Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TCG BDC, INC. | cgbd3q208-kearnings.htm |

| EX-99.1 - EX-99.1 - TCG BDC, INC. | cgbd3q20ex991earningspr.htm |

R-0 R-8 G-74 G-51 B-13 B-94 6 R-9 R-11 G-10 8 2 G-92 B-11 B-15 R-232 0 4 R-88 G- G-15 234 9 B-23 B-16 R-20 4 5 8 R-13 G-23 6 2 G-18 B-24 0 R-977 R-14B-83 G-16 0 1 G-14 B-22 1 R-234 OldB-15 R-12 7 Color2 0 G-21 s G-16 7 9 B-15 R-14 B-22 7 7 R-162 G-19 3 5 TCG BDC, INC. REPORTS THIRD G-14 B-19 3 7 QUARTER 2020 FINANCIAL RESULTS B-18 R-147 R-65 7 G-64 NOVEMBER 4, 2020 EXHIBIT 99.2 G-19 B-66 5 B-19 R-187 R-88 5 G-89 G-21 B-91 1 R-16 B-15 7 R-223 G-16 0 9 G-22 B-17 1 R-22 1 B-23 0 2 G-22 1 B-22 2

R-0 R-43 G-101 G-131 B-179 Disclaimer and Forward-Looking Statements B-35 R-145 This presentation (the “Presentation”) has been prepared by TCG BDC, Inc. (together with its consolidated subsidiaries, “we,” “us,” “our,” “TCG BDC” or the “Company”) R-156 G-213 (NASDAQ: CGBD) and may only be used for informational purposes only. This Presentation should be viewed in conjunction with the earnings conference call of the G-226 Company held on November 5, 2020 and the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2020. The information contained herein B-242 may not be used, reproduced, referenced, quoted, linked by website, or distributed to others, in whole or in part, except as agreed in writing by the Company. B-146 This Presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities in any state or jurisdiction in which such offer, solicitation or sale R-61 would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. R-163 G-175 This Presentation provides limited information regarding the Company and is not intended to be taken by, and should not be taken by, any individual recipient as G-143 B-46 investment advice, a recommendation to buy, hold or sell, or an offer to sell or a solicitation of offers to purchase, our common stock or any other securities that may be B-187 issued by the Company, or as legal, accounting or tax advice. An investment in securities of the type described herein presents certain risks. U This Presentation may contain forward-looking statements that involve substantial risks and uncertainties, including the impact of COVID-19 on the business. You can R-145 identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” R-127 se G-229 “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify G-127 co forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because B-0 B-127 lo they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. rs You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make them. Factors or events that could cause in R-85 our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections R-219 pr entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission (the G-67 “SEC”), and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as G-217 ef B-113 a result of new information, future events or otherwise, except as required by law. B-217 er Information throughout the Presentation provided by sources other than the Company (including information relating to portfolio companies) has not been independently re verified and, accordingly, the Company makes no representation or warranty in respect of this information. White d R-118 The following slides contain summaries of certain financial and statistical information about the Company. The information contained in this Presentation is summary R-255 or G-92 information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from de time to time. We undertake no duty or obligation to publicly update or revise the information contained in this Presentation. G-255 B-150 B-255 r TCG BDC is managed by Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”), an SEC-registered investment adviser and a wholly owned fo subsidiary of The Carlyle Group Inc. (together with its affiliates, “Carlyle”). Colors Text Dark Blue r R-0 This Presentation contains information about the Company and certain of its affiliates and includes the Company’s historical performance. You should not view be information related to the past performance of the Company as indicative of the Company’s future results, the achievement of which is dependent on many factors, R-0 G-161 many of which are beyond the control of the Company and the Investment Adviser and cannot be assured. There can be no assurances that future dividends will match G-74 st B-224 or exceed historical rates or will be paid at all. Further, an investment in the Company is discrete from, and does not represent an interest in, any other Carlyle entity. B-136 re Nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance of the Company or any other Carlyle entity. su Blue lts R-189 R-0 G-230 G-161 B-247 2 B-224

Draft R-0 R-85 G-101 G-67 B-179 TCG BDC Highlights B-113 R-0 • Middle-market lending focused BDC externally managed by Carlyle (1) R-118 G-161 (2) G-92 B-224 TCG BDC • Current market capitalization of $478 million (NASDAQ listed; ticker: CGBD) B-150 Overview • Track record of consistent dividend delivery to shareholders – LTM dividend yield on quarter-end net asset value ("NAV") of 11.1% R-145 R-163 G-213 G-143 B-242 B-187 • Directly originate private credit investments, with a focus on U.S. private equity finance R-189 Investment • Maintain appropriately diversified, defensively oriented portfolio of primarily senior secured debt R-154 G-230 instruments G-155 B-247 Strategy • Utilize Carlyle's extensive platform resources to generate differentiated results for TCG BDC B-156 shareholders R-43 R-219 G-131 G-217 B-35 • Founded in 1987, Carlyle is a leading global investment firm with $230bn of AUM B-217 Benefits of • Carlyle’s Global Credit segment, with $53bn of AUM, has a 20-year track record of successful credit investing R-61 Text G-175 Carlyle • Carlyle’s broad capabilities, scaled capital base and depth of expertise create sustainable Colors B-46 competitive advantages across market environments White R-255 G-255 R-145 • Well-diversified by issuer and industry: top 10 borrowers and top 3 industries 20% and 29% of B-255 G-229 exposure, respectively B-0 Defensively • Heavy portfolio tilt to 1st lien loans: historically 70% of portfolio, of which, >90% contain a financial Dark Blue Positioned Portfolio covenant (3) R-156 R-0 • Approximately half the exposure of broader markets to cyclical industries G-74 G-226 B-136 B-146 Source: The Carlyle Group Inc. As of September 30, 2020 unless otherwise stated. (1) TCG BDC is externally managed by the Investment Adviser, which is a wholly-owned subsidiary of The Carlyle Group Inc. (2) As of November 3, 2020 (3) LTM average of approximately 70% 3 of fair value, and excludes loans categorized as first lien last out. Blue R-145 G-229 B-0

