Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Arconic Corp | a52320410ex991.htm |

| 8-K - ARCONIC CORPORATION 8-K - Arconic Corp | a52320410.htm |

|

Exhibit 99.2

|

Third Quarter 2020 Earnings Call Tim Myers – Chief Executive OfficerErick Asmussen – Chief Financial

Officer November 5, 2020

Important Information 2 Forward-Looking Statements This presentation contains statements that relate

to future events and expectations and, as such, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as "anticipates,"

"believes," "could," "estimates," "expects," "forecasts," "goal," "guidance," "intends," "may," "outlook," "plans," "projects," "seeks," "sees," "should," "targets," "will," "would," or other words of similar meaning. All statements that

reflect Arconic’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts and expectations relating to the growth of the

aerospace, ground transportation, industrials, building and construction and other end markets; statements and guidance regarding future financial results, operating performance, working capital, cash flows, liquidity and financial position;

statements about cost savings and restructuring programs; statements about Arconic's strategies, outlook, business and financial prospects; statements related to costs associated with pension and other post-retirement benefit plans; statements

regarding projected sources of cash flow; statements regarding potential legal liability; statements regarding the potential impact of the COVID-19 pandemic; and statements regarding actions to mitigate the impact of COVID-19. These statements

reflect beliefs and assumptions that are based on Arconic’s perception of historical trends, current conditions and expected future developments, as well as other factors Arconic believes are appropriate in the circumstances. Forward-looking

statements are not guarantees of future performance. Although Arconic believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, these expectations may not be attained and it is possible that

actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and changes in circumstances, many of which are beyond Arconic’s control. Such risks and uncertainties

include, but are not limited to: (a) existing and future adverse effects in connection with COVID-19 and the potential for COVID-19 related issues to significantly heighten the other risks customarily associated with our business (including

those identified below); (b) the risk that we are unable to fully realize the expected benefits of the separation, or that dissynergy costs, costs of restructuring transactions and other costs incurred in connection with the separation, once

fully realized, will exceed our estimates; (c) the risk of operating our business as a standalone company, which could result in additional demands on Arconic’s resources, systems, procedures and controls, disruption of its ongoing business,

and diversion of management’s attention from other business concerns; (d) deterioration in global economic and financial market conditions generally; (e) unfavorable changes in the markets served by Arconic; (f) the inability to achieve the

level of revenue growth, cash generation, cost savings, benefits of our management of legacy liabilities, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted;

(g) competition from new product offerings, disruptive technologies, industry consolidation or other developments; (h) political, economic, and regulatory risks relating to Arconic’s global operations, including compliance with U.S. and foreign

trade and tax laws, sanctions, embargoes and other regulations; (i) manufacturing difficulties or other issues that impact product performance, quality or safety; (j) the inability to meet demand for our products successfully or to mitigate the

impact of cancellations of orders or reductions or delays caused by supply chain disruption; (k) a material disruption of Arconic’s operations, particularly at one or more of Arconic’s manufacturing facilities; (l) the inability to develop

innovative new products or implement technology initiatives successfully; (m) challenges to or infringements on Arconic’s intellectual property rights; (n) Arconic’s inability to realize expected benefits, in each case as planned and by

targeted completion dates, from acquisitions, divestitures, facility closures, curtailments, expansions, or joint ventures; (o) the impact of potential cyber attacks and information technology or data security breaches; (p) the loss of

significant customers or adverse changes in customers’ business or financial condition; (q) a significant downturn in the business or financial condition of a key supplier; (r) adverse changes in discount rates or investment returns on pension

assets; (s) our inability to adequately mitigate the impact of changes in aluminum prices and foreign currency exchange rates on costs and results; (t) the outcome of contingencies, including legal proceedings, government or regulatory

investigations, and environmental remediation, which can expose Arconic to substantial costs and liabilities; (u) a determination by the IRS that the distribution or certain related transactions should be treated as taxable transactions; (v)

risks associated with indebtedness, including potential restriction on our operations and the impact of events of default; and (w) the other risk factors summarized in Arconic’s Form 10-K for the year ended December 31, 2019 and other reports

filed with the U.S. Securities and Exchange Commission (SEC). The above list of factors is not exhaustive or necessarily in order of importance. Market projections are subject to the risks discussed above and other risks in the market. The

statements in this presentation are made as of the date of this presentation, even if subsequently made available by Arconic on its website or otherwise. Arconic disclaims any intention or obligation to update publicly any forward-looking

statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

Important Information (cont’d) 3 Non-GAAP Financial MeasuresSome of the information included in this

presentation is derived from Arconic’s consolidated financial information but is not presented in Arconic’s financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP).

Certain of these financial measures are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to any measure of performance or

financial condition as determined in accordance with GAAP, and investors should consider Arconic’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial

condition of Arconic. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP

financial measures presented by Arconic may not be comparable to non-GAAP financial measures presented by other companies. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the

non-GAAP financial measures can be found in the schedules to this presentation. Arconic has not provided reconciliations of any forward-looking non-GAAP financial measures, such as adjusted EBITDA, and free cash flow to the most directly

comparable GAAP financial measures because such reconciliations are not available without unreasonable efforts due to the variability and complexity with respect to the charges and other components excluded from the non-GAAP measures, such as

the effects of foreign currency movements, gains or losses on sales of assets, taxes, and any future restructuring or impairment charges. These reconciling items are in addition to the inherent variability already included in the GAAP measures,

which includes, but is not limited to, price/mix and volume. Arconic believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.Other InformationEffective July 1, 2020, the Company changed

its inventory cost method to average cost for all U.S. inventories previously carried at last-in, first-out (LIFO) cost. The effects of the change in accounting principle from LIFO to average cost have been retrospectively applied to all prior

periods presented. See the Company’s Form 10-Q for the quarterly period ended September 30, 2020 for further information.

3Q 2020 Highlights 4 3Q 2020: Cash provided from operations of $240M less capital expenditures of $39M

= consolidated free cash flow of $201M.Availability of the ABL is $678M as of October 21, 2020 due to working capital changes in the quarter.See appendix for non-GAAP financial measure reconciliations. Sales of $1.4 billion, up 19% from prior

quarter, down 22% (16% organically) year over yearNet income of $5 million, or $0.05 per share, compared to a net loss of $24 million, or $0.22 per share, in third quarter 2019Adjusted EBITDA of $165 million and Adjusted EBITDA margin of

11.7%Cash provided from operations of $240 million and capital expenditures of $39 million resulting in free cash flow of $201 million1Quarter-end cash balance of $802 million, debt of $1.3 billion, net debt of $480 million, and total liquidity

of ~$1.5 billion2Packaging non-compete expired October 31stChanged inventory cost method to average cost for all U.S. inventories previously carried at LIFO cost; also refined the Company’s Adjusted EBITDA measures to remove the impact of metal

price lag

3Q 2020 End Market Overview 5 3Q 2020 Organic Revenueby End Market (10%)year over year Ground

