢ 95¢ $1.12 – $1.20 Note: Incl. Midstream (3) 34¢ $1.11 $1.27 – $1.38 Analyst Consensus (4) 30¢ $1.30 …. 2020 GUIDANCE BASIS UTILITY EPS RANGE RAISED. Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions, 2020 Midstream Investments EPS expected range assumptions, and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company’s service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. (1) Combined Houston Electric and Indiana Electric Integrated (2) Represents Corporate & Other results allocated to utility business 5 (3) Excludes results from Discontinued Operations (Energy Services and Infrastructure Services) prior to closing of the divestitures. Reference Enable’s Q3 2020 Form 10-Q and third quarter 2020 earnings materials dated November 4, 2020. Includes the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 21 for details (4) Average Analyst’s EPS estimate per FactSet as of 11/3/2020

NEW MODEL, NEW PLAN…. Utility Investment – Grow Operational Excellence – Accelerate ✓ $16B five-year capital investment plan ✓ 1%-2% annual O&M reductions (3) (+$3B vs. prior) ✓ Productivity and continuous ✓ Top tier long-term rate base CAGR improvement mindset target of 10% (1) 1 2 ✓ Technology improvements ✓ Grow at high-end of 5%-7% long-term guidance basis Utility EPS range (2) Constructive regulation Customer Growth – Organic ✓ Beneficial recovery mechanisms ✓ High growth service territories reduce regulatory lag 4 3 (e.g. Houston) ✓ Supportive regulatory jurisdictions ✓ Strong economic activity ✓ Earning at-or-near allowed ROEs ✓ Provides “headroom” …. MORE DETAIL AT INVESTOR DAY ON DECEMBER 7 Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company’s service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. 6 (1) Refers to CNP Rate Base CAGR target from 2020E to 2025E (2) Refers to guidance basis Utility EPS and guidance basis utility EPS annual growth rate over 2021 – 2025 (3) Inclusive of Houston Electric, Indiana Electric Integrated and Natural Gas Distribution business segments. Excluding utility costs to achieve, severance costs and amounts with revenue offsets

1 UTILITY INVESTMENT – GROWS…. Industry Leading Long-Term Capital Investment Plan Rate Base Growth (1) 2020 – 2024 (old) 2021 – 2025 (new) 10% $16B +$3B / +23% $13B Capex 9% 9% 8%8% Median: 7% 7% 7% 7% 7% 7% 7% 7% 6% 6% 6% 5% Electric T&D Generation Technology Gas LDC 4% Gas LDC Electric T&D Generation Technology • Hardening Electric System • Organic Growth • Converting Old Generation To Renewables And Gas 2019 to 2020E to D Other Utilities FE ES ED SO 2024E 2025E XEL AEP AEE Connecting New Solar Farms NEE PEG CNP CNP • DUK WEC PNW EVGR • Accelerating Vintage Gas Pipe Replacements ….5%-7% GUIDANCE BASIS UTILITY EPS GROWTH EVERY YEAR (2) Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company’s service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. 7 (1) CNP Rate Base CAGR from 2020E to 2025E per the updated capital plan and CAGR from 2019 to 2024E per the previous capital plan. Peers’ Rate Base CAGR from 2019 to 2024E. (2) Refers to guidance basis Utility EPS and guidance basis Utility EPS annual growth rate over 2021 – 2025

OPERATIONAL EXCELLENCE – 2 ACCELERATES…. Utility O&M Reduction Target (1) O&M Management Initiatives 1.6 ✓ Continuous improvement – Lean 1.5 1.4 ✓ Investment in productivity $ Billions$ ✓ Work management ✓ Technology 2018 2020E 2025E ….QUALITY IMPROVEMENT AND COST REDUCTION Note: Refer to slide 2 for information on forward-looking statements. (1) Inclusive of Houston Electric, Indiana Electric Integrated and Natural Gas Distribution business segments. Excluding utility costs to achieve, severance costs and amounts with revenue offsets 8