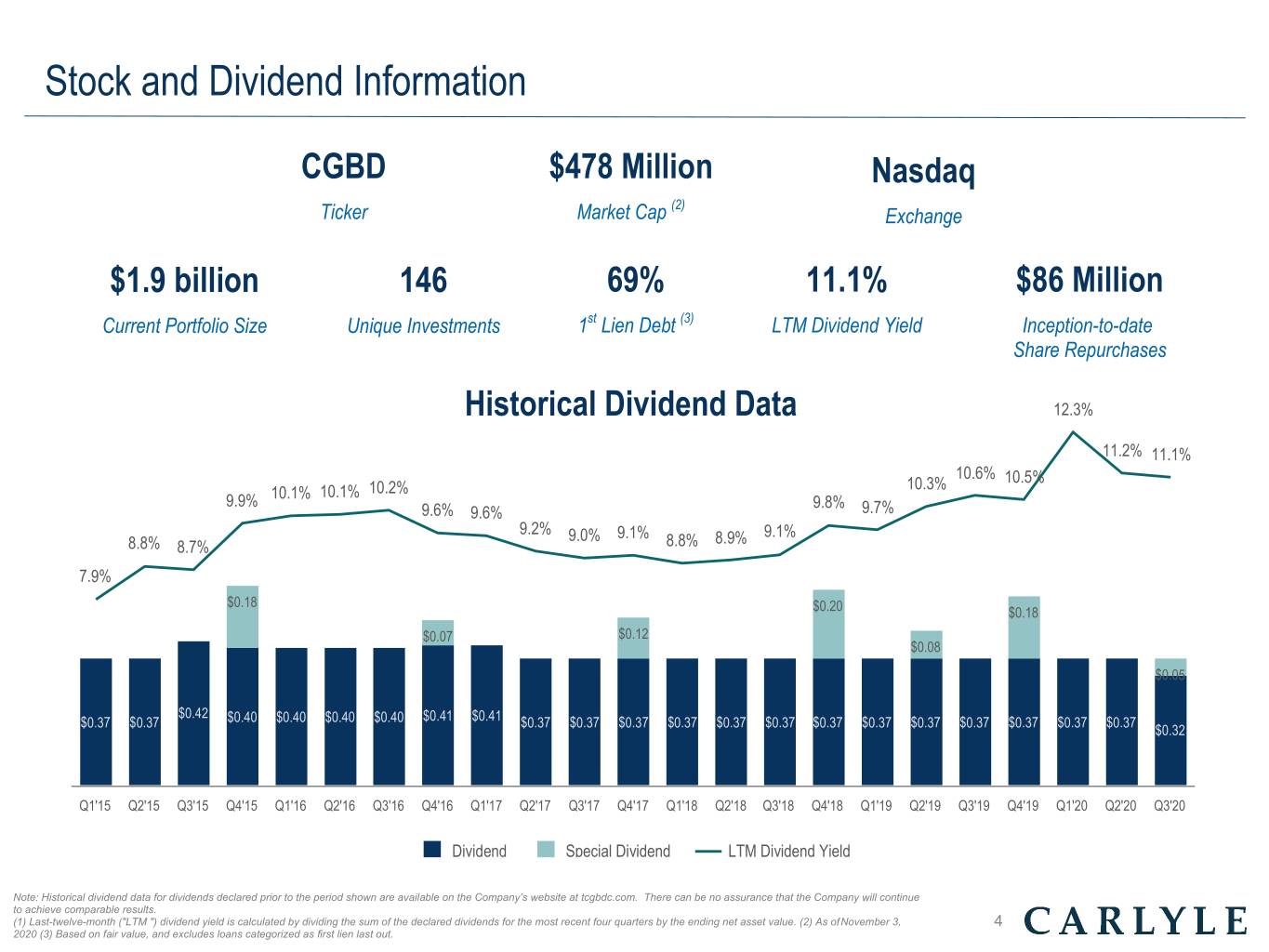

R-0 R-43 G-101 G-131 B-179 Stock and Dividend Information B-35 R-145 R-156 G-213 CGBD $478 Million Nasdaq G-226 B-242 (2) B-146 Ticker Market Cap Exchange R-61 R-163 G-175 $1.9 billion 146 69% 11.1% $86 Million G-143 B-46 Current Portfolio Size Unique Investments 1st Lien Debt (3) LTM Dividend Yield Inception-to-date B-187 Share Repurchases U R-145 R-127 se G-229 Historical Dividend Data 12.3% G-127 co B-0 B-127 lo 11.2% 11.1% 10.6% rs 10.3% 10.5% 10.1% 10.1% 10.2% in 9.9% 9.8% R-85 9.6% 9.6% 9.7% R-219 pr 9.2% G-67 9.0% 9.1% 8.9% 9.1% G-217 8.8% 8.7% 8.8% ef B-113 B-217 er 7.9% re $0.18 $0.20 d $0.18 White R-118 $0.07 $0.12 or $0.08 R-255 G-92 G-255 de $0.05 B-150 B-255 r $0.42 Colors Text fo $0.37 $0.37 $0.40 $0.40 $0.40 $0.40 $0.41 $0.41 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.37 $0.32 Dark Blue r R-0 be R-0 G-161 G-74 st B-224 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 B-136 re su Dividend Special Dividend LTM Dividend Yield Blue lts R-189 R-0 G-230 Note: Historical dividend data for dividends declared prior to the period shown are available on the Company’s website at tcgbdc.com. There can be no assurance that the Company will continue to achieve comparable results. G-161 B-247 (1) Last-twelve-month ("LTM ") dividend yield is calculated by dividing the sum of the declared dividends for the most recent four quarters by the ending net asset value. (2) As of November 3, 4 2020 (3) Based on fair value, and excludes loans categorized as first lien last out. B-224