TransportationSales increased 102% from prior quarter due to a 158% increase in automotiveYear over year sales declined 10% organically driven by commercial transportationAerospaceSales declined 36% from prior quarter and fell 50% organically

year over year, consistent with prior guidanceOEMs maintain significant backlogs, but continued to experience deferments and cancellations during the quarterBuilding and ConstructionSales increased 8% from prior quarter, but declined 13%

organically year over yearPackagingSales increased 2% from prior quarter and declined 3% organically year over year primarily at the China facilityIndustrial Products and OtherSales increased 11% from prior quarter and declined 3% organically

year over yearInternational trade litigation bolstered demand for domestic sheet used in industrial goods and industrial capacity at Tennessee continued to ramp up in the quarter (3%)year over year See appendix for non-GAAP financial measure

reconciliations. (50%)year over year (13%)year over year (3%)year over year

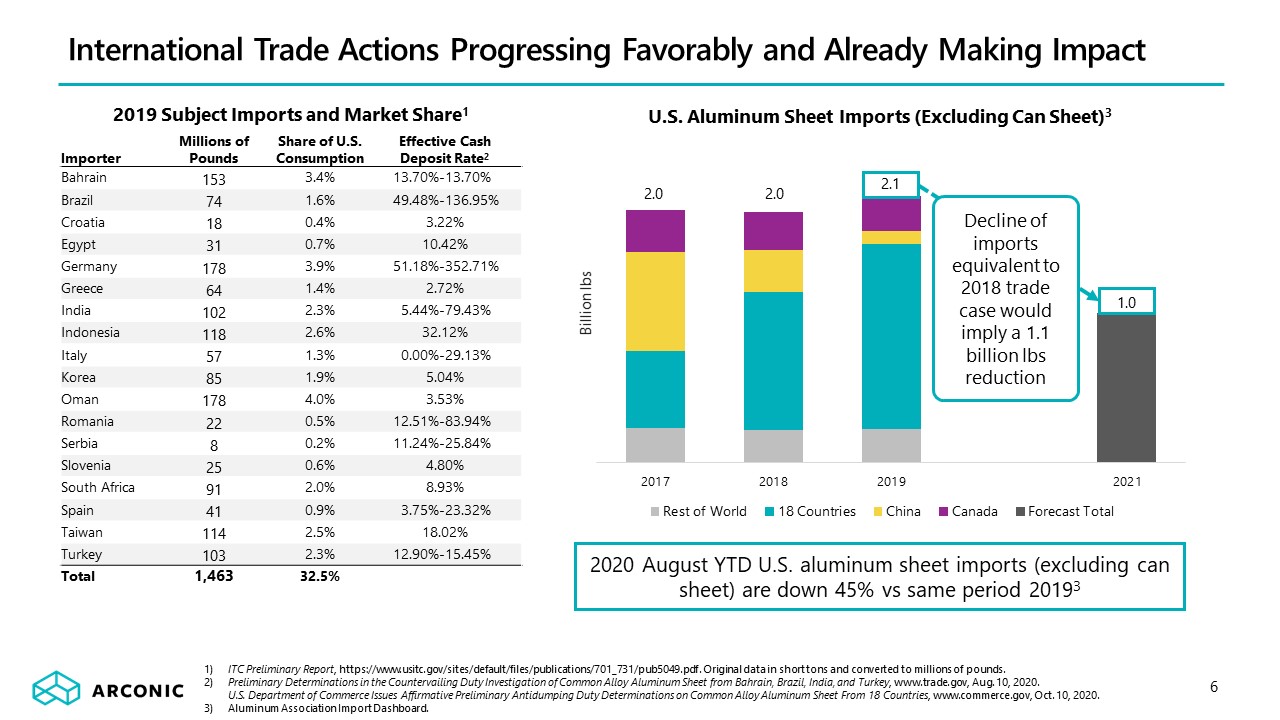

International Trade Actions Progressing Favorably and Already Making Impact 6 1) ITC Preliminary

Report, https://www.usitc.gov/sites/default/files/publications/701_731/pub5049.pdf. Original data in short tons and converted to millions of pounds.2) Preliminary Determinations in the Countervailing Duty Investigation of Common Alloy Aluminum

Sheet from Bahrain, Brazil, India, and Turkey, www.trade.gov, Aug. 10, 2020. U.S. Department of Commerce Issues Affirmative Preliminary Antidumping Duty Determinations on Common Alloy Aluminum Sheet From 18 Countries, www.commerce.gov, Oct. 10,

2020. 3) Aluminum Association Import Dashboard. 2019 Subject Imports and Market Share1 Importer Millions of Pounds Share of U.S. Consumption Effective CashDeposit Rate2 Bahrain 153 3.4% 13.70%- 13.70% Brazil 74

1.6% 49.48%- 136.95% Croatia 18 0.4% 3.22% Egypt 31 0.7% 10.42% Germany 178 3.9% 51.18%- 352.71% Greece 64 1.4% 2.72% India 102 2.3% 5.44%- 79.43% Indonesia 118 2.6% 32.12% Italy 57

1.3% 0.00%- 29.13% Korea 85 1.9% 5.04% Oman 178 4.0% 3.53% Romania 22 0.5% 12.51%- 83.94% Serbia 8 0.2% 11.24%- 25.84% Slovenia 25 0.6% 4.80% South Africa 91 2.0% 8.93% Spain 41

0.9% 3.75%- 23.32% Taiwan 114 2.5% 18.02% Turkey 103 2.3% 12.90%- 15.45% Total 1,463 32.5% U.S. Aluminum Sheet Imports (Excluding Can Sheet)3 2.1 1.0 2.0 Decline of imports equivalent to 2018 trade case would imply

a 1.1 billion lbs reduction 2.0 2020 August YTD U.S. aluminum sheet imports (excluding can sheet) are down 45% vs same period 20193

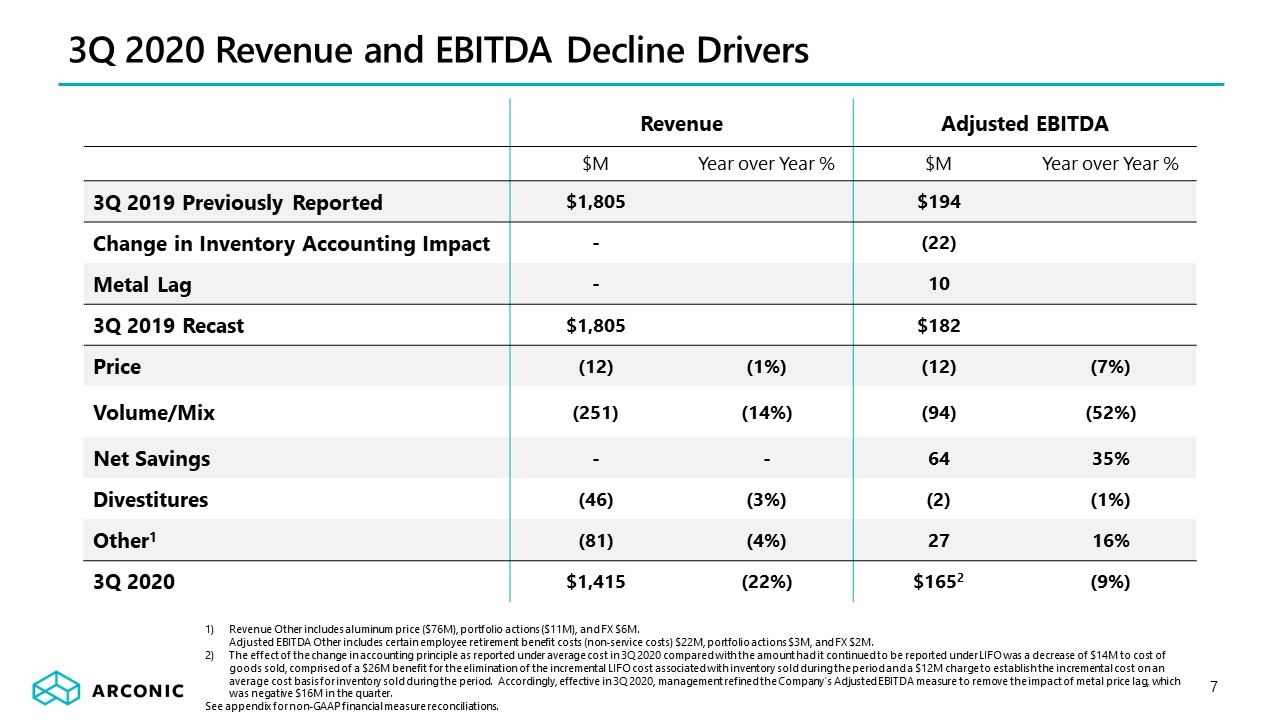

3Q 2020 Revenue and EBITDA Decline Drivers Revenue Other includes aluminum price ($76M), portfolio