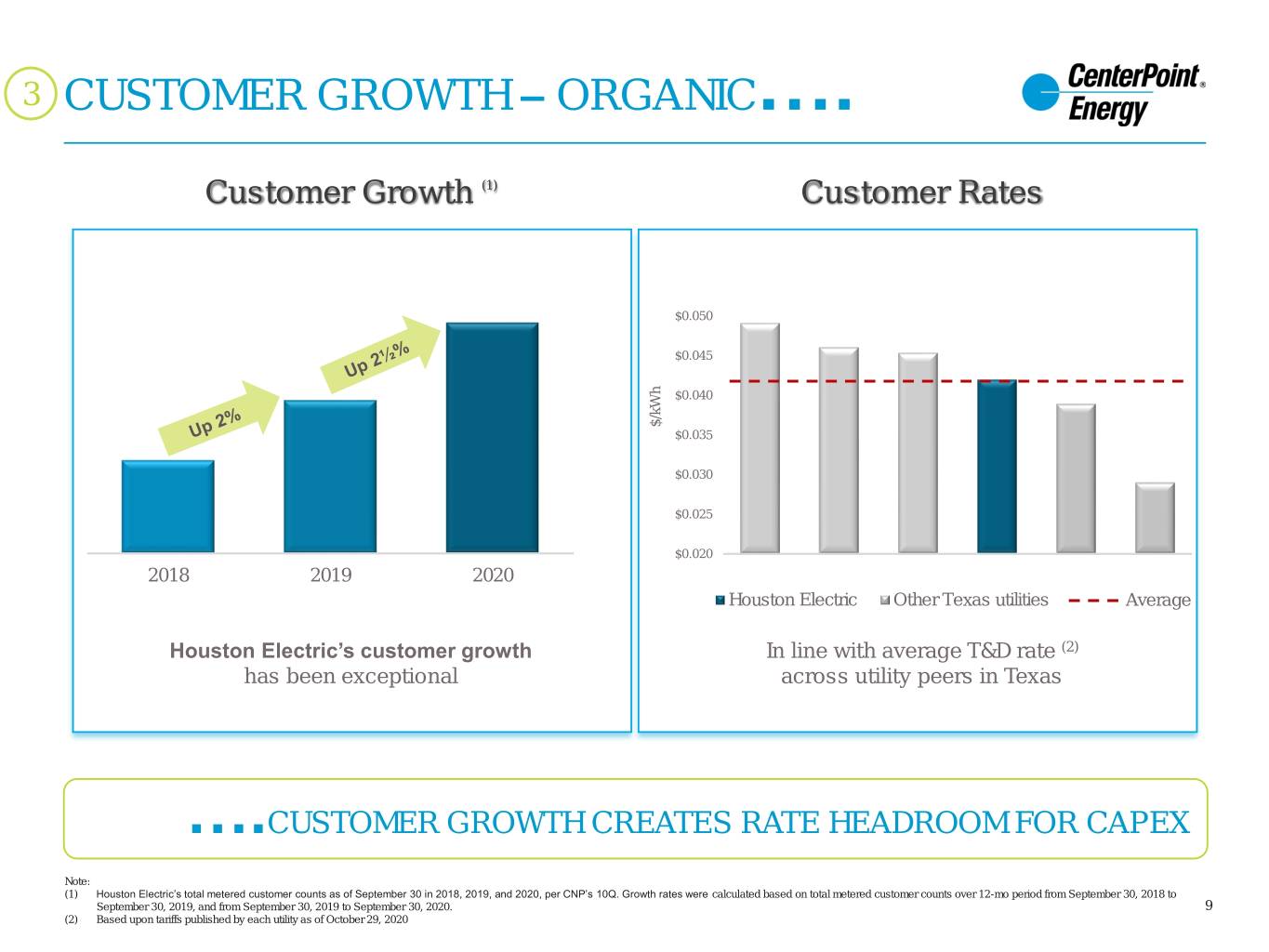

3 CUSTOMER GROWTH – ORGANIC…. Customer Growth (1) Customer Rates $0.050 $0.045 $0.040 $/kWh $0.035 $0.030 $0.025 $0.020 2018 2019 2020 Houston Electric Other Texas utilities Average Houston Electric’s customer growth In line with average T&D rate (2) has been exceptional across utility peers in Texas ….CUSTOMER GROWTH CREATES RATE HEADROOM FOR CAPEX Note: (1) Houston Electric’s total metered customer counts as of September 30 in 2018, 2019, and 2020, per CNP’s 10Q. Growth rates were calculated based on total metered customer counts over 12-mo period from September 30, 2018 to September 30, 2019, and from September 30, 2019 to September 30, 2020. 9 (2) Based upon tariffs published by each utility as of October 29, 2020

4 CONSTRUCTIVE REGULATION…. Regulation Features • Accelerated CapEx Recovery ✓ Transmission (TCOS) ✓ Distribution (DCRF) ✓ Gas Infrastructure (GRIP) ✓ Gas and Electric Transmission & Distribution (TDSIC) • Gas-Supportive Jurisdictions ✓ No operations in states with local building gas bans • Revenue Protection Features ✓ Revenue decoupling in Minnesota ✓ ~80% of Natural Gas Distribution margin is based upon a fixed and trued up rate (1) ….IN SUPPORTIVE REGULATORY JURISDICTIONS Note: TCOS = Interim Transmission Cost of Service adjustment, DCRF = Distribution Cost Recovery Factor, GRIP = Gas Reliability Infrastructure Program, TDSIC = Transmission, Distribution, and Storage System Improvement Charge 10 (1) Representative of blended percentage of all customer classes and all CNP’s Natural Gas Distribution jurisdictions.