Draft R-0 R-85 G-101 G-67 B-179 Q3 2020 Quarterly Results B-113 • Net investment income per common share, net of the preferred dividend, was $0.36, comfortably R-0 R-118 covering the regular dividend of $0.32 G-161 G-92 B-224 rd • There were no additional investments put on non-accrual status during the quarter, while risk rated B-150 3 Quarter 3-5 assets declined by approximately 2% R-145 R-163 Results • Net realized and unrealized gains totaled $12 million, or approximately $0.22 per common share G-213 G-143 B-242 • NAV per common share increased to $15.01 (up 1.4% from $14.80 last quarter), driven largely by B-187 underlying credit improvement and tightening yield benchmarks R-189 R-154 G-230 G-155 B-247 • Total investments at fair value were flat compared to last quarter at $1.9 billion B-156 • New fundings totaled $61 million with a yield of 8.78% and repayment/sale activity totaled $36 Portfolio & million with a yield of 8.44% R-43 R-219 G-131 Investment • Borrower financial performance and liquidity continues to improve alongside the economic G-217 B-35 recovery, while the new deal environment is on a path to normalization B-217 Activity • On November 3, we formed Middle Market Credit Fund II, LLC, an 84% owned joint-venture with a leading institutional credit investor, further solidifying our balance sheet position R-61 Text G-175 Colors B-46 White • Paid Q3 dividend at new regular level of $0.32 per common share, plus a special $0.05 dividend R-255 per common share, resulting in a LTM dividend yield of 11.1% based on quarter-end NAV G-255 R-145 Dividend & B-255 G-229 • Declared Q4 dividend of $0.32 per common share, plus a special $0.04 dividend per common B-0 Capital share Dark Blue Activity • Closed successful amendment to the corporate revolver facility that extended the reinvestment R-156 R-0 period and final maturity by one year G-74 G-226 B-136 B-146 5 Blue R-145 G-229 B-0

Draft R-0 R-85 G-101 G-67 B-179 TCG BDC Portfolio Highlights B-113 (1) R-0 Key Statistics Diversification by Borrower R-118 G-161 G-92 B-224 Total Investments and Commitments ($mm) $2,073 B-150 10% Unfunded Commitments (1) ($mm) $125 20% R-145 Investments at Fair Value ($mm) $1,948 R-163 G-213 G-143 (2) Top 10 Investments B-242 Yield of Debt Investments at Cost (%) 7.44 % Next 11-25 Investments B-187 Yield of Debt Investments at Fair Value (2) (%) 7.94 % Remaining Investments Investment Fund R-189 Number of Investments 146 23% R-154 47% G-230 G-155 Number of Portfolio Companies 114 B-247 B-156 Floating / Fixed (3) (%) 99.1% / 0.9% R-43 R-219 G-131 Asset Mix Diversification by Industry G-217 B-35 B-217 10% 11% R-61 Text 2% G-175 First Lien Debt High Tech Industries Colors Investment Fund B-46 (ex Unitranche) 32% 10% White First Lien/Last Out 15% Business Services Unitranche Healthcare & Pharmaceuticals R-255 Second Banking, Finance, Insurance & Real Estate G-255 R-145 Lien Debt Telecommunications 8% B-255 G-229 Equity Aerospace & Defense 4% B-0 Investments Software Investment Beverage, Food & Tobacco 7% 69% 4% Fund All Others Dark Blue R-156 6% 6% R-0 6% 6% G-74 G-226 B-136 B-146 (1) Excludes the Company’s commitments to fund capital to Middle Market Credit Fund, LLC ("Credit Fund"), which is not consolidated with the Company. (2) Weighted average yields of the debt investments include the effect of accretion of discounts and amortization of premiums and are based on interest rates as of period end. Actual yields earned over the life of each investment could differ materially from the yields presented above. Weighted average yields for TCG BDC do not include TCG BDC’s 6 investment in Credit Fund. (3) % of fair value of first and second lien debt. Blue R-145 G-229 B-0