actions ($11M), and FX $6M.Adjusted EBITDA Other includes certain employee retirement benefit costs (non-service costs) $22M, portfolio actions $3M, and FX $2M. The effect of the change in accounting principle as reported under average cost in

3Q 2020 compared with the amount had it continued to be reported under LIFO was a decrease of $14M to cost of goods sold, comprised of a $26M benefit for the elimination of the incremental LIFO cost associated with inventory sold during the

period and a $12M charge to establish the incremental cost on an average cost basis for inventory sold during the period. Accordingly, effective in 3Q 2020, management refined the Company’s Adjusted EBITDA measure to remove the impact of metal

price lag, which was negative $16M in the quarter.See appendix for non-GAAP financial measure reconciliations. 7 Revenue Adjusted EBITDA $M Year over Year % $M Year over Year % 3Q 2019 Previously

Reported $1,805 $194 Change in Inventory Accounting Impact - (22) Metal Lag - 10 3Q 2019 Recast $1,805 $182 Price (12) (1%) (12) (7%) Volume/Mix (251) (14%) (94) (52%) Net

Savings - - 64 35% Divestitures (46) (3%) (2) (1%) Other1 (81) (4%) 27 16% 3Q 2020 $1,415 (22%) $1652 (9%)

3Q 2020 Segment Results 8 Excludes metal lag in accordance with revised definition of adjusted

EBITDA.Total net savings exclude net corporate of ($4M), which is corporate actions net of year over year increases in corporate costs due to comparison of carve out to actual performance.Other items in corporate were $6M of certain employee

retirement benefit costs (non-service costs). Total company other includes certain employee retirement benefit costs (non-service costs) $22M, portfolio actions $3M, FX $2M, and divestitures ($2M).See appendix for non-GAAP financial measure

reconciliations. Revenue Segment Adjusted EBITDA1 Segment Adjusted EBITDA Margin Drivers ($M) 3Q19 3Q20 3Q19 Price Volume/Mix Net Savings2 Other3 3Q20 3Q19 3Q20 Rolled

Products $1,397 $1,092 $160 ($13) ($80) $54 $17 $138 11.5% 12.6% Volume declines in all end markets partially offset by strength in automotive subset of ground transportation as well as cost actions Year over year change (22%)(15%)

Organic (14%) +110bps Building and Construction Systems $282 $241 $39 - ($7) $7 $1 $40 13.8% 16.6% Adjusted EBITDA increased modestly year-over-year as volume declines in the quarter were fully offset by cost

actions Year over year change (15%)(16%) Organic 3% +280bps Extrusions $126 $82 ($8) $1 ($7) $7 $1 ($6) - - Cost actions largely offset by lower aerospace volumes Year over year change (35%)(25%)

Organic 25% -

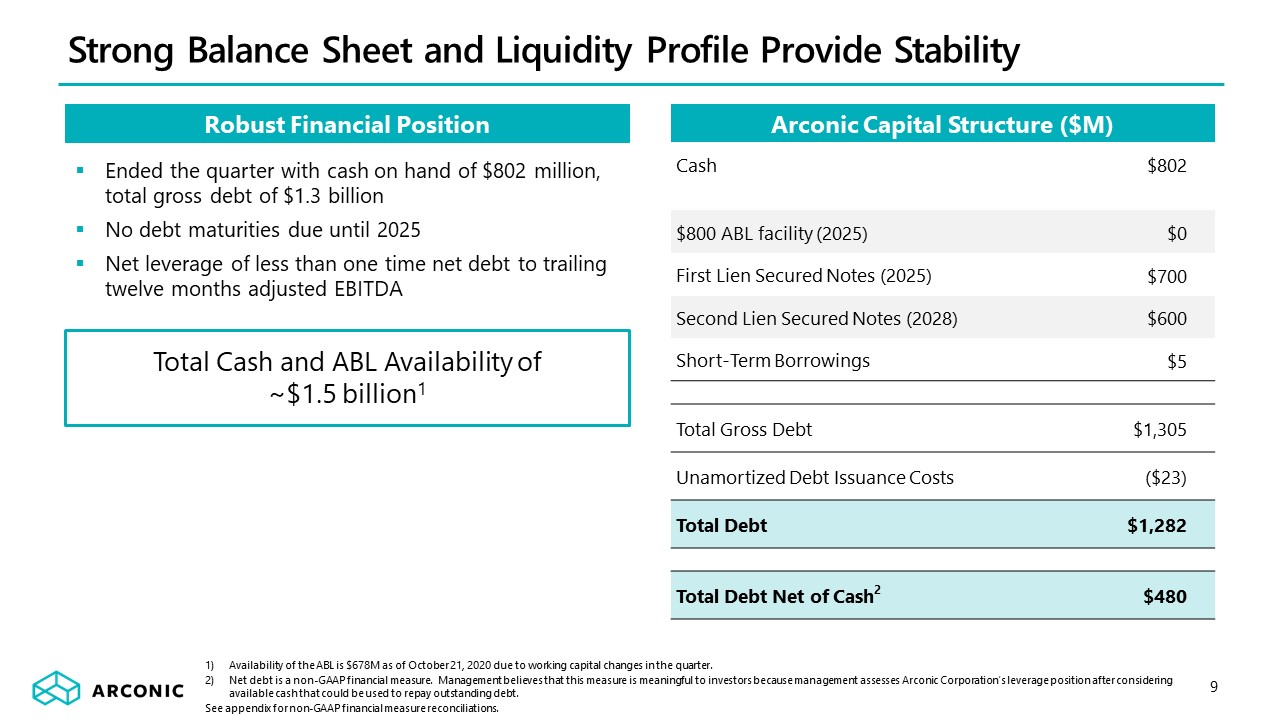

Strong Balance Sheet and Liquidity Profile Provide Stability 9 Arconic Capital Structure

($M) Cash $802 $800 ABL facility (2025) $0 First Lien Secured Notes (2025) $700 Second Lien Secured Notes (2028) $600 Short-Term Borrowings $5 Total Gross Debt $1,305 Unamortized Debt Issuance Costs ($23) Total

Debt $1,282 Total Debt Net of Cash2 $480 Robust Financial Position Total Cash and ABL Availability of~$1.5 billion1 Ended the quarter with cash on hand of $802 million, total gross debt of $1.3 billionNo debt maturities due until

2025Net leverage of less than one time net debt to trailing twelve months adjusted EBITDA Availability of the ABL is $678M as of October 21, 2020 due to working capital changes in the quarter. Net debt is a non-GAAP financial measure.