OUR MODEL IS SIMPLE…. Capital spending driving growth... ...while keeping customer rates down ↓ Consistent strong customer growth ↓ Focus on O&M and High cost management end of $3B guidance ↓ Efficient financing and 5%-7% (1) capex basis Utility balance sheet management EPS – no block equity range Creates headroom and keeps rates reasonable ....GOOD FOR CUSTOMERS AND INVESTORS Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company’s service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. 11 (1) Refers to guidance basis Utility EPS and guidance basis Utility EPS annual growth rate over 2021 – 2025

THE NEW CENTERPOINT ENERGY Increased Utility Accelerated Operational Investment Excellence 1 2 4 3 Constructive regulation Organic Customer Growth ....5% - 7% GUIDANCE BASIS UTILITY EPS GROWTH EVERY YEAR. (1) WE MANAGE THE BUSINESS, SO YOU DON’T HAVE TO WORRY! Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company’s service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous 12 revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. (1) Refers to guidance basis Utility EPS and guidance basis Utility EPS annual growth rate over 2021 – 2025

THANK YOU FOR YOUR SUPPORT Look forward to seeing you at our Investor Day – December 7 13

APPENDIX 14

Q3 2020 V Q3 2019 GUIDANCE BASIS (NON-GAAP) EPS(1) DRIVERS FOR CONTINUING OPERATIONS $0.08 Midstream Investments $0.10 $0.03 $0.05 Midstream Investments Primary Drivers $0.03 Rate increases, primarily capital recovery $0.03 Income Taxes $0.02 Customer Growth $0.05 Share count $0.04 COVID-19 $0.39 $0.03 O&M Management Utility $0.03 Depreciation and Amortization and Other Taxes $0.03 Other Operations $0.29 Utility Operations Q3 2019 Consolidated Utility Midstream Q3 2020 Consolidated Guidance Basis EPS (1) Operations(2) Investments (3) Guidance Basis EPS (1) Note: All bars exclude certain expenses associated with merger integration and severance costs. Quarterly 2019 Utility EPS on a guidance basis is as follows: Q1 2019 - $0.41; Q2 - $0.23; Q3 - $0.39; Q4 - $0.28 (1) Refer to slide 3 for information on non-GAAP measures and slides 22 and 24 for reconciliation to GAAP measures (2) Includes Houston Electric, Indiana Electric Integrated and Natural Gas Distribution and the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 21 for details (3) Reference Enable’s Q3 2020 Form 10-Q and third quarter 2020 earnings materials dated November 4, 2020. Includes the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 21 for details 15