R-0 R-43 G-101 G-131 B-179 Financial Performance Summary B-35 R-145 (Dollar amounts in thousands, except per share data) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 R-156 G-213 Net Asset Value Per Common Share G-226 B-242 (1) B-146 Net Investment Income Per Common Share $0.45 $0.43 $0.42 $0.38 $0.36 Net Realized & Unrealized Gain (Loss) Per Common Share (0.60) 0.02 (2.57) 0.61 0.22 R-61 Net Income (Loss) Per Common Share (0.15) 0.46 (2.15) 0.99 0.58 R-163 G-175 Dividends Paid Per Common Share 0.37 0.55 0.37 0.37 0.37 G-143 B-46 B-187 Impact of Share Repurchases Per Common Share 0.04 0.06 0.14 — — U Net Asset Value Per Common Share $16.58 $16.56 $14.18 $14.80 $15.01 R-145 R-127 se G-229 Common Shares Outstanding (in thousands) G-127 co B-0 B-127 lo Weighted Average Common Shares Outstanding for the Period 59,588 58,785 59,588 56,309 56,309 rs Common Shares Outstanding at End of Period 59,013 57,764 56,309 56,309 56,309 in R-85 Portfolio Highlights R-219 pr G-67 G-217 ef B-113 Total Fair Value of Investments $2,126,688 $2,123,964 $2,024,277 $1,907,555 $1,948,173 B-217 er Number of Portfolio Companies 110 112 110 111 114 re (2) Average Size of Investment in Portfolio Company (Notional) $20,828 $19,848 $20,337 $18,380 $19,119 White d R-118 (3) R-255 or G-92 Weighted Average all-in Yield on Investments at Amortized Cost 8.88 % 8.22 % 7.74 % 7.34 % 7.44 % de (3) G-255 B-150 Weighted Average all-in Yield on Investments at Fair Value 9.33 % 8.50 % 8.56 % 7.90 % 7.94 % B-255 r fo Debt to Equity Colors Text Dark Blue r R-0 Net Assets $978,601 $956,471 $798,534 $883,304 $895,222 be R-0 G-161 Debt $1,202,739 $1,177,832 $1,262,960 $1,035,799 $1,074,806 G-74 st (4) B-224 Net Financial Leverage at Quarter End 1.17x 1.20x B-136 re Statutory Debt To Equity at Quarter End (5) 1.23x 1.23x 1.58x 1.31x 1.33x su Blue lts R-189 Note: The net asset value per common share and dividends declared per common share are based on the common shares outstanding at each respective quarter-end. Net investment income per common share and net change in realized and unrealized gain (loss) per common share are based on the weighted average number of common shares outstanding for the R-0 G-230 period. (1) Net of the preferred dividend. (2) Excludes equity investments. (3) Weighted average yields include the effect of accretion of discounts and amortization of premiums and are G-161 based on interest rates as of each respective period end. Actual yields earned over the life of each investment could differ materially from the yields presented above. (4) Reflects B-247 cumulative convertible preferred securities as equity. (5) Reflects cumulative convertible preferred securities as debt. These securities are considered "senior securities" for the purposes 7 B-224 of calculating asset coverage pursuant to the Investment Company Act.

R-0 R-43 G-101 G-131 B-179 Origination Activity Detail B-35 R-145 R-156 G-213 (Dollar amounts in thousands and based on par/principal) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 G-226 B-242 B-146 TCG BDC Originations and Net Investment Activity Investment Fundings $ 237,004 $ 289,763 $ 328,119 $ 63,080 $ 60,826 R-61 R-163 Unfunded Commitments, Net Change 719 (23,963) (45,902) 13,630 7,706 G-175 G-143 B-46 Sales and Repayments (165,672) (319,882) (288,190) (264,200) (36,441) B-187 Net Investment Activity $ 72,051 $ (54,082) $ (5,973) $ (187,490) $ 32,091 U R-145 R-127 se G-229 G-127 co TCG BDC Originations by Asset Type B-0 B-127 lo First Lien Debt 68.10 % 87.80 % 43.87 % 65.43 % 99.41 % rs First Lien, Last-out Debt 12.25 % 3.50 % — % 33.17 % — % in R-85 R-219 pr G-67 Second Lien Debt 19.32 % 7.92 % 50.03 % 0.58 % — % G-217 ef B-113 Equity Investments 0.33 % 0.78 % 6.10 % 0.82 % 0.59 % B-217 er re (1) White d R-118 TCG BDC Total Investment Portfolio at Fair Value R-255 or G-92 de First Lien Debt 68.05 % 74.63 % 73.02 % 69.03 % 69.01 % G-255 B-150 B-255 r First Lien, Last-out Debt 10.04 % 3.68 % 2.79 % 4.10 % 4.04 % fo Colors Text Second Lien Debt 10.92 % 11.04 % 13.59 % 14.61 % 14.77 % Dark Blue r R-0 be Equity Investments 1.44 % 1.02 % 1.45 % 1.66 % 1.69 % R-0 G-161 G-74 st B-224 Investment Fund / Credit Fund 9.55 % 9.63 % 9.15 % 10.60 % 10.49 % B-136 re su Blue lts R-189 Please refer to the Company’s Form 10-Q for the period ended ended September 30, 2020 (“Form 10-Q”) for more information. No assurance is given that the Company will continue to R-0 G-230 achieve comparable results. (1) At quarter end. G-161 B-247 8 B-224