Management believes that this measure is meaningful to investors because management assesses Arconic Corporation’s leverage position after considering available cash that could be used to repay outstanding debt.See appendix for non-GAAP

financial measure reconciliations.

Ground Transportation2021 model year changeover and typical year-end automotive OEM shutdowns expected

to drive modest 4Q20 year over year decline of ~5-10%, but sales expected to be roughly flat sequentially Commercial transportation expected to improve sequentially in 4Q20 driven by heavy duty truck sales, which are expected to grow ~25%;

however sales are expected to be down ~5-10% year over year Aerospace4Q20 aerospace revenue expected to be down ~60% year over year and down ~10-15% from 3Q20 Building and Construction4Q20 likely to be flat to a modest decline from 3Q20

as construction markets remain tepid PackagingVolumes expected to be roughly flat in 4Q20 as non-compete expired October 31st and qualification is expected first half of 2021 Industrial Products and Other4Q20 revenue expected to increase

~10-15% sequentially with the ramp up of the Tennessee investment and impact of international trade case 4Q 2020 Revenue Outlook by End Market 10 4Q20 Trajectory from 3Q20

Looking Forward 11 Continue to keep employees safe and operations running wellCost actions and

productivity measures continue to drive margin performanceFree cash flow generation supports continued deleveraging of legacy liabilitiesExpired packaging non-compete opens up new market opportunities in 2021Trade actions on imports of common

alloy sheet levels the playing field and drives opportunity for U.S.-based manufacturersImproving ground transportation demand partially offsetting continued weakness in aerospace and building and construction end markets Outlook2020 revenue1:

$5.6B - $5.7B2020 Adjusted EBITDA2: $610M - $630M2Q20-4Q20 free cash flow2: $150M - $200M Full-year 2020 revenue assumes LME $1,660/mt + MWP $270/mt, which is based on actual prices for 1Q20-3Q20 and forecast for 4Q20.Arconic has not provided

reconciliations of any forward-looking non-GAAP financial measures, such as adjusted EBITDA, and free cash flow to the most directly comparable GAAP financial measures because such reconciliations are not available without unreasonable efforts

due to the variability and complexity with respect to the charges and other components excluded from the non-GAAP measures, such as the effects of foreign currency movements, equity income, gains or losses on sales of assets, taxes, and any

future restructuring or impairment charges. These reconciling items are in addition to the inherent variability already included in the GAAP measures, which includes, but is not limited to, price/mix and volume. Arconic believes such

reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Appendix

13 ($M) (unaudited) Quarter ended September 30, 2020 2019(1) Total Segment

Adjusted EBITDA(2),(3),(4) $ 172 $ 191 Unallocated amounts: Corporate expenses(3),(5) (6) (10) Stock-based compensation expense (6) (10) Metal price lag(6) (16) (10) Provision for depreciation and

amortization (63) (63) Restructuring and other charges (3) (64) Other(3),(7) (14) (12) Operating income(4) 64 22 Interest expense (22) (29) Other expenses, net(3) (27) – Provision for income

taxes(4) (10) (17) Net income attributable to noncontrolling interest – – Consolidated net income (loss) attributable to Arconic Corporation(4) $ 5 $ (24) Reconciliation of Segment Adjusted EBITDA Prior to April 1,

2020, Arconic Corporation’s financial statements were prepared on a carve-out basis, as the underlying operations of the Company were previously consolidated as part of Arconic Corporation’s former parent company’s financial statements.

Accordingly, the Company’s results of operations for the quarter ended September 30, 2019 were prepared on such basis. The carve-out financial statements of Arconic Corporation are not necessarily indicative of the Company’s consolidated

results of operations had it been a standalone company during the referenced period. See the Combined Financial Statements included in each of (i) Exhibit 99.1 to Arconic Corporation’s Form 10 Registration Statement (filed on February 7, 2020),

(ii) the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020), and (iii) the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2020 (filed on May 18, 2020), for additional

information.Effective in the second quarter of 2020, management elected to change the profit or loss measure of the Company’s reportable segments from Segment operating profit to Segment Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) for internal reporting and performance measurement purposes. This change was made to enhance the transparency and visibility of the underlying operating performance of each segment. Effective in the third quarter

of 2020, management refined the Company’s Segment Adjusted EBITDA measure to remove the impact of metal price lag (see footnote 6). This change was made to further enhance the transparency and visibility of the underlying operating performance

of each segment by removing the volatility associated with metal prices, which are driven by market factors that are beyond management’s control.Arconic Corporation calculates Segment Adjusted EBITDA as Total sales (third-party and

intersegment) minus each of (i) Cost of goods sold, (ii) Selling, general administrative, and other expenses, and (iii) and Research and development expenses, plus Stock-based compensation expense and Metal price lag. Previously, the Company

calculated Segment operating profit as Segment Adjusted EBITDA minus each of (i) the Provision for depreciation and amortization, (ii) Stock-based compensation expense, and (iii) Metal price lag. Arconic Corporation’s Segment Adjusted EBITDA

may not be comparable to similarly titled measures of other companies’ reportable segments.Also, effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S. inventories previously carried at last-in,

first-in (LIFO) cost. The effects of the change in accounting principle have been retrospectively applied to the Company’s Statement of Consolidated Operations for the quarter ended September 30, 2019. See footnote 4 for additional

information.Segment Adjusted EBITDA for the quarter ended September 30, 2019 was recast to reflect the new measure of segment profit or loss and the change in inventory cost method.Total Segment Adjusted EBITDA is the sum of the respective

Segment Adjusted EBITDA for each of the Company's three reportable segments: Rolled Products, Building and Construction Systems, and Extrusions. This amount is being presented for the sole purpose of reconciling Segment Adjusted EBITDA to the

Company's Consolidated net income (loss).

3) In preparation for the separation of Arconic Corporation from its former parent company, effective

January 1, 2020, certain U.S. defined benefit pension and other postretirement plans previously sponsored by the former parent company were separated into standalone plans for both Arconic Corporation and the former parent company.

Additionally, effective April 1, 2020, Arconic Corporation assumed a portion of the obligations associated with certain non-U.S. defined benefit pension plans that included participants related to both Arconic Corporation and its former parent

company, as well as legacy defined benefit pension plans assigned to the Company as a result of the separation from the former parent company. As a result, beginning in the first quarter of 2020 for these U.S. plans and in the second quarter of