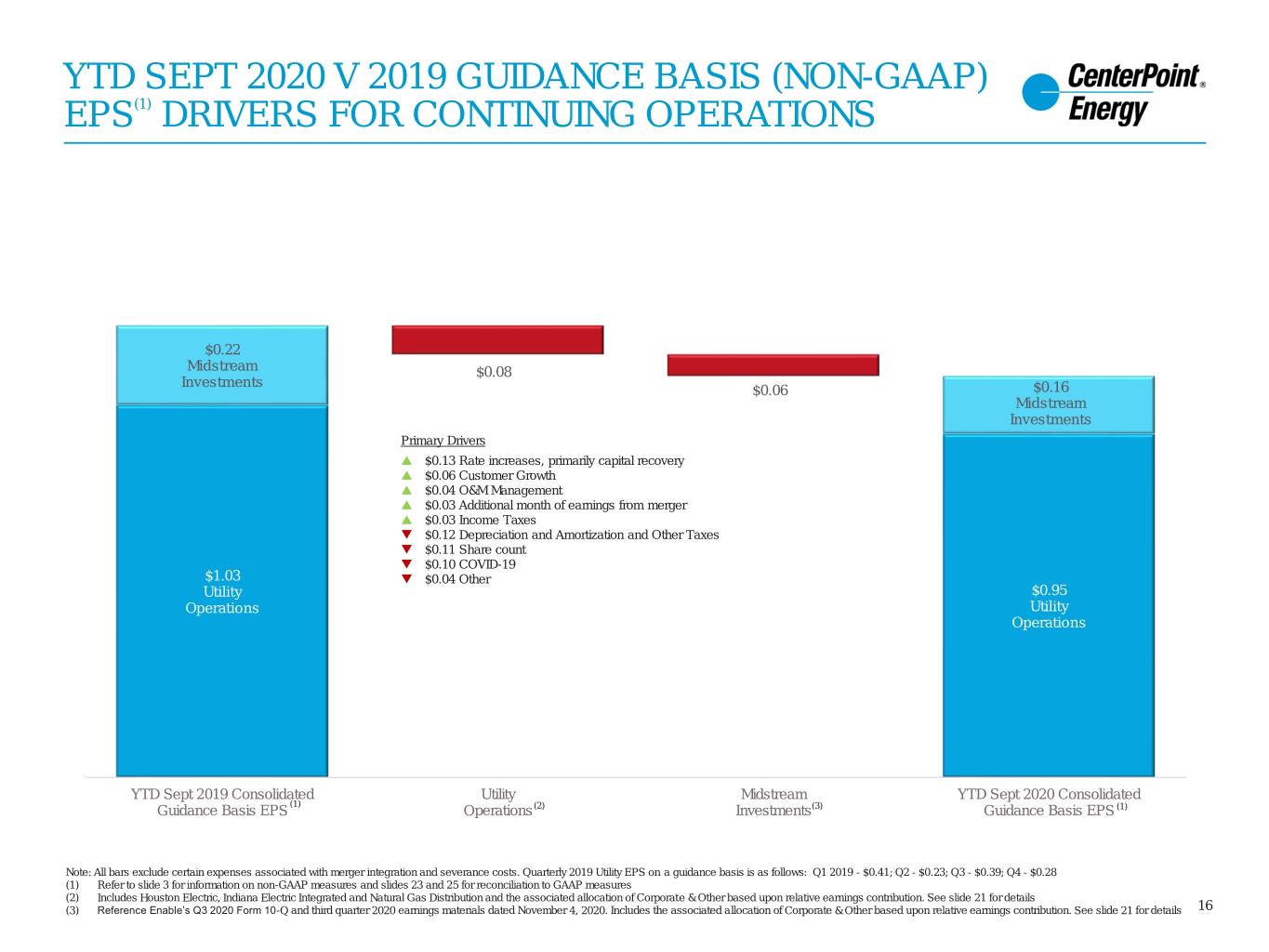

YTD SEPT 2020 V 2019 GUIDANCE BASIS (NON-GAAP) EPS(1) DRIVERS FOR CONTINUING OPERATIONS $0.22 Midstream $0.08 Investments $0.06 $0.16 Midstream Investments Primary Drivers $0.13 Rate increases, primarily capital recovery $0.06 Customer Growth $0.04 O&M Management $0.03 Additional month of earnings from merger $0.03 Income Taxes $0.12 Depreciation and Amortization and Other Taxes $0.11 Share count $0.10 COVID-19 $1.03 $0.04 Other Utility $0.95 Operations Utility Operations YTD Sept 2019 Consolidated Utility Midstream YTD Sept 2020 Consolidated Guidance Basis EPS (1) Operations (2) Investments(3) Guidance Basis EPS (1) Note: All bars exclude certain expenses associated with merger integration and severance costs. Quarterly 2019 Utility EPS on a guidance basis is as follows: Q1 2019 - $0.41; Q2 - $0.23; Q3 - $0.39; Q4 - $0.28 (1) Refer to slide 3 for information on non-GAAP measures and slides 23 and 25 for reconciliation to GAAP measures (2) Includes Houston Electric, Indiana Electric Integrated and Natural Gas Distribution and the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 21 for details (3) Reference Enable’s Q3 2020 Form 10-Q and third quarter 2020 earnings materials dated November 4, 2020. Includes the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 21 for details 16

INDIANA IRP UPDATE PREFERRED PORTFOLIO TIMELINE (1) Proposed replacement of 730 MWs of Coal with approximately 700 – 1,000 MWs of Solar & Solar + Storage, 300 MWs of Wind, 460 MWs of natural gas CTs and 30 MWs of demand response Coal 12% Natural Gas Renewables 24% 64% 2025E ResourceMix 2025E Note: Refer to slide 2 for information on forward-looking statements. IRP – Integrated Resource Plan; CT – Combustion Turbine. (1) Subject to change based on availability and approval 17

ESG ENVIRONMENTAL STEWARDSHIP LEADER (1) REDUCING GAS DISTRIBUTION ~96% REGULATED GAS LDC / T&D GHG EMISSIONS Generation 4% ~30% reduction Gas LDC 45% T&D 51% 2012 2019 ✓ Generation represents ~4% of rate base (1) ✓ Elimination of cast iron pipelines across all legacy CNP gas jurisdictions by YE 2018; ✓ Reduced CO2 emissions from generation assets by 20% from 2005 to 2019 legacy Vectren jurisdictions targeted by 2023/2024 ✓ Executing Indiana IRP will reduce emissions ✓ ~$5.5B anticipated capital investment 2021 by 67% by 2025 and 75% by 2035 (2) through 2025 focused on gas distribution ✓ Minimal carbon footprint within T&D system improvements ✓ Committed to reducing methane emissions Notes: Refer to slide 2 for information on forward-looking statements. CenterPoint Energy’s 2020 Corporate Responsibility Report is available at https://investors.centerpointenergy.com. GHG – Greenhouse gases; IRP – Integrated Resource Plan 18 (1) Based on 2019E Electric T&D, Electric Generation and Natural Gas Distribution rate base as calculated by the individual jurisdictions (2) Compared to 2005 levels. Per Vectren 2019 / 2020 Integrated Resource Plan – Non-Technical Summary.