R-0 R-43 G-101 G-131 B-179 Quarterly Operating Results Detail B-35 R-145 (Dollar amounts in thousands) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 R-156 G-213 Investment Income G-226 B-242 B-146 Interest Income $45,168 $44,248 $41,009 $35,026 $33,114 Payment-In-Kind Interest Income 2,396 910 643 1,202 1,810 R-61 R-163 G-175 Income From Credit Fund 6,459 7,028 6,549 5,500 5,750 G-143 B-46 Other Income 1,756 1,279 2,344 3,547 2,110 B-187 Total Investment Income $55,779 $53,465 $50,545 $45,275 $42,784 U R-145 R-127 se G-229 (Dollar amounts in thousands) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 G-127 co B-0 B-127 lo Expenses rs (1) Management Fees 8,016 7,702 7,386 7,065 7,134 in R-85 R-219 Incentive Fees (2) 5,710 5,383 5,086 4,667 4,322 pr G-67 G-217 ef B-113 Interest Expense & Credit Facility Fees 14,083 13,321 12,769 10,231 8,019 B-217 er re Other Expenses 1,166 1,447 1,280 1,520 1,688 White d R-118 Excise Tax Expense 49 235 52 100 387 R-255 or G-92 de Net Expenses 29,024 28,088 26,573 23,583 21,550 G-255 B-150 B-255 r fo Colors Text Net Investment Income 26,755 25,377 23,972 21,692 21,234 Dark Blue r R-0 be Net Realized and Unrealized Gains (Losses) (35,744) 1,459 (145,072) 34,466 12,374 R-0 G-161 G-74 st B-224 Net Income (Loss) $(8,989) $26,836 $(121,100) $56,158 $33,608 B-136 re (1) Beginning October 1, 2017, the base management fee is calculated at an annual rate of 1.50% of the Company’s gross assets, excluding cash and cash equivalents but including assets acquired su through the use of leverage. In addition, on August 6, 2018, the Company's Board of Directors approved a one-third (0.50%) reduction in the 1.50% annual base management fee rate charged by the Investment Adviser on assets financed using leverage in excess of 1.0x debt to equity. Effective July 1, 2018, the reduced annual fee of 1.00% applies to the average value of the Company's gross Blue lts R-189 assets as of the end of the two most recently completed calendar quarters that exceeds the product of (i) 200% and (ii) the average value of the Company's net asset value at the end of the two most R-0 G-230 recently completed calendar quarters. (2) Effective October 1, 2017, the Investment Adviser agreed to charge 17.5% instead of 20% with respect to the entire calculation of the incentive fee. G-161 B-247 Note: There can be no assurance that we will continue to earn income at this rate and our income may decline. If our income declines, we may reduce the dividend we pay and the yield you earn may 9 decline. Refer to the consolidated financial statements included in Part I, Item 1 of the Company’s Form 10-Q for additional details. B-224

R-0 R-43 G-101 G-131 B-179 Quarterly Balance Sheet Detail B-35 R-145 (Dollar amounts in thousands, except per share data) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 R-156 G-213 Assets G-226 B-242 Investments—non-controlled/non-affiliated, at fair value $1,893,216 $1,897,057 $1,826,422 $1,692,073 $1,737,044 B-146 Investments—non-controlled/affiliated, at fair value 6,607 — — — — Investments—controlled/affiliated, at fair value 226,865 226,907 197,855 215,482 211,129 R-61 Total investments, at fair value 2,126,688 2,123,964 2,024,277 1,907,555 1,948,173 R-163 G-175 Cash and cash equivalents 70,281 36,751 65,525 29,916 37,088 G-143 B-46 Receivable for investment sold 5,725 6,162 15,655 53 74 B-187 Deferred financing costs 4,687 4,032 4,026 3,749 3,651 U R-145 Interest Receivable from Non-Controlled/Non-Affiliated/Affiliated Investments 11,561 9,462 10,406 10,873 12,791 R-127 se G-229 Interest and Dividend Receivable from Controlled/Affiliated Investments 6,951 6,845 6,350 5,589 5,754 G-127 co B-0 Prepaid expenses and other assets 97 317 587 899 856 B-127 lo Total assets $2,225,990 $2,187,533 $2,126,826 $1,958,634 $2,008,387 rs in R-85 R-219 pr Liabilities G-67 Payable for investments purchased $11 $— $24,345 $61 $— G-217 ef B-113 B-217 er Secured borrowings 756,511 616,543 701,609 474,386 513,332 re 2015-1 Notes payable, net of unamortized debt issuance costs 446,228 446,289 446,351 446,413 446,474 White d R-118 Senior Notes — 115,000 115,000 115,000 115,000 or Due to Investment Adviser 142 — — — — R-255 G-92 G-255 de Interest and credit facility fees payable 7,680 6,764 6,100 4,532 3,405 B-150 B-255 r Dividend payable 21,825 31,760 20,824 21,379 20,830 fo Colors Text Base management and incentive fees payable 13,726 13,236 12,333 11,572 11,473 Dark Blue r R-0 Administrative service fees payable 66 77 98 129 85 be R-0 G-161 Other accrued expenses and liabilities 1,200 1,393 1,632 1,858 2,566 G-74 st B-224 Total liabilities 1,247,389 1,231,062 1,328,292 1,075,330 1,113,165 B-136 re su Net assets 978,601 956,471 798,534 883,304 895,222 Blue lts R-189 Total liabilities & net assets $2,225,990 $2,187,533 $2,126,826 $1,958,634 $2,008,387 Net Asset Value Per Common Share $16.58 $16.56 $14.18 $14.80 $15.01 R-0 G-230 G-161 Please refer to the Company’s Form 10-Q for more information. B-247 10 B-224