2020 for these non-U.S. plans, Arconic Corporation applied defined benefit plan accounting resulting in benefit plan expense being recorded in operating income (service cost) and nonoperating income (nonservice cost). In all historical periods

prior to these respective timeframes, Arconic Corporation was considered a participating employer in the former parent company’s defined benefit plans and, therefore, applied multiemployer plan accounting resulting in the Company’s share of

benefit plan expense being recorded entirely in operating income. Also, Arconic Corporation is the plan sponsor of certain other non-U.S. defined benefit plans that contain participants related only to the underlying operations of the Company

and, therefore, the related benefit plan expense was recorded in accordance with defined benefit plan accounting in all periods presented. The following table presents the total benefit plan expense (excluding settlements and curtailments)

recorded by Arconic Corporation based on the foregoing in each period presented:4) Effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S. inventories previously carried at LIFO cost. Management

believes the average cost method more closely reflects the physical flow of inventories, improves comparability of the Company’s operating results with its industry peers, and provides an increased level of consistency in the measurement of

inventories in the Company’s consolidated financial statements.. The effects of the change in accounting principle from LIFO to average cost have been retrospectively applied to the Company’s Statement of Consolidated Operations for the quarter

ended September 30, 2019. Accordingly, Net loss attributable to Arconic Corporation increased $17 (comprised of a $22 increase to Cost of goods sold and a $5 decrease to Provision for income taxes) from the amount previously reported in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020). See the Consolidated Financial Statements included in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2020 for

additional information.5) Corporate expenses are composed of general administrative and other expenses of operating the corporate headquarters and other global administrative facilities, as well as research and development expenses of the

corporate technical center. The amount presented for the quarter ended September 30, 2019 represents an allocation of Arconic Corporation’s former parent company’s corporate expenses (see footnote 1 above).6) Metal price lag represents the

financial impact of the timing difference between when aluminum prices included in Sales are recognized and when aluminum purchase prices included in Cost of goods sold are realized. This adjustment aims to remove the effect of the volatility

in metal prices and the calculation of this impact considers applicable metal hedging transactions.7) Other includes certain items that impact Cost of goods sold and Selling, general administrative, and other expenses on the Company’s Statement

of Consolidated Operations that are not included in Segment Adjusted EBITDA, including those described as “Other special items” (see footnote 5 to the reconciliation of Adjusted EBITDA within Calculation of Non-GAAP Financial Measures included

in this presentation). 14 Reconciliation of Segment Adjusted EBITDA (cont’d) Quarter endedSeptember 30, 2020 2019 Total Segment Adjusted EBITDA $ (7) $ (21) Unallocated amounts: Corporate expenses – (3)

Other – (3) Subtotal – (6) Other expenses, net (20) (1) Total $ (27) $ (28)

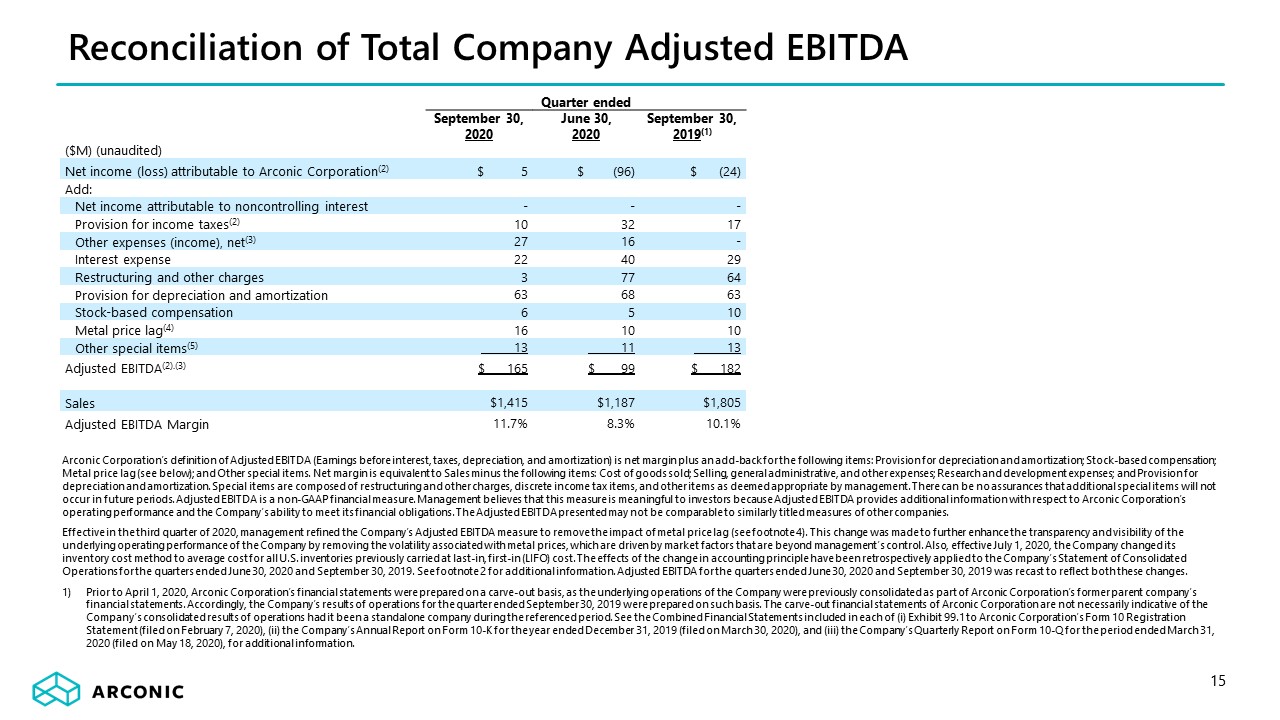

15 Quarter ended September 30, 2020 June 30,2020 September 30, 2019(1) ($M)

(unaudited) Net income (loss) attributable to Arconic Corporation(2) $ 5 $ (96) $ (24) Add: Net income attributable to noncontrolling interest - - - Provision for income taxes(2) 10 32 17 Other expenses

(income), net(3) 27 16 - Interest expense 22 40 29 Restructuring and other charges 3 77 64 Provision for depreciation and amortization 63 68 63 Stock-based compensation 6 5 10 Metal price lag(4) 16 10 10 Other

special items(5) 13 11 13 Adjusted EBITDA(2).(3) $ 165 $ 99 $ 182 Sales $1,415 $1,187 $1,805 Adjusted EBITDA Margin 11.7% 8.3% 10.1% Arconic Corporation’s definition of Adjusted EBITDA (Earnings before interest,

taxes, depreciation, and amortization) is net margin plus an add-back for the following items: Provision for depreciation and amortization; Stock-based compensation; Metal price lag (see below); and Other special items. Net margin is equivalent

to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation and amortization. Special items are composed of restructuring and

other charges, discrete income tax items, and other items as deemed appropriate by management. There can be no assurances that additional special items will not occur in future periods. Adjusted EBITDA is a non-GAAP financial measure.

Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Arconic Corporation’s operating performance and the Company’s ability to meet its financial obligations.

The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.Effective in the third quarter of 2020, management refined the Company’s Adjusted EBITDA measure to remove the impact of metal price lag (see

footnote 4). This change was made to further enhance the transparency and visibility of the underlying operating performance of the Company by removing the volatility associated with metal prices, which are driven by market factors that are

beyond management’s control. Also, effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S. inventories previously carried at last-in, first-in (LIFO) cost. The effects of the change in accounting

principle have been retrospectively applied to the Company’s Statement of Consolidated Operations for the quarters ended June 30, 2020 and September 30, 2019. See footnote 2 for additional information. Adjusted EBITDA for the quarters ended

June 30, 2020 and September 30, 2019 was recast to reflect both these changes.Prior to April 1, 2020, Arconic Corporation’s financial statements were prepared on a carve-out basis, as the underlying operations of the Company were previously

consolidated as part of Arconic Corporation’s former parent company’s financial statements. Accordingly, the Company’s results of operations for the quarter ended September 30, 2019 were prepared on such basis. The carve-out financial

statements of Arconic Corporation are not necessarily indicative of the Company’s consolidated results of operations had it been a standalone company during the referenced period. See the Combined Financial Statements included in each of (i)

Exhibit 99.1 to Arconic Corporation’s Form 10 Registration Statement (filed on February 7, 2020), (ii) the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020), and (iii) the Company’s Quarterly