ESG CARBON REDUCTION GOAL CENTERPOINT IS COMMITTED TO A CLEAN ENERGY FUTURE NEW GOALS TO REDUCE CARBON EMISSIONS from 2005 levels 70% 20–30% reduction from our operations reduction from gas customer usage by 2035 by 2040 ➢ Offering customers affordable conservation and energy-efficiency programs ➢ Continuing to develop alternative fuels programs ➢ Working with suppliers to lower their methane emissions ➢ Piloting and supporting research and development Note: Refer to slide 2 for information on forward-looking statements. 19

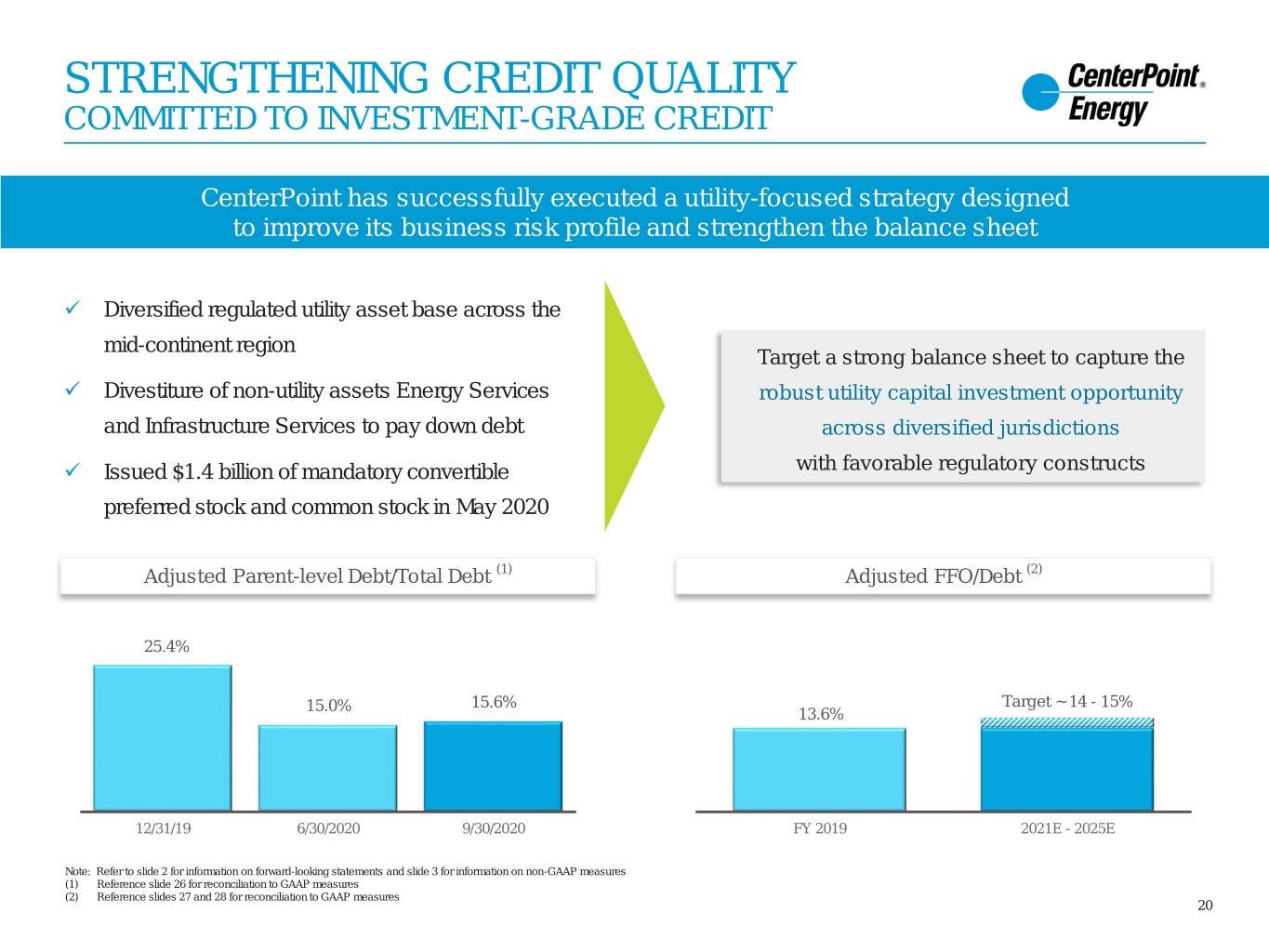

STRENGTHENING CREDIT QUALITY COMMITTED TO INVESTMENT-GRADE CREDIT CenterPoint has successfully executed a utility-focused strategy designed to improve its business risk profile and strengthen the balance sheet ✓ Diversified regulated utility asset base across the mid-continent region Target a strong balance sheet to capture the ✓ Divestiture of non-utility assets Energy Services robust utility capital investment opportunity and Infrastructure Services to pay down debt across diversified jurisdictions ✓ Issued $1.4 billion of mandatory convertible with favorable regulatory constructs preferred stock and common stock in May 2020 Adjusted Parent-level Debt/Total Debt (1) Adjusted FFO/Debt (2) 25.4% 15.0% 15.6% Target ~ 14 - 15% 13.6% 12/31/19 6/30/2020 9/30/2020 FY 2019 2021E - 2025E Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on non-GAAP measures (1) Reference slide 26 for reconciliation to GAAP measures (2) Reference slides 27 and 28 for reconciliation to GAAP measures 20