Draft R-0 R-85 G-101 G-67 B-179 Credit Fund Update (10% of TCG BDC Portfolio) B-113 R-0 Credit Fund Key Statistics Portfolio Composition R-118 G-161 G-92 B-224 B-150 Diversification by Borrower Diversification by Industry Total Investments and Commitments ($mm) $1,376 R-145 Unfunded Commitments ($mm) $85 R-163 G-213 G-143 B-242 Investments at Fair Value ($mm) $1,291 B-187 Yield of Debt Investments (%) (1) 5.95 % R-189 Number of Investments 65 R-154 G-230 First Lien Exposure (%) (2) 96% G-155 B-247 B-156 Floating / Fixed (%) (3) 98.3% / 1.7% R-43 Dividend Yield to TCG BDC 11 % R-219 G-131 G-217 B-35 B-217 R-61 Text G-175 (Dollar amounts in thousands and based on par/principal) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Colors B-46 Credit Fund Originations and Net Investment Activity White R-255 Investment Fundings $ 93,821 $ 139,134 $ 179,383 $ 56,795 $ 46,575 G-255 R-145 Unfunded Commitments, Net Change 1,429 11,101 (33,615) (26,933) 18,929 B-255 G-229 B-0 Sales and Repayments (154,969) (165,292) (141,762) (39,584) (31,413) Net Investment Activity $ (59,719) $ (15,057) $ 4,006 $ (9,722) $ 34,091 Dark Blue R-156 R-0 G-74 G-226 B-136 B-146 (1) Weighted average yields at cost of the debt investments include the effect of accretion of discounts and amortization of premiums and are based on interest rates as of period end. Actual yields earned over the life of each investment could differ materially from the yields presented above. (2) First lien, excluding loans categorized as first lien last out, as a % of fair value. (3) % of 11 fair value of first and second lien debt. Blue R-145 G-229 B-0

R-0 R-43 G-101 G-131 B-179 Net Asset Value Per Common Share Bridge B-35 R-145 R-156 G-213 Third Quarter 2020 YTD 3Q 2020 G-226 B-242 B-146 $1.16 R-61 $0.36 R-163 G-175 G-143 B-46 $0.22 B-187 $15.01 U R-145 R-127 se G-229 $16.56 $(1.11) G-127 co $14.80 $(0.37) B-0 B-127 lo rs in R-85 R-219 pr G-67 $0.14 G-217 ef B-113 B-217 er $15.01 re $(1.74) White d R-118 R-255 or G-92 de G-255 B-150 June 30, 2020 Net Investment Dividend Net Realized and September 30, December 31, Net Dividend Net Realized Impact of September B-255 r NAV Income Declared Unrealized Gain 2020 NAV 2019 NAV Investment Declared and Share 30, 2020 NAV fo (Loss) Income Unrealized Repurchases Colors Text Dark Blue r R-0 Gain (Loss) be R-0 G-161 G-74 st B-224 B-136 re su Blue lts R-189 R-0 G-230 Note: The net asset value per common share and dividends declared per common share are based on the common shares outstanding at each respective quarter-end. Net investment income per common share and net realized and unrealized gain (loss) per common share are based on the weighted average number of common shares outstanding for the period. Net G-161 investment Income is also net of the preferred dividend. B-247 12 B-224