Report on Form 10-Q for the period ended March 31, 2020 (filed on May 18, 2020), for additional information. Reconciliation of Total Company Adjusted EBITDA

2) Effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S.

inventories previously carried at LIFO cost. Management believes the average cost method more closely reflects the physical flow of inventories, improves comparability of the Company’s operating results with its industry peers, and provides an

increased level of consistency in the measurement of inventories in the Company’s consolidated financial statements. The effects of the change in accounting principle from LIFO to average cost have been retrospectively applied to the Company’s

Statement of Consolidated Operations for the quarters ended June 30, 2020 and September 30, 2019. Accordingly, for the quarter ended June 30, 2020, Net loss attributable to Arconic Corporation increased $4 (comprised of a $5 increase to Cost of

goods sold and a $1 increase to Benefit for income taxes), or $0.04 per share, from the amounts previously reported in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 (filed on August 4, 2020). Additionally, for

the quarter ended September 30, 2019, Net loss attributable to Arconic Corporation increased $17 (comprised of a $22 increase to Cost of goods sold and a $5 decrease to Provision for income taxes) from the amount previously reported in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020). See the Consolidated Financial Statements included in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2020 for

additional information.3) In preparation for the separation of Arconic Corporation from its former parent company, effective January 1, 2020, certain U.S. defined benefit pension and other postretirement plans previously sponsored by the former

parent company were separated into standalone plans for both Arconic Corporation and the former parent company. Additionally, effective April 1, 2020, Arconic Corporation assumed a portion of the obligations associated with certain non-U.S.

defined benefit pension plans that included participants related to both Arconic Corporation and its former parent company, as well as legacy defined benefit pension plans assigned to the Company as a result of the separation from the former

parent company. As a result, beginning in the first quarter of 2020 for these U.S. plans and in the second quarter of 2020 for these non-U.S. plans, Arconic Corporation applied defined benefit plan accounting resulting in benefit plan expense

being recorded in operating income (service cost) and nonoperating income (nonservice cost). In all historical periods prior to these respective timeframes, Arconic Corporation was considered a participating employer in the former parent

company’s defined benefit plans and, therefore, applied multiemployer plan accounting resulting in the Company’s share of benefit plan expense being recorded entirely in operating income. Also, Arconic Corporation is the plan sponsor of certain

other non-U.S. defined benefit plans that contain participants related only to the underlying operations of the Company and, therefore, the related benefit plan expense (excluding settlements and curtailments) was recorded in accordance with

defined benefit plan accounting in all periods presented:4) Metal price lag represents the financial impact of the timing difference between when aluminum prices included in Sales are recognized and when aluminum purchase prices included in

Cost of goods sold are realized. This adjustment aims to remove the effect of the volatility in metal prices and the calculation of this impact considers applicable metal hedging transactions.5) Other special items include the following:• for

the quarter ended September 30, 2020, costs related to several legal matters, including Grenfell Tower ($4) and other ($2), a write-down of inventory related to the curtailment of the casthouse operations at the Chandler (Arizona) extrusions

facility ($5), and other ($2);• for the quarter ended June 30, 2020, costs related to several legal matters, including a customer settlement ($5), Grenfell Tower ($3), and other ($3); and• for the quarter ended September 30, 2019, an allocation

of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies. 16 Quarter endedSeptember 30, 2020 2019 Cost of goods

sold $ 7 $ 24 Selling, general administrative, and other expenses – 3 Research and development expenses – - Other expenses, net 20 1 $ 27 $ 28 Reconciliation of Total Company Adjusted EBITDA (cont’d)

17 Quarter ended March 31, 2019(1) June 30, 2019(1) September 30, 2019(1) December 31,

2019(1) March 31,2020(1) June 30, 2020 ($M) (unaudited) Net income (loss) attributable to Arconic Corporation as previously reported $ 41 $ 5 $ (7) $ 186 $ 60 $ (92) Add: Net income attributable

to noncontrolling interest - - - - - - Provision (Benefit) for income taxes 25 8 22 (103) 31 (31) Other (income) expenses, net(2) (14) 10 - (11) 26 16 Interest expense 28 29 29 29 35 40 Restructuring and other

charges 2 38 64 (17) (19) 77 Provision for depreciation and amortization 63 64 63 62 60 68 Stock-based compensation 6 12 10 12 7 5 Other special items(3) 5 45 13 18 18 11 Adjusted EBITDA

previously reported(2) $ 156 $ 211 $ 194 $ 176 $ 218 $ 94 Add: Impact of change in inventory accounting method (LIFO)(4) (6) (11) (22) (23) (18) (5) Metal price lag(5) 15 8 10 6 4 10 Adjusted EBITDA,

excluding LIFO/Metal price lag $ 165 $ 208 $ 182 $ 159 $ 204 $ 99 Pension/OPEB non-service costs(6) 22 21 22 21 (1) - Adjusted EBITDA, excluding LIFO/Metal price lag and non-service costs $ 187 $ 229 $ 204 $ 180 $

203 $ 99 The information on this slide is being presented solely for informational purposes only. Specifically, the purpose of this slide is to reflect the impact of the implementation of two changes that occurred in the third

quarter of 2020 on the Company’s previously reported Reconciliation of Net Income (Loss) to Adjusted EBITDA. The following paragraph describes these changes.Effective in the third quarter of 2020, management refined the Company’s Adjusted

EBITDA measure to remove the impact of metal price lag (see footnote 5). This change was made to further enhance the transparency and visibility of the underlying operating performance of the Company by removing the volatility associated with

metal prices. Also, effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S. inventories previously carried at last-in, first-in (LIFO) cost. The effects of the change in accounting principle have been

retrospectively applied to the Company’s Statement of Consolidated Operations for all prior periods presented. See footnote 4 for additional information.Arconic Corporation’s previous definition of Adjusted EBITDA (Earnings before interest,

taxes, depreciation, and amortization) was net margin plus an add-back for the following items: Provision for depreciation and amortization; Stock-based compensation; and Other special items. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation and amortization. Special items are composed of restructuring and other charges,

discrete income tax items, and other items as deemed appropriate by management. There can be no assurances that additional special items will not occur in future periods. Adjusted EBITDA is a non-GAAP financial measure. Management believes that

this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Arconic Corporation’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA

presented may not be comparable to similarly titled measures of other companies.Prior to April 1, 2020, Arconic Corporation’s financial statements were prepared on a carve-out basis, as the underlying operations of the Company were previously

consolidated as part of Arconic Corporation’s former parent company’s financial statements. Accordingly, the Company’s results of operations for all periods prior to second quarter 2020 were prepared on such basis. The carve-out financial

statements of Arconic Corporation are not necessarily indicative of the Company’s consolidated results of operations had it been a standalone company during the referenced periods. See the Combined Financial Statements included in each of (i)

Exhibit 99.1 to Arconic Corporation’s Form 10 Registration Statement (filed on February 7, 2020), (ii) the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020), and (iii) the Company’s Quarterly

Report on Form 10-Q for the period ended March 31, 2020 (filed on May 18, 2020), for additional information. Reconciliation of Net Income (Loss) to Adjusted EBITDA, excluding non-service costs – previously reported

2) In preparation for the separation of Arconic Corporation from its former parent company, effective

January 1, 2020, certain U.S. defined benefit pension and other postretirement plans previously sponsored by the former parent company were separated into standalone plans for both Arconic Corporation and the former parent company.