2020 GUIDANCE BASIS EPS CONSIDERATIONS Translating Enable Guidance to CenterPoint’s Portion (in millions, except percentages and per share items) Guidance basis EPS before allocation of Corporate & Other Enable Net Income Attributable $195 - $235(2) to Common Units Midstream Utility Operations Corporate & Other Investments CNP Common Unit ownership percentage 53.7%(3) $1.34 - $1.39 $0.18 - $0.21 ($0.25) (4) (1) (1) Basis difference amortization $85 ~88% ~12% Interest 4.5% on $1,200 (CNP Midstream internal note) Marginal effective tax rate 24% Guidance basis EPS Estimated 2020 CNP Share Count 560 after allocation of Corporate & Other Midstream Investments EPS Utility Operations Midstream Investments $0.18 - $0.21 before allocation of Corporate & Other(5) Proportion share of $1.12 - $1.20 $0.15 - $0.18 ($0.03) Corporate & Other allocation (12%) ~88% ~12% Midstream Investments EPS $0.15 – $0.18 after allocation of Corporate & Other(5) Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 guidance basis Utility EPS range assumptions, 2020 Midstream Investments EPS expected range assumptions, and non-GAAP measures. Full-year 2020 COVID-19 guidance basis scenario range assumptions consider the following: a gradual re-opening of economy in Company's service territories; anticipate second quarter of 2020 to be peak of reduced demand levels and miscellaneous revenues; anticipate reduced demand and miscellaneous revenues over the remainder of 2020; reflects anticipated deferral and recovery of certain incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3. (1) Calculated as the relative contribution of each reporting area based off the guidance basis EPS for Utility Operations and Midstream Investments EPS expected range attributable to CenterPoint’s share of Enable’s Net Income Attributable to Common Units guidance range. The guidance basis earnings (loss) per share related to Corporate & Other is then proportionally allocated based on each reporting range’s relative contribution. Corporate & Other consists of interest expense, preferred stock dividend requirements, income on Enable preferred units and other items directly attributable to the parent along with the associated income taxes. (2) Source: Enable’s third quarter 2020 earnings presentation dated November 4, 2020 21 (3) Enable ownership position as of September 30, 2020 (4) Estimated full year 2020 basis difference accretion following company’s impairment of its investment in Enable in the first quarter of 2020. Does not consider any potential loss on dilution, net of proportional basis difference recognition (5) Earnings on a guidance basis would exclude potential impacts such as any changes in accounting standards, impairments or Enable’s unusual items

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO GUIDANCE BASIS INCOME AND GUIDANCE BASIS DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Quarter Ended September 30, 2020 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted EPS Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 193 $ 0.35 $ (62) $ (0.11) $ (56) $ (0.10) $ (6) $ (0.01) $ 69 $ 0.13 ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $18) (4)(5) - - - - (65) (0.12) - - (65) (0.12) Indexed debt securities (net of taxes of $18) (4) - - - - 66 0.12 - - 66 0.12 Impacts associated with the Vectren merger (net of taxes of $0, $1) (4) 2 - - - 2 0.01 - - 4 0.01 Severance costs (net of taxes of $1) (4) 4 0.01 - - - - - - 4 0.01 Impacts associated with the sales of CES (1) and CIS (2) (net of taxes of $0) (4) - - - - - - 7 0.01 7 0.01 Impacts associated with Series C preferred stock Preferred stock dividend requirement and amortization of beneficial conversion feature - - - - 23 0.04 - - 23 0.04 Impact of increased share count on EPS if issued as common stock - (0.03) - 0.01 - 0.01 - - - (0.01) Total Series C impacts - (0.03) - 0.01 23 0.05 - - 23 0.03 Loss on impairment (net of taxes of $29) (4) - - 92 0.15 - - - - 92 0.15 Corporate and Other Allocation (26) (0.04) (3) - 30 0.04 (1) - - - Consolidated on a guidance basis $ 173 $ 0.29 $ 27 $ 0.05 $ - $ - $ - $ - $ 200 $ 0.34 (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other segment plus income allocated to preferred shareholders Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS 22 (4) Taxes are computed based on the impact removing such item would have on tax expense (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other, plus income allocated to preferred shareholders