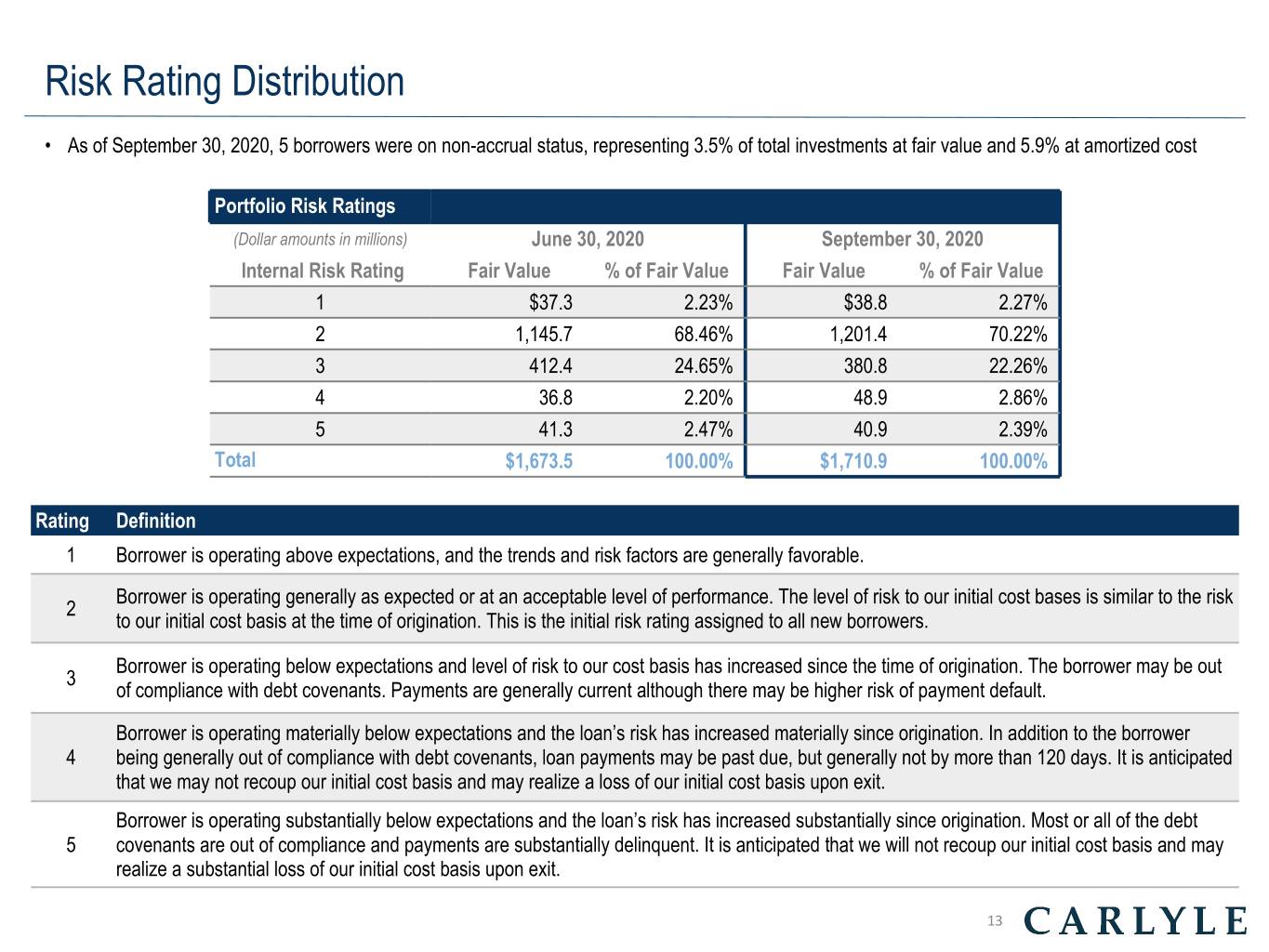

R-0 R-43 G-101 G-131 B-179 Risk Rating Distribution B-35 R-145 • As of September 30, 2020, 5 borrowers were on non-accrual status, representing 3.5% of total investments at fair value and 5.9% at amortized cost R-156 G-213 G-226 B-242 Portfolio Risk Ratings B-146 (Dollar amounts in millions) June 30, 2020 September 30, 2020 R-61 Internal Risk Rating Fair Value % of Fair Value Fair Value % of Fair Value R-163 G-175 1 $37.3 2.23 % $38.8 2.27 % G-143 B-46 B-187 2 1,145.7 68.46 % 1,201.4 70.22 % 3 412.4 24.65 % 380.8 22.26 % U R-145 R-127 se 4 36.8 2.20 % 48.9 2.86 % G-229 G-127 co B-0 5 41.3 2.47 % 40.9 2.39 % B-127 lo Total $1,673.5 100.00 % $1,710.9 100.00 % rs in R-85 Rating Definition R-219 pr G-67 G-217 ef B-113 1 Borrower is operating above expectations, and the trends and risk factors are generally favorable. B-217 er re Borrower is operating generally as expected or at an acceptable level of performance. The level of risk to our initial cost bases is similar to the risk 2 White d R-118 to our initial cost basis at the time of origination. This is the initial risk rating assigned to all new borrowers. R-255 or G-92 de Borrower is operating below expectations and level of risk to our cost basis has increased since the time of origination. The borrower may be out G-255 B-150 3 B-255 r of compliance with debt covenants. Payments are generally current although there may be higher risk of payment default. fo Colors Text Borrower is operating materially below expectations and the loan’s risk has increased materially since origination. In addition to the borrower r Dark Blue R-0 4 being generally out of compliance with debt covenants, loan payments may be past due, but generally not by more than 120 days. It is anticipated be R-0 G-161 that we may not recoup our initial cost basis and may realize a loss of our initial cost basis upon exit. G-74 st B-224 B-136 re Borrower is operating substantially below expectations and the loan’s risk has increased substantially since origination. Most or all of the debt su 5 covenants are out of compliance and payments are substantially delinquent. It is anticipated that we will not recoup our initial cost basis and may Blue lts R-189 realize a substantial loss of our initial cost basis upon exit. R-0 G-230 G-161 B-247 13 B-224