Additionally, effective April 1, 2020, Arconic Corporation assumed a portion of the obligations associated with certain non-U.S. defined benefit pension plans that included participants related to both Arconic Corporation and its former parent

company, as well as legacy defined benefit pension plans assigned to the Company as a result of the separation from the former parent company. As a result, beginning in the first quarter of 2020 for these U.S. plans and in the second quarter of

2020 for these non-U.S. plans, Arconic Corporation applied defined benefit plan accounting resulting in benefit plan expense being recorded in operating income (service cost) and nonoperating income (nonservice cost). In all historical periods

prior to these respective timeframes, Arconic Corporation was considered a participating employer in the former parent company’s defined benefit plans and, therefore, applied multiemployer plan accounting resulting in the Company’s share of

benefit plan expense being recorded entirely in operating income. Also, Arconic Corporation is the plan sponsor of certain other non-U.S. defined benefit plans that contain participants related only to the underlying operations of the Company

and, therefore, the related benefit plan expense (excluding settlements and curtailments) was recorded in accordance with defined benefit plan accounting in all periods presented. See footnote 3 to the Reconciliation of Total Company Adjusted

EBITDA included in this presentation for additional information.3) Other special items include the following:for the quarter ended March 31, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with

the following matters: a company-wide strategy and portfolio review by management ($3), the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($1), and a legal matter referred to as Grenfell Tower ($1);for

the quarter ended June 30, 2019, a charge for an ongoing environmental remediation matter referred to as Grasse River ($25) and an allocation of costs incurred by Arconic Corporation’s former parent company associated with the following

matters: the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($9), negotiation of a collective bargaining agreement with the United Steelworkers ($9), and a legal matter referred to as Grenfell Tower

($2);for the quarter ended September 30, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies;for the

quarter ended December 31, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($17) and a legal matter

referred to as Grenfell Tower ($1);for the quarter ended March 31, 2020, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone

publicly-traded companies; andfor the quarter ended June 30, 2020, costs related to several legal matters, including customer settlement ($5), Grenfell Tower ($3), and other ($3).4) Effective July 1, 2020, the Company changed its inventory cost

method to average cost for all U.S. inventories previously carried at LIFO cost. Management believes the average cost method more closely reflects the physical flow of inventories, improves comparability of the Company’s operating results with

its industry peers, and provides an increased level of consistency in the measurement of inventories in the Company’s consolidated financial statements. See the Consolidated Financial Statements included in the Company’s Quarterly Report on

Form 10-Q for the period ended September 30, 2020 for additional information.5) Metal price lag represents the financial impact of the timing difference between when aluminum prices included in Sales are recognized and when aluminum purchase

prices included in Cost of goods sold are realized. This adjustment aims to remove the effect of the volatility in metal prices and the calculation of this impact considers applicable metal hedging transactions.6) This adjustment reflects a

proxy of non-service cost associated with certain defined benefit pension and other postretirement plan obligations had standalone plans existed for all the Company’s participants instead of participating in defined benefit plans sponsored by

Arconic Corporation’s former parent company (see footnote 2 above). 18 Reconciliation of Net Debt to Adjusted EBITDA, excluding non-service costs (cont’d)

Arconic Corporation’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for the following items: Provision for depreciation and amortization; Stock-based compensation; Metal price lag (see below); and Other special items. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation and amortization. Special items are composed of restructuring and other charges,

discrete income tax items, and other items as deemed appropriate by management. There can be no assurances that additional special items will not occur in future periods. Adjusted EBITDA is a non-GAAP financial measure. Management believes that

this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Arconic Corporation’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA

presented may not be comparable to similarly titled measures of other companies.Effective in the third quarter of 2020, management refined the Company’s Adjusted EBITDA measure to remove the impact of metal price lag (see footnote 4). This

change was made to further enhance the transparency and visibility of the underlying operating performance of the Company by removing the volatility associated with metal prices, which are driven by market factors that are beyond management’s

control. Also, effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S. inventories previously carried at last-in, first-in (LIFO) cost. The effects of the change in accounting principle have been

retrospectively applied to the Company’s Statement of Consolidated Operations for all prior periods presented. See footnote 2 for additional information. Adjusted EBITDA for all prior periods presented was recast to reflect both these

changes.Prior to April 1, 2020, Arconic Corporation’s financial statements were prepared on a carve-out basis, as the underlying operations of the Company were previously consolidated as part of Arconic Corporation’s former parent company’s

financial statements. Accordingly, the Company’s results of operations for all periods prior to second quarter 2020 were prepared on such basis. The carve-out financial statements of Arconic Corporation are not necessarily indicative of the

Company’s consolidated results of operations had it been a standalone company during the referenced periods. See the Combined Financial Statements included in each of (i) Exhibit 99.1 to Arconic Corporation’s Form 10 Registration Statement

(filed on February 7, 2020), (ii) the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (filed on March 30, 2020), and (iii) the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2020 (filed on May

18, 2020), for additional information. 19 Quarter ended March 31, 2019(1) June 30, 2019(1) September 30, 2019(1) December 31, 2019(1) March 31,2020(1) June 30, 2020 September 30, 2020 ($M)

(unaudited) Net income (loss) attributable to Arconic Corporation(2) $ 37 $ (4) $ (24) $ 168 $ 46 $ (96) $ 5 Add: Net income attributable to noncontrolling

interest - - - - - - - Provision (Benefit) for income taxes(2) 23 6 17 (108) 27 (32) 10 Other (income) expenses, net(3) (14) 10 - (11) 26 16 27 Interest expense 28 29 29 29 35 40 22 Restructuring and other

charges 2 38 64 (17) (19) 77 3 Provision for depreciation and amortization 63 64 63 62 60 68 63 Stock-based compensation 6 12 10 12 7 5 6 Metal price lag(4) 15 8 10 6 4 10 16 Other special

items(5) 5 45 13 18 18 11 13 Adjusted EBITDA(2),(3) $ 165 $ 208 $ 182 $ 159 $ 204 $ 99 $ 165 Pension/OPEB non-service costs(6) 22 21 22 21 (1) - - Adjusted EBITDA, excluding non-service costs(2),(3) $

187 $ 229 $ 204 $ 180 $ 203 $ 99 $ 165 Long-term debt + Short-term borrowings $ 1,282 Less: Cash and cash equivalents 802 Net Debt(7) $ 480 Net Debt to Trailing

Twelve Months Adjusted EBITDA, excluding non-service costs 0.74 Reconciliation of Net Debt to Adjusted EBITDA, excluding non-service costs

2) Effective July 1, 2020, the Company changed its inventory cost method to average cost for all U.S.

inventories previously carried at LIFO cost. Management believes the average cost method more closely reflects the physical flow of inventories, improves comparability of the Company’s operating results with its industry peers, and provides an

increased level of consistency in the measurement of inventories in the Company’s consolidated financial statements. The effects of the change in accounting principle from LIFO to average cost have been retrospectively applied to the Company’s