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO GUIDANCE BASIS INCOME AND GUIDANCE BASIS DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Year-to-Date September 30, 2020 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 402 $ 0.77 $ (1,165) $ (2.22) $ (155) $ (0.30) $ (182) $ (0.35) $ (1,100) $ (2.10) Timing effects impacting CES (1): Mark-to-market (gains) losses (net of taxes of $3) (4) - - - - - - (10) (0.02) (10) (0.02) ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $3) (4)(5) - - - - (11) (0.02) - - (11) (0.02) Indexed debt securities (net of taxes of $5) (4) - - - - 20 0.04 - - 20 0.04 Impacts associated with the Vectren merger (net of taxes of $1, $3) (4) 5 0.01 - - 12 0.02 - - 17 0.03 Severance costs (net of taxes of $3, $0) (4) 11 0.02 - - 2 - - - 13 0.02 Impacts associated with the sales of CES (1) and CIS (2) (net of taxes of $10) (4) - - - - - - 217 0.41 217 0.41 Impacts associated with Series C preferred stock Preferred stock dividend requirement and amortization of beneficial conversion feature - - - - 39 0.08 - - 39 0.08 Impact of increased share count on EPS if issued as common stock - (0.04) - 0.12 - 0.01 - - - 0.09 Total Series C impacts - (0.04) - 0.12 39 0.09 - - 39 0.17 Losses on impairment (net of taxes of $0, $408) (4) 185 0.33 1,269 2.29 - - - - 1,454 2.62 Corporate and Other Allocation (74) (0.14) (13) (0.03) 93 0.17 (6) - - - Exclusion of Discontinued Operations (7) - - - - - - (19) (0.04) (19) (0.04) Consolidated on a guidance basis $ 529 $ 0.95 $ 91 $ 0.16 $ - $ - $ - $ - $ 620 $ 1.11 Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense 23 (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other, plus income allocated to preferred shareholders (7) Results related to discontinued operations are excluded from the company’s guidance basis results

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO GUIDANCE BASIS INCOME AND GUIDANCE BASIS DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Quarter Ended September 30, 2019 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 225 $ 0.44 $ 50 $ 0.10 $ (53) $ (0.10) $ 19 $ 0.03 $ 241 $ 0.47 Timing effects impacting CES (1): Mark-to-market (gains) losses (net of taxes of $1) (4) - - - - - - 1 - 1 - ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $12) (4)(5) - - - - (47) (0.09) - - (47) (0.09) Indexed debt securities (net of taxes of $12) (4) - - - - 50 0.10 - - 50 0.10 Impacts associated with the Vectren merger (net of taxes of $2, $7, $1) (4) 3 0.01 - - 13 0.03 4 0.01 20 0.05 Corporate and Other Allocation (34) (0.06) (8) (0.02) 37 0.06 5 0.02 - - Exclusion of Discontinued Operations (7) - - - - - - (29) (0.06) (29) (0.06) Consolidated on a guidance basis $ 194 $ 0.39 $ 42 $ 0.08 $ - $ - $ - $ - $ 236 $ 0.47 Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense 24 (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other, plus income allocated to preferred shareholders (7) Results related to discontinued operations are excluded from the company’s guidance basis results

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO GUIDANCE BASIS INCOME AND GUIDANCE BASIS DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Year-to-Date September 30, 2019 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 505 $ 1.00 $ 124 $ 0.25 $ (172) $ (0.34) $ 89 $ 0.17 $ 546 $ 1.08 Timing effects impacting CES (1): Mark-to-market (gains) losses (net of taxes of $11) (4) - - - - - - (36) (0.08) (36) (0.08) ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $43) (4)(5) - - - - (163) (0.32) - - (163) (0.32) Indexed debt securities (net of taxes of $45) (4) - - - - 171 0.34 - - 171 0.34 Impacts associated with the Vectren merger Merger impacts other than the increase in share count (net of taxes of $12, $23, $3) (4) 73 0.15 - - 62 0.13 11 0.02 146 0.30 Impact of increased share count on EPS - 0.02 - - - - - - - 0.02 Total merger impacts 73 0.17 - - 62 0.13 11 0.02 146 0.32 Corporate and Other Allocation (69) (0.14) (15) (0.03) 102 0.19 (18) (0.02) - - Exclusion of Discontinued Operations (7) - - - - - - (46) (0.09) (46) (0.09) Consolidated on a guidance basis $ 509 $ 1.03 $ 109 $ 0.22 $ - $ - $ - $ - $ 618 $ 1.25 Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense 25 (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other, plus income allocated to preferred shareholders (7) Results related to discontinued operations are excluded from the company’s guidance basis results