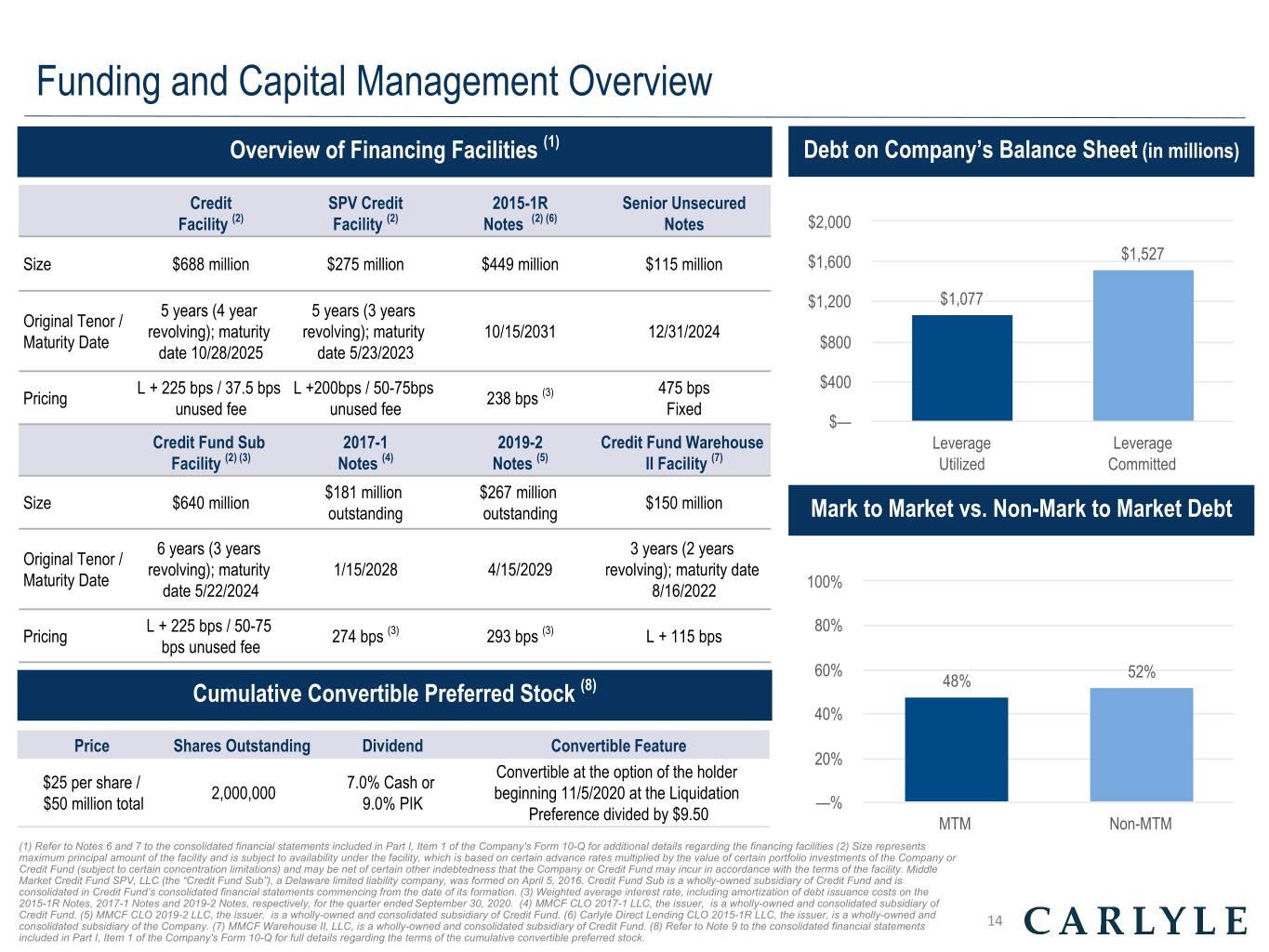

R-0 R-43 G-101 G-131 B-179 Funding and Capital Management Overview B-35 R-145 Overview of Financing Facilities (1) Debt on Company’s Balance Sheet (in millions) R-156 G-213 G-226 B-242 Credit SPV Credit 2015-1R Senior Unsecured B-146 Facility (2) Facility (2) Notes (2) (6) Notes $2,000 $1,527 R-61 Size $688 million $275 million $449 million $115 million $1,600 R-163 G-175 $1,200 $1,077 G-143 5 years (4 year 5 years (3 years B-46 Original Tenor / B-187 revolving); maturity revolving); maturity 10/15/2031 12/31/2024 Maturity Date $800 date 10/28/2025 date 5/23/2023 U $400 R-145 L + 225 bps / 37.5 bps L +200bps / 50-75bps (3) 475 bps R-127 se Pricing 238 bps G-229 unused fee unused fee Fixed G-127 co $— B-0 B-127 lo Credit Fund Sub 2017-1 2019-2 Credit Fund Warehouse Leverage Leverage Facility (2) (3) Notes (4) Notes (5) II Facility (7) Utilized Committed rs $181 million $267 million in Size $640 million $150 million R-85 outstanding outstanding Mark to Market vs. Non-Mark to Market Debt R-219 pr G-67 G-217 6 years (3 years 3 years (2 years ef Original Tenor / B-113 revolving); maturity 1/15/2028 4/15/2029 revolving); maturity date B-217 er Maturity Date 100% re date 5/22/2024 8/16/2022 White d R-118 L + 225 bps / 50-75 (3) (3) 80% Pricing 274 bps 293 bps L + 115 bps R-255 or G-92 bps unused fee de 60% 52% G-255 B-150 (8) 48% B-255 r Cumulative Convertible Preferred Stock fo 40% Colors Text Dark Blue r R-0 Price Shares Outstanding Dividend Convertible Feature 20% R-0 be Convertible at the option of the holder G-161 $25 per share / 7.0% Cash or G-74 st 2,000,000 beginning 11/5/2020 at the Liquidation B-224 $50 million total 9.0% PIK —% Preference divided by $9.50 B-136 re MTM Non-MTM su (1) Refer to Notes 6 and 7 to the consolidated financial statements included in Part I, Item 1 of the Company's Form 10-Q for additional details regarding the financing facilities (2) Size represents maximum principal amount of the facility and is subject to availability under the facility, which is based on certain advance rates multiplied by the value of certain portfolio investments of the Company or Blue lts R-189 Credit Fund (subject to certain concentration limitations) and may be net of certain other indebtedness that the Company or Credit Fund may incur in accordance with the terms of the facility. Middle Market Credit Fund SPV, LLC (the “Credit Fund Sub”), a Delaware limited liability company, was formed on April 5, 2016. Credit Fund Sub is a wholly-owned subsidiary of Credit Fund and is R-0 G-230 consolidated in Credit Fund’s consolidated financial statements commencing from the date of its formation. (3) Weighted average interest rate, including amortization of debt issuance costs on the 2015-1R Notes, 2017-1 Notes and 2019-2 Notes, respectively, for the quarter ended September 30, 2020. (4) MMCF CLO 2017-1 LLC, the issuer, is a wholly-owned and consolidated subsidiary of G-161 Credit Fund. (5) MMCF CLO 2019-2 LLC, the issuer, is a wholly-owned and consolidated subsidiary of Credit Fund. (6) Carlyle Direct Lending CLO 2015-1R LLC, the issuer, is a wholly-owned and B-247 consolidated subsidiary of the Company. (7) MMCF Warehouse II, LLC, is a wholly-owned and consolidated subsidiary of Credit Fund. (8) Refer to Note 9 to the consolidated financial statements 14 B-224 included in Part I, Item 1 of the Company's Form 10-Q for full details regarding the terms of the cumulative convertible preferred stock.