Statement of Consolidated Operations for all prior periods presented. See the Consolidated Financial Statements included in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2020 for additional information.3) In

preparation for the separation of Arconic Corporation from its former parent company, effective January 1, 2020, certain U.S. defined benefit pension and other postretirement plans previously sponsored by the former parent company were

separated into standalone plans for both Arconic Corporation and the former parent company. Additionally, effective April 1, 2020, Arconic Corporation assumed a portion of the obligations associated with certain non-U.S. defined benefit pension

plans that included participants related to both Arconic Corporation and its former parent company, as well as legacy defined benefit pension plans assigned to the Company as a result of the separation from the former parent company. As a

result, beginning in the first quarter of 2020 for these U.S. plans and in the second quarter of 2020 for these non-U.S. plans, Arconic Corporation applied defined benefit plan accounting resulting in benefit plan expense being recorded in

operating income (service cost) and nonoperating income (nonservice cost). In all historical periods prior to these respective timeframes, Arconic Corporation was considered a participating employer in the former parent company’s defined

benefit plans and, therefore, applied multiemployer plan accounting resulting in the Company’s share of benefit plan expense being recorded entirely in operating income. Also, Arconic Corporation is the plan sponsor of certain other non-U.S.

defined benefit plans that contain participants related only to the underlying operations of the Company and, therefore, the related benefit plan expense (excluding settlements and curtailments) was recorded in accordance with defined benefit

plan accounting in all periods presented. See footnote 3 to the Reconciliation of Total Company Adjusted EBITDA included in this presentation for additional information.4) Metal price lag represents the financial impact of the timing difference

between when aluminum prices included in Sales are recognized and when aluminum purchase prices included in Cost of goods sold are realized. This adjustment aims to remove the effect of the volatility in metal prices and the calculation of this

impact considers applicable metal hedging transactions.5) Other special items include the following:for the quarter ended March 31, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the

following matters: a company-wide strategy and portfolio review by management ($3), the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($1), and a legal matter referred to as Grenfell Tower ($1);for the

quarter ended June 30, 2019, a charge for an ongoing environmental remediation matter referred to as Grasse River ($25) and an allocation of costs incurred by Arconic Corporation’s former parent company associated with the following matters:

the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($9), negotiation of a collective bargaining agreement with the United Steelworkers ($9), and a legal matter referred to as Grenfell Tower ($2);for the

quarter ended September 30, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies;for the quarter ended

December 31, 2019, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded companies ($17) and a legal matter referred to as

Grenfell Tower ($1);for the quarter ended March 31, 2020, an allocation of costs incurred by Arconic Corporation’s former parent company associated with the April 1, 2020 separation of Arconic Inc. into two standalone publicly-traded

companies;for the quarter ended June 30, 2020, costs related to several legal matters, including customer settlement ($5), Grenfell Tower ($3), and other ($3); andfor the quarter ended September 30, 2020, costs related to several legal matters,

including Grenfell Tower ($4) and other ($2), a write-down of inventory related to the curtailment of the casthouse operations at the Chandler (Arizona) extrusions facility ($5), and other ($2).6) This adjustment reflects a proxy of non-service

cost associated with certain defined benefit pension and other postretirement plan obligations had standalone plans existed for all the Company’s participants instead of participating in defined benefit plans sponsored by Arconic Corporation’s

former parent company (see footnote 3 above).7) Net debt is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management assesses Arconic Corporation’s leverage position after considering

available cash that could be used to repay outstanding debt. 20 Reconciliation of Net Debt to Adjusted EBITDA, excluding non-service costs (cont’d)

21 Adjusted EBITDA to Free Cash Flow Bridge ($M) Quarter endedSeptember 30, 2020 Adjusted

EBITDA(1) $165 Change in working capital(2) 185 Cash payments for: Environmental remediation (Grasse River) (33) Other postretirement benefits (14) Restructuring actions (5) Interest (19) Income taxes (3) Capital

expenditures (39) Other (36) Free Cash Flow(3)(4) $201 Arconic Corporation’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for the following items:

Provision for depreciation and amortization; Stock-based compensation; Metal price lag; and Other special items. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation and amortization. Special items are composed of restructuring and other charges, discrete income tax items, and other items as deemed appropriate by management. There

can be no assurances that additional special items will not occur in future periods. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional

information with respect to Arconic Corporation’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. The

Company has provided a reconciliation of this non-GAAP measure to the most directly comparable GAAP measure in this presentation (see the Reconciliation of Total Company Adjusted EBITDA presented elsewhere in this Appendix). Arconic

Corporation’s definition of working capital is Receivables plus Inventories less Accounts payable, trade.Arconic Corporation’s definition of Free Cash Flow is Cash from operations less capital expenditures. Free Cash Flow is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations after taking into consideration capital expenditures, which are both necessary to maintain and

expand Arconic Corporation’s asset base and expected to generate future cash flows from operations. It is important to note that Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other

non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. 3Q 2020: Cash provided from operations of $240M less capital expenditures of $39M = consolidated free cash flow of $201M.

Reconciliation of Total Company Organic Revenue by End Market 22 Organic revenue is a non-GAAP

financial measure. Management believes this measure is meaningful to investors as it presents revenue on a comparable basis for all periods presented due to the impact of the sale of an aluminum rolling mill in Brazil (divested in February

2020), the sale of a hard alloy extrusions plant in South Korea (divested in March 2020), and the impact of changes in aluminum prices and foreign currency fluctuations relative to the prior year period. ($M) Ground Transportation Building

and Construction Aerospace Packaging Industrial Products and Other Total 2Q19 Revenue $666 $345 $344 $241 $327 $1,923 Less: Sales – Itapissuma 3 6 — 25 8 42 Sales –

Changwon — — 9 — 4 13 Organic Revenue $663 $339 $335 $216 $315 $1,868 2Q20 Revenue $257 $263 $237 $195 $239 $1,191 Less: Aluminum price impact (23) (6) (9) (22) (18) (78)

Foreign currency impact (2) (2) (1) (3) (8) (16) Organic Revenue $282 $271 $247 $220 $265 $1,285 3Q19 Revenue $618 $329 $311 $236 $311 $1,805 Less: Sales –

Itapissuma 3 3 — 22 5 33 Sales – Changwon — — 4 — 9 13 Organic Revenue $615 $326 $307 $214 $297 $1,759 3Q20 Revenue $518 $283 $151 $198 $265 $1,415 Less: Aluminum price

impact (36) (4) (3) (8) (25) (76) Foreign currency impact 3 3 (1) (1) 2 6 Organic Revenue $551 $284 $155 $207 $288 $1,485

Reconciliation of Organic Revenue by Segment 23 ($M) Quarter ended September

30, 2019 2020 Total Revenue $1,805 $1,415 Less: Revenue – Itapissuma 33 - Revenue – South Korea 13 - Aluminum price impact n/a

(76) Foreign currency impact n/a 6 Organic revenue $1,759 $1,485 Rolled Products Revenue $1,397 $1,092 Less: Revenue – Itapissuma 33 -

Aluminum price impact n/a (72) Foreign currency impact n/a 2 Organic revenue $1,364 $1,162 Building and Construction Systems Revenue $282 $241

Less: Aluminum price impact n/a (1) Foreign currency impact n/a 4 Organic revenue $282 $238 Extrusions Revenue $126 $82

Less: Revenue – South Korea 13 - Aluminum price impact n/a (3) Foreign currency impact n/a - Organic revenue $113 $85 Organic revenue is a non-GAAP financial

measure. Management believes this measure is meaningful to investors as it presents revenue on a comparable basis for all periods presented due to the impact of the sale of an aluminum rolling mill in Brazil (divested in February 2020), the

sale of a hard alloy extrusions plant in South Korea (divested in March 2020), and the impact of changes in aluminum prices and foreign currency fluctuations relative to the prior year period.