CENTERPOINT ENERGY ADJUSTED PARENT DEBT AS A PERCENTAGE OF TOTAL DEBT 12/31/2019 6/30/2020 9/30/2020 ($ in millions) Short-term Debt: Short-term borrowings - 19 37 Current portion of transition and system restoration bonds 231 206 208 Indexed debt (ZENS)** 19 17 16 Current portion of other long-term debt 618 1,707 1,114 Long-term Debt: Transition and system restoration bonds, net* 746 639 610 Other, net 13,498 10,298 11,336 Total Debt, net 15,112 12,886 13,321 12/31/2019 6/30/2020 9/30/2020 Short-term Debt: Short-term borrowings - - - Indexed debt (ZENS)** 19 17 16 Current portion of other long-term debt - - - Long-term Debt: CNP Inc. Commercial Paper 1,633 316 638 CNP Inc. Credit Facility Borrowings - - - CNP Inc. Term Loan 1,000 700 700 Pollution Control Bonds 68 68 68 CNP Inc. Senior Notes 3,200 3,200 3,200 Total Parent Debt 5,920 4,301 4,622 Less: Intercompany Promissory Notes CNP Midstream Intercompany Promissory Note 1,200 1,200 1,200 VUHI Intercompany Promissory Notes 693 1,168 1,343 Vectren Capital Corporation Intercompany Promissory Notes 191 - - Adjusted Total Parent Debt 3,836 1,933 2,079 Adjusted Total Parent Debt to Adjusted Total Debt, net 25.4% 15.0% 15.6% Note: Refer to slide 3 for information on non-GAAP measures. Parent debt calculated as a function of principal amounts of external debt at CNP Inc. adjusted for the internal note with Midstream Investments and other internal notes associated with affiliates. VUHI – Vectren Utility Holdings Inc. * The transition and system restoration bonds are serviced with dedicated revenue streams, and the bonds are non-recourse to CenterPoint Energy and CenterPoint Energy Houston Electric. 26 ** The debt component reflected on the financial statements was $16 million, $17 million, and $19 million as of September 30, 2020, June 30, 2020, and December 31, 2019. The principal amount on which 2% interest is paid was $828 million on each of September 30, 2020, June 30, 2020, and December 31, 2019. The contingent principal amount was $61 million, $66 million, and $75 million as of September 30, 2020, June 30, 2020, and December 31, 2019, respectively. At maturity or upon redemption, holders of ZENS will receive cash at the higher of the contingent principal amount or the value of the reference shares of AT&T and Charter Communications, Inc.

CENTERPOINT ENERGY CONSOLIDATED ADJUSTED CASH FROM OPERATIONS PRE-WORKING CAPITAL Year Ended December 31, 2019 ($ in millions) Net cash provided by operating activities 1,638 Less: Changes in other assets and liabilities Accounts receivable and unbilled revenues, net (226) Inventory 52 Taxes receivable 106 Accounts payable 455 Fuel cost recovery (92) Margin deposits, net 56 Interest and taxes accrued (54) Other current assets 22 Other current liabilities 107 Cash From Operations, Pre-working Capital 2,064 Amounts included in Cash Flows from Investing Activities Distributions from unconsolidated affiliates in excess of cumulative earnings 42 Cash From Operations, Pre-working Capital, including Distributions 2,106 Plus: Other Adjustments Defined Benefit Plan Contribution Less Service Cost 69 Operating Leases Rent Expense 19 Adjusted Cash From Operations Pre-Working Capital 2,194 Note: Refer to slide 3 for information on non-GAAP measures. This slide includes adjusted cash from operations pre-working capital which is net cash provided by operating activities excluding certain changes in other assets and liabilities, and including: (i) distributions from unconsolidated affiliates in excess of cumulative earnings included in cash flow from investing activities, as applicable and (ii) other adjustment for defined benefit plans and operating leases. 27

CENTERPOINT ENERGY CONSOLIDATED RATIO OF ADJUSTED CASH FROM OPERATIONS PRE-WORKING CAPITAL/ADJUSTED TOTAL DEBT Year Ended December 31, 2019 ($ in millions) Short-term Debt: Short-term borrowings - Current portion of transition and system restoration bonds 231 Indexed debt (ZENS)** 19 Current portion of other long-term debt 618 Long-term Debt: Transition and system restoration bonds, net* 746 Other, net 13,498 Total Debt, net 15,112 Plus: Other Adjustments 50% of Series A Preferred Stock Aggregate Liquidation Value 400 Benefit obligations 448 Present Value of Operating Lease Liabilities 63 Unamortized debt issuance costs and unamortized discount and premium, net 95 Adjusted Total Debt 16,118 Adjusted Cash From Operations Pre-Working Capital/Adjusted Total Debt (Adjusted FFO/Debt) 13.6% Note: Refer to slide 3 for information on non-GAAP measures and slide 27 for CenterPoint Energy's adjusted cash from operations pre-working capital calculation. This slide includes adjusted cash from operations pre-working capital which is net cash provided by operating activities excluding certain changes in other assets and liabilities, and including (i) distributions from unconsolidated affiliates in excess of cumulative earnings included in cash flow from investing activities, as applicable, and (ii) other adjustment for defined benefit plans and operating leases *The transition and system restoration bonds are serviced with dedicated revenue streams, and the bonds are non-recourse to CenterPoint Energy and CenterPoint Energy Houston Electric. 28 **The debt component reflected on the financial statements was $19 million as of December 31, 2019. The principal amount on which 2% interest is paid was $828 million as of December 31, 2019. The contingent principal amount was $75 million as of December 31, 2019. At maturity or upon redemption, holders of ZENS will receive cash at the higher of the contingent principal amount or the value of the reference shares of AT&T and Charter Communications, Inc.